Exhibit 99.2

Levi Strauss & Co.

Third-Quarter Results

Presented by:

Hans Ploos van Amstel

Chief Financial Officer

October 11, 2005

This presentation should be read in conjunction with Levi Strauss & Co.’s

report on Form 10-Q for the quarterly period ended August 28, 2005.

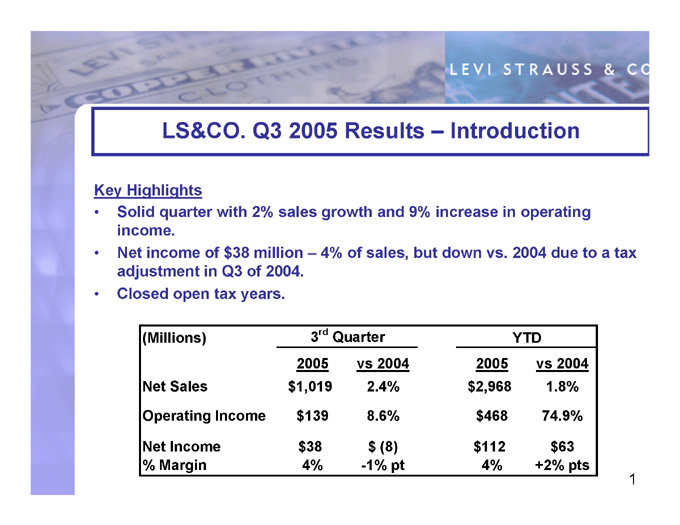

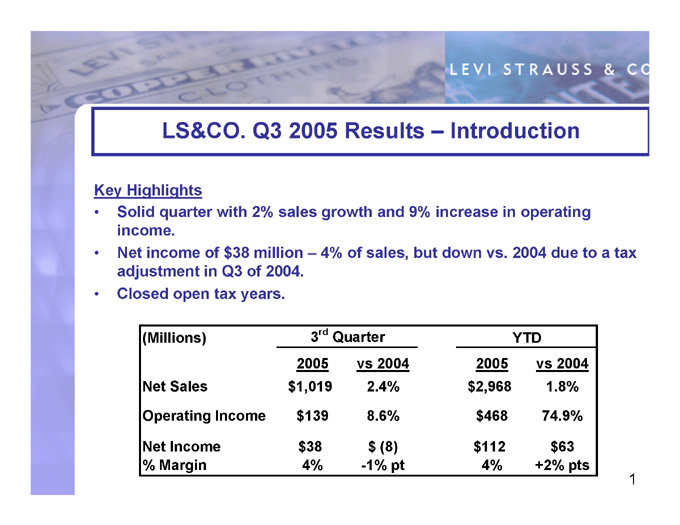

LS&CO. Q3 2005 Results – Introduction

Key Highlights

Solid quarter with 2% sales growth and 9% increase in operating income.

Net income of $38 million – 4% of sales, but down vs. 2004 due to a tax adjustment in Q3 of 2004.

Closed open tax years.

3rd Quarter

YTD

(Millions)

2005

vs 2004

2005

vs 2004

$2,968

2.4%

$1,019

Net Sales

1.8%

$468

8.6%

$139

Operating Income

74.9%

$112

$ (8)

$38

Net Income

$63

4%

-1% pt

4%

% Margin

+2% pts

1

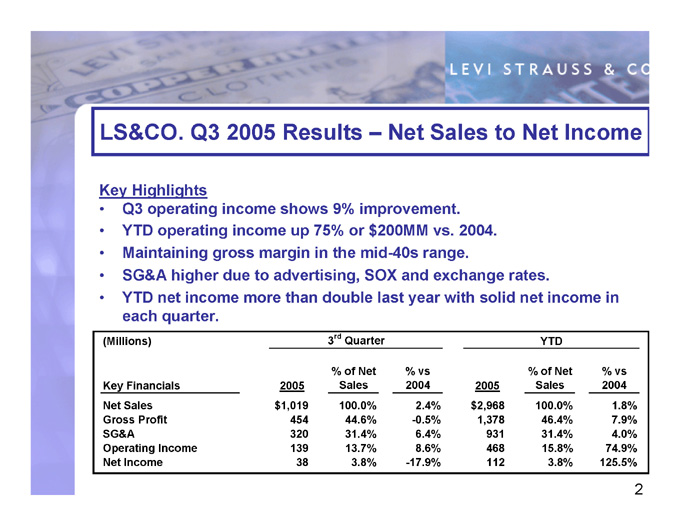

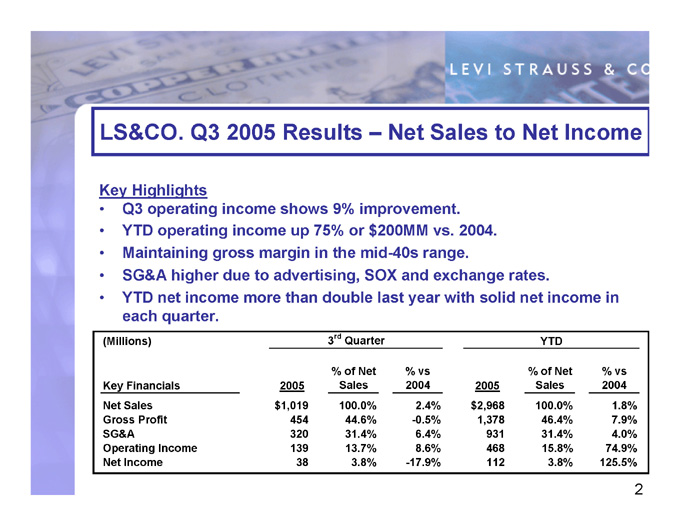

LS&CO. Q3 2005 Results – Net Sales to Net Income

Key Highlights

Q3 operating income shows 9% improvement.

YTD operating income up 75% or $200MM vs. 2004.

Maintaining gross margin in the mid-40s range.

SG&A higher due to advertising, SOX and exchange rates.

YTD net income more than double last year with solid net income in each quarter.

3rd Quarter

YTD

(Millions)

% of Net

% vs

% of Net

% vs

Sales

2004

Sales

2005

2005

Key Financials

2004

100.0%

$2,968

2.4%

100.0%

$1,019

Net Sales

1.8%

46.4%

1,378

-0.5%

44.6%

454

Gross Profit

7.9%

31.4%

931

6.4%

31.4%

320

SG&A

4.0%

15.8%

468

8.6%

13.7%

139

Operating Income

74.9%

3.8%

112

-17.9%

3.8%

38

Net Income

125.5%

2

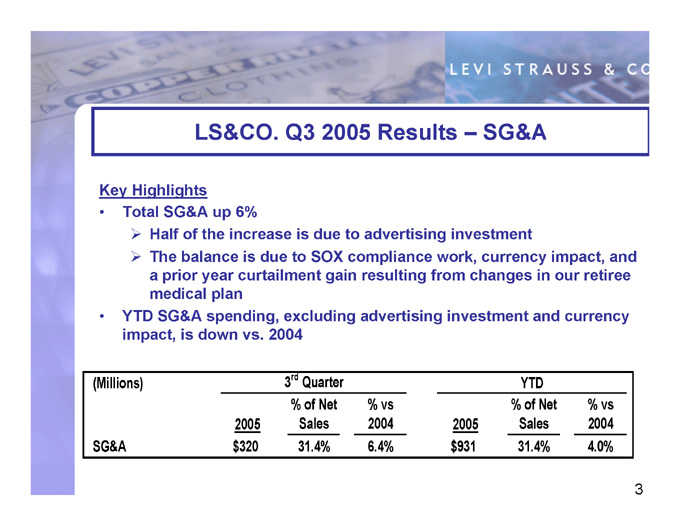

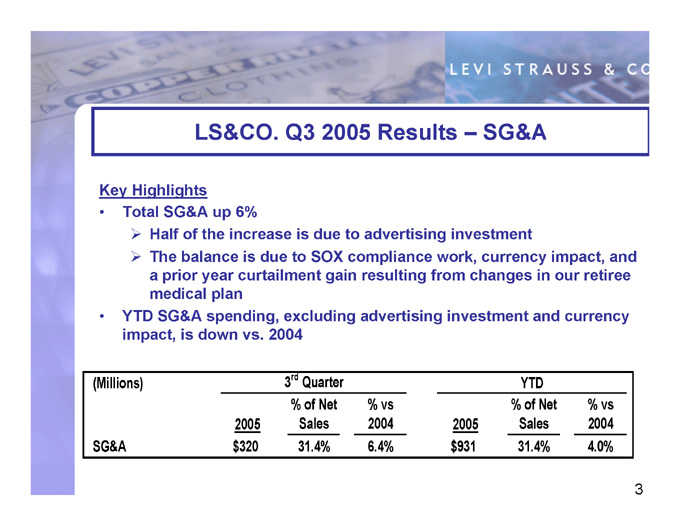

LS&CO. Q3 2005 Results – SG&A

Key Highlights

Total SG&A up 6%

Half of the increase is due to advertising investment

The balance is due to SOX compliance work, currency impact, and a prior year curtailment gain resulting from changes in our retiree medical plan

YTD SG&A spending, excluding advertising investment and currency impact, is down vs. 2004

3 rd Quarter

YTD

(Millions)

% vs

% of Net

% vs

% of Net

Sales

2004

Sales

2005

2005

2004

4.0%

31.4%

$931

6.4%

31.4%

$320

SG&A

3

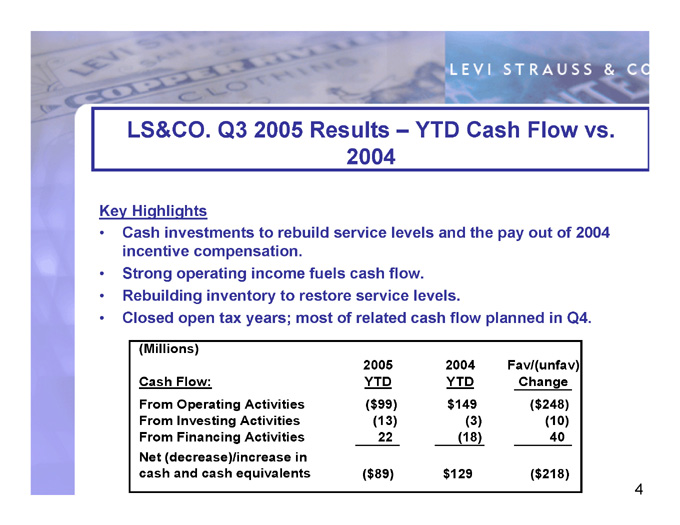

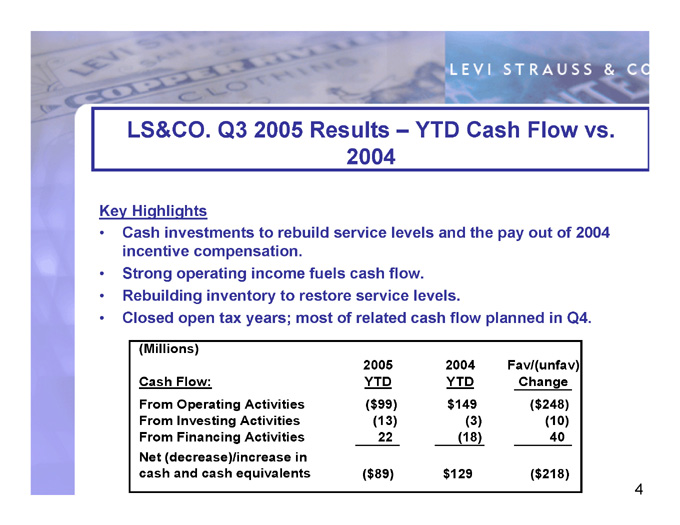

LS&CO. Q3 2005 Results – YTD Cash Flow vs. 2004

Key Highlights

Cash investments to rebuild service levels and the pay out of 2004 incentive compensation.

Strong operating income fuels cash flow.

Rebuilding inventory to restore service levels.

Closed open tax years; most of related cash flow planned in Q4.

(Millions)

2004

2005

Fav/(unfav)

YTD

YTD

Cash Flow:

Change

$149

($99)

From Operating Activities

($248)

(3)

(13)

From Investing Activities

(10)

(18)

22

From Financing Activities

40

Net (decrease)/increase in

($218)

$129

($89)

cash and cash equivalents

4

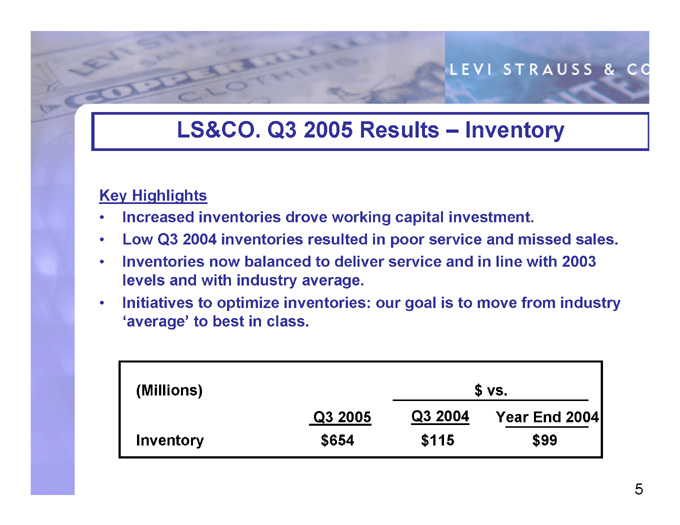

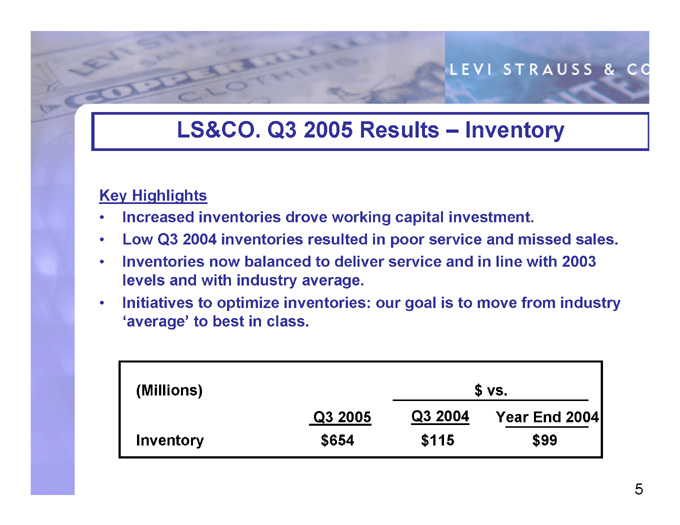

LS&CO. Q3 2005 Results – Inventory

Key Highlights

Increased inventories drove working capital investment.

Low Q3 2004 inventories resulted in poor service and missed sales.

Inventories now balanced to deliver service and in line with 2003 levels and with industry average.

Initiatives to optimize inventories: our goal is to move from industry ‘average’ to best in class.

(Millions)

$ vs.

Year End 2004

Q3 2005

Q3 2004

$115

$654

Inventory

$99

5

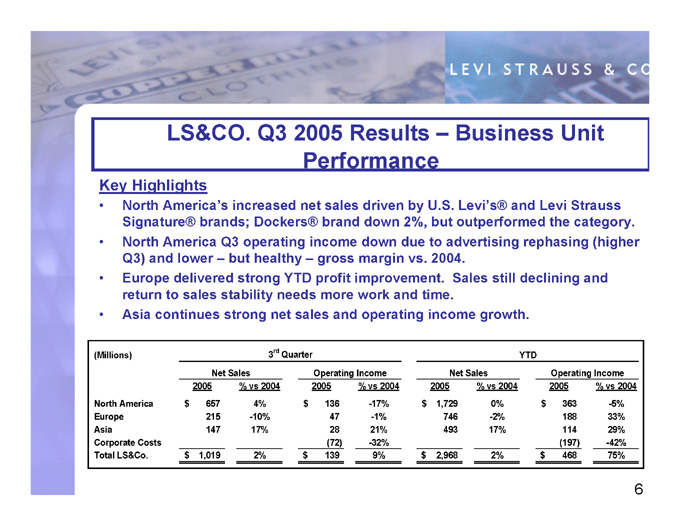

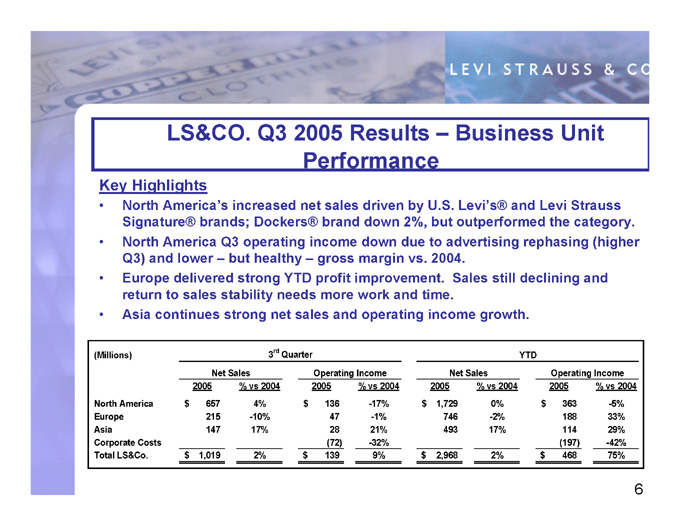

LS&CO. Q3 2005 Results – Business Unit Performance

Key Highlights

North America’s increased net sales driven by U.S. Levi’s® and Levi Strauss Signature® brands; Dockers® brand down 2%, but outperformed the category.

North America Q3 operating income down due to advertising rephasing (higher Q3) and lower – but healthy – gross margin vs. 2004.

Europe delivered strong YTD profit improvement. Sales still declining and return to sales stability needs more work and time.

Asia continues strong net sales and operating income growth.

3 rd Quarter

YTD

(Millions)

Operating Income

Net Sales

Operating Income

Net Sales

% vs 2004

2005

% vs 2004

2005

% vs 2004

2005

% vs 2004

2005

$ 363

0%

$ 1,729

-17%

$ 136

4%

$ 657

North America

-5%

188

-2%

746

-1%

47

-10%

$ 215

Europe

33%

114

17%

493

21%

28

17%

147

Asia

29%

(197)

-32%

(72)

Corporate Costs

-42%

75%

$ 468

2%

$ 2,968

9%

$ 139

2%

$ 1,019

Total LS&Co.

6

LS&CO. Q3 2005 Results – Key Conclusions

Solid quarter and continued progress in building financial strength.

Net sales stability to modest growth.

Healthy gross margin in the mid-40s.

Strong and improved profitability: operating and net income.

Resolutions of ’86 –’99 tax years and bond refinancing.

7