- LEVI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Levi Strauss & Co. (LEVI) DEF 14ADefinitive proxy

Filed: 8 Mar 22, 4:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Levi Strauss & Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

2022

Notice of Annual Meeting

of Shareholders and Proxy

Statement

April 20, 2022 (Wednesday)

10:30 a.m. (Pacific Time)

WHO WE ARE

We believe that clothes — and how you make them — can make a difference. Since 1853, we’ve been obsessed with innovation to meet people’s needs. We invented the first blue jean. And we reinvented khaki pants. We pioneered labor and environmental guidelines for our manufacturing partners. And we work to build sustainability into everything we do. A company doesn’t last 169 years by standing still. It endures by reinventing itself, striving to delight its consumers, winning in the marketplace, and by remaining true to its values. |

THAT’S THE STORY OF

| The past year saw significant growth at Levi Strauss & Co. (“LS&Co.”) on several fronts. Fiscal 2021 marked strong financial performance, the advancement of our environmental, social and governance (“ESG”) efforts, business diversification through the acquisition of Beyond Yoga, and the continued execution of our direct-to-consumer strategy. As a Board, we maintain a laser-like focus on the creation of long-term shareholder value. We are committed to supporting LS&Co.’s efforts to promote Profit through Principles and to maintain a workplace in which all employees feel welcomed and supported. In 2021, LS&Co. released its first stand-alone sustainability report informed by the Global Reporting Initiative (GRI) and Sustainable Accounting Standard Board (SASB) standards. In 2021, LS&Co. also launched “Buy Better, Wear Longer,” a global marketing campaign that urges customers to be more intentional about purchasing decisions, and introduced Levi’s Secondhand, a buy back and resale platform that extends our products’ useful lives. To further achieve our goals, we plan to continue fortifying each of our three main ESG pillars, to deliver meaningful progress while evolving our efforts to ensure our business becomes more sustainable, day by day: ● Climate - environmental impacts, including climate action, water stewardship and biodiversity

● Consumption - circular economy, sustainable fibers, use of safer chemicals and waste reduction

● Community - social and societal impacts, including diversity, equity and inclusion, employee support and development, supply chain transparency, standards and improvements, using our voice, and philanthropy and volunteering We are pleased that our efforts are being recognized by our recent inclusion on Fortune’s Change the World list for two initiatives: Levi’s® “Buy Better, Wear Longer” campaign, and LS&Co.’s paid leave programs and advocacy for American workers. In addition, we were included, for the third year in a row, in Fortune’s annual list of the World’s Most Admired Companies – ranking second among apparel companies globally. Engaging with our shareholders and sharing direct feedback with the Board are invaluable practices. We are pleased with the positive support we’ve received from shareholders regarding progress we have made on our sustainability reporting and diversity and inclusion efforts. We look forward to continuing our dialogue with you, our shareholders, and incorporating your feedback into our discussions as we strive to grow LS&Co. in a responsible and inclusive way. Since our inception 169 years ago, we have been committed to being a different kind of company. We have created a resilient, enduring brand that resonates with millions of people around the world. We look forward to our future with confidence and optimism - to be a company promoting profits through principles, supporting our communities, advocating for what’s right and bettering our planet.

Robert A. Eckert | |

| “As a Board, we maintain a laser-like focus on the creation of long-term shareholder value. We are committed to supporting LS&Co.’s efforts to promote Profit through Principles and to maintain a workplace in which all employees feel welcomed and supported.” | ||

|

| 2022 PROXY STATEMENT | 1 |

PERFORMANCE HIGHLIGHTS

$5.8 ~$200 million |  | approx | |

| 16,600 employees | |||

| approx | ||

| 50,000 retail locations | |||

| approx | ||

| 3,100 | brand-dedicated stores & shop-in-shops | ||

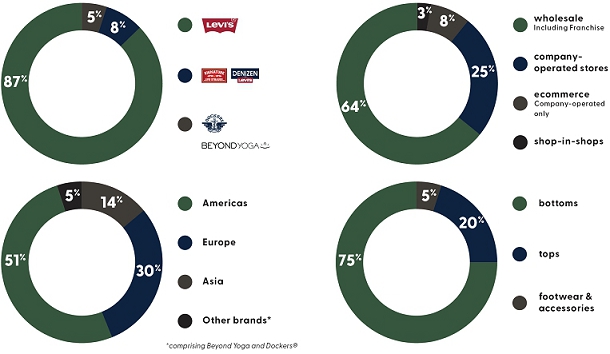

FY21 revenue share

| 2 |  |

2025 SUSTAINABILITY GOALS AND |

|

|  |  | ||

| 90% reduction of greenhouse gas (GHG) emissions in owned and operated (scope 1 and 2) facilities, against 2016 baseline | 100% renewable electricity in owned and operated facilities | 40% reduction of GHG emissions across supply chain (scope 3), against 2016 baseline | ||

|  |  | ||

| Progress through 2020: 57% reduction in Scope 1 and 2 emissions from 2016 baseline | Progress through 2020: 76% renewable electricity at our owned-and-operated facilities | Progress through 2020: 14% reduction in Scope 3 emissions from 2016 baseline | ||

|  |  | ||

| 50% reduction of water use in manufacturing in areas of high water stress, against 2018 baseline | All key fabric and garment suppliers will meet their contextual Water<Less® targets | “A-” score on the Carbon Disclosure Projects 2021 climate change survey | ||

|  | |||

| Progress through 2020: ~22% reduction in freshwater use in 2020 in high water-stressed locations | Progress through 2020: 67% of all LS&Co. products were made using Water<Less® finishing techniques or in facilities that meet our water recycle and reuse guidelines |

Key Sustainability Recognition

|  |  |  | |||

| Cited for Water Action Strategy, Screened Chemistry and Wellthread | Cited for corporate responsibility and environmental efforts | Awarded for our “Buy Better, Wear Longer” campaign and our support for paid family leave; third time on this list | Award for our Levi’s® Wellthead x renewcell collaboration | |||

| 2022 PROXY STATEMENT | 3 |

DIVERSITY, EQUITY AND INCLUSION

|  |  | |||||

TRANSPARENT DISCLOSURES In June 2020, we released our representation data for the first time and committed to annual updates. Although LS&Co. has long championed diversity, equity and inclusion, we believe that being transparent on the progress we are making in DE&I is important and it holds us accountable internally and externally. | FOUNDATIONAL CHANGES We took several concrete steps to attract, retain and grow diverse talent: ● Created and filled Chief Diversity, Equity & Inclusion Officer position in 2020 ● Committed to ensuring that half of interviewees for open positions are racially diverse ● Building out a global DE&I team with thought leaders located in key markets ● Expanding our leadership and development opportunities for racially diverse employees | PAY EQUITY We conduct independent pay equity audits every other year, with the goal of maintaining fair and equitable pay. Both the 2018 and 2020 studies found no systemic pay differences across gender and ethnicity. | |||||

|  | |||

EMPLOYEE RESOURCE GROUPS (ERG) ● Our 12 employee resource groups (ERGs) are designed to celebrate our differences, create safe spaces and build our collective cultural intelligence. ● All ERGs went virtual in 2020 and attracted more than 2,000 employees globally through a variety of educational and inspirational events. | INCLUSION AND ALLYSHIP Our diversity and allyship events feature leading speakers and learning opportunities that strengthen our understanding of the world around us. | |||

| 4 |  |

| NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS |

| PROPOSALS | BOARD VOTE RECOMMENDATION | FOR FURTHER DETAILS | ||||

| 1. | Election of Class III Directors | “FOR” each director nominee | Page 11 | |||

| 2. | Advisory Vote on Executive Compensation | “FOR” | Page 31 | |||

| 3. | Ratification of Selection of Independent Registered Public Accounting Firm | “FOR” | Page 57 | |||

| 4. | Slaughter Method Report | “AGAINST” | Page 59 | |||

| 5. | Workplace Non-Discrimination Audit | “AGAINST” | Page 60 | |||

Shareholders will also conduct any other business properly brought before the annual meeting or any adjournment or postponement thereof. A list of shareholders of record will be available for inspection by shareholders of record during normal business hours for 10 days prior to the annual meeting for any legally valid purpose at our corporate headquarters at 1155 Battery Street, San Francisco, CA 94111. The shareholder list will also be available during the annual meeting at www. virtualshareholdermeeting.com/LEVI2022.

Whether or not you expect to attend the annual meeting, you are urged to vote by proxy as promptly as possible to ensure your vote is counted. You may vote over the telephone, through the internet or by using the proxy card that you request as instructed in the Proxy Availability Notice. Even if you have voted by proxy, you may still vote at the annual meeting, as your proxy is revocable at your option. Note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder. See the Proxy Availability Notice for more information.

By Order of the Board of Directors,

NANCI PRADO

Corporate Secretary

ATTENDANCE AT THE MEETING

A live webcast of the annual meeting will be available at www.virtualshareholdermeeting. com/LEVI2022. To access the webcast, go to this website and follow the instructions provided. The webcast will be recorded and available for replay at this website through May 20, 2022. Electronic entry to the meeting will begin at 10:15 a.m., Pacific Time.

To attend, vote and submit questions during the annual meeting visit www.virtual shareholdermeeting.com/LEVI2022 and enter the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, voting instruction form or proxy card.

If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/LEVI2022.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 20, 2022

The notice of annual meeting, proxy statement and annual report to shareholders are available free of charge at www.proxyvote.com.

| DATE AND TIME | |||

| April 20, 2022 (Wednesday) 10:30 a.m. (Pacific Time) | ||||

| LOCATION | |||

| www.virtualshareholdermeeting.com/LEVI2022 | ||||

| WHO CAN VOTE | |||

| Shareholders as of February 25, 2022 are entitled to vote. | ||||

| HOW TO VOTE | ||||

| INTERNET | |||

● Visit www.proxyvote.com to vote online (you will need the voter control number from your proxy card or the Proxy Availability Notice) ● Your vote must be received by 8:59 p.m., Pacific Time, on April 19, 2022 | ||||

| TELEPHONE | |||

● Call 1-800-690-6903 and follow the recorded instructions (you will need the voter control number from your proxy card) ● Your vote must be received by 8:59 p.m., Pacific Time, on April 19, 2022 | ||||

| ||||

● Complete, sign, date and return the proxy card that may be delivered ● Your proxy card must be mailed by April 11, 2022 | ||||

| AT THE VIRTUAL MEETING | |||

| See “Attendance at the Meeting” | ||||

| QR CODE | |||

| Scan this QR code to vote with your mobile device | ||||

| 2022 PROXY STATEMENT | 5 |

| PROXY STATEMENT SUMMARY |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

| PROPOSAL 1 | ELECTION OF CLASS III DIRECTORS The Board recommends a vote FOR each director nominee. | See page 11 |

BOARD OF DIRECTORS

| AGE | DIRECTOR SINCE | COMMITTEE MEMBERSHIP | ||||||||

| NAME AND PRINCIPAL OCCUPATION | AC | FC | CHCC | NGCCC | ||||||

|  |  | TROY M. ALSTEAD IND Founder and President, | 58 | 2012 | C |  | |||

| CHARLES (“CHIP”) V. BERGH President and Chief Executive Officer, Levi Strauss & Co. | 64 | 2011 | |||||||

| ROBERT A. ECKERT IND Operating Partner, FFL Partners, LLC | 67 | 2010 |  | C | |||||

| PATRICIA SALAS PINEDA IND Retired; Former Group Vice President, Hispanic Business Strategy, Toyota Motor North America, Inc. | 70 | 1991 |  |  | |||||

|  |  | JILL BERAUD IND Retired; Former Chief Executive Officer, Ippolita | 61 | 2013 | C |  | |||

| SPENCER, C. FLEISCHER IND Chairman, FFL Partners, LLC | 68 | 2013 |  | C | |||||

| CHRISTOPHER J. MCCORMICK IND Retired; Former President and Chief Executive Officer, | 66 | 2016 |  |  | |||||

| ELLIOTT RODGERS IND Chief People Officer, project44 | 46 | 2020 |  |  | |||||

|  | DAVID A. FRIEDMAN IND Retired; Senior Principal, Emeritus Chief Executive Officer and Chair of the Board, Forell/Elsesser Engineers | 68 | 2018 |  |  | ||||

| YAEL GARTEN IND Director, AI/ML Data Science and Engineering, Apple | 43 | 2020 |  |  | |||||

| JENNY MING IND Retired; Former President and Chief Executive Officer, | 66 | 2014 |  |  | |||||

| JOSHUA E. PRIME IND Partner, Idea Generation and Research, | 44 | 2019 |  |  | |||||

| AC – Audit Committee | CHCC – Compensation and Human Capital Committee |  - Member - Member | IND – Independent |

| FC – Finance Committee | NGCCC – Nominating, Governance and Corporate | C - Chair | |

| Citizenship Committee |

| 6 |  |

PROXY STATEMENT SUMMARY

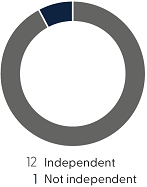

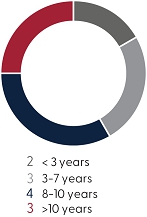

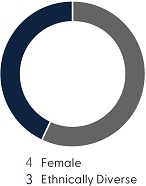

BOARD SNAPSHOT

| INDEPENDENCE | TENURE | AGE | DIVERSITY | |||

|  |  |  |

SKILLS & EXPERIENCE

GOVERNANCE BEST PRACTICES

| PRACTICES WE ENGAGE IN |  | PRACTICES WE DO NOT ENGAGE IN | |||||

Align pay with shareholder interests Align pay with shareholder interests |  Hedging shares Hedging shares | |||||||

Performance goals align with long-term value Performance goals align with long-term value |  Pledging shares Pledging shares | |||||||

Stock ownership guidelines Stock ownership guidelines |  Repricing stock options or SARs Repricing stock options or SARs | |||||||

Clawback policy Clawback policy |  Granting discount stock options or SARs Granting discount stock options or SARs | |||||||

Independent compensation consultant Independent compensation consultant |  Excessive benefits Excessive benefits | |||||||

Annual review of compensation program and practices Annual review of compensation program and practices |

| |||||||

Use of peer groups Use of peer groups | ||||||||

No excessive risk No excessive risk | ||||||||

Annual say on pay vote Annual say on pay vote | ||||||||

| 2022 PROXY STATEMENT | 7 |

PROXY STATEMENT SUMMARY

| PROPOSAL 2 | ADVISORY VOTE ON EXECUTIVE COMPENSATION The Board recommends a vote FOR this proposal. | See page 31 |

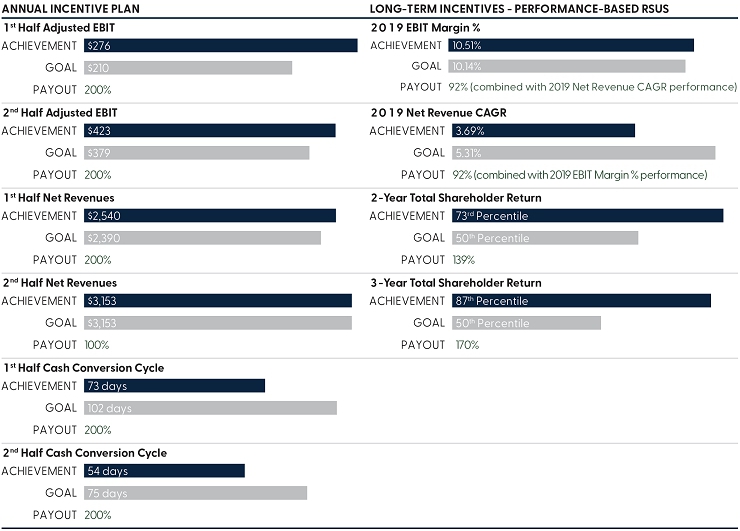

FINANCIAL PERFORMANCE

The company achieved strong results, including multi-decade record revenues and profitability, delivering an adjusted Earnings Before Interest and Taxes (EBIT) margin for the full year 2021 of 12.4% despite heightened supply chain challenges and product costs. This was a testament to the strength of our brands and our ability to leverage our pricing power to more than offset inflationary pressures while also reinvesting in our growth.

KEY PERFORMANCE MEASURES

EXECUTIVE COMPENSATION HIGHLIGHTS

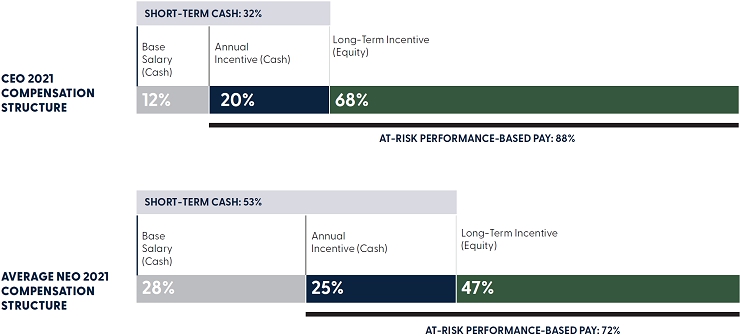

COMPENSATION SNAPSHOT

| 8 |  |

PROXY STATEMENT SUMMARY

HIGH SAY ON PAY RESULTS

At the 2021 Annual Meeting, over 99% of the votes cast were in favor of our advisory proposal | We held a shareholder advisory vote on executive compensation in 2021, commonly referred to as a “say-on-pay vote,” which resulted in shareholder approval by over 99% of the votes cast on the advisory proposal. We take the views of our shareholders seriously and view this vote result as an indication that the principles of our executive compensation program are strongly supported by our shareholders. |

| PROPOSAL 3 | RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board recommends a vote FOR this proposal. | See page 57 |

| PROPOSAL 4 | SLAUGHTER METHOD REPORT The Board recommends a vote AGAINST this proposal. | See page 59 |

| PROPOSAL 5 | WORKPLACE NON-DISCRIMINATION AUDIT The Board recommends a vote AGAINST this proposal. | See page 60 |

| 2022 PROXY STATEMENT | 9 |

| TABLE OF CONTENTS |

| 10 |  |

| CORPORATE GOVERNANCE |

ELECTION OF CLASS III DIRECTORS Our Board of Directors currently has 12 members and is divided into three classes, with directors elected for overlapping three-year terms. There are four Class III directors whose term of office expires in fiscal year 2022: Troy M. Alstead, Charles (“Chip”) V. Bergh, Robert A. Eckert and Patricia Salas Pineda. Our Board of Directors has recommended that each of these directors be re-elected as Class III directors to serve until the 2025 annual meeting of shareholders and until their successors are duly elected and qualified or, if sooner, until their resignation or removal. A biography of each nominee and a discussion of his or her specific experience, qualifications, attributes and skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class III director is set forth in this proxy statement under “Board of Directors—Nominees for Election as Class III Directors.” Directors are elected by a plurality of the votes of the holders of shares present at the meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the four nominees receiving the most FOR votes will be elected as Class III directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, FOR the election of the four nominees recommended by our Board of Directors and named in this proxy statement. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by us. Each nominee has agreed to serve as a Class III director if elected. We have no reason to believe that any nominee will be unable to serve. |

| Our Board of Directors unanimously recommends a vote “FOR” all of the named nominees. |

Our Board of Directors has 12 members. Our current Board of Directors is divided into three classes with directors elected for overlapping three-year terms:

| ● | The term for directors in Class III (Troy M. Alstead, Charles (“Chip”) V. Bergh, Robert A. Eckert, and Patricia Salas Pineda) will end at the 2022 annual meeting of shareholders. |

| ● | The term for directors in Class I (Jill Beraud, Spencer C. Fleischer, Christopher J. McCormick, and Elliott Rodgers) will end at the 2023 annual meeting of shareholders. |

| ● | The term for directors in Class II (David A. Friedman, Yael Garten, Jenny Ming and Joshua E. Prime) will end at the 2024 annual meeting of shareholders. |

At each annual meeting of shareholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election and until their successors are duly elected and qualified. We expect that additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Our corporate governance guidelines provide that directors are expected to attend our annual meetings of shareholders. All of our directors attended the 2021 annual meeting of shareholders.

| 2022 PROXY STATEMENT | 11 |

CORPORATE GOVERNANCE

The Board of Directors believes that it is in our best interests that the offices of CEO and Chair be held by separate individuals and, accordingly, our CEO and the Chair of our Board of Directors are currently separate individuals.

Our corporate governance guidelines are available under the “Governance” tab of our website at investors.levistrauss.com.

Our Board of Directors seeks members who are committed to the values of our company and are, by reason of their character, judgment, knowledge and experience, capable of contributing to the effective governance of our company. In reaching this determination, our Board of Directors considers each candidate’s relevant expertise, accomplishments in his or her field, the ability to exercise sound business judgment and a commitment to rigorously represent the long-term interests of our shareholders. Our Board of Directors also considers diversity (including with respect to race, gender, geography, sexual orientation and areas of expertise), age, skills and other factors that it deems appropriate to maintain a balance of knowledge, experience and capability. For an incumbent director whose term of office is set to expire, our Board of Directors reviews his or her overall service to the company during the completed term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair his or her independence. Our corporate governance guidelines provide that all directors are subject to a mandatory retirement age of 72, unless waived by our Board of Directors in its discretion.

| 12 |  |

CORPORATE GOVERNANCE

NOMINEES FOR ELECTION AS CLASS III DIRECTORS

The following is a brief biography of each nominee for Class III director and a discussion of his or her specific experience, qualifications, attributes or skills that led the Nominating, Governance and Corporate Citizenship Committee and our Board of Directors to recommend him or her as a nominee for Class III director.

| TROY M. ALSTEAD Founder and President, Table 47 and Ocean5 | ||

AGE: 58 DIRECTOR SINCE: 2012 | COMMITTEES: | Audit Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Founder and President of Table 47 and Ocean5, a restaurant and social concept. |

| ● | Retired from Starbucks Corporation in February 2016 after 24 years with the company, having most recently served as Chief Operating Officer. |

| ● | Held the positions of Group President, Chief Financial Officer and Chief Administrative Officer of Starbucks. |

| ● | Spent a decade in Starbucks international business, including roles as Senior Leader of Starbucks International, President of Europe, Middle East and Africa headquartered in Amsterdam and Chief Operating Officer of Starbucks Greater China headquartered in Shanghai. |

| ● | Currently serves as a director of Harley-Davidson, Inc., Array Technologies, Inc., OYO Global and EarthLab. |

KEY QUALIFICATIONS:

| Mr. Alstead brings to our Board of Directors his broad financial and business perspective developed over many years in the global consumer goods industry. |

| CHARLES (“CHIP”) V. BERGH President and Chief Executive Officer, Levi Strauss & Co. | ||

AGE: 64 DIRECTOR SINCE: 2011 | COMMITTEES: | None | |

CAREER HIGHLIGHTS:

| ● | President and Chief Executive Officer of Levi Strauss & Co. |

| ● | Joined LS&Co. after a distinguished career at Procter & Gamble. His last assignment was leading the Gillette integration following P&G’s $57 billion acquisition of that business and running the Gillette Blades & Razors business and the entire Male Grooming portfolio of P&G. |

| ● | Twenty-eight-year career at P&G included roles of increasing scope and complexity and included a six-year assignment as Regional President of Southeast Asia, India and Australia. |

| ● | Currently serves as the non-executive Chairman of HP Inc. |

| ● | Previously served on the Board of Directors for VF Corporation, the Singapore Economic Development Board and was a member of the US ASEAN Business Council, Singapore. |

KEY QUALIFICATIONS:

| Mr. Bergh’s position as our President and Chief Executive Officer and his past experience as a leader of large, global consumer brands make him well suited to be a member of our Board of Directors. |

| 2022 PROXY STATEMENT | 13 |

CORPORATE GOVERNANCE

| ROBERT A. ECKERT Operating Partner, FFL Partners, LLC | ||

AGE: 67 DIRECTOR SINCE: 2010 | COMMITTEES: | Nominating, Governance and Corporate Citizenship Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Chair of our Board of Directors, a position he has held since 2021. |

| ● | Operating Partner of FFL Partners, LLC, a private equity firm, since September 2014. |

| ● | Chairman Emeritus of Mattel, Inc., a role he has held since January 2013. |

| ● | Chairman and Chief Executive Officer of Mattel from May 2000 until December 2011, and he continued to serve as its Chairman until December 2012. |

| ● | Previously worked for Kraft Foods, Inc. for 23 years, and served as President and Chief Executive Officer from October 1997 until May 2000. |

| ● | Group Vice President of Kraft Foods from 1995 to 1997, and President of the Oscar Mayer foods division of Kraft Foods from 1993 to 1995. |

| ● | Currently a director of McDonald’s Corporation, Uber Technologies, Inc., Amgen, Inc., Eyemart Express Holdings, LLC and Quinn Group Inc. |

KEY QUALIFICATIONS:

| Mr. Eckert was selected to join our Board of Directors due to his experience as a senior executive engaged with the dynamics of building global consumer brands through high performance expectations, integrity and decisiveness in driving businesses to successful results. |

| PATRICIA SALAS PINEDA Retired; Former Group Vice President, Hispanic Business Strategy, Toyota Motor North America, Inc. | ||

AGE: 70 DIRECTOR SINCE: 1991 | COMMITTEES: | Finance Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Retired in October 2016 as Group Vice President of Hispanic Business Strategy for Toyota Motor North America, Inc., an affiliate of one of the world’s largest automotive firms, a position she held since May 2013. |

| ● | Served Toyota Motor North America as Group Vice President of National Philanthropy and the Toyota USA Foundation from 2004 to 2013. |

| ● | Served Toyota Motor North America as General Counsel and Group Vice President of Administration from 2006 to 2008 and as Group Vice President of Corporate Communications and General Counsel from 2004 to 2006. |

| ● | Served as Vice President of Legal, Human Resources and Government Relations, and Corporate Secretary of New United Motor Manufacturing, Inc. with which she had been associated since 1984. |

| ● | Currently a director of Frontier Group Holdings, Inc., Omnicom Group Inc., Chairwoman Emeritus and a board member of the Latino Corporate Directors Association and a member of the board of trustees of Earthjustice. |

| ● | Served as a member of the advisory board of the Latinos and Society Program at The Aspen Institute from September 2013 to October 2018. |

KEY QUALIFICATIONS:

| Ms. Pineda was selected as a member of our Board of Directors to bring her expertise in government relations and regulatory oversight, corporate governance and human resources matters. Her long tenure on our Board of Directors also provides valuable historical perspective. |

| 14 |  |

CORPORATE GOVERNANCE

CONTINUING DIRECTORS

The following is a brief biography of each director whose term will continue after the annual meeting.

| JILL BERAUD Retired; Chief Executive Officer, Ippolita | ||

AGE: 61 DIRECTOR SINCE: 2013 | COMMITTEES: | Finance Committee (Chair), Compensation and Human Capital Committee | |

CAREER HIGHLIGHTS:

| ● | Retired Chief Executive Officer of Ippolita, a privately held luxury jewelry company with distribution in high-end department stores, flagship and ecommerce, from October 2015 until September 2018. |

| ● | Executive Vice President for Tiffany & Co., with responsibility for its Global Retail Operations and E-Commerce with oversight of strategic store development and real estate from October 2014 until June 2015. |

| ● | Served as Chief Executive Officer for Living Proof, Inc., a privately held company that uses advanced medical and materials technologies to create hair care and skin care products for women from December 2011 to October 2014. |

| ● | Served as President of Starbucks/Lipton Joint Ventures and Chief Marketing Officer of PepsiCo Americas Beverages from July 2009 to June 2011, and PepsiCo’s Global Chief Marketing Officer from December 2008 to July 2009. |

| ● | Spent 13 years at Limited Brands in various roles, including Chief Marketing Officer of Victoria’s Secret and Executive Vice President of Marketing for its broader portfolio of specialty brands, including Bath & Body Works, C.O. Bigelow, Express, Henri Bendel and Limited Stores. |

| ● | Director of Revance Therapeutics, Inc. and serves on the Board of Governors for The World of Children non-profit organization. |

KEY QUALIFICATIONS:

| Ms. Beraud was selected to join our Board of Directors due to her extensive marketing, social media and consumer branding experience, as well as her extensive managerial and operational knowledge in the apparel and other consumer goods industries. |

| SPENCER C. FLEISCHER Chairman, FFL Partners, LLC | ||

AGE: 68 DIRECTOR SINCE: 2013 | COMMITTEES: | Compensation and Human Capital Committee (Chair), Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Current Chairman and former Managing Partner of FFL Partners, LLC, a private equity firm. |

| ● | Spent 19 years at Morgan Stanley & Company as an investment banker and senior leader, leading business units in Asia, Europe and the United States, before co-founding FFL Partners, LLC in 1997. |

| ● | Currently serves as a director of The Clorox Company and Americans for Oxford, Inc. |

| ● | Director of American West Bank until October 2015 when it was acquired by Banner Corporation, and was thereafter a director of Banner Corporation until December 2016. |

KEY QUALIFICATIONS:

| Mr. Fleischer was selected to join our Board of Directors due to his broad financial and international business perspectives developed over many years in the private equity and investment banking industries. |

| 2022 PROXY STATEMENT | 15 |

CORPORATE GOVERNANCE

| DAVID A. FRIEDMAN Retired; Senior Principal, Emeritus Chief Executive Officer and Chair of the Board, Forell/Elsesser Engineers | ||

AGE: 68 DIRECTOR SINCE: 2018 | COMMITTEES: | Compensation and Human Capital Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Retired Senior Principal, Emeritus Chief Executive Officer and Chair of the Board, and past President and Chief Executive Officer of Forell/Elsesser Engineers, with over 40 years of professional practice in structural and earthquake engineering. |

| ● | President and member of the Board of Directors for the Earthquake Engineering Research Institute, which disseminates lessons learned from earthquakes around the world, and served on its post-earthquake reconnaissance teams in Kobe, Japan in 1995 and Wenchuan, China in 2008. |

| ● | Involved in many institutional, academic, philanthropic and not-for-profit boards, including the San Francisco Foundation, the San Francisco Planning and Urban Research Association, the University of California, Berkeley Foundation, the Jewish Home of San Francisco and GeoHazards International. |

| ● | A licensed structural engineer in California, Nevada and British Columbia. |

KEY QUALIFICATIONS:

| Mr. Friedman was selected to join our Board of Directors due to his broad professional experience, as well as his extensive background with our company arising from his familial connection to our founder. |

| YAEL GARTEN Director, AI/ML Data Science and Engineering, Apple | ||

AGE: 43 DIRECTOR SINCE: 2020 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Director, AI/ML Data Science and Engineering, Apple, Inc. since August 2017. |

| ● | Worked at LinkedIn Corporation in a number of positions from October 2011 to August 2017, including as Director of Data Science from October 2015 to August 2017. |

| ● | Research Scientist and Text Mining Lead at Stanford University School of Medicine before joining LinkedIn. |

KEY QUALIFICATIONS:

| Dr. Garten was selected to join our Board of Directors for her expertise in data science, artificial intelligence and machine learning, and converting data into actionable product and business strategy. She has applied this expertise across products and services with massive global user bases. |

| 16 |  |

CORPORATE GOVERNANCE

| CHRISTOPHER J. MCCORMICK Retired. Former President and Chief Executive Officer, L.L. Bean, Inc | ||

AGE: 66 DIRECTOR SINCE: 2016 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | Served as President and Chief Executive Officer of L.L. Bean, Inc. from 2001 until 2016. |

| ● | Joined L.L. Bean in 1983, previously serving in a number of senior and executive level positions in advertising and marketing. |

| ● | Senior Vice President and Chief Marketing Officer of L.L. Bean from 2000 to 2001. |

| ● | Director of Big Lots!, Inc. and a former director of Sun Life Financial, Inc. |

KEY QUALIFICATIONS:

| Mr. McCormick brings to our Board of Directors his deep channel knowledge and ecommerce and direct marketing experience. |

| JENNY MING Retired; Former President and Chief Executive Officer, Charlotte Russe Inc. | ||

AGE: 66 DIRECTOR SINCE: 2014 | COMMITTEES: | Audit Committee, Nominating, Governance and Corporate Citizenship Committee | |

CAREER HIGHLIGHTS:

| ● | President and Chief Executive Officer of Charlotte Russe Inc., a fast-fashion specialty retailer of apparel and accessories catering to young women, from October 2009 to February 2019. In February 2019, Charlotte Russe Inc. filed a voluntary petition under Chapter 11 of the U.S. Bankruptcy Code. |

| ● | Was a member of Gap Inc.’s executive team that launched Old Navy, a $7 billion brand in Gap Inc.’s portfolio. Served as its first President from March 1999 to October 2006, where she oversaw all aspects of Old Navy and its 900 retail clothing stores in the United States and Canada. |

| ● | Joined Gap Inc. in 1986, serving in various executive capacities at its San Francisco headquarters. |

| ● | Serves on the Board of Directors of Poshmark, Inc., Affirm Holdings, Inc., Kendra Scott, LLC and Kaiser Hospital Health Plan. |

KEY QUALIFICATIONS:

| Ms. Ming was selected to join our Board of Directors due to her extensive operational and retail leadership experience in the apparel industry. |

| 2022 PROXY STATEMENT | 17 |

CORPORATE GOVERNANCE

| JOSHUA E. PRIME Partner, Idea Generation and Research, Indaba Capital Management, L.P. | ||

AGE: 44 DIRECTOR SINCE: 2019 | COMMITTEES: | Audit Committee, Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Partner, Idea Generation and Research, at Indaba Capital Management, L.P., where he has served since its founding in 2010. |

| ● | Manager of retail strategy for the Americas Region of Levi Strauss & Co. from 2007 to 2009. |

| ● | Served as an analyst in merger arbitrage, special situations and credit at Farallon Capital Management, L.L.C. from 1999 to 2005. |

KEY QUALIFICATIONS:

| Mr. Prime was selected to join our Board of Directors due to his broad professional experience, including with our company, and his extensive background with the company arising from his familial connection to our founder. |

| ELLIOTT RODGERS Chief People Officer, project44 | ||

AGE: 46 DIRECTOR SINCE: 2020 | COMMITTEES: | Audit Committee, Finance Committee | |

CAREER HIGHLIGHTS:

| ● | Chief People Officer at project44, a supply chain visibility platform. |

| ● | Previously was Chief Information Officer of Ulta Beauty. |

| ● | Joined Ulta Beauty in 2013 and served in a number of senior positions where he led distribution, transportation, supplier operations, sales and operations planning, and supply chain strategy. |

| ● | Led the transformation of Ulta Beauty’s supply chain in support of its strategic imperatives. |

| ● | Held operational leadership roles spanning retail, financial services, and logistics at Target, Citibank and the United States Army. |

| ● | Served in various assignments as an Army Officer, including leading logistics support operations for humanitarian service missions. |

KEY QUALIFICATIONS:

| Mr. Rodgers was selected to join our Board of Directors due to his broad professional experience and his extensive operational, technology and retail leadership experience. |

| 18 |  |

CORPORATE GOVERNANCE

DIRECTOR SKILLS AND QUALIFICATIONS

The table below summarizes the key qualifications, skills and attributes that our Board has determined are most relevant to service on our Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the director does not possess that qualification or skill. Our directors’ biographies describe each director’s background and relevant experience in more detail.

| ALSTEAD | BERAUD | BERGH | ECKERT | FLEISCHER | FRIEDMAN | GARTEN | McCORMICK | MING | PINEDA | PRIME | RODGERS | ||||||||||||||

| Consumer Brand and Marketing Strategy Expertise |  |  |  |  |  |  |  |  |  |  | ||||||||||||||

| Corporate Citizenship / Sustainability Expertise |  |  |  |  |  |  | ||||||||||||||||||

| Governance Expertise |  |  |  |  |  |  | ||||||||||||||||||

| Financial Expertise |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Global Expertise |  |  |  |  |  |  |  | |||||||||||||||||

| Omnichannel Expertise |  |  |  |  |  |  | ||||||||||||||||||

| Digital / Technology / Data Science Expertise / Cybersecurity |  |  |  | |||||||||||||||||||||

| Apparel Company Expertise |  |  |  |  | ||||||||||||||||||||

| Supply Chain / Logistics Expertise |  |  |  |  |  |  | ||||||||||||||||||

| Human Resources Expertise |  |  |  |  |  |  |  |  | ||||||||||||||||

| 2022 PROXY STATEMENT | 19 |

CORPORATE GOVERNANCE

IDENTIFICATION AND CONSIDERATION OF NEW NOMINEES

The Nominating, Governance and Corporate Citizenship Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements and having the highest personal integrity and ethics. The Nominating, Governance and Corporate Citizenship Committee also will consider factors such as whether a director nominee possesses relevant expertise upon which to be able to offer advice and guidance to management, has sufficient time to devote to the affairs of the company, demonstrates excellence in his or her field, has the ability to exercise sound business judgment and has the commitment to rigorously represent the long-term interests of the company’s shareholders. However, the Nominating, Governance and Corporate Citizenship Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements and the long-term interests of shareholders. In conducting this assessment, the Nominating, Governance and Corporate Citizenship Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of us and the Board, to maintain a balance of knowledge, experience and capability.

SHAREHOLDER NOMINATIONS

The Nominating, Governance and Corporate Citizenship Committee will consider director candidates recommended by shareholders. The Nominating, Governance and Corporate Citizenship Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a shareholder. Shareholders who wish to recommend individuals for consideration by the Nominating, Governance and Corporate Citizenship Committee to become nominees for election to our Board of Directors may do so by delivering a written recommendation to the Nominating, Governance and Corporate Citizenship Committee at 1155 Battery Street, San Francisco, CA 94111 in accordance with the procedures set forth in our bylaws. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

As required by New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. Our Board of Directors consults with counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in applicable NYSE listing standards, as in effect from time to time. In addition, the charters of the committees of our Board of Directors prohibit members from having any relationship that would interfere with the exercise of their independence from management and our company. The fact that a director may own our capital stock is not, by itself, considered an interference with independence under these charters.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and our company, senior management and our independent auditors, our Board of Directors has affirmatively determined that all of our directors are independent, with the exception of Mr. Bergh, who serves as our President and CEO.

Each of Mr. Friedman and Mr. Prime, either directly or by marriage, is a descendant of the family of our founder, Levi Strauss.

COMMITTEE MEMBERSHIP AND STRUCTURE

Our Board of Directors has established four standing committees: an Audit Committee, a Finance Committee, a Compensation and Human Capital Committee, and a Nominating, Governance and Corporate Citizenship Committee, each of which has the composition and responsibilities described below. From time to time, our Board of Directors may establish other committees to facilitate the management of our business. Below is a description of each committee of our Board of Directors.

| 20 |  |

CORPORATE GOVERNANCE

AUDIT COMMITTEE

MEETINGS IN FISCAL YEAR 2021:

8

MEMBERS:

| TROY M. ALSTEAD CHAIR |  |  |  |  |  | ||||||

| Yael Garten | Christopher J. McCormick | Jenny Ming | Joshua E. Prime | Elliott Rodgers |

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of the integrity of our financial statements, financial reporting processes, internal controls systems and compliance with legal requirements. |

| ● | Meets with our management regularly to discuss our critical accounting policies, internal controls and financial reporting process and our financial reports to the public. |

| ● | Meets with our independent registered public accounting firm and with our financial personnel and internal auditors regarding these matters. |

| ● | Examines the independence and performance of our internal auditors and our independent registered public accounting firm. |

| ● | Has sole and direct authority to engage, appoint, evaluate and replace our independent auditor. Both our independent registered public accounting firm and our internal auditors regularly meet privately with, and have unrestricted access to, the Audit Committee. |

Our Board of Directors has determined that each member of the Audit Committee satisfies the independence requirements for Audit Committee members under the listing standards of the NYSE and Rule 10A-3 of the Exchange Act and meets the financial literacy requirements under the rules and regulations of the NYSE and the U.S. Securities and Exchange Commission (“SEC”). Mr. Alstead has been determined to be an “audit committee financial expert” as defined by SEC rules.

The Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

FINANCE COMMITTEE

MEETINGS IN FISCAL 2021:

7

MEMBERS:

| JILL BERAUD CHAIR |  |  |  |  | |||||

| Spencer C. Fleischer | Patricia Salas Pineda | Joshua E. Prime | Elliott Rodgers |

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of our financial condition and management, financing strategies and execution and relationships with shareholders, creditors and other members of the financial community. |

| ● | Reviews and makes recommendations to the Board regarding dividends, share repurchases and other sources of shareholder liquidity. |

| ● | Evaluates potential acquisition or investment opportunities. |

| ● | Reviews capital returns from various aspects of operations. |

The Finance Committee operates under a written charter, which is available under the “Governance” tab of our website at investors. levistrauss.com.

| 2022 PROXY STATEMENT | 21 |

CORPORATE GOVERNANCE

COMPENSATION AND HUMAN CAPITAL COMMITTEE

MEETINGS IN FISCAL YEAR 2021:

4

MEMBERS:

| SPENCER C. FLEISCHER CHAIR |  |  |  |  | |||||

| Troy M. Alstead | Jill Beraud | Robert A. Eckert | David A. Friedman |

PRIMARY RESPONSIBILITIES:

| ● | Provides assistance to our Board of Directors in its oversight of our compensation, benefits and human resources programs and of senior management performance, composition and compensation. |

| ● | Reviews our compensation objectives and performance against those objectives, reviews market conditions and practices and our strategy and processes for making compensation decisions and approves (or, in the case of our CEO, recommends to our Board of Directors) the annual and long-term compensation for our executive officers,including our long-term incentive compensation plans. |

| ● | Reviews our succession planning process for all our senior executives, including our CEO. |

| ● | Reviews with management our Compensation Discussion and Analysis and considers whether to recommend that it be included in our SEC filings. |

| ● | Reviews our policies and strategies relating to culture, recruiting, retention, career development and progression, talent planning, and diversity and inclusion. |

Our Board of Directors has determined that each member of the Compensation and Human Capital Committee is a non-employee member of our Board of Directors as defined in Rule 16b-3 under the Exchange Act and an outside director as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The composition of the Compensation and Human Capital Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Compensation and Human Capital Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. Under this charter, the Compensation and Human Capital Committee may, in its discretion, delegate its duties to a subcommittee. This charter is available under the “Governance” tab of our website at investors.levistrauss.com.

The specific determinations of the Compensation and Human Capital Committee with respect to executive compensation for fiscal year 2021 are described in greater detail under “Compensation Discussion and Analysis.”

| 22 |  |

CORPORATE GOVERNANCE

NOMINATING, GOVERNANCE AND CORPORATE CITIZENSHIP COMMITTEE

MEETINGS IN 2021:

5

MEMBERS:

| ROBERT A. ECKERT CHAIR |  |  |  |  |  | ||||||

| David A. Friedman | Yael Garten | Christopher J. Mccormick | Jenny Ming | Patricia Salas Pineda |

PRIMARY RESPONSIBILITIES:

| ● | Responsible for identifying qualified candidates for, and making recommendations regarding the size and composition of, our Board of Directors in light of, among other factors, directors’ skills,experience, independence and availability of service. |

| ● | Responsible for overseeing our corporate governance matters, reporting and making recommendations to our Board of Directors concerning corporate governance matters, and reviewing the performance of the Chair of our Board of Directors and our CEO. |

| ● | Oversees the annual self-evaluations of the Board and its committees and makes recommendations concerning the structure and membership of the other committees. |

| ● | Assists our Board of Directors with oversight and review of corporate citizenship and sustainability matters which may have a significant impact on us. |

| ● | Reviews the composition of our Board in light of directors’ skills, experience, diversity (including, among other things, race, age, gender, sexual orientation and areas of expertise), independence and availability of service, and recommends nominees for each annual election of directors and to fill any vacancies on our Board. |

The composition of the Nominating, Governance and Corporate Citizenship Committee meets the requirements for independence under the current listing standards of the NYSE and current SEC rules and regulations.

The Nominating, Governance and Corporate Citizenship Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE. This charter is available under the “Governance” tab of our website at investors. levistrauss.com.

Our Board of Directors met eight times during the last fiscal year. Each director attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

In accordance with our corporate governance guidelines and applicable NYSE listing standards, executive sessions of non-management directors are scheduled for every meeting of our Board of Directors and at such other times as our non-management directors see fit. All executive sessions of non-management directors are presided over by the Chair of our Board of Directors. In the absence of the Chair of our Board of Directors, the participating non-management directors will select a director to preside over an executive session.

| 2022 PROXY STATEMENT | 23 |

CORPORATE GOVERNANCE

BOARD’S ROLE IN RISK MANAGEMENT

Management is responsible for the day-to-day management of the risks facing our company, while our Board of Directors—as a whole and through its committees—has responsibility for the oversight of risk management.

| BOARD OVERSIGHT | ||||||||||

| ● Responsible for the oversight of risk management as a whole and through its committees. | ||||||||||

| ||||||||||

AUDIT COMMITTEE ● Reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, along with management, the senior auditing executive and the independent registered public accounting firm. ● At each meeting, reviews the risks related to the company’s information technology use and protection, including but not limited to data governance, privacy, compliance, and cybersecurity. | COMPENSATION AND ● Reviews the risks arising from our compensation policies and practices applicable to all employees and to evaluate policies and practices that could mitigate any such risk. ● Consults with its compensation consultant, Semler Brossy, on such matters. ● Based on these reviews, the Compensation and Human Capital Committee does not believe that our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on our company. | FINANCE COMMITTEE ● Reviews the risks associated with our capital structure, financing needs, long-term financing strategy, banking relationships, credit rating agency relationships and compliance with credit agreement and bond indenture covenants. | NOMINATING, ● Reviews the risks associated with our corporate citizenship and sustainability initiatives, and reviews with management our corporate governance policies. | |||||||

| ||||||||||

| MANAGEMENT OVERSIGHT | ||

| ● Responsible for the day-to-day management of the risks facing our company. | ||

| ● Engages our Board of Directors in discussions concerning risk periodically and as needed, and addresses the topic as part of the annual planning discussions where our Board of Directors and management review key risks to our plans and strategies and the mitigation plans for those risks. |

| 24 |  |

CORPORATE GOVERNANCE

During our 169 years of business, we have built a platform to drive meaningful social change and environmental action. Over the years we have taken stands on issues such as gun violence prevention, equitable access to the polls, the rights of LGBTQ+ people, and many other issues that are important to our business, our customers and the communities we serve. The Levi Strauss Foundation and the company underpin these efforts with grantmaking support to organizations working for lasting changes on these and other important issues.

We review with the Nominating, Governance and Corporate Citizenship Committee the issues on which we are contemplating taking a stand on and with the full Board of Directors where appropriate. In determining which issues to support, we seek issues that directly affect our business and our people and discuss the business and sometimes morale case for taking action. We also take into consideration and discuss with the Nominating, Governance and Corporate Citizenship Committee and/or the Board, among other things, the potential impact on our business, customers, employees and communities in which we do business, risks related to taking a stand, measures to address and mitigate such risks, and how best to communicate our stance on such issues.

We intend to continue advocating for social change and encouraging others to do the same wherever we see opportunities to contribute to a more just, safe and inclusive society.

WORLDWIDE CODE OF BUSINESS CONDUCT

We have adopted a Worldwide Code of Business Conduct, applicable to all of our directors and employees (including our CEO, chief financial officer, controller and other senior financial employees). The Worldwide Code of Business Conduct covers a number of topics, including: accounting practices and financial communications; conflicts of interest; confidentiality; corporate opportunities; insider trading; and compliance with laws. The Worldwide Code of Business Conduct is available under the “Governance” tab of our website at investors.levistrauss.com. If we grant a waiver of the Worldwide Code of Business Conduct to one of our officers, we will disclose this waiver on our website.

SHAREHOLDER COMMUNICATIONS WITH OUR BOARD

Over the years, our Board of Directors and management have had a rich dialogue with shareholders about important issues, and we have in place an effective process that has ensured that various shareholder inputs are heard by our Board of Directors and management.

Our Board of Directors has adopted a formal process by which shareholders may communicate with our Board of Directors or any of its members. Shareholders who wish to communicate with our Board of Directors may do so by sending written communications addressed to Levi Strauss & Co., Attn: Corporate Secretary, 1155 Battery Street, San Francisco, CA 94111. All communications will be compiled by the Corporate Secretary and submitted to our Board of Directors or the individual directors on a periodic basis.

Any interested person may communicate directly with our non-management or independent directors as a group. Persons interested in communicating directly with our non-management or independent directors regarding their concerns or issues may do so by addressing correspondence to a particular director, or to the independent or non-management directors generally, in care of Levi Strauss & Co. at 1155 Battery Street, San Francisco, CA 94111. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the relevant committee chair.

RELATED PARTY TRANSACTION POLICY

We have a written policy concerning the review and approval of related party transactions. Potential related party transactions are identified through an internal review process that includes a review of director and officer questionnaires and a review of any payments made in connection with transactions in which related persons may have had a direct or indirect material interest. Any business transactions or commercial relationships between us and any of our directors or shareholders, or any of their immediate family members, are reviewed by the Nominating, Governance and Corporate Citizenship Committee and must be approved by at least a majority of the disinterested members of our Board of Directors. Business transactions or commercial relationships between us and our named executive officers (“NEOs”) who are not directors, or any of their immediate family members, requires approval from our CEO with reporting to the Audit Committee. Our NEOs are disclosed under “Compensation Discussion and Analysis.”

| 2022 PROXY STATEMENT | 25 |

CORPORATE GOVERNANCE

RELATED PARTY TRANSACTIONS

Since November 28, 2021, there have been no transactions to which we have been a participant in which the amount involved exceeded or will exceed $120,000, and in which any of our then directors, executive officers or holders of more than 5% of Class A and Class B common stock on a combined basis at the time of such transaction, or any members of their immediate family, had or will have a direct or indirect material interest, other than as noted below.

REGISTRATION RIGHTS AGREEMENT

In connection with our initial public offering in 2019, we entered into a registration rights agreement with certain holders of our capital stock, including Mr. Friedman, Mr. Prime, Mimi L. Haas, Mr. Peter E. Haas, Jr., Margaret E. Haas, Robert D. Haas, the Peter E. Haas Jr. Family Fund, Bradley J. Haas, Daniel S. Haas and Jennifer C. Haas. Pursuant to the registration rights agreement, holders of more than 90% of our Class B common stock have certain contractual rights with respect to the registration under the Securities Act of 1933, as amended (the “Securities Act”) of the shares of Class A common stock issuable upon conversion of their Class B common stock (“registrable securities”).

| ● | Piggyback Registration Rights. If we register any of our securities for public sale, the holders of any then-outstanding registrable securities will be entitled to notice of, and will have the right to include their registrable securities in, such registration. These piggyback registration rights will be subject to specified conditions and limitations, including the right of the underwriters of any underwritten offering to limit the number of registrable securities to be included in such offering (but in no case below 50% of the total number of securities included in such offering). |

| ● | Registration on Form S-3. If we are eligible to file a registration statement on Form S-3, the holders of any then-outstanding registrable securities will have the right to demand that we file registration statements on Form S-3. This right to have registrable securities registered on Form S-3 will be subject to specified conditions and limitations. |

| ● | Expenses of Registration. Subject to specified conditions and limitations, we will pay all expenses relating to any registration made pursuant to the registration rights agreement, other than underwriting discounts and commissions. |

| ● | Termination of Registration Rights. The registration rights of any particular holder of registrable securities will not be available when such holder is able to sell all of his, her or its registrable securities during a 90-day period pursuant to Rule 144 or other similar exemption from registration under the Securities Act. |

INDEMNIFICATION OF DIRECTORS AND OFFICERS

We have entered into indemnification agreements with each of our directors and executive officers. The indemnification agreements, as well as our certificate of incorporation and bylaws, require us to indemnify our directors and executive officers to the fullest extent permitted by Delaware law.

OTHER RELATIONSHIPS

Mr. Bergh, our President and CEO, is a member of the Board of Directors of the Levi Strauss Foundation, which is not one of our consolidated entities. Mr. Seth R. Jaffe, our Executive Vice President and General Counsel, is Vice President and member of the Board of Directors of the Levi Strauss Foundation. We donated $12.2 million to the Levi Strauss Foundation in fiscal year 2021.

NON-EMPLOYEE DIRECTOR COMPENSATION DURING FISCAL YEAR 2021

We provide compensation to our non-employee directors for the time and effort necessary to serve as a member of our Board of Directors. In addition, our non-employee directors are entitled to reimbursement of direct expenses incurred in connection with attending meetings of our Board of Directors or committees thereof.

Compensation for members of our Board of Directors is reviewed by the Compensation and Human Capital Committee and approved by our Board of Directors. The Compensation and Human Capital Committee consults regularly with its compensation consultant, Semler Brossy, which informs it of market trends and conditions, comments on market data relative to the non-employee directors’ current compensation, and provides perspective on other companies’ non-employee director compensation practices.

| 26 |  |

CORPORATE GOVERNANCE

In fiscal year 2021, director compensation consisted of an annual retainer paid in cash and equity compensation in the form of RSUs. Chairs of the committees of our Board of Directors also received an additional cash retainer, as described below.

In fiscal year 2021, each non-employee director received compensation consisting of an annual cash retainer fee and was eligible to participate in the provisions of our Deferred Compensation Plan that apply to directors. In fiscal year 2021, Spencer C. Fleischer and Elliott Rodgers participated in our Deferred Compensation Plan.

The annual retainer for our non-employee directors is at the rate of $100,000 per fiscal year.

In fiscal year 2021, each non-employee director also received an annual equity award in the form of restricted stock units (“RSUs”) which are granted under our 2019 Equity Incentive Plan (the “2019 EIP”). The annual equity award value in the form of RSUs granted under our 2019 EIP was $155,000. Our non-employee directors have target stock ownership guidelines of $400,000 of equity ownership within five years of joining the Board of Directors.

The RSUs vest one year following the grant date. In addition, each director’s initial RSU grant includes a deferral delivery feature, under which the director will not receive the vested awards until six months following the cessation of service on our Board of Directors.

Under the terms of our 2016 Equity Incentive Plan (the “2016 EIP”) and 2019 EIP, recipients of RSUs receive additional grants as a dividend equivalent when our Board of Directors declares a dividend to all shareholders. Dividend equivalents are subject to all the terms and conditions of the underlying RSU Award Agreement to which they relate.

COMPENSATION OF COMMITTEE CHAIRS AND BOARD CHAIR

In addition to the compensation described above, chairs of the committees of our Board of Directors receive an additional retainer fee in the amount of $20,000 for each of the Audit Committee and the Compensation and Human Capital Committee and $15,000 for each of the Finance Committee and the Nominating, Governance and Corporate Citizenship Committee.

For fiscal year 2021, Mr. Eckert was the Chair of our Board of Directors. The Chair of our Board of Directors is entitled to receive an additional annual retainer in the amount of $200,000, 50% of which is paid in cash and 50% of which is paid in the form of RSUs. The Chair of our Board of Directors may also receive the additional retainers earned by chairs of the committees of our Board of Directors, if applicable.

In determining the Chair’s compensation, our Board of Directors reviewed compensation data and market trends as advised by its compensation consultant, Semler Brossy. The Board of Directors also took into account the Chair’s additional role and responsibilities in interacting with our family shareholders over time.

| 2022 PROXY STATEMENT | 27 |

CORPORATE GOVERNANCE

The following table sets forth information regarding the compensation earned for service on our Board of Directors during fiscal year 2021 by our directors who were not also our NEOs. Mr. Bergh, our President and CEO, did not receive any additional compensation for his service on our Board of Directors during fiscal year 2021. His compensation as a NEO is set forth under “Summary Compensation Table.”

| NAME | FEES EARNED OR PAID IN CASH | STOCK AWARDS(1) | ALL OTHER COMPENSATION(2) | TOTAL | |||

| Troy M. Alstead | 120,000 | 154,977 | 15,563 | 290,540 | |||

| Jill Beraud | 111,250 | 154,977 | 8,080 | 274,307 | |||

| Robert A. Eckert(3) | 191,250 | 279,959 | 28,437 | 499,646 | |||

| Spencer Fleischer(4) | 118,750 | 154,977 | 18,599 | 292,326 | |||

| David A. Friedman | 100,000 | 154,977 | 6,760 | 261,737 | |||

| Yael Garten | 100,000 | 154,977 | 4,504 | 259,481 | |||

| Christopher J. McCormick | 100,000 | 154,977 | 10,234 | 265,211 | |||

| Jenny Ming | 100,000 | 154,977 | 19,218 | 274,195 | |||

| Patricia Salas Pineda | 100,000 | 154,977 | 16,776 | 271,753 | |||

| Joshua E. Prime(5) | 100,000 | 154,977 | 12,991 | 267,968 | |||

| Elliott Rodgers(6) | 100,000 | 244,866 | 1,925 | 346,791 |

| (1) | These amounts reflect the aggregate grant date fair value of RSUs granted under the 2019 EIP in fiscal year 2021 computed in accordance with FASB ASC 718. See the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for fiscal year 2021 for the relevant assumptions used to determine these awards. The following table shows as of November 28, 2021, the aggregate number of outstanding RSUs held by each person who was a director in fiscal year 2021, which number includes any RSUs that were vested but deferred and RSUs that were not vested as of such date: |

| NAME | AGGREGATE OUTSTANDING RSUs | |

| Troy M. Alstead | 57,877 | |

| Jill Beraud | 29,008 | |

| Robert A. Eckert | 83,349 | |

| Spencer Fleischer | 40,597 | |

| David A. Friedman | 25,141 | |

| Yael Garten | 17,243 | |

| Christopher J. McCormick | 42,688 | |

| Jenny Ming | 75,240 | |

| Patricia Salas Pineda | 63,569 | |

| Joshua E. Prime | 21,030 | |

| Elliott Rodgers | 9,965 |

| (2) | This column includes the aggregate grant date fair value of dividend equivalents provided to each director in fiscal year 2021 in the following amounts: |

| NAME | FAIR VALUE OF DIVIDEND EQUIVALENT RSUs GRANTED | |

| Troy M. Alstead | 15,563 | |

| Jill Beraud | 8,080 | |

| Robert A. Eckert | 20,937 | |

| Spencer Fleischer | 11.099 | |

| David A. Friedman | 6,760 | |

| Yael Garten | 4,504 | |

| Christopher J. McCormick | 10,234 | |

| Jenny Ming | 19,218 | |

| Patricia Salas Pineda | 16,776 | |

| Joshua E. Prime | 5,491 | |

| Elliott Rodgers | 1,925 |

| (3) | Mr. Eckert’s amount in the “Stock Awards” column includes an increase in his annual retainer upon being elected as our Board Chair, consistent with our standard Board compensation program. In the “All Other Compensation” column, this includes a charitable match of $7,500. |

| (4) | Mr. Fleischer’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (5) | Mr. Prime’s amount in the “All Other Compensation” column includes charitable matches of $7,500. |

| (6) | Mr. Rodgers’ amount in the “Stock Awards” column includes the value of the initial RSU grant he received upon joining our Board, consistent with our standard Board compensation program. |

| 28 |  |

The following is a brief biography of each of our executive officers except for Mr. Bergh, whose biography is set forth under “Continuing Board of Directors” above.

| NAME | AGE | POSITION | ||

| Charles (“Chip”) V. Bergh | 64 | President, Chief Executive Officer and Director | ||

| Seth M. Ellison | 63 | Executive Vice President and Chief Commercial Officer | ||

| Seth R. Jaffe | 65 | Executive Vice President and General Counsel | ||

| Elizabeth O’Neill | 50 | Executive Vice President and Chief Operations Officer | ||

| Harmit Singh | 58 | Executive Vice President and Chief Financial Officer |

| Seth M. Ellison | |||

| |||

Executive Vice President and Chief Commercial Officer Seth M. Ellison currently serves as our Executive Vice President and Chief Commercial Officer. Mr. Ellison is responsible for the company’s global commercial strategy and operations across all channels and markets around the world. In addition to this role, he remains president of Levi Strauss Europe and is a member of the company’s executive leadership team, which sets the company’s global direction. Mr. Ellison joined the company in September 2012 to serve as president of the Dockers® brand. He has a passion for growing brands and a track record of success in large and small companies. He has more than 30 years of apparel experience –including president of the swimwear group at Perry Ellis, vice president general manager of EMEA Apparel and president of Hurley International at Nike Inc. Most recently, Seth was the chief commercial officer at Alternative Apparel where he successfully evolved a T-shirt blank supplier into a global wholesale brand sold in key U.S. accounts, including Bloomingdales, Nordstrom, Macy’s, Dillard’s, Urban Outfitters and in 120 countries. | |||

| Seth R. Jaffe | |||

| |||

Executive Vice President and General Counsel Seth R. Jaffe currently serves as our Executive Vice President and General Counsel. Mr. Jaffe leads the global legal department in its support of businesses operating in over 110 countries. He is responsible for all aspects of legal, ethics and compliance, global security and resilience, and governance matters, in addition to acting as counselor to the board of directors and executive leadership. He is a member of the company’s executive leadership team. Mr. Jaffe also oversees the Levi Strauss Foundation, whose mission is to bring pioneering social change. Prior to joining Levi Strauss & Co. in 2011, Mr. Jaffe served as senior vice president and general counsel of specialty retailer Williams-Sonoma, Inc. Before that, he was chief administrative officer and general counsel of CareThere Inc., leading a broad range of business and legal areas for a healthcare technology company backed by Johnson & Johnson. | |||

| 2022 PROXY STATEMENT | 29 |

EXECUTIVE OFFICERS

| Elizabeth O’Neill | |||

| |||

Executive Vice President and Chief Operations Officer Liz O’Neill currently serves as our Executive Vice President and Chief Operations Officer. Ms. O’Neill is responsible for all supply chain operations which consists of sourcing, end-to-end planning, distribution, logistics and sustainability. Ms. O’Neill also leads companywide innovation managing our internal start-up capabilities and offsite design lab while simultaneously working closely with our vendor partners to execute our latest product creations. Ms. O’Neill is a member of the company’s executive leadership team, which guides the strategic direction for LS&Co. Prior to joining us, Ms. O’Neill was at Gap Inc., in leadership roles in both Gap brand and Old Navy, overseeing sourcing and production management for Gap’s global brands from 2001 to 2013. Ms. O’Neill previously spent several years at The Disney Store in Los Angeles and Abercrombie and Fitch in Ohio, holding positions in both merchandising and product management. | |||

| Harmit Singh | |||

| |||

Executive Vice President and Chief Financial Officer Harmit Singh currently serves as our Executive Vice President and Chief Financial Officer, a position he has held since January 2013. He is responsible for managing our finance, information technology, strategic sourcing and global business services functions globally. Previously, Mr. Singh was executive vice president and chief financial officer of Hyatt Hotels Corporation from August 2008 to December 2012. Prior to that, he spent 14 years at Yum! Brands, Inc. in a variety of global leadership roles including senior vice president and chief financial officer of Yum Restaurants International from 2005 to 2008. Before joining Yum!, Mr. Singh worked in various financial capacities for American Express India & Area Countries. Mr. Singh served on the board of directors and was the Audit Committee chair of Avendra, LLC through August 2012. Mr. Singh served as a member of the board of directors and was the Audit Committee chair of Buffalo Wild Wings Inc., the owner, operator and franchisor of Buffalo Wild Wings restaurants, from October 2016 to February 2018 when the company was sold. Mr. Singh serves on the board of directors and the Audit Committee of OpenText Corporation. | |||

| 30 |  |

| 2022 PROXY STATEMENT | 31 |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION & ANALYSIS

This Compensation Discussion and Analysis describes our executive compensation program, the compensation decisions we have made under our program for fiscal year 2021, and the reasoning underlying those decisions. It focuses on the compensation of our named executive officers (“NEOs”), who in fiscal year 2021 were:

| ● | Charles (“Chip”) V. Bergh, President and Chief Executive Officer (“CEO”) |

| ● | Harmit Singh, Executive Vice President and Chief Financial Officer (“CFO”) |

| ● | Seth Ellison, Executive Vice President and Chief Commercial Officer |

| ● | Elizabeth O’Neill, Executive Vice President and Chief Operations Officer |

| ● | Jennifer Sey, Executive Vice President and President, Brands |

| Ms. Sey resigned effective February 2022. | |

COMPENSATION PHILOSOPHY AND OBJECTIVES

Our executive compensation policies and programs are designed to drive shareholder value creation by motivating, retaining and attracting exceptional talent in pursuit of the company’s strategic goals. The continued strength of our company and our brands depends on the knowledge, capabilities, innovation, execution and integrity of our leaders.

Our compensation programs help create a high-performance, outcome-driven and principled culture by holding leaders accountable for delivering results, developing our employees and exemplifying our core values. In addition, we believe that our compensation policies and programs for leaders and employees are appropriately balanced, reinforcing both short-term and long-term results, and as such do not incentivize behavior that would have a material adverse effect on the company.