For an amount of €427 million of these operating loss carry-forwards no deferred tax assets were recognised in the balance sheet as at 31 December 2005 due to the fact that future realisation is not foreseen.

Back to Contents

| 108 | | | Buhrmann | | Chapter 8 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

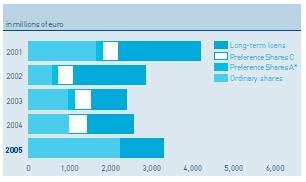

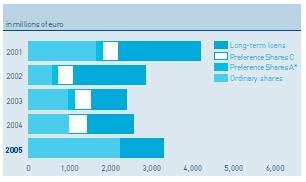

29 Long-term borrowings continued

Preference Shares C

On 28 October 1999, Preference Shares C were issued to two U.S. venture capital groups, Apollo Management IV L.P. and Bain Capital, LLC to provide part of the financing of the acquisition of Corporate Express. In 2005, the Preference Shares C were repurchased for an amount of US$520 million which resulted in a loss of €85 million (see Note 35).

The Preference Shares C had a conversion option. The conversion option was separately valued at fair value and recorded under ‘other non-current liabilities’. The liability component was stated as ‘long-term borrowings’ at amortised cost using an effective interest of 11.2%.

Convertible Bond

A seven-year Subordinated Convertible Bond Loan with listing at the Amsterdam Stock Exchange was issued in 2003 for an amount of €115 million, with a coupon of 2% payable annually on 18 June. At 31 December 2005, the bonds are convertible by the option of the holders into Buhrmann ordinary shares at a conversion price of €7.78 per share. The conversion price is adjusted annually, among others, for cash dividend. This loan must be redeemed on or before 18 December 2010. Buhrmann has the option to redeem the loan after 9 July 2008 if the official closing price of Buhrmann’s ordinary shares has been in excess of 150% of the conversion price for 20 trading days in a period of 30 trading days. The Convertible Bonds were issued at par. The market value of the Convertible Bond at 31 December 2005 amounted to €191 million.

The conversion option was measured at issue of this bond using the residual method after deduction of the liability component (measured at fair value) and recorded directly in shareholders’ equity. The liability component is stated at amortised cost (fair value less financing fees) using an effective interest rate of 9.25%.

High Yield Bonds due 2014

A ten-year, Subordinated Bond Loan was issued in 2004 for the amount of US$150 million (2014 Notes), with a coupon of 81 /4 %, payable semi-annually. This loan must be redeemed on 1 July 2014. At any time before 1 July 2007, Buhrmann can choose to redeem up to 35% of this loan at a redemption price of 108.25% of the principal amount, with proceeds raised in one or more equity offering made by Buhrmann, as long as certain conditions are met. Thereafter, the whole loan, or part of it, can be redeemed at contractual rates above par (starting at 1July 2009 at 104.125%, decreasing annually).

This High Yield Bond is stated at amortised cost using an effective interest rate of 9.02%.

The market value of this High Yield Bond at 31 December 2005 amounted to US$151 million (€128 million).

High Yield Bonds due 2015

A ten-year, Subordinated Bond Loan was issued in 2005 for the amount of US$150 million (2015 Notes), with a coupon of 7 7 /8 %, payable semi-annually. This loan must be redeemed on 1 March 2015. At any time before 1 March 2008, Buhrmann can choose to redeem up to 35% of this loan at a redemption price of 107.875% of the principal amount, with proceeds raised in one or more equity offerings made by Buhrmann, as long as certain conditions are met. Thereafter, the whole loan, or part of it, can be redeemed at contractual rates above par (starting from 1 March 2010 at 103.938%, decreasing annually).

This High Yield Bond is stated at amortised cost using an effective interest rate of 8.65%.

The market value of this High Yield Bond at 31 December 2005 amounted to US$147 million (€125 million).

Senior Facilities Agreement (Term Loan s A, B, C and D and Revolver)

The Senior Facilities Agreement was arranged in 2003 and funded on 31 December 2003. The Senior Facilities Agreement consisted of a Term Loan A of €120 million and Term Loans B with tranches of €50 million and US$380 million plus a working capital facility of €255 million (Revolver). The collateral provided for the Senior Facilities Agreement is a pledge on assets of Buhrmann NV, including all its material existing and future operating companies in the United States and the Netherlands. Borrowings under the Senior Facilities Agreement bear interest at floating rates related to LIBOR for the relevant currency for varying fixed interest periods. The interest rate margins vary with the leverage ratio (pricing grid). The initial margin for both the Revolver and the Term Loan A is 2.50% and for the Term Loans B 2.75%. The Revolver carries a fee of 0.75% for the undrawn balance. The documentation of the Senior Facilities Agreement allows for an increase in the Revolver as well as increases in Term Loans subject to meeting certain conditions such as a maximum leverage ratio. This gives the Company the opportunity to raise funds under the existing arrangements.

In July 2004, the Term Loans B were converted into Term Loans C. At the same time, the Term Loans C were increased by US$125 million and the initial interest rate margin was decreased to 2.50%. Subsequently, the Senior Facilities Agreement consisted of the Term Loan A of €112 million, the Term Loans C with tranches of €50 million and US$503 million and the Revolver of €255 million. On 30 November 2005 the Term Loans C were converted into the Term Loans D thereby reducing the applicable margin over LIBOR with 0.75%. At 31 December 2005 the applicable margins were 2.25% and 1.75% for the Term Loans A and D, respectively.

Back to Contents

| | | Buhrmann | | Chapter 8 | 109 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

29 Long-term borrowings continued

The interest rates in effect at 31 December 2005 and 2004 were as follows:

|

|

|

| |

| | 2005 | | 2004 | |

|

|

|

| |

| Term Loan A EUR | 4.72% | | 4.41% | |

|

|

|

| |

| Term Loan C EUR | – | | 4.66% | |

|

|

|

| |

| Term Loan D EUR | 4.22% | | – | |

|

|

|

| |

| Term Loan C USD | – | | 4.94% | |

|

|

|

| |

| Term Loan D USD | 6.20% | | – | |

|

|

|

| |

|

The market value of the Senior Facilities Agreement is primarily determined by credit status. Interest rate developments have a limited influence since these loans have a floating interest. Although these loans are not traded publicly, indication of market values can be obtained through the agent. The market value at 31 December 2005 approximated the book value.

The Senior Facilities Agreement is subject to a variety of conditions as is customary for these types of facilities and the financial position of Buhrmann. For example, specific minimum or maximum financial ratios (‘covenants’) must be met such as:

| Interest coverage ratio: | EBITDA/interest expense |

| Fixed charge ratio: | EBITDA + rent + lease expenses/fixed charges |

| Leverage ratio: | Indebtedness/EBITDA |

The definitions of certain accounting numbers for covenant calculation purposes (for example: operating result before depreciation of tangible fixed assets and internally used software and before amortisation and impairment of goodwill (‘EBITDA’) as well as exceptional items and indebtedness) differ from figures as published in these Consolidated Financial Statements due to specific contractual arrangements which are derived from our former Dutch GAAP reporting conventions. Also, income statement items used in covenants are calculated on a rolling 12 monthly basis. More detailed information on the covenant levels is available on the web site of Buhrmann. The actual covenant ratios at 31 December 2005 comply with the threshold ratios as per loan covenants.

The Term Loans C and D are stated at amortised cost using an average effective interest rate of 5.84% for the USD denominated loans and 4.65% for the EUR denominated loans. The Revolver is stated at its redemption value and the related financing fees are recorded as capitalised financing fees under ‘other non-current assets’. The Term Loans A are also stated at their redemption as no financing fees are allocated to these loans.

Securitised Notes

The Company has a trade receivable securitisation programme under which funds are raised by pledging trade receivables from subsidiaries in the USA as security for short-term and medium-term borrowings. Both trade receivables and borrowings related to this programme are included in the Consolidated Balance Sheet. The transactions under this programme are treated as collaterised borrowings.

The Short Term Notes are issued in USD, reflecting the currency of the pledged receivables. The amount of Short Term Notes outstanding against the receivables pledged fluctuates as a result of liquidity requirements, advance rates calculated and invoices outstanding. No Short Term Notes were outstanding during 2004 and 2005. To ensure availability of re-financing for the Notes, a back up liquidity facility has been arranged.

In July 2002, Medium Term Notes in USD and GBP were issued. As a consequence of the sale of the paper merchanting division, the collateral for the Notes denominated in GBP in the form of receivables denominated in GBP generated by paper merchanting companies in the U.K., no longer existed. At 31 December 2005, US$100 million of Medium Term Notes were outstanding.

The Medium Term Notes are stated at amortised cost using an average effective interest rate of 4.64% .

The market value of the Medium Term Notes approximates their book value as the Notes bear variable interest and have relatively short maturities.

The Securitised Notes are stated at their redemption value and the related financing fees are recorded as capitalised financing fees under ‘other non-current assets’.

The trade receivables securitisation programme raises funds by pledging trade receivables from operating companies in the United States as security for short-term and medium-term borrowings which is treated as collaterised borrowings. The receivables and borrowings related to this programme are included in the Consolidated Balance Sheet.

Back to Contents

| 110 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

29 Long-term borrowings continued

The operating companies sell their trade receivables to Buhrmann Silver US LLC, which in turn pledge the trade receivables to third-party dedicated entities as security for short-term borrowings in the form of short term notes (Short Term Notes). The programme delivers funding at attractive rates and at the same time diversifies sources of capital and increases financial flexibility.

The transactions relating to the Trade Receivable Securitisation Programme are as follows:

The Originators in the United States contribute their receivables to Buhrmann Silver US LLC (the U.S. Master Purchaser), which is a partnership with the Originators as partners. The U.S. Master Purchaser issues notes (Buhrmann U.S. Notes) to Buhrmann Silver Financing, LLC (the Silver Note Issuer) and Silver Funding Ltd (the MTN issuer).

With the Buhrmann U.S. Notes as collateral the MTN issuer has issued Medium Term Notes, which are listed on the Luxembourg Stock Exchange, in US dollars and euro. As the euro denominated notes have the U.S. dollar pool as their primary collateral, the Medium Term Notes outstanding in euro have been swapped to U.S. dollar until maturity of the Medium Term Notes. The shares of Silver Funding Ltd are held by the Silver Funding Charitable Trust, which is controlled by a board that is independent from Buhrmann.

The Silver Note Issuer has the ability to issue Silver Notes to Erasmus Capital Corporation with the Buhrmann U.S. Notes as collateral. With the Silver Notes as collateral Erasmus Capital Corporation can raise short-term funds in the market. The Silver Note issuer is a wholly owned Buhrmann subsidiary and Erasmus Capital Corporation is a Delaware company sponsored by Rabobank International.

Buhrmann Stafdiensten B.V. (a Dutch Buhrmann subsidiary) services the programme.

Average effective interest rate

The average blended effective cash interest rate, including margin and dividend on preference shares, was 6.9% in 2005 and 8.4% in 2004.

| Repayment schedule for long-term borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | |

| | 2006 | | 2007 | | 2008 | | 2009 | | >2009 | | Perpetual | | Total | | Fair value | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed rate debt: | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preference Shares A | | | | | | | | | | | 181 | | 181 | | 166 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| High Yield Bonds due 2014 | | | | | | | | | 127 | | | | 127 | | 128 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| High Yield Bonds due 2015 | | | | | | | | | 127 | | | | 127 | | 125 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subordinated Convertible Bonds | | | | | | | | | 115 | | | | 115 | | 191 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other | | | | | | | 2 | | – | | | | 2 | | 2 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total redemption value | | | | | | | | | | | | | | | | |

| fixed rate debt | | | | | | | 2 | | 369 | | 181 | | 552 | | 611 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | | | |

| Variable rate debt: | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Account receivables securitisation | | | 85 | | | | | | | | | | 85 | | 85 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Term Loan A | 16 | | 26 | | 26 | | 27 | | | | | | 96 | | 96 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Term Loans D | 5 | | 5 | | 5 | | 5 | | 449 | | | | 469 | | 469 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other | 25 | | 9 | | | | | | | | | | 34 | | 34 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total redemption value | | | | | | | | | | | | | | | | |

| variable rate debt | 46 | | 125 | | 31 | | 32 | | 449 | | 181 | | 684 | | 684 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total redemption value | 46 | | 125 | | 31 | | 34 | | 818 | | 181 | | 1,236 | | 1,295 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The fair values of Buhrmann’s fixed rate loans have been estimated based on applicable market interest rates available to Buhrmann for instruments of a similar nature and maturity. The fair value of variable rate debt approximates the carrying value. For cash, trade receivables, other short-term assets, trade payable, accrued liabilities and other short-term liabilities, the carrying value of these financial instruments approximates their fair value owing to the short-term maturities of these assets and liabilities.

The instalments in 2006 of €4 million per quarter for Term Loans A and approximately €1 million per quarter for Term Loans D fall due in March, June, September and December. Other includes the Revolver and Medium Term Securitised Notes. There were no Short Term Securitised Notes outstanding at 31 December 2005. The average remaining term of long-term debt, excluding Preference Shares A, is approximately four years.

Back to Contents

| | | Buhrmann | | Chapter 8 | 111 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

30 Other provisions

The movements in provisions other than pensions are as follows:

|

|

|

|

|

|

| | | Integration and | | | |

| | Total | | restructuring | | Other | |

|

|

|

|

|

|

| Position at 31 December 2004: | | | | | | |

|

|

|

|

|

| |

| Non-current | 85 | | 11 | | 74 | |

|

|

|

|

|

| |

| Current | 18 | | 8 | | 10 | |

|

|

|

|

|

|

|

| Total | 103 | | 19 | | 84 | |

|

|

|

|

|

|

|

| | | | | | | |

| Payments | (18 | ) | (7 | ) | (11 | ) |

|

|

|

|

|

| |

| Additions charged to result | 21 | | 17 | | 4 | |

|

|

|

|

|

| |

| Releases to result/usage | (6 | ) | (5 | ) | (1 | ) |

|

|

|

|

|

| |

| Translation differences | 2 | | 1 | | 1 | |

|

|

|

|

|

|

|

| Total changes | (1 | ) | 6 | | (7 | ) |

|

|

|

|

|

|

|

| | | | | | | |

| Position at 31 December 2005: | | | | | | |

|

|

|

|

|

| |

| Non-current | 67 | | 10 | | 57 | |

|

|

|

|

|

| |

| Current | 33 | | 15 | | 19 | |

|

|

|

|

|

|

|

| Total | 101 | | 25 | | 77 | |

|

|

|

|

|

|

|

The long-term balance at 31 December reflects amounts payable after more than one year. Amounts payable within one year are recorded as current provisions.

Integration and restructuring

Provisions for integration and restructuring mainly relate to the cost-saving restructuring measures in the Office Products operations in North America and Europe.

Other

Other provisions include primarily warranties regarding indemnifications with respect to divested businesses and various other contractual risks.

Also included is the provision for product warranties relating to potential liabilities in the event products delivered or services rendered do not meet the agreed qualities, in those cases that the guarantee period has not yet expired. The additions charged to result only relate to warranties issued during 2005 and are calculated as a percentage of net sales. This percentage is based on past experience.

31 Financial market risks

Buhrmann is exposed to financial market risks, including adverse changes in interest rates, currency exchange rates and availability of short-term liquidity. Our financial policies are designed to mitigate these risks by restricting the impact of interest and currency movements on our financial position while safeguarding an adequate liquidity profile.

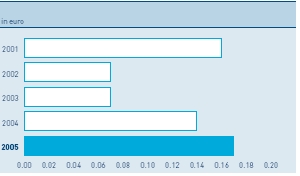

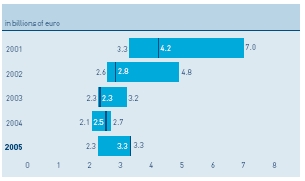

The financing policy aims to maintain a capital structure which enables us to achieve our Group strategic objectives and daily operational needs. The degree of flexibility of the capital structure, including appropriate access to capital markets, the financing of working capital fluctuations and the costs of financing (optimal weighted average cost of capital) are factors taken into consideration. With respect to the level of debt financing, Buhrmann focuses on cash interest cover (operating result before depreciation of tangible fixed assets and internally used software and other intangible assets and before special items over cash interest) and the relationship between borrowings and total enterprise value (market value based leverage, which is calculated by using the market capitalisation of equity and the nominal value of interest-bearing debt as the total enterprise value). The objective is to restrict the four quarterly rolling cash interest coverage to a minimum of three times and the market-value based gearing (net interest-bearing debt over total enterprise value) over time to a maximum of 50%. In addition, consideration is given to the development of specific capital ratios, of which the leverage ratio (net interest-bearing debt over operating result before depreciation of tangible fixed assets and internally used software and before special items) is the most relevant. Actual cash interest cover at 31 December 2005 was 5.6 (2004: 4.7), which is above our minimum target level of 3, and the leverage ratio was 2.7 (2004: 2.2). Both the debt reduction and the refinancing carried out in 2004 had a positive effect on the financial ratios.

Back to Contents

| 112 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

31 Financial market risks continued

Financial instruments such as currency and interest swaps are used only to hedge against financial market risks, rather than for speculative purposes. Financial instruments are primarily dealt with third parties by Buhrmann NV, Buhrmann US, Inc. and Buhrmann Shared Service Center (Europe) NV. These entities also act as the main financing companies for the Group. In addition, an accounts receivable securitisation programme is being operated using Buhrmann Silver US LLC.

Our treasury function does not operate under an own profit objective but it pursues benefits of scale and efficiency as well as provides in-house services in the area of financial logistics. Cash and third-party debt is concentrated in the main financing companies to ensure maximum efficiency in meeting changing business needs, while local operations are largely financed by a mix of equity and long-term inter-company loans denominated in local currencies.

Credit risks

The Company’s customer base is spread over many industries and sectors, including government institutions, and most of these customers are large corporations or institutions. No individual customer represents 10% or more of the Company’s total sales or trade accounts receivable balance in any year.

Management believes it has adequately provided for the collection risk in the Company’s accounts receivable, by recording an allowance for doubtful accounts, which reduces such amounts to their net realisable value, taking into consideration that collection risks are to a certain extent insured.

The Company has deposited its cash and deposits with and has obtained its loans from reputable financial institutions with high-quality credit ratings. The Company believes that the risk of non-performance by any of these institutions is remote.

Interest rate risks

Our interest policy is designed to restrict the short-term impact of fluctuations in interest rates while keeping the interest burden as low as possible. Of the non-current portion of long-term borrowings at 31 December 2005, 56% was at floating interest rates before hedging. Interest rate swaps are used to hedge against floating interest. We currently aim to have around 60% of the long-term borrowings, after hedging, at fixed interest given the present, improved, level of interest cover. At 31 December 2005, 70% of the non-current long-term borrowings was, after hedging, at fixed interest rates.

| Breakdown of long-term borrowings by interest profile: | | | | | | | | |

|

|

|

|

|

|

|

|

| | | | | | 31 December 2005 | |

| |

|

|

|

|

|

| | Fixed | | % | | Floating | | % | |

|

|

|

|

|

|

|

|

| Subordinated loans and Preference Shares A | 503 | | 44 | | – | | 0 | |

|

|

|

|

|

|

|

| |

| Other loans | 2 | | 0 | | 633 | | 56 | |

| |

|

|

|

|

|

|

| |

| | | | | | | | | |

| Interest swaps >1 year (see below) | 297 | | 44 | | (297 | ) | 56 | |

|

|

|

|

|

|

|

| |

| Total | 802 | | 70% | | 336 | | 30% | |

|

|

|

|

|

|

|

| |

| | | | | | | |

| Buhrmann’s interest rate swap contracts at 31 December 2005: | | | | | | |

|

|

|

|

|

| |

| | Notional amount1 | | Average interest | | Fair value | |

| Maturity | (in millions) | | rate in %2 | | (in millions) | |

|

|

|

|

|

| |

| < 1 year | 42 | | 2.74 | | 1 | |

|

|

|

|

|

| |

| < 2 years | 148 | | 4.27 | | 1 | |

|

|

|

|

|

| |

| < 3 years | 148 | | 4.71 | | 0 | |

|

|

|

|

|

| |

| < 5 years | 0 | | | | | |

|

|

|

|

|

| |

| Total | 339 | | | | 2 | |

|

|

|

|

|

| |

| | |

| 1 | The notional amount of these interest rates swaps is denominated in US dollars and has been translated at the year end exchange rate. |

| 2 | Pursuant to these swaps,Buhrmann pays the fixed interest rates indicated in the table and receives floating rates based on three-month LIBOR. |

The total fair value at 31 December 2004 of the interest rate swap contracts was €5 million negative.

The estimated fair value of the outstanding interest swap contracts (IRS’s) indicates how much would be paid or received in exchange for termination of the contracts without further commitments as per the balance sheet date, and is included in the tables above. In the period 1 January 2004 to 30 September 2004, no hedge accounting was applied on the IRS’s which means that the change in the fair value of the IRS’s in that period was recorded in the income statement. In the period 1 October 2004 to 31 December 2004, hedge accounting was applied to most IRS’s as these IRSs were designated as cash flow hedges which means that changes in the fair value of these IRS’s were recorded in the hedge reserve in shareholders’ equity rather than in the income statement. As of 1 January 2005, hedge accounting is applied to all IRS’s.

Back to Contents

| | | Buhrmann | | Chapter 8 | 113 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

31 Financial market risks continued

The fair value of the IRS’s at the start of hedge accounting is amortised to the hedge reserve with an offsetting amount in the income statement. The total amount recorded in the income statement in 2005 was a gain of €2 million (as financing costs) and a total amount of €5 million was added to the hedge reserve. In 2004, a gain of €4 million (as financing costs) was recorded in the income statement and an amount of €1 million was added to the hedge reserve.

The fair value of the interest rate swaps at 31 December 2005 of €2 million positive is included in other current assets.

Currency rate risks

Regarding currency risk exposure on trading transactions, it is the policy to cover these risks on a transaction basis as much as possible to protect the operational margins in local currency terms. Currency forward contracts with terms up to one year are also used to cover these risks. The occurrence of these exposures is relatively low as operating companies generally operate on local markets with local competitors.

Buhrmann aims to incur its debt by currency after hedges approximately in proportion to the forecasted split of operating result before depreciation of property, plant and equipment and internally used software, and before impairment of goodwill and other exceptional results over the major currencies. The remaining translation risk is not covered. Forward foreign exchange and currency swaps are used to adjust the currency profile of the loans issued towards the desired position in order to achieve the hedging as per policy.

Given the volatility of currency exchange rates, there can be no assurance that Buhrmann will be able to effectively manage its currency transaction risks or that any volatility in currency exchange rates will not have a material adverse effect on Buhrmann’s financial conditions or results of operations.

Breakdown of long-term borrowings by currency:

|

|

|

|

|

| | 31 December

2005 | | 31 December

2004 | |

|

|

|

|

|

| As issued: | | | | |

|

|

|

|

|

| EUR | 393 | | 404 | |

|

|

|

|

|

| USD | 741 | | 824 | |

|

|

|

|

|

| Other | 4 | | 4 | |

|

|

|

|

|

| | 1,138 | | 1,232 | |

|

|

|

|

|

| | | | | |

| After hedging with forward exchange | | | | |

| and currency swaps (see below): | | | | |

|

|

|

|

|

| EUR | 242 | | 246 | |

|

|

|

|

|

| USD | 846 | | 933 | |

|

|

|

|

|

| Other | 49 | | 53 | |

|

|

|

|

|

| | 1,138 | | 1,232 | |

|

|

|

|

|

Buhrmann’s forward foreign exchange and currency swap contracts at 31 December 2005:

|

|

|

|

|

|

|

|

|

| | | | Weighted | | Notional | | | |

| average |

| contractual |

| Contract | Maturity | exchange rate | amount | Fair value |

|

|

|

|

|

|

|

|

|

| Buy EUR/sell SKR | < 1 year | | 9.44 | | 37 | | 0 | |

|

|

|

|

|

|

|

|

|

| Buy EUR/sell USD | < 1 year | | 1.19 | | 105 | | (1 | ) |

|

|

|

|

|

|

|

|

|

| Buy EUR/sell GBP | < 1 year | | 0.69 | | 9 | | 0 | |

|

|

|

|

|

|

|

|

|

| Total | | | | | 151 | | (1 | ) |

|

|

|

|

|

|

|

|

|

The estimated fair value of the outstanding currency swap contracts indicates how much would be paid or received in exchange for termination of the contracts without further commitments as per the balance sheet date. The fair value of the currency swap contracts at 31 December 2005 of €1 million negative is included in other current liabilities. Buhrmann does not apply hedge accounting to the currency swaps which means that the changes in the fair value are recorded in the income statement and included in financing costs.

The total fair value at 31 December 2004 of the forward foreign exchange and currency swap contracts was less than €1 million.

Buhrmann has not applied hedge accounting to these currency swaps.

Back to Contents

| 114 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

32 Other current liabilities

|

|

|

|

|

| | 31 December

2005 | | 31 December

2004 | |

|

|

|

|

|

| | | | | |

| Taxes and social security contributions | 32 | | 30 | |

|

|

|

|

|

| Employee benefits other than pensions | 149 | | 114 | |

|

|

|

|

|

| Advance payments on orders | 6 | | 6 | |

|

|

|

|

|

| Short-term provisions | 18 | | 10 | |

|

|

|

|

|

| Other accrued liabilities | 84 | | 85 | |

|

|

|

|

|

| | 289 | | 245 | |

|

|

|

|

|

| Short-term provisions acquisition and restructuring related (see Note 30) | 26 | | 17 | |

|

|

|

|

|

| Financial payables and accruals * | 19 | | 24 | |

|

|

|

|

|

| Total | 334 | | 286 | |

|

|

|

|

|

* Financial payables and accruals mainly includes interest and profit tax.

33 Share-based payments

Buhrmann NV operates a share option plan, the ‘Buhrmann Incentive Plan’, in which a varying number (300 to 400) of senior managers participate and the members of the Executive Board. As of 2004, the number of options that will vest is dependent on the performance of the Company relative to a peer group as measured over a three-year period up to the vesting date. Up to 200% of the original options granted may vest. Corporate Express Australia (in which Buhrmann has 53.1% share) has its own share-based payment plans.

Buhrmann Incentive Plans

The movements in the outstanding number of options and weighted average exercise price are shown in the table below (including option rights held by the members of the Executive Board). Each option of the Buhrmann Incentive Plan and new Buhrmann Incentive Plan gives right to one Buhrmann ordinary share.

|

|

|

|

|

|

|

|

|

| | Plan up to 2003 | | Plan from 2004 | |

|

|

|

| | | Weighted | | | Weighted | |

| average | average |

| exercise | exercise |

| Number of | price per | Number of | price per |

| | options | option in EUR | options | option in EUR |

|

|

|

|

|

|

|

|

|

| Balance at 31 December 2003 | 5,046,698 | | 14.18 | | – | | – | |

|

|

|

|

|

|

|

|

|

| Options granted | – | | – | | 1,708,649 | | 7.79 | |

|

|

|

|

|

|

|

|

|

| Options exercised | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

| Options expired | (416,500 | ) | 15.61 | | – | | – | |

|

|

|

|

|

|

|

|

|

| Options forfeited | (183,983 | ) | 14.36 | | (100,623 | ) | 7.79 | |

|

|

|

|

|

|

|

|

|

| Balance at 31 December 2004 | 4,446,215 | | 14.04 | | 1,608,026 | | 7.79 | |

|

|

|

|

|

|

|

|

|

| Adjustments resulting the rights issue of 31 March 2005 * | 254,298 | | – | | 91,970 | | – | |

|

|

|

|

|

|

|

|

|

| Adjusted balance 31 December 2004 | 4,700,513 | | 13.28 | | 1,699,996 | | 7.37 | |

|

|

|

|

|

|

|

|

|

| Options granted | | | – | | 1,853,359 | | 7.40 | |

|

|

|

|

|

|

|

|

|

| Options exercised | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

| Options expired | (831,641 | ) | 25.99 | | – | | – | |

|

|

|

|

|

|

|

|

|

| Options forfeited | (202,802 | ) | 11.28 | | (210,243 | ) | 7.39 | |

|

|

|

|

|

|

|

|

|

| Balance at 31 December 2005 | 3,666,070 | | 10.50 | | 3,343,112 | | 7.39 | |

|

|

|

|

|

|

|

|

|

* As a result of the rights issue of 31 March 2005, the number of options granted before that date have been increased by 5.72% while the exercise price has been decreased with 5.41%.

Options granted are in principle hedged by purchasing the shares required on or close to the grant date. Options may not be hedged if the financial position of the Group gives rise to a decision not to purchase the shares required. Considerations for evaluating the financial position are the growth prospects and its required financing, as well as its capital structure. On the basis thereof it was decided not to purchase shares for this purpose in 2005 and 2004.

Back to Contents

| | | Buhrmann | | Chapter 8 | 115 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

33 Share-based payments continued

The total of options exercisable at the end of the year are:

|

|

|

|

|

| | Buhrmann Incentive Plans | |

|

|

| | | Weighted | |

| average |

| exercise |

| Number of | price per |

| options | option in EUR |

|

|

|

|

|

| 31 December 2004 | 1,707,922 | | 23.50 | |

|

|

|

|

|

| 31 December 2005 | 2,238,146 | | 15.47 | |

|

|

|

|

|

The weighted average fair values and weighted average exercise prices per option at the date of grant for the options outstanding at 31 December are as follows:

|

|

|

|

|

|

|

|

|

| | | | Plan up to 2003 | | | | Plan from 2004 | |

| |

| |

| |

| in euro | 2005 | | 2004 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

| Weighted average fair value of options granted with exercise prices equal to the market value of the share at the date of grant | 4.71 | | 5.63 | | 4.85 | | 4.90 | |

|

|

|

|

|

|

|

|

|

| Weighted average exercise price of options granted with exercise prices equal to the market value of the share at the date of grant | 10.18 | | 13.26 | | 7.39 | | 7.79 | |

|

|

|

|

|

|

|

|

|

| Weighted average fair value of options granted with exercise prices above the market value of the share at the date of grant | 6.21 | | 8.18 | | – | | – | |

|

|

|

|

|

|

|

|

|

| Weighted average exercise price of options granted with exercise prices above the market value of the share at the date of grant | 17.71 | | 25.36 | | – | | – | |

|

|

|

|

|

|

|

|

|

The following table summarises information about options outstanding at 31 December 2005:

|

|

|

|

|

|

|

|

|

| | | | Options outstanding | | | | Options exercisable | |

|

|

|

| | | Weighted | | Weighted | | | Weighted | | Weighted | |

| average | average | average | average |

| remaining | exercise | remaining | exercise |

| Number | contractual | price per | Number | contractual | price per |

| Exercise price in euro | of options | life (in years) | option in EUR | of options | life (in years) | option in EUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2.70 | 1,393,460 | | 4.3 | | 2.70 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.59 | 34,464 | | 4.3 | | 3.59 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.37 | 1,615,342 | | 5.3 | | 7.37 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.40 | 1,727,770 | | 6.3 | | 7.40 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12.95 | 1,299,063 | | 1.3 | | 12.95 | | 1,299,063 | | 1.3 | | 12.95 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 16.19 | 27,012 | | 1.3 | | 16.19 | | 27,012 | | 1.3 | | 16.19 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 18.55 | 815,866 | | 0.3 | | 18.55 | | 815,866 | | 0.3 | | 18.55 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 23.19 | 96,205 | | 0.3 | | 23.19 | | 96,205 | | 0.3 | | 23.19 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total | 7,009,182 | | 4.0 | | 9.02 | | 2,238,146 | | 0.9 | | 15.47 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

At 31 December 2005, a total number of 3,343,112 options were outstanding under the new Buhrmann Incentive Plan at an weighted average exercise price of €7.39 and a remaining weighted average contractual life of 5.8 years, none of which were exercisable at that date.

The fair value of the options granted up to 2003 were estimated on the basis of the Black & Scholes option model. Due to the performance hurdle introduced in 2004, the fair value of the options granted in 2004 and 2005 was estimated on the basis of a binomial model in combination with a Monte Carlo simulation taking into account the number of options that will vest based on the performance-related vesting conditions of the option programme. The following assumptions were used in 2005 and 2004:

|

|

|

|

|

| | 2005 | | 2004 | |

|

|

|

|

|

| Expected dividend yield | 2.3% | | 2.3% | |

|

|

|

|

|

| Expected share price volatility | 50.0% | | 50.0% | |

|

|

|

|

|

| Risk-free interest rate | 2.937% | | 3.563% | |

|

|

|

|

|

| Expected term | 5 years | | 5 years | |

|

|

|

|

|

The remuneration cost of all the option rights assigned is €7 million for 2005 (€6 million for 2004) and is included in the statements of income. The fair value of the options is measured at grant date and recognised as cost on a linear basis during the vesting period, with a corresponding increase shareholders’ equity as ‘option reserve’. When the options are exercised or lapsed, a reclassification from the option reserve to retained earnings within shareholders’ equity takes place. This policy is applied to all options that at the date of transition to IFRS at 1 January 2004 had not been exercised or vested or lapsed.

Back to Contents

| 116 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

33 Share-based payments continued

The fair value of the option rights is estimated by using expected dividend yield and share price volatility based on historic track records at the date of granting the options. These values do not constitute the market value. The assumptions were used exclusively for this calculation and do not necessarily provide an indication of expectations of management regarding developments in the future.

The Company granted interest-bearing loans to the Dutch optionees up to and including 2002 to finance their upfront tax obligations resulting from the options granted and which are due at the date of vesting.

| Option plans Corporate Express Australia |

| Until 26 November 2004, the Executive Option Plan (‘EOP’) was in place. Under the EOP: |

| – | The grant of options may be subject to appropriate, market competitive performance hurdles. |

| – | Each issue of options to executives must be held for a minimum holding period determined by the board of Corporate Express Australia before they can be considered for exercise. They can only be exercised if performance has exceeded any performance hurdle set by the board of Corporate Express Australia. |

| – | Options may be exercised before the end of their minimum holding period, but only in special circumstances. |

| – | The price at which options are issued is the weighted average market price of Corporate Express Australia’s sharess old on the Australian Stock Exchange during the five trading days immediately before the relevant options are issued. |

The Long Term Incentive Plan (‘LTIP’) replaces the EOP from 26 November 2004. Additional features of options or performance share rights issued under the LTIP are: senior executives of the Corporate Express Australia may be offered entitlement to ordinary shares in Corporate Express Australia, in the form of performance rights, that is, a right to acquire shares in Corporate Express Australia at a future date at no cost (in other words, a share option with a zero exercise price). The entitlement is conditional upon the satisfaction of performance hurdles measured over a period of years. The actual number of performance share rights granted to a participant will depend on the extent to which the performance conditions have been satisfied. No performance share rights will be provided prior to the final date of the relevant measurement period, and then will only be granted if the performance conditions have been met.

The performance measure applied to the entitlement granted under the LTIP is relative to a TSR (for a definition see Buhrmann Incentive Plan from 2004 above). The share prices to be used for the purpose of the TSR calculation are determined as the weighted average of Corporate Express Australia’s share price over the three-month period immediately preceding the start and end date of the performance period. The TSR of all the companies in the peer group, and Corporate Express Australia, will be ranked at the end of a three-year performance period.

| Under the EESP, which is open to participation by all permanent Australian and New Zealand employees, depending on the number of years continuous service with the Company, but not directors: |

| – | Any proposed allocation is limited to a maximum value of A$1,000 per employee in any taxation financial year, based on the market price at the time of issue. |

| – | Shares are registered in the name of the participants, but held in the plan until the sooner of three years after acquisition, or termination of employment by the participant. Shares are issued either by way of new issue, or are purchased by the employee share plan company on market. |

The remuneration cost of all the option rights assigned under the EOP and LTIP is €1 million for 2005 and 2004 (including minority interest) and is included in the statements of income.

The movements in the number of shares to which the outstanding options assigned under the EOP and LTIP give right and weighted average exercise price are as follows:

|

|

|

|

|

|

| | | | Weighted | |

| | | | | average | |

| | | | | exercise price | |

| | | Number of | | per share | |

| | | shares | | in AUD | |

|

|

|

|

|

|

| Balance at 1 January 2004 | | 2,063,606 | | 4.30 | |

|

|

|

|

|

|

| Options granted | | 466,846 | | 0.48 | |

|

|

|

|

|

|

| Options exercised | | (256,840 | ) | 1.87 | |

|

|

|

|

|

|

| Options expired | | – | | – | |

|

|

|

|

|

|

| Options forfeited | | (420,332 | ) | 4.35 | |

|

|

|

|

|

|

| Balance 31 December 2004 | | 1,853,280 | | 3.20 | |

|

|

|

|

|

|

| Options granted | | 355,183 | | 0.00 | |

|

|

|

|

|

|

| Options exercised | | (303,588 | ) | 2.91 | |

|

|

|

|

|

|

| Options expired | | – | | – | |

|

|

|

|

|

|

| Options forfeited | | (70,813 | ) | 3.29 | |

|

|

|

|

|

|

| Balance at 31 December 2005 | | 1,834,062 | | 2.72 | |

|

|

|

|

|

|

Back to Contents

| | | Buhrmann | | Chapter 8 | 117 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

33 Share-based payments continued

The total of shares to which the exercisable options assigned under the EOP and LTIP give right at the end of the year are:

|

|

|

|

|

|

| | | | | Weighted | |

| | | | | average | |

| | | | | exercise price | |

| | | Number of | | per share | |

| | | shares | | in AUD | |

|

|

|

|

|

|

| 2004 | | 544,434 | | 2.36 | |

|

|

|

|

|

|

| 2005 | | 905,759 | | 2.42 | |

|

|

|

|

|

|

The following table summarises information about options assigned under the EOP and LTIP outstanding at 31 December 2005:

|

|

|

|

|

|

|

|

|

|

| | | | | Options outstanding | | | | Options exercisable | |

| | |

|

|

| |

|

|

|

|

| | | Number | | Weighted | | Weighted | | Number | | Weighted | | Weighted | |

| | | of shares | | average | | average | | of shares | | average | | average | |

| | | to which | | remaining | | exercise | | to which | | remaining | | exercise | |

| | | the options | | contractual | | price per | | the options | | contractual | | price per | |

| Range of exercise price in AUD | | give right | | life (in years) | | share in AUD | | give right | | life (in years) | | share in AUD | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2.40 – 5.10 | | 2 | | 4.04 | | 1.55 | | 2 | | 4.04 | | 1.55 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.78 – 9.34 | | 2 | | 5.40 | | 4.67 | | 2 | | 5.40 | | 4.67 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.00 – 4.95 | | 1 | | 7.96 | | 2.26 | | 1 | | 6.51 | | 4.35 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 Commitments not included in the balance sheet

|

|

|

|

|

|

|

|

| | | | | Sub-lease | | | |

| | | Gross | | income | | Net | |

|

|

|

|

|

|

|

|

| 31 December 2005 | | | | | | | |

|

|

|

|

|

|

|

|

| Rental and operational lease | | | | | | | |

|

|

|

|

|

|

|

|

| The commitments are as follows: | | | | | | | |

|

|

|

|

|

|

|

|

| 2006 | | 98 | | (7 | ) | 91 | |

|

|

|

|

|

|

|

|

| 2007 | | 83 | | (5 | ) | 78 | |

|

|

|

|

|

|

|

|

| 2008 | | 62 | | (2 | ) | 60 | |

|

|

|

|

|

|

|

|

| 2009 | | 46 | | (1 | ) | 45 | |

|

|

|

|

|

|

|

|

| 2010 | | 37 | | 0 | | 37 | |

|

|

|

|

|

|

|

|

| Thereafter | | 145 | | 0 | | 145 | |

|

|

|

|

|

|

|

|

| Subtotal | | 471 | | (15 | ) | 456 | |

|

|

|

|

|

|

|

|

| | | | | | | | |

| Repurchase guarantees | | | | | | | |

|

|

|

|

|

|

|

|

| These lapse as follows: | | | | | | | |

|

|

|

|

|

|

|

|

| 2006 | | | | | | 10 | |

|

|

|

|

|

|

|

|

| 2007 | | | | | | 6 | |

|

|

|

|

|

|

|

|

| 2008 | | | | | | 7 | |

|

|

|

|

|

|

|

|

| 2009 | | | | | | 14 | |

|

|

|

|

|

|

|

|

| 2010 | | | | | | 5 | |

|

|

|

|

|

|

|

|

| Thereafter | | | | | | 1 | |

|

|

|

|

|

|

|

|

| Subtotal | | | | | | 43 | |

|

|

|

|

|

|

|

|

| | | | | | | | |

| Other | | | | | | | |

|

|

|

|

|

|

|

|

| These lapse as follows: | | | | | | | |

|

|

|

|

|

|

|

|

| 2006 | | | | | | 5 | |

|

|

|

|

|

|

|

|

| 2007 | | | | | | 1 | |

|

|

|

|

|

|

|

|

| 2008 | | | | | | 3 | |

|

|

|

|

|

|

|

|

| 2009 | | | | | | – | |

|

|

|

|

|

|

|

|

| 2010 | | | | | | – | |

|

|

|

|

|

|

|

|

| Thereafter | | | | | | – | |

|

|

|

|

|

|

|

|

| Subtotal | | | | | | 9 | |

|

|

|

|

|

|

|

|

| Total commitments | | | | | | 508 | |

|

|

|

|

|

|

|

|

Back to Contents

| 118 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

34 Commitments not included in the balance sheet continued

Operating lease commitments

The Company leases certain distribution facilities, equipment and offices under non-cancellable operating leases. The amounts in the table above are the future minimum lease payments under all non-cancellable operating leases. Certain of these distribution facilities and offices are subleased by the Company. Income to be received from these subleases is deducted from the amounts in the table. Lease expenses for non-cancellable operating leases for distribution facilities, equipment and offices charged to the income statement during the periods ended 31 December 2005 and 2004 were €73 million and €71 million respectively. Income from subleases included in the income statement was €1 million and €1 million respectively for the years ended 31 December 2005 and 2004.

Repurchase guarantees of €43 million in total at 31 December 2005 mainly relate to repurchase guarantees concerning graphic machines sold to customers and financed by external financing companies. Should the customer be declared in default, the respective financing company has a right of recourse against Buhrmann, which, in general, will be lower than market value. The amount included in the table is the maximum exposure under these guarantees.

Other commitments not included in the balance sheet include investment commitments relating to expenditure on projects, such as the development of IT systems.

In addition, the Company had certain contingent liabilities, commitments and guarantees which are not included in the table above and which are discussed below.

Buhrmann has issued certain performance guarantees to an estimated maximum amount of €2 million at 31 December 2005. The major part of these guarantees expires latest on 1 September 2007.

35 Related party transactions

Intercompany transactions, balances and unrealised gains on transactions between Group companies are eliminated on consolidation and are not disclosed in this Note. Details of transactions between the Group and other related parties are disclosed below.

Trading transactions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | Amounts owed by | | | | Amounts owed to | |

| | | | | Sales of goods | | | | Purchases of goods | | | | related parties | | | | related parties | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

| in millions of euro | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Faison Inc (see Note 11) | | 86 | | 59 | | – | | – | | 2 | | 2 | | 0 | | 0 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remuneration of the Members of the Executive Board and Supervisory Board

The total remuneration of members of the Executive Board during the year was as follows:

|

|

|

|

|

|

| in thousands of euro | | 2005 | | 2004 | |

|

|

|

|

|

|

| Short-term benefits | | 3,236 | | 2,994 | |

|

|

|

|

|

|

| Post-employment benefits | | 665 | | 702 | |

|

|

|

|

|

|

| Other long-term benefits | | 1,228 | | 1,585 | |

|

|

|

|

|

|

| Termination benefits | | – | | – | |

|

|

|

|

|

|

| Share-based payments | | 827 | | 775 | |

|

|

|

|

|

|

Short-term benefits in the table above includes base salary and annual bonus.

The total remuneration of the members of the Supervisory Board was €296 thousand in 2005 and €270 thousand in 2004.

At 31 December 2005, loans totalling €42 thousand were outstanding to the members of the Executive Board (2004: €74 thousand) which will be fully redeemed in 2006. These loans were granted to meet upfront Dutch income tax on share options. No new loans were granted since 2002. The members of the Executive Board held 95,454 ordinary shares Buhrmann NV at 31 December 2005 (2004: 128,724). At 31 December 2005, the members of the Supervisory Board held 42,384 ordinary shares Buhrmann NV (2004: 32,318) and 411 Depositary receipts of Preference Shares A Buhrmann NV (2004: 411).

Other related party transactions

On 31 March 2005, Buhrmann repurchased all outstanding Preference Shares C for an aggregate purchase price of US$520 million in cash. Also Buhrmann granted to all sellers of Preference Shares C options to acquire, in aggregate, 36,500,000 of our ordinary shares at a price of €10 per share. These options could only be exercised where, on or before 30 December 2005, Buhrmann and a third party either (i) made an announcement that it was expected to reach an agreement on the terms of a bid for all outstanding shares, or (ii) entered into an agreement in relation to a public bid on all our outstanding shares. The options lapsed on 30 December 2005.

Since the Supervisory Board included two representatives of the Preference Shares C holders, the transaction described above qualified as a related party transaction. Both representatives, Messrs Hannan and Barnes resigned on completion of this transaction.

Back to Contents

| | | Buhrmann | | Chapter 8 | 119 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

| 36 | Legal proceedings |

| Buhrmann is involved in various routine legal proceedings incidental to the conduct of its business. Buhrmann does not believe that any of these legal or regulatory proceedings will have a material adverse effect on its financial condition, results of operations or cash flows other than the proceedings disclosed below. |

Paper Merchanting Germany: anti-trust

In April 2000, the German competition authorities (the Bundeskartellamt or ‘BKA’) launched an investigation against a number of German paper merchants, among which is Buhrmann’s former subsidiary Deutsche Papier Vertriebs GmbH, alleging a violation of anti-trust rules in Germany in a number of regions. On 30 April 2004 the BKA imposed a fine of €7.6 million on Deutsche Papier Vertriebs GmbH and 11 other paper merchants in Germany. The fine relates to the period between 1995 and 2000 and covers the whole of Germany with the exception of the south. Deutsche Papier and the accused individuals do not agree with the fine and the calculation thereof and have appealed against this fine. A third-party investigation into the alleged surplus profit in a number of regions and a third-party investigation into the calculation of the surplus profit used by the BKA substantiated Buhrmann’s position that the fine reflects an overestimation of any assumed possible surplus profit. Buhrmann has given an indemnity to PaperlinX Limited, the buyer of the paper merchanting division.

Paper Merchanting Germany: completion accounts

Under the Agreement for the Sale and Purchase of the paper merchanting division of Buhrmann NV dated 8 September 2003 a post-completion dispute has arisen as to the valuation of a property in Germany for the purpose of inclusion in the completion accounts. The completion accounts are the basis for the calculation of the final purchase price. The valuation difference amounts to €7 million. The matter is currently pending the decision of an independent accountant. Once the value of the property has been determined, final settlement of the purchase price can take place.

Information Systems France: Agena S.A.– Béfec

In 1994 Buhrmann issued arbitration proceedings against the sellers of the French company Agena S.A., an acquisition made in 1991. Buhrmann’s claim for damages was based on a misrepresentation of the financial position of the company in the acquisition balance sheet. These proceedings resulted in an arbitral award adjudicating damages to the amount of €79 million received in 2003. In 1995 proceedings had also started against Béfec (a predecessor of PricewaterhouseCoopers, France), the accountants who in 1991 had certified the acquisition balance sheet. These proceedings were adjourned in anticipation of the outcome of the arbitration proceedings against sellers. The matter against Béfec was resumed after the arbitral award. Béfec raised preliminary defence against the claim which was rejected in the first instance. Although the defendant appealed against this judgment it may reasonably be anticipated that the principal matter will be permitted. Buhrmann is claiming damages to the amount of €134 million plus interest and costs. It is estimated that a final decision may still take a considerable period.

Under IFRS (IAS 37) and US GAAP (FAS 5), a contingent asset is disclosed when it is probable that an inflow of an economic benefit will be realised and the amount is estimable. In practice, contingent assets are not disclosed until the amount and timing of the inflow is known (e.g. there is a firm commitment from the counterparty). Accordingly, the above contingent assets may be judged to be a non-disclosure in accordance with IAS 37 and/or FAS 5, given the uncertainty as to its realisation and if so, the timing and amount of realisation.

| 37 | US GAAP reconciliation and additional disclosures |

| As of 1 January 2004, Buhrmann’s Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards (IFRS) which vary in certain respects from accounting principles generally accepted in the United States of America (US GAAP). The tables below give the effect that application of US GAAP would have on net result and shareholders’ equity as reported under IFRS. Buhrmann’s accounting policies under IFRS are in accordance with the standards as adopted for use in the European Union (EU). Some of the standards issued by the International Accounting Standards Board have not been endorsed by the EU. However, the standards which have not been endorsed are not applicable to Buhrmann and therefore there is no difference between IFRS as adopted for use in the EU and IFRS as issued by the International Accounting Standards Board. |

IFRS 1 provides first-time adopters of IFRS with a number of exemptions and exceptions from full retrospective application, some of which are applicable to Buhrmann (see Note 2). The US GAAP numbers are determined as if the U.S. standards had always been applied, i.e. US GAAP needs to be applied retrospectively. Had IFRS been applied fully retrospectively, net result and shareholders’ equity under IFRS would have been different, which in turn could have resulted in the elimination and different amounts of reconciling items as shown in the table below or additional reconciling items.

Back to Contents

| 120 | | Buhrmann | | Chapter 8 |

| | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

| 37 | US GAAP reconciliation and additional disclosures continued | | | | |

|

|

|

|

|

|

| | | 2005 | | 2004 | |

|

|

|

|

|

|

| Net result attributable to holders of | | | | |

| ordinary shares Buhrmann NV under IFRS | 2 | | 90 | |

|

|

|

| |

| b | Intangible fixed assets amortisation | (5 | ) | (6 | ) |

|

|

|

|

| |

| c | Derivatives | (1 | ) | (3 | ) |

|

|

|

|

| |

| d | Pensions | (3 | ) | 2 | |

|

|

|

|

| |

| e | Share-based payments | 7 | | 6 | |

|

|

|

|

| |

| f | Subordinated Convertible Bonds | 4 | | 4 | |

|

|

|

|

| |

| g | Preference Shares A | 11 | | 11 | |

|

|

|

|

| |

| h | Preference Shares C | 108 | | 14 | |

|

|

|

|

| |

| i | Revenue recognition | 4 | | 1 | |

|

|

|

|

| |

| j | Financing fees | 0 | | 2 | |

|

|

|

|

| |

| k | Catalogue contributions | 1 | | (1 | ) |

|

|

|

|

| |

| l | Translation adjustments | 3 | | – | |

|

|

|

|

| |

| m | Restructuring | 2 | | – | |

|

|

|

|

| |

| n | Others | (2 | ) | (2 | ) |

|

|

|

|

| |

| o | Deferred taxes | 5 | | (10 | ) |

|

|

|

|

| |

| Net income under US GAAP | 136 | | 108 | |

|

|

|

| |

| | | | | |

|

|

|

|

| |

| | | 31 December | | 31 December | |

| | | 2005 | | 2004 | |

|

|

|

|

| |

| Total equity under IFRS | 1,510 | | 1,118 | |

|

|

|

|

| |

| Less: minority interest | (59 | ) | (56 | ) |

|

|

|

|

| |

| Shareholders’ equity under IFRS | 1,450 | | 1,062 | |

|

|

|

|

| |

| a | Goodwill | (181 | ) | (159 | ) |

|

|

|

|

| |

| b | Intangible fixed assets | 67 | | 65 | |

|

|

|

|

| |

| d | Pensions | 130 | | 109 | |

|

|

|

|

| |

| f | Subordinated Convertible Bonds | (29 | ) | (34 | ) |

|

|

|

|

| |

| g | Preference Shares A | 178 | | 178 | |

|

|

|

|

| |

| h | Preference Shares C | – | | 295 | |

|

|

|

|

| |

| i | Revenue recognition | (18 | ) | (23 | ) |

|

|

|

|

| |

| j | Financing fees | 1 | | 1 | |

|

|

|

|

| |

| k | Catalogue contributions | (1 | ) | (1 | ) |

|

|

|

|

| |

| m | Restructuring | 2 | | – | |

|

|

|

|

| |

| n | Others | 1 | | 3 | |

|

|

|

|

| |

| o | Deferred taxes | (23 | ) | (22 | ) |

|

|

|

|

| |

| Shareholders’ equity under US GAAP | 1,578 | | 1,474 | |

|

|

|

|

| |

The differences between IFRS and US GAAP as indicated in the tables are explained below, including related disclosures required under US GAAP.

| a Goodwill |

| Differences between IFRS and US GAAP arise because of the exemption in IFRS 1 not to apply IFRS 3 ‘Business Combinations’ retrospectively to business combinations that occurred before the date of transition to IFRS which is 1 January 2004. This means that goodwill amounts recorded under Dutch GAAP as at 1 January 2004 are in principle carried forward under IFRS (see Note 2). The amount of goodwill carried forward under IFRS at 1 January 2004 was €175 million higher than under US GAAP which is due to: |

| – | For acquisitions occurring prior to 1 January 1997, goodwill was directly writtenoff to equity whereas under USGAAP this goodwill is capitalised and, until 31 December 2001, amortised over the estimated useful life of 40 years. |

| – | In connection with a number of acquisitions, certain fair value adjustments, including provisions for restructuring and integration and valuation allowances on deferred tax assets, were recorded which did not qualify for USGAAP. This led to a lower amount of goodwill under USGAAP. Inaddition, for USGAAP purposesonly, certain intangible assets (Corporate Express brand name and internally used software) were valued and recognised separately from goodwill, see point b) below. |

| – | Buhrmann repurchased the outstanding public minority share of a former subsidiary in 1998. This transaction was accounted for as are purchase of equity whereas under USGAAP the surplus paid over fair value of net assets was recorded as goodwill. |

| – | Differences in the method of testing goodwill for impairment resulted in a higher amount of impairment under USGAAP in 2002. |

Back to Contents

| | | Buhrmann | | Chapter 8 | 121 |

| | | 2005 Annual Report and Form 20-F | | 4 Consolidated Financial Statements |

Notes to the Consolidated Financial Statements

in millions of euro, unless stated otherwise

| 37 | US GAAP reconciliation and additional disclosures continued |

| Goodwill is not amortised under IFRS or US GAAP but tested for impairment annually. The annual impairment test on goodwill at 31 December 2004 and 2005 did not result in an impairment under IFRS or US GAAP. |

In 2004, positive translation adjustments of €16 million and in 2005 negative translation adjustments of €32 million were recorded on the differences in goodwill between US GAAP and IFRS as some of the goodwill items are denominated in US dollars.

In 2005, Corporate Express Australia purchased 6.3 million of its own shares from minority shareholders thereby raising Buhrmann’s interest in Corporate Express Australia from 51.5% to 53.1%. The amount paid in excess of the fair value was recorded as a reduction of shareholders’ equity under IFRS (€10 million) whereas under US GAAP this amount was recorded as goodwill.

The net effect at 31 December 2004 and 2005 of the items mentioned above was a lower amount of goodwill under US GAAP of €159 million and €181 million respectively compared to IFRS.

| The movements in goodwill under US GAAP were as follows: | | | | |

|

|

|

|

|

| | 2005 | | 2004 | |

|

|

|

|

|

| Book value at beginning of year | 1,165 | | 1,225 | |

|

|

|

| |

| Investments | 20 | | 6 | |

|

|

|

| |

| Translation differences | 136 | | (66 | ) |

|

|

|

| |

| Book value at end of year | 1,321 | | 1,165 | |

|

|

|

| |

| | | | | |

|

|

|

| |

| Accumulated cost | 2,468 | | 2,120 | |

|

|

|

| |

| Accumulated amortisation | (208 | ) | (168 | ) |

|

|

|

| |

| Accumulated impairment | (939 | ) | (787 | ) |

|

|

|

| |

| Book value at end of year | 1,321 | | 1,165 | |

|

|

|

| |

| | |

| b | Intangible fixed assets |

| Differences in the accounting for intangible fixed assets between IFRS and US GAAP arise because of the exemption in IFRS 1 not to apply IFRS 3 ‘Business Combinations’ retrospectively to business combinations that occurred before the date of transition to IFRS. This means, among others, that no intangibles are recognised under IFRS with respect to business combinations which took place before 1 January 2004 if these intangibles were also not recorded under Dutch GAAP (see Note 2). |

With the acquisition of Corporate Express in October 1999, certain intangible assets were valued and recognised separately from goodwill under US GAAP. These include the Corporate Express brand name (US$75 million) and internally used software (US$20 million). The Corporate Express brand name and internally used software are amortised over their estimated useful lives of 40 and seven years, respectively.

The book value of the Corporate Express brand name was US$64 million at 31 December 2005 and US$66 million at 31 December 2004. The accumulated amortisation was US$11 million at 31 December 2005 and US$9 million at 31 December 2004. The amortisation expense was US$2 million in each of 2005 and 2004 and will be US$2 million in each of the next five years.

The book value of the internally used software was US$2 million at 31 December 2005 and US$5 million at 31 December 2004. The accumulated amortisation was US$18 million at 31 December 2005 and US$15 million at 31 December 2004. The amortisation expense was US$3 million in each of 2005 and 2004 and will be US$2 million in 2006.

Also included under ‘Intangible fixed assets’ are amounts allocated to customer relationships of companies acquired in 2003 and 2002 of €7 million and €10 million, respectively, which are separated from goodwill and classified as intangible fixed assets under US GAAP and amortised over a period of ten years. The book value under US GAAP was €11 million at 31 December 2005 and €13 million at 31 December 2004. The accumulated amortisation was €6 million at 31 December 2005 and €4 million at 31 December 2004. The amortisation expense under US GAAP was €2 million in 2005 and 2004 and will be €2 million in each of the next five years.

| c | Derivatives |

| This item relates to interest rate swaps (IRS) which under both IFRS and US GAAP are valued at fair value. The IRS were entered into to hedge variable rate debt to fixed rate. |