Exhibit 4.2.(c)

2014 – 2016 Stock Option Plan

Rules

TELECOM ITALIA S.p.A.

2014 – 2016STOCKOPTIONPLAN

RULES

1. INTRODUCTION

In implementation of the resolutions made on 16 April 2014 by the Shareholders’ Meeting of Telecom Italia S.p.A. (with registered office in Milan, at 2 Piazza degli Affari, tax code and registration number in the Milan Business Register 00488410010, also referred to as “Telecom Italia”, the “Company” and the “Issuer”) and by the Board of Directors in the meeting made on 26 June 2014, based on the corresponding Information Document published on 13 March 2014, these rules (the “Rules”) have been drawn up for the “2014 – 2016 Stock Option Plan” (the “Plan”).

The section containing the Definitions is in annex 1.

2. Essential elements of the Plan

As indicated in the Information Document, the Plan is destined for three different categories of recipients: Executive Directors, Top Management and Selected Executives (the Beneficiaries)

The Plan consists of the allocation to the Beneficiaries of Options, as set out in the Letter of Attribution, that may be exercised in the Exercise Period to an extent that varies according to the level of achievement of the Performance Objectives in the three-year period 2014 – 2016, represented (i) by theTotal Shareholder Return (TSR) of Telecom Italia and (ii) the consolidatedadjusted Net Cash Flow before dividendsof the Group from the industrial plan 2014 – 2016, each of which determines 50% of the Options.

The Performance Objectives will be ascertained by the Board of Directors of the Company called on to approve the consolidated financial statements at 31 December 2016.

The Options are allocated to the Beneficiaries on a personal basis, and cannot be transferred or subject to restrictions, nor may they constitute the object of any other act of disposalinter vivos whatsoever.

3. Performance Objectives

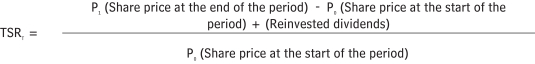

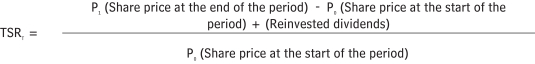

The relevant TSR of Telecom Italia, as a ranking within a peer group (AT&T, Verizon, Telefónica, Deutsche Telekom, France Télécom, Telekom Austria, Telecom Portugal, KPN, Swisscom, British Telecom, Vodafone and Telecom Italia) will be calculated using the following formula:

where:

| – | | T: Years of the plan 1 January 2014 – 31 December 2016, |

| – | | P0: Share price at the start of the period: Average of the official prices1 of the share in the October – December 2013 quarter, to two decimal places, equal to 0.68 euros. |

| – | | P1:Share price at the end of the period: Average of the official prices of the share in the October – December 2016 quarter, to two decimal places. |

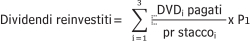

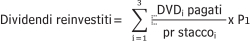

Dividends, as distribution of profits, paid in cash during the three-year incentive period and reinvested in the purchase of the same type of shares at the opening price on the ex-dividend date, as per normal market practice, are considered.

| 1 | if made available by the market where the share is listed, otherwise the officially published reference price or closure price will be considered. |

2

The consolidated adjusted Net Cash Flow Before Dividends for the 2014 – 2016 period measures the Free Cash Flow available for the payment of dividends and paying down debt, and will be calculated as a cumulative value for the three-year period, using the following formula:

| – | | Adjusted Net Cash Flow Before Dividends = Ebitda - Capex +/- change inoperating working capital and operating funds - financial expense - taxes +/- extraordinary transactions (Financial Investments anddisposals) |

To better represent the true dynamics of the debt and of the financial flows generated by operations, we believe that an “adjusted” measure of cash flow should be used, which excludes from the debts, and consequently from the cash flow, the merely accounting and non-monetary effects created by the valuation of the derivatives and the related financial liabilities/assets at fair value.

The adjusted Net Cash Flow Before Dividends objective also excludes the possible acquisition of licences in Latin America and any extraordinary transactions not envisaged in the Plan; also the gain produced by the IRES credits transfer (registered in the Annual Report 2012 after the enter into force of the D.L. 16/2012 ) will be insulated (as not envisaged in the Plan).

The criteria for the vesting of the Exercisable Options are indicated below, according to:

| | · | | Total Shareholder Return (weight: 50%): |

| | · | | 150% of the allocated Options will vest at target level if TSR of Telecom Italia is at 1st place in the rating. |

| | · | | 137.5% of the allocated Options will vest at target level if TSR of Telecom Italia is at 2nd place in the rating. |

| | · | | 125% of the allocated Options will vest at target level if TSR of Telecom Italia is at 3rd place in the rating. |

| | · | | 112.5% of the allocated Options will vest at target level if TSR of Telecom Italia is at 4th place in the rating. |

| | · | | 100% of the allocated Options will vest at target level if TSR of Telecom Italia is at 5th place in the rating. |

| | · | | 80% of the allocated Options will vest at target level if TSR of Telecom Italia is at 6th place in the rating. |

| | · | | 60% of the allocated Options will vest at target level if TSR of Telecom Italia is at 7th place in the rating. |

| | · | | 40% of the allocated Options will vest at target level if TSR of Telecom Italia is at 8th place in the rating. |

| | · | | none of the allocated Options will vest if TSR of Telecom Italia is between 9th and 12th place in the rating. |

| | · | | Adjusted Net Cash Flow Before Dividends (weight 50%): |

| | · | | 150% of the allocated Options will vest at target level if adjusted Net Cash Flow Before Dividends reaches a value of 110% of the target value of FCF in the 2014 – 2016 Industrial Plan equal to 7,179 million euros (or over). |

| | · | | 100% of the allocated Options will vest at target level if adjusted Net Cash Flow Before Dividends reaches a value equal to the 2014 – 2016 Industrial Plan equal to 6,526 million euros. |

| | · | | 80% of the allocated Options will vest at target level if adjusted Net Cash Flow Before Dividends reaches a value of 93% of the target value of FCF in the 2014 – 2016 Industrial Plan equal to 6,069 million euros. |

| | · | | vesting of a percentage of the allocated Options calculated using linear interpolation, in case of intermediate performance levels compared with those listed above |

| | · | | none of the allocated Options will vest if adjusted Net Cash Flow Before Dividends reaches a value of less than 93% of the target value of FCF in the 2014 – 2016 Industrial Plan. |

The percentages will be calculated to two decimal places and the number of Exercisable Options will be rounded down.

3

The Board of Directors may proceed to (i) update the parameters used to measure the Performance Objectives, if they should become obsolescent during the Incentive Period, and also (ii) make adjustments during the final ascertainment to neutralise any extraordinary phenomena or regulatory changes, after investigation by the Nomination and Remuneration Committee (or such other temporary Committee responsible for compensation issues).

During the Vesting Period and until the end of the Exercise Period, the Board of Directors will retain all the powers required to implement the Plan, making any amendments and/or additions to it that might be necessary to maintain unchanged its substantial and economic content, within the limits permitted by the law applicable at any given time. In particular, in the event of extraordinary transactions on the Company’s capital, the Board of Directors, independently and without the need for further approval by the Shareholders’ Meeting of the Company, will make all the amendments and additions to these Regulations deemed necessary or appropriate, including application of the ordinary market mechanisms to rectify the Exercise Price.

Any rectifications pursuant to the previous paragraph will be communicated to the Beneficiaries without delay.

4. Exercise of the Options

Each of the Beneficiaries may exercise their Exercisable Options within the Exercise Period according to the terms and by the methods that will be communicated without delay by the offices of the Company after the ascertainment by the Board of the level to which the Performance Objectives have been achieved.

The national insurance and tax contributions on the benefits relating to the Shares subscribed or purchased through exercise of the Options shall remain the respective responsibility of the Beneficiaries and the Company, for their respective competence, based on the applicablepro tempore regulations. When the company to which the Beneficiary belongs is required to pay tax, as withholding agent, it will deduct the tax due from payroll.

The national insurance and tax regime of Beneficiaries of the Plan who are resident abroad for tax purposes shall be that of the tax jurisdictions involved, without prejudice to any applicable international agreements on double taxation.

In case ofmortis causa succession, the successors and assignees may exercise the Exercisable options subject to compliance with the obligations prescribed by the applicable law. The tax regime applied to the successors and assignees of a Beneficiary who has died is the regime of themortis causa succession.

During the Vesting Period, the Options will definitively be forfeit and without any form of restoration in case of the death of the Beneficiary or if employment by/collaboration with the Company (or with a Subsidiary Company, even if not the Group company which employed the Beneficiary at the time of allocation of the Options) should cease for any reason.

If the employment/collaboration with the Company (or with one of its Subsidiary Companies) is terminated after the Vesting Period, the Options shall remain exercisable by the Beneficiary (or their heirs) in the following cases exclusively:

| | · | | with reference to any Executive Directors allocated Options, in case of (i) non-renewal of their mandate; (ii) early termination of their period of service with respect to the expiration of the mandate of the board due to objective causes, company initiatives without just cause, at the initiative of the affected party for just cause; (iii) total or permanent invalidity; (iv) death; |

| | · | | with reference to the other Beneficiaries, in case of: (i) retirement; (ii) consensual termination of the employment by/collaboration with the Company (or a Subsidiary Company); (iii) placement outside the Group’s area of competence, for any reason, of the company which the Beneficiary was employed by/collaborated with; (iv) dismissal for justified objective reasons; (v) total and permanent invalidity; (vi) death. |

In any other case of discontinuance/termination of the Beneficiary’s employment/collaboration relationship with the Company (or with Subsidiary Companies) the Exercisable Options shall be forfeit. If a notification of disciplinary proceedings is sent, the right to exercise the Exercisable Options will be suspended until receipt of the communication announcing the sanction to be applied or the communication notifying the recipient that no sanction will be applied.

The Options may not be exercised in the 30 days preceding approval by the Board of Directors of the draft financial statements and the half- yearly report of the Company, or in the 15 days preceding approval by the

4

Board of Directors of the report illustrating the results of the first and third quarters of the year. The right to exercise shall also be suspended from the tenth stock market trading day before the first or single call to a Meeting of the Shareholders’ of the Company to be attended by those shareholders who hold ordinary shares up to and including the date on which the meeting is to take place, and before any call subsequent to the first and, in any event, until the first date of “ex” rights listing of the Shares in case of payment of dividends.

In any Event, the Board of Directors reserves the right to establish periods of extraordinary suspension at its discretion.

Options not exercised within the Exercise Period shall be extinguished and consequently shall no longer attribute any right to the Beneficiary or any mortis causa successors or assignees.

5. Communications and disputes

Communications to the Beneficiaries pursuant to these Rules shall be made in writing, by ordinary post or by electronic mail.

Communications shall be made preferably to the work address or company e-mail address, or at the domicile and/or private e-mail address indicated by the Beneficiaries. For this purpose, it is the responsibility of the Beneficiaries to promptly communicate any changes to their domicile or private e-mail address to the offices of the People Value department.

Any disputes arising, dependent or in any way connected to the Plan are devolved to the sole jurisdiction of the Milan judicial authorities.

5

Annex 1

DEFINITIONS

Share/Shares—The ordinary shares of the Company, without par value, listed on the MTA electronic share market organised and managed by Borsa Italiana S.p.A.

Beneficiaries—The Employees and/or Executive Directors of the Company or of Subsidiary Companies to whom Options have been allocated, in a number determined discretionally, within the limits of quantity set out in the Plan Information Document.

Subsidiary Companies—Each of the companies that are at any given time directly or indirectly controlled by the Company, pursuant to Article 2359 of the Italian Civil Code.

Employees—Managers with permanent employment contracts with the Company or its Subsidiary Companies registered in Italy.

Group—The Company and the Subsidiary Companies.

Letter of Attribution—The communication by which the Beneficiary is individually identified, bearing the number of Options allocated, their Exercise Price, and the conditions upon which their exercising is dependent. The content of the Letter of Attribution and these Rules must be formally accepted by the Beneficiary.

Options—Rights attributed to the Beneficiaries to acquire (by subscription or purchase) Shares of the Company at a predetermined price (hereinafter the Exercise Price), in the proportion of one Share (newly issued or pre-existing, as decided by the Board of Directors and in any event with regular dividend entitlement and not subject to availability restrictions) for each Option exercised.

Exercisable Options—the number of Options that might be exercised against the level of achievement of the Objectives ascertained by the Board of Directors, which fulfil the initial term requirements set out in the Regulations and for which the Exercise Period has not yet expired.

Vesting Period—The period in which the Options allocated to the Beneficiaries will vest, conventionally corresponding to the period of time from 1 January 2014 – 31 December 2016, or the period of time starting from their effective allocation, after the former and until December 2016.

Exercise Period—The working days (i.e. days other than Saturday, Sunday, Italian bank holidays and the patron saint days of Rome, Milan and Turin) included in the period of three years starting from the first day immediately following the ascertainment by the Board of Directors of the level of achievement of the Objectives, after the Vesting Period, excepting those days on which the Regulations do not permit the options to be exercised.

Exercise Price—The price that the Beneficiaries must pay to subscribe or purchase a Share if they exercise Exercisable Options. Said price is determined by the Board of Directors[or its delegated representative] upon allocation of the Options to the Beneficiary as the arithmetic mean of the official Share price as from the thirtieth ordinary calendar day up to the previous trading day before assignment, both included, on the electronic share market organised and operated by Borsa Italiana S.p.A., calculated using as denominator only those days to which the prices used for the basis of the calculation apply, discounted by 10%, calculated to two decimal places (eurocents). In case of allocation of Options at different times, the Exercise Price shall never be less than the Exercise Price as determined upon first allocation. The arranged appreciation of the options attributed to the beneficiaries is equivalent to one third of the exercise price.

Performance Period—The period of time from 1 January 2014 to 31 December 2016 for which the degree of achievement of the Performance Objectives will be measured.

6