QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March, 2003

FALCONBRIDGE LIMITED

(Translation of registrant's name into English)

BCE Place, Suite 200, 181 Bay Street

Toronto, Ontario

M5J 2T3

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F]

Form 20-F o Form 40-F ý

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes ý No o

[If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-3920.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | FALCONBRIDGE LIMITED

(Registrant) |

March 21, 2003 |

|

By: |

/s/ P. D. LAFRANCE

P. D. Lafrance — Assistant Secretary |

FALCONBRIDGE LIMITED

Annual Report 2002

ENVISIONING OPPORTUNITIES

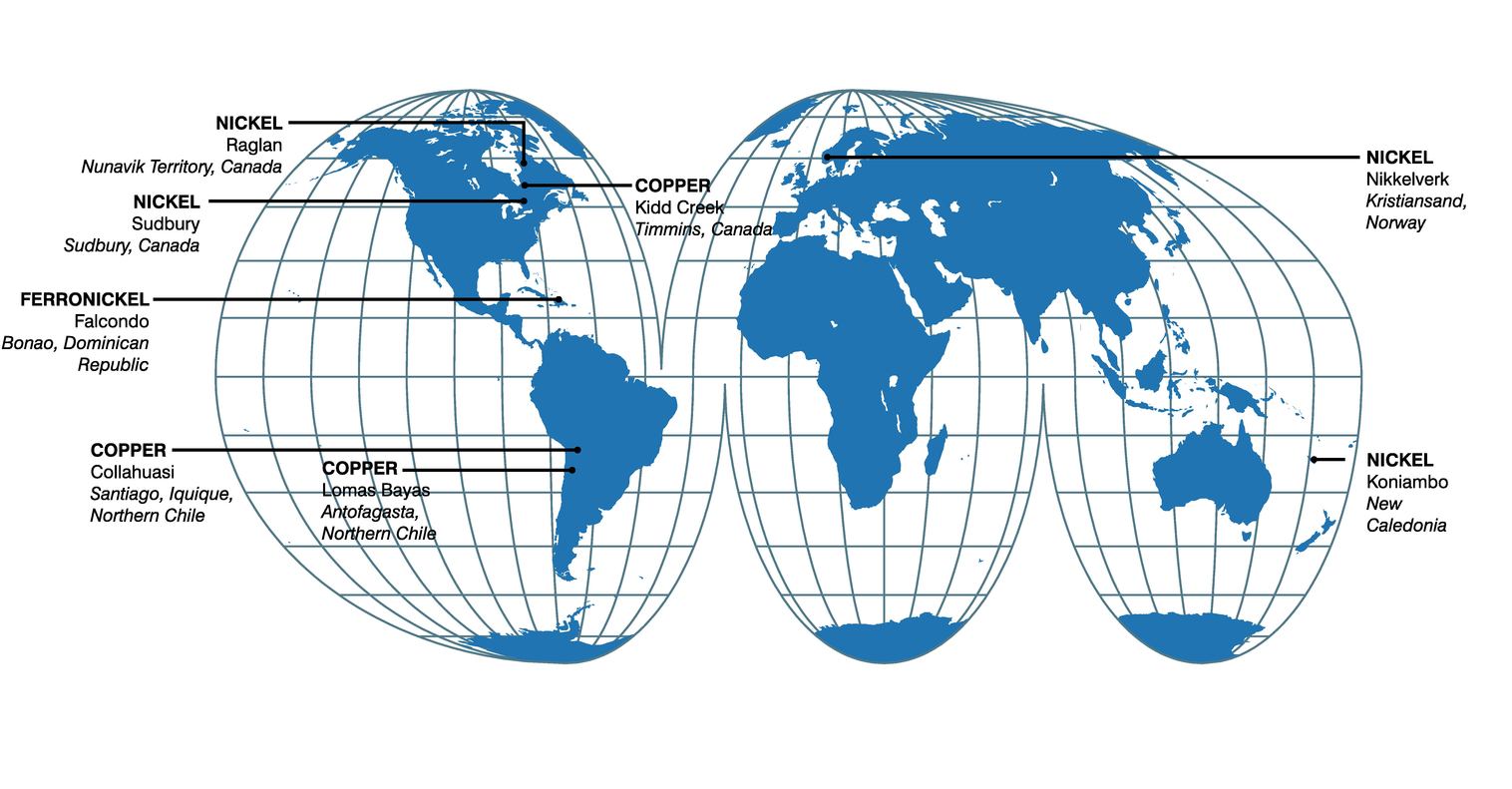

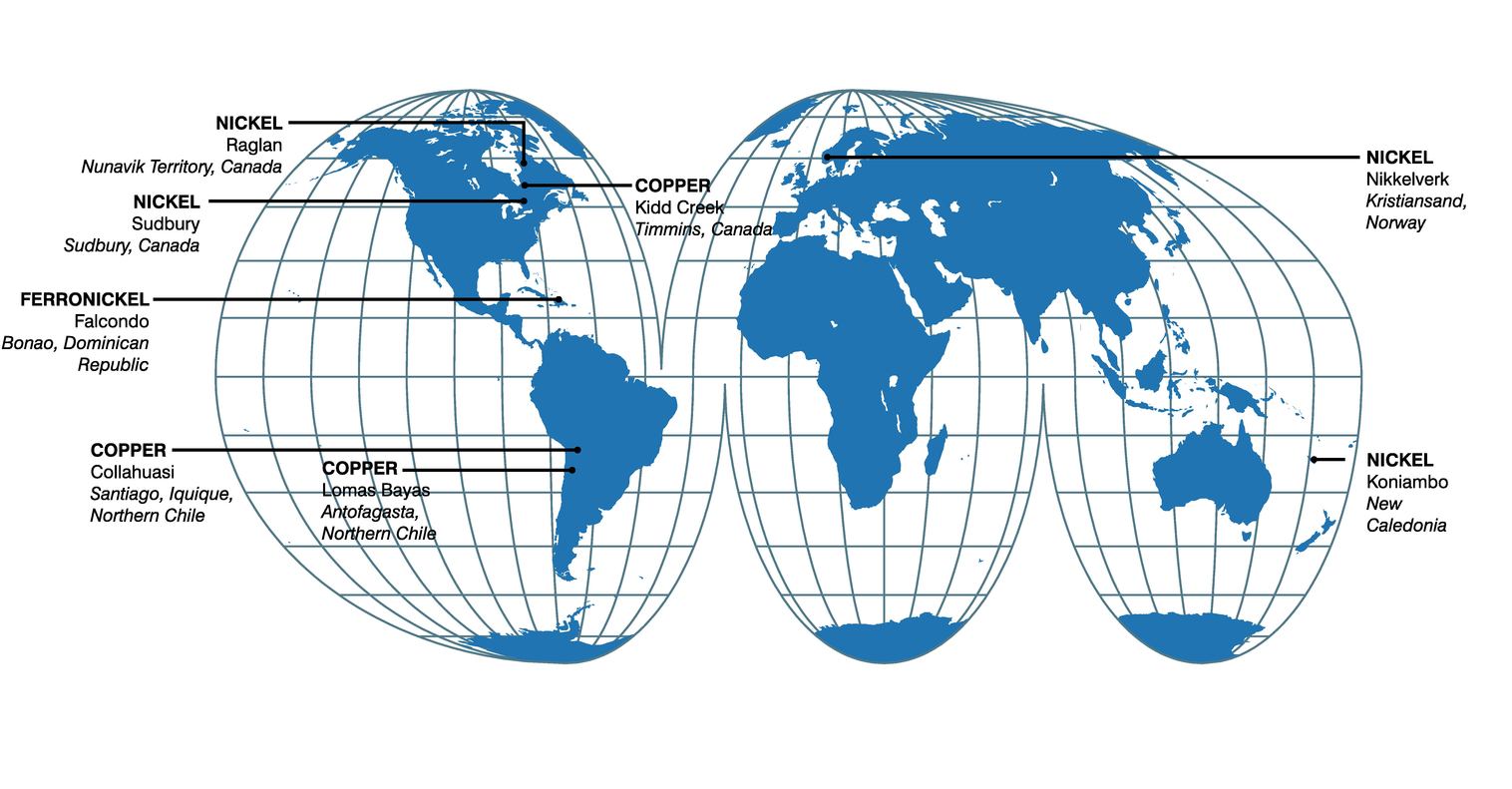

OUR OPERATIONS

NICKEL

Sudbury (Sudbury, Ontario)

- •

- Mines and mills nickel-copper ores from four mines (Craig, Fraser, Lindsley and Lockerby); smelts nickel-copper concentrate from Sudbury's mines and from Raglan, and processes custom feed materials.

Raglan (Rouyn-Noranda, Nunavik, Quebec)

- •

- Mines and mills nickel-copper ores from open pits and an underground mine.

Nikkelverk A/S (Kristiansand, Norway)

- •

- Refines nickel, copper, cobalt, precious and platinum group metals from Sudbury, Raglan and from custom feeds.

Falconbridge Dominicana, C. por A. (85.26%) (Bonao, Dominican Republic)

- •

- Mines, mills, smelts and refines its own nickel laterite ores.

Custom Feed (Brussels, Belgium; Pittsburgh, Pennsylvania; Christ Church, Barbados)

- •

- Acquires custom feeds for processing in Sudbury and Nikkelverk.

COPPER

Compañia Minera Doña Ines de Collahuasi S.C.M. (44%) (Santiago, Iquique and Northern Chile)

- •

- Mines and mills copper sulphide ores into concentrate; mines and leaches copper oxide ores to produce cathodes.

Kidd Mining Division (Timmins, Ontario)

- •

- Mines copper-zinc ores from the Kidd Mine.

Kidd Metallurgical Division (Timmins, Ontario)

- •

- Mills, smelts and refines copper-zinc ores from the Kidd Mine and processes Sudbury copper concentrate and custom feed materials, including some Collahuasi feed.

- •

- Mines copper oxide ores from an open pit; refines into copper cathode through the solvent extraction-electrowinning process (SX-EW).

CORPORATE

Corporate Office (Toronto, Ontario)

Project Offices (Kone and Noumea, New Caledonia; Brisbane, Australia)

Exploration Offices (Sudbury, Timmins and Toronto, Ontario; Laval, Quebec; Pretoria, South Africa; Belo Horizonte, Brazil; Brisbane, Australia)

Business Development (Toronto, Ontario)

- •

- Searches worldwide for attractive investment opportunities to support Falconbridge's business plans.

Marketing and Sales (Brussels, Belgium; Pittsburgh, Pennsylvania; Tokyo, Japan)

- •

- Markets and sells nickel, cobalt and other Falconbridge products worldwide.

- •

- Conducts research, development and engineering at all operation sites.

CORPORATE PROFILE

Falconbridge is a leading low-cost producer of nickel, copper, cobalt and platinum group metals. We are also a major recycler and processor of metal-bearing materials. Falconbridge is committed to improving shareholder returns through the responsible and profitable growth of our core nickel and copper businesses. We will accomplish this by focusing on high-quality and long-life ore bodies, by optimizing returns from our current assets, and by preparing to take advantage of market opportunities when they present themselves.

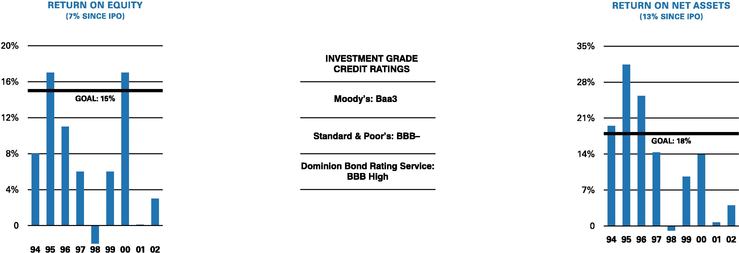

We target a minimum after-tax return on equity of 15% and an 18% return on net assets. Falconbridge entered the mining business in 1928 and today employs 6,400 people in 13 countries. Our common shares are listed on the Toronto Stock Exchange under the symbol FL. As of December 31, 2002, Falconbridge was owned by Noranda Inc. of Toronto (59.5%) and by other investors (40.5%).

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 1

2002 OPERATING HIGHLIGHTS

Falconbridge advanced its development programs at Collahuasi, Kidd Creek

and Lomas Bayas, ensuring that our copper production levels are maintained

for the next 20 years. Now, our focus turns to growth opportunities

in nickel, including the advancement of the Koniambo, Nickel Rim South,

Montcalm and Fraser Morgan projects.

- •

- Construction began on new grinding circuit at Ujina concentrator as part of the Ujina to Rosario transition project, increasing Collahuasi's concentrator design capacity to 110,000 tonnes per day and compensating for expected decline in ore grade in coming years.

- •

- Development work at Kidd Mine D continued on schedule and on budget, with shaft sinking, ramp development and hoist installation underway. Production expected to begin in late 2004.

- •

- Lomas Bayas had record year, producing 59,300 tonnes of copper.

- •

- Exceptional drill results released from Nickel Rim South property in Sudbury. Current resource estimates stand at 6.3 million tonnes grading 1.7% nickel and 3.4% copper, with significant showings of platinum and palladium.

- •

- Montcalm feasibility study neared completion. If approved, production could begin in late 2004, adding 8,000 tonnes of nickel production annually.

- •

- Koniambo project advanced with completion of pre-feasibility study. Bankable feasibility study will begin later in 2003, positioning partners to make development decision in late 2004.

- •

- Falconbridge and Noranda intensified efforts to improve operational and financial performances of North and South American copper businesses and corporate office activities. Working together, cost savings of $8 million have been identified, with further savings anticipated.

- •

- Over 375 employees received Six Sigma training and stage-gate process introduced to enhance efficiency and effectiveness of allocation and management of capital expenditures, to ensure returns are maximized.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 2

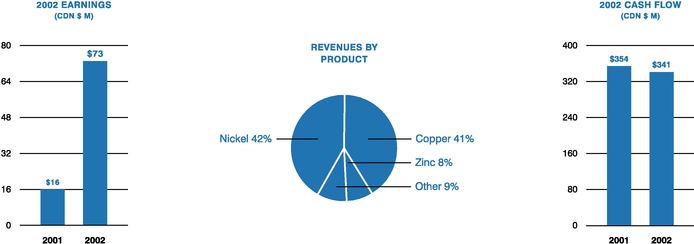

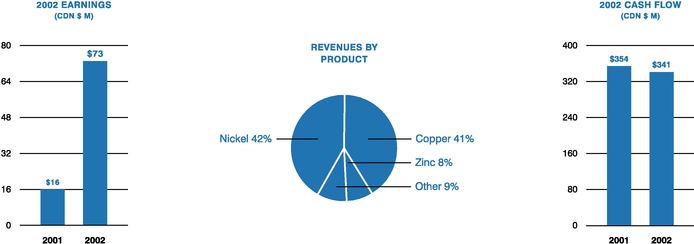

2002 FINANCIAL HIGHLIGHTS

The world economic expansion continued but at a much slower pace than originally anticipated. Nickel outperformed all other base metals, with prices rising 25% over the year. While Western demand for copper remained weak, the market outlook is improving. For 2003, we are cautiously optimistic that we will realize higher metal prices on the back of an economic recovery in the second half of the year.

MILLIONS, EXCEPT PER SHARE DATA

| | 2002

| | 2001

|

|---|

| OPERATING HIGHLIGHTS | | | | | | |

| Revenues | | $ | 2,394 | | $ | 2,138 |

| Operating income | | | 137 | | | 26 |

| Earnings | | | 73 | | | 16 |

| Cash provided by operating activities | | | 341 | | | 354 |

| Capital expenditures and deferred project costs | | | 358 | | | 348 |

FINANCIAL POSITION AT DECEMBER 31 |

|

|

|

|

|

|

| Cash and cash equivalents | | | 260 | | | 198 |

| Working capital | | | 627 | | | 482 |

| Total assets | | | 5,204 | | | 5,069 |

| Long-term debt | | | 2,023 | | | 1,867 |

| Shareholders' equity | | | 2,285 | | | 2,280 |

| Return on common shareholders' equity | | | 3% | | | 0% |

| Return on net assets | | | 4% | | | 1% |

| Ratio of net debt to net debt plus equity | | | 44% | | | 42% |

PER COMMON SHARE |

|

|

|

|

|

|

| Earnings | | $ | 0.34 | | $ | 0.02 |

| Cash provided by operating activities | | | 1.86 | | | 1.93 |

| Book value | | | 11.75 | | | 11.76 |

| Shares outstanding | | | 177.6 | | | 177.0 |

| | |

| |

|

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 3

POSITIONED FOR GROWTH

Aaron Regent, our new President and Chief Executive Officer, provides an outlook for nickel and copper, and outlines the progress our operations made on improving their performance, as well as his strategy for increasing shareholder value at Falconbridge.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 4

The past year was a challenging one for Falconbridge as we continued to adapt to and operate in an uncertain economic climate. This uncertainty negatively impacted demand for some of our products, leading to depressed metal prices, particularly for copper and zinc. Lower treatment charges for purchased concentrates at our Kidd Metallurgical facilities also impacted our profitability. The bright spot was nickel where positive fundamentals supported the nickel price over the course of the year.

As we look forward, we are optimistic that we will begin to see a broader recovery in metal prices. However, the timing of this recovery will be dependent on an overall improvement in the economy and resolution of uncertainty in the Middle East. In the longer term, we are very optimistic about the future for both nickel and copper due to positive demand growth rates and the increased challenge the industry faces in profitably adding new supply.

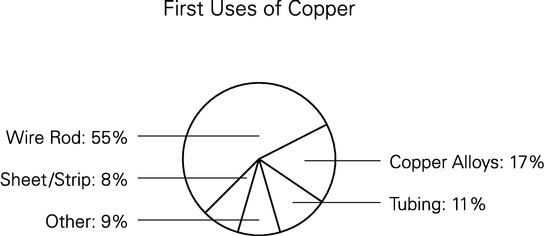

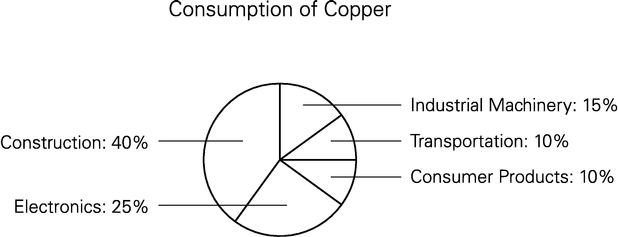

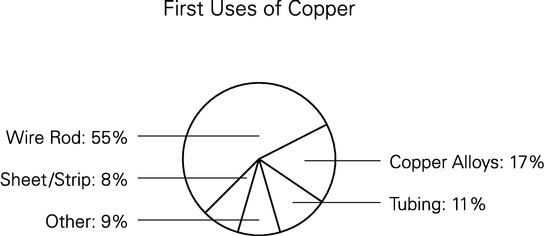

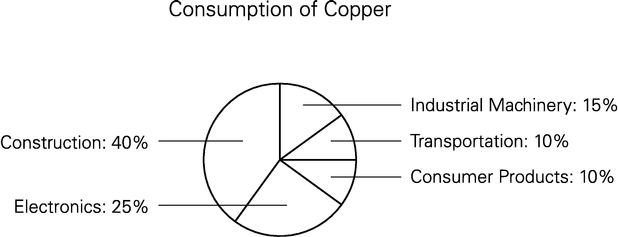

Our focus continues to be on nickel and copper, which offer the best fundamentals of all the base metals. Future demand is expected to be strong, particularly from China. Over the past five years, China has surpassed the United States as the world's largest consumer of copper, with consumption growing by 14% annually. China's nickel consumption has also grown rapidly, increasing by 17% annually. These growth rates are expected to continue as China develops its infrastructure and increases its consumption of durable goods. To meet its requirements, China must continue importing substantial quantities of both copper and nickel.

2002 PERFORMANCE VERSUS

OBJECTIVES

OBJECTIVE 1

Forge stronger links with potential partners in the mining industry and accelerate the delivery of additional synergies with Noranda

PERFORMANCE

Closer ties with Noranda established and further links developed with numerous junior exploration companies on nickel and pgm properties

OBJECTIVE 2

Advance development of Kidd Mine D and keep project on budget and on schedule

PERFORMANCE

Kidd Mine D remains on target to begin production in late 2004

OBJECTIVE 3

Achieve annual copper production rate of 58,000 tonnes at Lomas Bayas

PERFORMANCE

Lomas Bayas produced a record 59,300 tonnes of copper cathode in 2002

The mining industry's ability to meet future demand will become an increasing challenge. Expansion of current nickel production is limited and therefore future demand must be met with new projects. Copper expansion is possible but will largely compensate for a decrease in ore grades. For both nickel and copper, new projects are limited and the large size and scale of these projects, along with more stringent environmental standards, will increase the time required to construct and bring them into operation.

Falconbridge is well positioned to benefit from this positive outlook. We have a substantial asset base of high-quality copper and nickel operations with upside potential. We also have one of the most promising nickel projects in the world at Koniambo. And in copper, Collahuasi has further expansion potential.

Our strategy is to maximize the returns from our existing operations, advance the development of new growth opportunities in nickel and copper, and to maintain a strong financial position. Our fundamental goal is to maximize returns for shareholders with a 15% return on equity target.

In 2002, we made meaningful progress toward achieving these goals.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 5

Maximizing returns from existing assets

Refined nickel production from our Integrated Nickel Operations (INO) was 68,500 tonnes. Production was affected by lower volumes of available feeds and was below our annual refining capacity of 85,000 tonnes. We are focused on increasing the utilization rates of our smelting and refining facilities by increasing production from our own assets, acquiring additional properties and custom feeds, and by adding reserves, particularly in Sudbury and Raglan, through exploration.

The Nickel Rim South discovery continues to reinforce the potential of the Sudbury Basin and will help us maintain our current production levels into the future. The Montcalm property, acquired in 2001, is moving forward and a development decision is expected in 2003. When in operation, Montcalm will add 8,000 tonnes of nickel annually, beginning in late 2004.

In 2003 we expect our INO production to increase to 72,000 tonnes and to 77,000 tonnes in 2004. While still short of our goal, we are closing the gap.

Falcondo's profitability continues to be negatively impacted by high oil prices. Our efforts are focused on increasing energy efficiency to help manage these costs. In 2003 we expect to increase Falcondo's production by 15% to 27,000 tonnes.

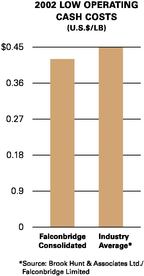

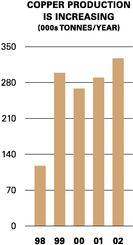

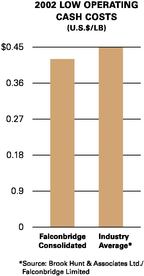

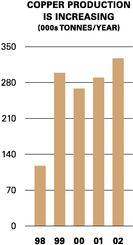

In copper, we achieved record levels of production — 13% higher than last year — at a very competitive consolidated cash cost of U.S.$0.42 per pound.

2002 PERFORMANCE

VERSUS OBJECTIVES (CONT'D)

OBJECTIVE 4

Ensure Koniambo is in position to complete bankable feasibility study in 2003

PERFORMANCE

Bankable feasibility study scheduled for third quarter of 2003

OBJECTIVE 5

Begin expansion of Collahuasi milling capacity in line with market needs

PERFORMANCE

Construction of new grinding circuit at Ujina concentrator approved in late 2002 and mechanical completion scheduled for June 2004

OBJECTIVE 6

Fill INO capacity with most profitable feeds

PERFORMANCE

Accessed profitable feeds from Sudbury mines, Raglan and custom feeds

OBJECTIVE 7

Continue to increase INO reserve base

PERFORMANCE

Nickel Rim South, Fraser Morgan and Montcalm added to Sudbury's resources

Over the next two years we are investing significant capital in our copper assets to further develop available resources and maintain our current production levels. At Collahuasi, the transition project and mill expansion remains on schedule with completion targeted for mid-2004. Once finished, production levels will be restored to around the 400,000-tonne level. At Kidd, the development of Mine D is 40% complete and will be finished in late 2004. Mine D will extend the mine life of Kidd to 2024.

Improving returns

We are also focused on making our operations more efficient. Six Sigma, a performance-enhancing program made famous by General Electric, is now being widely applied across Falconbridge. To date, over 375 people have received training and that number will expand to over 600 by the end of 2003. We are also using Six Sigma tools to improve the selection and management of capital expenditures.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 6

In addition, we are working more closely with Noranda to capture cost-saving opportunities and operational enhancements. In Toronto, we are sharing corporate support services to reduce costs. To improve efficiencies at our Kidd Metallurgical facilities, we are working closely with Noranda's Horne smelter and CCR copper refinery to coordinate operating activities, as well as feed procurement and supplies, and to share our technical and operating resources. In South America, our Lomas Bayas copper mine is working closely with Noranda's Altonorte copper smelter to achieve synergies in logistics, procurement and sulphuric acid. We have identified savings for Falconbridge of $8 million annually, with further benefits anticipated.

Growth opportunities — Koniambo

The most significant growth opportunity in our nickel business is the development of the Koniambo property. Koniambo is a world-class resource and on completion, it would increase Falconbridge's nickel production by 30,000 tonnes per year.

The pre-feasibility study is largely completed and it continues to support the attractive economics of the project. A bankable feasibility study will begin in the third quarter of 2003, with a development decision expected in late 2004.

Our financial position

During the year, debt levels increased but our liquidity remains high. We renewed our corporate credit facilities, as well as our Lomas Bayas and Collahuasi project loans, and accessed the U.S. debt markets successfully, issuing new 10-year corporate debentures.

- •

- Achieve efficiency, production and cost objectives set by each operation

- •

- Increase asset utilization within INO by increasing profitable feed volumes

- •

- Review Montcalm feasibility study and make development decision on this nickel deposit

- •

- Begin Koniambo bankable feasibility study

- •

- Grow nickel resource base through exploration, acquisitions, business partnerships and technology

- •

- Improve profitability of Kidd through cooperative activities with Horne smelter and CCR refinery

- •

- Advance development of Kidd Mine D and Collahuasi expansion and keep projects on budget and on schedule

- •

- Deliver cost savings and increased profits by working with Noranda and other mining companies

For 2003, we are optimistic that we will realize higher metal prices, particularly for nickel. With increased nickel production and copper production similar to 2002 levels, we expect an improvement in our earnings and cash flows. Capital expenditures are estimated to be $600 million and will be funded by increased cash flow from operations, cash on hand and credit facilities. Current debt levels are higher than our targets but continue to be manageable, particularly against a backdrop of improved metal prices. Our objective is to maintain our investment grade rating. Should the anticipated improvement in metal prices not materialize, consideration will be given to deferring some expenditures into future years.

Conclusion

The future for Falconbridge is bright. We are positioned to benefit from an improvement in future metal prices and continue to develop attractive growth opportunities. We remain committed to responsibly maximize the returns we deliver to shareholders. Our ability to deliver on this objective comes down to the thousands of people working within the company. I want to take this opportunity to thank them for their dedication, support and enthusiasm.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 7

Aaron Regent

President and

Chief Executive Officer

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 8

OPPORTUNITIES INNICKEL

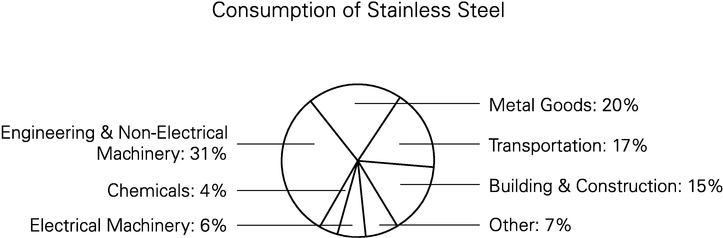

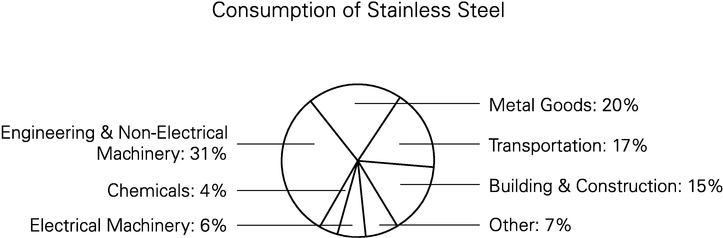

Jet engines, power plants, medical instruments, satellites, electronics.

All these things have one element in common:nickel. World consumption

of nickel, which is mainly used by stainless steel makers, is increasing

at an exceptional rate. Falconbridge is well positioned to take advantage

of these tremendous opportunities.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 9

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 10

WE UNCOVERED ONE OF THEHIGHEST GRADE

DEPOSITS EVER FOUNDIN THE SUDBURY

BASIN AT NICKEL RIM SOUTH.

The discovery is just one of many exciting nickel projects we're working on.

Our portfolio also includes Koniambo, Montcalm and Fraser Morgan.

Together, these projects will help Falconbridge increase its production of nickel

to meet the growing global demand for this important metal.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 11

Nickel Rim South yields exceptional drill results

A key focus is to increase Falconbridge's ore reserve base. By refocusing our efforts on small and medium size targets in the Sudbury Basin, we've identified two key properties near our existing facilities. Nickel Rim South's resources now stand at 6.3 million tonnes grading 1.7% nickel and 3.4% copper, with significant showings of platinum and palladium. By the end of June 2003, we should be in a position to decide whether to move forward with shaft sinking. We are also encouraged by an underground exploration drilling program we have underway near the Fraser Morgan resource.

Integrated Nickel Operations (INO) aim to profitably optimize smelting and refining capacities

In order to meet this challenge, we must intensify our focus on securing ownership of resources and custom feed. This objective will be met through resource acquisition, joint ventures, exploration opportunities, the further optimization of Raglan and growth in custom feeds.

The Montcalm property near Timmins is another attractive property in our portfolio. Montcalm's feasibility study is nearing completion and if approved, production could begin to flow into the refinery starting in late 2004 which would add 8,000 tonnes of nickel production annually.

- •

- Achieve efficiency, production and cost objectives set by each operation

- •

- Increase asset utilization within INO by increasing volumes from Sudbury, Raglan and custom feeds

- •

- Review Montcalm feasibility study and make development decision

- •

- Begin Koniambo bankable feasibility study

- •

- Grow nickel resource base through acquisitions, exploration, business partnerships and technology

REFINED NICKEL

PRODUCTION IS INCREASING

(000s TONNES/YEAR)

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 12

Falcondo is a major producer of ferronickel and provides a direct link to stainless steel markets

With the rapid growth in stainless steel production, Falcondo's ferro-nickel production strongly positions us in this important market. The stand-alone nature of this facility also provides us with the flexibility to take ferronickel production out of the market during periods of low nickel prices. This enables us to manage our reserves for the long-term benefit of all of our stakeholders.

Significant progress made on advancing our New Caledonian property

The pre-feasibility study was completed this year with a bankable feasibility study to begin later in 2003, positioning Falconbridge and its joint venture partner Société Minière du Sud Pacifique (SMSP) to make a development decision in late 2004. Should it proceed, the 60,000-tonne-per-year nickel-in-ferronickel project would enter production in 2008.

The project's strength rests on the size and quality of its resource and its substantial expansion potential — at a grade of 2.15%, Koniambo represents one of the world's best undeveloped nickel laterite deposits. The choice of a proven smelting process with modern technology and equipment will help reduce project risk and will also support a rapid and successful start-up. Strongly endorsed by government and local community leaders, Koniambo will be operated respecting community, cultural and environmental values.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 13

OPPORTUNITIES INCOPPER

Cell phones, satellites, cars, high-speed Internet and electronics.

All these things have one element in common:copper. World consumption

of copper is increasing at a healthy rate of over 3% annually.

Falconbridge is well positioned to benefit from this growth and take

advantage of market opportunities.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 14

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 15

WE HAVE MAINTAINED OUR POSITION AS A

LOW-COST COPPER PRODUCER,OPERATING

BELOW THE INDUSTRY AVERAGE.

As the market outlook for copper improves, we remain focused on advancing

our development programs at our three copper operations — Kidd Creek in

northern Ontario and Collahuasi and Lomas Bayas, both located in northern Chile.

These development projects will ensure our copper production levels are

maintained for the next 20 years.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 16

Collahuasi posts another strong year

Collahuasi continues to be a strong performer, exceeding targeted production and operating costs. This continues a track record of exceptional performance and an impressive record of continuous improvement. Since its start-up in 1999, ore grades have fallen by 22%, but copper in concentrate production has only fallen by 3%. In addition, the oxide plant is running 20% ahead of design capacity. And, cash operating costs remain very competitive at around U.S.$0.39 per pound.

In 2002, the Collahuasi Board approved the construction of a new grinding circuit at the Ujina concentrator as part of the Ujina to Rosario transition project. This project will increase Collahuasi's concentrator design capacity to 110,000 tonnes per day from 60,000 tonnes per day, compensating for the expected decline in ore grade. The total capital cost of the project is estimated at U.S.$654 million, with Falconbridge's 44% share of this cost totalling U.S.$288 million. The project is scheduled to achieve mechanical completion in June 2004.

| |

|

|---|

| • | | Achieve efficiency, production and cost objectives set by each operation |

| • | | Improve profitability of Kidd Creek through cooperative activities with Horne smelter and CCR refinery |

| • | | Advance development of Kidd Mine D and Collahuasi expansion and keep projects on budget and on schedule |

| • | | Maximize production at Lomas Bayas and continue evaluation of Fortuna de Cobre development |

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 17

Lomas Bayas producing beyond expectations

This Chilean mine has been a successful acquisition, meeting both its production and cost targets. Purchased in 2001 at 60% of its original construction cost, Lomas Bayas has continued to increase its production output and lower its costs. The potential development of the nearby Fortuna de Cobre copper deposit — which Falconbridge has the right to retain for U.S.$15 million — is currently under review. The operation recently agreed to purchase 100% of its sulphuric acid from Noranda's nearby Altonorte smelter and the two sites will continue to seek opportunities to coordinate their business activities.

Kidd Creek focuses on improving profitability

This asset, along with Noranda's Horne smelter and CCR refinery, has struggled this year as low copper and zinc prices, as well as low treatment and refining charges for feed have reduced profitability. In response, the management teams at Falconbridge and Noranda are focused on improving the overall profitability of these sites through combined cost reduction initiatives, materials management activities and capital expenditure rationalization.

At the Kidd Mine, development work at Mine D continued on schedule and on budget, with shaft sinking, ramp development and hoist installation underway. The mine will give access to an additional 10 million tonnes of reserves and 14 million tonnes of resources. Once Mine D is in full production, total Kidd Mine annual ore production will be back at the 2.4 million tonne level.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 18

SUMMARY OF MINERAL RESERVES AND MINERAL RESOURCES1

Operation

| | Percentage Ownership

| | Category

| | Thousand Tonnes

| | % Nickel

| | % Copper

| | % Zinc

| | g/t Silver

|

|---|

| MINERAL RESERVES | | | | | | | | | | | | | | |

| NICKEL DEPOSITS | | | | | | | | | | | | | | |

| Sudbury | | 100% | | Proven | | 7,914 | | 1.45 | | 1.36 | | — | | — |

| | | | | Probable | | 9,212 | | 1.22 | | 1.21 | | — | | — |

| | | | | Total | | 17,126 | | 1.33 | | 1.28 | | — | | — |

| Raglan | | 100% | | Proven | | 6,691 | | 3.04 | | 0.81 | | — | | — |

| | | | | Probable | | 11,418 | | 2.78 | | 0.78 | | — | | — |

| | | | | Total | | 18,109 | | 2.88 | | 0.79 | | — | | — |

| Falcondo2 | | 85.26% | | Proven | | 52,484 | | 1.19 | | — | | — | | — |

| | | | | Probable | | 11,636 | | 0.96 | | — | | — | | — |

| | | | | Total | | 64,120 | | 1.15 | | — | | — | | — |

| COPPER DEPOSITS | | | | | | | | | | | | | | |

| Kidd Creek | | 100% | | Proven | | 13,409 | | — | | 2.01 | | 5.77 | | 76 |

| | | | | Probable | | 10,285 | | — | | 2.25 | | 6.98 | | 54 |

| | | | | Total | | 23,694 | | — | | 2.11 | | 6.30 | | 66 |

| Lomas Bayas | | 100% | | Proven | | 77,914 | | — | | 0.37 | | — | | — |

| | | | | Probable | | 319,435 | | — | | 0.31 | | — | | — |

| | | | | Total | | 397,349 | | — | | 0.32 | | — | | — |

| Collahuasi2 | | 44% | | Proven | | 310,254 | | — | | 1.02 | | — | | — |

| | | | | Probable | | 1,528,494 | | — | | 0.90 | | — | | — |

| | | | | Total | | 1,838,748 | | — | | 0.92 | | — | | — |

| MINERAL RESOURCES (in addition to mineral reserves) | | | | | | | | | | | | | | |

| NICKEL DEPOSITS | | | | | | | | | | | | | | |

| Sudbury | | 100% | | Measured | | 85 | | 2.38 | | 1.27 | | — | | — |

| | | | | Indicated | | 16,748 | | 2.38 | | 1.10 | | — | | — |

| | | | | Total | | 16,833 | | 2.38 | | 1.10 | | — | | — |

| | | | | Inferred | | 22,100 | | 1.8 | | 2.4 | | — | | — |

| Raglan | | 100% | | Measured | | 289 | | 1.62 | | 0.41 | | — | | — |

| | | | | Indicated | | 2,587 | | 1.98 | | 0.76 | | — | | — |

| | | | | Total | | 2,876 | | 1.95 | | 0.72 | | — | | — |

| | | | | Inferred | | 3,400 | | 2.7 | | 0.87 | | — | | — |

| Falcondo2 | | 85.26% | | Measured | | — | | — | | — | | — | | — |

| | | | | Indicated | | 13,840 | | 1.53 | | — | | — | | — |

| | | | | Total | | 13,840 | | 1.53 | | — | | — | | — |

| | | | | Inferred | | 6,400 | | 1.4 | | — | | — | | — |

| COPPER DEPOSITS | | | | | | | | | | | | | | |

| Kidd Creek | | 100% | | Measured | | — | | — | | — | | — | | — |

| | | | | Indicated | | 100 | | — | | 2.96 | | 6.79 | | 50 |

| | | | | Total | | 100 | | — | | 2.96 | | 6.79 | | 50 |

| | | | | Inferred | | 14,100 | | — | | 3.4 | | 4.9 | | 91 |

| Lomas Bayas | | 100% | | Measured | | 13,754 | | — | | 0.27 | | — | | — |

| | | | | Indicated | | 157,607 | | — | | 0.27 | | — | | — |

| | | | | Total | | 171,361 | | — | | 0.27 | | — | | — |

| | | | | Inferred | | 73,400 | | — | | 0.28 | | — | | — |

| Collahuasi2 | | 44% | | Measured | | 48,205 | | — | | 0.57 | | — | | — |

| | | | | Indicated | | 429,766 | | — | | 0.63 | | — | | — |

| | | | | Total | | 477,971 | | — | | 0.63 | | — | | — |

| | | | | Inferred | | 1,840,000 | | — | | 0.72 | | — | | — |

Notes:

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 19

- 1.

- The mineral reserve and resource estimates are prepared in accordance with the "CIM Standards On Mineral Resources and Mineral Reserves, Definitions And Guidelines", adopted by CIM Council on August 20, 2000, using classical and/or geostatistical methods, plus economic and mining parameters appropriate to each project.

- 2.

- The mineral reserves and resources at Collahuasi and Falcondo are shown on a 100% basis.

There are no known environmental, permitting, legal, taxation, political or other relevant issue that would materially affect the estimates of the mineral reserves.

The mineral resources have reasonable prospects for economic extraction but have not yet had complete formal evaluation, or do not have demonstrated economic viability under current conditions. The mineral reserve and mineral resource estimates are compiled and verified by Chester Moore, Director, Mineral Reserve Estimation and Reporting, a member of the Professional Geoscientists of Ontario with 30 years experience as a geologist.

The mineral reserves and resources at Collahuasi are estimated and provided by the operator of the joint venture based on a copper price of $U.S.0.95. They are estimated and classified to industry standards following the Australasian Institute of Mining and Metallurgy's Joint Ore Reserve Committee code. These estimates have been restated to conform to the latest CIM mineral reserve and resource definitions. The estimates are inspected annually by Chester Moore.

MANAGEMENT'S DISCUSSION AND ANALYSIS

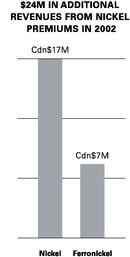

In 2002, as a result of higher metal prices and higher sales volumes, Falconbridge achieved net earnings of $73.4 million as compared to $16.0 million in 2001. Cash flow from operations before working capital changes was $411.5 million compared with $258.3 million in 2001. Our objective is to deliver a 15% return on equity to shareholders over the commodity price cycle.

OVERVIEW

Falconbridge's strategy remains focused on the exploration, development and production of nickel and copper metals. This is based on nickel's and copper's positive fundamentals and high growth rates, as well as Falconbridge's strong competitive position.

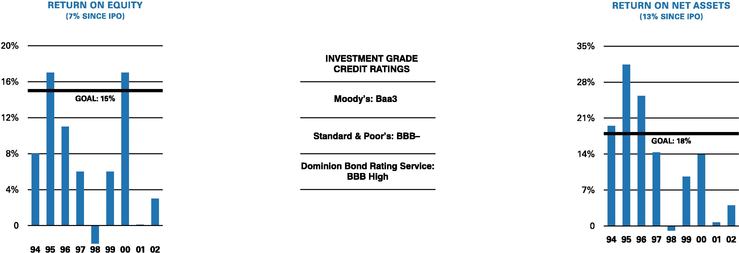

Over the cycle, our financial objective is a 15% return on equity and an 18% return on net assets. Our objective is to maintain a conservative capital structure and investment grade credit ratings.

In 2002, as a result of higher metal prices and higher sales volumes, Falconbridge achieved net earnings of $73.4 million as compared to $16.0 million in 2001. Cash flow from operations before working capital changes was $411.5 million compared with $258.3 million in 2001.

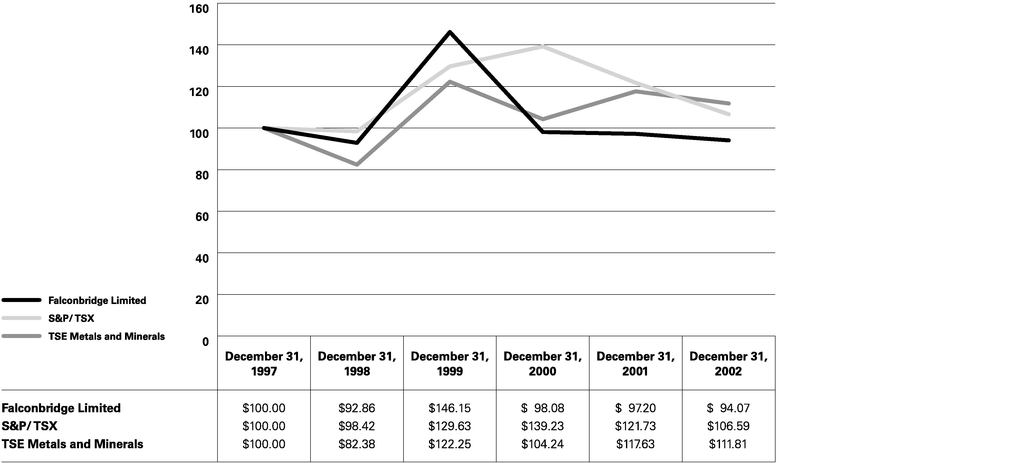

Since the Initial Public Offering (IPO) in 1994, Falconbridge has achieved an average return on net assets of 13%, which is below our 18% target. Low metal prices negatively impacted our returns particularly for copper, where substantial amounts of new capital have been invested from 1998 to 2002 — a period of depressed copper prices. Over the same period, our return on equity has been 7%, again largely impacted by low metal prices.

In 2002, Falconbridge advanced its development programs at Collahuasi, Kidd Creek and Lomas Bayas, ensuring that our copper production levels are maintained for the next 20 years. In particular, work continued on the Mine D project at Kidd Creek and on the expansion of the Collahuasi mill. Going forward, our focus turns to growth opportunities in nickel, including the advancement of the Koniambo, Nickel Rim South, Montcalm and Fraser Morgan projects.

The Corporation believes that financial flexibility is important and plans for the cyclical nature of the business.

In 2002, the net debt to net debt plus equity increased to 44% from 42%. The average net debt to net debt plus equity ratio since the IPO is 31%. Working capital stood at $626.6 million and cash resources were $259.9 million at December 31, 2002.

Falconbridge has significant liquidity and financial flexibility. We have an active Canadian commercial paper program which is supported by cash and unused Credit Facilities. At December 31, 2002, the Corporation had $259.9 million of cash and cash equivalents and $153.9 million of commercial paper and

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 20

bank borrowings outstanding. The Corporation's Credit Facilities total U.S.$415 million. In addition, the Corporation has no major debt maturities until 2005.

We are also working more closely with Noranda to capture cost-saving opportunities and operational enhancements. In Toronto, we are sharing corporate support services to reduce costs. To improve efficiencies at our Kidd Metallurgical facilities, we are working closely with Noranda's Horne smelter and CCR copper refinery to coordinate operating activities, as well as feed procurement and supplies, and to share our technical and operating resources. In South America, our Lomas Bayas copper mine is working closely with Noranda's Altonorte copper smelter to achieve synergies in logistics, procurement and sulphuric acid. We have identified savings for Falconbridge of $8 million annually, with further benefits anticipated.

Procedures are in place to record and ensure that transactions between Falconbridge and Noranda are on commercial terms. The Committee of Independent Directors of the Board of Falconbridge Limited review these transactions to ensure they are conducted on terms which are fair and equitable to Falconbridge and reflect fair market terms.

This discussion provides a review of the financial performance and position of Falconbridge for the years ended December 31, 2002 and 2001. It should be read in conjunction with the Corporation's audited financial statements and notes to those statements. All amounts are expressed in Canadian dollars, except where indicated. In addition, this discussion contains certain forward-looking statements regarding Falconbridge's businesses and operations. Actual results may differ materially from those contemplated by these statements depending on, among others, such key factors as supply and demand for metals to be produced, production levels, exchange rates and metals prices.

RESULTS OF OPERATIONS

Earnings for the year ended December 31, 2002 increased by $57.4 million (32 cents per common share) from 2001 to $73.4 million (34 cents per common share).

Operating income of $136.7 million in 2002 increased by $110.6 million from $26.1 million in 2001. The significant increase in operating income was attributable to the following factors:

- •

- Revenues for the year ended December 31, 2002 increased by $255.8 million to $2,394.0 million. The increased revenues result from higher realized prices for nickel and copper offset by lower zinc and cobalt prices; higher sales volumes for nickel, copper, zinc and cobalt which increased by 9%, 15%, 5% and 27%, respectively; and a more favourable exchange rate. Lower deliveries and lower prices for platinum and palladium offset the impact of higher sales volumes and prices of gold and silver resulting in a decrease of $66.3 million in total precious metals revenues during the year ended December 31, 2002.

- •

- Costs of metal and other product sales increased by $139.5 million.

- •

- Selling, general and administrative costs increased by $15.1 million.

- •

- Depreciation and amortization costs of $348.7 million increased by $17.9 million compared with $330.9 million in 2001.

- •

- Exploration, research and process development expenditures of $46.6 million were $9.8 million lower than in 2001.

- •

- Foreign exchange gains of $13.3 million in 2002 compared to a loss of $1.0 million in 2001.

- •

- Other expenses of $6.1 million compared with $9.3 million in 2001. The decrease in expense of $3.2 million is primarily due to a reduced loss of $9.9 million from futures/options and forward metal positions offset by an increase of $6.7 million in other expenses. The reduced loss from futures/options and forward metal positions in the current year reflects the non-recurrence of mark-to-market valuation losses recorded in 2001 on call options for nickel and copper.

Income and expenses were provided from the following non-operating sources:

- •

- Interest of $88.2 million in 2002 was $1.5 million higher than 2001. Lower interest rates were offset by slightly higher average net debt balances.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 21

- •

- Income and mining tax recovery of $24.8 million compared with a recovery of $75.4 million in 2001. Further details concerning income taxes can be found in note 7, page 40 of this annual report.

- •

- Losses at Falcondo in 2002 were lower than in 2001, reducing the non-controlling interest in the loss of subsidiaries by $1.1 million.

Earnings in 2002 were not affected by unusual charges as occurred in 2001. A strike at the Sudbury Operations reduced earnings in 2001 by $35.6 million. The 2001 results also included a tax benefit of $20.0 million.

The following table summarizes the results of operations for 2002 and 2001, including contributions from the reportable segments:

| | Year Ended December 31

| |

|---|

| | 2002

| | 2001

| |

|---|

| | (Millions)

| |

|---|

| Nickel operations | | | | | | | |

| | Integrated Nickel Operations (INO) | | $ | 146.6 | | $ | 84.6 | |

| | Falconbridge Dominicana, C. por A. | | | 1.0 | | | (18.2 | ) |

| | |

| |

| |

| | | | 147.6 | | | 66.4 | |

| | |

| |

| |

| Copper operations | | | | | | | |

| | Kidd Creek Operations | | | (77.8 | ) | | (64.0 | ) |

| | Collahuasi | | | 132.1 | | | 122.4 | |

| | Lomas Bayas | | | 28.0 | | | 7.6 | |

| | |

| |

| |

| | | | 82.3 | | | 66.0 | |

| | |

| |

| |

| Corporate and other | | | (93.2 | ) | | (106.4 | ) |

| | |

| |

| |

| Operating Income | | | 136.7 | | | 26.0 | |

| Interest | | | 88.2 | | | 86.6 | |

| Income and mining taxes | | | (24.8 | ) | | (75.4 | ) |

| Non-controlling interest | | | 0.1 | | | 1.2 | |

| | |

| |

| |

| Earnings for the year | | | 73.4 | | | 16.0 | |

| | |

| |

| |

| Dividends on preferred shares | | | 12.6 | | | 12.1 | |

| | |

| |

| |

| Earnings attributable to common shares | | $ | 60.8 | | $ | 3.9 | |

| | |

| |

| |

NICKEL OPERATIONS:

Falconbridge is the third-largest producer of refined nickel in the world, accounting for roughly 8% of world supply in 2002. Nickel operations include: the Integrated Nickel Operations (INO) which includes mines and plants in Sudbury and Raglan in Canada, a refinery at Nikkelverk in Norway and a significant custom feed business; and Falcondo, a ferronickel operation in the Dominican Republic.

Operating income of the nickel business was $147.6 million in 2002 compared with $66.4 million in 2001. Refined nickel production was 91,800 tonnes in 2002 compared with 89,900 tonnes in 2001. The operating cash cost per pound of nickel was U.S.$2.19 per pound for all of Falconbridge's mined nickel compared with U.S.$1.86 in 2001.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 22

Integrated Nickel Operations (INO)

The INO includes mines and plants in Sudbury and Raglan in Canada, a refinery at Nikkelverk in Norway and a significant custom feed business.

| | 2002

| | 2001

|

|---|

| Sales (tonnes) | | | | |

| Nickel | | 71,200 | | 65,200 |

| Copper | | 54,500 | | 34,500 |

| Cobalt | | 2,900 | | 2,300 |

| Revenues ($ millions) | | 1,088 | | 969 |

| Operating cash cost | | | | |

| (U.S.$ per pound of nickel)* | | 1.96 | | 1.52 |

| Operating income ($ millions) | | 147 | | 85 |

| | |

| |

|

- *

- Operating cash cost includes all cash production and selling costs, net of by-product credits, but excludes interest, corporate, exploration costs and custom feed profits. Continuing costs incurred during shutdowns or strikes are excluded.

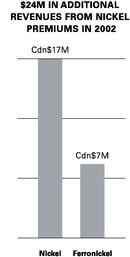

Revenues: Sales volumes of base metals increased in 2002. In 2001, volumes were affected by reduced productivity related to a strike by the production and maintenance workers at Sudbury Operations. Realized nickel prices in 2002 increased by 13%, copper prices remained the same, and cobalt prices decreased by 27%. Precious metals revenues decreased by $74.0 million. In 2002, consolidated revenues for the INO increased to $1,088.2 million from $968.7 million in 2001.

Costs: The operating cash cost (after by-product credits) of producing a pound of nickel from the mines in the INO, was U.S.$1.96 per pound of nickel. The U.S.$0.44, or 29%, increase over 2001 costs was the result of lower by-product credits and higher unit operating costs.

Operating income: The INO's 2002 operating income was $146.6 million compared with $84.6 million for 2001. The $62.0 million increase was attributable to the impact of increased sales volumes, higher nickel prices, the Cdn$/U.S.$ exchange rate, and the impact of strike costs on 2001 results, which were partially offset by lower precious metals revenues and higher unit production costs.

Production: Ore production at the Sudbury mines was 18% higher than in 2001. Nickel in concentrate production increased from 25,200 tonnes in 2001 to 27,800 tonnes in 2002 but some of the ore tonnage increase was offset by lower ore grades. Nickel in concentrate production in Sudbury in 2003 is planned at 26,500 tonnes.

At Raglan, nickel in concentrate production in 2002 remained unchanged at 24,600 tonnes. Production of nickel in concentrate in 2003 is planned at 24,500 tonnes as it is expected that the mine will return to an annual production level of approximately 950,000 tonnes of ore from 868,000 tonnes in 2001.

Productivity at Raglan, measured by the equivalent units of metals produced per hour worked, improved by 5% as the impact of higher ore grades more than offset the decline in ore tonnage.

At the smelter, nickel in matte production increased from 54,900 tonnes to 57,900 tonnes in 2002. Production records were established for matte production during the fourth quarter. Production of nickel in matte in 2003 is planned at 57,000 tonnes.

Production of nickel at the refinery in Kristiansand was 68,500 tonnes in 2002 or roughly the same as in 2001. Based on planned increases in custom feed deliveries and forecast mine feeds, production of nickel in 2003 is planned at 72,000 tonnes. Fourth quarter 2002 production of nickel, cobalt and precious metals established new production records. These production levels confirmed the refinery's annual production capacities of 85,000 tonnes for nickel, 4,500 tonnes for cobalt and 38,000 tonnes for copper.

Productivity at the refinery, measured by the equivalent units of metals produced per hour worked, improved by 4% as a result of increased throughput.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 23

During 2002, a new collective agreement was reached with the production and maintenance workers at Raglan.

INTEGRATED NICKEL OPERATIONS

| | 2002

| | 2001

|

|---|

| | Ore tonnes

(x 1,000)

| | Ni %

| | Cu %

| | Ore tonnes

(x 1,000)

| | Ni %

| | Cu %

|

|---|

| Production | | | | | | | | | | | | |

| Sudbury — Mine | | | | | | | | | | | | |

| Craig | | 980 | | 1.77 | | 0.57 | | 892 | | 1.94 | | 0.69 |

| Fraser | | 639 | | 1.08 | | 3.48 | | 581 | | 1.26 | | 2.52 |

| Lindsley | | 418 | | 1.19 | | 1.16 | | 317 | | 1.13 | | 1.18 |

| Lockerby | | 258 | | 2.10 | | 1.18 | | 156 | | 1.99 | | 1.09 |

| | |

| |

| |

| |

| |

| |

|

| Total mined | | 2,295 | | | | | | 1,946 | | | | |

| | |

| |

| |

| |

| |

| |

|

| Total — ore processed | | 2,295 | | 1.51 | | 1.56 | | 1,946 | | 1.61 | | 1.35 |

| | |

| |

| |

| |

| |

| |

|

| Raglan mine | | 868 | | 3.35 | | 0.97 | | 961 | | 2.98 | | 0.91 |

| | |

| |

| |

| |

| |

| |

|

| | Ni

| | Cu

| | Co

| | Ni

| | Cu

| | Co

|

|---|

| Metal in concentrate (tonnes) | | | | | | | | | | | | |

| Sudbury mine output | | 27,833 | | 31,050 | | 690 | | 25,226 | | 22,858 | | 630 |

| Raglan mine output | | 24,636 | | 6,500 | | 386 | | 24,570 | | 6,915 | | 318 |

| | |

| |

| |

| |

| |

| |

|

| Metal in copper concentrate | | 94 | | 21,666 | | — | | 60 | | 14,009 | | — |

| | |

| |

| |

| |

| |

| |

|

| Smelter, refinery | | | | | | | | | | | | |

| Smelter (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 28,243 | | 11,166 | | 691 | | 24,534 | | 8,890 | | 590 |

| | — Raglan | | 25,211 | | 6,617 | | 370 | | 26,914 | | 7,165 | | 419 |

| Custom | | 4,400 | | 2,735 | | 894 | | 3,444 | | 1,837 | | 779 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 57,854 | | 20,518 | | 1,955 | | 54,892 | | 17,892 | | 1,788 |

| | |

| |

| |

| |

| |

| |

|

| Refinery (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 27,170 | | 11,108 | | 621 | | 22,059 | | 7,144 | | 496 |

| | — Raglan | | 24,305 | | 6,741 | | 344 | | 29,375 | | 7,818 | | 439 |

| | Custom | | 17,055 | | 12,783 | | 3,029 | | 16,787 | | 11,760 | | 2,379 |

| | |

| |

| |

| |

| |

| |

|

| | Total | | 68,530 | | 30,632 | | 3,994 | | 68,221 | | 26,722 | | 3,314 |

| | |

| |

| |

| |

| |

| |

|

| | Ni

| | Cu

| | Co

| | Ni

| | Cu

| | Co

|

|---|

| Sales (tonnes) | | | | | | | | | | | | |

| | Mines — Sudbury | | 28,035 | | 34,352 | | 637 | | 20,104 | | 15,185 | | 480 |

| | — Raglan | | 25,250 | | 6,905 | | 358 | | 29,419 | | 7,599 | | 446 |

| | Custom | | 17,472 | | 13,238 | | 1,937 | | 14,696 | | 11,057 | | 1,365 |

| | Purchased product | | 396 | | — | | — | | 1,020 | | 673 | | 25 |

| | |

| |

| |

| |

| |

| |

|

| | Total | | 71,153 | | 54,495 | | 2,932 | | 65,239 | | 34,514 | | 2,316 |

| | |

| |

| |

| |

| |

| |

|

Reserves & exploration: The December 31, 2002 total proven and probable mineral reserves in Sudbury remained essentially unchanged at 17.1 million tonnes despite production of 2.2 million tonnes of ore during 2002. The 2002 production was replaced with an increase in reserves of 1.2 million tonnes at Craig Mine due to a lower cut-off grade, the upgrading and discovery of 0.8 million tonnes at Thayer Lindsley Mine and an additional 0.3 million tonnes due to the reinterpretation of 6 Zone at Fraser Mine.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 24

Exploration at Sudbury has resulted in the discovery of a new mineral resource, Nickel Rim South. Surface diamond drilling to date has defined an inferred resource consisting of 6.3 million tonnes of 1.7% nickel, 3.4% copper, 2.2 grams/tonne platinum, 2.5 grams/tonne palladium and 1.5 grams/tonne gold. A decision concerning an underground exploration program will be made in 2003. Underground drilling at Fraser Mine added 0.7 million tonnes grading 1.5% nickel and 0.4% copper in the Fraser Morgan zone. Total inferred mineral resources in Sudbury increased significantly to 22.1 million tonnes with Nickel Rim South and Fraser Mine being the main additions.

In combination with production and other reserve adjustments, the December 31, 2002 total proven and probable mineral reserves at Raglan decreased by 1.4 million tonnes, in 2002, to 18.1 million tonnes. Exploration in 2002 resulted in the discovery of approximately 0.25 million tonnes of probable mineral reserves in two individual lenses at Zone 2 and Katinniq. When added to mining gains and losses, these discoveries replaced part of the annual production of 869,000 tonnes.

Falconbridge Dominicana, C. por A. (Falcondo)

Located in the Dominican Republic, Falcondo mines, mills, smelts and refines its own nickel laterite ores. Falconbridge owns 85.26% of Falcondo.

| | 2002

| | 2001

| |

|---|

| Sales of ferronickel (tonnes) | | 21,400 | | 24,600 | |

| Production (tonnes) | | 23,300 | | 21,700 | |

| Revenues ($ millions) | | 234 | | 237 | |

| Operating cash cost | | | | | |

| (U.S.$ per pound of nickel)* | | 2.76 | | 2.63 | |

| Operating income (loss) ($ millions) | | 1 | | (18 | ) |

| | |

| |

| |

- *

- Excludes shutdown costs.

Revenues: Revenues at Falcondo in 2002 were $233.6 million compared with $237.8 million in 2001 as the decrease in sales to 21,400 tonnes from 24,600 tonnes offset the impact of an 11% increase in the realized ferronickel price.

Costs: Falcondo's operating cash cost per pound of ferronickel increased by 5% in 2002, to U.S.$2.76 per pound due to the increase in oil prices and costs associated with maintenance at the power plant and the electric furnaces.

Operating income: The Corporation's share of Falcondo's 2002 operating income was $0.9 million, compared with an operating loss of $18.2 million in 2001. The $19.1 million higher contribution reflects a higher ferronickel selling price which offset the impact of decreased sales volumes, higher oil costs and shutdown costs.

Production: Falcondo's planned production rate in 2003 is expected to return to normal levels of approximately 27,000 tonnes of nickel in ferronickel compared with 23,300 tonnes in 2002 and 21,700 tonnes in 2001. Production during 2002 and 2001 was reduced largely as a result of planned shutdowns.

Productivity at Falcondo, measured by the nickel units produced per hour worked, was unchanged in 2002.

Reserves & exploration: The December 31, 2002 total proven and probable mineral reserves at Falcondo increased by 3.4 million tonnes to 64.1 million tonnes. During the year, only 3.0 million tonnes of ore were mined due to a production shutdown in the early part of the year.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 25

COPPER OPERATIONS:

Falconbridge is also an important copper producer, ranking twelfth in the world in mined production during 2002. Our copper operations include Kidd Creek in Canada and Collahuasi and Lomas Bayas in Chile.

Operating income of the copper business was $82.3 million in 2002 compared with $66.0 million in 2001. Copper in concentrate production from the mines was 327,000 tonnes in 2002 compared with 290,000 tonnes in 2001. The operating cash cost per pound of copper was U.S.$0.42 per pound of copper compared with U.S.$0.43 per pound in 2001.

Kidd Creek Operations

Kidd Creek is engaged in the mining, milling, smelting and refining of its own copper/zinc ores and in the processing of custom feed.

| | 2002

| | 2001

|

|---|

| Sales (tonnes) | | | | |

| Copper (in metal and concentrate) | | 110,600 | | 105,100 |

| Zinc (in metal and concentrate) | | 148,400 | | 141,700 |

| Revenues ($ millions) | | 534 | | 505 |

| Operating cash cost | | | | |

| (U.S.$ per pound of copper) | | 0.62 | | 0.74 |

| Operating loss ($ millions) | | 78 | | 64 |

| | |

| |

|

Revenues: Revenues at the Kidd Creek Operations were $533.7 million in 2002, a 6% increase from 2001 due to higher sales volumes of copper and zinc, offset in part by lower copper and zinc prices. Relative to 2001, a higher proportion of the sales of zinc now comes from Kidd ores. As in 2001, custom feed sources account for a higher proportion of copper sales.

Costs: The operating cash cost at the Kidd Mine decreased in 2002, to U.S.$0.62 per pound of copper from U.S.$0.74 per pound of copper in 2001. The 2002 decrease is due largely to ground movement costs incurred in 2001 that were not incurred in 2002.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 26

Operating income: Kidd Creek Operations reported an operating loss of $78.0 million in 2002 compared with an operating loss of $64.0 million for 2001. The $14.0 million increase in the operating loss largely reflects lower metal prices at Kidd, and the impact of higher volumes of custom feed with lower profit margins.

KIDD CREEK OPERATIONS

| | 2002

| | 2001

|

|---|

| |

| | Ore tonnes

(x 1,000)

| | Cu %

| | Zn %

| | Ag g/t

| |

| | Ore tonnes

(x 1,000)

| | Cu %

| | Zn %

| | Ag g/t

|

|---|

| Production | | | | | | | | | | | | | | | | | | | | |

| Kidd Mining Division | | | | | | | | | | | | | | | | | | | | |

| | No. 1 Mine | | | | 902 | | 1.80 | | 7.78 | | 92 | | | | 703 | | 1.80 | | 6.75 | | 78 |

| | No. 2 Mine | | | | 216 | | 2.87 | | 0.99 | | 27 | | | | 281 | | 4.05 | | 0.25 | | 22 |

| | No. 3 Mine | | | | 1,112 | | 2.11 | | 5.89 | | 78 | | | | 993 | | 2.11 | | 5.98 | | 61 |

| | | | |

| |

| |

| |

| | | |

| |

| |

| |

|

| Total mined | | | | 2,230 | | | | | | | | | | 1,977 | | | | | | |

| | | | |

| |

| |

| |

| | | |

| |

| |

| |

|

| Total — ore processed | | | | 2,245 | | 2.12 | | 5.89 | | 78 | | | | 1,950 | | 2.31 | | 5.38 | | 61 |

| | | | |

| |

| |

| |

| | | |

| |

| |

| |

|

| | Cu

| | Cu Cathode

| | Cu Blister

| | Zn

| | Ag

| | Cu

| | Cu Cathode

| | Cu Blister

| | Zn

| | Ag

|

|---|

| Metal in concentrate from mines | | | | | | | | | | | | | | | | | | | | |

| (tonnes except 000 troy ounces of Ag) | | 45,434 | | — | | — | | 104,083 | | 3,671 | | 42,340 | | — | | — | | 81,670 | | 2,865 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Kidd Metallurgical Division | | | | | | | | | | | | | | | | | | | | |

| (tonnes except 000 troy ounces of Ag) | | | | | | | | | | | | | | | | | | | | |

| | Mines | | | | 46,945 | | 44,513 | | 103,609 | | 2,638 | | | | 41,758 | | 46,034 | | 67,399 | | 2,909 |

| | Custom — Sudbury | | | | 23,083 | | 23,083 | | — | | 125 | | | | 8,430 | | 8,430 | | — | | 23 |

| | Custom — Other | | | | 76,498 | | 76,498 | | 41,700 | | 1,084 | | | | 77,636 | | 77,636 | | 72,674 | | 347 |

| | | | |

| |

| |

| |

| | | |

| |

| |

| |

|

| Total | | | | 146,526 | | 144,094 | | 145,309 | | 3,847 | | | | 127,824 | | 132,100 | | 140,073 | | 3,279 |

| | | | |

| |

| |

| |

| | | |

| |

| |

| |

|

| | Cu

| | Cu in conc.

| | Zn

| | Zn in conc.

| | Ag

| | Cu

| | Cu in conc.

| | Zn

| | Zn in conc.

| | Ag

|

|---|

| Sales | | | | | | | | | | | | | | | | | | | | |

| (tonnes except 000s troy ounces Ag) | | | | | | | | | | | | | | | | | | | | |

| | Mines | | 47,190 | | — | | 103,711 | | 3,007 | | 2,638 | | 38,758 | | — | | 68,997 | | — | | 2,909 |

| | Custom — other | | 57,553 | | — | | 41,700 | | — | | 1,085 | | 66,385 | | — | | 72,674 | | — | | 347 |

| | Purchased metal | | 5,832 | | — | | — | | — | | — | | — | | — | | — | | — | | — |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 110,575 | | — | | 145,411 | | 3,007 | | 3,723 | | 105,143 | | — | | 141,671 | | — | | 3,256 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Production: At the Kidd Mining Division, ore hoisted and milled in 2002 increased by 13% and 15%, respectively, from 2001 volumes. Copper metal in concentrate increased by 3,100 tonnes to 45,400 tonnes due to the higher tonnage which was offset by lower ore grades. Zinc in concentrate was also higher by 22,400 tonnes at 104,100 tonnes due to increased tonnage and improved grades. Recoveries for both zinc and copper were lower than in 2001. In 2003, copper in concentrate from the mine is expected to total 48,000 tonnes while zinc in concentrate is forecast at 95,000 tonnes.

At Kidd Metallurgical Division, numerous production records were established including: copper smelter on-line time, copper smelter feed throughput volumes, blister copper output, copper cathode production and zinc metal production. Copper blister and cathode production at 144,100 tonnes and 146,500 tonnes were 9% and 15% higher than in 2001. Zinc metal production at 145,300 tonnes was 5,200 tonnes higher than last year. Sulphuric acid production at 584,200 tonnes was 69,900 tonnes above the 2001 volume. Copper cathode production in 2003 is estimated at 132,000 tonnes while production of zinc is estimated at 145,000 tonnes.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 27

During 2002, a new collective agreement was reached with the production and maintenance workers at the Kidd Metallurgical Division.

Reserves & exploration: After production of 2.2 million tonnes in 2002, the December 31, 2002 total proven and probable mineral reserves decreased by 1.3 million tonnes to 23.7 million tonnes. Approximately 0.9 million tonnes of proven mineral reserves were added in 2002 by the complete re-estimation of stope blocks in No. 3 Mine.

Collahuasi

Compañia Minera Doña Inés de Collahuasi S.C.M., in which Falconbridge holds a 44% interest, operates the Collahuasi mine in northern Chile. Collahuasi mines and mills copper sulphide ores into concentrate and mines and leaches copper oxide ores to produce cathodes.

Falconbridge share

| | 2002

| | 2001

|

|---|

| Sales of copper (tonnes) | | 187,500 | | 191,900 |

| Production (tonnes) | | 185,000 | | 193,100 |

| Revenues ($ millions) | | 386 | | 366 |

| Operating cash cost | | | | |

| | (U.S.$ per pound of copper) | | 0.39 | | 0.38 |

| Operating income ($ millions) | | 132 | | 122 |

Revenues: Falconbridge's share of revenues at Collahuasi in 2002 was $386.6 million compared with $365.7 million in 2001. The increase of $20.9 million is due to an increase in the realized copper price from U.S.$0.68 a pound to U.S.$0.71 a pound.

Costs: The operating cash cost of producing a pound of copper in 2002 was U.S.$0.39 per pound compared with U.S.$0.38 in 2001 due largely to the impact of lower ore grades and recoveries.

Operating income: The Corporation's share of Collahuasi's 2002 operating income was $132.1 million compared with $122.4 million in 2001.

Production: Falconbridge's share of annual copper production totalled 185,000 tonnes, which compared with 193,100 tonnes in 2001. Falconbridge's share of cathode from the oxide plant reached 26,700 tonnes (or 20% above design capacity), while production of copper in concentrate was 158,300 tonnes. Falconbridge's share of total copper production in 2003 is forecast at 168,000 tonnes.

During the year, the Board of Directors of Compañia Minera Doña Inés de Collahuasi approved the construction of a new grinding circuit at the Ujina concentrator. This is part of the Ujina to Rosario transition project, which also involves transferring mine production from the Ujina to the Rosario ore body in June of 2004. The project will increase Collahuasi's concentrator design capacity to 110,000 tonnes per day from 60,000 tonnes per day, compensating for an expected decline in ore grade and thereby enabling Collahuasi to maintain copper production at historical levels. The total capital cost of the transition and concentrator expansion project is estimated at U.S.$654 million, with Falconbridge's 44% share of this cost totalling U.S.$288 million.

Reserves & exploration: The December 31, 2002 total proven and probable mineral reserves at Collahuasi were 1,838.7 million tonnes, down by 28.9 million tonnes. Production of 30.7 million tonnes was slightly offset by mining gains in the various ore types of 1.8 million tonnes.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 28

Lomas Bayas

In 2001, Falconbridge acquired Compañia Minera Falconbridge Lomas Bayas (Lomas Bayas). The results of operations have been included in the consolidated statements from that date forward. Lomas Bayas mines and leaches copper oxide ores to produce cathodes.

| | 2002

| | Since acquisition 2001

| | Calendar 2001

|

|---|

| Sales of copper (tonnes) | | 60,300 | | 27,400 | | N/A |

| Production (tonnes) | | 59,300 | | 24,700 | | 56,300 |

| Revenues ($ millions) | | 152 | | 61 | | N/A |

| Operating cash cost | | | | | | |

| | (U.S.$ per pound of copper) | | 0.45 | | 0.45 | | N/A |

| Operating income ($ millions) | | 28 | | 8 | | N/A |

N/A — not applicable.

Revenues: Falconbridge's revenues for the year 2002 were $151.9 million compared with $61.0 million from the date of acquisition to December 31, 2001.

Costs: The operating cash cost of producing a pound of copper in 2002 remained constant at the 2001 cost of U.S.$0.45 per pound.

Operating income: Lomas Bayas' 2002 operating income was $28.0 million, compared with $7.6 million from the date of acquisition to December 31, 2001.

Production: Lomas Bayas produced 59,300 tonnes of copper cathode in 2002 compared with 56,300 tonnes in calendar year 2001. Copper production in 2003 is forecast at 58,000 tonnes.

Reserves & exploration: The December 31, 2002 total proven and probable mineral reserves at Lomas Bayas decreased by 48.2 million tonnes due to mine production of 26.7 million tonnes and the decrease in the long-term copper price from U.S.$0.95 to U.S.$0.90. Much of the material dropped from the reserves was added to the mineral resources, which increased by 19.4 million tonnes.

Corporate and other

Corporate and other includes corporate costs, exploration, research and development expenditures, foreign exchange gains and losses and other income and expenses.

Corporate and other costs in 2002 of $93.2 million were $13.1 million lower than in 2001. Increases in general and administrative expenditures were offset by reductions in exploration and research and development expenditures, as well as reduced losses from futures and forward metal positions and higher foreign exchange gains. Included in other income and expenses are losses on metals trading of $4.9 million in 2002 and $14.8 million in 2001. Since implementation of the program in 1999, trading has contributed $53.1 million to pre-tax profits.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 29

LIQUIDITY AND CAPITAL RESOURCES

The cash position and changes in cash in each of the last two years ended December 31 are summarized below:

| | Year Ended December 31

| |

|---|

| | 2002

| | 2001

| |

|---|

| |

(millions)

| |

|---|

| Cash provided by operating activities | | $ | 341.4 | | $ | 354.5 | |

| Cash used in investing activities | | | (373.4 | ) | | (448.2 | ) |

| Cash provided by financing activities | | | 93.6 | | | 41.6 | |

| | |

| |

| |

| Cash provided (used) during the year | | | 61.6 | | | (52.1 | ) |

| Cash and cash equivalents, beginning of year | | | 198.3 | | | 250.4 | |

| | |

| |

| |

| Cash and cash equivalents, end of year | | $ | 259.9 | | $ | 198.3 | |

| | |

| |

| |

Liquidity and cash flow

Consolidated cash and cash equivalents increased by $61.6 million to $259.9 million at December 31, 2002, compared with $198.3 million at the end of last year. These items were invested primarily in high-quality short-term money market instruments.

The Corporation has a commercial paper program. Unused lines of credit and cash on hand are used to support the commercial paper program. Borrowings against the lines of credit may be in the form of letters of credit which offset amounts available under the Credit Facility. The Corporation's Credit Facilities at December 31, 2002 totalled U.S.$415 million. As at December 31, 2002, the Corporation had borrowed U.S.$63.5 million and had drawn letters of credit totalling U.S.$36.5 million under a Credit Facility. As at December 31, 2002, the Corporation had commercial paper outstanding of U.S.$27.6 million and Cdn$10.0 million.

Working capital increased by $144.2 million to $626.6 million at the end of 2002 from $482.4 million primarily due to the impact of higher metal prices.

Cash generated from operations totalled $341.4 million compared with $354.5 million for 2001.

The ratio of current assets to current liabilities improved to 2.5:1 from 2.1:1 in 2001.

Based on planned production levels, estimated LME prices and forecasted Canadian/U.S. dollar exchange rates, it is anticipated that funds provided from operations, available cash, and proceeds from existing lines of credit will be sufficient to finance planned capital expenditures in 2003 and the dividends declared to date.

Outstanding indebtedness

Total debt increased to $2,022.5 million at December 31, 2002 from $1,867.3 million at the end of 2001. The increase was attributable to the issue of $383.4 million of new debt offset by debt repayments of $219.9 million and foreign exchange gains of $8.3 million, on U.S. dollar-denominated debt, from the strengthening of the Canadian dollar at December 31, 2002 relative to December 31, 2001. The current portion of long-term debt is $99.7 million.

The ratio of net debt (debt minus cash and temporary investments) to net debt plus equity rose to 44% at the end of 2002 from 42% in 2001.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 30

Capital expenditures and deferred project costs

The following table summarizes the expenditures incurred or planned for the periods indicated:

| |

| | Year Ended December 31

|

|---|

| | Planned in 2003

|

|---|

| | 2002

| | 2001

|

|---|

| |

(millions)

|

|---|

| Sudbury | | $ | 60 | | $ | 26 | | $ | 37 |

| Nikkelverk | | | 16 | | | 8 | | | 14 |

| Raglan | | | 35 | | | 37 | | | 47 |

| Falcondo | | | 18 | | | 22 | | | 23 |

| Kidd Creek | | | 113 | | | 124 | | | 150 |

| Collahuasi | | | 268 | | | 84 | | | 29 |

| New Caledonia | | | 32 | | | 32 | | | 33 |

| Montcalm | | | 62 | | | 5 | | | 12 |

| Lomas Bayas | | | 18 | | | 17 | | | 2 |

| Other | | | 5 | | | 3 | | | 1 |

| | |

| |

| |

|

| Total | | $ | 627 | | $ | 358 | | $ | 348 |

| | |

| |

| |

|

Expenditures in 2002 were directed towards development of Mine D at the Kidd Mining Division, the Collahuasi transition from Ujina to Rosario, the debottlenecking of the SX/EW plant at Lomas Bayas, evaluation work at New Caledonia and to maintain and improve productive capacity at all locations.

Expenditures in 2003 will primarily be used to proceed with the continued development of Mine D at the Kidd Mining Division, the Collahuasi transition from Ujina to Rosario, the development of the Nickel Rim South deposit, continued evaluation work at New Caledonia and to maintain and improve productive capacity at all locations. Expenditures will be financed from internal sources and existing lines of credit. Capital expenditures over the next few years will be focused on providing sustaining capital for existing operations and planned developments at Mine D, the Collahuasi transition and expansions, the development of Montcalm, Nickel Rim South and New Caledonia.

Energy

In 2002, Falconbridge continued developing and implementing business processes focused on managing energy procurement from global markets and providing load response to price fluctuations. Notably, Central Energy Services located in Falconbridge, Ontario coordinates the procurement, risk management and delivery of electricity and natural gas from competitive provincial and national energy markets for four non-contiguous provincial sites. The operations in Norway, Chile and the Dominican Republic address their supply of energy with similar attention to price, risk and security of supply.

Overall, energy expenditures continue to represent a significant percentage of operating costs. During 2002, Falconbridge reduced its over all energy costs by about $5.0 million as part of its three-year 10% cost reduction plan. Nikkelverk, through ongoing efforts to improve energy intensity, achieved its lowest energy consumption per unit of production ever.

SUSTAINABLE DEVELOPMENT

The estimated liability for future site restoration costs remained constant at $225 million at December 31, 2002 relative to the prior year-end. This estimate is based on information currently available, including preliminary closure plans and alternatives, applicable regulations, planned spending on site restoration and the remaining life of Falconbridge's ore reserves. At December 31, 2002, Falconbridge had provided $93.3 million compared with $85.2 million last year, in addition to ongoing capital and operating expenditures. The remaining balance will be accrued and expensed during the remaining lives of the operations.

Our "Report on Sustainable Development" is scheduled for release in April 2003.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 31

EXPLORATION AND BUSINESS DEVELOPMENT

Exploration

Falconbridge's exploration program is largely focused on nickel and platinum group metals. The mandate is to discover mineral deposits, delineate inferred/indicated mineral resources and advance them through pre-feasibility and feasibility stages. In order for a project to advance, the mineral resource is generally expected to be of strategic size, provide an after-tax return on equity of 15%, have operating costs below the industry mid-point, and be in a location with acceptable country risk. The use of joint ventures to share cost, spread risk and to increase the level of focused activity is preferred.

Exploration at Sudbury, Ontario has resulted in the discovery of a new mineral resource, Nickel Rim South. Surface diamond drilling to date has defined an inferred resource consisting of 6.3 million tonnes of 1.7% nickel, 3.4% copper, 2.2 grams/tonne platinum, 2.5 grams/tonne palladium and 1.5 grams/tonne gold. This project has entered the stage-gate process and a decision on whether or not to proceed with an underground exploration program will be made in 2003.

ADVANCED PROJECTS — Mineral Resources 1

(December 31, 2002)

Project

| | Resource location

| | Percentage ownership

| | Category

| | Million tonnes

| | % Nickel

| | % Copper

| | % Cobalt

| | % Zinc

|

|---|

| Nickel deposits | | | | | | | | | | | | | | | | |

| Nickel Rim South 2 | | Sudbury | | 100% | | Inferred | | 6.3 | | 1.7 | | 3.4 | | 0.03 | | — |

| Onaping Depth 2 | | Sudbury | | 100% | | Indicated | | 14.6 | | 2.52 | | 1.15 | | 0.06 | | — |

| | | | | | | Inferred | | 1.2 | | 3.6 | | 1.2 | | 0.07 | | — |

Montcalm |

|

Ontario |

|

100% |

|

Indicated |

|

7.0 |

|

1.36 |

|

0.67 |

|

0.06 |

|

— |

| | | | | | | Inferred | | 0.7 | | 1.7 | | 0.70 | | 0.07 | | — |

Côte d'Ivoire |

|

Ivory Coast |

|

85% |

|

Indicated |

|

123.9 |

|

1.57 |

|

— |

|

0.10 |

|

— |

| | | | | | | Inferred | | 134 | | 1.4 | | — | | 0.12 | | — |

Koniambo 3 |

|

New Caledonia |

|

49% |

|

Measured |

|

2.2 |

|

2.20 |

|

— |

|

0.05 |

|

— |

| | | | | | | Indicated | | 118.8 | | 2.15 | | — | | 0.06 | | — |

| | | | | | |

| |

| |

| |

| |

| |

|

| | | | | | | Total | | 121.0 | | 2.15 | | — | | 0.06 | | — |

| | | | | | |

| |

| |

| |

| |

| |

|

| | | | | | | Inferred | | 190.0 | | 2.1 | | — | | 0.08 | | — |

Copper deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mine D 4 | | Timmins | | 100% | | Inferred | | 14.1 | | — | | 3.4 | | — | | 4.9 |

Fortuna de Cobre 5 |

|

Chile |

|

100% |

|

Measured |

|

61.0 |

|

— |

|

0.35 |

|

— |

|

— |

| | | | | | | Indicated | | 206.0 | | — | | 0.31 | | — | | — |

| | | | | | |

| |

| |

| |

| |

| |

|

| | | | | | | Total | | 267.0 | | — | | 0.32 | | — | | — |

| | | | | | |

| |

| |

| |

| |

| |

|

| | | | | | | Inferred | | 127.0 | | — | | 0.26 | | — | | — |

| | | | | | |

| |

| |

| |

| |

| |

|

Notes:

- 1.

- The mineral resource estimates were prepared in accordance with the "CIM Standards on Mineral Resources and Mineral Reserves, Definitions and Guidelines", adopted by CIM Council on August 20, 2000, using classical and/or geostatistical methods, plus economic and mining parameters appropriate to each project.

The mineral resources have been compiled under the supervision of Chester Moore, Director, Mineral Reserve Estimation and Reporting, a member of the Professional Geoscientists of Ontario with 30 years experience as a geologist.

The mineral resources have reasonable prospects for economic extraction but have not yet had complete formal evaluation, or do not have demonstrated economic viability under current conditions.

- 2.

- Also included as part of the Sudbury mineral resources on the Mineral Reserves and Mineral Resources table.

- 3.

- Option to earn. Cut-off grade used to estimate the 2002 mineral resources was decreased to 1.5% nickel from 2.0% nickel in 2001.

FALCONBRIDGE LIMITED 2002 ANNUAL REPORT / PAGE 32

- 4.

- Also included as part of the Kidd Creek mineral resources on the Mineral Reserves and Mineral Resources table.

- 5.

- Option to purchase.

In addition to the exploration programs at Falconbridge's current operations, exploration projects are in progress in Canada, Africa, Australia and Brazil.

The table below summarizes exploration expenditures incurred or planned for the periods indicated:

| |

| | Year Ended December 31

|

|---|

| | Planned in 2003

|

|---|

| | 2002