Noranda Inc.

Annual General & Special Meeting

April 26, 2005

[GRAPHIC]

| | [LOGO] |

| | |

[PHOTO] | | David Kerr |

| | Chairman |

[GRAPHIC]

Board of Directors

[PHOTO] | | [PHOTO] |

| | |

Derek Pannell | | David Kerr |

[PHOTO] | | [PHOTO] |

| | |

Alex G. Balogh | | André Bérard |

[PHOTO] | | [PHOTO] |

| | |

Jack L. Cockwell | | Maureen Kempston Darkes |

[PHOTO] | | [PHOTO] |

| | |

The Honourable

J. Trevor Eyton | | Bruce Flatt |

[PHOTO] | | [PHOTO] |

| | |

A.L. (Al) Flood | | Norman R. Gish |

[PHOTO] | | [PHOTO] |

| | |

Robert Harding | | James W. McCutcheon |

[GRAPHIC]

Noranda Inc.

Annual General & Special Meeting

April 26, 2005

[GRAPHIC]

Board of Directors

[PHOTO] | | [PHOTO] | | [PHOTO] | | [PHOTO] | | [PHOTO] |

David Kerr | | Derek Pannell | | Alex G. Balogh | | André Bérard | | Jack L. Cockwell |

Chairman | | President & CEO | | | | | | |

| | | | | | | | |

[PHOTO] | | [PHOTO] | | [PHOTO] | | [PHOTO] | | [PHOTO] |

The Honourable | | Bruce Flatt | | A.L. (Al) Flood | | Norman R. Gish | | Robert Harding |

J. Trevor Eyton | | | | | | | | |

| | | | | | | | |

| | [PHOTO] | | [PHOTO] | | [PHOTO] | | |

| | Maureen Kempston | | James W. | | George Myhal | | |

| | Darkes | | McCutcheon | | | | |

[GRAPHIC]

Noranda Inc.

Annual General & Special Meeting

April 26, 2005

[GRAPHIC]

| | Derek Pannell |

[PHOTO] | | President and |

| | Chief Executive Officer |

[GRAPHIC]

Forward-Looking Statements

Noranda cautions that statements made to describe the Company’s intentions, expectations or predictions may be “forward-looking statements” within the meaning of securities laws. The Company cautions that, by their nature, forward-looking statements involve risk and uncertainty and that the Company’sactual results could differ materially from those expressed or implied in such statements. Reference should be made to the Company’s most recent Annual Information Form filed with Canadian securities regulatory authorities (and available at www.sedar.com) for a description of the major risk factors.

All dollar amounts expressed in U.S. dollars

All production volumes and reserves and resources in metric tonnes

Investor Information

This communication is being made in respect of (a) the offer (the “Falconbridge Offer”) by Noranda Inc. to acquire all of the outstanding common shares of Falconbridge Limited (other than shares owned by Noranda) on the basis of 1.77 Noranda common shares for each Falconbridge common share and (b) the issuer bid (the “Preference Share Exchange Offer”) by Noranda to repurchase approximately 63.4 million Noranda common shares in exchange for three new series of preference shares. In connection with the Falconbridge Offer and the Preference Share Exchange Offer, Noranda filed with the U.S. Securities and Exchange Commission (the “SEC”) registration statements on Form F-8 containing a share exchange take-over bid circular to be delivered to the shareholders of Falconbridge and an issuer bid circular to be delivered to shareholders of Noranda. Noranda, if required, will be filing other documents regarding the transactions with the SEC.

INVESTORS ARE URGED TO READ CAREFULLY THE SHARE EXCHANGE TAKE-OVER BID CIRCULAR AND THE ISSUER BID CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors will be able to obtain documents filed with the SEC free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Noranda may be obtained free of charge by contacting Noranda at (416) 982-7111.

Agenda

1 2004 Highlights

2 Review of Issuer Bid & Proposed Merger with Falconbridge

3 Financial Review

4 Market Outlook

5 Review of Operations & Growth Opportunities

Noranda

Highlights

[GRAPHIC]

Highlights

• 2004 Financial Results

• Earnings: $551 million ($1.78 per share)

• Profitability increased in each business unit

• EBITDA: $1.9 billion

• Operations

• Maximized production in each business

• Improved operating efficiencies

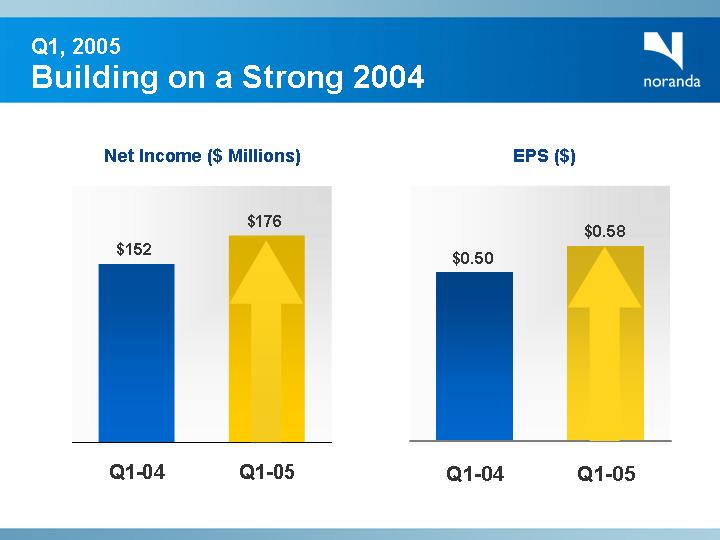

• Q1 2005 Financial Results

• Earnings: $176 million ($0.58 per share)

2004 Highlights

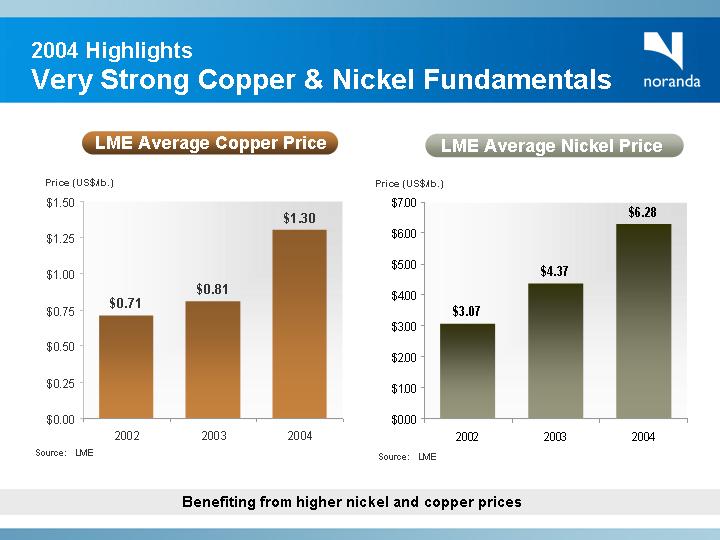

Very Strong Copper & Nickel Fundamentals

LME Average Copper Price | | LME Average Nickel Price |

| | |

[CHART] | | [CHART] |

| | |

Source: LME | | Source: LME |

Benefiting from higher nickel and copper prices

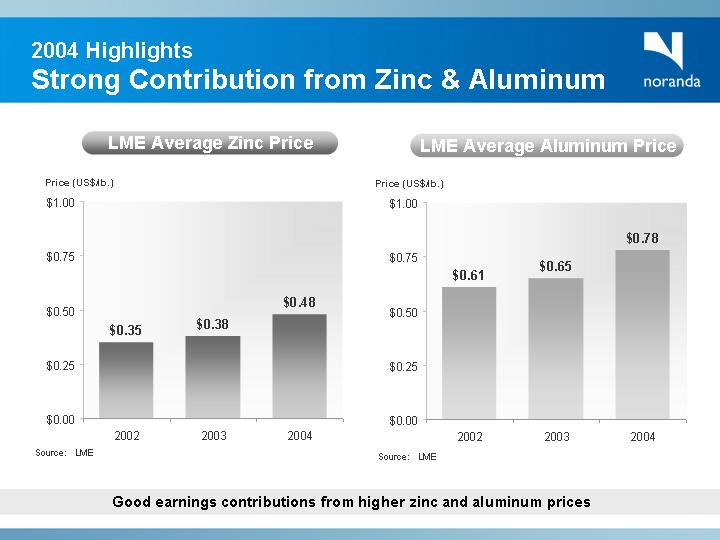

Strong Contribution from Zinc & Aluminum

LME Average Zinc Price | | LME Average Aluminum Price |

| | |

[CHART] | | [CHART] |

| | |

Source: LME | | Source: LME |

Good earnings contributions from higher zinc and aluminum prices

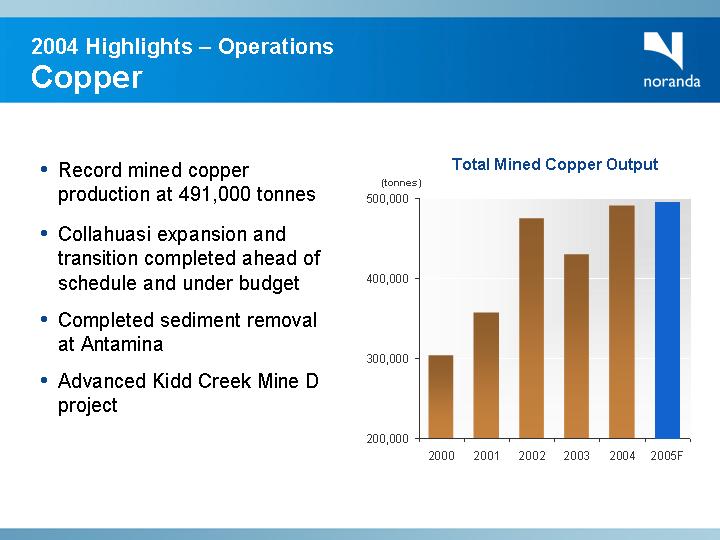

2004 Highlights – Operations

Copper

• Record mined copper production at 491,000 tonnes

• Collahuasi expansion and transition completed ahead of schedule and under budget

• Completed sediment removal at Antamina

• Advanced Kidd Creek Mine D project

Total Mined Copper Output

[CHART]

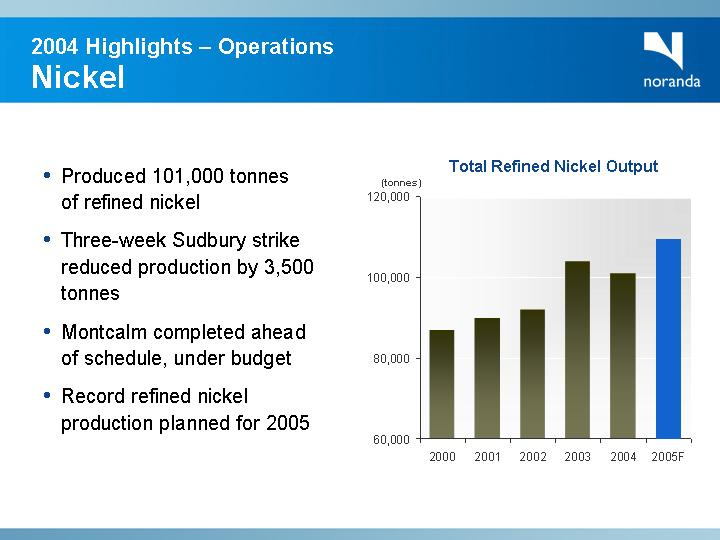

Nickel

• Produced 101,000 tonnes of refined nickel

• Three-week Sudbury strike reduced production by 3,500 tonnes

• Montcalm completed ahead of schedule, under budget

• Record refined nickel production planned for 2005

Total Refined Nickel Output

[CHART]

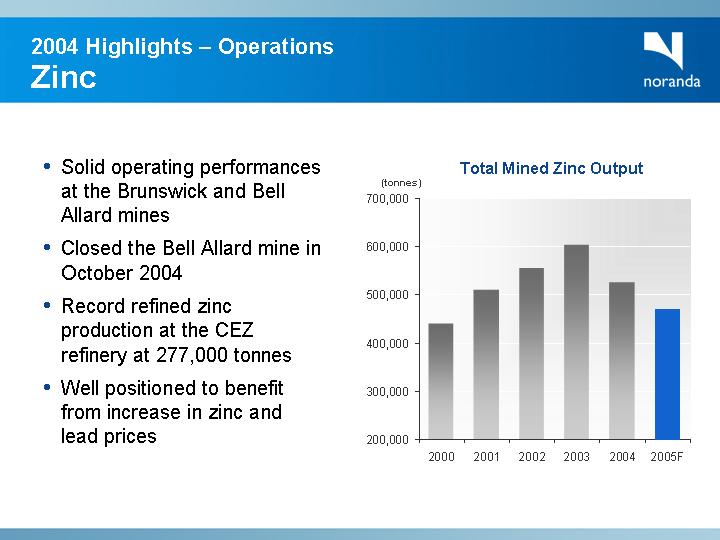

Zinc

• Solid operating performances at the Brunswick and Bell Allard mines

• Closed the Bell Allard mine in October 2004

• Record refined zinc production at the CEZ refinery at 277,000 tonnes

• Well positioned to benefit from increase in zinc and lead prices

Total Mined Zinc Output

[CHART]

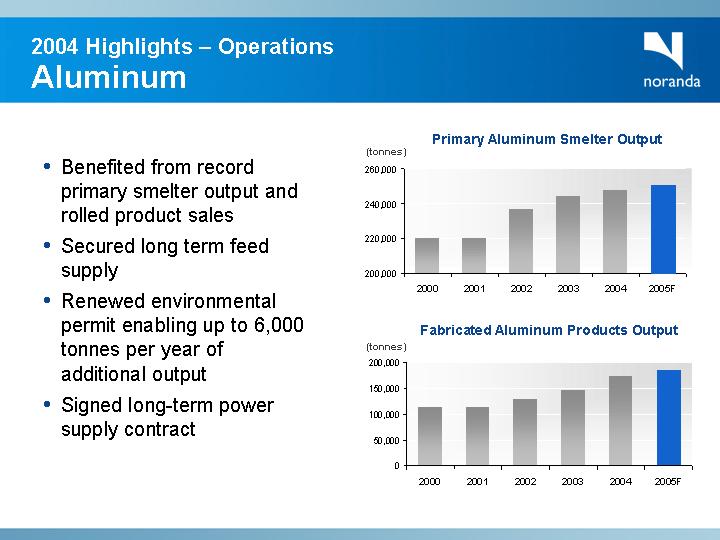

Aluminum

• Benefited from record primary smelter output and rolled product sales

• Secured long term feed supply

• Renewed environmental permit enabling up to 6,000 tonnes per year of additional output

• Signed long-term power supply contract

Primary Aluminum Smelter Output

[CHART]

Fabricated Aluminum Products Output

[CHART]

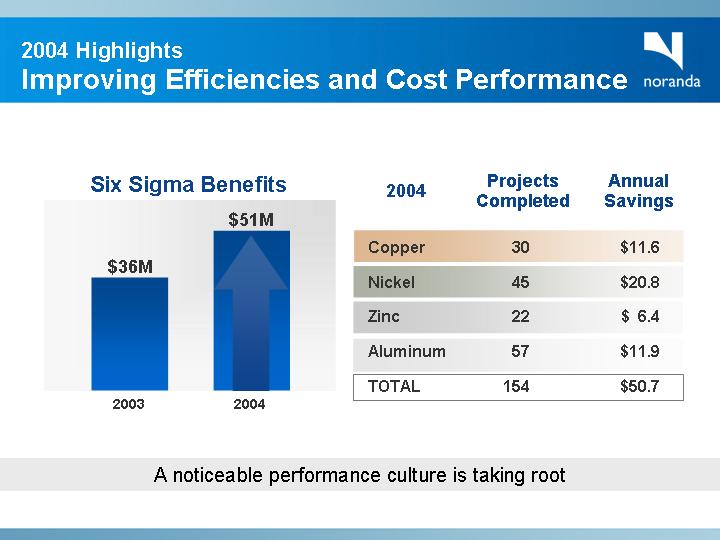

2004 Highlights

Improving Efficiencies and Cost Performance

Six Sigma Benefits

[CHART]

2004 | | Projects

Completed | | Annual

Savings | |

Copper | | 30 | | $ | 11.6 | |

Nickel | | 45 | | $ | 20.8 | |

Zinc | | 22 | | $ | 6.4 | |

Aluminum | | 57 | | $ | 11.9 | |

TOTAL | | 154 | | $ | 50.7 | |

A noticeable performance culture is taking root

Noranda

Issuer Bid

&

Proposed Merger

[GRAPHIC]

Merger of Noranda & Falconbridge

Strategic Rationale for Merger

• One public company, widely held with enhanced market capitalization

• Increased trading liquidity

• Elimination of current cap on both companies’ share prices

• Enhanced investor appeal due to simplified corporate structure

• Potential re-rating of the share price in line with comparable mining base-metals companies offers substantial upside

• Focused play on copper and nickel

Establishes Premier Mining Company

• Increased leverage to strong Cu, Ni, Zn and Al market fundamentals

• Diversified portfolio of mines and integrated processing capacity

• Significant portfolio of low-risk, high-potential brownfield and greenfield development projects

• Improved ability to fund new growth with substantial operating cash flows

• Track record of strengthening operating and financial results

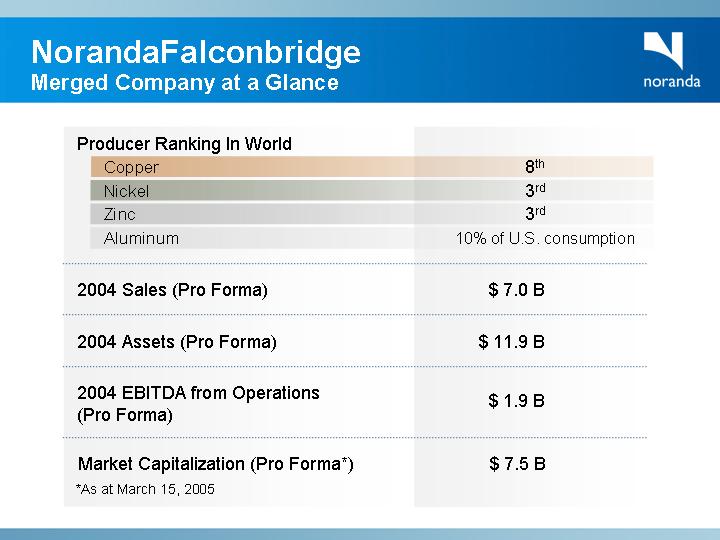

NorandaFalconbridge

Merged Company at a Glance

Producer Ranking In World

Copper | | 8th | |

Nickel | | 3rd | |

Zinc | | 3rd | |

Aluminum | | 10% of U.S. consumption | |

2004 Sales (Pro Forma) | | $ | 7.0 | B |

2004 Assets (Pro Forma) | | $ | 11.9 | B |

2004 EBITDA from Operations (Pro Forma) | | $ | 1.9 | B |

Market Capitalization (Pro Forma*) | | $ | 7.5 | B |

*As at March 15, 2005

| | Steve Douglas |

[PHOTO] | | Executive Vice President |

| | & Chief Financial Officer |

[GRAPHIC]

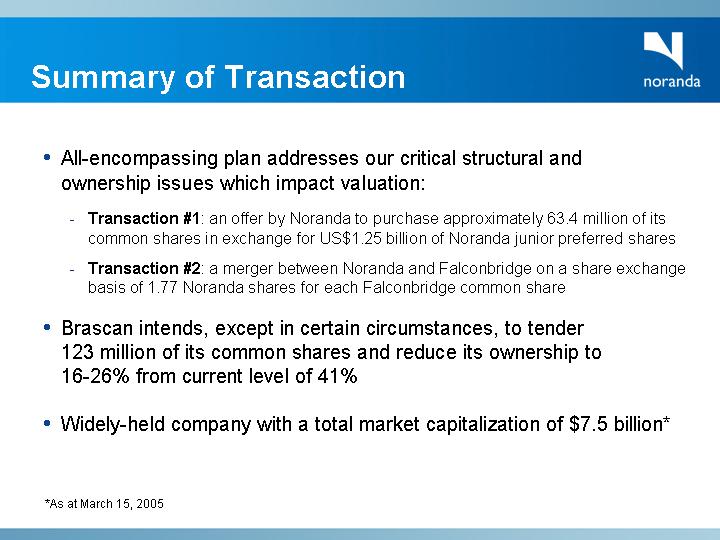

Summary of Transaction

• All-encompassing plan addresses our critical structural and ownership issues which impact valuation:

• Transaction #1: an offer by Noranda to purchase approximately 63.4 million of its common shares in exchange for US$1.25 billion of Noranda junior preferred shares

• Transaction #2: a merger between Noranda and Falconbridge on a share exchange basis of 1.77 Noranda shares for each Falconbridge common share

• Brascan intends, except in certain circumstances, to tender 123 million of its common shares and reduce its ownership to 16-26% from current level of 41%

• Widely-held company with a total market capitalization of $7.5 billion*

*As at March 15, 2005

NorandaFalconbridge

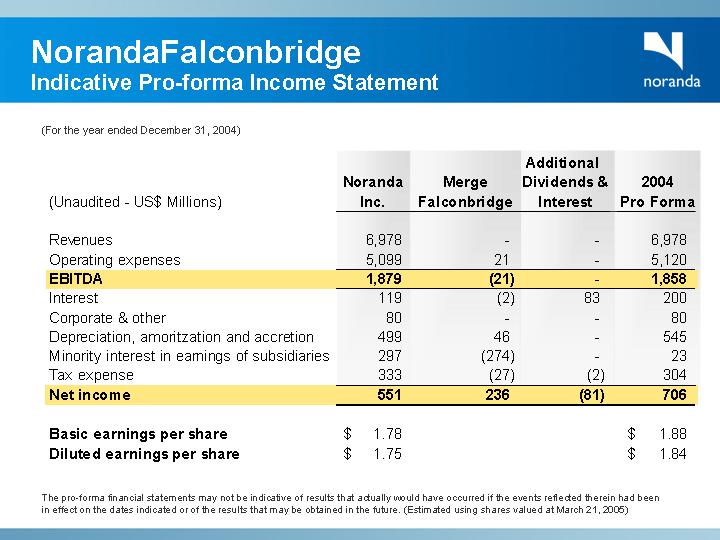

Indicative Pro-forma Income Statement

(For the year ended December 31, 2004)

(Unaudited - US$ Millions) | | Noranda

Inc. | | Merge

Falconbridge | | Additional

Dividends &

Interest | | 2004

Pro Forma | |

| | | | | | | | | |

Revenues | | 6,978 | | — | | — | | 6,978 | |

Operating expenses | | 5,099 | | 21 | | — | | 5,120 | |

EBITDA | | 1,879 | | (21 | ) | — | | 1,858 | |

Interest | | 119 | | (2 | ) | 83 | | 200 | |

Corporate & other | | 80 | | — | | — | | 80 | |

Depreciation, amoritzation and accretion | | 499 | | 46 | | — | | 545 | |

Minority interest in earnings of subsidiaries | | 297 | | (274 | ) | — | | 23 | |

Tax expense | | 333 | | (27 | ) | (2 | ) | 304 | |

Net income | | 551 | | 236 | | (81 | ) | 706 | |

| | | | | | | | | |

Basic earnings per share | | $ | 1.78 | | | | | | $ | 1.88 | |

Diluted earnings per share | | $ | 1.75 | | | | | | $ | 1.84 | |

The pro-forma financial statements may not be indicative of results that actually would have occurred if the events reflected therein had been in effect on the dates indicated or of the results that may be obtained in the future. (Estimated using shares valued at March 21, 2005)

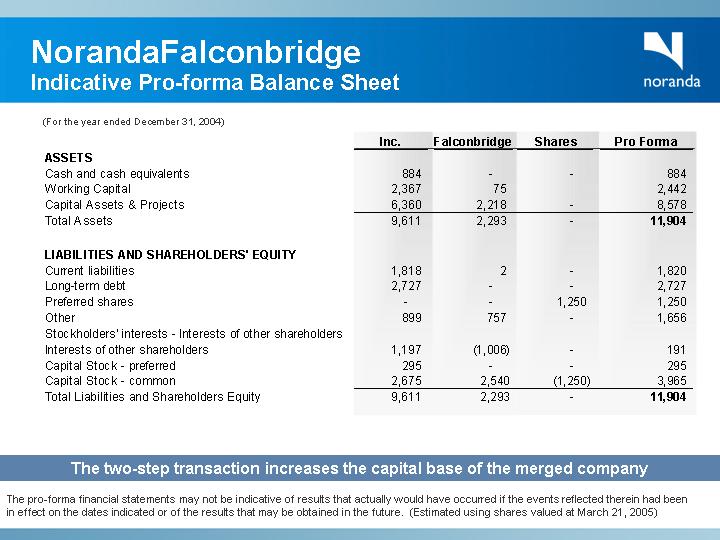

Indicative Pro-forma Balance Sheet

(For the year ended December 31, 2004)

| | Inc. | | Falconbridge | | Shares | | Pro Forma | |

ASSETS | | | | | | | | | |

Cash and cash equivalents | | 884 | | — | | — | | 884 | |

Working Capital | | 2,367 | | 75 | | | | 2,442 | |

Capital Assets & Projects | | 6,360 | | 2,218 | | — | | 8,578 | |

Total Assets | | 9,611 | | 2,293 | | — | | 11,904 | |

| | | | | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

Current liabilities | | 1,818 | | 2 | | — | | 1,820 | |

Long-term debt | | 2,727 | | — | | — | | 2,727 | |

Preferred shares | | — | | — | | 1,250 | | 1,250 | |

Other | | 899 | | 757 | | — | | 1,656 | |

Stockholders’ interests - Interests of other shareholders | | | | | | | | | |

Interests of other shareholders | | 1,197 | | (1,006 | ) | — | | 191 | |

Capital Stock - preferred | | 295 | | — | | — | | 295 | |

Capital Stock - common | | 2,675 | | 2,540 | | (1,250 | ) | 3,965 | |

Total Liabilities and Shareholders Equity | | 9,611 | | 2,293 | | — | | 11,904 | |

The two-step transaction increases the capital base of the merged company

The pro-forma financial statements may not be indicative of results that actually would have occurred if the events reflected therein had been in effect on the dates indicated or of the results that may be obtained in the future. (Estimated using shares valued at March 21, 2005)

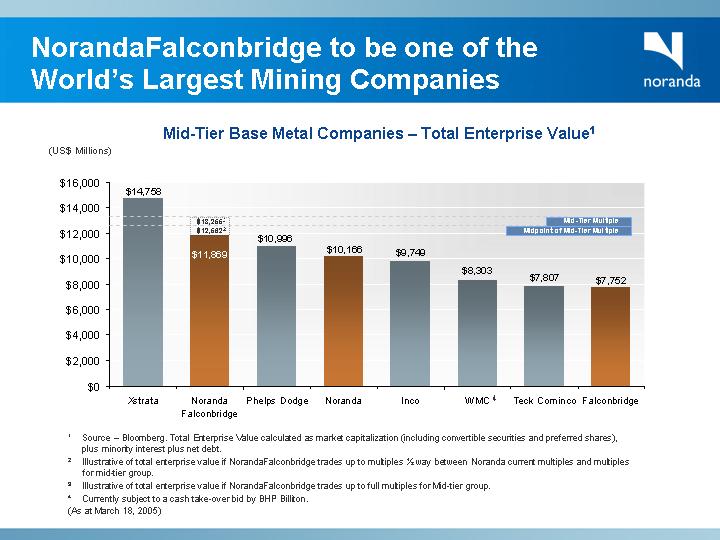

NorandaFalconbridge to be one of the

World’s Largest Mining Companies

Mid-Tier Base Metal Companies – Total Enterprise Value(1)

(US$ Millions)

[CHART]

(1) Source – Bloomberg. Total Enterprise Value calculated as market capitalization (including convertible securities and preferred shares), plus minority interest plus net debt.

(2) Illustrative of total enterprise value if NorandaFalconbridge trades up to multiples ½ way between Noranda current multiples and multiples for mid-tier group.

(3) Illustrative of total enterprise value if NorandaFalconbridge trades up to full multiples for Mid-tier group.

(4) Currently subject to a cash take-over bid by BHP Billiton.

(As at March 18, 2005)

Noranda

Financial Review

[GRAPHIC]

A Year of Very Strong Performance

• Increased profitability

• Higher cash flow

• Strengthened balance sheet

• Enhanced financial flexibility

[GRAPHIC]

Significantly Higher Profitability

Net Income ($ Millions) | | EPS ($) |

| | |

[CHART] | | [CHART] |

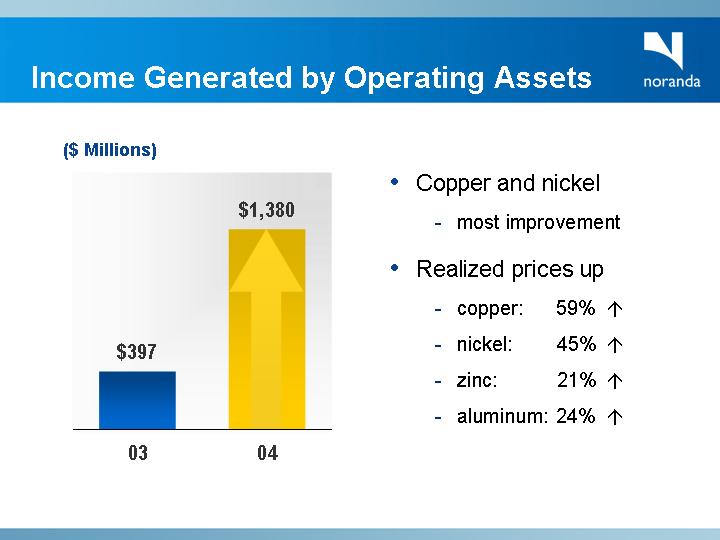

Income Generated by Operating Assets

($ Millions)

[CHART]

• Copper and nickel

• most improvement

• Realized prices up

• | | copper: | | 59 | % |

| | | | | |

• | | nickel: | | 45 | % |

| | | | | |

• | | zinc: | | 21 | % |

| | | | | |

• | | aluminum: | | 24 | % |

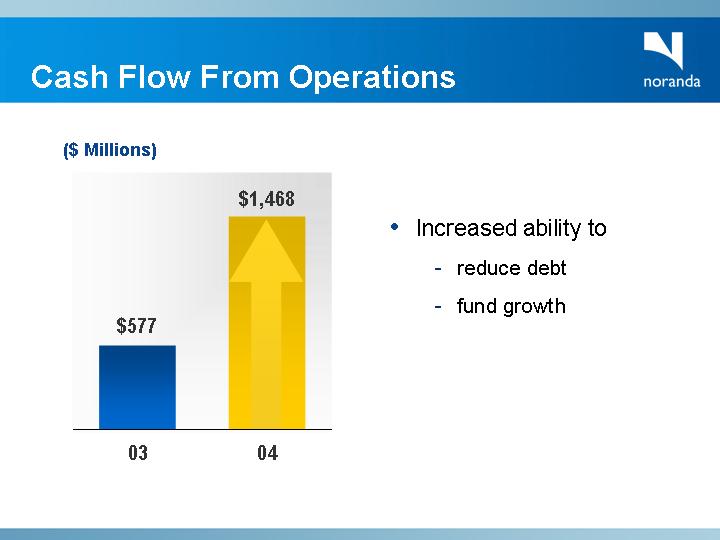

Cash Flow From Operations

($ Millions)

[CHART]

• Increased ability to

• reduce debt

• fund growth

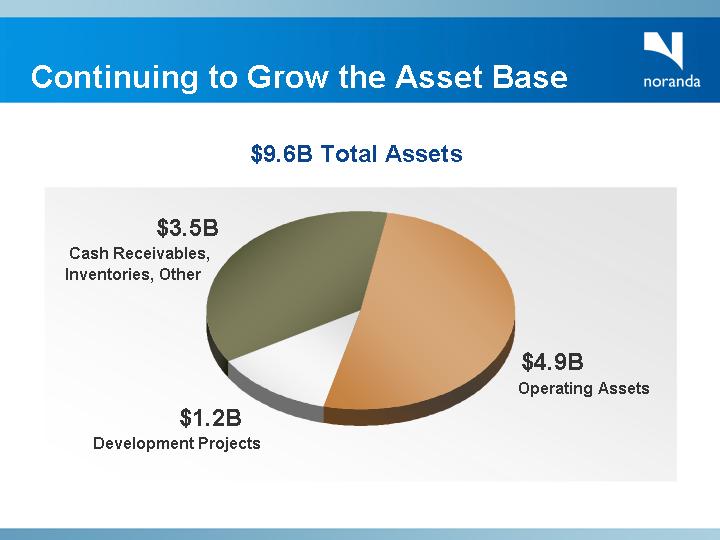

Continuing to Grow the Asset Base

$9.6B Total Assets

[CHART]

Q1, 2005

Building on a Strong 2004

Net Income ($ Millions) | | EPS ($) |

| | |

[CHART] | | [CHART] |

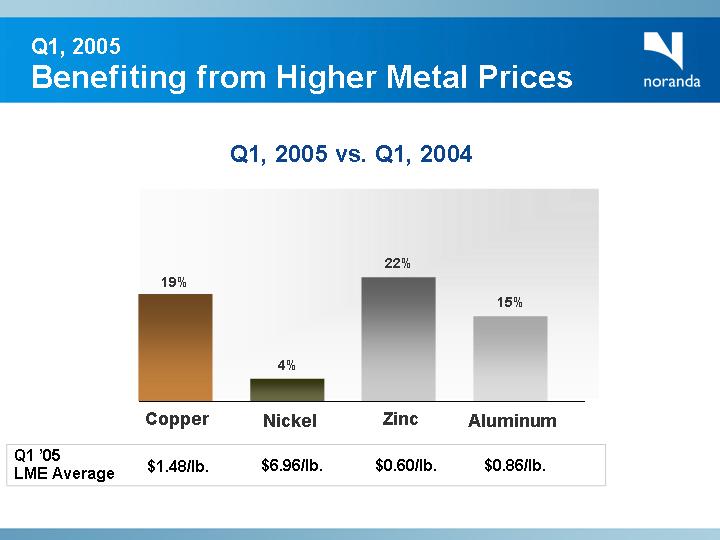

Benefiting from Higher Metal Prices

Q1, 2005 vs. Q1, 2004

[CHART]

Q1 ’05

LME Average | | $ | 1.48/lb. | | $ | 6.96/lb. | | $ | 0.60/lb. | | $ | 0.86/lb. | |

Income Generated By Operating Assets

($ Millions) | | Q1, 2005 | | Q1, 2004 | |

Copper | | $ | 286 | | $ | 187 | |

Nickel | | $ | 223 | | $ | 219 | |

Zinc | | $ | 15 | | $ | 20 | |

Aluminum | | $ | 47 | | $ | 25 | |

Other | | $ | 2 | | $ | 27 | |

EBITDA from Op. Assets | | $ | 573 | | $ | 478 | |

Dep’n., Amort. & Other | | $ | (118 | ) | $ | (117 | ) |

EBIT from Op. Assets | | $ | 455 | | $ | 361 | |

EBITDA from operating assets increased $95 million

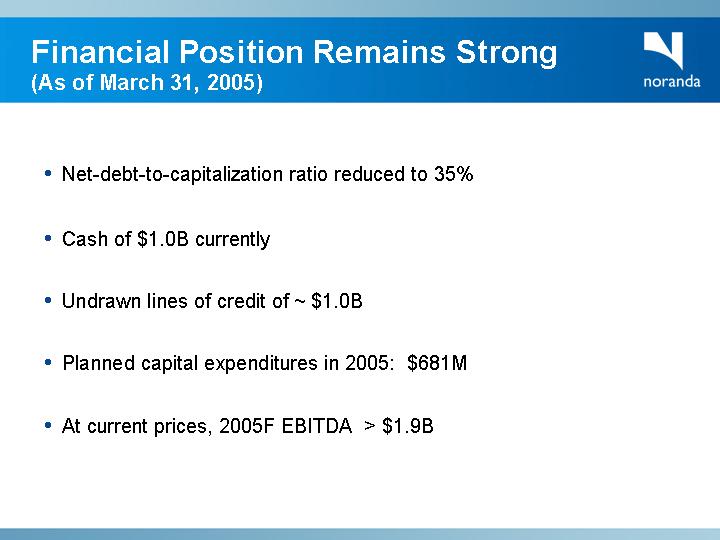

Financial Position Remains Strong

(As of March 31, 2005)

• Net-debt-to-capitalization ratio reduced to 35%

• Cash of $1.0B currently

• Undrawn lines of credit of ~ $1.0B

• Planned capital expenditures in 2005: $681M

• At current prices, 2005F EBITDA > $1.9B

Financial Summary

• Outlook remains positive

• Focused on maximizing production

• All businesses are contributing

• 2005 will be another year of significant earnings

| | Derek Pannell |

| | |

[PHOTO] | | President and |

| | Chief Executive Officer |

[GRAPHIC]

Noranda

Market Outlook

[GRAPHIC]

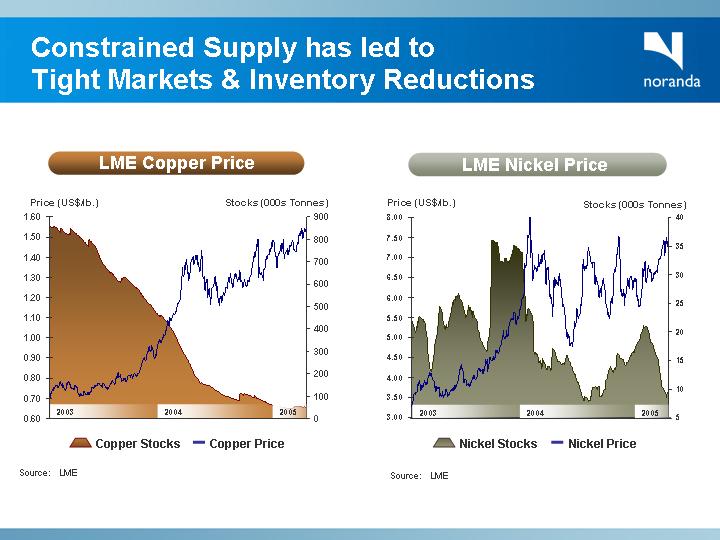

Constrained Supply has led to

Tight Markets & Inventory Reductions

LME Copper Price | | LME Nickel Price |

| | |

[CHART] | | [CHART] |

| | |

Source: LME | | Source: LME |

New Capacity Needed But…

• Substantial barriers to entry exist:

• Increased size and scale of next generation of projects

• Higher complexity of new technology and processes

• Longer lead times due to more extensive permitting requirements

• More remote locations

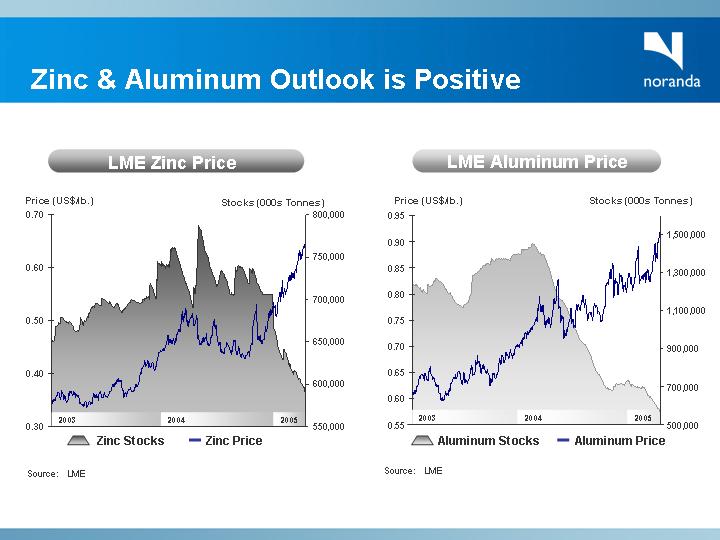

Zinc & Aluminum Outlook is Positive

LME Zinc Price | | LME Aluminum Price |

| | |

[CHART] | | [CHART] |

| | |

Source: LME | | Source: LME |

Market Outlook

Conclusions

Strong Fundamentals For Base Metals:

• Positive demand growth rates

• Additional supply needed to meet growing demand

• New supply likely; however:

• Long lead times

• Projects are more capital intensive, more complex

• Longer permitting process

Favourable Price Environment

Review of Operations &

Growth Opportunities

[GRAPHIC]

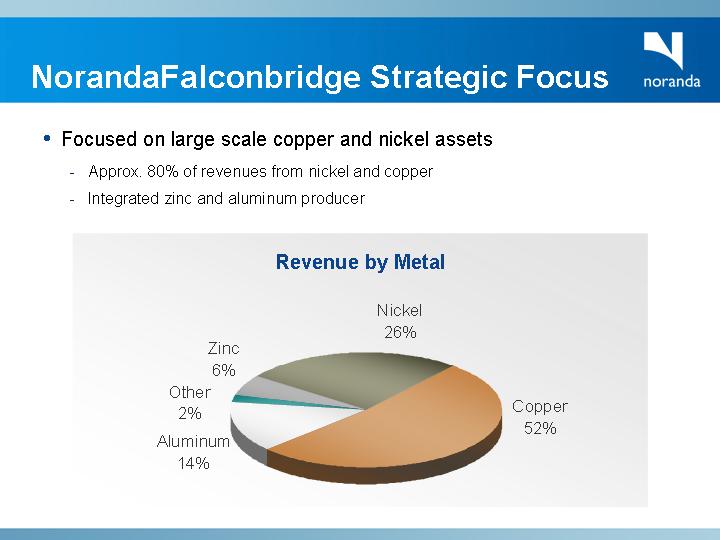

NorandaFalconbridge Strategic Focus

• Focused on large scale copper and nickel assets

• Approx. 80% of revenues from nickel and copper

• Integrated zinc and aluminum producer

Revenue by Metal

[CHART]

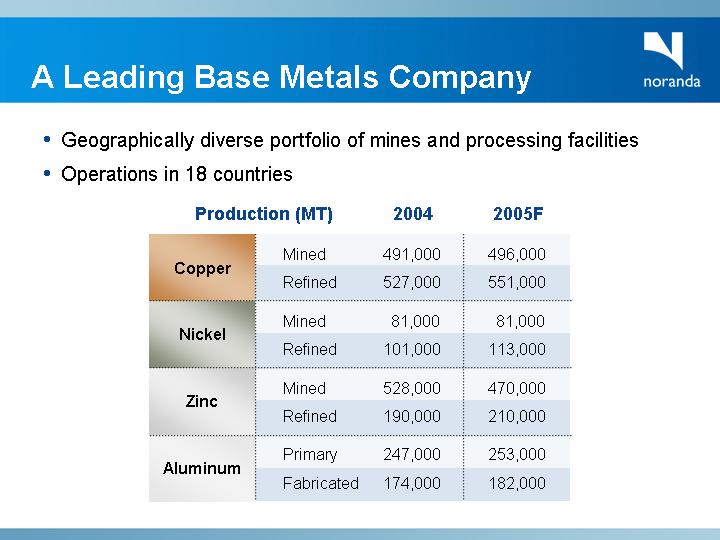

A Leading Base Metals Company

• Geographically diverse portfolio of mines and processing facilities

• Operations in 18 countries

Production (MT) | | 2004 | | 2005F | |

Copper | Mined | | 491,000 | | 496,000 | |

Refined | | 527,000 | | 551,000 | |

Nickel | Mined | | 81,000 | | 81,000 | |

Refined | | 101,000 | | 113,000 | |

Zinc | Mined | | 528,000 | | 470,000 | |

Refined | | 190,000 | | 210,000 | |

Aluminum | Primary | | 247,000 | | 253,000 | |

Fabricated | | 174,000 | | 182,000 | |

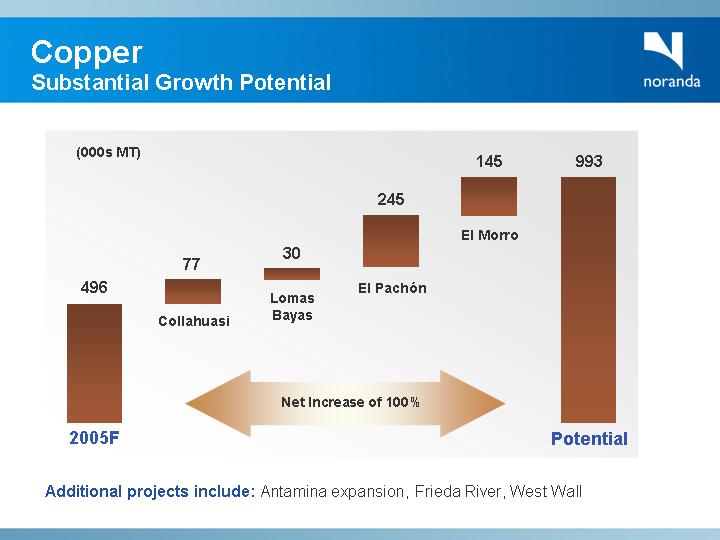

Copper

Substantial Growth Potential

[CHART]

Additional projects include: Antamina expansion, Frieda River, West Wall

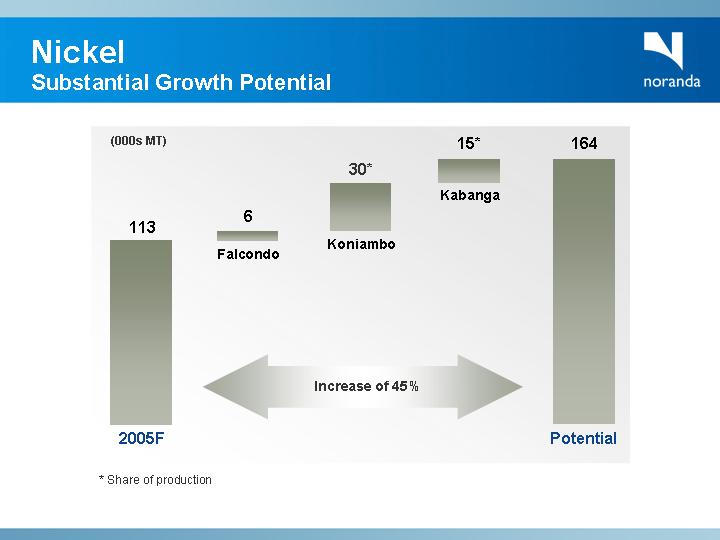

Nickel

Substantial Growth Potential

[CHART]

* Share of production

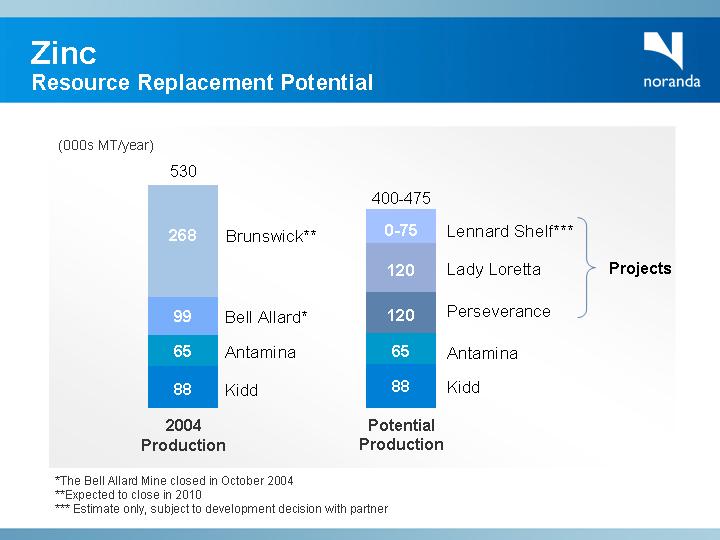

Zinc

Resource Replacement Potential

(000s MT/year)

[CHART]

*The Bell Allard Mine closed in October 2004

**Expected to close in 2010

*** Estimate only, subject to development decision with partner

Aluminum

Primary Operations

• Bauxite mine - St. Ann, Jamaica

• Alumina refinery – Gramercy, Louisiana

• Long-term alumina supply secured

• Aluminum smelter - New Madrid, Missouri

• Supplies approximately 10% of U.S. primary aluminum consumption

• Five-year collective agreement signed in 2004

• New 15-year power contract secured

Primary Aluminum Smelter Output

[CHART]

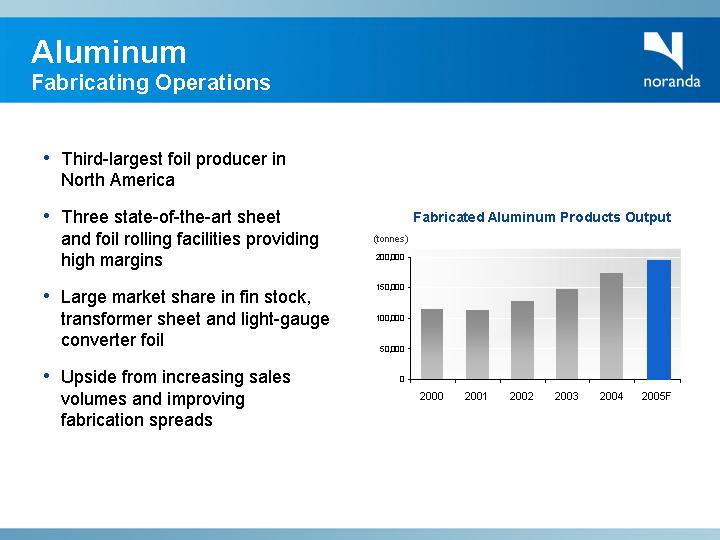

Aluminum

Fabricating Operations

• Third-largest foil producer in North America

• Three state-of-the-art sheet and foil rolling facilities providing high margins

• Large market share in fin stock, transformer sheet and light-gauge converter foil

• Upside from increasing sales volumes and improving fabrication spreads

Fabricated Aluminum Products Output

[CHART]

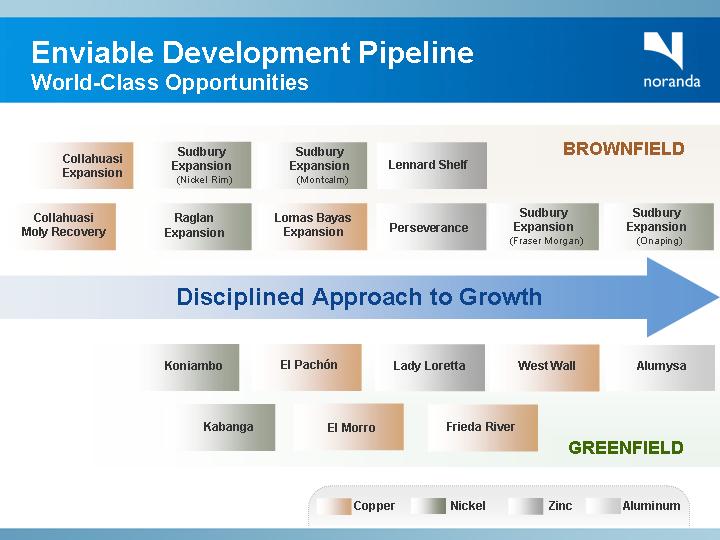

Enviable Development Pipeline

World-Class Opportunities

Collahuasi | | Sudbury | | Sudbury | | | | BROWNFIELD |

Expansion | | Expansion | | Expansion | | Lennard Shelf | | |

| | (Nickel Rim) | | (Montcalm) | | | | | | |

| | | | | | | | | | |

Collahuasi | | Raglan | | Lomas Bayas | | | | Sudbury | | Sudbury |

Moly Recovery | | Expansion | | Expansion | | Perseverance | | Expansion | | Expansion |

| | | | | | | | (Fraser Morgan) | | (Onaping) |

|

Disciplined Approach to Growth |

| | | | | | | | | | |

| | Koniambo | | El Pachón | | Lady Loretta | | West Wall | | Alumysa |

| | | | | | | | | | |

| | Kabanga | | El Morro | | Frieda River | | GREENFIELD |

Positioned for Growth

[GRAPHIC]

Improved Strategic Platform

• Low-cost operating base with demonstrated reliable production and steady growth

• Portfolio of low-risk, long-life, low-cost growth projects

• Focused copper and nickel growth strategy

• Proven international project construction experience

• Outlook for market fundamentals is strong

• Simplified corporate structure with control returned to the market

• Merged company provides improved liquidity and superior financial strength & capacity

Noranda Inc.

Annual General & Special Meeting

April 26, 2005

[GRAPHIC]