Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos.333-103545-05 & 333-190926

Subject to Completion, dated July 15, 2015

This preliminary Remarketing Prospectus Supplement is subject to completion. The Notes offered hereby may not be sold nor may offers to buy be accepted prior to the time a final Remarketing Prospectus Supplement is completed. This preliminary Remarketing Prospectus Supplement shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these Notes in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration qualification or exemption under the securities laws of any such jurisdiction.

Preliminary Remarketing Prospectus Supplement

to Base Prospectus dated July 15, 2015

relating to the remarketing of

(up to)

$180,000,000

CLASS A-5 NOTES

SLM Student Loan Trust 2005-7

Issuing Entity

Navient Funding, LLC

Depositor

Navient Solutions, Inc.

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

The remarketing agents are remarketing, on behalf of SLM Student Loan Trust 2005-7, the class A-5 notes (the “class A-5 notes”). The class A-5 notes were originally issued by the trust on August 11, 2005. If successfully remarketed on July 27, 2015, the class A-5 notes will have the following terms:

| Class | | Outstanding Principal Amount | | Interest Rate | | Price | | Next Reset Date | Legal Maturity Date |

| Class A-5 Notes | | $ | 180,000,000 | | 3-month LIBOR plus % | | | 100.00% | | October 26, 2015 | January 25, 2040 |

Other than as provided herein, no person has been authorized to give any information or to make any representations other than those contained in this preliminary remarketing prospectus supplement and, if given or made, such information or representations must not be relied upon. This preliminary remarketing prospectus supplement does not constitute an offer to sell, or a solicitation of an offer to buy, any securities other than the class A-5 notes nor an offer of such securities to any person in any state or other jurisdiction in which it is unlawful to make such offer or solicitation. The delivery of this preliminary remarketing prospectus supplement at any time does not imply that the information herein is correct as of any time after its date.

All existing class A-5 noteholders are hereby advised that if you want to retain your class A-5 notes you are required to submit a hold notice prior to 12:00 p.m. (noon), New York City time, on July 17, 2015, to one of the remarketing agents. Otherwise your notes will be deemed to have been tendered for remarketing.

The class A-5 notes have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”), any state securities commission or any other regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of this remarketing or the accuracy or adequacy of this preliminary remarketing prospectus supplement. Any representation to the contrary is a criminal offense.

You should consider carefully the risk factors on page S-22 of this preliminary remarketing prospectus supplement and on page 15 of the base prospectus.

We are not offering the class A-5 notes in any state or other jurisdiction where the offer is prohibited.

The notes are asset-backed securities and are obligations of the issuing entity, which is a trust. They are not obligations of or interests in Navient Corporation, the sponsor, the depositor, any seller of loans to the depositor, the administrator, the servicer or any of their respective affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

The trust will be relying on an exclusion or exemption from the Investment Company Act of 1940 contained in rule 3a-7 under the Investment Company Act of 1940, although there may be additional exclusions or exemptions available to the trust. The trust is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in this offering memorandum).

Remarketing Agents

| | | | |

| | BofA Merrill Lynch | Deutsche Bank Securities | |

| | | | |

July , 2015

REMARKETING TERMS SUMMARY

On April 27, 2015 (absent a Failed Remarketing, or the exercise by Navient Corporation or one of its wholly-owned subsidiaries of its call option), the class A-5 notes will be reset from their current terms to the following terms, which terms will be applicable until the next reset date for the class A-5 notes (definitions for certain capitalized terms may be found in the Glossary at the end of this preliminary remarketing prospectus supplement):

| | Original principal amount | $180,000,000 | |

| | Current outstanding principal balance | $180,000,000 | |

| | Principal amount being remarketed | $180,000,000 (1) | |

| | Remarketing Terms Determination Date | July 15, 2015 | |

| | Notice Date(2) | July 17, 2015 | |

| | Spread Determination Date(3) | On or before July 22, 2015 | |

| | Current Reset Date | April 27, 2015 | |

| | All Hold Rate | Three-Month LIBOR plus % | |

| | Next applicable reset date | October 26, 2015 | |

| | Interest rate mode | Floating | |

| | Index | Three-Month LIBOR(4) | |

| | Spread(5) | Plus % | |

| | Day-count basis | Actual/360 | |

| | Weighted average remaining life | (6) | |

___________________

(1) Subject to the receipt of timely delivered Hold Notices.

(2) Unless an existing class A-5 noteholder submits a Hold Notice to the remarketing agents prior to 12:00 p.m. (noon), New York City time, on the Notice Date, such notes will be irrevocably deemed to have been tendered for remarketing.

(3) The applicable Spread may be determined at any time after 12:00 p.m. (noon), New York City time, on the Notice Date but not later than 3:00 p.m., New York City time, on July 22, 2015.

(4) Three-month LIBOR will be reset on each LIBOR Determination Date in accordance with the procedures set forth under “Additional Information Regarding the Notes—Determination of Indices—LIBOR” in the base prospectus.

(5) To be determined on the spread determination date.

(6) The projected weighted average remaining life to the October 26, 2015 reset date of the class A-5 notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment scenarios is approximately 0.25 years. More information may be found under “Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes” to be included as Exhibit I to the final remarketing prospectus supplement to be distributed to potential investors on or prior to the spread determination date.

The remarketing agents may be contacted as follows:

Deutsche Bank Securities Inc.

60 Wall Street, 3rd Floor

New York, New York 10005

Attention: Con Accibal

Telephone: 212-250-7730

Facsimile: 212-797-2031

Email: con.accibal@db.com

Merrill Lynch, Pierce, Fenner & Smith Incorporated

One Bryant Park

New York, New York 10036

Attention: Brian Kane

Telephone: 646-855-9095

E-mail: brian.f.kane@baml.com

INTRODUCTION

The Student Loan-Backed Notes issued by SLM Student Loan Trust 2005-7 consist of the class A-5 notes, as well as the class A-3 notes (referred to as the “other reset rate notes” and together with the class A-5 notes, the “reset rate notes”), the class A-1, class A-2 and class A-4 notes (collectively referred to as the “floating rate class A notes”) and the class B notes (which, together with the floating rate class A notes, and the reset rate notes are referred to as the “notes”). As of the date of this preliminary remarketing prospectus supplement (referred to as the “preliminary remarketing prospectus supplement”), the class A-1 and class A-2 notes have been paid in full and are no longer outstanding. None of the notes other than the class A-5 notes (collectively referred to as the “other notes”) are being offered under this preliminary remarketing prospectus supplement. Any information contained herein with respect to the other notes is provided only to present a better understanding of the class A-5 notes. The class A-5 notes were originally offered for sale pursuant to the prospectus supplement, dated August 3, 2005, and the related base prospectus, dated August 1, 2005.

Deutsche Bank Securities Inc. and Merrill Lynch, Pierce, Fenner & Smith Incorporated are serving as the remarketing agents (in such capacity, collectively, the “remarketing agents”) for the class A-5 notes.

The notes were issued on August 11, 2005 (referred to as the “closing date”), are obligations of an issuing entity known as SLM Student Loan Trust 2005-7 (referred to as the “trust”), and are secured by the assets of the trust, which consist primarily of a pool of consolidation student loans (the “trust student loans”).

Principal of and interest on the notes are payable as described herein on the 25th day of each January, April, July and October or, if such day is not a business day, then on the next succeeding business day (each, a “distribution date”). The “initial reset date” for the class A-5 notes was July 25, 2013. A failed remarketing was declared with respect to the initial reset date and each subsequent reset date. Pursuant to the terms of these failed remarketings, (i) the holders of the class A-5 notes were required to retain their notes, (ii) the class A-5 notes were reset to bear interest at the failed remarketing rate, which is an annual rate equal to three-month LIBOR plus 0.75%, which rate remained in effect after this failed remarketing, and (iii) a three-month reset period ending on the next distribution date was established. We refer to the July 27, 2015 reset date as the “current reset date” in this preliminary remarketing prospectus supplement. If successfully remarketed on the current reset date, interest will accrue on the class A-5 notes at the rate specified in the summary of this preliminary remarketing prospectus supplement and will be calculated based on the actual number of days elapsed in each accrual period and a 360-day year until their next reset date which will occur on October 26, 2015. Interest will accrue on the outstanding principal balance of the class A-5 notes during three-month accrual periods and will be paid on each distribution date. The first distribution date after the current reset date is scheduled to occur on October 26, 2015. Each accrual period will begin on a distribution date and end on the day before the next distribution date.

Investors in the class A-5 notes are strongly urged to keep in contact with the remarketing agents because notices and required information pertaining to the remarketing of the class A-5 notes sent to the clearing agencies by the administrator or the remarketing agents, as applicable, may not be communicated in a timely manner to the related beneficial owners.

TABLE OF CONTENTS

Preliminary Remarketing Prospectus Supplement

REMARKETING TERMS SUMMARY | i |

INTRODUCTION | iii |

SUMMARY OF NOTE TERMS | S-1 |

RISK FACTORS | S-21 |

DEFINED TERMS | S-26 |

THE TRUST | S-26 |

USE OF PROCEEDS | S-31 |

THE TRUST STUDENT LOAN POOL | S-31 |

DESCRIPTION OF THE NOTES | S-39 |

STATIC POOLS | S-65 |

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE REMAINING LIFE AND EXPECTED MATURITY OF THE CLASS A-5 NOTES | S-65 |

U.S. FEDERAL INCOME TAX CONSEQUENCES | S-66 |

EUROPEAN UNION DIRECTIVE ON THE TAXATION OF SAVINGS INCOME | S-69 |

ERISA CONSIDERATIONS | S-70 |

ACCOUNTING CONSIDERATIONS | S-71 |

REPORTS TO NOTEHOLDERS | S-71 |

REMARKETING | S-72 |

NOTICES TO INVESTORS | S-72 |

LISTING INFORMATION | S-73 |

CERTAIN INVESTMENT COMPANY ACT CONSIDERATIONS | S-74 |

RATINGS | S-75 |

LEGAL PROCEEDINGS | S-75 |

LEGAL MATTERS | S-75 |

GLOSSARY | S-77 |

| ANNEX A: | The Trust Student Loan Pool as of May 31, 2015 |

| APPENDIX A: | Federal Family Education Loan Program |

| EXHIBIT I: | Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes |

| APPENDIX I: | Base Prospectus, dated July 15, 2015 |

THE INFORMATION IN THIS PRELIMINARY REMARKETING PROSPECTUS SUPPLEMENT AND THE BASE PROSPECTUS ATTACHED HERETO AS APPENDIX I

We provide information to you about the class A-5 notes in two separate sections of this document that provide progressively more detailed information. These two sections are: (a) the accompanying base prospectus (referred to as the “base prospectus”), which begins after the end of this preliminary remarketing prospectus supplement and which provides general information about the issuing entity, the trust student loans and the notes, some of which will not apply to the class A-5 notes, and (b) this preliminary remarketing prospectus supplement, which describes the specific terms of the class A-5 notes that are being offered hereby and provides information about the trust student loans as of May 31, 2015. You should read both the base prospectus and this preliminary remarketing prospectus supplement to fully understand the class A-5 notes.

For your convenience, we include cross-references in this preliminary remarketing prospectus supplement and in the base prospectus to captions in these materials where you can find related information. The Table of Contents on page vi provides the pages on which you can find these captions.

The class A-5 notes may not be offered or sold to persons in the United Kingdom in a transaction that results in an offer to the public within the meaning of the securities laws of the United Kingdom.

The class A-5 notes are currently listed on the Luxembourg Stock Exchange. You should consult with Deutsche Bank Luxembourg S.A., the Luxembourg listing agent for the class A-5 notes, for additional information regarding their status.

This preliminary remarketing prospectus supplement is not required to contain all information that is required to be included in the final prospectus supplement and base prospectus. The information in this preliminary remarketing prospectus supplement is preliminary and is subject to completion or change. The information in this preliminary remarketing prospectus supplement, if conveyed prior to the time of your commitment to purchase any class of notes, supersedes any information contained in any prior preliminary remarketing prospectus supplement relating to the notes.

FORWARD-LOOKING STATEMENTS

Certain statements contained in or incorporated by reference in this preliminary remarketing prospectus supplement and the base prospectus consist of forward-looking statements relating to future economic performance or projections and other financial items. These statements can be identified by the use of forward-looking words such as “may,” “will,” “should,” “expects,” “believes,” “anticipates,” “estimates,” or other comparable words. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance with governmental regulations, customer preferences and various other matters, many of which are beyond our control. Because we cannot predict the future, what actually happens may be very different from what is contained in our forward-looking statements.

SUMMARY OF NOTE TERMS

This summary highlights selected information about the class A-5 notes. It does not contain all of the information that you might find important in making your investment decision. It provides only an overview to aid your understanding. You should read the full description of this information appearing elsewhere in this document and in the attached base prospectus. We have provided information in this preliminary remarketing prospectus supplement with respect to the other notes in order to further the understanding by potential investors of the class A-5 notes.

ISSUING ENTITY

SLM Student Loan Trust 2005-7.

CLASS A-5 NOTES

The Reset Rate Class A-5 Student Loan-Backed Notes that are being remarketed hereunder were originally issued by the trust on August 11, 2005 in the principal amount of $180,000,000 and are currently outstanding in the same amount.

The initial reset date for the class A-5 notes was July 25, 2013. A failed remarketing was declared with respect to the initial reset date and each subsequent reset date. Pursuant to the terms of the these failed remarketings, (i) the holders of the class A-5 notes were required to retain their notes, (ii) the class A-5 notes were reset to bear interest at the failed remarketing rate, which is an annual rate equal to three-month LIBOR plus 0.75%, which rate remained in effect after this failed remarketing, and (iii) a three-month reset period ending on the next distribution date was established. We refer to the July 27, 2015 reset date as the "current reset date" in this preliminary remarketing prospectus supplement. Absent a failed remarketing or an exercise of the related call option by Navient Corporation (formerly known as SLM Corporation) or one of its wholly-owned subsidiaries with respect to the current reset date, the next reset date for the class A-5 notes will be October 26, 2015. The legal maturity date for the class A-5 notes is January 25, 2040.

Interest. During the reset period following the July 27, 2015 reset date, interest will accrue on the outstanding principal balance of the class A-5 notes during each accrual period and will be paid on each distribution date.

If successfully remarketed on the April 27, 2015 reset date, the class A-5 notes, until the end of the accrual period relating to the October 26, 2015 reset date, will bear interest at an annual rate equal to three-month LIBOR plus % based on the actual number of days elapsed in each accrual period and a 360-day year. Each accrual period during such reset period will begin on a distribution date and will end on the day before the next distribution date. The next accrual period for the class A-5 notes will begin on July 27, 2015 and end on October 25, 2015.

During the reset period ending on July 27, 2015, the class A-5 notes have borne interest at the failed remarketing rate equal to three-month LIBOR plus 0.75% per annum.

For each subsequent reset period, the related currency, applicable accrual periods and applicable distribution dates will be determined on the related remarketing terms determination date as specified under “Description of the Notes—The Reset Rate Notes” and “—Reset Periods” in this preliminary remarketing prospectus supplement.

Principal. Payments of principal to the class A-5 notes will generally be made only after the class A-3 and class A-4 notes, in that order, have been retired. The class A-1 and class A-2 notes, which were earlier in the sequence of principal payments, have been paid in full and are no longer outstanding. The class A-3 and class A-4 notes, however, are still outstanding. Absent an event of default, no principal will be paid to the class A-5 notes until the outstanding principal balance of each class of publicly offered class A notes has been reduced to zero.

There will be no payment of principal on the class A-5 notes from the trust on the July 27, 2015 reset date.

Reset Date Procedures

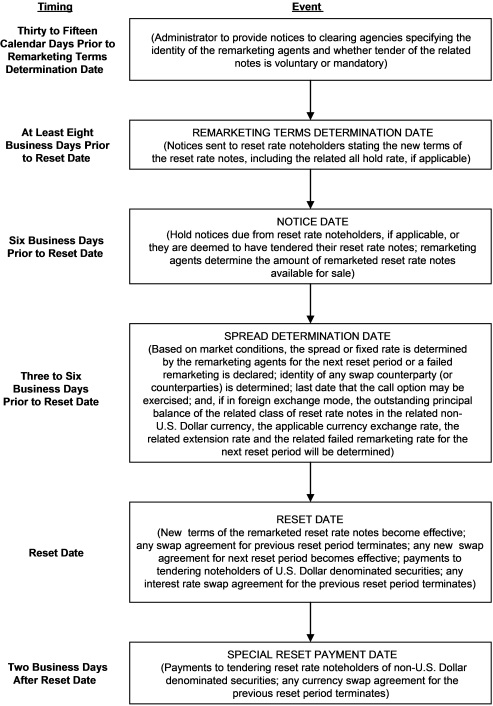

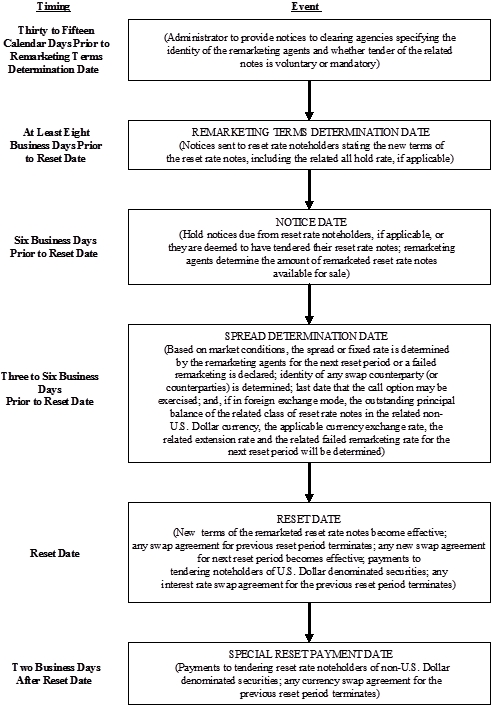

Remarketing Terms Determination Date. Not later than eight business days prior to the related reset date, which we refer to as the remarketing terms determination date and which, for the class A-5 notes and with respect to the current reset date, is July 15, 2015, the remarketing agents, in consultation with the administrator, will determine for the class A-5 notes, among other things, the applicable currency, the applicable interest rate mode, whether principal will be paid periodically or at the end of the related reset period, the index, if applicable, the length of the reset period and the applicable distribution dates, the identities of any potential swap counterparties, if applicable, and the all hold rate. See “Description of the Notes—The Reset Rate Notes” in this preliminary remarketing prospectus supplement.

All Hold Rate. The all hold rate for the reset rate notes will be the interest rate applicable for the reset rate notes for the next reset period if all holders of the reset rate notes choose not to tender their notes to the remarketing agents for remarketing, which for the class A-5 notes and the current reset date occurring on July 27, 2015 is equal to an annual rate of three-month LIBOR plus 0.75%. The all hold rate will be applicable only if the class A-5 notes are denominated in U.S. Dollars in both the then-current reset period and the immediately following reset period (as will be the case for the class A-5 notes on the July 27, 2015 reset date).

Tendered Notes. Absent a failed remarketing, holders of reset rate notes denominated in U.S. Dollars in the then-current reset period and the immediately following reset period (as will be the case for the class A-5 notes assuming a successful remarketing on the July 27, 2015 reset date) that wish to sell some or all of their reset rate notes on a reset date will be able to obtain a 100% repayment of principal by tendering the applicable amount of their reset rate notes pursuant to the remarketing process. Holders of reset rate notes denominated in a non-U.S. Dollar currency in the then-current reset period or the immediately following reset period will be deemed to have tendered their reset rate notes pursuant to the remarketing process.

Hold Notices. In connection with the current reset date, holders of the class A-5 notes will be given until the notice date, which is 12:00 p.m. (noon), New York City time, on the date not less than six business days prior to the related reset date, to choose whether to hold their notes by delivering a hold notice to the remarketing agents. The notice date with respect to the class A-5 notes and the current reset date is July 17, 2015. Any class A-5 notes for which a hold notice is not timely received on or prior to the notice date, will be deemed to be tendered and will be remarketed on the related reset date.

Spread Determination Date. Absent receipt by the remarketing agents of hold notices

from 100% of the holders of the class A-5 notes or an exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries, the spread will be determined by the remarketing agents at any time after the notice date but no later than 3:00 p.m., New York City time, on the date which is three business days prior to the related reset date, which we refer to as the spread determination date and which, for the class A-5 notes and with respect to the current reset date, is any time during the period beginning after 12:00 p.m. (noon), New York City time, on July 17, 2015 and ending at 3:00 p.m., New York City time, on July 22, 2015. The spread for the current reset date will be the lowest spread to three-month LIBOR, but not less than the all hold rate (which is equal to an annual rate of three-month LIBOR plus 0.75% for the class A-5 notes), which would enable all tendering noteholders to receive a payment equal to 100% of the outstanding principal balance of their reset rate notes. Absent a failed remarketing or an exercise of the related call option by Navient Corporation or one of its wholly owned subsidiaries with respect to the July 27, 2015 reset date, the class A-5 notes will be reset to bear interest until October 26, 2015, the next reset date, at an annual floating rate equal to the sum of three-month LIBOR plus %. LIBOR will be determined as specified under “Additional Information Regarding the Notes—Determination of Indices—LIBOR” in the base prospectus.

Reset Date. Reset dates always occur on a distribution date and reset periods always end on a distribution date and may not extend beyond the maturity date of the reset rate notes. The current reset date for the class A-5 notes is July 27, 2015. The next scheduled reset date for the class A-5 notes is October 26, 2015. Holders of class A-5 notes that wish to be repaid on the current reset date will be able to obtain a 100% repayment of principal by tendering their reset rate notes pursuant to the remarketing process. Tender is mandatory for any reset rate notes that are denominated in a non-U.S. Dollar currency during either the then-current or the immediately following reset period and all holders of such reset rate notes will be deemed to have tendered their notes on the related reset date. If there is a failed remarketing of the reset rate notes with respect to such reset date, existing holders of such notes will not be permitted to exercise any remedies as a result of the failure of their reset rate notes to be remarketed on such reset date.

Failed Remarketing. There will be a failed remarketing for the class A-5 notes with respect to the July 27, 2015 reset date if:

| · | the remarketing agents cannot determine the applicable required reset terms on or before the remarketing terms determination date; |

| · | the remarketing agents cannot establish the required spread on the spread determination date; |

| · | either sufficient committed purchasers cannot be obtained for all of the class A-5 notes at the spread set by the remarketing agents, or committed purchasers default on their purchase obligations and the remarketing agents choose not to purchase the class A-5 notes themselves; |

| · | any rating agency then rating the notes has not confirmed or upgraded its then-current rating of any class of notes, if such confirmation is required; or |

| · | certain other conditions specified in the remarketing agreement are not satisfied. |

See “Description of the Notes—The Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures” in this

preliminary remarketing prospectus supplement.

In the event a failed remarketing is declared with respect to the class A-5 notes:

| · | all holders of the class A-5 notes will retain their notes, including in all deemed mandatory tender situations; |

| · | the related interest rate for the class A-5 notes will be reset to a failed remarketing rate of three-month LIBOR plus 0.75% per annum; and |

| · | the related reset period will be set at three months. |

Call Option. Navient Corporation, or one of its wholly-owned subsidiaries (to whom it has the right at any time to transfer such call option), has the option to purchase the class A-5 notes in their entirety as of any reset date. If this right is exercised, the interest rate for the reset rate notes, which we refer to as the call rate, will be (1) if no related swap agreement was in effect with respect to the reset rate notes during the previous reset period (as has been the case with respect to the class A-5 notes and the reset period ending on July 27, 2015), the floating rate applicable for the most recent reset period during which the failed remarketing rate was not in effect, or (2) if one or more related interest rate swap agreements were in effect with respect to the reset rate notes during the previous reset period, an annual three-month LIBOR-based interest rate equal to the weighted average of the floating rates of interest that the trust paid to the swap counterparties hedging the basis risk for the reset rate notes during the preceding reset period.

The call rate will continue to apply for each reset period while Navient Corporation, or any of its wholly-owned subsidiaries, if applicable, retains the reset rate notes pursuant to its exercise of the call option. In either case, the next reset date for the reset rate notes will occur on the next distribution date.

The administrator will notify the Luxembourg Stock Exchange of any exercise of the call option and will cause a notice to be published in a leading newspaper having general circulation in Luxembourg (which is expected to be Luxemburger Wort) and/or on the Luxembourg Stock Exchange’s website at http://www.bourse.lu.

See “Description of the Notes—The Reset Rate Notes” in this preliminary remarketing prospectus supplement for a more complete discussion of the remarketing process.

Denominations. The class A-5 notes will be available for purchase in minimum denominations of $100,000 and additional increments of $1,000 in excess thereof. The class A-5 notes will be available only in book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear System. You will not receive a certificate representing your class A-5 notes except in very limited circumstances.

DATES

The closing date for the original offering was August 11, 2005. We refer to this date as the closing date.

The statistical cutoff date for the original offering was July 25, 2005. We refer to this date as the statistical cutoff date.

Unless otherwise indicated, all information provided in this preliminary remarketing prospectus supplement regarding the notes and the pool of trust student loans is

presented as of May 31, 2015. We refer to this date as the statistical disclosure date.

A distribution date for each class of notes is the 25th of each January, April, July and October. If any January 25, April 25, July 25 or October 25 is not a business day, the distribution date will be the next business day.

Each reset date will occur on a distribution date for the class A-5 notes. The related reset period will always end on a distribution date and may not extend beyond the maturity date of the class A-5 notes.

Interest and principal will be payable to holders of record as of the close of business on the record date, which is the day before the related distribution date.

A collection period is the three-month period ending on the last day of March, June, September or December, in each case for the distribution date in the following month.

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE REMAINING LIFE AND EXPECTED MATURITY OF THE CLASS A-5 NOTES

The projected weighted average remaining life to the July 27, 2015 reset date of the class A-5 notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment scenarios is approximately 0.25 years. More information may be found under “Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-5 Notes” to be included as Exhibit I to the final remarketing prospectus supplement to be distributed to potential investors on or prior to the spread determination date.

THE OTHER NOTES

On the closing date, the trust also issued its class A-1, class A-2, class A-3, class A-4 and class B notes, as more specifically described below.

Floating Rate Class A Notes:

| · | Class A-1 Student Loan-Backed Notes in the original principal amount of $453,000,000, none of which remain outstanding; |

| · | Class A-2 Student Loan-Backed Notes in the original principal amount of $315,000,000, none of which remain outstanding; and |

| · | Class A-4 Student Loan-Backed Notes in the original principal amount of $307,339,000, and currently outstanding in the same amount. |

Reset Rate Class A Notes:

| · | Class A-3 Student Loan-Backed Notes in the original principal amount of $266,000,000.00, and currently outstanding in the amount of $113,774,642.87. |

Class B Notes:

| · | Class B Student Loan-Backed Notes in the original principal amount of $47,052,000.00, and currently outstanding in the amount of $33,391,549.98. |

We sometimes refer to:

| · | the floating rate class A notes and the reset rate class A notes collectively as the class A notes; |

| · | the floating rate class A notes and the class B notes as the floating rate notes; and |

| · | the floating rate notes and the reset rate notes as the notes. |

Interest Rates. The outstanding floating rate notes bear interest at an annual rate equal to the sum of three-month LIBOR and the applicable spread listed in the table below:

| | Class | | Spread | |

| | Class A-4 | | plus 0.15% | |

| | Class B | | plus 0.31% | |

For all classes of notes, the administrator determines LIBOR as specified under “Additional Information Regarding the Notes—Determination of Indices—LIBOR” in the base prospectus. For the floating rate notes, interest is calculated based on the actual number of days elapsed in each accrual period and a 360-day year.

The class A-3 notes bear interest at an annual rate equal to the sum of three-month LIBOR plus 1.35%. For the floating rate notes, interest is calculated based on the actual number of days elapsed in each accrual period and a 360-day year.

ALL NOTES

Interest Payments. Interest accrues on the outstanding principal balance of the notes during each accrual period and is payable on the related distribution date.

An accrual period for the floating rate notes begins on a distribution date and ends on the day before the next distribution date.

An accrual period for reset rate notes that bear a fixed rate of interest will begin on the 25th day of the month of the immediately preceding distribution date and end on the 24th day of the month of the current distribution date.

Principal Payments. Principal will be payable or allocable on each distribution date in an amount generally equal to (a) the principal distribution amount for that distribution date plus (b) any shortfall in the payment of principal as of the preceding distribution date.

Priority of Principal Payments. We will apply or allocate principal sequentially on each distribution date as follows:

| · | first, the class A noteholders' principal distribution amount, sequentially to the class A-3 notes, class A-4 notes and class A-5 notes, in that order, until their respective principal balances are reduced to zero; and |

| · | second, on each distribution date on and after the stepdown date, and provided that no trigger event is in effect on such distribution date, the class B noteholders’ principal distribution amount, to the class B notes, until their principal balance is reduced to zero. |

On each distribution date prior to the stepdown date, which occurred on the July 2011 distribution date, the class B notes were not entitled to any payments of principal. On each distribution date on and after the stepdown date, provided that no trigger event is in effect, the class B notes will continue to be entitled to their pro rata share of principal, subject to the existence of sufficient available funds.

The class A noteholders’ principal distribution amount is equal to the principal distribution amount times the class A percentage, which is equal to 100% minus the class B percentage. The class B noteholders’ principal distribution amount is equal to the principal distribution amount times the class B percentage.

The class B percentage was 0% prior to the stepdown date and will be 0% on any other distribution date when a trigger event is in effect. On each other distribution date, the class B percentage is the percentage obtained by dividing (x) the aggregate principal balance of the class B notes, by (y) the aggregate principal balance, or U.S. Dollar equivalent, of all outstanding notes less all amounts on deposit, exclusive of any investment earnings, in the accumulation account, in each case determined immediately prior to that distribution date.

A trigger event will be in effect on any distribution date if the outstanding principal balance of the notes, less amounts on deposit in the accumulation account, exclusive of any investment earnings and after giving effect to distributions to be made on that distribution date, would exceed the adjusted pool balance for that distribution date.

See “Description of the Notes— Distributions” in this preliminary remarketing prospectus supplement for a more detailed description of principal payments.

Maturity Dates.

The class A-1 notes were repaid in full on the October 2007 distribution date.

The class A-2 notes were repaid in full on the October 2012 distribution date.

Each class of outstanding notes will mature no later than the date set forth in the table below for that class:

| | Class | | Maturity Date | |

| | Class A-3 | | July 25, 2025 | |

| | Class A-4 | | October 25, 2029 | |

| | Class A-5 | | January 25, 2040 | |

| | Class B | | January 25, 2040 | |

The actual maturity of any class of outstanding notes could occur earlier if, for example:

· there are prepayments on the trust student loans;

· the servicer exercises its option to purchase all remaining trust student loans, which will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance; or

· the indenture trustee auctions all remaining trust student loans, which absent an event of default under the indenture, will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance.

The initial pool balance is equal to the sum of: (i) the pool balance as of the closing date and (ii) all amounts deposited into the supplemental purchase account and the add-on consolidation loan account on the closing date.

Subordination of the Class B Notes. Payments of interest on the class B notes will be subordinate to payments of interest on the class A notes and to certain trust swap payments due to any swap counterparty, if applicable. In general, payments of principal on the class B notes will be subordinate to the payment of both interest and principal on the class A notes, trust swap payments due to any swap counterparty, if applicable, and any deposits required to be made into any supplemental interest account or any investment reserve account. See “Description of the Notes—The Notes—The Class B Notes—Subordination of the Class B Notes” in this preliminary remarketing prospectus supplement.

Security for the Notes. The notes are secured by the assets of the trust, primarily the trust student loans.

Potential Future Interest Rate Cap Agreement. At any time, at the written direction of the administrator, the trust may enter into one or more interest rate cap agreements (collectively, the “potential future interest rate cap agreement”) with one or more eligible swap counterparties (collectively, the “potential future cap counterparty”) to hedge some or all of the interest rate risk of the notes. Any payment due by the trust to a potential future cap counterparty would be payable only out of funds available for distribution under clause (p)(1) of “Description of the Notes—Distributions—Distributions from the Collection Account” in this preliminary remarketing prospectus supplement. Any payments received from a potential future cap counterparty would be included in available funds. It is not anticipated that the trust would be required to make any payments to any potential future cap counterparty under any potential future interest rate cap agreement other than an upfront payment and, in some circumstances, a termination payment. See “Description of the Notes—Potential Future Interest Rate Cap Agreement” in this preliminary remarketing prospectus supplement.

As of the July 27, 2015 reset date, the trust will not have entered into any potential future interest rate cap agreements.

INDENTURE TRUSTEE AND PAYING AGENT

The trust issued the notes under an indenture dated as of August 1, 2005. Under the indenture, Deutsche Bank National Trust Company acts as successor indenture trustee for the benefit of, and to protect the interests of, the noteholders and acts as paying agent for the notes.

LUXEMBOURG PAYING AGENT

If the rules of the Luxembourg Stock Exchange require a Luxembourg paying agent, the depositor will cause one to be appointed.

ELIGIBLE LENDER TRUSTEE

Deutsche Bank Trust Company Americas, a New York banking corporation, is the successor eligible lender trustee under the trust agreement. It holds legal title to the assets of the trust.

DELAWARE TRUSTEE

BNY Mellon Trust of Delaware, a Delaware banking corporation, is the Delaware trustee. The Delaware trustee acts in the capacities required under the Delaware Statutory Trust Act and under the trust agreement. Its principal Delaware address is 100 White Clay Center, Suite 102, Newark, Delaware 19711.

REMARKETING AGENTS

The remarketing agents will be entitled to a fee on each reset date in connection with a successful remarketing of the reset rate notes from amounts on deposit in the remarketing fee account. In connection with a successful remarketing of the class A-5 notes on the July 27, 2015 reset date, the remarketing agents will be paid a remarketing fee by the trust in an amount that will not exceed $630,000.00. As of the July 2015 distribution date, there was $630,000.00 on deposit in the remarketing fee account. The trust will also be obligated to reimburse the remarketing agents, on a subordinated basis, for certain out-of-pocket expenses incurred in connection with each reset date.

ADMINISTRATOR AND SPONSOR

Navient Solutions, Inc. (formerly known as Sallie Mae, Inc.), is the sponsor of the trust and, as the assignee of the rights of SLMA under the related administration agreement, acts as the administrator of the trust under an administration agreement. Navient Solutions, Inc. is a Delaware corporation and a wholly-owned subsidiary of Navient Corporation. Subject to certain conditions, Navient Solutions, Inc. may transfer its obligations as administrator to an affiliate.

INFORMATION ABOUT THE TRUST

The trust is a Delaware statutory trust created under a trust agreement dated as of July 29, 2005.

The only activities of the trust that are currently permitted are acquiring, owning and managing the trust student loans and the other assets of the trust, issuing and making payments on the notes, entering into any required swap agreements or potential future interest rate cap agreements and other related activities. See “The Trust—General” in this preliminary remarketing prospectus supplement.

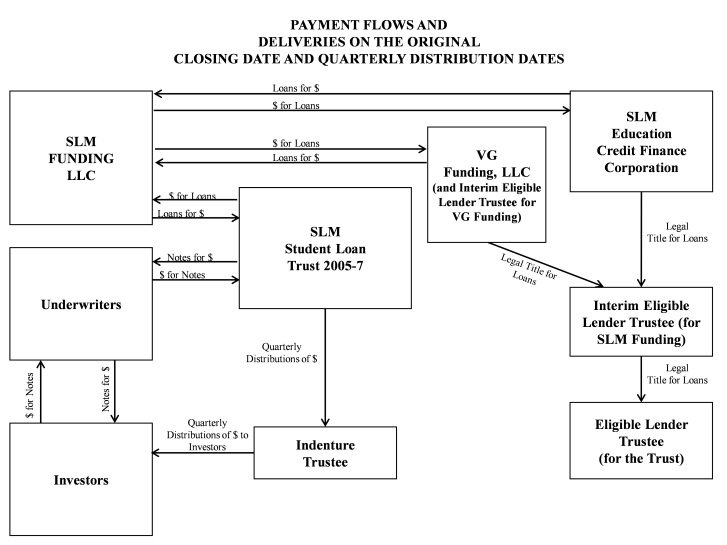

Navient Funding, LLC (formerly known as SLM Funding LLC), as depositor, after acquiring the student loans from one of VG Funding LLC (“VG Funding”) or Navient Credit Finance Corporation (formerly known as SLM Education Credit Finance Corporation) (“Navient CFC”) under separate purchase agreements, sold them to the trust on the closing date under a sale agreement (we sometimes refer to Navient CFC and VG Funding as the “sellers”). The depositor is a limited liability company of which Navient CFC is the sole member. Chase Bank USA, National Association, as interim eligible lender trustee, initially held legal title to the student loans for the depositor under an interim trust arrangement prior to their transfer to the trust and then as eligible lender trustee for the benefit of the trust under the trust agreement. Deutsche Bank Trust Company Americas now serves as successor interim eligible lender trustee for the depositor and successor eligible lender trustee on behalf of the trust.

Its Assets

The assets of the trust include:

| · | the trust student loans; |

| · | collections and other payments on the trust student loans; |

| · | funds it currently holds or will hold from time to time in its trust accounts, including a collection account; a reserve account; an accumulation account; a supplemental interest account; an investment reserve account; an investment premium purchase account; a remarketing fee account; and if the class A-5 notes are denominated in a currency other than U.S. Dollars, a currency account; |

| · | its rights under the transfer and servicing agreements, including the right to require VG Funding (or Navient Solutions, Inc., as servicer, acting on its behalf), Navient CFC, the depositor or the servicer to repurchase trust student loans from it or to substitute loans under certain conditions; |

| · | its rights under any swap agreement or potential future interest rate cap agreement, as applicable; and |

| · | its rights under the guarantee agreements with guarantors. |

The rest of this section more fully describes the trust student loans and trust accounts.

Trust Student Loans. The trust student loans (including the initial trust student loans, any additional trust student loans and any add-on consolidation loans) are education loans to students and parents of students made under the Federal Family Education Loan Program, known as the FFELP. All of the trust student loans are consolidation loans.

Consolidation loans are used to combine a borrower’s or borrowers’ obligations under various federally authorized student loan programs into a single loan. See “Appendix A—Federal Family Education Loan Program” in this preliminary remarketing prospectus supplement, which supersedes in its entirety Appendix A to the base prospectus.

The trust student loans were selected from student loans owned by Navient CFC or VG Funding, or their affiliates, based on the criteria established by the depositor, as described in the base prospectus.

Guaranty agencies described in this document guarantee all of the trust student loans. They are also reinsured by the United States Department of Education (which we refer to as the Department of Education).

Initial Trust Student Loans. The initial trust student loans had a pool balance of approximately $1,500,391,111 as of the statistical cutoff date. The trust student loans have a pool balance of approximately $620,974,603 as of the statistical disclosure date.

As of the statistical disclosure date, (i) the weighted average annual borrower interest rate of the trust student loans was approximately 3.60% and (ii) their weighted average remaining term to scheduled maturity was approximately 202 months.

Special allowance payments on 0.10% of the trust student loans by principal balance (as of the statistical disclosure date) are based on the 91-day treasury bill rate. Special allowance payments on 99.90% of the trust student loans by principal balance (as of the statistical disclosure date) are based on the one-month LIBOR rate.

For more details concerning the trust student loans as of the statistical disclosure date, see “Annex A—The Trust Student Loan Pool” attached to this preliminary remarketing prospectus supplement.

Collection Account. The administrator established and maintains the collection account as an asset of the trust in the name of the indenture trustee. The administrator will deposit collections on the trust student loans, interest subsidy payments and special allowance payments into the collection account, as described in this preliminary remarketing prospectus supplement and the base prospectus.

Reserve Account. The administrator established and maintains the reserve account as an asset of the trust in the name of the indenture trustee. As of the April 2015 distribution date, the amount on deposit in the reserve account was $2,280,587.00.

Funds in the reserve account may be replenished on each distribution date by additional funds available after all prior required distributions have been made. See “Description of the Notes—Distributions.”

The specified reserve account balance is the amount required to be maintained in the reserve account. The specified reserve account balance for any distribution date will be equal to the greater of (a) 0.25% of the pool balance at the end of the related collection period and (b) $2,280,587.00. The specified reserve account balance will be subject to adjustment as described in this

preliminary remarketing prospectus supplement. In no event will it exceed the outstanding principal balance of the notes, less all amounts then on deposit in the accumulation account (exclusive of investment earnings), if any.

Amounts remaining in the reserve account in excess of the specified reserve account balance on any distribution date, after the payment of amounts described below, will be deposited into the collection account for distribution on that distribution date.

The reserve account will be available to cover any shortfalls in payments of the primary servicing fee, the administration fee, the remarketing fees, if any, the class A noteholders’ interest distribution amount (but only up to an annual interest rate equal to three-month LIBOR plus 0.75% in the case of the class A-5 notes), the class B noteholders’ interest distribution amount, payments due to any swap counterparty with respect to interest, if applicable, and certain swap termination payments. As of the April 2015 distribution date, amounts on deposit in the reserve account have not been required for these purposes.

In addition, the reserve account will be available:

| · | on the related maturity date for each class of class A notes and upon termination of the trust, to cover shortfalls in payments of the class A noteholders’ principal and accrued interest to the related class of notes; and |

| · | on the class B maturity date and upon termination of the trust, to cover shortfalls in payments of the class B noteholders’ principal and accrued interest, any carryover servicing fees, any remaining swap termination payments and remarketing fees and expenses. |

The reserve account enhances the likelihood of payment to noteholders. In certain circumstances, however, the reserve account could be depleted which could result in shortfalls in distributions to noteholders.

On any distribution date, if the market value of the reserve account, together with amounts on deposit in any supplemental interest account, is sufficient to pay the remaining principal and interest accrued on the notes and any carryover servicing fees, amounts on deposit in those accounts will be so applied on that distribution date. See “Description of the Notes—Credit Enhancement—Reserve Account” in this preliminary remarketing prospectus supplement.

Capitalized Interest Account. All funds on deposit in the capitalized interest account that was created and funded on the closing date were transferred to the collection account on the October 2007 distribution date. No additional sums were subsequently or will be deposited into this account.

Remarketing Fee Account. The administrator established and maintains a remarketing fee account as an asset of the trust in the name of the indenture trustee, for the benefit of the remarketing agents and the class A noteholders. Beginning on the distribution date that is one year prior to the initial reset date or next reset date, as applicable, for the applicable class of reset rate notes, and through the reset date, the trust is required to deposit into the remarketing fee account available funds up to the related quarterly required amount on each related distribution date, until the balance on deposit in the remarketing fee account reaches the targeted level for the related reset date, prior to the payment of interest on the notes. As of the April 2015 distribution date, there was $630,000.00 on deposit in the remarketing fee account. As of the July 27, 2015 reset date, the required

amount for this account will not exceed $630,000.00.

Investment earnings on deposit in the remarketing fee account are withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date. In addition, if on any distribution date, a class A note interest shortfall would exist, or if on the maturity date for any class of class A notes, available funds would not be sufficient to reduce the principal balance of that class to zero, the amount of that class A note interest shortfall or principal deficiency, as applicable, may be withdrawn from the remarketing fee account and used for payment of interest or principal on the class A notes, to the extent sums are on deposit in that account. See “Description of the Notes—The Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures” in this preliminary remarketing prospectus supplement.

Accumulation Account. The administrator will establish and maintain, in the name of the indenture trustee, an accumulation account for the benefit of the class A-5 notes whenever such notes are structured not to receive a payment of principal until the end of the related reset period (as will be the case in any future reset period during which the class A-5 notes are reset to bear interest at a fixed rate or are denominated in a currency other than U.S. Dollars). With respect to each related reset period, on each distribution date, the indenture trustee will deposit any payments of principal allocated to the class A-5 notes, in U.S. Dollars, into the accumulation account. All sums on deposit in the accumulation account, including any amounts deposited into the accumulation account on the related distribution date, but exclusive of investment earnings, will be paid either:

| · | if the class A-5 notes are then denominated in U.S. Dollars, on the next reset date, to the reset rate noteholders, after all other required distributions have been made on that reset date; or |

| · | if the class A-5 notes are then denominated in a currency other than U.S. Dollars, on or about the next reset date, to the currency swap counterparty or counterparties, which will in turn pay the applicable currency equivalent of those amounts to the trust, for payment to the reset rate noteholders on the second business day following the related reset date, after all other required distributions have been made on that reset date. |

Amounts on deposit in the accumulation account (exclusive of investment earnings) may be used only to pay principal on the class A-5 notes or to the currency swap counterparty or counterparties and for no other purpose. Investment earnings on deposit in the accumulation account will be withdrawn on each distribution date, deposited into the collection account and included as a part of available funds for that distribution date.

Amounts on deposit in the accumulation account may be invested in eligible investments that can be purchased at a price equal to par, at a discount, or at a premium. Eligible investments may be purchased at a premium over par only if there are sufficient amounts on deposit in the investment premium purchase account described below to pay the amount of the purchase price in excess of par.

As of the April 2015 distribution date there were no amounts on deposit in the accumulation account.

Investment Premium Purchase Account. When required, the administrator will establish and maintain, in the name of the indenture trustee, an investment premium purchase account related to the accumulation account. On each distribution date when funds are deposited into the accumulation account, the indenture trustee will be required to deposit, subject to sufficient available funds, an amount generally equal to 1.0% of the amount deposited into the accumulation account into the investment premium purchase account, together with any carryover amounts from previous distribution dates if there were insufficient available funds on any previous distribution date to make the required deposits in full.

Amounts on deposit in the investment premium purchase account may be used from time to time to pay amounts in excess of par on eligible investments purchased with funds on deposit in the accumulation account. Amounts not used to pay such premium purchase amounts will become a part of available funds on future distribution dates pursuant to a formula set forth in the administration agreement.

As of the April 2015 distribution date there were no amounts on deposit in the investment premium purchase account.

Investment Reserve Account. When required, the administrator will establish and maintain, in the name of the indenture trustee, an investment reserve account related to the accumulation account. On any distribution date, and to the extent of available funds, if the ratings of any eligible investments in the accumulation account have been downgraded by one or more rating agencies, the indenture trustee will deposit into the investment reserve account an amount, if any, to be set by each applicable rating agency in satisfaction of the rating agency condition, which amount will not exceed the amount of the unrealized loss on the related eligible investments. On each distribution date, all amounts on deposit in the investment reserve account either will be withdrawn from the investment reserve account and deposited into the accumulation account in an amount required to offset any realized losses on eligible investments related to the accumulation account, or will be deposited into the collection account to be included as a part of available funds on that distribution date.

As of the April 2015 distribution date there were no amounts on deposit in the investment reserve account.

Supplemental Interest Account. When required, the administrator will establish and maintain, in the name of the indenture trustee, a supplemental interest account related to the accumulation account.

On each distribution date when amounts are deposited into or are on deposit in the accumulation account, the administrator will cause the indenture trustee, subject to sufficient available funds, to make a deposit into the supplemental interest account. This deposit will equal the amount sufficient to pay either to the reset rate noteholders or to each swap counterparty, as applicable, the floating rate payments due to the reset rate noteholders or the swap counterparty, as applicable, through the next distribution date at the related LIBOR-based floating rate on all amounts on deposit in the accumulation account, after giving effect to an assumed rate of investment earnings on that account.

All amounts on deposit in the supplemental interest account will be withdrawn on or before each distribution date, deposited into the collection account and included as a part of available funds for that distribution date.

As of the April 2015 distribution date there were no amounts on deposit in the supplemental interest account.

Spread Supplement Account. On April 25, 2008, the reset date for the class A-3 notes, Navient Corporation made a one-time capital contribution to the trust in an amount that represents the excess of the expected cash flow requirements in order to pay noteholders of the class A-3 notes interest at the annualized stated reset rate of interest over the amount that would be payable by the trust if such class of notes bore an annual rate of interest equal to LIBOR plus 0.75%. Such amounts were deposited into a newly created trust account (the “spread supplement account”) for the benefit of the class A-3 noteholders exclusively. On each distribution date, the indenture trustee will withdraw the excess of interest earned on the class A-3 notes at the applicable stated reset rate of interest over interest that would have been payable on such class of notes if they bore interest at an annual rate of LIBOR plus 0.75% and pay such amounts directly to the class A-3 noteholders. All investment earnings on the spread supplement account will be paid to the excess distribution certificateholder on each distribution date. No amounts on deposit in the spread supplement account will become a part of available funds nor may be used to satisfy any other obligations of the trust. On each distribution date, any amount on deposit in the spread supplement account in excess of the required specified balance for such account will be withdrawn and paid to the excess distribution certificateholder. Following payment in full of all outstanding amounts on the class A-3 notes, any sums remaining on deposit in the spread supplement account will be withdrawn on the related distribution date and paid to the excess distribution certificateholder.

ADMINISTRATION OF THE TRUST

Distributions

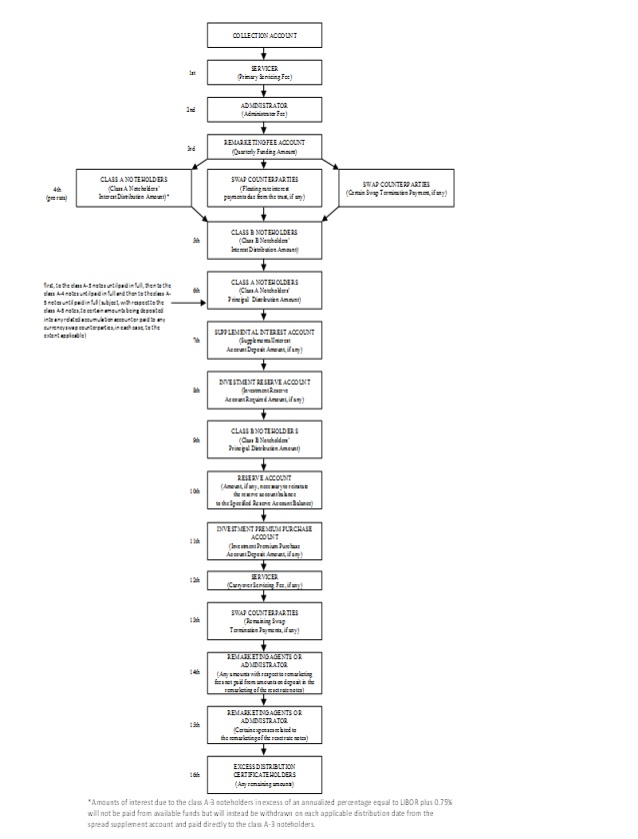

Navient Solutions, Inc., as administrator, will instruct the indenture trustee to withdraw funds on deposit in the collection account and the other accounts, as described above. These funds will be applied on or before each applicable distribution date generally as shown in the chart on the following page. Funds on deposit in the collection account and, to the extent required, the reserve account will be applied monthly to the payment of the primary servicing fee.

See “Description of the Notes— Distributions” in this preliminary remarketing prospectus supplement for a more detailed description of distributions.

Transfer of the Assets to the Trust

Under a sale agreement, the depositor sold the trust student loans to the trust, with the eligible lender trustee holding legal title to the trust student loans.

If the depositor breaches a representation under the sale agreement regarding a trust student loan, generally the depositor will have to cure the breach, repurchase or replace that trust student loan or reimburse the trust for losses resulting from the breach.

Each seller has similar obligations under the purchase agreements. See “Transfer and Servicing Agreements—Purchase of Student Loans by the Depositor; Representations and Warranties of the Sellers” in the base prospectus.

Servicing of the Assets

Under a servicing agreement, Navient Solutions, Inc., as servicer, is responsible for servicing, maintaining custody of and making collections on the trust student loans. It also bills and collects payments from the guaranty agencies and the Department of Education.

The servicer manages and operates the loan servicing functions for the Navient Corporation family of companies. The servicer may enter into subservicing agreements with respect to some or all of its servicing obligations, but these arrangements will not affect the servicer’s obligations to the trust. Under some circumstances, the servicer may transfer its obligations as servicer.

If the servicer breaches a covenant under the servicing agreement regarding a trust student loan, generally it will have to cure the breach, purchase that trust student loan or reimburse the trust for losses resulting from the breach. See “The Trust Student Loan Pool—Insurance of Student Loans; Guarantors of Student Loans” in this preliminary remarketing prospectus supplement.

Compensation of the Servicer

The servicer receives two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee for any month is equal to 1/12th of an amount not to exceed 0.50% of the outstanding principal amount of the trust student loans.

The primary servicing fee is payable in arrears out of available funds and amounts on deposit in the reserve account on the 25th day of each month, or if the 25th day is not a business day, then on the next business day. Fees are calculated as of the first day of the preceding calendar month. Fees include amounts from any prior monthly servicing payment dates that remain unpaid.

The carryover servicing fee is payable to the servicer on each distribution date out of available funds.

The carryover servicing fee is the sum of:

| · | the amount of specified increases in the costs incurred by the servicer; |

| · | the amount of specified conversion, transfer and removal fees; |

| · | any amounts described in the first two bullets that remain unpaid from prior distribution dates; and |

| · | interest on any unpaid amounts. |

See “Description of the Notes—Servicing Compensation” in this preliminary remarketing prospectus supplement.

TERMINATION OF THE TRUST

The trust will terminate upon:

| · | the maturity or other liquidation of the last trust student loan and the disposition of any amount received upon its liquidation; and |

| · | the payment of all amounts required to be paid to the noteholders. |

See “The Student Loan Pools—Termination” in the base prospectus.

Optional Purchase

The servicer may purchase or arrange for the purchase of all remaining trust student loans on any distribution date when the pool balance is 10% or less of the initial pool balance.

The exercise of this purchase option will result in the early retirement of the remaining notes, including an early distribution of all amounts then on deposit in the accumulation account. The purchase price will equal the amount required to prepay in full, including all accrued and unpaid interest, the remaining trust student loans as of the end of the preceding collection period, but will not be less than a prescribed minimum purchase amount.

This prescribed minimum purchase amount is the amount that would be sufficient to:

| · | pay to noteholders the interest payable on the related distribution date; and |

| · | reduce the outstanding principal amount of each class of notes then outstanding on the related distribution date to zero, taking into account all amounts then on deposit in the accumulation account. |

For these purposes, if the class A-5 notes:

| · | are then structured not to receive a payment of principal until the end of the related reset period, the outstanding principal balance of the class A-5 notes will be deemed to have been reduced by any amounts on deposit, exclusive of any investment earnings, in the accumulation account; and/or |

| · | are then denominated in a non-U.S. Dollar currency, the U.S. Dollar equivalent of the then-outstanding principal balance of the class A-5 notes will be determined based upon the exchange rate provided for in the currency swap agreement or agreements. |

The pool balance as of the statistical disclosure date is approximately 41.39% of the initial pool balance.

Auction of Trust Assets

The indenture trustee will offer for sale all remaining trust student loans at the end of the first collection period when the pool balance is 10% or less of the initial pool balance.

The trust auction date will be the third business day before the related distribution date. An auction will be consummated only if the servicer has first waived its optional purchase right as described above. The servicer will waive its option to purchase the remaining trust student loans if it fails to notify the eligible lender trustee and the indenture trustee, in writing, that it intends to exercise its purchase option before the indenture trustee accepts a bid to purchase the trust student loans. The depositor and its affiliates, including Navient CFC and the servicer, and unrelated third parties may offer bids to purchase the trust student loans. The depositor or any affiliate may not

submit a bid representing greater than fair market value of the trust student loans.

If at least two bids are received, the indenture trustee will solicit and re-solicit new bids from all participating bidders until only one bid remains or the remaining bidders decline to resubmit bids. The indenture trustee will accept the highest of the remaining bids if it equals or exceeds the higher of (a) the minimum purchase amount described under “—Optional Purchase” above (plus any amounts owed to the servicer as carryover servicing fees); or (b) the fair market value of the trust student loans as of the end of the related collection period.

If at least two bids are not received or the highest bid after the re-solicitation process does not equal or exceed the amount in the immediately preceding paragraph, the indenture trustee will not complete the sale. The indenture trustee may, and at the direction of the depositor will be required to, consult with a financial advisor, including any of the original underwriters of the notes, or the administrator, to determine if the fair market value of the trust student loans has been offered. See “The Student Loan Pools—Termination” in the base prospectus.

The net proceeds of any auction sale, plus all amounts, exclusive of investment earnings, then on deposit in the accumulation account, will be used to retire any outstanding notes on the related distribution date.

If the sale is not completed, the indenture trustee may, but will not be under any obligation to, solicit bids for sale of the trust student loans after future collection periods upon terms similar to those described above, including the servicer’s waiver of its option to purchase remaining trust student loans.

If the trust student loans are not sold as described above, on each subsequent distribution date, if the amount on deposit in the reserve account after giving effect to all withdrawals, except withdrawals payable to the depositor, exceeds the specified reserve account balance, the administrator will direct the indenture trustee to distribute the amount of the excess as accelerated payments or allocations of note principal.

The indenture trustee may or may not succeed in soliciting acceptable bids for the trust student loans either on the trust auction date or on subsequent distribution dates.

See “The Student Loan Pools— Termination” in the base prospectus.

TAX CONSIDERATIONS

Subject to important considerations described in the base prospectus:

| · | Federal tax counsel for the trust is of the opinion that the class A-5 notes will be characterized as debt for federal income tax purposes. |

| · | Federal tax counsel for the trust is of the opinion that the trust will not be characterized as an association or a publicly traded partnership taxable as a corporation for federal income tax purposes. |

| · | Delaware tax counsel for the trust is of the opinion that the same characterizations will apply for Delaware state income tax purposes as for federal income tax purposes and that noteholders who were not otherwise subject to Delaware taxation on income would not become subject to Delaware taxation as a result of their ownership of notes. |

See “U.S. Federal Income Tax Consequences” in this preliminary remarketing prospectus supplement and in the base prospectus.

ERISA CONSIDERATIONS

Subject to important considerations and conditions described in this preliminary remarketing prospectus supplement and the base prospectus, the class A-5 notes may, in general, be purchased by or on behalf of an employee benefit plan, including an insurance company general account, only if:

| · | an exemption from the prohibited transaction provisions of Section 406 of the Employee Retirement Income Security Act of 1974, as amended, and Section 4975 of the Internal Revenue Code of 1986, as amended, applies, so that the purchase or holding of the class A-5 notes will not result in a non-exempt prohibited transaction; and |

| · | the purchase or holding of the class A-5 notes will not cause a non-exempt violation of any substantially similar federal, state, local or foreign laws. |

Each fiduciary who purchases a note will be deemed to represent that an exemption exists and applies to it and that no non-exempt violations of any substantially similar laws will occur.

See “ERISA Considerations” in this preliminary remarketing prospectus supplement and in the base prospectus for additional information concerning the application of ERISA.

CERTAIN INVESTMENT COMPANY ACT CONSIDERATIONS

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is intended to be structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in this offering memorandum). See “Certain Investment Company Act Considerations” in this offering memorandum for more information.

RATINGS

The class A-5 notes are currently rated by two or more rating agencies. A rating addresses only the likelihood of the timely payment of stated interest and the payment of principal at final maturity, and does not address the timing or likelihood of principal distributions prior to final maturity. See “Ratings” in this preliminary remarketing prospectus supplement.

LISTING INFORMATION

The class A-5 notes are currently listed on the Luxembourg Stock Exchange. You should consult with Deutsche Bank Luxembourg S.A., the Luxembourg listing agent for the notes, for additional information regarding their status. You can contact the listing agent at 2 Boulevard Konrad Adenauer L-1115, Luxembourg.

So long as the class A-5 notes are listed on the Luxembourg Stock Exchange, and its rules so require, notices relating to that class of notes, including if any of such class is delisted, will be published in a leading newspaper having general circulation in

Luxembourg, which is expected to be LuxemburgerWort and/or on the Luxembourg Stock Exchange’s website at: http://www.bourse.lu.

The class A-5 notes are currently able to be cleared and settled through Clearstream, Luxembourg and Euroclear.

RISK FACTORS

Some of the factors you should consider before making an investment in the class A-5 notes are described in this preliminary remarketing prospectus supplement and in the base prospectus under “Risk Factors.”

IDENTIFICATION NUMBERS

The class A-5 notes have the following identification numbers:

| CUSIP Number | 78442G QK 5 |

| International Securities Identification Number (ISIN) | US78442GQK57 |

| European Common Code | 022702858 |

RISK FACTORS

You should carefully consider the following factors in order to understand the structure and characteristics of the notes and the potential merits and risks of an investment in the class A-5 notes. Potential investors must review and be familiar with the following risk factors in deciding whether to purchase the class A-5 notes. The base prospectus describes additional risk factors that you should also consider beginning on page 21. These risk factors could affect your investment in or return on the class A-5 notes.

| Federal Financial Regulatory Legislation Could Have An Adverse Effect On Navient Corporation, The Sponsor, The Servicer, The Depositor, Navient CFC or Any Other Seller And The Trust, Which Could Result In Losses Or Delays In Payments On Your Notes | | On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) to reform and strengthen supervision of the U.S. financial services industry. The Dodd-Frank Act represents a comprehensive change to existing laws, imposing significant new regulation on almost every aspect of the U.S. financial services industry. The Dodd-Frank Act will result in significant new regulation in key areas of the business of Navient Corporation (formerly known as SLM Corporation), the indirect parent of Navient Solutions, Inc. and Navient Funding, LLC, and its affiliates and the markets in which Navient Corporation, the sponsor and their affiliates operate. Pursuant to the Dodd-Frank Act, Navient Corporation and many of its subsidiaries are subject to regulations promulgated by the Consumer Financial Protection Bureau (the “CFPB”). The CFPB will have substantial power to define the rights of consumers and the responsibilities of certain institutions, including Navient Corporation’s education loan servicing business. The CFPB began exercising its authority on July 21, 2011. Most of the component parts of the Dodd-Frank Act continues to be subject to intensive rulemaking and public comment over the coming months and none of Navient Corporation, the sponsor or their affiliates can predict the ultimate effect the Dodd-Frank Act or required examinations of the private education loan market could have on their operations at this time. It is likely, however, that operational expenses will increase if new or additional compliance requirements are imposed on their operations and their competitiveness could be significantly affected if they are subjected to supervision and regulatory standards not otherwise applicable to their competitors. The Dodd-Frank Act also creates a liquidation framework for the resolution of bank holding companies and other non-bank financial companies determined to be “covered financial companies.” If Navient Corporation or its affiliates were determined to be covered financial companies, it is possible that the Federal Deposit |

| | | Insurance Corporation (the “FDIC”) could be appointed receiver of Navient Corporation, the sponsor or any of their affiliates under the Orderly Liquidation Authority (“OLA”) provisions of the Dodd-Frank Act. If that occurred, the FDIC could repudiate contracts deemed burdensome to the estate, including secured debt. The sponsor has structured the transfers of the student loans to the depositor and the trust as a valid and perfected sale under applicable state law and under the United States Bankruptcy Code to mitigate the risk of the recharacterization of the sale as a security interest to secure debt of Navient Solutions, Inc. Any attempt by the FDIC to recharacterize the securitization transaction as a secured loan (which the FDIC could then repudiate) could cause delays in payments or losses on the notes. In addition, if the trust were to become subject to the OLA, the FDIC could repudiate the debt of the trust with the result that the noteholders would have a secured claim in the receivership of the trust. Also, if the trust were subject to OLA, noteholders would not be permitted to accelerate the debt, exercise remedies against the collateral or replace the servicer without the FDIC’s consent for 90 days after the receiver is appointed. As a result of any of these events, delays in payments on the notes and reductions in the amount of those payments could occur. See “The Trust Student Loan Pool—Dodd-Frank Act—Potential Applicability and Orderly Liquidation Authority Provisions—FDIC’s Repudiation Power Under the OLA” in this preliminary remarketing prospectus supplement. |