Filed Pursuant to Rule 433

Registration Statement Nos. 333-103545-07 & 333-190926

Subject to Completion and Modification

NAVIENT FUNDING, LLC HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE FREE-WRITING BASE PROSPECTUS IN THAT REGISTRATION STATEMENT AND THE OTHER DOCUMENTS NAVIENT FUNDING, LLC HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT NAVIENT FUNDING, LLC AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT WWW.SEC.GOV. ALTERNATIVELY, NAVIENT FUNDING, LLC, ANY REMARKETING AGENT OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE FREE-WRITING BASE PROSPECTUS IF YOU REQUEST IT BY CALLING 1-800-321-7179.

Free-Writing Prospectus

relating to the remarketing of

(up to)

$597,500,000*

(*Using an exchange rate of $1.1950 = €1.00)

CLASS A-7A NOTES

SLM Student Loan Trust 2005-9

Issuing Entity

Navient Funding, LLC

Depositor

Navient Solutions, Inc.

Sponsor, Servicer and Administrator

Student Loan-Backed Notes

The remarketing agents are remarketing, on behalf of SLM Student Loan Trust 2005-9, the class A-7A notes (the "class A-7A notes"). The class A-7A notes were originally issued by the trust on November 15, 2005. If successfully remarketed on January 25, 2016, the class A-7A notes will have the following terms:

| Class | | Outstanding Principal Amount | | Interest Rate | | Price | | Next Reset Date | | Legal Maturity Date |

| Class A-7A Notes | | $597,500,000 | | 3-month LIBOR

plus % | | 100% | | April 25, 2016 | | January 25, 2041 |

______________________________________________________________________________________________________________________________

All existing class A-7A noteholders are hereby advised that because the class A-7A notes were denominated in a non-U.S. Dollar currency during their current reset period, pursuant to their terms, the class A-7A notes are subject to a mandatory tender.

The class A-7A notes have not been approved or disapproved by the United States Securities and Exchange Commission (the "SEC"), any state securities commission or any other regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of this remarketing or the accuracy or adequacy of this free-writing prospectus. Any representation to the contrary is a criminal offense.

You should consider carefully the risk factors on page 25 of this free-writing prospectus and on page 15 of the free-writing base prospectus.

We are not offering the class A-7A notes in any state or other jurisdiction where the offer is prohibited.

This document constitutes a "free-writing prospectus" within the meaning of Rule 405 under the Securities Act of 1933, as amended.

The notes are asset-backed securities and are obligations of the issuing entity, which is a trust. They are not obligations of or interests in Navient Corporation, the sponsor, the depositor, any seller of loans to the depositor, the administrator, the servicer, the remarketing agents or any of their respective affiliates.

The notes are not guaranteed or insured by the United States or any governmental agency.

The trust relies on an exclusion or exemption from the Investment Company Act of 1940 contained in rule 3a-7 under the Investment Company Act of 1940, although there may be additional exclusions or exemptions available to the trust. The trust was structured so as not to constitute a "covered fund" for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in this free-writing prospectus).

Remarketing Agents

| Credit Suisse | Deutsche Bank Securities |

January 12, 2016

REMARKETING TERMS SUMMARY

On January 25, 2016 (absent a Failed Remarketing, or the exercise by Navient Corporation or one of its wholly‑owned subsidiaries of its call option), the class A-7A notes will be reset from their current terms to the following terms, which terms will be applicable until the next reset date for the class A-7A notes (definitions for certain capitalized terms may be found in the Glossary at the end of this free-writing prospectus):

| |

| Original principal amount | $597,500,000(1) |

| Current outstanding principal balance | $597,500,000(1) |

| Principal amount being remarketed | $597,500,000(1) |

| Remarketing Terms Determination Date | January 12, 2016 |

Notice Date(2) | January 14, 2016 |

Spread Determination Date(3) | On or before January 20, 2016 |

| Current Reset Date | January 25, 2016 |

| All Hold Rate | N/A(4) |

| Next applicable reset date | April 25, 2016 |

| Interest rate mode | Floating |

| Index | Three-Month LIBOR(5) |

Spread(6) | Plus % |

| Day-count basis | Actual/360 |

| Weighted average remaining life | (7) |

___________________

(1) The class A-7A notes were originally issued in Euros and their initial outstanding principal balance is equal to €500,000,000. The U.S. Dollar equivalent of this principal balance has been calculated using an exchange rate equal to $1.1950 = €1.00.

(2) The class A-7A notes were denominated in a non-U.S. Dollar currency during their current reset period and therefore, pursuant to their terms, the class A-7A notes are subject to a mandatory tender.

(3) The applicable Spread may be determined at any time after 12:00 p.m. (noon), New York City time, on the Notice Date but not later than 3:00 p.m., New York City time, on January 20, 2016.

(4) The All Hold Rate is not applicable.

(5) Three-month LIBOR will be reset on each LIBOR Determination Date in accordance with the procedures set forth under "Additional Information Regarding the Notes—Determination of Indices—LIBOR" in the free-writing base prospectus.

(6) To be determined on the spread determination date.

(7) The projected weighted average remaining life to the April 25, 2016 reset date of the class A-7A notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment scenarios is approximately 0.25 years. More information may be found under "Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-7A Notes" to be included as Exhibit I to the final remarketing prospectus supplement to be distributed to potential investors on or prior to the spread determination date.

The remarketing agents may be contacted as follows:

Credit Suisse Securities (USA) LLC

Eleven Madison Avenue

New York, New York 10010-3629

Attention: Craig Leonard

Telephone: 212-325-8549

Email: craig.leonard@credit-suisse.com

Deutsche Bank Securities Inc.

60 Wall Street, 3rd Floor

New York, New York 10005

Attention: Con Accibal

Telephone: 212-250-7730

Facsimile: 212-797-2031

Email: con.accibal@db.com

The Student Loan-Backed Notes issued by SLM Student Loan Trust 2005-9 consist of the class A‑7A notes and the class A-6 notes (referred to as the "reset rate notes" and the class A‑1, class A‑2, class A‑3, class A‑4, class A‑5 and class A‑7B notes (collectively referred to as the "floating rate class A notes") and the class B notes (which, together with the floating rate class A notes, are referred to as the "floating rate notes" and the floating rate notes, together with the reset rate notes, are referred to as the "notes"). As of the date of this remarketing free-writing prospectus (referred to as the "free-writing prospectus"), the class A-1, class A-2, class A-3 and class A-4 notes have been paid in full and are no longer outstanding. No class of notes other than the class A-7A notes (collectively referred to as the "other notes") is being offered under this free-writing prospectus. Any information contained herein with respect to the other notes is provided only to present a better understanding of the class A-7A notes. The class A-7A notes were originally offered for sale pursuant to the prospectus supplement, dated November 4, 2005 and the related prospectus, dated November 4, 2005.

Credit Suisse Securities (USA) LLC and Deutsche Bank Securities Inc. are serving as the remarketing agents (in such capacity, collectively, the "remarketing agents") for the class A-7A notes.

The notes were issued on November 15, 2005 (referred to as the "closing date"), are obligations of an issuing entity known as SLM Student Loan Trust 2005-9 (referred to as the "trust") and are secured by the assets of the trust, which consist primarily of a pool of consolidation student loans (the "trust student loans").

Principal of and interest on the notes are generally payable or allocable as described herein on the 25th day of each January, April, July and October or, if such day is not a business day, then on the next business day (each, a "distribution date"). The initial "reset date" for the class A-7A notes is January 25, 2016. We refer to the January 25, 2016 reset date as the "current reset date" in this free-writing prospectus.

If the class A-7A notes are successfully remarketed on the current reset date, interest will accrue on the class A-7A notes at the rate specified in the summary of this free-writing prospectus and will be calculated based on the actual number of days elapsed in each accrual period and a 360‑day year until the next reset date, which will occur on April 25, 2016. Interest will accrue on the outstanding principal balance of the class A-7A notes during three-month accrual periods and will be paid on each distribution date. The first distribution date after the current reset date is scheduled to occur on April 25, 2016. Each accrual period will begin on a distribution date and end on the day before the next distribution date.

Investors in the class A-7A notes are strongly urged to keep in contact with the remarketing agents because notices and required information pertaining to the remarketing of the class A-7A notes sent to the clearing agencies by the administrator or the remarketing agents, as applicable, may not be communicated in a timely manner to the related beneficial owners.

TABLE OF CONTENTS

Preliminary Remarketing Prospectus Supplement

| REMARKETING TERMS SUMMARY | i |

| | |

| INTRODUCTION | iii |

| | |

| SUMMARY OF NOTE TERMS | 1 |

| | |

| RISK FACTORS | 25 |

| | |

| DEFINED TERMS | 34 |

| | |

| CURRENCY PRESENTATION | 34 |

| | |

| THE TRUST | 34 |

| | |

| USE OF PROCEEDS | 39 |

| | |

| THE TRUST STUDENT LOAN POOL | 39 |

| | |

| DESCRIPTION OF THE NOTES | 48 |

| | |

| STATIC POOLS | 81 |

| | |

| PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE LIVES AND EXPECTED MATURITIES OF THE CLASS A-7A NOTES | 81 |

| | |

| U.S. FEDERAL INCOME TAX CONSEQUENCES | 82 |

| | |

| EUROPEAN UNION DIRECTIVE ON THE TAXATION OF SAVINGS INCOME | 85 |

| | |

| ERISA CONSIDERATIONS | 85 |

| | |

| ACCOUNTING CONSIDERATIONS | 87 |

| | |

| REPORTS TO NOTEHOLDERS | 87 |

| | |

| REMARKETING | 87 |

| | |

| NOTICES TO INVESTORS | 88 |

| | |

| LISTING INFORMATION | 89 |

| | |

| CERTAIN INVESTMENT COMPANY ACT CONSIDERATIONS | 90 |

| | |

| RATINGS | 91 |

| | |

| LEGAL PROCEEDINGS | 91 |

| | |

| LEGAL MATTERS | 92 |

| | |

| GLOSSARY | 93 |

| ANNEX A: | The Trust Student Loan Pool as of November 30, 2015 |

| | |

| APPENDIX A: | Federal Family Education Loan Program |

| | |

| EXHIBIT I: | Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-7A Notes |

| | |

| APPENDIX I: | Free-Writing Base Prospectus, dated January 12, 2016 |

THE INFORMATION IN THIS FREE-WRITING PROSPECTUS AND THE FREE-WRITING

BASE PROSPECTUS ATTACHED HERETO AS APPENDIX I

We provide information to you about the class A-7A notes in two separate sections of this document that provide progressively more detailed information. These two sections are: (a) the accompanying free-writing base prospectus (referred to as the "free-writing base prospectus"), which begins after the end of this free-writing prospectus and which provides general information about the issuing entity, the trust student loans and the notes, some of which will not apply to the class A-7A notes, and (b) this free-writing prospectus, which describes the specific terms of the class A-7A notes that are being offered hereby and provides information about the trust student loans as of November 30, 2015. You should read both the free-writing base prospectus and this free-writing prospectus to fully understand the class A-7A notes.

For your convenience, we include cross‑references in this free-writing prospectus and in the free-writing base prospectus to captions in these materials where you can find related information. The Table of Contents on page iv provides the pages on which you can find these captions.

The class A-7A notes are currently listed on the Luxembourg Stock Exchange. You should consult with Deutsche Bank Luxembourg S.A., the Luxembourg listing agent for the class A-7A notes, for additional information regarding their status.

This free-writing prospectus is not required to contain all information that is required to be included in the final prospectus supplement and base prospectus. The information in this free-writing prospectus is preliminary and is subject to completion or change. The information in this free-writing prospectus, if conveyed prior to the time of your commitment to purchase any class of notes, supersedes any information contained in any prior free-writing prospectus relating to the notes.

FORWARD-LOOKING STATEMENTS

Certain statements contained in or incorporated by reference in this free-writing prospectus and the free-writing base prospectus consist of forward-looking statements relating to future economic performance or projections and other financial items. These statements can be identified by the use of forward-looking words such as "may," "will," "should," "expects," "believes," "anticipates," "estimates," or other comparable words. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual results to differ from the projected results. Those risks and uncertainties include, among others, general economic and business conditions, regulatory initiatives and compliance with governmental regulations, customer preferences and various other matters, many of which are beyond our control. Because we cannot predict the future, what actually happens may be very different from what is contained in our forward-looking statements.

This summary highlights selected information about the class A-7A notes. It does not contain all of the information that you might find important in making your investment decision. It provides only an overview to aid your understanding. You should read the full description of this information appearing elsewhere in this document and in the attached free-writing base prospectus. We have provided information in this free-writing prospectus with respect to the other notes in order to further the understanding by potential investors of the class A-7A notes.

ISSUING ENTITY

SLM Student Loan Trust 2005-9.

CLASS A-7A NOTES

The Reset Rate Class A-7A Student Loan‑Backed Notes that are being remarketed hereunder were originally issued by the trust on November 15, 2005 in the principal amount of €500,000,000, which is equal to $597,500,000 (using an exchange rate of $1.1950 = €1.00) and are currently outstanding in the same amount.

The initial reset date for the class A-7A notes is January 25, 2016. We refer to the January 25, 2016 reset date as the "current reset date" in this free-writing prospectus. Absent a failed remarketing or an exercise of the related call option by Navient Corporation (formerly known as SLM Corporation) or one of its wholly-owned subsidiaries with respect to the current reset date, the next reset date for the class A-7A notes will be April 25, 2016. The legal maturity date for the class A-7A notes is January 25, 2041.

Interest. During their initial reset period, the class A-7A notes have been denominated in Euros and have borne interest at a floating rate equal to three-month EURIBOR plus 0.10%, which interest accrued annually.

During the reset period following the January 25, 2016 reset date, interest will accrue on the outstanding principal balance of the class A-7A notes during each accrual period and will be paid on each distribution date.

With respect to any reset period when a class of reset rate notes is denominated in a currency other than U.S. Dollars (as has been the case during the initial reset period with respect to the class A-7A notes), for the distribution date that coincides with a reset date (as will be the case on the January 25, 2016 reset date), interest and principal will be paid to the related noteholders on the second business day following such distribution date, together with additional interest on the applicable principal balance at the related interest rate.

For any reset period when a class of reset rate notes is denominated in a currency other than U.S. Dollars (as has been the case during the initial reset period with respect to the class A-7A notes), following a reset date upon which a failed remarketing has occurred up to and including the reset date resulting in a successful remarketing or an exercise of the call option for the applicable class of reset rate notes, payments of interest and principal to holders of such class of reset rate notes will be made on the second business day following the related reset date without payment of any additional interest.

If successfully remarketed on the January 25, 2016 reset date, the class A-7A notes, until the end of the accrual period relating to the April 25, 2016 reset date, will bear interest at an annual rate equal to three-month LIBOR plus % based on the

actual number of days elapsed in each accrual period and a 360-day year.

During any reset period (or upon a successful remarketing on the January 25, 2016 reset date) when a class of reset rate notes bears a floating rate of interest (including both U.S. Dollar and non-U.S. Dollar denominated notes), accrual periods will generally begin on a distribution date and will end on the day before the next distribution date. The next accrual period for the class A-7A notes will begin on January 25, 2016 and end on April 24, 2016.

For each subsequent related reset date, if any, the related currency, applicable accrual periods and distribution dates will be determined on the related remarketing terms determination date as specified under "Description of the Notes—The Reset Rate Notes" and "—Reset Periods" in this free-writing prospectus.

Principal. Payments of principal of the class A-7A notes will generally be made only after the class A-5 and class A-6 notes, in that order, have been retired. The class A‑1, class A‑2, class A‑3 and class A-4 notes, which were earlier in the sequence of principal payments, have been paid in full and are no longer outstanding. The class A‑5 and class A‑6 notes, however, are still outstanding. Absent an event of default, no principal will be paid to the class A-7A notes until the outstanding principal balances of the class A‑5 and class A‑6 notes have been reduced to zero.

As of the October 2015 distribution date, no principal payments have been made or allocated to the class A-7A notes and there were no amounts on deposit in the accumulation account. Therefore, there will be no payment of principal on the class A-7A notes from the trust on the January 25, 2016 reset date.

RESET DATE PROCEDURES

Remarketing Terms Determination Date. Not later than eight business days prior to the related reset date, which we refer to as the remarketing terms determination date and which, for the class A-7A notes and with respect to the current reset date, is January 12, 2016, the remarketing agents, in consultation with the administrator, will determine for the reset rate notes, among other things, the applicable currency, the applicable interest rate mode, whether principal will be paid periodically or at the end of the related reset period, the index, if applicable, the length of the related reset period and the applicable distribution dates, the identities of any potential swap counterparties, if applicable, and the related all hold rate. If the class A-7A notes are listed on the Luxembourg Stock Exchange, a copy of such notice will be sent to the Luxembourg Stock Exchange and will also be published in a leading newspaper having general circulation in Luxembourg (which is expected to be Luxemburger Wort) and/or on the Luxembourg Stock Exchange's website at http://www.bourse.lu.

See "Description of the Notes—The Reset Rate Notes" in this free-writing prospectus.

With respect to the current reset date for the class A-7A notes, the remarketing terms determination date is January 12, 2016.

All Hold Rate. The all hold rate, if applicable, for any class of reset rate notes will be the interest rate applicable for that class of reset rate notes for the next reset period if all holders of that class of reset rate notes choose not to tender their notes to the remarketing agents. For the class A-7A notes and the current reset date however, tender is mandatory and, therefore, the all hold rate is not applicable. See "Description of the Notes—Reset Rate Notes—Foreign

Exchange Mode" in this free-writing prospectus.

Tendered Notes. Absent a failed remarketing, holders of reset rate notes denominated in U.S. Dollars in the then-current reset period and the immediately following reset period that wish to sell some or all of their reset rate notes on a reset date will be able to obtain a 100% repayment of principal by tendering the applicable amount of their reset rate notes pursuant to the remarketing process. Holders of reset rate notes denominated in a non-U.S. Dollar currency in the then-current reset period or the immediately following reset period will be deemed to have tendered their reset rate notes pursuant to the remarketing process.

Hold Notices. If a class of reset rate notes is denominated in a non-U.S. Dollar currency in either the then-current or the immediately following reset period (as has been the case with respect to the current reset period for the class A-7A notes), they will be subject to mandatory tender, the related noteholders will be deemed to have tendered their class of reset rate notes on the related reset date, and hold notices will not be applicable.

If a class of reset rate notes is denominated in U.S. Dollars in both the then-current and the immediately following reset period, holders of such notes will be given until the notice date, which is 12:00 p.m. (noon), New York City time, six business days prior to the related reset date, to choose whether to hold their notes by delivering a hold notice to the remarketing agent. Any reset rate notes for which a hold notice is not timely received on or prior to the notice date, will be deemed to be tendered and will be remarketed on the related reset date.

Absent a failed remarketing or exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries, holders of reset rate notes denominated in U.S. Dollars that wish to sell some or all of their reset rate notes on a reset date will be able to obtain a 100% repayment of principal by tendering the applicable amount of their reset rate notes pursuant to the remarketing process.

Tender is mandatory for a class of reset rate notes at the end of any reset period if such notes are denominated in a non-U.S. Dollar currency during either the then-current (as has been the case with respect to the class A-7A notes during the initial reset period) or the immediately following reset period, and all holders of such class are deemed to have tendered their notes pursuant to the remarketing process. Absent a failed remarketing or exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries, holders of reset rate notes denominated in a non-U.S. Dollar currency who are deemed to have tendered their notes (as will be the case for the class A-7A noteholders with respect to the January 14, 2016 notice date) pursuant to the remarketing process will receive a 100% repayment of principal of their reset rate notes on the related reset date. However, if there is a failed remarketing with respect to a class of reset rate notes, existing holders of such reset rate notes will remain noteholders of such reset rate notes during the immediately following reset period (absent any separate secondary market trades) regardless of whether they tendered their reset rate notes for remarketing or if their notes were deemed tendered automatically, and such noteholders will not be permitted to exercise any remedies as a result of the failure of such notes to be successfully remarketed on the related reset date. See "—Failed Remarketing" below.

Spread Determination Date. Absent an exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries or, with respect to reset rate

notes denominated in U.S. Dollars, receipt by the remarketing agents of hold notices from 100% of the holders of the related class of reset rate notes, the spread or the applicable fixed rate for each such class of notes will be determined by the remarketing agents at any time after the notice date but no later than 3:00 p.m., New York City time, on the date which is three business days prior to the related reset date. We refer to the date during this period when the spread or the applicable fixed rate is determined as the spread determination date.

For the class A-7A notes and with respect to the current reset date, the related spread determination date may occur any time during the period beginning after 12:00 p.m. (noon), New York City time, on January 14, 2016 and ending at 3:00 p.m., New York City time, on January 20, 2016. The spread will be the lowest spread to three-month LIBOR which would permit all of the notes tendered for remarketing to be purchased at a price equal to 100% of the outstanding principal balance of that class.

Absent a failed remarketing or an exercise of the related call option by Navient Corporation or one of its wholly-owned subsidiaries with respect to the January 25, 2016 reset date, the class A-7A notes will be reset to bear interest until their next reset date at an annual floating rate equal to the sum of three-month LIBOR plus �� %, based on the actual number of days elapsed in each accrual period and a 360-day year. LIBOR will be determined as specified under "Additional Information Regarding the Notes—Determination of Indices—LIBOR" in the free-writing base prospectus.

Reset Dates. Reset dates always occur on a distribution date and reset periods always end on the day before a distribution date and may not extend beyond the maturity date of the related class of reset rate notes. The current reset date for the class A-7A notes is January 25, 2016. The next scheduled reset date for the class A-7A notes is April 25, 2016. The maturity date for the class A-7A notes is January 25, 2041.

Tender is mandatory for any reset rate notes that are denominated in a non-U.S. Dollar currency during either the then-current (as is the case with respect to the class A-7A notes and the reset period ending on January 25, 2016) or the immediately following reset period and all holders of such reset rate notes will be deemed to have tendered their notes on the related reset date. If there is a failed remarketing of the reset rate notes with respect to such reset date, existing holders of such notes will not be permitted to exercise any remedies as a result of the failure of their reset rate notes to be remarketed on such reset date.

Failed Remarketing. There will be a failed remarketing with respect to a class of reset rate notes on a related reset date if:

| · | the remarketing agents, in consultation with the administrator, cannot determine the applicable required reset terms for such class of notes on or before the related remarketing terms determination date; |

| · | the remarketing agents cannot establish the required spread or fixed rate on the spread determination date; |

| · | the remarketing agents are unable to remarket some or all of the tendered reset rate notes at the spread or fixed rate set by the remarketing agents (and the remarketing agents do not choose to purchase such reset rate notes themselves); |

| · | if applicable, one or more interest rate and/or currency swap agreements satisfying all required criteria cannot be obtained; |

| · | any rating agency then rating the notes has not confirmed or upgraded its then-current ratings of any class of notes, if such confirmation is required; or |

| · | certain other conditions specified in the remarketing agreement are not satisfied with respect to such class of notes. |

In the event of a failed remarketing with respect to a class of reset rate notes at a time when such notes are denominated in a currency other than U.S. Dollars (as has been the case during the initial reset period with respect to the class A-7A notes):

| · | all holders will retain their notes (including in all deemed mandatory tender situations, as is the case for the current reset date with respect to the class A-7A notes); |

| · | such notes will remain denominated in the then-current currency (which, with respect to the class A-7A notes and the current reset period, is Euros); |

| · | each currency swap counterparty will be entitled to receive quarterly payments from the trust at an increased LIBOR-based rate (referred to in this free-writing prospectus as the "extension rate"); |

| · | the trust will be entitled to receive from the currency swap counterparty, for payment to the related noteholders, quarterly floating rate payments at the specified failed remarketing rate; and |

| · | the related reset period will be three months. |

With respect to the initial class A-7A currency swap agreement, the extension rate payable by the trust to the initial currency swap counterparty will be an annual rate of three‑month LIBOR plus 0.75% and the failed remarketing rate payable by the initial currency swap counterparty to the trust, for payment to the class A-7A noteholders, will be an annual rate of three-month EURIBOR plus 0.55%, which terms will continue to apply to the class A-7A notes in the event of a failed remarketing on the January 25, 2016 reset date. See "Description of the Notes—Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures" in this free-writing prospectus.

In the event of a failed remarketing with respect to a class of reset rate notes at a time when such notes are denominated in U.S. Dollars:

| · | all holders will retain their notes; |

| · | the related interest rate will be reset to a failed remarketing rate of three-month LIBOR plus 0.75%; and |

| · | the related reset period will be three months. |

If there is a failed remarketing on the January 25, 2016 reset date, the class A-7A notes will continue to have an outstanding principal balance of €500,000,000.

Call Option. Navient Corporation, or one of its wholly-owned subsidiaries, has the option to purchase each class of reset rate notes in its entirety as of any reset date. If Navient Corporation, or one of its wholly-

owned subsidiaries, exercises this right, the interest rate for that class of reset rate notes, which we refer to as the call rate, will be (1) for any class for which no related swap agreement was in effect during the previous reset period, the floating rate applicable for the most recent reset period during which the failed remarketing rate was not in effect, or (2) for any class for which one or more related swap agreements were in effect during the previous reset period (as has been the case with respect to the current reset period for the class A-7A notes), an annual LIBOR-based interest rate equal to the weighted average of the floating rates of interest that the trust paid to the related swap counterparties hedging the currency and/or basis risk for the related notes during the preceding reset period.

The call rate will continue to apply for each reset period while Navient Corporation, or any subsidiary, retains that class of reset rate notes pursuant to its exercise of the related call option. In either case, the next reset date for that class of reset rate notes will occur on the next distribution date.

Listing. For so long as a class of reset rate notes is listed on the Luxembourg Stock Exchange, the administrator will notify the Luxembourg Stock Exchange of any exercise of the related call option and a notice will be published in a leading newspaper having general circulation in Luxembourg, which is expected to be Luxemburger Wort, and/or on the Luxembourg Stock Exchange's website at http://www.bourse.lu.

See "Description of the Notes—The Reset Rate Notes" in this free-writing prospectus for a more complete discussion of the remarketing process.

Denominations. During any reset period when a class of reset rate notes is denominated in U.S. Dollars, they will be issued in minimum denominations of $250,000, and additional increments of $1. During any reset period when a class of reset rate notes is denominated in a non-U.S. Dollar currency, they will be issued in minimum denominations of the applicable currency equivalent (approximately) of $250,000 and additional increments of the applicable currency equivalent of $1 (which will be determined by reference to the exchange rate to be set forth in the related currency swap agreement); provided, that during any reset period when a class of reset rate notes is denominated in Euros (as has been the case during the initial reset period with respect to the class A-7A notes), such notes will be issued in minimum denominations of €100,000 and additional increments of €1; and provided, further, that during any reset period when a class of reset rate notes is denominated in Pounds Sterling, such notes will be issued in minimum denominations of £100,000 and additional increments of £1.

The administrator will notify the Luxembourg Stock Exchange of the applicable exchange rate for the applicable class of reset rate notes and a notice containing that exchange rate will also be published in a leading newspaper having general circulation in Luxembourg, which is expected to be Luxemburger Wort, and/or on the Luxembourg Stock Exchange's website at http://www.bourse.lu. The reset rate notes may be held and transferred, and will be offered and sold, in principal balances of not less than their applicable minimum denomination.

The reset rate notes will only be available in book-entry form through The Depository Trust Company, Clearstream, Luxembourg and the Euroclear System. You will not receive a certificate representing your reset rate notes except in very limited circumstances.

DATES

The closing date for the original offering was November 15, 2005. We refer to this date as the closing date.

The statistical cutoff date for the original offering was October 24, 2005. We refer to this date as the statistical cutoff date.

A distribution date for each class of notes is the 25th of each January, April, July and October. If any January 25, April 25, July 25 or October 25 is not a business day, the distribution date will be the next business day.

Interest and principal will be payable to holders of record as of the close of business on the record date, which is the day before the related distribution date.

Unless otherwise indicated, all information provided in this free-writing prospectus regarding the notes and the pool of trust student loans is presented as of November 30, 2015. We refer to this date as the statistical disclosure date.

PREPAYMENTS, EXTENSIONS, WEIGHTED AVERAGE REMAINING LIFE AND EXPECTED MATURITY OF THE CLASS A-7A NOTES

The projected weighted average remaining life to the April 25, 2016 reset date of the class A-7A notes (and assuming a successful remarketing of such notes on the current reset date) under various usual and customary prepayment scenarios is approximately 0.25 years. More information may be found under "Prepayments, Extensions, Weighted Average Remaining Life and Expected Maturity of the Class A-7A Notes," to be included as Exhibit I to the final remarketing prospectus supplement to be distributed to potential investors on or prior to the spread determination date.

THE OTHER NOTES

On the closing date, the trust also issued its class A-1, class A-2, class A-3, class A-4, class A-5, class A-6, class A-7B and class B notes, as more specifically described below.

Floating Rate Class A Notes:

| · | Class A-1 Student Loan-Backed Notes in the original principal amount of $233,000,000, none of which remain outstanding; |

| · | Class A-2 Student Loan-Backed Notes in the original principal amount of $446,000,000, none of which remain outstanding; |

| · | Class A-3 Student Loan-Backed Notes in the original principal amount of $240,000,000, none of which remain outstanding; |

| · | Class A-4 Student Loan-Backed Notes in the original principal amount of $563,000,000, none of which remain outstanding. |

| · | Class A-5 Student Loan-Backed Notes in the original principal amount of $278,962,000, and currently outstanding in the amount of $116,093,663.53. |

| · | Class A-7B Student Loan-Backed Notes in the original principal amount of $380,000,000, and currently outstanding in the same amount. |

Reset Rate Class A Notes:

| · | Class A-6 Student Loan-Backed Notes in the original principal amount of |

| | €235,000,000, and currently outstanding in the same amount. |

Class B Notes:

| · | Class B Student Loan-Backed Notes in the original principal amount of $93,381,000, and currently outstanding in the amount of $64,321,600.86. |

We sometimes refer to:

| · | the floating rate class A notes and the reset rate notes collectively as the class A notes; |

| · | the floating rate class A notes and the class B notes as the floating rate notes; |

| · | the class A-6 notes and class A-7A notes, together, as the reset rate notes; and |

| · | the floating rate notes and the reset rate notes as the notes. |

Interest Rates. The outstanding floating rate notes bear interest at an annual rate equal to the sum of three-month LIBOR and the applicable spread listed in the table below:

| Class | | Spread |

Class A-4 | | plus 0.10% |

Class A-5 | | plus 0.12% |

Class A-7B | | plus 0.16% |

Class B | | plus 0.30% |

For all classes of floating rate notes, the administrator determines LIBOR as specified under "Additional Information Regarding the Notes—Determination of Indices—LIBOR" in the free-writing base prospectus. For the floating rate notes, interest is calculated based on the actual number of days elapsed in each accrual period and a 360-day year.

The class A-6 notes had their initial reset date on October 25, 2012. A failed remarketing was declared with respect to the October 25, 2012 reset date and each subsequent reset date until the April 25, 2013 reset date. On that date, the class A-6 notes were reset until maturity at an annual rate of three-month LIBOR plus 0.55%.

ALL NOTES

Interest Payments. Interest accrues on the outstanding principal balance of the notes during each accrual period and is payable on the related distribution date.

An accrual period for the floating rate notes begins on a distribution date and ends on the day before the next distribution date.

An accrual period for reset rate notes that bear a fixed rate of interest will begin on the 25th day of the month of the immediately preceding distribution date and end on the 24th day of the month of the current distribution date.

Principal Payments. Principal is payable or allocable on each distribution date in an amount generally equal to (a) the principal distribution amount for that distribution date plus (b) any shortfall in the payment of principal as of the preceding distribution date.

Priority of Principal Payments. We apply or allocate principal sequentially on each distribution date as follows:

| · | first, the class A noteholders' principal distribution amount: |

| · | to the class A-5 notes until their principal balance is reduced to zero; and then |

| · | to the class A-6 notes until their principal balance is reduced to zero; provided, that any payments due to the reset rate noteholders will be |

| | allocated to the accumulation account if the class A-6 notes are then structred not to receive a payment of principal until the end of the related reset period (as is currently the case); and then |

| · | pro rata, to the class A-7A and class A-7B notes until their principal balance is reduced to zero; provided that either (a) if the class A-7A notes are then denominated in a currency other than U.S. Dollars (as has been the case with respect to the initial reset period for the class A-7A notes), any payments due to the applicable reset rate noteholders will be made to the related currency swap counterparty or (b) if the class A-7A notes are then structured not to receive a payment of principal until the end of the related reset period, any payments due to the applicable reset rate noteholders will be allocated to the related accumulation account; and |

| · | second, on each distribution date on and after the stepdown date, and provided that no trigger event is in effect on such distribution date, the class B noteholders' principal distribution amount, to the class B notes, until their principal balance is reduced to zero. |

For purposes of priority first above, if a class of reset rate notes is then bearing interest at a fixed rate, the outstanding principal balance of that class or its U.S. Dollar equivalent, as applicable, will be deemed to have been reduced by any amounts on deposit in the related accumulation account (exclusive of any investment earnings).

If any class of reset rate notes is structured not to receive a payment of principal until the end of the related reset period, principal payments will be allocated to the related accumulation account for such class of notes, where such funds will remain until the next related reset date for such class of notes. However, if during a reset period any class of reset rate notes is denominated in a currency other than U.S. Dollars and one or more currency swap agreements are in effect relating to that class (as has been the case with respect to the current reset period for the class A-7A notes) (a) the amounts on deposit in the related accumulation account will be paid to the related currency swap counterparty, who will in turn pay to the trust, for payment to the holders of the related class of notes, the non-U.S. Dollar currency equivalent of those amounts received at the exchange rate set forth in the related currency swap agreements and (b) all amounts will be paid to the applicable noteholders on the second business day following the related reset date, together, with respect to the first reset date after such cross-currency swap agreements are entered into, with additional interest on the applicable principal balance at the related interest rate.

Payments or allocations of principal to the reset rate notes will be made pro rata among those classes based on their outstanding principal balances.

On each distribution date prior to the stepdown date, which occurred on the January 2011 distribution date, the class B notes were not entitled to any payments of principal. On each distribution date on and after the stepdown date, provided that no trigger event is in effect, the class B notes will continue to be entitled to their pro rata share of principal, subject to the existence of sufficient available funds.

The class A noteholders' principal distribution amount is equal to the principal distribution amount times the class A percentage, which is equal to 100% minus the class B percentage. The class B noteholders' principal distribution amount is

equal to the principal distribution amount times the class B percentage.

The class B percentage was 0% prior to the stepdown date and will be 0% on every other distribution date if a trigger event is in effect. On each other distribution date, the class B percentage is the percentage obtained by dividing:

| · | the aggregate principal balance of the class B notes, by |

| · | the aggregate principal balance, or U.S. Dollar equivalent, of all outstanding notes less all amounts on deposit, exclusive of any investment earnings, in the accumulation account, in each case determined immediately prior to that distribution date. |

A trigger event will be in effect on any distribution date if the outstanding principal balance of the notes, less any amounts on deposit in the accumulation account, exclusive of investment earnings and after giving effect to distributions to be made on that distribution date, would exceed the adjusted pool balance for that distribution date.

See "Description of the Notes—Distributions" in this free-writing prospectus for a more detailed description of principal payments.

Maturity Dates.

The class A-1 notes were repaid in full on the October 2006 distribution date.

The class A-2 notes were repaid in full on the October 2007 distribution date.

The class A-3 notes were repaid in full on the October 2009 distribution date.

The class A-4 notes were repaid in full on the July 2014 distribution date.

Each class of outstanding notes will mature no later than the date set forth in the table below for that class:

| Class | | Maturity Date |

Class A-5 | | January 27, 2025 |

Class A-6 | | October 26, 2026 |

Class A-7A | | January 25, 2041 |

Class A-7B | | January 25, 2041 |

Class B | | January 25, 2041 |

The actual maturity of any class of outstanding notes could occur earlier if, for example:

| · | there are prepayments on the trust student loans; |

| · | the servicer exercises its option to purchase all remaining trust student loans, which will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance; or |

| · | the servicer has exercised its purchase option described above, the indenture trustee auctions the remaining trust student loans, which absent an event of default under the indenture, will not occur until the first distribution date on which the pool balance is 10% or less of the initial pool balance. |

The initial pool balance is equal to the sum of: (i) the pool balance as of the closing date and (ii) all amounts deposited into the supplemental purchase account and the add‑on consolidation loan account on the closing date.

Subordination of the Class B Notes. Payments of interest on the class B notes will be subordinate to payments of interest on the class A notes and to certain trust swap payments due to any swap

counterparty, if applicable. In general, payments of principal of the class B notes will be subordinate to the payment of both interest on and principal of the class A notes, trust swap payments due to any swap counterparty and any deposits required to be made into any supplemental interest account or the investment reserve account. See "Description of the Notes—The Notes— The Class B Notes—Subordination of the Class B Notes" in this free-writing prospectus.

Potential Future Interest Rate Cap Agreement. At any time, at the written direction of the administrator, the trust may enter into one or more interest rate cap agreements (collectively, the "potential future interest rate cap agreement") with one or more eligible swap counterparties (collectively, the "potential future cap counterparty") to hedge some or all of the interest rate risk of the notes. Any payment due by the trust to a potential future cap counterparty would be payable only out of funds available for distribution under clause (p)(1) of "

Description of the Notes—Distributions—Distributions from the Collection Account" in this free-writing prospectus. Any payments received from a potential future cap counterparty would be included in available funds. It is not anticipated that the trust would be required to make any payments to any potential future cap counterparty under any potential future interest rate cap agreement other than an upfront payment and, in some circumstances, a termination payment. See "

Description of the Notes—Potential Future Interest Rate Cap Agreement" in this free-writing prospectus.

As of the January 25, 2016 reset date, the trust will not have entered into any potential future interest rate cap agreements.

Security for the Notes. The notes are secured by the assets of the trust, primarily the trust student loans.

INDENTURE TRUSTEE AND PAYING AGENT

The trust issued the notes under an indenture dated as of November 1, 2005. Under the indenture, Deutsche Bank National Trust Company acts as successor indenture trustee for the benefit of, and to protect the interests of, the noteholders and acts as paying agent for the notes.

LUXEMBOURG PAYING AGENT

As long as the rules of the Luxembourg Stock Exchange require a Luxembourg paying agent, the depositor will cause one to be appointed. Deutsche Bank Luxembourg S.A. acts as the Luxembourg paying agent with respect to any of the notes listed on the Official List of the Luxembourg Stock Exchange and traded on the Luxembourg Stock Exchange's Euro MTF Market.

ELIGIBLE LENDER TRUSTEE

The trust was created under a trust agreement dated as of October 25, 2005. Deutsche Bank Trust Company Americas, a New York banking corporation, is the successor eligible lender trustee under the trust agreement. It holds legal title to the assets of the trust.

DELAWARE TRUSTEE

BNY Mellon Trust of Delaware (formerly known as BNYM (Delaware)), a Delaware banking corporation, is the Delaware trustee. The Delaware trustee acts in the capacities required under the Delaware Statutory Trust Act and under the trust agreement. Its principal Delaware address is 100 White Clay Center, Suite 102, Newark, Delaware 19711.

REMARKETING AGENTS

The remarketing agents will be entitled to a fee on each reset date in connection with a successful remarketing of the class A-7A

notes from amounts on deposit in the remarketing fee account. In connection with a successful remarketing of the class A-7A notes on the January 25, 2016 reset date, the remarketing agents will be paid a remarketing fee by the trust in an amount not to exceed $[1,673,887.50]. As of the October 2015 distribution date, there was $1,673,000.00 on deposit in the remarketing fee account. The trust will also reimburse the remarketing agents, on a subordinated basis, for certain out-of-pocket expenses incurred in connection with each reset date.

ADMINISTRATOR AND SPONSOR

Navient Solutions, Inc. (formerly known as Sallie Mae, Inc.) is the sponsor of the trust and acts as the administrator of the trust under an administration agreement dated as of the closing date. Navient Solutions, Inc. is a Delaware corporation and a wholly-owned subsidiary of Navient Corporation. Subject to certain conditions, Navient Solutions, Inc. may transfer its obligations as administrator to an affiliate.

INFORMATION ABOUT THE TRUST

The trust is a Delaware statutory trust.

The only activities of the trust that are currently permitted are acquiring, owning and managing the trust student loans and the other assets of the trust, issuing and making payments on the notes, entering into any required swap agreements or potential future interest rate cap agreements and making payments thereunder and other related activities. See "The Trust—General" in this free-writing prospectus.

Navient Funding, LLC, as depositor, after acquiring the student loans from one of VG Funding LLC ("VG Funding") or Navient Credit Finance Corporation (formerly known as SLM Education Education Credit Finance Corporation) ("Navient CFC") under separate purchase agreements, sold them to the trust under a sale agreement (we sometimes refer to Navient CFC and VG Funding as the "sellers"), each dated as of the closing date. The depositor is a limited liability company of which Navient CFC is the sole member. Chase Manhattan Bank USA, National Association, as interim eligible lender trustee, initially held legal title to the student loans for the depositor under an interim trust arrangement prior to their transfer to the trust and then as eligible lender trustee for the benefit of the trust under the trust agreement. Deutsche Bank Trust Company Americas now serves as successor interim eligible lender trustee on behalf of the depositor and successor eligible lender trustee on behalf of the trust.

Its Assets

The assets of the trust include:

| · | the trust student loans; |

| · | collections and other payments on the trust student loans; |

| · | funds it currently holds or will hold from time to time in its trust accounts, including the collection account; the reserve account; any accumulation account; any supplemental interest account; any investment reserve account; any investment premium purchase account; the remarketing fee account; the Euro account; and if any class of reset rate notes is denominated in a currency other than U.S. Dollars or Euros, a currency account; |

| · | its rights under the transfer and servicing agreements, including the right to require VG Funding (or Navient Solutions, Inc., as servicer, |

| | acting on its behalf), Navient CFC, the depositor or the servicer to repurchase trust student loans from it or to substitute loans under certain conditions; |

| · | its rights under any swap agreement or potential future interest rate cap agreement, as applicable; and |

| · | its rights under the guarantee agreements with guarantors. |

The rest of this section describes the trust student loans and trust accounts more fully.

Trust Student Loans. The trust student loans are education loans to students and parents of students made under the Federal Family Education Loan Program, known as the FFELP. All of the trust student loans are consolidation loans.

Consolidation loans are used to combine a borrower's obligations under various federally authorized student loan programs into a single loan. See "Appendix A—Federal Family Education Loan Program" in this free-writing prospectus, which supersedes in its entirety Appendix A to the free-writing base prospectus.

The trust student loans were selected from student loans owned by Navient CFC or VG Funding, or their affiliates, based on the criteria established by the depositor, as described in the free-writing base prospectus.

Guaranty agencies described in this document guarantee all of the trust student loans. They are also reinsured by the United States Department of Education (which we refer to as the Department of Education).

Initial Trust Student Loans. The initial trust student loans had a pool balance of approximately $3,001,136,238 as of the original cutoff date. On the closing date, $9,818,772.66 was deposited into the supplemental purchase account and during the supplemental purchase period, $9,696,783.54 aggregate principal balance of trust student loans was added to the pool balance through the purchase of additional student loans using funds on deposit in the supplemental purchase account. On the closing date, $20,000,000 was deposited into the add-on consolidation loan account and during the consolidation loan add-on period, $14,693,257.09 aggregate principal balance of trust student loans was added to the pool balance through the purchase of add-on consolidation loans using funds on deposit in the add-on consolidation loan account. The trust student loans have a pool balance of approximately $1,413,288,538 as of the statistical disclosure date.

As of the statistical disclosure date, (i) the weighted average annual borrower interest rate of the trust student loans was approximately 3.91% and (ii) the weighted average remaining term of the trust student loans to scheduled maturity was approximately 211 months.

Special allowance payments on 3.45% of the trust student loans by principal balance (as of the statistical disclosure date) are based on the 91-day treasury bill rate. Special allowance payments on 96.55% of the trust student loans by principal balance (as of the statistical disclosure date) are based on the one-month LIBOR rate.

Approximately 2.81% of the trust student loans by principal balance (as of the statistical disclosure date) are segments of consolidation loans that have a variable rate of interest that is not subject to any cap on the interest rate and that is not eligible to receive special allowance payments or interest subsidy payments.

For more details concerning the trust student loans, see "Annex A—The Trust Student Loan Pool" attached to this free-writing prospectus.

Collection Account. The administrator established and maintains the collection account as an asset of the trust in the name of the indenture trustee. The administrator will deposit collections on the trust student loans, interest subsidy payments and special allowance payments into the collection account, as described in this free-writing prospectus and the free-writing base prospectus.

Reserve Account. The administrator established and maintains the reserve account as an asset of the trust in the name of the indenture trustee. As of the October 2015 distribution date, the amount on deposit in the reserve account was $4,531,704.00. Funds in the reserve account may be replenished on each distribution date by additional funds available from the trust after all prior required distributions have been made. See "Description of the Notes—Distributions."

Amounts in the reserve account in excess of the specified reserve account balance (as described below) on any distribution date, after the payments described below, will be deposited into the collection account for distribution on that distribution date.

The specified reserve account balance is the amount required to be maintained in the reserve account. The specified reserve account balance for any distribution date will be equal to the greater of:

| · | 0.25% of the pool balance at the end of the related collection period and |

The specified reserve account balance will be subject to adjustment as described in this free-writing prospectus. In no event will it exceed the outstanding principal balance of the notes, less all amounts then on deposit in the accumulation account (exclusive of investment earnings), if any.

The reserve account will be available to cover any shortfalls in payments of the primary servicing fee, the administration fee, the remarketing fees, if any, the class A noteholders' interest distribution amount (but only up to an annual interest rate equal to three-month EURIBOR plus 0.55% in the case of the class A-7A notes), the class B noteholders' interest distribution amount, and payments due to any swap counterparty in respect of interest and certain swap termination payments. As of the October 2015 distribution date, amounts on deposit in the reserve account have not been required for these purposes.

In addition, the reserve account will be available:

| · | on the related maturity date for each class of class A notes and upon termination of the trust, to cover shortfalls in payments of the class A noteholders' principal and accrued interest to the related class of notes; and |

| · | on the class B maturity date and upon termination of the trust, to cover shortfalls in payments of the class B noteholders' principal and accrued interest, any carryover servicing fees, any remaining swap termination payments and remarketing fees and expenses. |

The reserve account enhances the likelihood of payment to noteholders. In certain circumstances, however, the reserve account could be depleted. This depletion could result in shortfalls in distributions to noteholders.

If the market value of the reserve account, together with amounts on deposit in the supplemental interest account on any distribution date, is sufficient to pay the remaining principal (for such purpose, as reduced by all amounts, other than investment earnings, on deposit in the accumulation account) and interest accrued on the notes and any carryover servicing fee, amounts on deposit in those accounts will be so applied on that distribution date. See "

Description of the Notes—Credit Enhancement—Reserve Account" in this free-writing prospectus

.

Capitalized Interest Account. All funds on deposit in the capitalized interest account that was created and funded on the closing date were transferred to the collection account on the January 2007 distribution date. No additional sums were subsequently or will be deposited into this account.

Remarketing Fee Account. The administrator established and maintains a remarketing fee account as an asset of the trust in the name of the indenture trustee, for the benefit of the remarketing agents and the class A noteholders. On the October 2011 distribution date, which was the distribution date one year prior to the initial reset date for the class A-7A notes, the trust began to deposit into the remarketing fee account available funds up to the related quarterly required amount. The trust is required to make such deposits on each related distribution date until the balance on deposit in the remarketing fee account reaches the targeted level for the related reset date, prior to the payment of interest on the notes. As of the January 25, 2016 reset date, the required amount for this account will not exceed $1,673,000. As of the October 2015 distribution date, there was $1,673,000.00 on deposit in the remarketing fee account.

Investment earnings on deposit in the remarketing fee account are withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date. In addition, if on any distribution date, a class A note interest shortfall would exist, or if on the maturity date for any class of class A notes, available funds would not be sufficient to reduce the principal balance of that class to zero, the amount of that class A note interest shortfall or principal deficiency, as applicable, may be withdrawn from the remarketing fee account and used for payment of interest or principal on the class A notes, to the extent sums are on deposit in that account. See "Description of the Notes—The Reset Rate Notes—Tender of Reset Rate Notes; Remarketing Procedures" in this free-writing prospectus.

Accumulation Account. The administrator established or will establish and maintains or will maintain in the name of the indenture trustee a separate accumulation account for the benefit of either class of reset rate notes, generally, whenever such class bears interest at a fixed rate or bears interest at a floating rate but is structured not to receive a payment of principal until the end of the related reset period. With respect to each such class for the related reset period, on each distribution date, the indenture trustee will deposit any payments of principal allocated to that class, in U.S. Dollars, into the related accumulation account. All sums, exclusive of investment earnings, will be paid either:

| · | if the applicable class of reset rate notes is then denominated in U.S. Dollars, on the next related reset date to the noteholders of that class, after all other required distributions have been made on that reset date; or |

| · | if the applicable class of reset rate notes is then denominated in a non- |

| | U.S. Dollar currency (as has been the case during the initial reset period with respect to the class A-7A notes), on or about the next related reset date, to the related currency swap counterparties (which counterparties will in turn pay the applicable currency equivalent of such amounts to the trust, for payment to the related noteholders on the second business day following such reset date), after all other required distributions have been made on that reset date. |

Amounts on deposit in the accumulation account, exclusive of investment earnings, may be used only to pay principal to the related class of reset rate notes (or to the related swap counterparties, if applicable) and for no other purpose. Investment earnings on amounts on deposit in the accumulation account will be withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date.

Amounts on deposit in the accumulation account may be invested in eligible investments that can be purchased at a price equal to par, at a discount, or at a premium. Eligible investments may be purchased at a premium over par only if there are sufficient amounts on deposit in the investment premium purchase account described below to pay the amount of the purchase price in excess of par.

As of the October 2015 distribution date, there were no funds on deposit in any accumulation account for any class of reset rate notes.

Investment Premium Purchase Account. The administrator established and maintains, in the name of the indenture trustee, an investment premium purchase account. On each distribution date when funds are deposited into an accumulation account, the indenture trustee will be required to deposit, subject to sufficient available funds, an amount generally equal to 1.0% of the amount deposited into the accumulation account into the investment premium purchase account (together with any carryover amounts from previous distribution dates if there were insufficient available funds on any previous distribution date to make the required deposits in full).

Amounts on deposit in the investment premium purchase account may be used from time to time to pay amounts in excess of par on eligible investments purchased with funds on deposit in the accumulation account. Amounts not used to pay such premium purchase amounts will become a part of available funds on future distribution dates pursuant to a formula set forth in the administration agreement.

As of the October 2015 distribution date there were no amounts on deposit in the investment premium purchase account.

Investment Reserve Account. The administrator established and maintains, in the name of the indenture trustee, an investment reserve account. On any distribution date, and to the extent of available funds, if the ratings of any eligible investments related to an accumulation account have been downgraded by one or more rating agencies, the indenture trustee will deposit into the investment reserve account an amount, if any, to be set by each applicable rating agency in satisfaction of the rating agency condition, which amount will not exceed the amount of the unrealized loss on the related eligible investments. On each distribution date, all amounts on deposit in the investment reserve account either will be withdrawn from the investment reserve account and deposited

into the accumulation account in an amount required to offset any realized losses on eligible investments related to the accumulation account, or will be deposited into the collection account to be included in available funds on that distribution date.

As of the October 2015 distribution date there were no amounts on deposit in the investment reserve account.

Supplemental Interest Account. The administrator will establish and maintain, in the name of the indenture trustee, a supplemental interest account with respect to the accumulation account for a class of reset rate notes.

On each distribution date when amounts are deposited into or are on deposit in the accumulation account for a class of reset rate notes, the indenture trustee, subject to sufficient available funds, will deposit into the supplemental interest account an amount sufficient to pay either to the reset rate noteholders or to each swap counterparty, as applicable, the floating rate payments due to the reset rate noteholders or the swap counterparty, as applicable, through the next distribution date at the related LIBOR-based floating rate on all amounts on deposit in the accumulation account, after giving effect to an assumed rate of investment earnings on that account.

All amounts on deposit in the supplemental interest account will be withdrawn on each distribution date, deposited into the collection account and included in available funds for that distribution date.

As of the October 2015 distribution date there were no amounts on deposit in the supplemental interest account.

Euro Account. The administrator established and maintains a Euro account as an asset of the trust in the name of the indenture trustee, for the benefit of the reset rate noteholders, during any reset period when the reset rate notes are denominated in Euros (as has been the case during, with respect to the class A-7A notes, the current reset period and, with respect to the class A-7A notes, their initial reset period). Any payments received in Euros from a swap counterparty will be deposited into the Euro account, as described in this free-writing prospectus.

Other Currency Accounts. If a class of reset rate notes is denominated in a currency other than U.S. Dollars or Euros during any related reset period and the administrator has not previously established a currency account for the applicable currency, then the administrator will establish and maintain a currency account for the applicable currency in the name of the indenture trustee, for the benefit of the related noteholders. Any payments received from a swap counterparty in a currency other than U.S. Dollars will be deposited into such a currency account.

INITIAL CURRENCY SWAP AGREEMENTS

On the closing date, the trust entered into initial currency swap agreements with each of Credit Suisse First Boston International and Deutsche Bank AG, New York Branch as the initial class A-6 currency swap counterparty and class A-7A currency swap counterparty, respectively, to hedge the currency exchange risk that resulted from:

| · | the payment of principal and interest in Euros by the trust to the class A‑6 and class A‑7A noteholders during the related applicable reset periods; and |

| · | the required payment in Euros to the class A-6 and class A-7A noteholders upon the first successful remarketing of the applicable class of reset rate notes. |

The initial class A-6 currency swap agreement terminated in accordance with its terms on April 25, 2013.

The initial class A-7A currency swap agreement will terminate in accordance with its terms on the earliest to occur of:

| · | the first reset date on which there is a successful remarketing of the class A-7A notes; |

| · | the reset date on which the call option is exercised; |

| · | the distribution date on which the outstanding principal balance of the class A-7A notes is reduced to zero; or |

| · | January 25, 2041 (which is the maturity date of the class A-7A notes). |

Other than the initial class A-7A currency swap agreement, the trust may not enter into additional swap agreements with respect to the class A-7A notes unless each rating agency then rating the notes confirms its then-current ratings of the class A-7A notes and, with respect to any currency swap agreements, certain additional criteria are satisfied (for a description of such criteria, see "Description of the Notes—The Reset Rate Notes—Foreign Exchange Mode," "—Floating Rate Mode" and "—Fixed Rate Mode" in this free-writing prospectus).

If the class A-7A notes are successfully remarketed on the January 25, 2016 reset date, the initial class A-7A currency swap agreement will terminate in accordance with its terms on that date.

ADMINISTRATION OF THE TRUST

Distributions

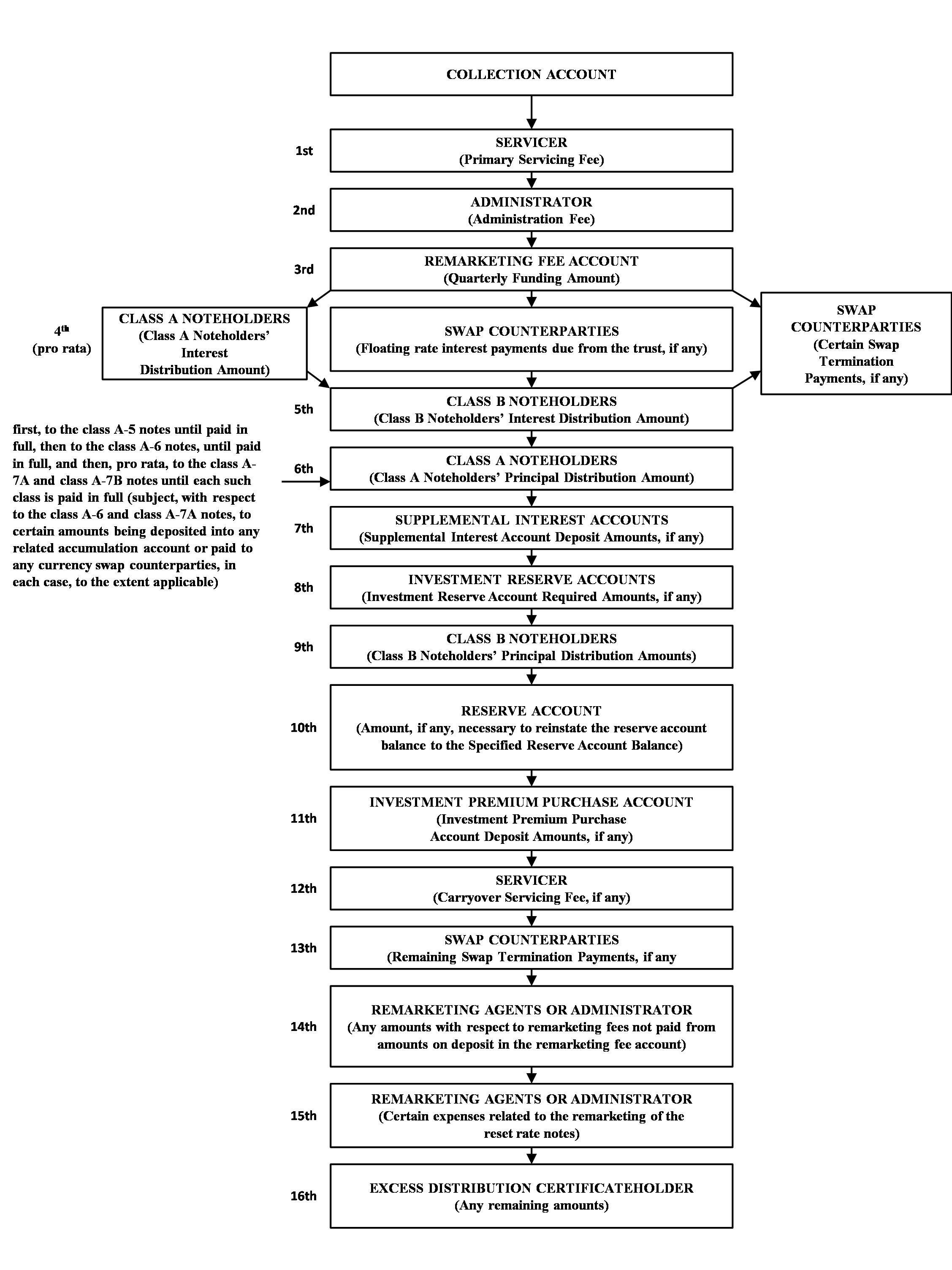

Navient Solutions, Inc., as administrator, will instruct the indenture trustee to withdraw funds on deposit in the collection account and the various accounts described above. These funds will be applied on or before each applicable distribution date generally as shown in the chart on the following page. Funds on deposit in the collection account and, to the extent required, the reserve account will be applied monthly to the payment of the primary servicing fee.

See "Description of the Notes— Distributions" in this free-writing prospectus for a more detailed description of distributions.

Transfer of the Assets to the Trust

Under a sale agreement, the depositor sold the trust student loans to the trust, with the eligible lender trustee holding legal title to the trust student loans.

If the depositor breaches a representation under the sale agreement regarding a trust student loan, generally the depositor will have to cure the breach, repurchase or replace that trust student loan or reimburse the trust for losses resulting from the breach.

Each seller has similar obligations under the related purchase agreement. See "Transfer and Servicing Agreements—Purchase of Student Loans by the Depositor; Representations and Warranties of the Sellers" in the free-writing base prospectus.

Servicing of the Assets

Under a servicing agreement, Navient Solutions, Inc., as servicer, is responsible for servicing, maintaining custody of and making collections on the trust student loans. It also bills and collects payments from the guaranty agencies and the Department of Education.

The servicer manages and operates the loan servicing functions for the Navient Corporation family of companies. The servicer may enter into subservicing agreements with respect to some or all of its servicing obligations, but these arrangements will not affect the servicer's obligations to the trust. Under some circumstances, the servicer may transfer its obligations as servicer.

If the servicer breaches a covenant under the servicing agreement regarding a trust student loan, generally it will have to cure the breach, purchase that trust student loan or reimburse the trust for losses resulting from the breach. See "The Trust Student Loan Pool—Insurance of Student Loans; Guarantors of Student Loans" in this free-writing prospectus.

Compensation of the Servicer

The servicer receives two separate fees: a primary servicing fee and a carryover servicing fee.

The primary servicing fee for any month is equal to 1/12th of an amount not to exceed 0.50% of the outstanding principal amount of the trust student loans.

The primary servicing fee is payable in arrears out of available funds and amounts on deposit in the reserve account on the 25th day of each month, or if the 25

th day is not a business day, then on the next business day. Fees are calculated as of the first day of the preceding calendar month. Fees include amounts from any prior monthly servicing payment dates that remain unpaid.

The carryover servicing fee is payable to the servicer on each distribution date out of available funds.

The carryover servicing fee is the sum of:

| · | the amount of specified increases in the costs incurred by the servicer; |

| · | the amount of specified conversion, transfer and removal fees; |

| · | any amounts described in the first two bullets that remain unpaid from prior distribution dates; and |

| · | interest on any unpaid amounts. |

See "Description of the Notes—Servicing Compensation" in this free-writing prospectus.

TERMINATION OF THE TRUST

The trust will terminate upon:

| · | the maturity or other liquidation of the last trust student loan and the disposition of any amount received upon its liquidation; and |

| · | the payment of all amounts required to be paid to the noteholders. |

See "The Student Loan Pools—Termination" in the free-writing base prospectus.

Optional Purchase

The servicer may purchase or arrange for the purchase of all remaining trust student loans on any distribution date when the pool balance is 10% or less of the initial pool balance.

The exercise of this purchase option will result in the early retirement of the remaining notes, including an early distribution of all amounts then on deposit in any accumulation account. The purchase price will equal the amount required to prepay in full, including all accrued and unpaid interest, the remaining trust student loans as of the end of the preceding collection period, but will not be less than a prescribed minimum purchase amount.

This prescribed minimum purchase amount is the amount that would be sufficient to:

| · | pay to noteholders the interest payable on the related distribution date; and |

| · | reduce the outstanding principal amount of each class of notes then outstanding on the related distribution date to zero, taking into account all amounts then on deposit in any accumulation account. |

For these purposes, if any class of reset rate notes:

| · | is then structured not to receive a payment of principal until the end of the related reset period, the outstanding principal balance of the class A-7A notes will be deemed to have been reduced by any amounts on deposit, exclusive of any investment earnings, in the related accumulation account; and/or |

| · | is then denominated in a non-U.S. Dollar currency, the U.S. Dollar equivalent of the then-outstanding principal balance of the class A-7A notes will be determined based upon the exchange rate provided for in the related currency swap agreement or agreements. |

The pool balance as of the statistical disclosure date is approximately 46.71% of the initial pool balance.

Auction of Trust Assets

The indenture trustee will offer for sale all remaining trust student loans on the first distribution date on which the pool balance is less than or equal to 10% of the initial pool balance.