Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

MIG similar filings

- 23 May 11 Submission of Matters to a Vote of Security Holders

- 6 May 11 Results of Operations and Financial Condition

- 5 May 11 Regulation FD Disclosure

- 22 Feb 11 Regulation FD Disclosure

- 30 Nov 10 Regulation FD Disclosure

- 17 Nov 10 Regulation FD Disclosure

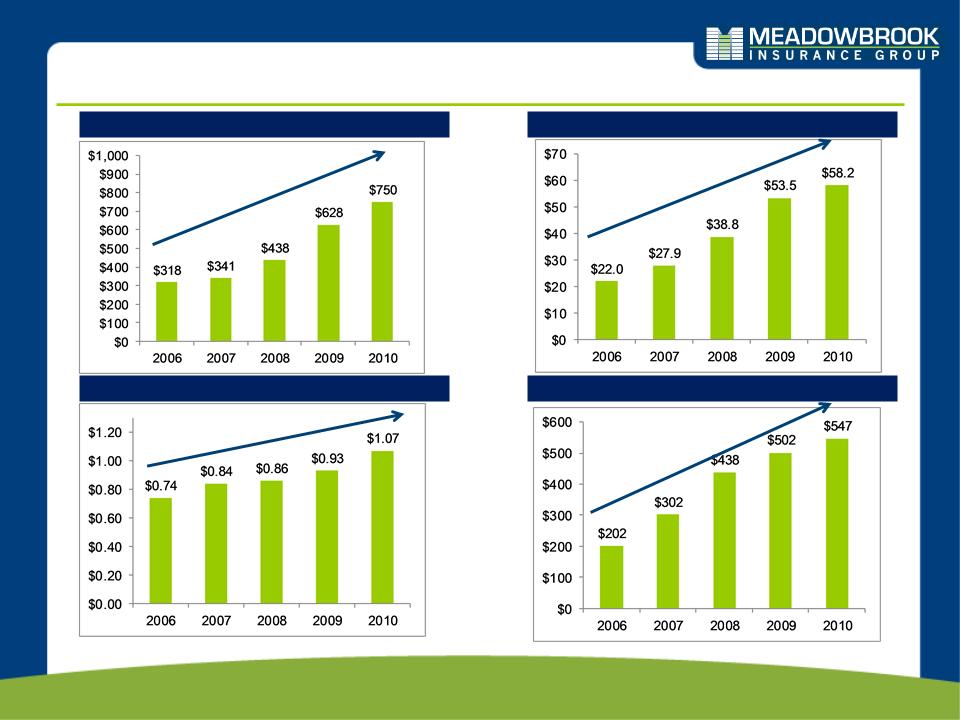

- 5 Nov 10 Meadowbrook Insurance Group, Inc. Reports Third Quarter 2010 Results

Filing view

External links