10

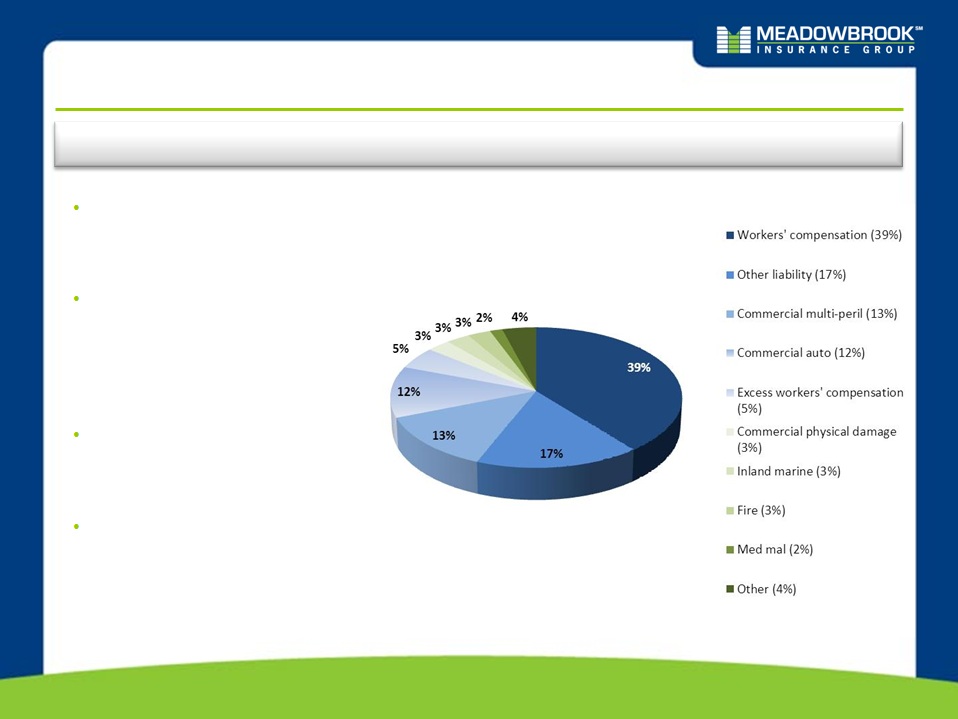

Diverse Revenue

Sources

Earned premium from insurance operations

Fee revenue from risk management services

Flexibility to utilize multiple distribution channels

Positioned to Manage

Insurance Cycles

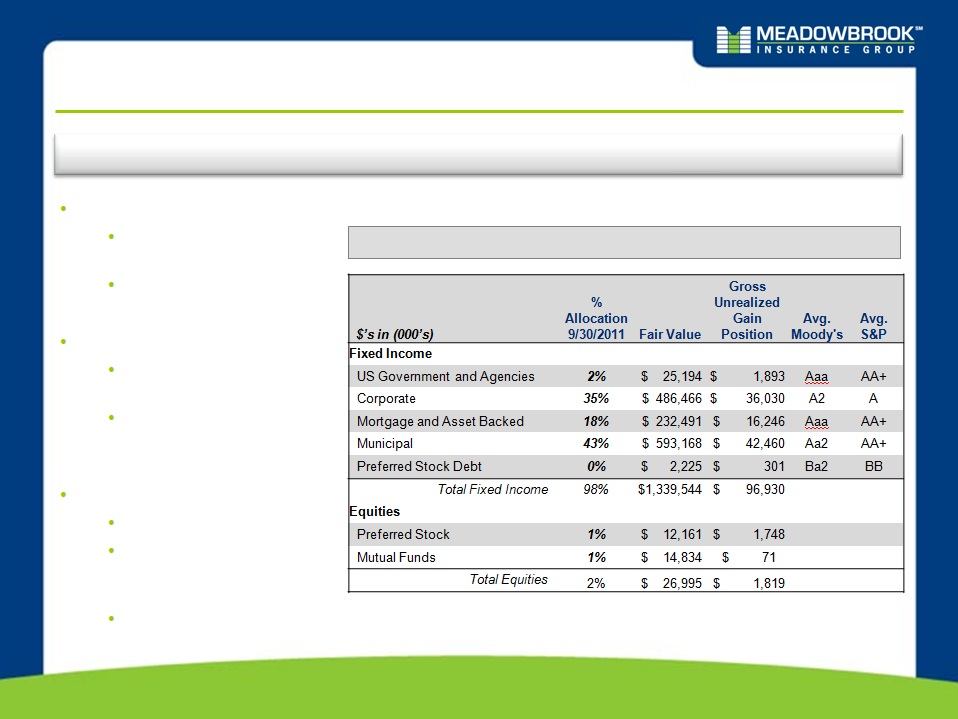

Conservative

Investment

Philosophy

Culture of Disciplined

Underwriting, Claims

Handling & Reserving

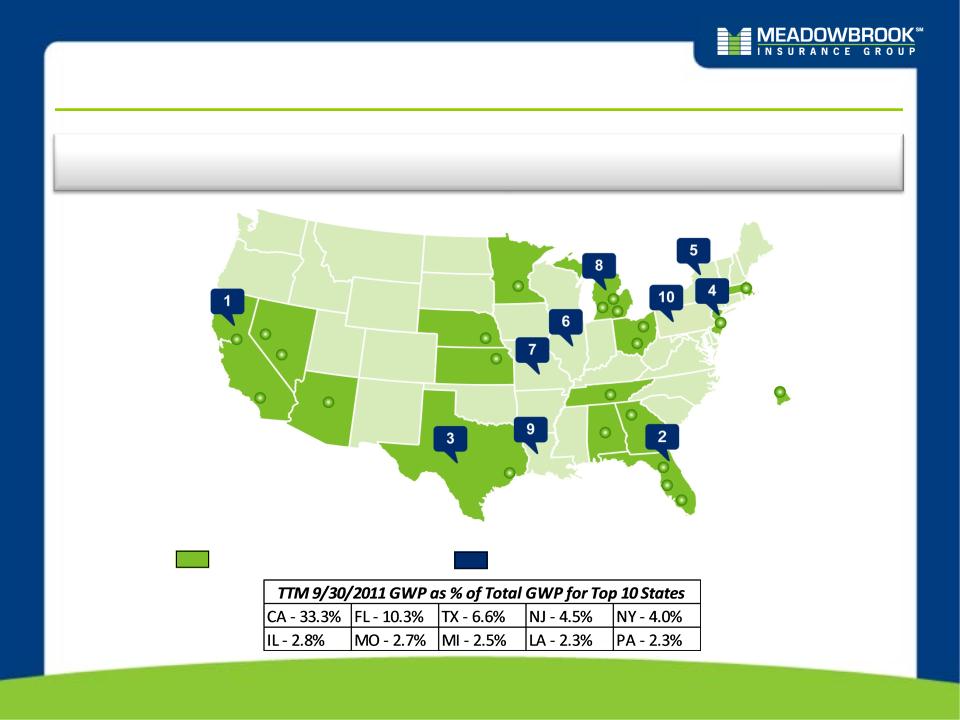

Product, program and geographic diversification

Admitted market capabilities contribute to stability and higher renewal retention

Non-admitted capabilities enable opportunistic response in volatile pricing environment

High-quality fixed income approach to our $1.4B portfolio

Investment approach reinforces our focus on underwriting profitability

Insurance subsidiaries rated A- (Excellent) by A.M. Best

Insurance subsidiary surplus levels can support meaningful premium growth

Insurance subsidiaries have additional borrowing capacity through FHLB membership

Generate cash flows from both regulated and non-regulated sources, which provides

flexibility

Manageable debt levels, with access to $35M line of credit

(no outstanding balance)

Strong Capital and

Liquidity Position

Team of talented insurance professionals with a wide range of expertise across all

functions and lines of business

Focused on achieving pricing adequacy and adherence to disciplined underwriting

standards

Our balanced business model allows us to adapt to changing market conditions

and deliver more predictable results.