6

Full Year 2011 vs. 2010 Combined Ratio Analysis

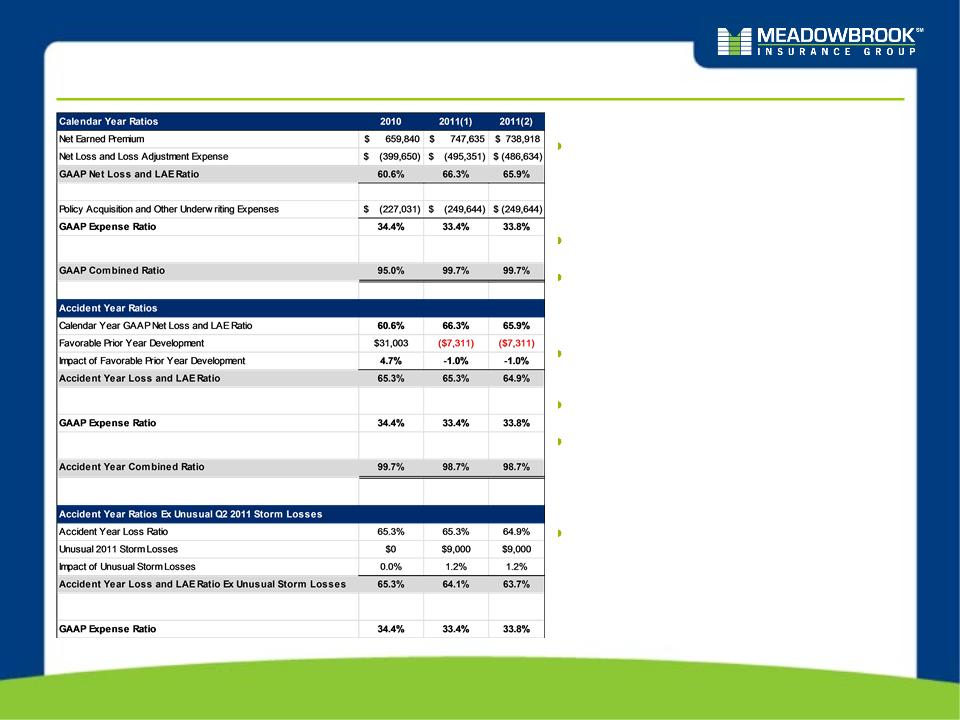

2011 Pro Forma Results

Pro forma results exclude the impact of a one-time

replacement policy for one of our self-insured clients for

which we purchased a reinsurance policy from a third-

party reinsurer and transferred 100% of the risk; this

transaction did not impact underwriting profit or the

combined ratio

This transaction reduced our loss and LAE ratio by 0.4

points and increased our expense ratio by 0.4 points

For comparative purposes, we believe it is more relevant

to compare 2010 results to the 2011 pro forma, which

exclude the impact of the “replacement policy”.

Loss and LAE Ratio

The 2011 loss and LAE ratio includes 1.0 points of

unfavorable development compared to 4.7 points of

favorable development in 2010.

The 2011 loss and LAE ratio includes 1.2 points of

unusual 2011 storm losses.

Excluding the impact of storm losses and the

replacement policy, the pro forma 2011 accident year

loss and LAE ratio improved 1.6 points reflecting the

impact of underwriting and pricing actions taken.

Expense Ratio

The pro forma 2011 expense ratio decreased 0.6 points

in comparison to the same 2010 period. The decrease

reflects a reduction in performance based variable

compensation in 2011 as compared to 2010.

(1) As reported

(2) Pro forma, see “2011 Pro Forma Results” above for detail.