EXHIBIT 99.1

Investor Presentation

First Quarter 2012 Update

2

Forward-Looking Statements & Non-GAAP Financial

Measures

Measures

Certain statements made by Meadowbrook Insurance Group, Inc. in this presentation may constitute

forward-looking statements including, but not limited to, those statements that include the words

"believes," "expects," "anticipates," "estimates," or similar expressions. Please refer to the

Company's most recent 10-K, 10-Q, and other Securities and Exchange Commission filings for more

information on risk factors. Actual results could differ materially. These forward-looking statements

involve risks and uncertainties including, but not limited to the following: the frequency and severity

of claims; uncertainties inherent in reserve estimates; catastrophic events; a change in the demand

for, pricing of, availability or collectability of reinsurance; increased rate pressure on premiums;

obtainment of certain rate increases in current market conditions; investment rate of return; changes

in and adherence to insurance regulation; actions taken by regulators, rating agencies or lenders;

obtainment of certain processing efficiencies; changing rates of inflation; and general economic

conditions. Meadowbrook is not under any obligation to (and expressly disclaims any such obligation

to) update or alter its forward-looking statements whether as a result of new information, future

events or otherwise.

forward-looking statements including, but not limited to, those statements that include the words

"believes," "expects," "anticipates," "estimates," or similar expressions. Please refer to the

Company's most recent 10-K, 10-Q, and other Securities and Exchange Commission filings for more

information on risk factors. Actual results could differ materially. These forward-looking statements

involve risks and uncertainties including, but not limited to the following: the frequency and severity

of claims; uncertainties inherent in reserve estimates; catastrophic events; a change in the demand

for, pricing of, availability or collectability of reinsurance; increased rate pressure on premiums;

obtainment of certain rate increases in current market conditions; investment rate of return; changes

in and adherence to insurance regulation; actions taken by regulators, rating agencies or lenders;

obtainment of certain processing efficiencies; changing rates of inflation; and general economic

conditions. Meadowbrook is not under any obligation to (and expressly disclaims any such obligation

to) update or alter its forward-looking statements whether as a result of new information, future

events or otherwise.

Notes on Non-GAAP Financial Measures

(1) Net operating income is a non-GAAP measure defined as net income excluding after-tax realized

gains and losses.

gains and losses.

(2) Accident year combined ratio is a non-GAAP measure that the impact of any adverse or favorable

development on prior year loss reserves.

development on prior year loss reserves.

These non-GAAP metrics are common measurements for property and casualty insurance

companies. We believe this presentation enhances the understanding of our results by highlighting

the underlying profitability of our insurance business. Additionally, these measures are key internal

management performance standards.

companies. We believe this presentation enhances the understanding of our results by highlighting

the underlying profitability of our insurance business. Additionally, these measures are key internal

management performance standards.

3

Presentation Outline

| I. | Overview of Meadowbrook |

II. The Meadowbrook Approach

III. Financial Review

IV. Key Investment Considerations

4

I. Overview of Meadowbrook

5

Overview of Meadowbrook

Specialty niche focused commercial insurance underwriter and insurance

administration services company

administration services company

• Founded in 1955, organized as holding company in 1985, IPO in 1995

• Headquartered in Southfield, MI with 34 locations throughout the U.S. and

Bermuda and over 1,000 employees

Bermuda and over 1,000 employees

• Platform supports both risk bearing and non-risk bearing opportunities

• Rated “A-” by A.M. Best, with statutory surplus of $381M and shareholders’

equity of $586M at 3/31/2012

equity of $586M at 3/31/2012

• Full year 2011 gross written premium of $904M

6

Overview of Meadowbrook

Key Statistics

• Market Capitalization (at 5/3/2012): $433.4M

• Book Value at 3/31/2012: $585.7M

• Book Value per Share at 3/31/2012: $11.60

• Excluding unrealized gains/losses, net of deferred taxes: $10.26

• Tangible Book Value per Share: $8.53

• Price to Book (at 5/3/2012): 0.74x

• Dividend Yield (at 5/3/12): 2.3%

• Statutory Premium Leverage (TTM 3/31/12) Actual Targeted Maximum

• GWP to Statutory Surplus 2.5 to 1 2.75 to 1

• NWP to Statutory Surplus 2.1 to 1 2.25 to 1

• Debt to Equity (3/31/12): 22.3%; 8.5% excluding debentures

• Debt to Total Capital (3/31/12): 18.2%; 6.9% excluding debentures

• Insider Ownership (3/31/2012): 6.6%

7

Capability Building Through Successful Acquisitions

Retail Agency Only

1955: Founded as a retail insurance agency

Core Capability Build Out

1985: Star Insurance Company

1990: Savers Property & Casualty Insurance Company

1994: American Indemnity Insurance Company

1996: Association Self Insurance Services

1997: Williamsburg National Insurance Company

Crest Financial Services

1998: Ameritrust Insurance Corporation

Florida Preferred Administrators, Inc.

1999: TPA Insurance Agency

Continued Synergistic Expansion

2007: USSU

2008: Procentury

Continued Synergistic Expansion

Strategic Staging of Acquisitions

• Meadowbrook actively reviews acquisition

prospects on a strategic basis and enters into

transactions that will increase long-term

shareholder value

prospects on a strategic basis and enters into

transactions that will increase long-term

shareholder value

• We consider a range of strategic factors when

looking at acquisitions including:

looking at acquisitions including:

– Opportunity to leverage our diverse

revenue platform, by expanding current

distribution, servicing capabilities, and

complementary product lines and

classes

revenue platform, by expanding current

distribution, servicing capabilities, and

complementary product lines and

classes

– Ability to attract talented insurance

professionals that are a good fit with

Meadowbrook culture

professionals that are a good fit with

Meadowbrook culture

– Opportunity to create “win-win” situation

by mitigation our downside risk and

providing seller with opportunity to obtain

fair value through deal structure

by mitigation our downside risk and

providing seller with opportunity to obtain

fair value through deal structure

8

We Have Delivered Results Over Time

Total Revenue ($M)

Net Operating Income ($M)

Shareholders’ Equity ($M)

GAAP Combined Ratio

CAGR* (2007 to 2011) = 25%

CAGR* (12/31/2007 to 12/31/2011) = 18%

CAGR* (2007 to 2011) = 14% (excludes unusual 2011

storm losses of $9.0M($5.9M after-tax))

storm losses of $9.0M($5.9M after-tax))

*CAGR=Compound annual growth rate

9

II. The Meadowbrook Approach

10

The Meadowbrook Approach

Our Objective:

• To deliver consistent earnings, across the market cycle, with a target return on average equity

of 10% - 17%

of 10% - 17%

• We view objective relative to risk free rate, reinvestment rate

As reported

(2) Pro forma, results exclude $5.9M of unusual 2011 after-tax storm losses

We seek to leverage the unique characteristics of our balanced business model to achieve

consistent, profitable results across the market cycle.

consistent, profitable results across the market cycle.

11

Diverse Revenue

Sources

Sources

• Earned premium from insurance operations

• Fee revenue from risk management services

• Flexibility to utilize multiple distribution channels

Positioned to Manage

Insurance Cycles

Insurance Cycles

Conservative

Investment

Philosophy

Investment

Philosophy

Culture of Disciplined

Underwriting, Claims

Handling & Reserving

Underwriting, Claims

Handling & Reserving

• Product, program and geographic diversification

• Admitted market capabilities contribute to stability and higher renewal retention

• Non-admitted capabilities enable opportunistic response in volatile pricing environment

• High-quality fixed income investment portfolio of $1.5B

• Investment approach reinforces our focus on underwriting profitability

• Insurance subsidiaries rated A- (Excellent) by A.M. Best

• Insurance subsidiary surplus levels can support meaningful premium growth

• Insurance subsidiaries have additional borrowing capacity through FHLB membership ($20M

outstanding balance on credit facility at 3/31/2012)

outstanding balance on credit facility at 3/31/2012)

• Generate cash flows from both regulated and non-regulated sources, which provides

flexibility

flexibility

• Manageable debt levels, with access to $35M line of credit ($9.5M outstanding balance at

3/31/2012)

3/31/2012)

Strong Capital and

Liquidity Position

Liquidity Position

• Team of talented insurance professionals with a wide range of expertise across all

functions and lines of business

functions and lines of business

• Focused on achieving pricing adequacy and adherence to disciplined underwriting

standards

standards

Our balanced business model allows us to adapt to changing market conditions

and deliver more predictable results.

and deliver more predictable results.

12

Diverse Revenue Sources

Insurance Operations

Net Commission & Fee Revenue

Diverse revenue sources enhance the durability of our business model.

• Admitted programs & standard products

• Main Street Excess & Surplus Lines

• Non-admitted programs

• Specialty markets

• Relatively small but provides a valuable

source of unregulated cash flow

source of unregulated cash flow

• Agency commission from non-affiliated

carriers

carriers

• Managed program revenue

• Municipality and association clients

2011

Net Earned Premium: $747.6 M

Pre-Tax Net Earned Premium Profit : $2.6M

Net Investment Income: $54.5M

2011

Net Commission & Fee Revenue: $32.1 M

Pre-Tax Commission & Fee Income: $7.3M

13

Main Street Excess

and Surplus Lines

and Surplus Lines

Admitted Programs &

Standard Market

Products

Standard Market

Products

Non-Admitted

Programs

Programs

Specialty Market

Products

Products

• Homogeneous specialized programs

• Heterogeneous geographic centers

• Promotes specialty agents

• Includes standard market products

• Broad classes of “Main Street”

commercial risks

commercial risks

• Promotes general agent distribution

• Specialized programs ignored or

underserved by the standard market

underserved by the standard market

• Promotes wholesalers with specialty

underwriting authority

underwriting authority

2011 GWP: $488M

2010 GWP: $468M

• Food service industry

• Educators

• Auto re-possessors

• Custom harvesters

Description

Examples

• Apartments, hotels and motels

• Contractors liability

• Restaurants, bars and taverns

• Convenience stores

• Oil and gas contractors

• Pet-sitters

• Professional liability

• Package delivery

• Excess workers’ comp

• Environmental

• Marine

• Med Mal

• Solutions designed for very specific

products and market segments

products and market segments

• Includes both admitted and excess &

surplus lines business

surplus lines business

2011 GWP: $43M

2010 GWP: $37M

2011 GWP: $122M

2010 GWP: $119M

2011 GWP: $251M

2010 GWP: $178M

14

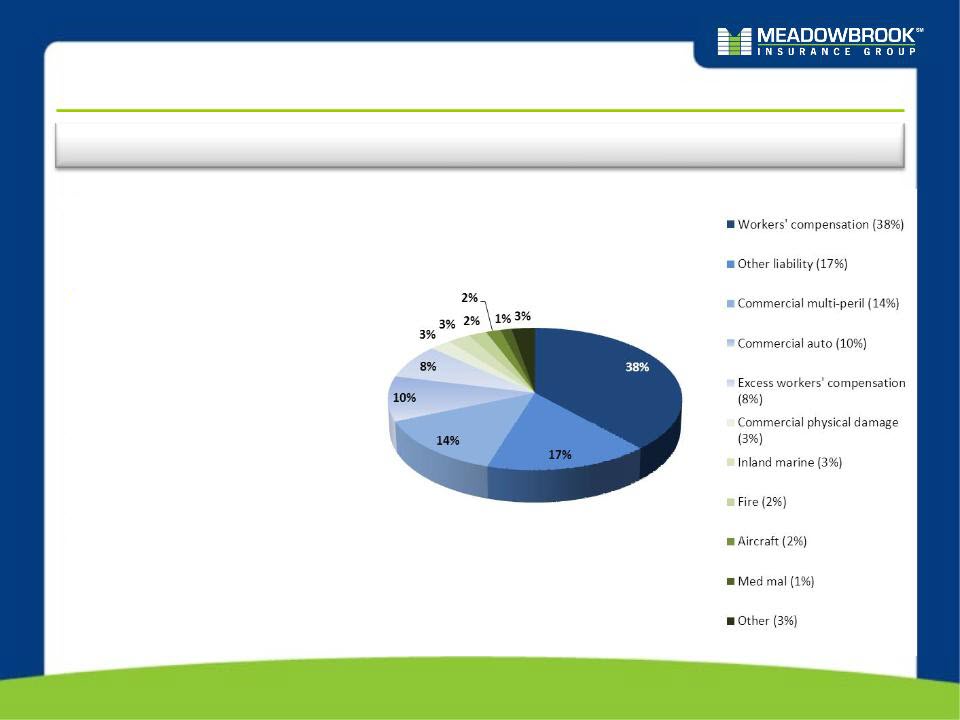

Positioned to Manage Insurance Cycles

Diverse Mix of Business

Diverse Mix of Business

TTM 3/31/2012 Gross Written Premium Business Mix

• We have built our business to

create product diversification as

indicated by the mix of business

create product diversification as

indicated by the mix of business

• This platform enables us to

grow our business

opportunistically with a focus on

underwriting discipline and

pricing adequacy

grow our business

opportunistically with a focus on

underwriting discipline and

pricing adequacy

• Our wide range of product

expertise positions us well to

support future growth

expertise positions us well to

support future growth

• Our new business is primarily

rollover books of business with

a proven track record of

profitability

rollover books of business with

a proven track record of

profitability

15

Positioned to Manage Insurance Cycles

Diverse Geographic Distribution

Diverse Geographic Distribution

Our regional perspective provides the infrastructure to achieve geographic

diversification, while maintaining our effective local touch.

diversification, while maintaining our effective local touch.

Meadowbrook locations

Top 10 production states (2011)

1

5

9

10

3

9

6

8

7

Bermuda

TTM 3/31/12 GWP by Top 10 States | ||||

CA - 33.9% | FL - 9.6% | TX - 6.5% | NJ - 4.3% | NY - 3.7% |

IL -2.7% | MO - 2.6% | MI - 2.5% | PA - 2.2% | LA - 2.0% |

Culture of Disciplined Underwriting, Claims

Handling & Reserving

Handling & Reserving

16

AY Loss ratios

*2006AY-2008AY loss

ratios re-estimated(1) as

of 12/31/09

ratios re-estimated(1) as

of 12/31/09

*2009AY-2011AY include

initial loss ratio estimates

initial loss ratio estimates

Our diverse mix of business, combined with our disciplined underwriting and low loss

retention levels enhances the predictability of our loss reserves.

retention levels enhances the predictability of our loss reserves.

(1) Re-estimated AY loss ratios reflect reserve adjustments made following the accident year, for example, the 12/31/09 re-estimated 2006 AY loss ratio of 60.7% reflects

new loss development information gathered over the 3 years from 12/31/06 to 12/31/09; the 3/31/12 re-estimated 2006 AY loss ratio reflects new loss development

gathered over the 5.25 years from 12/31/2006 to 3/31/2012; etc.

new loss development information gathered over the 3 years from 12/31/06 to 12/31/09; the 3/31/12 re-estimated 2006 AY loss ratio reflects new loss development

gathered over the 5.25 years from 12/31/2006 to 3/31/2012; etc.

(2) The 2006 - 2007 initial and re-estimated AY combined ratios excludes Century. The 2008 re-estimated AY combined ratio includes a pro-rata portion of the Century AY

2008 development for the 5 post-merger months.

2008 development for the 5 post-merger months.

Re-estimated (1)

AY loss ratios as

of 3/31/2012

AY loss ratios as

of 3/31/2012

0.2%

0.9%

(2.7%)

0.2%

0.8%

0.6%

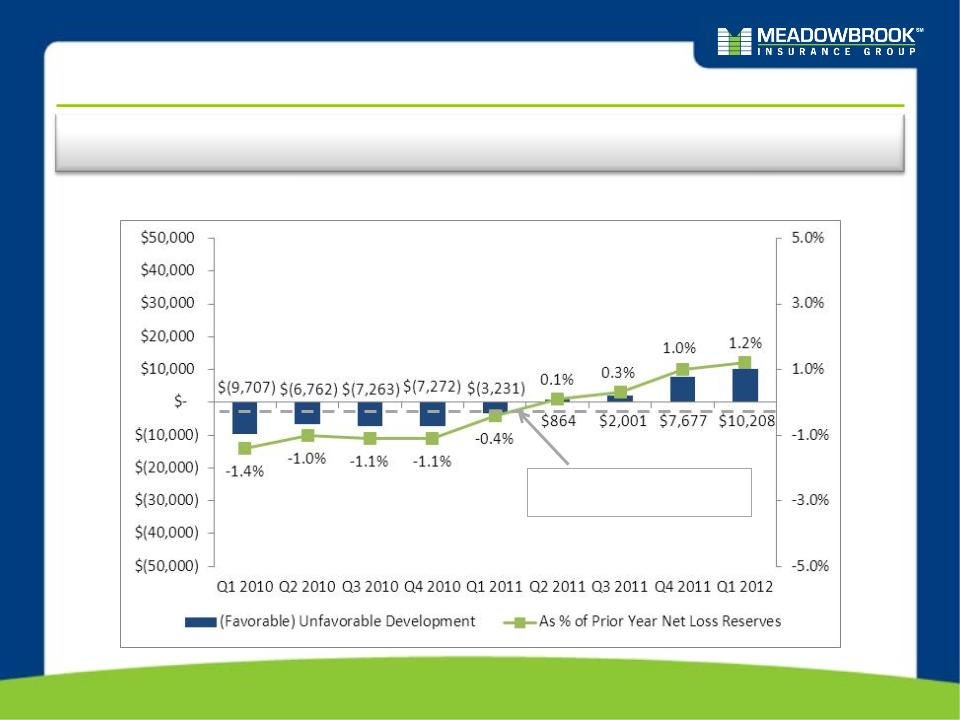

(Favorable) Unfavorable Development

Between Estimation Points

Between Estimation Points

Culture of Disciplined Underwriting, Claims

Handling & Reserving

Handling & Reserving

17

Our diverse mix of business, combined with our disciplined underwriting and low loss

retention levels enhances the predictability of our loss reserves.

retention levels enhances the predictability of our loss reserves.

Average = (0.3%)

Standard Deviation = 0.9%

(Favorable) Unfavorable Development Since 2009

$ in ‘000s

18

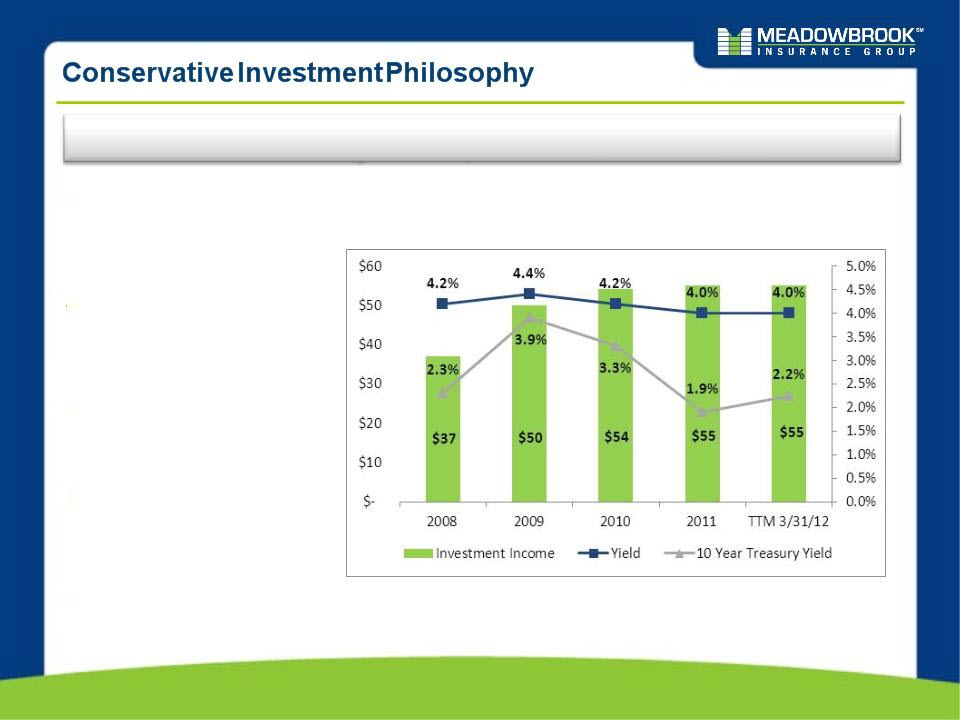

Conservative Investment Philosophy

We maintain a high-quality, low-risk investment portfolio.

Portfolio Allocation and Quality

NOTE: Data above as of March 31, 2012

•Low equity risk exposure

• 98% fixed income and

cash

cash

• 2% equity

•High credit quality

• 99% of bonds are

investment grade

investment grade

• Average S&P rating of

AA/Moody’s of Aa3

AA/Moody’s of Aa3

•Interest Rate Risk Protection

• Hold to maturity

• High credit quality =

low historical

impairments

low historical

impairments

• Access to additional

capital if needed

capital if needed

$’s in (000’s) | % Allocation 03/31/2012 | Fair Value | Gross Unrealized Gain Position | Avg. Moody's | Avg. S&P |

Fixed Income | |||||

US Government and Agencies | 2% | $ 23,116 | $ 1,629 | Aaa | AA+ |

Corporate | 39% | $ 574,813 | $ 41,679 | A2 | A |

Mortgage and Asset Backed | 14% | $ 211,756 | $ 13,881 | Aaa | AA+ |

Municipal | 43% | $ 625,116 | $ 46,100 | Aa2 | AA+ |

Preferred Stock Debt | 0% | $ 2,355 | $ 431 | Ba2 | BB |

Total Fixed Income | 98% | $1,437,157 | $ 103,721 | ||

Equities | |||||

Preferred Stock | 1% | $ 12,423 | $ 2,228 | ||

Mutual Funds | 1% | $ 15,460 | $ 697 | ||

Total Equities | 2% | $ 27,883 | $ 2,925 |

19

Our high quality investment portfolio is well matched to our loss

reserves and generates a predictable stream of income.

reserves and generates a predictable stream of income.

• Net investment income

has grown to $55M (TTM

3/31/12) from $37M in

2008

has grown to $55M (TTM

3/31/12) from $37M in

2008

• Invested asset base

increased to $1.5B at

3/31/2012, from $1.0B at

12/31/2008

increased to $1.5B at

3/31/2012, from $1.0B at

12/31/2008

• Pre-tax book yield was

4.0% at 3/31/2012 vs.

4.2% at 12/31/2008

4.0% at 3/31/2012 vs.

4.2% at 12/31/2008

• The duration of our

portfolio increased to 5.0

years at 3/31/2012 from

4.8 years at 12/31/2008

portfolio increased to 5.0

years at 3/31/2012 from

4.8 years at 12/31/2008

• The duration on net

reserves of $905M is

approximately 3.8 years

reserves of $905M is

approximately 3.8 years

Pre-tax Net Investment Income ($ in M) and Average

Investment Yield

Investment Yield

*4.8

*5.1

*5.0

*4.9

*5.0

*Effective Duration

20

III. Financial Review

21

Financial Highlights - First Quarter Update

Highlights ($ in M, except per share amounts)

While our first quarter results were impacted by unfavorable development, our current

accident year performed in line with expectations.

accident year performed in line with expectations.

* 2011 results presented above reflect the adoption of new accounting guidance associated with acquiring or renewing

insurance contracts. This guidance was adopted retrospectively effective January 1, 2012.

insurance contracts. This guidance was adopted retrospectively effective January 1, 2012.

Expense Ratio Analysis

22

Reduction in internal expense ratio reflects a reduction in variable compensation and a shift

in mix of business resulting in a lower commission expense.

in mix of business resulting in a lower commission expense.

Net earned premium $170.7M $192.8M

Policy acquisition $58.2M(1) $63.1M

and other u/w expenses

and other u/w expenses

Expense ratio 34.1% 32.7%

2011 policy acquisition and other u/w expenses presented above reflect the adoption of new accounting guidance associated with

acquiring or renewing insurance contracts. This guidance was adopted retrospectively effective January 1, 2012.

acquiring or renewing insurance contracts. This guidance was adopted retrospectively effective January 1, 2012.

Loss & LAE Ratio Analysis

23

The increase in the GAAP loss & LAE ratio reflects a change in development in 2012 as

compared to 2011, while the accident year loss and LAE ratio for both periods was similar.

compared to 2011, while the accident year loss and LAE ratio for both periods was similar.

GAAP Loss & LAE Ratio

AY Loss & LAE Ratio

Underwriting & Pricing Actions Taken

24

Recent Actions Taken:

• Took action on certain workers’ compensation programs securing significant rate increases, as

well as restricting business from certain states and classes of business

well as restricting business from certain states and classes of business

• Since 1/1/2010 we have achieved cumulative rate increases of 16.3% on workers’

compensation line of business

compensation line of business

• Took action on a national transportation program increasing rate by 46.0% since the first

quarter of 2011, tightening underwriting procedures through review of driver records and

reducing the overall book of business by 41.2%

quarter of 2011, tightening underwriting procedures through review of driver records and

reducing the overall book of business by 41.2%

• Maintain culture of “early intervention” through continuous review of all programs and books of

business to ensure that our profitability targets are met

business to ensure that our profitability targets are met

We actively manage our business to achieve profitable results.

25

2011 Results and 2012 Guidance

Looking ahead, we believe our balanced business model positions us well to continue

to deliver predictable earnings

to deliver predictable earnings

Gross Written Premium

• $904M

GAAP Combined Ratio

• 99.7%*

Net income from operations

• $40.9M*

Net operating income per share

• $0.78*

2011 Results

• Leverage multiple revenue

sources and diverse insurance

offering to maximize

opportunities across market

cycles

sources and diverse insurance

offering to maximize

opportunities across market

cycles

• Increase underwriting leverage

through selective growth

opportunities, while sustaining

appropriate diversification

through selective growth

opportunities, while sustaining

appropriate diversification

• Increase investment leverage

through cash from operations

through cash from operations

• Leverage fixed costs over a

larger revenue base

larger revenue base

• Increase fee-for service income

through new opportunities and

margin expansion

Driving Long-term

Enterprise Value

Enterprise Value

2012 Guidance

Gross Written Premium

• Range of $890M - $910M

GAAP Combined Ratio

• 97.5% - 98.5%

Net income from operations

• $46M - $51M*

Net operating income per share

• $0.90 - $1.00*

*We expect to be at or near the low end of

our net operating income and net

operating income per share range

our net operating income and net

operating income per share range

* 2011 results include unusual storm

activity that increased the combined

ratio by 1.2%, reduced net income by

$5.9M and reduced net operating

income per share by $0.11.

activity that increased the combined

ratio by 1.2%, reduced net income by

$5.9M and reduced net operating

income per share by $0.11.

26

IV. Investment Considerations

Investment Considerations

27

• Balanced business model delivers consistent, profitable results

• Average GAAP combined ratio of 95.5% (2007-2011)

• GAAP combined ratio standard deviation of 2.6% (2007-2011)

• Average ROAE (net operating income)10.2% (2007-2011)

• Proven history of generating profitable growth

• Revenue CAGR (2007-2011): 25%

• Net Operating Income CAGR (2007-2011): 10%

• BVPS CAGR (12/31/2007-12/31/2011): 9%

• Strong balance sheet

• Current capital and low debt levels position us well to fund future growth

• High-quality, low-risk investment portfolio

• Disciplined reserving culture and track record of reserve adequacy

• Proactive capital management

• Since 2008 we have returned $89M, or 44% of net operating income, to shareholders

through dividends and share repurchases

through dividends and share repurchases

• Quarterly dividend initiated in 2008; increased to $0.05 per share in 2011

• Management authorized to repurchase up to an additional 4.5M shares