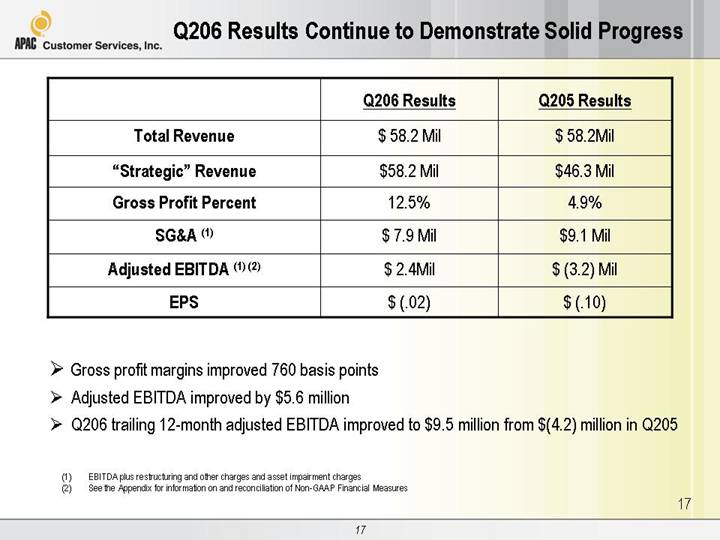

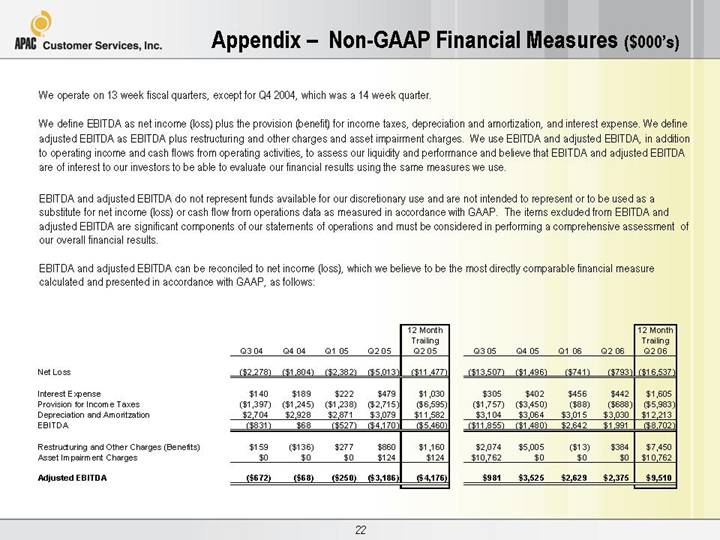

Appendix – Non-GAAP Financial Measures ($000’s) We operate on 13 week fiscal quarters, except for Q4 2004, which was a 14 week quarter. We define EBITDA as net income (loss) plus the provision (benefit) for income taxes, depreciation and amortization, and interest expense. We define adjusted EBITDA as EBITDA plus restructuring and other charges and asset impairment charges. We use EBITDA and adjusted EBITDA, in addition to operating income and cash flows from operating activities, to assess our liquidity and performance and believe that EBITDA and adjusted EBITDA are of interest to our investors to be able to evaluate our financial results using the same measures we use. EBITDA and adjusted EBITDA do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income (loss) or cash flow from operations data as measured in accordance with GAAP. The items excluded from EBITDA and adjusted EBITDA are significant components of our statements of operations and must be considered in performing a comprehensive assessment of our overall financial results. EBITDA and adjusted EBITDA can be reconciled to net income (loss), which we believe to be the most directly comparable financial measure calculated and presented in accordance with GAAP, as follows: 12 Month 12 Month Trailing Trailing Q3 04 Q4 04 Q1 05 Q2 05 Q2 05 Q3 05 Q4 05 Q1 06 Q2 06 Q2 06 Net Loss ($2,278) ($1,804) ($2,382) ($5,013) ($11,477) ($13,507) ($1,496) ($741) ($793) ($16,537) Interest Expense $140 $189 $222 $479 $1,030 $305 $402 $456 $442 $1,605 Provision for Income Taxes ($1,397) ($1,245) ($1,238) ($2,715) ($6,595) ($1,757) ($3,450) ($88) ($688) ($5,983) Depreciation and Amoritzation $2,704 $2,928 $2,871 $3,079 $11,582 $3,104 $3,064 $3,015 $3,030 $12,213 EBITDA ($831) $68 ($527) ($4,170) ($5,460) ($11,855) ($1,480) $2,642 $1,991 ($8,702) Restructuring and Other Charges (Benefits) $159 ($136) $277 $860 $1,160 $2,074 $5,005 ($13) $384 $7,450 Asset Impairment Charges $0 $0 $0 $124 $124 $10,762 $0 $0 $0 $10,762 Adjusted EBITDA ($672) ($68) ($250) ($3,186) ($4,176) $981 $3,525 $2,629 $2,375 $9,510 |