QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

NEW WORLD RESTAURANT GROUP, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NEW WORLD RESTAURANT GROUP, INC.

246 Industrial Way West

Eatontown, New Jersey 07724

Dear Stockholder:

You are cordially invited to the 2002 Annual Meeting of Stockholders of New World Restaurant Group, Inc., to be held on December 6, 2002 at 10:00 a.m., Eastern Time, at Proskauer Rose LLP, 1585 Broadway, New York, New York 10036.

At the meeting, you will be asked to consider and vote upon a proposal to amend the Company's Certificate of Incorporation by modifying the Certificate of Designation, Preferences and Rights of Series F Preferred Stock, to consider and vote upon a proposal to amend the Company's 1994 Stock Plan and to ratify the appointment of Grant Thornton LLP as independent accountants for the fiscal year ending December 31, 2002.

Enclosed with this letter is a proxy authorizing officers of the Company to vote your shares for you if you do not attend the Annual Meeting. Whether or not you are able to attend the Annual Meeting, I urge you to complete your proxy and return it in the enclosed addressed, postage-paid envelope, as a quorum of the stockholders must be present at the Annual Meeting, either in person or by proxy.

|

|

Yours truly, |

|

|

Anthony D. Wedo

Chairman and Chief Executive Officer |

NEW WORLD RESTAURANT GROUP, INC.

246 Industrial Way West

Eatontown, New Jersey 07724

NOTICE OF ANNUAL MEETING

The 2002 Annual Meeting of Stockholders of New World Restaurant Group, Inc., a Delaware corporation, will be held on December 6, 2002 at 10:00 a.m., Eastern Time, at Proskauer Rose LLP, 1585 Broadway, New York, New York 10036 for the following purposes:

1. to consider and vote upon a proposal to amend the Company's Certificate of Incorporation by modifying the Certificate of Designation, Preferences and Rights of Series F Preferred Stock;

2. to consider and vote upon a proposal to increase from 750,000 to 6,500,000 the number of shares with respect to which options and other awards may be granted under the Company's 1994 Stock Plan;

3. to ratify the appointment of Grant Thornton LLP as independent accountants of the Company for the fiscal year ending December 31, 2002; and

4. to transact such other business as may properly come before the Annual Meeting and any and all adjournments thereof.

The Board of Directors has fixed the close of business on November 11, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any and all adjournments.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States. The proxy is revocable at any time prior to its use.

| | | By Order of the Board of Directors, |

|

|

Anthony D. Wedo

Chairman and Chief Executive Officer |

NEW WORLD RESTAURANT GROUP, INC.

246 Industrial Way West

Eatontown, New Jersey 07724

ANNUAL MEETING OF STOCKHOLDERS

December 6, 2002

PROXY STATEMENT

ANNUAL MEETING AND PROXY SOLICITATION INFORMATION

The accompanying proxy is solicited by the Board of Directors of New World Restaurant Group, Inc., a Delaware corporation (the "Company"), for use at the 2002 Annual Meeting of Stockholders to be held at Proskauer Rose LLP, 1585 Broadway, New York, New York 10036, on December 6, 2002, at 10:00 a.m., Eastern Time, and at any and all adjournments thereof (the "Annual Meeting"). The proxy may be revoked at any time before it is voted. If no contrary instruction is received, signed proxies returned by stockholders will be voted in accordance with the Board of Directors' recommendations.

This proxy statement and accompanying proxy were first sent to stockholders on or about November 22, 2002.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us (Attention: Secretary) a written notice of revocation on a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person.

Only stockholders of record at the close of business on November 11, 2002 are entitled to vote at the Annual Meeting. Each outstanding share of our common stock, par value $0.001 per share is entitled to one vote. The holders of a majority of the votes entitled to be cast whether present in person or by proxy shall constitute a quorum for purposes of the Annual Meeting.

We will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees in person, or by mail, courier, telephone or facsimile. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

At the Annual Meeting, stockholders will vote on the proposal to amend the Company's Certificate of Incorporation by modifying the Certificate of Designation, Preferences and Rights of Series F Preferred Stock (Proposal 1); the proposal to increase from 750,000 to 6,500,000 the number of shares with respect to which options and other awards may be granted under our 1994 Stock Plan (Proposal 2) and the ratification of the selection of independent accountants (Proposal 3).

Stockholders representing a majority of the shares of stock outstanding and entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the Annual Meeting. Under the Delaware General Corporation Law ("DGCL"), for each of the proposals, the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter is required to approve the matter.

Abstentions may be specified on all proposals and will be counted as present for the purposes of the proposal for which the abstention is noted. For purposes of determining whether a proposal has received a majority of the votes cast, where a stockholder abstains from voting, those shares will be counted against the proposal.

The independent tabulator appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. For the purposes of determining whether a proposal has received the requisite vote in instances where brokers are prohibited from exercising or choose not to exercise discretionary authority for beneficial owners who have not provided voting instructions (so-called "broker non-votes"), those shares will not be included in the vote totals and, therefore, will have no effect on the vote. Pursuant to the NASD Rules of Fair Practice, brokers who hold shares in street name have the authority, in limited circumstances, to vote on certain items when they have not received instructions from beneficial owners. A broker will only have such authority if (i) the broker holds the shares as executor, administrator, guardian, trustee or similar representative or fiduciary capacity with authority to vote, or (ii) the broker is acting pursuant to the rules of any national securities exchange of which the broker is also a member.

2

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of November 11, 2002, we had outstanding 50,984,607 shares of common stock, which are our only outstanding voting securities. The following table sets forth information regarding beneficial ownership of our common stock as of November 11, 2002 (i) by each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common stock, (ii) by each of our executive officers, (iii) by each of our directors, and (iv) by all of our directors and executive officers as a group.

Beneficial Owner**

| | Amount and Nature of Beneficial Ownership

| | Percentage

| |

|---|

| Halpern Denny III, L.P. | | 23,265,107 | (1) | 55.9 | % |

| Greenlight Capital, L.L.C. | | 16,289,023 | (2) | 48.2 | % |

| Brookwood New World Investors, LLC | | 4,995,825 | (3) | 9.8 | % |

| BET Associates, L.P. | | 5,174,026 | (4) | 10.1 | % |

| Special Situations Fund III, L.P. | | 4,740,526 | (5) | 21.5 | % |

| Frank and Lydia LaGalia | | 1,881,200 | (6) | 10.8 | % |

| Anthony D. Wedo | | 0 | (7) | * | |

| Paul J. B. Murphy III | | 0 | | * | |

| William Nimmo | | 31,614 | (8) | * | |

| Leonard Tannenbaum | | 172,874 | (9) | * | |

| Eve Trkla | | 72,632 | (10) | * | |

| All directors and executive officers as a group (5 persons) | | 247,140 | (11) | * | |

- *

- Less than one percent (1%).

- **

- Address for each officer and director is our principal office located at 246 Industrial Way West, Eatontown, New Jersey 07724.

- (1)

- Based upon an amendment to a Schedule 13D filed with the Securities and Exchange Commission on November 12, 2002. Includes 1,000 shares of common stock that may be purchased upon the exercise of warrants. Effective November 8, 2002, Halpern Denny exercised its rights to purchase 27,141,454 shares of common at a price of $0.01 per share pursuant to the warrants. Pursuant to the term of the warrants, Halpern Denny used 3,877,347 shares of common stock that would have otherwise become issuable under the warrants as payment for the exercise price, and therefore received an aggregate of 23,264,107 shares of common stock.

- (2)

- Based on an amendment to a Schedule 13D filed with the Securities and Exchange Commission on June 19, 2001. The Schedule 13D was filed on behalf of Greenlight, Greenlight Capital, L.P., of which Greenlight is the general partner, Greenlight Capital Offshore, Ltd., for whom Greenlight Capital acts as investment advisor, Greenlight Capital Qualified, L.P., of which Greenlight Capital is the general partner, and David Einhorn and Jeffrey A. Keswin, the principals of Greenlight Capital. Consists of common stock that may be purchased upon the exercise of warrants.

- (3)

- Based upon an amendment to a Schedule 13D filed with the Securities and Exchange Commission on November 12, 2002. Includes 500 shares of common stock that may be purchased upon the exercise of warrants. Effective November 7, 2002, Brookwood exercised its rights to purchase 6,252,011 shares of common stock at a price of $0.01 per share pursuant to the warrants. Pursuant to the terms of the warrants, Brookwood used 1,257,186 shares of common stock that would have otherwise been issuable under the warrants as payments for the exercise price, and therefore received an aggregate of 4,995,325 shares of common stock.

- (4)

- Includes 10,000 shares of common stock that may be purchased upon the exercise of warrants held by BET Associates, LP. Bruce E. Toll is the sole member of BRU LLC, a Delaware limited liability company, which is the sole general partner of BET Associates, L.P. Mr. Toll also owns 219,250 shares of

3

common stock. Also includes 24,500 shares of common stock that may be purchased upon the exercise of warrants held by The Bruce E. Toll Family Trust and 73,500 shares of common stock that may be purchased upon the exercise of warrants held by the Robbi S. Toll Foundation. On August 2, 2002, BET Associates, L.P. exercised a warrant to purchase 450,066 shares of common stock. Effective November 7, 2002, BET Associates, L.P. exercised its right to purchase 5,777,171 shares of common stock at a price of $0.01 per share pursuant to the warrants. Pursuant to the terms of the warrants, BET Associates, L.P. used 1,161,211 shares of common stock that would have otherwise been issuable under the warrants as payment for the exercise price, and therefore received an aggregate of 4,615,960 shares of common stock.

- (5)

- Based upon a Schedule 13D filed with the Securities and Exchange Commission on June 19, 2002. The Schedule 13D was filed by Special Situations Funds III, L.P., Special Situations Private Equity Fund, L.P., Special Situations Cayman Fund, L.P., MGO Advisors Limited Partnership, MG Advisors, L.L.C., AWM Investment Company, Inc., Austin W. Marxe and David Greenhouse. The principal business address for each of the foregoing, other than Special Situations Cayman Fund, L.P., is 153 East 53rd Street, New York, New York 10022. The principal business address for Special Situations Cayman Fund is c/o CIBC Bank and Trust Company (Cayman) Limited, CIBC Bank Building, P.O. Box 694 Grand Cayman, Cayman Islands, British West Indies. Includes (i) 181,200 shares of common stock and 2,594,249 shares of common stock that may be purchased upon the exercise of warrants held by Special Situations Funds III, L.P., (ii) 1,092,298 shares of common stock that may be purchased upon the exercise of warrants held by Special Situations Private Equity Fund, L.P. and (iii) 8,000 shares of common stock and 864,779 shares of common stock that may be purchased upon the exercise of warrants held by Special Situations Cayman Fund, L.P.

- (6)

- Based upon an amendment filed to a Schedule 13G filed with the Securities and Exchange Commission on June 18, 2002. Includes 272,000 shares of common stock owned of record by Frank LaGalia. Includes 81,500 shares of common stock owned of record by Lydia LaGalia, the spouse of Frank LaGalia. Includes 1,123,000 shares of common stock owned of record jointly by Mr. and Mrs. LaGalia. Includes 30,500 shares of common stock owned of record jointly by Frank LaGalia and his father. Includes 170,000 shares of common stock that are owned of record by Mr. LaGalia's father. Includes 196,200 shares owned of record by Carmela LaGalia's Individual Retirement Account. Carmela LaGalia is Frank LaGalia's aunt. Includes 8,000 shares of common stock owned by Mr. and Mrs. LaGalia's minor son. The address for Frank and Lydia LaGalia is 2050 Center Avenue, Suite 200, Fort Lee, NJ 07024.

- (7)

- Does not include options to purchase 5,040,242 shares of common stock granted in connection with Mr. Wedo's employment agreement.

- (8)

- Includes 30,000 shares of common stock, which may be acquired upon the exercise of presently exercisable options. Does not include 26,841,276 shares of common stock owned beneficially by Halpern Denny in which Mr. Nimmo is a partner. Mr. Nimmo disclaims any beneficial interest in the common stock beneficially owned by Halpern Denny.

- (9)

- Includes options to purchase 50,000 shares of common stock and warrants to purchase 70,000 shares of common stock. Does not include 6,461,815 shares of common stock owned beneficially by BET Associates, L.P., of which Mr. Tannenbaum is a limited partner, and of which shares Mr. Tannenbaum disclaims beneficial ownership.

- (10)

- Includes 30,000 shares of common stock, which may be acquired upon the exercise of presently exercisable options. Ms. Trkla is a controlling person of Brookwood Financial Partner, L.P., an affiliate of Brookwood. Ms. Trkla disclaims any beneficial interest in the shares of common stock beneficially owned by Brookwood, except to the extent that Thomas N. Trkla, her spouse, has a direct or indirect pecuniary interest therein.

- (11)

- Includes 80,000 shares of common stock, which may be acquired upon the exercise of presently exercisable options.

4

DIRECTORS

Our board of directors currently consists of four directors, and we have four vacancies on our board of directors as the result of the resignation of one of our directors in April 2002 and three of our directors in May 2002. Our by-laws provide that our board of directors is divided into three classes, designated Class I, Class II and Class III. Each director is appointed for a three-year term. Anthony D. Wedo and Leonard Tannenbaum are Class III directors. Mr. Tannenbaum was elected to our board of directors by our common stockholders. Anthony Wedo was appointed as a director pursuant to the terms of his employment agreement. Our other directors were designated pursuant to the terms of a stockholders agreement (the "Stockholders Agreement") dated January 18, 2001, as amended March 29, 2001, June 19, 2001 and July 9, 2001, with BET Associates, L.P. ("BET"), Brookwood New World Investors, LLC ("Brookwood"), Halpern Denny III, L.P. ("Halpern Denny"), Greenlight Capital, L.L.C. ("Greenlight Capital") and certain of its affiliates and Special Situations Fund III, L.P. ("Special Situations Fund") and certain of its affiliates. Pursuant to the Stockholders Agreement, BET and Brookwood are each entitled to designate one member to our Board of Directors, and Halpern Denny is entitled to designate two members to our Board of Directors. Halpern Denny has only designated one director at this time. Pursuant to the Stockholders Agreement, William Nimmo, Leonard Tannenbaum and Eve Trkla have been designated as directors.

Pursuant to our by-laws our Class I directors were to be elected at the Annual Meeting. Prior to their resignations, we had two Class I directors. We have not identified any candidates for director to fill the two Class I vacancies prior to mailing this proxy statement. Accordingly, we have not nominated any individuals for election to the board of directors and we will continue to search for appropriate and qualified candidates to fill the vacancies. If we identify any appropriate candidates prior to next year's annual meeting, we anticipate appointing such individuals to fill the vacancies on our board of directors as permitted by our certificate of incorporation and by-laws and the DGCL.

The names of our directors, their ages as of September 30, 2002, and other information about them is set forth below:

Name

| | Age

| | Position

|

|---|

| Anthony D. Wedo | | 43 | | Chairman, Chief Executive Officer and Director (Class III) |

| William Nimmo (1)(2) | | 48 | | Director |

| Leonard Tannenbaum (1)(2) | | 31 | | Director (Class III) |

| Eve Trkla (1)(2) | | 39 | | Director |

- (1)

- Member of Audit Committee

- (2)

- Member of Compensation Committee

Anthony D. Wedo. Mr. Wedo joined us as Chief Executive Officer in July 2001 and was appointed a director in August 2001. Mr. Wedo was appointed Chairman in April 2002. From 1998 to July 2001, Mr. Wedo served as the Chief Executive Officer and Managing Partner of Atlantic Restaurant Group, a venture group focused on acquiring high-growth restaurant concepts. From 1994 through 1997, he served as President and Chief Executive Officer of Mid-Atlantic Restaurant Systems, a Boston Market franchisee. From 1987 through 1993, Mr. Wedo was employed by Pepsico Inc.'s KFC division, most recently as a Divisional Vice President in charge of a 1,200 store territory. Mr. Wedo has a B.S. degree in Marketing and Finance from Pennsylvania State University.

William Nimmo. Mr. Nimmo has served as our director since January 2001 and is a partner at Halpern, Denny & Co., a private equity investment firm. From 1989 to 1997, Mr. Nimmo was a partner at Cornerstone Equity Investors, Inc. Prior to 1989, Mr. Nimmo spent ten years with J.P. Morgan &

5

Company. Mr. Nimmo is a graduate of Dartmouth College and received an M.B.A. from the Amos Tuck School of Business Administration at Dartmouth. Mr. Nimmo serves on the boards of a number of private companies.

Leonard Tannenbaum. Leonard Tannenbaum, C.F.A., has served as our director since March 1999 and is the Managing Partner at MYFM Capital LLC, a boutique investment banking firm, and a partner at BET Associates, L.P., a capital fund. From 1997 until 1999, Mr. Tannenbaum was a partner at LAR Management, a hedge fund. From 1996 until 1997, Mr. Tannenbaum was an assistant portfolio manager at Pilgrim Baxter and Co. From 1994 until 1996, Mr. Tannenbaum was Assistant Vice President in the small company group of Merrill Lynch. Mr. Tannenbaum currently serves on the board of directors of Corteq Inc., a biopharmaceutical company, General Devices Inc., a company that provides contract technical services, and Assisted Living Concepts, Inc., a company that owns and operates assisted living residences. Mr. Tannenbaum has an M.B.A in Finance and Bachelors of Science in Management from The Wharton School at the University of Pennsylvania.

Eve Trkla. Ms. Trkla has served as our director since August 2000 and is a controlling person of Brookwood Financial Partners, L.P., an affiliate of Brookwood New World Investors, LLC. Ms. Trkla has been, since May 1993, the Chief Financial Officer of Brookwood Financial Partners, L.P. Ms. Trkla's prior experience in the financial services field includes eight years as a lender at The First National Bank of Boston and one year as the Senior Credit Officer at The First National Bank of Ipswich. Ms. Trkla also serves as a director of UbiquiTel, Inc., a Sprint PCS affiliate. Ms. Trkla is a cum laude graduate of Princeton University.

Director Compensation

During 2001 and until June 20, 2002, each of our non-employee directors was paid $2,000 for each of the quarterly board meetings of each calendar year, $1,000 for each additional board meeting held in the same calendar year and $500 for each committee meeting. Such payments were made in shares of our common stock. Effective June 20, 2002, each of our non-employee directors will receive a $15,000 annual retainer to be paid on January 1 of each year for services relating to the prior year, plus $2,000 for each of the quarterly board meetings of each calendar year, $1,000 for each additional board meeting held in the same calendar year and $500 for each committee meeting, attended in person. Any director not attending at least 75% of all committee and board meetings held during that year will not receive the annual retainer. Each non-employee director also receives stock options to purchase 10,000 shares of our common stock on the date on which such person first becomes a director, and on October 1 of each year if, on such date, such director shall have served on our board of directors for at least six months. The exercise price of such options is equal to the market value of the shares of common stock on the date of grant. Employee directors are not compensated for service provided as directors. All directors are reimbursed for out-of-pocket expenses incurred by them in connection with attendance of board meetings and committee meetings.

6

PROPOSAL NO. 1

PROPOSAL TO AMEND THE COMPANY'S CERTIFICATE OF INCORPORATION

BY MODIFYING THE CERTIFICATE OF DESIGNATION, PREFERENCES AND

RIGHTS OF SERIES F PREFERRED STOCK

In connection with our Series F preferred stock financing in January 2001, pursuant to authority granted by our certificate of incorporation, our board of directors approved and, on January 16, 2001, we filed a Certificate of Designation, Preferences and Rights of Series F Preferred Stock (the "Certificate of Designation") with the Delaware Secretary of State, designating 65,000 shares of Series F preferred stock and setting forth the designations, rights and preferences of those shares. No vote of our stockholders was required in connection with the approval of the Certificate of Designation. In accordance with the DGCL, the Certificate of Designation had the effect of amending our certificate of incorporation.

In connection with our Series F preferred stock financings in June 2001, we agreed with the Series F investors to file a Second Amended and Restated Certificate of Designation, Preferences and Rights of Series F Preferred Stock (the "Second Certificate of Designation") with the Delaware Secretary of State. The Second Certificate of Designation was approved by our board of directors and the requisite holders of our Series F preferred stock and we filed the Second Certificate of Designation with the Delaware Secretary of State on June 19, 2001. A copy of the Second Certificate of Designation is attached hereto as Annex A.

The purpose of the Second Certificate of Designation was to increase the number of shares designated under the Certificate of Designation as shares of Series F preferred stock from 65,000 to 116,000 and to amend the designation, rights and preferences of the Series F preferred stock to:

- •

- establish certain rights as between the investors who purchased our Series F preferred stock prior to March 31, 2001 and the investors that purchased our Series F preferred stock after March 31, 2001;

- •

- include a provision that provided for penalty dividends in the event that we failed to file an amendment to our certificate of incorporation increasing the number of authorized shares of common stock to at least 125 million on or prior to October 17, 2001 (which amendment was filed on September 26, 2001);

- •

- increase from 67% to 70% the percentage approval of the holders of Series F preferred stock required to authorize the issuance of shares of any class of stock having any preference or priority as to dividends or assets superior to or on parity with the Series F preferred stock, including, without limitation, the Series E preferred stock;

- •

- add a provision to the Certificate of Designation to enable us to sell stores owned by our subsidiaries and us without the prior approval of the holders of Series F preferred stock;

- •

- add a provision to the Certificate of Designation to enable us to issue $140 million senior secured increasing rate notes due 2003, $35 million secured increasing rate notes due 2002 and to borrow up to $7.5 million under a revolving line of credit and incur up to $4.5 million of other indebtedness; and

- •

- add a provision to the Certificate of Designation to enable us to effect changes to our executive officers without the consent of the holders of Series F preferred stock.

Because the filing of the Certificate of Designation had the effect of amending our certificate of incorporation, the vote of our stockholders is required to approve the Second Certificate of Designation. Upon approval by the stockholders, the Second Certificate of Designation will have the effect of amending our certificate of incorporation.

7

If the Certificate of Degsignation is not approved by the stockholders, we will not be able to satisfy our obligations under agreements with our Series F investors and such investors could pursue any available remedies against us.

The affirmative vote of a majority of the shares of common stock entitled to vote at the Annual Meeting is required to approve the Second Amended and Restated Certificate of Designation, Preferences and Rights of Series F Preferred Stock. The board of directors recommends a voteIN FAVOR of the approval of the Second Amended and Restated Certificate of Designation, Preferences and Rights of Series F Preferred Stock. If not otherwise specified, proxies will be votedIN FAVOR of this proposal.

8

PROPOSAL NO. 2

APPROVAL OF INCREASE OF SHARES OF COMMON STOCK

AUTHORIZED FOR ISSUANCE UNDER THE 1994 STOCK PLAN

We are asking you to approve an amendment to our 1994 Stock Plan that will increase the number of shares of common stock authorized for issuance under the 1994 Stock Plan by 5,750,000 shares. Following approval of this amendment, the maximum aggregate number of shares reserved for issuance under the 1994 Stock Plan shall not exceed 6,500,000 shares.

In connection with Anthony Wedo's amended and restated employment agreement, we granted him options to purchase 5,040,242 shares of common stock. We need to increase the number of shares authorized for issuance under the 1994 Stock Plan in order to give effect to the grant of these options. In addition, we believe that this amendment is necessary to ensure that a sufficient reserve of common stock is available under the 1994 Stock Plan. We also believe that the operation of the 1994 Stock Plan is important in attracting and retaining employees in a competitive labor market, which is essential to our long-term growth and success.

The essential features of the 1994 Stock Plan, including this proposed amendment, are summarized below. This summary is not a complete description of all the provisions of the 1994 Stock Plan. Any stockholder of the Company who wishes to obtain a copy of the complete 1994 Stock Plan document may do so upon written request to the Assistant Secretary at our principal executive offices.

As of September 30, 2002, options to purchase 88,700 shares were outstanding under the 1994 Stock Plan, 20,409 shares had been issued pursuant to the exercise of options granted under such plan and 640,891 shares remained available for future grants. No stock purchase rights have been granted under the 1994 Stock Plan. The number of shares currently available under the 1994 Stock Plan is insufficient in light of the number of options granted to Mr. Wedo pursuant to his employment agreement and the potential continued growth in our operations. For this reason, the board of directors has determined that it is in our best interests and the best interests of our stockholders to increase the number of shares available for issuance under the 1994 Stock Plan by 5,750,000 shares.

Options granted under the 1994 Stock Plan may be either "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or nonstatutory stock options, at the discretion of the board of directors or any of its appointed committees and as reflected in the terms of the written option agreement. The board of directors, at its discretion, may also grant rights to purchase common stock directly, rather than pursuant to stock options, subject to certain restrictions discussed below.

The purposes of the 1994 Stock Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to our employees and consultants and to promote the success of our business.

The 1994 Stock Plan is administered by the Administrator, which may be either our board of directors or any one of its committees that is appointed pursuant to the 1994 Stock Plan. The 1994 Stock Plan is currently being administered by our compensation committee. The compensation committee, which is constituted to satisfy the applicable requirements of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Section 162(m) of the Code, has the exclusive authority to recommend the grant stock options and purchase rights to the board of directors

9

and otherwise administer the 1994 Stock Plan with respect to the officers, directors, consultants and other employees.

The 1994 Stock Plan provides that incentive stock options, nonstatutory stock options or stock purchase rights may be granted to employees (including officers and directors) of the Company or any parent or subsidiary of the Company. In addition, the 1994 Stock Plan provides that nonstatutory stock options and stock purchase rights may be granted to consultants of the Company or any parent or subsidiary of the Company. An employee or consultant who has been granted an option or stock purchase right may, if otherwise eligible, be granted additional options or stock purchase rights. The Administrator selects the optionees and determines the number of shares to be subject to each option. In making such determination, a number of factors are taken into account, including the duties and responsibilities of the optionee, the value of the optionee's services to us, the optionee's present and potential contribution to our success and other relevant factors. As of September 30, 2002, there were approximately 12,960 employees, officers, consultants and directors eligible to receive grants under the 1994 Stock Plan.

In addition, the 1994 Stock Plan provides that no officer may be granted options to purchase more than 100,000 shares in any fiscal year of the Company and that no officer may be granted options to purchase more than 250,000 shares over the remaining term of the 1994 Stock Plan. These limitations satisfy the requirements applicable to options intended to qualify as "performance-based compensation," as set forth in Section 162(m) of the Code. In the event the Administrator determines that such limitations are not required to qualify options as performance-based compensation, the Administrator may modify or eliminate such limitations.

Each option is evidenced by a stock option agreement between the optionee and us. Under the 1994 Stock Plan, as modified by the proposed amendment, each option is subject to the following terms and conditions:

(a) Exercise of the Option. The Administrator determines when options may be exercised. An option is exercised by giving written notice of exercise to us specifying the number of full shares of common stock to be purchased and by tendering full payment of the purchase price. Full payment may, as authorized by the board of directors, consist of any consideration and method of payment allowable under the 1994 Stock Plan.

(b) Exercise Price. The exercise price under the 1994 Stock Plan is determined by the Administrator and subject to certain conditions. If an incentive stock option or a nonstatutory stock option is granted to an employee who, at the time of the grant, owns stock representing more than ten percent of the voting power of all classes of our stock, the per share exercise price cannot be less than 110% of the fair market value per share on the date of grant. The per share exercise price for an incentive stock option that is granted to any employee cannot be less than 100% of the fair market value per share on the date of grant. If a nonstatutory stock option is granted to any person, the per share exercise price cannot be less than 85% of the fair market value per share on the date of grant. The fair market value of a share of our common stock is defined as (1) the closing sale price of our common stock on the Nasdaq Stock Market; (2) the mean between the high bid and low asked prices for our common stock on the date of determination as reported on The Wall Street Journal or such other source as the board of directors deems reliable, if our common stock is quoted on the Nasdaq Stock Market, but not on the National Market thereof or (3) a determination in good faith by the Administrator in the absence of an established market for our common stock. The purchase price payable upon the exercise of the options will consist of cash, check or other shares of our common

10

stock (which, if acquired from us, have been held for at least six months and have a fair market value on the date of surrender equal to the aggregate exercise price of the shares as to which the option is exercised), a combination of the foregoing or any other consideration or method permitted under applicable law.

(c) Termination of Employment. If the optionee's employment or consulting relationship terminates for any reason other than disability, death or a change of status from employee to consultant, options under the 1994 Stock Plan may be exercised within such a period of time as is determined by the Administrator of at least 30 days after termination (or in the case of an incentive stock option such other period of time not more than three months after the date of termination) and may be exercised only to the extent the option was exercisable on the date of termination. In no event may any optionee exercise an option after the expiration of its term.

(d) Disability. If an optionee is unable to continue his or her employment or consulting relationship with us as a result of his or her total and permanent disability, options may be exercised within 12 months from the date of termination and may be exercised only to the extent the option was exercisable on the date of termination, but in no event may the option be exercised after the expiration of its term.

(e) Death. In the event of the optionee's death, the optionee's estate or person who acquired the right to exercise the option by bequest or inheritance may exercise the option within 12 months following the date of death and only to the extent that the optionee was entitled to exercise it on the date of death, but in no event may the option be exercised after the expiration of its term. If at the time of death the optionee was not entitled to exercise his or her entire option in full, the shares covered by the unexercisable portion of the option shall immediately revert to the plan.

(f) Buyout Provisions. The Administrator may at any time offer to buy-out for payment in cash or shares, an option previously granted, based on such terms and conditions as the Administrator establishes and communicates to the optionee at the time that such offer is made.

(g) Terminations of the Options. The 1994 Stock Plan provides that options granted under the 1994 Stock Plan have the term provided in the option agreement; provided, however, that the term shall be no more than ten years from the date of the grant. Incentive stock options granted to an optionee who, immediately before the grant of such option, owned more than ten percent of the total combined voting power of all classes of stock of the Company or any of its subsidiaries may not in any case have a term of more than five years. No option may be exercised by any person after its expiration.

(h) Option Not Transferable. An option is nontransferable by the optionee other than by will or the laws of descent and distribution, and is exercisable only by the optionee during his or her lifetime.

(i) Merger or Consolidation, Assumption or Substitution of Options. In the event of a proposed sale of all or substantially all of our assets or a merger with or into another corporation, the option or the stock purchase right will be assumed or an equivalent option or stock purchase right will be substituted by the successor corporation. If the successor corporation does not agree to such substitution or assumption, the board of directors may give 15 days' notice of the optionee's right to exercise his or her outstanding option or stock purchase right at any time within 15 days of such notice. If the board of directors does not make an option or stock purchase right fully exercisable in lieu of assumption or substitution, such option and stock purchase right terminates as of the date of the closing of the sale of assets or merger.

The 1994 Stock Plan permits the granting of rights to purchase our common stock either alone, in addition to, or in tandem with other awards made by us. No such grants have been made to date.

11

Upon the granting of a stock purchase right under the 1994 Stock Plan, the offeree is advised in writing of the terms, conditions and restrictions related to the offer, including the number of shares of common stock that such person is entitled to purchase, the price to be paid and the time within which such person must accept such offer, which shall in no event exceed 30 days from the date upon which the Administrator made the determination to grant the stock purchase right.

Unless the Administrator determines otherwise, the underlying stock purchase agreement for stock purchased pursuant to a stock purchase right granted under the 1994 Stock Plan will grant us a repurchase option exercisable upon the voluntary or involuntary termination of the purchaser's employment with us for any reason (including death or disability) at the original price paid by the purchaser. The repurchase option shall lapse at such a rate as the Administrator may determine, but at a minimum rate of 20% per year.

Adjustments Upon Changes in Capitalization, Dissolution or Liquidation

In the event of any change, such as a stock split, reverse stock split, stock dividend, combination or reclassification of the common stock, is made in our capitalization that results in an increase or decrease in the number of outstanding shares of common stock without receipt of consideration by us, appropriate adjustment shall be made in the exercise price of each outstanding option, the number of shares subject to each option, the number of shares of common stock covered by each outstanding option or stock purchase right, as well as the number of shares available for issuance under the 1994 Stock Plan. In the event of a proposed dissolution or liquidation of us, the board of directors will notify the optionee at least 15 days prior to such proposed action and the option or stock purchase right will terminate immediately prior to the consummation of such proposed action.

We may at any time amend, alter, suspend or discontinue the 1994 Stock Plan, but we can not amend, alter, suspend or discontinue the 1994 Stock Plan if it would impair the rights of any optionee under any grant without his or her consent. In addition, we must obtain stockholder approval of any amendment to the 1994 Stock Plan to the extent necessary and desirable to comply with Rule 16b-3 under the Exchange Act or with Section 422 of the Code (or any other applicable law or regulation, including the requirements of the NASD or an established stock exchange). Any amendment or termination of the 1994 Stock Plan will not affect options or stock purchase rights already granted and such options and stock purchase rights will remain in full force and effect as if the 1994 Stock Plan was not amended or terminated, unless mutually agreed otherwise by the optionee and the board of directors, which is in writing and signed by the optionee and us.

We cannot currently determine the number of shares subject to options that may be granted in the future to executive officers, directors and employees under the 1994 Stock Plan. The following table sets forth information with respect to the stock options granted under the 1994 Stock Plan to the Named Executive Officers (as hereinafter defined), all current executive officers as a group and all employees and consultants (including all current officers who are not executive officers) as a group under the 1994 Stock Plan during the year ended January 1, 2002. No additional stock options were granted to the Named Executive Officers after January 1, 2002 and prior to the date of this proxy statement.

12

PLAN BENEFITS

1994 STOCK PLAN

Name and Position

| | Exercise Price

per Share(1)

| | Number of Shares Subject to Options

Granted under the 1994 Stock Plan

During the Year Ended Janaury 1, 2002

| |

|---|

Anthony D. Wedo

Chairman and Chief Executive Officer | | $ | 1.15 | (2) | 3,077,035 | (2) |

Paul J.B. Murphy III

Chief Operating Officer-Einstein Bros./Noah's | | | — | | 0 | |

William Rianhard(3)

Former President and Chief Operating Officer-Manhattan/Chesapeake | | | — | | 0 | |

R. Ramin Kamfar(4)

Former Chairman | | | — | | 0 | |

Jerold E. Novack(5)

Former Executive Vice President and Chief Financial Officer | | $ | 0.53 | | 1,143,635 | (5) |

| All current executive officers as a group (2 persons) | | $ | 1.15 | (2) | 3,077,035 | (2) |

| All current employees and consultants (including all current officers who are not executive officers) as a group (12,957 persons) | | $ | 1.20 | | 50,000 | |

- (1)

- The actual benefits, if any, to the holders of stock options issued under the 1994 Stock Plan are not determinable prior to exercise as the value, if any, of such stock options to their holders is represented by the difference between the market price of a share of our common stock on the date of exercise and the exercise price of a holder's stock option.

- (2)

- Mr. Wedo's options were cancelled in connection with his entering into an amended and restated employment agreement with us effective January 1, 2002. Mr. Wedo was subsequently granted options to purchase 5,040,242 shares of common stock.

- (3)

- Effective May 31, 2002, Mr. Rianhard resigned.

- (4)

- Effective April 1, 2002, Mr. Kamfar resigned as an officer and director.

- (5)

- Effective April 2, 2002, we terminated Mr. Novack for cause. Mr. Novack's options expired pursuant to their terms 90 days after the termination of his employment.

13

EQUITY COMPENSATION PLAN INFORMATION

Plan Category

| | Number of Securities

to be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Available for Future

Issuance Under Equity

Compensation Plans

|

|---|

| Equity compensation plans approved by stockholders: | | | | | | | |

| | 1994 Stock Option Plan | | 88,700 | (1) | $ | 1.23 | | 940,891 |

| | 1995 Directors Option Plan | | 110,000 | | $ | 0.96 | | 90,000 |

| Equity compensation plans not approved by stockholders: | | | | | | | |

| | Barry Levine(2) | | 10,000 | | $ | 4.86 | | 0 |

| | Robert Williams(2) | | 10,000 | | $ | 4.86 | | 0 |

| | Barry Levine(3) | | 10,000 | | $ | 5.26 | | 0 |

| | Robert Williams(3) | | 10,000 | | $ | 5.26 | | 0 |

| | Robert Williams(4) | | 20,000 | | $ | 1.97 | | 0 |

| | Barry Levine(4) | | 20,000 | | $ | 1.97 | | 0 |

| | Leonard Tannenbaum(5) | | 70,000 | | $ | — | | 0 |

| | Bruce Toll(6) | | 98,000 | | $ | — | | 0 |

| | B&B Ventures(7) | | 10,000 | | $ | 2.44 | | 0 |

| | Genesis Select Corporation(8) | | 150,000 | | $ | 2.83 | | 0 |

| | | Total | | 606,700 | | $ | 1.56 | | 1,030,891 |

- (1)

- Effective January 1, 2002, pursuant the terms of Anthony Wedo's amended and restated employment agreement, Mr. Wedo was granted options to purchase 5,040,242 shares of common stock at an exercise price of $0.32 per share. Mr. Wedo's options were granted under the 1994 Stock Plan subject to any necessary increase in the shares reserved for issuance under that plan.

- (2)

- Represents options granted on October 1, 1996 for consulting services in connection with the operation of our coffee roasting facility in Connecticut. The options vested immediately upon grant.

- (3)

- Represents warrants granted on October 25, 1996 for consulting services in connection with the operation of our coffee roasting facility in Connecticut. The options vested immediately upon grant.

- (4)

- Represents options granted on March 25, 1998 for consulting services in connection with the operation of our coffee roasting facility in Connecticut. The options vested immediately upon grant.

- (5)

- Represents warrants granted to Mr. Tannenbaum in 2000 for financial advisory services.

- (6)

- Represents warrants granted in 2000 to Mr. Toll for financial advisory services.

- (7)

- Represents warrants granted on May 1, 2000 for consulting services in connection with the operation of our coffee roasting facility in Connecticut.

- (8)

- Represents warrants granted to Genesis Select Corporation for investor relation services pursuant to a consulting services agreement dated September 1, 2000. As a portion of its compensation under the agreement, we granted Genesis Select warrants exercisable for 150,000 shares of common stock (50,000 shares with an exercise price of $2.00 per share, 50,000 shares with an exercise price of $3.00 per share and 50,000 share with an exercise price of $3.50 per share).

14

100,000 warrants expire on September 11, 2003 and the remaining 50,000 warrants expire on December 31, 2003.

As of November 11, 2002, we had warrants to purchase 40,766,700 shares of common stock outstanding and options to purchase 5,368,942 shares of common stock outstanding.

The following is a summary of the effect of U.S. federal income taxation upon the optionee and us with respect to the grant and exercise of options under the 1994 Stock Plan. This summary does not purport to be complete and, among other things, does not discuss the income tax laws of any municipality, state or foreign country in which an optionee may reside.

Options granted under the 1994 Stock Plan may be either "incentive stock options," as defined in Section 422 of the Code, or nonstatutory stock options. The recipient of an incentive stock option does not incur ordinary taxable income at the time of grant or exercise of the option. However, the optionee may incur alternative minimum tax upon exercise of the option. We are not entitled to a tax deduction at the time of exercise of an incentive stock option regardless of the applicability of the alternative minimum tax. Upon the sale or exchange of the shares at least one year after receipt of the shares by the optionee and two years after the grant of the incentive stock option, any gain is treated as long-term capital gain. If these holding periods are not satisfied, the optionee recognizes ordinary taxable income equal to the difference between the exercise price, and the lower of the fair market value of the stock at the date of the option exercise or the sale price of the stock. In turn, we are entitled to a tax deduction for the amount of the ordinary income recognized by the optionee. Any gain to the optionee in excess of the ordinary income from a disposition, which does not meet the statutory holding period requirements, is long-term capital gain if the sale occurs more than one year after exercise or short-term capital gain if the sale occurs within one year after the exercise. Capital losses may be netted against capital gains. Net capital losses up to $3,000 annually may offset ordinary and other income.

Options that do not qualify as incentive stock options are nonstatutory options. An optionee does not recognize taxable income at the time of grant of a nonstatutory stock option. However, upon exercise, the optionee does recognize ordinary taxable income to the excess of fair market value of the shares at the time of exercise over the exercise price. The income recognized by an optionee who is also an employee is subject to income tax withholding. Upon resale of such shares by the optionee, any difference between the sale price and the optionee's tax basis (exercise plus the income recognized upon exercise) is treated as capital gain or loss.

The affirmative vote of a majority of the shares of common stock entitled to vote at the Annual Meeting is required to approve the increase of shares of common stock authorized for issuance under the 1994 Stock Plan. The board of directors recommends a voteIN FAVOR of the increase of shares of common stock authorized for issuance under the 1994 Stock Plan. If not otherwise specified, proxies will be votedIN FAVOR of this proposal.

15

PROPOSAL NO. 3

APPOINTMENT OF INDEPENDENT ACCOUNTANTS

A resolution will be presented at the Annual Meeting to ratify the appointment by the board of directors of the firm of Grant Thornton LLP as independent accountants, to examine our financial statements for the year ending December 31, 2002, and to perform other appropriate accounting services.

Changes in Principal Accountants

On July 29, 2002, we dismissed Arthur Andersen LLP as our independent auditors and engaged the accounting firm of Grant Thornton LLP as our new independent auditors. The decision to change auditors was recommended by the audit committee of our board of directors and unanimously approved by the board of directors.

During the two most recent fiscal years ended January 1, 2002 and December 21, 2000, and the subsequent interim period through July 29, 2002, there were no disagreements between Arthur Andersen LLP and us on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to Arthur Andersen LLP's satisfaction, would have caused Arthur Andersen LLP to make reference to the subject matter of such disagreement in its reports on the our consolidated financial statements for such years, and there occurred no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

The audit reports of Arthur Andersen LLP on our consolidated financial statements for the fiscal years ended January 1, 2002 and December 21, 2000 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. Arthur Andersen LLP subsequently notified us that their opinion related to our 2000 and 2001 financial statements could no longer be relied upon.

We requested that Arthur Andersen LLP furnish a letter addressed to the Securities and Exchange Commission stating whether they agree with the above statements. A representative of Arthur Andersen LLP advised us that Arthur Andersen LLP was no longer in a position to provide letters relating to its termination as a former audit client's independent auditor, and that Arthur Andersen LLP's inability to provide such letters has been discussed with the staff at the Securities and Exchange Commission.

During the two most recent fiscal years ended January 1, 2002 and December 21, 2000, and the subsequent interim period through July 29, 2002, we did not consult Grant Thornton LLP regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our consolidated financial statements, or any of the matters or reportable events set forth in Items 304(a)(2)(i) and (ii)��of Regulation S-K.

Fees Paid to Principal Accountants

For the fiscal year ended January 1, 2002, Arthur Andersen LLP, our principal independent accountant during that period, billed the approximate fees set forth below.

Audit Fees. Aggregate fees paid to Arthur Andersen LLP in connection with their audit of our consolidated financial statements as of and for the year ended January 1, 2002 and their limited reviews of our unaudited condensed consolidated interim financial statements were $230,000.

16

Financial Information Systems Design and Implementation Fees. We did not engage Arthur Andersen LLP to provide services regarding financial information systems design and implementation during the year ended January 1, 2002.

All Other Fees. Aggregate fees paid to Arthur Andersen LLP for (i) services related to our acquisition of the assets of Einstein/Noah Bagel Corp. and Einstein/Noah Bagel Partners, L.P. were $170,000, (ii) services related to our sale of $140 million of secured increasing rate notes were $391,000 and (iii) services related to the proposed refinancing of our secured increasing rate notes were $140,000.

The directors that were members of the audit committee during the year ended January 1, 2002 resigned in May 2002 and we dismissed Arthur Andersen LLP as our independent auditors in July 2002. As a result, we do not know whether the audit committee discussed with Arthur Andersen LLP the firm's independence or considered whether the non-audit services provided by Arthur Andersen LLP were compatible with Arthur Andersen LLP maintaining its independence.

No fees were paid to Grant Thornton LLP during the fiscal year ended January 1, 2002.

Representatives of Grant Thornton LLP will not attend the Annual Meeting and will not have the opportunity to make a statement at the Annual Meeting. They will be available by telephone conference to respond to appropriate questions.

The affirmative vote of a majority of the shares of common stock entitled to vote is required to ratify the appointment of Grant Thornton LLP. The board of directors recommends a voteIN FAVOR of the ratification of its appointment of Grant Thornton LLP as independent accountants. If not otherwise specified, proxies will be votedIN FAVOR of this proposal.

17

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation awarded to, earned by or paid during our last three fiscal years to our Chief Executive Officer, to our other two executive officers and to two former executive officers ("Named Executive Officers").

| | Annual Compensation

| | Long-Term Compensation

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation ($)

| | Restricted

Stock Awards ($)

| | Securities

Underlying

Options/ SARs (#)

| |

|---|

Anthony D. Wedo(1)

Chairman and Chief Executive Officer | | 2001 | | $ | 183,077 | | $ | 187,516 | | $ | 8,308(2 | ) | — | | 3,077,035 | (3) |

Paul J.B. Murphy III(4)

Chief Operating Officer-Einstein Bros./Noah's | | 2001 | | $ | 161,538 | | $ | 150,000 | | $ | — | | — | | — | |

William Rianhard(5)

Former President and Chief Operating Officer-Manhattan/Chesapeake | | 2001

2000 | | $

$ | 160,000

98,923 | | $

$ | 40,000

25,000 | | $

$ | 12,000(2

12,000(2 | )

) | — | | —

60,000 | |

R. Ramin Kamfar(6)

Former Chairman | | 2001

2000

1999 | | $

$

$ | 300,000

300,000

175,000 | | $

$

$ | 300,000

305,000

87,500 | | $

$

$ | 24,000(2

24,000(2

24,000(2 | )(7)

)(7)

)(6) | —

250,000

— | | —

250,000

250,000 | |

Jerold E. Novack(8)

Former Executive Vice

President and Chief Financial Officer | | 2001

2000

1999 | | $

$

$ | 230,000

154,808

150,000 | | $

$

$ | 150,000

77,500

37,5000 | | $

$

$ | 12,000(2

12,000(2

12,000(3 | )(9)

)(9)

)(9) | 118,816

100,000

— | | 1,143,635

200,000

125,000 | |

- (1)

- We hired Mr. Wedo in July 2001.

- (2)

- Represents a car allowance for the respective individuals.

- (3)

- Mr. Wedo's options were cancelled in connection with his entering into an amended and restated employment agreement with us effective January 1, 2002. Mr. Wedo was subsequently granted options to purchase 5,040,242 shares of common stock under the amended and restated employment agreement.

- (4)

- Mr. Murphy became an officer in connection with our acquisition of the assets of Einstein/Noah Bagel Corp. and Einstein/Noah Bagel Partners, L.P.

- (5)

- We hired Mr. Rianhard in April 2000. Effective May 31, 2002, Mr. Rianhard resigned. All of Mr. Rianhard's options expired, pursuant to their terms, 90 days after the termination of his employment.

- (6)

- Effective April 1, 2002, Mr. Kamfar resigned as an officer and director. In connection with his departure from our company, we permitted Mr. Kamfar to retain $1,445,000 previously paid to him, which amount is not included in the amounts set forth in the table. In addition, one-half of Mr. Kamfar's options were cancelled when his employment with us ended and the remainder terminated 90 days thereafter pursuant to their terms.

- (7)

- In addition to his car allowance, Mr. Kamfar had the use of a car paid for by us (in 2001, beginning in August, Mr. Kamfar had the use of a second car paid for by us, the cost of which was reimbursed to us in 2002) and we reimbursed Mr. Kamfar for his garage expenses, tolls and car repairs. The cost of the cars and such reimbursed expenses are not included in the amounts set forth in the table.

- (8)

- Effective April 2, 2002, we terminated Mr. Novack for cause. Certain unauthorized payments made to Mr. Novack are not included in the amounts set forth in the table. All of Mr. Novack's options expired, pursuant to their terms, 90 days after the termination of his employment.

- (9)

- In addition to his car allowance, Mr. Novack had the use of a car paid for by us and, beginning in August, 2001, the use of a second car paid for by us and we reimbursed Mr. Novack for tolls and car repairs. The cost of the cars and such reimbursed expenses are not included in the amounts set forth in the table.

18

Stock Option Grants in Last Fiscal Year

Set forth below is information on grants of stock options for the Named Executive Officers for the year ended January 1, 2002. In addition, as required by Securities and Exchange Commission rules, the table sets forth hypothetical gains that would exist for the shares subject to such options based on assumed annual compounded rates of stock price appreciation during the option term.

OPTION GRANTS IN FISCAL 2001

| |

| | Percentage of Total Options Granted to Employees in Fiscal Year

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term (1)

|

|---|

| | Number of Securities Underlying Option Granted

| |

| |

|

|---|

| | Exercise Price

($ per Share)

| |

|

|---|

| | Expiration Date

| | 5%(2)

| | 10%(3)

|

|---|

| Anthony D. Wedo(4) | | 3,077,035 | | 72.9 | % | $ | 1.15 | | 07/14/2011 | | $ | 2,225,401 | | $ | 5,639,602 |

| Jerold Novack(5) | | 1,143,635 | | 27.1 | % | $ | 0.53 | | 09/19/2011 | | $ | 1,629,306 | | $ | 2,953,427 |

- (1)

- The potential realizable value illustrates value that might be realized upon exercise of the options immediately prior to the expiration of their terms, assuming the specified compounded rates of appreciation of the market price per share from the date of grant to the end of the option term. Actual gains, if any, on stock option exercise are dependent upon a number of factors, including the future performance of the common stock and the timing of option exercises, as well as the optionee's continued employment through the vesting period. The gains shown are net of the option exercise price, but do not include deductions for taxes and other expenses payable upon exercise of the option or for the sale of underlying shares of common stock. There can be no assurance that the amounts reflected in this table will be achieved.

- (2)

- Assumes 5% compounded rate of appreciation in the market price per share from the date of grant to the end of the option term.

- (3)

- Assumes 10% compounded rate of appreciation in the market price per share from the date of grant to the end of the option term.

- (4)

- Mr. Wedo's options were cancelled in connection with his entering into an amended and restated employment agreement with us effective January 1, 2002. Mr. Wedo was subsequently granted options to purchase 5,040,242 shares of common stock under the amended and restated employment agreement.

- (5)

- Mr. Novack's options terminated pursuant to their terms, 90 days after the termination of his employment in April 2002.

Fiscal Year End Option Values

During the fiscal year ended January 1, 2002, none of the Named Executive Officers exercised any stock options. Set forth below is information on the number of stock options held by the Named Executive Officers as of January 1, 2002. None of such stock options were in-the-money as of January 1, 2002.

19

FISCAL YEAR END OPTION VALUES

| | Number of Securities Underlying

Unexercised Options at

Fiscal Year End (#)

|

|---|

| | Exercisable

| | Unexercisable

|

|---|

| Anthony D. Wedo(1) | | 0 | | 3,077,035 |

| William Rianhard(2) | | 30,000 | | 30,000 |

| Paul J.B. Murphy | | 0 | | 0 |

| R. Ramin Kamfar(3) | | 684,367 | | 0 |

| Jerold Novack(4) | | 802,874 | | 762,423 |

- (1)

- Mr. Wedo's options were cancelled in connection with his entering into an amended and restated employment agreement with us effective January 1, 2002. Mr. Wedo was subsequently granted options to purchase 5,040,242 shares of common stock under the amended and restated employment agreement.

- (2)

- Mr. Rianhard resigned effective as of May 31, 2002. All of Mr. Rianhard's options terminated 90 days thereafter pursuant to their terms.

- (3)

- Effective April 1, 2002, Mr. Kamfar resigned as an officer and director. In connection with his resignation, one-half of Mr. Kamfar's options were cancelled. The remainder of his options terminated 90 days thereafter pursuant to their terms.

- (4)

- Effective April 2, 2002, we terminated Mr. Novack for cause. All of Mr. Novack's options terminated 90 days thereafter pursuant to their terms.

Employment and Other Arrangements

Anthony Wedo. In July 2001, we entered into an employment agreement with Mr. Wedo, our Chief Executive Officer. Effective as of January 1, 2002, we entered into an amended and restated employment agreement with Mr. Wedo. The agreement expires on December 31, 2004, but is automatically renewed for additional one-year periods commencing each January 1, unless either party gives written notice of its desire not to renew such term at least 90 days prior to the end of the term or any such renewal term. The agreement provides for base salary of $565,000 per year. At the beginning of each year during the term of the employment agreement, Mr. Wedo's base salary will be subject to annual review by our board of directors at the recommendation of the compensation committee. Mr. Wedo is entitled to an annual performance bonus of up to 150% of his base salary for such year. The amount of the bonus will be determined by the board of directors after review by the compensation committee and is based upon the achievement of predetermined individual and company goals during such period. For the period July 16, 2001 to July 31, 2002, Mr. Wedo will receive a guaranteed bonus of $187,500 payable in the amount of $46,875 on each of October 31, 2001, January 31, 2002, April 30, 2002 and July 31, 2003, which is considered a prepayment of the annual performance bonus described above.

In connection with entering into the amended and restated employment agreement, Mr. Wedo's options to purchase 3% of our outstanding common stock at a price per share of $1.15 granted under the prior employment agreement were cancelled. Mr. Wedo was granted new options to purchase 6% of our outstanding common stock (including the common stock issuable under outstanding options and warrants with an exercise price of $3.00 per share or less) as of May 10, 2002 for $0.26 per share. The options were granted subject to the approval of the stockholders of any necessary increase in the number of shares reserved for issuance pursuant to the 1994 Stock Plan. The options vest in one-third increments on each of December 31, 2002, December 31, 2003 and December 31, 2004.

20

In the event that we terminate Mr. Wedo's employment other than for cause, he will be paid severance compensation equal to one times his annual base salary.

Mr. Wedo has agreed that from the date of the employment agreement until the first anniversary of the termination of the employment agreement, he will not directly or indirectly, without our prior written consent, engage anywhere in the United States (whether as an employee, consultant, proprietor, partner, director or otherwise), or have any ownership interest in (except for ownership of 10% or less of any outstanding entity whose securities are listed on a national securities exchange), or participate in the financing, operation, management or control of, any firm, corporation or business (other than us) that engages in the marketing or sale of specialty coffee, bagels and/or fast casual sandwiches as one of its principal businesses. In addition, Mr. Wedo has agreed that from the date of the employment agreement until the second anniversary of the termination of the employment agreement, he will not directly or indirectly, without our prior written consent, solicit the services, or cause to be employed, any person who was an employee of the Company at the date of such termination, or within 6 months prior to such time.

William Rianhard. In April 2000, we entered into an employment agreement with Mr. Rianhard with a term beginning May 15, 2000 and ending May 15, 2002, which term would be automatically renewed from year to year unless either party gave notice to the contrary not less than 90 days prior to the commencement of any one-year extension period. The agreement was not renewed at the end of the initial two-year term. The agreement provided for a base salary of $160,000 plus such increases as the board of directors may have approved. The agreement also provided for an annual service bonus equal to 25% of Mr. Rianhard's base salary and an annual performance bonus of up to 25% of Mr. Rianhard's base compensation, as determined by the board of directors. The agreement also provided for an option to purchase 60,000 shares of common stock at $2.63, a $12,000 annual automobile allowance, a $12,000 annual rent allowance and a moving allowance.

If there was a change in control, Mr. Rianhard would have been entitled to a bonus equal to 50% of his base compensation for the year in which the same occured, and if he was terminated within six months after the change of control, Mr. Rianhard would have been entitled to receive 12 months' base compensation, one year's bonus and 12 months' automobile allowance and would have been entitled to fully exercise his options. For a period of one year following Mr. Rianhard's voluntary termination or termination for cause, Mr. Rianhard cannot perform services for, have an equity interest (except for an interest of 5% or less in an entity whose securities are listed on a national securities exchange) in any business (other than us) or participate in the financing, operation, management or control of, any firm, corporation or business (other than us) that engages in the marketing or sale of specialty coffee or bagels as its principal business.

Effective May 31, 2002, Mr. Rianhard resigned.

Ramin Kamfar. In September 2000, we entered into an employment agreement with Mr. Kamfar, then our Chairman and Chief Executive Officer. The agreement expired on December 31, 2001 but would automatically renew for additional one-year periods commencing each January 1 unless either party gave written notice to the other of its desire not to renew such term, which notice must be given no later than 90 days prior to the end of each term on any such renewal. The agreement provided for a base salary of $300,000 per year, and an annual performance bonus of between 35% and 100% of Mr. Kamfar's base salary for calendar year 2000 and any subsequent calendar year. Each bonus was based on the attainment of certain corporate and individual goals. In the event that we terminated Mr. Kamfar's employment upon a change in control or other than for cause, he would be paid severance compensation equal to three times his annual base salary (at the rate payable at the time of such termination) plus an amount equal to the greater of three times the amount of his bonus for the calendar year preceding such termination or 35% of his base salary.

21

Effective April 1, 2002, Mr. Kamfar resigned as an officer of our company and from his seat on our board of directors. In connection with his departure, we permitted Mr. Kamfar to retain $1,445,000 previously paid to him.

Jerold E. Novack. In September 2001, we entered into a new employment agreement with Mr. Novack, then our Executive Vice President, Chief Financial Officer and Secretary. The agreement expired on June 30, 2002. The agreement provided for a base salary of $300,000 per year, and an annual performance bonus of 30% to 100% of Mr. Novack's base salary based on Mr. Novack's and our performance.

Mr. Novack was granted an option to purchase 1.5% of the then outstanding common stock (including the common stock issuable under outstanding options and warrants) at a price per share of $.53, which option vested as to one-third of the amount thereof on July 1, 2001.

For a period of one year following Mr. Novack's voluntary termination or termination for cause, Mr. Novack cannot engage anywhere in the Northeastern United States, have an equity interest (except for an interest of 10% or less in an entity whose securities are listed on a national securities exchange) in any business (other than us) or participate in the financing, operation, management or control of, any firm, corporation or business (other than us) that engages in the marketing or sale of specialty coffee or bagels as its principal business.

Effective April 2, 2002, we terminated Mr. Novack for cause.

22

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following Compensation Committee Report on Executive Compensation and the Performance Graph that follows shall not be deemed to be "Soliciting Material," is not deemed "filed" with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filings.

Compensation Committee Report on Executive Compensation

The compensation committee of the board of directors administers our executive compensation programs. During 2001 until April 2002, the members of the compensation committee were Keith Barket, Ramin Kamfar and William Nimmo. Effective April 2002, Ramin Kamfar resigned from the board of directors and all committees thereof and the board of directors appointed Leonard Tannenbaum to the compensation committee. Mr. Barket resigned in May 2002 from the board of directors and all committees thereof. Effective June 2002, the board of directors appointed Eve Trkla to the compensation committee. All of the current members of the compensation committee are non-employee directors.

Our executive compensation program is designed to attract, retain and motivate high caliber executives and to focus the interests of the executives on objectives that enhance stockholder value. These goals are attained by emphasizing "pay for performance" by having a portion of the executive's compensation dependent upon business results and by providing equity interests in the company. The principal elements of our executive compensation program are base salary, bonus and stock options.

Executive Officer Salaries. Base salaries for our executives are intended to reflect the scope of each executive's responsibilities, our success and contributions of each executive to that success. Executive salaries are adjusted gradually over time and only as necessary to meet this objective. Increases in base salary may be moderated by other considerations, such as geographic or market data, industry trends or internal fairness within the company. The base salaries for Anthony Wedo, Ramin Kamfar, William Rianhard and Jerold Novack for 2001 are set forth in their respective employment agreements, which are described under "Employment and Other Arrangements."

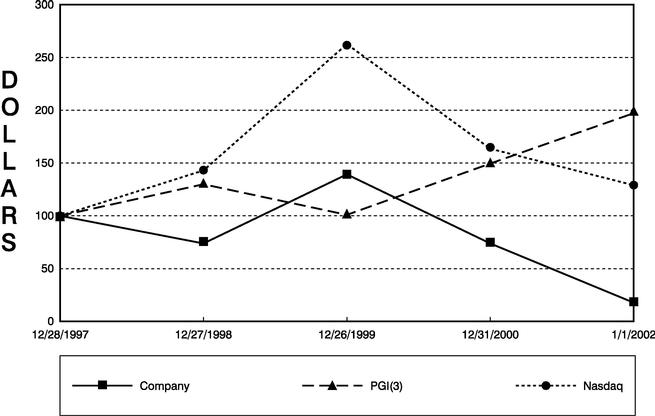

Bonuses. The compensation committee determined the amount of the annual discretionary and other bonuses paid by us. The employment agreements with Anthony Wedo, Ramin Kamfar, William Rianhard and Jerold Novack each provided for annual performance bonuses based upon criteria established by the board of directors. As set forth in their respective employment agreements, a portion of these annual performance bonuses were guaranteed.