UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | |

x ¨ ¨ | | Definitive Proxy Statement | | | | | |

| | Definitive Additional Materials | | | | | |

| | Soliciting Material Pursuant to §240.14a-12 | | | | | |

EINSTEIN NOAH RESTAURANT GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

555 Zang Street, Suite 300

Lakewood, Colorado 80228

March 23, 2009

Dear Stockholder:

You are cordially invited to the 2009 Annual Meeting of Stockholders of Einstein Noah Restaurant Group, Inc. to be held on May 5, 2009 at 9:00 a.m., Mountain Time, at our offices located at 555 Zang Street, Suite 300, Lakewood, Colorado 80228.

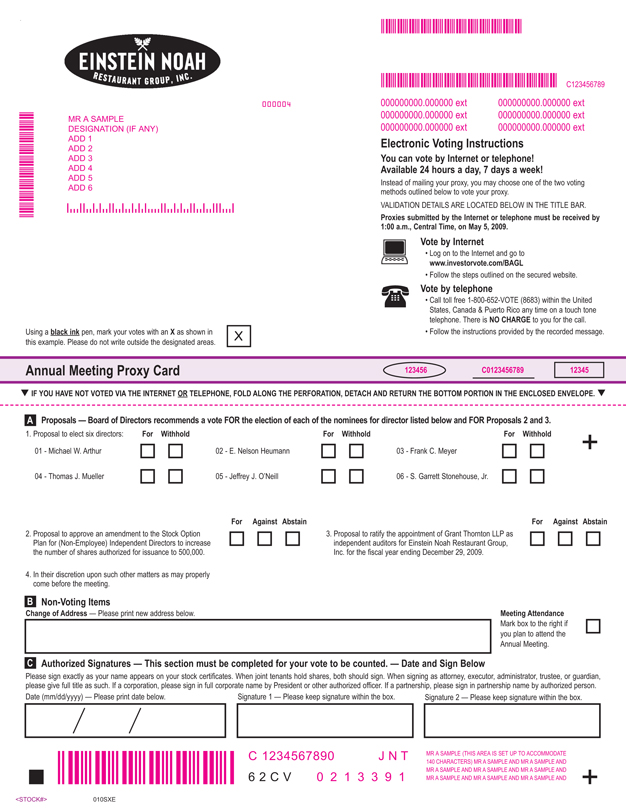

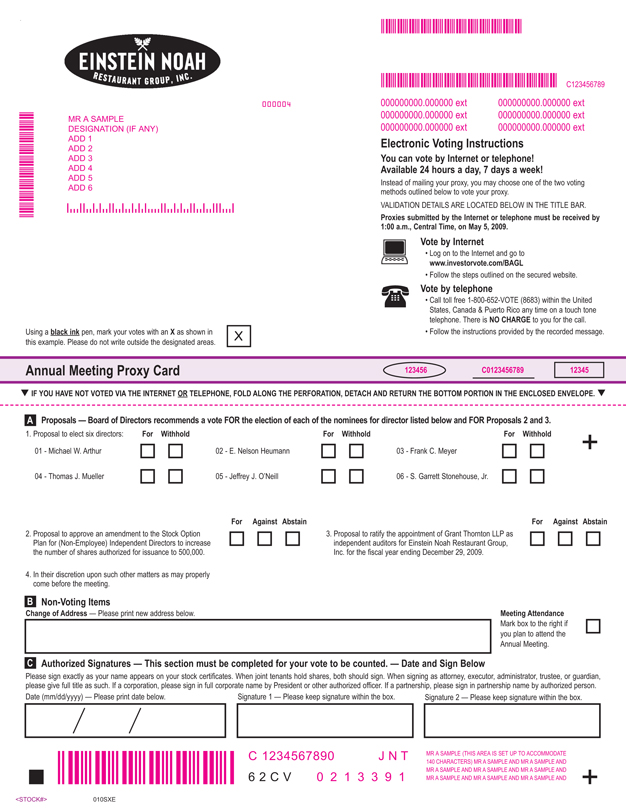

At the Annual Meeting, you will be asked to consider and vote upon proposals (1) to elect six directors to serve until the 2010 Annual Meeting of Stockholders, and until their respective successors are elected and qualified; (2) to approve an amendment to the Stock Option Plan for (Non-Employee) Independent Directors to increase the number of authorized shares for issuance under the Plan and (3) to ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 29, 2009.

Whether or not you are able to attend the Annual Meeting, I urge you to complete, sign, date and return the enclosed proxy card as promptly as possible in the postage paid envelope provided, as a quorum of the stockholders must be present, either in person or by proxy, in order for the Annual Meeting to take place. Stockholders of record may also vote by telephone or Internet by following the instructions on the enclosed proxy card.

I would appreciate your immediate attention to the mailing of this proxy.

Yours truly,

Jeffrey J. O’Neill

President and Chief Executive Officer

555 Zang Street, Suite 300

Lakewood, Colorado 80228

Notice of Annual Meeting of Stockholders To Be Held on May 5, 2009

You are cordially invited to attend the annual meeting of stockholders of Einstein Noah Restaurant Group, Inc., which will be held at our offices at 555 Zang Street, Suite 300, Lakewood, Colorado 80228 on May 5, 2009 at 9:00 a.m., Mountain Time, for the following purposes:

| | 1. | To elect six directors to serve until the 2010 Annual Meeting of Stockholders, and until their respective successors are elected and qualified; and |

| | 2. | To approve an amendment to the Stock Option Plan for (Non-Employee) Independent Directors to increase the number of shares authorized for issuance to 500,000 shares; and |

| | 3. | To ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 29, 2009; and |

| | 4. | To transact such other business as may properly come before the meeting. |

The close of business on March 18, 2009 has been set as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any and all adjournments.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States. Stockholders of record may also vote by telephone or Internet by following the instructions on the enclosed proxy card. If you choose to attend the Annual Meeting, you may still vote your shares in person even though you have previously returned your proxy by mail, telephone or Internet. If your shares are held in a bank or brokerage account, please refer to the materials provided by your bank or broker for voting instructions. The proxy is revocable at any time prior to its use.

Jill B.W. Sisson

Secretary

Lakewood, Colorado

March 23, 2009

YOU ARE URGED TO MARK, DATE AND SIGN THE ENCLOSED

PROXY CARD AND RETURN IT PROMPTLY. YOUR PROXY IS

REVOCABLE AT ANY TIME PRIOR TO ITS USE.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting to be held on May 5, 2009.

This year we are following a new Securities and Exchange Commission (“SEC”) rule which requires us to make available to you on the Internet a copy of this proxy statement and our annual report to stockholders. These are available to you athttps://www.sendd.com/EZProxy/?project_id=190.

EINSTEIN NOAH RESTAURANT GROUP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 5, 2009

The accompanying proxy is solicited by the board of directors of Einstein Noah Restaurant Group, Inc., a Delaware corporation (the Company), for use at the 2009 Annual Meeting of Stockholders to be held at our principal executive offices located at 555 Zang Street, Suite 300, Lakewood, Colorado 80228, on May 5, 2009, at 9:00 a.m., Mountain Time, and at any and all adjournments and postponements thereof (the Annual Meeting). The proxy may be revoked at any time before it is voted. If no contrary instruction is received, signed proxies returned by stockholders will be voted in accordance with the board of directors’ recommendations.

This proxy statement and accompanying proxy card are first being sent to stockholders on or about March 23, 2009.

Shares Outstanding and Voting Rights

Our board of directors fixed the close of business on March 18, 2009 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Our only outstanding voting stock is our common stock, $0.001 par value per share, of which 16,032,943 shares were outstanding as of the close of business on the record date. Each outstanding share of common stock is entitled to one vote.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us (Attention: Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute the revocation of a proxy.

At the Annual Meeting, stockholders will vote on proposals to elect six directors to serve until the 2010 Annual Meeting of Stockholders, and until their respective successors are elected and qualified (Proposal 1); to approve an amendment to the Stock Option Plan for (Non-Employee) Independent Directors to increase the number of shares authorized for issuance to 500,000 shares (Proposal 2); and to ratify our selection of Grant Thornton LLP as our independent auditors for the fiscal year ending December 29, 2009 (Proposal 3).

Stockholders representing one-third in voting power of the shares of stock outstanding and entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the Annual Meeting. With respect to the election of directors, our stockholders may vote in favor of the nominees, may withhold their vote for all of the nominees, or may withhold their vote as to specific nominees. Under the Delaware General Corporation Law (DGCL) and our restated certificate of incorporation, the affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve Proposals 1 and 3 and the affirmative vote of the holders of a majority of the votes cast on Proposal 2 is required to approve Proposal 2.

Abstentions may be specified on all proposals and will be counted as present for the purposes of the proposal for which the abstention is noted. A vote withheld for a nominee in the election of directors will have the same effect as a vote against the nominee. For purposes of determining whether any of the other proposals has received the requisite vote, where a stockholder abstains from voting, it will have the same effect as a vote against the proposal.

The independent tabulator appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. For the purposes of determining whether a proposal has received the requisite vote of the holders of the common stock in instances where brokers are prohibited from exercising or choose not to exercise

1

discretionary authority for beneficial owners who have not provided voting instructions (so-called broker non-votes), those shares of common stock will not be included in the vote totals and, therefore, will have no effect on the vote on any of the proposals. Pursuant to the FINRA Conduct Rules, brokers who hold shares in street name have the authority, in limited circumstances, to vote on certain items when they have not received instructions from beneficial owners. A broker will only have such authority if:

| | • | | the broker holds the shares as executor, administrator, guardian or trustee or is a similar representative or fiduciary with authority to vote; or |

| | • | | the broker is acting pursuant to the rules of any national securities exchange of which the broker is also a member. |

Under these rules, absent authority or directions described above, brokers will not be able to vote on Proposal 2.

Costs of Solicitation

We will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees, without additional compensation, in person, or by mail, courier, telephone or facsimile. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Annual Report

Our 2008 Annual Report on Form 10-K, including consolidated financial statements as of and for the year ended December 30, 2008, is being distributed to all stockholders entitled to vote at the Annual Meeting together with this proxy statement, in satisfaction of the requirements of the Securities and Exchange Commission (the SEC). Additional copies of the Annual Report are available at no charge upon request. To obtain additional copies of the Annual Report, please contact us at 555 Zang Street, Suite 300, Lakewood, Colorado 80228, Attention: Secretary, or at telephone number (303) 568-8000. The Annual Report does not form any part of the materials for the solicitation of proxies. In addition, this year we are following a new Securities and Exchange Commission (“SEC”) rule which requires us to make available to you on the Internet a copy of this proxy statement and our annual report to stockholders. These are available to you at https://www.sendd.com/EZProxy/?project_id=190.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of March 18, 2009, we had 16,032,943 shares of common stock outstanding, which are our only outstanding voting securities. In addition, we had 57,000 shares of Series Z preferred stock outstanding. The following table sets forth information regarding the beneficial ownership of our common stock as of March 18, 2009, by:

| | • | | each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common stock; |

| | • | | each of our executive officers; |

| | • | | each of our current directors; and |

| | • | | all directors and executive officers as a group. |

Unless otherwise indicated below, the address of each person listed below is 555 Zang Street, Suite 300, Lakewood, Colorado 80228.

2

BENEFICIAL OWNERSHIP

| | | | | | |

Name of beneficial owner | | Amount and nature of

beneficial ownership | | | Percent of

class | |

Greenlight Capital, L.L.C. and its affiliates 140 E. 45th, 24th Floor New York, New York 10017 | | 10,733,469 | (1) | | 67.2 | % |

Paul J.B. Murphy, Jr. | | 250,000 | (2) | | 1.5 | % |

James W. Hood | | 109,212 | (3) | | * | |

| | |

Jeffrey J. O’Neill | | 63,776 | (4) | | * | |

Daniel J. Dominguez | | 75,386 | (5) | | * | |

Richard P. Dutkiewicz | | 93,773 | (6) | | * | |

Jill B. W. Sisson | | 100,003 | (7) | | * | |

Michael W. Arthur | | 89,652 | (8) | | * | |

E. Nelson Heumann | | — | (9) | | — | |

Frank C. Meyer | | 71,059 | (10) | | * | |

Thomas J. Mueller | | 10,356 | (11) | | * | |

S. Garrett Stonehouse, Jr. | | 20,750 | (12) | | * | |

| | | | | | |

All directors and executive officers as a group (9 persons) | | 524,755 | (13) | | 3.2 | % |

| (1) | Based on an amendment to a Schedule 13D filed with the SEC on April 14, 2008. The amended Schedule 13D was filed on behalf of Greenlight Capital L.L.C., Greenlight Capital, Inc., Greenlight Capital, L.P., of which Greenlight Capital, L.L.C. is the general partner, Greenlight Capital Offshore, Ltd., for whom Greenlight Capital, Inc. acts as investment advisor, Greenlight Capital Qualified, L.P., of which Greenlight Capital, L.L.C. is the general partner, DME Advisors, L.P. of which DME Advisors GP, L.L.C. is the general partner, and David Einhorn, the principal of Greenlight Capital, L.L.C. |

| (2) | Includes 250,000 shares of common stock which may be acquired upon exercise of stock options that are exercisable. Mr. Murphy resigned as a director and Chief Executive Officer on December 3, 2008. |

| (3) | Includes 20,834 shares of common stock which may be acquired upon exercise of stock options and indirect ownership of 7,000 shares of which 5,000 shares are held by IRA and 1,000 shares each are held under Uniform Gifts to Minors Act for Mr. Hood’s daughter and son, respectively. Mr. Hood served as Chief Marketing Officer until November 25, 2008 when his employment terminated. |

| (4) | Includes 63,776 shares of restricted common stock. Does not include 100,000 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (5) | Includes 75,386 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 55,481 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (6) | Includes 85,273 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 40,407 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (7) | Includes 98,886 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 33,407 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (8) | Includes 40,000 shares of common stock which may be acquired upon exercise of presently exercisable stock options and indirect ownership of 34,633 shares held by IRA. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (9) | Does not include 10,733,469 shares of common stock beneficially owned by Greenlight Capital, L.L.C. and its affiliates, over which Mr. Heumann disclaims beneficial ownership. Mr. Heumann is an employee of Greenlight. |

3

| (10) | Includes 40,000 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (11) | Includes 10,356 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable in 60 days. |

| (12) | Includes 20,000 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 10,000 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (13) | Includes a total of 369,901 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days, indirect ownership of 34,633 shares and 63,776 shares of restricted common stock. Does not include 269,295 shares of common stock subject to stock options which are not exercisable within 60 days and does not include shares or options held by Messrs. Murphy and Hood. |

Pledge of Shares

In the ordinary course of its business, prime brokers for Greenlight Capital, L.L.C. and its affiliates (Greenlight) have taken a security interest in Greenlight’s shares in the Company. In the event that the prime brokers were to exercise remedies under the security interests, a change of control of the Company could occur.

To our knowledge, none of our officers or directors has pledged any of his or her shares.

Series Z Preferred Stock

Our Series Z Preferred Stock generally is non-voting. However, under our Certificate of Designation, Preferences and Rights of Series Z Preferred Stock (the Certificate of Designation), we cannot take any of the following actions without the vote or written consent by the holders of at least a majority of the then outstanding shares of the Series Z Preferred Stock:

| | • | | amend, alter or repeal any provision of, or add any provision to, the Certificate of Designation, whether by merger, consolidation or otherwise; |

| | • | | subject to the clause above, amend, alter or repeal any provision of, or add any provision to, our Restated Certificate of Incorporation or bylaws, whether by merger, consolidation or otherwise, except as may be required to authorize a Certificate of Designation for stock junior to the Series Z Preferred Stock, or to increase the authorized amount of any junior stock, including junior stock issued to management or employees under equity incentive plans; |

| | • | | authorize or issue shares of any class of stock having any preference or priority as to dividends, assets or payments in liquidation superior to or on a parity with the Series Z Preferred Stock, including, without limitation, Series Z Preferred Stock, whether by merger, consolidation or otherwise; |

| | • | | take any action that results in us or any of our direct or indirect subsidiaries incurring or assuming indebtedness (including the guaranty of any indebtedness) in excess of the greater of $185 million or 3.75 times EBITDA (as defined) for the trailing 12-month period prior to such date; |

| | • | | consummate any merger or change of control that does not result in the redemption of the Series Z Preferred Stock at the stated redemption price, payable in cash, at the effective time of the merger or change of control transaction; |

| | • | | make any restricted payment in violation of the covenant set forth in the Certificate of Designation; or |

| | • | | enter into any agreement to do any of the foregoing items. |

All 57,000 shares of our outstanding Series Z Preferred Stock are held by Halpern Denny Fund III, L.P.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of six directors and the board has nominated six directors for election at the Annual Meeting to serve until the 2010 Annual Meeting of Stockholders, and until their respective successors are duly elected and qualified. Our restated certificate of incorporation authorizes three to nine directors, as determined by the board, and all directors are to be elected annually. Stockholders are not entitled to cumulate votes in the election of directors and may not vote for a greater number of persons than the number of nominees named.

We are soliciting proxies in favor of the re-election of each of the nominees identified below. We intend that all properly executed proxies will be voted for these six nominees unless otherwise specified. All nominees have consented to serve as directors, if elected. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by the board of directors. The proxies may not vote for a greater number of persons than the number of nominees named. As of the date of this proxy statement, the board of directors has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected. Greenlight has indicated its intention to vote in favor of each of the nominees.

Information About the Nominees

The names of the nominees, their ages as of March 18, 2009, and other information about them are set forth below:

Michael W. Arthur. Mr. Arthur, 69, was appointed to the board of directors in October 2004. Since 1990, Mr. Arthur has headed Michael Arthur and Associates, a consulting and interim management firm specializing in restructurings, business development, and strategic, financial, marketing and branding strategies. During their restructurings, he served as CEO of California Federal Bank and financial advisor to Long John Silver’s Restaurants. Prior to 1990, Mr. Arthur served as Executive Vice President and Chief Financial Officer for Sizzler Restaurants and Pinkerton Security; Vice President of Marketing for Mattel Toys; and also served in various other management roles for D’Arcy, Masius, Benton & Bowles Advertising and Procter and Gamble. He also serves on the board of directors of the Alzheimers Association. Mr. Arthur has a B.A. degree from Johns Hopkins University and attended the Wharton Graduate School of Business.

E. Nelson Heumann. Mr. Heumann, C.F.A., 51, has served as our director since May 2004 and as Chairman of the Board since October 2004. Mr. Heumann joined Greenlight Capital, Inc., an investment management firm, in March 2000 and was made a managing member of Greenlight Capital, L.L.C. in January 2002. Prior to joining Greenlight, he served as director of distressed investments at SG Cowen from January 1997 to January 2000. From 1990 to January 1997, Mr. Heumann was a director responsible for distressed debt research and trading at Schroders. Prior to that, he was vice-president of bankrupt and distressed debt research for Merrill Lynch. Earlier in his career, Mr. Heumann was employed with Claremont Group, a leveraged buyout firm, and Value Line. He graduated from Louisiana State University in 1980 with a B.S. in Mechanical Engineering and in 1985 with an M.S. in Finance.

Frank C. Meyer. Mr. Meyer, 65, has served as our director since May 2004 and is a private investor. He was chairman of Glenwood Capital Investments, LLC, an investment advisory firm he co-founded, from January 1988 to January 2004. Since 2000, Glenwood has been a wholly owned subsidiary of the Man Group, plc, an investment advisor based in England specializing in alternative investment strategies. Mr. Meyer also serves on the board of directors of United Capital Financial Partners, Inc., a firm that converts transaction-oriented brokers into fee-based financial planners, and Fifth Street Finance Corp., a mezzanine lender to corporations. Mr. Meyer holds an M.B.A. from the University of Chicago and began his career at the University’s School of Business as an instructor of statistics.

5

Thomas J. Mueller. Mr. Mueller, 57, was appointed to the board of directors in December 2007. He has been the President and Partner of Mueller Consulting Inc., a consulting firm specializing in the restaurant industry, since 2006. From 2000 to 2006, Mr. Mueller served as President and Chief Operating Officer of Wendy’s International, Inc., the third largest restaurant hamburger chain in the quick service franchise industry. He began his career at Wendy’s in 1998 as the Senior Vice President, Special Projects. From 1995 to 1997, Mr. Mueller was Senior Vice President of Operations—North America, for Burger King Corporation, where he began his career as a restaurant manager in 1973. Mr. Mueller attended State University of New York at Fredonia and currently serves on the Board of Trustees of Ohio Dominican University.

Jeffrey J. O’Neill. Mr. O’Neill, 52, was named President and Chief Executive Officer and appointed to our board of directors in December 2008. In May 2005, Mr. O’Neill joined Priszm Income Fund in Toronto, Ontario, Canada. Priszm Income Fund holds an approximate 60 percent interest in Priszm Limited Partnership, which employs more than 9,000 people and owns and operates 465 quick service and quick casual restaurants (KFC, Taco Bell and Pizza Hut) across seven Canadian provinces. From January 2008 to October 2008, he served as Chief Executive Officer, and from May 2005 to January 2008, he served as President and Chief Operating Officer of Priszm Income Fund. From February 2003 until February 2005, he acted as Vice President of Sales for Quaker Foods USA, and from March 1999 to January 2003, he served as President of Pepsi Cola Canada. He holds an Honors Bachelor of Commerce Degree from the University of Ottawa and is currently a Board member of the North York General Hospital Foundation.

S. Garrett Stonehouse, Jr. Mr. Stonehouse, 39, has served as our director since February 2004. He has been a principal and founding partner of MCG Global, LLC, a private equity investment firm in Westport, CT, since 1995. Mr. Stonehouse is also the chairman of the board of directors of both Denver- based Imperial Headwear, Inc. and Boston-based Novations Group, Inc. Prior to co-founding MCG Global, he was vice president of Fidelco Capital Group. Before joining Fidelco in 1994, he held various positions with GE Capital. Mr. Stonehouse received a B.A. degree from Boston College in economics and mathematics.

Board Composition

Our board of directors has determined that Michael W. Arthur, Frank C. Meyer, Thomas J. Mueller and S. Garrett Stonehouse, Jr., all current directors, qualify as “independent” directors under the rules promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the Exchange Act), and by the Nasdaq Stock Market. There are no family relationships among any of our executive officers, directors or nominees for director.

Greenlight currently owns shares of our common stock sufficient to elect all of the members of our board of directors without the approval of any other stockholder.

Meetings of the Board of Directors and Committees

The board of directors held eight meetings during fiscal 2008 and took action by written consent on one occasion. During fiscal 2008, no director then in office attended fewer than 75% of the aggregate total number of meetings of the board of directors held during the period in which he was a director and of the total number of meetings held by all of the committees of the board of directors on which he served. The two standing committees of the board of directors are the audit committee and the compensation committee.

6

The following table shows the membership and number of meetings held by the board and each committee during fiscal 2008:

DIRECTOR COMMITTEE MEMBERSHIP AND MEETINGS

| | | | | | | | | | |

Director | | Settlement

Committee | | Independent

Committee | | Audit

Committee | | Compensation

Committee | | Board of

Directors |

Michael W. Arthur | | | | X | | Chair | | X | | X |

E. Nelson Heumann | | Chair | | | | | | | | Chair |

Frank C. Meyer (1) | | | | X | | X | | X | | X |

Thomas J. Mueller (1) | | X | | | | | | X | | X |

Paul J. B Murphy III (2) | | | | | | | | | | X |

Jeffrey J. O’Neill (2) | | | | | | | | | | X |

S. Garrett Stonehouse, Jr. | | | | Chair | | X | | Chair | | X |

Fiscal 2008 Meetings and Consents | | 2 | | 1 | | 5 | | 9 | | 8 |

| (1) | On January 23, 2008 Mr. Meyer resigned as a member of the Compensation Committee and Mr. Mueller was elected to serve on the Compensation Committee. |

| (2) | On December 3, 2008 Mr. Murphy resigned from the board of directors of the Company and Mr. O’Neill was elected to the board. |

We have not established a policy on director attendance at annual stockholders’ meetings; however, all of our directors then in office attended our last Annual Meeting held in May 2008.

Our board of directors has not established a process for our stockholders to communicate directly with the board because of the fact that Greenlight owns approximately 67.2% of our common stock and it was not deemed necessary or appropriate. Our audit committee has established a process for communicating complaints regarding accounting or auditing matters. Any such complaints received on the established hotline or submitted to the Chief Compliance Officer are promptly forwarded to the audit committee to take such action as may be appropriate.

Audit Committee

Michael W. Arthur (chairman), Frank C. Meyer and S. Garrett Stonehouse, Jr. are the current members of the audit committee. Each of them is “independent” as required by the rules promulgated by the SEC under the Exchange Act, and by the Nasdaq Stock Market. Each of them also meets the financial literacy requirements of the Nasdaq Stock Market. Our board of directors has determined that Mr. Arthur qualifies as an “audit committee financial expert” as defined by the rules promulgated by the SEC.

The audit committee is primarily concerned with monitoring:

| | (1) | the integrity of our financial statements; |

| | (2) | our compliance with legal and regulatory requirements; and |

| | (3) | the independence and performance of our auditors. |

The audit committee also is responsible for handling complaints regarding our accounting, internal accounting controls or auditing matters. The audit committee’s responsibilities are set forth in its charter which was last amended in February 2009 and is reviewed annually. The charter is available on our website atwww.einsteinnoah.com. There were 4 meetings of the audit committee during fiscal 2008 and action was taken once by written consent.

7

Compensation Committee

S. Garrett Stonehouse, Jr. (chairman), Thomas J. Mueller and Michael W. Arthur are the current members of the compensation committee. Mr. Mueller was elected to the committee and Mr. Meyer resigned from the committee on January 23, 2008. Each of the current members is “independent” as defined in the rules promulgated by the SEC under the Exchange Act and by the Nasdaq Stock Market. This committee is primarily concerned with determining the compensation of our employees generally and approving compensation of our executive officers. The committee does not establish or recommend compensation for our independent directors; that compensation is approved by the board of directors as a whole.

The compensation committee’s responsibilities are set forth in its charter. The charter was most recently updated in February 2008 and is reviewed annually. The committee’s charter is posted on the Company’s website atwww.einsteinnoah.com. The responsibilities as outlined in the charter are:

| | (1) | to review and approve all aspects of the compensation of the Company’s executive officers; |

| | (2) | to review and approve corporate goals and objectives relevant to the compensation of the chief executive officer; |

| | (3) | to review and make periodic recommendations to the board regarding the general compensation, benefits, and perquisites policies and practices of the Company; and |

| | (4) | to review the Compensation Discussion and Analysis with management annually and to recommend its inclusion in the annual proxy statement. |

There were seven meetings of the compensation committee during fiscal 2008 and action was taken twice by written consent.

The compensation committee chairman, in consultation with senior management, sets the agenda for compensation committee meetings. The Corporate Secretary has attended meetings of the compensation committee to provide appropriate record keeping. The committee has also invited the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, and Vice President—Human Resources to attend certain compensation committee meetings. These individuals may attend compensation committee meetings but would not attend executive sessions. The compensation committee appoints a secretary to take minutes of the executive sessions.

Nomination of Directors

The nominees for re-election to our board at the Annual Meeting were formally nominated by the full board of directors consisting of Messrs. Arthur, Heumann, Mueller, Meyer, O’Neill, and Stonehouse. The Company does not have a standing nominating committee or committee performing similar functions because Greenlight owns approximately 67.2% of our common stock and can therefore elect all of our directors without the vote of any other stockholder. Although the board will consider nominees recommended by stockholders, the board has not established any specific procedures for stockholders to follow to recommend potential director nominees for consideration. Messrs. Arthur, Heumann, Meyer, Mueller, O’Neill and Stonehouse participated in the consideration of director nominees.

At this time, the board has neither established any specific written procedures for identifying and evaluating potential director nominees nor established any minimum qualifications or skills for directors. Because of the fact that Greenlight owns approximately 67.2% of the voting stock and, as such, the Company is a “controlled company”, the board did not deem it necessary to adopt specific written procedures.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of the Company. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

8

Vote Required

Directors will be elected by a majority of the votes of the holders of shares present in person or by proxy at the Annual Meeting. Greenlight has indicated its intention to vote in favor of each of the nominees.

Recommendation

The board of directors recommends that stockholders vote FOR each of the nominees for director. If not otherwise specified, proxies will be voted FOR each of the nominees for director.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Greenlight Capital, L.L.C. and its affiliates

E. Nelson Heumann is the chairman of our board of directors and is a current employee of Greenlight. Greenlight beneficially owns approximately 67.2% of our common stock. As a result, Greenlight has sufficient voting power without the vote of any other stockholders to determine what matters will be submitted for approval by our stockholders, to elect all of our board of directors and, among other things, to determine whether a change in control of our Company occurs. Greenlight has been involved in our financings and refinancings, has purchased our debt and equity securities and was involved in our equity recapitalization.

Procedures for Review of Transactions with Related Persons

Any proposed transaction with a related person is subject to review, negotiation and action by a committee consisting entirely of independent and disinterested directors, which committee is appointed by the board of directors at the time of any proposed transaction. The committee’s purpose and authority are set forth in resolutions appointing the committee and generally include the authority to retain such consultants, advisers and attorneys as it deems advisable in order to perform its duties.

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE

STOCK OPTION PLAN FOR (NON-EMPLOYEE) INDEPENDENT DIRECTORS

TO INCREASE THE NUMBER OF

SHARES AUTHORIZED FOR ISSUANCE TO 500,000 SHARES

We are asking you to approve an amendment to the Stock Option Plan for (Non-Employee) Independent Directors (the Director Plan) to increase the number of shares authorized for issuance from 300,000 shares to 500,000 shares. A copy of the Director Plan, prior to this amendment, is attached as Annex A. On January 21, 2009, our board of directors approved the amendment to increase the shares authorized for issuance under the plan, subject to the approval of our stockholders at the Annual Meeting. A copy of the amendment to increase the shares authorized is attached as Annex B.

Our stockholders previously approved the Director Plan, initially at our 2004 Annual Meeting, approved changes to the plan, relating to pro rata awards for directors elected to our board mid-year, at our 2005 Annual Meeting and approved an amendment to increase the number of shares authorized for issuance under the plan from 200,000 to 300,000 at our 2007 Annual Meeting. The copy of the Director Plan attached as Annex A includes the terms of the Director Plan, as amended and restated, effective as of September 1, 2008. Subsequent to our 2007 Annual meeting we made two non-material amendments to the Director Plan to change our company name and to incorporate provisions for compliance with tax law requirements for deferred compensation arrangements under Section 409A of the Internal Revenue Code of 1986, as amended, and related regulations and other applicable guidance (Section 409A and the Code).

9

The Director Plan provides for annual option grants, effective each January 1, to each of our independent directors to purchase 10,000 shares of our common stock. Independent directors elected mid-year receive an option grant with a pro rated number of shares based upon the director’s term of service for the calendar year. In January 2009, we granted options to purchase a total of 40,000 shares to our four independent directors. As of January 1, 2009, we have granted options to purchase a total of 266,164 shares under this plan and options to purchase 20,000 shares have been forfeited and cancelled, leaving 53,836 shares available for future option grants. By increasing the number of shares authorized under the plan by 200,000 shares, we anticipate that the plan will have sufficient shares available for issuance for five additional years, based upon our current number of independent directors, four. The amendment to the Director Plan is subject to stockholder approval, and will become effective only if Proposal 2 is approved by the requisite vote of stockholders at the Annual Meeting.

Summary

The primary purposes of the Director Plan are to provide our independent directors with an added incentive to continue in service with us and to have a more direct interest in the future success of our operations. Our stockholders previously authorized 300,000 shares of our common stock for issuance under the Director Plan and that number will increase to 500,000 if our stockholders approve Proposal 2.

The Director Plan permits the grant of non-qualified stock options. Directors who qualify as independent under the Sarbanes-Oxley Act of 2002 and rules promulgated by the SEC pursuant to the Exchange Act may receive options under the Director Plan. As of January 1, 2009, we had four non-employee, independent directors who were eligible to receive options under the Director Plan.

The Director Plan provides for automatic annual option grants to independent directors on January 1 of each year. Options that have been granted under the Director Plan are set forth in the “Director Compensation” table below. The aggregate market value of the shares of our common stock that may be awarded under the Director Plan is approximately $330,553, which is based on the maximum number of shares that remain available for grant under the Director Plan (53,836 shares), multiplied by $6.14, the last reported sales price of our common stock on Nasdaq on March 18, 2009.

Our board of directors believes it is in the best interest of our stockholders to approve the amendment to the Director Plan and recommends that our stockholders approve this amendment. The principal features of the Director Plan are summarized below.

Administration of the Director Plan

Our board of directors administers and interprets the Director Plan.

Stock Options

The Director Plan provides for the grant of non-qualified stock options. On January 1 of each year, each independent director then serving on our board automatically receives an option to acquire 10,000 shares of our common stock. If an individual is elected or appointed during the calendar year as an independent director, the independent director is awarded an option for a number of shares equal to the pro rata portion of the 10,000 share annual grant based on the number of days the individual serves as an independent director during the calendar year. Each option vests six months after the date of grant and expires five years after the date of grant, unless earlier terminated or exercised. The exercise price for each option is the fair market value, the closing price of a share of our common stock, on date of grant.

An option holder may exercise an option by written notice to the company and payment of the exercise price:

| | • | | by certified, cashier’s or other check acceptable to us; |

10

| | • | | by the surrender of a number of shares of common stock already owned by the option holder for at least six months and with a fair market value equal to the exercise price; or |

| | • | | in any combination of the foregoing methods. |

Adjustments

The plan provides for adjustment to the number of shares authorized for issuance under the plan and the number of shares subject to outstanding options in the event of stock splits, stock dividends, recapitalizations and other dilutive changes in our common stock. The board also has discretion to make equitable adjustments in the event of any other changes in our outstanding common stock, provided, that any adjustment is consistent with the requirements of Section 409A.

Non-Transferability

Options granted under the Director Plan are non-transferable, except by will or pursuant to the laws of descent and distribution and may be exercised during the lifetime of the option holder only by the holder (or, in the event of incapacity, his or her guardian or legal representative).

Effect of Termination of Services

An outstanding option will terminate prior to the end of its five-year term in three circumstances. If the option holder is removed from the board for cause, as determined by the board in its sole discretion, the outstanding option becomes void for all purposes upon the removal, regardless of the option term. If the option holder dies while a director, the outstanding option will terminate upon the first to occur of 12 months following the date of death or the end of the option term. If the option holder terminates service as a director of the Company for any other reason, the outstanding option will terminate upon the first to occur of 12 months following the date the option holder is no longer a director or the end of the option term.

Corporate Reorganization; Change of Control

Upon the occurrence of a “corporate transaction,” the board may determine that any or all outstanding options will:

| | (1) | become fully exercisable; |

| | (2) | terminate at the closing of the transaction; |

| | (3) | be cancelled in exchange for a cash payment, to the extent permitted under Section 409A, equal to the greater of: |

| | • | | the excess of the fair market value of our common stock over the exercise price or |

| | • | | the fair market value as determined by the board of the consideration for which a share of common stock is to be exchanged in the transaction less the exercise price, multiplied by the number of shares of common stock subject to the option; |

| | (4) | be assumed or substituted by the successor or purchaser in the transaction; provided that the action is in accordance with Section 409A; or |

| | (5) | be dealt with in any other manner as the board deems appropriate; provided that the action is in accordance with Section 409A. |

A corporate transaction generally includes the following events:

| | • | | our merger, consolidation or reorganization (other than a reorganization under the U.S. bankruptcy Code or a merger or consolidation in which we are the continuing corporation and that does not result in any changes in the outstanding shares of common stock); or |

11

| | • | | the sale of all or substantially all of our assets (other than a sale in which we continue as the holding company of an entity that conducts the business formerly conducted by us); or |

| | • | | our dissolution or liquidation; or |

| | • | | a “change of control” of the company. A “change of control” generally means any transaction or event occurring on or after the date of the Director Plan as a direct or indirect result of which: |

| | (1) | any person or any group in the aggregate equity interests (other than Greenlight Capital, L.L.C. and its affiliates) shall: |

| | • | | beneficially own (directly or indirectly) more than 50% of the aggregate voting power of all of our equity interests at the time outstanding; or |

| | • | | have the right or power to appoint a majority of our board of directors; or |

| | (2) | during any period of two consecutive years, individuals who at the beginning of such period constituted our board of directors (together with any new directors whose election by such board of directors or whose nomination for election by our stockholders was approved by a vote of a majority of our directors then still in office who were either directors at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute at least a majority of our board of directors then in office; or |

| | (3) | any event or circumstance constituting a “change of control” under any documentation evidencing or governing any of our indebtedness in a principal amount in excess of $10.0 million shall occur which results in an our obligation to prepay (by acceleration or otherwise purchase, offer to purchase, redeem or defease) all or a portion of such indebtedness; or |

| | • | | any other transaction determined by resolution of the board to be a corporate transaction. |

Deductibility under Section 280G of the Code

Options that are not otherwise exercisable at the time of a corporate transaction will only become exercisable, be cancelled and settled in cash or other consideration to the extent the exercise and issuance of shares or payment with respect to a non-employee director continues to be deductible by the company pursuant to Section 280G of the Code (the golden parachute tax rules).

Amendment and Termination

The board may amend, modify or terminate the Director Plan in any respect at any time, but no amendment can impair any option previously granted or deprive an option holder of any common stock acquired without the option holder’s consent. We will obtain stockholder approval of amendments to the extent required by applicable laws or rules. The Director Plan does not have a fixed term. The plan will terminate whenever the board adopts a resolution to that effect.

Federal Income Tax Consequences

The following summary generally describes the principal federal (but not state and local) income tax consequences of option grants made pursuant to the Director Plan. It is general in nature and is not intended to cover all tax consequences that may apply to a particular recipient or to us. The provisions of the Code and the regulations thereunder relating to these matters are complicated and their impact in any one case may depend upon the particular circumstances.

When a non-qualified stock option is granted, there are no income tax consequences for the option holder or us. When a non-qualified stock option is exercised, in general, the option holder recognizes ordinary income equal to the excess of the fair market value of the common stock on the date of exercise over the exercise price. We are entitled to a deduction equal to the ordinary income recognized by the option holder for our taxable year that ends with or within the taxable year in which the option holder recognized the ordinary income.

12

Section 409A imposes time and form of payment requirements for “nonqualified deferred compensation,” including certain stock options. If a nonqualified deferred compensation arrangement subject to Section 409A fails to satisfy, or is not operated in accordance with, the requirements of Section 409A, the service provider may be required to accelerate the recognition of income and be subject to an additional 20% tax, plus interest. The stock options issuable under the plan are designed to comply with Section 409A.

New Plan Benefits

The benefits to be received in the future under the Director Plan are indeterminable as they are dependent on the number of independent directors either in office on January 1 of each year or added to the board mid-year. Based upon our current level of four independent directors, each January 1, those independent directors as a group will receive a total of 40,000 stock options. Our named executive offices, other executive officers and other employees are not eligible to participate in the Director Plan and will not receive any benefits under the Director Plan.

Vote Required

The affirmative vote of a majority of the votes cast on this proposal is required to approve Proposal 2. Greenlight has indicated its intention to vote in favor of Proposal 2.

Recommendation

The board of directors recommends that stockholders vote FOR the approval of Proposal 2. If not otherwise specified, proxies will be voted FOR Proposal 2.

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

A resolution will be presented at the Annual Meeting to ratify the appointment by the board of directors of the firm of Grant Thornton LLP, an independent registered public accounting firm, as independent auditors to audit our financial statements for the year ending December 29, 2009. Inclusion of this proposal in our proxy statement to ratify the appointment of our independent auditors for year ending December 29, 2009 is not required, but is being submitted as a matter of good corporate practice.

Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they wish to do so, and will be available to respond to appropriate questions.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Fees Paid to Independent Auditors

For the fiscal years ended December 30, 2008 and January 1, 2008, Grant Thornton LLP, our independent auditor, billed the approximate fees set forth below:

Audit Fees

Aggregate fees billed by Grant Thornton LLP in connection with the audit of our consolidated financial statements as of and for the year ended December 30, 2008 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended December 30, 2008 were approximately

13

$459,354, including approximately $173,882 related to compliance with Sarbanes-Oxley requirements and $8,500 related to the Company’s Form S-8 registration statement. Aggregate fees billed by Grant Thornton LLP in connection with the audit of the consolidated financial statements as of and for the year ended January 1, 2008 and its reviews of the unaudited condensed consolidated interim financial statements during the year ended January 1, 2008 were approximately $721,171, including approximately $212,000 related to compliance with Sarbanes-Oxley requirements and $189,000 related to the Company’s public equity offering.

Audit-Related Fees

There were no audit-related fees billed by Grant Thornton LLP in fiscal years ended December 30, 2008 and January 1, 2008.

Tax Fees

The aggregate fees billed by Grant Thornton LLP for the years ended December 30, 2008 and January 1, 2008 were $0 and $23,087, respectively, for tax consultation services relating primarily to refunds for overpayment of use taxes and sales tax refunds.

All Other Fees

There were no other fees billed by Grant Thornton LLP during the years ended December 30, 2008 and January 1, 2008.

Pre-Approval Policies and Procedures

Our audit committee has established procedures for pre-approval of audit and non-audit services as set forth in the audit committee charter. The audit committee pre-approves all services performed by Grant Thornton LLP and discloses such fees under the headings “Audit-Related Fees,” “Tax Fees” and “All Other Fees” above. The audit committee considers whether the provision of the services disclosed under the headings “Audit-Related Fees,” “Tax Fees” and “All Other Fees” is compatible with maintaining Grant Thornton LLP’s independence. Services relating to tax overpayments and sales tax refunds were pre-approved by the audit committee during the fiscal year ended January 2, 2007 and continued during the year ended January 1, 2008.

Vote Required

The affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy and entitled to vote thereon is required to approve Proposal 3. Greenlight has indicated its intention to vote in favor of Proposal 3.

Recommendation

The board of directors recommends that stockholders vote FOR Proposal 3. If not otherwise specified, proxies will be voted FOR Proposal 3.

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following Audit Committee Report and Compensation Committee Report shall not be deemed to be “Soliciting Material,” are not deemed “filed” with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filings.

14

AUDIT COMMITTEE REPORT

The audit committee of the board of directors consists of three non-employee independent directors, Michael W. Arthur, Chairman, Frank C. Meyer and S. Garrett Stonehouse, Jr. The audit committee is a standing committee of the board of directors and operates under a written charter initially approved by the board of directors in January 2004, which is reviewed annually and which was most recently reviewed, amended and approved by the committee in February 2009.

Management is responsible for our system of internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The audit committee is responsible for monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our auditors.

The audit committee has reviewed with our management and the independent accountants the audited consolidated financial statements in the annual report on Form 10-K for the year ended December 30, 2008, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the consolidated financial statements. Management represented to the audit committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The audit committee discussed with the independent accountants matters required to be discussed by Statement of Auditing Standards No. 61,Communication With Audit Committees.

Our independent accountants also provided to the audit committee the written disclosure required by applicable requirements of the Public Company Accounting Oversight Board regarding independent accountant’s communications with the audit committee concerning independence. The audit committee discussed with the independent accountants that firm’s independence. The audit committee considered the non-audit services provided by the independent accountants and subsequently concluded that such services were compatible with maintaining the accountants’ independence.

Based on the audit committee’s discussion with management and the independent accountants, and the audit committee’s review of the representation of management and the report of the independent accountants to the audit committee, the audit committee recommended that the board of directors include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 30, 2008 filed with the SEC.

AUDIT COMMITTEE

Michael W. Arthur, Chairman

Frank C. Meyer

S. Garrett Stonehouse, Jr.

COMPENSATION COMMITTEE REPORT

The compensation committee has discussed and reviewed the Compensation Discussion and Analysis with management. Based upon this review and discussion, the compensation committee recommended to the board of directors that the Compensation Discussion and Analysis be included in this proxy statement.

COMPENSATION COMMITTEE

S. Garrett Stonehouse, Jr., Chairman

Michael W. Arthur

Thomas J. Mueller

15

COMPENSATION DISCUSSION & ANALYSIS

Introduction

In this Compensation Discussion and Analysis, we discuss our compensation objectives, our compensation decisions and the rationale behind those decisions in connection with 2008 compensation of our executive officers. The named executive officers discussed in this section are: Jeffrey J. O’Neill, who was elected our Chief Executive Officer (CEO) in December 2008, Paul J.B. Murphy, III, our CEO until December 2008, Richard P. Dutkiewicz, our Chief Financial Officer (CFO), Daniel J. Dominguez, our Chief Operating Officer (COO), Jill B. W. Sisson, our General Counsel (GC) and James W. Hood, our Chief Marketing Officer (CMO) until November 2008. We refer to them collectively as our named executive officers (NEOs).

Who designs our compensation program and makes compensation decisions?

The compensation committee is responsible for designing and administering our executive compensation programs and makes decisions regarding compensation of our executive officers. The members of our compensation committee are S. Garrett Stonehouse, Jr., Chairman, Michael W. Arthur and Thomas J. Mueller. Although in 2008 our compensation decisions with respect to salaries were made in the third quarter of the calendar year (retroactive to May 2008), our compensation planning process neither begins nor ends with any particular committee meeting. Business and succession planning, evaluation of management performance and consideration of the business environment are year-round processes. During 2008, the committee met seven times to discuss cash compensation, benefit plans, bonuses and the bonus plan, option grants, executive performance reviews and other components of executive compensation and took action twice by unanimous consent.

How are compensation decisions made?

Compensation discussions and decisions are designed to promote our fundamental business objectives and strategy. The compensation committee periodically reviews data about the compensation levels of executives in the restaurant industry. The purpose of these reviews is to determine whether our compensation packages are competitive. In 2008, the committee performed a review of our NEO base salaries compared to other executives in these positions at similarly-sized restaurant companies using information from a variety of resources, including public information about certain companies and surveys. For each NEO, the surveys and companies referred to were:

CEO: HVS 2007 Executive Search Annual CEO/CFO Compensation Report (Chain Restaurant Edition), Chain Restaurant Comp Association Survey 2007, Mercer 2007 US Retail Compensation/Benefits Survey, Red Robin Gourmet Burgers, Inc., Caribou Coffee Company, Peet’s Coffee & Tea, Inc., Cosi Inc. and Sonic.

COO: Chain Restaurant Comp Association Survey 2007, Mercer 2007 US Retail Compensation/Benefits Survey, Chipotle Mexican Grill, Peet’s Coffee & Tea, Red Robin Gourmet Burgers, Inc. and Cosi Inc.

CFO: HVS 2007 Executive Search Annual CEO/CFO Compensation Report (Chain Restaurant Edition), Chain Restaurant Comp Association Survey 2007, Mercer 2007 US Retail Compensation/Benefits Survey, Chipotle Mexican Grill, Red Robin Gourmet Burgers, Inc. Cosi Inc., PF Chang’s China Bistro, Panera Bread Company and Tim Hortons Inc.

CMO: Mercer 2007 US Retail Compensation/Benefits Survey, CompAnalyst, Panera Bread Company and Tim Hortons Inc.

GC: Chain Restaurant Comp Association Survey 2007, Association of Corporate Counsel SoCal 2008 Survey, Mercer 2007 US Retail Compensation/Benefits Survey, Champps Entertainment, and Coffee Bean & Tea.

16

Although the committee has the authority, it did not engage outside compensation consultants to provide compensation information during 2008.

What are the objectives of our compensation program?

The objectives of our compensation program are to attract and retain high caliber executives and to motivate them to enhance stockholder value by achieving our corporate objectives. The compensation committee evaluates our business and compensation objectives on a regular basis, most recently reviewing the business objectives in December 2008.

Our compensation strategy is necessarily tied to our stage of development and growth as a business. During 2008, we pursued our growth strategy, opening 17 new restaurants and upgrading 45 restaurants, while continuing to focus on growth of earnings before interest, taxes, depreciation and amortization (EBITDA). In order to accomplish our goals, the Committee saw the need to incent and motivate our NEOs to achieve financial results and growth and, therefore, continued to use EBITDA and subjective criteria for our bonus plan. The committee strives to balance the goal of providing competitive compensation consistent with our financial resources, while motivating our NEOs to achieve business objectives for increased stockholder value. The committee further reviews the total level of compensation to determine that our levels of pay are competitive relative to the company’s performance and restaurant industry norms. As a result, the specific direction, emphasis and components of our executive compensation program continue to evolve in parallel with the evolution of our business strategy and performance expectations. For example, target and threshold EBITDA goals, our primary economic metric, have been reviewed and adjusted upward to reflect our growth and development plans. The Committee will continue to evaluate our compensation philosophy and make modifications designed to balance financial rewards and incentives in order to drive our business.

What are the elements of compensation?

The material elements of our executive compensation program are: base salary, cash bonuses, and equity awards in the form of stock options and restricted stock. The program is designed to motivate our NEOs to enhance stockholder value by rewarding them for performance and achieving short-term and long-term company goals.

The 2008 compensation program was designed to reward goals that have a direct impact on our business results, in particular our financial results. The program also considers our overall financial position. Positive and ongoing improvements in our financial results have been rewarded through both the bonus and equity award elements of our compensation program. Annual salaries and bonuses are designed to reward current performance while equity awards provide a long-term incentive and align NEOs’ and stockholders’ interests.

We utilize the annual bonus plan to motivate the NEOs to achieve specific business and financial goals based on our annual business plan. In 2008, the financial component of the bonus plan was tied to EBITDA and further adjusted up (or down) for the following items (Adjusted EBITDA):

| | • | | Loss (gain) on sale, disposal or abandonment of assets, net; |

| | • | | Impairment charges and other related costs; |

| | • | | Transition expenses relating to the resignation of our former CEO and employment of a new CEO; and |

| | • | | Stock-based compensation expense. |

Adjusted EBITDA is similar to consolidated EBITDA, as defined in our existing loan agreements. Adjusted EBITDA is an important measure in our compensation program because it ties executive compensation to stockholder interests, is a quantitative measure of operating performance and has direct correlation to meeting our obligations to our lenders.

17

Elements of Compensation

Base Salary

We pay base salary to our NEOs to provide current compensation for their services. The amount of base salary is designed to be competitive with salaries for similar positions in the restaurant retail and hospitality industries. We regularly review competitor and market data to determine the reasonableness of our compensation within the financial constraints of our performance. We benchmark our compensation against similar businesses in the restaurant retail and hospitality industries, using revenues and geography to further refine this analysis. As described above, for each of the NEO positions, we used survey data based upon our industry and size, and public information about companies that we consider competitors. Based in part upon this information, in 2008 we made modest adjustments (3.3%, 3.1% and 3.1%, respectively) in base salaries for our CFO, CMO and our GC and our COO received a 12% increase. Mr. Murphy, our former CEO, did not receive an increase in base salary. In addition, the committee authorized an executive search for a Chief Executive Officer (CEO) during 2008 and, through the recruitment process, we learned additional information regarding other restaurant companies’ compensation packages for this position and set Mr. O’Neill’s compensation as CEO accordingly.

Bonus

We provide an annual cash bonus opportunity to each NEO as a short-term incentive. The purpose of this element is to drive company-based initiatives and financial results and to directly tie executive compensation to those financial results. Each executive is eligible for a cash bonus based on Adjusted EBITDA performance.

The committee adopted the 2008 Bonus Plan in February 2008. Under the plan, 85% of the bonus is based solely on Adjusted EBITDA results (Company Performance Portion) and 15% on individual performance (Individual Performance Portion). In order for our executives to be eligible for the Company Performance Portion or the Individual Performance Portion of the bonus, the Company must achieve a minimum threshold level of Adjusted EBITDA. Once the threshold level is met, increasing percentages of bonuses are earned based upon the degree to which actual Adjusted EBITDA exceeds the threshold level. If performance far exceeds the anticipated goal, additional bonuses may be paid out at the discretion of the board of directors upon recommendation of the committee. The Adjusted EBITDA threshold level and scale for 2008 represented growth goals for the Company and were set to challenge NEOs to achieve those results.

Once the Adjusted EBITDA threshold is met, 85% of the bonus (the Company Performance Portion) is earned. The committee then reviews the individual performance of each NEO compared to the job description, key initiatives, goals and objectives of each NEO. Individual performance is also evaluated in light of financial, operational and customer experience elements that most accurately reflect the NEO’s role and responsibilities. Based on the Committee’s evaluation, up to 100% of the Individual Performance Portion is awarded.

The potential bonus percentage based on the base salary for each NEO for 2008 bonuses is: CEO 100%; COO, CMO and CFO 75% and GC 60%. In February 2009, the committee evaluated the Company’s performance against the specific financial targets set at the beginning of the year to determine whether any participant was eligible for a bonus. For 2008, the threshold was $42.0 million Adjusted EBITDA, with no payments for performance below this amount. If Adjusted EBITDA results increased from $42 million to $46 million, from $46 million to $50 million and above $50 million, the amounts in the bonus pool increased in increments. Based on Adjusted EBITDA of approximately $44.4 million for 2008, the bonus pool level was 25% of the highest target level attained. Adjusted EBITDA of approximately $44.4 million includes the calculated bonus pool. The amount of total bonus paid for 2008 is reported in our Summary Compensation Table under two separate columns, the Company Performance Portion is reported in the Non-Equity Incentive Plan Compensation column and the Individual Performance Portion is reported in the Bonus column.

In February 2009, the committee adopted the 2009 Bonus Plan. Under the 2009 plan, 85% of the bonus is based solely on Adjusted EBITDA results (the Company Performance Portion) and 15% on individual

18

performance (the Individual Performance Portion), once a threshold Adjusted EBITDA is met. In other respects, the 2009 plan incorporates the same terms as the 2008 plan, except for increased levels of Adjusted EBITDA to incent improved company performance.

Equity Awards

Equity-based incentives are the long-term component of our executive officer compensation program. We believe these forms of compensation align the interests of executives with those of our stockholders for periods greater than the single year focus of the cash bonus plan. Equity incentives also encourage retention of employees through multi-year vesting schedules. Historically, the company has granted equity awards to our NEOs in the form of stock options. On January 9, 2009, the company also granted restricted stock to our CEO, Mr. O’Neill, in connection with his employment. During 2008, the company granted stock appreciation rights to a broad-based group of our employees, excluding our NEOs.

Stock Options. We grant stock options under our Executive Employee Incentive Plan. Stock options reward the recipient for the increase in our stock price during the holding period but are also high-risk as the potential value of each option can fall to zero if the price of our stock is lower than the exercise price when the options expire. The number of options granted to each NEO is determined by reviewing levels of responsibility, experience, internal equity, retention concerns, total compensation and number of options reserved under the Option Plan. Stock options have been granted to NEOs and other employees at an exercise price equal to the fair market value of a share of our common stock on the date of grant, and the options generally expire ten years after date of grant. Through 2008, options vested based upon two equally-weighted components: Adjusted EBITDA performance and tenure. Vesting based on Adjusted EBITDA performance means that1/6 of these options shall vest on April 1 of the first, second and third years after grant on meeting at least 100% of the Adjusted EBITDA target in the business plan for the preceding year (Performance Year).1/12 of the options vest upon meeting less than the target Adjusted EBITDA in the Performance Year’s business plan but more than the sum of (a) the threshold Adjusted EBITDA in the Performance Year’s business plan plus (b) 50% of the difference between the threshold Adjusted EBITDA and target Adjusted EBITDA in the Performance Year’s business plan. Otherwise, the Adjusted EBITDA performance-based portion of the options will not vest. The tenure component is vested equally on the first, second and third anniversaries of the grant date. Because a portion of options vested only upon achievement of a specific financial metric, Adjusted EBITDA, we believed this provided an additional incentive to drive financial results. For 2008, the Adjusted EBITDA vesting goal was not met so options based on achieving that goal were cancelled. However, the tenure-based options did vest. In February 2008 and August 2008, a total of 124,592 additional options were granted, at an exercise price equal to the fair market value of a share of our common stock on the dates of grant, to the NEOs with vesting based on Adjusted EBITDA performance and tenure. In February 2009, the Committee decided to simplify the vesting schedule and granted options to acquire a total of 54,000 shares to our COO, CFO and GC vesting in three equal annual installments on the first, second and third anniversaries of the grant date.

On occasion, in order to provide an incentive to achieve a specific goal or result, the compensation committee may grant options with vesting based on specific events, performance or timing. For example, in February 2007, the committee granted options to purchase a total of 85,000 shares of common stock to our NEOs. These options, which vested upon completion of our public equity offering in June 2007, were granted to further incent and compensate the NEOs for the achievement of this goal which substantially reduced indebtedness and resulted in substantial cash interest expense savings.

As an inducement to accept the position of CEO, the committee granted Mr. O’Neill options to purchase a total of 100,000 shares of common stock at an exercise price equal to fair market value of a share of our common stock on the date of grant, $4.60 per share, vesting in three equal annual installments in December 2009, 2010 and 2011, provided he is then employed by the company. These options expire ten years after the date of grant. The committee also agreed to grant him 25,000 options per year during the first three years of his employment, commencing in February 2010.

19

Restricted Stock. Also as an inducement to accept employment as our CEO, the committee agreed to grant Mr. O’Neill 63,776 shares of restricted stock, valued at $375,000 on January 9, 2009, the date of grant. One-third of these restricted shares vest on each of January 9, 2010, January 9, 2011 and January 9, 2012, provided he remains employed by the company.

Our NEOs’ total compensation may vary significantly year to year based on company and individual performance. Further, the value of equity awards made to our senior executives will vary in value based on our stock price performance.

What benefits and perquisites do NEOs receive?

Our NEOs (with the exception of our GC who is a non-employee consultant) participate in our health and welfare benefit programs, such as medical, dental and vision care coverage, disability insurance and life insurance that are generally available to our employees. They receive four (4) weeks of paid time off each year. Paid time off is earned in increments throughout the year. Our NEOs are expected to manage personal time off in a manner that does not impact performance or achievement of company and individual goals. Upon termination, each NEO is entitled to payment of accrued benefits earned prior to his or her termination.

Our COO is also reimbursed for travel, lodging, food, transportation and other incidental expenses incurred in connection with his commute from his home in California to our corporate offices in Lakewood, Colorado.

What other plans may NEOs participate in?