UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EINSTEIN NOAH RESTAURANT GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

555 Zang Street, Suite 300

Lakewood, Colorado 80228

March 25, 2013

Dear Stockholder:

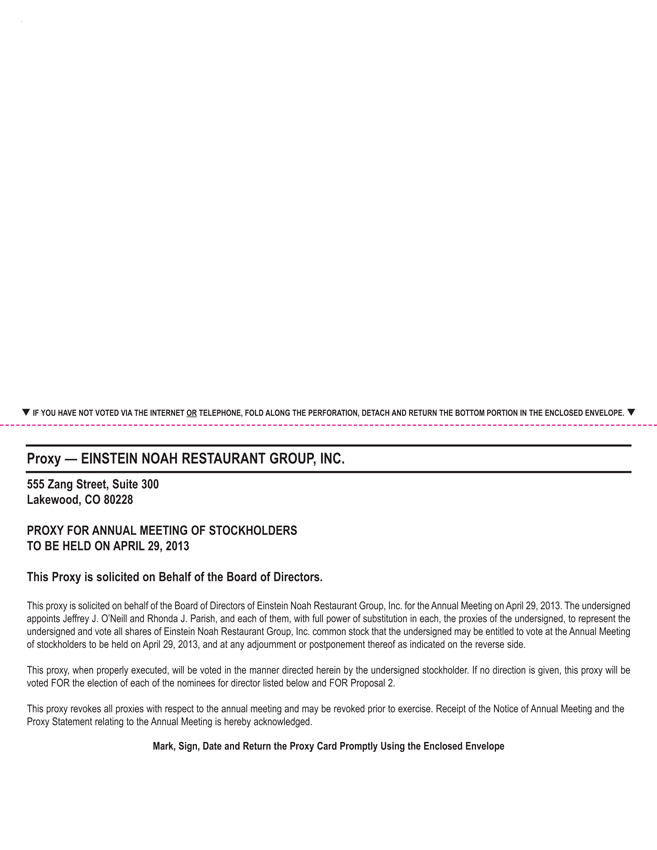

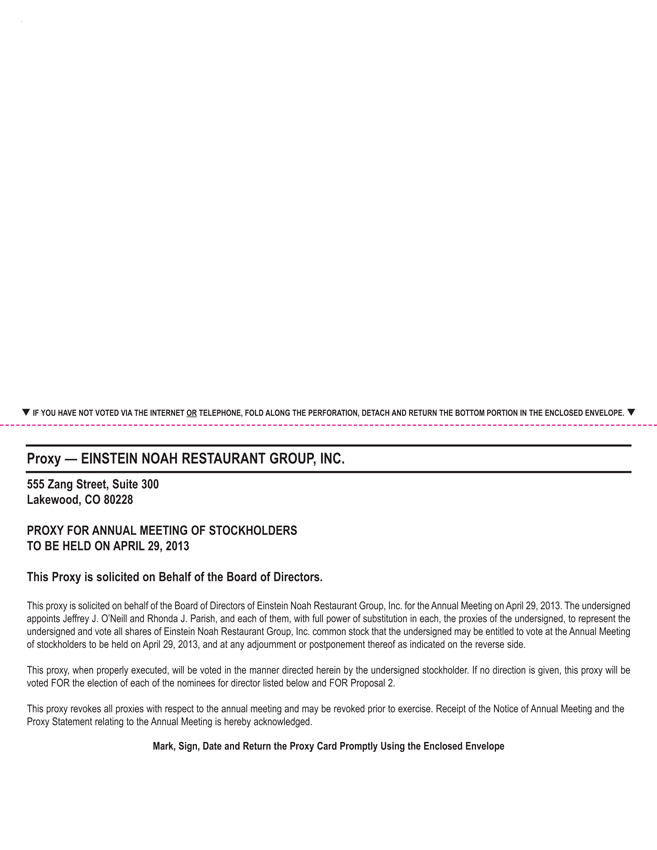

You are cordially invited to the 2013 Annual Meeting of Stockholders of Einstein Noah Restaurant Group, Inc. to be held on April 29, 2013 at 9:00 a.m., Mountain Time, at our offices located at 555 Zang Street, Suite 300, Lakewood, Colorado 80228.

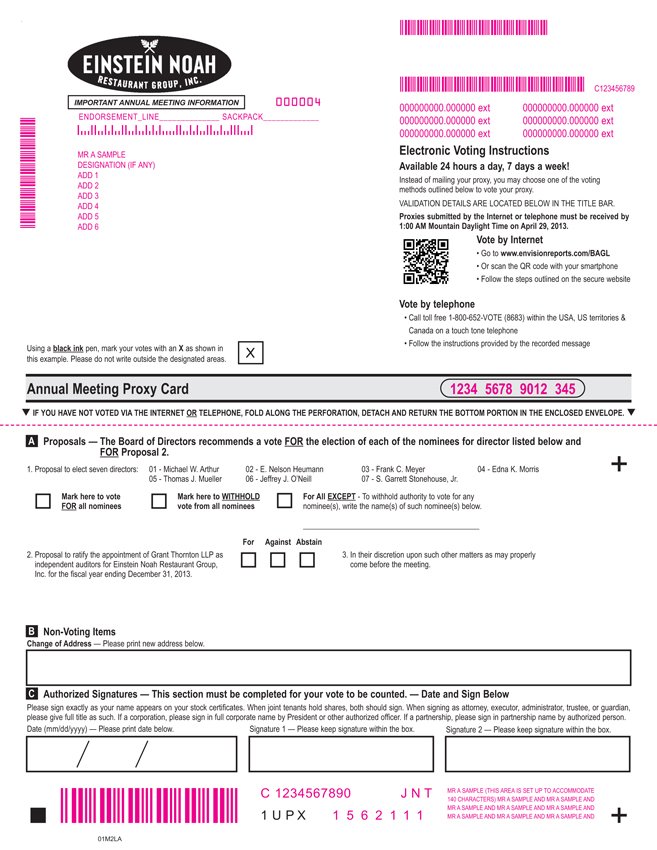

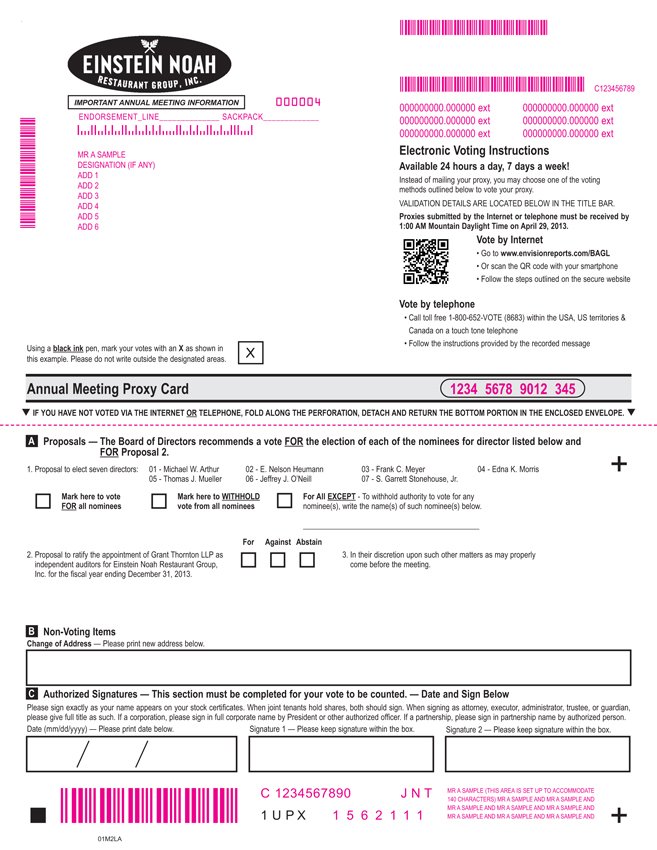

At the Annual Meeting, you will be asked to consider and vote upon proposals (1) to elect seven nominees named herein as directors to serve until the 2014 Annual Meeting of Stockholders, and until their respective successors are elected and qualified and (2) to ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2013.

Whether or not you are able to attend the Annual Meeting, I urge you to complete, sign, date and return the enclosed proxy card as promptly as possible in the postage paid envelope provided, as a quorum of the stockholders must be present, either in person or by proxy, in order for the Annual Meeting to take place. Stockholders of record may also vote by telephone or Internet by following the instructions on the enclosed proxy card.

I would appreciate your immediate attention to the mailing of this proxy.

|

Yours truly, |

|

| Jeffrey J. O’Neill |

| President and Chief Executive Officer |

555 Zang Street, Suite 300

Lakewood, Colorado 80228

Notice of Annual Meeting of Stockholders To Be Held on April 29, 2013

You are cordially invited to attend the annual meeting of stockholders of Einstein Noah Restaurant Group, Inc., which will be held at our offices at 555 Zang Street, Suite 300, Lakewood, Colorado 80228 on April 29, 2013 at 9:00 a.m., Mountain Time, for the following purposes:

| | 1. | To elect seven nominees named herein as directors to serve until the 2014 Annual Meeting of Stockholders, and until their respective successors are elected and qualified; |

| | 2. | To ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2013; and |

| | 3. | To transact such other business as may properly come before the meeting. |

The close of business on March 8, 2013 has been set as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any and all adjournments.

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you expect to attend the Annual Meeting, please complete, date and sign the enclosed proxy and return it in the envelope provided for that purpose, which does not require postage if mailed in the United States. Stockholders of record may also vote by telephone or Internet by following the instructions on the enclosed proxy card. If you choose to attend the Annual Meeting, you may still vote your shares in person even though you have previously returned your proxy by mail, telephone or Internet. If your shares are held in a bank or brokerage account, please refer to the materials provided by your bank or broker for voting instructions. The proxy is revocable at any time prior to its use.

Please note that brokers may not vote your shares on the election of directors or any other non-routine matters if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker so that your vote can be counted.

|

|

| Rhonda J. Parish |

| Secretary |

Lakewood, Colorado

March 25, 2013

YOU ARE URGED TO MARK, DATE AND SIGN THE ENCLOSED

PROXY CARD AND RETURN IT PROMPTLY. YOUR PROXY IS

REVOCABLE AT ANY TIME PRIOR TO ITS USE.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting to be held on April 29, 2013.

A copy of this proxy statement and our annual report to stockholders are available to you on the Internet at www.edocumentview.com/BAGL.

EINSTEIN NOAH RESTAURANT GROUP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

April 29, 2013

The accompanying proxy is solicited by the board of directors of Einstein Noah Restaurant Group, Inc., a Delaware corporation (the Company), for use at the 2013 Annual Meeting of Stockholders to be held at our principal executive offices located at 555 Zang Street, Suite 300, Lakewood, Colorado 80228, on April 29, 2013, at 9:00 a.m., Mountain Time, and at any and all adjournments and postponements thereof (the Annual Meeting). The proxy may be revoked at any time before it is voted. If no contrary instruction is received, signed proxies returned by stockholders will be voted in accordance with the board of directors’ recommendations.

This proxy statement and accompanying proxy card are first being sent to stockholders on or about March 25, 2013.

Shares Outstanding and Voting Rights

Our board of directors fixed the close of business on March 8, 2013 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Our only outstanding voting stock is our common stock, $0.001 par value per share, of which 17,130,186 shares were outstanding as of the close of business on the record date. Each outstanding share of common stock is entitled to one vote.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us (Attention: Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute the revocation of a proxy.

At the Annual Meeting, stockholders will vote on proposals to elect seven nominees named herein as directors to serve until the 2014 Annual Meeting of Stockholders, and until their respective successors are elected and qualified (Proposal 1) and to ratify the appointment of Grant Thornton LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2013 (Proposal 2).

In accordance with our restated certificate of incorporation, stockholders representing one-third in voting power of the shares of stock outstanding and entitled to vote must be present or represented by proxy in order to constitute a quorum to conduct business at the Annual Meeting. With respect to the election of directors, our stockholders may vote in favor of the nominees, may withhold their vote for all of the nominees, or may withhold their vote as to specific nominees. With respect to the appointment of Grant Thornton LLP, our stockholders may vote for or against or abstain from voting thereon. Votes withheld in the election of directors and abstentions regarding the appointment of Grant Thornton LLP shall be counted for purposes of determining the existence of a quorum and will have the same effect as a vote against the nominee or appointment, as applicable. Under the Delaware General Corporation Law (DGCL) and our restated certificate of incorporation, the affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve Proposals 1 and 2.

Brokers who hold shares in street name for the benefit of customers generally do not have authority to vote such shares on non-routine matters unless they have instructions from their customers regarding such vote. Shares that are not voted by a broker because of the absence of customer direction are called “broker non-votes.” Broker non-votes are not considered votes for or withheld from a nominee or for or against any other proposal and therefore will have no direct impact on any proposal. Under these rules, absent authority or directions from customers, brokers will not be able to vote on Proposal 1, which is considered a non-routine matter. Proposal 2 is a routine proposal on which a broker or other nominee is generally empowered to vote.

1

Costs of Solicitation

We will pay the cost of soliciting proxies for the Annual Meeting. Proxies may be solicited by our regular employees, without additional compensation, in person, or by mail, courier, telephone or facsimile. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such brokerage houses, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

Annual Report

Our 2012 Annual Report on Form 10-K, including consolidated financial statements as of and for the year ended January 1. 2013, is being distributed to all stockholders entitled to vote at the Annual Meeting together with this proxy statement, in satisfaction of the requirements of the Securities and Exchange Commission (the SEC).Additional copies of the Annual Report are available at no charge upon request. To obtain additional copies of the Annual Report, please contact us at 555 Zang Street, Suite 300, Lakewood, Colorado 80228, Attention: Secretary, or at telephone number (303) 568-8000.The Annual Report does not form any part of the materials for the solicitation of proxies. In addition, a copy of this proxy statement and our annual report to stockholders are available to you on the internet at www.edocumentview.com/BAGL.

VOTING SECURITIES AND PRINCIPAL HOLDERS

As of March 8, 2013, we had 17,130,186 shares of common stock outstanding, which are our only outstanding voting securities. The following table sets forth information regarding the beneficial ownership of our common stock as of March 8, 2013, by:

| | • | | each person (or group of affiliated persons) who is known by us to own beneficially more than 5% of our common stock; |

| | • | | each of our executive officers; |

| | • | | each of our current directors; and |

| | • | | all directors and executive officers as a group. |

Unless otherwise indicated below, the address of each person listed below is 555 Zang Street, Suite 300, Lakewood, Colorado 80228.

BENEFICIAL OWNERSHIP

| | | | | | | | |

Name of beneficial owner | | Amount and nature of

beneficial ownership | | | Percent

of class | |

Greenlight Capital, L.L.C. and its affiliates | | | 10,733,469 | (1) | | | 62.7 | % |

140 E. 45th, 24th Floor | | | | | | | | |

New York, New York 10017 | | | | | | | | |

Jeffrey J. O’Neill | | | 281,127 | (2)(3) | | | * | |

Brian L. Unger | | | 70,994 | (2)(4) | | | | |

Emanuel P.N. Hilario | | | 50,017 | (2)(5) | | | * | |

Rhonda J. Parish | | | 98,476 | (2)(6) | | | * | |

Michael W. Arthur | | | 78,013 | (2)(7) | | | * | |

E. Nelson Heumann | | | 35,231 | (2)(8) | | | * | |

Frank C. Meyer | | | 94,420 | (2)(9) | | | * | |

Edna K. Morris | | | 4,577 | (2)(10) | | | * | |

Thomas J. Mueller | | | 43,361 | (2)(9) | | | * | |

S. Garrett Stonehouse, Jr. | | | 44,111 | (2)(9) | | | * | |

| | | | | | | | |

All directors and executive officers as a group (10 persons) | | | 800,327 | (2)(11) | | | 4.8 | % |

2

| (1) | Based on an amendment to a Schedule 13D filed with the SEC on January 17, 2012. This Amendment was filed on behalf of Greenlight Capital, L.L.C., Greenlight Capital, Inc., Greenlight Capital, L.P., of which Greenlight LLC is the general partner and for which Greenlight Inc. acts as investment manager, Greenlight Capital Qualified, L.P., of which Greenlight LLC is the general partner and for which Greenlight Inc. acts as investment manager, Greenlight Capital Offshore Partners, for which Greenlight Inc. acts as investment manager, DME Advisors GP, LLC, DME Capital Management, L.P., of which Advisors GP is the general partner, and Mr. David Einhorn. Mr. Einhorn is the principal of each of Greenlight LLC, Greenlight Inc., and Advisors GP. In addition, Advisors GP is the general partner of DME Capital Advisors, L.P., Advisors acts as the investment manager for a managed account. DME CM acts as the investment manager for Greenlight Capital Offshore Master (Gold), Ltd. and DME Management GP, LLC is the general partner of Greenlight Capital (Gold), L.P. |

| (2) | In January 2013, all outstanding options were adjusted as follows to reflect the effects of an extraordinary cash dividend: the number of option shares was multiplied by 1.3 and the exercise price was divided by 1.3. |

| (3) | Includes 5,200 shares of common stock subject to restricted stock units which will vest within 60 days and 268,928 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 31,200 shares of common stock subject to restricted stock units which will not vest within 60 days and 175,792 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (4) | Includes 5,000 shares of common stock subject to restricted stock units which will vest within 60 days and 60,668 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 15,500 shares of common stock subject to restricted stock units which will not vest within 60 days and 77,000 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (5) | Includes 1,500 shares of common stock subject to restricted stock units which will vest within 60 days and 45,603 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 12,500 shares of common stock subject to restricted stock units which will not vest within 60 days and 79,164 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (6) | Includes 1,500 shares of common stock subject to restricted stock units which will vest within 60 days and 65,003 shares of common stock which may be acquired upon exercise of stock options that are exercisable or will become exercisable within 60 days. Does not include 9,000 shares of common stock subject to restricted stock units which will not vest within 60 days and 45,997 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (7) | Includes 28,465 shares of common stock which may be acquired upon exercise of presently exercisable stock options and indirect ownership of 22,633 shares held by IRA. Does not include 2,457 shares of common stock subject to restricted stock units which will not vest within 60 days and 2,457 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (8) | Includes 5,115 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 4,914 shares of common stock subject to restricted stock units which will not vest within 60 days, and 4,914 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (9) | Includes 41,465 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 2,457 shares of common stock subject to restricted stock units which will not vest within 60 days and 2,457 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (10) | Includes 2,587 shares of common stock which may be acquired upon exercise of presently exercisable stock options. Does not include 2,457 shares of common stock subject to restricted stock units which will not vest within 60 days and 2,457 shares of common stock subject to stock options which are not exercisable within 60 days. |

| (11) | Includes a total of 13,200 shares of common stock subject to restricted stock units which will vest within 60 days and 600,764 shares of common stock which may be acquired upon exercise of stock options that are |

3

| | exercisable or will become exercisable within 60 days and indirect ownership of 22,633. Does not include 85,399 shares of common stock subject to restricted stock units which will not vest within 60 days and 323,152 shares of common stock subject to stock options which are not exercisable within 60 days. |

Pledge of Shares

In the ordinary course of its business, prime brokers for Greenlight Capital, L.L.C. and its affiliates (Greenlight) have taken a security interest in Greenlight’s shares in the Company. In the event that the prime brokers were to exercise remedies under the security interests, a change of control of the Company could occur.

To our knowledge, none of our officers or directors has pledged any of his or her shares.

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors and the board has nominated seven directors for election at the Annual Meeting to serve until the 2014 Annual Meeting of Stockholders, and until their respective successors are duly elected and qualified. Our restated certificate of incorporation authorizes three to nine directors, as determined by the board, and all directors are to be elected annually. Stockholders are not entitled to cumulate votes in the election of directors and may not vote for a greater number of persons than the number of nominees named.

We are soliciting proxies in favor of the re-election of each of the nominees identified below. All properly executed proxies will be voted for these seven nominees unless otherwise specified. All nominees have consented to serve as directors, if elected. If for any reason any nominee shall not be a candidate for election as a director at the Annual Meeting (an event that is not now anticipated), the shares represented by a properly signed and returned proxy card will be voted for such substitute, if any, as shall be designated by the board of directors, or the board may determine to leave the vacancy temporarily unfilled or reduce the authorized number of directors in accordance with our restated certificate of incorporation. Greenlight has indicated its intention to vote in favor of each of the nominees.

Information About the Nominees

The names of the nominees, their ages as of March 8, 2013, and other information about them are set forth below:

| | |

Michael W. Arthur Director since October 2004 Age 73 | | Since 1990, Mr. Arthur has headed Michael Arthur and Associates, a consulting and interim management firm specializing in restructurings, business development, and strategic, financial, marketing and branding strategies. During their restructurings, he served as CEO of California Federal Bank and financial advisor to Long John Silver’s Restaurants. Prior to 1990, Mr. Arthur served as Executive Vice President and Chief Financial Officer for Sizzler Restaurants and Pinkerton Security; Vice President of Marketing for Mattel Toys; and also served in management roles for D’Arcy, Masius, Benton & Bowles Advertising and Procter and Gamble. Mr. Arthur has a B.A. degree from Johns Hopkins University and attended the Wharton Graduate School of Business. He also serves on the board of directors of the Alzheimers Association. Mr. Arthur brings to the board over 30 years of business, finance, marketing and leadership experience in retail, banking, consumer products and restaurant industries making him a well-qualified candidate for a director of the Company. |

4

| | |

E. Nelson Heumann Director since May 2004— Chairman of the Board since October 2004 Age 55 | | Mr. Heumann retired from Greenlight Capital, Inc., an investment management firm, in February 2011. He joined Greenlight Capital, Inc. in March 2000 and was made a managing member of Greenlight Capital, L.L.C. in January 2002. Prior to joining Greenlight, he served as director of distressed investments at SG Cowen from January 1997 to January 2000. From 1990 to January 1997, Mr. Heumann was a director responsible for distressed debt research and trading at Schroders. Prior to that, he was vice-president of bankrupt and distressed debt research for Merrill Lynch. Earlier in his career, Mr. Heumann was employed with Claremont Group, a leveraged buyout firm, and Value Line. He graduated from Louisiana State University in 1980 with a B.S. in Mechanical Engineering and in 1985 with an M.S. in Finance. Mr. Heumann brings to the board extensive experience in investments and finance making him a well-qualified candidate for a director of the company. |

| |

Frank C. Meyer Director since May 2004 Age 69 | | Mr. Meyer is a private investor who was chairman of Glenwood Capital Investments, LLC, an investment advisory firm he co-founded, from January 1988 to January 2004. Since 2000, Glenwood has been a wholly owned subsidiary of the Man Group, plc, an investment advisor based in England specializing in alternative investment strategies. Mr. Meyer holds an M.B.A. from the University of Chicago and began his career at the University’s School of Business as an instructor of statistics. Mr. Meyer also serves on the board of directors of United Capital Financial Partners, Inc., a firm that converts transaction-oriented brokers into fee-based financial planners, Fifth Street Finance Corp., a mezzanine lender to corporations, and Ferox, a family of convertible hedge funds. Mr. Meyer brings to the board extensive experience in investments and finance. He also has valuable corporate governance experience serving on other company boards and committees making him a well-qualified candidate for a director of the company. |

| |

Edna K. Morris Director since January 2012 Age 61 | | Ms. Morris has been one of the Managing Directors for Axum Capital Partners, a private equity firm focused on education services and restaurants, since October 2009 where she leads the restaurant strategy practice. Additionally, since April 2008 she has been Chief Executive Officer and a Partner in Range Restaurant Group, which owns and operates two CityRange restaurants in Greenville and Spartanburg, South Carolina. During the prior 15 years, Ms. Morris served as President of Red Lobster and Quincy’s Family Steakhouse, and led the development and opening of a chef driven, casual dining concept, CityRange, while at Advantica, the owner and operator of Quincy’s Family Steakhouse. Ms. Morris also served as President of the James Beard Foundation, a not-for-profit entity, and was the founding president of the Women’s Foodservice Forum. In 1974, she graduated with a BS degree in psychology from the University of South Carolina. Over the past 10 years, Ms. Morris has served on the boards of Cosi, Inc. and the Culinary Institute of America. She currently serves on the board, governance committee and chair of the compensation committee for Tractor Supply Company. |

5

| | |

| | Ms. Morris brings to the board diverse leadership experience in the restaurant industry as well as extensive knowledge of executive compensation and corporate cultures. Her valuable corporate governance experience serving on other company boards makes her a well-qualified candidate for a director of the company. |

| |

Thomas J. Mueller Director since December 2007 Age 61 | | Mr. Mueller has been the President and Partner of Mueller Consulting Inc., a consulting firm specializing in the restaurant industry, since 2006. From 2000 to 2006, Mr. Mueller served as President and Chief Operating Officer of Wendy’s International, Inc., the third largest restaurant hamburger chain in the quick service franchise industry. He began his career at Wendy’s in 1998 as the Senior Vice President, Special Projects. From 1995 to 1997, Mr. Mueller was Senior Vice President of Operations—North America, for Burger King Corporation, where he began his career as a restaurant manager in 1973. Mr. Mueller attended State University of New York at Fredonia and is chairman of the Board of Trustees of Ohio Dominican University. Mr. Mueller brings to the board over 30 years of restaurant operational expertise, franchising, global business experience and strong management skills. His broad understanding of public restaurant companies makes him a well-qualified candidate for a director of the Company. |

| |

Jeffrey J. O’Neill Director since December 2008 Age 56 | | Mr. O’Neill has served as President and Chief Executive Officer of the company since December 2008. In May 2005, Mr. O’Neill joined Priszm Income Fund in Toronto, Ontario, Canada and served as its President and Chief Operating Officer until being named Chief Executive Officer in January 2008. Priszm Income Fund owned and operated 465 quick service and quick casual restaurants (KFC, Taco Bell and Pizza Hut) across seven Canadian provinces. From 1999 until 2005, Mr. O’Neill was employed by PepsiCo. He served as President of PepsiCola Canada from March 1999 to January 2003 and from February 2003 through March 2005 he was Vice President of Sales for Quaker Foods USA where he worked on the integration of the Quaker Oats Company after the acquisition by PepsiCo. He holds an Honors Bachelor of Commerce Degree from the University of Ottawa and is currently a Board member of Ruby Tuesday, Inc. and the Rocky Vista Medical School located in Denver, Colorado.. Mr. O’Neill brings to the board extensive experience in restaurant and franchise management as well as extensive experience in operations of public companies. He also brings over 20 years’ experience in the food and beverage industry and as a member of outside boards making him a well-qualified candidate for a director of the Company. |

| |

S. Garrett Stonehouse, Jr. Director since February 2004 Age 43 | | Mr. Stonehouse has been a principal and founding partner of MCG Global, LLC, a private equity investment firm in Stratford, CT, since 1995. Prior to co-founding MCG Global, he was vice president of Fidelco Capital Group. Before joining Fidelco in 1994, he held various positions with GE Capital. Mr. Stonehouse is also the founder of Aventine Hill, LLC, a boutique importer and wholesaler of specialty wines from throughout Italy. Mr. Stonehouse received a B.A. degree from Boston College in economics and mathematics. Mr. Stonehouse is the chairman of the board of directors of Denver-based Imperial Headwear, Inc. and a former member of the board of directors of Boston-based Global Novations, LLC. |

6

| | |

| | Mr. Stonehouse brings to the board expertise in investments, finance and consumer products. He also brings experience in corporate governance and board leadership as a chairman and member of other company boards and committees making him a well-qualified candidate for a director of the Company. |

Nomination of Directors

The nominees for re-election to our board at the Annual Meeting were formally nominated by the full board of directors. The Company does not have a standing nominating committee or committee performing similar functions because Greenlight owns approximately 62.7% of our common stock as of the record date and can therefore elect all of our directors without the vote of any other stockholder. Although the board will consider nominees recommended by stockholders, since Greenlight owns approximately 62.7% of the voting stock as of the record date and, as such, the Company is a “controlled company”, the board has not established any specific procedures for stockholders to follow to recommend potential director nominees for consideration. Messrs. Arthur, Heumann, Meyer, Mueller, O’Neill and Stonehouse and Ms. Morris participated in the consideration of director nominees.

As our majority stockholder, Greenlight identifies qualified individuals to be considered for our board of directors. Greenlight’s goal is to create a balance of diverse knowledge, experience, and interest among the board members, and Greenlight evaluates potential candidates accordingly. Our board assesses director candidates for their character, judgment, business experience and acumen.At a minimum, a director candidate must possess personal and professional integrity, sound judgment and forthrightness. A director candidate must also have sufficient time and energy to devote to the affairs of the Company and be free from conflicts of interest with the Company. There are no specific weights assigned to any particular criteria and no particular criterion is necessarily applicable to all prospective director candidates. For a discussion of the specific backgrounds and qualifications of our current director nominees, see “Information About the Nominees” above.

In accordance with the Company’s restated certificate of incorporation, any stockholder entitled to vote in the election of directors generally may nominate one or more persons for election as directors at an annual meeting only pursuant to the Company’s notice of such meeting or if written notice of such stockholder’s intent to make such nomination or nominations has been received by the Secretary of the Company not less than sixty nor more than ninety days prior to the first anniversary of the preceding year’s annual meeting. Each such notice shall set forth: (a) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) relating to the nomination or nominations; (d) the class and number of shares of the Company which are beneficially owned by such stockholder and the person to be nominated as of the date of such stockholder’s notice and by any other stockholders known by such stockholder to be supporting such nominees as of the date of such stockholder’s notice; (e) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC; and (f) the consent of each nominee to serve as a director of the Company if so elected as evidenced by the signature of such nominee.

Leadership and Board Composition

Currently, E. Nelson Heumann, a retired employee of Greenlight, serves as the chairman of our board of directors and Jeffrey J. O’Neill serves as our president and chief executive officer. The Company has determined that this current leadership structure is appropriate given that Greenlight is our majority stockholder and can elect all of the members of our board of directors without the approval of any other stockholder. Our board of directors has determined that Michael W. Arthur, Frank C. Meyer, Edna K. Morris, Thomas J. Mueller and S. Garrett

7

Stonehouse, Jr., all current directors, qualify as “independent” directors under the rules promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the Exchange Act), and by the Nasdaq Stock Market. There are no family relationships among any of our executive officers, directors or nominees for director.

Greenlight currently owns shares of our common stock sufficient to elect all of the members of our board of directors without the approval of any other stockholder.

Board’s Role in Risk Oversight

The board of directors is actively involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the board, as disclosed in the descriptions of each of the committees below, but the full board has retained responsibility for general oversight of risks. The board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Meetings of the Board of Directors and Committees

The board of directors held sixteen meetings during fiscal 2012 and did not take any action by written consent. During fiscal 2012, no director then in office attended fewer than 75% of the aggregate total number of meetings of the board of directors held during the period in which he or she was a director and of the total number of meetings held by all of the committees of the board of directors on which he or she served. The two standing committees of the board of directors are the audit committee and the compensation committee.

The following table shows the membership and number of meetings held by the board and each committee during fiscal 2012:

DIRECTOR COMMITTEE MEMBERSHIP AND MEETINGS

| | | | | | |

Director | | Audit

Committee | | Compensation

Committee | | Board of

Directors |

Michael W. Arthur | | Chair | | X(1) | | X |

E. Nelson Heumann | | | | | | Chair |

Frank C. Meyer | | X | | | | X |

Edna K. Morris | | | | X(1) | | X |

Thomas J. Mueller | | | | X | | X |

Jeffrey J. O’Neill | | | | | | X |

S. Garrett Stonehouse, Jr. | | X | | Chair | | X |

Fiscal 2012 Meetings | | 4 | | 4 | | 16 |

| (1) | Edna K. Morris was appointed to the Compensation Committee on May 1, 2012 replacing Michael W. Arthur. |

We have not established a policy on director attendance at annual stockholders’ meetings; however, all of our directors then in office attended our last annual meeting held in May 2012.

Our board of directors has not established a formal process for our stockholders to communicate directly with the board because of the fact that Greenlight owns approximately 62.7% of our common stock as of the record date, and, as a result, it was not deemed necessary or appropriate. Our audit committee has established a

8

process for communicating complaints regarding accounting or auditing matters. Any such complaints received on the established hotline or submitted to the Chief Compliance Officer are promptly forwarded to the audit committee to take such action as may be appropriate.

Audit Committee

Michael W. Arthur (chairman), Frank C. Meyer and S. Garrett Stonehouse, Jr. are the current members of the audit committee. Each of them is “independent” as required by the rules promulgated by the SEC under the Exchange Act, and by the Nasdaq Stock Market. Each of them also meets the financial literacy requirements of the Nasdaq Stock Market. Our board of directors has determined that Mr. Arthur qualifies as an “audit committee financial expert” as defined by the rules promulgated by the SEC.

The audit committee is primarily concerned with monitoring:

| | (1) | the integrity of our financial statements; |

| | (2) | our compliance with legal and regulatory requirements; and |

| | (3) | the independence and performance of our auditors. |

The audit committee also is responsible for handling complaints regarding our accounting, internal accounting controls or auditing matters. The audit committee’s responsibilities are set forth in its charter which was last amended in February 2010 and is reviewed annually. The charter is available on our website atwww.einsteinnoah.com . There were 4 meetings of the audit committee during fiscal 2012.

Compensation Committee

S. Garrett Stonehouse, Jr. (chairman), Thomas J. Mueller and Edna K. Morris are the current members of the compensation committee. Each of the current members is “independent” as defined in the rules promulgated by the SEC under the Exchange Act and by the Nasdaq Stock Market. The compensation committee’s primary responsibility is determining the compensation of our employees generally and determining and approving compensation of our executive officers. The committee does not establish or recommend compensation for our independent directors, which is established and approved by the board of directors as a whole.

The compensation committee’s responsibilities are set forth in its charter. The charter was most recently updated in February 2013 and is reviewed annually. The committee’s charter is posted on our website atwww.einsteinnoah.com. The responsibilities as outlined in the charter are:

| | (1) | to review and approve all aspects of the compensation of the Company’s executive officers; |

| | (2) | to review and approve corporate goals and objectives relevant to the compensation of the chief executive officer; |

| | (3) | to review and make periodic recommendations to the board regarding the general compensation, benefits, and perquisites policies and practices of the Company; |

| | (4) | to review succession planning recommendations from the Chief Executive Officer and Executive Vice President of Human Resources and make periodic recommendations to the Board with respect to succession planning of the executive officers; and |

| | (5) | to review the Compensation Discussion and Analysis with management annually and to recommend its inclusion in the annual proxy statement. |

There were 4 meetings of the compensation committee during fiscal 2012.

The compensation committee chairman, in consultation with senior management, sets the agenda for compensation committee meetings. The Corporate Secretary has attended meetings of the compensation

9

committee to provide appropriate record keeping. The committee has also invited the Chief Executive Officer, Chief Financial Officer and Chief Restaurant Officer to attend certain compensation committee meetings. These individuals may attend compensation committee meetings but would not attend executive sessions.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is an officer or employee of the Company. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Vote Required

Directors will be elected by the affirmative vote of the holders of a majority in voting power of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter. Greenlight has indicated its intention to vote in favor of each of the nominees.

Recommendation

The board of directors recommends that stockholders vote FOR each of the nominees for director. If not otherwise specified, proxies will be voted FOR each of the nominees for director.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Greenlight Capital, L.L.C. and its affiliates

Greenlight beneficially owns approximately 62.7% of our common stock as of the record date. As a result, Greenlight has sufficient voting power without the vote of any other stockholders to determine what matters will be submitted for approval by our stockholders, to elect all of our board of directors and, among other things, to determine whether a change in control of our Company occurs. Greenlight has been involved in our financings and refinancings, has purchased our debt and equity securities and was involved in our equity recapitalization. E. Nelson Heumann is the chairman of our board of directors and retired from Greenlight in February 2011.

Procedures for Review of Transactions with Related Persons

Any proposed transaction with a related person is subject to review, negotiation and action by a committee consisting entirely of independent and disinterested directors, which committee is appointed by the board of directors at the time of any proposed transaction. The committee’s purpose and authority are set forth in resolutions appointing the committee and generally include the authority to retain such consultants, advisers and attorneys as it deems advisable in order to perform its duties.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

A resolution will be presented at the Annual Meeting to ratify the appointment by the board of directors of the firm of Grant Thornton LLP, an independent registered public accounting firm, as independent auditors to audit our financial statements for the year ending December 31, 2013. Inclusion of this proposal in our proxy statement to ratify the appointment of our independent auditors for year ending December 31, 2013 is not required, but is being submitted as a matter of good corporate practice.

10

Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they wish to do so, and will be available to respond to appropriate questions.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Fees Paid to Independent Auditors

For the fiscal years ended January 1, 2013 and January 3, 2012, Grant Thornton LLP, our independent auditor, billed the approximate fees set forth below:

Audit Fees

Aggregate fees billed by Grant Thornton LLP in connection with the audit of our consolidated financial statements as of and for the year ended January 1, 2013 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended January 1, 2013 were approximately $413,803. Aggregate fees billed by Grant Thornton LLP in connection with the audit of our consolidated financial statements as of and for the year ended January 3, 2012 and their reviews of the unaudited condensed consolidated interim financial statements during the year ended January 3, 2012 were approximately $472,865.

Audit-Related Fees

Audit-related fees billed by Grant Thornton LLP in fiscal years ended January 1, 2013 and January 3, 2012 were approximately $18,536 and $18,000, respectively, relating to the annual 401(k) audit.

Tax Fees

The aggregate fees billed by Grant Thornton LLP in fiscal years ended January 1, 2013 and January 3, 2012 were $21,085 and $3,461, respectively, for assisting both the Company and their tax representative with an IRS examination in 2012 and completion of a fixed asset capitalization review study and a sales and use taxability study in 2011.

All Other Fees

There were no other fees billed by Grant Thornton LLP during the years ended January 1, 2013 and January 3, 2012.

Pre-Approval Policies and Procedures

Our audit committee has established procedures for pre-approval of audit-related and non-audit services as set forth in the audit committee charter. The audit committee pre-approves all services performed by Grant Thornton LLP and discloses such fees under the headings “Audit-Related Fees,” “Tax Fees” and “All Other Fees” above. The audit committee considers whether the provision of the services disclosed under the headings “Audit-Related Fees,” “Tax Fees” and “All Other Fees” is compatible with maintaining Grant Thornton LLP’s independence.

Vote Required

The affirmative vote of the holders of a majority in voting power of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon is required to approve Proposal 2. Greenlight has indicated its intention to vote in favor of Proposal 2.

11

Recommendation

The board of directors recommends that stockholders vote FOR Proposal 2. If not otherwise specified, proxies will be voted FOR Proposal 2.

Notwithstanding anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the following Audit Committee Report and Compensation Committee Report shall not be deemed to be “Soliciting Material,” are not deemed “filed” with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filings.

AUDIT COMMITTEE REPORT

The audit committee of the board of directors consists of three non-employee independent directors, Michael W. Arthur, Chairman, Frank C. Meyer and S. Garrett Stonehouse, Jr. The audit committee is a standing committee of the board of directors and operates under a written charter initially approved by the board of directors in January 2004 and most recently amended in February 2010, which is reviewed annually and which was most recently reviewed and approved by the committee in February 2013.

Management is responsible for our system of internal controls and the financial reporting process. The independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The audit committee is responsible for monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our auditors.

The audit committee has reviewed with our management and the independent accountants the audited consolidated financial statements in the Annual Report on Form 10-K for the year ended January 1, 2013, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the consolidated financial statements. Management represented to the audit committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The audit committee discussed with the independent accountants matters required to be discussed by Statement of Auditing Standards No. 61, as amended,Communication With Audit Committees .

Our independent accountants also provided to the audit committee the written disclosure required by applicable requirements of the Public Company Accounting Oversight Board regarding independent accountant’s communications with the audit committee concerning independence. The audit committee discussed with the independent accountants that firm’s independence. The audit committee considered the audit-related and non-audit services provided by the independent accountants and subsequently concluded that such services were compatible with maintaining the accountants’ independence.

Based on the audit committee’s discussion with management and the independent accountants, and the audit committee’s review of the representation of management and the report of the independent accountants to the audit committee, the audit committee recommended that the board of directors include the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended January 1, 2013 filed with the SEC.

AUDIT COMMITTEE

Michael W. Arthur, Chairman

Frank C. Meyer

S. Garrett Stonehouse, Jr.

12

COMPENSATION COMMITTEE REPORT

The compensation committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based upon this review and discussion, the compensation committee recommended to the board of directors that the Compensation Discussion and Analysis be included in this proxy statement.

COMPENSATION COMMITTEE

S. Garrett Stonehouse, Jr., Chairman

Edna K. Morris

Thomas J. Mueller

The following Compensation Discussion & Analysis makes reference to certain non-GAAP measures used to determine company performance as reconciled in our Form 10-K on pages 30, 35, 36 and 43 and discussed on page 28 of our Form 10-K.

COMPENSATION DISCUSSION & ANALYSIS

In this Compensation Discussion and Analysis, we discuss our compensation objectives, our compensation decisions and the rationale behind those decisions in connection with 2012 compensation of our executive officers, which consist of our CEO, CFO, CRO and CLPRO. Our CRO only served a portion of 2012. Our named executive officers, or NEOs, include:

| | |

Jeffrey J. O’Neill | | President and Chief Executive Officer (CEO) |

Brian L. Unger | | Chief Restaurant Officer (CRO) |

Emanuel P.N. Hilario | | Chief Financial Officer (CFO) |

Rhonda J. Parish | | Chief Legal, People and Risk Officer (CLPRO) |

Brian L. Unger was elected as Chief Restaurant Officer on February 28, 2012. As of the end of fiscal year 2012, the Company had a total of four executive officers.

Executive Summary

How was our company performance for fiscal 2012?

During 2012, we invested in promotions and marketing initiatives in order to attract new customers and encourage existing customers to try new products. In addition, we added breadth and awareness of our brands and products which contributed to our continued modest growth. We continued to focus on expanding store level margins at our Company-owned restaurants by reducing costs. We believe that this strategy contributed to key positive Company results as summarized in the chart below.

| | |

| 2012 BUSINESS HIGHLIGHTS | | |

| Store Openings: | | 15 Company-owned restaurants 13 Franchise stores 27 License stores |

| Adjusted EBITDA: | | Reported $49.7 million, representing growth of 11.7% |

| Returned to Stockholders: | | $76.6 million, through dividends, including a special cash dividend |

13

How does our executive compensation tie to company performance?

Our compensation philosophy reflects our business strategy by its focus on a mix of financial results using adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), system-wide store sales and comparable store sale percentages, as well as individual performance evaluations under our annual performance bonus plan. In addition, the long-term compensation opportunity for our NEOs, delivered in the form of stock options and restricted stock units, is dependent on the performance of our stock price over the life of the awards. For additional information about our annual performance bonus plan and long-term equity awards, see “Elements of Executive Compensation” below.

Say-on-Pay

Our board of directors, our compensation committee and our management value the opinions of our stockholders. At the 2011 annual meeting of stockholders, over ninety-nine percent (99%) of the votes cast on the say-on-pay proposal were in favor of our executive compensation. The board of directors and compensation committee considered the strongly supportive stockholder vote and, as a result, we did not make any substantive changes to our executive compensation program. Consistent with the voting preference of our stockholders, we have determined to hold a vote on a say-on-pay proposal every third year. A say-on-pay proposal will be presented for a vote of our stockholders at the 2014 Annual Meeting of Stockholders. The next vote on the frequency of presenting say-on-pay proposals is scheduled to occur at the 2017 Annual Meeting of Stockholders.

Objectives of our Executive Compensation Program

What are the objectives of our compensation program?

The objectives of our compensation program are to attract and retain talented executives to carry out our strategic objectives and to motivate them to enhance stockholder value. The compensation committee evaluates our business and compensation objectives on a regular basis, most recently reviewing the business objectives in November 2012. Our compensation strategy is necessarily tied to our stage of development and growth as a business.

The committee strives to balance the goal of providing competitive compensation consistent with our financial resources, while motivating our NEOs to achieve business objectives that drive stockholder value. The committee further reviews the total level of compensation to determine that our levels of pay are competitive relative to the Company’s performance and restaurant industry peers. As a result, the specific direction, emphasis and components of our executive compensation program continue to evolve together with our business strategy and performance expectations. For example, target and threshold goals for Adjusted EBITDA, one of the primary financial measures in our incentive compensation program, have been reviewed and revised from year-to-year to reflect our growth and development plans. The committee will continue to evaluate our compensation programs and make modifications designed to balance financial rewards and incentives in order to foster our business objectives and increase stockholder value.

Who designs our compensation program and makes compensation decisions?

The compensation committee is responsible for designing and administering our executive compensation programs and making decisions regarding compensation of our executive officers. In 2012, our compensation decisions with respect to salaries, incentive compensation and equity award grants were made in the first quarter of the calendar year after several months of analysis. Our compensation planning process neither begins nor ends with any particular committee meeting. Business and succession planning, evaluation of management performance and consideration of the business environment are year-round board processes.

14

How are compensation decisions made?

The compensation committee assists our board of directors in discharging its responsibilities relating to compensation of our executive officers. Each of the three members of our compensation committee is independent under the director independence standards adopted by our board of directors. Their independence from management allows the compensation committee members to apply independent judgment when designing our compensation program and in making pay decisions.

The compensation committee periodically reviews data about the compensation levels of executives in the restaurant industry in order to determine whether our compensation packages are competitive. In connection with the appointment of our CRO in 2012, the committee performed a review of our NEO base salaries compared to other executives in these positions at similarly-sized restaurant companies using information from a variety of resources, including public information about certain companies. See “What is the role of compensation consultants and market data?” below for additional information regarding the component companies reviewed in 2012 for the compensation competitive analysis. In addition, our CEO provides executive compensation recommendations to the committee based on NEO job descriptions and performance, other than for himself.

What is the role of compensation consultants and market data?

To assist in evaluating our compensation practices, the compensation committee has the authority, at Company expense, to retain independent advisors from time to time. In 2010, the compensation committee engaged Meridian Compensation Partners LLC (Meridian) as an independent compensation consultant to assist with certain analyses, information and compensation design components for consideration and guidance with respect to future NEO compensation decisions.

With the assistance of Meridian in 2010, the compensation committee selected the following companies in the restaurant, retail and hospitality industries as a compensation peer group. The committee used this peer group in 2011 and 2012 to provide competitive analysis of compensation levels (primarily base salary and short- and long-term incentives) for selected officers, including our NEOs:

AFC Enterprises, Inc.

Biglari Holdings, Inc.

Buffalo Wild Wings, Inc.

California Pizza Kitchen, Inc.

Caribou Coffee Co.

CEC Entertainment, Inc.

CKE Restaurants, Inc.

Famous Daves of America

Jamba Inc.

Panera Bread Co.

Peet’s Coffee & Tea, Inc.

Red Robin Gourmet Burgers, Inc.

Ruby Tuesday, Inc.

Sonic Corp.

Texas Roadhouse, Inc.

The compensation committee uses the market information obtained from time to time from compensation peer groups or third-party data sources to test the reasonableness of the compensation decisions it makes, but does not target any element of our executive compensation package at a particular level or quartile within a particular peer group.

15

What is the impact of an individual NEO’s performance on compensation?

The compensation committee or its chair meets periodically with the CEO to evaluate the NEOs’ respective performance according to their essential job duties. These meetings include a performance evaluation of the CEO in executive session, as well as an annual opportunity to review with the CEO the results of each NEO’s job performance based on the NEO’s personal performance objectives for the year. They also discuss any modifications to the job duties for each NEO for the coming year. Following the review with the CEO of each NEO’s performance, the CEO schedules and conducts a performance evaluation meeting with each NEO, focusing the executive on operational and service objectives in addition to financial objectives. Individual performance affects both the base salary and the individual performance component of the bonus of each NEO.

Elements of Executive Compensation

What are the elements of our executive compensation program?

We have three elements of total direct compensation to our executive compensation program: base salary, annual performance bonus (cash), and equity awards (primarily stock options and restricted stock units). The program is designed to motivate our NEOs to enhance stockholder value by rewarding them for their performance and contributions toward achievement of short-term and long-term Company goals.

The 2012 compensation program was designed to reward attainment of goals that have a direct impact on our business results, in particular our financial results. The program also considers our overall financial position. Positive and ongoing improvements in our financial results have been rewarded through both the annual performance bonus and equity award elements of our compensation program. Base salary and annual performance bonuses are designed to reward current performance while equity awards provide a long-term incentive and align our NEOs’ and stockholders’ interests.

For 2012, Adjusted EBITDA, system-wide store sales and comparable store sales percentages were important measures in our compensation program because they aligned executive compensation with stockholder interests, are a quantitative measure of operating performance and have a direct correlation to meeting our obligations to our lenders.

Base Salary

We pay base salary to our NEOs to provide current compensation for their services. The amount of base salary is designed to be competitive with salaries for similar positions in the restaurant, retail and hospitality industries. We regularly review competitor and market data in the restaurant, retail and hospitality industries to determine the reasonableness of our compensation within the financial constraints of our performance. We use revenues and geography to further refine this analysis. Based in part upon this information, in 2012 we made adjustments averaging 2.3% increases in base salaries for our CEO, CFO and CLPRO. Our CRO was elected on February 28, 2012.

Annual Performance Bonus

We use the annual performance bonus plan to motivate our NEOs to achieve specific business and financial goals based on our annual business plan. In 2012, the financial component of the annual performance bonus plan was tied to Adjusted EBITDA, system-wide store sales and comparable store sales percentages. We adjust EBITDA up (or down) for the following items (Adjusted EBITDA):

| | • | | Loss (gain) on sale, disposal or abandonment of assets, net; |

| | • | | Impairment charges and other related costs; |

| | • | | (Other income) expense; and |

| | • | | Significant non-recurring items as approved by the directors. |

16

We consider system-wide store sales as net sales from all restaurants, including Company-owned, franchised and licensed locations.

The purpose of the annual performance bonus is to drive Company-based initiatives and financial results and to directly tie a substantial portion of executive compensation to achievement of those financial results. For 2012, participants in the annual performance bonus plan were eligible to earn a cash bonus if a minimum financial performance goal was achieved, and a higher cash bonus if a target or maximum financial performance goal was achieved. The compensation committee approved the potential bonus range for each NEO, based on the achievement of these financial goals (weighted at 80%) and individual performance (weighted at 20%).

The threshold, target, maximum and actual annual cash bonuses for our NEOs in 2012, expressed as a percentage of base salary, were as follows:

| | | | | | | | | | | | | | | | |

Name | | Threshold*

(% of base salary) | | | Target*

(% of base salary) | | | Maximum*

(% of base salary) | | | Actual

(% of base salary) | |

Jeffrey J. O’Neill | | | 10 | % | | | 100 | % | | | 150 | % | | | 95 | % |

Brian L. Unger | | | 7.5 | % | | | 75 | % | | | 112.5 | % | | | 72 | % |

Emanuel P.N. Hilario | | | 7.5 | % | | | 75 | % | | | 112.5 | % | | | 74 | % |

Rhonda J. Parish | | | 7.5 | % | | | 75 | % | | | 112.5 | % | | | 71 | % |

| * | Threshold percentages shown above assume threshold performance under the financial performance component, and no payout under the individual performance component, of the plan. Target percentages assume target performance under the financial component and target payout under the individual performance component. Maximum percentages shown in the table assume maximum payout under both the financial and individual performance components. |

Plan Design. After several months of analysis and discussion, the committee redesigned our bonus plan in 2011 to reinforce the linkage between pay and performance. The committee determined that this updated bonus plan design had provided the desired results for 2011 and, therefore, elected to implement the same design for 2012. Under the 2012 bonus plan, 80% of the target bonus opportunity was based on financial performance measures, consisting of Adjusted EBITDA weighted at 70%, system-wide store sales weighted at 15%, and comparable store sales percentages weighted at 15%, with possible adjustment in each category for significant non-recurring items approved by the directors (Company Performance Portion). The remaining 20% of the 2012 target bonus opportunity was based on individual performance (Individual Performance Portion). To be eligible for the Company Performance Portion, the Company must achieve minimum threshold levels set for Adjusted EBITDA, system-wide store sales and comparable store sales percentages. Once the threshold level is met, increasing percentages of bonuses are earned based upon the degree to which the actual Company Performance Portion exceeds the threshold level, with 150% of that portion of the target bonus being the maximum payout. The amounts earned with respect to each of the three financial performance components are added together to comprise the aggregate Company Performance Portion, which in the aggregate represents 80% of the total annual bonus opportunity.

17

The following table illustrates the design of the 2012 annual bonus plan. These targets are used in the limited context of our executive compensation program and should not be understood to be statements of management’s expectations of our future results or other guidance. Investors should not apply these targets in any other context:

| | | | | | | | | | |

| | | | | Threshold* | | Target* | | Maximum* | | Weighted

(% of target

opportunity) |

| Company Performance Portion | | Adjusted EBITDA | | $43.3 million | | $48.7 million | | $51.4 million | | 56% |

| | Corresponding Payout (% of target) | | 10% | | 100% | | 150% | | |

| | | | | |

| | System-wide Store Sales | | $529 million | | $577 million | | $555 million | | 12% |

| | Corresponding Payout (% of target) | | 10% | | 100% | | 150% | | |

| | | | | |

| | Growth in Comparable Store Sales | | 0.0% | | 2.5% | | 5.0% | | 12% |

| | Corresponding Payout (% of target) | | 10% | | 100% | | 150% | | |

| | |

| Individual Performance Portion | | Portion of the bonus that is based on a discretionary assessment of individual performance. Assumes generally that approximately 20% of the target bonus opportunity will be earned for strong performance, with a capped maximum of an additional 50% of target for any NEO. | | 20% |

| | 100% |

| * | For Company Performance Portion: No payout if performance is less than Threshold. Payout for performance between Threshold and Target or between Target and Maximum is determined by interpolation. Performance at or above the Maximum level results in a maximum-level payout. |

In February 2013, the committee evaluated the Company’s performance against the specific financial targets set at the beginning of 2012. The results of the Company Performance Portion are illustrated in the following table:

| | | | | | | | | | |

Financial Performance Component | | Threshold | | Target | | Maximum | | Actual | | Actual as %

of Target |

Adjusted EBITDA (1) | | $43.3 million | | $48.7 million | | $51.4 million | | $49.7 million | | 102% |

System-wide Store Sales | | $529 million | | $577 million | | $600 million | | $555 million | | 96% |

Growth in Comparable Store Sales | | 0.0% | | 2.5% | | 5.0% | | 1.0% | | 40% |

| (1) | Adjusted EBITDA includes executive bonuses under the 2012 performance bonus plan. |

Individual Performance.As discussed above, a portion of the bonus opportunity for each of our NEOs is based on an assessment of individual performance. The compensation committee reviews the recommendations of the CEO based on the individual performance of each NEO compared to the NEO’s job description, key initiatives, goals and objectives. Individual performance is also evaluated in light of financial, operational and customer experience elements that most accurately reflect each NEO’s role and responsibilities.

The discretionary portion of the bonus that is based on a subjective assessment of individual performance begins with a normative assumption that approximately 20% of the target bonus opportunity will be earned for strong performance, with a capped maximum at an additional 50% of target bonus opportunity for outstanding performance for any NEO. Mr. O’Neill was awarded 100% of his 2012 total annual bonus opportunity based on individual performance. Mr. Unger was awarded 105%, Mr. Hilario 115% and Ms. Parish 95%.

18

The amount of total annual performance bonus paid to our NEOs for 2012 is reported in our Summary Compensation Table under two separate columns: the Company Performance Portion is reported in the Non-Equity Incentive Plan Compensation column and the Individual Performance Portion is reported in the Bonus column.

2013 Bonus Plan. In February 2013, the committee adopted the bonus plan for 2013. The 2013 plan incorporates the same design components, performance metrics and weightings as the 2012 plan, except that it incorporates different target levels for the financial component of the bonus plan in order to incent our NEOs to achieve improved Company performance.

Equity Awards

Equity-based incentives are the long-term component of our executive officer compensation program. We believe that equity awards align the financial interests of our executives with those of our stockholders for longer periods than the single-year focus of the annual performance bonus plan. Equity incentives also encourage retention of employees through multi-year vesting schedules.

In order to further achieve our long-term incentive compensation objectives, the 2011 Omnibus Incentive Plan (the “Omnibus Plan”) was approved by our stockholders in May 2011. The Omnibus Plan replaced our Executive Employee Incentive Plan and was designed with the flexibility to award stock options, stock appreciation rights, restricted stock awards, restricted stock units, performance unit awards, performance share awards, cash-based awards and other equity-based awards to eligible persons.

The compensation committee considers both market practices and the desired impact of the incentive award when determining the types of equity awards to grant. In determining the amount of awards to grant each year, the compensation committee considers the practices of the companies in our compensation peer group and Company performance, as well as the levels of personal performance, responsibility, experience, internal pay equity, retention concerns and total compensation of each NEO. The compensation committee also considers that different forms of equity create different incentives. For fiscal year 2012, the compensation committee selected a mix of equity award types to accomplish several objectives, including:

| | • | | providing an incentive to grow stockholder value; |

| | • | | providing an incentive to preserve stockholder value and avoid excessive risks; and |

| | • | | positively impacting employee retention. |

In 2012 we granted the long-term incentive opportunity to our NEOs in a combination of stock options and restricted stock units. During 2012, we granted stock appreciation rights to a broad-based group of our employees, excluding our NEOs.

Stock Options. Stock options reward the recipient for the increase in our stock price during the holding period and are also a form of at-risk compensation because the potential value of each option is tied to the increase, if any, in our stock price during the option term. We grant stock options with an exercise price equal to the closing price of our common stock on the date of grant, and the options generally expire ten years after the date of grant. Commencing with options granted to our CEO at the time of his employment in December 2008 and continuing in 2012, options vest in three equal installments on the first, second and third anniversaries of the grant date. Based on a review of the compensation practices and analyses of our compensation peer group, as well as Company performance in 2011, in February 2012, we granted a total of 130,200 options to our NEOs. This grant of stock options represented approximately 77% of the total equity awards granted to each NEO in 2012.

Restricted Stock Units. Restricted stock units represent the right to receive common stock of the Company if and when applicable vesting requirements are met. Such “full value” awards provide less leverage than stock options, but tend to be more effective in encouraging employee retention because the awards retain some value even if the stock price declines after the grant date. The restricted stock units we granted in 2012 vest in three

19

equal installments on the first, second and third anniversaries of the grant date. Based on a review of the compensation practices and analyses of our compensation peer group, as well as personal performance, experience and retention concerns for each NEO, in February 2012, we granted a total of 39,100 restricted stock units to our NEOs, representing approximately 23% of the total equity awards granted to each NEO in 2012.

Our NEOs’ total compensation may vary significantly from year-to-year based on Company and individual performance. Further, the value of equity awards made to our senior executives will vary in value based on our stock price performance.

Other Compensation Decisions

What benefits and perquisites do our NEOs receive?

Our NEOs participate in our health and welfare benefit programs, such as medical, dental and vision care coverage, disability insurance and life insurance that are generally available to our employees. They are also eligible for paid time off, which is earned in increments throughout the year. Upon termination, each NEO is entitled to payment of accrued benefits earned prior to his or her termination.

What other plans may our NEOs participate in?

Our NEOs may participate in our non-qualified deferred compensation plan. Under federal tax rules, the participation of our NEOs and certain other management employees in our 401(k) plan is limited. The purpose of the non-qualified plan is to provide a similar means of saving for retirement for affected individuals. Eligible employees, including the CEO, CFO and other NEOs, may elect to defer the payment of up to 80% of their base salary and bonus under this plan. None of our NEOs currently participate in the non-qualified deferred compensation plan.

Do we have agreements for payments upon termination of employment or a change in control?

Offer Letters. We do not currently have employment agreements, other than offers of employment. As part of Mr. O’Neill’s employment offer, the Company agreed to pay him severance equal to one year’s salary if his employment is terminated without cause and, in the event of a change of control, in addition to severance, to vest all of his equity awards. Under the offer of employment by the Company to Mr. Hilario, the Company agreed to pay him severance in an amount equal to one year’s salary if his employment is terminated for any reason other than for cause.

Transaction Agreements. In April, 2012, we entered into a letter agreement with each of Messrs. O’Neill, Hilario and Unger and Ms. Parish that is effective until December 31, 2014 unless sooner terminated by its terms or extended in writing. The agreements provide the following compensation and benefits for the executive in connection with the Company’s review of strategic alternatives at that time and the desire of the Company to ensure continuity of management:

| | • | | Upon a change in control of the Company, all outstanding equity awards become fully vested. If the executive’s employment is terminated without “cause” or he or she resigns for “good reason” (which in either case is referred to as a “qualifying termination”) within 24 months after the change in control, any options that were outstanding as of the date of the change in control shall remain exercisable for a period of two years following the qualifying termination, but not to exceed the expiration of the original option term. |

| | • | | If the executive remains employed through the consummation of a change in control, the Company will pay the executive a transaction success bonus in the form of a lump-sum cash payment. The amount of the transaction bonus varies by executive and by level of consideration received by the Company in the transaction. The potential transaction success bonus range for each executive is: Mr. O’Neill $100,000- |

20

| | $500,000; Mr. Hilario $75,000-$300,000; Mr. Unger $60,000-$275,000; and Ms. Parish $60,000-$275,000. If the executive incurs a qualifying termination prior to the transaction, the Company will pay the transaction success bonus to the executive at the time of the change in control. |

| | • | | If the executive incurs a qualifying termination within 24 months after a change in control, in addition to all accrued but unpaid salary, accrued vacation and unused paid time off, the Company will provide the executive a lump-sum cash payment, continued benefits, and outplacement services as follows: (i) a severance payment determined as the sum of: (A) two times the executive’s then current base salary, plus (B) one times (one and one-half times for the CEO) the executive’s target bonus for the year of the qualifying termination or, if greater the year of the change in control, plus (C) a pro rata portion of one times the executive’s target bonus in effect on the date of the qualifying termination, prorated for the number of months of service completed prior to termination; and (ii) continued access to Company group medical, dental, vision and prescription benefits for the COBRA period, payable at the active employee rate, and outplacement services for an 18-month period, payable by the Company. |

The letter agreements include covenants of both the Company and the executive set forth in a form of mutual release, indemnification, confidentiality and non-solicitation agreement, to be executed following the executive’s termination.