In view of the significance of this uncertainty the auditors consider that it should be brought to shareholders’ attention but their opinion is not qualified in this respect.

Back to Contents

Summary Directors’ Remuneration Report

REMUNERATION POLICY

This report sets out the Company’s policy on directors’ remuneration for 2003. The remuneration committee is currently able to state its general remuneration policy for 2003, but is unable to confirm that this policy will continue without significant change or amendment. This is principally because the proposed Financial Restructuring of the Company may result in changes in governance leading to a revision of certain aspects of current remuneration policy. Also, the remuneration committee considers that a successful remuneration policy needs to be sufficiently flexible to take account of future changes in the Company’s business environment and in remuneration practice. All statements in this report in relation to remuneration policy should be read in light of this paragraph.

THE REMUNERATION COMMITTEE

The role of the remuneration committee is to set the remuneration policy for the executive directors of the Company and to review proposals for other senior executives as appropriate. Specifically, the remuneration committee determines the base salaries and benefits (including bonus schemes and share-based incentives and the extent of any awards made thereunder); and agrees employment agreements and other terms and conditions.

The remuneration committee consists solely of independent non-executive directors. Its members are Stanislas Yassukovich (chairman), Denise Kingsmill and Tony Rice. Dennis Durkin representing Microsoft and Miranda Curtis representing Liberty Media were also members of the remuneration committee during the year and up to the date of their resignations from the board. The chairman and managing director are generally invited to attend meetings; however they are not present during any discussion on their own remuneration. The remuneration committee met four times during 2002.

The remuneration committee is advised internally by the group company secretary, Clive Burns, the deputy human resources director, Ulf Larsen, and the reward director, Stephen Turley. It is also provided with independent advice from external remuneration specialists, Hewitt Bacon & Woodrow in respect of remuneration and New Bridge Street Consultants in respect of share schemes. The advisors were appointed by, and their costs met by, the Company and they currently do not advise the Company on any other matters. The remuneration committee can call upon additional external advisors as required.

GENERAL POLICY FOR EXECUTIVE DIRECTORS

It is the policy of the Company that employment agreements for executive directors will normally include notice periods on termination by the Company of no longer than 12 months. However, in order to attract executives of the required calibre it may be necessary to agree longer notice periods for an initial period in order to secure a chosen executive. Should this be the case, the aim of the Company will be to revert to a maximum 12 month notice period at the end of the initial period.

In the event of the termination of an executive director’s agreement, the remuneration committee’s aim is to ensure the Company’s obligations under the agreement are met (taking into account an executive director’s duty to mitigate his or her loss).

The remuneration packages are designed to motivate, reward and retain executive directors of high quality and to be competitive in terms of market practice. In order to motivate for future achievement, a major element of remuneration is delivered through short and long-term incentive arrangements based on operational and financial performance. Performance-related elements of the remuneration package seek to align the interests of executive directors with those of shareholders through the imposition of stretching performance targets and the delivery of a significant proportion of long-term incentives in the form of shares.

The bonus scheme is designed to reward the achievement of stretching but realistic targets, with a specified bonus paid for on-target performance and an increased bonus payable only where performance has been exceptional.

Long-term incentives are share-based in order to align executives’ interests so far as possible with those of shareholders. The overall aim of these plans is to produce value for the participants where the performance of the Company exceeds that of a relevant index or comparator group of other companies. Detailed descriptions of the current performance conditions are shown on page 15.

Telewest summary financial statement 2002 13

Back to Contents

Summary Directors’ Remuneration Report

continued

Market data is obtained by our external consultants, and benchmarked against relevant companies with which Telewest competes for people and talent. Our consultants look at similar roles in comparable organisations by reference to sector and company size. For the executive directors, two comparator groups are used: a broad sample of companies of similar size determined by turnover, revenues and other appropriate factors, and a sample of telecommunications and high technology companies in the Company’s sector.

The objective is to position total remuneration (base salary, bonus and the value of long-term incentives) at around the median within the comparator group for on-target performance.

GENERAL POLICY FOR NON-EXECUTIVE DIRECTORS

It is the policy of the Company that the appointment of non-executive directors will normally be for an initial period of three years subject to extension for a further three year period.

With the exception of Cob Stenham, no compensation is payable to any non-executive director if their appointment is terminated early.

Non-executive directors’ fees are positioned to be competitive with those paid by other UK listed companies and are set at a level to attract individuals with the required experience and abilities to make a substantial contribution to the Company. Their remuneration is approved by the board of directors.

The non-executive directors are not eligible for pension scheme membership and other than disclosed on page 19, do not participate in any of the Company’s bonus, share option or other incentive schemes.

EXECUTIVE DIRECTORS; ELEMENTS OF REMUNERATION

The main components of executive directors’ remuneration currently comprise: base salary; benefits; bonus scheme; pension and long-term share incentives.

The various elements of the executive directors’ remuneration are structured so that the majority are linked to the achievement of performance targets such that the delivery of on-target performance will lead to around two-thirds of an executive director’s total remuneration being performance-related.

Base salary

Base salary for each executive director is set by the remuneration committee and is reviewed, but not necessarily increased, annually. Determining factors are individual performance, changes in job responsibilities, changes in the market place and general economic conditions.

Benefits

Benefits for executive directors typically include a company car or cash payment in lieu thereof, life assurance, income protection insurance and private medical insurance. The value of these benefits is shown on page 18.

Bonus scheme

The bonus scheme for executive directors is structured to reward the achievement of results against set objectives. For 2002 the level of bonus payable to each executive director was determined by the Group’s EBITDA performance against budget, with achievement of budget delivering a bonus of 25% of annual base salary. A further 15% of annual base salary was payable against the achievement of personal objectives as set by the remuneration committee.

Bonuses for the executive directors for the year ended 31 December 2002 have been paid in full. However, in the case of Charles Burdick and Stephen Cook, if the executive leaves employment in certain specified circumstances within 12 months of the date of payment, a proportion of the bonus (ranging between 25% and 100%, depending on when the event occurs) must be repaid.

14 Telewest summary financial statement 2002

Back to Contents

Further details of bonuses paid for the year ended 31 December 2002 are given on page 18. Any bonuses paid are non-pensionable.

Future bonus schemes will be structured to reward the performance required for the needs of the business following the proposed Financial Restructuring.

Pensions

The Company operates a Money Purchase Occupational Pension Plan, which is offered to all employees. The Company and members pay predetermined or defined levels of contributions in order to fund future pension benefits.

The directors do not participate in the Company pension plan. Each of the executive directors receives a contribution towards their personal pension scheme and/or a cash sum for their personal pension arrangements as shown on page 18.

Share schemes and long-term incentive plan

The Company operates the following schemes in which all or some of the executive directors participate:

| i) | The Telewest 1995 (No.1) Executive Share Option Scheme (an Inland Revenue approved scheme) and the Telewest 1995 (No.2) Executive Share Option Scheme (an unapproved scheme)

Under these schemes, options which have been granted are normally only exercisable after the expiry of three years from the date of grant and lapse if not exercised within 10 years. Outstanding options under these schemes are normally only exercisable if the Company’s Total Shareholder Return (“TSR”) outperforms that of the FTSE 100 Index over any three year period between the dates of grant and exercise. The remuneration committee chose these performance conditions because it considered that they would align participant interests with the interests of shareholders at the time of each grant of options made under the schemes. However, for future grants of options under the schemes the remuneration committee will review the performance condition to ensure its suitability at the time of grant. Participants are granted options up to a market value of £30,000 at the time of grant under the approved scheme and thereafter any further options are granted under the unapproved scheme. The remuneration committee intends to continue its policy of making grants of options on a phased basis up to 100% of base salary each year. |

| | |

| ii) | The Telewest Long Term Incentive Plan (“LTIP”)

Under the LTIP, a participant is awarded the provisional right to receive, for no payment, a number of shares with a value of up to 100% of base salary. |

| | |

| | The shares will not vest unless certain performance conditions, based on TSR assessed over the three year period, starting from the first day of the financial year in which the award is made, are met. The award is divided equally, with vesting of 50% depending on the Company’s TSR meeting a performance condition relating to the TSR of the constituents of the FTSE 100 Index and 50% depending on the Company’s performance against the TSR of a group of comparator companies from the Telecommunications and Media sectors, in each case over the three year period. (The comparator companies for the last awards made under the LTIP (in 2001) are British Sky Broadcasting Group, BT Group, Cable & Wireless, Carlton Communications, Colt Telecom Group, Energis, Granada, NTL, Pearson and Vodafone.) The remuneration committee reviews the suitability of these performance conditions prior to making any awards under the LTIP. If the Company’s TSR is in the top quartile of the FTSE 100 over the three year period, the participant will receive 50% of the number of shares awarded to him; if the Company’s TSR is 50th place in the FTSE 100, the participant will receive 12.5% of the number of shares awarded to him; if below 50th place in the FTSE 100, the participant will receive nothing in respect of that portion of the award. Similarly, if the Company’s TSR is in the top quartile of the group of comparator companies in the three year period, the participant will receive 50% of the number of shares awarded to him; if the Company’s TSR is at the median position the participant will receive 12.5% of the number of shares awarded to him; if below the median position, the participant will receive nothing in respect of that portion of the award. In either test a proportionate number of shares will be received for intermediate positions. The remuneration committee chose these performance conditions because, at the time of the awards it considered that they would most appropriately align participants’ interests with the interests of shareholders. 50% of the shares which vest may be transferred to the participant on the third anniversary of the award date and the remaining 50% of the vested shares may be transferred on the fourth anniversary of the award date. Currently the Company has no intentions to make any further grants under this scheme. |

| | |

| | TSR calculations for the executive share option schemes and the LTIP are performed independently by New Bridge Street Consultants. |

Telewest summary financial statement 2002 15

Back to Contents

Summary Directors’ Remuneration Report

continued

| iii) | The Telewest Restricted Share Scheme

Under this scheme, a participant receives an award over shares which are held by the Trustees of the Telewest 1994 Employees’ Share Ownership Plan Trust. Nothing is payable by the participant for the shares. The award normally vests after three years and remains exercisable for up to seven years from the date of vesting. This scheme is generally used for special one-off awards relating to the retention of certain key individuals and in certain circumstances, recruitment. For this reason the awards do not have performance conditions attached to them unless the remuneration committee decides otherwise. |

| | |

| iv) | The Telewest Equity Participation Plan

Under this scheme, an employee at manager level or above (including an executive director) or any employee with two years’ service can use up to 100% of any bonus payable to him under the bonus scheme to acquire shares in the Company (“bonus shares”). The participant must deposit the bonus shares with the Trustees of the Telewest 1994 Employees’ Share Ownership Plan Trust. In return, the participant is provisionally allocated (for no payment) a matching number of shares in the Company (calculated on the gross amount of bonus). Provided the bonus shares are retained for three years and the participant remains employed for three years, the bonus and matching shares would thereafter be released to the participant. A release of shares to an individual under the scheme is not linked to performance conditions, however the bonus used to purchase the bonus shares was subject to the performance conditions applying to the bonus scheme at that time. The Company currently has no intention to make further awards under this scheme. |

| | |

| v) | The Telewest 1995 Sharesave Scheme

Under this scheme, participants enter into a savings contract whereby they can save up to £250 per month for a period of three or five years and use the funds accumulated at the end of the savings period to purchase shares in the Company at a discount of up to 20% of the market value of the shares at the date of grant. This is an all-employee scheme and not subject to performance conditions. |

| | |

| Details of options or awards granted to directors under any of the above schemes are shown on page 19. |

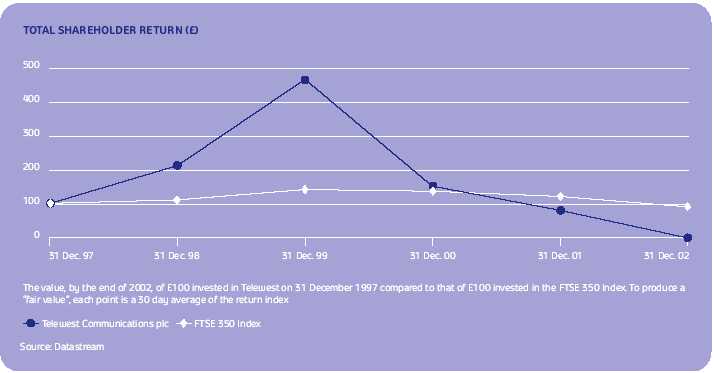

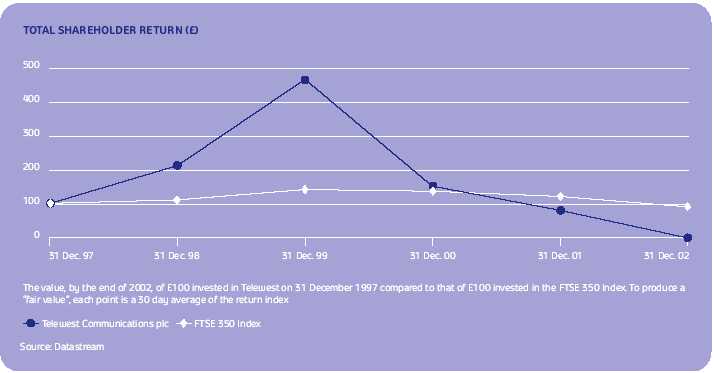

PERFORMANCE GRAPH

Under the Directors’ Remuneration Report Regulations 2002, this report must contain a graph showing the Company’s Total Shareholder Return (“TSR”) performance over the previous five years compared to a broad equity market index (TSR is the change in value over the period including the value of any dividends, should they be paid, and which are reinvested). The graph below shows the performance of the Company against the UK FTSE 350 Index. This has been chosen as the comparator index because, whilst the Company is not currently a constituent of it, the turnover of the Company is comparable to a current constituent.

16 Telewest summary financial statement 2002

Back to Contents

Executive directors’ employment agreements

Charles Burdick has an employment agreement, dated 7 August 1997, which will continue until terminated by either party giving to the other not less than 12 months’ notice however, his employment agreement can be terminated, subject to certain conditions, upon a change of control (as defined in the employment agreement). If notice is given by either party within the six months following the date of a change of control, the notice period shall be six months if given by Charles Burdick to the employing company or 24 months if given by the employing company to Charles Burdick. Thereafter the notice period will revert to 12 months’ notice by either party. His current basic annual salary is £500,000 per annum and he is provided with a company car or cash allowance in lieu thereof, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. Pension contributions are made to a personal pension scheme of 15% of his gross basic annual salary up to the earnings cap (currently £97,200) and an additional cash sum of 20% of his gross basic annual salary above the earnings cap is paid to him for his personal pension arrangements (these payments are subject to a personal contribution of 10% of his gross basic annual salary to a personal pension scheme). He is eligible to participate in the Company share schemes.

Stephen Cook has an employment agreement, dated 21 October 1998, which will continue until terminated by either party giving to the other not less than 12 months’ notice. His current basic annual salary is £370,000 per annum and he is provided with a company car or cash allowance in lieu thereof, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. A cash sum of 20% of Stephen Cook’s gross basic annual salary is paid to him for his personal pension arrangements (these payments are subject to a personal contribution of 4% of his gross basic annual salary to a personal pension scheme). He is eligible to participate in the Company share schemes.

Mark Luiz has an employment agreement, dated 9 November 1995, which will continue until terminated by either party giving to the other not less than 12 months’ notice. His current basic annual salary is £350,000 per annum and he is provided with a company car or cash allowance in lieu thereof, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. Pension contributions are made to a personal pension scheme of 12% of Mark Luiz’s gross basic annual salary (these payments are subject to a personal contribution of 4% of his gross basic annual salary to a personal pension scheme). He is eligible to participate in the Company share schemes.

Adam Singer, who resigned as a director on 31 July 2002, had an employment agreement, dated 27 May 1999 which was terminable by him giving to the employing company 12 months’ notice or by the employing company giving to Adam Singer 24 months’ notice. This notice period was considered appropriate when the employment agreement with Adam Singer was entered into. Adam Singer’s basic annual salary as at the date of resignation was £600,000 per annum and he was provided with a company car, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. Pension contributions were made to a personal pension scheme of 10% of Adam Singer’s gross basic annual salary and an additional cash sum of 3.5% of his gross basic annual salary was paid to him for his personal pension arrangements.

Non-executive directors’ terms of appointment

Cob Stenham has a letter of appointment for a fixed term of one year from 1 December 1999, continuing thereafter unless terminated by 12 months’ notice by either party except in the event of a change of control when the notice period extends to 24 months. Cob Stenham has confirmed that his notice period would not increase where the change of control is part of a Group reorganisation. He has also confirmed that he would relinquish his right to the enhancement of his notice period in a transaction where it was thought that his independence was compromised by the existence of such right. Cob Stenham’s fee for his services as a non-executive director is £175,000 per annum. This fee reflects his role as the chairman of the board. He is provided with a company car and private medical insurance (for himself and for his family).

Denise Kingsmill has a letter of appointment dated 26 July 2001 for an initial period of three years subject to extension for a further three year period. The appointment may be terminated at any time without giving rise to damages for loss of office or fees payable in respect of any unexpired portion of the term of appointment. Denise Kingsmill’s fee for her services as a non-executive director is £35,000 per annum.

Tony Rice has no letter of appointment. Tony Rice’s fee for his services as a non-executive director is £35,000 per annum.

Stanislas Yassukovich has a letter of appointment dated 29 April 1999. The appointment is for a 12 month period to run from the date of reappointment at each Annual General Meeting. The appointment may be terminated at any time without giving rise to damages for loss of office or fees payable in respect of any unexpired portion of the term of appointment. Stanislas Yassukovich’s fee for his services as a non-executive director is £41,000 per annum. This fee reflects his role as the senior independent non-executive director on the board.

Telewest summary financial statement 2002 17

Back to Contents

Summary Directors’ Remuneration Report

continued

Former directors and compensation for loss of office

On 14 May 2002, Microsoft Corporation advised the Company that it was withdrawing its three non-executive directors from the board. Consequently, Dennis Durkin, Salman Ullah and Henry Vigil resigned as directors as from this date. They had no letters of appointment and received no fees or compensation for loss of office.

On 17 July 2002, Liberty Media advised the Company that it was withdrawing its three non-executive directors from the board. Consequently, Robert Bennett, Miranda Curtis and Graham Hollis resigned as directors as from this date. They had no letters of appointment and received no fees or compensation for loss of office.

Adam Singer resigned as a director on 31 July 2002. In compensation for the early termination of his employment agreement described above, he was paid a sum equal to two years’ basic salary plus benefits on leaving the Company. He is also permitted to exercise his outstanding share options (in accordance with the scheme rules).

DIRECTORS’ COMPENSATION

| | Salaries/Fees | | Allowances | 1 | Non-cash

benefits | | Performance-

related bonuses | | Compensation for

loss of office | | Total emoluments

excluding pensions | | Pension

Contributions | 2 |

| | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | | 2002

£000 | | 2001

£000 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Executive | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| C J Burdick | 400 | | 347 | | 73 | | 30 | | 3 | | 11 | | 160 | | 283 | | – | | – | | 636 | | 671 | | 15 | | 14 | |

| S S Cook | 350 | | 347 | | 78 | | 78 | | 6 | | 3 | | 140 | | 112 | | – | | – | | 574 | | 540 | | – | | – | |

| R Fuller (res 31.8.01) | – | | 273 | | – | | – | | – | | 10 | | – | | – | | – | | – | | – | | 283 | | – | | 61 | |

| M W Luiz | 350 | | 338 | | – | | – | | 18 | | 14 | | 140 | | 109 | | – | | – | | 508 | | 461 | | 42 | | 40 | |

| A N Singer (res 31.7.02) | 350 | | 575 | | 12 | | – | | 10 | | 18 | | – | | 186 | | 1,422 | | – | | 1,794 | | 779 | | 35 | | 58 | |

| Non-executive | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lord Borrie (res 21.6.01) | – | | 17 | | – | | – | | – | | – | | – | | – | | – | | – | | – | | 17 | | – | | – | |

| D P Kingsmill | 35 | | 18 | | – | | – | | – | | – | | – | | – | | – | | – | | 35 | | 18 | | – | | – | |

| W A Rice | 35 | | 35 | | – | | – | | – | | – | | – | | – | | – | | – | | 35 | | 35 | | – | | – | |

| A W P Stenham | 175 | | 175 | | – | | – | | 21 | | 15 | | – | | – | | – | | – | | 196 | | 190 | | – | | – | |

| S M Yassukovich | 41 | | 41 | | – | | – | | – | | – | | – | | – | | – | | – | | 41 | | 41 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 1,736 | | 2,166 | | 163 | | 108 | | 58 | | 71 | | 440 | | 690 | | 1,422 | | – | | 3,819 | | 3,035 | | 92 | | 173 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The following non-executive directors did not receive any remuneration from the Company in either 2002 or 2001 for their services: R R Bennett, M T C Curtis and G Hollis (all resigned 17.7.02); D Durkin, S Ullah and H P Vigil (all resigned 14.5.02); and N Holloway (resigned 2.8.01).

| Notes |

| 1 Company car allowances paid to the directors in lieu of a company car are included within the allowances figure shown above. In previous years this has been disclosed in the salary figure and therefore the comparative figures for 2001 have been amended by £21,000 to reflect this reporting change. |

| | |

| Additional cash sums paid to the directors for their personal pension arrangements are also included within the allowances figure shown above. In previous years this has been shown in either the salary figure or the pension contributions figure and therefore the pension contribution comparative figures for 2001 have been amended by £70,000 and the salary comparative figures for 2001 by £17,000 to reflect this reporting change. |

| | |

| The directors believe that this more fairly reflects the true nature of these costs. |

| | |

| 2 The pension contributions for the directors were paid into their personal pension schemes. Allowances, benefits in kind and bonuses paid to directors are not pensionable. None of the directors are members of the Company’s Money Purchase Occupational Pension Plan. |

| | |

| 3 No amounts were paid to the directors in respect of their qualifying services by way of expense allowances that were chargeable to UK income tax. |

18 Telewest summary financial statement 2002

Back to Contents

Summary Directors’ Remuneration Report

continued

DIRECTORS’ INTERESTS

Beneficial interests in ordinary shares of the Company are as follows:

| | 31 December 2001 | | 31 December 2002 | |

|

|

|

| |

| C J Burdick | 294,201 | | 294,201 | |

| D P Kingsmill | 30,983 | | 30,983 | |

| M W Luiz | 20,631 | | 20,631 | |

| W A Rice | 27,120 | | 27,120 | |

| A W P Stenham | 40,000 | | 40,000 | |

| S M Yassukovich | 47,513 | | 47,513 | |

|

|

|

| |

OPTIONS OVER ORDINARY SHARES

Directors’ share options are as follows:

| | 31 December | | Granted during | | Lapsed during | | 31 December | |

| | 2001 | | 2002 | | 2002 | | 2002 | |

|

|

|

|

|

|

|

| |

| Executive Share Option Schemes | | | | | | | | |

| C J Burdick | 2,837,676 | | – | | – | | 2,837,676 | |

| S S Cook | 2,983,589 | | – | | (763,415 | ) | 2,220,174 | |

| M W Luiz | 2,436,296 | | – | | (397,776 | ) | 2,038,520 | |

| A N Singer (res 31.7.02) | 3,153,994 | | – | | – | | 3,153,994 | |

| Sharesave Option Schemes | | | | | | | | |

| S S Cook | 10,977 | | – | | – | | 10,977 | |

| M W Luiz | 10,977 | | – | | – | | 10,977 | |

| A N Singer (res 31.7.02) | 3,247 | | – | | (3,247 | ) | – | |

| A W P Stenham | 10,977 | | – | | – | | 10,977 | |

|

|

|

|

|

|

|

| |

No Executive or Sharesave options were exercised during the year ended 31 December 2002. The options outstanding (as disclosed above) under the Company’s Executive and Sharesave Option Schemes are exercisable at prices between 75.0 pence and 235.0 pence. The middle market price on 31 December 2002, was 2.0 pence and the range during the year was 67.5 pence to 0.75 pence.

In addition, C J Burdick has the following entitlements to ordinary shares of the Company:

| | 31 December | | Awarded during | | Lapsed during | | Transferred during | | 31 December | |

| Scheme | 2001 | | 2002 | | 2002 | | 2002 | | 2002 | |

|

|

|

|

|

|

|

|

|

| |

| Long Term Incentive Plan | 117,667 | | – | | (51,546 | ) | – | | 66,121 | |

|

|

|

|

|

|

|

|

|

| |

| Restricted Share Scheme | 185,915 | | – | | – | | – | | 185,915 | |

|

|

|

|

|

|

|

|

|

| |

| Equity Participation Plan | 40,390 | | – | | – | | – | | 40,390 | |

|

|

|

|

|

|

|

|

|

| |

The Summary Directors’ Remuneration Report was approved by the board of directors on 26 March 2003 and signed on its behalf by:

Stanislas Yassukovich

Chairman of the remuneration committee

Telewest summary financial statement 2002 19

Back to Contents

Summary Consolidated Profit and Loss Account

for the year ended 31 December 2002

| | 2002 | | 2002 | | 2002 | | 2001 | |

| | Before | | Exceptional | | | | | |

| | exceptional | | items | | | | | |

| | items | | (note 2) | | Total | | Total | |

| | £ million | | £ million | | £ million | | £ million | |

|

|

|

|

|

|

|

| |

| GROUP TURNOVER | 1,283 | | (16 | ) | 1,267 | | 1,260 | |

| Operating expenses before depreciation and amortisation | (915 | ) | (22 | ) | (937 | ) | (954 | ) |

|

|

|

|

|

|

|

| |

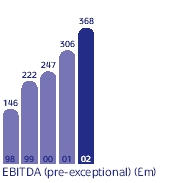

| EBITDA (note 3) | 368 | | (38 | ) | 330 | | 306 | |

| Depreciation and amortisation | (609 | ) | (1,573 | ) | (2,182 | ) | (1,618 | ) |

|

|

|

|

|

|

|

| |

| Total operating expenses | (1,524 | ) | (1,595 | ) | (3,119 | ) | (2,572 | ) |

| GROUP OPERATING LOSS | (241 | ) | (1,611 | ) | (1,852 | ) | (1,312 | ) |

| Share of operating profits of joint ventures | 10 | | – | | 10 | | 9 | |

| Share of operating losses of associated undertakings | (1 | ) | – | | (1 | ) | (7 | ) |

| Gain/(loss) on disposal of investments | 36 | | – | | 36 | | (4 | ) |

| Interest receivable and similar income | 309 | | – | | 309 | | 15 | |

| Amounts written off investments | (47 | ) | (70 | ) | (117 | ) | (138 | ) |

| Interest payable and similar charges | (572 | ) | (31 | ) | (603 | ) | (494 | ) |

|

|

|

|

|

|

|

| |

| Loss on ordinary activities before taxation | (506 | ) | (1,712 | ) | (2,218 | ) | (1,931 | ) |

| Tax on loss on ordinary activities | (1 | ) | – | | (1 | ) | (5 | ) |

|

|

|

|

|

|

|

| |

| Loss on ordinary activities after taxation | (507 | ) | (1,712 | ) | (2,219 | ) | (1,936 | ) |

| Minority interests | 1 | | – | | 1 | | 1 | |

|

|

|

|

|

|

|

| |

| Loss for the financial year | (506 | ) | (1,712 | ) | (2,218 | ) | (1,935 | ) |

|

|

|

|

|

|

|

| |

| Loss per share (pence) | (17.6 | ) | (59.6 | ) | (77.2 | ) | (67.2 | ) |

|

|

|

|

|

|

|

| |

Summary Consolidated Balance Sheet

as at 31 December 2002

| | 2002 | | 2001 | |

| | £ million | | £ million | |

|

|

|

| |

| Fixed assets | | | | |

| Intangible assets | 157 | | 1,743 | |

| Tangible assets | 3,398 | | 3,498 | |

| Investments | 356 | | 548 | |

|

|

|

| |

| | 3,911 | | 5,789 | |

|

|

|

| |

| Current assets | 640 | | 340 | |

| Creditors: amounts falling due within one year (note 5) | (4,410 | ) | (670 | ) |

|

|

|

| |

| Net current liabilities | (3,770 | ) | (330 | ) |

|

|

|

| |

| Total assets less current liabilities | 141 | | 5,459 | |

| Creditors: amounts falling due after more than one year (note 5) | (1,932 | ) | (5,031 | ) |

| Minority interests | 1 | | (1 | ) |

|

|

|

| |

| Net (liabilities)/assets | (1,790 | ) | 427 | |

|

|

|

| |

| Equity shareholders’ (deficit)/funds | (1,790 | ) | 427 | |

|

|

|

| |

| The summary financial statement was approved by the board of directors on 26 March 2003 and signed on its behalf by: |

| | |

| C J Burdick | M W Luiz |

| Director | Director |

20 Telewest summary financial statement 2002

Back to Contents

Summary Consolidated Cash Flow Statement

for the year ended 31 December 2002

| | 2002 | | 2001 | |

| | £ million | | £ million | |

|

|

|

| |

| Net cash inflow from operating activities | 391 | | 348 | |

| Dividends received from associated undertakings | 1 | | 3 | |

| Net cash outflow from returns on investments and servicing of finance | (287 | ) | (379 | ) |

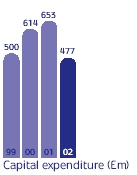

| Net cash outflow for capital expenditure | (447 | ) | (546 | ) |

| Net cash inflow/(outflow) from acquisitions and disposals | 71 | | (24 | ) |

|

|

|

| |

| Net cash outflow before use of liquid resources and financing | (271 | ) | (598 | ) |

| (Increase)/decrease in fixed and secured deposits (net) | (229 | ) | 11 | |

| Net cash inflow from financing | 639 | | 560 | |

|

|

|

| |

| Increase/(decrease) in cash in the year | 139 | | (27 | ) |

|

|

|

| |

Notes to the Summary Financial Statement

as at 31 December 2002

1 PREPARATION OF THE SUMMARY FINANCIAL STATEMENT

Statutory information

The financial information included in this Summary Financial Statement does not constitute the Company’s statutory financial statements for the years ended 31 December 2002 or 2001 but is derived from those financial statements. Statutory financial statements for 2001 have been delivered to the Registrar of Companies, whereas those for 2002 will be delivered following the Company’s Annual General Meeting. The auditors have reported on those financial statements; their reports were unqualified and did not contain a statement under section 237(2) or (3) of the Companies Act 1985.

Going concern

The group finance director has discussed the proposed Financial Restructuring in the Summary Financial Review. The directors believe that the proposed Financial Restructuring will be successful and are therefore of the opinion that the going concern basis of preparation of this Summary Financial Statement remains appropriate. Full details are given in the full annual report and financial statements.

2 EXCEPTIONAL ITEMS

The Group has carried out an impairment review of goodwill arising on acquisitions of subsidiary undertakings, joint ventures and associated undertakings and of its network assets. The impairment review was carried out in accordance with FRS 11 Impairment of Fixed Assets and Goodwill, to ensure that the carrying value of our separately identifiable assets in both Cable and Content Divisions are stated at no more than their recoverable amount, being the higher of net realisable value and value in use. The review concluded that the deterioration in cash flows, as a result of the tighter capital markets in which the Group operates and a subsequent focus on profitability, indicated an impairment in carrying values had occurred. The impairment loss restated the carrying values of goodwill and network assets to their value in use and was determined using an average pre-tax discount rate of 12.8%.

As a result, exceptional charges totalling £1,643 million have been included in the profit and loss account for the year ended 31 December 2002; £1,486 million has been included within amortisation of goodwill and intangible assets, in respect of goodwill impairment relating to the Group’s acquired subsidiaries; £87 million has been included within impairment of tangible fixed assets, in respect of certain Cable Division assets; and a further £70 million was written off goodwill in respect of joint ventures. There is no cash flow impact arising from these exceptional charges.

In 2001, the Group also reviewed the carrying value of goodwill associated with its recent acquisitions. The review resulted in non-cash goodwill impairment adjustments of £992 million relating to the Group’s investment in Flextech and £138 million relating to its equity investments in SMG and UKTV, included in amortisation and amounts written off investments, respectively.

The Group has provided £16 million against turnover as a result of a VAT & Duties Tribunal judgement in a dispute over the VAT status of our Cable TV listings magazines. Previously this was disclosed as a contingent liability. The amount arises from VAT payable in the period from January 2000 to July 2002. The Company has appealed against this ruling. An exceptional amount of £2 million has also been provided for interest on the amount in dispute.

Telewest summary financial statement 2002 21

Back to Contents

Notes to the Summary Financial Statement

continued

Additionally shown as exceptional items are £22 million of legal and professional costs incurred during the year relating to the financial restructuring of the Group’s balance sheet and £29 million of bank facility fees which were being amortised over the lifetime of our Senior Secured Facility. At the year end this facility was in cross default and therefore repayable on demand. As a result the remaining fees have been written off within interest payable to the profit and loss account.

3 EBITDA

The directors have decided to publish EBITDA in addition to the statutory financial information as they consider that EBITDA is a standard measure commonly reported and widely used by analysts, investors and other interested parties in the cable television and telecommunications industry. EBITDA represents Group operating profit before deducting depreciation of fixed assets and amortisation of goodwill.

4 DIRECTORS’ EMOLUMENTS

Directors’ emoluments for the year amounted to £3.9 million (2001: £3.2 million). Details are set out on page 18.

5 CREDITORS: AMOUNTS FALLING DUE WITHIN ONE YEAR

| | | | | | Principal | | | | Earliest | | | |

| | 2002 | | 2001 | | at maturity | | Maturity | | redemption | | Interest | |

| | £ million | | £ million | | million | | date | | date | | rate % | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Accreting Convertible Notes 2003 | 282 | | – | | £294 | | 1/11/03 | | 1/11/03 | | 5 | |

| Senior Debentures 2006 | 186 | | – | | $300 | | 1/10/06 | | 1/10/00 | | 9.625 | |

| Senior Discount Debentures 2007 | 955 | | – | | $1,537 | | 1/10/07 | | 1/10/00 | | 11 | |

| Senior Notes 2008 | 216 | | – | | $350 | | 1/11/08 | | 1/11/03 | | 11.25 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 1,639 | | – | | | | | | | | | |

| Senior Secured Facility | 2,000 | | – | | | | | | | | | |

| Other Creditors and Accruals | 771 | | 670 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 4,410 | | 670 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| |

CREDITORS: AMOUNTS FALLING DUE AFTER MORE THAN ONE YEAR

| | | | | | Principal | | | | Earliest | | | |

| | 2002 | | 2001 | | at maturity | | Maturity | | redemption | | Interest | |

| | £ million | | £ million | | million | | date | | date | | rate % | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Accreting Convertible Notes 2003 | – | | 268 | | £294 | | 1/11/03 | | 1/11/03 | | 5 | |

| Senior Convertible Notes 2005 | 309 | | 339 | | $500 | | 7/7/05 | | 7/7/03 | | 6 | |

| Senior Debentures 2006 | – | | 206 | | $300 | | 1/10/06 | | 1/10/00 | | 9.625 | |

| Senior Convertible Notes 2007 | 299 | | 297 | | £300 | | 19/2/07 | | 9/3/03 | | 5.25 | |

| Senior Discount Debentures 2007 | – | | 1,072 | | $1,537 | | 1/10/07 | | 1/10/00 | | 11 | |

| Senior Notes 2008 | – | | 231 | | $350 | | 1/11/08 | | 1/11/03 | | 11.25 | |

| Senior Discount Notes 2009 | 560 | | 511 | | £325 & $500 | | 15/4/09 | | 15/4/04 | | 9.875 & 9.25 | |

| Senior Notes 2010 | 392 | | 384 | | £180 & $350 | | 1/2/10 | | 1/2/05 | | 9.875 | |

| Senior Discount Notes 2010 | 220 | | 194 | | $450 | | 1/2/10 | | 1/2/05 | | 11.375 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 1,780 | | 3,502 | | | | | | | | | |

| Senior Secured Facility | – | | 1,324 | | | | | | | | | |

| Other Creditors | 152 | | 205 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 1,932 | | 5,031 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

| |

| The Debentures and Notes are unsecured liabilities of the Group. Early redemption is at the Group’s option. |

On 30 September 2002 the Group announced that it was deferring payment of interest under certain of its Notes and the settlement of certain foreign exchange hedge contracts. Such non-payment continues and has resulted in defaults under the Group’s bank facilities and a number of other financing arrangements. Those financing arrangements which are technically in default at the year end have been reclassified as due within one year.

6 SUBSEQUENT EVENTS

Since the balance sheet date a number of interest payments which became due were not paid. As a result additional financing arrangements became technically in default. At the date of issue of this Summary Financial Statement the Senior Convertible Notes 2005, Senior Convertible Notes 2007 and Senior Notes 2010 are technically in default. The total amount of these financing arrangements of £1,000 million has been classified in these accounts as due after more than one year.

The Group is renegotiating its bank facilities and debt financing arrangements. Further details of the proposed Financial Restructuring are included in the Summary Financial Review.

22 Telewest summary financial statement 2002

Back to Contents

Auditor’s Statement

Statement of the independent auditor to the members of Telewest Communications plc pursuant to section 251 of the Companies Act 1985.

We have examined the Summary Financial Statement set out on pages 20 to 22.

This statement is made solely to the Company’s members, as a body, in accordance with section 251 of the Companies Act 1985. Our work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in such a statement and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members as a body, for our work, for this statement, or for the opinions we have formed.

RESPECTIVE RESPONSIBILITIES OF DIRECTORS AND AUDITORS

The directors are responsible for preparing the summarised financial statement in accordance with applicable United Kingdom law. Our responsibility is to report to you our opinion on the consistency of pages 20 to 22 of the Summary Financial Statement, with the full annual financial statements and Directors’ Report and the Directors’ Remuneration Report, and its compliance with the relevant requirements of section 251 of the Companies Act 1985 and the regulations made thereunder.

We also read the other information contained in the Summary Financial Statement and consider the implications for our report if we become aware of any apparent misstatements or material inconsistencies with pages 20 to 22 of the Summary Financial Statement.

BASIS OF OPINION

We conducted our work in accordance with Bulletin 1999/6 “The auditor’s statement on the summary financial statement” issued by the Auditing Practices Board for use in the United Kingdom. Our report on the Group’s full annual financial statements describes the basis of our audit opinion on those financial statements.

Fundamental uncertainty – going concern

In forming our opinion we have considered the adequacy of the disclosures made in note 1 to the full financial statements concerning the fundamental uncertainty as to the ability of the Company and Group to continue to meet their debts as they fall due. This depends upon the successful conclusion of the Financial Restructuring which is referred to in note 1.

In view of the significance of this uncertainty we consider that it should be brought to your attention but our opinion is not qualified in this respect.

OPINION

In our opinion pages 20 to 22 of the Summary Financial Statement are consistent with the full annual financial statements, the Directors’ Report and the Directors’ Remuneration Report of Telewest Communications plc for the year ended 31 December 2002 and comply with the applicable requirements of section 251 of the Companies Act 1985 and the regulations made thereunder.

KPMG Audit Plc

Chartered Accountants

Registered Auditor

London

26 March 2003

Telewest summary financial statement 2002 23

Back to Contents

Shareholder Information

PROPOSED FINANCIAL CALENDAR 2003

First Quarter operating statistics and financial results: May 2003

Announcement of interim results for 2003: July 2003

Third Quarter operating statistics and financial results: November 2003

REGISTRARS

Enquiries concerning holdings of the Company’s shares should be addressed to the Registrars, who are Lloyds TSB Registrars, The Causeway, Worthing, West Sussex, BN99 6DA. Telephone: 0870 600 3964. Changes in a holder’s address should also be notified to the Registrars.

SHAREHOLDERS

As at 26 March 2003, the Company had two shareholders holding 82,507,747 convertible limited voting shares and 45,185 shareholders holding 2,873,546,425 ordinary shares of which 4,153 shareholders, holding 1,826,451,524 ordinary shares, held their shares in the CREST settlement system.

LOW COST SHARE DEALING SERVICE

The Company is pleased to be able to offer shareholders a postal share dealing service through NatWest Stockbrokers Limited and the use of the Instant Share Dealing Service which is available in many NatWest branches. If you would like details of any of these services, please contact NatWest Stockbrokers Limited on 0870 600 2050 or e-mail for a brochure at contactces@natwest.com (quoting Telewest Shareholder Service)*.

ENQUIRIES

For general investor information please contact:

Richard Williams

Head of Investor Relations

Telewest Communications plc

160 Great Portland Street

London W1W 5QA

Telephone: 020 7299 5479

Fax: 020 7299 5494

For all other enquiries please contact:

Clive Burns

Company Secretary

Telephone: 020 7299 5537

Fax: 020 7299 5494

For postal enquiries please write to:

The Company Secretary

Telewest Communications plc

Genesis Business Park, Albert Drive,

Woking, Surrey GU21 5RW

24 Telewest summary financial statement 2002

*Insofar as this constitutes an investment advertisement it has been approved by NatWest Stockbrokers Limited for the purposes of Section 21(2)(b) of the Financial Services and Markets Act 2000 only.

NatWest Stockbrokers Limited is a member of the London Stock Exchange and is regulated by the FSA. Telephone calls with NatWest Stockbrokers may be monitored or recorded in order to maintain and improve service.

Back to Contents

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | NOTE | | |

| | | This summary financial statement does not contain sufficient information to allow as full an understanding of the results of the Group and state of affairs of the Company or of the Group as would be provided by the full annual report and financial statements. | | |

| | | | | |

| | | Any shareholder or debenture holder requiring more detailed information may download a copy from our website www.telewest.co.uk and/or may obtain a copy of the full annual report and financial statements (free of charge) by writing to the Company’s Registrars, Lloyds TSB Registrars, at the address shown on page 24. | | |

| | | | | |

| | | Telewest is committed to keeping costs down. This document has cost no more than if it were produced in black and white. | | |

| | | | | |

| | | | | |

| | Designed and produced by CGI BrandSense

Printed by Pillans & Wilson Greenaway working to the ISO14001 International Environmental Standard. The paper is supplied from a mill also accredited with ISO14001 and the paper used is from fully sustainable forests and was produced without the use of any chlorine compounds. | |

| | |

| | | | | |

| | | | | |

Back to Contents