| | |

| | | Filed by Telewest Communications plc pursuant to Rule 425 Under the Securities Act of 1933 Subject Company: Telewest Global, Inc. Subject Company Exchange Act File No.: Registration Statement No.: 333-110815 |

The information in this document is not complete and may be changed. This document is not an offer to sell securities nor an offer for subscription in respect of securities and we are not soliciting an offer to buy or subscribe for securities in any jurisdiction where the offer, sale or subscription is not permitted. Certain statements of fact are made in this draft of the document which are anticipated to be true and correct at the time this document will be mailed to Scheme Creditors, but may not necessarily be true statements of fact as at the date that this draft of the document is made available on the Telewest website atwww.telewest.co.uk.

Subject to completion, dated 15 April 2004

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION.If you are in any doubt as to the action you should take, you are recommended immediately to seek your own personal financial advice from your stockbroker, bank manager, solicitor or other independent financial adviser duly authorised under the Financial Services and Markets Act 2000 if you are in the United Kingdom or, if not, seek another appropriately authorised independent financial adviser.

This document is being sent to Scheme Creditors and Bondholders. If you have sold or otherwise transferred, or sell or otherwise transfer, your interests as a Scheme Creditor or a Bondholder before the Record Date, please send this document and the accompanying documentation to the person or persons to whom you have sold or transferred, or sell or transfer, your interests as a Scheme Creditor or a Bondholder or the bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Further copies of this document can be obtained by contacting Innisfree M&A Incorporated on 877 750 2689 (toll free from the US), 0800 917 2009 (toll free from the UK) or +1 412 209 1704 (from outside the US).

This document comprises an explanatory statement in accordance with section 426 of the Act in respect of the Telewest Scheme and in accordance with section 426 of the Act and article 126 of the Jersey Companies Law in respect of the Jersey Scheme.

Application has been made to have the New Shares quoted on the Nasdaq National Market. Admission to listing and trading is expected to become effective, and unconditional dealings in the New Shares are expected to commence, at 9.30 a.m. (prevailing Eastern Time) on the Business Day following the Bar Date, which is expected to be [19 July] 2004 (or as soon as practicable thereafter).

EXPLANATORY STATEMENT TO SCHEMES OF ARRANGEMENT

(pursuant to section 425 of the Act in respect of the Telewest Scheme and pursuant to section 425 of the Act and article 125 of the Jersey Companies Law in respect of the Jersey Scheme)

between

Telewest Communications plc

(Incorporated under the Act and registered in England and Wales with registered number 2983307)

and the

Telewest Scheme Creditors

and

Telewest Finance (Jersey) Limited

(Incorporated under the Jersey Companies Law and registered in Jersey with registered number 77278)

and the

Jersey Scheme Creditors

It is anticipated that Meetings of (i) the Jersey Scheme Creditors to consider the Jersey Scheme and (ii) the Telewest Scheme Creditors to consider the Telewest Scheme will be held consecutively on [1 June 2004] starting at [10.00 a.m. and 11.00 a.m. (or as soon thereafter as the Jersey Meeting shall have been concluded or adjourned)] (UK time). The Meetings will be held at The Lincoln Centre, 18 Lincoln’s Inn Fields, London, WC2A 3ED. The notice of the Telewest Meeting is set out at Appendix 3 to Schedule 1 to this document and the notice of the Jersey Meeting is set out at Appendix 3 to Schedule 2 to this document. Whether or not relevant Scheme Creditors or Bondholders intend to attend the relevant Meeting(s), they are requested to complete, execute and return the appropriate Form of Proxy sent with this document in accordance with the instructions set out therein as soon as possible but, in any event, to be received no later than 7.00 p.m. (prevailing Eastern time) on [27 May] 2004.

If the Telewest Scheme Creditors and the Jersey Scheme Creditors approve the Telewest Scheme and the Jersey Scheme respectively, a fairness hearing before the High Court is necessary in order to sanction the Telewest Scheme, and fairness hearings before the High Court and the Jersey Court are necessary in order to sanction the Jersey Scheme. All relevant Scheme Creditors are entitled to attend the relevant court hearings in person or through counsel to support or oppose the sanction of the relevant Scheme. It is expected that the High Court hearings to sanction the Telewest Scheme and the Jersey Scheme will be held on [14 June] 2004 at the Royal Courts of Justice, Strand, London WC2A 2LL and that the Jersey Court hearing to sanction the Jersey Scheme will be held on [15 June] 2004 at the Royal Court, Royal Square, St. Helier, Jersey. Telewest and/or Telewest Jersey will announce the exact date of such hearings by making an announcement of such dates on a Regulatory Information Service and on Telewest’s website atwww.telewest.co.uk at least two Business Days in advance of such hearings.

No person has been authorised by Telewest or Telewest Jersey to give any information or make any representation other than those contained in this document and the accompanying documents and, if given or made, such information or representation must not be relied upon as having been so authorised.

[·· 2004]

Some of the statements in this document constitute “forward-looking statements”. These statements relate to future events or the Group’s or New Telewest’s future financial performance, including, but not limited to, strategic plans, potential growth (including penetration of developed markets and opportunities in emerging markets), product introductions and innovation, meeting customer expectations, planned operational changes (including product improvements), expected capital expenditures, future cash sources and requirements, liquidity, customer service improvements, cost savings and other benefits of acquisitions or joint ventures – potential and/or completed – that involve known and unknown risks, uncertainties and other factors that may cause New Telewest’s or its businesses’ actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “could”, “would”, “should”, “expect”, “plan”, “anticipate”, “intend”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of those terms or other comparable terminology.

There are a number of important factors that could cause Telewest’s, or, if the Financial Restructuring is completed, New Telewest’s, actual results and future development to differ materially from those expressed or implied by those forward-looking statements, including, but not limited to:

| · | Telewest’s ability to successfully conclude the restructuring of its balance sheet; |

| · | the extent to which Telewest or New Telewest is able to compete with other providers of broadband internet services, including BT; |

| · | the extent to which consumers regard cable telephony as an attractive alternative to telephony services provided by, for example, BT, or the emergence of voice-over-internet protocol as a viable alternative to cable telephony; |

| · | the extent to which Telewest or New Telewest is able to successfully compete with mobile network operators; |

| · | the extent to which Telewest or New Telewest is able to retain its current customers and attract new customers; |

| · | the extent to which Telewest or New Telewest is able to migrate customers to additional products or services or to high-margin products or services; |

| · | the extent to which regulatory and competitive pressures in the UK telephony market continue to reduce prices; |

| · | Telewest’s or New Telewest’s ability to develop and introduce attractive interactive and high-speed data services in a rapidly changing and highly competitive business environment; |

| · | Telewest’s or New Telewest’s ability to penetrate markets and respond to changes or increases in competition; |

| · | Telewest’s or New Telewest’s ability to compete against digital television service providers, including BSkyB and Freeview, by increasing its digital customer base; |

| · | Telewest’s or New Telewest’s ability to compete with other internet service providers; |

| · | Telewest’s or New Telewest’s ability to have an impact on, or respond to, new or changed government regulations; |

| · | Telewest’s or New Telewest’s ability to improve operating efficiencies, including through cost reductions; |

| · | Telewest’s or New Telewest’s ability to maintain and upgrade Telewest’s network in a cost-efficient and timely manner; |

| · | adverse changes in the price or availability of telephony interconnection or cable television programming; and |

| · | disruption in supply of programming, services and equipment. |

Unless otherwise required by applicable securities laws, Telewest, Telewest Jersey and New Telewest disclaim any intention or obligation to publicly update or revise any of the forward-looking statements after the date of this document to conform them to actual results, whether as a result of new information, future events or otherwise. All of the forward-looking statements are qualified in their entirety by reference to the factors discussed under the caption “Risk Factors” in Part IV of this document which describe risks and factors that could cause results to differ materially from those projected in those forward-looking statements.

These risk factors may not be exhaustive. Other sections of this document may describe additional factors that could adversely impact Telewest’s or New Telewest’s business and financial performance. Telewest operates, and it is expected that New Telewest will operate, in a continually changing business environment, and new risk factors may emerge from time to time. Management cannot anticipate all of these new risk factors, nor can they definitively assess the impact, if any, of new risk factors on Telewest or New Telewest or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results.

Citigroup is acting for Telewest, Telewest Jersey and TCN and no one else in connection with the Financial Restructuring, and will not be responsible to anyone other than Telewest, Telewest Jersey and TCN for providing the protections afforded to clients of Citigroup, nor for giving advice in relation to the Financial Restructuring.

Gleacher is acting for the board of Telewest and no one else in connection with the Financial Restructuring, and will not be responsible to anyone other than the board of Telewest for providing the protections afforded to clients of Gleacher, nor for giving advice in relation to the Financial Restructuring.

The New Shares to be distributed pursuant to the Telewest Scheme and the Jersey Scheme to the Scheme Creditors will be distributed pursuant to exemptions from, or in transactions not subject to, the registration requirements of the Securities Act, including the exemption provided by section 3(a)(10) thereof, and have not been and will not be registered under the Securities Act or the securities laws of any state of the United States. Any Scheme Creditor who is not and will not be an affiliate of Telewest or New Telewest prior to or after the completion of the Schemes may resell its New Shares received by it upon the completion of the Schemes without restriction under the Securities Act. Any Scheme Creditor who is or will be an affiliate of Telewest or New Telewest prior to or after the completion of the Schemes will be subject to certain US transfer restrictions relating to the New Shares received by it upon the completion of the Schemes. Such a Scheme Creditor may not resell such New Shares without registration under the Securities Act, except for sales outside the United States pursuant to Regulation S or pursuant to the applicable resale provisions of Rule 145(d) promulgated under the Securities Act, if any, or another applicable exemption from the registration requirements of the Securities Act. As defined under Rule 144 under the Securities Act, an “affiliate” of the Company or New Telewest is any person that directly or indirectly controls, or is controlled by, or is under common control with, a Telewest or New Telewest entity. Any Scheme Creditor who believes it may be an affiliate of Telewest or New Telewest for the purposes of the Securities Act should consult its own legal advisers.

The New Shares to be distributed to the Telewest Shareholders pursuant to the Telewest Scheme will be registered under the Securities Act pursuant to a Registration Statement, incorporating a shareholders’ circular and prospectus, filed with the United States Securities and Exchange Commission. Telewest may not distribute those New Shares until the Registration Statement is declared effective by the United States Securities and Exchange Commission. This document does not relate to the New Shares to be issued to the Telewest Shareholders.

2

CONTENTS

3

IMPORTANT NOTICE TO SCHEME CREDITORS

Scheme Creditors with Ancillary Claims must have notified Telewest or Telewest Jersey (or the Escrow Agent by submitting a duly completed Claim Form), as appropriate, of such Ancillary Claims prior to the Bar Date. The Bar Date will be on or around [5.00 p.m. on 16 July] 2004. Notification of the earliest possible date of the Bar Date will be made to Scheme Creditors by announcement on a Regulatory Information Service, on Telewest’s website atwww.telewest.co.uk and by advertisement at least 10 Business Days in advance of such date. In the event that Scheme Creditors with Ancillary Claims do not notify Telewest or Telewest Jersey (or the Escrow Agent), as appropriate, prior to the Bar Date, their Ancillary Claims will be compromised without any entitlement to receive any consideration whatsoever in respect of such Ancillary Claims. All other Scheme Claims are Known Scheme Claims and do not need to be notified to Telewest or Telewest Jersey.

If Scheme Creditors or Bondholders have any questions relating to this document or the completion of the relevant Form of Proxy, or if Bondholders’ Participants have any questions relating to the completion of the requisite details on the Participant Website, they should contact Innisfree M&A Incorporated on telephone number 877 750 2689 (toll free in the US), +1 412 209 1704 (from outside the US) or 0800 917 2009 (toll free in the UK) during normal New York business hours. If you have any questions relating to the completion of the relevant Claim Form, please contact The Bank of New York on + 44 20 7964 5977 during normal London business hours.

You should not construe the contents of this document as legal, tax or financial advice. You are recommended to consult your own professional advisers as to legal, tax, financial or other matters relevant to the action you should take in connection with the Schemes.

The summary of the principal provisions of the Schemes contained in this document is qualified in its entirety by reference to the Schemes themselves, the full texts of which are set out at Schedule 1 and Schedule 2 to this document. Each Bondholder and Scheme Creditor is advised to read and consider carefully the text of the relevant Schemes themselves.

The distribution of this document and the distribution of New Shares may be restricted by law in certain jurisdictions. None of Telewest, Telewest Jersey, the Directors or the Jersey Directors represents that this document may be lawfully distributed, or that New Shares may be lawfully distributed, in compliance with any applicable registration or other requirement in any such jurisdiction, or pursuant to an exemption available thereunder, or assumes any responsibility for facilitating any such distribution. Accordingly, neither this document nor any other offering material may be distributed or published, and none of the New Shares may be distributed, in any jurisdiction, except under circumstances that will result in compliance with all applicable laws and regulations. Persons into whose possession this document may come must inform themselves about, and observe, any such restrictions on the distribution of this document and the distribution of the New Shares.

The information contained in this document has been prepared based upon information available to the relevant company. To the best of Telewest’s and Telewest Jersey’s knowledge, information and belief, the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of such information. The financial statements have been prepared in accordance with US GAAP. There may be differences between the way in which they are presented and the presentation of financial statements in public filings in other jurisdictions. Telewest and Telewest Jersey have taken all reasonable steps to ensure that this document contains the information reasonably necessary to enable Scheme Creditors and Bondholders to make an informed decision about the effect of the relevant Schemes on them.

The Scheme Creditors entitled to the distribution of New Shares under the Schemes must comply with all laws and regulations applicable to them in force in any jurisdiction and must obtain any consent, approval or

4

permission required to be obtained by them under the laws and regulations applicable to them in force in any jurisdiction to which they are subject and none of Telewest, Telewest Jersey, New Telewest, the Directors, the Jersey Directors or the directors of New Telewest shall have any responsibility therefor.

Certain Bondholders and Scheme Creditors have entered into voting agreements to cast their votes in favour of the Schemes subject to rights of termination under certain circumstances. As at [the Record Date], such Bondholders and Scheme Creditors collectively hold, or have the right to vote, over· per cent. of the Telewest Known Scheme Claims and over· per cent. of the Jersey Known Scheme Claims.

The Senior Lenders have not authorised the content of this document or any part of it, nor do they accept any responsibility for the accuracy, completeness or reasonableness of the statements contained within it.

5

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Scheme Creditors and Bondholders should observe the deadlines set by any institution or settlement system through which they hold any Notes to ensure that the relevant Form of Proxy is returned in time for the purposes of voting at the relevant Meeting.

| | |

| |

Record Date (1) | | [30 April] 2004 |

| |

US Bankruptcy Court hearings for section 304 of the US Bankruptcy Code preliminary injunction orders (2) | | [3 May] 2004 |

| |

First Extraordinary General Meeting | | · a.m. on [17 May] 2004 |

| |

Voting Deadline (1) | | 7.00 p.m. on [27 May] 2004 (prevailing Eastern time) |

| |

| Latest time on which Participants can submit details of Notes on the Participant Website | | 1.00 p.m. on [28 May] 2004 (prevailing Eastern time) |

| |

Jersey Meeting (3) | | 10.00 a.m. on [1 June] 2004 |

| |

Telewest Meeting (3) | | 11.00 a.m. on [1 June] 2004 |

| |

High Court hearing to sanction the Telewest Scheme (4) | | · a.m. on [14 June] 2004 |

| |

High Court hearing to sanction the Jersey Scheme (4) | | · a.m. on [14 June] 2004 |

| |

Jersey Court hearing to sanction the Jersey Scheme (4) | | · a.m. on [15 June] 2004 |

| |

US Bankruptcy Court hearings for section 304 of the US Bankruptcy Code permanent injunction orders (2) | | [16 June] 2004 |

| |

ADRs cease trading on Nasdaq | | [13 July] 2004 |

| |

Last day of dealings in Telewest Shares | | [14 July] 2004 |

| |

Effective Date and Jersey Effective Date (5) | | [15 July] 2004 |

| |

Bar Date (6) | | 5.00 p.m. on [16 July] 2004 |

| |

Initial distribution of New Shares to Agreed Scheme Creditors | | 9.30 a.m. on [19 July] 2004 (prevailing Eastern time) |

| |

Commencement of trading in New Shares on the Nasdaq National Market (7) | | 9.30 a.m. on [19 July] 2004 (prevailing Eastern time) |

If any of the above times and/or dates change, the revised times and/or dates will be notified to Scheme Creditors and Bondholders by announcement on a Regulatory Information Service and on Telewest’s website atwww.telewest.co.uk. All references to time in this document are to London time except where otherwise stated.

Notes:

| (1) | The identity of Scheme Creditors or Bondholders is assessed for voting and distribution purposes as at the Record Date. Forms of Proxy may only be completed by relevant Scheme Creditors or Bondholders with Scheme Claims as at the Record Date and who have not subsequently disposed of their Notes or any interest in them. Details of the actions to be taken by Scheme Creditors or Bondholders are set out in paragraph 3 of Part III of this document. Forms of Proxy must be received by the Agent by no later than the Voting Deadline. |

6

| (2) | These dates are indicative only. The dates of the US Bankruptcy Court hearings have not yet been settled, although they are expected to take place on or about the dates indicated. |

| (3) | These dates are the dates that are anticipated to be the dates of the Meetings. In both cases, the terms of the Court orders allow the Meetings to be held either on this date, or on such later date (being not later than 15 June 2004) as the board of Telewest or Telewest Jersey (as appropriate) may decide. If the dates of the Meetings are postponed, Scheme Creditors will be given adequate notice of the revised date. The Telewest Meeting shall take place at this time or as soon thereafter as the Jersey Meeting shall have been concluded or adjourned. |

| (4) | These dates are indicative only. The date of the High Court hearings of the petitions to sanction the Telewest Scheme and the Jersey Scheme and the date of the Jersey Court hearing of the petition to sanction the Jersey Scheme have not yet been settled, although they are expected to take place on or about the dates indicated. If any of the High Court hearings to sanction the Telewest Scheme and the Jersey Scheme, or the Jersey Court hearing to sanction the Jersey Scheme, does not take place on the date currently expected, there will be a corresponding impact on the remainder of the timetable. Telewest and/or Telewest Jersey, as appropriate, will notify Scheme Creditors of the exact date of the hearings by making an announcement of such dates on a Regulatory Information Service and on Telewest’s website atwww.telewest.co.uk at least two Business Days in advance of such hearings. |

| (5) | These dates are indicative only. In practice, the Telewest Scheme is conditional on the Jersey Scheme becoming effective and the Jersey Scheme is conditional on the Telewest Scheme becoming effective; therefore the Effective Date and the Jersey Effective Date will occur on the same date. |

| (6) | This date is indicative only. Notification of the earliest possible date of the Bar Date will be made to Scheme Creditors by announcement on a Regulatory Information Service and on Telewest’s website atwww.telewest.co.uk at least 10 Business Days in advance of such date. The Bar Date for both the Telewest Scheme and the Jersey Scheme will be 5.00 p.m. (London time) on the day after the Effective Date.Scheme Creditors with Ancillary Claims must notify Telewest or Telewest Jersey, as appropriate, of their Ancillary Claims prior to the Bar Date or their Ancillary Claims will be compromised without any entitlement to receive any consideration whatsoever in respect of such Ancillary Claims. |

| (7) | This date is indicative only. Commencement of trading on Nasdaq is expected to take place on the Business Day following the Bar Date (or as soon as practicable thereafter). |

7

Voting and Claiming Mechanics

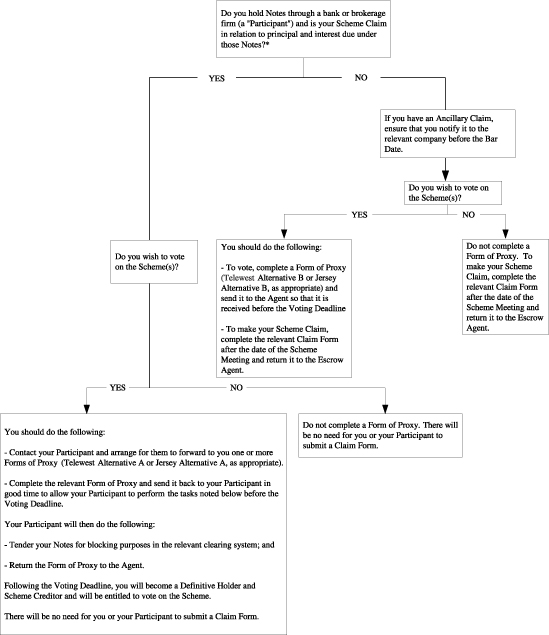

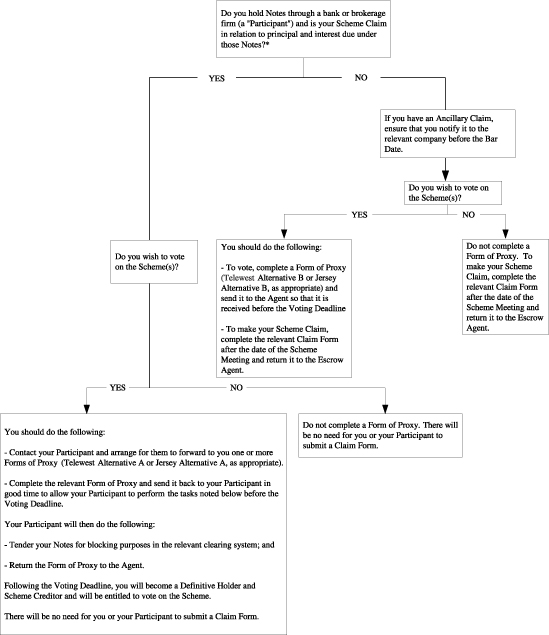

The following diagram is a summary of the steps that Scheme Creditors and Bondholders should take in order to vote on the Schemes and to claim their Share Entitlements. It is qualified in its entirety by the more detailed information contained in Part III of this document.

| * | If your Scheme Claim is partially of this type and partially of another type, you should follow each outlined procedure in respect of the applicable element of your Scheme Claim. |

8

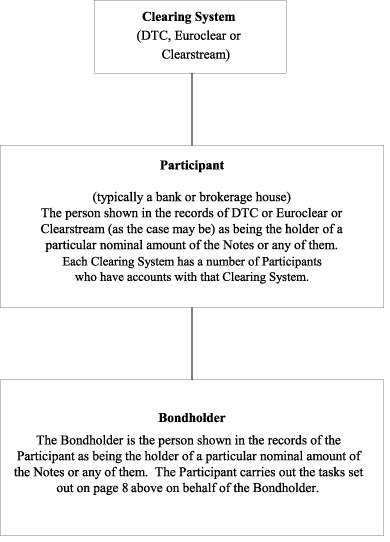

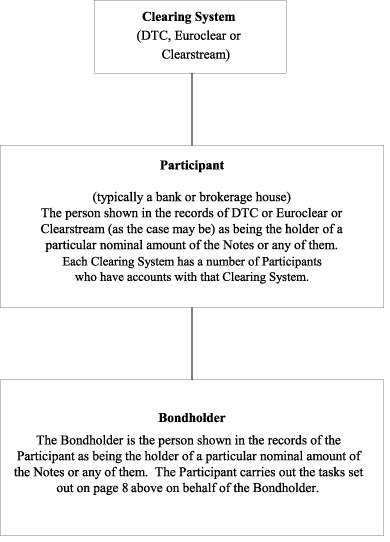

The following diagram illustrates the relationship between certain persons with interests in Notes:

9

PART I: LETTER FROM THE CHAIRMAN OF TELEWEST AND TELEWEST JERSEY

| | |

Telewest Finance (Jersey) Limited | | Telewest Communications plc |

Whiteley Chambers | | Export House |

Don Street | | Cawsey Way |

St Helier | | Woking |

Jersey JE4 9WG | | Surrey GU21 6QX |

Channel Islands | | |

| |

(Registered no. 77278) | | (Registered no. 2983307) |

| |

| | | ··2004 |

Dear Bondholders and Scheme Creditors

1. Introduction

I am writing to give you notice of Meetings of the Scheme Creditors of Telewest and Telewest Jersey which are anticipated to be held at [11.00 a.m.] and [10.00 a.m.] respectively (UK time) on [1 June 2004], at The Lincoln Centre, 18 Lincoln’s Inn Fields, London, WC2A 3ED. I want to set out the reasons for, and the background to, the Meetings and to urge you to vote in favour of the Schemes.

As you likely know, the Directors, the Jersey Directors and their advisers have been exploring ways to secure the Group’s financial position and future. We have now come to a decision that a restructuring of Telewest’s and Telewest Jersey’s balance sheets is the right way forward and in the interests of all of Telewest’s and Telewest Jersey’s stakeholders. The Financial Restructuring will essentially be effected through the issuance of equity to Scheme Creditors, principally the Holders of the Company Notes and the Jersey Notes, in exchange for the Holders’ agreement to cancel the debt represented by those Notes. Significantly, we have now agreed the terms of this restructuring with key Bondholders and the major Telewest Shareholders and reached agreement, subject to conditions, with the Senior Lenders on the terms of an amendment of the Senior Secured Credit Facility.

The terms of the Financial Restructuring are complex and we have summarised the key points in this letter. We urge you, however, to read this entire document with care, since it contains a great deal of important information.

In this document we use many defined terms, which have initial capital letters, such as “Financial Restructuring”. A list of these definitions can be found in Part XVI of this document. This document also contains extracts from New Telewest’s Registration Statement. These extracts, which are clearly highlighted, have been inserted without amendment, and therefore in some instances do not use the defined terms contained elsewhere in this document. However, we believe the meaning of those extracts is clear. Copies of the Registration Statement are available from Telewest or can be accessed on the SEC website atwww.sec.gov.

This letter is addressed to Bondholders and Scheme Creditors because generally Bondholders do not become Scheme Creditors in respect of their claims for principal and interest due under the Notes unless and until they have become Definitive Holders by following the steps set out in Part III of this document.

2. Reasons for the Financial Restructuring

In common with other cable, telecom and media companies, the Group has borrowed large amounts of money to finance the growth of its business. This money was used principally to finance the construction of its national network and the acquisition of smaller cable companies during the period of consolidation in the UK cable industry. Despite the growth of the Group’s business, it is the clear view of the Board and the Jersey Directors and their advisers that the Group’s current level of debt is not now sustainable. A significant factor in this view has been the very marked change in stock market valuations of telecom and media companies in general, and Telewest in particular, and Telewest’s resulting inability to access capital markets in order to refinance its existing debt as it falls due. As a result, it is now necessary for Telewest and Telewest Jersey to undertake the Financial Restructuring on the terms described in this document.

10

It is now evident to the Board, the Jersey Directors and their advisers that, if a financial restructuring is not completed, Telewest is likely to need to petition for some sort of insolvency procedure. If Telewest enters into administration or any other insolvency procedure, given its financial position and the fact that the Group’s banking syndicate would have first claim on substantially all of Telewest’s assets, in such circumstances the proceeds available to Telewest Scheme Creditors (and indirectly to the Jersey Scheme Creditors) could be reduced to a level considerably less than the value of the New Shares they would receive under the Schemes.

It is equally clear that to be successful any financial restructuring must have the support of the Senior Lenders under the Senior Secured Credit Facility Agreement and the Bondholders, including the Bondholder Committee and W.R. Huff (a substantial Bondholder). The Board, the Jersey Directors and their advisers have therefore worked to develop proposals that would secure their support.

We have now secured the support of Scheme Creditors and Bondholders who hold, or have the right to vote, between them, over· per cent. of the Telewest Known Scheme Claims, and over· per cent. of the Jersey Known Scheme Claims, and it is the view of the Board and the Jersey Directors that, if the Financial Restructuring is not achieved on the terms set out in this document, Telewest and Telewest Jersey may become subject to an insolvent liquidation or other insolvency procedure.

3. Background to the Financial Restructuring

On 30 September 2002, following extensive negotiations, a preliminary non-binding agreement with the Bondholder Committee was announced. On 9 June 2003, we further announced that we had been notified by the Bondholder Committee that in order to obtain the support of certain other Bondholders, the Bondholder Committee was requesting changes to the economic and other terms of the preliminary non-binding agreement. Following further discussions with stakeholders, on 12 September 2003, a term sheet relating to the Financial Restructuring was signed by Telewest, Telewest Jersey, the Bondholder Committee, W.R. Huff, Liberty Media and IDT. On·· 2004 a commitment letter relating to the Amended Senior Secured Credit Facility was signed by Telewest, TCN, New Telewest, Telewest UK and the Senior Lenders.

4. Principal Elements of the Financial Restructuring

The principal elements of Telewest and Telewest Jersey’s proposed Financial Restructuring are:

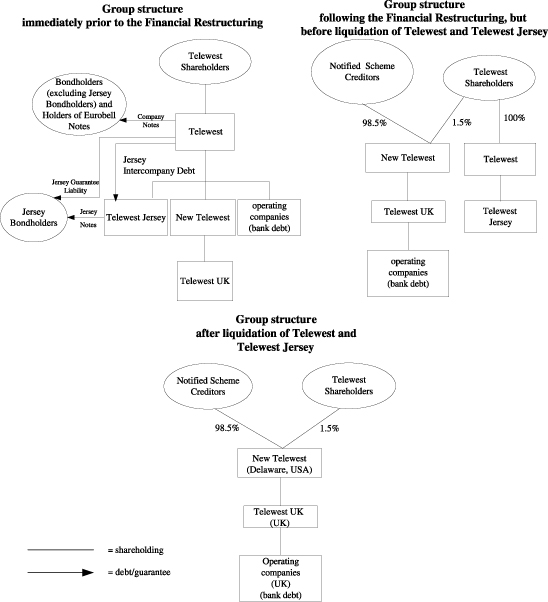

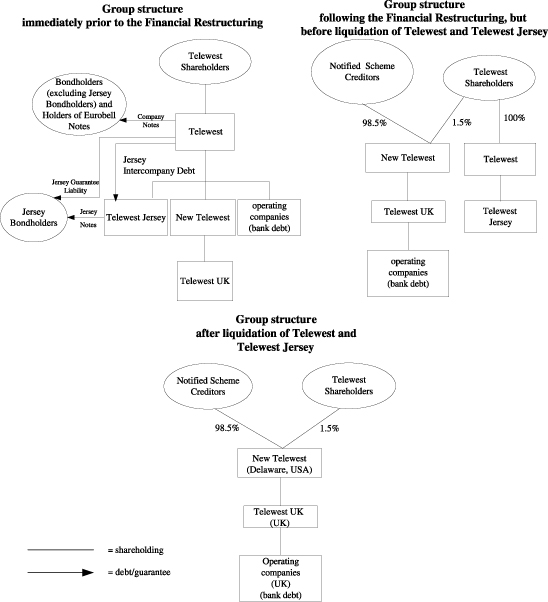

| | · | Telewest Global, Inc., a company incorporated in Delaware, will become the new holding company for the businesses that currently constitute the Group. This company is referred to in this document as New Telewest; |

| | · | subject to the passing of the Resolution by Telewest Shareholders, substantially all of the assets of Telewest will be transferred to Telewest UK Limited, referred to as Telewest UK, a wholly owned English subsidiary of New Telewest. Telewest UK will assume substantially all of the liabilities of Telewest and Telewest Jersey that have not been compromised as a result of the Financial Restructuring, and New Telewest will issue shares of common stock to the Escrow Agent for distribution in accordance with the Schemes. These shares are referred to in this document as the New Shares; |

| | · | following both the Telewest Scheme and the Jersey Scheme becoming effective, Scheme Creditors, consisting primarily of holders of the Notes, will receive 98.5 per cent. of the New Shares referred to above, and eligible Telewest Shareholders will receive the remaining 1.5 per cent. of the New Shares; and |

| | · | Telewest and its wholly owned subsidiary, TCN, which is the borrower under the Senior Secured Credit Facility Agreement, New Telewest and Telewest UK, have signed a commitment letter with the Senior Lenders. The commitment letter provides that, subject to the satisfaction of certain conditions and subject to certain termination rights, the Amended Senior Secured Credit Facility Agreement will come into effect and replace the Senior Secured Credit Facility Agreement. In view of the short-term nature of the Amended Senior Secured Credit Facility, most of which will mature on 31 December 2005, the Company considers it appropriate to plan for the refinancing of that debt in the near term. |

11

| | Such a refinancing might involve putting in place an Alternative Financing on or before the Effective Date instead of the Amended Senior Secured Credit Facility. Further details of the Amended Senior Secured Credit Facility Agreement are set out in paragraph 6 of Part II of this document. Further details of an Alternative Financing are set out in paragraph 7 of Part II of this document. |

Following the completion of the Financial Restructuring, Telewest’s assets will consist of an indemnity granted by Telewest UK, the outstanding shares of Telewest Jersey and one share of New Telewest common stock. Telewest’s liabilities are expected to be covered by the above indemnity, other than certain liabilities which are to be covered by a cash amount to be held on trust by Telewest (as described in more detail below in paragraph 4 of Part II of this document). Telewest will also no longer have any relationship with the restructured business and, subject to shareholder approval, is expected to be put into solvent liquidation. Until the liquidation is completed, Telewest Shareholders will continue to hold their Telewest Shares, although following the transfer of substantially all of Telewest’s assets to Telewest UK and completion of the Financial Restructuring, those shares will no longer trade on the London Stock Exchange and will have no value. Telewest Jersey is also expected to be put into solvent liquidation.

The New Shares are expected to trade on the Nasdaq National Market in the United States.

YOUR ATTENTION IS DRAWN TO CERTAIN RISKS ASSOCIATED WITH THE FINANCIAL RESTRUCTURING, WHICH ARE SET OUT IN PART IV OF THIS DOCUMENT.

5. What you will receive under the Financial Restructuring

In the event that the Schemes become effective and that no Ancillary Claims notified to Telewest or Telewest Jersey on or before the Bar Date are subsequently agreed, it is anticipated that Scheme Creditors or their Nominated Recipients will receive the following in exchange for their Scheme Claims:

| | |

| For each $1,000 due under the Company Notes | | approximately· New Shares. |

| |

| For each £1,000 due under the Company Notes | | approximately· New Shares. |

| |

| For each $1,000 due under the Jersey Notes | | approximately· New Shares. |

The amounts due under each of the Notes are determined by reference to the principal of, and interest or accreted value (as appropriate) due under the terms of, the relevant Note as at the Record Date.

A Scheme Creditor with a Notified Ancillary Scheme Claim which has been agreed, or otherwise determined in accordance with the relevant Scheme, will receive the same number of New Shares as a Known Scheme Creditor who has a Scheme Claim with the same Total Amount in that Scheme.

If the board of directors of New Telewest determines that the number of New Shares outstanding immediately after the Effective Date would be too large, such that the New Shares may trade at a price below the US$5 per share minimum required by the Nasdaq National Market, New Telewest may, by agreement with Telewest, reduce the total number of New Shares to be distributed pursuant to the Telewest Scheme, provided that the aggregate number of New Shares distributed to Scheme Creditors shall, at the Effective Date, represent 98.5 per cent. of the issued share capital of New Telewest.

Legal restrictions in certain jurisdictions other than the United Kingdom, the United States and the Republic of Ireland may prevent the distribution of New Shares or make that distribution unduly onerous. Scheme Creditors in those jurisdictions will receive the net proceeds of the sale of the New Shares to which they would otherwise be entitled. (Further details are set out in paragraph 6 of Part III of this document.)

6. New Telewest, the New Shares and listings

New Telewest is incorporated in the state of Delaware in the United States and will therefore operate under a different legal regime than Telewest.

12

The New Shares to which Scheme Creditors will be entitled, if the Schemes become effective, will be common stock with a par value of $0.01 per share. Application has been made to include the New Shares for listing on the Nasdaq National Market. Subject to the Financial Restructuring taking place, it is expected that trading will commence on the Nasdaq National Market at 9.30 a.m. (prevailing Eastern time) on [19 July] 2004.

It is currently intended that Telewest will apply for cancellation of the listing of its shares on the Official List of the UK Listing Authority and the trading of its shares on the London Stock Exchange with effect from 4.30 p.m. (UK time) on [14 July 2004,] being the Business Day prior to the date on which the Telewest Scheme is currently expected to become effective. It is expected that dealings in Telewest Shares on the London Stock Exchange will cease at 4.30 p.m. (UK time) on [14 July 2004] and that ADRs will cease trading on the Nasdaq National Market at 4.30 p.m. (prevailing Eastern time) on the previous Business Day. The New Shares will not be listed on the Official List or traded on the London Stock Exchange.

7. Management

Certain members of the Board have agreed to step down from the Board to allow the New Telewest board to lead the group going forward. As announced on 18 November 2003, Stanislas Yassukovich CBE resigned from the Board as a non-executive director. On 19 February 2004, Telewest announced that Charles Burdick had resigned as group managing director and as a director of Telewest and as a director, president and chief executive officer of New Telewest. Charles Burdick will be available as a consultant to Telewest until the completion of the Financial Restructuring, and has been succeeded by Barry Elson, who was appointed acting chief executive officer of Telewest and president and acting chief executive officer of New Telewest. Anthony Rice and Denise Kingsmill CBE, two non-executive directors, have proffered their resignations conditional upon the mailing of this document to the Scheme Creditors and Bondholders and the mailing of the shareholders’ circular and prospectus to Telewest Shareholders.

The Board during the remaining stages of the Financial Restructuring will be comprised of Stephen Cook and myself. Mr Cook has agreed to tender his resignation from the Board upon the completion of the Financial Restructuring, but will continue as vice president, group strategy director and general counsel of New Telewest. I have agreed to continue as a director and chairman of Telewest after the Financial Restructuring is completed in order to permit an orderly liquidation of Telewest. In addition, I have agreed to serve as chairman of the board of New Telewest to provide further management continuity for the reorganised business.

8. The Telewest Scheme and the Jersey Scheme

The Financial Restructuring is proposed to be effected by a scheme of arrangement of Telewest under the laws of England and Wales (the Telewest Scheme) and two schemes of arrangement of Telewest Jersey, one under the laws of England and Wales and one under the laws of Jersey (together the Jersey Scheme). The Schemes are formal processes under which Telewest and Telewest Jersey will be released from claims of certain creditors (principally current holders of the Notes and former holders of the Notes in respect of any Ancillary Claims that may exist) in return for the distribution of the New Shares. The Scheme Creditors will be entitled to receive, in aggregate, 98.5 per cent. of New Telewest’s issued share capital immediately following the Telewest Scheme becoming effective.

The Telewest Scheme will involve: (i) all Holders of the Company Notes; (ii) all Holders of the Jersey Notes (in their capacity as beneficiaries of the guarantee granted by Telewest in respect of the Jersey Notes); (iii) Telewest Jersey (as creditor under the Jersey Intercompany Debt); and (iv) any other Telewest Scheme Creditors with Telewest Scheme Claims arising in connection with the Notes, the Indentures, the Jersey Guarantee Liability or the Jersey Intercompany Debt, i.e., a Telewest Scheme Creditor with a Telewest Ancillary Claim.

The Jersey Scheme will involve: (i) all Holders of the Jersey Notes; and (ii) any other Jersey Scheme Creditors with Jersey Scheme Claims arising in connection with the Jersey Notes, the Jersey Indenture, the Jersey Guarantee Liability or the Jersey Intercompany Debt, i.e., a Jersey Scheme Creditor with a Jersey Ancillary Claim.

13

Scheme Creditors with Ancillary Claims must duly notify Telewest or Telewest Jersey (or the Escrow Agent by submitting a duly completed Claim Form) as appropriate, of their Ancillary Claims before the Bar Date in order to obtain an entitlement to receive New Shares in the event that their Ancillary Claim is subsequently agreed. In the event that Scheme Creditors with Ancillary Claims do not duly notify the relevant company (or the Escrow Agent) prior to the Bar Date, their Ancillary Claims will be compromised but they will not be entitled to receive any consideration whatsoever in respect of such Ancillary Claims.

The Telewest Scheme also provides for New Shares, representing 1.5 per cent. of New Telewest’s issued share capital immediately following the Telewest Scheme becoming effective, to be distributed to eligible Telewest Shareholders.

The Telewest Scheme is, in practice, conditional upon the Jersey Scheme becoming effective and the Jersey Scheme is conditional upon the Telewest Scheme becoming effective.

Each Scheme must be approved by a majority in number representing at least 75 per cent. in value of the Scheme Creditors of the appropriate company present and voting either in person or by proxy before it can become effective. It is anticipated that a meeting of the Telewest Scheme Creditors will take place at [11.00 a.m.] on [1 June 2004] and a meeting of the Jersey Scheme Creditors will take place at [10.00 a.m.] on [1 June 2004] or, in both cases, such later date (being not later than 15 June 2004) as the board of Telewest or Telewest Jersey (as appropriate) may decide. If approved, each Scheme will take effect once it has received the relevant court sanction and, subject to the conditions set out below, the orders sanctioning the Schemes have been delivered to the relevant registrars of companies.

Telewest will not take the necessary steps to make the Telewest Scheme effective until, among other things, the Resolution has been passed, the Amended Senior Secured Credit Facility Agreement or an Alternative Financing has been entered into and become unconditional (except for conditions that can only be satisfied once the Telewest Scheme becomes effective), Liberty Media has terminated the Relationship Agreement, the Jersey Scheme has been sanctioned, the New Shares have been authorised for quotation on the Nasdaq National Market, subject to notice of issuance, an order from the US Bankruptcy Court has been obtained, and any proceedings under Chapter 11 of the US Bankruptcy Code in respect of Telewest (if any proceedings have been commenced) have been completed.

The need to obtain an order from the US Bankruptcy Court and the completion of any proceedings under Chapter 11 of the US Bankruptcy Code may be waived by a majority of the Bondholders (by Principal Amount).

It is expected that if the Telewest Scheme and the Jersey Scheme have not become effective by the later of·· 2004 or 60 days after the date of any vote by Scheme Creditors to approve the Schemes, subject to that vote occurring on or before·· 2004, then both the Telewest Scheme and the Jersey Scheme will be withdrawn.

9. Support for the Financial Restructuring

Telewest and Telewest Jersey have entered into voting agreements with certain of the Bondholders and Scheme Creditors pursuant to which those Bondholders and Scheme Creditors have agreed to vote in favour of the Financial Restructuring. Telewest and Telewest Jersey have also entered into a similar voting agreement with Liberty Media. Together, these agreements represent commitments to vote in favour of the Financial Restructuring from persons that hold, or have the right to vote, over· per cent. of the aggregate amount of the Telewest Known Scheme Claims and over· per cent. of the aggregate amount of the Jersey Known Scheme Claims.

Liberty Media also beneficially owns over 25 per cent. of Telewest’s issued share capital. IDT beneficially owns over 23 per cent. of Telewest’s issued share capital. On·· 2004, IDT and Liberty Media entered into voting agreements pursuant to which they have agreed to vote the Telewest Shares they hold in favour of the Resolution at the First EGM. Liberty Media has also consented to various aspects of the Financial Restructuring as required under the Relationship Agreement and to terminate the Relationship Agreement (conditional upon the Effective Date).

14

Further details of these voting agreements, including various conditions and termination rights, are set out in paragraphs 3 to 5 of Part XV of this document.

10. The Resolution and Transfer Agreement

The First EGM is being called for the purpose of proposing an ordinary resolution to approve, as required by the Listing Rules of the UK Listing Authority, the transfer by Telewest of substantially all of its assets on the terms and conditions set out in the Transfer Agreement among Telewest, New Telewest and Telewest UK. Approval of the Transfer Agreement is a condition of the Financial Restructuring and, accordingly, the Financial Restructuring will not be completed as contemplated in this document unless the Shareholders approve the Resolution.

The Transfer Agreement provides that substantially all of the assets of Telewest (including Telewest’s shares in TCN and its other operating companies, but excluding the shares in Telewest Jersey and one share of New Telewest common stock) will be transferred to Telewest UK. In consideration for the transfer, Telewest UK will assume responsibility for the satisfaction of all of the debts, obligations and liabilities of Telewest, except for those debts, obligations and liabilities compromised in the Scheme, certain expenses arising as a result of the Financial Restructuring and such debts and liabilities as are paid out of the cash amount held on trust as described below. Telewest UK will also allot and issue 99 shares to New Telewest. Conditional on the Telewest Scheme becoming effective, it is anticipated that New Telewest will issue 245,000,000 shares to the Escrow Agent for distribution in accordance with the terms of the Schemes. Eligible Shareholders will be entitled to receive 1.5 per cent. of the shares of New Telewest common stock and Bondholders and certain other Scheme Creditors will receive the remaining 98.5 per cent. of the shares of New Telewest common stock.

The Transfer Agreement further provides that Telewest will retain all cash held by Telewest immediately before the completion of the Transfer Agreement. This retained cash will be held on trust and used to satisfy debts and liabilities of Telewest and Telewest Jersey that have not been compromised in the Financial Restructuring. These debts and liabilities will include (i) the fees and expenses of the liquidators of Telewest and Telewest Jersey; (ii) costs and expenses incurred in connection with the implementation of the Financial Restructuring, including advisers’ fees; and (iii) any other debts and liabilities of Telewest or Telewest Jersey, as appropriate. Any surplus not used for such payments will be transferred to Telewest UK, together with any accrued interest, for transfer to TCN.

For the year ended 31 December 2003, Telewest recorded a net loss of approximately £183 million, and had a shareholder deficit on that date of approximately £2.6 billion, attributable to the assets to be transferred under the Transfer Agreement.

Further details of the Transfer Agreement are set out in paragraph 4 of Part II of this document.

Further details of the First EGM are set out in paragraph 8 of Part II of this document.

11. The proposed liquidation of Telewest and Telewest Jersey

If Telewest’s proposed Financial Restructuring is completed as expected, Telewest will no longer have any assets of, or relationship to, the restructured business and it is expected that Telewest will be put into solvent liquidation by the Telewest Shareholders. Telewest Shareholders will not receive any distribution under the proposed members’ voluntary liquidation of Telewest since Telewest will have no assets other than the shares of Telewest Jersey (which itself will have no assets) and one share of New Telewest common stock.

It is also expected that Telewest, as Telewest Jersey’s sole shareholder, will place Telewest Jersey into solvent liquidation.

It is expected that the solvent liquidations of Telewest and Telewest Jersey will commence as soon as practicable after the Telewest Scheme and the Jersey Scheme become effective.

12. Taxation

A number of US and UK tax considerations for Scheme Creditors and Bondholders in relation to the Financial Restructuring are set forth in Part XIV of this document. The comments are of a general, non-exhaustive nature and are included for information purposes only and are not intended to be legal or tax advice. You should therefore consult your own tax advisers with respect to possible tax consequences of receiving New Shares.

15

13. Other matters

As mentioned earlier, you are urged to read this document which contains detailed information on New Telewest, risks to be considered, and business and financial information in relation to Telewest and New Telewest.

14. Action to be taken by you

| | (a) Actions | by Scheme Creditors and Bondholders |

Except for the Eurobell Notes, each of the Notes is currently held in global form by the Bank of New York as Depositary, and each Bondholder has a beneficial interest in those global notes. Because the Bank of New York is the registered owner of each of the global notes, under English and Jersey law no Bondholder will be a “Scheme Creditor” in respect of Known Scheme Claims under their Notes unless they are issued a definitive registered certificate in respect of their Notes. Once such a definitive registered certificate is issued, the Bondholder becomes a Scheme Creditor. That is why, in this Explanatory Statement, we often refer to “Scheme Creditors and Bondholders.”

If the Financial Restructuring is completed, all Bondholders will be entitled to receive New Shares in respect of their Known Scheme Claims whether or not they have been issued with a definitive registered certificate. However, no Bondholder that holds Notes through DTC, Euroclear, Clearstream or any other Clearing System will have the right to vote at the relevant Meeting unless it follows the procedure outlined in Part III of this document so that a definitive registered certificate can be issued in its name.

| | (b) How | to vote on the Financial Restructuring |

Scheme Creditors (including Bondholders once they become Scheme Creditors) are invited, and are entitled, to attend and vote at the appropriate Meeting on [1 June] 2004, either in person or by proxy. In order to do so, Scheme Creditors and Bondholders, as appropriate, must complete and arrange for the return of the relevant Form of Proxy accompanying this document to the Agent in accordance with the procedures described in Part III of this document in sufficient time for the Agent to have received the relevant information by no later than 7.00 p.m. (prevailing Eastern Time) in New York on [27 May] 2004.

Bondholders that hold Notes through DTC, Euroclear, Clearstream or any other Clearing System will not be entitled to vote in the relevant Schemes unless they follow the procedure outlined in Part III of this document for the issue of definitive registered certificates into their names and they therefore become a Scheme Creditor under English and Jersey law.

Further details of the action to be taken by Bondholders and Scheme Creditors are set out in Part III of this document. Questions in relation to completion of the Forms of Proxy should be addressed to Innisfree M&A Incorporated, who can be contacted on the following telephone numbers during New York business hours:

Toll free from the US – 877 750 2689

Toll free from the UK – 0800 917 2009

From outside the US or the UK – + 1 412 209 1704

| | (c) Making | your Scheme Claim |

Bondholders holding Notes through one of the Clearing Systems do not need to complete a Claim Form or take any other action in respect of Known Scheme Claims. To enable Telewest and Telewest Jersey to be in a position to agree any other Scheme Claim (if appropriate), Scheme Creditors must complete and return a Claim Form to the Escrow Agent in accordance with the procedures described in Part III of this document. Questions in relation to completion of a Claim Form should be addressed to The Bank of New York, which can be contacted on + 44 20 7964 5977 (during London business hours).

15. Consequences of the Financial Restructuring not being implemented

��

(a) Telewest

Whilst the Financial Restructuring is underway, the High Court is unlikely to make a winding-up order or enforce a judgment obtained by a creditor of Telewest. If the Telewest Scheme or the Jersey Scheme are not

16

approved by the Scheme Creditors at the Meetings, or if the High Court or the Jersey Court, as applicable, do not sanction the Schemes, or if the Resolution is not passed by the Telewest Shareholders at the First Extraordinary General Meeting or if any of the other conditions to the Schemes are not met:

| | · | creditors may seek to advance their individual interests by obtaining and enforcing judgments or by presenting or proceeding with a petition to wind up Telewest; |

| | · | the Senior Lenders may seek to enforce their security by appointing an administrative receiver of TCN or its subsidiaries or a receiver in respect of the TCN shares held by Telewest and any loans due from TCN or its subsidiaries to Telewest; and |

| | · | unless the Board were able to satisfy themselves within a short period of time that an alternative financial restructuring would likely be successful or, if shareholder approval is not forthcoming, that the Financial Restructuring could be properly implemented in any case, the Directors are likely to have little alternative but to petition for insolvent liquidation in respect of Telewest or to take steps to put Telewest into administration in order to protect Telewest’s assets for the benefit of Telewest’s creditors as a whole. An administrator is only likely to be appointed by the High Court if it can be demonstrated that an administration is likely to achieve a better result for creditors, taken as a whole, than an insolvent liquidation. If an administrator is appointed (and to the extent that it is permitted by the High Court), it is likely to try to sell Telewest’s shares in TCN. A liquidator of Telewest, if appointed, would be likely to close down the operations of Telewest and realise its assets. |

An orderly realisation by an administrator or liquidator of Telewest of Telewest’s assets, the majority of which are subject to security in favour of the Senior Lenders, would require the cooperation of the Senior Lenders. The Directors believe that cooperation of the Senior Lenders would depend on:

| | · | whether the Senior Lenders considered that their security was in jeopardy (i.e., that there was a prospect that the value of the secured assets might not be sufficient for them to recover amounts owed to them); |

| | · | whether they considered that their position was improving or deteriorating over time; and |

| | · | whether they believed that the administrator was likely to achieve a better or worse realisation for the Senior Lenders than an administrative receiver whose primary responsibility was to them. |

The Board believes that any orderly realisation of Telewest’s assets by an administrator or liquidator of Telewest, or an orderly realisation by an administrative receiver or a receiver appointed by the Senior Lenders over their security, is likely to consist principally of a disposal of TCN as a going concern. However, an administrator of Telewest, or an administrative receiver or receiver appointed by the Senior Lenders, may conclude that a better price could be obtained for TCN by continuing to operate for a period of time prior to seeking a disposal. In those circumstances, any recovery by Telewest’s creditors would be significantly delayed.

The value realised for creditors through a disposal of TCN as a going concern is likely to be significantly less than the fundamental value of TCN as a going concern outside an insolvency process, due to:

| | · | the uncertainty that would surround such a disposal; |

| | · | the likely adverse impact that the insolvency process would have on the willingness of Telewest’s customers and suppliers to continue to support Telewest; |

| | · | the distressed nature of such a disposal; and |

| | · | the additional transaction and administrative costs. |

Telewest, as an unsecured creditor of TCN, would only receive proceeds from a sale of the business of TCN as a going concern to the extent that a subsequent liquidator of TCN pays a dividend to creditors. That dividend would only be paid to the extent that there is a surplus after the claims of the Senior Lenders and all the other liabilities of TCN that rank in priority to its unsecured creditors (which would include the fees and expenses of

17

the administrative receiver and liquidator of TCN and any other preferential or secured claims) had been settled in full. As an unsecured creditor of TCN, Telewest’s claim in respect of loans owed by TCN to Telewest would rankpari passuwith all other unsecured creditors of TCN. These loans have been secured in favour of the Senior Lenders.

The ultimate return to Telewest’s creditors would be determined by a series of complex circumstances relevant at the time of the insolvency. There may be unforeseen events, changes in economic conditions, and other potential variations that could impact upon and affect the return to creditors.

Given the above analysis, if the Telewest Scheme is not approved or any other condition to the completion of the Financial Restructuring is not satisfied, this will increase the uncertainty as to the value of any proceeds available to Telewest Scheme Creditors. In certain circumstances, enforcement of the Senior Lenders’ security could significantly reduce the proceeds available to Telewest Scheme Creditors to a level considerably less than the value of the New Shares they would receive under the Telewest Scheme.

(b) Telewest Jersey

The Jersey Scheme is conditional,inter alia, upon the Telewest Scheme becoming effective, as the New Shares to be transferred to Jersey Scheme Creditors under the Jersey Scheme cannot become available for distribution unless and until the Telewest Scheme has become effective. Therefore, if the Telewest Scheme does not become effective, the Jersey Scheme will also fail and Telewest Jersey will be in the same position in respect of the Jersey Intercompany Debt as other Telewest Scheme Creditors as described above.

Indésastre proceedings, or an insolvent liquidation of Telewest Jersey under either Jersey or English law, the Jersey Directors believe that the proceeds available to Jersey Scheme Creditors from any dividend received by Telewest Jersey following the administration or liquidation of Telewest would be less than the return to Jersey Scheme Creditors if the Jersey Scheme becomes effective. In addition to the potential reduction in value described above, the costs of thedésastre proceedings or the insolvent liquidation would rank in priority to the Jersey Scheme Creditors.

Given the above analysis, the Jersey Directors believe it is likely that the proceeds available to Jersey Scheme Creditors if the Jersey Scheme does not become effective would be less than the value of the New Shares they would receive under the Jersey Scheme.

16. Directors’ recommendations

The terms of the Financial Restructuring are complex and you are urged to read this document with care, since it contains a great deal of important information. If you are in any doubt as to the action you should take, you are recommended immediately to seek your own personal financial advice from your stockbroker, bank manager, solicitor or other independent financial adviser duly authorised under the FSMA if you are in the United Kingdom or, if not, seek advice from another appropriately authorised independent financial adviser.

The Directors consider that the Financial Restructuring is in the best interests of Telewest and its stakeholders taken as a whole and therefore unanimously recommend that Telewest Scheme Creditors vote in favour of the Telewest Scheme at the Telewest Meeting. The Jersey Directors consider that the Financial Restructuring is in the best interests of Telewest Jersey and its stakeholders taken as a whole and therefore unanimously recommend that Jersey Scheme Creditors vote in favour of the Jersey Scheme at the Jersey Meeting.

Yours faithfully

Cob Stenham

Chairman

Telewest Communications plc

Telewest Finance (Jersey) Limited

18

PART II: THE FINANCIAL RESTRUCTURING

1. Overview of the Financial Restructuring

The Financial Restructuring will be effected through:

| | (a) | the incorporation of New Telewest and Telewest UK (companies which are wholly owned subsidiaries of Telewest and New Telewest respectively, but which will become the new holding companies of the Group following the Financial Restructuring); |

| | (b) | the Transfer Agreement, which transfers substantially all of Telewest’s assets to Telewest UK in consideration for the assumption by Telewest UK of substantially all of Telewest’s liabilities following the Effective Date, the issue to New Telewest of shares in Telewest UK and the issue of the New Shares to the Escrow Agent by New Telewest conditional upon the Effective Date to be held in accordance with the terms of the Escrow Agent Agreement; |

| | (c) | the Telewest Scheme, under which Telewest, acting through the Escrow Agent, will transfer 98.5 per cent. of the New Shares to the Telewest Scheme Creditors and 1.5 per cent. of the New Shares to Telewest Shareholders on the register at the close of business on the last day of dealings in Telewest Shares on the London Stock Exchange before the Effective Date; |

19

| | (e) | the Amended Senior Secured Credit Facility or an Alternative Financing; and |

| | (f) | the First Extraordinary General Meeting at which the Resolution will be proposed. |

The New Shares will be quoted for trading on Nasdaq. New Telewest will not be listed on the London Stock Exchange.

Following the Effective Date, it is intended that Telewest and Telewest Jersey will commence solvent liquidations.

Telewest intends either to pay in full its trade creditors and its creditors under finance leases or to have its payment obligations novated to a subsidiary of New Telewest, which will assume Telewest’s payment obligations. Telewest has also reached compromises with certain creditors outside the Telewest Scheme.

The various steps of the Financial Restructuring are explained in more detail below.

2. Background to, and reasons for, the Financial Restructuring

Since Telewest’s flotation in 1994, the Group has incurred substantial operating and net losses and has incurred substantial borrowings principally to fund the capital costs of the Group’s network construction and operations and the acquisition of UK cable assets. Telewest incurred these substantial borrowings during a period when the UK cable industry, which has a considerably shorter history than its US counterpart, was being established. Borrowings generally reflected expectations for growth that were based on subscription levels experienced by US cable companies during similar stages of their development, the anticipated impact of regulatory and technological changes in the UK which permitted Telewest to offer telephony and internet services in addition to cable television, and a belief that Telewest would be able to refinance existing debt as it matured. Penetration rates for services offered by Telewest and other UK cable companies have, however, not equalled penetration rates achieved in the US and revenues from those services have in aggregate been considerably lower than expected. In addition, in the first half of 2002, a series of circumstances, including the well-publicised downturn in the telecommunications, media and technology sector, increasingly tight capital markets, and the downgrading of Telewest’s corporate credit ratings in March and April 2002, severely limited the Group’s access to financing and consequently impaired the Group’s ability to service its debt and refinance its existing debt obligations.

Subsequently, as a result of defaults under the Notes, including the non-payment of interest on the Notes and the non-payment of principal due under certain Notes on 1 November 2003, and resulting cross-defaults under the Senior Secured Credit Facility Agreement:

| | · | Telewest’s obligations under the Senior Secured Credit Facility and the Notes are capable of being accelerated; |

| | · | TCN is no longer able to drawdown funds under the Senior Secured Credit Facility Agreement; |

| | · | the Senior Lenders are entitled to enforce their security under the Senior Secured Credit Facility Agreement; and |

| | · | the obligations of each of Telewest and its subsidiary, TCN, under certain lease and finance arrangements and commercial contracts material to the business operations of Telewest are capable of being terminated by the relevant counterparties. |

While the Financial Restructuring is in process, the High Court is unlikely to make a winding-up order or enforce a judgment obtained by a creditor of Telewest. However, if the Financial Restructuring is not completed and the Directors and the Jersey Directors are not able to satisfy themselves within a short period that an alternative financial restructuring would be successful, the Directors and the Jersey Directors are likely to have little alternative but to petition for some form of insolvency proceeding for Telewest and/or Telewest Jersey in order to protect their assets for the benefit of all of their creditors. This is likely to consist of either administration or insolvent liquidation.

20

Neither Telewest nor New Telewest can give assurances, even if the Financial Restructuring is successfully completed, that the New Telewest business will be successful in the future. For example, if New Telewest’s results of operations in future periods fall short of current expectations, New Telewest may go into default under the terms of the Amended Senior Secured Credit Facility or any Alternative Financing and may fail to secure financing to enable it to repay amounts owing under that facility. Even if New Telewest remains in compliance, the Amended Senior Secured Credit Facility will mature on 31 December 2005. New Telewest does not expect to be able to generate sufficient free cash flow to be able to repay that facility at maturity and will therefore need to refinance a substantial portion of the Amended Senior Secured Credit Facility prior to 31 December 2005. It is possible that such a refinancing could take place in conjunction with the Financial Restructuring—see paragraph 7 of Part II of this document —“Possible Alternative Financing”. There is no assurance that any refinancing could be effected on a timely basis or on satisfactory terms, although New Telewest’s ability to refinance its debt will be significantly enhanced by the significant reduction in outstanding debt effected by the Financial Restructuring. Please see Part IV of this document (“Risk Factors”) for a more detailed discussion of the principal risks and contingencies to which the business of New Telewest will be subject. Nevertheless, the Directors and the Jersey Directors are of the opinion that the transfer of substantially all of Telewest’s assets in accordance with the terms of the Transfer Agreement, in the context of the Financial Restructuring, is in the best interests of Telewest, Telewest Jersey and their stakeholders taken as a whole.

In response to these developments, Telewest began exploring a number of options to address its funding requirements, including hiring Citigroup in April 2002 to advise it on strategic options and commencing discussions with the Bondholder Committee and the Senior Lenders. Since April 2002, events surrounding Telewest’s response to these developments have proceeded as follows:

| | · | On 11 June 2002, Telewest announced that it was exploring all options to address Telewest’s funding requirements. During this period Telewest explored the feasibility of various alternatives to the Financial Restructuring, including public and private sales of equity, asset sales and other means of refinancing Telewest’s outstanding indebtedness. |

| | · | On 12 June 2002, Liberty Media, one of Telewest’s current major shareholders, announced a tender offer for certain of Telewest’s publicly traded Notes. At that time, Liberty Media disclosed that it beneficially owned approximately $194.0 million of dollar denominated notes and £45.0 million of sterling denominated notes, representing approximately 4.9 per cent. of the aggregate principal amount of Telewest’s outstanding dollar denominated Company Notes and approximately 4.1 per cent. of the aggregate principal amount of Telewest’s outstanding sterling denominated Company Notes. Liberty Media announced that upon completion of the tender offer it intended to “propose to the company’s board of directors a restructuring plan.” Certain Bondholders, including members of the Bondholder Committee and W.R. Huff, opposed the tender offer and initiated litigation seeking to enjoin it. These Bondholders’ claims also raised claims concerning Liberty Media’s access to non-public information in connection with the tender offer by virtue of being a major shareholder of Telewest with three non-executive directors on the Board. Telewest, the Directors and certain former directors of Telewest were subsequently joined into this action on 12 June 2003. This action has been stayed pending completion of the Financial Restructuring. Additional information in relation to the tender offer litigation can be found in the paragraph headed “Eximius Litigation” in Part IX of this document. The litigation has been stayed pending completion of the Financial Restructuring. |

| | · | On 27 June 2002, Liberty Media announced that it was extending its tender offer and that it had purchased an additional $210 million of the aggregate principal amount of the Notes outside of the tender offer process. |

| | · | On 4 July 2002, Telewest announced in a letter to Telewest Shareholders that, subject to obtaining the necessary waivers and consents from the Senior Lenders, it was proposing to enter into discussions relating to a possible restructuring of its balance sheet with the Bondholder Committee and with Liberty Media. The Bondholder Committee initially consisted of the following institutions: Angelo Gordon & Co. L.P., Capital Research & Management Co., Continental Casualty Company, Fidelity Management & Research Co., Goldentree Asset Management, LP, Oaktree Capital Management LLC and OZ Management LLC. Over the restructuring process, the membership of the Bondholder Committee has changed. In March 2003, Franklin Mutual Advisors, LLC joined the Bondholder Committee. Capital Research & Management Co. resigned by a letter dated 11 September 2003 after |

21

| | being an inactive member of the Bondholder Committee for a period of time. Continental Casualty Company sold its Notes and resigned from the Bondholder Committee in October 2003. Currently the Bondholder Committee consists of six members: Angelo Gordon & Co. L.P., Franklin Mutual Advisors, LLC, Fidelity Management & Research Co., Goldentree Asset Management, LP, Oaktree Capital Management LLC and OZ Management LLC. |

| | · | On 17 July 2002, Liberty Media, citing a decline in the US and UK securities markets and its own share price, terminated its tender offer for certain of Telewest’s publicly traded Notes. On the same day, Liberty Media announced that it had informed Telewest that it was withdrawing its three non-executive directors from the Board. Liberty Media has the right to nominate up to three representatives to the Board under corporate shareholder arrangements with Telewest. Liberty Media indicated that the decision was taken to “eliminate any potential conflict of interest or appearance of conflict of interest in any upcoming restructuring discussions.” |

| | · | On 24 July 2002, legal and financial due diligence by the Bondholder Committee began. |

| | · | On 21 August 2002, Telewest reached an agreement with its Senior Lenders as to the terms on which it was permitted to enter restructuring discussions with its other stakeholders. |

| | · | On 6 September 2002, Telewest made a restructuring proposal to the Bondholder Committee. |

| | · | On 30 September 2002, following extensive negotiations with some of Telewest’s principal stakeholders, a preliminary non-binding agreement with the Bondholder Committee was announced. The principal terms of this non-binding preliminary agreement were the cancellation of all Notes in exchange for shares representing 97 per cent. of Telewest’s issued share capital. The Senior Secured Credit Facility, Telewest’s vendor financing, trade debt and other obligations of TCN, Telewest’s principal operating subsidiary, and its subsidiaries would have remained outstanding. |

| | · | On 1 October 2002, Telewest failed to pay a sum of approximately £10.5 million due to Crédit Agricole Indosuez on the maturity of a foreign currency swap contract to which Crédit Agricole Indosuez is the counterparty. The failure to pay this amount resulted in a technical default under Telewest’s outstanding debt securities, and resulted in a cross-default under the Senior Secured Credit Facility and all of the Notes. On 29 October, Crédit Agricole Indosuez presented a winding-up petition in respect of Telewest following its non-payment. See the paragraph headed “Foreign Exchange Contracts Dispute” in Part IX of this document for additional information. |

| | · | Following the preliminary non-binding agreement announced on 30 September 2002, and in consultation with the Bondholder Committee, Telewest did not pay the interest due on 1 October 2002 on certain of the Company Notes. Subsequently, on 1 November 2002, 1 February 2003, 19 February 2003, 1 April 2003, 1 May 2003, 1 August 2003, 19 August 2003, 1 October 2003, 1 November 2003, 9 January 2004, 1 February 2004, 19 February 2004 and 1 April 2004 Telewest did not pay interest on additional outstanding Company Notes as it fell due and did not pay the principal amount of the Eurobell Notes due on 1 November 2003. Additionally, Telewest Jersey did not pay interest due on 7 January 2003, 7 July 2003 and 7 January 2004 under the Jersey Notes. Telewest also deferred the settlement of the Derivative Agreements, pending completion of the Financial Restructuring. |

| | · | On 15 January 2003, Telewest announced that it had reached a non-binding agreement with respect to the terms of the Amended Senior Secured Credit Facility with both the Bondholder Committee and a steering committee of its Senior Lenders. As of that date, the terms of the Amended Senior Secured Credit Facility had received credit committee approval, subject to documentation and other issues, from all of the Senior Lenders, save for those banks which are also creditors by virtue of being counterparties to the Derivative Agreements. |

| | · | On 14 March 2003, Telewest notified its Senior Lenders that, as a result of provisions made for a VAT judgment (see the paragraph headed “VAT Dispute” in Part IX of this document for further details) and fees incurred in respect of the Financial Restructuring, and the resulting impact of these provisions on Telewest’s net operating cash flow, it was in breach of two financial covenants under the Senior Secured Credit Facility Agreement during the three months ended 31 December 2002. |

| | · | On 24 April 2003 and 12 May 2003, process was filed in the Supreme Court of the State of New York in relation to actions by Eximius, a fund advised by W.R. Huff, against, among others, Telewest and |

22