UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07345

Natixis Funds Trust III

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: June 30, 2008

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

DIVERSIFIED PORTFOLIOS

SEMIANNUAL REPORT

June 30, 2008

Natixis Income Diversified Portfolio

Active Dividend Equity Discipline

AEW Diversified REIT Discipline

Loomis Sayles Inflation Protected Securities Discipline

Loomis Sayles Multi-Sector Bond Discipline

Natixis Moderate Diversified Portfolio

Active International Discipline

Dreman Mid Cap Value Discipline

Harris Associates Large Cap Value Discipline

Loomis Sayles Core Fixed Income Discipline

Loomis Sayles Large Cap Growth Discipline

TABLE OF CONTENTS

Management Discussion and

Performance page 1

Portfolio of Investments page 12

Financial Statements page 26

NATIXIS INCOME DIVERSIFIED PORTFOLIO

PORTFOLIO PROFILE

Objective:

Seeks current income with a secondary objective of capital appreciation

Strategy:

Focuses on fixed-income and equity securities through a diversified portfolio of complementary income-producing investment disciplines from specialized money managers

Inception Date:

November 17, 2005

Subadvisors:

AEW Management and Advisors, L.P.

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | IIDPX |

| Class C | | CIDPX |

What You Should Know:

One segment of this fund invests in dividend-paying equity securities that can fall out of favor and underperform growth stocks during certain market conditions. One segment of the fund invests in real estate investment trusts (REITs), which are subject to default and prepayment risks, fluctuating property values and changes in interest rates. Two of the fund’s segments invest in different types of fixed-income securities that decline in value as interest rates rise. The U.S. government guarantees the timely payment of principal and interest on some of these securities, but the value of fund shares is not guaranteed and will fluctuate. Lower-rated, high-yield securities are considered riskier than higher-quality securities because there is a greater risk of default. Foreign securities are subject to currency fluctuations, differing political and economic conditions and different accounting standards.

Management Discussion

During the first half of 2008, the fixed-income markets faced a steady stream of problems, including the crisis in the credit and housing markets, a slowing economy, rising inflation and mounting unemployment. In the first quarter, investors abandoned assets with even the slightest amount of risk, seeking relative safety in the Treasury market. Early in the second quarter the fixed-income markets stabilized and risk came back into the market. However, in June renewed concerns about credit-market insolvency, along with soaring energy and food prices, triggered another flight to quality.

Natixis Income Diversified Portfolio’s four segments include Active Dividend Equity Discipline, an indexed portfolio of dividend-paying common stocks based on the Dow Jones Select Dividend Index, tracked by Active Investment Advisors (AIA), a division of Natixis Asset Management Advisors; AEW Diversified REIT Discipline, composed of Real Estate Investment Trusts (REITs), managed by AEW Management and Advisors, a specialist in this income-producing equity field; Loomis Sayles Inflation Protected Securities Discipline, a portfolio of Treasury Inflation-Protected Securities (TIPS), managed by Loomis Sayles; and Loomis Sayles Multi-Sector Bond Discipline, a diversified portfolio of domestic and foreign bonds.

For the six months ended June 30, 2008, the combined return of the fund’s four segments was -5.29% based on the net asset value of Class A shares, including $0.26 in dividends and $0.10 in capital gains reinvested during the period. The fund’s primary benchmark, the Lehman Aggregate Bond Index, returned 1.13% for the period, and the return on its secondary benchmark was -4.04%. The fund’s secondary benchmark is an unmanaged, blended index composed of the following weights: 40% Lehman Aggregate Bond Index; 25% Morgan Stanley Capital International U.S. REIT Index; 20% Dow Jones Select Dividend Index; and 15% Lehman U.S. TIPS Index. The average return on the fund’s Morningstar peer group, the Conservative Allocation category, was -3.92% for the period.

ACTIVE DIVIDEND EQUITY DISCIPLINE SHIFTED WITH ITS BENCHMARK

This segment fully replicates its benchmark, the Dow Jones Select Dividend Index, holding substantially all of the securities within the index in the same proportions. The benchmark is composed of equity securities that have paid a relatively high dividend yield consistently over time. It includes 100 of the highest dividend-yielding securities (other than REITs) in the Dow Jones Total Market Index – a broad-based index that represents the total market for U.S. equity securities.

As a fully replicating strategy, the segment is designed to mirror the index on a gross of fees basis. Investment management fees, trading costs, cash drag, corporate actions, the timing of index changes and shifting portfolio weightings all have an impact on how well the segment tracks the index. Normally, most security weightings are kept very close to the Index weightings.

Performance is highly sensitive to the financial sector, which accounts for nearly half the stocks in the Index. Difficulties in this sector during the past six months caused the segment and its Index to decline in value. During the six months ended June 30, 2008, 17 adjustments were made to the Index, most of which were made when companies failed to meet dividend requirements. These companies were replaced with higher-yielding entities. Two companies – Total System Services and Philip Morris International – had spin-offs that were not added to the Index so AIA eliminated them.

1

NATIXIS INCOME DIVERSIFIED PORTFOLIO

Management Discussion

STOCK SELECTION, SECTOR ALLOCATION HELPED AEW DIVERSIFIED REIT DISCIPLINE

REITs were not immune to the confluence of problems that affected the broader stock market during the six-month period, including concerns about the health of the economy, soaring commodity costs, falling home prices and credit market difficulties. The U.S. REIT market fell 3.5% over the period, with performance largely driven by an 11% decline in June.

Both stock selection and sector allocation had a modestly positive impact on relative performance during the period. Investments in the industrial, hotel and healthcare sectors were positive, but this was partially offset by negative results in the apartment, triple net lease and shopping center areas. Individual REITs that contributed the most to performance included storage REIT Public Storage; Liberty Property Trust, an industrial REIT; and Simon Property Group, a regional mall REIT. The segment benefited from being overweight relative to the benchmark in the storage sector, which did well, and underweight in the triple net lease sector, which did poorly.

AEW expects volatility within the REIT sector to persist in the near-term, as investors cope with the slowing economy and difficulties in the housing and credit markets. In this environment, the segment will make incremental adjustments as values, prices and catalysts change.

LOOMIS SAYLES INFLATION PROTECTED SECURITIES DISCIPLINE OUTPERFORMED

For the first half of 2008, real yields on five- and 10-year TIPS declined as the yield curve steepened, reflecting concerns about the weak real estate market, rising commodity prices, a contraction in consumer spending and a general decline in economic growth. Because of its longer duration and some opportunistic adjustments, the TIPS Discipline outperformed its benchmark during the period.

The main driver of the segment’s results was its focus on U.S. TIPS, which produced strong results as interest rates declined and the consumer price index (CPI) rose. Managing the fund’s duration in response to interest-rate changes was also helpful. The Discipline’s exposure to U.S. government agency securities, although much smaller than its concentration in TIPS, was disappointing. During the first quarter of 2008, agency spreads (the difference in yield between higher- and lower-quality issues) narrowed, along with spreads on most other debt securities. Spreads widened again in the second quarter, as concerns arose about the liquidity and capital requirements of government-sponsored enterprises, such as Fannie Mae and Freddie Mac.

If the U.S. economy rebounds in 2009, as Loomis Sayles’ economist forecasts, U.S. Treasury returns may be dampened, but return profiles for most other sectors could improve. However, Loomis believes a tough road lies ahead.

LOOMIS SAYLES MULTI-SECTOR BOND DISCIPLINE CAPITALIZED ON VOLATILITY

For the six months ended June 30, 2008, this Discipline faced an environment that generally favored safety over yield. During the first quarter, the deterioration of the housing market sparked a “flight to quality,” boosting Treasuries but holding back sectors with even the slightest amount of risk. The Federal Reserve Board aggressively cut interest rates early in the period in an effort to stimulate the economy and support the U.S. dollar. Loomis used this as an opportunity to invest in the corporate investment-grade and high-yield areas while they were out of favor, including select telecommunications and technology companies. As investors’ appetite for risk returned in April and May, the segment’s long duration strategy performed well, primarily among long Treasuries and investment-grade corporate bonds. Specific convertible securities did especially well.

However, in June mortgage-related problems once again had a negative impact on the credit markets. The segment’s agency holdings declined in value as concerns mounted that such government-backed enterprises as Fannie Mae and Freddie Mac would have to raise capital to compensate for declines in the value of their mortgage assets. Adding to the turmoil were rising commodity prices, which triggered concerns about the potential for accelerating inflation. Higher commodity prices were constructive for the segment’s holdings in the strong currencies of Australia, Canada and Brazil. However, they were negative for the retail, airline, automotive and home-building sectors. They also had a negative impact on the performance of the segment’s high-quality bonds denominated in the currencies of Mexico, Indonesia and South Korea.

2

NATIXIS INCOME DIVERSIFIED PORTFOLIO

Investment Results through June 30, 2008

PERFORMANCE IN PERSPECTIVE

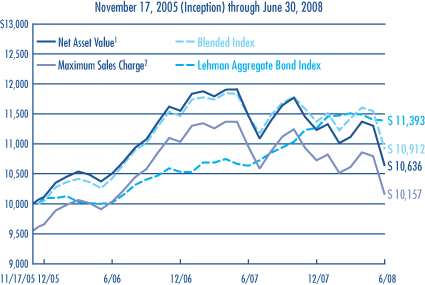

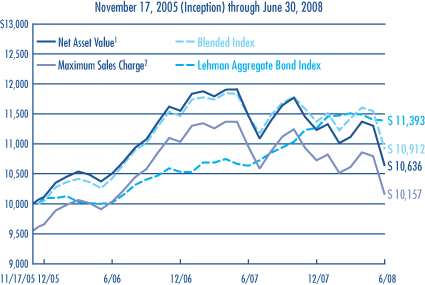

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A shares5

Average Annual Total Returns — June 30, 20085

| | | | | | | | | |

| | | | |

| | | 6 MONTHS | | | 1 YEAR | | | SINCE

INCEPTION | |

Class A (Inception 11/17/05) | | | | | | | | | |

Net Asset Value1 | | -5.29 | % | | -7.24 | % | | 2.39 | % |

With Maximum Sales Charge2 | | -9.52 | | | -11.41 | | | 0.61 | |

| | | | |

Class C (Inception 11/17/05) | | | | | | | | | |

Net Asset Value1 | | -5.65 | | | -7.96 | | | 1.62 | |

With CDSC3 | | -6.57 | | | -8.82 | | | 1.62 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | SINCE

INCEPTION4 | |

Lehman Aggregate Bond Index | | 1.13 | % | | 7.12 | % | | 5.18 | % |

Blended Index | | -4.04 | | | -4.82 | | | 3.43 | |

Morningstar Conservative Allocation Fund Avg. | | -3.92 | | | -2.51 | | | 3.50 | |

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those noted. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 6/30/08 | | 12/31/07 |

Common Stocks | | 37.9 | | 40.3 |

Preferred Stocks | | 0.6 | | 0.4 |

Bond and Notes | | 59.9 | | 58.6 |

Short-Term Investments and Other | | 1.6 | | 0.7 |

| |

| | | % of Net Assets as of |

| LARGEST HOLDINGS | | 6/30/08 | | 12/31/07 |

Equities | | | | |

Simon Property Group, Inc. | | 2.1 | | 1.9 |

Equity Residential | | 1.3 | | 1.1 |

Boston Properties, Inc. | | 1.3 | | 1.3 |

Public Storage, Inc. | | 1.2 | | 1.0 |

Vornado Realty Trust | | 1.1 | | 1.0 |

Fixed-Income | | | | |

U.S. Treasury Bond,

3.375%, 4/15/2032 | | 2.5 | | 3.3 |

U.S. Treasury Note,

1.625%, 1/15/2015 | | 1.4 | | 1.0 |

HSBC Bank USA, 144A, Zero Coupon, 5/17/2012 | | 1.3 | | 0.9 |

Federal National

Mortgage Association,

4.625%, 10/15/2013 | | 1.2 | | — |

Comcast Corp.,

5.650%, 6/15/2035 | | 1.2 | | 1.0 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 6/30/08 | | 12/31/07 |

Treasuries | | 15.3 | | 16.8 |

Banking | | 7.7 | | 8.9 |

Wirelines | | 4.6 | | 3.2 |

REITs — Regional Malls | | 3.7 | | 3.3 |

REITs — Apartments | | 3.4 | | 3.0 |

Portfolio holdings and asset allocations will vary.

FUND EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio6 | | Net Expense Ratio7 |

A | | 1.10% | | 1.10% |

C | | 1.85 | | 1.85 |

NOTES TO CHARTS

See page 7 for a description of the indexes.

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 4.50%. |

3 | Class C share performance assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

4 | The since-inception comparative performance figures shown for Class A and C shares were calculated from 12/1/05. |

5 | Fund performance has been increased by expense reductions and reimbursements, without which performance would have been lower. |

6 | Before reductions and reimbursements. |

7 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 4/30/09. |

3

NATIXIS MODERATE DIVERSIFIED PORTFOLIO

PORTFOLIO PROFILE

Objective:

Seeks long-term capital appreciation, with income as a secondary objective

Strategy:

Combines equity and fixed-income investments through a diversified portfolio of complementary investment disciplines from specialized money managers. Equity disciplines feature U.S. growth and value as well as international investments. The fixed-income discipline focuses on U.S. investment-grade, fixed-income securities

Inception Date:

July 15, 2004

Subadvisors:

Dreman Value Management, LLC

Harris Associates L.P.

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | AMDPX |

| Class C | | CMDPX |

What You Should Know:

Growth stocks focus on future expectations of a security. The fund may be exposed to greater volatility if the expectations are not met. Value stocks can fall out of favor and underperform growth stocks during certain market conditions. Foreign investments involve unique risks, such as currency fluctuations, differing political and economic conditions, and different accounting standards. Fixed-income securities are subject to credit risk, interest rate risk and liquidity risk. Lower-rated securities are considered riskier than investment-grade securities because there is a greater risk of default.

Management Discussion

The financial markets were turbulent during the first half of 2008, as investors grappled with slowing economic growth in the United States, rising inflation worldwide and turmoil in the financial system. In this environment, most stock indexes posted negative results for the period, while fixed-income indexes produced modest gains.

Natixis Moderate Diversified Portfolio combines five investment strategies, each focusing on a different asset class and managed by one of four firms. This multi-advisor approach provides shareholders with exposure to fixed-income, U.S. equity and international securities. Active International Discipline invests in stocks believed to be a representative sampling of the S&P ADR Index, tracked by Active Investment Advisors (AIA), a division of Natixis Asset Management Advisors, L.P. Dreman Mid Cap Value Discipline features mid-size companies that it believes are undervalued, but which appear to have good prospects for capital appreciation. Harris Associates Large Cap Value Discipline focuses on large- and mid-cap companies that it believes are trading at substantial discounts to their “true business value.” Loomis Sayles manages two segments. Loomis Sayles Core Fixed Income Discipline invests primarily in U.S. investment-grade, fixed-income securities, including government, corporate, mortgage- and asset-backed securities. Loomis Sayles Large Cap Growth Discipline emphasizes common stocks, convertible and other equity securities of larger companies.

For the six months ended June 30, 2008, Class A shares of Natixis Moderate Diversified Portfolio returned -8.86% at net asset value, with $0.10 in dividends and $0.17 in capital gains reinvested during the period. The portfolio held up better than its equity benchmark, the S&P 500 Index, which returned -11.91%, but did not do as well as its fixed-income benchmark, the Lehman Aggregate Bond Index, which was up 1.13%. The portfolio also underperformed the - -7.02% average return on the funds in Morningstar’s Moderate Allocation category.

THE ACTIVE INTERNATIONAL DISCIPLINE INVESTS IN LARGE, GLOBAL COMPANIES

AIA assumed responsibility for this Discipline at the beginning of August 2007. It uses a sampling approach based on the S&P ADR Index, a U.S.-dollar-denominated version of the broad-based S&P Global 1200, which represents 70% of the world’s total market capitalization. The S&P ADR Index includes stocks of foreign companies that offer ADRs (American Depositary Receipts) – certificates that provide U.S. investors with a convenient way to invest in non-U.S. securities. This Discipline emphasizes the largest stocks in all representative sectors of the S&P ADR Index in roughly the same sector weights. As a result, the segment remains relatively compact, in terms of the number of stocks held, while representing the majority of market capitalization of the benchmark index.

During the first half of 2008, the S&P ADR Index declined, hindered by the slowdown in global markets. Financial stocks constitute the largest portion of the Index (almost 24%), followed by energy (about 21%). Financial stocks were among the weakest during the period, while energy stocks generally rose. Great Britain is the largest country in the Index, making up about 27%, followed by Canada with about 16%.

DREMAN MID CAP VALUE DISCIPLINE EMPHASIZED OUT-OF-FAVOR COMPANIES

Stocks in the consumer staples, energy, materials and telecommunication services sectors helped performance. However, the consumer discretionary, financial, and healthcare sectors detracted from results.

Among the worst performing stocks for the period were CIT Group, Men’s Wearhouse and HCC Insurance. CIT Group, a commercial finance company, was hurt by the growing number of non-performing assets in the company’s portfolio. To shore up its balance sheet, CIT raised capital by selling more shares, which diluted their value. Shares of specialty retailer Men’s Wearhouse declined on weak same-store sales comparisons. HCC Insurance, a property/casualty insurer, declined after missing analysts’ earnings estimates. All three stocks remain in the segment because Dreman believes they are undervalued in light of their positive outlook for these companies.

4

NATIXIS MODERATE DIVERSIFIED PORTFOLIO

Management Discussion

The segment’s top performers included Yamana Gold, a gold mining company that flourished as the price of gold rose on inflation concerns. Chesapeake Energy was also among the top three performers. An oil and natural gas exploration and production company, Chesapeake benefited from record-high oil prices. Dreman sold the stock on strength. Defense manufacturer DRS Technologies was another top performer for the period. DRS was acquired by an Italian company at a substantial premium.

Dreman believes investors may be overreacting to current economic news stories, and that this may create opportunities for value-oriented equity investors.

HARRIS ASSOCIATES LOOKED FOR BARGAINS AMONG LARGE-CAP COMPANIES

Careful stock selection and this segment’s lack of exposure to the underperforming telecommunications sector helped performance, although this edge was offset by the segment’s lack of exposure to energy stocks, which performed well. Harris Associates believes energy stocks are overpriced and that there are better investment opportunities elsewhere. Motorola and Sun Microsystems were the two worst performers and both stocks were sold. Intel also fell short of expectations, as the market reacted negatively to the company’s fourth-quarter earnings announcement. However, Harris Associates believes investors may have overreacted to Intel’s announcement and the stock remains in the segment. Largely because of the credit crisis, Merrill Lynch had a negative impact on return, but Harris Associates has confidence in the firm’s management team and it too remains in the portfolio.

The best-performing stocks for the period were Union Pacific, Schering-Plough and Pulte Homes. Union Pacific continues to report solid earnings, and Harris Associates believes a strong pricing environment, combined with an aggressive pursuit of operational improvements, should allow the company to expand margins. Research-based pharmaceutical company Schering-Plough beat analysts’ earnings forecasts on almost all of its key products, and the firm’s gross margin was better than expected. Pulte Homes rebounded strongly early in the year, but the position was sold on strength as conditions in the housing market weakened.

LOOMIS SAYLES CORE FIXED-INCOME DISCIPLINE GRAPPLED WITH THE CREDIT CRISIS

Both sector allocation and individual security selection held back performance. Relative to its benchmark, this Discipline was underweight in government securities, which did especially well as insecure investors sought quality and liquidity. This underweight was the largest detractor from performance. Loomis chose to pursue attractive yields available from some higher-risk issues, including asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), and investment-grade corporate bonds. Bonds in the home equity ABS industry endured price declines as mortgage delinquencies mounted and market liquidity dried up. Other finance-related areas, such as brokers and finance companies, also did poorly on mortgage-related concerns.

The segment’s holdings in credit-card ABS were positive, and the position was increased as yields rose. U.S. Treasuries were the best performers, especially the position in a long-term STRIP, which was purchased in anticipation of a decline in interest rates. (A STRIP is a Treasury security that has its coupon and principal repayments separated into what effectively becomes a zero-coupon Treasury bond.) By the end of the period, this Discipline had added exposure to investment-grade corporate bonds, and ABS securities in the credit card and automotive areas. It had also reduced its holdings in mortgage-backed securities to take advantage of opportunities in other areas where yield spreads have widened because of a lack of liquidity.

LOOMIS LARGE CAP GROWTH DISCIPLINE FAVORED INDUSTRY LEADERS

Because of the volatility in the equity markets, this Discipline focused on stocks that Loomis believed could inspire confidence. The segment’s exposure to the financials sector was trimmed during the period as performance was held back by investments in various exchanges that dropped in value early in the year. These included CME Group (Chicago Mercantile Exchange), the world’s largest futures exchange; Intercontinental Exchange, which operates internet-based marketplaces that trade futures and over-the-counter energy and commodity contracts; and NYMEX Holdings, parent company of the New York Mercantile Exchange, the world’s largest physical commodities futures and options exchange. All three stocks were sold.

Poor stock selection in the technology sector detracted from results, as Apple, Microsoft and MEMC Electronic Materials all fell short of expectations. Microsoft and MEMC were sold. In the consumer discretionary sector, Google and Amazon.com also proved disappointing. However, energy companies that benefited from rising crude oil prices were strongly positive. Top performers included Southwestern Energy, an integrated energy company; XTO Energy, an oil and gas producer; Transocean, an offshore drilling company; and Flowserve Corporation, a manufacturer of products used in the energy industry. Investments in the automotive and transportation area were also positive; railroad company CSX’s stock rose on earnings guidance that surpassed analysts’ expectations. The company also announced that it would increase its dividend and its share buy-back program.

5

NATIXIS MODERATE DIVERSIFIED PORTFOLIO

Investment Results through June 30, 2008

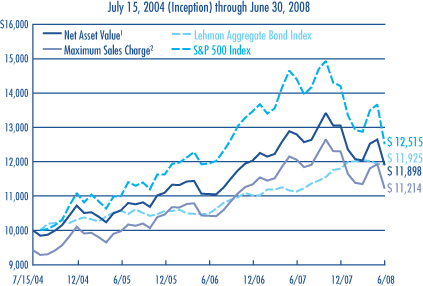

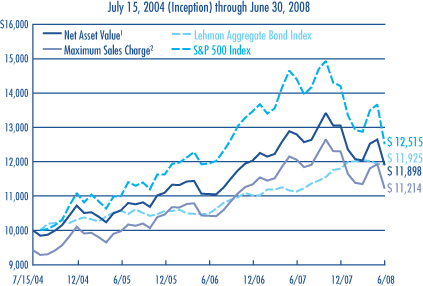

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, an index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares5

Average Annual Total Returns — June 30, 20085

| | | | | | | | | |

| | | | |

| | | 6 MONTHS | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A (Inception 7/15/04) | | | | | | | | | |

Net Asset Value1 | | -8.86 | % | | -7.01 | % | | 4.48 | % |

With Maximum Sales Charge2 | | -14.12 | | | -12.33 | | | 2.93 | |

| | | | |

CLASS C (Inception 7/15/04) | | | | | | | | | |

Net Asset Value1 | | -9.24 | | | -7.65 | | | 3.71 | |

With CDSC3 | | -10.13 | | | -8.47 | | | 3.71 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 6 MONTHS | | | 1 YEAR | | | SINCE

INCEPTION4 | |

S&P 500 Index | | -11.91 | % | | -13.12 | % | | 5.89 | % |

Lehman Aggregate Bond Index | | 1.13 | | | 7.12 | | | 4.60 | |

Morningstar Moderate Allocation Fund Avg. | | -7.02 | | | -6.54 | | | 5.87 | |

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those noted. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 6/30/08 | | 12/31/07 |

Common Stocks | | 62.8 | | 63.0 |

Bonds and Notes | | 36.1 | | 30.4 |

Short-Term Investments and Other | | 1.1 | | 6.6 |

| |

| | | % of Net Assets as of |

| LARGEST HOLDINGS | | 6/30/08 | | 12/31/07 |

Equities | | | | |

Intel Corp. | | 1.3 | | 2.1 |

Dell, Inc. | | 1.1 | | 0.8 |

McDonald’s Corp. | | 1.1 | | 1.4 |

Hewlett-Packard Co. | | 1.0 | | 1.4 |

Apple, Inc. | | 1.0 | | 1.3 |

Fixed-Income | | | | |

FNMA, 5.000%, 7/01/2035 | | 1.5 | | 1.2 |

FNMA, 4.000%, 2/01/2020 | | 1.4 | | 1.1 |

FNMA, 5.000%, 8/01/2035 | | 1.3 | | 1.4 |

FHLMC, 4.500%, 6/01/2035 | | 1.3 | | 1.3 |

FNMA, 5.500%, 12/01/2035 | | 1.2 | | 1.0 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 6/30/08 | | 12/31/07 |

Mortgage Related | | 17.0 | | 18.5 |

Oil, Gas & Consumable Fuels | | 5.5 | | 3.0 |

Capital Markets | | 5.5 | | 4.6 |

Computers & Peripherals | | 4.4 | | 4.4 |

Commercial MBS | | 3.4 | | 3.0 |

Portfolio holdings and asset allocations will vary.

FUND EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio6 | | Net Expense Ratio7 |

A | | 1.34% | | 1.34% |

C | | 2.08 | | 2.08 |

NOTES TO CHARTS

See page 7 for a description of the indexes.

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Class C share performance assumes a 1.00% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

4 | The since-inception comparative performance figures shown for Class A and C shares were calculated from 8/1/04. |

5 | Fund performance has been increased by expense reductions and reimbursements, if any, without which performance would have been lower. |

6 | Before reductions and reimbursements. |

7 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 4/30/09. |

6

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

For more complete information on any Natixis Fund, contact your financial professional or call Natixis Funds and ask for a free prospectus, which contains more complete information including charges and other ongoing expenses. Investors should consider a fund’s objective, risks and expenses carefully before investing. This and other fund information can be found in the prospectus. Please read the prospectus carefully before investing.

INDEX/AVERAGE DESCRIPTIONS:

Blended Index is an unmanaged, blended index comprised of the following weights: 40% Lehman Aggregate Bond Index, 25% Morgan Stanley Capital International U.S. REIT Index, 20% Dow Jones Select Dividend Index, and 15% Lehman U.S. TIPS Index. The four indices comprising the Blended Index measure, respectively, the performance of investment grade fixed income securities, equity REIT securities, dividend-yielding equity securities, and Treasury inflation-protected securities. The weightings of the indices that comprise the Blended Index are rebalanced on a monthly basis to maintain the allocations as described above.

Lehman Aggregate Bond Index is an unmanaged index of investment-grade bonds with one- to ten-year maturities issued by the U.S. government, its agencies and U.S. corporations.

Morningstar Conservative Allocation Fund Average is the average performance without sales charges of funds with similar current investment objectives, as calculated by Morningstar, Inc.

Morningstar Moderate Allocation Fund Average is the average performance without sales charges of funds with similar current investment objectives, as calculated by Morningstar, Inc.

S&P 500 Index is an unmanaged index of U.S. common stocks.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 1-800-225-5478; on the funds’ website at www.funds.natixis.com; and on the Securities and Exchange Commission’s (SEC) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12-month period ended June 30, 2008 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

7

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different costs: transaction costs, including sales charges (loads) on purchases and certain exchange fees, and ongoing costs, including management fees, sales and distribution fees (12b-1 fees), and other fund expenses. In addition, each fund assesses a minimum balance fee of $20 on an annual basis for accounts that fall below the required minimum to establish an account. Certain exceptions may apply. These costs are described in more detail in the funds’ prospectus. The examples below are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class of fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the fund from January 1, 2008 through June 30, 2008. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your class.

The second line in the table for each class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs such as sales charges or exchange fees. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | |

| NATIXIS INCOME DIVERSIFIED PORTFOLIO | | BEGINNING ACCOUNT VALUE

1/1/08 | | ENDING ACCOUNT VALUE

6/30/08 | | EXPENSES PAID DURING PERIOD*

1/1/08 – 6/30/08 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $947.40 | | $5.18 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.54 | | $5.37 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $943.70 | | $8.80 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,015.81 | | $9.12 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 1.07% and 1.82%, for Class A and Class C, respectively, multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

| | | | | | |

| NATIXIS MODERATE DIVERSIFIED PORTFOLIO | | BEGINNING ACCOUNT VALUE

1/1/08 | | ENDING ACCOUNT VALUE

6/30/08 | | EXPENSES PAID DURING PERIOD*

1/1/08 – 6/30/08 |

CLASS A | | | | | | |

Actual | | $1,000.00 | | $911.40 | | $6.27 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.30 | | $6.62 |

CLASS C | | | | | | |

Actual | | $1,000.00 | | $907.60 | | $9.82 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,014.57 | | $10.37 |

| * | Expenses are equal to the Fund’s annualized expense ratio (after fee reduction/reimbursement): 1.32%, and 2.07% for Class A and C, respectively, multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). |

8

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

The Board of Trustees, including the Independent Trustees, considers matters bearing on each Portfolio’s advisory and sub-advisory agreements (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review and Governance Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Portfolios’ investment advisers believe to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Portfolios and the performance of peer groups of funds and the Portfolios’ performance benchmarks, (ii) information on the Portfolios’ advisory and sub-advisory fees, if any, and other expenses, including information comparing the Portfolios’ expenses to those of peer groups of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Portfolios, (iv) information about the profitability of the Agreements to the Portfolios’ advisers and sub-advisers (collectively, the “Advisers”), and (v) information obtained through the completion of a questionnaire by the Advisers (the Trustees are consulted as to the information requested through that questionnaire). The Board of Trustees, including the Independent Trustees, also consider other matters such as (i) each Adviser’s financial results and financial condition, (ii) each Portfolio’s investment objective and strategies and the size, education and experience of the Advisers’ respective investment staffs and their use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Portfolios’ shares and the related costs, (iv) the procedures employed to determine the value of the Portfolios’ assets, (v) the allocation of the Portfolios’ brokerage, if any, including allocations to brokers affiliated with the Advisers and the use of “soft” commission dollars to pay Portfolio expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Portfolios’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, and (vii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Advisers.

In addition to the materials requested by the Trustees in connection with the annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board of Trustees that provide detailed information about the Portfolios’ investment performance and the fees charged to the Portfolios for advisory and other services. This information generally includes, among other things, an internal performance rating for each Portfolio (and segment, in the case of Portfolios managed by multiple sub-advisers) based on agreed-upon criteria, graphs showing performance and fee differentials against each Portfolio’s peer group, performance ratings provided by a third-party, total return information for various periods, and third-party performance rankings for various periods comparing a Portfolio against its peer group. The portfolio management team for each Portfolio makes periodic presentations to the Contract Review and Governance Committee and/or the full Board of Trustees, and Portfolios identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Portfolio.

The Board of Trustees most recently approved the continuation of the Agreements at their meeting held in June, 2008. The Agreements were continued for a one-year period for all Portfolios. In considering whether to approve the continuation of the Agreements, the Board of Trustees, including the Independent Trustees, did not identify any single factor as determinative. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included the following:

The nature, extent and quality of the services provided to the Portfolios under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Advisers and their affiliates to the Portfolios and the resources dedicated to the Portfolios by the Advisers and their affiliates, including recent or planned investments by certain of the Advisers in additional personnel or other resources. They also took note of the competitive market for talented personnel, in particular, for personnel who have contributed to the generation of strong investment performance. They considered the need for the Advisers to offer competitive compensation in order to attract and retain capable personnel.

The Trustees considered not only the advisory services provided by the Advisers to the Portfolios, but also the monitoring and oversight services provided by Natixis Advisors with respect to sub-advised Portfolios and the Portfolios for which Natixis Advisors provides advisory oversight services. They also considered the administrative services provided by Natixis Advisors and its affiliates to the Portfolios.

9

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

For each Portfolio, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Portfolios and the Advisers. As noted above, the Trustees received information about the performance of the Portfolios over various time periods, including information which compared the performance of the Portfolios to the performance of peer groups of funds and the Portfolios’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party which analyzed the performance of the Portfolios using a variety of performance metrics, including metrics which also measured the performance of the Portfolios on a risk adjusted basis.

With respect to each Portfolio, the Board concluded that the Portfolio’s performance and other relevant factors supported the renewal of the Agreement(s) relating to that Portfolio. In the case of each Portfolio that had performance that lagged that of a relevant peer group for certain (although not necessarily all) periods, the Board concluded that other factors relevant to performance supported renewal of the Portfolios’ Agreements. These factors varied from Portfolio to Portfolio, but included one or more of the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Portfolio’s Advisers that were reasonable and consistent with the Portfolio’s investment objective and policies; (2) that the Natixis Income Diversified Portfolio’s relative ranking in its category was largely a function of being compared with funds that have exposure to different types of investments than the Portfolio; and (3) that reductions in the Portfolio’s expense levels resulting from decreased expenses and/or increased assets were not yet fully reflected in the Portfolio’s performance results.

The Trustees also noted that the Natixis Income Diversified Portfolio was recently formed and therefore performance comparisons were unavailable or related to a time period that was too short for a comparison to be meaningful.

The Trustees also considered each Adviser’s performance and reputation generally, the Portfolios’ performance as a fund family generally (as noted by certain financial publications), and the historical responsiveness of the Advisers to Trustee concerns about performance and the willingness of the Advisers to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Portfolios and the Advisers supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Advisers and their affiliates from their respective relationships with the Portfolios. The Trustees considered the fees charged to the Portfolios for advisory and sub-advisory services as well as the total expense levels of the Portfolios. This information included comparisons (provided both by management and also by an independent third party) of the Portfolios’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Advisers to comparable accounts. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets. In evaluating each Portfolio’s advisory and sub-advisory fees, the Trustees also took into account the demands, complexity and quality of the investment management of such Portfolio. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps. They noted that the Portfolios currently have expense caps in place, and they considered the amounts waived or reimbursed by the Advisers under these caps.

The Trustees also considered the compensation directly or indirectly received by the Advisers and their affiliates from their relationships with the Portfolios. The Trustees reviewed information provided by management as to the profitability of the Advisers’ and their affiliates’ relationships with the Portfolios, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and Portfolio growth on Adviser profitability, including information regarding resources spent on distribution activities and the increase in net sales for the family of funds. When reviewing profitability, the Trustees also considered information about court cases in which adviser profitability was an issue, the performance of the relevant Portfolios, the expense levels of the Portfolios, and whether the Advisers had implemented breakpoints and/or expense caps with respect to such Portfolios.

10

BOARD APPROVALOFTHE EXISTING ADVISORYAND SUB-ADVISORY AGREEMENTS

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fees charged to each of the Portfolios were fair and reasonable, and that the costs of these services generally and the related profitability of the Advisers and their affiliates in respect of their relationships with the Portfolios supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Advisers and whether those economies are shared with the Portfolios through breakpoints in their investment advisory fees or other means, such as expense waivers. The Trustees noted that the Portfolios had breakpoints in their advisory fees were subject to expense caps. The Trustees also considered management’s representation that for certain Portfolios, the Portfolios’ Advisers did not benefit from economies of scale in providing services to the Portfolios (because of the investment style of the Portfolio, the small size of the Portfolio or for other reasons) or were capacity constrained with respect to the relevant investment strategy. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Advisers and their affiliates of their relationships with the Portfolios, as discussed above.

After reviewing these and related factors, the Trustees considered, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Portfolios supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| · | | whether each Portfolio has operated in accordance with its investment objective and the Portfolio’s record of compliance with its investment restrictions, and the compliance programs of the Portfolios and the Advisers. They also considered the compliance-related resources the Advisers and their affiliates were providing to the Portfolios. |

| · | | the nature, quality, cost and extent of administrative and shareholder services performed by the Advisers and their affiliates, both under the Agreements and under separate agreements covering administrative services. |

| · | | so-called “fallout benefits” to the Advisers, such as the engagement of affiliates of the Advisers to provide distribution, administrative and brokerage services to the Portfolios, and the benefits of research made available to the Advisers by reason of brokerage commissions generated by the Portfolios’ securities transactions. The Trustees also considered the fact that Natixis Advisors’ parent company benefits from the retention of affiliated Advisers. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing advisory and sub-advisory agreements should be continued through June 30, 2009.

11

NATIXIS INCOME DIVERSIFIED PORTFOLIO — PORTFOLIOOF INVESTMENTS

Investments as of June 30, 2008 (Unaudited)

| | | | | |

| Shares | | Description | | Value (†) |

| | | | | |

| Common Stocks — 37.9% of Net Assets | | | |

| | Auto Components — 0.1% | | | |

| 5,179 | | Superior Industries International, Inc.(b) | | $ | 87,422 |

| | | | | |

| | Automotive — 0.1% | | | |

| 5,450 | | General Motors Corp.(b) | | | 62,675 |

| | | | | |

| | Banking — 4.4% | | | |

| 6,677 | | Associated Bancorp(b) | | | 128,799 |

| 5,164 | | Bank of Hawaii Corp.(b) | | | 246,839 |

| 8,219 | | BB&T Corp.(b) | | | 187,147 |

| 7,958 | | Colonial BancGroup, Inc.(b) | | | 35,174 |

| 8,898 | | Comerica, Inc.(b) | | | 228,056 |

| 9,327 | | F N B Corp.(b) | | | 109,872 |

| 9,112 | | Fifth Third Bancorp(b) | | | 92,760 |

| 5,877 | | First Bancorp(b) | | | 37,260 |

| 13,263 | | First Horizon National Corp.(b) | | | 98,544 |

| 6,530 | | First Midwest Bancorp, Inc.(b) | | | 121,785 |

| 8,424 | | FirstMerit Corp.(b) | | | 137,395 |

| 6,355 | | Frontier Financial Corp.(b) | | | 54,145 |

| 7,609 | | Fulton Financial Corp.(b) | | | 76,470 |

| 11,202 | | Huntington Bancshares, Inc.(b) | | | 64,636 |

| 9,533 | | KeyCorp(b) | | | 104,672 |

| 6,670 | | Marshall & Ilsley Corp.(b) | | | 102,251 |

| 6,438 | | Pacific Capital Bancorp(b) | | | 88,716 |

| 6,244 | | PacWest Bancorp | | | 92,911 |

| 5,521 | | PNC Financial Services Group, Inc. | | | 315,249 |

| 9,346 | | Popular, Inc.(b) | | | 61,590 |

| 8,268 | | Provident Bankshares Corp.(b) | | | 52,750 |

| 9,097 | | Regions Financial Corp.(b) | | | 99,248 |

| 6,449 | | Suntrust Banks, Inc.(b) | | | 233,583 |

| 5,259 | | Synovus Financial Corp.(b) | | | 45,911 |

| 7,843 | | TCF Financial Corp.(b) | | | 94,351 |

| 5,387 | | Trustmark Corp.(b) | | | 95,081 |

| 7,262 | | U.S. Bancorp(b) | | | 202,537 |

| 7,473 | | Umpqua Holdings Corp.(b) | | | 90,648 |

| 6,040 | | UnionBanCal Corp.(b) | | | 244,137 |

| 5,783 | | United Bankshares, Inc.(b) | | | 132,720 |

| 6,842 | | Valley National Bancorp(b) | | | 107,898 |

| 9,257 | | Wachovia Corp.(b) | | | 143,761 |

| 6,207 | | Webster Financial Corp.(b) | | | 115,450 |

| 5,825 | | Wells Fargo & Co.(b) | | | 138,344 |

| 5,667 | | Wilmington Trust Corp.(b) | | | 149,835 |

| | | | | |

| | | | | 4,330,525 |

| | | | | |

| | Building Products — 0.1% | | | |

| 6,143 | | Masco Corp.(b) | | | 96,629 |

| | | | | |

| | Chemicals — 1.0% | | | |

| 5,696 | | Dow Chemical Co. (The)(b) | | | 198,847 |

| 4,009 | | Eastman Chemical Co.(b) | | | 276,060 |

| 4,298 | | PPG Industries, Inc.(b) | | | 246,576 |

| 5,417 | | RPM International, Inc.(b) | | | 111,590 |

| 3,687 | | Sensient Technologies Corp.(b) | | | 103,826 |

| | | | | |

| | | | | 936,899 |

| | | | | |

| | Commercial Services & Supplies — 0.8% | | | |

| 4,659 | | Avery Dennison Corp. | | | 204,670 |

| 4,747 | | Deluxe Corp. | | | 84,592 |

| 5,255 | | Pitney Bowes, Inc.(b) | | | 179,196 |

| 4,060 | | R. R. Donnelley & Sons Co.(b) | | | 120,541 |

| 4,088 | | Waste Management, Inc.(b) | | | 154,158 |

| | | | | |

| | | | | 743,157 |

| | | | | |

| | | | | |

| Shares | | Description | | Value (†) |

| | | | | |

| | Containers & Packaging — 0.1% | | | |

| 4,545 | | Sonoco Products Co. | | $ | 140,668 |

| | | | | |

| | Distributors — 0.2% | | | |

| 4,339 | | Genuine Parts Co.(b) | | | 172,172 |

| | | | | |

| | Diversified Financial Services — 0.6% | | | |

| 8,789 | | Bank of America Corp. | | | 209,793 |

| 10,204 | | Citigroup, Inc. | | | 171,019 |

| 4,883 | | JPMorgan Chase & Co. | | | 167,536 |

| | | | | |

| | | | | 548,348 |

| | | | | |

| | Diversified Telecommunication Services — 0.2% | | | |

| 4,932 | | AT&T, Inc. | | | 166,159 |

| | | | | |

| | Electric Utilities — 1.2% | | | |

| 4,945 | | DPL, Inc.(b) | | | 130,449 |

| 3,603 | | Entergy Corp.(b) | | | 434,089 |

| 3,829 | | FirstEnergy Corp. | | | 315,241 |

| 7,045 | | Pinnacle West Capital Corp.(b) | | | 216,775 |

| 4,166 | | Unisource Energy Corp.(b) | | | 129,188 |

| | | | | |

| | | | | 1,225,742 |

| | | | | |

| | Food Products — 0.3% | | | |

| 3,762 | | General Mills, Inc.(b) | | | 228,617 |

| 3,702 | | Sara Lee Corp. | | | 45,349 |

| | | | | |

| | | | | 273,966 |

| | | | | |

| | Gas Utilities — 0.7% | | | |

| 6,511 | | AGL Resources, Inc. | | | 225,150 |

| 6,079 | | Nicor, Inc.(b) | | | 258,905 |

| 4,583 | | Oneok, Inc. | | | 223,788 |

| | | | | |

| | | | | 707,843 |

| | | | | |

| | Hotels, Restaurants & Leisure — 0.4% | | | |

| 10,500 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 420,735 |

| | | | | |

| | Household Durables — 0.2% | | | |

| 6,446 | | D.R. Horton, Inc.(b) | | | 69,939 |

| 375 | | KB Home(b) | | | 6,349 |

| 7,763 | | Leggett & Platt, Inc.(b) | | | 130,185 |

| | | | | |

| | | | | 206,473 |

| | | | | |

| | Household Products — 0.3% | | | |

| 4,441 | | Kimberly-Clark Corp. | | | 265,483 |

| | | | | |

| | Insurance — 1.3% | | | |

| 6,973 | | Arthur J Gallagher & Co.(b) | | | 168,049 |

| 5,202 | | Cincinnati Financial Corp.(b) | | | 132,131 |

| 4,119 | | Lincoln National Corp. | | | 186,673 |

| 6,476 | | Mercury General Corp.(b) | | | 302,559 |

| 6,160 | | Old Republic International Corp.(b) | | | 72,934 |

| 5,810 | | Unitrin, Inc.(b) | | | 160,182 |

| 6,992 | | Zenith National Insurance Corp.(b) | | | 245,839 |

| | | | | |

| | | | | 1,268,367 |

| | | | | |

| | Leisure Equipment & Products — 0.1% | | | |

| 5,551 | | Mattel, Inc. | | | 95,033 |

| | | | | |

| | Machinery — 0.1% | | | |

| 5,575 | | Briggs & Stratton Corp.(b) | | | 70,691 |

| | | | | |

| | Media — 0.3% | | | |

| 6,308 | | Gannett Co., Inc.(b) | | | 136,694 |

| 7,645 | | Lee Enterprises, Inc.(b) | | | 30,504 |

| 7,784 | | New York Times Co., Class A(b) | | | 119,796 |

| | | | | |

| | | | | 286,994 |

| | | | | |

See accompanying notes to financial statements.

12

NATIXIS INCOME DIVERSIFIED PORTFOLIO — PORTFOLIOOF INVESTMENTS (continued)

Investments as of June 30, 2008 (Unaudited)

| | | | | |

| Shares | | Description | | Value (†) |

| | | | | |

| | Multi Utilities — 1.1% | | | |

| 4,696 | | Black Hills Corp.(b) | | $ | 150,554 |

| 5,323 | | Centerpoint Energy, Inc. | | | 85,434 |

| 6,632 | | DTE Energy Co.(b) | | | 281,462 |

| 6,429 | | Energy East Corp. | | | 158,925 |

| 6,990 | | NiSource, Inc.(b) | | | 125,261 |

| 6,114 | | PNM Resources, Inc. | | | 73,123 |

| 5,932 | | SCANA Corp.(b) | | | 219,484 |

| | | | | |

| | | | | 1,094,243 |

| | | | | |

| | Oil, Gas & Consumable Fuels — 0.4% | | | |

| 3,588 | | Chevron Corp., ADR | | | 355,678 |

| | | | | |

| | Paper & Forest Products — 0.1% | | | |

| 4,350 | | Meadwestvaco Corp.(b) | | | 103,704 |

| | | | | |

| | Pharmaceuticals — 0.6% | | | |

| 5,789 | | Bristol-Myers Squibb Co. | | | 118,848 |

| 4,561 | | Eli Lilly & Co. | | | 210,536 |

| 3,705 | | Merck & Co., Inc. | | | 139,642 |

| 7,071 | | Pfizer, Inc. | | | 123,530 |

| | | | | |

| | | | | 592,556 |

| | | | | |

| | REITs — Apartments — 3.4% | | | |

| 13,000 | | Apartment Investment & Management Co., Class A | | | 442,780 |

| 9,000 | | AvalonBay Communities, Inc.(b) | | | 802,440 |

| 13,100 | | Camden Property Trust(b) | | | 579,806 |

| 34,100 | | Equity Residential(b) | | | 1,305,007 |

| 7,600 | | UDR, Inc.(b) | | | 170,088 |

| | | | | |

| | | | | 3,300,121 |

| | | | | |

| | REITs — Diversified — 1.4% | | | |

| 12,400 | | BioMed Realty Trust, Inc.(b) | | | 304,172 |

| 12,500 | | Vornado Realty Trust | | | 1,100,000 |

| | | | | |

| | | | | 1,404,172 |

| | | | | |

| | REITs — Healthcare — 1.5% | | | |

| 9,600 | | HCP, Inc.(b) | | | 305,376 |

| 5,800 | | Healthcare Realty Trust, Inc. | | | 137,866 |

| 19,500 | | Nationwide Health Properties, Inc.(b) | | | 614,055 |

| 21,100 | | Omega Healthcare Investors, Inc. | | | 351,315 |

| | | | | |

| | | | | 1,408,612 |

| | | | | |

| | REITs — Hotels — 0.9% | | | |

| 22,000 | | Ashford Hospitality Trust(b) | | | 101,640 |

| 2,100 | | Hospitality Properties Trust(b) | | | 51,366 |

| 49,500 | | Host Hotels & Resorts, Inc.(b) | | | 675,675 |

| | | | | |

| | | | | 828,681 |

| | | | | |

| | REITs — Industrial — 3.0% | | | |

| 11,500 | | AMB Property Corp. | | | 579,370 |

| 51,000 | | DCT Industrial Trust, Inc.(b) | | | 422,280 |

| 13,400 | | First Potomac Realty Trust(b) | | | 204,216 |

| 22,000 | | Liberty Property Trust | | | 729,300 |

| 13,200 | | ProLogis(b) | | | 717,420 |

| 4,500 | | PS Business Parks, Inc. | | | 232,200 |

| | | | | |

| | | | | 2,884,786 |

| | | | | |

| | REITs — Office — 3.0% | | | |

| 14,300 | | Boston Properties, Inc.(b) | | | 1,290,146 |

| 17,000 | | Brandywine Realty Trust | | | 267,920 |

| 11,500 | | Corporate Office Properties Trust(b) | | | 394,795 |

| 4,000 | | Digital Realty Trust, Inc.(b) | | | 163,640 |

| 12,900 | | Dupont Fabros Technology, Inc.(b) | | | 240,456 |

| | | | | | |

| Shares | | Description | | Value (†) |

| | | | | | |

| | | REITs — Office — continued | | | |

| | 28,500 | | HRPT Properties Trust(b) | | $ | 192,945 |

| | 8,800 | | Kilroy Realty Corp.(b) | | | 413,864 |

| | | | | | |

| | | | | | 2,963,766 |

| | | | | | |

| | | REITs — Regional Malls — 3.7% | | | |

| | 13,500 | | General Growth Properties, Inc.(b) | | | 472,905 |

| | 11,700 | | Macerich Co. (The)(b) | | | 726,921 |

| | 22,500 | | Simon Property Group, Inc. | | | 2,022,525 |

| | 8,700 | | Taubman Centers, Inc.(b) | | | 423,255 |

| | | | | | |

| | | | | | 3,645,606 |

| | | | | | |

| | | REITs — Shopping Centers — 2.8% | | | |

| | 20,800 | | Developers Diversified Realty Corp.(b) | | | 721,968 |

| | 9,500 | | Federal Realty Investment Trust(b) | | | 655,500 |

| | 11,000 | | Kimco Realty Corp.(b) | | | 379,720 |

| | 15,700 | | Kite Realty Group Trust(b) | | | 196,250 |

| | 12,700 | | Regency Centers Corp.(b) | | | 750,824 |

| | | | | | |

| | | | | | 2,704,262 |

| | | | | | |

| | | REITs — Storage — 1.5% | | | |

| | 19,500 | | Extra Space Storage, Inc.(b) | | | 299,520 |

| | 14,500 | | Public Storage, Inc.(b) | | | 1,171,455 |

| | | | | | |

| | | | | | 1,470,975 |

| | | | | | |

| | | REITs — Triple Net Lease — 0.3% | | | |

| | 11,600 | | iStar Financial, Inc.(b) | | | 153,236 |

| | 6,000 | | Realty Income Corp.(b) | | | 136,560 |

| | | | | | |

| | | | | | 289,796 |

| | | | | | |

| | | Real Estate Operating Companies — 0.5% | | | |

| | 27,000 | | Brookfield Properties Corp. | | | 480,330 |

| | | | | | |

| | | Thrifts & Mortgage Finance — 0.7% | | | |

| | 6,542 | | Astoria Financial Corp.(b) | | | 131,363 |

| | 7,500 | | Federal Home Loan Mortgage Corp.(b) | | | 123,000 |

| | 6,894 | | First Niagara Financial Group, Inc.(b) | | | 88,657 |

| | 8,415 | | New York Community Bancorp, Inc.(b) | | | 150,124 |

| | 4,719 | | People’s United Financial, Inc.(b) | | | 73,617 |

| | 5,893 | | Washington Federal, Inc.(b) | | | 106,663 |

| | | | | | |

| | | | | | 673,424 |

| | | | | | |

| | | Tobacco — 0.3% | | | |

| | 5,670 | | Altria Group, Inc. | | | 116,575 |

| | 5,153 | | Universal Corp.(b) | | | 233,019 |

| | | | | | |

| | | | | | 349,594 |

| | | | | | |

| | | Trading Companies & Distributors — 0.2% | | | |

| | 6,000 | | Watsco, Inc.(b) | | | 250,800 |

| | | | | | |

| | | Total Common Stocks (Identified Cost $50,978,368) | | | 36,907,087 |

| | | | | | |

Principal

Amount (‡) | | | | |

| | Bonds and Notes — 59.9% | | | |

| | | ABS Car Loan — 0.1% | | | |

| $ | 100,000 | | ARG Funding Corp., 144A,

2.642%, 5/20/2011(c) | | | 91,594 |

| | | | | | |

| | | ABS Credit Card — 0.1% | | | |

| | 100,000 | | American Express Credit Account Master Trust, 144A,

5.650%, 1/15/2014 | | | 95,945 |

| | | | | | |

| | | Aerospace & Defense — 0.3% | | | |

| | 115,000 | | Bombardier, Inc.,

7.350%, 12/22/2026 (CAD) | | | 106,945 |

See accompanying notes to financial statements.

13

NATIXIS INCOME DIVERSIFIED PORTFOLIO — PORTFOLIOOF INVESTMENTS (continued)

Investments as of June 30, 2008 (Unaudited)

| | | | | | |

Principal

Amount (‡) | | Description | | Value (†) |

| | | | | | |

| | | Aerospace & Defense — continued | | | |

| $ | 200,000 | | Embraer Overseas Ltd.,

6.375%, 1/24/2017 | | $ | 195,000 |

| | | | | | |

| | | | | | 301,945 |

| | | | | | |

| | | Airlines — 0.9% | | | |

| | 1,547 | | Continental Airlines, Inc., Series 1999-1, Class C,

6.954%, 8/02/2009 | | | 1,452 |

| | 1,026,321 | | United Air Lines, Inc., Series 2007-1, Class A,

6.636%, 7/02/2022 | | | 839,018 |

| | | | | | |

| | | | | | 840,470 |

| | | | | | |

| | | Automotive — 2.1% | | | |

| | 115,000 | | Cummings Engine, Inc.,

7.125%, 3/01/2028(b) | | | 109,118 |

| | 30,000 | | Ford Motor Co.,

6.375%, 2/01/2029 | | | 15,750 |

| | 15,000 | | Ford Motor Co.,

6.500%, 8/01/2018 | | | 8,700 |

| | 1,805,000 | | Ford Motor Co.,

6.625%, 10/01/2028(b) | | | 965,675 |

| | 725,000 | | Ford Motor Co.,

7.450%, 7/16/2031(b) | | | 422,313 |

| | 40,000 | | Goodyear Tire & Rubber Co.,

7.000%, 3/15/2028 | | | 33,400 |

| | 480,000 | | Harley-Davidson Funding Corp., 144A,

6.800%, 6/15/2018 | | | 474,256 |

| | | | | | |

| | | | | | 2,029,212 |

| | | | | | |

| | | Banking — 3.3% | | | |

| | 275,000 | | Bank of America Corp.,

5.750%, 12/01/2017 | | | 258,257 |

| | 110,000,000 | | Barclays Financial LLC, 144A,

4.060%, 9/16/2010 (KRW) | | | 105,946 |

| | 300,000,000 | | Barclays Financial LLC, 144A,

4.470%, 12/04/2011 (KRW) | | | 292,414 |

| | 123,800,000 | | Barclays Financial LLC, 144A,

4.740%, 3/23/2009 (KRW) | | | 119,510 |

| | 90,000 | | Bear Stearns Cos., Inc. (The),

4.650%, 7/02/2018 | | | 75,777 |

| | 90,000 | | Bear Stearns Cos., Inc. (The),

5.550%, 1/22/2017(b) | | | 83,180 |

| | 35,000 | | Citigroup, Inc.,

5.000%, 9/15/2014 | | | 32,416 |

| | 145,000 | | Citigroup, Inc.,

5.500%, 2/15/2017 | | | 132,232 |

| | 700,000 | | HSBC Bank PLC, 144A,

Zero Coupon, 4/18/2012 | | | 198,935 |

| | 437,254 | | HSBC Bank USA,144A,

Zero Coupon, 11/28/2011 | | | 297,989 |

| | 4,405,000 | | HSBC Bank USA, 144A,

Zero Coupon, 5/17/2012 | | | 1,239,736 |

| | 425,000 | | Wachovia Bank NA,

6.600%, 1/15/2038 | | | 370,341 |

| | | | | | |

| | | | | | 3,206,733 |

| | | | | | |

| | | Brokerage — 1.6% | | | |

| | 65,000 | | Goldman Sachs Group, Inc.(The),

5.625%, 1/15/2017 | | | 60,226 |

| | 3,339,258,780 | | JPMorgan Chase & Co., 144A,

Zero Coupon, 4/12/2012 (IDR) | | | 229,909 |

| | | | | | |

Principal

Amount (‡) | | Description | | Value (†) |

| | | | | | |

| | | Brokerage — continued | | | |

| $ | 160,000 | | Lehman Brothers Holdings, Inc.,

5.750%, 1/03/2017 | | $ | 141,195 |

| | 175,000 | | Lehman Brothers Holdings, Inc.,

6.000%, 5/03/2032(c) | | | 133,795 |

| | 255,000 | | Lehman Brothers Holdings, Inc.,

6.875%, 7/17/2037 | | | 219,503 |

| | 200,000 | | Merrill Lynch & Co., Inc.,

6.110%, 1/29/2037 | | | 158,841 |

| | 115,000 | | Merrill Lynch & Co., Inc.,

6.400%, 8/28/2017 | | | 106,563 |

| | 485,000 | | Merrill Lynch & Co., Inc.,

6.875%, 4/25/2018 | | | 461,587 |

| | | | | | |

| | | | | | 1,511,619 |

| | | | | | |

| | | Building Materials — 0.7% | | | |

| | 170,000 | | Masco Corp.,

5.850%, 3/15/2017 | | | 154,086 |

| | 85,000 | | Owens Corning, Inc.,

6.500%, 12/01/2016 | | | 77,391 |

| | 525,000 | | USG Corp.,

6.300%, 11/15/2016 | | | 422,625 |

| | | | | | |

| | | | | | 654,102 |

| | | | | | |

| | | Chemicals — 0.3% | | | |

| | 45,000 | | Borden, Inc.,

7.875%, 2/15/2023 | | | 27,000 |

| | 10,000 | | Borden, Inc.,

8.375%, 4/15/2016 | | | 6,700 |

| | 25,000 | | Borden, Inc.,

9.200%, 3/15/2021 | | | 15,750 |

| | 200,000 | | Hercules, Inc., Subordinated Note,

6.500%, 6/30/2029 | | | 162,000 |

| | 55,000 | | Methanex Corp., Senior Note,

6.000%, 8/15/2015 | | | 51,173 |

| | | | | | |

| | | | | | 262,623 |

| | | | | | |

| | | Construction Machinery — 0.4% | | | |

| | 380,000 | | Joy Global, Inc.,

6.625%, 11/15/2036 | | | 370,250 |

| | | | | | |

| | | Consumer Cyclical Services — 0.6% | | | |

| | 245,000 | | Kar Holdings, Inc.,

10.000%, 5/01/2015 | | | 205,800 |

| | 435,000 | | Western Union Co.,

6.200%, 11/17/2036 | | | 405,938 |

| | | | | | |

| | | | | | 611,738 |

| | | | | | |

| | | Consumer Products — 0.0% | | | |

| | 20,000 | | Hasbro, Inc., Senior Debenture,

6.600%, 7/15/2028 | | | 18,677 |

| | | | | | |

| | | Electric — 0.3% | | | |

| | 180,000 | | Ameren Energy Generating Co., 144A,

7.000%, 4/15/2018 | | | 180,251 |

| | 20,000 | | NGC Corp. Capital Trust I, Series B,

8.316%, 6/01/2027 | | | 16,525 |

| | 135,000 | | TXU Corp., Series Q,

6.500%, 11/15/2024 | | | 99,603 |

| | | | | | |

| | | | | | 296,379 |

| | | | | | |

| | | Entertainment — 1.2% | | | |

| | 800,000 | | Time Warner, Inc.,

6.500%, 11/15/2036 | | | 712,159 |

See accompanying notes to financial statements.

14

NATIXIS INCOME DIVERSIFIED PORTFOLIO — PORTFOLIOOF INVESTMENTS (continued)

Investments as of June 30, 2008 (Unaudited)

| | | | | | |

Principal

Amount (‡) | | Description | | Value (†) |

| | | | | | |

| | | Entertainment — continued | | | |

| $ | 425,000 | | Time Warner, Inc.,

6.625%, 5/15/2029 | | $ | 386,740 |

| | 35,000 | | Time Warner, Inc.,

6.950%, 1/15/2028 | | | 33,583 |

| | | | | | |

| | | | | | 1,132,482 |

| | | | | | |

| | | Food — 0.2% | | | |

| | 190,000 | | Kraft Foods, Inc.,

6.500%, 11/01/2031 | | | 175,855 |

| | 30,000 | | Sara Lee Corp.,

6.125%, 11/01/2032 | | | 27,176 |

| | | | | | |

| | | | | | 203,031 |

| | | | | | |

| | | Government Guaranteed — 0.3% | | | |

| | 2,625,000 | | Kreditanstalt fuer Wiederaufbau, Series E, (MTN),

8.500%, 7/16/2010 (ZAR) | | | 308,462 |

| | | | | | |

| | | Government Owned — No Guarantee — 0.3% | | | |

| | 320,000 | | DP World Ltd., 144A,

6.850%, 7/02/2037 | | | 274,583 |

| | | | | | |

| | | Government Sponsored — 0.2% | | | |

| | 200,000 | | Federal National Mortgage Association,

2.290%, 2/19/2009 (SGD) | | | 147,483 |

| | | | | | |

| | | Healthcare — 2.6% | | | |

| | 655,000 | | Amgen, Inc.,

6.375%, 6/01/2037 | | | 625,497 |

| | 265,000 | | HCA, Inc.,

6.375%, 1/15/2015 | | | 219,950 |

| | 610,000 | | HCA, Inc.,

6.500%, 2/15/2016(b) | | | 507,825 |

| | 25,000 | | HCA, Inc.,

7.050%, 12/01/2027 | | | 18,932 |

| | 5,000 | | HCA, Inc.,

7.500%, 12/15/2023 | | | 4,066 |

| | 460,000 | | HCA, Inc.,

7.500%, 11/06/2033 | | | 354,200 |

| | 135,000 | | HCA, Inc.,

7.580%, 9/15/2025 | | | 109,498 |

| | 310,000 | | HCA, Inc.,

7.690%, 6/15/2025 | | | 253,508 |

| | 30,000 | | HCA, Inc.,

7.750%, 7/15/2036 | | | 23,725 |

| | 20,000 | | HCA, Inc.,

8.360%, 4/15/2024 | | | 17,023 |

| | 345,000 | | Owens & Minor, Inc.,

6.350%, 4/15/2016 | | | 338,855 |

| | 110,000 | | UnitedHealth Group, Inc.,

6.500%, 6/15/2037 | | | 100,309 |

| | | | | | |

| | | | | | 2,573,388 |

| | | | | | |

| | | Home Construction — 1.4% | | | |

| | 175,000 | | Centex Corp.,

5.250%, 6/15/2015 | | | 138,250 |

| | 50,000 | | DR Horton, Inc., Senior Note,

5.250%, 2/15/2015 | | | 39,750 |

| | 25,000 | | DR Horton, Inc.,

5.625%, 9/15/2014 | | | 20,250 |

| | 30,000 | | DR Horton, Inc., Guaranteed Note,

5.625%, 1/15/2016 | | | 23,400 |

| | | | | | |

Principal

Amount (‡) | | Description | | Value (†) |

| | | | | | |

| | | Home Construction — continued | | | |

| $ | 275,000 | | K. Hovnanian Enterprises, Inc., Senior Note,

6.250%, 1/15/2016 | | $ | 170,500 |

| | 25,000 | | K. Hovnanian Enterprises, Inc., Guaranteed Note,

6.375%, 12/15/2014 | | | 16,250 |

| | 100,000 | | K. Hovnanian Enterprises, Inc., Guaranteed Note,

6.500%, 1/15/2014 | | | 65,000 |

| | 20,000 | | K. Hovnanian Enterprises, Inc.,

7.500%, 5/15/2016(b) | | | 13,300 |

| | 175,000 | | KB Home, Guaranteed Note,

5.875%, 1/15/2015 | | | 145,250 |

| | 125,000 | | KB Home, Guaranteed Note,

6.250%, 6/15/2015 | | | 105,000 |

| | 105,000 | | KB Home, Guaranteed Note,

7.250%, 6/15/2018 | | | 90,825 |

| | 140,000 | | Lennar Corp., Series B, Guaranteed Note,

5.600%, 5/31/2015 | | | 102,375 |

| | 10,000 | | Pulte Homes, Inc.,

5.200%, 2/15/2015 | | | 8,150 |

| | 80,000 | | Pulte Homes, Inc.,

6.000%, 2/15/2035 | | | 62,400 |

| | 470,000 | | Pulte Homes, Inc.,

6.375%, 5/15/2033 | | | 364,250 |

| | 25,000 | | Toll Brothers Financial Corp.,

5.150%, 5/15/2015 | | | 21,650 |

| | | | | | |

| | | | | | 1,386,600 |

| | | | | | |

| | | Independent Energy — 0.5% | | | |

| | 410,000 | | Pioneer Natural Resources Co.,

7.200%, 1/15/2028 | | | 361,975 |

| | 50,000 | | Talisman Energy, Inc.,

5.850%, 2/01/2037 | | | 43,080 |

| | 120,000 | | Talisman Energy, Inc.,

6.250%, 2/01/2038 | | | 110,306 |

| | | | | | |

| | | | | | 515,361 |

| | | | | | |

| | | Insurance — 0.5% | | | |

| | 55,000 | | Fund American Cos., Inc.,

5.875%, 5/15/2013 | | | 53,206 |

| | 465,000 | | White Mountains RE Group, 144A,

6.375%, 3/20/2017 | | | 416,064 |

| | | | | | |

| | | | | | 469,270 |

| | | | | | |

| | | Lodging — 0.0% | | | |

| | 35,000 | | Royal Caribbean Cruises Ltd.,

7.500%, 10/15/2027(b) | | | 28,175 |

| | | | | | |

| | | Media Cable — 1.3% | | | |

| | 1,370,000 | | Comcast Corp.,

5.650%, 6/15/2035 | | | 1,164,138 |

| | 65,000 | | Comcast Corp.,

6.450%, 3/15/2037 | | | 60,495 |

| | 80,000 | | Comcast Corp.,

6.500%, 11/15/2035 | | | 76,050 |

| | | | | | |

| | | | | | 1,300,683 |

| | | | | | |

| | | Media Non-Cable — 0.8% | | | |

| | 80,000 | | Intelsat Corp.,

6.875%, 1/15/2028 | | | 62,000 |

| | 520,000 | | News America, Inc.,

6.200%, 12/15/2034 | | | 479,534 |

See accompanying notes to financial statements.

15

NATIXIS INCOME DIVERSIFIED PORTFOLIO — PORTFOLIOOF INVESTMENTS (continued)

Investments as of June 30, 2008 (Unaudited)

| | | | | | |

Principal

Amount (‡) | | Description | | Value (†) |

| | | | | | |

| | | Media Non-Cable — continued | | | |

| $ | 125,000 | | News America, Inc.,

6.400%, 12/15/2035 | | $ | 118,290 |

| | 270,000 | | Tribune Co.,

5.250%, 8/15/2015(b) | | | 107,325 |

| | | | | | |

| | | | | | 767,149 |

| | | | | | |

| | | Mining — 0.4% | | | |

| | 310,000 | | Newmont Mining Corp.,

5.875%, 4/01/2035 | | | 265,323 |

| | 185,000 | | Vale Overseas, Ltd.,

6.875%, 11/21/2036 | | | 171,816 |

| | | | | | |

| | | | | | 437,139 |

| | | | | | |

| | | Mortgage Related — 1.2% | | | |

| | 1,150,000 | | FNMA,

4.625%, 10/15/2013 | | | 1,172,301 |

| | | | | | |

| | | Municipal — 0.0% | | | |