UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07345

Natixis Funds Trust III

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

Natixis Distributors, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

EQUITY FUNDS

ANNUAL REPORT

December 31, 2008

CGM Advisor Targeted Equity Fund

Delafield Select Fund

Hansberger International Fund

Harris Associates Focused Value Fund

Harris Associates Large Cap Value Fund

Vaughan Nelson Small Cap Value Fund

Vaughan Nelson Value Opportunity Fund

Natixis U.S. Diversified Portfolio

BlackRock Investment Management

Harris Associates

Loomis, Sayles & Company

TABLE OF CONTENTS

Management Discussion and Performance page 1

Portfolio of Investments page 25

Financial Statements page 41

CGM ADVISOR TARGETED EQUITY FUND

PORTFOLIO PROFILE

Objective:

Seeks long-term growth of capital through investments in equity securities of companies whose earnings are expected to grow at a faster rate than the overall U.S. economy

Strategy:

Generally invests in a focused portfolio of common stocks of large-cap companies

Inception Date:

November 27, 1968

Manager:

G. Kenneth Heebner

Symbols:

| | |

| Class A | | NEFGX |

| Class B | | NEBGX |

| Class C | | NEGCX |

| Class Y | | NEGYX |

What You Should Know:

The fund invests in a small number of securities, which may result in greater volatility than more diversified funds. Growth stocks can be more sensitive to market movements because their prices are based in part on future expectations. The fund may invest in foreign securities that involve risks not associated with domestic securities.

Management Discussion

Stock prices fell in value across the board in 2008 as financial markets deteriorated, credit markets froze, unemployment climbed, home prices collapsed, oil prices first soared and then plummeted, and consumer spending stalled. The broad-based S&P 500 Index posted its sharpest decline since 1937 and the picture was even bleaker outside of the United States.

CGM Advisor Targeted Equity Fund returned -38.36% for the fiscal year ended December 31, 2008, based on the net asset value of Class A shares and $0.06 in dividends and $0.44 in capital gains reinvested. For the same period, the fund’s benchmark, the S&P 500 Index, returned -37.00% and the average fund in Morningstar’s Large Growth category returned - -40.67%.

WHAT WAS THE FUND’S RESPONSE TO THIS VOLATILITY?

During the first half of 2008, the fund was positioned to benefit from anticipated strength in emerging market economies, with sizable investments in energy stocks, metals, and ADRs (American Depositary Receipts). We largely eliminated these positions during the second half of the year when emerging market economies were negatively impacted by the global recession. By year end, the portfolio was concentrated in financial stocks and consumer staples, which we believed would not be adversely impacted by global economic weakness.

WHICH STOCKS WERE THE FUND’S WORST PERFORMERS IN 2008?

The most sizeable loss the fund sustained occurred in Brazil’s state-run oil company, Petroleo Brasileiro (better known as Petrobras). One of the few oil and gas companies to show significant growth in production, Petrobras also has the most favorable exploration and production prospects. However, the drop in oil prices, from a high of nearly $150 a barrel in July to about $40 a barrel by year end, sharply reduced the company’s earnings outlook and the stock price fell.

Ford Motor Company was another detractor. Although Ford has taken constructive steps aimed at improving profits and increasing market share, the dramatic decline in automobile and truck demand during the second half of 2008 had a severely negative impact on the price of the stock.

Shares of JPMorgan Chase also plunged as the financial giant experienced a considerable breakdown in mortgage loans. We believe the company, under the leadership of Jamie Dimon, will eventually be one of America’s leading banks, but the weak economy and severe housing deflation are likely to defer meaningful progress until 2010.

We sold all three positions.

WHICH STOCKS OR STRATEGIES HELPED?

MasterCard, one of the two leading transaction processors in the credit card industry, was modestly positive. The company benefited from a growth in credit card lending in foreign markets, as well as a reduction in marketing and overhead expenditures. We sold the stock early in the year before the major market decline in financials. By year-end we had also added a number of companies with limited economic sensitivity. We expect these stocks to profit from positive company fundamentals going forward.

By year-end 2008 one of the fund’s largest positions was CVS Caremark Corporation, a major integrated pharmacy services provider. The company is benefiting from consolidation in the drug store business as well as from its entry into the pharmacy benefit business. Another positive holding for the fund was Philip Morris International, which was spun off from Altria in March of 2008. Based in Switzerland, the company is benefiting from rising cigarette consumption in international markets as well as favorable acquisitions.

WHAT LIES AHEAD IN 2009?

A number of factors make a case for economic recovery, including the much-anticipated economic stimulus package and greater confidence in the credit markets, but these are uncharted waters. We believe the fund’s overall defensive posture should help protect it from further market declines near term. Longer term, we believe our emphasis on established companies with superior growth potential should position the fund for good upside performance.

1

CGM ADVISOR TARGETED EQUITY FUND

Investment Results through December 31, 2008

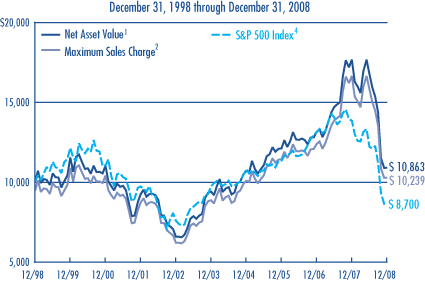

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares

Average Annual Total Returns — December 31, 2008

| | | | | | | | | | | | |

| | | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

Class A (Inception 11/27/68) | | | | | | | | | | | | |

Net Asset Value1 | | -38.36 | % | | 3.01 | % | | 0.83 | % | | — | |

With Maximum Sales Charge2 | | -41.89 | | | 1.81 | | | 0.24 | | | — | |

| | | | | |

Class B (Inception 2/28/97) | | | | | | | | | | | | |

Net Asset Value1 | | -38.90 | | | 2.24 | | | 0.07 | | | — | |

With CDSC3 | | -41.82 | | | 1.90 | | | 0.07 | | | — | |

| | | | | |

Class C (Inception 9/1/98) | | | | | | | | | | | | |

Net Asset Value1 | | -38.85 | | | 2.25 | | | 0.08 | | | — | |

With CDSC3 | | -39.43 | | | 2.25 | | | 0.08 | | | — | |

| | | | | |

Class Y (Inception 6/30/99) | | | | | | | | | | | | |

Net Asset Value1 | | -38.28 | | | 3.29 | | | — | | | 0.70 | % |

| | | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

CLASS Y

INCEPTION6 | |

S&P 500 Index4 | | -37.00 | % | | -2.19 | % | | -1.38 | % | | -2.66 | % |

Morningstar Large Growth

Fund Avg.5 | | -40.67 | | | -3.37 | | | -2.46 | | | -3.89 | |

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those noted. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are only available to certain investors, as outlined in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 | | 12/31/07 |

Common Stocks | | 93.3 | | 95.8 |

Short-Term Investments and Other | | 6.7 | | 4.2 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 | | 12/31/07 |

Colgate-Palmolive Co. | | 5.8 | | — |

CVS Caremark Corp. | | 5.4 | | — |

Wal-Mart Stores, Inc. | | 5.3 | | — |

Philip Morris International, Inc. | | 5.3 | | — |

Teva Pharmaceutical Industries Ltd., Sponsored ADR | | 5.3 | | — |

Abbott Laboratories | | 5.3 | | — |

General Mills, Inc. | | 5.2 | | — |

McDonald’s Corp. | | 5.2 | | 5.0 |

Procter & Gamble Co. | | 5.1 | | — |

Baxter International, Inc. | | 5.1 | | — |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 | | 12/31/07 |

Household Products | | 10.9 | | — |

Food & Staples Retailing | | 10.7 | | — |

Pharmaceuticals | | 10.5 | | 4.8 |

Food Products | | 9.6 | | — |

Capital Markets | | 9.1 | | — |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio | | | Net Expense Ratio | |

A | | 1.17 | % | | 1.17 | % |

B | | 1.92 | | | 1.92 | |

C | | 1.93 | | | 1.93 | |

Y | | 0.90 | | | 0.90 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | S&P 500 Index is an unmanaged index of U.S. common stocks. |

5 | Morningstar Large Growth Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

6 | The since-inception comparative performance figures shown for Class Y shares are calculated from 7/1/99. |

2

DELAFIELD SELECT FUND

PORTFOLIO PROFILE

Objective:

Seeks long-term capital appreciation

Strategy:

Invests in small- and mid- capitalization companies using a bottom-up value-oriented investment process.

Inception Date:

September 26, 2008

Managers:

J. Dennis Delafield

Charles W. Neuhauser

Vincent Sellecchia

Donald Wang

Symbols:

| | |

| Class A | | DESAX |

Class C Class Y | | DESCX

DESYX |

What You Should Know:

The fund invests in a small number of securities, which may result in greater price volatility than more diversified funds. Value stocks may fall out of favor with investors and underperform the overall market during any given period. Investing in mid-cap companies may involve greater risk than investing in larger companies since mid-cap companies tend to be more susceptible to adverse business events or economic downturns, are less liquid and more thinly traded and are subject to greater price volatility.

Management Discussion

For the fiscal year ended December 31, 2008, Delafield Select Fund* provided a total return of -38.06%, based on the net asset value of Class A shares and $0.01 in reinvested dividends. For the same 12 months, the fund’s benchmark, the Russell 2500 Index, returned -36.79%, while the average performance of the funds in Morningstar’s Mid-Cap Value category was -36.77%.

The fund’s philosophy is to maintain a concentrated portfolio of value-oriented stocks constructed “bottom up” rather than “top down.” We use detailed internal analysis to select a few securities we believe are attractively priced and likely to grow over time. Given the severity of the current economy, we have been focusing increasingly on companies with good balance sheets and strong free cash flows. (Free cash flow is the amount of cash a company has after paying its expenses.) Companies with above-average leverage need ample free cash to meet their liquidity needs.

WHICH COMPANIES PROVED DISAPPOINTING?

One example was Flextronics International, which provides facilities and support services to original equipment manufacturers worldwide. The company’s clients include Microsoft, which contracted with them to build the Zune MP3 players, Xboxes and related accessories. Early in the fourth quarter Flextronics was trading at nearly $7 a share. The rapid decline in consumer spending, especially in the electronics area, drove shares down to about $1.50. We took advantage of the price decline to add to the fund’s position because of the company’s strong cash flow and market position. Shares of KapStone Paper & Packaging also declined. The firm’s extra-strength papers are used to make sturdy leaf and trash bags, as well as bags to hold charcoal, pet foods and cement. Their business has been growing, but when the economy ground to a virtual halt in the fourth quarter of 2008, KapStone’s customers began drawing down inventory to trim expenses. Although the firm’s earnings will probably fall below projections for the year, we added to the position as the price of shares declined, in anticipation of a recovery down the line.

WHICH STOCKS WERE STRONGER?

Two of the fund’s best performers, on a relative basis, were Barnes Group and j2 Global Communications. An aerospace and industrial components manufacturer, Barnes has done a good job improving profitability in their manufacturing business and we expect their underperforming distribution business to improve after certain unprofitable entities in the U.K are closed. However, near-term results are likely to be weak due to the slumping economy. We initiated the position when shares sold off sharply during the fourth quarter. California-based j2 provides internet-based communications systems to businesses worldwide. Its most popular service, called “eFax,” allows users to send and receive faxes via the internet. The firm has a dominant market share in this young industry, which provides a high return on capital. The business is protected by patents and by its ability to acquire new subscribers at a low cost. They have no debt and have been buying back their own shares.

WHAT’S YOUR OUTLOOK?

We think the economy could remain weak into 2010 and that stocks will remain volatile. If the credit markets begin to stabilize, we expect confidence to return, helping stocks resume a more normal trading pattern.

* As of the close of business on September 26, 2008 the fund acquired the assets and liabilities of the Reich & Tang Concentrated Portfolio L.P. (the “Predecessor Fund”) (see Note 1 of the Notes to Financial Statements). For periods prior to the inception of Class A shares (September 29, 2008) performance shown is based upon Predecessor Fund returns restated to reflect the expenses and sales loads of Class A shares.

3

DELAFIELD SELECT FUND

Investment Results through December 31, 2008

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares1,7

Average Annual Total Returns — December 31, 20081,7

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Class A (Inception 9/29/08)1 | | | | | | | | | |

Net Asset Value2 | | -38.06 | % | | -0.92 | % | | 8.25 | % |

With Maximum Sales Charge3 | | -41.63 | | | -2.09 | | | 7.61 | |

| | | | |

Class C (Inception 9/29/08)1 | | | | | | | | | |

Net Asset Value2 | | -38.60 | | | -1.91 | | | 7.26 | |

With CDSC4 | | -39.21 | | | -1.91 | | | 7.26 | |

| | | | |

Class Y (Inception 9/26/08)1 | | | | | | | | | |

Net Asset Value2 | | -37.73 | | | -0.55 | | | 8.61 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Russell 2500 Index5 | | -36.79 | % | | -0.98 | % | | 4.08 | % |

Morningstar Mid-Cap Value Fund Avg.6 | | -36.77 | | | -1.07 | | | 5.23 | |

All results represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are only available to certain investors, as outlined in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 |

Common Stocks | | 90.8 |

Short-Term Investments and Other | | 9.2 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 |

Collective Brands, Inc. | | 5.7 |

Kennametal, Inc. | | 5.5 |

Flextronics International Ltd. | | 4.8 |

Tier Technologies, Inc., Class B | | 4.5 |

Albany International Corp., Class A | | 4.4 |

Thermo Fisher Scientific, Inc. | | 4.4 |

Carlisle Cos., Inc. | | 4.4 |

Barnes Group, Inc. | | 4.3 |

Crane Co. | | 4.1 |

Cognizant Technology Solutions Corp., Class A | | 3.9 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 |

Machinery | | 21.6 |

Electronic Equipment & Instruments | | 10.8 |

Specialty Retail | | 9.4 |

IT Services | | 8.4 |

Chemicals | | 6.2 |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio8 | | | Net Expense Ratio9 | |

A | | 1.54 | % | | 1.40 | % |

C | | 2.29 | | | 2.15 | |

Y | | 1.26 | | | 1.15 | |

NOTES TO CHARTS

1 | The performance of Class Y shares of Delafield Select Fund includes performance from the Reich & Tang Concentrated Portfolio L.P., which was reorganized to Class Y shares as of the close of business on September 26, 2008. The Reich & Tang Concentrated Portfolio L.P. performance has been adjusted to reflect the expenses of Class Y shares. For the periods prior to the inception of Class A and Class C shares (September 29, 2008), performance shown for Class A and Class C shares is based upon the Reich & Tang Concentrated Portfolio L.P.’s returns restated to reflect the expenses and sales loads of Class A and Class C shares. Performance from September 29, 2008 forward reflects actual Class A and Class C share performance. |

2 | Does not include a sales charge. |

3 | Includes the maximum sales charge of 5.75%. |

4 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

5 | Russell 2500 Index is an unmanaged index that measures the 2500 smallest companies in the Russell 3000 Index. It is a popular indicator of the performance of the small to mid-cap segment of the U.S. stock market. |

6 | Morningstar Mid-Cap Value Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

7 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

8 | Before reductions and reimbursements. |

9 | After reductions and reimbursements. Expense reductions are contractual and are set to expire 4/30/10. |

4

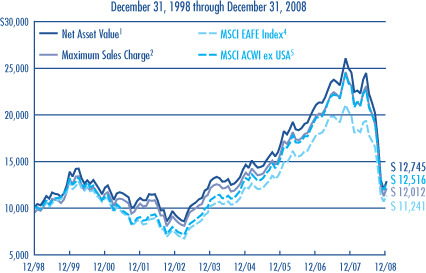

HANSBERGER INTERNATIONAL FUND

PORTFOLIO PROFILE

Objective:

Seeks long-term growth of capital

Strategy:

Invests in common stocks of small-, mid- and large-cap companies located outside the United States. Assets are invested across developed and emerging markets

Inception Date:

December 29, 1995

Managers:

Growth:

Trevor Graham

Barry A. Lockhart

Patrick H. Tan

Thomas R.H. Tibbles

Value:

Ronald Holt

Lauretta Reeves

Symbols:

| | |

| Class A | | NEFDX |

| Class B | | NEDBX |

| Class C | | NEDCX |

What You Should Know:

Foreign securities involve risks not associated with domestic securities, such as currency fluctuations, differing political and economic conditions and different accounting standards. Growth stocks can be more sensitive to market movements because their prices are based in part on future expectations. Value stocks may fall out of favor and underperform the overall market during any given period.

Management Discussion

Hansberger International Fund’s total return for the fiscal year ended December 31, 2008 was -47.63%, based on the net asset value of Class A shares and $0.24 (including $0.09 that has been designated as a return of capital distribution) in dividends and $0.68 in capital gains reinvested during the period. By comparison, the fund’s benchmarks, the MSCI EAFE Index and the MSCI ACWI ex USA, returned -43.06% and -45.24%, respectively, expressed in U.S. dollars. The average performance of the fund’s Morningstar peer group, the Foreign Large Blend category, was -43.99%. Neither the fund nor its benchmarks include U.S. stocks and the Morningstar category has only limited exposure to domestic equities.

In a complete reversal of 2007, international markets — particularly emerging market countries — fell off sharply in 2008, underperforming the S&P 500 Index, which returned -37.00% for the year. Russia, India, Brazil and China were among the weakest markets, and U.S. investors who owned internationally diversified portfolios were also negatively impacted by the strengthening U.S. dollar.

Two teams of Hansberger’s international equity professionals manage the fund. One team focuses on value and the other seeks growth potential. In general, value investors fared better than growth investors in 2008.

HOW DID THE VALUE TEAM FARE?

In this year’s challenging environment, the value portfolio’s exposure to economically sensitive sectors posted sharp losses. In energy, Norwegian oil services company Subsea 7 fell sharply as the price of oil slumped in the second half to its lowest level since 2004. Materials investments also hurt performance; steel company ArcelorMittal and nickel producer MMC Norilsk Nickel posted sharply negative returns. All three stocks remain in the portfolio in anticipation of improving returns.

Its overweight position in Japan had a positive impact on the fund, as returns were boosted by a strengthening yen. Specific Japanese holdings that helped performance included Shionogi & Co, a pharmaceutical company, and Sumitomo Trust and Banking, one of Japan’s largest financial institutions. Both stocks remain in the portfolio.

WHAT ABOUT THE FUND’S GROWTH PORTFOLIO?

After strong performance in 2007, the growth portfolio also endured a difficult year. Energy was a key detractor, with the portfolio’s holdings in oil, natural gas and nuclear energy companies underperforming. Financials were disappointing as well. Holdings such as Austria’s Erste Bank and the National Bank of Greece declined as a result of their exposure to Eastern Europe. Both holdings were sold during the year. Consumer discretionary stocks also hurt relative performance. Being underweight in defensive sectors, such as utilities and consumer staples, hurt performance.

On a positive note, the portfolio’s holdings in information technology and telecommunications services did well. French internet and telephone company Iliad SA was a strong contributor late in the year, rebounding from a sharp drop in September and early October.

WHAT IS YOUR OUTLOOK FOR 2009?

While there may be due cause for pessimism about the future for international equity markets given the many negatives that surfaced in 2008, we believe there are also reasons for optimism. Many of the key variables for favorable equity markets are already visible, including low interest rates, moderating inflation and attractive equity valuations. While the near-term pace of economic growth has slowed markedly, we believe the long-term outlook for many economies — especially the emerging markets of China, India and Brazil — are still very promising. Historically, economic forecasts start improving before corporate earnings follow suit. We believe earnings growth should eventually flow through from aggressive monetary and fiscal stimuli currently in place. While downside risk is still possible in the form of a continuation of poor corporate news flows and further earnings downgrades, we think 2009 may be closer to a cyclical trough in corporate earnings rather than to a peak.

5

HANSBERGER INTERNATIONAL FUND

Investment Results through December 31, 2008

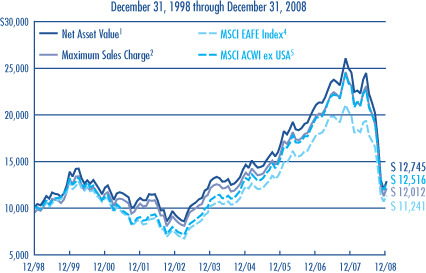

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares7

Average Annual Total Returns — December 31, 20087

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Class A (Inception 12/29/95) | | | | | | | | | |

Net Asset Value1 | | -47.63 | % | | -0.05 | % | | 2.46 | % |

With Maximum Sales Charge2 | | -50.63 | | | -1.22 | | | 1.85 | |

| | | | |

Class B (Inception 12/29/95) | | | | | | | | | |

Net Asset Value1 | | -48.03 | | | -0.78 | | | 1.71 | |

With CDSC3 | | -50.48 | | | -1.07 | | | 1.71 | |

| | | | |

Class C (Inception 12/29/95) | | | | | | | | | |

Net Asset Value1 | | -48.00 | | | -0.78 | | | 1.69 | |

With CDSC3 | | -48.49 | | | -0.78 | | | 1.69 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

MSCI EAFE Index4 | | -43.06 | % | | 2.10 | % | | 1.18 | % |

MSCI ACWI ex USA5 | | -45.24 | | | 3.00 | | | 2.27 | |

Morningstar Foreign Large Blend Fund Avg.6 | | -43.99 | | | 1.21 | | | 0.90 | |

All results represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 | | 12/31/07 |

Common Stocks | | 99.2 | | 97.3 |

Preferred Stocks | | 1.1 | | 1.3 |

Bonds and Notes | | 0.1 | | - |

Short-Term Investments and Other | | -0.4 | | 1.4 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 | | 12/31/07 |

Nintendo Co. Ltd. | | 2.5 | | 1.9 |

Roche Holding AG | | 2.5 | | 0.8 |

Nestle SA, (Registered) | | 2.2 | | 1.3 |

Novartis AG, (Registered) | | 2.0 | | 1.2 |

Infosys Technologies Ltd., Sponsored ADR | | 1.7 | | 1.3 |

Banco Santander Central Hispano SA | | 1.7 | | 1.7 |

China Communications Construction Co. Ltd., Class H | | 1.6 | | - |

Tesco PLC | | 1.6 | | 1.4 |

Shin-Etsu Chemical Co. Ltd. | | 1.4 | | 0.6 |

Credit Suisse Group, (Registered) | | 1.4 | | 0.5 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST COUNTRIES | | 12/31/08 | | 12/31/07 |

Japan | | 17.2 | | 14.0 |

United Kingdom | | 13.0 | | 13.0 |

France | | 10.5 | | 9.9 |

Switzerland | | 10.4 | | 8.9 |

Germany | | 8.3 | | 6.6 |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio | | Net Expense Ratio |

A | | 1.45% | | 1.45% |

B | | 2.20 | | 2.20 |

C | | 2.20 | | 2.20 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | Morgan Stanley Capital International Europe Australasia and Far East Index (MSCI EAFE Index) is an unmanaged index designed to measure developed market equity performance, excluding the United States and Canada. |

5 | Morgan Stanley Capital International All Countries World Index ex USA (MSCI ACWI ex USA) is an unmanaged index designed to measure equity market performance in developed and emerging markets, excluding the United States. |

6 | Morningstar Foreign Large Blend Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

7 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

6

HARRIS ASSOCIATES FOCUSED VALUE FUND

PORTFOLIO PROFILE

Objective:

Seeks long-term capital appreciation

Strategy:

Focuses on 25 to 30 stocks of mid- to large-cap U.S. companies

Inception Date:

March 15, 2001

Managers:

Robert M. Levy

Michael J. Mangan

Symbols:

| | |

| Class A | | NRSAX |

| Class B | | NRSBX |

| Class C | | NRSCX |

What You Should Know:

The fund invests in a small number of securities, which may result in greater volatility than more diversified funds. Value stocks may fall out of favor with investors and underperform the overall market during any given period.

Management Discussion

SPECIAL NOTICE

At their meeting on February 6, 2009, the Natixis Funds Board of Trustees voted to liquidate Harris Associates Focused Value Fund. After extensive analysis, the Trustees concluded that this fund’s small asset level does not provide the scale needed to remain viable for shareholders. The sale of the fund’s assets and the corresponding liquidating distributions will be completed on or about April 17, 2009.

The following is a discussion of the factors that materially affected the fund’s performance during the fiscal year ending December 31, 2008. Because the fund is being liquidated, the discussion does not include forward looking comments.

HOW DID THE FUND PERFORM IN THIS VOLATILE MARKET?

Last year’s steep market decline did not discriminate in terms of company quality or size. Stocks of many large, established corporations with strong balance sheets and leading industry positions fell alongside smaller, less-well-financed issues. The year’s disappointing returns for Harris Associates Focused Value Fund demonstrate the impact of the period’s widespread market weakness. Its sizeable exposure to financial stocks, as well as some holdings in the technology and consumer sectors, caused the fund’s performance to lag its benchmark and its Morningstar peer group. For the fiscal year ended December 31, 2008, Class A shares of the fund returned -47.69% at net asset value, assuming reinvestment of $0.15 in capital gains during the year. For the same period, the fund’s benchmark, the S&P 500 Index, returned -37.00%, while the average return on the funds in Morningstar’s Large Blend category was -37.79%.

WHAT PART DID ENERGY STOCKS PLAY?

We were correct in our long-held view that steadily rising prices for oil and gas were not sustainable. When energy prices plunged in the second half of 2008, the fund made up some of the ground it lost in the first half, when the fund was underweight in this sector. However, in the fourth quarter, we added some energy holdings as stock prices fell faster than prices of the underlying commodities. National-Oilwell Varco, which delivers oilfield services, and XTO Energy, an exploration and production company, made small, positive contributions during the closing weeks of 2008. These initial positions reflect our shifting outlook for the energy sector and our respect for their impressive management teams and history of wise use of capital.

WHAT ABOUT FINANCIAL AND TECH STOCKS?

Most of the fund’s shortfall during 2008 occurred in the battered financial sector, as the credit crisis pressured a long list of companies. Shares of Merrill Lynch had fallen sharply before its proposed purchase by Bank of America. Troubled mutual fund company Legg Mason also saw its shares decline during the period, but we think management addressed these problems effectively and the shares regained some lost ground late in the year. Another mutual fund company, Franklin Resources, moved higher after we purchased shares late in the year. Franklin is a well-run company with strong mutual fund brands both domestically and abroad. The firm’s balance sheet also includes considerable cash.

National Semiconductor fell amid a sagging market for its analog chips, which are used in high volume applications like phones and music players. The company has sizeable net cash on its books and management is buying back shares, which currently trade at a discount to the sector. Starwood Hotels & Resorts Worldwide also fell. With hindsight, we were early in this purchase, given the economic slowdown, but Starwood has good cash flow from its franchisees and such strong hotel brands as Westin, Sheraton and Le Meridien.

7

HARRIS ASSOCIATES FOCUSED VALUE FUND

Investment Results through December 31, 2008

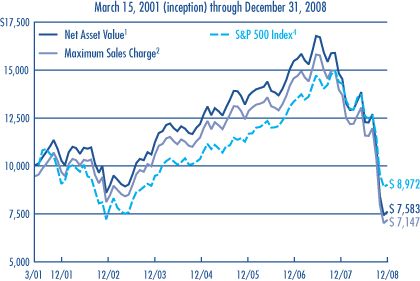

PERFORMANCE IN PERSPECTIVE

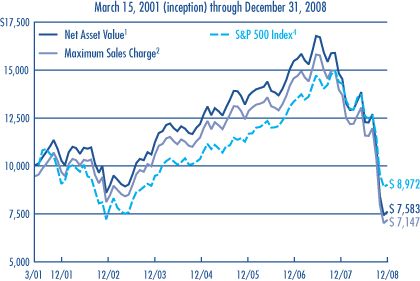

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares7

Average Annual Total Returns — December 31, 20087

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | SINCE

INCEPTION | |

CLASS A (Inception 3/15/01) | | | | | | | | | |

Net Asset Value1 | | -47.69 | % | | -8.44 | % | | -3.48 | % |

With Maximum Sales Charge2 | | -50.69 | | | -9.52 | | | -4.21 | |

| | | | |

CLASS B (Inception 3/15/01) | | | | | | | | | |

Net Asset Value1 | | -48.05 | | | -9.10 | | | -4.18 | |

With CDSC3 | | -50.60 | | | -9.32 | | | -4.18 | |

| | | | |

CLASS C (Inception 3/15/01) | | | | | | | | | |

Net Asset Value1 | | -48.05 | | | -9.10 | | | -4.18 | |

With CDSC3 | | -48.56 | | | -9.10 | | | -4.18 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | SINCE

INCEPTION6 | |

S&P 500 Index 4 | | -37.00 | % | | -2.19 | % | | -1.39 | % |

Morningstar Large Blend Fund Avg.5 | | -37.79 | | | -2.47 | | | -1.49 | |

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 | | 12/31/07 |

Common Stocks | | 99.3 | | 100.0 |

Short-Term Investments and Other | | 0.7 | | — |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 | | 12/31/07 |

Intel Corp. | | 7.6 | | 9.0 |

Robert Half International, Inc. | | 7.1 | | 4.9 |

Teradata Corp. | | 5.4 | | 1.3 |

Legg Mason, Inc. | | 5.0 | | — |

Starwood Hotels & Resorts Worldwide, Inc. | | 5.0 | | — |

National Semiconductor Corp. | | 5.0 | | 6.1 |

Tiffany & Co. | | 4.9 | | 2.7 |

Advance Auto Parts, Inc. | | 4.6 | | — |

Dr Pepper Snapple Group, Inc. | | 4.5 | | — |

Avon Products, Inc. | | 4.4 | | 4.7 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 | | 12/31/07 |

Capital Markets | | 15.8 | | 5.0 |

Semiconductors & Semiconductor Equipment | | 12.6 | | 21.7 |

Specialty Retail | | 11.9 | | 2.7 |

Hotels, Restaurants & Leisure | | 8.7 | | 6.8 |

Professional Services | | 7.1 | | — |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio8 | | Net Expense Ratio9 |

A | | 1.39% | | 1.39% |

B | | 2.14 | | 2.14 |

C | | 2.14 | | 2.14 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | S&P 500 Index is an unmanaged index of U.S. common stocks. |

5 | Morningstar Large Blend Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

6 | The since-inception comparative performance figures shown are calculated from 4/1/01. |

7 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

8 | Before reductions and reimbursements. |

9 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 4/30/09. |

8

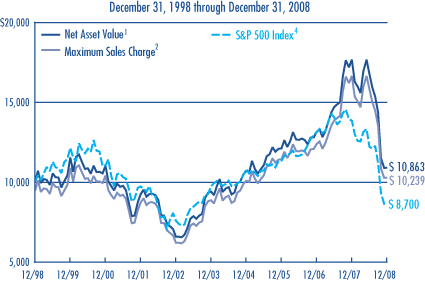

HARRIS ASSOCIATES LARGE CAP VALUE FUND

PORTFOLIO PROFILE

Objective:

Seeks opportunities for long-term capital growth and income

Strategy:

Invests primarily in common stock of large- and mid-cap companies in any industry

Inception Date:

May 6, 1931

Managers:

Edward S. Loeb

Michael J. Mangan

Diane L. Mustain

Symbols:

| | |

| Class A | | NEFOX |

| Class B | | NEGBX |

| Class C | | NECOX |

| Class Y | | NEOYX |

What You Should Know:

Value stocks may fall out of favor with investors and underperform the overall market during any given period.

Management Discussion

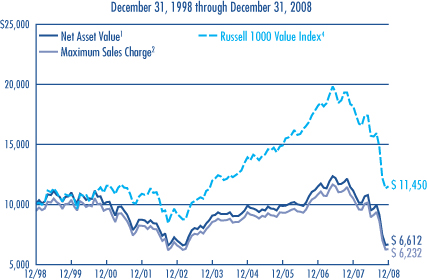

Stocks across the equity spectrum felt shockwaves from the economic storm that buffeted markets in 2008. Many large, well-capitalized companies with solid finances and entrenched industry positions fell as steeply as lower quality shares. For the fiscal year ended December 31, 2008, Class A shares of Harris Associates Large Cap Value Fund returned -40.45% at net asset value, assuming $0.13 in dividends reinvested during the period. These results trailed the fund’s benchmark and its Morningstar peer group. The Russell 1000 Value Index returned -36.85%, while the average return on the funds in Morningstar’s Large Blend category was -37.79% for the 12-month period.

WHICH STOCKS HELPED OR HURT PERFORMANCE?

We steered clear of some financial stocks that were especially poor performers — names like Bear Stearns, Lehman Brothers and AIG. Although fund holdings JP Morgan Chase, Bank of New York Mellon and credit card issuer Capital One Financial were all battered, they held up better than the sector as a whole. Merrill Lynch teetered on extinction before Bank of America agreed to acquire it, and American Express declined when its bad debt reserves proved inadequate. Shares of troubled mutual fund company Legg Mason were down sharply during the period, but we think they have turned a corner. Our level of concern about financial issuers generally has diminished, as many companies are selling at historically low valuations even though many are in a repair mode.

Some of the industrial stocks we selected held up well. Transportation giant Union Pacific, which is restructuring, declined less than its sector, and diversified tool maker Illinois Tool Works contributed positively. We purchased General Dynamics late in the year, and it too was helpful. As a group, our consumer discretionary holdings were modestly positive, relative to the benchmark. We took sizeable profits in McDonald’s and deployed these assets into fresh commitments. Hotel chains Starwood Hotels & Resorts Worldwide and Marriott International remained under pressure, but we view their rebound potential as significant in a recovery.

WHICH SECTORS WERE MOST INFLUENCIAL?

Energy and technology were primarily responsible for the fund’s underperformance relative to the benchmark. We had downplayed energy while oil and gas prices were surging in the first half of 2008, although that helped comparative returns after energy prices peaked in July and then plummeted. Late in the year we made a series of opportunistic purchases of energy shares, including Apache Corp., National-Oilwell Varco and Williams Cos., in hopes of capitalizing on valuations that reflected only worst-case scenarios.

As the economy slowed markedly, we believed large technology companies with reasonable valuations and solid balance sheets should provide some stability. However, fund technology holdings Intel, Dell and Texas Instruments fell as sharply as shares of mortgage companies and home builders, which were at the core of the credit crisis. At year-end, these and other tech giants were trading at discounts that we believed were too great to last long.

WHAT IS YOUR CURRENT OUTLOOK?

During bear markets, investors generally see only uncertainty and assume that negative trends will never end. But we believe powerful forces are now at play — unprecedented government action, record low interest rates and more affordable energy — that may stabilize the economy. If signs of an improvement emerge, investors may reallocate some of the vast stores of cash now on the sidelines into equities that are selling well below their potential value if the economy improves. We are currently finding companies trading at less than half of our estimates of their intrinsic value. The potential for appreciation from these depressed levels could be impressive, although it may be a while before valuations begin climbing toward our targets. However, if and when the economic outlook brightens, high-quality, large-cap stocks now available at what look like bargain prices may significantly outstrip returns on higher-risk investments.

9

HARRIS ASSOCIATES LARGE CAP VALUE FUND

Investment Results through December 31, 2008

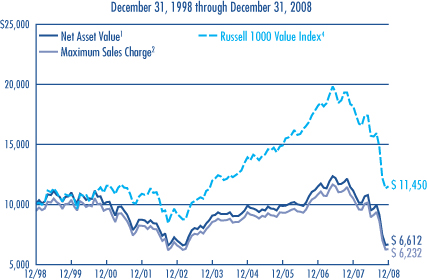

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares6

Average Annual Total Returns — December 31, 20086

| | | | | | | | | |

| | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

CLASS A (Inception 5/6/31) | | | | | | | | | |

Net Asset Value1 | | -40.45 | % | | -6.01 | % | | -4.06 | % |

With Maximum Sales Charge2 | | -43.87 | | | -7.12 | | | -4.62 | |

| | | | |

CLASS B (Inception 9/13/93) | | | | | | | | | |

Net Asset Value1 | | -40.87 | | | -6.71 | | | -4.78 | |

With CDSC3 | | -43.83 | | | -7.08 | | | -4.78 | |

| | | | |

CLASS C (Inception 5/1/95) | | | | | | | | | |

Net Asset Value1 | | -40.90 | | | -6.72 | | | -4.78 | |

With CDSC3 | | -41.49 | | | -6.72 | | | -4.78 | |

| | | | |

CLASS Y (Inception 11/18/98) | | | | | | | | | |

Net Asset Value1 | | -40.18 | | | -5.68 | | | -3.65 | |

| | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

Russell 1000 Value Index4 | | -36.85 | % | | -0.79 | % | | 1.36 | % |

Morningstar Large Blend Fund Avg.5 | | -37.79 | | | -2.47 | | | -0.84 | |

All returns represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are only available to certain investors, as outlined in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 | | 12/31/07 |

Common Stocks | | 94.6 | | 96.4 |

Short-Term Investments and Other | | 5.4 | | 3.6 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 | | 12/31/07 |

Intel Corp. | | 6.3 | | 6.9 |

Hewlett-Packard Co. | | 5.9 | | 5.0 |

Carnival Corp. | | 5.6 | | 4.2 |

Bank of New York Mellon Corp. | | 4.2 | | 4.8 |

FedEx Corp. | | 3.9 | | 3.0 |

Dell, Inc. | | 3.8 | | 4.4 |

JP Morgan Chase & Co. | | 3.7 | | 3.5 |

Schering-Plough Corp. | | 3.6 | | — |

Capital One Financial Corp. | | 3.0 | | 3.5 |

Merrill Lynch & Co., Inc. | | 2.9 | | 2.6 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 | | 12/31/07 |

Capital Markets | | 13.9 | | 10.2 |

Computers & Peripherals | | 9.7 | | 10.9 |

Hotels, Restaurants & Leisure | | 9.6 | | 7.4 |

Media | | 9.2 | | 12.2 |

Semiconductors & Semiconductor Equipment | | 8.2 | | 9.4 |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | |

| Share Class | | Gross Expense Ratio7 | | Net Expense Ratio8 |

A | | 1.28% | | 1.28% |

B | | 2.04 | | 2.04 |

C | | 2.04 | | 2.04 |

Y | | 0.91 | | 0.91 |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | Russell 1000 Value Index is an unmanaged index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. |

5 | Morningstar Large Blend Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

6 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

7 | Before reductions and reimbursements. |

8 | After reductions and reimbursements. Expense reductions are contractual and are set to expire on 4/30/09. |

10

VAUGHAN NELSON SMALL CAP VALUE FUND

PORTFOLIO PROFILE

Objective:

Seeks capital appreciation

Strategy:

Invests in small-cap companies with a focus on absolute return, using a bottom-up value-oriented investment process.

Inception Date:

December 31, 1996

Managers:

Chris D. Wallis

Scott J. Weber

Symbols:

| | |

| Class A | | NEFJX |

| Class B | | NEJBX |

Class C Class Y | | NEJCX

NEJYX |

What You Should Know:

Investing in small-cap stocks carries special risk, including narrower markets, limited financial and management resources, less liquidity and greater volatility than large company stocks. Value stocks may fall out of favor with investors and underperform the overall market during any given period.

Management Discussion

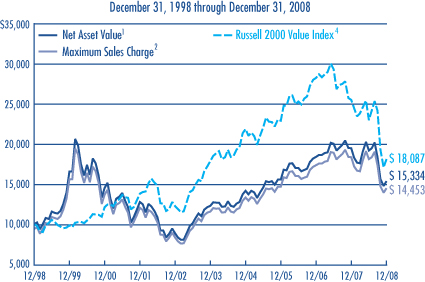

Stocks in all capitalization ranges lost ground in 2008, as the credit crisis spread and investor confidence crumbled in the face of a deepening recession. Although Vaughan Nelson Small Cap Value Fund’s performance was negative for the period, it held up better than its benchmark and a group of comparable funds.

For the fiscal year ended December 31, 2008, the fund’s total return was -21.11% based on the net asset value of Class A shares and $0.03 in reinvested capital gains. For the same period, the Russell 2000 Value Index, the fund’s benchmark, returned -28.92%, while the average performance of the funds in Morningstar’s Small Blend category was -36.56%.

WHAT STEPS DID YOU TAKE TO SHELTER THE FUND?

Stock selection was key. In light of the weak economy, we intensified our credit analysis, emphasizing companies we believe are well positioned to renew their debt obligations as they mature. We have been wary of financial stocks due to high debt loads, burgeoning loan losses and concern that the balance sheets of some mortgage companies included what we regard as unacceptable risks. However, avoiding commercial banks was a negative, as investors favored small-cap banks with clean balance sheets and prospects for industry consolidation. We also steered clear of most consumer-related issues, which benefited the fund as consumer spending stalled.

We took substantial profits in energy stocks in the first half of the year, trimming the portfolio’s energy exposure. That move proved positive when collapsing oil and gas prices pulled down energy shares later in 2008. Continental Resources, an exploration company with special expertise in drilling in unconventional formations, and Petrohawk, an onshore U.S. exploration and production company, were both sold at a profit. In materials, Cliffs Natural Resources, a supplier of iron ore and metallurgical coal to the steel industry, was another performance leader. We took profits when shares reached high valuations and then repurchased them when prices declined late in the year. Packaging companies Silgan Holdings, which makes metal and plastic food containers, Pactiv, whose products include Hefty trash bags, and glass container maker Owens-Illinois all benefited from declining material and energy costs.

WHICH POSITIONS HURT PERFORMANCE?

Industrials were the fund’s weakest sector. They had been positive contributors for some time, thanks to expanding global infrastructure, but they ran afoul of 2008’s global economic slowdown. General Cable, which serves utilities and industrial clients, declined sharply. In the consumer arena, we realized losses on the sale of Tempur-Pedic; the firm’s high-end bedding products lost ground as consumers retrenched. However, we continue to hold Pediatrix Medical Group (recently renamed Mednax), operators of hospital-based neonatal intensive care units and anesthesiology practices, even though the value of shares was impacted by lower admissions and a changing mix to more Medicaid patients in a weaker economy.

WHAT IS YOUR CURRENT OUTLOOK?

We have reined in the fund’s vulnerability to business cycles through further cutbacks in energy, industrials and financial issues. We are also avoiding vulnerable consumer businesses, including most specialty retail, auto and media stocks. We think pressure will remain on consumer-related businesses until housing prices bottom out. In our opinion, a sustainable rebound is also likely to require more transparency from banks regarding what they own and what it is worth. We believe investors will maintain low risk profiles until the credit markets stabilize, and that the slow process of reducing corporate and personal debt will delay recovery.

Although we expect below-trend growth to continue, we are comfortable that the fund’s current holdings have the potential to perform relatively well even in less-than-ideal circumstances. We also believe that the enormous cash reserves that have accumulated on the sidelines may drive equity prices higher once the outlook improves.

11

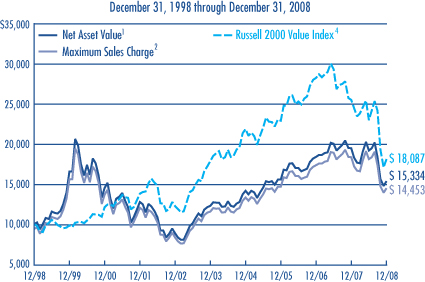

VAUGHAN NELSON SMALL CAP VALUE FUND

Investment Results through December 31, 2008

PERFORMANCE IN PERSPECTIVE

The charts comparing the fund’s performance to an index provide a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Growth of a $10,000 Investment in Class A Shares6

Average Annual Total Returns — December 31, 20086

| | | | | | | | | | | | |

| | | | | |

| | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE

INCEPTION | |

Class A (Inception 12/31/96) | | | | | | | | | | | | |

Net Asset Value1 | | -21.11 | % | | 4.59 | % | | 4.37 | % | | — | |

With Maximum Sales Charge2 | | -25.65 | | | 3.35 | | | 3.75 | | | — | |

| | | | | |

Class B (Inception 12/31/96) | | | | | | | | | | | | |

Net Asset Value1 | | -21.67 | | | 3.83 | | | 3.59 | | | — | |

With CDSC3 | | -25.58 | | | 3.48 | | | 3.59 | | | — | |

| | | | | |

Class C (Inception 12/31/96) | | | | | | | | | | | | |

Net Asset Value1 | | -21.71 | | | 3.81 | | | 3.59 | | | — | |

With CDSC3 | | -22.49 | | | 3.81 | | | 3.59 | | | — | |

| | | | | |

Class Y (Inception 8/31/06) | | | | | | | | | | | | |

Net Asset Value1 | | -20.81 | | | — | | | — | | | -3.33 | % |

| | | | | |

| COMPARATIVE PERFORMANCE | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | | | SINCE CLASS Y

INCEPTION7 | |

Russell 2000 Value Index4 | | -28.92 | % | | 0.27 | % | | 6.11 | % | | -13.86 | % |

Morningstar Small Blend Fund Avg.5 | | -36.56 | | | -1.30 | | | 4.39 | | | -14.90 | |

All results represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are only available to certain investors, as outlined in the prospectus.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | | | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 | | 12/31/07 |

Common Stocks | | 88.7 | | 95.4 |

Exchange Traded Funds | | 4.6 | | — |

Short-Term Investments and Other | | 6.7 | | 4.6 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 | | 12/31/07 |

iShares Russell 2000 Value Index Fund | | 4.6 | | — |

Silgan Holdings, Inc. | | 2.5 | | — |

Pactiv Corp. | | 2.5 | | — |

HCC Insurance Holdings, Inc. | | 2.5 | | 2.0 |

Watson Wyatt Worldwide, Inc., Class A. | | 2.3 | | — |

Waste Connections, Inc. | | 2.2 | | 0.9 |

Sybase, Inc. | | 2.2 | | 1.9 |

Owens-Illinois, Inc. | | 2.1 | | — |

SRA International, Inc., Class A | | 2.1 | | — |

Cullen/Frost Bankers, Inc. | | 2.0 | | 1.3 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 | | 12/31/07 |

Health Care Providers & Services | | 9.1 | | 5.2 |

Insurance | | 7.4 | | 5.9 |

Containers & Packaging | | 7.1 | | — |

Commercial Services & Supplies | | 6.0 | | 2.5 |

Software | | 5.6 | | 3.9 |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio8 | | | Net Expense Ratio9 | |

A | | 1.58 | % | | 1.46 | % |

B | | 2.32 | | | 2.21 | |

C | | 2.33 | | | 2.21 | |

Y | | 1.19 | | | 1.19 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class B shares assumes a maximum 5.00% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C share performance assumes a 1.00% CDSC applied when you sell shares within one year of purchase. |

4 | Russell 2000 Value Index is an unmanaged index that measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. |

5 | Morningstar Small Blend Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

6 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

7 | The since-inception comparative performance figures shown are calculated from 9/1/06. |

8 | Before reductions and reimbursements. |

9 | After reductions and reimbursements. Expense reductions are contractual and are set to expire 4/30/09. |

12

VAUGHAN NELSON VALUE OPPORTUNITY FUND

PORTFOLIO PROFILE

Objective:

Seeks long-term capital appreciation

Strategy:

Invests in medium capitalization companies with a focus on absolute return, using a bottom-up, value-oriented investment process

Inception Date:

October 31, 2008

Managers:

Dennis G. Alff

Chris D. Wallis

Scott J. Weber

Symbols:

| | |

| Class A | | VNVAX |

Class C Class Y | | VNVCX

VNVYX |

What You Should Know:

Value stocks may fall out of favor with investors and underperform the overall market during any given period.

Management Discussion

Although Vaughan Nelson Value Opportunity Fund’s results for the two months since its inception were negative, the fund declined less than its benchmark and its Morningstar peer group. Between October 31, 2008 and December 31, 2008, the fund’s total return was -3.75% based on the net asset value of Class A shares and $0.02 in reinvested dividends. For the same period, the Russell Midcap Value Index returned -5.73%, while the average performance of funds in Morningstar’s Mid-Cap Value category was -4.22%. Please bear in mind that this brief period was one of the most volatile in history.

WHICH STOCKS OR STRATEGIES HELPED OR HURT THE FUND?

One positive factor was that the fund was underweight in poorly performing financial stocks relative to the benchmark. Those financial stocks we did hold – mostly property casualty insurers, insurance brokers and select regional banks – performed relatively well. We also enjoyed good results from some container and packaging stocks that benefited from the decline in energy costs and raw materials in the latter part of 2008. Owens-Illinois and Pactiv are two examples. Owens makes glass bottles for beer and other beverages. Pactiv makes the Hefty line of trash bags and other plastic products. AutoZone, a do-it-yourself retailer of auto parts and accessories, also proved positive because we bought shares at low prices when the market was correcting. All three remain in the portfolio. We avoided auto manufacturers, homebuilders and most apparel retailers, all of which were casualties during the period.

Sectors were mixed during the period but, as you might expect, defensive stocks did slightly better. We did not have much exposure to utilities – a traditionally defensive area – because we felt that utility company earnings would be under pressure from slowing energy usage in a weak economy, as well as from pressure on regulated returns in a low interest-rate environment. We lost some ground in this area, and the one utility we did own, Calpine Corporation, proved disappointing. The fact that it does not pay a dividend may have made the stock lose favor with nervous investors. However, we continue to hold Calpine due to the attractiveness of its power generation assets, which are fueled by natural gas or geothermal energy.

HOW DID YOU RESPOND TO THE ECONOMIC SLOWDOWN?

We increased the fund’s exposure to industries we believe are less sensitive to the economy, like consumer staples and healthcare. In addition, the fund’s focus on fundamental research and valuation gives it a defensive bias. Our investment process has always included rigorous review and analysis of the financial condition of each company we consider. Recently we went one step further, digging into the actual debt structure of each investment candidate. Given the stresses on the credit markets, we want to avoid companies that could have difficulty rolling over maturing debt.

High-yielding stocks tend to be regarded as more defensive, but our focus is on each company’s cash flow and return profile that may contribute to long-term appreciation potential rather than on income. Companies with strong cash flows may be less dependent on the credit markets to finance growth, making them attractive in the current market environment.

WHAT IS YOUR CURRENT OUTLOOK?

This is an especially difficult time to make projections, given the uncharted waters that lie ahead. We believe this recession may be longer than past recessions, so we are remaining cautious. We expect the markets to remain volatile and we plan to take advantage of periods of weakness, being patient and disciplined with regard to valuation.

We think the prevailing headwind for some time to come will be the de-leveraging cycle, as consumers, banks, hedge funds and others continue to retrench, unwinding costly debt. When a recovery does get underway, we think it is likely to be at a subdued rate.

13

VAUGHAN NELSON VALUE OPPORTUNITY FUND

Investment Results through December 31, 2008

PERFORMANCE IN PERSPECTIVE

The table comparing the fund’s performance to an index provides a general sense of how it performed. The fund’s total return for the period shown below appears with and without sales charges and includes fund expenses and fees. An index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged and does not have expenses that affect the results. It is not possible to invest directly in an index. Investors would incur transaction costs and other expenses if they purchased the securities necessary to match the index.

Average Annual Total Returns — December 31, 20086

| | | |

| | |

| | | SINCE

INCEPTION | |

Class A (Inception 10/31/08) | | | |

Net Asset Value1 | | -3.75 | % |

With Maximum Sales Charge2 | | -9.29 | |

| | |

Class C (Inception 10/31/08) | | | |

Net Asset Value1 | | -3.90 | |

With CDSC3 | | -4.86 | |

| | |

Class Y (Inception 10/31/08) | | | |

Net Asset Value1 | | -3.74 | |

| | |

| COMPARATIVE PERFORMANCE | | SINCE INCEPTION7 | |

Russell Midcap Value Index4 | | -5.73 | % |

Morningstar Mid-Cap Value Fund Avg.5 | | -4.22 | |

All results represent past performance and do not guarantee future results. Periods of less than one year are not annualized. Share price and return will vary, and you may have a gain or loss when you sell your shares. All results include reinvestment of dividends and capital gains. Current returns may be higher or lower than those shown. For performance current to the most recent month-end, visit www.funds.natixis.com. Class Y shares are only available to certain investors, as outlined in the prospectus.

The table does not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

PORTFOLIO FACTS

| | |

| |

| | | % of Net Assets as of |

| FUND COMPOSITION | | 12/31/08 |

Common Stocks | | 94.3 |

Exchange Traded Funds | | 4.5 |

Other | | 1.2 |

| |

| | | % of Net Assets as of |

| TEN LARGEST HOLDINGS | | 12/31/08 |

iShares Russell Midcap Value Index Fund | | 4.5 |

Owens-Illinois, Inc. | | 3.9 |

Annaly Mortgage Management, Inc. | | 3.4 |

ACE Ltd. | | 3.3 |

DaVita, Inc. | | 2.9 |

Energizer Holdings, Inc. | | 2.8 |

W.R. Berkley Corp. | | 2.7 |

ConAgra Foods, Inc. | | 2.6 |

IPC Holdings Ltd. | | 2.5 |

HCC Insurance Holdings, Inc. | | 2.5 |

| |

| | | % of Net Assets as of |

| FIVE LARGEST INDUSTRIES | | 12/31/08 |

Insurance | | 13.5 |

Food Products | | 8.8 |

Health Care Providers & Services | | 6.2 |

Software | | 5.6 |

Containers & Packaging | | 5.5 |

Portfolio holdings and asset allocations will vary.

EXPENSE RATIOS AS STATED IN THE MOST RECENT PROSPECTUS

| | | | | | |

| Share Class | | Gross Expense Ratio8 | | | Net Expense Ratio9 | |

A | | 1.74 | % | | 1.40 | % |

C | | 2.49 | | | 2.15 | |

Y | | 1.49 | | | 1.15 | |

NOTES TO CHARTS

1 | Does not include a sales charge. |

2 | Includes the maximum sales charge of 5.75%. |

3 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

4 | Russell Midcap Value Index is an unmanaged index that measures the performance of those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. |

5 | Morningstar Mid-Cap Value Fund Average is the average performance without sales charges of funds with similar investment objectives, as calculated by Morningstar, Inc. |

6 | Fund performance has been increased by expense reductions/reimbursements, without which performance would have been lower. |

7 | The since-inception comparative performance figures shown are calculated from 11/1/08. |

8 | Before reductions and reimbursements. |

9 | After reductions and reimbursements. Expense reductions are contractual and are set to expire 4/30/10. |

14

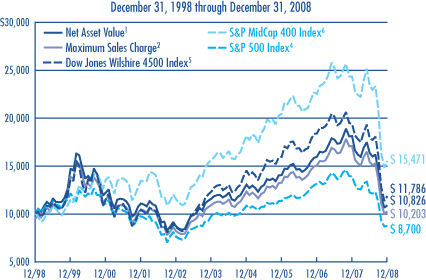

NATIXIS U.S. DIVERSIFIED PORTFOLIO

PORTFOLIO PROFILE

Objective:

Seeks long-term growth of capital

Strategy:

Features growth and value investments through a diversified portfolio of complementary equity investment disciplines provided by specialized money managers

Inception Date:

July 7, 1994

Subadvisors:

BlackRock Investment Management, LLC

Harris Associates, L.P.

Loomis, Sayles & Company, L.P.

Symbols:

| | |

| Class A | | NEFSX |

| Class B | | NESBX |

Class C Class Y | | NECCX

NESYX |

What You Should Know:

Growth stocks can be more sensitive to market movements because their values are based on future expectations. Value stocks may fall out of favor with investors and underperform the overall market. Small-cap stocks carry special risks, including narrower markets, limited financial and management resources, less liquidity and greater volatility.

Management Discussion

A pullback in economic growth, rising unemployment, declining corporate profits and a credit crunch sent investors to the sidelines during 2008. For much of the 12-month period, securities with even the slightest amount of risk were sold off and the U.S. equity market posted steep declines. Both growth and value stocks in every asset class — small-, mid-, and large-cap — proved disappointing.

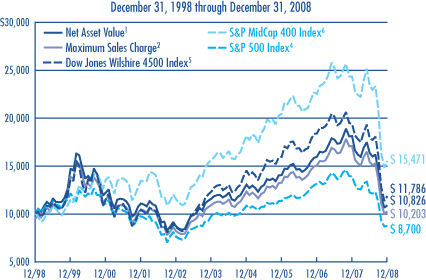

Each of the fund’s four segments is managed using a different discipline, providing investors with exposure to a wide spectrum of investment styles and strategies. BlackRock seeks long-term growth of capital in companies of any size, with an emphasis on those with capitalizations greater than $2 billion. The segment managed by Harris Associates invests primarily in common stocks of large- and mid-cap companies that the manager believes are trading at a substantial discount to their “true business value.” Loomis Sayles manages two segments. One invests in mid-cap growth stocks, and the other focuses on small-cap value stocks.

For the fiscal year ended December 31, 2008, Natixis U.S. Diversified Portfolio returned -40.05% based on the net asset value of Class A shares and $0.42 in reinvested capital gains. The fund underperformed the -37.00% return of the S&P 500 Index and the -36.23% return of the S&P MidCap 400 Index. The fund’s return was slightly behind the -39.02% return of the Dow Jones Wilshire 4500 Index and slightly better than the -40.67% average return of the funds in Morningstar’s Large Growth category.

BLACKROCK EMPHASIZED DEFENSIVE SECTORS

Overweight positions in the relatively defensive healthcare and consumer staples sectors benefited performance, as these areas declined less than others during the period. Maintaining an underweight in energy was also helpful during the second half of the year when stock prices in this sector plunged along with oil and gas prices. The segment was also underweight in industrials relative to its benchmark. Two healthcare stocks that contributed to relative performance were Gilead Sciences and Celgene Corporation. Biotechnology companies historically are less influenced by recessions than other businesses. Gilead is developing cures for life-threatening diseases like HIV, and Celgene has developed medicines to treat bone marrow cancer. Google, Hologic and Apple were among the biggest disappointments in this segment. Given their strong business prospects, Google and Apple performed well in 2007 but their share prices fell sharply in 2008 as investor sentiment turned away from stocks that were perceived to carry higher risk. Both companies have dominant brands and strong balance sheets, and they remain in the segment. Hologic, a provider of medical technology used for women’s health needs, declined on concerns that hospitals may reduce capital expenditures in the current economic environment and the stock was sold from this segment.

HARRIS ASSOCIATES FAVORED STOCKS TRADING AT A DISCOUNT

This segment’s investment approach is based on a bottom-up stock selection process in which each stock is evaluated on its own merits. Sector allocation is determined by the stock-selection process. Harris Associates focused on high-quality businesses that were selling at little or no premium to their lower-quality counterparts. Underweight positions in consumer staples and energy detracted from performance, and technology holdings performed poorly. However, stocks in the industrial and financial sectors were helpful, as was this segment’s emphasis on the consumer discretionary sector. One of the segment’s best-performing stocks in the second quarter, Schering-Plough, produced outstanding earnings; revenues on most of its key products beat forecasts, and the firm’s gross margin was higher than expected. Home Depot performed well for much of the year. By controlling inventory and pricing, the company reported better-than-expected earnings during the fourth quarter. Harris Associates’ research determined that Home Depot’s unique position among retailers, strong balance sheet and improving margins were not adequately reflected in its stock price. Pulte Homes rebounded strongly early in the year, making it a top contributor to performance, but the position was eliminated later in the year when conditions in the housing market worsened. Merrill Lynch,

15

NATIXIS U.S. DIVERSIFIED PORTFOLIO

Management Discussion

Dell and Intel had the most negative impact. Merrill Lynch’s shares declined in advance of its acquisition by Bank of America. Upon completion of this acquisition, the segment’s shares of Merrill will be exchanged for shares of the Bank. Dell’s 2008 sales fell in response to the weak macroeconomic environment, which resulted in reduced global spending on technology. Management is now focused on lower-end consumer notebooks. The firm continues to trim expenses and has reduced its workforce in the past several months. Intel had a tough second half in 2008 as economic growth slowed, although it reported increased sales for the third quarter and indicated that global demand for its products remains strong. The company believes it can grow gross margins. Harris Associates regards Intel as an attractively valued company that continues to gain market share.

LOOMIS SAYLES MID-CAP SEGMENT FAVORED DEFENSIVE STOCKS

This segment’s management team began 2008 believing that the United States was in or was about to enter a recession, that earnings expectations were overstated, and that stocks were entering a “bear market.” Based on these assumptions, the segment reduced exposure to cyclical stocks in anticipation of a global economic slowdown and increased defensive investments, such as consumer staples and healthcare. Alpha Natural Resources, the largest producer of metallurgical coal used in steel making, was one of the top performers. We took profits in the stock. Dollar Tree’s growth was also among the segment’s top stocks. The company is an extreme value retailer pricing merchandise at one dollar or less. In a difficult retail environment, Dollar Tree was driven in part by expansion of its customer base to higher-income shoppers. Apollo Group was also among the best performers. It is the largest private institution for post secondary education operating in several states and offering on-line courses through its University of Phoenix. Apollo reported relatively strong earnings and growth in student enrollment. NASDAQ OMX Group, Continental Resources and Kansas City Southern railroads were among the segment’s biggest detractors. NASDAQ was affected by general market activity and increased pricing pressure from competitors, such as the emerging electronic trading platforms. Continental Resources, an oil and gas exploration and production company, has principal operations in areas with shale oil. Because of declining oil prices, the company curtailed its drilling program, lowering its estimated production for 2008 and 2009. Kansas City Southern provides rail transportation in the central and south central United States and Mexico. Because of deteriorating macroeconomic conditions, the railroad industry has seen volumes decline sharply, which cut earnings estimates. All three stocks were sold.

LOOMIS SAYLES SMALL-CAP SEGMENT WAS OPPORTUNISTIC