SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 | |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| Sturm, Ruger & Company, Inc. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| [ ] | Fee paid previously with preliminary materials: | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| 1) | Amount previously paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

|

STURM, RUGER & COMPANY, Inc. |

1 LACEY PLACE, SOUTHPORT, CT 06890 U.S.A. | 203-259-7843 | WWW.RUGER.COM | NYSE:RGR |

April 1, 2021

Dear Fellow Stockholders:

In light of the COVID-19 pandemic and in the interest of employee and shareholder safety, we have decided to forego a live Annual Meeting of Stockholders in favor of a “virtual” meeting. You are cordially invited to participate in the 2021 Annual Meeting of Stockholders of Sturm, Ruger & Company, Inc. to be held at 9:00 a.m. Eastern Daylight Time on Wednesday, May 12, 2021. Details regarding how to participate in the meeting and the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

The Board of Directors looks forward to your participation in the 2021 Annual Meeting.

| STURM, RUGER & COMPANY, INC. |

| |

|

|

| Christopher J. Killoy |

| Chief Executive Officer |

|

STURM, RUGER & COMPANY, Inc. |

1 LACEY PLACE, SOUTHPORT, CT 06890 U.S.A. | 203-259-7843 | WWW.RUGER.COM | NYSE:RGR |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 12, 2021

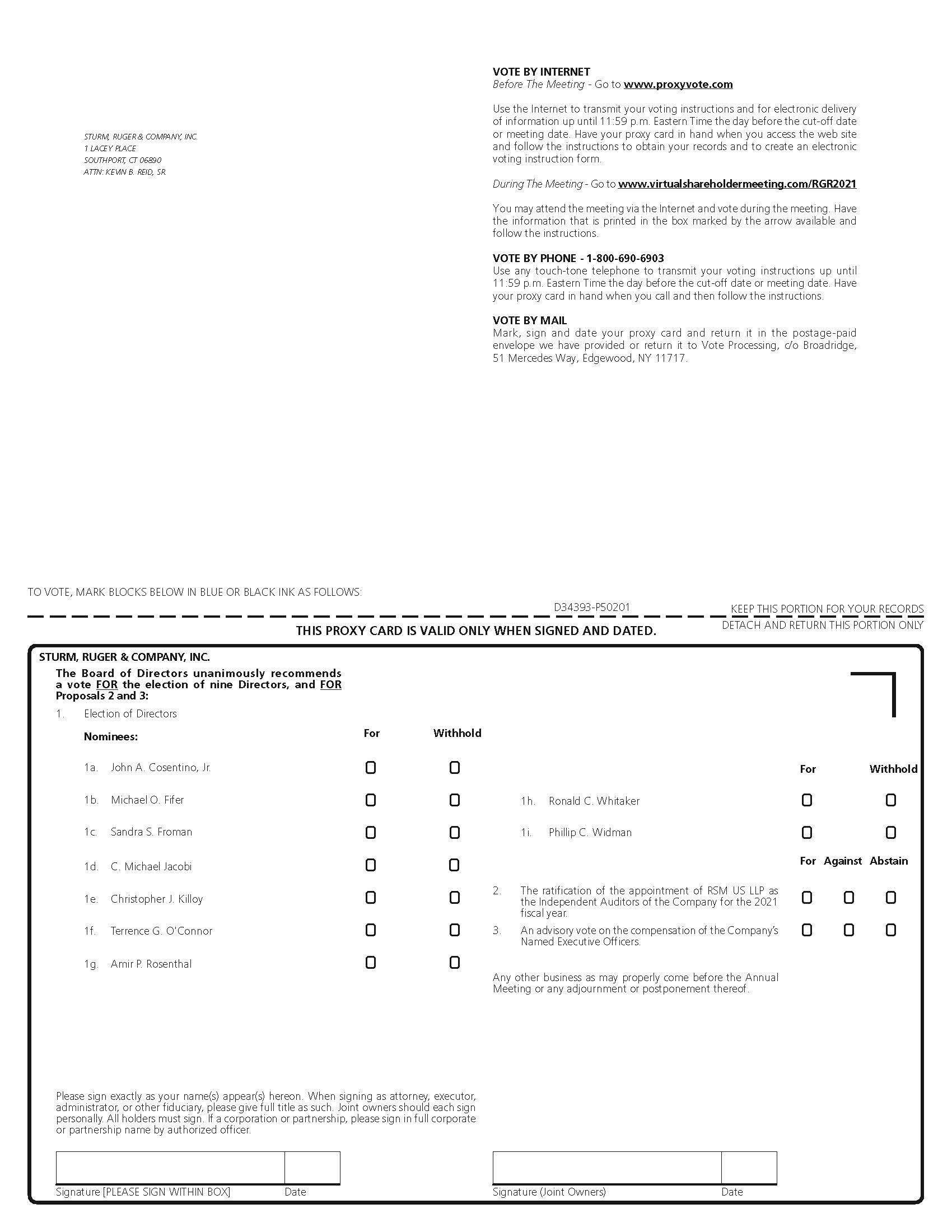

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Stockholders of STURM, RUGER & COMPANY, INC. (the “Company”) will be held on May 12, 2021 at 9:00 a.m. Eastern Daylight Time. The Annual Meeting of Stockholders will be a virtual meeting webcast live via the Internet. You will be able attend the meeting, vote, and submit questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/RGR2021 and entering the 16-digit control number on your proxy card or the instructions included in your proxy materials. The following matters will be considered and acted upon at the Annual Meeting of Stockholders:

1.

A proposal to elect nine (9) Directors to serve on the Board of Directors for the ensuing year;

2.

A proposal to ratify the appointment of RSM US LLP as the Company’s independent auditors for the 2021 fiscal year;

3.

An advisory vote on the compensation of the Company’s Named Executive Officers; and

4.

Any other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Only holders of record of Common Stock at the close of business on March 15, 2021 will be entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. The complete list of stockholders entitled to vote at the Annual Meeting shall be open to the examination of any stockholder, for any purpose germane to the Annual Meeting, during ordinary business hours, for a period of 10 days prior to the Annual Meeting, at the Company’s offices located at 1 Lacey Place, Southport, CT 06890.

The Company’s Proxy Statement is attached hereto.

| By Order of the Board of Directors |

|

|

| Kevin B. Reid, Sr. |

| Corporate Secretary |

Southport, Connecticut

April 1, 2021

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO PARTICIPATE IN THE LIVE ANNUAL MEETING VIA THE INTERNET AT WWW.VIRTUALSHAREHOLDERMEETING.COM/RGR2021. YOUR VOTE IS IMPORTANT. TO ENSURE THAT YOUR VOTE IS RECORDED PROMPTLY, PLEASE VOTE YOUR PROXY AS SOON AS POSSIBLE, EVEN IF YOU PLAN TO PARTICIPATE IN THE ANNUAL MEETING. MOST STOCKHOLDERS HAVE THREE OPTIONS FOR SUBMITTING THEIR VOTES PRIOR TO THE ANNUAL MEETING: (1) VIA THE INTERNET AT WWW.PROXYVOTE.COM, (2) BY TELEPHONE AT 1-800-690-6903, OR (3) BY REQUESTING AND RETURNING A PAPER PROXY USING THE POSTAGE-PAID ENVELOPE PROVIDED. STOCKHOLDERS MAY REQUEST THE PROXY MATERIALS AT WWW.PROXYVOTE.COM OR BY CALLING 1-800-579-1639.

Table of Contents

i

Table of Contents |

|

(Continued) |

|

ii

Table of Contents |

|

(Continued) |

|

| Sturm, Ruger & Company, Inc. |

|

| April 1, 2021 | |

PROXY STATEMENT

Annual Meeting of Stockholders of the Company to be held on May 12, 2021

PROXY SOLICITATION AND VOTING INFORMATION

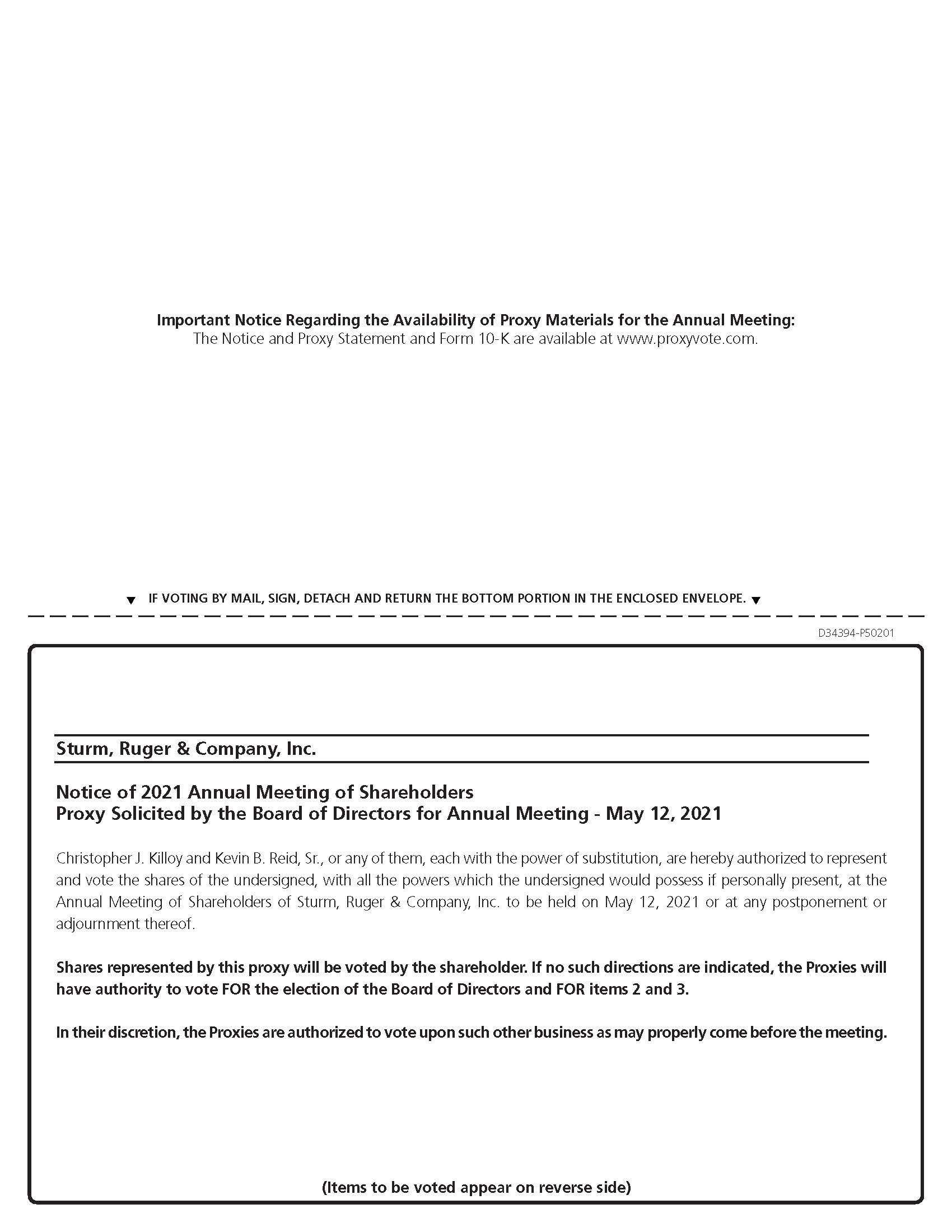

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board” or the “Board of Directors”) of Sturm, Ruger & Company, Inc. (the “Company”) for use at the 2021 Annual Meeting of Stockholders (the “Meeting” or the “Annual Meeting of Stockholders”) of the Company to be held live via the Internet at 9:00 a.m. Eastern Time on May 12, 2021, or at any adjournment or postponement thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement has been posted and is available on the Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov and the Company’s website at www.ruger.com. In addition, stockholders may view or request the proxy materials at www.proxyvote.com or by calling 1-800-579-1639, and may vote their proxy at www.proxyvote.com or by calling 1-800-690-6903. Please review the proxy materials before voting your shares.

The mailing address of the principal executive office of the Company is 1 Lacey Place, Southport, Connecticut 06890.

In accordance with rules established by the SEC that allow companies to furnish their proxy materials over the Internet, on April 1, 2021, we are mailing a Notice of Internet Availability of Proxy Materials instead of a paper copy of our Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2020 to our stockholders who have not specified that they wish to receive paper copies of our proxy materials. The Notice of Availability of Proxy Materials also contains instructions on how to request a paper copy of our proxy materials, including our Proxy Statement, Annual Report on Form 10-K for the year ended December 31, 2020 and a form of proxy card. We believe this process will allow us to provide our stockholders with the information they need in a more timely, environmentally friendly and cost-effective manner. All expenses in connection with the solicitation of these proxies, which are estimated to be $100,000, will be borne by the Company. We encourage our stockholders to contact the Company’s transfer agent, Computershare Investor Services, LLC, or their stockbrokers to sign up for electronic delivery of proxy materials in order to reduce printing, mailing and environmental costs.

If your proxy is signed and returned, it will be voted in accordance with its terms. However, a stockholder of record may revoke his or her proxy before it is exercised by: (i) giving written notice to the Company’s Secretary at the Company’s address indicated above, (ii) duly executing a subsequent proxy relating to the same shares and delivering it to the Company’s Secretary before the Meeting or (iii) participating in the Meeting and voting via the Internet during the Meeting (although participation in the Meeting will not, in and of itself, constitute revocation of a proxy).

The Company’s Annual Report on Form 10-K for the year ended December 31, 2020, including financial statements, is enclosed herewith and has been posted and is available on the SEC’s website at www.sec.gov and the Company’s website at www.ruger.com.

Only holders of shares of Common Stock, $1.00 par value, of the Company (the “Common Stock”) of record at the close of business on March 15, 2021 will be entitled to vote at the Meeting. Each holder of record of the issued and outstanding shares of Common Stock is entitled to one vote per share. As of March 15, 2021, 17,582,191 shares of Common Stock were issued and outstanding and there were no outstanding shares of any other class of stock. The presence of stockholders holding a majority of the issued and outstanding Common Stock, either present (participating in the internet Meeting) or represented by proxy, will constitute a quorum for the transaction of business at the Meeting. Directions to withhold authority to vote for the election of directors, abstentions, and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. In connection with the treatment of abstentions and broker non-votes, only the proposal to ratify the independent auditors is considered a “routine” matter, and brokers are entitled to vote uninstructed shares only with respect to this proposal.

Determination of whether a matter specified in the Notice of Annual Meeting of Stockholders has been approved will be determined, in accordance with the Company’s By-laws and applicable law, as follows:

•

Proposal No. 1 – Election of Directors: Directors will be elected by a plurality of the votes cast by the holders of shares of Common Stock present in person (participating in the internet Meeting) or by proxy at the Meeting and entitled to vote. Consequently, the nine nominees who receive the greatest number of votes cast for election as Directors will be elected. Shares present, which are properly withheld as to voting with respect to any one or more nominees, and broker non-votes will not be counted as voting on the election of Directors and accordingly will have no effect as votes on the election of Directors.

•

Proposal No. 2 – Ratification of Independent Auditors: The affirmative vote of the holders of shares of Common Stock representing a majority of the votes cast with respect to Proposal No. 2 at the Meeting (and entitled to vote thereon) is required to ratify the appointment of RSM US LLP as the Company’s independent auditors for the 2021 fiscal year. Abstentions and broker non-votes are not considered to be votes cast and accordingly will have no effect on the outcome of such vote. As noted above, because the ratification of independent auditors is considered a “routine” matter, brokers are entitled to vote uninstructed shares with respect to Proposal No. 2.

•

Proposal No. 3 – Say on Pay: The affirmative vote of the holders of shares of Common Stock representing a majority of the votes cast with respect to Proposal No. 3 at the Meeting (and entitled to vote thereon) is required to approve the advisory vote on executive compensation. Abstentions and broker non-votes are not considered to be votes cast and accordingly will have no effect on the outcome of such vote.

LIST OF PROPOSALS AND RECOMMENDATIONS OF THE BOARD OF DIRECTORS

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Nine Directors will be elected at the Meeting, each to hold office until the next Annual Meeting of Stockholders or until his or her successor is elected and has qualified.

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR”each of the named nominees.

PROPOSAL NO. 2 – RATIFICATION OF INDEPENDENT AUDITORS

RSM US LLP has served as the Company’s independent auditors since 2005. Subject to the ratification of the Company’s stockholders, the Board of Directors has reappointed RSM US LLP as the Company’s independent auditors for the 2021 fiscal year.

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR” the ratification of RSM US LLP as the Company’s independent auditors.

PROPOSAL NO. 3 – SAY ON PAY

The Company shall seek an advisory vote on executive compensation.

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR” approval of the pay-for-performance compensation policies and practices employed by the Compensation Committee, as described in the Compensation Discussion and Analysis and the tabular disclosure regarding Named Executive Officer compensation in this Proxy Statement.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Nine Directors will be elected at the Meeting, each to hold office until the next Annual Meeting of Stockholders or until his or her successor is elected and has qualified.

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR”each of the nominees named below.

DIRECTOR NOMINEES

The following table lists each nominee for Director and sets forth certain information concerning each nominee’s age, business experience, other directorships and committee memberships in publicly held corporations, current Board committee assignments, and qualifications to serve on the Board as of the date of this Proxy Statement. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills which led the Board to conclude that he or she should serve as a Director, the Board also believes that all of our Director nominees have established reputations of integrity, honesty and adherence to high ethical standards, and have demonstrated a commitment of service to the Company, an appreciation of its products and the Constitutional rights of American citizens to keep and bear arms. Each nominee has effectively demonstrated business acumen and the ability to exercise sound judgment in his or her individual careers and service on other public boards and board committees, as applicable.

All of the nominees for Director listed below were elected at last year’s Annual Meeting. Should any of the said nominees for Director not remain a candidate at the time of the Meeting (a condition which is not now anticipated), proxies solicited hereunder will be voted in favor of those nominees for Director selected by the Board of Directors.

Name, Age, First Became A Director

| Business Experience During the Past Five Years, Other Directorships, Current Committee Memberships and Board Qualifications |

John A. Cosentino, Jr. Age 71 Director since August, 2005 | Mr. Cosentino has been a partner of Ironwood Manufacturing Fund, LP since 2002, a Director of Simonds International, Inc. since 2001, the Chairman of the Board of Habco Industries LLC since 2012, a Director of Flux Power Holdings, Inc. since 2020, and Senior Advisor of Ironwood Capital Holdings LLC since 2012. He was a Director of Addaero LLC from 2014 to 2019, a Director of Whitcraft LLC from 2011 to 2017, a Director of the Bilco Company from 2007 to 2016, Chairman of North American Specialty Glass LLC from 2005 to 2012, Vice Chairman of Primary Steel LLC from 2005 to 2007, and a Director of the Wiremold Company from 1991 to 2000. Mr. Cosentino was a partner of Capital Resource Partners, LP from 1999 to 2000, and a Director in the following Capital Resource Partners, LP portfolio companies: Spirit Brands from 1998 to 2006, Pro Group, Inc. from 1999 to 2002, World Power Technologies, Inc. from 1998 to 2001, and Todd Combustion, Inc. from 1997 to 1999. Mr. Cosentino is the former Vice President-Operations of the Stanley Works, former President and Co-owner of PCI Group, Inc., former CEO and Co-owner of Rau Fastener, LLC, former President of the Otis Elevator-North America division of United Technologies, and former Group Executive of the Danaher Corporation. Mr. Cosentino was named as the Company’s Vice Chairman on April 28, 2010, having served as Lead Director from April 2007 to May 2018, and as Lead Vice Chairman beginning on May 9, 2017 (which function encompasses the duties of Lead Director). He is currently Chairman of the Compensation Committee and a member of the Audit Committee of the Company. The Board believes that Mr. Cosentino’s extensive executive management, investment management and board experience qualify him to serve on the Board of Directors. |

Name, Age, First Became A Director | Business Experience During the Past Five Years, Other Directorships, Current Committee Memberships and Board Qualifications |

Michael O. Fifer Age 64 Director since October, 2006 | Mr. Fifer was the Chief Executive Officer of the Company from September 25, 2006 to May 9, 2017. Additionally, he served as President of the Company from April 23, 2008 to January 1, 2014. He was the Executive Vice President and President of Engineered Products of Mueller Industries, Inc. from 2003 to 2006, President of North American Operations of Watts Industries, Inc. from 1998 to 2002, President of Various Watts Industries divisions from 1994 to 1998, and a member of the Board of Directors and Audit, Compensation and Special Committees of Conbraco Industries from 2003 to 2006. Mr. Fifer was named Vice Chairman of the Board in May 2017 and is a member of the Capital Policy Committee. The Board believes that Mr. Fifer’s executive leadership and management experience and skills, including his service as the CEO and President of the Company, and his deep understanding of the Company and its products and the firearms industry qualify him to serve on the Board of Directors. |

Sandra S. Froman Age 71 Director since December, 2015 | Ms. Froman is an attorney and formerly in private civil law practice with the Law and Mediation Office of Sandra S. Froman, P.L.C. She is a former partner of Snell & Wilmer, LLP a former shareholder of Bilby & Shoenhair, PC, and a former partner of Loeb & Loeb, LLP. Ms. Froman is a former President and board member of the Arizona Bar Foundation. She taught law school courses at Santa Clara University Law School from 1983 to 1985. Ms. Froman has been a member of the Board of Directors of the National Rifle Association (“NRA”) since 1992. She served as a Vice President from 1998 to 2005 and as NRA President from 2005 to 2007. She has chaired a number of NRA committees, including the Executive Committee, the Legislative Policy Committee, the Grassroots Development Committee and the Industry Relations Task Force. She holds a lifetime position on the NRA Executive Council. She is also a former President and Trustee of the NRA Foundation and a former Trustee of the NRA Civil Rights Defense Fund. Ms. Froman is President of Mzuri Wildlife Foundation and serves on its Board. Ms. Froman is currently a member of the Nominating and Corporate Governance, Compensation, and Risk Oversight Committees of the Company. The Board believes that Ms. Froman’s experience as an attorney and deep knowledge of, and involvement with, the firearms industry qualify her to serve on the Board of Directors. |

C. Michael Jacobi Age 79 Director since June, 2006 | Mr. Jacobi has been the President of Stable House 1, LLC, a private real estate development company since 1999. He was a member of the Board of Directors of CoreCivic (formerly Corrections Corporation of America) from 2000 until 2017, and served as a member of its Audit Committee. Mr. Jacobi was a member of the Board of Directors of Webster Financial Corporation from 1993 until 2017, served as a member of its Audit Committee from 1993 until 2011 (including as Audit Committee chair from 1996 to 2011), served as a member of its Compensation Committee from 2011 to 2015, and was a member of its Risk Committee from 2010 until 2017. He was a member of the Board of Directors and Audit Committee of KCAP Financial Corporation from 2006 to 2019, and has served as a member of its Nominating and Corporate Governance Committee from 2012 to 2019. In 2012, Mr. Jacobi became a member of the Board of Directors of Performance Sports Group Ltd. (formerly Bauer Performance Sports) and served on various committees, both as a member and as Chairman, until his retirement in 2017. He is the former President, CEO and Board member of Katy Industries, Inc. and the former President, CEO and Board member of Timex Corporation. Mr. Jacobi also is a Certified Public Accountant. He was the non-executive Chairman of the Company’s Board of Directors from 2010 to 2019 and was Co-Chair of the Executive Operating Committee. He is currently Chairman of the Nominating and Corporate Governance Committee and a member of the Compensation Committee. The Board believes that Mr. Jacobi’s extensive business, investment management, board experience and financial expertise qualify him to serve on the Board of Directors. |

Name, Age, First Became A Director | Business Experience During the Past Five Years, Other Directorships, Current Committee Memberships and Board Qualifications |

Christopher J. Killoy Age 62 Director since August, 2016 | Mr. Killoy was named CEO of the Company on May 9, 2017 and has served as President since January 1, 2014. He was COO of the Company from January 1, 2014 to May 9, 2017. Prior to that, Mr. Killoy served as Vice President of Sales and Marketing beginning in November 2006. Mr. Killoy originally joined the Company in 2003 as Executive Director of Sales and Marketing, and subsequently as Vice President of Sales and Marketing from 2004 to 2005. From 2005 to 2006, Mr. Killoy served as Vice President and General Manager of Savage Range Systems. Prior to joining Ruger, Mr. Killoy was Vice President of Sales and Marketing for Smith & Wesson. He is a member of the Board of Governors of the National Shooting Sports Foundation (NSSF) and a member of the Board of Directors of Velocity Outdoor, a subsidiary of Compass Diversified Holdings. Mr. Killoy is a 1981 graduate of the United States Military Academy at West Point and subsequently served in a variety of Armor and Infantry assignments in the U.S. Army. The Board believes that Mr. Killoy’s intimate knowledge of the Company, his service as the CEO and President of the Company and his extensive business and management experience in the firearms industry qualify him to serve on the Board of Directors. |

Terrence G. O’Connor Age 65 Director since September, 2014 | Mr. O’Connor has spent over 30 years in the financial services industry. Mr. O’Connor has been a principal of High Rise Capital Partners, LLC, a private real estate investment firm, since 2010 (including its predecessor company). He is also the sole owner of Pokka, LLC an e-commerce company specializing in writing instruments. He previously served as the Managing Partner of Cedar Creek Management, LLC, a private investment partnership, and as Partner at HPB Associates, also a private investment firm. Between 1990 and 1992, Mr. O’Connor served as an analyst with Feshbach Brothers. Prior to that, Mr. O’Connor spent 10 years at Kidder Peabody as a principal in equity sales and investment banking. Mr. O’Connor served as a Board Member of Covenant House New Jersey and on the Finance and Investment Committees of Covenant House International. He also served on the Compliance, Audit and Special Committees of SRV Bancorp. Mr. O’Connor is the Chairman of the Company’s Capital Policy Committee, and a member of the Company’s Nominating and Corporate Governance and Risk Oversight Committees. The Board believes that Mr. O’Connor’s financial insight and extensive knowledge of the firearms industry qualify him to serve on the Board of Directors |

Amir P. Rosenthal Age 59 Director since January, 2010 | Mr. Rosenthal is currently CFO of The Granite Group Wholesalers LLC and has been in this role since 2018. He was the Executive Vice President and a member of the Board of Advisors for Kensington Investment Corporation from 2017 to 2018. Before that, Mr. Rosenthal was the President of Performance Sports Group Ltd. (formerly Bauer Performance Sports Ltd.) from 2015 to 2016. He served as its Chief Financial Officer and Executive Vice President of Finance and Administration from 2012 to 2015, and Chief Financial Officer from 2008 to 2012. From 2001 to 2008, Mr. Rosenthal served in a variety of positions at Katy Industries, Inc., including Vice President, Chief Financial Officer, General Counsel and Secretary. From 1989 to 2001, Mr. Rosenthal served in a variety of positions at Timex Corporation, including Treasurer, Counsel and Senior Counsel, as well as Director and Chairman of Timex Watches Ltd. Mr. Rosenthal currently is the Chairman of the Company’s Risk Oversight Committee, and a member of the Company’s Audit, Nominating and Corporate Governance, and Capital Policy Committees. The Board believes that Mr. Rosenthal’s comprehensive business, legal and financial expertise qualifies him to serve on the Board of Directors. |

Name, Age, First Became A Director | Business Experience During the Past Five Years, Other Directorships, Current Committee Memberships and Board Qualifications |

Ronald C. Whitaker Age 73 Director since June, 2006 | Mr. Whitaker served as the President and CEO of Hyco International from 2003 and as a member of its Board from 2001 until his retirement in 2011. In 2013, he joined the Board of Payne & Dolan (now Walbec Group), a family owned road construction business based in Wisconsin, and currently serves as a member of the Compensation Committee and is the Chairman of the Special Litigation Committee. Mr. Whitaker was a Board member of Global Brass and Copper Holdings, Inc. from 2011-2019, and served as the Chairman of its Compensation Committee and as a member of its Audit, and Nominating and Corporate Governance Committees. He was the Chairman of the Indiana University Manufacturing Policy Initiative at the School of Public and Environmental Affairs from June 2017 to 2020. He has been a member of the Advisory Board for the Manufacturing Policy Initiative at the Indiana University School of Public and Environmental Affairs since June 2017. Mr. Whitaker was a Board member of Pangborn Corporation from 2006 to 2015 and served as the chair of its Compensation Committee. He was a member of the Board and Executive Committee of Strategic Distribution, Inc., and was its President and CEO from 2000 to 2003. Mr. Whitaker was the President and CEO of Johnson Outdoors from 1996 to 2000, and CEO, President and Chairman of the Board of Colt’s Manufacturing Co., Inc. from 1992 to 1995. He is a former Board member of Firearms Training Systems, Group Decco, Michigan Seamless Tube, Precision Navigation, Inc.; Weirton Steel Corporation and Code Alarm, and a former Trustee of the College of Wooster. Mr. Whitaker has been the Chairman of the Company’s Board of Directors since 2019 and is currently a member of the Compensation and the Audit Committees. The Board believes that Mr. Whitaker’s significant executive, board and firearms industry experience, and his knowledge of the Company’s products qualify him to serve on the Board of Directors. |

Phillip C. Widman Age 66 Director since January, 2010 | Mr. Widman was the Senior Vice President and Chief Financial Officer of Terex Corporation from 2002 until his retirement in 2013. In 2014, Mr. Widman joined the Board of Directors of Harsco Corporation, where he serves as the Chairman of its Audit Committee, and a member of its Governance Committee. Also in 2014, Mr. Widman joined the Board of Directors of Vectrus, Inc. and serves as a member of its Audit and Compensation Committees. He served as a Board and Nominating and Governance Committee member, and as Audit Committee chair, of Lubrizol Corp from November 2008 until September 2011. Mr. Widman was the Executive Vice President and Chief Financial Officer of Philip Services Corporation from 1998 to 2001. Mr. Widman currently is Chairman of the Company’s Audit Committee, and a member of the Risk Oversight and Capital Policy Committees. The Board believes that Mr. Widman’s extensive business management, board and audit committee experience, financial expertise and personal experience in the shooting sports qualify him to serve on the Board of Directors. |

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR”each of the nominees named above.

THE BOARD OF DIRECTORS, ITS COMMITTEES AND POLICIES

The Board of Directors is committed to good business practice, transparency in financial reporting and the highest level of corporate governance. To that end, the Board of Directors and its Committees continually review the Company’s governance policies and practices as they relate to the practices of other public companies, specialists in corporate governance, the rules and regulations of the SEC, Delaware law (the state in which the Company is incorporated) and the listing standards of the New York Stock Exchange (“NYSE”).

Corporate Board Governance Guidelines and Code of Business Conduct and Ethics

The Company’s corporate governance practices are embodied in the Corporate Board Governance Guidelines. In addition, the Company has adopted a Code of Business Conduct and Ethics, which governs the obligation of all employees, executive officers, and Directors of the Company to conform their business conduct to be in compliance with all applicable laws and regulations, among other things. The Company actively monitors internal compliance with the Code of Business Conduct and Ethics. Copies of the Corporate Board Governance Guidelines and Code of Business Conduct and Ethics are posted on the Company’s website at www.ruger.com and are available in print to any stockholder who requests them by contacting the Corporate Secretary as set forth in “STOCKHOLDER AND INTERESTED PARTY COMMUNICATIONS WITH THE BOARD OF DIRECTORS” below.

Political Contributions Policy

The Board of Directors established a Political Contributions Policy providing for the disclosure of political contributions, if any, as defined in the Political Contributions Policy, in excess of $50,000 in the aggregate. A copy of the Political Contributions Policy is posted on the Company’s website at www.ruger.com.

Human Rights

The Company is committed to conducting its business in a manner that respects the human rights of stakeholders, which include our employees, business partners and the communities in which we operate. To that end, the Company adopted a Human Rights Policy Statement in October 2019, which is available at www.ruger.com and applies to all of the Company’s operations and facilities. Ultimate oversight for issues related to the Company’s Human Rights Policy Statement resides with the Board of Directors.

The Company expects all employees and third parties that it conducts business with, including suppliers, vendors and other business partners, to conduct themselves in accordance with the Company’s Human Rights Policy Statement and other Company policies and applicable laws and regulations described in the Human Rights Policy Statement. The Company has integrated the Human Rights Policy Statement and the Company’s Code of Business Conduct and Ethics into its internal training programs, which are mandatory for all employees.

Diversity And Inclusion

The Company is an equal opportunity employer and seeks diversity and inclusion for all individuals at all levels of its operations, regardless of race, color, religion, gender, sexual orientation, age, national origin, disability or any other protected legal classification. As of March 18, 2021, 546 of 1,905 Company employees were women, which is 28.7% of our full time workforce. As of that date, 275, or 14.4%, of Company employees identified as racially or ethnically diverse.

The Board of Directors and the Nominating and Corporate Governance Committee are committed to actively seeking qualified female and minority candidates as director nominees, and the Company is committed to actively seeking to hire and develop female and minority members of the Company’s senior management team.

Human Capital

The Board of Directors and Company management deeply value Company employees and recognize the critical role they play in the Company’s overall success. The Company is dedicated to attracting, developing, and retaining employees by providing a preferred work environment that epitomizes our core values of Integrity, Respect, Innovation and Teamwork.

The Company seeks to attract candidates and retain employees by offering competitive compensation packages that include profit sharing, medical and welfare coverages, paid holidays and other paid time off, and 401(k) plan participation.

Our primary vehicle for Human Capital development is Ruger University, whose mission is to enhance the understanding of our industry, Company and culture; strengthen the technical, interpersonal and leadership skills of each employee; and allow employees to positively change their own lives while creating value for all Ruger stakeholders. All employees participate in Ruger University courses to satisfy mandatory training and job-specific requirements. Beyond that, all employees have access to Ruger University learning content, which includes computer skills, leadership, business basics, principles of finance and accounting, and many others. Content is accessible from work computers, and 24/7 from home computers or personal mobile devices.

On an annual basis, the Company conducts an Associate Engagement Survey for all employees, which is administered by a neutral third party. The Company analyzes survey responses carefully, which helps Company management understand, assess and improve employee satisfaction using dedicated, site-specific action plans.

In addition to its educational initiatives, the Company also has a myriad of policies regarding occupational health and safety issues that cover all of the Company’s facilities and operations. As a manufacturer that proudly produces all of its products in the United States, employee health and safety issues are of paramount importance to the Company.

During the global outbreak of COVID-19, the Company adopted many proactive steps to protect the health and safety of its employees. These actions included:

-

Providing all hourly employees with additional COVID-19 paid time off;

-

Encouraging employees to work remotely, wherever possible, and implementing social distancing throughout each Company manufacturing facility, including in every manufacturing cell within each facility;

-

Through dedicated nurses at the Company’s facilities, confidentially communicating with and assisting employees with potential health issues;

-

Restricting visitor access to avoid the spread of the virus in the Company’s facilities;

-

Implementing additional cleaning, sanitizing, improved ventilation and other health and safety processes to maintain a clean and safe workplace;

-

Providing all employees with multiple facemask coverings and other personal protective equipment and mandating their use at all times in our facilities; and

-

Issuing periodic guidance and reminders to all employees – directly to their phones when possible – to encourage them to engage in safe and responsible behaviors.

The Board’s Role in Risk Oversight

The Board’s role in the oversight of risk management includes receiving regular reports from the Risk Oversight Committee and senior management in areas of material risk to the Company, including operational, financial, legal and regulatory, strategic, reputational and industry-related risks. The Risk Oversight Committee and the full Board review and discuss these reports with the goal of overseeing the identification and management of, and the development of mitigation strategies for these risks.

Independent, Non-Management Directors

More than a majority of the current Directors are “independent” under the rules of the NYSE. The Board has affirmatively determined that none of Messrs. Cosentino, Jacobi, O’Connor, Rosenthal, Widman, and Whitaker or Ms. Froman, has or had a material relationship with the Company or any affiliate of the Company, either directly or indirectly, as a partner, shareholder or officer of an organization (including a charitable organization) that has a relationship with the Company, and are therefore “independent” for such purposes under the rules of the NYSE, including Rule 303A thereof.

The Company contracts with the National Rifle Association (“NRA”) for some of its promotional and advertising activities. Ms. Froman serves on the Board of Directors of the NRA.

The independent, non-management members of the Board meet regularly in executive sessions and the independent, non-executive Chairman of the Board, or in his absence, the Lead Vice Chairman (the independent, non-management Vice Chairman), leads each such meeting. Ronald C. Whitaker has served as the non-executive Chairman of the Board since May 8, 2019, and John A. Cosentino, Jr. served as the sole Vice Chairman from April 28, 2010 through May 9, 2017, as the sole Lead Vice Chairman since May 9, 2017.

Board Leadership Structure

On April 24, 2007, the By-Laws were amended to require the Chairman of the Board to be an independent, non-management Director who would preside at all meetings of the Board, including meetings of the independent, non-management Directors in executive session, which would generally occur as part of each regularly scheduled Board meeting. The separation of Chairman and Chief Executive Officer duties recognizes the difference in the two roles: the Chairman of the Board leads the Board of Directors as it provides guidance to and oversight of the CEO, while the CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company.

The April 24, 2007 By-Laws amendment also provided that an independent, non-management Lead Director would be named to preside at stockholder, Board and executive session meetings and to act as an intermediary between the non-management Directors and management of the Company when special circumstances exist or communication out of the ordinary course is necessary, such as the absence or disability of the non-executive Chairman of the Board. On April 28, 2010, the Board amended the By-Laws to create the position of Vice Chairman, who assumes the duties of Lead Director as outlined above. On May 8, 2017, the By-Laws were amended to permit a second Vice Chairman, who does not need to be independent. Michael O. Fifer has served in that role since May 9, 2017.

Director Resignation Policy

In 2008, the Board of Directors established a policy whereby any Director who experiences a change in employment must submit his or her resignation to the Board for its consideration.

Membership and Meetings of the Board and Its Committees

Following the 2020 Annual Meeting of Stockholders, the members of the Board were C. Michael Jacobi, John A. Cosentino, Jr., Christopher J. Killoy, Terrence G. O’Connor, Amir P. Rosenthal, Ronald C. Whitaker, Phillip C. Widman, Sandra S. Froman, and Michael O. Fifer. The Board of Directors held 14 meetings during 2020, including four regular meetings and ten special meetings. Each Director attended at least 75% of the meetings of the Board and of the Committees on which he or she served that were held during 2020. In addition, all members of the Board attended the 2020 virtual Annual Meeting of Stockholders. It is the policy of the Company that attendance at all meetings of the Board, all Committee meetings, and the Annual Meeting of Stockholders is expected, unless a Director has previously been excused by the Chairman of the Board for good cause. Committee memberships at year end and the number of meetings of the full Board and its Committees held during the fiscal year 2020 are set forth in the table below. When feasible and appropriate, it is the practice of the Board to hold its regular Committee meetings in conjunction with the regular meetings of the Board of Directors.

Each Committee is governed by a written charter that has been adopted by the Board. A copy of each Committee’s charter is posted on the Company’s website at www.ruger.com, and is available in print to any stockholder who requests it by contacting the Corporate Secretary as set forth in “STOCKHOLDER AND INTERESTED PARTY COMMUNICATIONS WITH THE BOARD OF DIRECTORS” below.

MEMBERSHIP AND MEETINGS OF THE BOARD AND ITS COMMITTEES TABLE FOR YEAR 2020

Name | Board of Directors | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Risk Oversight Committee | Capital Policy Committee |

Ronald C. Whitaker | Chairman | Member | Member | |||

John A. Cosentino, Jr. | Lead Vice Chairman | Member | Chair | |||

Amir P. Rosenthal | Member | Member | Member | Chair | Member | |

C. Michael Jacobi | Member | Member | Chair | |||

Phillip C. Widman | Member | Chair | Member | Member | ||

Terrence G. O’Connor | Member | Member | Member | Chair | ||

Sandra S. Froman | Member | Member | Member | Member | ||

Michael O. Fifer | Vice Chairman | Member | ||||

Christopher J. Killoy | Member | |||||

Total Number of Meetings | 14 | 5 | 3 | 5 | 4 | 4 |

COMMITTEES OF THE BOARD

Audit Committee

In 2020, the members of the Audit Committee of the Board were Phillip C. Widman, John A. Cosentino, Jr., Amir P. Rosenthal and Ronald C. Whitaker. Mr. Widman serves as Chairman of the Audit Committee. All members of the Audit Committee are considered “independent” for purposes of service on the Audit Committee under the rules of the NYSE, including Rule 303A thereof, and Rule 10A-3 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). All members of the Audit Committee are financially literate and have a working familiarity with basic finance and accounting practices. In addition, the Company has determined that each of Messrs. Cosentino, Rosenthal, Whitaker and Widman is an audit committee financial expert as defined by the SEC rules and regulations.

The purpose of the Audit Committee is to provide assistance to the Board in fulfilling its responsibility with respect to its oversight of: (i) the quality and integrity of the Company’s financial statements; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications and independence; and (iv) the performance of the Company’s internal audit function and independent auditors. In addition, the Audit Committee prepares the report required by the SEC rules included in this Proxy Statement.

Report of the Audit Committee*

Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the audited financial statements.

RSM US LLP is the independent registered public accounting firm appointed by the Company, and ratified by the Company’s stockholders on May 13, 2020, to serve as the Company’s independent auditors for the 2020 fiscal year. The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee by PCAOB Auditing Standard 1301 (Communications with Audit Committees). In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and the Company, and has received the written disclosures and the letter from the independent auditors as required by PCAOB Ethics and Independence Rule 3526, “Communication with Audit Committees Concerning Independence” and RSM US LLP’s report regarding its internal controls as required by NYSE Rule 303A.07. The Audit Committee also has considered whether RSM US LLP’s provision of non-audit services to the Company is compatible with maintaining its independence from the Company.

The Audit Committee discussed with the independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The Audit Committee held five meetings during fiscal year 2020.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2020 for filing with the Securities and Exchange Commission.

The Audit Committee’s responsibility is to monitor and oversee the audit and financial reporting processes. However, the members of the Audit Committee are not practicing certified public accountants or professional auditors and rely, without independent verification, on the information provided to them and on the representations made by management, and the report issued by RSM US LLP.

AUDIT COMMITTEE | |

| |

Phillip C. Widman, Chairman | |

John A. Cosentino, Jr. | |

Amir P. Rosenthal | |

Ronald C. Whitaker |

February 12, 2021

* | The report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under either the Securities Act of 1933, as amended, or the Exchange Act (together, the “Acts”), except to the extent that the Company specifically incorporates such report by reference; and further, such report shall not otherwise be deemed to be “soliciting material” or “filed” under the Acts. |

Compensation Committee

In 2020, the members of the Compensation Committee of the Board were Ronald C. Whitaker, John A. Cosentino, Jr., C. Michael Jacobi and Sandra S. Froman. Mr. Cosentino serves as Chairman of the Compensation Committee. All members of the Compensation Committee are considered “independent” for purposes of service on the Compensation Committee under the rules of the NYSE, including Rule 303A thereof.

The purposes of the Compensation Committee are: (i) discharging the responsibilities of the Board with respect to the compensation of the Chief Executive Officer of the Company, the other executive officers of the Company and members of the Board; (ii) establishing and administering the Company’s cash-based and equity-based incentive programs; and (iii) producing an annual report on executive compensation to be included in the Company’s annual Proxy Statement, in accordance with the rules and regulations of the NYSE and the SEC, and any other applicable rules or regulations. The Compensation Committee has the authority to form and delegate authority to one or more subcommittees, made up of one or more of its members, as it deems appropriate from time to time.

Compensation Committee Interlocks and Insider Participation

During the 2020 fiscal year, none of the Company’s executive officers served on the board of directors of any entities whose directors or officers serve on the Company’s Compensation Committee. No current or past executive officers of the Company serve on the Compensation Committee.

Compensation Committee Report on Executive Compensation *

The Committee has reviewed and discussed with management the Compensation Discussion and Analysis. In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

COMPENSATION COMMITTEE | |

| |

John A. Cosentino, Jr., Chairman | |

C. Michael Jacobi | |

Sandra S. Froman | |

Ronald C. Whitaker |

March 15, 2021

* | The report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing of the Acts, except to the extent that the Company specifically incorporates such report by reference; and further, such report shall not otherwise be deemed to be “soliciting material” or “filed” under the Acts. |

Nominating and Corporate Governance Committee

In 2020, the members of the Nominating and Corporate Governance Committee of the Board were C. Michael Jacobi, Sandra S. Froman, Amir P. Rosenthal and Terrence G. O’Connor. Mr. Jacobi serves as Chairman of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee is responsible to the Board for identifying, vetting and nominating potential Directors and establishing, maintaining and supervising the corporate governance program. Some of these responsibilities are discussed in more detail below.

As required under its charter, the Nominating and Corporate Governance Committee has adopted criteria for the selection of new Directors, including, among other things, career specialization, technical skills, strength of character, independent thought, practical wisdom, mature judgment and cultural, gender and ethnic diversity. The Committee considers it important for Directors to have experience serving as a chief executive or financial officer (or another, similar position) in finance, audit, manufacturing, advertising, military or government, and to have knowledge and familiarity of firearms and the firearms industry. The Committee will also consider any such qualifications as required by law or applicable rule or regulation, and will consider questions of independence and conflicts of interest. In addition, the following characteristics and abilities, as excerpted from the Company’s Corporate Board Governance Guidelines, will be important considerations of the Nominating and Corporate Governance Committee:

•

Personal and professional ethics, strength of character, integrity and values;

•

Success in dealing with complex problems or having excelled in a position of leadership;

•

Sufficient education, experience, intelligence, independence, fairness, ability to reason, practicality, wisdom and vision to exercise sound and mature judgment;

•

Cultural, gender and ethnic diversity;

•

Stature and capability to represent the Company before the public and the stockholders;

•

The personality, confidence and independence to undertake full and frank discussion of the Company’s business assumptions;

•

Willingness to learn the business of the Company, to understand all Company policies and to make themselves aware of the Company’s finances;

•

Willingness at all times to execute their independent business judgment in the conduct of all Company matters;

•

Diversity of skills, attributes and experience which augment the composition of the Board in execution of its oversight responsibilities to the benefit to the Company.

The charter also grants the Nominating and Corporate Governance Committee the responsibility to identify and meet individuals believed to be qualified to serve on the Board and recommend that the Board select candidates for directorships. The Nominating and Corporate Governance Committee’s process for identifying and evaluating nominees for Director, as set forth in the charter, includes inquiries into the backgrounds and qualifications of candidates. These inquiries include studies by the Nominating and Corporate Governance Committee and may also include the retention of a professional search firm to be used to assist it in identifying or evaluating candidates.

The Nominating and Corporate Governance Committee has a written policy which states that it will consider Director candidates recommended by stockholders. There is no difference in the manner in which the Nominating and Corporate Governance Committee will evaluate nominees recommended by stockholders and the manner in which it evaluates candidates recommended by other sources. Shareholder recommendations for the nomination of directors should set forth (a) as to each proposed nominee, (i) their name, age, business address and, if known, residence address, (ii) their principal occupation or employment, (iii) the number of shares of stock of the Company which are beneficially owned by each such nominee and (iv) any other information concerning the nominee that must be disclosed as to nominees in proxy solicitations pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to be named as a nominee and to serve as a Director of the Company if elected); (b) as to the shareholder giving the notice, (i) their name and address, as they appear on the Company’s books, (ii) the number of shares of the Company which are beneficially owned by such shareholder and (iii) a representation that such shareholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such nomination; and (c) as to the beneficial owner, if any, on whose behalf the nomination is made, (i) the name and address of such person and (ii) the class and number of shares of the Company which are beneficially owned by such person. The Company may require any proposed nominee to furnish such other information as it may reasonably need to determine the eligibility of a proposed nominee to serve as a Director of the Company, including a statement of the qualifications of the candidate and at least three business references. All recommendations for nomination of Directors should be sent to the Corporate Secretary, Sturm, Ruger & Company, Inc., 1 Lacey Place, Southport, CT 06890. The Corporate Secretary will accept such recommendations and forward them to the Chairman of the Nominating and Corporate Governance Committee. In order to be considered for inclusion by the Nominating and Corporate Governance Committee as a candidate at the Company’s next Annual Meeting of Stockholders, stockholder recommendations for Director candidates must be received by the Company in writing delivered or mailed by first class United States mail, postage prepaid, no earlier than January 12, 2022 (120 days prior to the first anniversary of this year’s Annual Meeting of Stockholders) and no later than February 11, 2022 (90 days prior to the first anniversary of this year’s Annual Meeting of Stockholders).

The Company has not rejected any Director candidates put forward by a stockholder or group of stockholders who beneficially owned more than 5% of the Company’s Common Stock for at least one year prior to the date of the recommendation.

Risk Oversight Committee

In 2020, the members of the Risk Oversight Committee were Amir P. Rosenthal, Phillip C. Widman, Terrence G. O’Connor and Sandra S. Froman. Amir P. Rosenthal serves as Chairman of the Risk Oversight Committee.

The Board established the Risk Oversight Committee in 2010 to collaborate with the Company’s executive team in assisting the Board in fulfilling its responsibility with respect to the Company’s enterprise risk management oversight. The Risk Oversight Committee’s responsibilities and roles are as follows:

•

To monitor all enterprise risk. In doing so, the Committee recognizes the responsibilities delegated to other committees of the Board, and understands that the other committees of the Board may emphasize specific risk monitoring through their respective activities.

•

To receive, review and discuss regular reports from senior management in areas of material risk to the Company, including operational, financial, legal and regulatory, strategic, reputational and industry-related risks.

•

To discuss with management the Company’s major risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessments and risk management policies.

•

To study or investigate any matter of interest or concern that the Committee deems appropriate.

Capital Policy Committee

In 2020, the members of the Capital Policy Committee were Terrence G. O’Connor, Amir P. Rosenthal, Phillip C. Widman, and Michael O. Fifer. Terrence G. O’Connor serves as Chairman of the Capital Policy Committee.

The Board established the Capital Policy Committee in 2016 to help the Board fulfill its responsibility for the Company’s capital allocation oversight. The Capital Policy Committee’s responsibilities and roles are as follows:

•

To ensure that the Company has a clearly articulated plan for capital structure, dividend policy and share repurchases that considers future growth plans, business and financial risks, and financial and regulatory constraints.

•

To discuss with management the Company’s major internal capital investments, and monitor the effectiveness of such investments as a whole.

•

To review all significant proposed external transactions, such as mergers, acquisitions, divestitures, joint ventures and equity investments.

•

To ensure that share repurchases by the Company, if any, are executed pursuant to a program that has been reviewed by legal counsel to ensure that the applicable legal requirements have been satisfied.

DIRECTOR COMPENSATION

The Board believes that compensation for the Company’s non-management Directors should be a combination of cash and equity-based compensation. The Directors and the Compensation Committee annually review Director compensation utilizing published compensation studies. Any recommendations for changes are made to the full Board by the Compensation Committee.

Directors’ Fees and Other Compensation

Effective July 1, 2020, the Board approved a fee schedule whereby non-management Directors receive base annual retainer compensation as follows:

Chairman of the Board | $168,000 |

Lead Vice Chairman | $144,000 |

Vice Chairman | $135,000 |

All others | $120,000 |

The retainer compensation is paid as 2/3 in cash and 1/3 in one-year restricted stock grants. In addition to the annual retainer fees, all non-management Directors receive annual long-term equity compensation of $60,000 paid in the form of three-year restricted stock units. All non-management Directors also receive long-term equity compensation of $100,000, in the form of five-year restricted stock units, upon joining the Board of Directors.

Committee Chairpersons receive the following additional annual retainer:

Audit | $18,000 |

Capital Policy | $12,000 |

Compensation | $12,000 |

Nominating and Corporate Governance | $12,000 |

Risk Oversight | $12,000 |

The Company’s one management Director, Chief Executive Officer Christopher J. Killoy, did not receive compensation for his service as a member of the Board of Directors.

On May 13, 2020, the annual restricted shares awarded on May 13, 2019 vested and the related shares were issued to the then-current non-management Directors. On May 12, 2020, the long-term restricted stock awarded on May 12, 2017 vested and the related shares were issued to the then-current non-management Directors. In addition, on May 14, 2020, the then-current non-management Directors were granted their 2020 annual and long-term awards of restricted stock.

On August 1, 2016, the Company entered into a transition services and consulting agreement (the “Fifer Agreement”) with Mr. Fifer, who resigned as Chief Executive Officer of the Company on May 9, 2017. The Fifer Agreement provides for (i) Mr. Fifer to continue to serve as Chief Executive Officer of the Company from August 1, 2016 until May 9, 2017, (ii) Mr. Fifer to provide certain consulting, advisory and other services to the Company for 6 years beginning May 9, 2017, (iii) the Company to compensate Mr. Fifer for such services at the rate of $350,000 per annum, (iv) the continued vesting of Mr. Fifer’s existing restricted stock unit awards during the period he provides such services and (v) a prohibition against Mr. Fifer engaging in certain activities that compete or interfere with the Company from August 1, 2016 through the second anniversary of the end of the period he is providing services under the Fifer Agreement. The compensation paid to Mr. Fifer under the Fifer Agreement is not related to, or predicated upon, his past, present or future service as a Director.

On August 1, 2016, the Company entered into an agreement (the “2016 Killoy Agreement”) with Mr. Killoy, who became the Chief Executive Officer of the Company on May 9, 2017. The 2016 Killoy Agreement provides for (i) Mr. Killoy to serve as Chief Executive Officer of the Company from and after May 9, 2017, (ii) the Company to pay Mr. Killoy a base salary at a rate of not less than $500,000 per annum while he serves as the Chief Executive Officer, (iii) Mr. Killoy to be eligible to receive, during the period he serves as Chief Executive Officer of the Company, an annual target cash bonus, annual performance equity-based incentive compensation and annual retention equity-based incentive compensation, each equal to 100% of his base salary, (iv) Mr. Killoy to receive 24 months of severance, in a lump sum, and continued insurance benefits, if Mr. Killoy is terminated without cause, resigns for good reason (as defined in the 2016 Killoy Agreement) or there is a

Change in Control (as defined in the Company’s 2017 Stock Incentive Plan) and a subsequent reduction of his salary or a diminution of his duties and thereafter he or the Company terminates his employment and (v) a prohibition against Mr. Killoy engaging in certain activities that compete or interfere with the Company during his employment with the Company and for two years thereafter. The compensation paid to Mr. Killoy under the 2016 Killoy Agreement is not related to, or predicated upon, his past, present or future service as a Director.

On November 10, 2020, the Company entered into an Amended and Restated Agreement (the “Amended Killoy Agreement”) with Mr. Killoy, the Chief Executive Officer of the Company, which amended and restated the 2016 Killoy Agreement by adding the following additional provisions: (i) Mr. Killoy to continue to serve as Chief Executive Officer of the Company until the 2025 Annual Meeting of the Company’s stockholders, and to resign from such position on such date, (ii) Mr. Killoy to receive a base salary of $700,000 per annum for such services, (iii) Mr. Killoy to provide certain consulting, advisory and other services to the Company following such resignation until December 31, 2026, (iv) the Company to compensate Mr. Killoy for such services at the rate of $500,000 per annum, (v) the continued vesting of Mr. Killoy’s restricted stock unit awards as if Mr. Killoy remained employed as the Chief Executive Officer of the Company and (vi) a prohibition against Mr. Killoy engaging in certain activities that compete or interfere with the Company during the period he is providing services under the Amended Killoy Agreement.

Directors are covered under the Company’s business travel accident insurance policy for $1,000,000 while traveling on Company business, and are covered under the Company’s director and officer liability insurance policies for claims alleged in connection with their service as Directors.

All Directors were reimbursed for reasonable out-of-pocket expenses related to attendance at Board, Committee and stockholder meetings.

DIRECTORS’ COMPENSATION TABLE FOR YEAR 2020

The following table reflects the compensation received during the 2020 fiscal year by each non-management Director.

Name | Fees Earned or Paid in Cash (1) ($) | Number of Shares Underlying Stock Awards (#) | Stock Awards (2) ($) | Other Compensation (3) ($) | Total Director Compensation (4) ($) |

C. Michael Jacobi | $88,000 | 1,750 | $104,000 | $2,957 | $194,957 |

John A. Cosentino, Jr. | $104,000 | 1,885 | $112,000 | $3,096 | $219,096 |

Amir P. Rosenthal | $88,000 | 1,750 | $104,000 | $3,003 | $195,003 |

Ronald C. Whitaker | $112,000 | 1,952 | $116,000 | $3,050 | $231,050 |

Phillip C. Widman | $92,000 | 1,784 | $106,000 | $2,934 | $200,934 |

Terrence G. O’Connor | $88,000 | 1,750 | $104,000 | $2,911 | $194,911 |

Sandra S. Froman | $80,000 | 1,683 | $100,000 | $2,864 | $182,864 |

Michael O. Fifer | $90,000 | 1,767 | $105,000 | $2,957 | $197,957 |

Notes to Directors’ Compensation Table

(1) | See “DIRECTORS’ FEES AND OTHER COMPENSATION” above. |

|

(2) | Represents aggregate grant date fair value of non-qualified equity awards made to each non-management Director on May 14, 2020 under the 2017 Stock Incentive Plan in accordance with the Director annual fee schedule approved in July 2020. The amounts shown represent the full grant date fair value of the awards calculated in accordance with the provisions of FASB ASC 718, and are shown at the maximum unit value expected upon the attainment of the time-based vesting of the awards. | |

(3) | Consists of accrued dividends paid upon the May 12, 2020 and May 13, 2020 vesting and conversion of restricted stock units awarded to each Director as described above. | |

(4) | The Company’s non-management Directors do not receive non-equity incentive plan compensation, stock options, pension benefits or non-qualified deferred compensation. |

Directors’ and Executive Officers’ Beneficial Equity Ownership

The Board has established a minimum equity ownership requirement for independent, non-management Directors of five times their annual base cash retainer to be achieved within five years of the date of adoption or the date of a Director’s election. As Directors are expected to hold a meaningful ownership position in the Company, a significant portion of overall Director compensation is intended to be in the form of Company equity. This has been partially achieved through options granted to the non-management Directors under the 2001 Stock Option Plan for Non-Employee Directors or the 2007 Stock Incentive Plan and through the annual deferred equity awards made to the Directors under the 2007 Stock Incentive Plan and the 2017 Stock Incentive Plan. The Board has also established a minimum equity ownership requirement for the Company’s Chief Executive Officer of five times his base salary, for Senior Vice Presidents of three times their base salary, and for the Company’s other Named Executive Officers of two times their respective base salaries, to be achieved within five years of their appointment. The current amounts of Common Stock beneficially owned by each Director and Named Executive Officer may be found in the “BENEFICIAL OWNERSHIP OF DIRECTORS AND MANAGEMENT TABLE” below.

BENEFICIAL OWNERSHIP OF DIRECTORS AND MANAGEMENT TABLE

The following table sets forth certain information as of March 15, 2021 as to the number of shares of the Company’s Common Stock beneficially owned by each Director, Named Executive Officer and all Directors and Executive Officers of the Company as a group.

Name | Beneficially Owned Shares of Common Stock | Stock Options Currently Exercisable or to Become Exercisable within 60 days after March 15, 2021 | Total Shares Beneficially Owned | Percent of Class |

Non-Management Directors: | ||||

C. Michael Jacobi | 7,000 | 0 | 7,000 | * |

John A. Cosentino, Jr. | 7,430 | 0 | 7,430 | * |

Amir P. Rosenthal | 13,832 | 0 | 13,832 | * |

Ronald C. Whitaker | 30,120 | 0 | 30,120 | * |

Phillip C. Widman | 24,736 | 0 | 24,736 | * |

Terrence G. O’Connor | 7,680 | 0 | 7,680 | * |

Sandra S. Froman | 10,477 | 0 | 10,477 | * |

Michael O. Fifer | 22,069 | 0 | 22,069 | * |

| ||||

Christopher J. Killoy (also a Director) | 154,048 | 0 | 154,048 | 0.9% |

Thomas A. Dineen | 51,201 | 0 | 51,201 | * |

Thomas P. Sullivan | 50,740 | 0 | 50,740 | * |

Kevin B. Reid, Sr. | 36,188 | 0 | 36,188 | * |

Shawn C. Leska | 29,922 | 0 | 29,922 | * |

Directors and executive officers as a group: (8 non-management Directors, 1 Director who is also an executive officer and 9 other executive officers) | 559,602 | 0 | 559,602 | 3.2% |

Notes to Beneficial Ownership Table

* | Beneficial owner of less than 1% of the outstanding Common Stock of the Company. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s Officers and Directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC and the NYSE. Officers, Directors and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of the Section 16(a) report forms furnished to the Company and written representations that no other reports were required, that with respect to the period from January 1, 2020 through December 31, 2020, (including with respect to prior years), all such forms were filed in a timely manner by the Company’s Officers, Directors and greater than 10% beneficial owners.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

The Board has a policy of monitoring and reviewing issues involving potential conflicts of interest, and reviewing and approving all related-party transactions. The Company’s Code of Business Conduct and Ethics provides that, in order to ensure that the Company’s business decisions are not influenced by self-interest, transactions involving an actual or apparent conflict of interest on the part of an employee, Officer or Director may only be undertaken if (i) the conflicting interest is fully disclosed to the individual’s immediate supervisor, personnel manager, facility director or the General Counsel (or in the case of an Officer or Director, to the Board), (ii) the individual with the conflict of interest takes no part in the consideration and approval of the transaction and (iii) the transaction is approved only by persons who do not have a conflict of interest.

The Company contracted with the National Rifle Association (“NRA”) for some of its promotional and advertising activities. The Company paid the NRA $0.6 million in 2020. Ms. Froman serves as a Member of the Board of the NRA and does not receive any portion of the payments made by the Company to the NRA.

As discussed above under “DIRECTOR COMPENSATION,” Mr. Fifer, the Company’s former Chief Executive Officer, entered into a transition services and consulting agreement with the Company on August 1, 2016, pursuant to which he has agreed to provide certain consulting, advisory and other services to the Company for 6 years beginning on May 9, 2017, when he resigned as the Chief Executive Officer.

On November 10, 2020, the Company entered into the Amended Killoy Agreement with Mr. Killoy, the Chief Executive Officer of the Company, which amended and restated the 2016 Killoy Agreement by adding the following additional provisions: (i) Mr. Killoy to continue to serve as Chief Executive Officer of the Company until the 2025 Annual Meeting of the Company’s stockholders, and to resign from such position on such date, (ii) Mr. Killoy to receive a base salary of $700,000 per annum for such services, (iii) Mr. Killoy to provide certain consulting, advisory and other services to the Company following such resignation until December 31, 2026, (iv) the Company to compensate Mr. Killoy for such services at the rate of $500,000 per annum, (v) the continued vesting of Mr. Killoy’s restricted stock unit awards as if Mr. Killoy remained employed as the Chief Executive Officer of the Company and (vi) a prohibition against Mr. Killoy engaging in certain activities that compete or interfere with the Company during the period he is providing services under the Amended Killoy Agreement.

There were no other related-party transactions in 2020.

PRINCIPAL STOCKHOLDERS

The following table sets forth as of December 31, 2020 the ownership of the Company’s Common Stock by each person of record or known by the Company to beneficially own more than 5% of such stock.

Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) (#) | Percent of Class (%) |

Common Stock |

BlackRock Inc. 55 East 52nd Street New York, NY 10055

| 2,780,408 | 15.8% |

Common Stock

|

The Vanguard Group, Inc. 100 Vanguard Boulevard Malvern, PA 19355

| 1,770,800 | 10.0% |

Common Stock |

Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation 800 Third Avenue New York, NY 10022

| 1,291,006 | 7.3% |

Notes to Principal Stockholder Table

(1) | Such information is as of December 31, 2020 and is derived exclusively from Schedules 13G or Schedules 13G/A filed by the named beneficial owners on or before March 15, 2021. |

PROPOSAL NO. 2 - RATIFICATION OF INDEPENDENT AUDITORS

PRINCIPAL ACCOUNTANTS’ FEES AND SERVICES

The following table summarizes the fees incurred by the Company for professional services rendered by RSM US LLP during fiscal years 2020 and 2019.

Principal Accountants’ Fees | ||

2020 | 2019 | |

Audit Fees | $758,900 | $746,500 |

Audit-Related Fees | $27,600 | $27,000 |

Tax Fees | $15,500 | $15,000 |

All Other Fees | - | $5,000 |

Total Fees | $802,000 | $793,500 |

Audit Fees

Consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements, the audit of internal controls over financial reporting per Section 404 of the Sarbanes-Oxley Act and the review of interim consolidated financial statements included in quarterly reports.

Audit-Related Fees

Consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include audits of the Company’s employee benefit and compensation plans.

Tax Fees

Consist of fees billed for professional services for tax assistance, including pre-filing reviews of original and amended tax returns for the Company.

All Other Fees

Consist of fees billed for professional services related to miscellaneous matters including implementation of new accounting standards, transaction advisory services, and financial due diligence.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

It is the policy of the Audit Committee to meet and review and approve in advance, on a case-by-case basis, all engagements by the Company of permissible non-audit services or audit, review or attest services for the Company to be provided by the independent auditors, with exceptions provided for de minimis amounts under certain circumstances as prescribed by the Exchange Act. The Audit Committee may, at some later date, establish a more detailed pre-approval policy pursuant to which such engagements may be pre-approved without a meeting of the Audit Committee. Any request to perform any such services must be submitted to the Audit Committee by the independent auditors and management of the Company and must include their views on the consistency of such request with the SEC’s rules on auditor independence.

All of the services of RSM US LLP which consisted of Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees described above were approved by the Audit Committee in accordance with its policy on permissible non-audit services or audit, review or attest services for the Company to be provided by its independent auditors, and no such approval was given through a waiver of such policy for de minimis amounts or under any of the other circumstances as prescribed by the Exchange Act.

Representatives of RSM US LLP will be participating in the Meeting, will have the opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Board of Directors Recommendation

The Board of Directors recommends a vote “FOR” the ratification of RSM US LLP as the Company’s independent auditors.

PROPOSAL NO. 3 – ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS