SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under §240.14a-12 |

Elizabeth Arden, Inc.

(Name of Registrant as specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration No.: |

ELIZABETH ARDEN, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held on June 22, 2004

The annual meeting of shareholders of Elizabeth Arden, Inc. will be held on Tuesday, June 22, 2004, at 10:00 a.m., local time, at our principal executive offices located at 14100 N.W. 60th Avenue, Miami Lakes, Florida 33014, for the following purposes, as described in the attached proxy statement:

| | 1. | To elect a board of six directors to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified; |

| | 2. | To approve our 2004 Stock Incentive Plan; |

| | 3. | To approve our 2004 Non-Employee Director Stock Option Plan; |

| | 4. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for fiscal 2005; and |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The board of directors has fixed the close of business on April 26, 2004 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting and at any adjournment or postponement of that meeting. Only shareholders of record at the close of business on that date will be entitled to vote at the annual meeting. For 10 days prior to the annual meeting, a list of shareholders entitled to vote will be available for inspection at our offices at 14100 N.W. 60th Avenue, Miami Lakes, Florida 33014.

It is important that your shares be represented at the annual meeting regardless of how many shares you own. Whether or not you intend to be present at the annual meeting in person, we urge you to please complete, date and sign the enclosed proxy card and return it in the envelope provided for that purpose. Many shareholders who hold their shares in the street name of a bank or brokerage firm may have the option to vote by telephone or Internet. We urge you to vote by telephone or Internet, if possible, since your vote will be recorded quickly and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. See your proxy card for further instructions on voting. Voting by mail, by telephone or through the Internet will not prevent you from voting in person at the meeting. If you are able to attend the meeting, you may revoke your proxy and vote your shares in person even if you have previously completed and returned the enclosed proxy card or voted by telephone or through the Internet. Also, you may revoke your proxy by written notice to our corporate secretary or by delivery of a later-dated proxy at any time before it is voted.

By Order of the Board of Directors

OSCAR E. MARINA

Secretary

Miami Lakes, Florida

May 14, 2004

YOU ARE URGED TO COMPLETE, DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY

IN THE ACCOMPANYING POSTAGE-FREE ENVELOPE OR TO VOTE BY TELEPHONE OR

INTERNET WHERE POSSIBLE. THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

ELIZABETH ARDEN, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 22, 2004

General

This proxy statement is being furnished to holders of common stock, par value $.01 per share, of Elizabeth Arden, Inc., in connection with the solicitation of proxies by our board of directors for use at our annual meeting of shareholders to be held at our principal executive offices located at 14100 N.W. 60th Avenue, Miami Lakes, Florida 33014, at 10:00 a.m., local time, on June 22, 2004, and at any adjournment or postponement of this meeting, for the purposes set forth in the accompanying notice of meeting.

It is anticipated that our annual report for the fiscal year ended January 31, 2004, this proxy statement and the accompanying form of proxy card will be first mailed to our shareholders on or about May 17, 2004. The annual report is not to be regarded as proxy soliciting material.

The company was organized in Florida in 1960. Following our acquisition of the Elizabeth Arden fragrance, cosmetics and skin care business in January 2001, we changed our name to Elizabeth Arden, Inc. Our primary business is the manufacture, marketing and distribution of prestige fragrances, skin treatment and cosmetic products.

Outstanding Shares and Voting Rights

Only holders of record of our common stock at the close of business on April 26, 2004 are entitled to notice of and to vote at the annual meeting. On that date, there were 26,056,412 shares of common stock entitled to vote on each matter to be presented at the annual meeting. Holders of the common stock have one vote per share on all matters. No other class of our stock has voting rights.

A majority of the shares of our common stock entitled to vote on a matter, represented in person or by proxy, will constitute a quorum for action on a matter at the annual meeting. In determining the presence of a quorum at the annual meeting, abstentions are counted, and broker non-votes are not. Our By-Laws provide that the affirmative vote of a majority of the shares of the voting stock represented, in person or by proxy, and entitled to vote on a matter at a meeting in which a quorum is present will be the act of the shareholders, except as otherwise provided by law. The affirmative vote of a majority of the shares of common stock represented, in person or by proxy, and entitled to vote at the meeting is required to approve our 2004 Stock Incentive Plan and our 2004 Non-Employee Director Stock Option Plan and to ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for fiscal 2005. The Florida Business Corporation Act provides that directors are elected by a plurality of the votes cast. Abstentions and broker non-votes have no legal effect on whether a nominee for director is elected but will have the same effect as votes against the ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors for fiscal 2005.

Shares represented by a properly executed proxy received in time to permit its use at the annual meeting or any adjournment or postponement of this meeting, and not revoked, will be voted in accordance with the instructions indicated therein. If no instructions are indicated, the shares represented by the proxy will be voted FOR the election of all of the nominees for director, FOR the approval of the 2004 Stock Incentive Plan, FOR the approval of the 2004 Non-Employee Director Stock Option Plan, FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors for fiscal 2005 and in the discretion of the proxy holders as to any other matter which may properly come before the annual meeting.

You are requested, regardless of the number of shares you hold, to sign the proxy and return it promptly in the enclosed envelope, or, if permitted by your bank or brokerage firm, vote by telephone or Internet. Each shareholder giving a proxy has the power to revoke it at any time before it is voted by written notice to our corporate secretary or by delivery of a later-dated proxy. Voting by mail, by telephone or through the Internet will not prevent you from voting in person at the meeting. If you are able to attend the meeting, you may revoke your proxy and vote your shares in person even if you have previously completed and returned the enclosed proxy card or voted by telephone or through the Internet.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 26, 2004 (except as noted below), (i) the ownership of common stock by all persons known by us to own beneficially more than 5% of the outstanding shares of our common stock, and (ii) the beneficial ownership of common stock by (a) each of our directors and director-nominees, (b) the chief executive officer and each of the other named executives as set forth in the “Summary Compensation Table” under “Executive Compensation” below and (c) all of our directors and executive officers as a group, without naming them:

| | | | |

Name and Address of Beneficial Owner(1)

| | Amount and

Nature of

Beneficial

Ownership(2)

| | Percentage

of the

Class(2)

|

E. Scott Beattie (3) | | 1,633,800 | | 6.0 |

Fred Berens (4) | | 864,153 | | 3.3 |

George Dooley (5) | | 83,500 | | * |

Richard C.W. Mauran (6) | | 1,819,698 | | 7.0 |

Stephen J. Smith (7) | | 178,522 | | * |

Ronald L. Rolleston (8) | | 133,928 | | * |

Joel B. Ronkin (9) | | 125,770 | | * |

William M. Tatham (10) | | 42,180 | | * |

J.W. Nevil Thomas (11) | | 251,062 | | * |

Paul F. West (12) | | 365,858 | | 1.4 |

Conopco, Inc. (13) | | 2,297,900 | | 8.8 |

Goodman & Company, Investment Counsel Ltd. (14) | | 2,670,350 | | 10.2 |

William Blair & Company, L.L.C. (15) | | 1,695,824 | | 6.5 |

All directors and executive officers as a group (13 persons) (16) | | 5,766,802 | | 20.4 |

| * | Less than one percent of the class. |

| (1) | The address of each of the persons shown in the above table other than Messrs. Mauran, Thomas and Tatham, Conopco, Inc., Goodman & Company, Investment Counsel Ltd. and William Blair & Company, L.L.C., is c/o Elizabeth Arden, Inc., 14100 N.W. 60th Avenue, Miami Lakes, Florida 33014. The address of Mr. Mauran is 31 Burton Court, Franklins Row, London SW3, England. The address of Mr. Tatham is 4100 Yonge Street, Suite 612, Toronto, Ontario M2P 2B5 Canada. The address of Mr. Thomas is 200 Front Street West, Suite 3003, Box 10, Toronto, Ontario M5V 3K2 Canada. The address of Conopco, Inc. is 390 Park Avenue, New York, New York 10022. The address of Goodman & Company, Investment Counsel Ltd. is 55th Floor, Scotia Plaza, 40 King Street West, Toronto, Ontario M5H 4A9 Canada. The address of William Blair & Company, L.L.C. is 222 W. Adams, Chicago, Illinois 60606. |

| (2) | Includes, where applicable, shares of common stock issuable upon the exercise of options to acquire common stock held by such person that may be exercised within 60 days after April 26, 2004. Also includes shares of restricted stock, performance accelerated restricted stock and performance-based restricted stock as to which |

-2-

| | such person has voting power but no dispositive power. Unless otherwise indicated, we believe that all persons named in the table above have sole voting power and/or investment power with respect to all shares of common stock beneficially owned by them. |

| (3) | Includes (i) 267,895 shares of common stock, (ii) 39,055 shares of restricted stock, (iii) 81,000 shares of performance accelerated restricted stock, (iv) 42,250 shares of performance-based restricted stock, (v) 1,078,600 shares of common stock issuable upon the exercise of stock options, and (vi) 125,000 shares of common stock for which Mr. Beattie has an option to purchase from an unaffiliated third party. |

| (4) | Includes (i) 796,653 shares of common stock, and (ii) 67,500 shares of common stock issuable upon the exercise of stock options. |

| (5) | Includes (i) 9,000 shares of common stock owned by Mr. Dooley together with his spouse as joint tenants with right of survivorship, and (ii) 74,500 shares of common stock issuable upon the exercise of stock options. |

| (6) | Includes (i) 1,752,198 shares of common stock owned by Euro Credit Investments Limited, a company controlled by Mr. Mauran, and (ii) 67,500 shares of common stock issuable upon the exercise of stock options. |

| (7) | Includes (i) 2,170 shares of common stock, (ii) 9,685 shares of restricted stock, (iii) 24,000 of shares of performance accelerated restricted stock, (iv) 10,000 shares of performance-based restricted stock, and (v) 132,667 shares of common stock issuable upon the exercise of stock options. |

| (8) | Includes (i) 2,002 shares of common stock, (ii) 5,596 shares of restricted stock, (iii) 24,000 shares of performance accelerated restricted stock, (iv) 6,500 shares of performance-based restricted stock, and (v) 95,830 shares of common stock issuable upon the exercise of stock options. |

| (9) | Includes (i) 2,035 shares of common stock, (ii) an additional 1,000 shares of common stock owned by Mr. Ronkin together with his spouse as joint tenants with right of survivorship, (iii) 5,484 shares of restricted stock, (iv) 15,000 shares of performance accelerated restricted stock, (v) 6,500 shares of performance-based restricted stock, and (vi) 95,751 shares of common stock issuable upon the exercise of stock options. |

| (10) | Includes (i) 3,230 shares of common stock owned individually by Mr. Tatham, (ii) 1,950 shares of common stock owned by Mr. Tatham’s spouse, and (iii) 37,000 shares of common stock issuable upon the exercise of stock options. Mr. Tatham disclaims beneficial ownership as to the shares of common stock owned by his spouse. |

| (11) | Includes (i) 15,184 shares of common stock owned individually by Mr. Thomas, (ii) 137,425 shares of common stock owned by Nevcorp, Inc., a corporation controlled by a trust for which Mr. Thomas and his wife serve as trustees, (iii) 4,772 shares of common stock held in four trusts for the benefit of Mr. Thomas’ children and for which he serves as a trustee, (iv) 26,181 shares of common stock owned by Mr. Thomas’ spouse, and (v) 67,500 shares of common stock issuable upon the exercise of stock options. Mr. Thomas disclaims beneficial ownership as to the shares of common stock owned by his spouse, Nevcorp, Inc. and the four trusts. |

| (12) | Includes (i) 9,136 shares of common stock, (ii) 19,318 shares of restricted stock, (iii) 39,000 shares of performance accelerated restricted stock, (iv) 22,000 shares of performance-based restricted stock, and (v) 276,404 shares of common stock issuable upon the exercise of stock options. |

| (13) | Based on correspondence received from Conopco, Inc. dated April 26, 2004, includes (i) 1,602,480 shares owned by Conopco, Inc., and (ii) 695,420 shares owned by the Unilever United States Foundation, Inc., a charitable organization. Conopco disclaims beneficial ownership as to the shares of common stock owned by the Unilever United States Foundation, Inc. |

| (14) | Based on a Schedule 13G/A reporting ownership as of January 7, 2004 filed by Goodman & Company, Investment Counsel Ltd. (formerly Dynamic Mutual Funds Ltd.). Shares are held in certain accounts managed by Goodman & Company, Investment Counsel Ltd. (formerly Dynamic Mutual Funds Ltd.) acting as investment counsel and portfolio manager. |

-3-

| (15) | Based on a Schedule 13G reporting ownership as of December 31, 2003 filed by William Blair & Company, L.L.C. |

| (16) | Includes 2,177,004 shares of common stock issuable upon exercise of stock options. |

PROPOSAL 1—

ELECTION OF DIRECTORS

Information about the Nominees

Six directors are to be elected at the annual meeting. The six nominees named below are currently serving as our directors and have been designated by the board of directors as nominees for election as directors, to serve until the next annual meeting of shareholders and until their successors are duly elected and qualified. In the event that any nominee is unable or unwilling to serve, discretionary authority is reserved to the persons named in the accompanying form of proxy to vote for substitute nominees. The board of directors does not anticipate that such an event will occur. Each director must be elected by a plurality of the votes cast.

The names of the nominees for our board of directors and information about them are set forth below.

E. Scott Beattie, age 45, has served as our chairman of the board of directors since April 2000, as our chief executive officer since March 1998 and as a director of the company (including the predecessor fragrance company) since January 1995. Mr. Beattie served as our president from April 1997 to March 2003, as our chief operating officer from April 1997 until March 1998 and as vice chairman of the board of directors and assistant secretary from November 1995 to April 1997. Mr. Beattie served as executive vice president of Bedford Capital Corporation, a Toronto, Canada-based merchant banking firm, from March 1995 to March 1998. Prior to co-founding Bedford Capital Corporation, Mr. Beattie served as vice president and director of mergers & acquisitions of Merrill Lynch, Inc., where he specialized in management buyouts and divestitures. Mr. Beattie was also a manager of Andersen Consulting, specializing in the design and implementation of enterprise resource planning systems. Mr. Beattie is a director of Bedford Capital Corporation, a director of the Cosmetic, Toiletry & Fragrance Association and a member of the advisory board of the Ivey Business School.

J. W. Nevil Thomas, age 66, has served as our vice chairman of the board of directors since April 1997 and previously served as chairman of the board of directors of the company (including the predecessor fragrance company) from July 1992 to April 1997. Since 1970, Mr. Thomas has served as president of Nevcorp, a financial and management consulting firm that is controlled by Mr. Thomas. Mr. Thomas is also chairman of the board of Bedford Capital Corporation and a director of Reliable Life Insurance Company and Old Republic Insurance Company of Canada, non-public wholly-owned subsidiaries of Old Republic International Corporation, and a director of Templeton Growth Funds, Ltd., a publicly traded mutual fund managed by a wholly-owned subsidiary of Franklin Resources, Inc.

Fred Berens, age 61, has served as a director since July 1992 (including the predecessor fragrance company). Mr. Berens has served as director, investments of Wachovia Securities, Inc. (formerly known as Prudential Securities, Inc.), an investment banking firm, since March 1965. Mr. Berens served as a director of our company, when it was known as Suave Shoe Corporation, until December 1994.

Richard C. W. Mauran, age 70, has served as a director of the company since July 1992 (including the predecessor fragrance company). Mr. Mauran is a private investor and a director of Bedford Capital Corporation.

-4-

George Dooley, age 71, has served as a director of the company since March 1996. Mr. Dooley served as president and chief executive officer of (i) Community Television Foundation of South Florida, Inc., a not-for-profit corporation supporting, and a licensee of, public television station WPBT Channel 2, from 1955 to 2004, (ii) WPBT Communications Foundation, Inc., a not-for-profit corporation supporting public television station WPBT Channel 2, from 1981 to 2004, and (iii) Comtel, Inc., a company providing television facilities to television producers, since 1981.

William M. Tatham, age 44, has served as a director of the company since July 2001. Mr. Tatham has served as chief executive officer of XJ Partners, Inc., a Canada-based strategy consulting company, since September 2001. From November 2000 to June 2001, Mr. Tatham served as vice president and general manager of Siebel Systems, Inc., an eBusiness applications software company. From 1990 until its acquisition by Siebel Systems in November 2000, Mr. Tatham served as the president and chief executive officer of Janna Systems, Inc., a Canada-based software development company that Mr. Tatham founded. Mr. Tatham serves as Executive Chairman of Bycast, Inc., a Canada-based developer of grid computing storage solutions for medical imaging.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH NOMINEE FOR DIRECTOR.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Federal securities laws require our directors, executive officers and persons who beneficially own more than ten percent of our common stock to file reports of initial ownership and reports of subsequent changes in ownership with the U.S. Securities and Exchange Commission (“SEC”) and to provide us copies of these reports. Specific due dates have been established and we are required to disclose any failure of these persons to file timely those reports during our fiscal year ended January 31, 2004. To the best of our knowledge, based solely upon a review of copies of reports furnished to us, filings with the SEC and written representations that no other reports were required, all of our directors, executive officers and ten percent or greater beneficial owners of common stock made all such filings timely, except that one report reporting one transaction for each of Messrs. Beattie, Ronkin, Smith, Tatham and West and three reports reporting five transactions for Mr. Rolleston, were inadvertently filed late.

GOVERNANCE OF THE COMPANY

Corporate Governance Guidelines and Principles. Our Corporate Governance Guidelines and Principles includes responsibilities and qualification standards of the members of our board of directors and is intended as a component of the flexible governance framework within which the board of directors, assisted by its committees, directs our affairs. The full text of our Corporate Governance Guidelines and Principles, as approved by the board of directors, is attached as Annex A to this proxy statement. These guidelines also are published on our website at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance.”

The independent directors on the board of directors are required to meet regularly without members of management or other directors present in executive session, no less frequently than twice a year, and as otherwise determined by such directors. A majority of the board of directors are required to be independent directors as defined in the listing standards of the Nasdaq Stock Market, Inc. (“Nasdaq”) and the SEC rules. The board of directors has determined that every director, with the exception of Mr. Beattie, is independent under the Nasdaq and SEC rules.

Shareholders are invited to communicate with the board of directors, individual members of the board or its committees by writing to: Secretary, Elizabeth Arden, Inc., 14100 N.W. 60th Ave, Miami Lakes, FL 33014.

-5-

Code of Business Conduct. All our employees, officers and directors are required to abide by our Code of Business Conduct and adhere to the highest ethical standards in full compliance with all applicable laws and regulations and with the utmost integrity and honesty. The full text of the Code of Business Conduct, as approved by the board of directors, is published on our website, at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance—Code of Business Conduct.”

Supplemental Code of Ethics. Our directors, the chief executive officer, the chief financial officer and the executive and finance officers are also required to comply with the Supplemental Code of Ethics for the Directors and Executive and Finance Officers. This Code of Ethics is intended to cover, among other things, the areas of ethical dealings on our behalf, or with us, avoidance and handling of conflict of interest situations and review of accounting matters, including disclosure controls and procedures and internal controls over financial reporting. Any violation of the Code of Ethics or any violation of law must be reported to the company’s general counsel or the audit committee, which may be done anonymously, in accordance with the procedures set forth in the Code of Ethics and the Code of Business Conduct.

The full text of this Code of Ethics, as approved by the board of directors, is published on our website, at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance—Code of Ethics for Directors and Executive and Finance Officers.” We intend to disclose future amendments to, or waivers from, the provisions of this Code of Ethics on our website.

Meetings and Committees of Board of Directors

During fiscal 2004, the board of directors met eight times and each director attended at least 75% of the total meetings of the board of directors and at least 75% of the total meetings of the committees of the board of directors on which he served. During fiscal 2004, the board of directors had two committees—the audit committee and the compensation committee. Our nominating and corporate governance committee was established on March 10, 2004 and has not conducted any meetings.

Directors are not required to attend our annual meetings of shareholders. At our 2003 annual shareholders meeting, Mr. Beattie was present.

The following table provides fiscal 2004 meeting information for these committees and current membership for each of the committees of the board of directors.

| | | | | | | | | |

Director

| | Audit

| | | Compensation

| | | Nominating

and

Corporate

Governance**

| |

Mr. Berens | | X | * | | X | * | | | |

Mr. Dooley | | X | | | X | | | | |

Mr. Mauran | | | | | | | | X | |

Mr. Thomas | | X | | | | | | | |

Mr. Tatham | | | | | X | | | X | |

Total Fiscal 2004 Meetings | | 5 | | | 1 | | | | ** |

| ** | Committee was established in March 2004 and no meetings were held during the fiscal year ended January 31, 2004. |

-6-

The Audit Committee.

The audit committee oversees the quality and integrity of our accounting and financial reporting process, the adequacy of our internal controls, the audits of our financial statements, and carries out such other duties as directed by the board of directors. Its duties include, among others, the following: (1) selecting, negotiating the compensation, and overseeing the work, of the independent public auditor including approving all auditing, audit-related and permitted non-audit services performed for us by the independent auditor; (2) reviewing the planning and staffing of the audit; (3) investigating matters brought to the attention of the audit committee; (4) reviewing our financial reporting activities, including the annual and quarterly reports, the accounting principles, standards, policies and practices followed and the adequacy of our internal controls over financial reporting; and (5) reviewing disclosures made to the audit committee and in the company filings with the SEC.

This summary of the responsibilities of the audit committee, as approved by the board of directors, is qualified in its entirety by the more detailed information included in the audit committee charter, a copy of which is attached as Annex B to this proxy statement, and is also available on our website at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance—Committee Charters—Audit Committee.” In addition, a separate report of the audit committee is set forth below.

Our board of directors have determined that Messrs. Berens and Thomas are “audit committee financial experts” for purposes of the SEC’s rules and that all of the members of the audit committee are independent, as defined by the applicable Nasdaq rules.

The Compensation Committee.

The compensation committee is responsible for the following: (1) establishing an overall compensation strategy and guidelines for employees, including making grants of stock and options awards pursuant to stock incentive plans; (2) reviewing and approving the compensation of our executive officers; and (3) administering the stock incentive and purchase plans.

This summary of the responsibilities of the compensation committee, as approved by the board of directors, is qualified in its entirety by the more detailed information included in the committee’s charter, a copy of which is attached as Annex C to this proxy statement, and is also available on our website at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance—Committee Charters—Compensation Committee.” In addition, a separate report of the compensation committee is set forth below.

The board of directors has determined that each of the members of the compensation committee is independent, as defined by the applicable Nasdaq rules.

The Nominating and Corporate Governance Committee.

In March 2004, the board of directors established a nominating and corporate governance committee whose responsibilities include recommending to the board of directors candidates for nomination for election or re-election by the shareholders, considering corporate governance issues and developing appropriate recommendations and policies for the board of directors regarding such matters.

The nominating and corporate governance committee’s assessment of members of the board of directors and its nominees includes issues of judgment, diversity, age, skills (such as understanding of relevant business experience, financial background, etc.), in the context of an assessment of the perceived needs of the board of directors at the time of assessment. The nominating and corporate governance committee considers recommendations for board of directors candidates submitted by shareholders using the same criteria it applies to recommendations from its committee, directors or members of management. Shareholders may submit recommendations by writing to the nominating and corporate governance

-7-

committee as follows: Nominating and Corporate Governance Committee, c/o Secretary, Elizabeth Arden, Inc., 14100 NW 60th Ave, Miami Lakes, FL 33014. In addition to recommendations of director candidates to the nominating and corporate governance committee, shareholders of record may nominate candidates for election to the board of directors by following the procedures set forth in our By-laws.

This summary of the responsibilities of the nominating and corporate governance committee is qualified in its entirety by the more detailed information included in the committee’s charter, a copy of which is attached as Annex D to this proxy statement, and is also available on our website at www.elizabetharden.com, under the section “Corporate Information—Investor Information—Corporate Governance—Committee Charters—Nominating and Corporate Governance Committee.”

The board of directors has determined that both members of the nominating and corporate governance committee are independent in accordance with applicable Nasdaq rules.

DIRECTOR COMPENSATION

The board of directors’ general policy on director compensation is that compensation for independent directors should consist of both cash and equity-based compensation. Directors who are our employees (currently Mr. Beattie) are not paid for board service in addition to their regular employee compensation. For board service since the June 2003 annual meeting of shareholders, non-employee directors (currently Messrs. Berens, Dooley, Mauran, Tatham and Thomas) received an annual retainer of $25,000 and a fee of $1,000 for each meeting of our board of directors attended or a committee of the board attended on a date separate from a board meeting. In the event a committee meeting was on the same date as a board meeting, the board member received $500 for attending the committee meeting. A $3,500 annual retainer was paid to the audit committee chairperson and a $2,500 annual retainer was paid to the compensation committee chairperson. Non-employee directors received a grant of stock options for 5,000 shares of our common stock under our Non-Employee Director Stock Option Plan upon re-election to the board at the 2003 annual meeting of shareholders. These options will be exercisable on June 25, 2006, which is three years after the date of grant, and the exercise price for each option is equal to $13.04, which was the closing price of our common stock on the date of grant. In addition, our board members were reimbursed for all expenses incurred in connection with their activities as directors.

In 2003, the compensation committee retained Mercer Human Resource Consulting, a global compensation and benefits consulting firm, to review board of directors’ compensation. As a result of that review, the board determined that market practices of a peer group of consumer products and beauty companies supported an increase in cash compensation and a decrease in equity compensation for our non-employee directors and, accordingly, the board changed board compensation to be more consistent with those market practices. The changes included a decrease in the annual grant of stock options upon re-election to the board from 15,000 shares to 5,000 shares and an increase in the vesting period from one year to three years. At the time, Mercer’s review suggested that an annual award of 7,000 shares of stock options would reflect market conditions, but that a reduction to 5,000 shares would be consistent with the approach taken in 2003 with respect to employee option grants because of stock incentive run rate limitations. This year, the board determined that a grant of 7,000 shares of stock options upon re-election to the board at the next annual meeting was appropriate and consistent with Mercer’s recommendations. This change will become effective if the 2004 Non-Employee Director Stock Option Plan is approved at our June 2004 annual shareholders meeting. The cash compensation to our board members will remain the same as we established last year. In addition, our board members will continue to be reimbursed for all expenses incurred in connection with their activities as directors.

-8-

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the annual compensation for services in all capacities to us for the fiscal years ended January 31, 2004, January 31, 2003 and January 31, 2002 of the chief executive officer and each of our four executive officers who were serving in that capacity at January 31, 2004:

| | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | Long-Term Compensation |

| | | | Annual Compensation

| | | Awards

|

Name and Principal Position

| | Year (1)

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)(2)

| | | Restricted Stock Awards ($)

| | | Securities Underlying Options (#) (3)

| | All Other Compensation ($)(4)

|

E. Scott Beattie

Chairman and

Chief Executive Officer | | 1/31/04

1/31/03

1/31/02 | | 569,333

413,333

400,000 | | 495,000

187,500

— | | 3,766

394

3,195 |

| | 499,144

929,890

12,677 | (5)

(6)

(7) | | 75,600

135,000

— | | 16,309

19,990

7,783 |

| | | | | | | |

Paul F. West

President and

Chief Operating Officer | | 1/31/04

1/31/03

1/31/02 | | 391,667

345,833

325,000 | | 286,000

113,750

— | | 2,999

525

76,281 |

| | 246,232

451,871

8,711 | (5)

(6)

(7) | | 36,960

65,000

— | | 14,866

13,082

5,354 |

| | | | | | | |

Stephen J. Smith

Executive Vice President and

Chief Financial Officer(8) | | 1/31/04

1/31/03

1/31/02 | | 321,833

305,000

214,807 | | 175,500

166,800

— | | —

—

125,163 |

(9) | | 123,449

281,735

1,938 | (5)

(6)

(7) | | 18,000

40,000

100,000 | | 9,964

11,033

1,487 |

| | | | | | | |

Ronald L. Rolleston

Executive Vice President,

Global Marketing | | 1/31/04

1/31/03 | | 292,500

287,500 | | 158,490

117,083 | | 3,036

393 |

| | 70,514

280,483 | (5)

(6) | | 10,000

40,000 | | 12,623

12,917 |

| | | | | | | |

Joel B. Ronkin

Executive Vice President

and Chief Administrative

Officer | | 1/31/04

1/31/03 | | 239,333

208,333 | | 105,436

92,500 | | 920

159 |

| | 69,147

176,454 | (5)

(6) | | 10,000

25,000 | | 11,386

11,491 |

| (1) | The amounts shown for “1/31/04,” “1/31/03” and “1/31/02” are for the fiscal years ended January 31, 2004, 2003 and 2002, respectively. |

| (2) | During the fiscal years ended January 31, 2004, 2003 and 2002, respectively, the named executives were reimbursed for the following amounts of taxes incurred as a result of the payment of executive disability insurance premiums: (a) E. Scott Beattie – $3,766, $394 and $3,195; (b) Paul F. West – $2,999, $525 and $2,703; (c) Ronald L. Rolleston – $3,036 (fiscal 2004) and $393 (fiscal 2003); and (d) Joel B. Ronkin – $920 (fiscal 2004) and $159 (fiscal 2003). The amount shown for Mr. West for the fiscal year ended January 31, 2002 also includes $58,141 that was reimbursed by us for relocation-related expenses, as well as $15,437 that was reimbursed by us for the payment of taxes on the relocation reimbursement benefit. The amounts reflected in the above table do not include any other amounts for perquisites and other personal benefits. Except as stated above for Mr. West and as stated in Note 9 for Mr. Smith, the aggregate amount of such compensation for each named executive did not exceed the lesser of either $50,000 or 10% of the total annual salary and bonus and, accordingly, has been omitted from the table as permitted by the rules of the SEC. |

| (3) | Option grants awarded during the fiscal years ended January 31, 2004 and 2003, respectively, were for performance during the fiscal years ended January 31, 2003 and 2002, respectively. |

-9-

| (4) | Amounts consist of matching payments made by us under our 401(k) plan, term life insurance premiums and disability insurance premiums paid or reimbursed by us. For the fiscal year ended January 31, 2004, these amounts were as follows: |

| | | | | | |

Name

| | 401(k) Match($)

| | Life Insurance($)

| | Disability

Insurance($)

|

E. Scott Beattie | | 9,432 | | 1,340 | | 5,537 |

| | | |

Paul F. West | | 9,524 | | 1,287 | | 4,055 |

| | | |

Stephen J. Smith | | 8,063 | | 1,121 | | 780 |

| | | |

Ronald L. Rolleston | | 8,020 | | 957 | | 3,646 |

| | | |

Joel B. Ronkin | | 8,793 | | 802 | | 1,791 |

| (5) | During the fiscal year ended January 31, 2004, we granted restricted stock to each of the named executives on two different dates. On June 25, 2003, we granted restricted stock to the named executives in the following amounts: (i) Mr. Beattie – 37,800 shares; (ii) Mr. West – 18,480 shares; (iii) Mr. Smith – 9,000 shares; (iv) Mr. Rolleston – 5,000 shares; and (v) Mr. Ronkin – 5,000 shares. These grants of restricted stock vest in thirds over a three-year period from the date of grant. In addition, we also granted on April 21, 2003 restricted stock to all regular, full-time employees based in the United States and Puerto Rico which is due to vest one year from the date of grant, including grants to the named executives as follows: (i) Mr. Beattie – 611 shares; (ii) Mr. West – 515 shares; (iii) Mr. Smith – 597 shares; (iv) Mr. Rolleston – 521 shares; and (v) Mr. Ronkin – 387 shares. Grants of restricted stock vest only if the employee is employed by us on the vesting date (with limited exceptions), and the shares are eligible for the payment of dividends, if the board of directors were to declare dividends on the common stock. |

Amounts represent the dollar value of the restricted stock granted during the fiscal year ended January 31, 2004, determined by multiplying the total number of shares of restricted stock granted to the named executives on the dates of such grants by the respective closing prices of our common stock on those grant dates. At January 31, 2004, based on the closing price of the common stock on the last stock trading day of fiscal 2004: (a) Mr. Beattie had 119,411 shares of restricted stock (valued at $2,419,267); (b) Mr. West had 57,995 shares of restricted stock (valued at $1,174,979); (c) Mr. Smith had 33,597 shares of restricted stock (valued at $680,675); (d) Mr. Rolleston had 29,521 shares of restricted stock (valued at $598,095); and (e) Mr. Ronkin had 20,387 shares of restricted stock (valued at $413,041).

| (6) | During the fiscal year ended January 31, 2003, we granted two types of restricted stock to each of the named executives: (a) performance accelerated restricted stock (PARS) on March 22, 2002, which has a vesting period of six years that can be accelerated to three, four or five years from the date of grant if the company’s total shareholder return exceeds the median total shareholder return of the companies comprising the Russell 2000 Index over the respective three, four or five-year period and, in such circumstance, would cause an award of a new grant of PARS; and (b) restricted stock on March 21, 2002 and September 3, 2002, which was due to vest one year from the date of grant and was granted to all our regular, full-time employees based in the United States and Puerto Rico. Shares of both PARS and restricted stock vest only if the employee is still employed by us on the vesting date (with limited exceptions), and the shares are eligible for the payment of dividends, if the board of directors were to declare dividends on the common stock. |

During the fiscal year ended January 31, 2003, we granted: (i) Mr. Beattie – 81,000 shares of PARS and 1,210 shares of restricted stock; (ii) Mr. West – 39,000 shares of PARS and 996 shares of restricted stock; (iii) Mr. Smith – 24,000 shares of PARS and 983 shares of restricted stock; (iv) Mr. Rolleston – 24,000 shares of PARS and 861 shares of restricted stock; and (v) Mr. Ronkin – 15,000 shares of PARS and 651 shares of restricted stock.

Amounts represent the dollar value of the restricted stock granted during the fiscal year ended January 31, 2003, determined by multiplying the total number of shares of restricted stock granted to the named executives on the dates of such grants by the respective closing prices of our common stock on those grant dates.

| (7) | During the fiscal year ended January 31, 2002, shares of regular restricted stock, which vest one year from the date of grant, were granted on October 12, 2001 to all our regular, full-time employees based in the United States and Puerto Rico. Amounts represent the dollar value of the restricted stock, determined by |

-10-

multiplying the number of shares of restricted stock granted during the fiscal year ended January 31, 2002 by the closing price of our common stock on the date of grant.

| (8) | Mr. Smith was appointed to the position of executive vice president and chief financial officer in May 2001. |

| (9) | Amount represents $65,163 paid to offset forgone incentive compensation from a prior employer and $60,000 paid to defray certain taxes. Mr. Smith’s stock option grant during the fiscal year ended January 31, 2002 was issued in May 2001 as an incentive to join us. |

Option Grants In Last Fiscal Year

The following table sets forth information concerning stock options granted during the fiscal year ended January 31, 2004 to the named executives:

| | | | | | | | | | | | | |

| | | Individual Grants

| | |

Name

| | Number of Securities Underlying

Options Granted(#)(1)

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price ($/

Share)(2)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term($)(3)

|

| | | | | | | | | | | | 5%

| | 10%

|

E. Scott Beattie | | 75,600 | | 17.7 | % | | 13.04 | | 6/25/13 | | 619,979 | | 1,571,150 |

Paul F. West | | 36,960 | | 8.6 | % | | 13.04 | | 6/25/13 | | 303,101 | | 768,118 |

Stephen J. Smith | | 18,000 | | 4.2 | % | | 13.04 | | 6/25/13 | | 147,614 | | 374,083 |

Ronald L. Rolleston | | 10,000 | | 2.3 | % | | 13.04 | | 6/25/13 | | 82,008 | | 207,824 |

Joel B. Ronkin | | 10,000 | | 2.3 | % | | 13.04 | | 6/25/13 | | 82,008 | | 207,824 |

| (1) | The options vest in equal thirds over a three-year period on the anniversary date of the grant if the employee is still employed by us at that time (with limited exceptions) unless there is a change in control, in which case the option vests immediately. |

| (2) | The exercise price of the options granted was based upon the closing price of our common stock on the date of grant. |

| (3) | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration dates. Hypothetical gains are calculated based on rules promulgated by the SEC and do not represent an estimate by us of our future stock price growth. This table does not take into account any appreciation in the price of our common stock to date. Actual gains, if any, on option exercises and common stock holdings are dependent on the timing of those exercises and the future performance of the common stock. There can be no assurances that the rates of appreciation assumed in this table can be achieved, or that the amounts reflected would be received by the named executives. |

-11-

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information concerning options exercised by the named executives during the fiscal year ended January 31, 2004 and unexercised options held by the named executives at January 31, 2004:

| | | | | | | | |

Name

| | Shares

Acquired on Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities Underlying

Unexercised Options at Fiscal Year-End Exercisable / Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($) Exercisable / Unexercisable (2)

|

E. Scott Beattie | | 1,600 | | 18,872 | | 1,008,400 / 165,600 | | 8,266,734 / 1,349,532 |

Paul F. West | | 50,000 | | 571,565 | | 242,417 / 80,293 | | 2,542,053 / 653,815 |

Stephen J. Smith | | — | | — | | 13,334 / 144,666 | | 119,073 / 578,087 |

Ronald L. Rolleston | | 44,921 | | 468,498 | | 79,163 / 36,666 | | 752,673��/ 310,327 |

Joel B. Ronkin | | — | | — | | 84,084 / 26,666 | | 828,414 / 221,027 |

| (1) | Value is based on the difference between the option exercise price and the closing price of the common stock on the date of exercise multiplied by the number of shares underlying the option. |

| (2) | Value is based on the difference between the option exercise price and the closing price of the common stock on January 31, 2004 multiplied by the number of shares underlying the option. |

Equity Compensation Plan Information

The following table sets forth information concerning common stock authorized for issuance under compensation plans of the company at January 31, 2004:

| | | | | | | |

Plan Category

| | Number of

securities

to be issued

upon

exercise of

outstanding

options,

warrants

and

rights(1)

| | Weighted-

average

exercise

price of

outstanding

options,

warrants

and rights

| | Number of

securities

remaining

available for

future

issuance

under equity

compensation

plans

(excluding

securities

reflected in

the first

column)

|

Equity compensation plans approved by security holders | | 3,850,638 | | $ | 11.98 | | 709,890 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 3,850,638 | | $ | 11.98 | | 709,890 |

| (1) | Does not include 784,242 shares of restricted common stock issued under our 2000 Stock Incentive Plan. |

-12-

Employment Contracts and Termination of Employment and Change in Control Arrangements

None of our executive officers has employment contracts. In March 2002, the compensation committee of the board recommended, and the board approved, a severance and change in control arrangement for senior executives, including the named executives. Under the arrangement, the executive receives severance benefits, based on his or her position and responsibility, in the event the executive’s employment is terminated without “cause” and is not the result of a resignation or death. Currently, the severance benefit for the named executives is as follows: (a) Mr. Beattie, 24 months of base salary; (b) Mr. West, 18 months of base salary; (c) Mr. Smith, 24 months of base salary plus preceding year’s bonus; and (d) Messrs. Rolleston and Ronkin, 12 months of base salary.

Under the change in control arrangement, a severance benefit is paid to senior executives based on a “base amount” in the event there is an actual or constructive termination of employment (e.g., decrease in pay or job responsibility) following a change in control, except as noted below. “Base amount” is the average salary plus average bonus the executive has received over the most recent five-year period. The monthly base amount is the base amount divided by twelve. Currently, the severance benefit due to a change in control for the named executives is as follows: (a) Mr. Beattie, 35.88 months of monthly base amount; (b) Mr. West, 24 months of monthly base amount; (c) Mr. Smith, 24 months of base salary plus preceding year’s bonus; and (d) Messrs. Rolleston and Ronkin, 18 months of monthly base amount.

Compensation Committee Interlocks and Insider Participation

All members of the compensation committee of the board of directors during the fiscal year ended January 31, 2004 were independent directors, and none of them were employees or former employees of the company. During the fiscal year ended January 31, 2004, none of our executive officers served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on the compensation committee of our board of directors.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In March 2002, we provided a loan to Mr. Beattie in the aggregate principal amount of $500,000, which matured on March 31, 2004 and bore quarterly interest at a rate of 5%. This loan replaced earlier loans made by us to Mr. Beattie in 1998. In July 2002, Mr. Beattie re-paid $100,000 of the principal amount of the loan. The highest amount of principal and accrued interest on the loan outstanding at any time during the fiscal year ended January 31, 2004 was $405,000. The loan balance and accrued interest was re-paid by Mr. Beattie in March 2004.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Overview of Compensation Philosophy and Program

Elizabeth Arden’s executive compensation program consists of base salaries, short-term incentive cash payments and long-term incentive compensation. All of the components of executive compensation are designed to facilitate fulfillment of our compensation objectives, which include:

| | • | providing market-competitive compensation to attract, retain and motivate key management personnel; |

| | • | relating management compensation to the achievement of company goals and performance; and |

| | • | aligning the interests of management with those of the company’s shareholders. |

-13-

The determination of the total compensation package for the company’s senior management and other key personnel was made after reviewing and considering a number of factors, including achievement of company goals and the individual’s contribution to the achievement of those goals, job responsibility, level of individual performance, compensation levels at competitive companies, as well as at companies of a similar size and type, and the company’s historical compensation levels. Except for short-term incentive cash payments, which generally are based on an individual’s attainment of certain pre-determined key performance indicators and company financial performance targets, the compensation decisions for fiscal 2004 performance were based upon an overall review of all of the relevant factors without giving specific weight to any one factor.

Evaluation of Compensation Strategy and Programs

In 2002, the compensation committee, with assistance from Mercer Human Resource Consulting, a global compensation and benefits consulting firm, formalized the company’s compensation strategy and its compensation programs. We again retained Mercer this year to assist us in the evaluation of the company’s compensation strategy and programs for executives and employees and to ensure that the strategy and programs continue to accomplish the company’s objectives.

After a review of market conditions and competitive practices, we determined that the compensation strategy adopted in 2002 is still appropriate and, in many ways, established compensation practices that we believe are best practices and are consistent with the practices of other leading companies. In accordance with that strategy, we intend to target base salaries below market median levels for the most senior executives and at market median levels for other executives and key employees. Total cash compensation, which includes base salary and bonus, was targeted at levels that are somewhat above the market median for positions below the senior executive level, while total cash compensation levels for senior executives will be targeted at slightly lower levels due to our desire to place the primary compensation emphasis on long-term incentives. The relatively greater emphasis on long-term incentives for our management group underscores the company’s primary business strategy of maximizing shareholder value.

Consistent with this compensation strategy, we have adopted a general framework for determining the various components of the compensation of the company’s management group on an annual basis. In general, short-term incentive cash payments (e.g., bonuses) and long-term incentive grants (e.g., stock options and restricted stock grants) will be determined as a percentage of base salary, with variances based on level of responsibility, individual performance and market conditions.

Short-Term Incentive Program

The company’s short-term incentive program consists of cash bonuses and is designed to motivate and reward eligible employees for both company and individual performance. The incentive program is designed to result in incentive payments below the market median when company performance is below targets, and incentive payments above the market median when company performance exceeds targets. Short-term incentive program payouts are determined, in most cases, based upon the achievement of two types of performance objectives: company performance targets and individual key performance indicators. Generally, more senior-level employees have a greater percentage of their bonuses tied to company performance than individual performance in comparison with less senior-level employees. The short-term incentive opportunities of both the company’s chief executive officer and its chief operating officer are based 100% upon company performance. The maximum short-term incentive payout opportunity for any employee is two times base salary.

In determining management bonuses for fiscal 2004 performance, the primary factor used for the measurement of company performance was the company’s achievement of actual versus budgeted EBITDA (net income plus provision for income taxes, plus interest expense, plus depreciation and amortization), adjusted to exclude debt extinguishment charges associated with refinancing activities as

-14-

well as operational restructuring charges. Excluding these charges, the company exceeded its budgeted EBITDA for fiscal 2004 and, thus, pursuant to the terms of the company’s short-term incentive program, eligible participants received payouts equal to 110% of the corporate-performance portions of the their par bonus potentials for fiscal 2004. With respect to individual performance, eligible short-term incentive program participants were evaluated and compensated based upon their achievement of certain key performance indicators established for each participant for fiscal 2004.

Long-Term Incentive Programs

To assist us in our review, we asked Mercer to analyze the long-term incentive programs of companies that were of a similar size or type or from a similar industry as the company, including other consumer product companies. As a result of this review, we have determined that we should target an annualized level of stock incentive grants (i.e., run rate) of approximately 3.0% of common shares outstanding (including shares convertible into common stock). Because there were, however, an insufficient number of shares available to grant under the company’s stock incentive plans for fiscal 2004 performance, we authorized, and the board approved, granting additional stock incentives for this year at only a 2.7% run rate and recommended to the board of directors the adoption of the 2004 Stock Incentive Plan and the submission of the plan for shareholder approval. This plan, included in Annex E and described in Proposal 2 of this proxy statement, will provide a basis for future stock options and awards, which are designed to attract, retain and motivate our key employees and is consistent with our compensation strategy.

We decided to continue to award the company’s management team approximately equal values of stock option and restricted stock grants annually, as well as to continue to periodically grant other forms of restricted stock that would vest over a longer period of time. Mercer recommended, however, and we agreed, to change the type of restricted stock being granted annually from tenure-based restricted stock to performance-based restricted stock. We believe that the use of performance-based restricted stock better aligns the company’s management team’s interests with those of the company’s shareholders in that it requires the achievement of pre-established performance criteria as a condition to the vesting of those shares.

We used this revised approach in determining the appropriate number and type of long-term incentive shares to be awarded for fiscal 2004 performance. On March 10, 2004, we authorized, and the board approved, the grant of stock incentives to managerial employees in an aggregate amount of 556,000 shares, consisting of: (i) approximately 364,000 shares in the form of stock options, including 147,300 shares to the named executives, and (ii) approximately 192,000 shares in the form of performance-based restricted stock, including 87,250 shares to the named executives. The stock options are due to vest over three years in thirds after each succeeding year from the date of grant, assuming the person receiving the grant is employed by the company at the time of vesting. The exercise price of those stock options is $21.60 per share, which was the closing price of the company’s common stock on the date of grant. The options expire ten years from the date of grant.

The performance-based restricted stock will vest as to one third of the stock granted on each of the first, second and third anniversaries of the date of grant, but only if the person receiving the grant is employed by the company at the time of vesting and the company achieves a cumulative annualized increase in earnings per share of 10%, excluding any one-time or extraordinary events (as determined by the compensation committee), and after giving effect to any stock splits or other recapitalizations. The vesting dates are subject to deferral if the company’s fiscal year is less than 12 months long.

The amount and allocation of individual stock incentive grants relative to fiscal 2004 performance were set by us for all executive officers and were set by senior management, consistent with the guidelines established by the compensation committee, for all other eligible employees based on a number of factors, including job responsibilities, individual performance and market conditions.

-15-

Stock Ownership Requirements

In 2002, we established stock ownership requirements for all of the company executives at the level of senior vice president and above, and we required the executives to comply in stages over five years. The full ownership requirements range from one times base salary for senior vice presidents to five times base salary for the chief executive officer. The company’s chief executive officer already complies with the full ownership requirements and all of the company’s remaining named executives comply with the 50% ownership requirement required at this time. The ownership guidelines may be reviewed from time to time to ensure market competitiveness and to reflect appropriate market conditions.

Chief Executive Officer Compensation

One of our responsibilities includes reviewing and establishing the compensation of the company’s chief executive officer. In connection with our review of executive compensation this year, we asked Mercer to update the analysis of chief executive officer compensation it conducted last year. In addition, we asked Mercer to measure the company’s performance compared to a peer group of consumer product and beauty companies (the peer group) and assist us in determining if the pay of the company’s chief executive officer was appropriately linked.

Based on the updated review of market data and the analysis of the pay-and-performance linkage, we determined that the cash compensation of the company’s chief executive officer, E. Scott Beattie, was below market levels and that an increase in his base pay would be appropriate in light of the performance of both Mr. Beattie and the company. Specifically, the median base salary for chief executive officers, based on Mercer’s salary survey of the peer group and a broader group of similarly-situated executives, is approximately $721,000. Mercer has determined that a base salary midpoint of $648,900 (90% of $721,000) equates to approximately the 45th percentile of chief executive officer base pay, which is consistent with our strategy to pay slightly less than market salaries to the company’s most senior executives. As a result of these survey results and the pay-and-performance analysis and considering the company’s strong operating performance during fiscal 2004 and Mr. Beattie’s successful leadership and involvement in the company’s public offering of stock, the refinancing of its long-term debt and the consolidation of its U.S. distribution facilities, we have determined that an increase in Mr. Beattie’s base salary from $600,000 to $650,000 is appropriate for fiscal 2005.

Taking into account the decreased stock incentive run rate we adopted for fiscal 2004 performance and applying the company’s compensation strategy in an equitable fashion, on March 10, 2004 we granted Mr. Beattie an option to purchase 71,300 shares of common stock and an award of 42,250 shares of performance-based restricted stock related to fiscal 2004 performance. The stock option would vest and the restrictions on the restricted stock would lapse in the same manner as described previously with respect to the other March 10, 2004 stock incentive grants. In addition, as was the case with all other short-term incentive program participants, Mr. Beattie earned a bonus that equates to 110% of the corporate-performance portion of his par bonus potential for fiscal 2004 performance, which resulted in a bonus payment of $495,000.

William M. Tatham did not join in this report covering compensation for the company’s fiscal year ended January 31, 2004 as the matters described in this report were either begun or were implemented prior to his appointment to the compensation committee on March 10, 2004.

Fred Berens (Chairman)

George Dooley

-16-

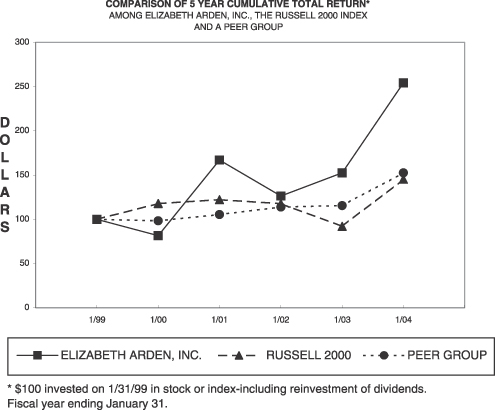

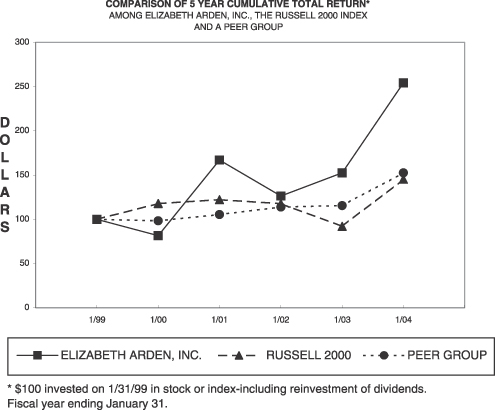

PERFORMANCE GRAPH

The following performance graph data and table compare the cumulative total shareholder returns, including the reinvestment of dividends, on our common stock with the companies in the Russell 2000 Index and a market-weighted index of publicly traded peer companies for the period from January 31, 1999 through January 31, 2004. The peer group is a good representation of consumer products and beauty companies with similar market capitalizations and/or business models to our company. The publicly traded companies in the peer group are Avon Products, Inc., Chattem, Inc., The Estee Lauder Companies, Inc., Inter Parfums, Inc. (formerly known as Jean Philippe Fragrances, Inc.) and Revlon, Inc. The graph and table assume that $100 was invested on January 31, 1999 in each of the Russell 2000 Index and the peer group and our common stock, and that all dividends were reinvested. Our common stock is listed on The Nasdaq National Market under the symbol “RDEN.”

| | | | | | | | | | | | |

| | | January 31,

|

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Elizabeth Arden, Inc. | | 100.00 | | 81.57 | | 167.07 | | 126.24 | | 152.58 | | 254.24 |

Russell 2000 Index | | 100.00 | | 117.74 | | 122.09 | | 117.70 | | 91.96 | | 145.31 |

Peer Group | | 100.00 | | 98.37 | | 105.44 | | 113.91 | | 115.52 | | 152.48 |

-17-

PROPOSAL 2–—

APPROVAL OF THE

2004 STOCK INCENTIVE PLAN

General

We are requesting that the shareholders vote in favor of the approval of the 2004 Stock Incentive Plan (the “2004 Plan”), which was adopted by the board of directors on May 10, 2004. If approved, the 2004 Plan will become the plan for providing stock-based incentive compensation to eligible employees and others that provide services to the company. The adoption of the 2004 Plan is consistent with, and will allow for the implementation of the compensation strategy and programs adopted by the board of directors of the company in 2002 as recommended by Mercer Human Resource Consulting. We believe our compensation strategy and programs are consistent with best practices and link employee compensation to the performance of the company and shareholder return. These practices include the increasing use of performance-based restricted stock and performance accelerated restricted stock (PARS), the establishment of stock ownership guidelines for executives and the implementation of a cash bonus program largely tied to company performance. We firmly believe that a broad-based stock incentive program is a necessary and powerful employee incentive and retention tool that benefits all of our shareholders.

In making the decision to adopt the 2004 Plan and recommend its approval to the shareholders, the board of directors noted that: (i) at April 26, 2004, there were virtually no shares of common stock available for grant under existing employee stock incentive plans, and additional shares are needed to implement the broad-based compensation programs established by the compensation committee for management and non-management employees; (ii) additional shares of common stock likely will be needed in March 2005 for stock incentive grants as our total shareholder return is likely to exceed the total shareholder return of the median of the companies comprising the Russell 2000 Index over a three year period and, in such circumstance, the PARS granted in March 2002 would vest and a new grant of PARS or other similar periodic stock incentive grant would be awarded; and (iii) at the target run rate of 3% adopted by the compensation committee this year based on market conditions, the 2004 Plan should have sufficient shares of common stock for regular grants projected in 2005 and 2006 and the PARS grant projected in 2005. Accordingly, on May 10, 2004, our board of directors adopted, subject to shareholder approval, the 2004 Plan establishing that the company may issue 2,000,000 shares of common stock under the 2004 Plan. If the shareholders approve the 2004 Plan at the annual meeting, it will become effective as of May 10, 2004 and the term during which options or stock awards may be granted will expire on May 10, 2014.

Summary of the 2004 Stock Incentive Plan

The following summary of the 2004 Plan is qualified in its entirety by reference to the full text of such plan, which is attached to this proxy statement as Annex E.

Administration. The 2004 Plan will be administered by the compensation committee of the board of directors, which is comprised of not less than two members who shall be (i) “Non-Employee Directors” within the meaning of Rule 16b-3(b)(3) (or any successor rule) promulgated under the Securities Exchange Act of 1934, as amended, and (ii) “outside directors” within the meaning of Treasury Regulation § 1.162-27(e)(3) under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The compensation committee is authorized, subject to the provisions of the 2004 Plan, to establish such rules and regulations as it deems necessary for the proper administration of the 2004 Plan and to make such determinations and interpretations and to take such action in connection with the 2004 Plan and any Benefits (as defined below) granted as it deems necessary or advisable. Thus, among the compensation committee’s powers are the authority to select officers and other employees of, and consultants and advisors to, us and our subsidiaries to receive Benefits, and to determine the form, amount and other terms and conditions of Benefits, the timing of any grants, the number of shares subject

-18-

to each award, the period of exercisability, the designation of options as incentive stock options (“ISOs”) or non-qualified options (“NSOs”) and the other terms and provisions thereof.

Eligibility. Benefits may be awarded to officers and employees of, and consultants and advisors to, our company and our subsidiaries and affiliates as the compensation committee in its sole discretion determines to be responsible for our success and future growth and profitability.

Type of Benefits. Benefits under the 2004 Plan may be granted in any one or a combination of (a) Stock Options, (b) Stock Appreciation Rights, (c) Stock Awards, (d) Performance Awards and (e) Stock Units (as such terms are defined in the 2004 Plan, and collectively, the “Benefits”). Stock Awards, Performance Awards and Stock Units may, as determined by the compensation committee in its discretion, constitute Performance-Based Awards, as described in Section 10 of the 2004 Plan. Benefits shall be evidenced by agreements (which need not be identical) in such forms as the compensation committee may from time to time approve;provided,however, that in the event of any conflict between the provisions of the 2004 Plan and any such agreements, the provisions of the 2004 Plan shall prevail. Benefits may be granted singly, in combination, or in tandem as determined by the compensation committee.

Stock Options. Under the 2004 Plan, the compensation committee may grant awards in the form of options to purchase shares of common stock (“Stock Options”). Stock Options may either be ISOs, qualifying for special tax treatment, or NSOs. The compensation committee will, with regard to each Stock Option, determine the number of shares subject to the Stock Option, the manner and time of the Stock Option’s exercise (but in no event later than ten years after the date of grant) and vesting, and the exercise price per share of stock subject to the Stock Option; however, the exercise price shall not be less than 100% of the fair market value of the common stock as reflected by the closing price of the common stock on the date the Stock Option is granted (the “Fair Market Value”). The exercise price may be paid in cash or, in the discretion of the compensation committee, by the delivery of shares of our common stock then owned by the participant, or by delivery to us of (x) irrevocable instructions to deliver directly to a broker the stock certificates representing the shares for which the Stock Option is being exercised, and (y) irrevocable instructions to such broker to sell such shares for which the Stock Option is being exercised, and promptly deliver to us the portion of the proceeds equal to the Stock Option exercise price and any amount necessary to satisfy our obligation for withholding taxes, or any combination thereof. For purposes of making payment in shares of common stock, such shares shall be valued at their Fair Market Value on the date of exercise of the Stock Option and shall have been held by the participant for at least six months. The compensation committee may prescribe any other method of paying the exercise price that it determines to be consistent with applicable law and the purpose of the 2004 Plan, including, without limitation, in lieu of the exercise of a Stock Option by delivery of shares of common stock then owned by a participant, providing us with a notarized statement attesting to the number of shares owned, where upon verification by us, we would issue to the participant only the number of incremental shares to which the participant is entitled upon exercise of the Stock Option or by us retaining from the shares of common stock to be delivered upon the exercise of the Stock Option that number of shares having a Fair Market Value on the date of exercise equal to the option price of the number of shares with respect to which the participant exercises the Stock Option.

In the case of ISOs, however, the exercise price per share of ISOs granted to any holder of our capital stock (or any subsidiary or parent corporation) representing 10% or more of our voting power (or any subsidiary or parent corporation) will be not less than 110% of the Fair Market Value of the common stock on the date the ISO is granted.

Stock Options granted under the 2004 Plan are exercisable at such times, in such amounts and during such period or periods as the compensation committee may determine at the date the option is granted, which period or periods will end, at the discretion of the compensation committee, not more than 10 years after the date of grant and, in the case of a person who at the date of grant owns our capital stock (or the capital stock of any subsidiary or parent corporation) representing 10% or more of our voting

-19-

power (or the voting power of any subsidiary or parent corporation), not more than five years from the date of grant. Except as otherwise provided under the Code, to the extent that the aggregate fair market value of shares subject to ISOs (under any of our plans or the plans of any subsidiary or parent corporation) exercisable for the first time in any calendar year exceeds $100,000, such excess will be treated as NSOs.

Stock Appreciation Rights (SARs). The 2004 Plan authorizes the compensation committee to grant an SAR either in tandem with a Stock Option or independent of a Stock Option. An SAR is a right to receive a payment, in cash, common stock, or a combination thereof, equal to the excess of (x) the Fair Market Value, or other specified valuation (which shall not be greater than the Fair Market Value), of a specified number of shares of common stock on the date the right is exercised over (y) the fair market value, or other specified valuation (which shall not be less than Fair Market Value), of such shares of common stock on the date the right is granted, all as determined by the compensation committee. Each SAR shall be subject to such terms and conditions as the compensation committee shall impose from time to time.

Stock Awards. The compensation committee may, in its discretion, grant Stock Awards (which may include mandatory payment of bonus incentive compensation in stock) consisting of common stock issued or transferred to participants with or without other payments therefore. Stock Awards may be subject to such terms and conditions as the compensation committee determines appropriate, including, without limitation, vesting, restrictions on the sale or other disposition of such shares, the right of the company to reacquire such shares for no consideration upon termination of the participant’s employment within specified periods, and may constitute Performance-Based Awards, as described below. The Stock Award shall specify whether the participant shall have, with respect to the shares of common stock subject to a Stock Award, all of the rights of a holder of shares of common stock, including the right to receive dividends and to vote the shares.