UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2008

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-6370

Elizabeth Arden, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Florida | | 59-0914138 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

2400 SW 145th Avenue, Miramar, Florida | | 33027 |

| (Address of principal executive offices) | | (Zip Code) |

(954) 364-6900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.01 Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of voting Common Stock held by non-affiliates of the registrant was approximately $443 million based on the closing price of the Common Stock on the NASDAQ Global Select Market of $20.35 per share on December 31, 2007, the last business day of the registrant’s most recently completed second fiscal quarter, based on the number of shares outstanding on that date less the number of shares held by the registrant’s directors, executive officers and holders of at least 10% of the outstanding shares of Common Stock.

As of September 5, 2008, the registrant had 28,804,588 shares of Common Stock outstanding.

Documents Incorporated by Reference

Portions of the Registrant’s definitive proxy statement relating to its 2008 Annual Meeting of Shareholders, to be filed no later than 120 days after the close of the Registrant’s fiscal year ended June 30, 2008, are hereby incorporated by reference in Part III of this Annual Report on Form 10-K.

1

Elizabeth Arden, Inc.

TABLE OF CONTENTS

2

PART I

ITEM 1. BUSINESS

General

Elizabeth Arden, Inc. is a global prestige beauty products company with an extensive portfolio of prestige fragrance, skin care and cosmetics brands. Elizabeth Arden branded products include the Elizabeth Arden fragrances:Red Door,Elizabeth Arden 5th Avenue,Elizabeth Arden Provocative Woman, Elizabeth Arden green tea, andElizabeth Arden Mediterranean; the Elizabeth Arden skin care brands:Ceramide,Eight Hour Cream,Intervene andPREVAGE®; and the Elizabeth Arden branded lipstick, foundation and other color cosmetics products. Our prestige fragrance portfolio includes the following celebrity, lifestyle and designer fragrances:

| | |

| Celebrity Fragrances | | Elizabeth Taylor’sWhite Diamonds andPassion, curious Britney Spears, fantasy Britney Spears andBritney Spears believe, with Love…Hilary Duff, Danielle by Danielle Steel, M by Mariah Carey, Usher |

| |

| Lifestyle Fragrances | | Curve, Giorgio Beverly Hills, Lucky, PS Fine Cologne for Men, Design and White Shoulders |

| |

| Designer Fragrances | | Juicy Couture, Badgley Mischka, Rocawear, Alberta Ferretti, Alfred Sung, Nannette Lepore, Geoffrey Beene, Halston, Bob Mackie, and GANT |

In addition to our owned and licensed fragrance brands, we distribute over 400 additional prestige fragrance brands, primarily in the United States, through distribution agreements and other purchasing arrangements.

We sell our prestige beauty products to retailers and other outlets in the United States and internationally, including;

| | • | | U.S. department stores such as Macy’s, Dillard’s, Belk, JCPenney, Saks, Bloomingdales and Nordstrom; |

| | • | | U.S. mass retailers such as Wal-Mart, Target, Sears, Kohl’s, Walgreens, Rite-Aid and CVS; and |

| | • | | International retailers such as Boots, Debenhams, Sephora, Marionnaud, Hudson’s Bay, Shoppers Drug Mart, Myer, Douglas and various travel retail outlets such as Nuance, Heinemann and World Duty Free. |

In the United States, we sell our Elizabeth Arden skin care and cosmetics products primarily in prestige department stores and our fragrances in department stores and mass retailers. We also sell our Elizabeth Arden fragrances, skin care and cosmetics products and other fragrance lines in approximately 90 countries worldwide through perfumeries, boutiques, department stores and travel retail outlets, such as duty free shops and airport boutiques, and on the internet.

Our operations are organized into the following reportable segments:

| | • | | North America Fragrance — Our North America Fragrance segment sells fragrances to department stores, mass retailers and wholesalers in the United States, Canada and Puerto Rico. This segment also sells our Elizabeth Arden products in prestige department stores in Canada and Puerto Rico, and to other selected retailers. |

| | • | | International — Our International segment sells our portfolio of owned and licensed brands, including our Elizabeth Arden products, in approximately 90 countries outside of North America through perfumeries, boutiques, department stores and travel retail outlets worldwide. |

3

| | • | | Other — The Other reportable segment sells our Elizabeth Arden products in prestige department stores in the United States and through the Red Door beauty salons, which are owned and operated by an unrelated third party. |

Financial information relating to our reportable segments is included in Note 18 to the Notes to Consolidated Financial Statements.

Our net sales to customers in the United States and in foreign countries (in U.S. dollars) and net sales as a percentage of consolidated net sales for the years ended June 30, 2008, 2007 and 2006, are listed in the following chart:

| | | | | | | | | | | | | | | | | | |

| | | Year Ended June 30, | |

| | | 2008 | | | 2007 | | | 2006 | |

| (Amounts in millions) | | Sales | | % | | | Sales | | % | | | Sales | | % | |

United States | | $ | 685.4 | | 60 | % | | $ | 706.5 | | 63 | % | | $ | 576.7 | | 60 | % |

Foreign | | | 455.7 | | 40 | % | | | 421.0 | | 37 | % | | | 377.9 | | 40 | % |

| | | | | | | | | | | | | | | | | | |

Total | | $ | 1,141.1 | | 100 | % | | $ | 1,127.5 | | 100 | % | | $ | 954.6 | | 100 | % |

| | | | | | | | | | | | | | | | | | |

Our largest foreign countries in terms of net sales for the years ended June 30, 2008, 2007 and 2006, are listed in the following chart:

| | | | | | | | | |

| | | Year Ended June 30, |

| (Amounts in millions) | | 2008 | | 2007 | | 2006 |

United Kingdom | | $ | 85.7 | | $ | 71.5 | | $ | 68.5 |

Australia | | | 40.1 | | | 38.8 | | | 32.1 |

Canada | | | 40.0 | | | 31.6 | | | 20.4 |

Spain | | | 28.1 | | | 23.9 | | | 23.0 |

The financial results of our international operations are subject to volatility because of foreign currency exchange rate changes, inflation and changes in political and economic conditions in the countries in which we operate. The value of international assets is also affected by fluctuations in foreign currency exchange rates. For information on the breakdown of our long-lived assets in the United States and internationally and risks associated with our international operations, see Note 18 to the Notes to Consolidated Financial Statements.

Our principal executive offices are located at 2400 S.W. 145th Avenue, Miramar, Florida 33027, and our telephone number is (954) 364-6900. We maintain a website with the address www.elizabetharden.com. We are not including information contained on our website as part of, nor incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such material with or furnish such material to the Securities and Exchange Commission.

Information relating to corporate governance at Elizabeth Arden, Inc., including our Corporate Governance Guidelines and Principles, Code of Ethics for Directors and Executive and Finance Officers, Code of Business Conduct and charters for the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee, is available on our website under the section “Corporate Info — Investor Relations — Corporate Governance.” We will provide the foregoing information without charge upon written request to Secretary, Elizabeth Arden, Inc., 2400 S.W. 145th Avenue, Miramar, FL 33027.

Business Strategy

Our business strategy is to increase net sales, operating margins and earnings by (a) growing the sales of our existing brand portfolio, including theElizabeth Arden brand, through new product

4

innovation and targeting additional demographics and geographic markets, (b) acquiring prestige beauty brands through licensing opportunities and acquisitions, (c) expanding the prestige fragrance category at mass retail customers in the U.S., and (d) implementing initiatives to improve our cost structure and working capital efficiencies.

We believe theElizabeth Arden brand is one of the most widely recognized beauty brands in the world, and we intend to continue to invest behind and grow this brand on a global basis through brand innovation and increased penetration in certain international markets. In fiscal 2009, we plan to introduce a number of new Elizabeth Arden branded products, including (i) a new Elizabeth Arden fragrance, (ii) PREVAGE® Body (a product under the PREVAGE® franchise), (iii) a mineral-based foundation, and a number of other Elizabeth Arden branded skin care and color products. In addition, during fiscal 2009 we plan to launch a new fragrance under ourRocawear fragrance license, a new Juicy Couture fragrance and new fragrances under our Mariah Carey, Giorgio Beverly Hills, Badgley Mischka, GANT and Usher licenses.

We continue to pursue business efficiencies throughout our company, particularly in the supply chain, logistics and information technology areas to improve our cash flow, operating margins and profitability and to accommodate the anticipated growth of our business. In fiscal 2007, we commenced a comprehensive review of our global business processes to re-engineer our extended supply chain, logistics and transaction processing systems. We call this initiative our Global Efficiency Re-engineering initiative. This initiative includes (i) improvements in the efficiency of our supply chain and business processes, (ii) a migration to a shared services model to simplify transaction processing by consolidating our global transaction processing functions, and (iii) the implementation of an Oracle financial accounting and order processing system.

We continue to evaluate and invest in markets around the world that we believe have significant opportunities for growth of our products. For example, during the last three fiscal years, we have established sales affiliates in France, the Middle East (Dubai) and Greater China, where previously we had used distributors in those markets to sell our products. We are also focused on expanding sales of our products in developing markets including Latin America, Eastern Europe and India.

Recent License Agreements and Acquisitions

Effective June 9, 2008, we became the exclusive, global licensee for the sale, manufacture, distribution and marketing of the Liz Claiborne fragrance brands under a long-term agreement with Liz Claiborne, Inc. and certain of its affiliates. The Liz Claiborne fragrance portfolio consists of theJuicy Couture,Curve by Liz Claiborne,Lucky,Liz,Realities,Bora Bora andMambo fragrances. In connection with the Liz Claiborne license agreement we also assumed a license for the Usher celebrity fragrances. We anticipate that the Liz Claiborne licensing arrangement will allow us to (i) increase our market share in our North America Fragrance segment, (ii) gain efficiencies from a larger fragrance business, particularly by leveraging our supply chain, logistics and sales organizations, (iii) increase our gross margins by converting existing North America mass customer sales from distribution margins to owned/licensed margins, and (iv) provide additional sales volume for our International segment.

During the fiscal years ended June 30, 2007 and 2006, we (i) entered into a license agreement with Procter & Gamble for the license of the Giorgio Beverly Hills fragrance brand, (ii) completed the acquisition of certain assets comprising the fragrance business of Sovereign Sales, LLC, a distributor of prestige fragrances to mass retail customers, allowing us to offer additional fragrance brands to our mass retail customers, and (iii) completed the acquisition of certain assets of Riviera Concepts Inc., including brand licenses for a number of fragrance brands, including Alfred Sung, HUMMER™, Badgley Mischka, Nannette Lepore and Bob Mackie.

5

Products

Our net sales of products and net sales of products as a percentage of consolidated net sales for the years ended June 30, 2008, 2007 and 2006, are listed in the following chart.

| | | | | | | | | | | | | | | | | | |

| | | Year Ended June 30, | |

| | | 2008 | | | 2007 | | | 2006 | |

| (Amounts in millions) | | Sales | | % | | | Sales | | % | | | Sales | | % | |

Fragrance | | $ | 845.4 | | 74 | % | | $ | 851.1 | | 75 | % | | $ | 716.6 | | 75 | % |

Skin Care | | | 217.6 | | 19 | % | | | 200.6 | | 18 | % | | | 169.0 | | 18 | % |

Cosmetics | | | 78.1 | | 7 | % | | | 75.8 | | 7 | % | | | 69.0 | | 7 | % |

| | | | | | | | | | | | | | | | | | |

Total | | $ | 1,141.1 | | 100 | % | | $ | 1,127.5 | | 100 | % | | $ | 954.6 | | 100 | % |

| | | | | | | | | | | | | | | | | | |

Fragrance. We offer a wide variety of fragrance products for both men and women, including perfume, cologne, eau de toilette, eau de parfum, body spray and gift sets. Our fragrances are classified into the Elizabeth Arden branded fragrances, celebrity branded fragrances, designer branded fragrances, and lifestyle fragrances. Each fragrance is sold in a variety of sizes and packaging assortments. In addition, we sell bath and body products that are based on the particular fragrance, such as soaps, deodorants, body lotions, gels, creams and dusting powder, to complement the fragrance lines. We sell fragrance products worldwide, primarily to department stores, mass retailers, wholesalers, perfumeries, boutiques and travel retail outlets. We tailor the size and packaging of the fragrance to suit the particular target customer.

Skin Care. Our skin care lines are sold under the Elizabeth Arden name and include products such as moisturizers, creams, lotions and cleansers. Our core Elizabeth Arden branded products includeCeramide,PREVAGE®,Eight Hour Cream, andIntervene. OurCeramide skin care line targets women who are 40 and over.Intervene is our pre-emptive anti-aging skin care line, targeted to the 25 to 39 year old interested in fighting the signs of aging.PREVAGE® is our premium cosmeceutical skin care line. We sell skin care products worldwide, primarily in prestige department and specialty stores, perfumeries and travel retail outlets.

Cosmetics. Under the Elizabeth Arden name, we offer a variety of cosmetics, including foundations, lipsticks, mascaras, eye shadows and powders. We offer these products in a wide array of shades and colors. Our strategy is to align our color offerings with our core skin care products. We use our cosmetic products to attract consumers to the beauty counters at department stores where the Elizabeth Arden fragrance and skin care products are also sold. We sell our cosmetics internationally and in the United States, primarily in prestige and specialty stores, perfumeries and travel retail outlets.

Trademarks, Licenses and Patents

We own or have rights to use the trademarks necessary for the manufacturing, marketing, distribution and sale of numerous fragrance, cosmetic and skin care brands, including Elizabeth Arden’sRed Door, Red Door Revealed, Elizabeth Arden 5th Avenue,Elizabeth Arden Provocative Woman, Elizabeth Arden Mediterranean, Plump Perfect, Intervene, Millennium,White Shoulders, Halston, Z-14,PS Fine Cologne for Men, DesignandWings. These trademarks are registered or have pending applications in the United States and in certain of the countries in which we sell these product lines. We consider the protection of our trademarks to be important to our business.

We are the exclusive worldwide trademark licensee for a number of fragrance brands including:

| | • | | the Elizabeth Taylor fragrancesWhite DiamondsandElizabeth Taylor’s Passion; |

| | • | | the Liz Claiborne fragrancesCurve,Realities,Lucky,Mambo andBora Bora; |

| | • | | the Juicy Couture fragrancesJuicy Couture, Dirty English and Viva la Juicy; |

6

| | • | | the Mariah Carey fragranceM by Mariah Carey; |

| | • | | the Alfred Sung fragrancesSUNG Alfred Sung,SHI Alfred Sung andJEWEL Alfred Sung; |

| | • | | the designer fragrance brands of Badgley Mischka, Alberta Ferretti, Rocawear, Nanette Lepore, Bob Mackie, Geoffrey Beene and Halston; |

| | • | | the Britney Spears fragrancescurious Britney Spears, fantasy Britney Spears and Britney Spears believe; |

| | • | | the Hilary Duff fragrancewith Love…Hilary Duff; |

| | • | | the Danielle Steel fragranceDanielle by Danielle Steel; and |

| | • | | the Giorgio fragrancesGiorgio Beverly HillsandGiorgio Red. |

We are the exclusive worldwide licensee for the PREVAGE® skin care line for retail outlets. The Elizabeth Taylor license agreement terminates in October 2022 and is renewable by us, at our sole option, for unlimited 20-year periods. The Britney Spears license terminates in December 2009 and is renewable by us, at our sole option, for a five-year term. The PREVAGE® license terminates in December 2010 and is renewable by us for unlimited five-year terms if certain sales targets are achieved. The license agreement with Liz Claiborne Inc. and its affiliates relating to the Liz Claiborne and Juicy Couture fragrances terminates in December 2017, and is renewable by us for two additional five-year terms, provided specified conditions are met. The other license agreements have terms ranging from 2009 to 2045 and beyond, and, typically, have renewal terms dependent on sales targets being achieved.

We also have the right under various exclusive distributor and license agreements and arrangements to distribute other fragrances in various territories and to use the registered trademarks of third parties in connection with the sale of these products.

Certain of our skin care and cosmetic products and the PREVAGE® skin care line incorporate patented or patent-pending formulations. In addition, several of our packaging methods, packages, components and products are covered by design patents, patent applications and copyrights. Substantially all of our trademarks and all of our patents are held by us or by one of our wholly-owned United States subsidiaries.

Sales and Distribution

We sell our prestige beauty products to retailers in the United States, including department stores such as Macy’s, Dillard’s, Saks, JCPenney, Belk, Bloomingdales and Nordstrom; specialty stores such as Ulta and Sephora and mass retailers such as Wal-Mart, Target, Sears, Kohl’s, Walgreens, Rite-Aid and CVS; and to international retailers such as Boots, Debenhams, Sephora, Marionnaud, Hudson’s Bay, Shoppers Drug Mart, Myer, Douglas and various travel retail outlets such as Nuance, Heinemann and World Duty Free. We also sell products to independent fragrance, cosmetic, gift and other stores and through our e-commerce site at www.elizabetharden.com. We currently sell our skin care and cosmetics products in North America primarily in prestige department and specialty stores. We also sell our fragrances, skin care and cosmetic products in approximately 90 other countries worldwide through department stores, perfumeries, pharmacies, specialty retailers, and other retail shops and “duty free” and travel retail locations. In certain countries, we maintain a dedicated sales force that solicits orders and provides customer service. In other countries and jurisdictions, we sell our products through local distributors under contractual arrangements. We manage our operations outside of North America from our offices in Geneva, Switzerland.

We also sell our Elizabeth Arden products in the Elizabeth Arden 5th Avenue store in New York, which we operate, and in Red Door beauty salons, which are owned and operated by an unrelated

7

third party. In addition to the sales price of our products sold to the operator of these salons, we receive a licensing fee based on the net sales from each of the salons for the use of the “Elizabeth Arden” or “Red Door” trademarks.

Our sales and marketing support staff and personnel are organized by customer account. Our sales force routinely visits retailers to assist in the merchandising, layout and stocking of selling areas. In the U.S., we have a sales force for Elizabeth Arden branded products that are sold in prestige distribution. For many of our mass retailers in the United States and Canada, we sell basic products in special packaging that deter theft and permit the products to be sold in open displays. Our fulfillment capabilities enable us to reliably process, assemble and ship small orders on a timely basis. We use this ability to assist our customers in their retail distribution through “drop shipping” directly to their stores and by fulfilling their sales of beauty products over the Internet.

As is customary in the beauty industry, we do not generally have long-term or exclusive contracts with any of our retail customers. Sales to customers are generally made pursuant to purchase orders. We believe that our continuing relationships with our customers are based upon our ability to provide a wide selection and reliable source of prestige beauty products, our expertise in marketing and new product introduction, and our ability to provide value-added services, including our category management services, to U.S. mass retailers.

Our ten largest customers accounted for approximately 39% of net sales for the year ended June 30, 2008. The only customer that accounted for more than 10% of our net sales during that period was Wal-Mart (including Sam’s Club), which accounted for approximately 15% of our consolidated net sales and approximately 25% of our North America Fragrance segment net sales. The loss of or a significant adverse change in our relationship with any of our largest customers could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

The industry practice for businesses that market beauty products has been to grant certain retailers, subject to our authorization and approval, the right to either return merchandise or to receive a markdown allowance for certain products. We establish estimated return reserves and markdown allowances at the time of sale based upon historical and projected experience, economic trends and changes in customer demand. Our reserves and allowances are reviewed and updated as needed during the year, and additions to these reserves and allowances may be required. Additions to our reserves and allowances may have a negative impact on our financial results. We have a dedicated sales organization to sell returned products that are saleable.

Marketing

Our marketing approach emphasizes a consistent global image for our brands, and each of our fragrance, skin care and cosmetics products is distinctively positioned with specific advertising themes, logos and packaging tailored for that particular product. We utilize our spokesperson, Catherine Zeta-Jones, to contemporize the Elizabeth Arden brand globally, and our classic Red Door symbol to reinforce the Elizabeth Arden brand heritage. We use traditional print, television and radio advertising, and point-of-sale merchandising, including displays and sampling, as well as less traditional methods, such as the internet, mobile phones and instant messaging. We work with third party advertising agencies to assist us in our worldwide media planning, which includes developing the media strategy for our brands and assisting us in developing the marketing campaigns for many of our products. We believe these agencies have the expertise to help us effectively market our products.

During the last three fiscal years, we have focused our Elizabeth Arden skin care and color cosmetics innovation on our three core skin care franchises:Ceramide,PREVAGE®, andIntervene. By aligning our cosmetic product offerings with these franchises, we have simplified our product offerings, reduced excess stock-keeping units (SKUs) and, we believe, more effectively leveraged our advertising and marketing expenditures.

8

New product introduction is an important element in attracting consumers to our brands and in creating brand excitement with our retail customers. Our marketing personnel work closely with our retail customers to develop new products and promotions and extensions of our well-established brands. Our efforts are primarily focused on the identification of consumer needs and shifts in consumer preferences in order to develop new fragrance, skin care and cosmetic products, develop line extensions and promotions, and redesign or reformulate existing products.

Our marketing efforts also benefit from cooperative advertising programs with our retailers, often linked with particular promotions. In our department store and perfumerie accounts we periodically promote our brands with “gift with purchase” and “purchase with purchase” programs. At in-store counters, sales representatives offer personal demonstrations to market individual products. We also engage in extensive sampling programs.

With many of our retail customers, our marketing personnel often design model schematic planograms for the customer’s fragrance department, identify trends in consumer preferences and adapt the product assortment to these trends, conduct training programs for the customer’s sales personnel and manage in-store “special events.” Our marketing personnel also work to design gift sets tailored to the customer’s needs. For certain customers, we provide comprehensive sales analysis and active management of the prestige fragrance category. We believe these services distinguish us from our competitors and contribute to customer loyalty.

Seasonality

Our operations have historically been seasonal, with higher sales occurring in the first half of our fiscal year as a result of increased demand by retailers in anticipation of and during the holiday season. For the year ended June 30, 2008, approximately 61% of our net sales were made during the first half of our fiscal year. Due to product innovations and new product launches, the size and timing of certain orders from our customers, and additions or losses of brand distribution rights, sales, results of operations, working capital requirements and cash flows can vary significantly between quarters of the same and different years. As a result, we expect to experience variability in net sales, operating margin, net income, working capital requirements and cash flows on a quarterly basis. Increased sales of skin care and cosmetic products relative to fragrances may reduce the seasonality of our business.

Manufacturing, Supply Chain and Logistics

We use third-party contract manufacturers in the United States and Europe to obtain substantially all of our raw materials, components and packaging products and to manufacture finished products relating to our owned and licensed brands. Our fragrance and skin care products are primarily manufactured by Cosmetic Essence, Inc., an unrelated third party, in plants located in New Jersey and Roanoke, Virginia, under a manufacturing agreement that expires on January 31, 2010. Pricing is based on fixed costs per item. Third parties in Europe manufacture certain of our fragrance and cosmetic products. We also have a small manufacturing facility in South Africa primarily to manufacture local requirements of our products.

Except for the Cosmetic Essence, Inc. manufacturing agreement, as is customary in our industry, we generally do not have long-term or exclusive agreements with contract manufacturers of our owned and licensed brands or with fragrance manufacturers or suppliers of our distributed brands. We generally make purchases through purchase orders. We believe that we have good relationships with manufacturers of our owned and licensed brands and that there are alternative sources should one or more of these manufacturers become unavailable. We receive our distributed brands in finished goods form directly from fragrance manufacturers, as well as from other sources. Our ten largest fragrance manufacturers or suppliers of brands that are distributed by us on a non-exclusive basis accounted for approximately 33% of our cost of sales for the year ended June 30, 2008. The loss of, or a significant adverse change in our relationship with, any of our key

9

fragrance manufacturers for our owned and licensed brands, such as Cosmetic Essence, Inc., or suppliers of our distributed fragrance brands could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

Our fulfillment operations for the United States and certain other areas of the world are conducted out of a leased distribution facility in Roanoke, Virginia. The 400,000 square-foot Roanoke facility accommodates our distribution activities and houses a large portion of our inventory. Our fulfillment operations for Europe are conducted under a logistics services agreement by CEPL, an unrelated third party, at CEPL’s facility in Beville, France. The CEPL agreement expired in June 2008, and we are negotiating an extension of this logistics services agreement through June 2013. While we insure our inventory and the Roanoke facility, the loss of either of these distribution facilities, as well as the inventory stored in those facilities, would require us to find replacement facilities and inventory and could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

Government Regulation

We and our products are subject to regulation by the Food and Drug Administration and the Federal Trade Commission in the United States, as well as by various other federal, state, local and international regulatory authorities in the countries in which our products are produced or sold. Such regulations principally relate to the ingredients, manufacturing, labeling, packaging and marketing of our products. We believe that we are in substantial compliance with such regulations, as well as with applicable federal, state, local and international and other countries’ rules and regulations governing the discharge of materials hazardous to the environment.

Management Information Systems

Our primary information technology systems discussed below provide a complete portfolio of business systems, business intelligence systems, and information technology infrastructure services to support our global operations:

| | • | | Logistics and supply chain systems, including purchasing, materials management, manufacturing, inventory management, order management, customer service, pricing, demand planning, warehouse management and shipping; |

| | • | | Financial and administrative systems, including general ledger, payables, receivables, personnel, payroll, tax, treasury and asset management; |

| | • | | Electronic data interchange systems to enable electronic exchange of order, status, invoice, and financial information with our customers, financial service providers and our partners within the extended supply chain; |

| | • | | Business intelligence and business analysis systems to enable management’s informational needs as they conduct business operations and perform business decision making; and |

| | • | | Information technology infrastructure services to enable seamless integration of our global business operations through Wide Area Networks (WAN), personal computing technologies, electronic mail, and service agreements with outsourced computing operations. |

These management information systems and infrastructure provide on-line business process support for our global business operations. Further, many of these capabilities have been extended into the operations of our U.S. customers and third party service providers to enhance these arrangements, with examples such as vendor managed inventory, third party distribution, third party manufacturing, inventory replenishment, customer billing, retail sales analysis, product availability, pricing information and transportation management.

10

In connection with our Global Efficiency Re-engineering initiative, we are implementing an Oracle financial accounting and order processing system to improve key transaction processes and accommodate anticipated growth of our business. We expect this infrastructure investment to simplify our transaction processing by utilizing a common platform to centralize all of our global transaction processing functions.

We have back-up facilities to enhance the reliability of our management information systems. These facilities are designed to continue to operate if our main facilities should fail. We also have a disaster recovery plan, which is tested periodically, to protect our business operations and customer information. We also have business interruption insurance to cover a portion of any disruption in our management information systems resulting from certain hazards.

Competition

The beauty industry is highly competitive and, at times, subject to rapidly changing consumer preferences and industry trends. Competition is generally a function of brand strength, assortment and continuity of merchandise selection, reliable order fulfillment and delivery, and level of brand support and in-store customer support. We compete with a large number of manufacturers and marketers of beauty products, some of which have substantially more resources than we do.

We believe that we compete primarily on the basis of brand recognition, quality, product efficacy, price, and our emphasis on providing value-added customer services, including category management services, to certain retailers. There are products that are better-known and more popular than the products manufactured or supplied by us. Many of our competitors are substantially larger and more diversified, and have substantially greater financial and marketing resources than we do, as well as greater name recognition and the ability to develop and market products similar to and competitive with those manufactured by us.

Employees

As of September 5, 2008, we had approximately 2,125 full-time employees and approximately 400 part-time employees in the United States and 17 foreign countries. None of our employees are covered by a collective bargaining agreement. We believe that our relationship with our employees is satisfactory.

Executive Officers of the Company

The following sets forth the names and ages of each of our executive officers as of September 5, 2008 and the positions they hold:

| | | | |

Name | | Age | | Position with the Company |

E. Scott Beattie | | 49 | | Chairman, President and Chief Executive Officer |

Stephen J. Smith | | 48 | | Executive Vice President and Chief Financial Officer |

L. Hoy Heise | | 62 | | Executive Vice President and Chief Information Officer |

Michael H. Lombardi | | 65 | | Executive Vice President, Package Design and Innovation |

Oscar E. Marina | | 49 | | Executive Vice President, General Counsel and Secretary |

Elizabeth Park | | 45 | | Executive Vice President, Skin Care & Color Marketing and General Manager — Arden U.S. |

Ronald L. Rolleston | | 52 | | Executive Vice President, Global Fragrance Marketing |

Joel B. Ronkin | | 40 | | Executive Vice President, General Manager — North America Fragrances |

Jacobus A. J. Steffens | | 47 | | Executive Vice President, General Manager — International |

Each of our executive officers holds office for such term as may be determined by our board of directors. Set forth below is a brief description of the business experience of each of our executive officers.

11

E. Scott Beattie has served as Chairman of the Board of Directors since April 2000, as our President and Chief Executive Officer since August 2006, as our Chief Executive Officer since March 1998 and as a member of our Board of Directors since January 1995. Mr. Beattie also served as our President from April 1997 to March 2003, as our Chief Operating Officer from April 1997 to March 1998, and as our Vice Chairman of the Board of Directors and Assistant Secretary from November 1995 to April 1997. Mr. Beattie is a director of Object Video, Inc., an information technology company. Mr. Beattie is also a director and a member of the Executive Committee of The Personal Care Products Council and a member of the advisory board of the Ivey Business School.

Stephen J. Smith has served as our Executive Vice President and Chief Financial Officer since May 2001. Previously, Mr. Smith was with PricewaterhouseCoopers LLP, an international professional services firm, as partner from October 1993 until May 2001, and as manager from July 1987 until October 1993.

L. Hoy Heise has served as our Executive Vice President and Chief Information Officer since November 2007, as our Executive Vice President, Chief Information Officer and Operations Planning from March 2006 to November 2007, and as our Senior Vice President and Chief Information Officer from May 2004 to February 2006. From February 2003 to April 2004, Mr. Heise was the founder and principal of his own technology consulting firm. From June 1999 until May 2001, Mr. Heise was Senior Vice President of Gartner, an information technology research firm. Prior to that time, Mr. Heise worked in various management and consulting capacities for Renaissance Worldwide, a global provider of business process improvement and information technology consulting services.

Michael H. Lombardi has served as our Executive Vice President, Package Design and Innovation since November 2007, as our Executive Vice President, Operations from April 2004 to October 2007, as our Senior Vice President, Operations from January 2001 to March 2004, and as Senior Vice President, Marketing/Supply Chain Operations with the Elizabeth Arden Company, a division of Unilever N.V., from April 1999 to January 2001. Prior to joining the Elizabeth Arden Company, Mr. Lombardi worked in various management capacities for Chesebrough Ponds, Inc.

Oscar E. Marina has served as our Executive Vice President, General Counsel and Secretary since April 2004, as our Senior Vice President, General Counsel and Secretary from March 2000 to March 2004, and as our Vice President, General Counsel and Secretary from March 1996 to March 2000. From October 1988 to March 1996, Mr. Marina was an attorney with the law firm of Steel Hector & Davis L.L.P. in Miami, becoming a partner of the firm in January 1995.

Elizabeth Parkhas served as our Executive Vice President, Skin Care & Color Marketing and General Manager — Arden U.S., since April 2006 and as our Senior Vice President, Global Marketing from May 2005 to March 2006. Prior to joining our company, Ms. Park was Senior Vice President Marketing U.S.A. for Lancôme, a division of L’Oreal Products from March 2003 to March 2005. From July 1995 to July 2002, Ms. Park held several marketing management positions with The Estee Lauder Companies.

Ronald L. Rolleston has served as our Executive Vice President, Global Fragrance Marketing since April 2006, as our Executive Vice President, Global Marketing from April 2003 to March 2006, as our Executive Vice President, Global Marketing and Prestige Sales from April 2002 to April 2003, as our Senior Vice President, Global Marketing from October 2001 to January 2002, and as our Senior Vice President, Prestige Sales from March 1999 to January 2001. Mr. Rolleston served as President of Paul Sebastian, Inc., a fragrance manufacturer, from September 1997 to January 1999. Mr. Rolleston served as Executive Vice President of Global Marketing of the Elizabeth Arden Company from January 1995 to March 1997 and as the General Manager of Europe for the Calvin Klein Cosmetics Company from May 1990 to September 1994.

12

Joel B. Ronkin has served as our Executive Vice President, General Manager — North America Fragrances since July 2006, as our Executive Vice President and Chief Administrative Officer from April 2004 to June 2006, as our Senior Vice President and Chief Administrative Officer from February 2001 through March 2004, and as our Vice President, Associate General Counsel and Assistant Secretary from March 1999 through January 2001. From June 1997 through March 1999, Mr. Ronkin served as the Vice President, Secretary and General Counsel of National Auto Finance Company, Inc., an automobile finance company. From May 1992 to June 1997, Mr. Ronkin was an attorney with the law firm of Steel Hector & Davis L.L.P. in Miami, Florida.

Jacobus A. J. Steffens has served as our Executive Vice President, General Manager — International since March 2004 and as our Senior Vice President, General Manager — International from January 2001 through February 2004. Before joining the company, Mr. Steffens worked in various management capacities for divisions of Unilever N.V., including as the Chief Information Officer of Unilever’s European Ice Cream & Frozen Foods division from January 1997 to December 2000, as the Controller Global Marketing & Creative at the Elizabeth Arden Company from January 1992 to December 1995 and in various financial roles for Unilever’s Quest International Flavours and Fragrances division from the end of 1986 to December 1991.

ITEM 1A. RISK FACTORS

The risk factors in this section describe the major risks to our business, prospects, results of operations, financial condition or cash flows, and should be considered carefully. In addition, these factors constitute our cautionary statements under the Private Securities Litigation Reform Act of 1995 and could cause our actual results to differ materially from those projected in any forward-looking statements (as defined in such act) made in this Annual Report on Form 10-K. Investors should not place undue reliance on any such forward-looking statements. Any statements that are not historical facts and that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intends,” “plans,” “believes” and “projects”) may be forward-looking and may involve estimates and uncertainties which could cause actual results to differ materially from those expressed in the forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We do not have contracts with customers or suppliers of our distributed brands, so if we cannot maintain and develop relationships with customers and suppliers our business, prospects, results of operations, financial condition or cash flows may be materially adversely affected.

We do not have long-term or exclusive contracts with any of our customers and generally do not have long-term or exclusive contracts with our suppliers of distributed brands. Our ten largest customers accounted for approximately 39% of our net sales in the year ended June 30, 2008. Our only customer who accounted for more than 10% of our net sales in the year ended June 30, 2008 was Wal-Mart (including Sam’s Club), who, on a global basis, accounted for approximately 15% of our consolidated net sales and approximately 25% of our North America Fragrance segment net sales. In addition, our suppliers of distributed brands, which represented approximately 33% of our cost of sales for fiscal 2008, generally can, at any time, elect to supply products to our customers directly or through another distributor. Our suppliers of distributed brands may also choose to

13

reduce or eliminate the volume of their products distributed by us. The loss of any of our key suppliers or customers, or a change in our relationship with any one of them, could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

We rely on third-party manufacturers and component suppliers for substantially all of our owned and licensed products.

We do not own or operate any significant manufacturing facilities. We use third-party manufacturers and component suppliers to manufacture substantially all of our owned and licensed products. We currently obtain these products from a limited number of manufacturers and other suppliers. Our business, prospects, results of operations, financial condition or cash flows could be materially adversely affected if our manufacturers or component suppliers were to experience problems with product quality or delays in the delivery of the finished products or the raw materials or components used to make such product.

The loss of or disruption in our distribution facilities may have a material adverse effect on our business.

We currently have one distribution facility in the United States and use a third-party fulfillment center in France primarily for European distribution. These facilities house a large portion of our inventory. Any loss of or damage to these facilities or the inventory stored in these facilities, could adversely affect our business, prospects, results of operations, financial condition or cash flows.

We may be adversely affected by factors affecting our customers’ businesses.

Factors that adversely impact our customers’ businesses may also have an adverse effect on our business, prospects, results of operations, financial condition or cash flows. These factors may include:

| | • | | any credit risks associated with the financial condition of our customers; |

| | • | | the effect of consolidation or weakness in the retail industry, including the closure of customer doors and the uncertainty resulting therefrom; and |

| | • | | inventory reduction initiatives and other factors affecting customer buying patterns, including any reduction in retail space commitment to fragrances and cosmetics and practices used to control inventory shrinkage. |

We may be adversely affected by domestic and international economic conditions and other events that impact consumer confidence and demand.

We believe that consumer spending on beauty products is influenced by general economic conditions and the availability of discretionary income. U.S. or international general economic downturns, including periods of inflation or high gasoline prices or declining consumer confidence, may affect consumer purchasing patterns and result in reduced net sales to our customers. Sudden disruptions in business conditions due to events such as terrorist attacks or natural disasters may have a short-term, or sometimes long-term, adverse impact on consumer spending. In addition, any reductions in travel or increases in restrictions on travelers’ ability to transport our products on airplanes due to general economic downturns, diseases, acts of war or terrorism could result in a material decline in the net sales and profitability of our travel retail business.

The beauty industry is highly competitive and if we cannot effectively compete our business and results of operations will suffer.

The beauty industry is highly competitive and can change rapidly due to consumer preferences and industry trends. We compete primarily with global prestige beauty companies, some of whom have greater resources than we have and brands with greater name recognition and consumer loyalty

14

than our brands. Our products also compete with new products that often are accompanied by substantial promotional campaigns. Our success depends on our products’ appeal to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change, and on our ability to develop new products through product innovations and product line extensions. We may incur expenses in connection with product development, marketing and advertising that are not subsequently supported by a sufficient level of sales, which could negatively affect our results of operations. These competitive factors, as well as new product risks, could have an adverse effect on our business, prospects, results of operations, financial condition or cash flows.

Our business strategy depends upon our ability to acquire or license additional brands or secure additional distribution arrangements and obtain the required financing for these agreements and arrangements.

Our business strategy contemplates the continued growth of our portfolio of owned, licensed and distributed brands. Our future expansion through acquisitions, new product licenses or new product distribution arrangements, if any, will depend upon our ability to identify suitable brands to acquire, license or distribute and our ability to obtain the required financing for these acquisitions, licenses or distribution arrangements, and thus depends on the capital resources and working capital available to us. We may not be able to identify, negotiate, finance or consummate such acquisitions, licenses or arrangements, or the associated working capital requirements, on terms acceptable to us, or at all, which could hinder our ability to increase revenues and build our business.

The success of our business depends, in part, on the demand for celebrity beauty products.

We have license agreements to manufacture, market and distribute a number of celebrity beauty products, including those of Elizabeth Taylor, Britney Spears, Hilary Duff, Danielle Steel, Mariah Carey and Usher. In fiscal 2008, we derived approximately 20% of our net sales from these celebrity beauty products. The demand for these products is, to some extent, dependent on the appeal to consumers of the particular celebrity and the celebrity’s reputation. To the extent that the celebrity fragrance category or a particular celebrity ceases to be appealing to consumers or a celebrity’s reputation is adversely affected, sales of the related products and the value of the brands can decrease materially. In addition, under certain circumstances lower net sales may shorten the duration of the applicable license agreement.

We may not be able to successfully and cost-effectively integrate acquired businesses or new brands.

Acquisitions entail numerous integration risks and impose costs on us that could materially and adversely affect our business, prospects, results of operations, financial condition or cash flows, including:

| | • | | difficulties in assimilating acquired operation, products or brands, including disruptions to our operations or the unavailability of key employees from acquired businesses; |

| | • | | diversion of management’s attention from our core business; |

| | • | | adverse effects on existing business relationships with suppliers and customers; |

| | • | | incurrence or assumption of additional debt and liabilities; and |

| | • | | incurrence of significant amortization expenses related to intangible assets and the potential impairment of acquired assets. |

Our business could be adversely affected if we are unable to successfully protect our intellectual property rights.

The market for our products depends to a significant extent upon the value associated with our trademarks and trade names. We own, or have licenses or other rights to use, the material

15

trademark and trade name rights used in connection with the packaging, marketing and distribution of our major owned and licensed products both in the U.S. and in other countries where such products are principally sold.

Although most of our brand names are registered in the U.S. and in certain foreign countries in which we operate, we may not be successful in asserting trademark or trade name protection. In addition, the laws of certain foreign countries may not protect our intellectual property rights to the same extent as the laws of the U.S. The costs required to protect our trademarks and trade names may be substantial. We also cannot assure that the owners of the trademarks that we license can or will successfully maintain their intellectual property rights or that we will be able to comply with the terms set forth in the applicable license agreements, including among other things payment of minimum royalties, minimum marketing expenses and maintenance of certain levels of sales.

If other parties infringe on our intellectual property rights or the intellectual property rights that we license, the value of our brands in the marketplace may be diluted. In addition, any infringement of our intellectual property rights would also likely result in a commitment of our time and resources to protect these rights through litigation or otherwise. We may infringe on others’ intellectual property rights. One or more adverse judgments with respect to these intellectual property rights could negatively impact our ability to compete and could materially adversely affect our business, prospects, results of operations, financial condition or cash flows.

We are subject to risks related to our international operations.

We operate on a global basis, with sales in approximately 90 countries. Approximately 40% of our fiscal 2008 net sales were generated outside of the United States. Our international operations could be adversely affected by:

| | • | | import and export license requirements; |

| | • | | changes in tariffs and taxes; |

| | • | | restrictions on repatriating foreign profits back to the United States; |

| | • | | changes in, or our unfamiliarity with, foreign laws and regulations; |

| | • | | difficulties in staffing and managing international operations; and |

| | • | | changes in social, political, legal and other conditions. |

Fluctuations in foreign exchange rates could adversely affect our results of operations and cash flows.

Our functional currency is the U.S. dollar. Our results of operations, debt, interest expense and a significant portion of our overhead expenses are reported in U.S. dollars. Approximately 40% of our net sales for fiscal 2008 were from our international operations, with a substantial portion of this amount denominated in currencies other than the U.S. dollar. Outside the United States, our sales and costs are denominated in a variety of currencies including the Euro, British pound, Swiss franc and Canadian and Australian dollar. A weakening of the foreign currencies in which we generate sales relative to the currencies in which our costs are denominated, which is primarily the U.S. dollar, may adversely affect our ability to meet our obligations and could adversely affect our results of operations and cash flows used to fund working capital.

Our quarterly results of operations fluctuate due to seasonality and other factors, and we may not have sufficient liquidity to meet our seasonal working capital requirements.

We generate a significant portion of our net income in the first half of our fiscal year as a result of higher sales in anticipation of the holiday season. Similarly, our working capital needs are greater

16

during the first half of the fiscal year. We may experience variability in net sales and net income on a quarterly basis as a result of a variety of factors, including new product innovations and launches, the size and timing of customer orders and additions or losses of brand distribution rights. If we were to experience a significant shortfall in sales or internally generated funds, we may not have sufficient liquidity to fund our business.

Our level of debt and debt service obligations, and the restrictive covenants in our revolving credit facility and our indenture for our 7 3/4% senior subordinated notes, may reduce our operating and financial flexibility and could adversely affect our business and growth prospects.

At June 30, 2008, we had total debt of approximately $344 million, including $225 million in aggregate principal amount outstanding of our 7 3/4% senior subordinated notes and $119 million outstanding under our revolving bank credit facility, both of which have requirements that may limit our operating and financial flexibility. Our indebtedness could adversely impact our business, prospects, results of operations, financial condition or cash flows by increasing our vulnerability to general adverse economic and industry conditions and restricting our ability to consummate acquisitions or fund working capital, capital expenditures and other general corporate requirements.

Specifically, our revolving credit facility and our indenture for our 7 3/4% senior subordinated notes limit or otherwise affect our ability to, among other things:

| | • | | pay dividends or make other restricted payments; |

| | • | | create or permit certain liens, other than customary and ordinary liens; |

| | • | | sell assets other than in the ordinary course of our business; |

| | • | | invest in other entities or businesses; and |

| | • | | consolidate or merge with or into other companies or sell all or substantially all of our assets. |

These restrictions could limit our ability to finance our future operations or capital needs, make acquisitions or pursue available business opportunities. Our revolving credit facility also requires us to maintain specified amounts of borrowing capacity or maintain a debt service coverage ratio. Our ability to meet these conditions and our ability to service our debt obligations will depend upon our future operating performance, which can be affected by general economic, financial, competitive, legislative, regulatory, business and other factors beyond our control. If our actual results deviate significantly from our projections, we may not be able to service our debt or remain in compliance with the conditions contained in our revolving credit facility, and we would not be allowed to borrow under the revolving credit facility. If we were not able to borrow under our revolving credit facility, we would be required to develop an alternative source of liquidity. We cannot assure you that we could obtain replacement financing on favorable terms or at all.

A default under our revolving credit facility could also result in a default under our indenture for our 7 3/4% senior subordinated notes. Upon the occurrence of an event of default under our indenture, all amounts outstanding under our other indebtedness may be declared to be immediately due and payable. If we were unable to repay amounts due on our secured debt, the lenders would have the right to proceed against the collateral granted to them to secure that debt.

Our success depends, in part, on the quality, efficacy and safety of our products.

Our success depends, in part, on the quality, efficacy and safety of our products. If our products are found to be defective or unsafe, or if they otherwise fail to meet our customers’ standards, our relationships with customers or consumers could suffer, the appeal of one or more of our brands

17

could be diminished, and we could lose sales and/or become subject to liability claims, any of which could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

Our success depends upon the retention and availability of key personnel and the succession of senior management.

Our success largely depends on the performance of our management team and other key personnel. Our future operations could be harmed if we are unable to attract and retain talented, highly qualified senior executives and other key personnel. In addition, if we are unable to effectively provide for the succession of senior management, including our chief executive officer, our business, prospects, results of operations, financial condition or cash flows may be materially adversely affected.

Our business is subject to regulation in the United States and internationally.

The manufacturing, distribution, formulation, packaging and advertising of our products and those we distribute are subject to numerous federal, state and foreign governmental regulations. Compliance with these regulations is difficult and expensive. If we fail to adhere, or are alleged to have failed to adhere, to any applicable federal, state or foreign laws or regulations, our business, prospects, results of operation, financial condition or cash flows may be adversely affected. In addition, our future results could be adversely affected by changes in applicable federal, state and foreign laws and regulations (including product liability, trade rules and customs regulations, intellectual property, consumer laws, privacy laws and product regulation), as well as changes in accounting standards and taxation requirements (including tax-rate changes, new tax laws and revised tax law interpretations).

The market price of our common stock may fluctuate as a result of a variety of factors.

The market price of our common stock could fluctuate significantly in response to various factors, many of which are beyond our control, including:

| | • | | volatility in the financial markets; |

| | • | | actual or anticipated variations in our quarterly or annual financial results; |

| | • | | announcements or significant developments with respect to beauty products or the beauty industry in general; |

| | • | | general economic and political conditions; and |

| | • | | governmental policies and regulations. |

We are subject to risks associated with implementing global information systems.

We have information systems that support our business processes, including marketing, sales, order processing, distribution, finance and intracompany communications throughout the world. These systems may be susceptible to outages due to fire, floods, tornadoes, hurricanes, power loss, telecommunications failures, and similar events. Despite the implementation of network security measures, our systems may be vulnerable to computer viruses and similar disruptions from unauthorized tampering. The occurrence of these or other events could disrupt or damage our information systems and adversely affect our business and results of operations. In addition, we are implementing an Oracle financial accounting and order processing system, which will require a substantial investment and dedication of management resources. Any failure to properly maintain or upgrade our systems or to implement the Oracle financial accounting and order processing system on a timely and cost-effective basis may adversely affect our business prospects, results of operations, financial condition or cash flows.

18

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

United States. Our corporate headquarters are located in Miramar, Florida, where we lease approximately 35,000 square feet of general office space. The lease expires May 31, 2011. Our U.S. fulfillment operations are conducted in our Roanoke, Virginia distribution facility that consists of approximately 400,000 square feet and is leased through September 2013. We also lease (i) a 76,000-square foot warehouse in Roanoke to coordinate returns processing that is leased through December 2009 and, (ii) a 132,000-square foot overflow warehouse in Roanoke that is leased through July 2009. From time to time, we also lease additional temporary warehouse facilities to handle inventory overflow. We lease 62,000 square feet of general office space for our supply chain, information systems and finance operations in Stamford, Connecticut under a lease that expires October 2011. We lease approximately 33,000 square feet of general offices primarily for our marketing operations in New York City under a lease that expires in April 2016.

International. Our international operations are headquartered in leased offices in Geneva, Switzerland. We are negotiating an extension of this lease through December 2012. We also lease sales offices in Australia, Austria, Canada, China, Denmark, Dubai, France, Germany, Italy, Korea, New Zealand, Puerto Rico, Singapore, South Africa, Spain, Taiwan, and the United Kingdom, and a small distribution facility in Puerto Rico. We own a small manufacturing and distribution facility in South Africa primarily to manufacture and distribute local requirements of our products.

ITEM 3. LEGAL PROCEEDINGS

In October 2005, we received a demand from Mystic Tan, Inc., a licensee of certain of our patents, alleging that we had breached the license agreement with them, indicating that it would not pay any further royalties and requesting that we return approximately $3 million in royalty payments already made by it. In November 2006, we filed a lawsuit against the licensee in the U.S. District Court for the Southern District of New York seeking recovery of our damages for breach of contract. In April 2007, the licensee filed a counterclaim for breach of contract, negligence, unjust enrichment and other related counts, and also sought declaratory relief that the licensee was not obligated to make further royalty payments and was entitled to recover approximately $3 million in royalty payments already made by it, plus interest. In April 2008, we settled our litigation with the licensee. Under the terms of the settlement, the licensee agreed to pay us $540,000 in royalties in installments through June 2010, and we agreed to provide the licensee with a fully-paid license to use one of our patents for the duration of the patent.

We are a party to a number of other legal actions, proceedings and claims. While any action, proceeding or claim contains an element of uncertainty and it is possible that our cash flows and results of operations in a particular quarter or year could be materially affected by the impact of such actions, proceedings and claims, our management believes that the outcome of such actions, proceedings or claims will not have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year ended June 30, 2008.

19

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information. Our common stock, $.01 par value per share, has been traded on the NASDAQ Global Select Market under the symbol “RDEN” since January 25, 2001. The following table sets forth the high and low sales prices for our common stock, as reported by NASDAQ for each of our fiscal quarters from July 1, 2006 through June 30, 2008.

| | | | | | |

Quarter Ended | | High | | Low |

6/30/08 | | $ | 21.63 | | $ | 12.81 |

3/31/08 | | $ | 20.86 | | $ | 16.04 |

12/31/07 | | $ | 28.05 | | $ | 19.85 |

9/30/07 | | $ | 27.11 | | $ | 18.21 |

6/30/07 | | $ | 24.73 | | $ | 21.64 |

3/31/07 | | $ | 22.97 | | $ | 17.41 |

12/31/06 | | $ | 19.74 | | $ | 16.06 |

9/30/06 | | $ | 19.04 | | $ | 13.63 |

Holders. As of September 5, 2008, there were 391 record holders of our common stock. The number of record holders does not include beneficial owners of common stock whose shares are held in the names of banks, brokers, nominees or other fiduciaries.

Dividends. We have not declared any cash dividends on our common stock since we became a beauty products company in 1995, and we currently have no plans to declare dividends on our common stock in the foreseeable future. Any future determination by our board of directors to pay dividends on our common stock will be made only after considering our financial condition, results of operations, capital requirements and other relevant factors. Additionally, our revolving credit facility and the indentures relating to our 7 3/4% senior subordinated notes due 2014 restrict our ability to pay cash dividends based upon our ability to satisfy certain financial covenants, including having a certain amount of borrowing capacity and a fixed charge coverage ratio after the payment of the dividends. See Notes 9 and 10 to the Notes to Consolidated Financial Statements.

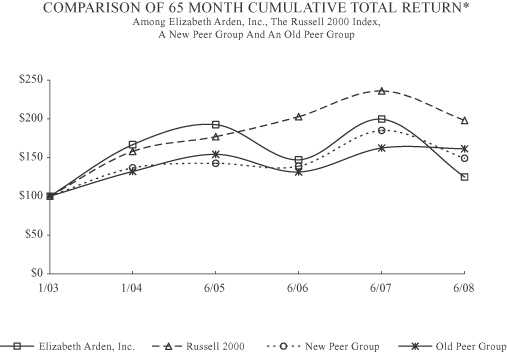

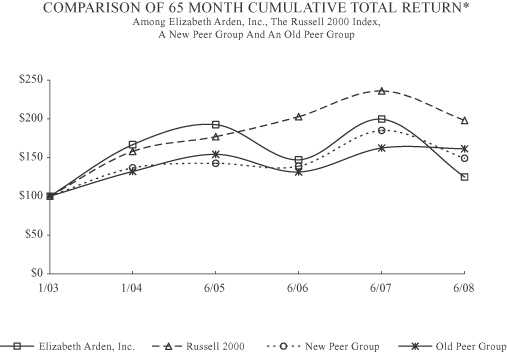

Performance Graph. The following performance graph data and table compare the cumulative total shareholder returns, including the reinvestment of dividends, on our common stock with the companies in the Russell 2000 Index and a market-weighted index of publicly traded peer companies for the 65 month period from January 31, 2003 through June 30, 2008 (in June 2004, we changed our fiscal year end from January 31 to June 30).

We have elected to modify our peer group to include four new beauty products companies (Bare Escentuals, Inc., Clarins S.A., International Flavors and Fragrances, Inc., and Physicians Formula Holdings, Inc.) and remove Avon Products, Inc. and Chattem, Inc. We believe that the four new peer companies are more comparable to our business than the two companies that we have removed from the peer group in terms of size (market capitalization and/or revenues), channels of distribution, and/or products sold. We believe that our newly-selected peer group is a good representation of beauty companies with similar market capitalizations, channels of distribution and/or products as our company. The publicly traded companies in our new peer group are Bare Escentuals, Inc., Clarins, S.A., The Estee Lauder Companies Inc., International Flavors and Fragrances, Inc., Inter Parfums, Inc., Physicians Formula Holdings, Inc., and Revlon, Inc. The publicly traded companies in our old peer group were Avon Products, Inc., Chattem, Inc., The Estee Lauder Companies Inc., Inter Parfums, Inc. and Revlon, Inc. The graph and table assume that $100 was invested on January 31, 2003 in each of the Russell 2000 Index, each of the new and old peer groups, and our common stock, and that all dividends were reinvested.

20

| | | | | | | | | | |

| | | Fiscal Year Ended |

| | | January 31,

2004(1) | | June 30, |

| | | | 2005(1) | | 2006 | | 2007 | | 2008 |

Elizabeth Arden, Inc. | | 166.63 | | 192.37 | | 147.05 | | 199.52 | | 124.85 |

Russell 2000 Index | | 158.03 | | 176.96 | | 202.76 | | 236.08 | | 197.85 |

New Peer Group | | 136.62 | | 142.53 | | 138.82 | | 184.88 | | 148.94 |

Old Peer Group | | 132.01 | | 154.06 | | 131.31 | | 162.20 | | 161.36 |

| (1) | | As a result of the change in our fiscal year end, the measurement point from January 31, 2004 to June 30, 2005 covers a period of 17 months which includes the five-month transition period from February 1, 2004 through June 30, 2005 and the fiscal year period from July 1, 2004 through June 30, 2005. |

| ITEM 6. | SELECTED FINANCIAL DATA |

We derived the following selected financial data from our audited consolidated financial statements. The following data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this annual report.

21

On June 2, 2004, our board of directors approved a change in fiscal year end from January 31 to June 30, effective as of June 30, 2004. The change was implemented to better reflect our business cycle and to enhance business planning relative to our customers’ retail calendars. See our website www.elizabetharden.com\Corporate Info for unaudited financial results for the twelve months ended June 30, 2004.

| | | | | | | | | | | | | | | | | | | | | | | | |

(Amounts in thousands, except per share

data) | | Year Ended June 30, | | | Five Months

Ended

June 30, 2004 | | | Year Ended

January 31,

2004 | |

| | 2008 | | | 2007 | | | 2006 | | | 2005 | | | |

Selected Statement of Income Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,141,075 | | | $ | 1,127,476 | | | $ | 954,550 | | | $ | 920,538 | | | $ | 222,784 | | | $ | 814,425 | |

Gross profit | | | 466,118 | (1) | | | 461,319 | | | | 404,072 | | | | 411,364 | | | | 88,284 | | | | 335,777 | |

Income (loss) from operations | | | 49,030 | (1) | | | 74,006 | | | | 68,257 | | | | 78,533 | | | | (32,314 | ) | | | 72,330 | |

Debt extinguishment charges | | | — | | | | — | | | | 758 | | | | — | | | | 3,874 | | | | 34,808 | |

Net income (loss) | | | 19,901 | | | | 37,334 | | | | 32,794 | | | | 37,604 | | | | (31,843 | ) | | | 2,036 | |

Accretion and dividend on preferred stock | | | — | | | | — | | | | — | | | | — | | | | 762 | | | | 3,502 | |

Accelerated accretion on converted preferred stock | | | — | | | | — | | | | — | | | | — | | | | 19,090 | | | | 18,584 | |

Net income (loss) attributable to common shareholders | | | 19,901 | | | | 37,334 | | | | 32,794 | | | | 37,604 | | | | (51,695 | ) | | | (20,050 | ) |

| | | | | | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per common share | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.71 | (2) | | $ | 1.35 | (3) | | $ | 1.15 | (3) | | $ | 1.35 | (4) | | $ | (2.08 | )(5) | | $ | (1.02 | )(6) |

Diluted | | $ | 0.68 | (2) | | $ | 1.30 | (3) | | $ | 1.10 | (3) | | $ | 1.25 | (4) | | $ | (2.08 | )(5) | | $ | (1.02 | )(6) |

Weighted average number of common shares | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 27,981 | | | | 27,607 | | | | 28,628 | | | | 27,792 | | | | 24,885 | | �� | | 19,581 | |

Diluted | | | 29,303 | | | | 28,826 | | | | 29,818 | | | | 30,025 | | | | 24,885 | | | | 19,581 | |

| | | | | | |

Other Data | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(7) | | $ | 73,798 | | | $ | 98,524 | | | $ | 89,608 | | | $ | 100,038 | | | $ | (27,495 | ) | | $ | 58,374 | |

Net cash provided by (used in) operating activities | | | 8,037 | | | | 58,816 | | | | 65,276 | | | | 35,549 | | | | (46,591 | ) | | | 45,801 | |

Net cash (used in) investing activities | | | (28,588 | ) | | | (110,518 | ) | | | (24,335 | ) | | | (17,508 | ) | | | (4,138 | ) | | | (11,365 | ) |

Net cash provided by (used in) financing activities | | | 16,791 | | | | 53,120 | | | | (37,584 | ) | | | (15,785 | ) | | | (15,080 | ) | | | 31,196 | |

| | | |

| | | Year Ended June 30, | | | Five Months

Ended

June 30, 2004 | | | Year Ended

January 31,

2004 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | |

Selected Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 26,396 | | | $ | 30,287 | | | $ | 28,466 | | | $ | 25,316 | | | $ | 23,494 | | | $ | 89,087 | |

Inventories | | | 408,563 | | | | 380,232 | | | | 269,270 | | | | 273,343 | | | | 258,638 | | | | 193,382 | |

Working capital | | | 305,863 | | | | 298,165 | | | | 280,942 | | | | 275,628 | | | | 191,872 | | | | 220,843 | |

Total assets | | | 970,734 | | | | 939,175 | | | | 759,903 | | | | 719,897 | | | | 663,686 | | | | 698,079 | |

Short-term debt | | | 119,000 | | | | 97,640 | | | | 40,000 | | | | 47,700 | | | | 65,900 | | | | — | |

Long-term debt, including current portion | | | 224,957 | | | | 225,655 | | | | 225,951 | | | | 233,802 | | | | 238,566 | | | | 325,089 | |

Convertible, redeemable preferred stock | | | — | | | | — | | | | — | | | | — | | | | — | | | | 10,793 | |

Shareholders’ equity | | | 336,601 | | | | 320,927 | | | | 277,847 | | | | 259,200 | | | | 202,060 | | | | 210,959 | |