Refining . . . Plus Much More

September 21, 2004

Safe Harbor Statement

Those statements made by representatives of Sunoco during the course of this presentation that are not historical facts are forward-looking statements intended to be covered by the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon a number of assumptions by Sunoco concerning future conditions, any or all of which may ultimately prove to be inaccurate. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect Sunoco’s business prospects and performance, causing actual results to differ materially from those discussed during this presentation. Such risks and uncertainties include, by way of example and not of limitation: general business and economic conditions; competitive products and pricing; changes in refining, chemical and other product margins; variation in petroleum-based commodity prices and availability of crude oil supply or transportation; fluctuations in supply of feedstocks and demand for products manufactured; changes in operating conditions and costs; changes in the expected level of environmental capital, operating or remediation spending; potential equipment malfunction; potential labor relations problems; the legislative or regulatory environment; ability to identify acquisition candidates, enter into agreement of terms favorable to us and integrate them into our existing businesses, ability to enter into joint ventures and other collaborations with favorable terms, plant construction/repair delays, non-performance by major customers, suppliers or other business partners; and political and economic conditions including the impact of potential terrorist acts and international hostilities. These and other applicable risks and uncertainties have been described more fully in Sunoco’s Second Quarter 2004 Form 10-Q, filed with the Securities and Exchange Commission on August 5, 2004. Unpredictable or unknown factors not discussed herein could also have material adverse effects on forward-looking statements. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements.

Sunoco undertakes no obligation to update any forward-looking statements whether as a result of new information or future events.

2

Sunoco Representatives

Jack Drosdick Chairman and CEO

Joel Maness Senior V. P. Refining & Supply

Bob Owens Senior V. P. Retail Marketing

Bruce Fischer Senior V. P. Chemicals

Mike Dingus Senior V.P. Sun Coke

Tom Hofmann Senior V. P. Finance and CFO

3

Agenda

What we have done

What we have recently added to the businesses

What more we can do with existing assets

What we expect in the future

4

Refining & Supply

Joel Maness

Refining

Refining Capacity (MB/D)

Phila / Marcus Hook 505

Eagle Point 150

NERC 655

Toledo 150

Tulsa 85

MCRC 235

Total 890

Annual Production of 335 MMB

Each $1.00/B in refining margins » $2.70 /share

Tulsa

Toledo

Philadelphia

Eagle Point

Marcus Hook

6

Refining & Supply

Excluding Eagle Point: Average earnings of $209 MM and ROCE of 19% for 2000—03 . . . $252 MM net income in 1H04

with Eagle Point: $317 MM earnings in 1H04 . . . on average Capital Employed of approximately $900 MM

Implemented “Five Fingers” culture . . . Safe, Environmentally Sound, Reliable, Solomon Pacesetter, Optimization . . . throughout the organization

Have achieved substantial operating gains throughout the system

safety and environment performance improvements have led the way

have improved UEDC and EII to 1st / 2nd quartile levels

annual production increased 15 MMB since 2000 . . . equivalent to a 40,000 BPD refinery

7

Refining & Supply—Employee Recordable Rate

Recordable injuries / illnesses per 200,000 hours worked

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

2000

2001

2002

2003

08-30-2004

8

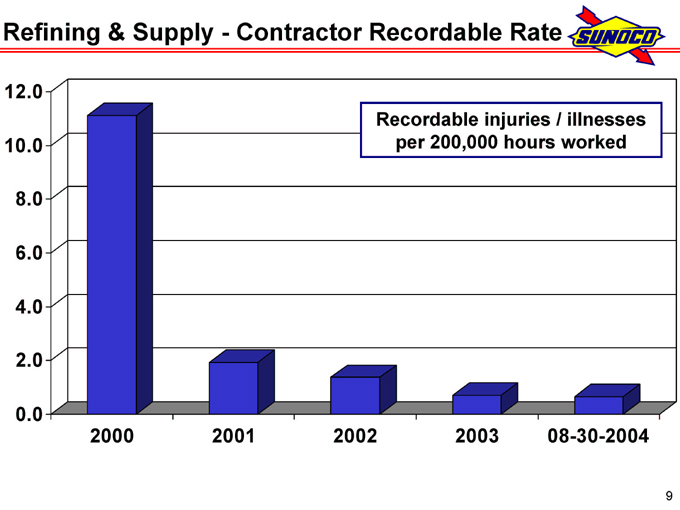

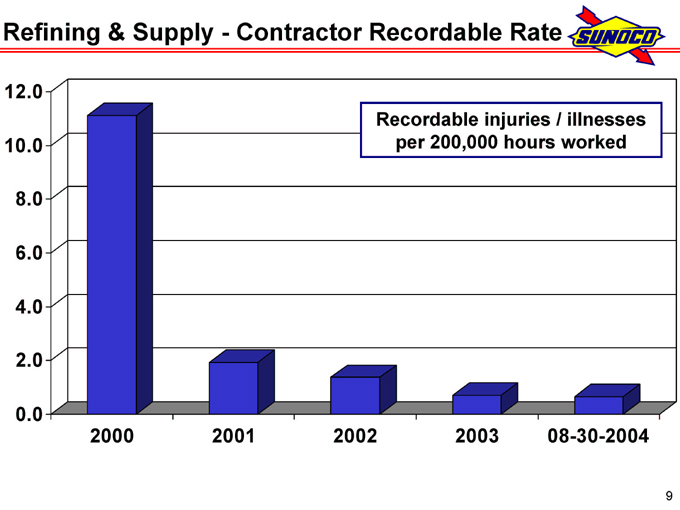

Refining & Supply—Contractor Recordable Rate

Recordable injuries / illnesses per 200,000 hours worked

0.0

2.0

4.0

6.0

8.0

10.0

12.0

2000

2001

2002

2003

08-30-2004

9

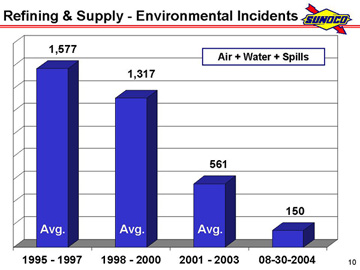

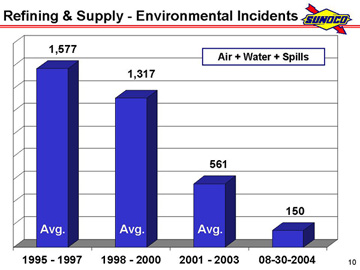

Refining & Supply—Environmental Incidents

Air + Water + Spills

1,577

1,317

561

150

1995—1997

1998—2000

2001—2003

08-30-2004

10

U.S. Refinery Utilization, (UEDC)

Percent

95

90

85

80

75

70

73 94.1 91.5 92.0 89.7 85.3

1996 1998 2000 2002 1H04

NERC *

88.8

Better

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

1% UEDC improvement = $6—7 MM/yr in increased production for Refining & Supply

* NERC excludes Eagle Point (acquired 1/2004)

11

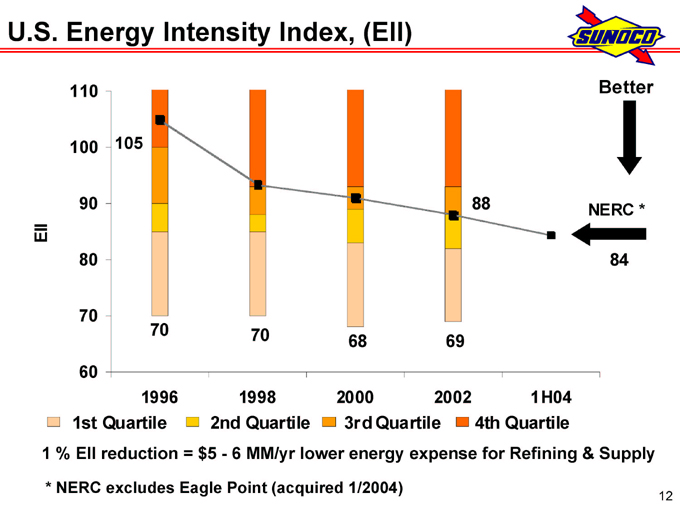

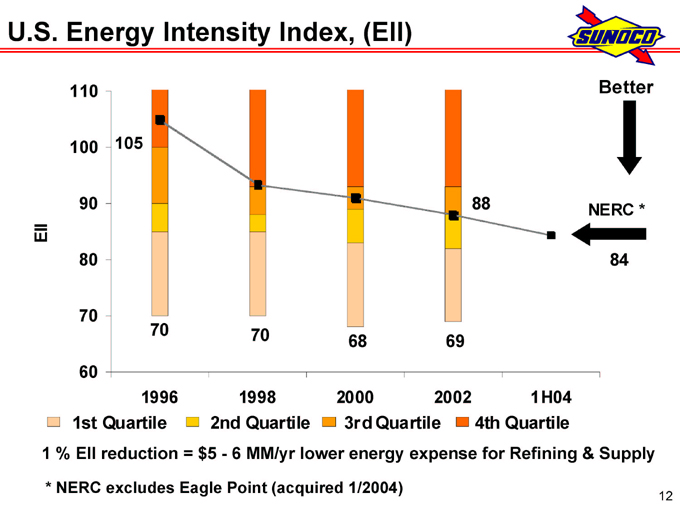

U.S. Energy Intensity Index, (EII)

EII

110 100 90 80 70 60

105

88

70 70

68 69

1996 1998 2000 2002 1H04

Better

NERC *

84

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

1% EII reduction = $5—6 MM/yr lower energy expense for Refining & Supply

* NERC excludes Eagle Point (acquired 1/2004)

12

Eagle Point

Acquired in January 2004 for $235 MM (including inventory)

150,000 BPD refinery . . . expanded Sunoco capacity by 20%

also included a 4,500 BPD cumene unit ($40 MM), logistics assets sold to Sunoco Logistics Partners ($20 MM)

immediate integration into Sunoco system and real synergy capture

$65 MM income contribution in 1H04

further improvement opportunities and action plans developed

13

Income Improvement Initiatives

Eagle Point

improve Energy Intensity Index (EII) to levels comparable with rest of Northeast system (119 vs. 84)

Expand crude oil supply alternatives

higher sulfur, higher acid sweet crudes for Northeast system

increased Canadian supply for Mid-Continent system

Organic income improvement investments

Continued progress on “Five Fingers”

14

Expectations

Margins continue to be volatile and cyclical . . . but also continue to be above historical mid-cycle over the next several years

Continue to “get more” from the existing system . . . aided by capital where appropriate

Continue to be opportunistic and disciplined in acquisition efforts

Continue to provide a strong base of earnings and cash flow for the Company

15

Retail Marketing

Bob Owens

Net Income and ROCE

Average $73 MM income / 14% ROCE (1997—2003)

MM$ 100

80 60 40 20 0

% 20

16 12 8 4 0

1997 1998 1999 2000 2001 2002 2003 1H04

Net Income

ROCE(%)

17

Sunoco Marketing Area: 1997

3,600 Sites

3.4 B Gallons

$540 MM Cap Employed

18

Sunoco Marketing Area: 2004

4,800 Sites

5.2 B Gallons

$600 MM Cap Employed *

* Projected average

19

Coastal Acquisitions: 2001 & 2002

$62 MM

Tested Sunoco brand acceptance in Southeast with modest investment

Coastal brand used as secondary offering

20

Recent Acquisitions

$343 MM

Speedway: high-quality, Co-op sites in Southeast

Expect to recover $30 MM through real estate divestments

COP: high volume, good real estate, contiguous to primary Sunoco market

Expected to contribute $30 MM per year in earnings

Speedway: 2003

ConocoPhillips: 2004

21

MCJ1

Retail Portfolio Management (RPM)

Optimize invested capital

Expect $200 MM real estate proceeds in 2003-05

$100 MM realized, balance over next 18 months

370 of 1,600 Company-owned / leased sites

Retain volume with dealers / distributors

$100 MM from credit card outsourcing (2Q04)

Expect modest earnings accretion

Expect net gain on divestments

Improves ROCE

75 in 2003 Spring

22

More From Existing Assets

Brand position

Retail buying experience

NASCAR

Capital investments

Stores / stations

Technology

Process improvement

Same-store sales growth

Fuel and merchandise

Expense control

23

Expectations

Competitive pressures to continue but average margins comparable to 2000-03 period

Business to reflect improved earnings power and ROCE as a result of recent acquisitions, RPM and improvement initiatives

Continue to be opportunistic in considering acquisitions and further growth of our Brand

24

Chemicals

Bruce Fischer

Chemicals Capital Employed, MM$

Phenol $450

Polypropylene $600

Other—$15

Total: $1.065 B at 6/30/04

26

Chemicals

Steady financial improvement ($0.07 EPS in 2001, $0.68 EPS in 2003) but ROCE has been unacceptable—- economics have favored feedstock providers

Focus on cash generation to Sunoco and optimizing operations

$323 MM net cash generation (ex-acquisitions) from 1/1/01 to 6/30/04, including plasticizers divestment

shut down approximately 10 % of phenol and polypropylene capacity

improved employee productivity by 30 %

optimized logistics and raw material procurement

27

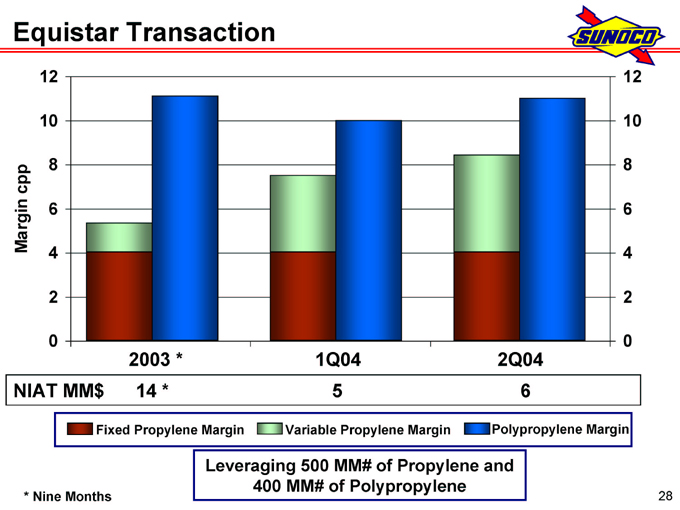

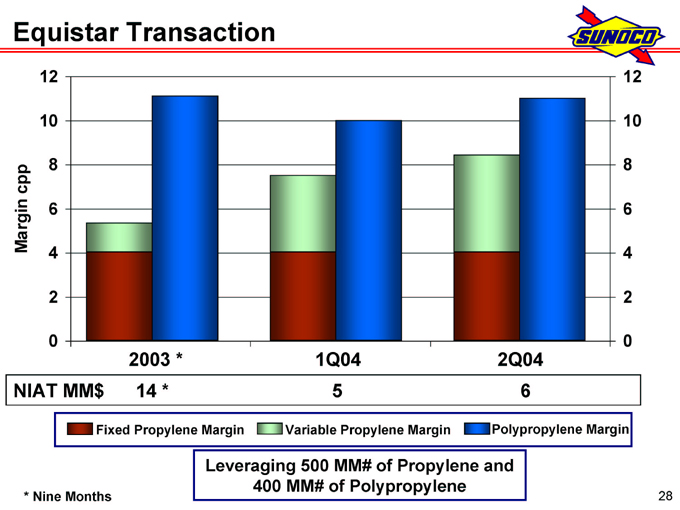

Equistar Transaction

Margin cpp

12 10 8 6 4 2 0

12 10 8 6 4 2 0

2003 * 1Q04 2Q04 NIAT MM$ 14 * 5 6

Fixed Propylene Margin Variable Propylene Margin Polypropylene Margin

Leveraging 500 MM# of Propylene and 400 MM# of Polypropylene

Nine Months

28

Operating Rates

North American

Polypropylene & Phenol Operating Rates

Industry Utilization, (%)

100 95 90 85 80 75 70

2000 2001 2002 2003 2004 Est.

Polypropylene

Phenol

Source: Industry Statistics

29

Current Sunoco Status

Productivity initiatives implemented

Operating rates 90 % +

Spot market pricing moving up (Asia export)

Gaining pricing power

Income in a $45 /BBL crude environment

No significant industry capacity additions announced

Believe Cyclical Recovery is Underway

30

Sun Coke

Mike Dingus

Sun Coke Advantage

32

Sun Coke Advantage

33

Sun Coke Advantage

34

Sun Coke Advantage

35

Sun Coke Advantage

Superior Technology . . . heat recovery vs. traditional chemical by-product plants

lower capital and operating costs

higher quality coke . . . improved blast furnace efficiency

greater coal blend flexibility

environmentally superior . . . negative pressure . . . convert waste heat into steam or electric power

Unique Joint Venture development model

36

Coke Plant Demand

400 MM ton world market

China, India and CIS = 250 MM tons

Aging by-products plants

New blast furnace cannot be financed without secure coke supply

Steel companies no longer willing to rely on China as coke supplier . . . want secure supply at a reasonable cost

37

Sun Coke Strategy

Demonstrate technology and develop growth plan, based on:

good customers, assets and credit

good logistics

stable energy markets with spot, medium and long-term contracts

long-term take-or-pay contacts . . . coal price pass through . . . targeted steady return on equity investment

seeks customers as partners

38

Sun Coke Today

Jewell (Virginia)

Completed in the 1960’s . . . 700,000 ton

$309 MM proceeds from sale of partnership interests (in 1995/00)

ISG—offtaker

Indiana Harbor (Indiana) . . . 1,300,000 ton

Completed in 1998 for $195 MM

$415 MM proceeds from sale of partnership interests (in 1998/02)

Ispat Inland – offtaker

39

Sun Coke Today

Haverhill I (Ohio)

550,000 ton, $140MM

Under construction, expected completion 1Q 2005

ISG—offtaker

Steam supply to Sunoco Chemicals Haverhill phenol plant

Vitoria, Brazil—1% ownership, currently

1,600,000 ton, $380 MM

Under construction, expected completion 3Q 2006

Option to increase ownership to 20%

CST, Belgo Mineria, Acesita, CVRD—offtakers

SCC earns technology and operating fees

40

Sun Coke Business Plan for the Future

Multiple minority interest projects

Sun Coke equity ownership < 40% . . . generally $15 MM to $35 MM invested per project

non-recourse project financing

expect equity to earn attractive return . . . other equity owners to include steel company customers . . . parallel interests and goals

Sun Coke also receives technology and operating fees

responsible for construction engineering and ongoing operations

41

Prototype Coke Plant

240 ovens, 1.2 MM tons

100 MW electricity

$365 MM capital cost

$255 MM project financing, $77 MM partners equity, $33 MM Sun Coke equity

Partners typically steel company customer, power operator / marketer or coal provider

After-tax income of $15—20 MM / year to Sun Coke

42

Active Development Projects

3 projects in permitting phase . . . representing approximately 2.7 MM tons and $850 MM total construction cost

Subject to finalization of contracts and other contingencies and approvals

At 30% equity interest in each project . . . Sun Coke total investment would be approximately $75 MM

With fees, total income potential of approximately $30 MM / year

Option to increase Brazil ownership to 20% . . . approximately $5 MM incremental income per year

In various stages of discussion on several other projects

43

Financial Review

Tom Hofmann

Strategy Has Been Consistent

(1) Get more from existing assets

Higher refinery production (15 MMB since 2000)

Improved refinery efficiency (EII / UEDC)

Higher retail throughputs (up 15% since 2000)

Rationalized chemical production lines / costs

Asset rationalization

$100 MM retail portfolio management program

$90 MM sale of plasticizers business

$100 MM sale of Proprietary Credit Card

$129 MM SXL secondary offering

45

Strategy Has Been Consistent

(2) Opportunistically upgrade the asset base

Purchase Price (MM$) 1H04 Income (MM$)

Refining & Supply—Eagle Point (1/04) 235 65

Retail Marketing—Speedway (6/03) 162 4

Retail Marketing—ConocoPhillips (4/04) 181 5

Chemicals—Equistar (4/03) 198 11

776 85

46

Strategy Has Been Consistent

(2) Opportunistically upgrade the asset base

Purchase Price (MM$) 1H04 Income (MM$)

Refining & Supply—Eagle Point (1/04) 235 65

Retail Marketing—Speedway (6/03) 162 4

Retail Marketing—ConocoPhillips (4/04) 181 5

Chemicals—Equistar (4/03) 198 11

776 85

Haverhill Ohio Coke Plant (1Q05) 140 15*

* Expected annualized Sunoco earnings

47

Strategy Has Been Consistent

(3) Return cash to shareholder

Increased dividend in 2003 and 2004

Dividend is $1.20 / share, highest yield among refining peers

Reduced shares outstanding 17% (net of option exercises) since 1/1/00

New $500 MM authorization

48

Strategy Has Been Consistent

(4) Maintained financial strength

Strong balance sheet

Balanced approach of funding asset growth, dividend and share repurchase

Strong operating cash flow

Generated $1.2 B from asset sales / other sources

Increased total assets from $5.5 B at 12/31/00 to $8.0 B at 6/30/04

Debt restructuring underway

Maintained investment grade rating

49

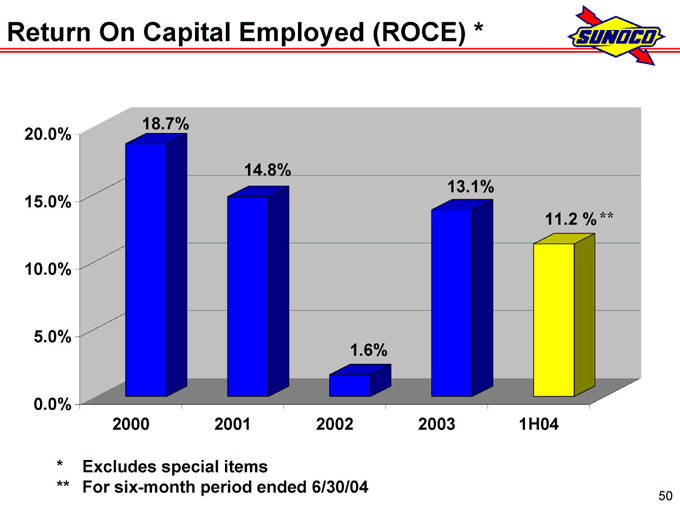

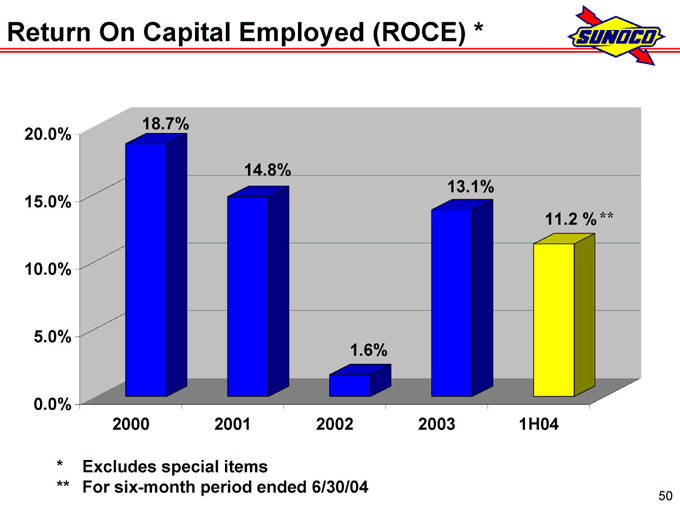

Return On Capital Employed (ROCE) *

20.0% 15.0% 10.0% 5.0% 0.0%

18.7%

14.8%

13.1%

11.2 %**

1.6%

2000 2001 2002 2003 1H04

* Excludes special items

** For six-month period ended 6/30/04

50

Strategy remains unchanged

Positive market fundamentals

Substantial organic growth and improvement potential from existing asset base

Financial capacity to do more

Prudent growth in all businesses

Return cash to shareholders

Summary

Continue to build a bigger, more diversified company with greater earnings power and less shares outstanding.

51

Appendix

Summary of Results

2000

2001

2002

2003

1H04

Income (Loss) before Special Items, MM$

438

380

(25)

335

327

Income (Loss) before Special Items EPS, $/share

5.01

4.63

(0.33)

4.32

4.29

ROCE, % *

18.7

14.8

1.6

13.1

11.2

Debt / Capital, % (net of cash) **

47***

49

45

42

34

Share Repurchase, MM$

144

393

—

136

65

Shares O/S @ Period-end, MM

84.8

75.5

76.4

75.4

75.3

Share Price @ Period-end, $/share

33.69

37.34

33.18

51.15

63.62

* Calculated using Income before Special Items. 1H ratio not annualized.

** Per Revolver Covenant

*** Pro-forma to reflect Aristech acquisition completed 1/1/01.

A1

Earnings Profile, MM$

2000

2001

2002

2003

1H04

Refining & Supply

317

290

(31)

261

317

Retail Marketing

77

87

20

91

20

Chemicals

16

6

28

53

24

Logistics

46

42

33

26

17

Coke

61

61

42

43

18

Corporate / Net Financing

(79)

(106)

(117)

(139)

(69)

438

380

(25)

335

327

Special Items

(16)

18

(22)

(23)

(4)

Consolidated Net Income (Loss)

422

398

(47)

312

323

EPS (diluted):

Income (Loss) before Special Items

5.01

4.63

(0.33)

4.32

4.29

Special Items

(0.19)

0.22

(0.29)

(0.29)

(0.06)

Net Income (Loss)

4.82

4.85

(0.62)

4.03

4.23

A2

Total Shareholder Return (4+ Years)

Dollars

Peer Group Ashland Lyondell Marathon Premcor Tesoro Valero

Major Oil Cos. Amerada Hess BP

ChevronTexaco Exxon Mobil ConocoPhillips

350 300 250 200 150 100 50 0

Sunoco, Inc.

Peer Major Group Oil Cos.

S&P 500 Stock Index

1999 2000 2001 2002 2003

* Estimated total return (including reinvested dividends) 1/1/00—9/17/04. Peer Group and Major Oil returns weighted by market capitalization (proxy methodology).

A3

Sunoco Shares Outstanding, MM

Have repurchased 21 MM shares ($810 MM) over this period

90 85 80 75 70 65

89.9 84.8 75.5 76.4 75.4 74.6

12-31-99 12-31-00 12-31-01 12-31-02 12-31-03 09-01-04

A4