Exhibit 99.2

4Q04 Earnings Conference Call January 20, 2005

1

Safe Harbor Statement

This slide presentation (including the Appendix) should be reviewed in conjunction with Sunoco’s Fourth Quarter 2004 earnings conference call, held on January 20, 2005 at 3:00 p.m. ET. You may listen to the audio portion of the conference call on this website or an audio recording will be available after the call’s completion by calling 1-800-642-1687 and entering conference ID # 3155978.

Those statements made by representatives of Sunoco during the course of this conference call that are not historical facts are forward-looking statements intended to be covered by the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon a number of assumptions by Sunoco concerning future conditions, any or all of which may ultimately prove to be inaccurate. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect Sunoco’s business prospects and performance, causing actual results to differ materially from those discussed during this conference call. Such risks and uncertainties include, by way of example and not of limitation: general business and economic conditions; competitive products and pricing; effects of weather conditions and natural disasters on product supply and demand; changes in refining, chemical and other product margins; variation in petroleum-based commodity prices and availability of crude oil supply or transportation; effects of transportation disruptions; changes in the price differentials between light-sweet and heavy-sour crude oils; fluctuations in supply of feedstocks and demand for products manufactured; changes in product specifications; availability and pricing of oxygenates; phase-outs or restrictions on the use of MTBE; changes in operating conditions and costs; changes in the expected level of environmental capital, operating or remediation expenditures; age of, and changes in, the reliability and efficiency of the Company’s or a third party’s operating facilities; potential equipment malfunction; potential labor relations problems; the legislative and regulatory environment; ability to identify acquisitions under favorable terms and integrate them into the Company’s existing businesses; ability to enter into joint ventures and other arrangements with favorable terms; plant construction/repair delays; non-performance by major customers, suppliers or other business partners; changes in financial markets impacting pension expense and funding requirements; political and economic conditions, including the impact of potential terrorist acts and international hostilities; and changes in the status of, or initiation of, new litigation. These and other applicable risks and uncertainties have been described more fully in Sunoco’s Third Quarter 2004 Form 10-Q filed with the Securities and Exchange Commission on November 4, 2004. Unpredictable or unknown factors not discussed herein could also have material adverse effects on forward-looking statements. All forward-looking statements included in this conference call are expressly qualified in their entirety by the foregoing cautionary statements.

Sunoco undertakes no obligation to update any forward-looking statements whether as a result of new information or future events.

2

Summary

Income before special items

4Q04: $188 MM ($2.62/share)

FY04: $639 MM ($8.53/share)

Income from 2003/04 acquired assets

4Q04: $61 MM (32%)

FY04: $190 MM (30%)

Share repurchase activity

4Q04: 4.3 MM shares ($332 MM)

FY04: 8.0 MM shares ($568 MM)

Outstanding shares at 12/31/04 = 69.3 MM (down 8% vs. 12/31/03)

3

Summary

Net debt-to-capital (per revolver covenant)

12/31/03: 42%

12/31/04: 37%

2004 refinancing activities lowered (future) annual pre-tax interest expense by $20 MM

2005 capital spending plan: $846 MM

Includes $294 MM for Clean Fuels

Includes $17 MM to complete Haverhill coke plant (1Q05)

Includes $107 MM of other income improvement projects

4

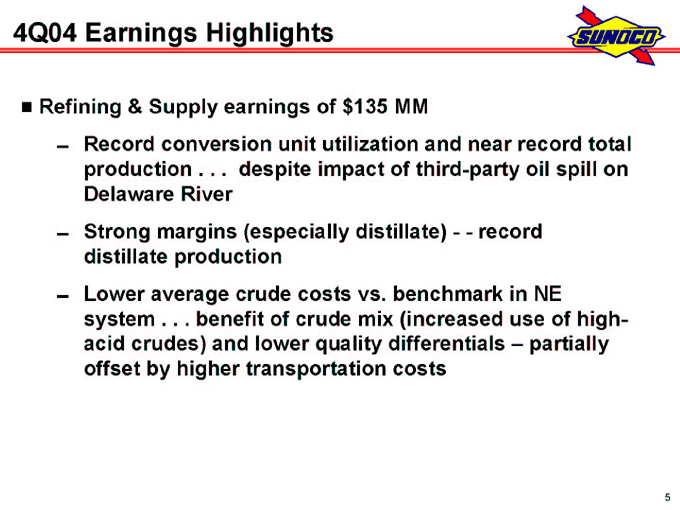

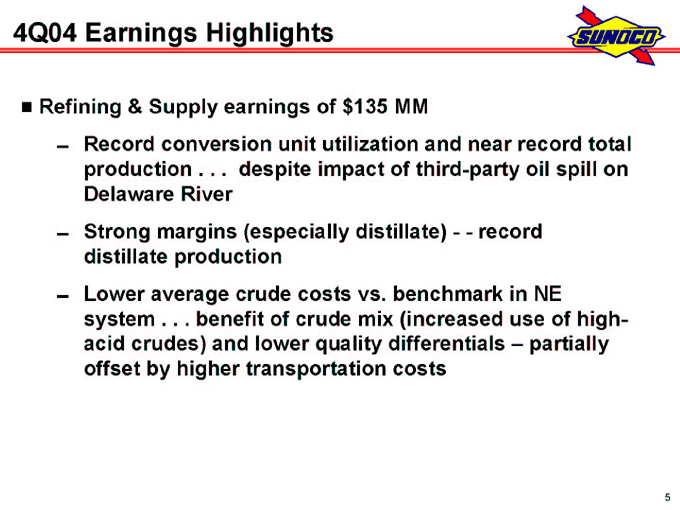

4Q04 Earnings Highlights

Refining & Supply earnings of $135 MM

Record conversion unit utilization and near record total production . . . despite impact of third-party oil spill on Delaware River

Strong margins (especially distillate)—- record distillate production

Lower average crude costs vs. benchmark in NE system . . . benefit of crude mix (increased use of high-acid crudes) and lower quality differentials – partially offset by higher transportation costs

5

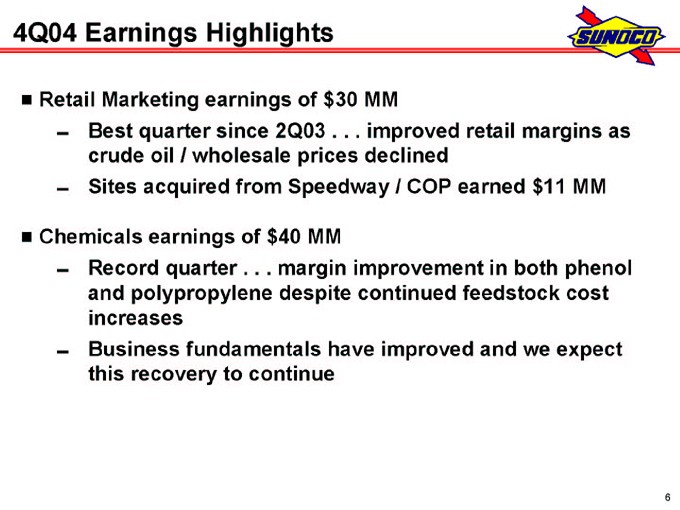

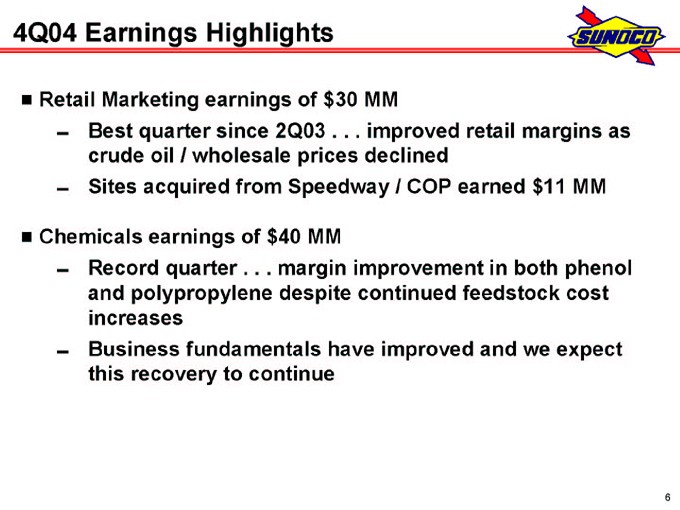

4Q04 Earnings Highlights

Retail Marketing earnings of $30 MM

Best quarter since 2Q03 . . . improved retail margins as crude oil / wholesale prices declined

Sites acquired from Speedway / COP earned $11 MM

Chemicals earnings of $40 MM

Record quarter . . . margin improvement in both phenol and polypropylene despite continued feedstock cost increases

Business fundamentals have improved and we expect this recovery to continue

6

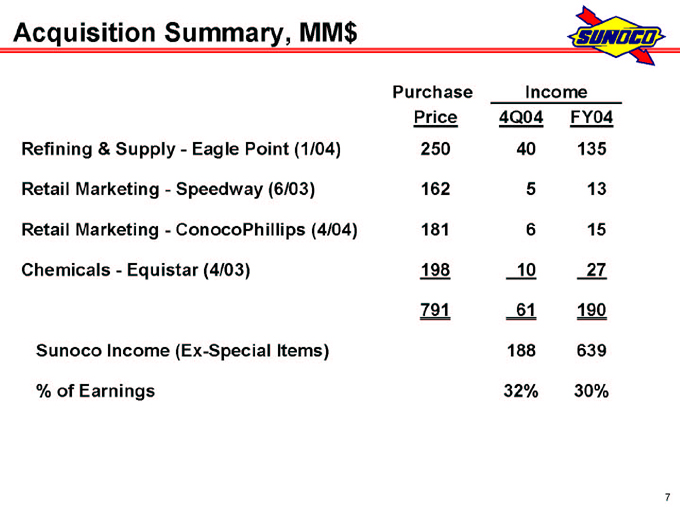

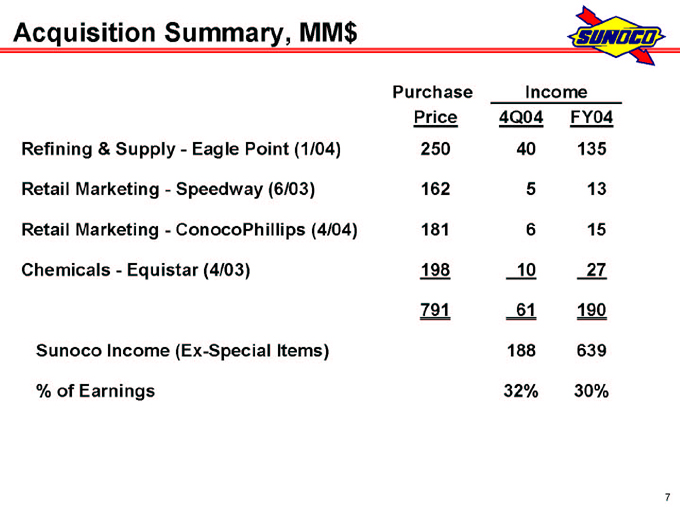

Acquisition Summary, MM$

Purchase Income

Price 4Q04 FY04

Refining & Supply—Eagle Point (1/04) 250 40 135

Retail Marketing—Speedway (6/03) 162 5 13

Retail Marketing—ConocoPhillips (4/04) 181 6 15

Chemicals—Equistar (4/03) 198 10 27

791 61 190

Sunoco Income (Ex-Special Items) 188 639

% of Earnings 32% 30%

7

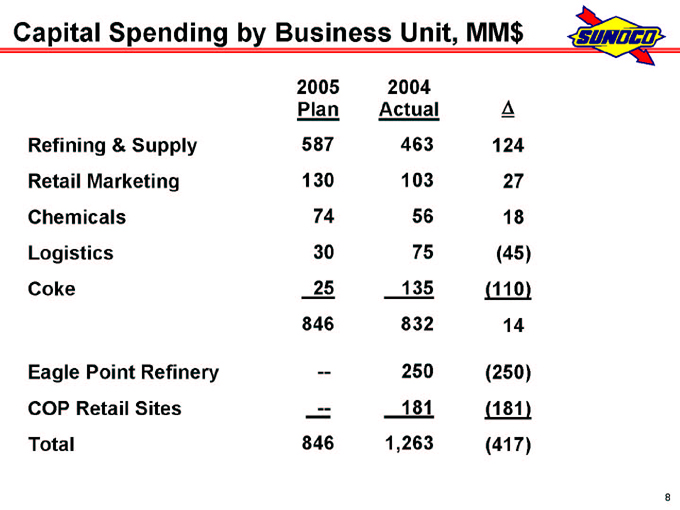

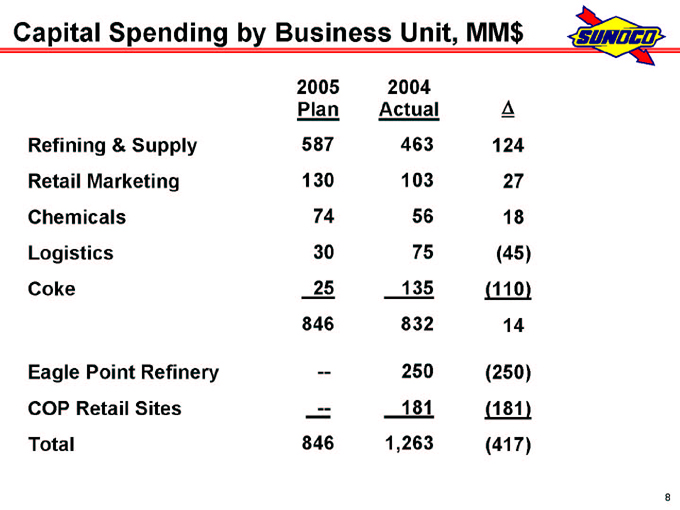

Capital Spending by Business Unit, MM$

2005 2004

Plan Actual D

Refining & Supply 587 463 124

Retail Marketing 130 103 27

Chemicals 74 56 18

Logistics 30 75 (45)

Coke 25 135 (110)

846 832 14

Eagle Point Refinery — 250 (250)

COP Retail Sites — 181 (181)

Total 846 1,263 (417)

8

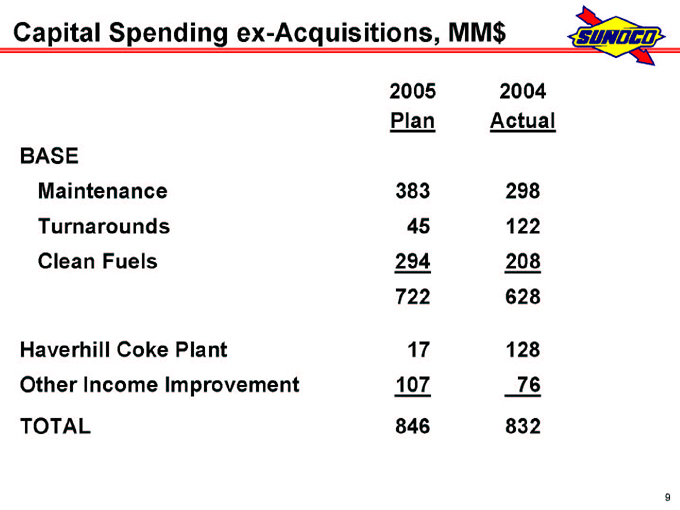

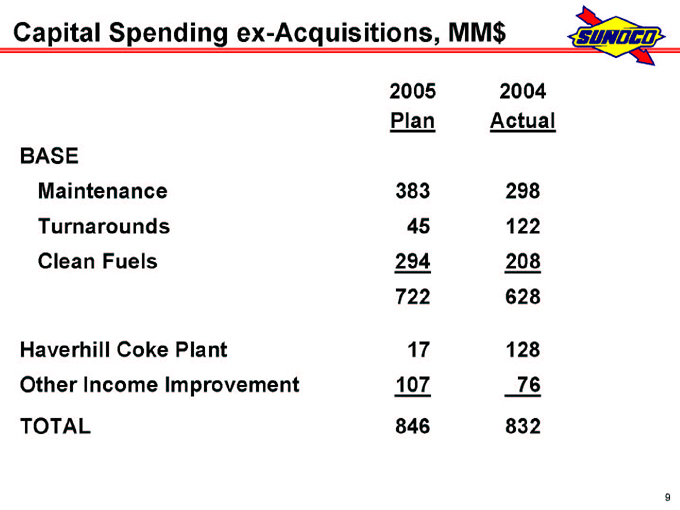

Capital Spending ex-Acquisitions, MM$

2005 2004

Plan Actual

BASE

Maintenance 383 298

Turnarounds 45 122

Clean Fuels 294 208

722 628

Haverhill Coke Plant 17 128

Other Income Improvement 107 76

TOTAL 846 832

9

Appendix

4Q04 Earnings Conference Call January 20, 2005

A1

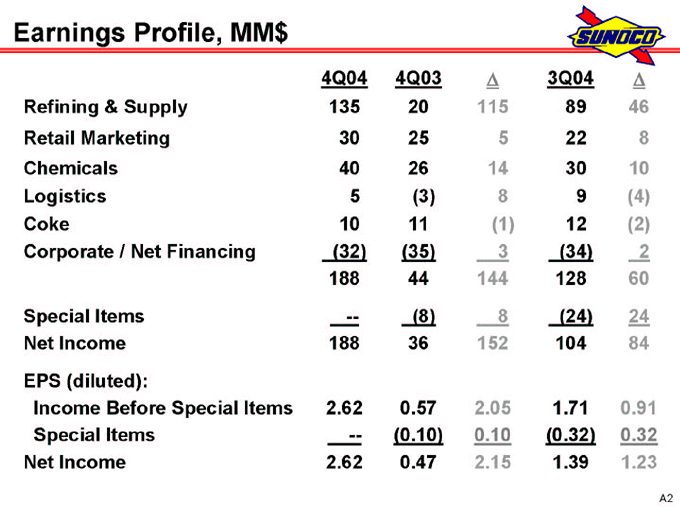

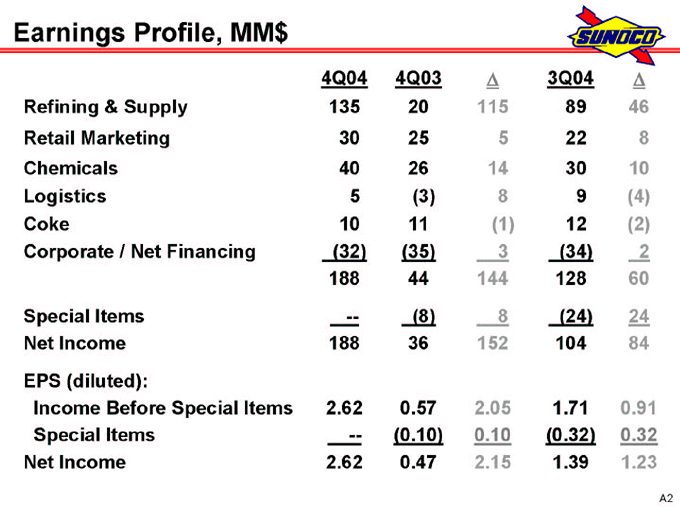

Earnings Profile, MM$

4Q04 4Q03 D 3Q04 D

Refining & Supply 135 20 115 89 46

Retail Marketing 30 25 5 22 8

Chemicals 40 26 14 30 10

Logistics 5 (3) 8 9 (4)

Coke 10 11 (1) 12 (2)

Corporate / Net Financing (32) (35) 3 (34) 2

188 44 144 128 60

Special Items — (8) 8 (24) 24

Net Income 188 36 152 104 84

EPS (diluted):

Income Before Special Items 2.62 0.57 2.05 1.71 0.91

Special Items — (0.10) 0.10 (0.32) 0.32

Net Income 2.62 0.47 2.15 1.39 1.23

A2

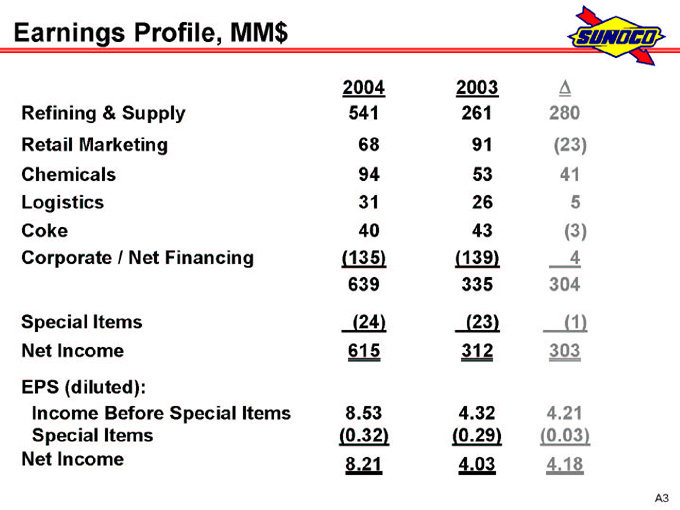

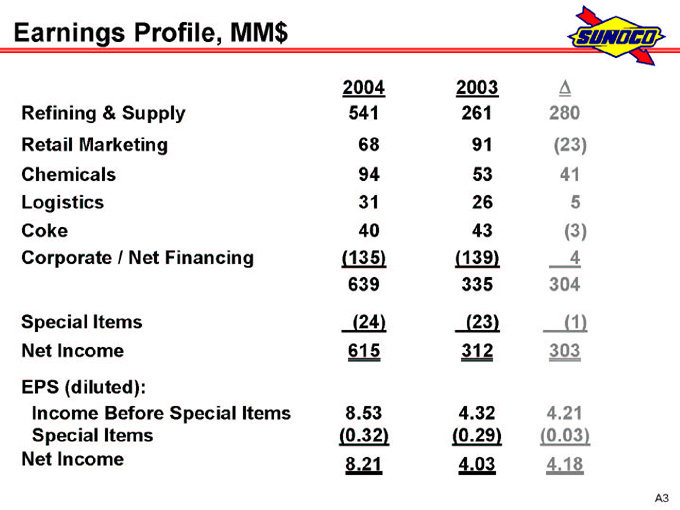

Earnings Profile, MM$

2004 2003 D

Refining & Supply 541 261 280

Retail Marketing 68 91 (23)

Chemicals 94 53 41

Logistics 31 26 5

Coke 40 43 (3)

Corporate / Net Financing (135) (139) 4

639 335 304

Special Items (24) (23) (1)

Net Income 615 312 303

EPS (diluted):

Income Before Special Items 8.53 4.32 4.21

Special Items (0.32) (0.29) (0.03)

Net Income 8.21 4.03 4.18

A3

FY04 Highlights

Refining & Supply’s earnings of $541 MM

Strong margins throughout the year . . . gasoline, distillate and petrochemicals

Eagle Point contribution of $135 MM

Excluding Eagle Point, increased production by 4 MM bbls. over 2003

Significant marine transportation savings vs. spot market (40% time charter coverage)

A4

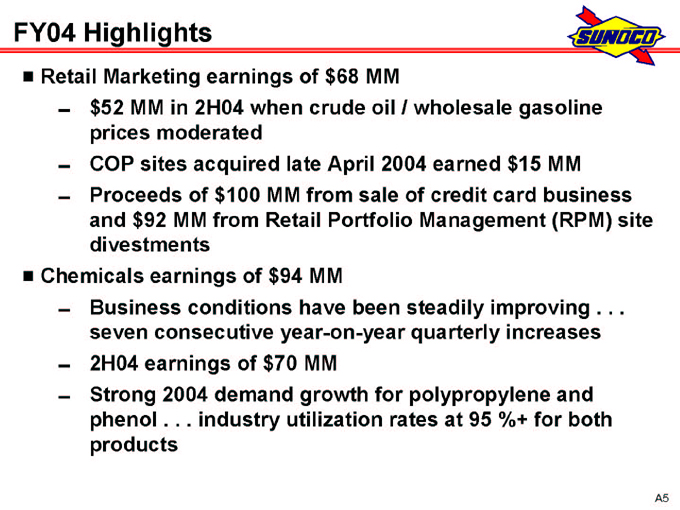

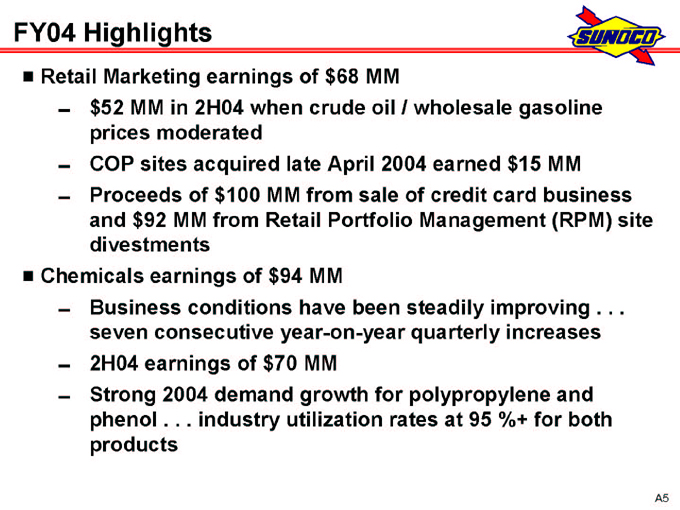

FY04 Highlights

Retail Marketing earnings of $68 MM

$52 MM in 2H04 when crude oil / wholesale gasoline prices moderated

COP sites acquired late April 2004 earned $15 MM

Proceeds of $100 MM from sale of credit card business and $92 MM from Retail Portfolio Management (RPM) site divestments

Chemicals earnings of $94 MM

Business conditions have been steadily improving . . . seven consecutive year-on-year quarterly increases

2H04 earnings of $70 MM

Strong 2004 demand growth for polypropylene and phenol . . . industry utilization rates at 95 %+ for both products

A5

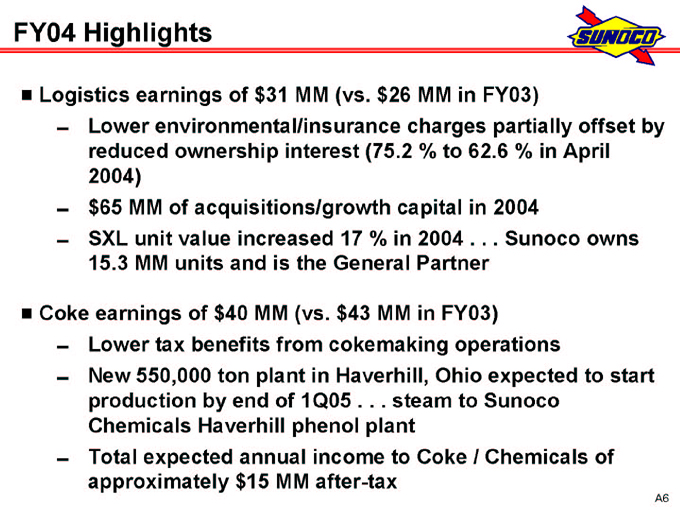

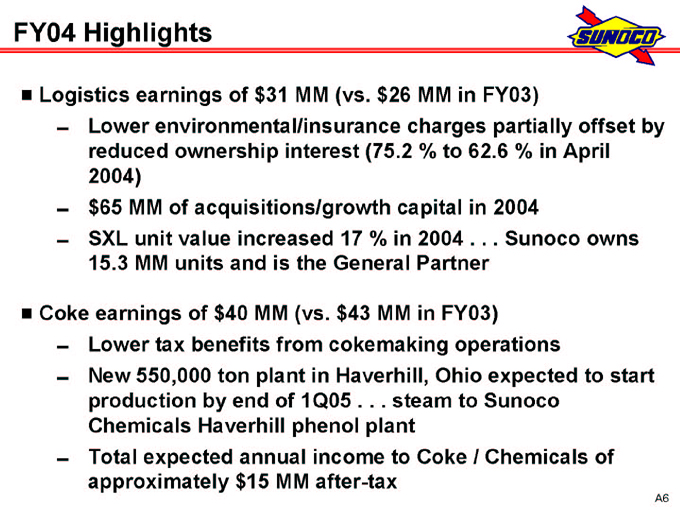

FY04 Highlights

Logistics earnings of $31 MM (vs. $26 MM in FY03)

Lower environmental/insurance charges partially offset by reduced ownership interest (75.2 % to 62.6 % in April 2004)

$65 MM of acquisitions/growth capital in 2004

SXL unit value increased 17 % in 2004 . . . Sunoco owns 15.3 MM units and is the General Partner

Coke earnings of $40 MM (vs. $43 MM in FY03)

Lower tax benefits from cokemaking operations

New 550,000 ton plant in Haverhill, Ohio expected to start production by end of 1Q05 . . . steam to Sunoco Chemicals Haverhill phenol plant

Total expected annual income to Coke / Chemicals of approximately $15 MM after-tax

A6

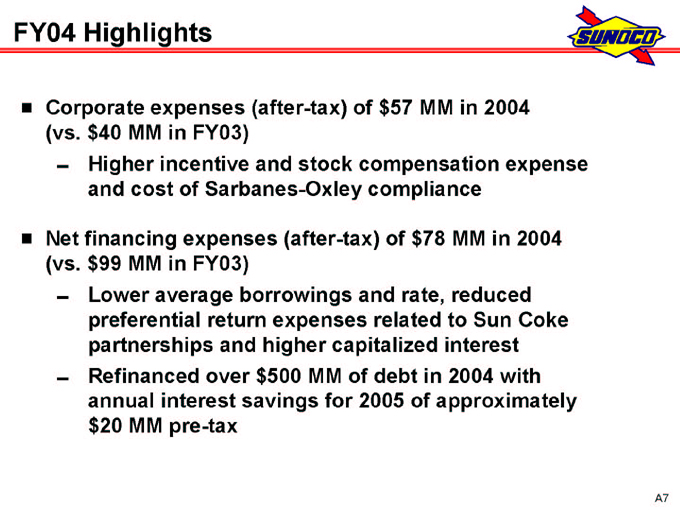

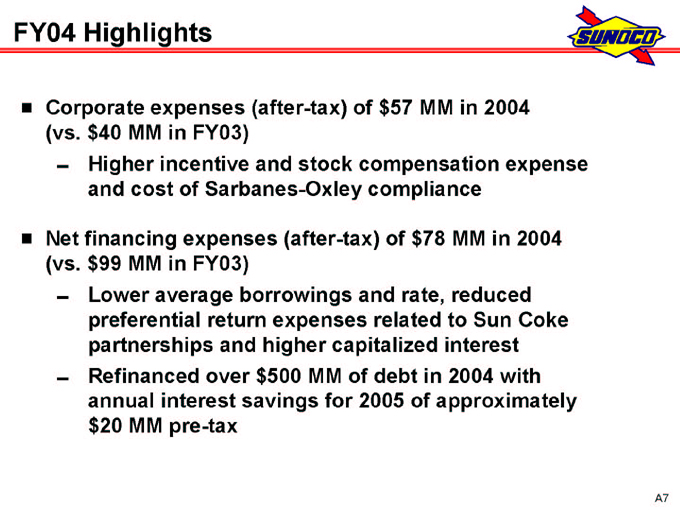

FY04 Highlights

Corporate expenses (after-tax) of $57 MM in 2004 (vs. $40 MM in FY03)

Higher incentive and stock compensation expense and cost of Sarbanes-Oxley compliance

Net financing expenses (after-tax) of $78 MM in 2004 (vs. $99 MM in FY03)

Lower average borrowings and rate, reduced preferential return expenses related to Sun Coke partnerships and higher capitalized interest

Refinanced over $500 MM of debt in 2004 with annual interest savings for 2005 of approximately $20 MM pre-tax

A7

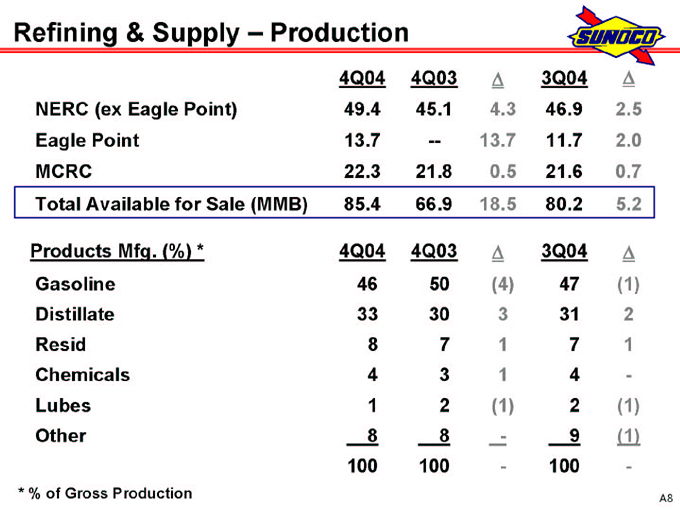

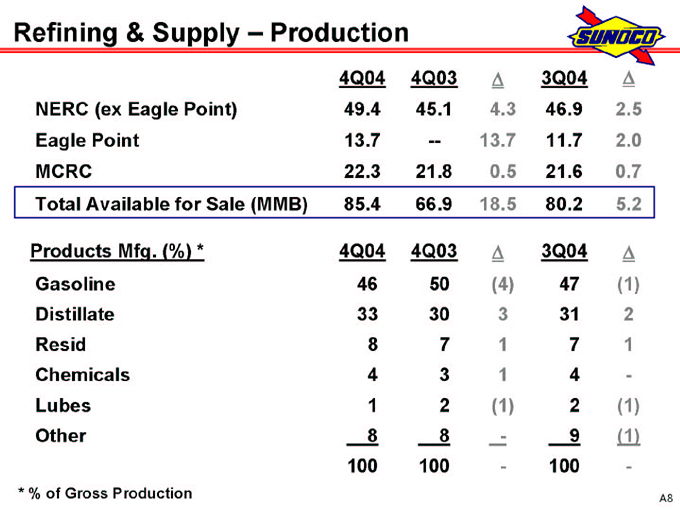

Refining & Supply – Production

4Q04 4Q03 D 3Q04 D

NERC (ex Eagle Point) 49.4 45.1 4.3 46.9 2.5

Eagle Point 13.7 — 13.7 11.7 2.0

MCRC 22.3 21.8 0.5 21.6 0.7

Total Available for Sale (MMB) 85.4 66.9 18.5 80.2 5.2

Products Mfg. (%) * 4Q04 4Q03 D 3Q04 D

Gasoline 46 50 (4) 47 (1)

Distillate 33 30 3 31 2

Resid 8 7 1 7 1

Chemicals 4 3 1 4 -

Lubes 1 2 (1) 2 (1)

Other 8 8 - 9 (1)

100 100 - 100 -

* % of Gross Production

A8

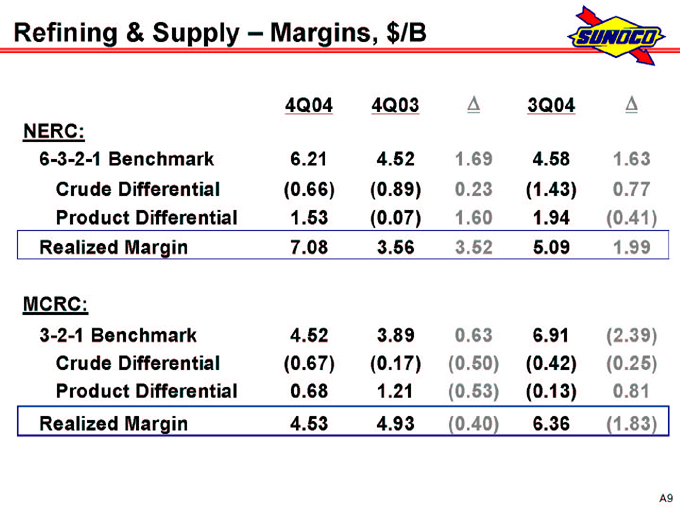

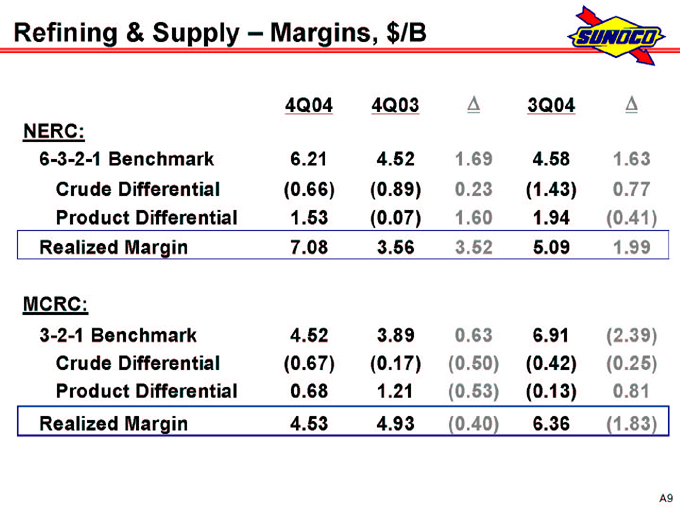

Refining & Supply – Margins, $/B

4Q04 4Q03 D 3Q04 D

NERC:

6-3-2-1 Benchmark 6.21 4.52 1.69 4.58 1.63

Crude Differential (0.66) (0.89) 0.23 (1.43) 0.77

Product Differential 1.53 (0.07) 1.60 1.94 (0.41)

Realized Margin 7.08 3.56 3.52 5.09 1.99

MCRC:

3-2-1 Benchmark 4.52 3.89 0.63 6.91 (2.39)

Crude Differential (0.67) (0.17) (0.50) (0.42) (0.25)

Product Differential 0.68 1.21 (0.53) (0.13) 0.81

Realized Margin 4.53 4.93 (0.40) 6.36 (1.83)

A9

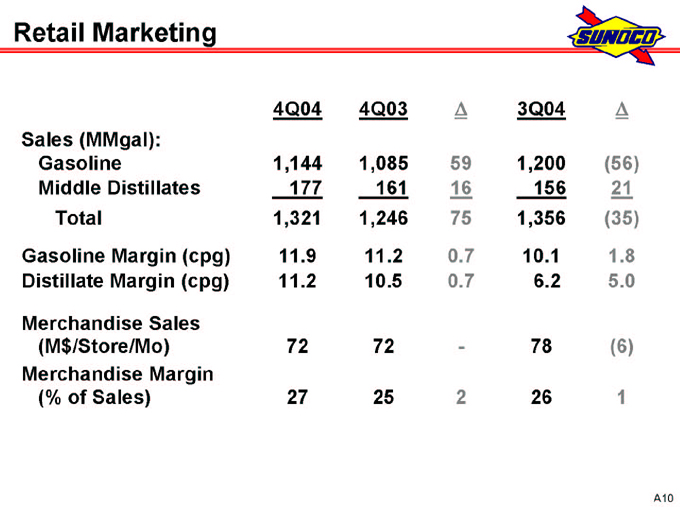

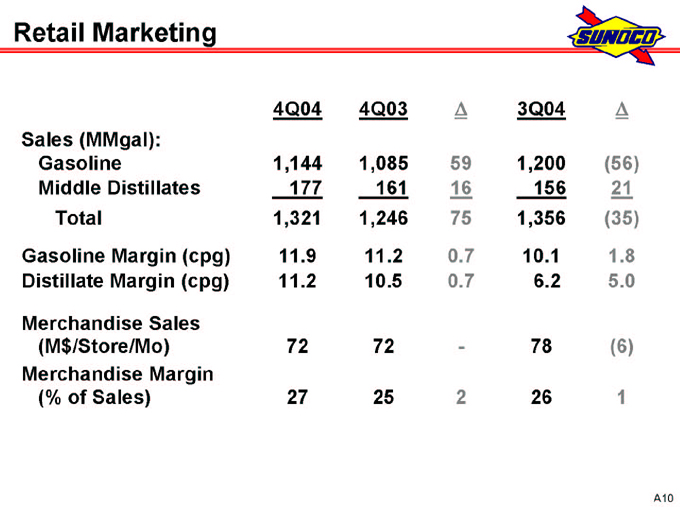

Retail Marketing

4Q04 4Q03 D 3Q04 D

Sales (MMgal):

Gasoline 1,144 1,085 59 1,200 (56)

Middle Distillates 177 161 16 156 21

Total 1,321 1,246 75 1,356 (35)

Gasoline Margin (cpg) 11.9 11.2 0.7 10.1 1.8

Distillate Margin (cpg) 11.2 10.5 0.7 6.2 5.0

Merchandise Sales

(M$/Store/Mo) 72 72 - 78 (6)

Merchandise Margin

(% of Sales) 27 25 2 26 1

A10

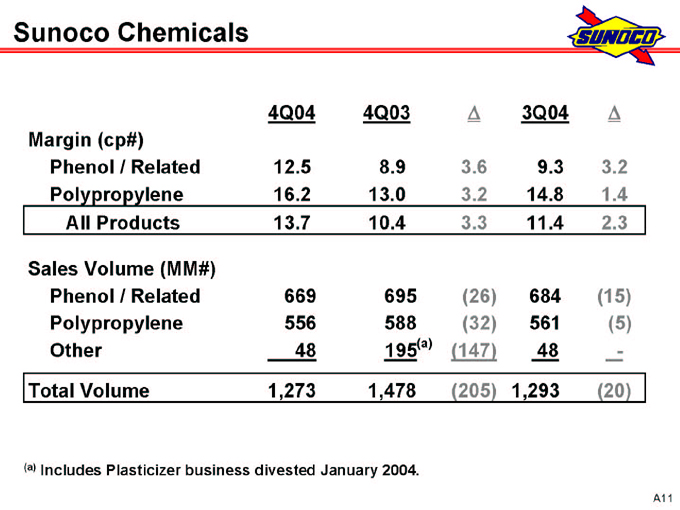

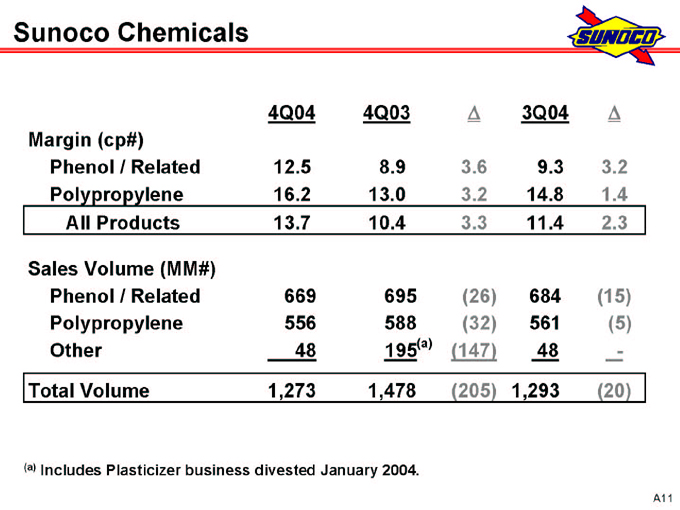

Sunoco Chemicals

4Q04 4Q03 D 3Q04 D

Margin (cp#)

Phenol / Related 12.5 8.9 3.6 9.3 3.2

Polypropylene 16.2 13.0 3.2 14.8 1.4

All Products 13.7 10.4 3.3 11.4 2.3

Sales Volume (MM#)

Phenol / Related 669 695 (26) 684 (15)

Polypropylene 556 588 (32) 561 (5)

Other 48 195(a) (147) 48 -

Total Volume 1,273 1,478 (205) 1,293 (20)

(a) Includes Plasticizer business divested January 2004.

A11

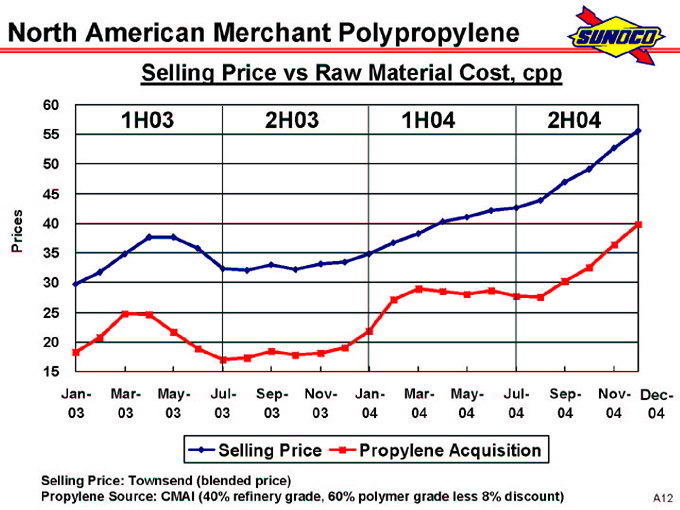

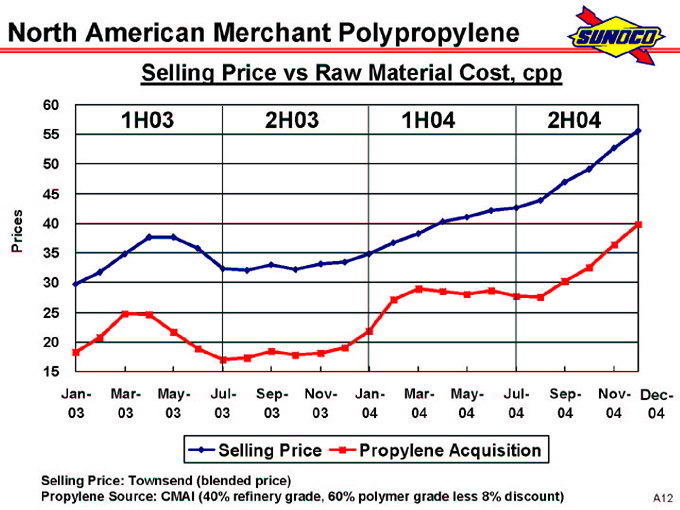

North American Merchant Polypropylene

Selling Price vs Raw Material Cost, cpp

60 55 50

45 Prices 40 35 30

25 20 15

1H03

2H03

1H04

2H04

Jan- Mar- May- Jul- Sep- Nov- Jan- Mar- May- Jul- Sep- Nov- Dec-

03 03 03 03 03 03 04 04 04 04 04 04 04

Selling Price

Propylene Acquisition

Selling Price: Townsend (blended price)

Propylene Source: CMAI (40% refinery grade, 60% polymer grade less 8% discount)

A12

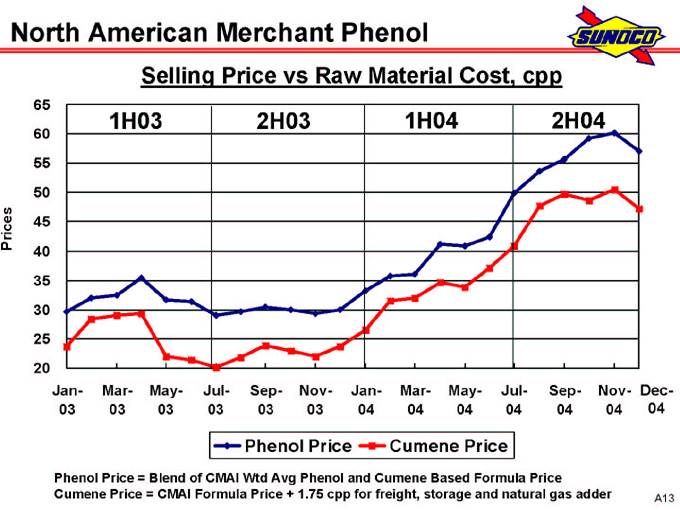

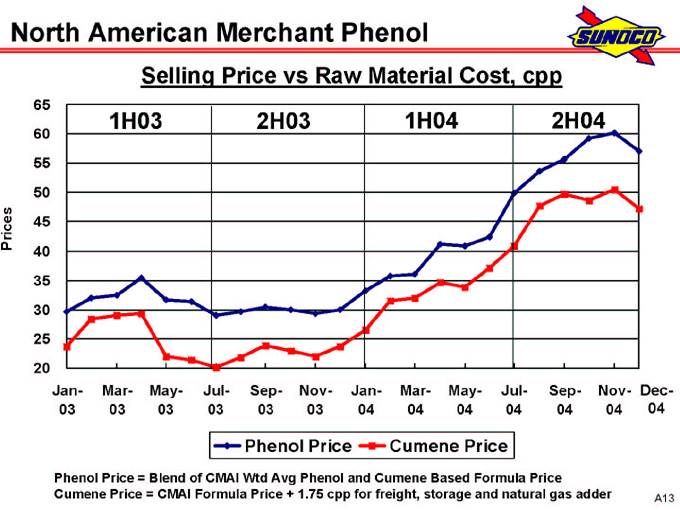

North American Merchant Phenol

Selling Price vs Raw Material Cost, cpp

65 60 55 50 Prices 45 40 35 30 25 20

1H03

2H03

1H04

2H04

Jan- Mar- May- Jul- Sep- Nov- Jan- Mar- May- Jul- Sep- Nov- Dec-

03 03 03 03 03 03 04 04 04 04 04 04 04

Phenol Price

Cumene Price

Phenol Price = Blend of CMAI Wtd Avg Phenol and Cumene Based Formula Price

Cumene Price = CMAI Formula Price + 1.75 cpp for freight, storage and natural gas adder

A13

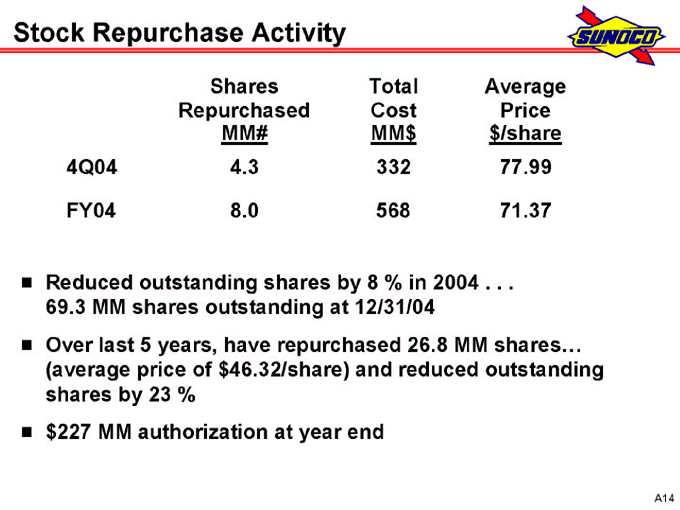

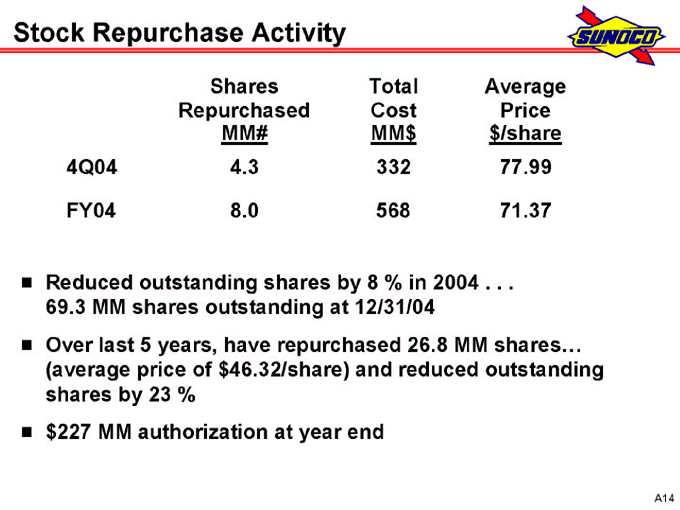

Stock Repurchase Activity

Shares Total Average

Repurchased Cost Price

MM# MM$ $/share

4Q04 4.3 332 77.99

FY04 8.0 568 71.37

Reduced outstanding shares by 8 % in 2004 . . . 69.3 MM shares outstanding at 12/31/04 Over last 5 years, have repurchased 26.8 MM shares… (average price of $46.32/share) and reduced outstanding shares by 23 % $227 MM authorization at year end

A14

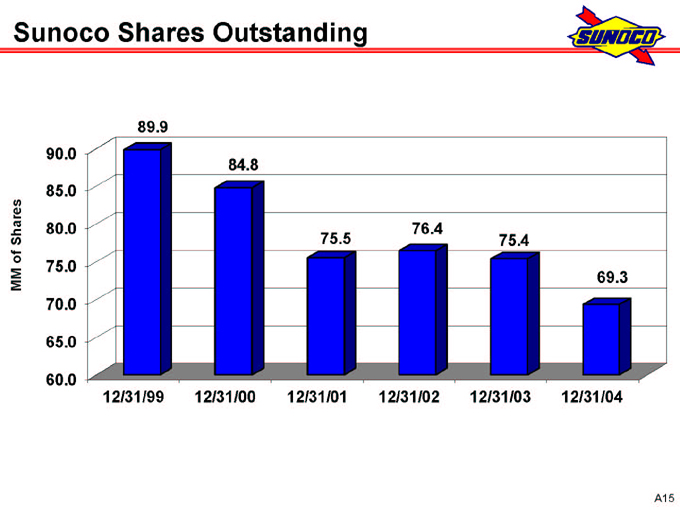

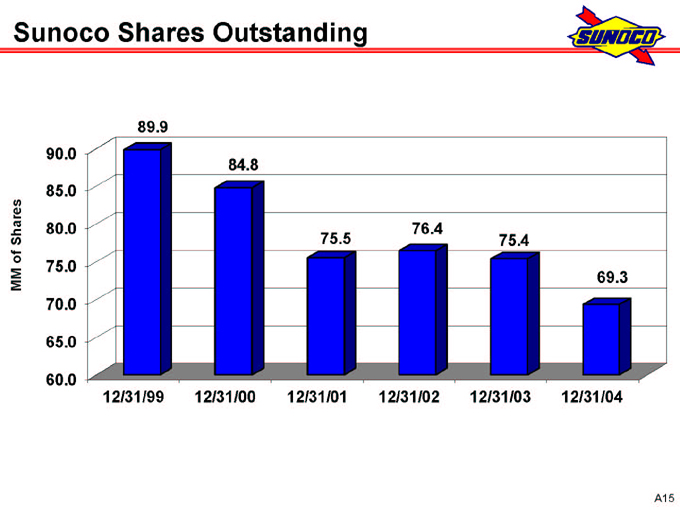

Sunoco Shares Outstanding

90.0

85.0

80.0

MM of Shares 75.0

70.0 65.0 60.0

89.9

84.8

75.5

76.4

75.4

69.3

12/31/99 12/31/00 12/31/01 12/31/02 12/31/03 12/31/04

A15

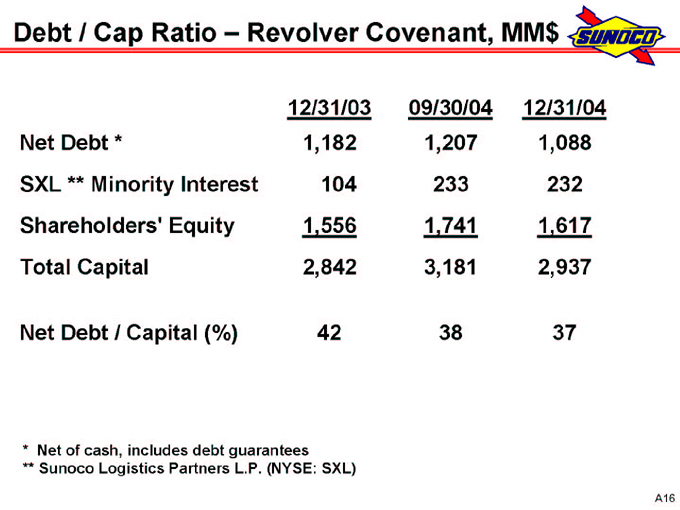

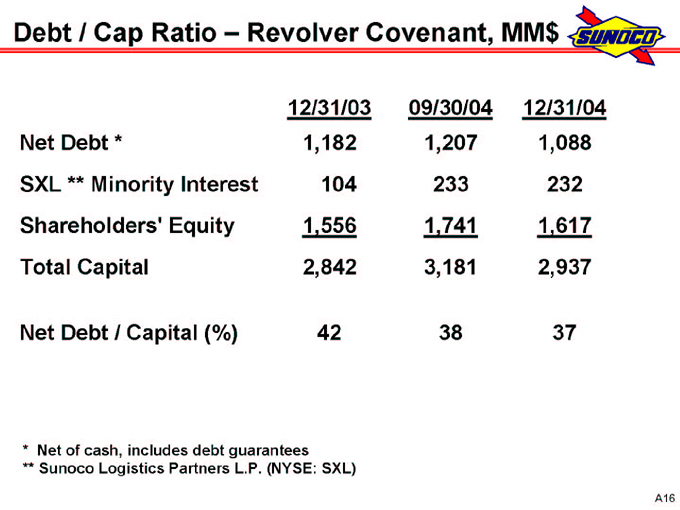

Debt / Cap Ratio – Revolver Covenant, MM$

12/31/03 09/30/04 12/31/04

Net Debt * 1,182 1,207 1,088

SXL ** Minority Interest 104 233 232

Shareholders’ Equity 1,556 1,741 1,617

Total Capital 2,842 3,181 2,937

Net Debt / Capital (%) 42 38 37

* Net of cash, includes debt guarantees ** Sunoco Logistics Partners L.P. (NYSE: SXL)

A16

For More Information

Press releases and SEC filings are available on our website at www.SunocoInc.com

Contact for more information:

Terry Delaney (215) 977-6106 John Sadlowski (215) 977-6764

A17