UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ý | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

| SUPERVALU INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required. | |||

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

¨ | Fee paid previously with preliminary materials. | |||

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule, or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

SUPERVALU Files Investor Presentation

Outlines Rapid Transformation Underway and Delivering Results

Blackwells Not Offering Any Meaningful New Ideas;

Blackwells’ Nominees’ Experience Not Additive to Board

Urges Stockholders to Vote “FOR” the Superior SUPERVALU Board Slate

on the WHITE Proxy Card

MINNEAPOLIS - July 17, 2018 - SUPERVALU INC. (NYSE:SVU) today announced that it has released an investor presentation in connection with the Company’s upcoming 2018 Annual Meeting of Stockholders, to be held on August 16, 2018.

The presentation and other important information related to the 2018 Annual Meeting can be found on SUPERVALU’s website at http://www.supervaluinvestors.com.

Highlights of the presentation include:

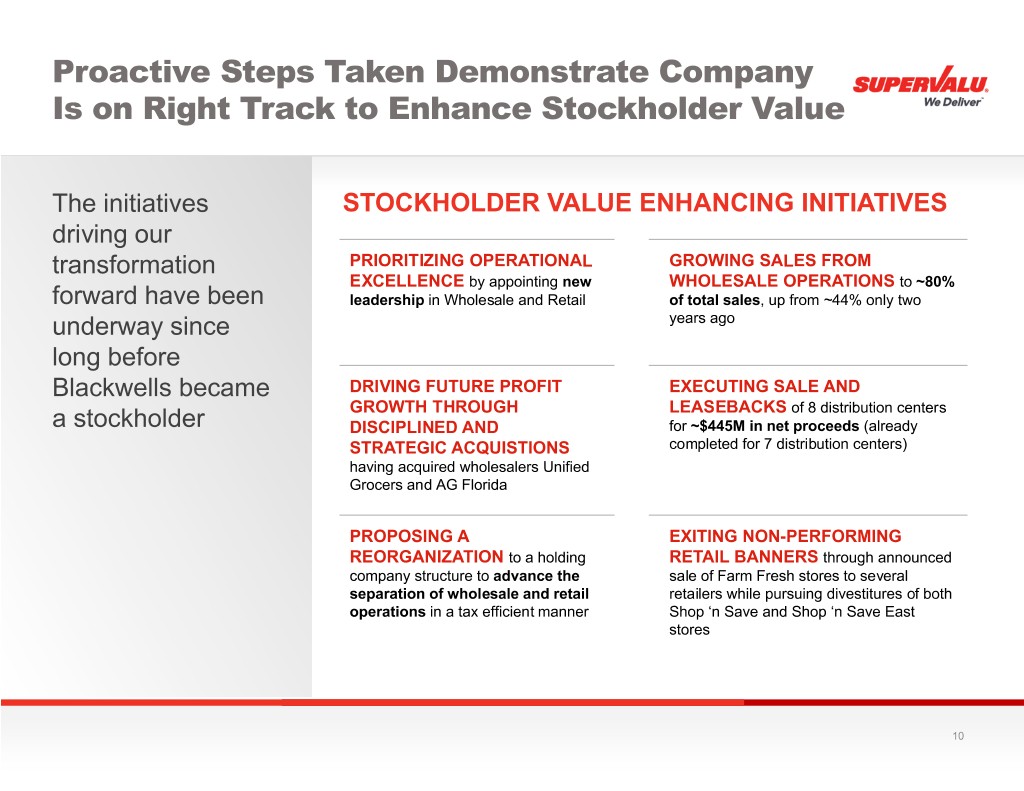

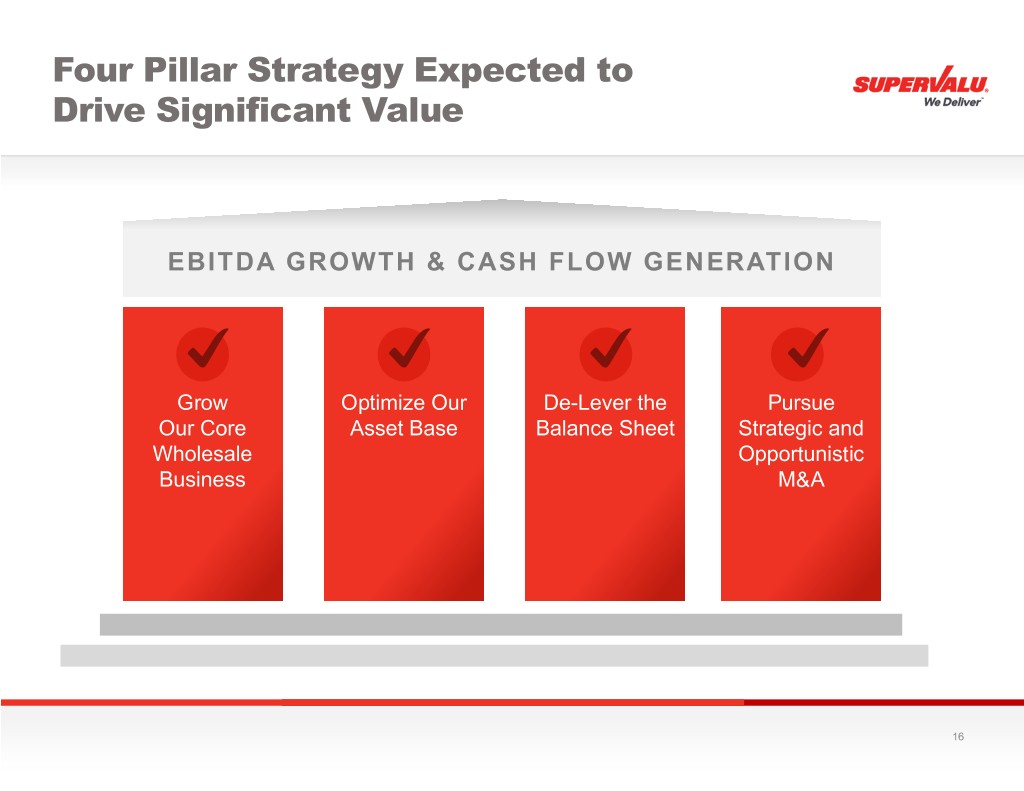

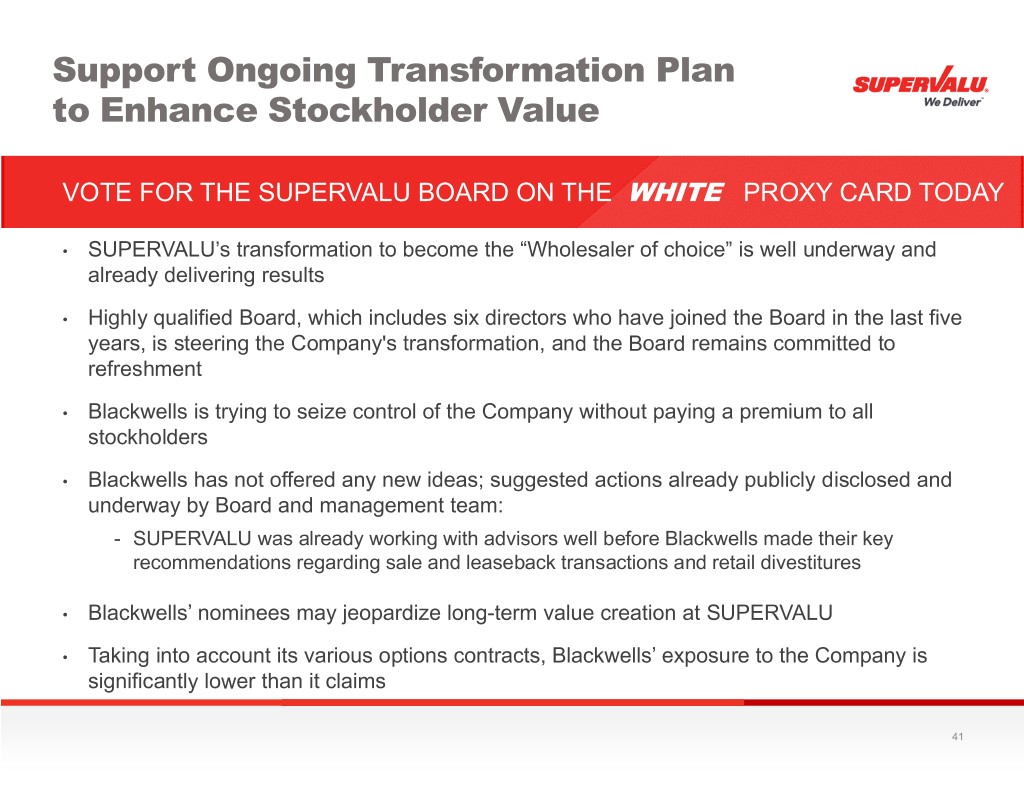

SUPERVALU’s transformation plan is well underway and delivering results.

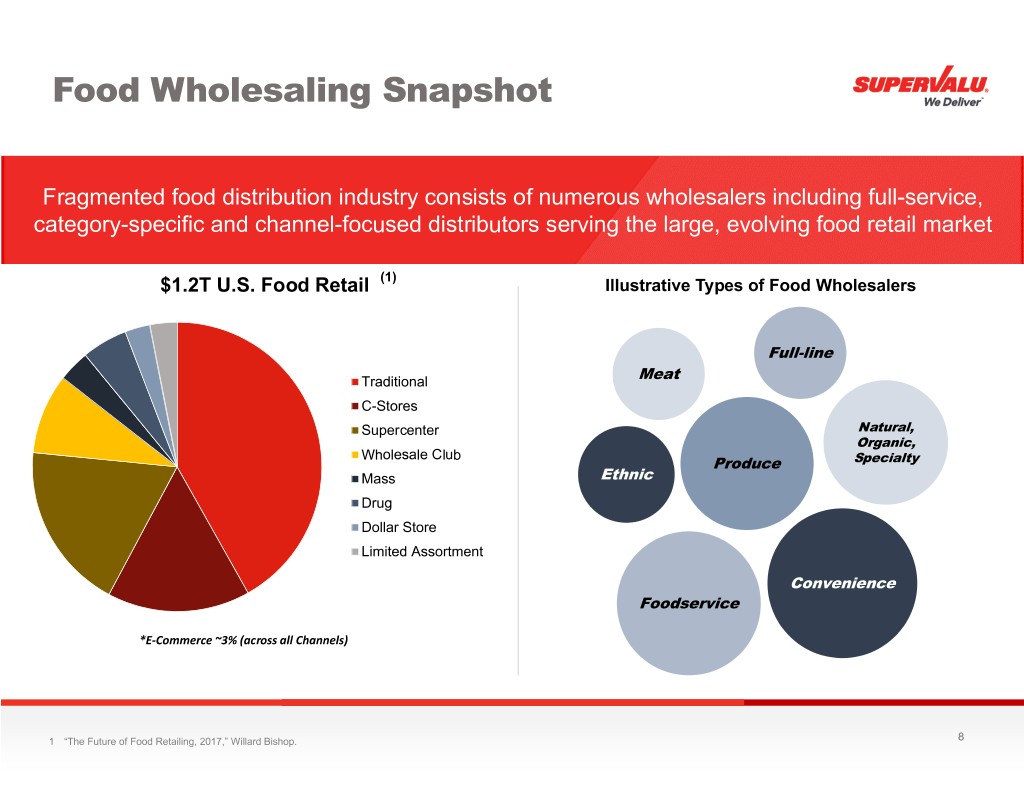

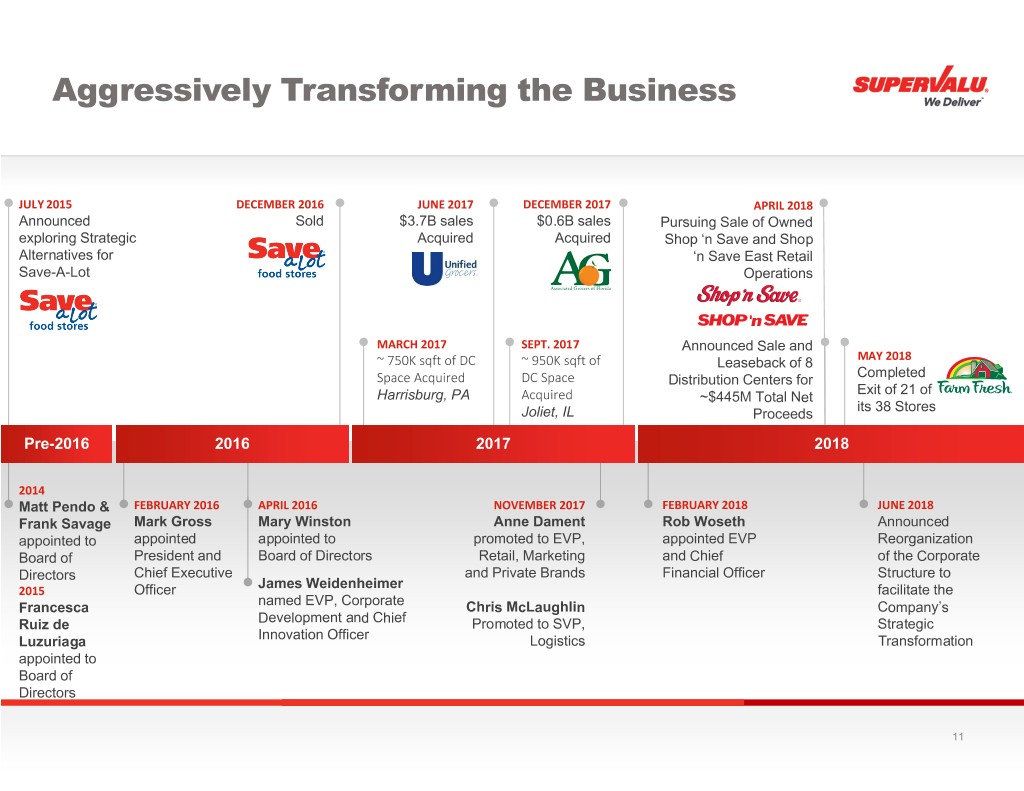

| • | For over two years, SUPERVALU has been rapidly and strategically transforming its business to become a wholesale company of choice focused on distribution across the U.S. |

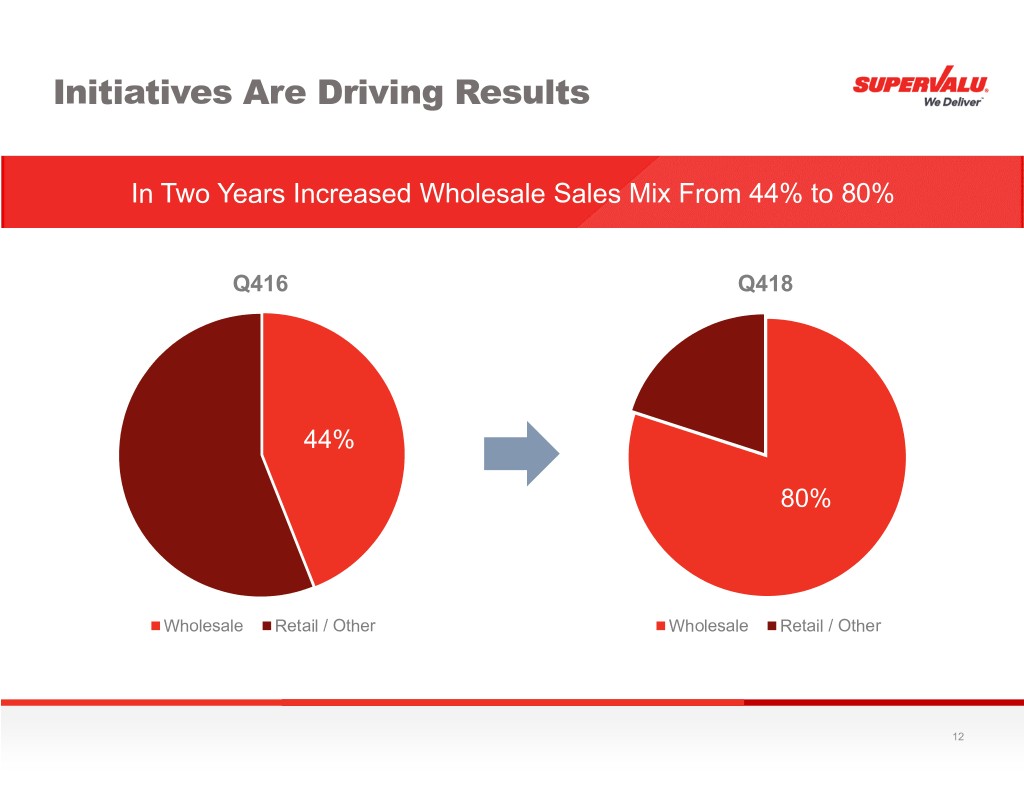

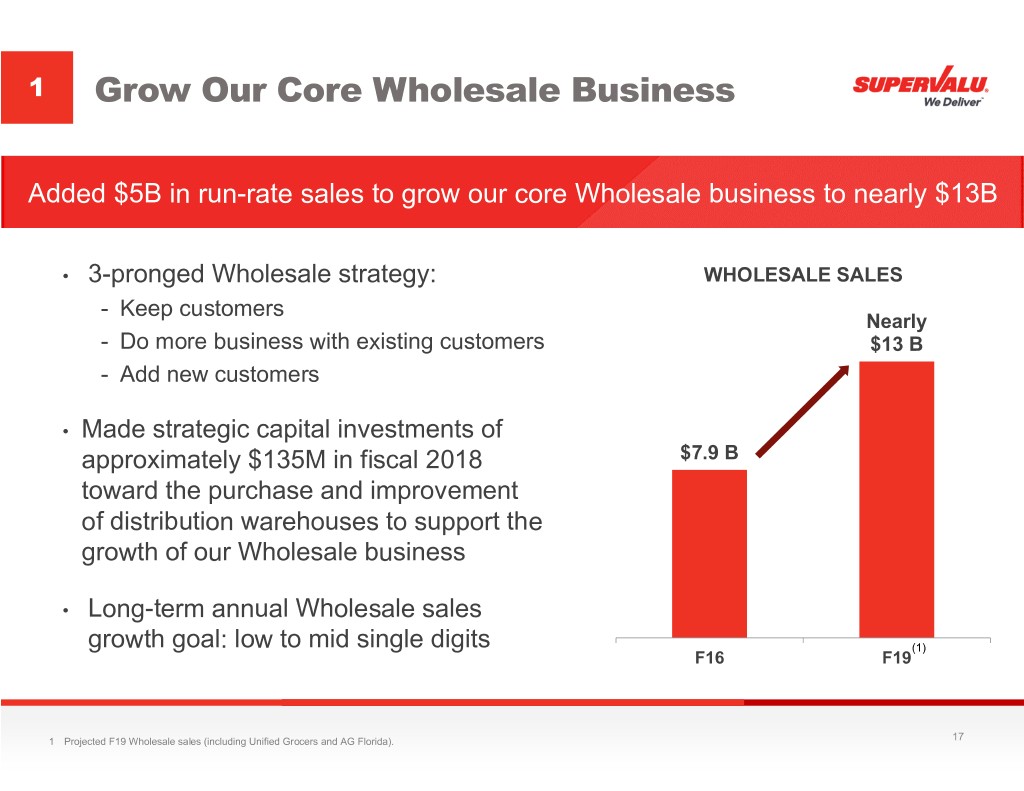

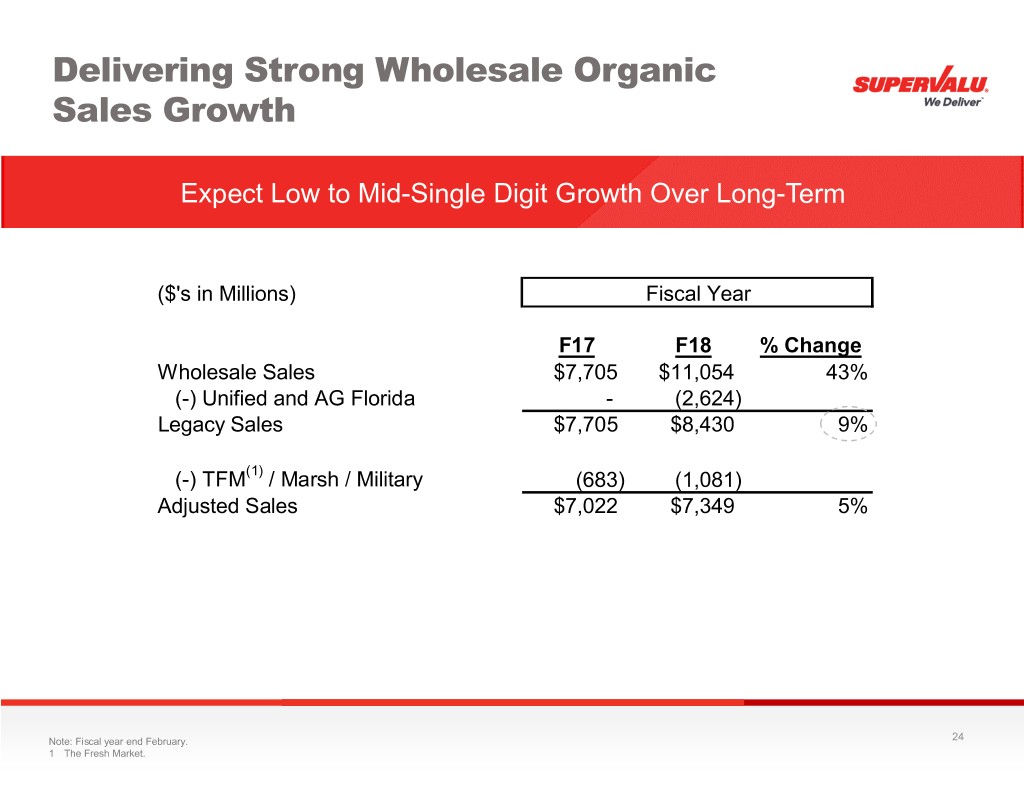

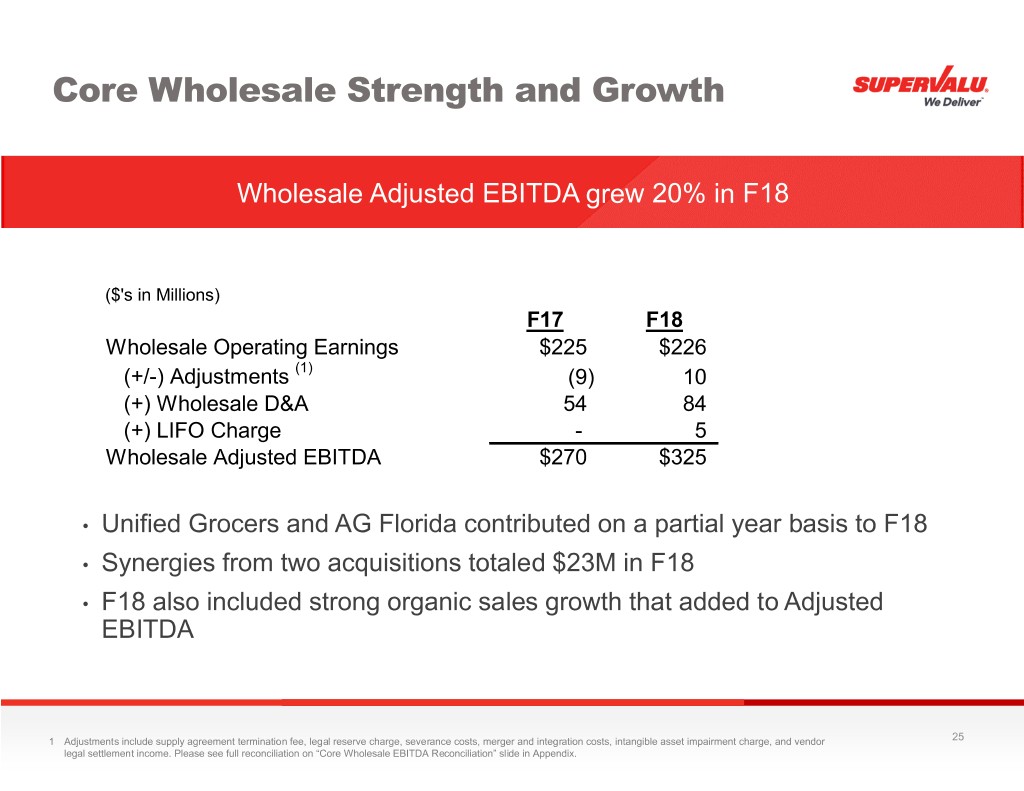

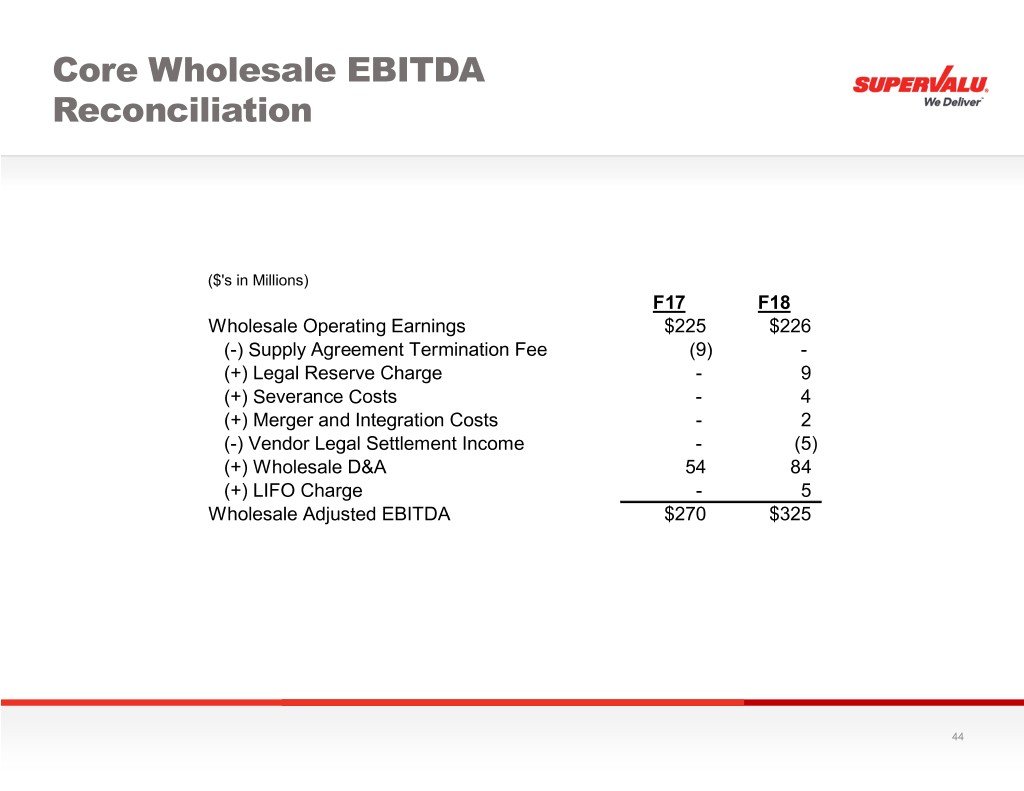

| • | The Company has added $5 billion in run-rate sales to grow its core Wholesale business, which now represents 80% of total company sales, up from 44% in 2016. |

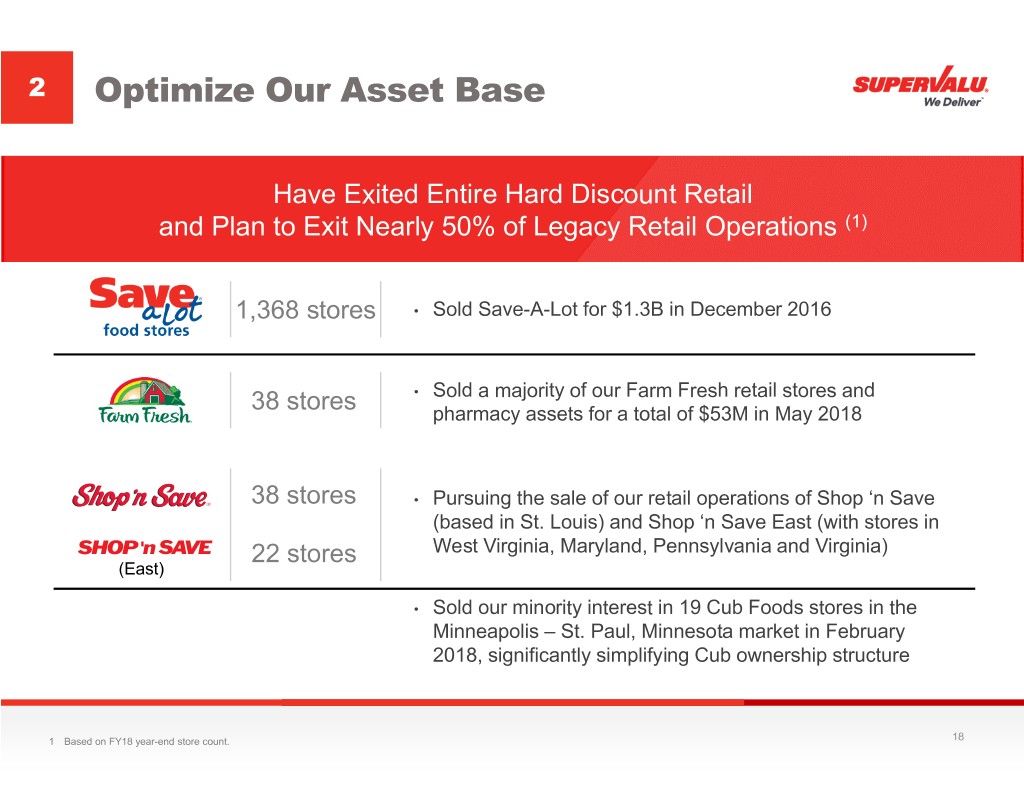

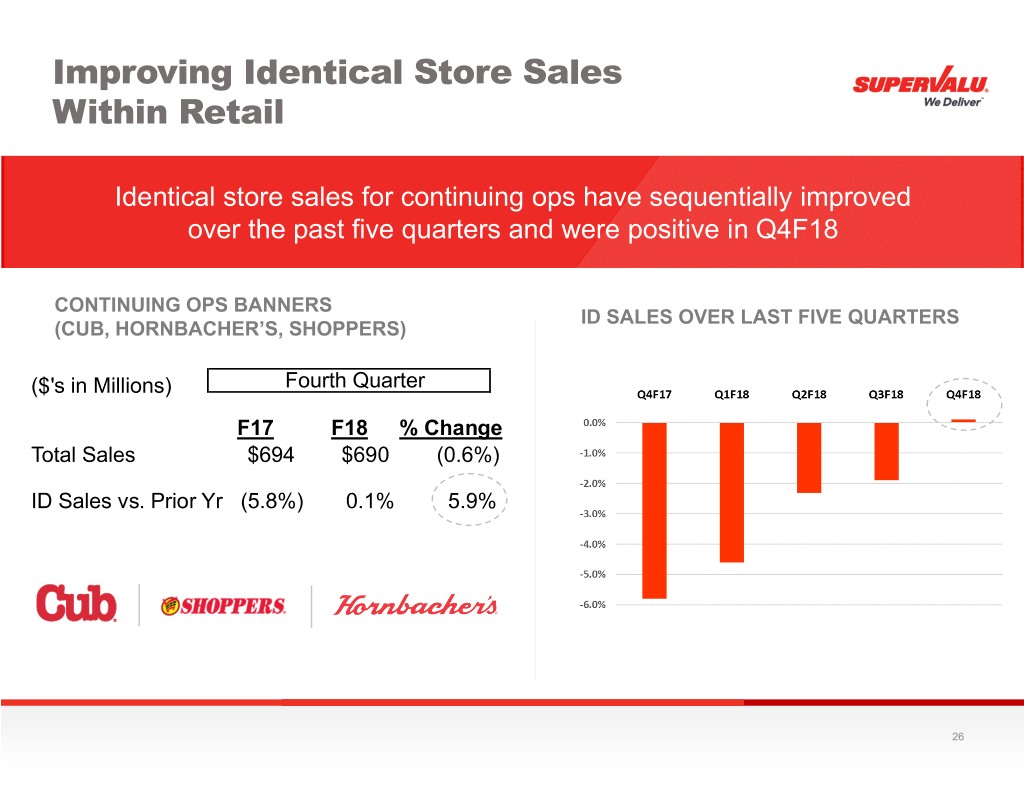

| • | SUPERVALU continues to optimize its asset base through the sale of a majority of its Farm Fresh stores and its minority interest in a number of franchised Cub Foods stores, and is pursuing the sale of its Shop ‘n Save and Shop ‘n Save East retail operations. |

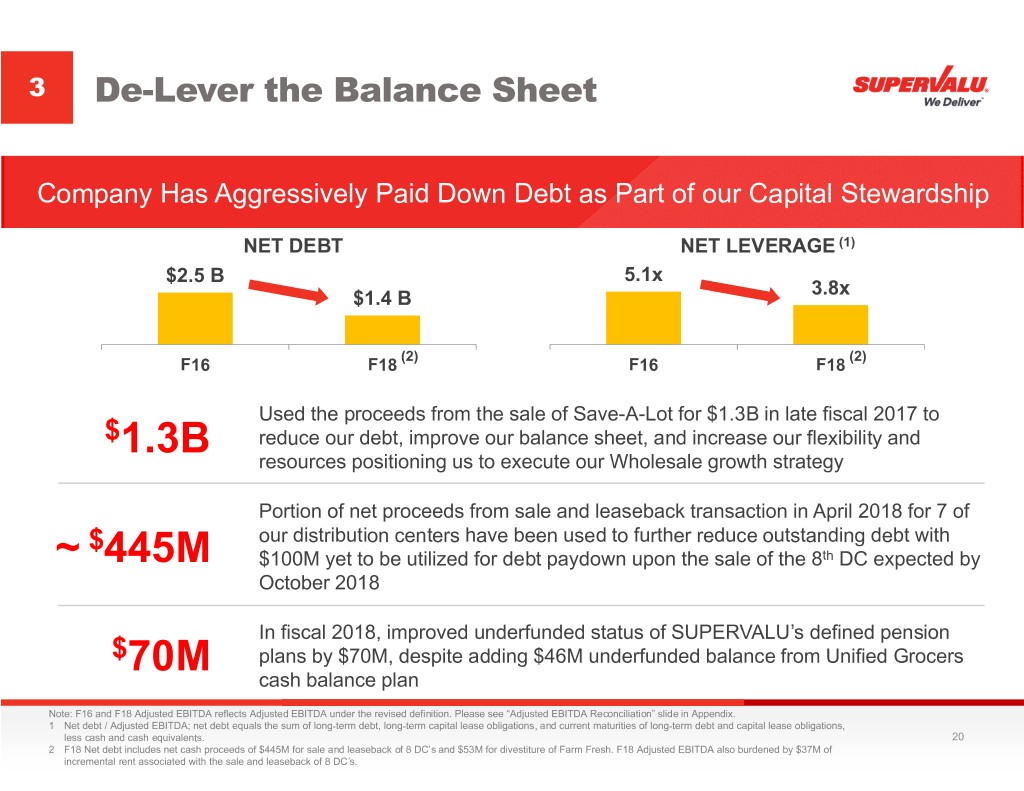

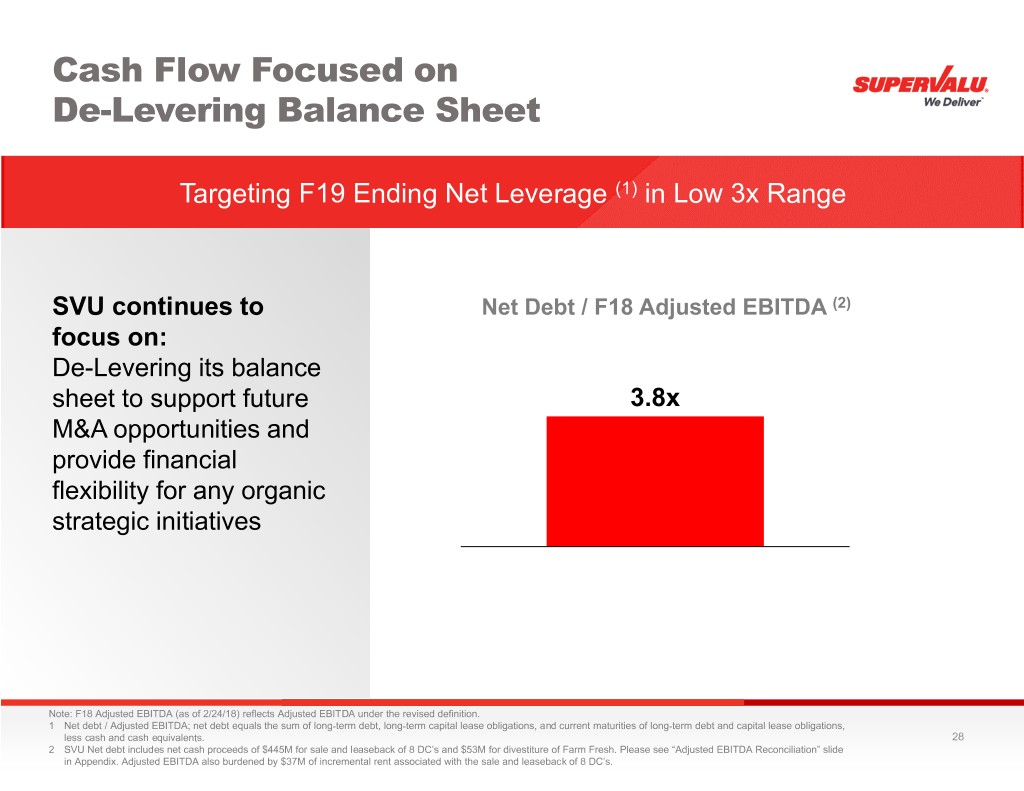

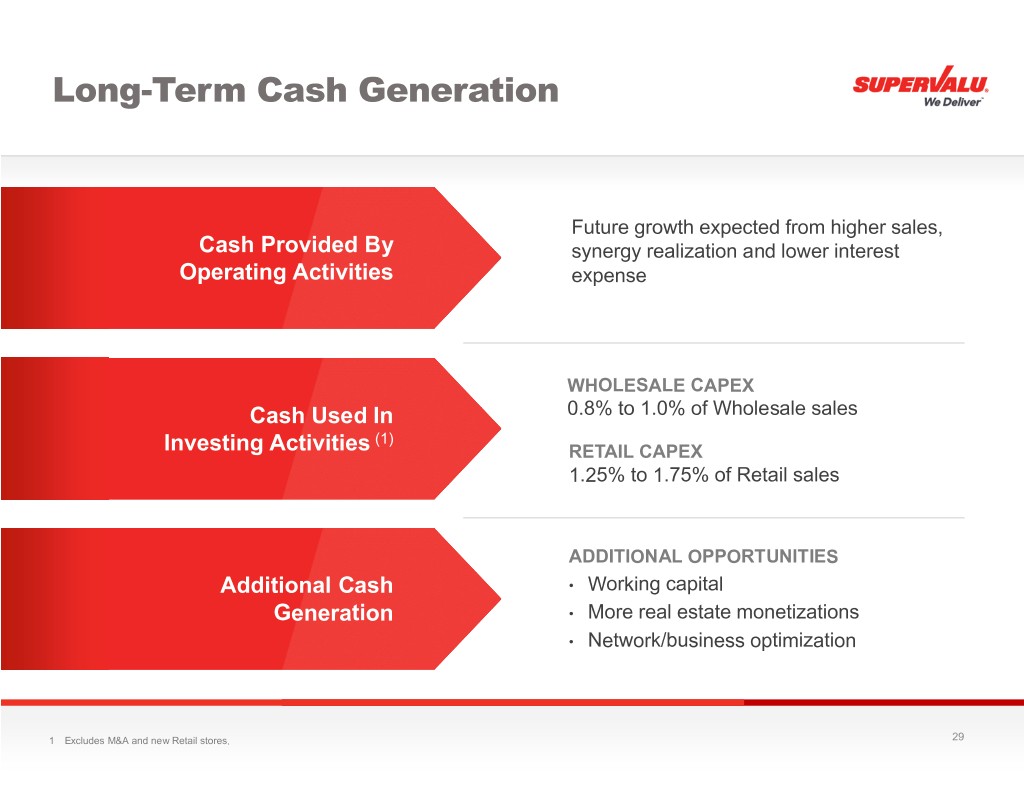

| • | The proceeds from the Company’s $1.3 billion sale of Save-A-Lot in late 2016 and the approximately $445 million in net proceeds from distribution center sale and leaseback transactions earlier this year are strengthening the Company’s balance sheet by reducing debt and to increase the Company’s flexibility to execute its wholesale growth strategy. |

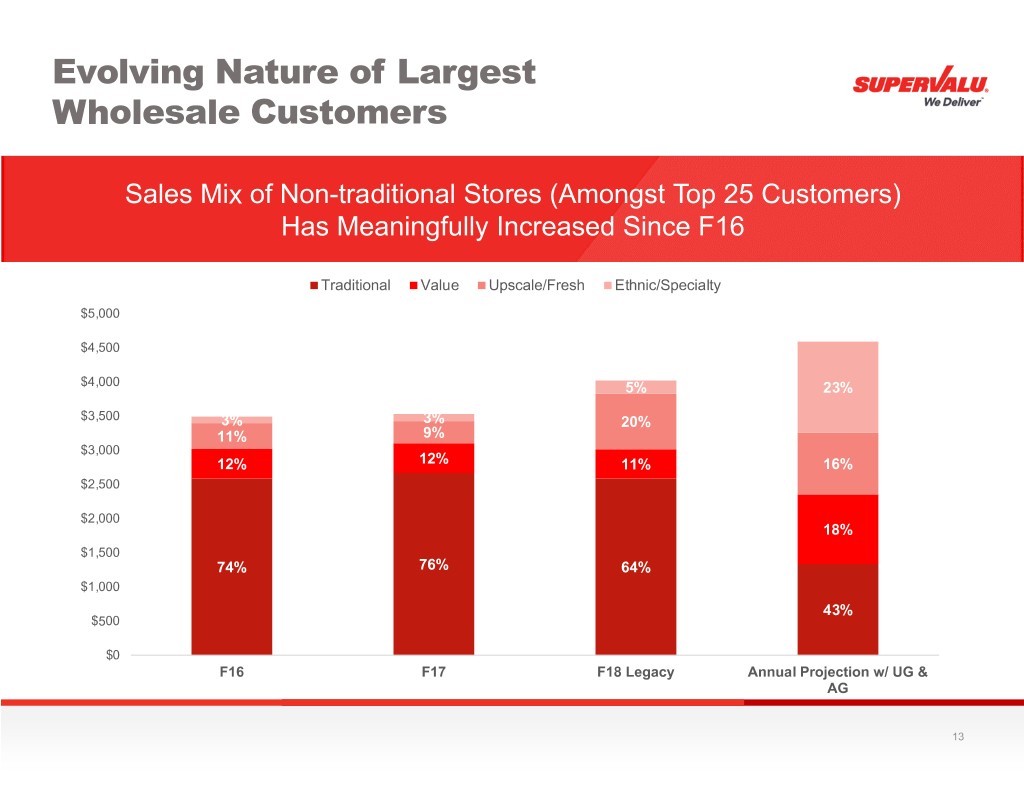

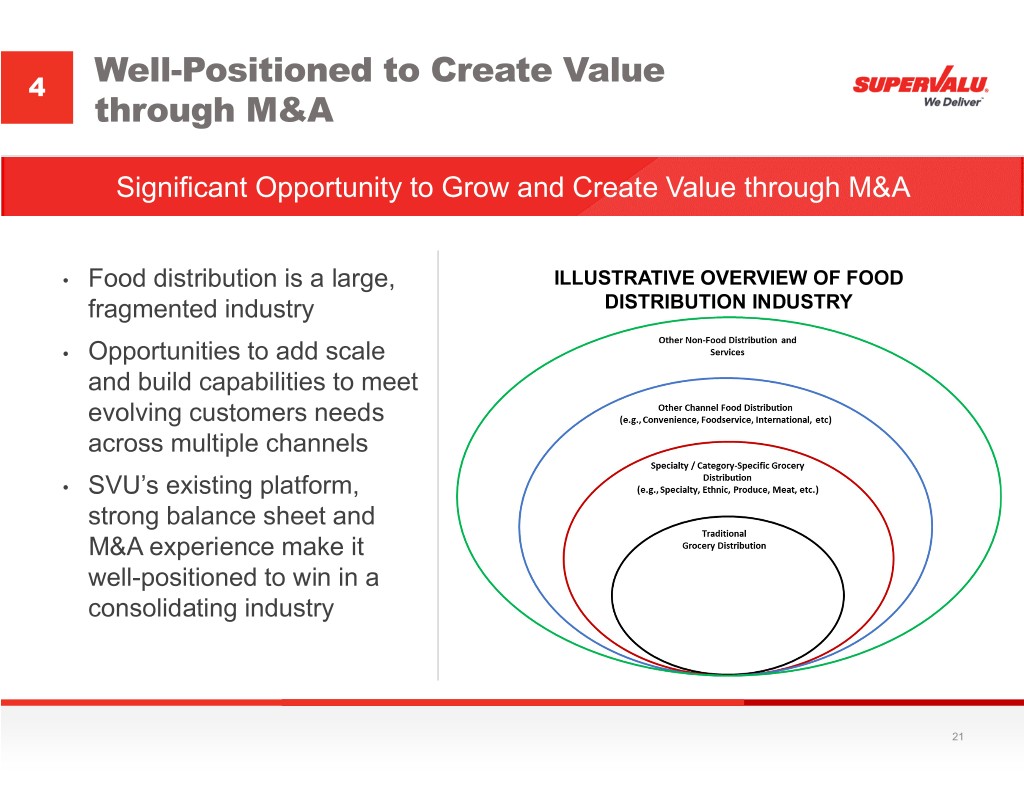

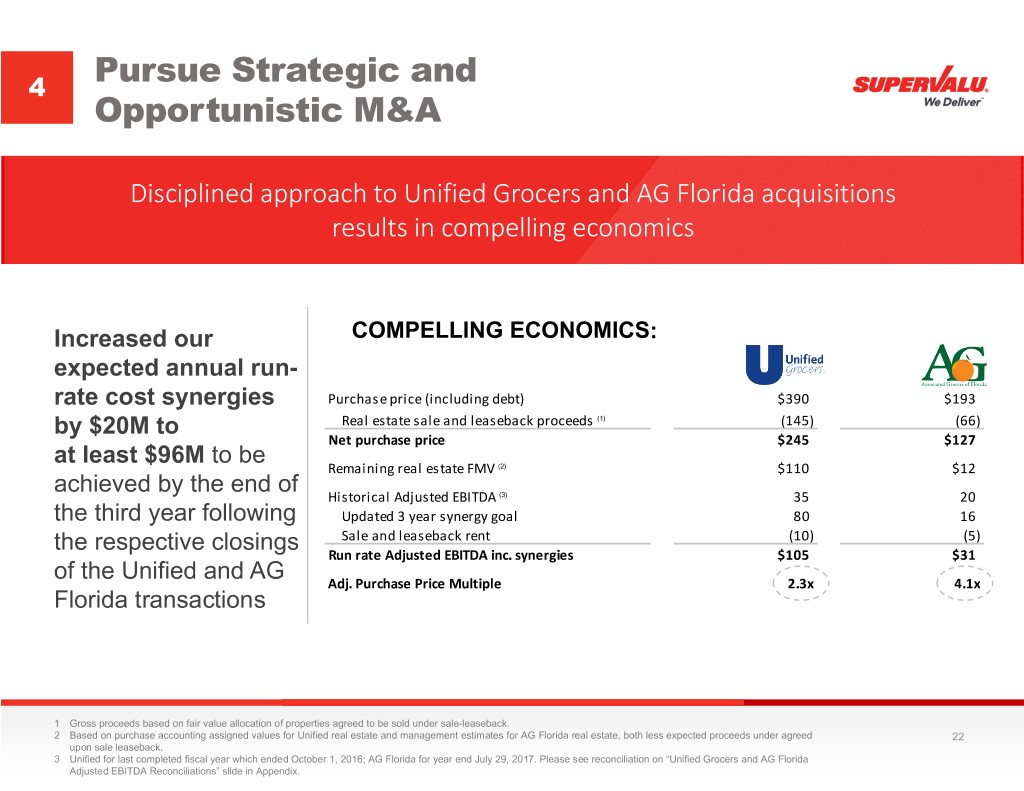

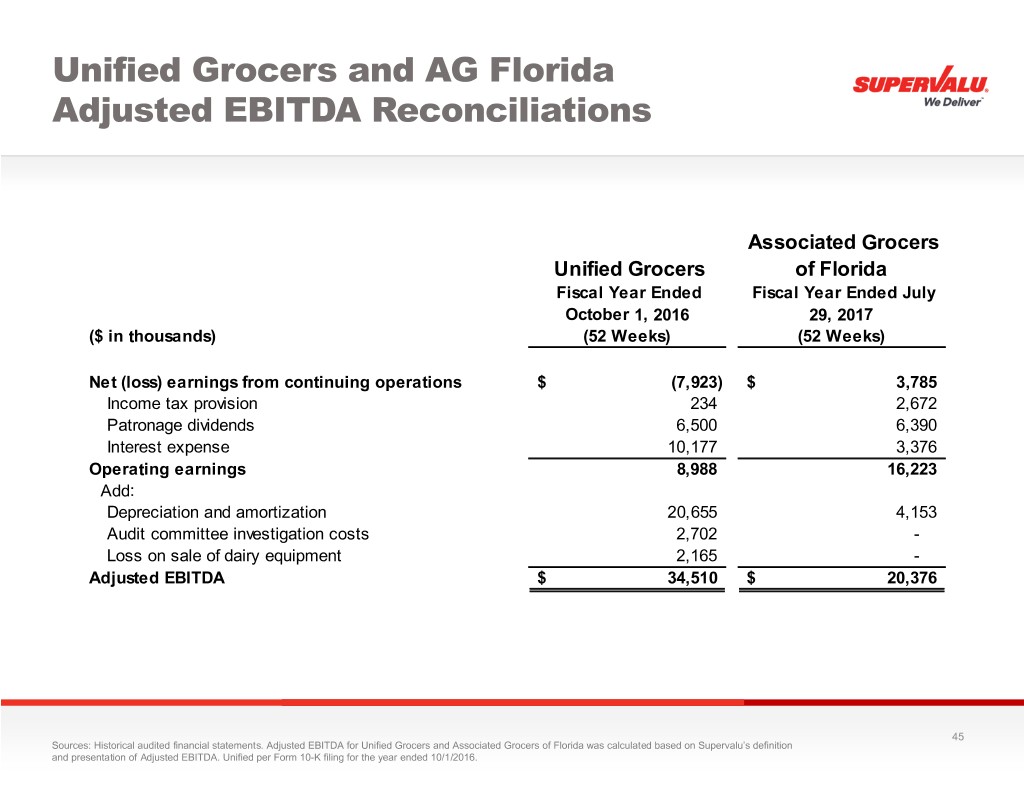

| • | The Company has completed and continues to pursue strategic and opportunistic acquisition opportunities to augment its Wholesale business, including the recently completed acquisitions of Unified Grocers and AG Florida. |

SUPERVALU continues to take decisive action to best position SUPERVALU in an evolving grocery industry.

| • | The Company continues to be well positioned for future wholesale growth and to benefit from further industry consolidation. |

| • | The Company has appointed new leadership in Wholesale and Retail to prioritize driving operational excellence and better align retail initiatives with wholesale operations. |

| • | SUPERVALU is proposing to reorganize its corporate structure into a holding company to further segregate the wholesale and retail operations and more efficiently and effectively advance the Company’s other transformation initiatives, as well as potentially generate significant cash tax benefits of approximately $300 million over the course of the next approximately 15 years. |

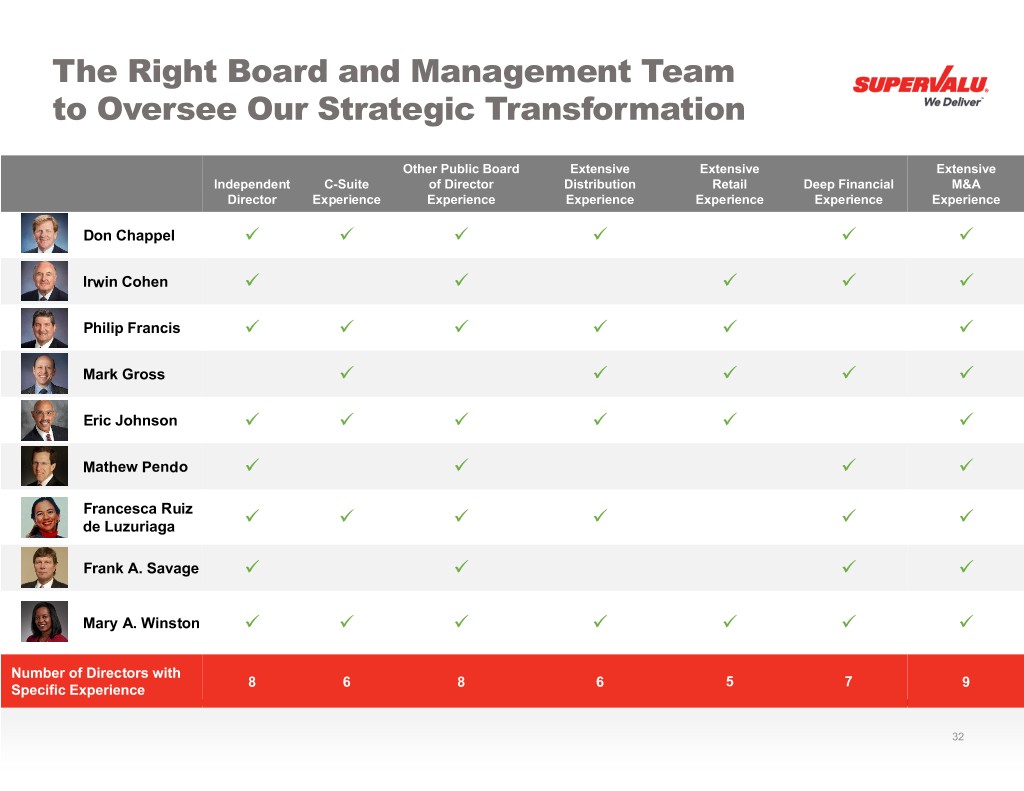

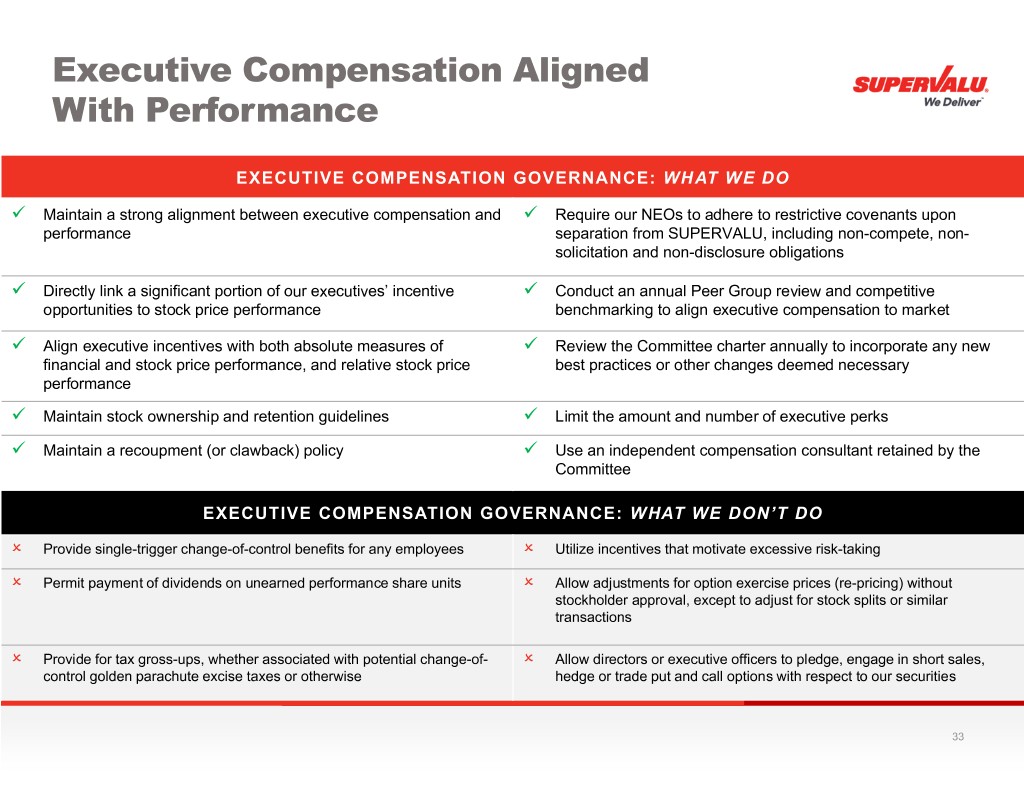

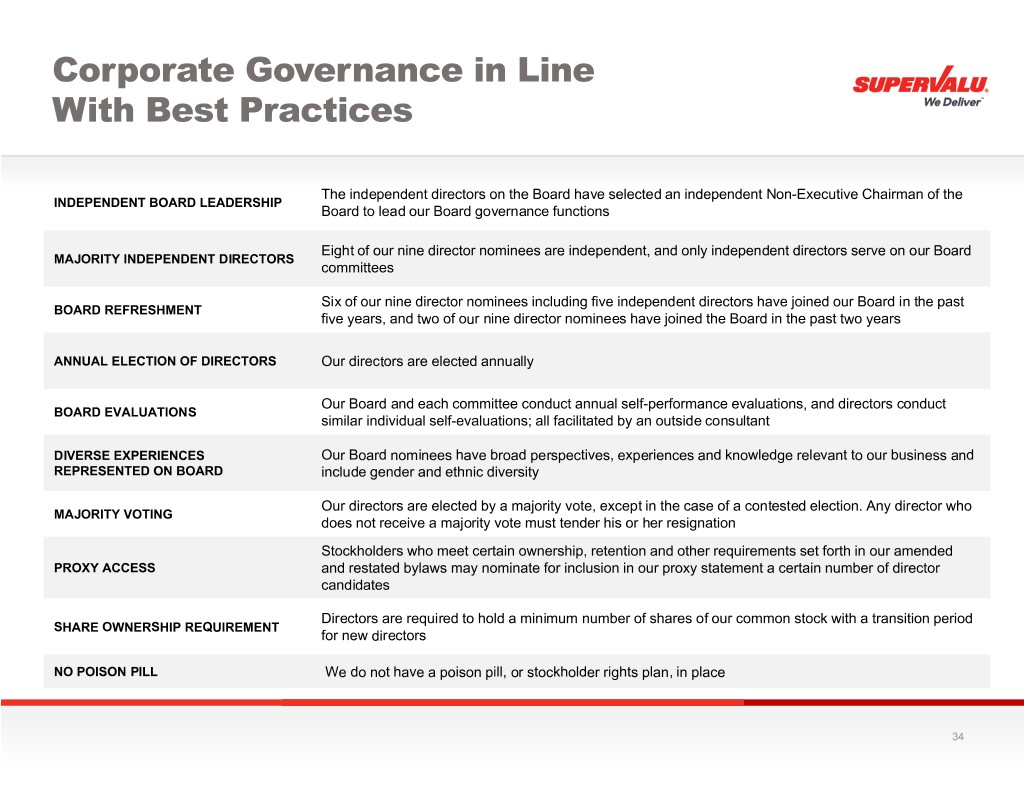

SUPERVALU’s Board and management team have the right experience and skills to lead the Company’s strategic transformation.

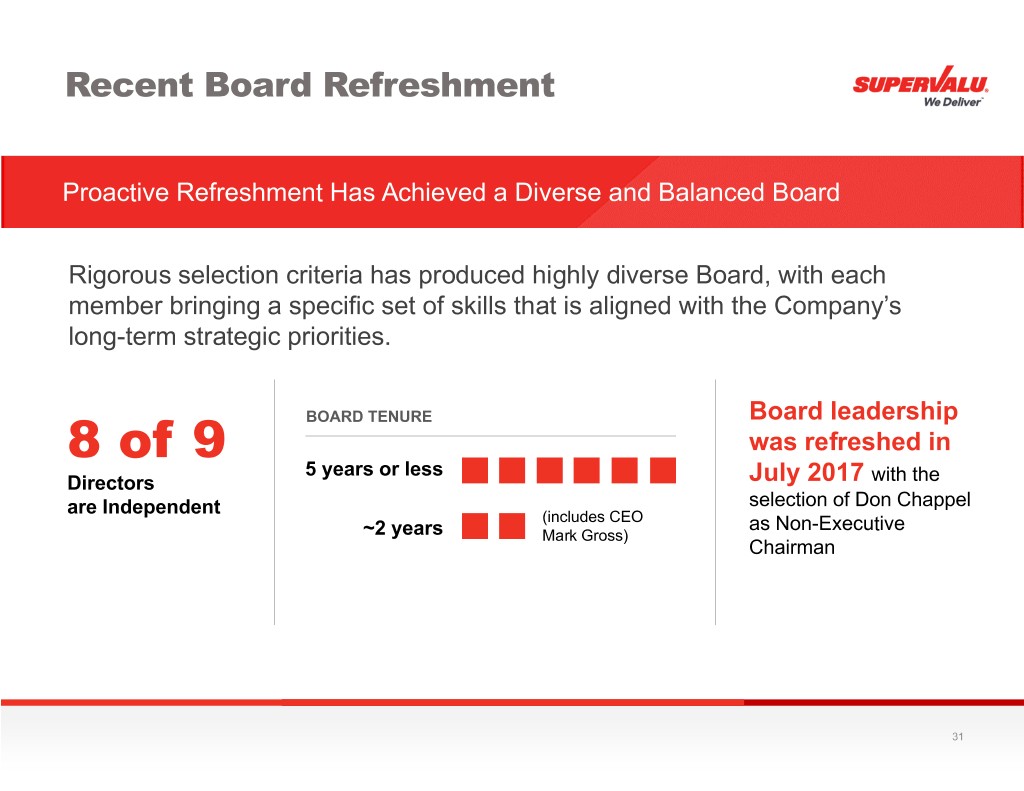

| • | The Board is independent and highly qualified, with significant C-suite, public board, M&A, financial, distribution and retail experience. The Board has demonstrated a strong commitment to refreshment to ensure it has the right mix of diversity, independence and experience to best address the evolving needs of the grocery industry and position SUPERVALU for future success. |

| • | CEO Mark Gross and Mary Winston joined the Board in 2016, both bringing strong backgrounds in grocery retail and distribution, finance and M&A, which make them critically valuable as the Company continues its ongoing strategic transformation. |

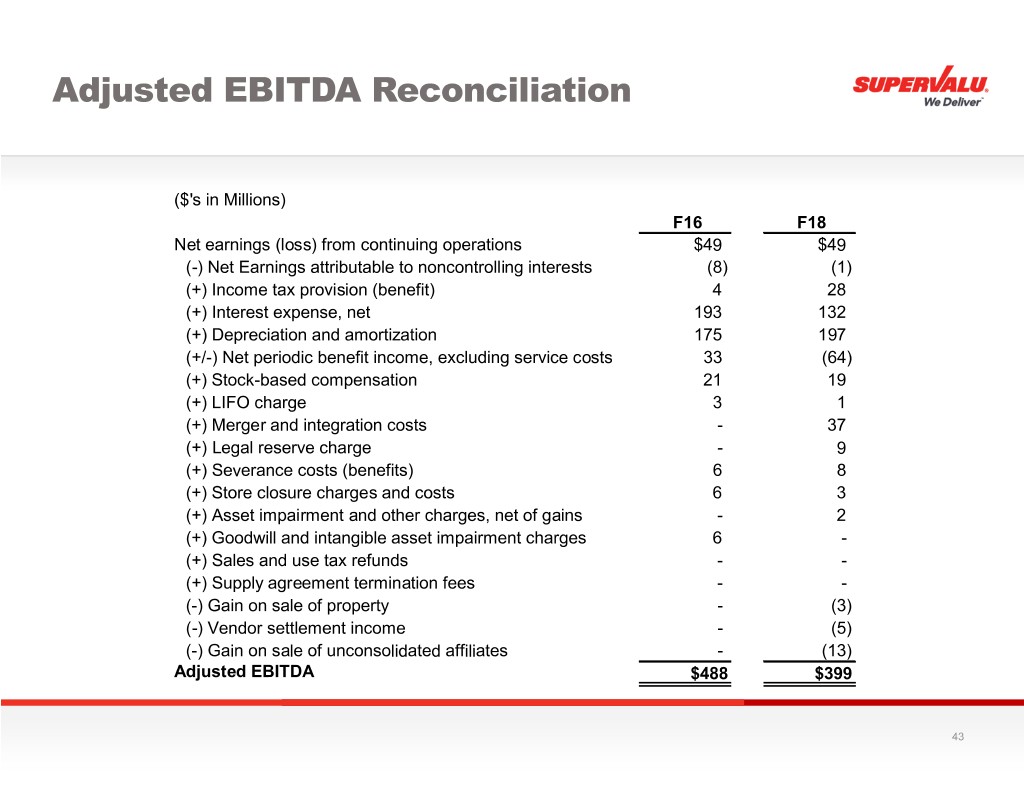

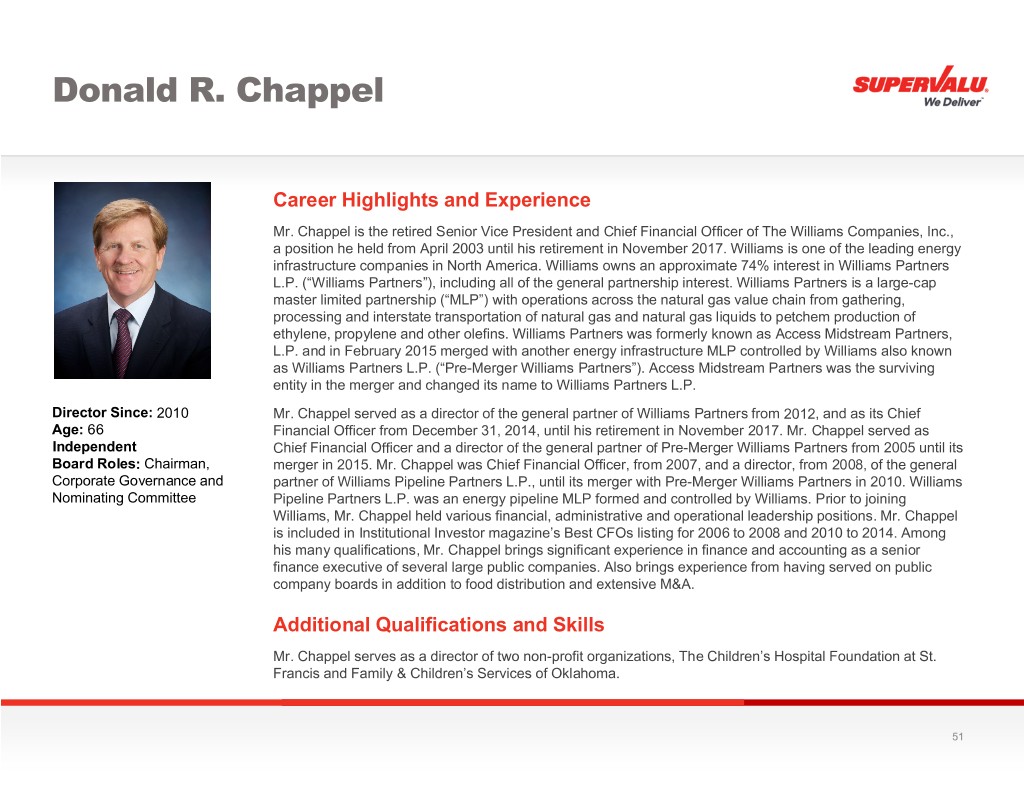

| • | SUPERVALU’s Board also has a wealth of directors with deep financial and accounting backgrounds, including Don Chappel, Irwin Cohen, Mark Gross, Mathew Pendo, Frank Savage, Mary Winston and Francesca Ruiz de Luzuriaga. Under their leadership and guidance, the Company has significantly reduced |

its debt, improved its balance sheet, and increased its flexibility to pursue strategic capital investments to drive wholesale growth.

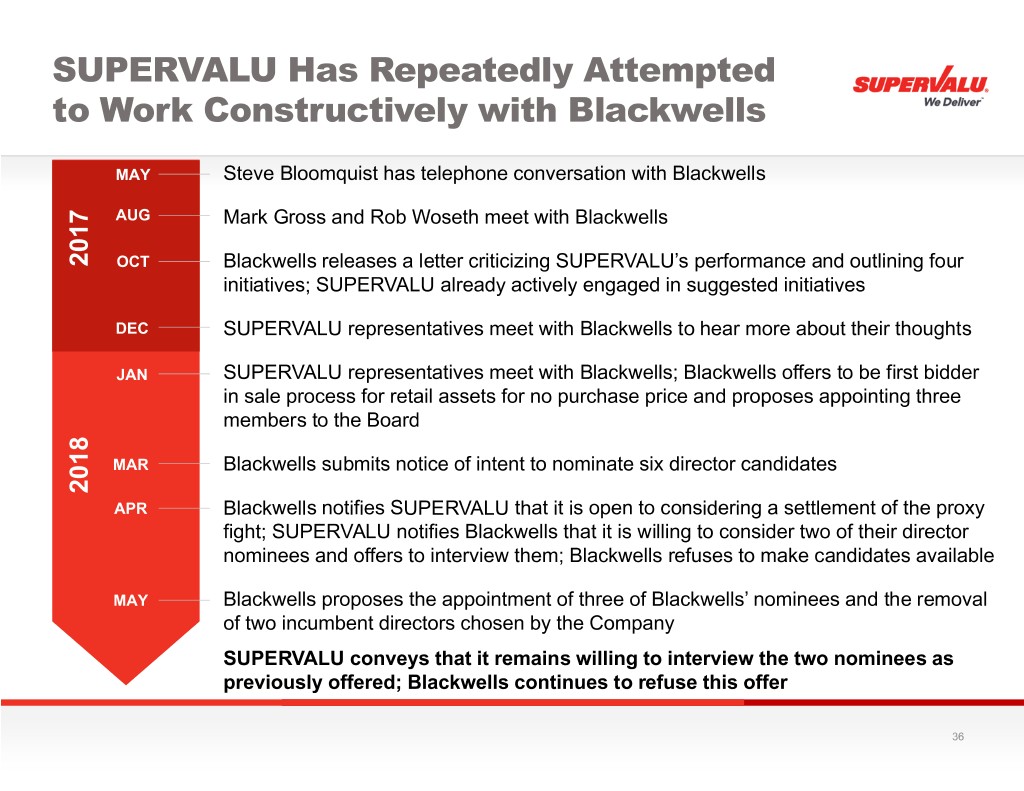

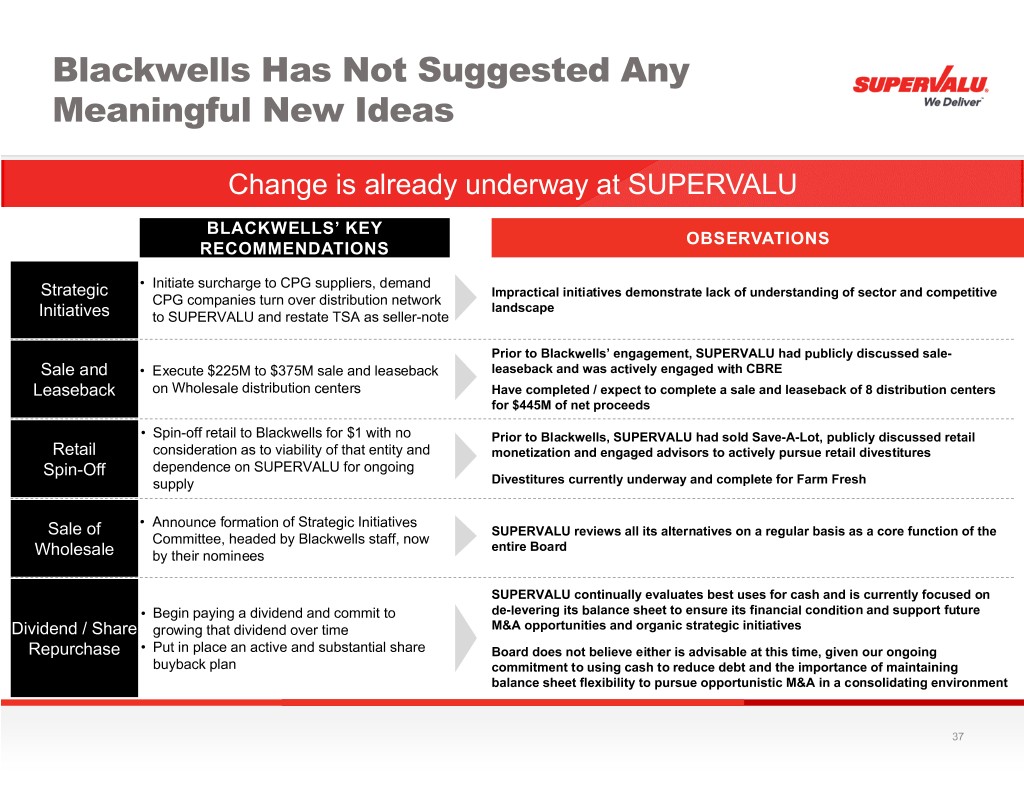

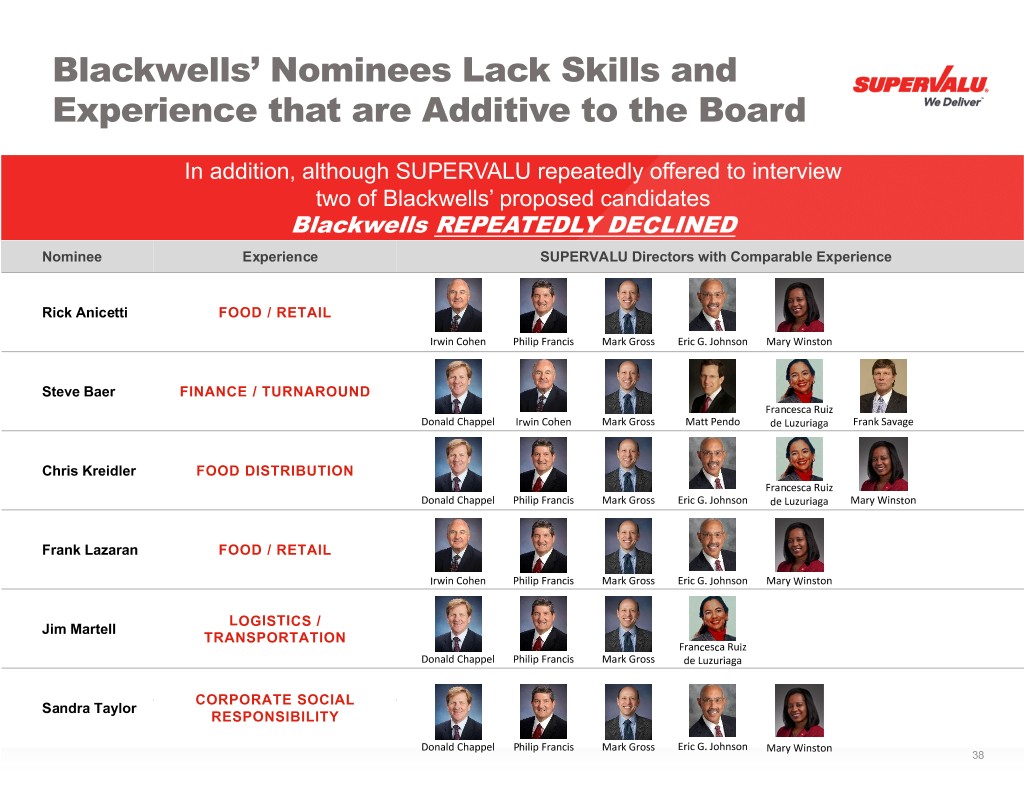

Blackwells has not suggested any meaningful new ideas, and its nominees lack experience that is additive to the Board.

| • | Transformation is already underway at SUPERVALU, and the Board and management team have been taking bold steps since long before Blackwells purchased a single share of SUPERVALU. |

| • | Additionally, Blackwells’ director nominees would not bring new or additive expertise to the Board, and are not necessary to ensure the continued execution of the Company’s initiatives to create stockholder value. |

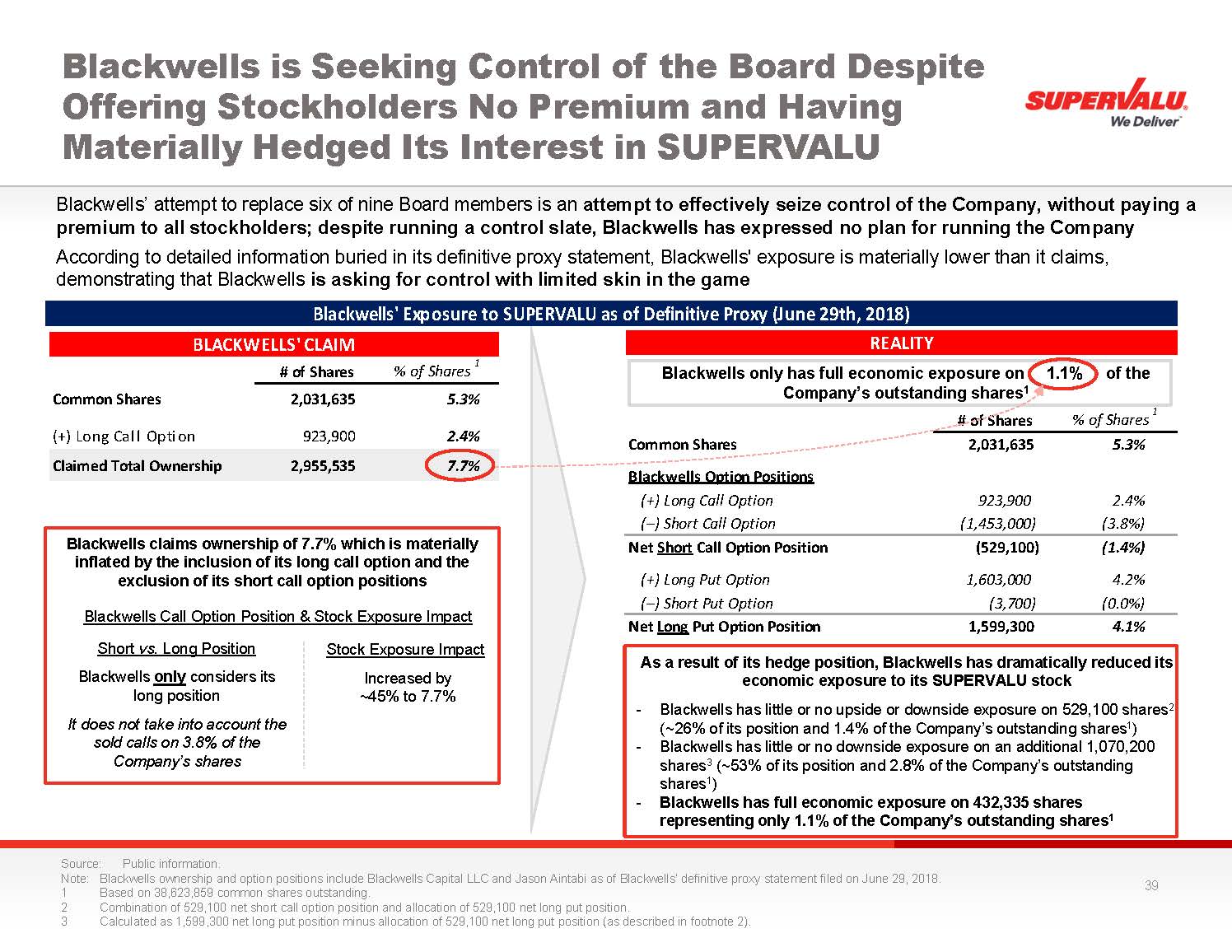

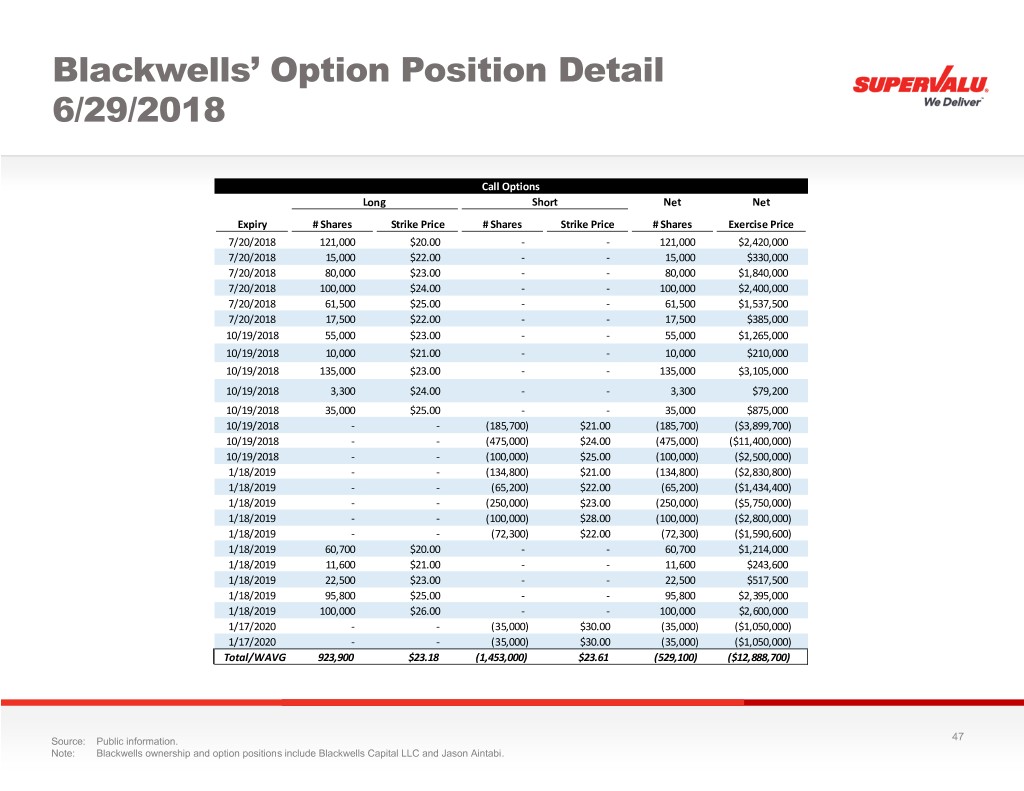

| • | Further, by attempting to replace six of nine Board members, Blackwells is trying to effectively seize control of SUPERVALU without paying a premium to all stockholders, and is seeking a level of representation dramatically disproportionate to its purported ownership in the Company. |

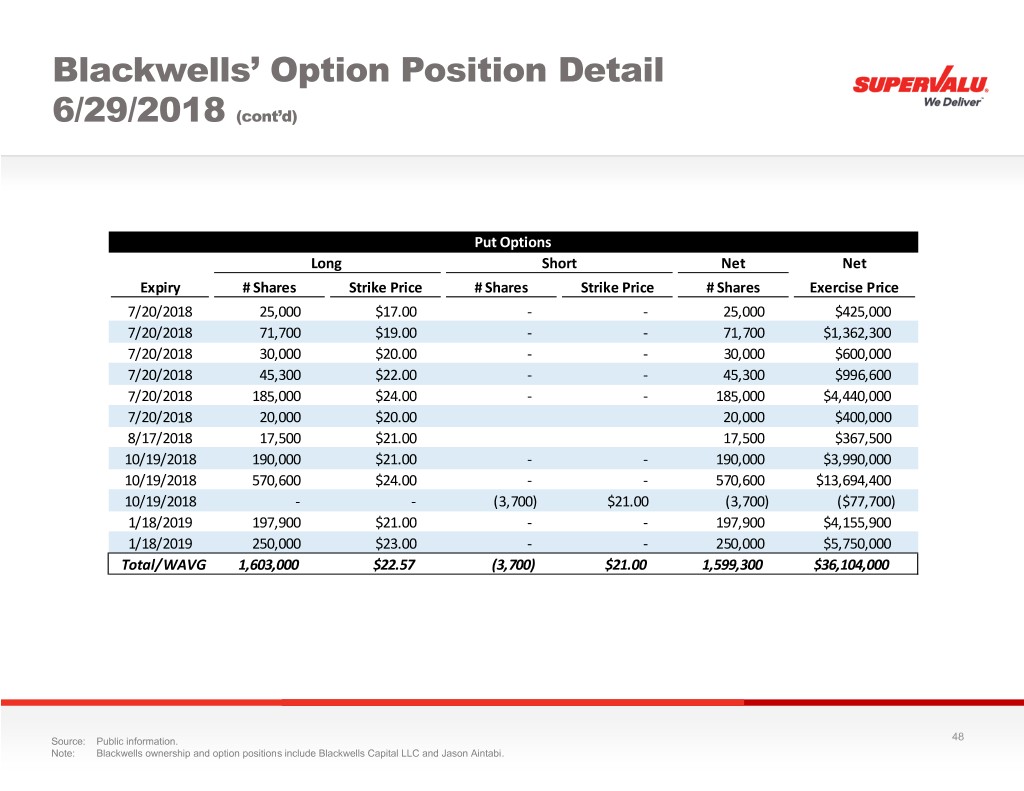

| • | In fact, despite proposing a majority slate, Blackwells has used options contracts to significantly reduce its economic exposure to SUPERVALU stock. |

The SUPERVALU Board of Directors unanimously recommends that stockholders vote “FOR ALL” nine of SUPERVALU’s highly qualified director candidates and “FOR” the Holding Company Proposal on the WHITE proxy card.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995.

Except for the historical and factual information, the matters set forth in this communication, particularly those pertaining to SUPERVALU’s efforts and initiatives to transform its business and assets and SUPERVALU’s expectations regarding the potential impact of those efforts and initiatives on its future operating results, and other statements identified by words such as “estimates” “expects,” “projects,” “plans,” “intends,” “outlook” and similar expressions are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the ability to continue to transform our business and to execute on our initiatives on a timely basis or at all, the ability to recognize the expected benefits of the initiatives, the potential for disruption to our business during the process, the ability to execute on the Holding Company Proposal on a timely basis or at all, the ability to recognize the expected benefits of the reorganization, the amount and timing of any cash tax benefits resulting from the reorganization being different than expected, our ability to complete a sale of certain of our retail assets to third parties or another strategic transaction prior to the expiration of our capital loss carryforward in February 2019, the potential for disruption to our business during the process, the ability to effectively manage organization changes during the pendency of or following our business transformation including any reorganization and related transactions, the requirement that we offer to repurchase certain indebtedness of the Company and obtain certain third-party consents as a result of the reorganization and costs and expenses associated with doing so, and other risk factors relating to our business or industry as detailed from time to time in SUPERVALU’s reports filed with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this communication. For more information, see the risk factors described in SUPERVALU’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement/prospectus for the 2018 Annual Meeting of Stockholders and other filings with the SEC. Unless legally required, SUPERVALU undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Important Stockholder Information and Where You Can Find It

SUPERVALU has filed with the SEC a definitive proxy statement/prospectus and accompanying definitive WHITE proxy card in connection with its 2018 Annual Meeting of Stockholders. The definitive proxy statement/prospectus contains important information about SUPERVALU, the 2018 Annual Meeting of Stockholders and related matters.

In connection with the Holding Company Proposal, SUPERVALU Enterprises, Inc., the entity that will be the new holding company following completion of the reorganization (“SUPERVALU Enterprises”), has filed with the SEC a Registration Statement on Form S-4 (Registration Statement No. 333-225586) that includes the definitive proxy statement of SUPERVALU and a prospectus of SUPERVALU Enterprises, as well as other relevant documents concerning the proposed reorganization. The Holding Company Proposal will be submitted to SUPERVALU’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, THE ACCOMPANYING WHITE PROXY CARD AND ANY OTHER RELEVANT SOLICITATION MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION.

A free copy of the definitive proxy statement/prospectus, as well as other filings containing information about SUPERVALU and SUPERVALU Enterprises, is able to be obtained at the SEC’s Internet site (http://www.sec.gov). You are also able to obtain these documents, free of charge, from SUPERVALU at http://www.supervaluinvestors.com or by directing a request to SUPERVALU INC., P.O. Box 990, Minneapolis, Minnesota 55440, Attention: Investor Relations, telephone (952) 828-4000.

Participants in the Solicitation

SUPERVALU, its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from SUPERVALU’s stockholders in connection with the matters to be considered at its 2018 Annual Meeting of Stockholders. Information regarding the names of SUPERVALU’s directors and certain of its executive officers and employees and their respective interests in SUPERVALU by security holdings or otherwise is set forth in SUPERVALU’s proxy statement/prospectus for the 2018 Annual Meeting of Stockholders filed with the SEC.

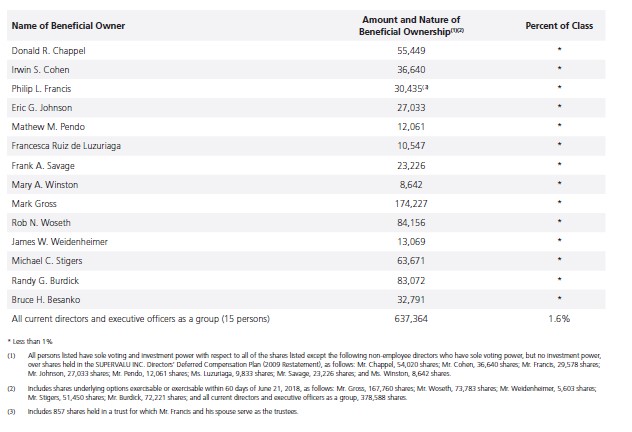

The following table sets forth information as of June 21, 2018 concerning beneficial ownership of SUPERVALU’s common stock by each director and each of the executive officers named in the Summary Compensation Table that is included in SUPERVALU’s proxy statement for the 2018 Annual Meeting of Stockholders and for all of our current directors and executive officers as a group. The definition of beneficial ownership for purposes of the following information includes shares over which a person has sole or shared voting power or dispositive power, whether or not a person has any economic interest in the shares. The definition also includes shares that a person has a right to acquire currently or within 60 days.

Additional information regarding the interests of these participants in any proxy solicitation and a description of their direct and indirect interests, if any, by security holdings or otherwise, is also included in the definitive proxy statement/prospectus for the 2018 Annual Meeting of Stockholders, the accompanying definitive WHITE proxy card

and other relevant solicitation materials and in Form 3s and Form 4s filed by SUPERVALU’s directors and executive officers after the date of the proxy statement. These documents (when they become available), and any and all documents filed by SUPERVALU with the SEC, may be obtained by investors and stockholders free of charge on the SEC’s website at www.sec.gov.

PROTECT YOUR INVESTMENT! PLEASE VOTE TODAY ON THE WHITE PROXY CARD! If you have questions, need assistance in voting your shares, or wish to change a prior vote, please contact: INNISFREE M&A INCORPORATED Stockholders Call Toll-Free: (877) 456-2510 |

About SUPERVALU INC.

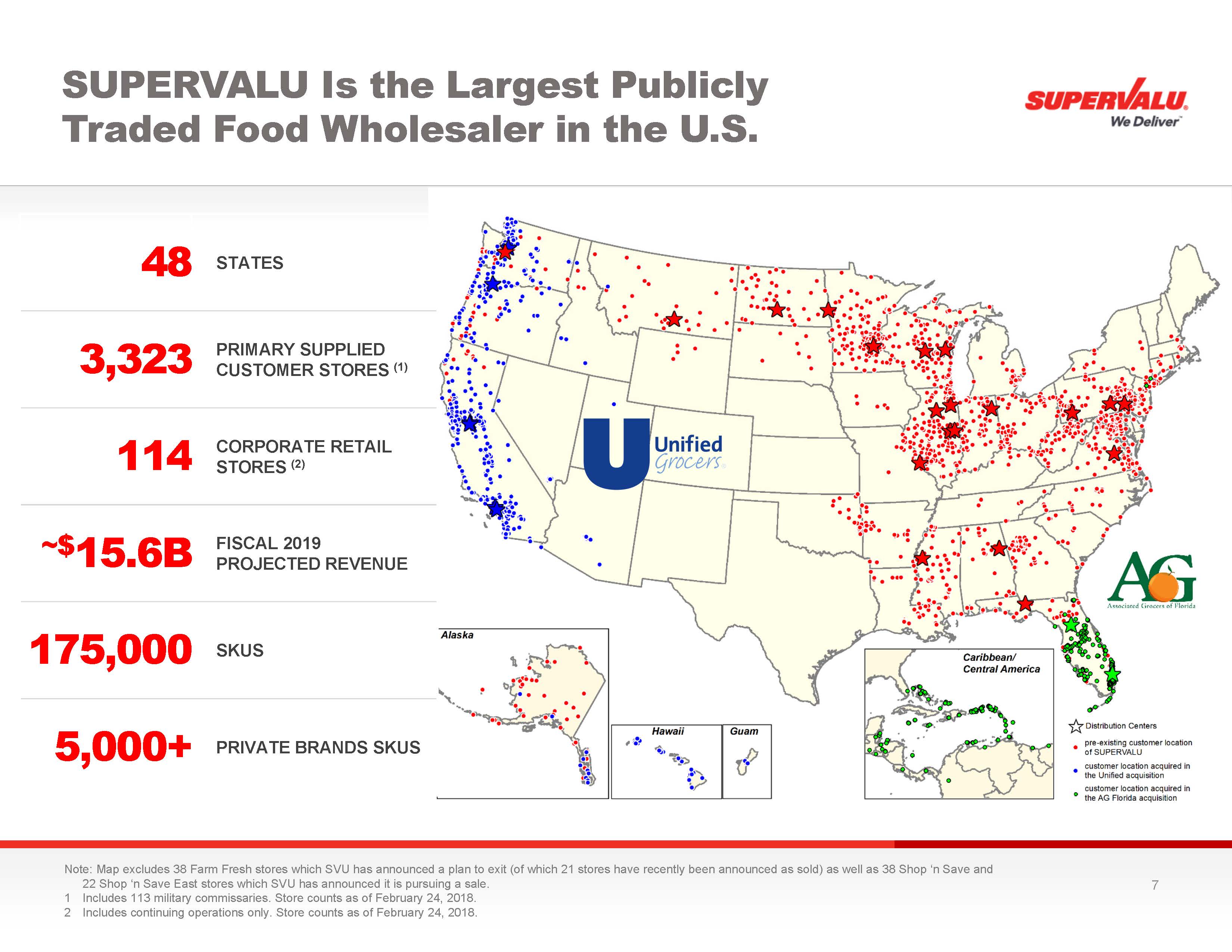

SUPERVALU INC. is one of the largest grocery wholesalers and retailers in the U.S. with fiscal 2018 annual sales of approximately $14 billion. SUPERVALU serves customers across the United States through a network of 3,437 stores composed of 3,323 wholesale primary stores operated by customers serviced by SUPERVALU’s food distribution business and 114 traditional retail grocery stores in continuing operations operated under three retail banners in three geographic regions (store counts as of February 24, 2018). Headquartered in Minnesota, SUPERVALU has approximately 23,000 employees (in continuing operations). For more information about SUPERVALU visit www.supervalu.com.

Contact Information

SUPERVALU INC.

For Investors:

Steve Bloomquist, 952-828-4144

steve.j.bloomquist@supervalu.com

or

For Media:

Jeff Swanson, 952-903-1645

jeffrey.s.swanson@supervalu.com

or

Joele Frank, Wilkinson Brimmer Katcher

James Golden / Leigh Parrish

212-355-4449