Forging the Future of Grocery Retailing

Jeff Noddle, Chairman and CEO

Pamela Knous, EVP and Chief Financial Officer

Meetings with Investment Community

March 14-17, 2006

Exhibit 99.1

Filed by SUPERVALU INC.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: SUPERVALU INC., File #1-5418

1

Forward-Looking Statement

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Except for the historical and factual information contained herein, the matters set forth in this presentation, including statements as

to the expected benefits of the acquisition such as efficiencies, cost savings, market profile and financial strength, and the competitive

ability and position of the combined company, and other statements identified by words such as “estimates,” “expects,” “projects,”

“plans,” and similar expressions are forward-looking statements within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual

results to differ materially, including required approvals by Supervalu and Albertsons shareholders and regulatory agencies, the possibility

that the anticipated benefits from the acquisition cannot be fully realized or may take longer to realize than expected, the possibility that

costs or difficulties related to the integration of Albertsons operations into Supervalu will be greater than expected, the impact of

competition and other risk factors relating to our industry as detailed from time to time in each of Supervalu’s and Albertsons reports filed

with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this

presentation. Unless legally required, Supervalu undertakes no obligation to update publicly any forward-looking statements, whether as

a result of new information, future events or otherwise.

ADDITIONAL INFORMATION

Supervalu and Albertsons will file a joint proxy statement/prospectus with the Securities and Exchange Commission (SEC). INVESTORS

ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION. You will be able to obtain the joint proxy statement/prospectus, as well as other filings containing information

about Supervalu and Albertsons, free of charge, at the website maintained by the SEC at www.sec.gov. Copies of the joint proxy

statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also

be obtained, free of charge, by directing a request to Supervalu, Inc., 11840 Valley View Road, Eden Prairie, Minnesota, 55344, Attention:

Corporate Secretary, or to Albertsons, Inc., 250 East Parkcenter Boulevard, Boise, Idaho, 83706-3940, Attention: Corporate Secretary.

The respective directors and executive officers of Supervalu and Albertsons and other persons may be deemed to be participants in the

solicitation of proxies in respect of the proposed transaction. Information regarding Supervalu’s directors and executive officers is

available in its proxy statement filed with the SEC by Supervalu on May 12, 2005, and information regarding Albertsons directors and

executive officers is available in its proxy statement filed with the SEC by Albertsons on May 6, 2005. Other information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be

contained the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment

decisions.

2

Agenda

Company Overview

How We View the Market

Strategy for Change

The Deal

Financial Discussion

Implementing Change

Summary

3

Who We Are: A SUPERVALU Overview

135-year legacy of grocery industry

excellence

Multi-format grocery retail leadership

1,381 retail locations across seven banners

Diverse portfolio of formats to address the full

spectrum of grocery shopping preferences

Industry leader in supply chain services

Serve more than 2,200 primary customer

sites, plus our own retail operations

Unparalleled basis-point discipline engrained

in all our businesses

60+ years of dividend payments

4

Extreme value

Small Box Format

Highly efficient model

National Banner

Super-Regional Banners

Super-regional

Two dominant

formats: Fresh Focus

and Price Impact

5

SUPER-Regional Banner Edges: Setting Ourselves Apart

227 stores in network

Providing products,

service, ambiance

Powerful differentiators:

Fresh departments

HBC departments

Ethnic specialty

departments

Store brands

Center store programs

6

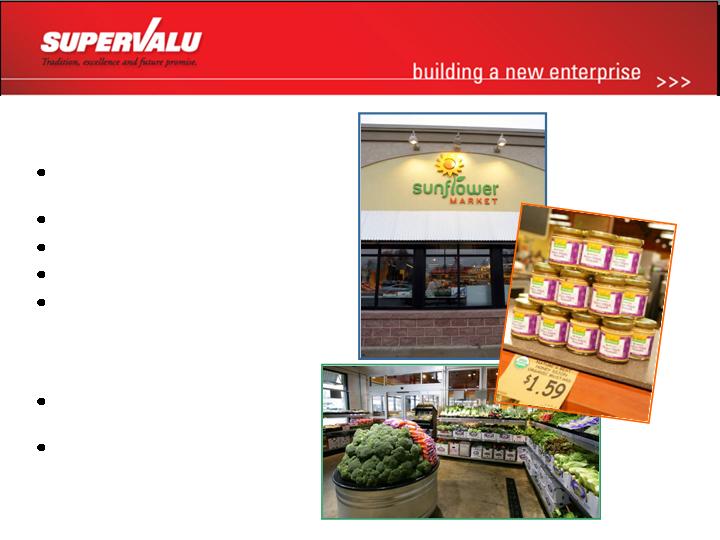

Our New Fresh Concept

January 2006,

Indianapolis

8,000 – 12,000 SKUs

12,000 – 15,000 sq. ft.

Limited assortment

Value-priced at 10%-15%

lower than conventional

and natural store

competitors

Focus on perishables,

especially produce

High-quality natural and

organic departments

7

National Banner Save-A-Lot: Big Savings in a Small Box

The fastest-growing limited

assortment retailer in the U.S.

1,154 stores in 39 states

862 licensed

292 corporate

Target customer

Household incomes under

$35,000

43.3 million households

12,000 – 15,000 sq. ft. footprint

Approximately 1,250 SKUs

70% Custom Brand products

8

Our Supply Chain Services Profile

Serving more than 2,200 primary

customer sites and 227 corporate

retail locations

Travel almost 100 million miles

annually

Supported by 24 locations

Move more than

half-billion cases annually

Industry-leading service levels

Industry leader in efficiency and

service offerings to retail grocery channel

9

Our Customer Profile Today

SUPERVALU supports nearly 90 million sq. ft. of retail space

Mass Merchandisers

Independent Retailers

National

Banner

Super-Regional

Banners

10

How We View the Market

New Realities Creating Opportunities to Shape SUPERVALU and the

Grocery Retail Sector

Channel Blur - Everybody is selling food

Non-traditional retailers using food to build store traffic

Shopping patterns and preferences are shifting as store formats adapt

Industry ripe for rationalization

Excess supply of retail space

List of troubled players sets the stage for major consolidation events

Understanding and catering to the customer

Determining the right mix of merchandizing, shopping experience, and

price is critical

Food preferences remain locally driven

SUPERVALU is actively shaping its future and positioning itself

to succeed in the grocery retailing industry

11

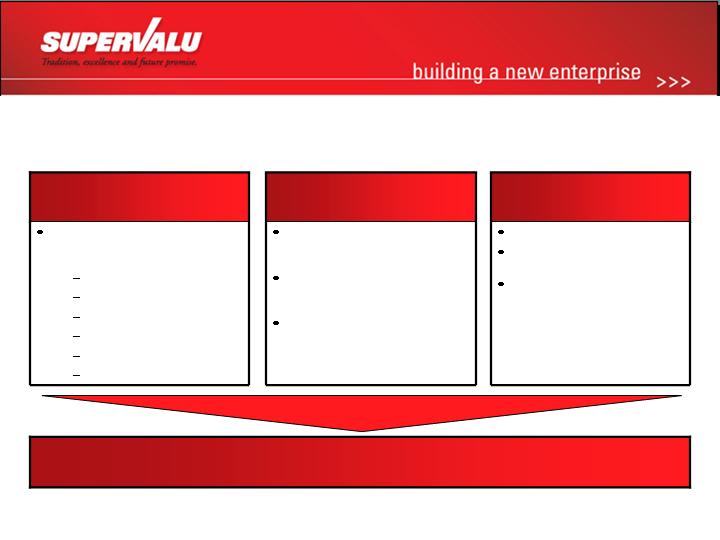

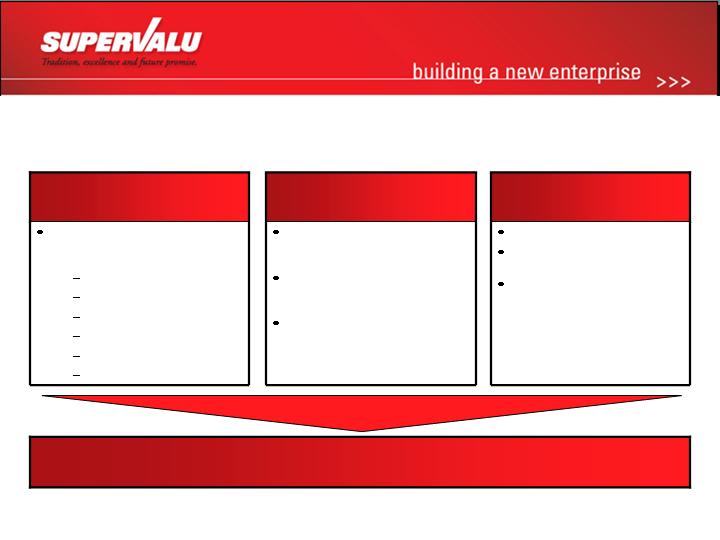

Successfully competing requires a multi-faceted

approach to achieve sustainable grocery retail success

Ideally positioned to capitalize

on serving diverse customer

needs and wants

Extreme Value

Price Impact

Traditional / Full Service

Natural / Organic

High-end Gourmet

Fuel and Convenience

Scale and Diversity of

Retail Formats

Leveraging world-class

supply chain capabilities and

buying power

Develop unique scalable

competitive advantages like

W. Newell & Co. in produce

Robust technology

platforms: SV Harbor,

T-squared, and more

Strong Supply Chain

Backbone

Strong local management

Customized and innovative

local merchandising

Commitment to superior

shopping experience in

competitive atmosphere

Empowered People

Creating Sustainable Success

12

We Are Well Positioned to Capitalize

on Market Opportunity

Years of operational and financial staging

have prepared us

Proven ability to manage a variety

of retail formats

Track record of successful integration

of acquisitions

Basis-point discipline embedded in culture

In Albertsons, we see great assets,

markets and people

13

Our Acquisition Discipline Was Applied

Synergistic and

Accretive

Strong local market

leadership

Realizable synergies

Additive competencies

Don’t seek turnarounds

Fit with SVU strategy

Rigorous due diligence

Enhance shareholder value

Disciplined

Selection and

Rigorous Due

Diligence

14

The Deal

Transaction Summary

SUPERVALU, CVS and Cerberus-led

investment group to acquire Albertsons

for $17.4 billion in cash, stock and debt

assumption (with HITS).

SUPERVALU to acquire premier retail

properties - more than 1,100 stores:

Acme Markets

Bristol Farms

Jewel-Osco

Shaw’s and Star Markets

569 Albertsons stores in Idaho, Southern

California, Nevada, Utah and Northwestern U.S.

In-store pharmacies: Osco Drug and Sav-on

SUPERVALU takes No. 2 spot in the

grocery industry by revenue

15

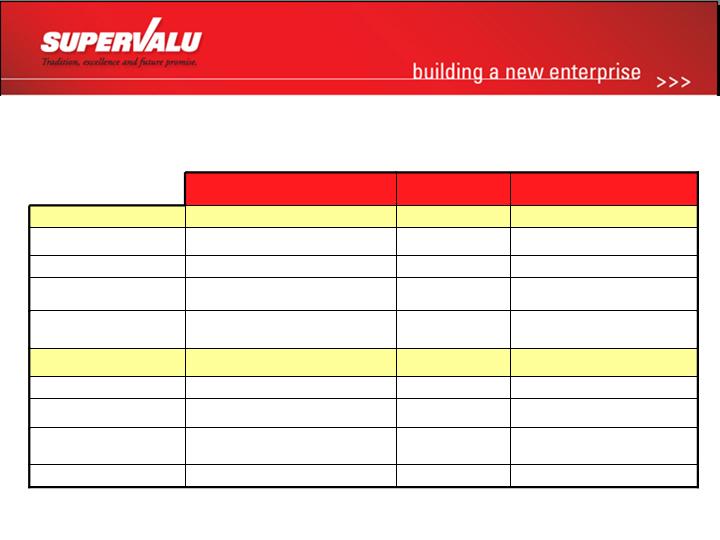

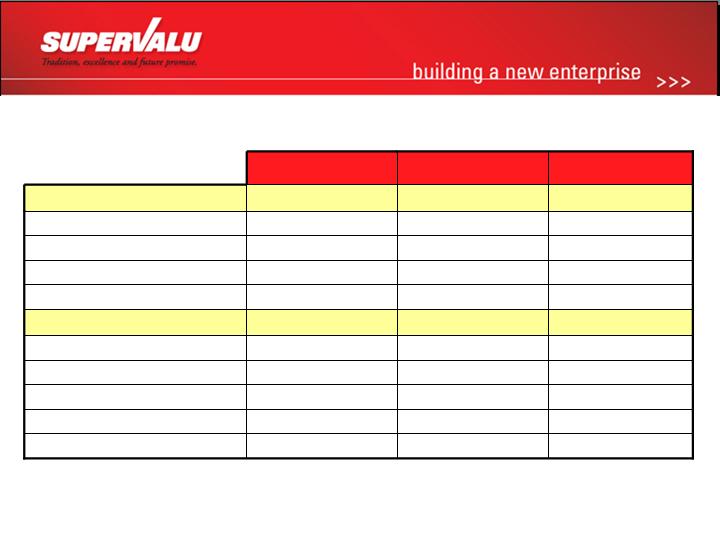

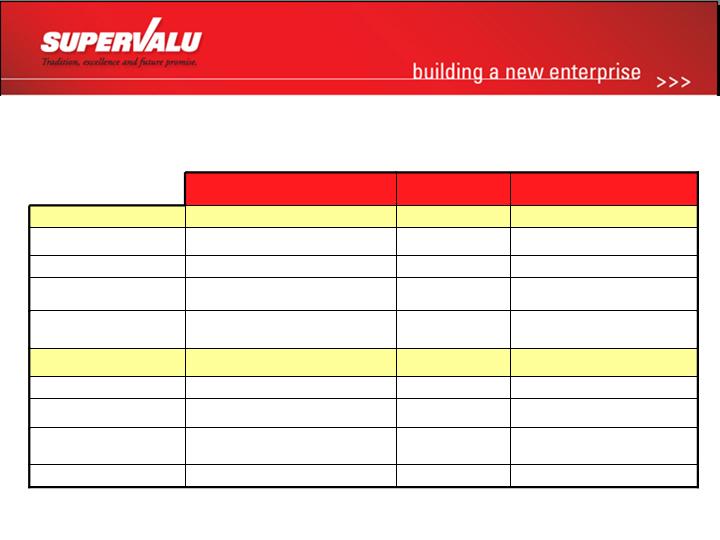

878

722

156

In-store

Pharmacies

$150-$175 million

pretax over 3 yrs.

Synergies

89% Retail

67% Retail

EBITDA Mix

80% Retail

53% Retail

Revenue Mix

194,000

144,000

50,000

Employees

2,505

1,124

1,381*

Store Network*

Financial

Operational

117

107

10

Fuel Centers

$44B

$25B

$19B

Revenue (FY ’05)

New SUPERVALU

Business to be

Acquired

SUPERVALU

Transformation in Scope and Scale

(all data approximate)

*Store network adjusted for sale of Pittsburgh and Chicago stores and the announced sale of Deals

stores.

16

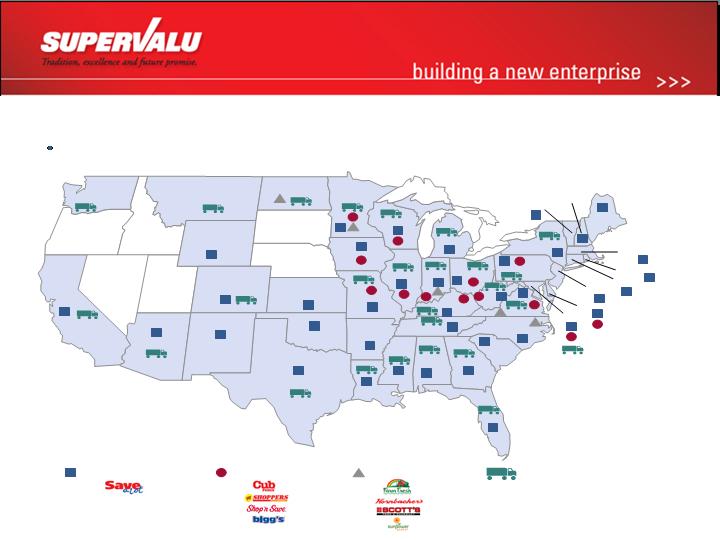

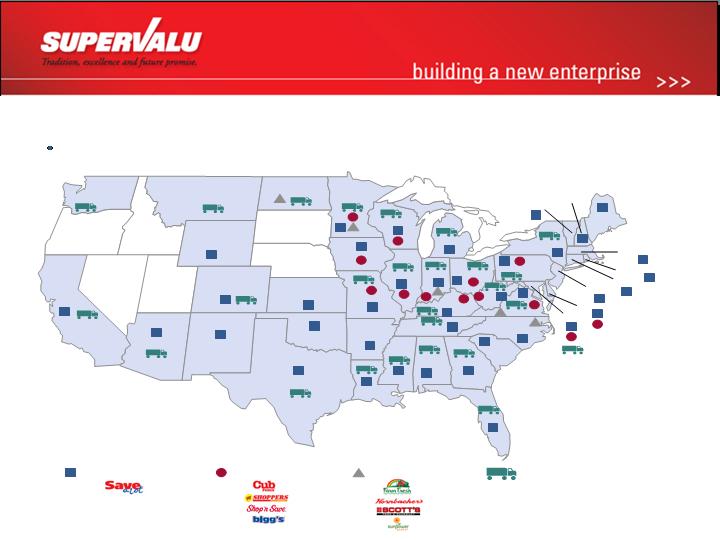

SUPERVALU’s Current Footprint

SUPERVALU has a retail or distribution presence in 42 states, and is predominately focused in the

East, Southeast and Midwest

(1)

Includes 27 TLC owned or managed

facilities

Supermarkets

Extreme Value Stores

Price Superstores

Supply Chain Services/

Distribution Centers (1)

Texas

New Mexico

Colorado

Wyoming

Montana

Idaho

California

Arizona

Nevada

Utah

Washington

Oregon

North Dakota

South Dakota

Nebraska

Kansas

Oklahoma

Arkansas

Missouri

Iowa

Minnesota

Michigan

Wisconsin

Illinois

Indiana

Ohio

Pennsylvania

New York

Kentucky

Tennessee

Louisiana

Mississippi

Alabama

Georgia

Florida

Maine

South

Carolina

North Carolina

Virginia

West

Virginia

Massachusetts

New Hampshire

Vermont

Connecticut

New Jersey

Delaware

Maryland

Rhode Island

18

23

15

5

6

1

89

31

64

20

48

1

19

7

3

7

117

1

18

20

39

12

92

62

1

22

53

22

9

43

4

105

16

18

55

13

3

9

103

1

19

22

40

39

17

7

3

2

1

3

3

1

2

2

5

6

3

2

1

1

4

3

1

4

2

1

8

2

2

9

7

2

14

1

2

37

1

17

1

3

1

1

1

17

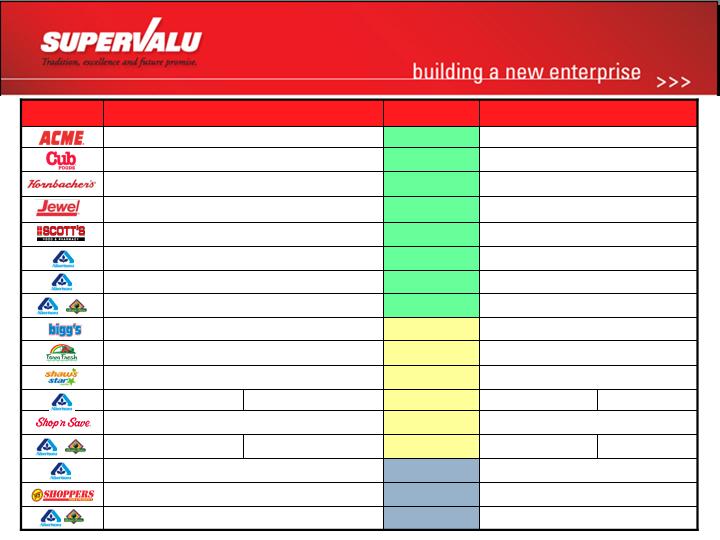

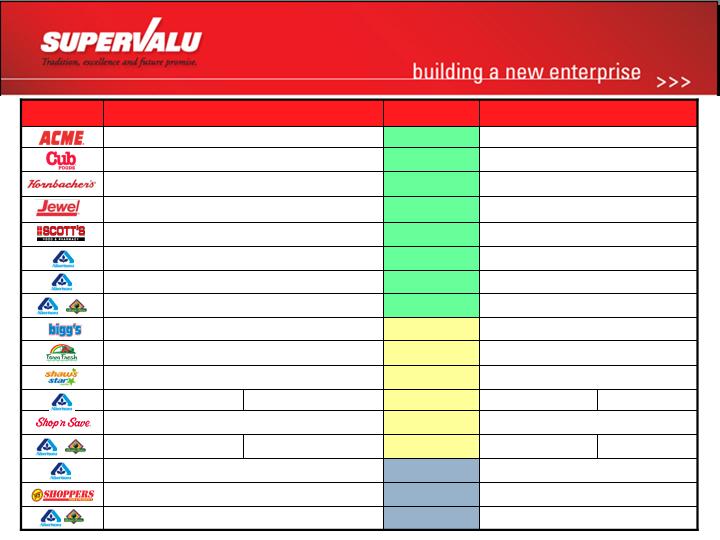

Retail Store Footprint To Be Acquired

Banners

Combination / Conventional

Stores

85

55

Oregon

Washington

Montana

Idaho

Utah

Arizona

New Mexico

Colorado

North Dakota

South Dakota

Nebraska

Kansas

Missouri

Oklahoma

Texas

Arkansas

Louisiana

Iowa

Minnesota

Wisconsin

Illinois

Indiana

Ohio

Michigan

Kentucky

Tennessee

Mississippi

Alabama

Georgia

South

Carolina

North Carolina

Virginia

West

Virginia

Pennsylvania

New York

Vermont

Maine

New

Hampshire

Massachusetts

Rhode Island

Connecticut

New Jersey

Delaware

Maryland

Florida

43

34

47

1

1

2

1

15

178

6

53

18

23

35

94

16

25

61

12

8

32

280

California

Nevada

Northwestern /

Intermountain

Southern

California

Wyoming

2

1,124 Locations in 24 States

18

Proforma Operations Footprint of The New SUPERVALU

Supermarkets

Supply Chain Services/

Distribution Centers (1)

Supermarkets

Price Superstores

Extreme Value Stores

SUPERVALU

New Banners

Texas

New Mexico

Colorado

Wyoming

Montana

Idaho

California

Arizona

Nevada

Utah

Washington

Oregon

North Dakota

South Dakota

Nebraska

Kansas

Oklahoma

Arkansas

Missouri

Iowa

Minnesota

Michigan

Wisconsin

Illinois

Indiana

Ohio

Pennsylvania

New York

Kentucky

Tennessee

Louisiana

Mississippi

Alabama

Georgia

Florida

Maine

South

Carolina

North Carolina

Virginia

West

Virginia

Massachusetts

New Hampshire

Vermont

Connecticut

New Jersey

Delaware

Maryland

Rhode Island

18

23

15

5

6

1

89

31

64

48

1

19

7

3

7

117

1

18

20

39

12

92

62

1

22

53

22

9

43

4

105

16

18

55

13

3

9

103

1

19

22

40

39

17

7

3

2

1

3

3

1

2

2

5

8

3

2

1

1

5

3

1

6

1

2

1

8

2

2

9

7

2

14

1

2

37

1

17

1

280

55

85

34

43

47

32

2

178

15

6

1

2

61

53

94

16

25

35

18

12

8

22

1

1

3

1

1

1

1

1

1

1

(1)

Includes 27 TLC owned or managed

facilities

Northwestern /

Intermountain

Southern California

2,500+ Locations in 48 States…National Retail Powerhouse

19

Las Vegas

# 1 Market Share

Southern Cal.

# 1 or # 2

Market Share

Mpls. / St. Paul

# 1 Market Share

Chicago

# 1 Market Share

Boston / New

England

# 2 Market Share

Philadelphia

# 1 Market Share

St. Louis

# 2 Market Share

Washington

D.C. / Baltimore

# 3 Market Share

Leading Positions in Large and Growing Markets

Boise

# 1 Market Share

Virginia Beach /

Norfolk

# 2 Market Share

Los Angeles

#3 Market Share

20

Strong Positioning: 73% of Revenues

from #1 or #2 Market Positions

Safeway, Kroger

San Diego, Ventura, CA

Kroger, Wal-Mart

Salt Lake City/Ogden, UT

Kroger

#1

Las Vegas, NV

#3

#3

#3

#2

#2

#2

#2

#2

#2

#1

#1

#1

#1

#1

#1

#1

Share Rank

Sun Mart

Fargo, ND

Banner

Giant, Safeway

Washington, D.C./ Baltimore, MD

Safeway, Rosauers

Spokane, WA

Stop & Shop, Demoulas

Boston, MA-NH

Kroger, Meijer

Cincinnati, OH

Dominick’s

Chicago, IL

Wal-Mart

Billings, MT and Boise, ID

Stater Bros., Kroger

Riverside-San Bern., CA

Kroger

Orange County, CA

Safeway, Qual. Food Cent. / Fred Meyer

Seattle-Bellevue-Everett / Tacoma, WA

Schnuck’s, Dierberg’s

St. Louis, MO

Kroger, Safeway

Los Angeles-Long Beach, CA

Food Lion, Wal-Mart

Norfolk/Virginia Beach, VA

Kroger

Rainbow

Genuardi

Primary Competition

Fort Wayne, IN

Minneapolis – St. Paul, MN

Philadelphia, PA-NJ

MSA Markets

21

Advantages of Our Expanded Retail Portfolio

High-end Gourmet

Price Impact

Traditional Full

Service

Fuel / Convenience

Natural & Organic

Extreme Value

Formats

Strong geographic footprint, excellent market shares

combined with our collective competencies offer

tremendous opportunities

Increased Purchasing

Power

World Class Supply

Chain Backbone

Local Merchandising

Expertise

Expanded Market

Intelligence

Expanded Pharmacy

Footprint

Increased Fuel Program

Successful Licensee

Formula

Expanded Private Label

Offering

Competencies

Scalable and

Highly

Effective

Competitive

Retail Model

+

=

22

Investing in Strong and Growing Markets

Combined capital spending is $1.1B

To be allocated heavily toward remodeling

and expanding store network

Remodeling

Strong commitment to well-maintained,

contemporary store fleet

85% of SUPERVALU’s current fleet is new

or newly remodeled within past seven

years

Investing in key markets

Acquired Albertsons properties reflect the

company’s premier operations

Commitment to strengthening these key

market share positions

23

Everyone’s Favorite Question: What About Wal-Mart

States with the most

Wal-Mart stores

Texas 415

Florida 224

California 194

Illinois 158

Ohio 151

Pennsylvania 139

Georgia �� 137

Missouri 132

North Carolina 130

Tennessee 119

Source: http://www.walmartfacts.com, 2/1/06

High Share States

Low Share States

Total U.S. - All Outlets 52 w/e 12/25/04 - Wal-Mart banners only

Med Share States

Expansion States

24

Stacking up against Wal-Mart

Not Significant

Not Significant

WMT

2.2%

1.8%

WMT

23.3%

20.9%

Acme

Philadelphia

1.1%

0.7%

WMT

12.2%

12.3%

Albertsons

Los Angeles

WMT

Albertsons

Jewel

WMT

Shop’n Save

WMT

Farm Fresh

Chain

Trend

2005

2003

Market

18.1%

25.8%

36.6%

10.8%

20.9%

22.6%

19.1%

27.6%

Las Vegas

21.1%

St. Louis

18.4%

23.4%

43.9%

11.9%

21.8%

Chicago

Va. Beach

Market Share

Source: Trade Dimensions: 2003 and 2005 Market Scope

25

Creating a New Enterprise

Bringing two powerful

organizations together

In-market focus shared by

Albertsons and SUPERVALU

Preserving local focus and

customer experience is a

strategic key

Rich set of competencies at

both companies to leverage

the new enterprise

Planned and thoughtful

transition effort underway

Unlock the Value in the Combined Enterprise

26

Enterprise Building Framework

Collaborative, Thoughtful and Swift Process

Prepare

Transition

Plan

Implement

Plan

Capture

Initial

Synergies

Execute

Growth Plan

Track &

Validate

Post Close

Pre-Close

Enterprise Executive Lead:

Mike Jackson, SUPERVALU President and COO

27

Pamela Knous

Executive Vice President and Chief Financial Officer

Creating a New SUPERVALU

28

Transaction Progress

Preliminary proxy filed March 13

Debt syndication in process

Transaction moving forward

SUPERVALU’s 4th quarter available mid-April

ABS 10-K available in March; SVU 10K available late April

Plan to close in early summer

Process is moving along well

29

Key Transaction Highlights

SUPERVALU, CVS and Cerberus–led investment group to acquire

Albertsons for $17.4 billion in cash, stock and assumption of debt.

Assumes settlement of HITS.

Simultaneous transaction

Whereby sale of “standalone drug” to CVS and “non-core” properties to Cerberus

generates cash proceeds of $3.9B and $0.4B respectively. SUPERVALU to provide

temporary transition support services to both parties.

SUPERVALU’s consideration equals approximately $12.4B

HITS settle with transaction: $3.8B in cash, $2.5B in stock, $6.1B assumption of

debt. TOTAL: $12.4B

HITS settle 5/07: $4.1B in cash, $2.2B in stock, $6.1B assumption of debt. TOTAL:

$12.4B

EBITDA multiple of 7.0X

Newly capitalized company will be formed, comprised of:

SVU shareholders – approximately 65%

ABS shareholders – approximately 35%

SUPERVALU will continue to pay dividends

30

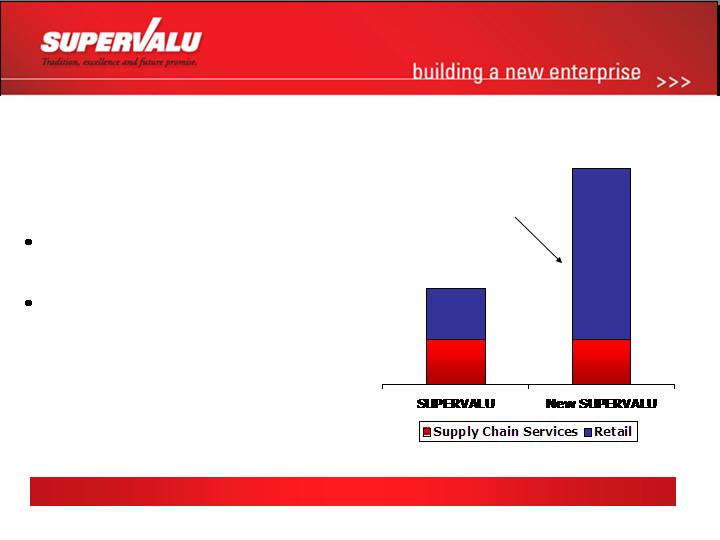

The New SUPERVALU Provides:

Broad-based Future Growth Potential and Immediate Diluted

Earnings Per Share Accretion on Annualized Basis

Excluding One-Time Costs

Expect transaction to be immediately double-digit accretive

when excluding one-time transaction costs

Proforma FY’06 EBITDA margins increase 140 basis points

from 4.8% to 6.2% through combination.

EBITDA margins expected to increase by additional 30 - 40

basis points to 6.5% - 6.6% after combined entity synergies

of $150-175 million realized.

31

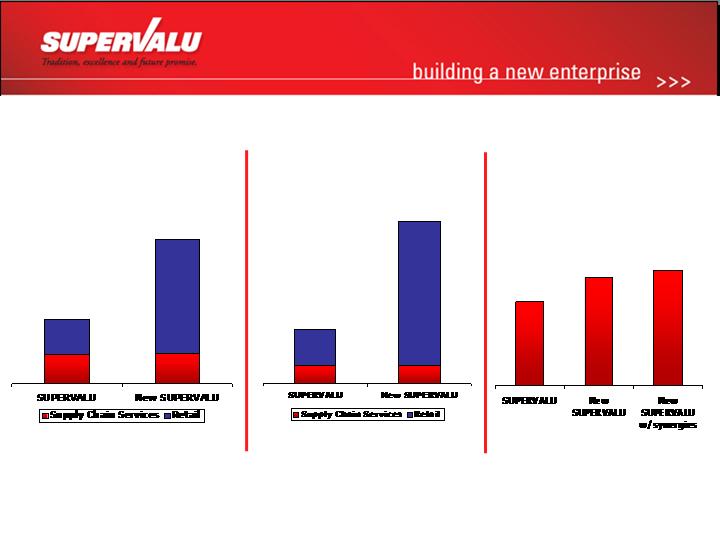

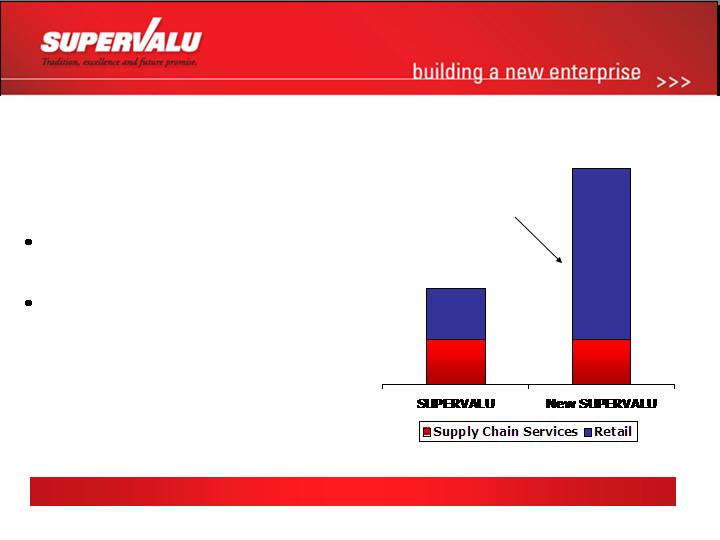

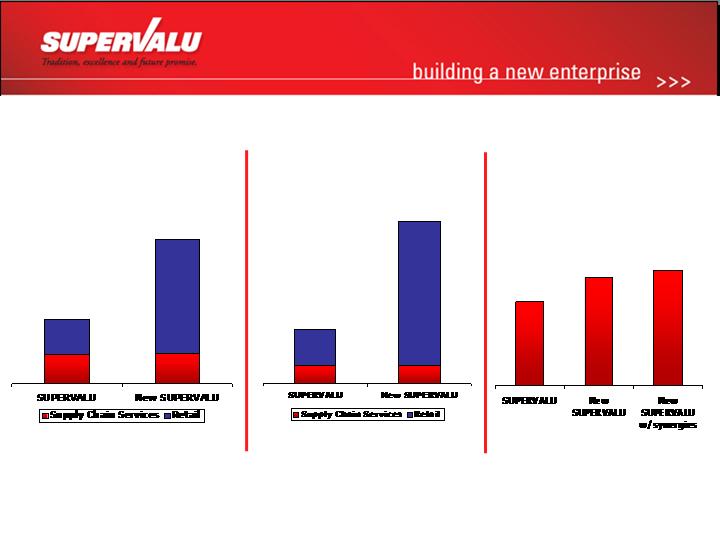

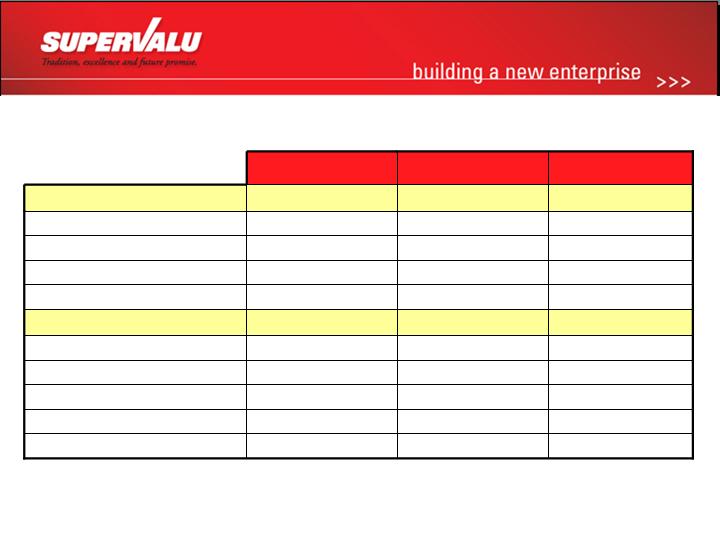

Scale, Improved Retail EBITDA Mix Enhances Business Model

($ Billions)

$19

$44

47%

53%

20%

80%

$0.9

$2.7

33%

67%

11%

89%

Sales

EBITDA

SVU figures represent First Call estimates, ABS figures represent management estimates

EBITDA Margin

4.8%

6.2%

6.5%

to

6.6%

32

Anticipated Synergies Breakdown

Expect Synergies to be Realized by the End of the Third Full Year

$150 - $175 million

Total Pretax Synergies

$25 - $30 million

Supply Chain Optimization

$50 - $60 million

Corporate Synergies

$75 - $85 million

Retail Leverage and Efficiencies

33

Illustrative EPS Accretion reflecting preliminary purchase

accounting treatment

$44 B

$44 B

$25* B

$19 B

Sales

+30%

+12%

Accretion

223

$2.92

$654

1,072

(1,018)

(760)

150

$2,700

Combined

with

Synergies

$2.51

$2.24

EPS

$ in million except EPS

223

77

146

Share Count Fully Diluted

$562

$242

$320

Net Income

922

414

508

Pretax

(1,018)

(706)

(312)

Depreciation/Amortization

(760)

(645)

(115)

Net Interest Expense

Synergies

$2,700

$1,765*

$935

EBITDA

Combined

w/o

Synergies

Combination

Adjustments

SUPERVALU

F’06E

First Call

*Represents Albertsons management estimates for Fiscal 2006. SVU First Call data for F06 does not reflect

impact of Hurricane, Pittsburgh exit, sale of Chicago stores, impairment related to announced sale of Deals,

and third quarter transaction costs. Combined data excludes one time transaction costs.

34

Comparison Illustrative EPS Accretion: Jan 23 to March 13*

$44 B

$44 B

$44 B

$44 B

Sales*

+30%

+12%

+35%

+17%

Accretion

223

$2.92

$654

1,072

(1,018)

(760)

150

$2,700

Combined

with

Synergies

$2.51

$3.02

$2.61

EPS

As presented January 23 As presented in proxy March 13

223

224

224

Share Count Fully Diluted

$562

$677

$585

Net Income

922

1,110

960

Pretax

(1,018)

(995)

(995)

Depreciation/Amortization

(760)

(745)

(745)

Net Interest Expense

150

Synergies

$2,700

$2,700

$2,700

EBITDA*

Combined

w/o

Synergies

Combined

with Synergies

Combined

w/o

Synergies

* Represents Albertsons management estimates for Fiscal 2006. SVU First Call data for F06 does not reflect

impact of Hurricane, Pittsburgh exit, sale of Chicago stores, impairment related to announced sale of Deals,

and third quarter transaction costs. Combined data excludes one time transaction costs.

35

Illustrative Combined Free Cash Flow

(Excluding One-Time Transaction Costs)

$ in million

540

371

169

Free Cash Flow

(925)

(550)

(375)

Cash Capital Expenditures

(150)

(62)

(88)

Dividends

(360)

(172)

(188)

Income Taxes

(725)

(610)

(115)

Interest (cash)

2,700

1,765*

935

EBITDA

Combined

Combination

Adjustments

SUPERVALU

F’06E

First Call

* EBITDA represents Albertsons management estimates for Fiscal 2006

36

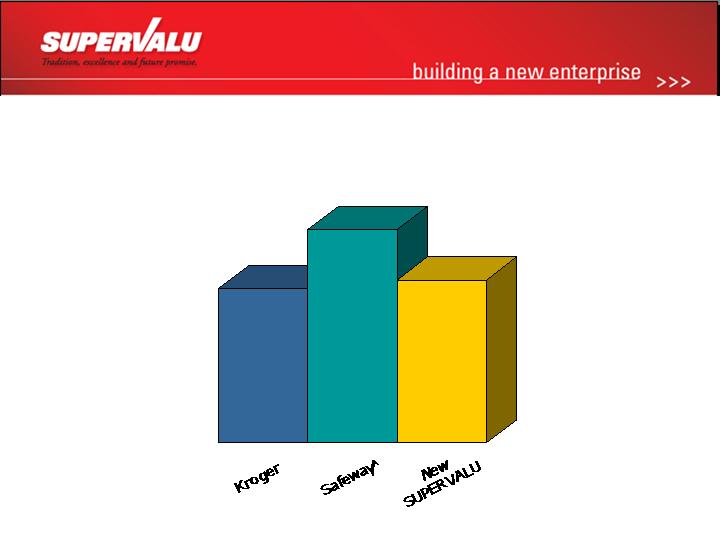

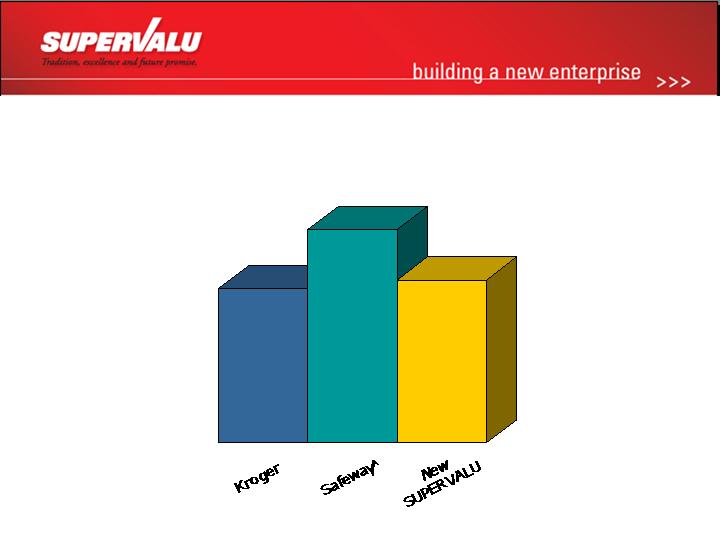

Retail Capital Spending – Supporting Retail Growth

Fiscal 2006 Projected Retail Capital Expenditure

as % of Projected Retail Sales Compared to our Peers*

2.9%

3.8%

2.75%

*Based on First Call data

A Safeway’s figures represent cash cap ex as % of sales

37

Investing in our Future

Sufficient Capital Dollars to Grow and Support Store Network

Capital Spending

Committed to new stores

and remodels

Retail capital budget as % of

$34 B of retail revenues is 2.9%

Sales

$1.0 Billion

of capital

allocated to

retail

operations

38

Debt/EBITDA

Illustrative Combined Leverage

$ in million

3.6

4.6

1.8

Debt/EBITDA

2,700

1,765

935

EBITDA

9,718

8,035

1,683

Debt

Combined

Combination

Adjustments

SUPERVALU

FY’06 E

EBITDA represents SUPERVALU First Call and Albertsons management estimates for Fiscal 2006

39

Analysis of Sources

assuming HITS settle in conjunction with transaction

SVU Debt

Beginning debt $1.6 B

Assumed debt $6.1

New borrowings $2.0

Total $9.7

Sources

SVU new facility $2.0 B

SVU cash $0.6

ABS cash $0.3

Drug proceeds $3.9

Noncore proceeds $1.0

HITS $1.1

Expenses/Other ($0.3)

Total $8.6 B

Cash Required

424 million shares @$20.35 = $8.6 Billion

40

We Are Committed to Investment Grade and ROIC Improvement

Resetting the Clock on 2 Key Metrics

Strong Operating Discipline will Support Progress on

Important Benchmarks

ROIC

Committed to return to 15% ROIC

Proven track-record of delivering

returns in a variety of market

conditions

Disciplined asset management and

capital allocation

Debt to Capital Ratio

Committed to return to investment

grade

Proven track-record of debt reduction

Strong cash flow business model

Debt-to-Capital is calculated as debt, which includes notes payable, current debt, current obligations under capital leases, long-term debt

and long-term obligations under capital leases, divided by the sum of debt and stockholders’ equity. ROIC is defined as earnings before

interest and taxes (EBIT) divided by a five-quarter average invested capital, which is defined as total debt plus equity.

41

Proxy Related Disclosures

Proforma data reflects last full fiscal year and YTD third quarter

actuals

SVU – 52 weeks ended Feb 26, 2005; 40 weeks ending Dec 3, 2005

ABS – 53 weeks ended Feb 3, 2005; 39 weeks ending Nov 3, 2005

Proforma income statement data requires use of historical data

to create a depiction of the transaction as if it occurred on Feb

29, 2004

Historical data reflects Albertsons’ slow recovery from labor dispute in So.

California, SUPERVALU sale of Winco, impact of Pittsburgh and Chicago exit

Proforma balance sheet requires use of historical data to create

a depiction of transaction as if it occurred on December 3, 2005

Use of 12/3 balance sheet data necessitates utilizing cash and debt

balances to close transaction at that point in time

42

Proxy Related Disclosures

Preliminary purchase accounting estimates reflected

Significant items include: write up of pp&e to fair value, analysis of

goodwill and other intangibles, long term debt fair value adjustments,

conforming accounting policies. Also reflects transaction specifics: cash

paid, debt assumed, elimination of historical ABS equity, etc.

Neither synergies or one-time transaction costs are included

in the proforma financial statements

One-time transaction costs now estimated at $145 million which includes

retention bonuses, upfront costs to achieve synergies, consultant fees,

transfer taxes, and filing fees, etc.

Economics of transition services agreement reflected

43

Transition Services Agreement

CVS DRUG

CERBERUS

NEW SUPERVALU

2 year term

Fixed + variable payments

Allows for lower payments as store

support needs decline

6 month term

Fixed payment

Transition services agreement structure provides for

reimbursement of costs associated

with supporting Cerberus and CVS during transition period

44

Transition Services Agreement

Proforma financial statements for twelve months F05 and third-quarter YTD F06

results reflect cost reimbursement payments of $193 million and $127 million,

respectively for transition services.

Reimbursement amounts per agreement are based on current run rate of

expenses which are lower than amounts in the historical financial statements

included in the proforma financial statements.

Proforma presentation of cost reimbursement for transition services agreement

is separately identified as a proforma adjustment.

SVU will eliminate the costs of support for non core and stand alone drug as

transition service requirements decline.

Cost reductions from the elimination of corporate administrative costs related to

support of noncore and stand alone drug are not a component of synergies

identified by management.

45

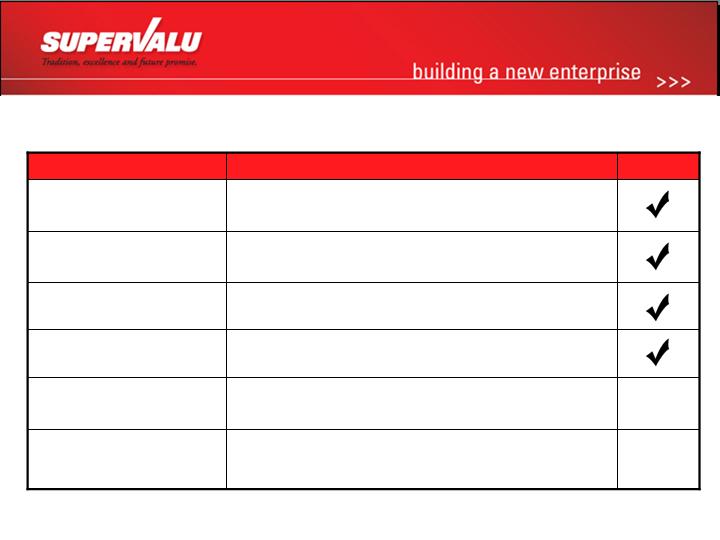

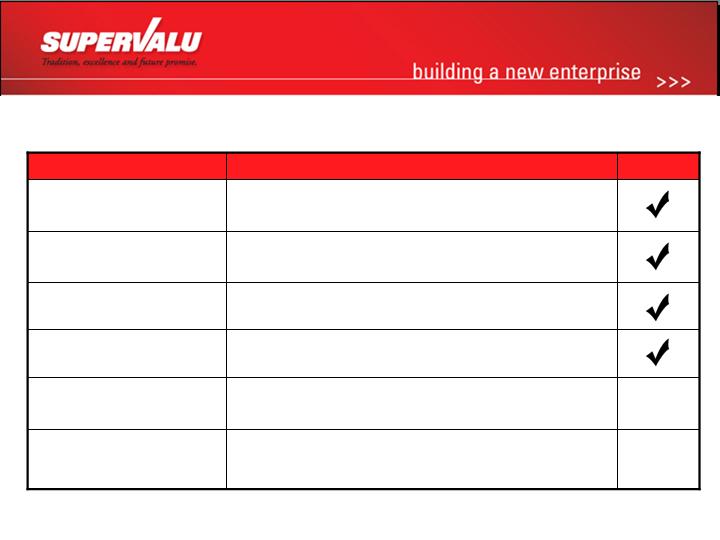

Conditions for Acquisition Approval

File preliminary proxy

March ’06

File Hart-Scott-Rodino (HSR)

February ‘06

On

Track

Close

By Early Summer ’06

On

Track

Gain shareholder approval

By Early summer ’06

Both SUPERVALU and Albertsons boards of

directors recommend shareholder approval

January ‘06

Secure bank financing

December ‘05

Status

Action

Date

46

Summary – Enhancing Shareholder Value

Synergies, scale and a national retail portfolio will support

sustainable retail success

Strong cash flow: financial strength to invest in fleet and

aggressively reduce debt

More profitable business model – nearly 90% of Company’s

EBITDA will be in the higher-growth retail segment

Provides Albertsons shareholders with residual equity in the

New SUPERVALU.

47

No. 2 grocery retailer in the nation, with

The industry’s best regional nameplates

A broad-based future growth potential

The right formula for sustainable grocery retail

success

Forging the Future of Grocery Retailing

Unlocking the Value in the New SUPERVALU

48

THE NEW

Northwestern /

Intermountain

Southern California

49

Appendix: Illustrative Combined Key Metrics

35

11

24

Distribution Facilities

878

722

156

In-store Pharmacies

117

107

10

Fuel Centers

2,505

1,124

1,381

Store Network*

194,000

144,000

50,000

Employees

65%

N/A

39%

Debt-to-Capital Ratio

Financial

Operational

$1.1B

$650M

$450M

Capital Spending

$2.7B

$1.77B

$0.9B

EBITDA

$43.7B

$24.4B

$19.3B

Revenue

New SUPERVALU

Business to be

Acquired

SUPERVALU

EBITDA is SUPERVALU’s First Call and Albertsons management estimates for Fiscal 2006. Store network

adjusted for sale of Pittsburgh and Chicago stores, and announced sale of Deals stores.

50