Annual Meeting of Shareholders June 28, 2006 Embarking on a New Era Exhibit 99.1 |

Now, I would like to provide an update on SUPERVALU – and it is with great pleasure that we have the opportunity to talk about one of the most transformational events in SUPERVALU’s history – our acquisition of the premier retail properties of Albertsons.

Today, we’ll take a look at this acquisition and I’ll outline our vision for creating a national retail powerhouse.

Pam Knous, executive vice president and chief financial officer will also provide some financial perspective on this transaction.

1

Forward-Looking Statement CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 Except for the historical and factual information contained herein, the matters set forth in this filing, including statements as to the expected benefits of the acquisition such as efficiencies, cost savings, market profile and financial strength, and the competitive ability and position of the combined company, and other statements identified by words such as "estimates," "expects," "projects," "plans," and similar expressions are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the possibility that the anticipated benefits from the acquisition cannot be fully realized or may take longer to realize than expected, the possibility that costs or difficulties related to the integration of Albertsons operations into SUPERVALU will be greater than expected, the impact of competition and other risk factors relating to our industry as detailed from time to time in SUPERVALU's reports filed with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Unless legally required, SUPERVALU undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. |

But first, a cautionary statement. Please note that any forward-looking statements in today’s presentation are subject to safe harbor provisions.

Risks and uncertainties related to such statements are detailed in our Fiscal 2006 10-K filing and additional filings related specifically to the Albertsons transaction.

2

“We are transforming SUPERVALU into a national retail powerhouse that embraces changing demographics and keeps the needs of the customer central to our mission.” -- Jeff Noddle |

As we have said throughout the process of the Albertsons acquisition, this transaction truly transforms SUPERVALU.

We’ve become a national retail powerhouse – with new markets representing significant market share – and possessing an exceptionally strong supply chain backbone.

We believe that the New SUPERVALU extends our locally focused approach to addressing shifting customer needs and changing demographics.

3

Creating Sustainable Success Successfully competing requires a multi-faceted approach to achieve sustainable grocery retail success • Ideally positioned to capitalize on serving diverse customer needs and wants – Extreme Value – Price Impact – Traditional/Full Service – Natural/Organic – Pharmacy/Drug – High-end Gourmet – Fuel and Convenience Scale and Diversity of Retail Formats • Leverage world-class supply chain capabilities and buying power • Develop unique scalable competitive advantages like W. Newell & Co., third-party logistics • Robust technology platforms: SV Harbor, T-squared, and more Strong Supply Chain Backbone • Strong local management • Customized and innovative local merchandising • Commitment to superior shopping experience in competitive atmosphere Empowered People |

This slide represents the essence of our vision for the new SUPERVALU business and a multi-faceted approach built on

| • | | Significant scale and diversity of retail formats |

| • | | Strong supply chain infrastructure |

| • | | and empowered associates. |

First - The New SUPERVALU is very diverse in its format offerings. We can tailor our formats to each customer demographic, having all these available in our portfolio. As you can see, we range all the way from extreme value, to price impact, to traditional full-service stores, to pharmacy and drug and high-end gourmet. We also have natural and organic stores under our newest banner, Sunflower Market - a value-priced natural and organic store.

This multi-format approach is a tremendous asset because it gives us the ability to look differently at various markets — and even within markets - and apply the optimal formats and merchandizing mix.

Second - As I mentioned, this approach is backed up by a very strong supply chain backbone. We have been working at this for 135 years. This gives us significant scale. We are the only company that really operates in all 48 states from a supply chain standpoint. And we’re investing considerably in technology platforms that promise to take our efficiency to an even higher level within our supply chain operations.

And third- We also believe very strongly in empowering people in our local markets. It’s vital to our success and we’re fortunate to have the type of leadership — across all of our banners and regions — necessary to effectively execute on our locally focused strategies.

4

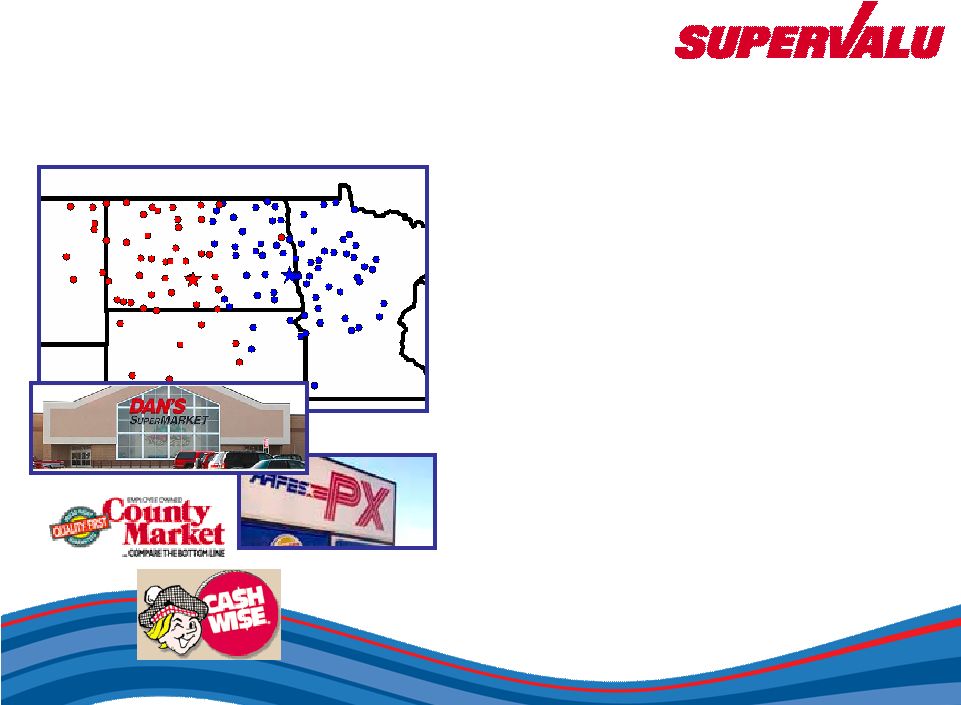

Supply Chain Services in North Dakota Fargo, Bismarck DCs serve 6 states • Serving nearly 150 retail endpoints – Minnesota, North Dakota, South Dakota, Montana and Wyoming • Employing nearly 250 people • SUPERVALU has maintained a presence in North Dakota since the 1920s • Long-standing relationships with independent retailers – many carry the SUPERVALU name • Supporting successful corporately owned retailer Hornbacher’s |

And that is certainly evident here in North Dakota. It’s great to be in Fargo today. As this map denotes - we enjoy a strong business base in this region including our corporately owned banner Hornbacher’s and a network of independent retailers supported by 2 distribution centers in Fargo and Bismarck.

In fact, Bismarck is celebrating 80 years of serving the region - our first distribution center began operations there in 1926. And Fargo has been servicing customers since 1933.

For me, it’s something of a homecoming - I was president of our Fargo division from 1982 to 1985 and enjoyed being part of this community.

We are honored to be in this market - serving more than 150 stores across this region – many of them under the SUPERVALU name.

5

Fargo Distribution Center • Thriving amidst expansion of supercenters in the region • Pilot DC for many company-wide initiative including VoCollect |

Here in Fargo, our independent retailers are thriving in these markets - despite the expansion of supercenters in this region. Today, Gary Schmidt is our general manager.

Fargo often plays an important role in developing new programs for SUPERVALU’s supply chain operations by serving as a pilot site for new initiatives. In 2001, Fargo piloted our VoCollect voice-directed selection system, which we’ve since rolled out across the company.

Our distribution centers are often a place where employees build lifelong careers:

| • | | Like Rebecca Slusher, who began as a receptionist 40 years ago and today is an office clerk in our Accounting department. |

| • | | Chet Rehder, our warehouse manager, has been with our Fargo division for 36 years. |

| • | | Francis Arends, a forklift operator, has spent 35 years with the company, beginning as a night warehouse worker. |

| • | | And truck driver York Sinkler, who has 40 years under his belt as a truck driver – a role that makes him the face of SUPERVALU to dozens of independent retailers every day. |

6

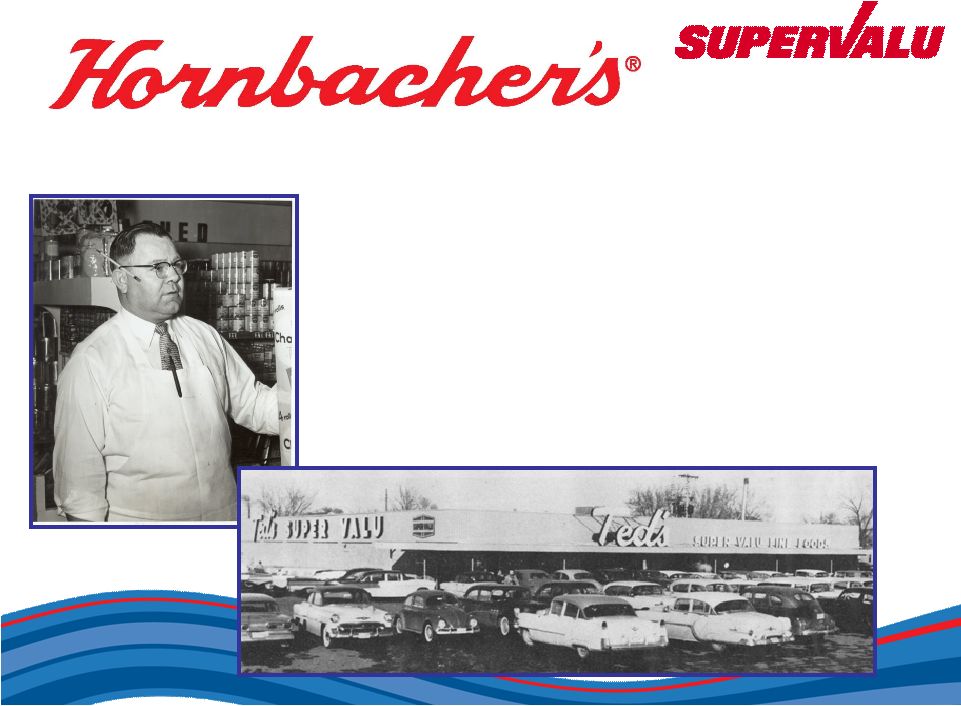

Your hometown grocer for more than 50 years • 1951: Ted Hornbacher opened the first store in Moorhead, Minnesota – 1965: Expanded to Fargo with opening of Northport store – Both stores operated under the name of Ted’s SUPERVALU – 1968: Store names change to Hornbacher’s – 1975: Became part of SUPERVALU |

Another important part of the Fargo community for more than 50 years is Hornbacher’s - a retailer that we are proud to have as part of the SUPERVALU family.

Many people remember Ted Hornbacher, who opened his first store in 1951 under the Ted’s SUPERVALU banner. As his business grew, he changed the company name in 1968 to Hornbacher’s and in 1975 joined SUPERVALU as our first corporate retail banner.

7

Customer satisfaction and community partnership • Today: No. 1 grocer in Fargo/Moorhead – Dean Hornbacher at the helm – Six locations locally focused on value, variety, quality and service • More than 1,000 employees – Strong customer focus – An “employer for life” • A community leader – Cherries for Charity – United Way – Local schools – Big Brother Big Sister |

Today, Hornbacher’s is the leading grocer in the Fargo-Moorhead area, and a Hornbacher is still at the helm. Dean Hornbacher is a vital part of this organization and is well known for his civic leadership.

Hornbacher’s is also known as a great place to work. In fact, Hornbacher’s has many employees who have spent their entire careers with the company.

| • | | Becky Leaf, who has been with us for 16 years, began her career as a checker at the Village West store. In September 2005, Becky became their first female store manager, helming the Moorhead location. |

| • | | Bruce Anderson has been at Hornbacher’s 30 years, joining in 1976 as a meat cutter. Bruce just transferred to the new Osgood store to open and run the meat department. In addition, he serves as Hornbacher’s Meat category manager. |

| • | | David Brunsvold, a life-long resident of the Fargo-Moorhead community has been a Hornbacher’s employee for 30 years. He started as a full-time produce clerk in 1972 at the old Moorhead store. Today he fills two roles for the company – produce manager of our Village West location and Produce category manager for all six Hornbacher’s stores. |

Hornbacher’s recently celebrated the opening of its 6th store – the Osgood location. This new store is the first to feature a fuel center and boasts expanded organic and natural, and cheese departments. It also holds one of our signature “Power Drug” departments, designed to stimulate sales in the health and beauty category. We’re pleased with the results we’re seeing here, they reflect the community’s knowledge that Hornbacher’s is a locally focused store with an emphasis on value, variety, quality and signature Hornbacher’s service.

Hornbacher’s is also a leader in supporting the Fargo-Moorhead community. Through fundraising programs like Cherries for Charity and “Bowl for Kids Sake” to support the local Big Brother Big Sister organization, and successful United Way campaigns and in-kind donations to local schools and non-profits, Hornbacher’s is committed to making this a great area to live.

8

Today – Third Largest U.S. Grocery Retailer • Annual revenue: approximately $44B – 80%/20% mix of retail/supply chain services • Approximately 2,500 corporately owned stores – Nation’s 8 largest pharmacy provider: nearly 900 in-store pharmacies – More than 100 fuel centers • Immediate leading positions in premier urban markets • Unparalleled national supply chain network serving nearly 5,000 retail end points th |

Of course, Hornbacher’s is a part of a much larger retail family – the 3rd largest in the nation now, to be precise. We closed on the acquisition of Albertson’s premier properties on June 2.

Today, retail operations generate about 80 percent of our revenues. We now operate a network of approximately 2,500 retail locations nationwide. That network includes about 900 in-store pharmacies, making SUPERVALU the nation’s 8th largest pharmacy provider.

Of course, we also have the added advantage of an unparalleled supply chain network, which not only fuels our own retail network, but also provides the product supply lifeline for thousands on independent grocery retail destinations across the country.

9

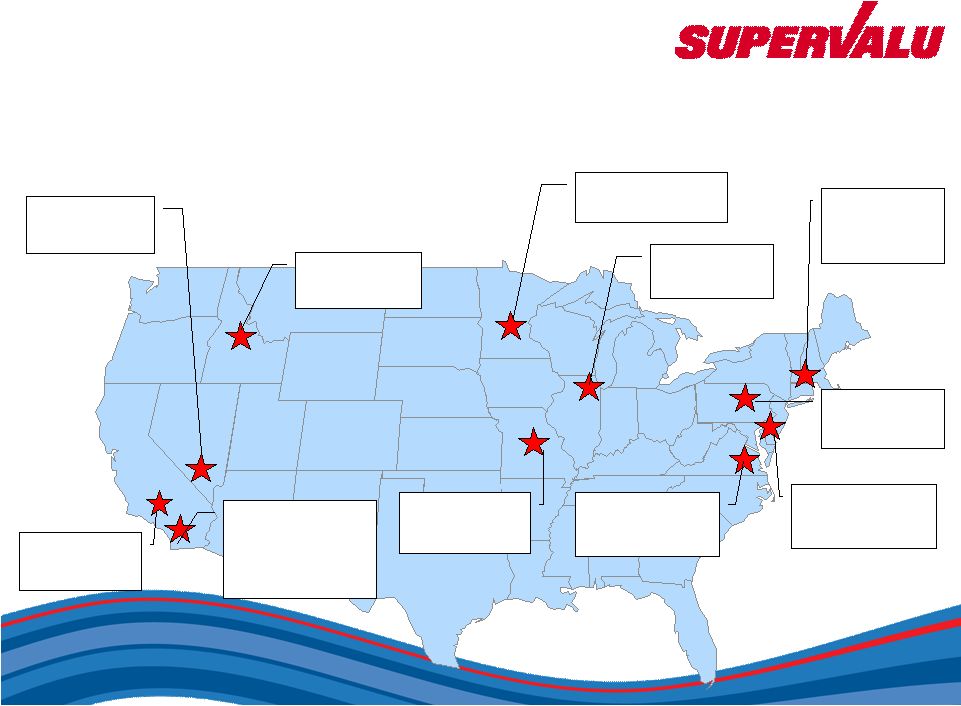

Las Vegas #1 Market Share Southern Cal. #1 in Orange County; #2 in San Diego Market Share Mpls./St. Paul #1 Market Share Chicago #1 Market Share Boston / New England #2 Market Share Philadelphia #1 Market Share St. Louis #2 Market Share Washington D.C. / Baltimore #3 Market Share Leading Positions in Large Markets 73% of retail revenues from No.1 or No.2 market positions Boise #1 Market Share Virginia Beach / Norfolk #2 Market Share Los Angeles #3 Market Share |

Here’s a snapshot of some key markets and share positions in our network. You rarely get the opportunity to go into a company the size of Albertsons and just select certain markets.

And we acquired some brands that are very well-known, household names – For example, Acme Markets is number one in Philadelphia. Jewel is number 1, with well over 40% of the market in Chicago. Shaw’s and Star Market in New England are number two. And we are acquiring more than 550 named Albertsons stores in Idaho, Southern California, Las Vegas, Utah and the northwestern part of the U.S., with many local areas having leading market share.

But what is significant is that this transactionimmediatelygave us leading positions in many premier urban markets that can be incredibly hard to penetrate through organic growth.

In fact, nearly 75 percent of our retail revenues are now generated by major markets where we hold No. 1 or No. 2 market positions.

10

Investing in our Future • Deploy capital to highest-need markets • Leverage strong market positions and excellent retail locations • Position competitive strengths • Focus on in-store experience |

Of course, we have a lot of work ahead of us over the next several months as we work to bring two companies together. But I think you’ll begin to see some themes take shape.

We are going to be highly focused on ensuring that our store fleet is healthy and competitive. We detailed some of our capital spending plans over the past month, or so. These pictures show some of the new remodeling projects underway including Shop ‘n Save in St. Louis and new Pharmacy departments, and, as always, produce department upgrades.

Our goal is to prioritize our capital to the highest need markets to leverage our strong market positions and excellent real estate locations.

All of this ultimately provides our customer with an improved in-store experience.

11

$1 Billion to the Store Fleet 5 250* 50-75 7 2 1 1 4 10 2 11 2 2 4 3 5 13 6 14 5 18 6 Remodels New stores * Licensee remodels |

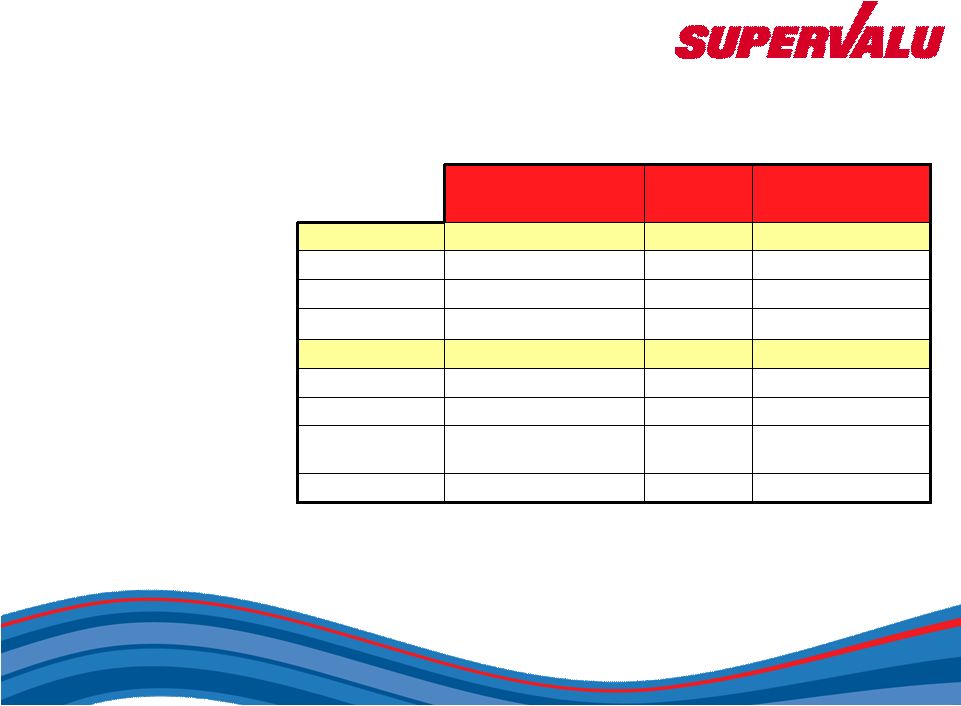

We’re dedicating $1 billion of capital spending to our retail operations in Fiscal 2007 and here is how that capital is divided among these very important banners.

The largest number of stores are going into Jewel. But all of our banners are receiving capital.

You can also see the level of remodeling activity planned in the current year. For those of you who follow us closely, you know that over the last several years, we have been moving our Company toward a goal of having 80% of our store fleet new or newly remodeled in the last seven years.

We actually achieved that benchmark at the end of fiscal ‘05. With our expanded retail network, we will continue to focus on that goal and you will see a high level of commitment to remodels.

Let’s take a closer look at a couple of specific markets

12

In-Market Impact: Chicago • Today: More than 11.5 million square feet of retail space • Largest competitor – Dominick’s • Fiscal 2007 expansion – 6 new stores – 18 remodels |

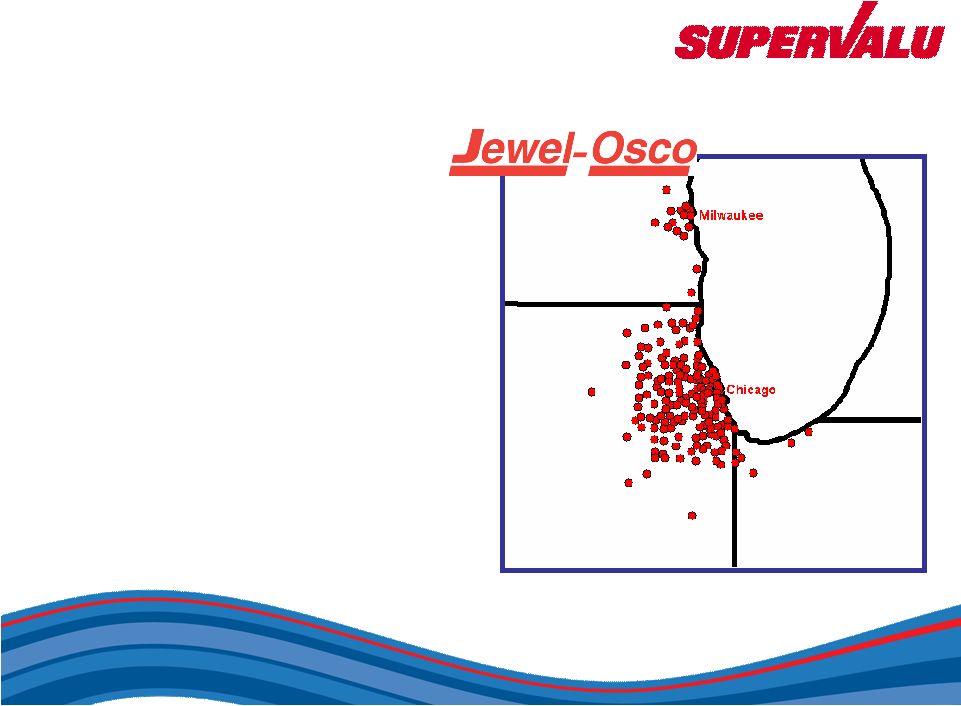

First in the Midwest. We have ambitious plans for our Jewel-Osco banner. Currently, Jewel-Osco operates approximately 200 stores, primarily in the Chicago area. Dominick’s represents our largest competition in this market.

For Fiscal 2007, we plan to expand Jewel-Osco by six stores and remodel another 18 locations, which will provide meaningful reinforcement in a market where we currently enjoy a No. 1 market share position.

13

In-Market Impact: New England • Today: More than 11 million square feet of retail space • Largest competitors – Stop & Shop – Demoulas • Fiscal 2007 expansion – 5 new stores – 14 remodels |

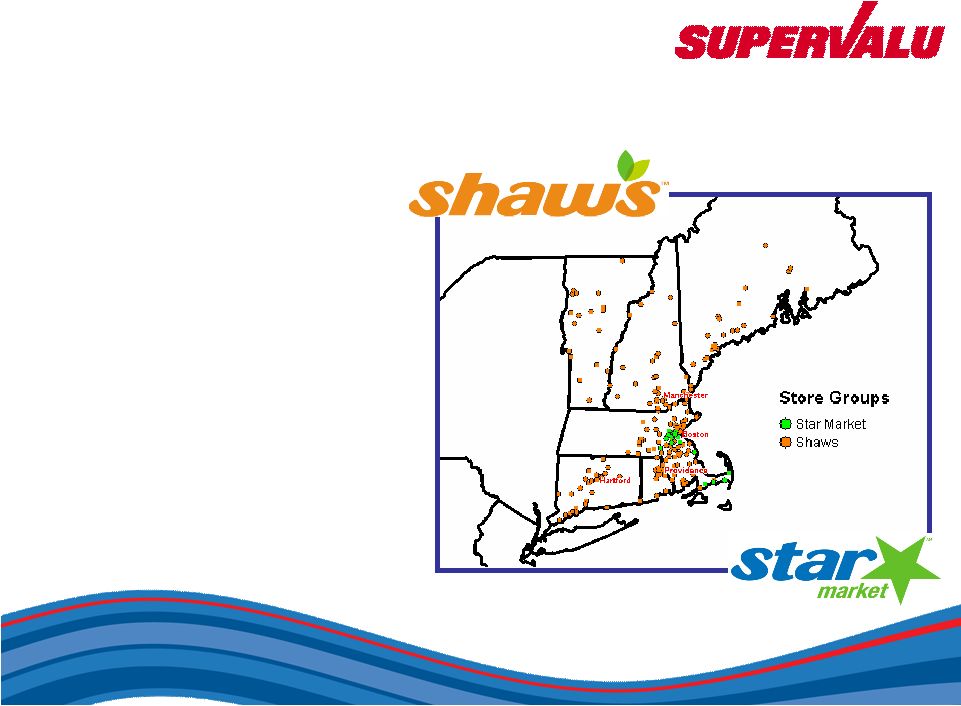

And in New England, Shaw’s and Star Market operate approximately 210 stores and we currently enjoy a number 2 share in the region. These banners face formidable competition from the likes of Ahold-owned Stop ‘n Shop, as well as Demoulas.

Our plans for Fiscal 2007 are to significantly add to this market by opening 5 stores and remodeling an additional 14 locations.

I think our plans in the New England and Chicago markets are representative of our capital spending philosophy – robust, yet thoughtful and focused investment across our retail footprint to further reinforce our share positions.

Now, I’d like to turn it over to Pam Knous. Pam?

14

Financial Highlights Pam Knous Executive Vice President and CFO |

Thanks Jeff and hello everyone. I am glad to be here today to review with you the potential transforming effect that this acquisition will have on our financial position.

Please note that, today, we will not be providing an outlook for Fiscal 2007. Rather, the information that we’ll share on the combined company represents a proforma look at the New SUPERVALU — based on historical financial information — and is designed to illustrate the combined operations. We will be reporting our Fiscal 2007 first quarter results on July 26th.

15

Transformational in Scale and Scope (F06 Proforma) 878 722 156 In-store Pharmacies 89% Retail 67% Retail EBITDA Mix 80% Retail 53% Retail Revenue Mix 194,000 144,000 50,000 Employees 2,505 1,124 1,381* Store Network* Financial Operational 117 107 10 Fuel Centers $44B $25B $19B Revenue New SUPERVALU Business to be Acquired SUPERVALU *Store network adjusted for sale of Pittsburgh and Chicago stores and the announced sale of Deals stores. • $12.4 billion purchase price in assumed debt, cash and stock • Dramatically expands revenues and percentage of profitability from food retail • Transforms SUPERVALU across a wide range of metrics |

Our acquisition of the premier properties of Albertsons was a sizable transaction — by any measure – financed using a blend of debt, cash on hand and the issuance of stock.

To undertake a transaction of this size, we had to be very confident in our ability to transform the scale and scope of our business. This slide shows just how powerful that transformation is.

As you can see, we more than double annual revenues. Retail operations truly take the lead in terms of its contributions to revenue and profitability. And we dramatically expand our national footprint to more than 2,500 stores with almost 200,000 associates.

16

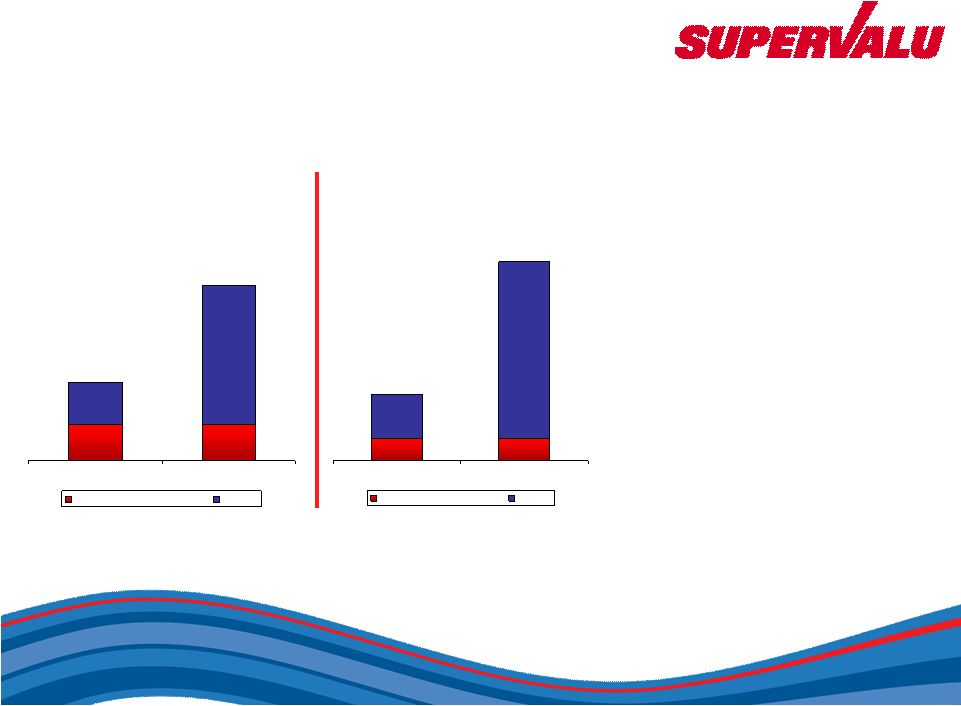

A Strengthened Business Model (F06 Proforma) ($ Billions) SUPERVALU New SUPERVALU Supply Chain Services Retail $20 $44 47% 53% 20% 80% SUPERVALU New SUPERVALU Supply Chain Services Retail $0.9 $2.7 33% 67% 11% 89% Sales EBITDA SVU figures represent FY06 actuals, ABS figures represent management estimates • Mix of retail increases dramatically and powers business model • Almost triples EBITDA to $2.7 billion proforma (FY’ 06). • Immediately double-digit accretive to earnings after financing costs and additional share issuance – excluding one-time transaction costs • $150-$175 million in synergies by end of year three |

Taking a look at it graphically – we can better see the strength in this new business model. On a proforma basis, you can see the dramatic shift in retail-driven revenues. 80% of our revenues and 89% of our earnings before interest, taxes, depreciation and amortization — or EBITDA — will come from retail — reflecting a higher-margin business than supply chain.

The result? A more profitable company. Our Fiscal 2006 proforma EBITDA nearly triples to $2.7 billion. This transaction is also immediately double-digit accretive to earnings, which is unusual in a transaction of this size using additional equity.

And to just recap the potential synergies from the transaction, by the end of the third year, we expect to realize pre-tax synergies of $150 to $175 million – comprised of:

$75 to $85 million in retail leverage and efficiencies,

$50 to $60 million at the corporate level, and

$25 to $30 million from supply chain optimization.

We anticipate a three year timeframe to fully realize these synergies.

17

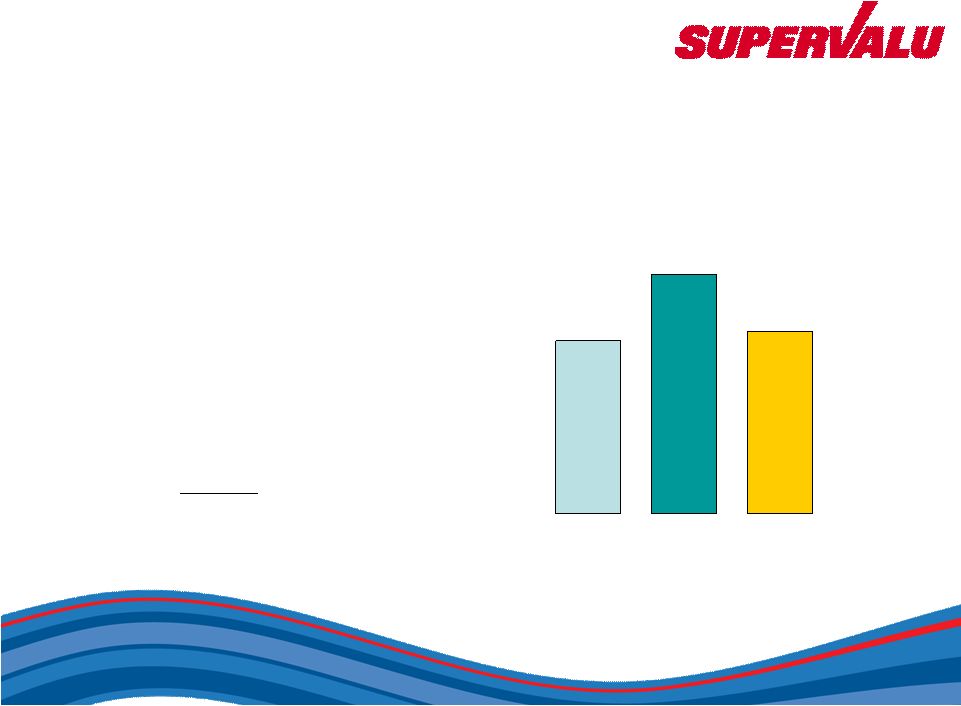

A Robust, Focused Capital Spend Kroger Safeway A New SUPERVALU 3.98% 2.78% (Retail only) 2.9% *Based on First Call data and company data A Safeway’s figures represent cash cap ex as % of sales Fiscal 2007 Projected Retail CapEx as % of Projected Retail Sales* • Sufficient capital dollars to grow and support store network • Combined capital spending for retail approx. $1 billion • Retail capital budget as % of $34 B of retail revenues is 2.9% SUPERVALU data represents F06 proforma |

We have received a lot of questions about the level of capital spending that we will be making in the future. Many new stores were planned by Albertsons themselves this year, and those projects are on going, as well as remodeling and other types of activities.

Our capital plan for this first year is the combination of SUPERVALU on a stand-alone basis and of Albertsons. But it’s important to remember that of our total capital spend, approximately 1 billion will be dedicated to retail.

This bar graph shows our results — on a comparable basis to our peers, Kroger and Safeway — how we benchmark if you compared our investment in retail capital spending to what they have said they would do in that same timeframe. At 2.9% of sales, we stack up well against them.

We do have plans to look at that capital spend and to prioritize it to the areas that we think are most appropriate. And we clearly believe that over the next year or so, we are going to have a greater emphasis on remodeling activity than Albertsons had traditionally.

18

Managing Our Debt Levels • Post-acquisition – debt of approximately $9 billion – Debt to capital ratio: approximately 62% • Successful track record of managing these debt levels • Post-Richfoods Acquisition: 62% debt to capital ratio. Reduced that ratio to less than 40% in six years. • Continuing that same financial discipline - Strong cash flow to aggressively reduce debt and invest in our business |

Our commitment to managing this business to maximize cash flow means that we believe we will have sufficient cash tobothfuel the capital expenditure required to stay competitive,andsteadily pay down debt to improve our financial health.

Debt to capital ratio at closing was approximately 65%. We would expect at the end of the first full year that debt to capital would be at 62%. Interestingly, that was our leverage point when we completed the Richfood acquisition back in 1999. And for those of you who have closely followed our debt-reduction progress since the Richfood acquisition, you’ll note that our financial discipline allowed us to take that ratio to under 40 percent just prior to the close of Albertsons transaction.

So clearly, this is a debt level that we are comfortable with. And were confident that by applying the same financial disciplines as we have in the past, we will make meaningful debt reduction and have publicly stated that after the first full year, we expect to be paying down at least $400 million of debt annually.

19

Recent Dividend Increase • 1.5 % increase in dividend • Annual dividend increases to $0.66 per share up from $0.65 per share • New quarterly rate of $0.1650 up from $0.1625 • Continues nearly 70 years of dividend payments |

Of course, our financial discipline also supports SUPERVALU’s strong history as a dividend payer. SUPERVALU has paid dividends for nearly 70 years, and we plan to preserve that commitment as we become a new enterprise. The recent announcement of our dividend increase underscores SUPERVALU’s commitment to shareholder return.

The Board recently approved an increase in the annual dividend to $0.66 per share, up from $0.65 per share. The new quarterly dividend rate of $0.1650 per share will be effective with the September dividend payment.

With that, I’d like to turn to podium back over to Jeff.

20

Thank you, Pam. We are truly embarking on a new era for SUPERVALU. And I know that I speak for our entire management team when I say that we do so with tremendous optimism. While we have a lot of work ahead of us, we have a very bright future.

21

Forging a New Future • Bringing two powerful organizations together – Preserving local focus and customer experience is a strategic key • Rich set of competencies to leverage in the new enterprise • Strong banner-level leadership • Planned and thoughtful transition effort underway |

We are forging a new future that leverages the strong growth potential of our combined companies.

We look to:

Maximize our market coverage

Leverage the rich set of retail grocery formats for growth

Build on our collective competencies

Be urgent in our delivery of results

Anticipate the competition

Invest in our properties

Cultivate strong managers in the field

So, we have a very planned and thoughtful transition underway. As I said, we are really forging a new entity, which we think not only will be, by size, the number three grocery retailer in the nation, but embody the industry’s best regional nameplates.

22

Today we are: – Operating the industry’s best regional nameplates – Supporting broad-based future growth potential – Sustaining the right formula for sustainable grocery retail success – Creating the best places to shop in the industry – Creating the best place to work in the industry – Creating the best place to invest in the sector No. 3 grocery retailer in the nation |

And that really sets the table for us as we move out over the next several months and our efforts to combine our companies take hold.

One of the things that we have stressed very much is that our ultimate goal here is not to be the biggest. Our ultimate goal is to create the best places for consumers to shop in the industry, be the best place to work in this industry and, of course, be the best place to invest in this industry. This is what will guide our success in this endeavor.

23

24