UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2007

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

| | |

Commission file number 1-6615 |

| | |

| SUPERIOR INDUSTRIES INTERNATIONAL, INC. |

| |

| (Exact Name of Registrant as Specified in Its Charter) |

| | |

| California | 95-2594729 |

| (State or Other Jurisdiction of | (IRS Employer |

| Incorporation or Organization) | Identification No.) |

| | |

| 7800 Woodley Avenue, Van Nuys, California | 91406 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | |

Registrant’s Telephone Number, Including Area Code: (818) 781-4973 |

| |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title Of Each Class | Name Of Each Exchange On Which Registered |

| Common Stock, $0.50 par value | New York Stock Exchange |

| | |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the registrant’s $0.50 per share par value common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second quarter was $579,081,000, based on a closing price of $21.76. On March 14, 2008, there were 26,639,190 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s 2008 Annual Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of this Form 10-K.

SUPERIOR INDUSTRIES INTERNATIONAL, INC. ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | PAGE |

| | | | 1 |

| | | | 5 |

| | | | 10 |

| | | | 10 |

| | | | 11 |

| | | | 12 |

| | | | | 12 |

| | | | | |

| | | | |

| | | | |

| | | | | 14 |

| | | | 15 |

| | | | |

| | | | | 22 |

| | | | 33 |

| | | | 34 |

| | | | |

| | | | | 73 |

| | | | 74 |

| | | | 75 |

| | | | | |

| | | | |

| | | | 76 |

| | | | 76 |

| | | | |

| | | | | 76 |

| | | | 76 |

| | | | 76 |

| | | | | |

| | | | |

| | | | 77 |

| | | | | |

| | | |

| | | | | |

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. We may from time to time make written or oral statements that are “forward-looking”, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, including statements contained in this report and other filings with the Securities and Exchange Commission and reports and other public statements to our shareholders. These statements may, for example, express expectations or projections about future actions or results that we may anticipate but, due to developments beyond our control, do not materialize. Actual results could differ materially because of issues and uncertainties such as those listed herein, which, among others, should be considered in evaluating our financial outlook. The principal factors that could cause our actual performance and future events and actions to differ materially from such forward-looking statements include, but are not limited to, changes in the automotive industry, increased global competitive pressures, our dependence on major customers and third party suppliers and manufacturers, our exposure to foreign currency fluctuations, and other factors or conditions described in Item 1A – Risk Factors section of this Annual Report on Form 10-K. We assume no obligation to update publicly any forward-looking statements.

EXPLANATORY NOTE REGARDING RESTATEMENTS

During the preparation and review of our 2007 income tax provision, we discovered that we had not properly reconciled our tax liabilities related to differences between the net book basis and the net tax basis of our depreciable property, plant and equipment and several other miscellaneous deferred tax liabilities. As a result of completing the necessary reconciliations for each year since 2002, we identified errors that impacted our previously filed financial statements for the fiscal years 2003 through 2006 and our previously filed interim financial statements for those years related to our tax liabilities and our income tax provisions.

During the fourth quarter of 2007, we determined the cumulative impact of known differences in our accounting for our equity method investment in Suoftec Light Metal Products Production and Distribution Ltd. (Suoftec) and our summary financial information presented for Suoftec, which we considered to be immaterial to any individual reporting period, required restatement. The errors relate to the quantification and recording of the adjustments to report the Suoftec earnings on the basis of U.S. GAAP versus on the Hungarian accounting rules followed by Suoftec. These differences principally relate to overhead cost capitalization into inventory and deferred income taxes on property, plant and equipment.

In accordance with the provisions of Statement of Financial Accounting Standards (SFAS) No. 154, “Accounting Changes and Error Corrections” (SFAS No. 154), we have restated, to the earliest period practical, our previously filed financial statements. See Item 6 – Selected Financial Data in Part I of this Annual Report on Form 10-K, for the effect of the restatements on fiscal years 2003 and 2004, Note 2 – Restatement of Consolidated Financial Statements in Notes to Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K, for the effect of the restatements on fiscal years 2005 and 2006, and Exhibit 99.1 for the effect of the restatements on the interim consolidated condensed financial information for the first three quarters of fiscal year 2007 and all four quarters of fiscal year 2006. We have not amended and do not intend to amend any of our previously filed Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q for the periods affected by these restatements.

We have reported a material weakness in our internal control over financial reporting, in this 2007 Annual Report on Form 10-K relating to corrections to our income tax provisions and deferred tax liabilities included in previously filed financial statements, and as such have concluded that our internal control over financial reporting was not effective as of December 30, 2007. See Item 9A – Controls and Procedures in Part II of this Annual Report on Form 10-K for further discussion regarding this material weakness.

General Development and Description of Business

Headquartered in Van Nuys, California, the principal business of Superior Industries International, Inc. (referred to herein as the “company” or in the first person notation “we,” “us” and “our”) is the design and manufacture of aluminum road wheels for sale to original equipment manufacturers (OEM). We are one of the largest suppliers of cast and forged aluminum wheels to the world’s leading automobile and light truck manufacturers, with wheel manufacturing operations in the United States, Mexico and Hungary. Customers in North America represent the principal market for our products, with approximately 19 percent of our unit shipments to international customers by our North American facilities, primarily delivered to their assembly operations in the United States.

The company was initially incorporated in Delaware in 1969 and reincorporated in California in 1994, as the successor to three businesses founded by Louis L. Borick, Founding Chairman and a Director of the company. These businesses had been engaged in the design, manufacture and sale of principally automotive accessories and related aftermarket products since 1957.

Aluminum Road Wheels - Our entry into the OEM aluminum road wheel business in 1973 resulted from our successful development of manufacturing technology, quality control and quality assurance techniques that enabled us to satisfy the quality and volume requirements of the OEM market. Initial production of an aluminum road wheel for a domestic customer was a Mustang wheel for Ford Motor Company (Ford). In 1990, we formed a sales and marketing joint venture, Topy-Superior Limited (TSL), with Topy Industries, Limited (Topy), Japan's largest wheel manufacturer. TSL markets our wheels to Japanese OEM customers with plants in Japan and in the United States. In 2007, TSL had agreements to provide 34 wheel programs being manufactured in our facilities for delivery to Japanese customers.

As part of our strategy to reduce costs, the company has located facilities in low labor cost regions of the world. In 1994, we built our first facility in Chihuahua, Mexico. Subsequently, another facility was built nearby and began operations at the end of 2001. A third facility was completed and began operations at the end of 2006. These facilities set the standard for state-of-the art worldwide cast aluminum wheel making and are optimized for production of larger diameter wheels. In addition, we completed the planned closure of our wheel manufacturing facility located in Johnson City, Tennessee, at the end of the first quarter of 2007. This was the latest step in our program to rationalize our production capacity and reduce costs.

Also in 1994, in response to the steadily growing popularity of chrome-plated aluminum wheels and to provide capacity due to increased customer demand, we completed construction of a wheel plating facility. We were the first OEM aluminum wheel manufacturer to develop this in-house capability and the operation was one of the largest of its kind in the world. In 1998, we added a polishing operation for aluminum wheels to this facility. Due to a recent shift in the market for chromed wheels to a less expensive chrome finishing process, the sales forecasts for our chromed wheels declined significantly. Accordingly, on December 1, 2005, we estimated that we would not be able to recover the carrying value of certain machinery and equipment in our chrome plating operation. Accordingly, such assets were written down to their estimated fair value and we recorded an asset impairment and other charges totaling approximately $9.2 million. In the third quarter of 2006, all of our chrome-plating requirements were outsourced to a third party supplier and we ceased operations of our chrome finishing operation.

In 1995, we entered into a 50-50 joint venture, Suoftec Light Metal Products Production & Distribution Ltd. (Suoftec), with Germany-based Otto Fuchs Metallwerke (Otto Fuchs) to establish a European manufacturing facility. The joint venture produces both lightweight forged and cast aluminum wheels for sale to OEM customers, principally in Europe. Shipments of forged and cast wheels began in 1997 and 1998, respectively, from our facility located in Tatabanya, Hungary. This venture established our commitment to enter the European market and introduced new wheel making technology to both the European and U.S. markets. In 1998, we completed an initial expansion of the cast aluminum production facility, which doubled its original casting capacity. Following a second expansion of the cast aluminum operations in 2002, the facility’s total capacity has increased to approximately 2.5 million wheels per year.

Aluminum Suspension Components - In 1999, we began to manufacture aluminum suspension and related underbody components using the licensed Cobapressä technology, which was another step toward expanding our sales to the OEM market. At the time, this diversification of our business emphasized the commitment to our long-term strategy to broaden our domestic and international OEM customer base and to expand our product lines into complementary areas, which utilize our design and manufacturing expertise. However, this strategy had not produced sufficient results to warrant the diversion of our attention away from our core business. Consequently, on September 24, 2006, we sold substantially all of the assets and working capital of the aluminum suspension components business to St. Jean Industries, SAS, from whom we licensed the Cobapressä technology, for $17.0 million. See Note 17 – Discontinued Operations in Notes to Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data in this Annual Report on Form 10-K for further discussion.

Fiscal Year End

Our fiscal year is the 52- or 53-week period ending on the last Sunday of the calendar year. The fiscal year 2007 comprised the 52-week period ended December 30, 2007. The fiscal year 2006 comprised the 53-week period ended December 31, 2006. The fiscal years 2005, 2004 and 2003 comprised the 52-week periods ended December 25, 2005, December 26, 2004 and December 28, 2003, respectively. For convenience of presentation, all fiscal years are referred to as beginning as of January 1 and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

Principal Products

Our OEM aluminum road wheels, including shipments from our 50 percent owned joint venture in Hungary, are sold for factory installation, or as optional or standard equipment on many vehicle models, to Ford, General Motors, Chrysler, Audi, BMW, Fiat, Jaguar, Land Rover, Mazda, Mercedes Benz, Mitsubishi, Nissan, Seat, Skoda, Subaru, Suzuki, Toyota, Volkswagen and Volvo. We currently supply cast and forged aluminum wheels for many North American model passenger cars and light trucks.

Customer Dependence

We have proven our ability to be a consistent producer of quality aluminum wheels with the capability of quickly expanding production capacity to meet increasing customer demand. We strive to continually enhance our relationships with our customers through continuous improvement programs, not only through our manufacturing operations but in the engineering, program development and quality areas, as well. These key business relationships have resulted in multiple vehicle supply contract awards with key customers over the past year.

Ford, GM and Chrysler LLC were the only customers accounting for more than 10 percent of our consolidated net sales in 2007. Sales to GM, as a percentage of consolidated net sales, were 36 percent in 2007, and 37 percent in 2006 and 2005. Sales to Ford, as a percentage of consolidated net sales, were 33 percent in 2007, 34 percent in 2006 and 33 percent in 2005. Sales to Chrysler LLC, as a percentage of consolidated net sales, were 13 percent in 2007, and 15 percent in 2006 and 2005.

The loss of all or a substantial portion of our sales to Ford, GM or Chrysler LLC would have a significant adverse effect on our financial results, unless the lost sales volume could be replaced. However, this risk is partially offset in part by the numerous multi-year purchase orders for wheel programs with these customers. We have had excellent long-term relationships, including contractual arrangements that are in place, with our other customers. However, intense global competitive pricing pressure continues to make it difficult to maintain these contractual arrangements, and we expect this trend to continue into the future.

Net Sales Backlog

We receive OEM purchase orders to produce aluminum road wheels and component parts typically for multiple model years. These purchase orders are for vehicle wheel programs that can last three to five years. However, customers can impose competitive pricing provisions in those purchase orders each year, thereby reducing our profit margins or increasing the risk of our losing future sales under those purchase orders. We manufacture and ship based on customer release schedules, normally provided on a weekly basis, which can vary due to cyclical automobile production or high dealer inventory levels. Accordingly, even though we have purchase orders covering multiple model years, weekly release schedules can vary with customer demand, thus firm backlog is insignificant.

Seasonal Variations

The automotive industry is cyclical and varies based on the timing of consumer purchases of vehicles, which in turn vary based on a variety of factors such as general economic conditions, interest rates and fuel costs. While there have been no significant seasonal variations in the past few years, production schedules in our industry can vary significantly from quarter to quarter to meet the scheduling demands of our customers. During the past few years, there have been no significant consistent seasonal variations.

Raw Materials

We purchase substantial quantities of aluminum for the manufacture of our aluminum road wheels, which accounted for approximately all of our total raw material requirements during 2007. The majority of our aluminum requirements are met through purchase orders with several major domestic and foreign producers. Generally, the orders are fixed as to minimum and maximum quantities of aluminum, which the producers must supply during the term of the orders. During 2007, we were able to successfully secure aluminum commitments from our primary suppliers to meet production requirements and we are not anticipating any problems with our aluminum requirements for our expected level of production in 2008.

When market conditions warrant, we may also enter into contracts to purchase certain commodities used in the manufacture of our products, such as aluminum, natural gas, environmental emission credits and other raw materials. Any such commodity commitments are expected to be purchased and used over a reasonable period of time in the normal course of business. Accordingly, pursuant to Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for Derivative Instruments and Hedging Activities,” they are not accounted for as a derivative. We currently have several purchase agreements for the delivery of natural gas through 2008. The contract value and fair value of these purchase commitments approximated $11 million at December 31, 2007. As of December 31, 2006, the aggregate contract value and fair value of these commitments were $15 million and $12 million, respectively. Percentage changes in the market prices of natural gas will impact the fair value by a similar percentage. We do not hold or purchase any natural gas forward contracts for trading purposes.

We obtain our requirements for other materials through numerous suppliers with whom we have established trade relationships. When an outside supplier produces components for our products, we normally own or have the right to purchase the tools and dies located in the supplier's facilities or have developed alternative sources.

Patents and Licensing Agreements

We currently hold patents for eight of our inventions and one other patent is pending. We have a policy of applying for patents when new products or processes are developed. However, we believe our success is more dependent upon manufacturing and engineering skills and the quality and market acceptance of our products, than upon our ability to obtain and defend patents.

Research and Development

Our policy is to continuously review, improve and develop engineering capabilities so that customer requirements are met in the most efficient and cost effective manner available. We strive to achieve this objective by attracting and retaining top engineering talent and by maintaining the latest state-of-the-art computer technology to support engineering development. Two fully staffed engineering centers, located in Van Nuys, California, and Fayetteville, Arkansas, support our research and development manufacturing needs. We also have a technical center in Detroit, Michigan, that maintains a complement of engineering staff centrally located near our largest customers’ headquarters, engineering and purchasing offices. Research and development costs (primarily engineering and related costs), which are expensed as incurred, are included in cost of sales in the consolidated statements of operations. Amounts expended during each of the three years were $6.3 million in 2007, $6.8 million in 2006 and $9.6 million in 2005.

Government Regulation

Safety standards in the manufacture of vehicles and automotive equipment have been established under the National Traffic and Motor Vehicle Safety Act of 1966. We believe that we are in compliance with all federal standards currently applicable to OEM suppliers and to automotive manufacturers.

Environmental Compliance

Our manufacturing facilities, like most other manufacturing companies, are subject to solid waste, water and air pollution control standards mandated by federal, state and local laws. Violators of these laws are subject to fines and, in extreme cases, plant closure. We believe our facilities are substantially in compliance with all standards presently applicable. However, costs related to environmental protection may continue to grow due to increasingly stringent laws and regulations and our ongoing commitment to rigorous internal standards. The cost of environmental compliance was approximately $1.3 million in 2007, $1.7 million in 2006 and $3.4 million in 2005. We expect that future environmental compliance expenditures will approximate these levels and will not have a material effect on our consolidated financial position.

Competition

The market for aluminum road wheels is highly competitive based primarily on price, technology, quality, delivery and overall customer service. We are one of the leading suppliers of aluminum road wheels for OEM installations in the world. We supply approximately 30 to 35 percent of the aluminum wheels installed on passenger cars and light trucks in North America. Competition is global in nature with growing exports from Asia. There are several competitors with facilities in North America, none of which aggregate greater than 10 percent of the total. See additional comments concerning competition in Item 1A – Risk Factors below. For the model year 2006, according to Wards Auto Info Bank, an industry publication, aluminum wheel installation rates on passenger cars and light trucks produced in North America were unchanged at approximately 63 percent for the model years 2006 and 2005. While aluminum wheel installation rates have grown from only 10 percent in the mid-1980s, in recent years, this growth rate has slowed. We expect the trend of slow growth or no growth in installation rates to continue. Accordingly, we expect that our ability to grow in the future will be dependent upon increasing our share of the existing market. In addition, intense global pricing pressure may decrease profitability and could potentially result in the loss of business in the future.

Employees

As of December 31, 2007, we had approximately 5,300 full-time employees including our joint venture, Suoftec, compared to 5,700 and 6,700 at December 31, 2006 and 2005, respectively. Our joint venture manufacturing facility in Hungary employed 488 full-time employees at December 31, 2007. None of our employees are part of a collective bargaining agreement.

Financial Information About Geographic Areas

Financial information about geographic areas is contained in Note 3 – Business Segments in Notes to Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements, and any amendments thereto are available, without charge, on or through our website www.supind.com under “Investor”, as soon as reasonably practicable after they are filed electronically with the Securities and Exchange Commission (SEC). The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, that contains these reports, proxy and other information regarding the company. Also included on our website, www.supind.com under Investors is our Code of Business Conduct and Ethics, which, among others, applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. Copies of all SEC filings and our Code of Business Conduct and Ethics are also available, without charge, from Superior Industries International, Inc., Shareholder Relations, 7800 Woodley Avenue, Van Nuys, CA 91406.

The following discussion of risk factors contains “forward-looking” statements, which may be important to understanding any statement in this Annual Report on Form 10-K or elsewhere. The following information should be read in conjunction with Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

Our business routinely encounters and addresses risks, some of which will cause our future results to differ, sometimes materially, from those originally anticipated. Discussion about the important operational risks that our businesses encounter can be found in the MD&A section of this Annual Report on Form 10-K and in the business descriptions in Item 1 – Business of this Annual Report on Form 10-K. Below, we have described our present view of certain important strategic risks. Our reactions to material future developments as well as our competitors’ reactions to those developments will determine our future results.

Risks Relating To Our Company

Automotive Industry Trends - A significant portion of our sales are to domestic automotive OEMs, and therefore our financial performance depends, in large part, on conditions in the automotive industry, which, in turn, are dependent upon the U.S. and global economies generally. As a result, economic and other factors adversely affecting automotive production and consumer spending could adversely impact our business. A further weakening of the U.S. and global economies could adversely affect consumer spending, and result in decreased demand for automobiles and light trucks. If OEMs were to decrease production due to such reduced demand or union work stoppages, our financial performance could be adversely affected. In addition, relatively modest declines in our customers’ production levels could have a significant adverse impact on our profitability because we have substantial fixed production costs. Due to the present uncertainty in the economy, some of our OEM customers have been reducing their forecasts for new vehicle production. If actual production volume were to be reduced accordingly, our business would be adversely affected. Our sales are also impacted by our customers’ inventory levels and production schedules. If our OEM customers significantly reduce their inventory levels and reduce their orders from us, our performance would be adversely impacted. In this environment, we cannot predict future production rates or inventory levels or the underlying economic factors. Continued uncertainty and unexpected fluctuations may have a significant negative impact on our business.

Changing Nature of the Automotive Industry - In the automotive industry, there has been a trend toward consolidation. Continued consolidation of the automotive industry could adversely affect our business. Such consolidation could result in a loss of some of our present customers to our competitors and could thereby lead to reduced demand, which may have a significant negative impact on our business. Additionally, our major customers have been seeking ways to lower their own costs of manufacturing through increased use of internal manufacturing or through relocation of production to countries with lower production costs. This internal manufacturing or reliance on local or other foreign suppliers may have a significant negative impact on our business.

Global Pricing Pressure - We continue to experience increased competition in our domestic and international markets. Since some products are being shipped to the U.S. from Asia and elsewhere, many of our North American competitors have excess capacity and, in order to promote volume, are placing intense pricing pressure in our market place. These competitive pressures are expected to continue and may result in decreased sales volumes and unit price reductions, resulting in lower revenues, gross profit and operating income.

Additionally, cost-cutting initiatives adopted by our customers generally result in increased downward pressure on pricing. OEMs historically have had significant leverage over their outside suppliers because the automotive component supply industry is fragmented and serves a limited number of automotive OEMs, and, as such, Tier 1 suppliers are subject to substantial continued pressure from OEMs to reduce the price of their products. If we are unable to generate sufficient production cost savings in the future to offset price reductions, our gross margin and profitability would be adversely affected. In addition, changes in OEMs’ purchasing policies or payment practices could have an adverse effect on our business.

Cyclical Nature of Industry - Our principal operations are directly related to domestic and, to a lesser extent, foreign production of passenger cars and light trucks. Industry sales and production are cyclical and therefore can be affected by the strength of the economy generally, by consumer spending, or, in specific regions such as North America or Europe, by prevailing interest rates and by other factors, which may have an effect on the level of sales of new automobiles. Any decline in the demand for new automobiles could have a material adverse impact on our financial condition and results of operations.

Competition - The automotive component supply industry is highly competitive, both domestically and internationally. Competition is based primarily on price, technology, quality, delivery and overall customer service. Some of our competitors are companies, or divisions or subsidiaries of companies that are larger and have greater financial and other resources than we do. We cannot assure you that our products will be able to compete successfully with the products of these or other companies. Furthermore, the rapidly evolving nature of the markets in which we compete has attracted new entrants, particularly in low cost countries. As a result, our sales levels and margins are being adversely affected by pricing pressures caused by such new entrants, especially in low-cost foreign markets, such as China. Such new entrants with lower cost structures pose a significant threat to our ability to compete internationally and domestically. These factors led to selective sourcing of future business by our customers to foreign competitors in the past and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately than us, develop products that are superior to our products, have the ability to produce similar products at a lower cost than us, or adapt more quickly than us to new technologies or evolving customer requirements. As a result, our products may not be able to compete successfully with their products. As a result of highly competitive market conditions in our industry, a number of our competitors have been forced to seek bankruptcy protection. These competitors may emerge and in some cases have emerged from bankruptcy protection with stronger balance sheets and a desire to gain market share by offering their products at a lower price than our products, which would have an adverse impact on our financial performance.

Dependence on Major Customers - - We derived approximately 82 percent of our fiscal 2007 net sales on a worldwide basis from Ford, GM and Chrysler LLC and their subsidiaries. We do not have guaranteed long-term agreements with these customers and cannot predict that we will maintain our current relationships with these customers or that we will continue to supply them at current levels. The loss of a significant portion of sales to Ford, GM or Chrysler LLC would have a material adverse effect on our business, unless the lost revenues were replaced. Ford and GM have been experiencing decreasing market share in North America. In addition, if any of our significant customers were to encounter financial difficulties, work stoppages or seek bankruptcy protection, our business could be adversely affected.

Furthermore, our OEM customers are not required to purchase any minimum amount of products from us. The contracts we have entered into with most of our customers provide for supplying the customers for a particular vehicle model, rather than for manufacturing a specific quantity of products. Such contracts range from one year to the life of the model (usually three to five years), typically are non-exclusive, and do not require the purchase by the customer of any minimum number of wheels from us. Therefore, a significant decrease in demand for certain key models or group of related models sold by any of our major customers, or a decision by a manufacturer not to purchase from us, or to discontinue purchasing from us, for a particular model or group of models, could have a material adverse effect on us.

Dependence on Third-Party Suppliers and Manufacturers - Generally, our raw materials, supplies and energy requirements are obtained from various sources and in the quantities desired. Although we currently maintain alternative sources, our business is subject to the risk of price increases and periodic delays in the delivery. Fluctuations in the prices of these requirements may be driven by the supply/demand relationship for that commodity or governmental regulation. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated, the availability or price of these requirements could be adversely affected.

Although we are able to periodically pass aluminum cost increases onto our customers, our customers are not obligated to accept energy or other supply cost increases that we may attempt to pass along to them. This inability to pass on these cost increases to our customers could adversely affect our operating margins and cash flow, possibly resulting in lower operating income and profitability.

Existing Cost Structure – In recent years, we have implemented several cost cutting initiatives in order to reduce our overall costs and improve our margins in response to pricing pressures from our customers. We have built additional production facilities in Mexico with cost structures lower than our U.S. facilities, in order to optimize our global manufacturing capacity and align our cost structures more effectively with the realities of the automotive market. During 2006, we discontinued our in-house chrome-plating operation, downsized our Van Nuys, California wheel operations, and sold our unprofitable components business. During 2007, we completed our planned closure of our Johnson City, Tennessee, wheel manufacturing facility. In addition, we are continuing to evaluate our workforce requirements at all of our facilities. However, our strategy of optimizing our cost structures may never materialize or may not be sufficient to offset future price pressures from our customers and may have an adverse impact on our financial performance.

In light of the additional capacity coming on line in our new facility in Mexico, if North American production of passenger cars and light trucks using our wheel programs continues to decrease, it is possible that we will be unable to recover the full value of certain other production assets in our other plants in the United States. We will continue to monitor the recoverability of these assets.

Unexpected Production Interruptions - An interruption in production capabilities at any of our facilities as a result of equipment failure, interruption of supply, labor disputes or other reasons could result in our inability to produce our products, which would reduce our sales and earnings for the affected period. We have, from time to time, undertaken significant re-tooling and modernization initiatives at our facilities, which in the past have caused, and in the future may cause unexpected delays and plant underutilization, and such adverse consequences may continue to occur as we continue to modernize our production facilities. In addition, we generally deliver our products only after receiving the order from the customer and thus do not hold large inventories. In the event of a stoppage in production at any of our manufacturing facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times could be severely affected. Any significant delay in deliveries to our customers could lead to returns or cancellations and cause us to lose future sales, as well as expose us to claims for damages. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, earthquakes, explosions or violent weather conditions. We have in the past and may in the future experience plant shutdowns or periods of reduced production as a result of facility modernization initiatives, equipment failure, delays in deliveries or catastrophic loss, which could have a material adverse effect on our results of operations or financial condition.

Dependence on Key Personnel - Our success depends in part on our ability to attract, hire, train, and retain qualified managerial, engineering, sales and marketing personnel. We face significant competition for these types of employees in our industry. We may be unsuccessful in attracting and retaining the personnel we require to conduct our operations successfully.

In addition, key personnel may leave us and compete against us. Our success also depends to a significant extent on the continued service of our senior management team. We may be unsuccessful in replacing key managers who either resign or retire. The loss of any member of our senior management team or other experienced, senior employees could impair our ability to execute our business plans and strategic initiatives, cause us to lose customers and reduce our net sales, or lead to employee morale problems and/or the loss of other key employees. In any such event, our financial condition, results of operations, internal control over financial reporting, or cash flows could be adversely affected.

Effective Internal Control Over Financial Reporting – Management is responsible for establishing and maintaining adequate internal control over financial reporting. Many of our key controls rely on maintaining a sufficient complement of personnel with an appropriate level of accounting knowledge, experience and training in the application of accounting principles generally accepted in the United States of America in order to operate effectively. If we are unable to attract, hire, train and retain a sufficient complement of qualified personnel required to operate these controls effectively, our financial statements may contain material misstatements, unintentional errors, or omissions and late filings with regulatory agencies may occur. We have reported a material weakness in our internal control over financial reporting, in this 2007 Annual Report on Form 10-K relating to corrections to our income tax provisions and deferred tax liabilities included in previously filed financial statements, and as such have concluded that our internal control over financial reporting was not effective as of December 30, 2007. Reporting of material weaknesses may result in negative perceptions of our business among our customers, suppliers, investors and others, which may have a material adverse impact on our business.

Impact of Aluminum Pricing - The cost of aluminum is a significant component in the overall production cost of a wheel. Additionally, a portion of our selling prices to OEM customers is tied to the cost of aluminum. Our selling prices are adjusted periodically to current aluminum market conditions based upon market price changes during specific pricing periods. Theoretically, assuming selling price adjustments and raw material purchase prices move at the same rate, as the price of aluminum increases, the effect is an overall decrease in the gross margin percentage, since the gross profit in absolute dollars would be the same. The opposite would then be true in periods during which the price of aluminum decreases.

However, since the pricing periods and pricing methodologies during which selling prices are adjusted for changes in the market prices of aluminum differ for each of our customers, and the selling price changes are fixed for various periods, our selling price adjustments may not entirely offset the increases or decreases experienced in our aluminum raw material purchase prices. This is especially true during periods of frequent increases or decreases in the market price of aluminum and when a portion of our aluminum purchases is via long-term fixed purchase agreements. Accordingly, our gross profit is subject to fluctuations, since the change in the product selling prices related to the cost of aluminum does not necessarily match the change in the aluminum raw material purchase prices during the period being reported, which may have a material adverse effect on our operating results.

Legal Proceedings - The nature of our business subjects us to litigation in the ordinary course of our business. We are exposed to potential product liability and warranty risks that are inherent in the design, manufacture and sale of automotive products, the failure of which could result in property damage, personal injury or death. Accordingly, individual or class action suits alleging product liability or warranty claims could result. Although we currently maintain what we believe to be suitable and adequate product liability insurance in excess of our self-insured amounts, we cannot assure you that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. In addition, if any of our products prove to be defective, we may be required to participate in a recall involving such products. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our results of operations or financial condition. In addition, we have been named as a nominal defendant in a shareholder derivative lawsuit relating to our historical stock option practices, and a number of our past and present directors, officers and employees have been named as individual defendants in this lawsuit. We may in the future be named in additional lawsuits or government inquiries relating to our historical stock price practices. See Item 3 - Legal Proceedings section of this Annual Report on Form 10-K for a description of the significant legal proceedings in which we are presently involved. We cannot assure you that any current or future claims will not adversely affect our cash flows, financial condition or results of operations.

Implementation of New Systems - - We are currently considering upgrades to our financial reporting and other operational functions within our business. We may encounter technical and operating difficulties during the implementation of these upgrades, as our employees learn and operate the systems, which are critical to our operations. Any difficulties that we encounter in upgrading the system may affect our internal control over financial reporting; disrupt our ability to deal effectively with our employees, customers and other companies with which we have commercial relationships; and also may prevent us from effectively reporting our financial results in a timely manner. Any such disruption could have a material adverse impact on our financial condition, cash flows or results of operations. In addition, the costs incurred in correcting any errors or problems with the upgraded system could be substantial.

Intellectual Property - We consider ourselves to be an industry leader in product and process technology. Therefore, protection of our intellectual properties is important to our business. We rely on a combination of intellectual property, principally patents, to provide protection in this regard, but this protection might be inadequate. For example, our pending or future patent applications might not be approved or, if allowed, they might not be of sufficient strength or scope. Conversely, third parties might assert that our technologies infringe upon their proprietary rights. In either case, litigation, which could result in substantial costs and diversion of our efforts, might be necessary, and whether or not we are ultimately successful, the litigation could adversely affect our business.

Implementation of Operational Improvements - As part of our ongoing focus on being a low-cost provider of high quality products, we continually analyze our business to further improve our operations and identify cost-cutting measures. Our continued analysis may include identifying and implementing opportunities for: (i) further rationalization of manufacturing capacity; (ii) streamlining of marketing and general and administrative overhead; (iii) implementation of lean manufacturing and Six Sigma initiatives; and (iv) efficient investment in new equipment and technologies and the upgrading of existing equipment. We may be unable to successfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors.

We are continuing to implement action plans to improve operational performance and mitigate the impact of the severe pricing environment in which we now operate. We must emphasize, however, that while we continue to reduce costs through process automation and identification of industry best practices, the curve of customer price reductions may continue to be at a rate faster than our progress on achieving cost reductions for an indefinite period of time, due to the slow and methodical nature of developing and implementing these cost reduction programs. In addition, fixed price natural gas contracts that expire in the next year may expose us to higher costs that cannot be immediately recouped in selling prices. The impact of these factors on our future financial position and results of operations may be negative, to an extent that cannot be predicted, and we may not be able to implement sufficient cost saving strategies to mitigate any future impact.

Resources for Future Expansion - We have recently completed building a new facility in Chihuahua, Mexico, to supply aluminum wheels to the North American aluminum wheel market. This is our third manufacturing facility in Chihuahua, Mexico. A significant change in our business, the economy or an unexpected decrease in our cash flow for any reason could result in our inability to have the capital required to complete similar projects in the future without outside financing.

New Product Introduction - In order to effectively compete in the automotive supply industry, we must be able to launch new products to meet our customers’ demand in a timely manner. We cannot assure you, however, that we will be able to install and certify the equipment needed to produce products for new product programs in time for the start of production, or that the transitioning of our manufacturing facilities and resources to full production under new product programs will not impact production rates or other operational efficiency measures at our facilities. In addition, we cannot assure you that our customers will execute on schedule the launch of their new product programs, for which we might supply products. Our failure to successfully launch new products, or a failure by our customers to successfully launch new programs, could adversely affect our results.

Technological and Regulatory Changes - Changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our products obsolete or less attractive. Our ability to anticipate changes in technology and regulatory standards and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. We cannot assure you that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in product development and failure of products to operate properly.

International Operations - We manufacture our products in Mexico and Hungary and sell our products throughout the world. Unfavorable changes in foreign cost structures, trade protection laws, policies and other regulatory requirements affecting trade and investments, social, political, labor, or economic conditions in a specific country or region, including foreign exchange rates, difficulties in staffing and managing foreign operations and foreign tax consequences, among other factors, could have a negative effect on our business and results of operations.

Labor Relations - We do not anticipate our workforce becoming unionized, but if such eventuality occurred, our labor costs could increase which would increase our overall production costs. In addition, we could be adversely affected by any labor difficulties or work stoppage involving our customers.

Foreign Currency Fluctuations – Due to the increase in our operations outside of the United States, we have experienced increased foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the euro, the Mexican peso and any currencies of other countries in which we conduct our business may have a material impact on our financial condition as cash flows generated in other currencies will be used, in part, to service our U.S. dollar-denominated creditors.

In addition, fluctuations in foreign currency exchange rates may affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability of period-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which foreign competitors and we sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot assure you that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations, or cause significant fluctuations in quarterly and annual results of operations.

Environmental Matters - We are subject to various foreign, federal, state and local environmental laws, ordinances, and regulations, including those governing discharges into the air and water, the storage, handling and disposal of solid and hazardous wastes, the remediation of soil and groundwater contaminated by hazardous substances or wastes, and the health and safety of our employees. Under certain of these laws, ordinances or regulations, a current or previous owner or operator of property may be liable for the costs of removal or remediation of certain hazardous substances on, under, or in its property, without regard to whether the owner or operator knew of, or caused, the presence of the contaminants, and regardless of whether the practices that resulted in the contamination were legal at the time they occurred. The presence of, or failure to remediate properly, such substances may adversely affect the ability to sell or rent such property or to borrow using such property as collateral. Persons who generate, arrange for the disposal or treatment of, or dispose of hazardous substances may be liable for the costs of investigation, remediation or removal of these hazardous substances at or from the disposal or treatment facility, regardless of whether the facility is owned or operated by that person. Additionally, the owner of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. We believe that we are in material compliance with environmental laws, ordinances and regulations and do not anticipate any material adverse effect on our earnings or competitive position relating to environmental matters. It is possible, however, that future developments could lead to material costs of environmental compliance for us. The nature of our current and former operations and the history of industrial uses at some of our facilities expose us to the risk of liabilities or claims with respect to environmental and worker health and safety matters which could have a material adverse effect on our financial health. We are also required to obtain permits from governmental authorities for certain operations. We cannot assure you that we have been or will be at all times in complete compliance with such permits. If we violate or fail to comply with these permits, we could be fined or otherwise sanctioned by regulators. In some instances, such a fine or sanction could be material. In addition, some of our properties are subject to indemnification and/or cleanup obligations of third parties with respect to environmental matters. However, in the event of the insolvency or bankruptcy of such third parties, we could be required to bear the liabilities that would otherwise be the responsibility of such third parties.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

Our worldwide headquarters is located in leased office space adjacent to leased manufacturing and warehousing facilities in Van Nuys, California. We maintain and operate a total of eight facilities that produce aluminum wheels for the automotive industry, located in Arkansas, California, Kansas, Chihuahua, Mexico, and Tatabanya, Hungary. In 2004, we started construction of our third aluminum wheel facility in Chihuahua, Mexico, which began producing aluminum wheels at the end of 2006. These eight facilities encompass 3,652,000 square feet of manufacturing space, 50,000 square feet of warehouse space and 30,000 square feet of office space. We own all of our facilities with the exception of two warehouses, one in Rogers, Arkansas, and the other in Chihuahua, Mexico, and our worldwide headquarters and adjacent manufacturing and warehousing facilities located in Van Nuys, California, that are leased. We ceased wheel manufacturing operations in our Johnson City, Tennessee facility, totaling 301,500 square feet, at the end of the first quarter of 2007. This property is available for sale at this time.

In general, these facilities, which have been constructed at various times over the past several years, are in good operating condition and are adequate to meet our productive capacity requirements. There are active maintenance programs to keep these facilities in good condition, and we have an active capital spending program to replace equipment as needed to keep technologically competitive on a worldwide basis.

Additionally, reference is made to Note 1 - Summary of Significant Accounting Policies, Note 6 - - Property, Plant and Equipment and Note 9 - Leases and Related Parties, in Notes to the Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

In late 2006, two shareholder derivative complaints were filed, one each by plaintiffs Gary B. Eldred and Darrell D. Mack, based on allegations concerning some of the company’s past stock option grants and practices. These cases were subsequently consolidated as In re Superior Industries International, Inc. Derivative Litigation, which is pending in the United States District Court for the Central District of California. In the plaintiffs’ consolidated complaint, filed on March 23, 2007, the company was named only as a nominal defendant from whom the plaintiffs sought no monetary recovery. In addition to naming the company as a nominal defendant, the plaintiffs named various present and former employees, officers and directors of the company as individual defendants from whom they sought monetary and/or equitable relief, purportedly for the benefit of the company.

Plaintiffs purported to base their claims against the individual defendants on allegations that the grant dates for some of the options granted to certain company directors, officers and employees occurred prior to upward movements in the stock price, and that the stock option grants were not properly accounted for in the company’s financial reports and not properly disclosed in the company’s SEC filings. The company and the individual defendants filed motions to dismiss plaintiffs’ consolidated complaint on May 14, 2007. In an order dated August 9, 2007, the court granted Superior's motion to dismiss the consolidated complaint, and granted the plaintiffs leave to file an amended complaint.

On August 29, 2007, the plaintiffs filed an amended consolidated complaint that is substantially similar to the prior consolidated complaint. In response, the company and the individual defendants filed motions to dismiss on September 21, 2007. These renewed motions to dismiss were originally scheduled to be heard on November 12, 2007. However, the hearing on the motions was taken off calendar to accommodate the reassignment of the case to a new judge. As of March 24, 2008, the court has yet to reset on the calendar of the new judge the motions to dismiss. Discovery is stayed in the case pending resolution of motions to dismiss. As this litigation remains at a preliminary stage, it would be premature to anticipate the probable outcome of this case and whether such an outcome would be materially adverse to the company.

In 2006, we were served with notice of a class action lawsuit against the company. The complaint alleges that among other claims, certain employees at our Van Nuys, California, facility were denied rest and meal periods as required under the California Labor Code. After conducting initial discovery, the parties participated in mediation that concluded on August 22, 2007. The mediator proposed that the parties settle the lawsuit for a total settlement payment not to exceed $2,700,000. This settlement amount is all-inclusive and includes the company’s settlement payment to the lead plaintiff and the settlement class, together with costs and attorneys’ fees for plaintiff’s counsel. In addition, the mediator proposed that the settlement payment to the class would be on a “claims made” basis, with a minimum of 40 percent of the net settlement being distributed to the settlement class. Provided the minimum settlement claims are paid to the settlement class, the company will not be liable for any claim that is not valid or timely filed.

Subject to certain conditions, both parties agreed to the mediator’s proposal and executed a Settlement Term Sheet on August 22, 2007. The parties submitted the proposed settlement for preliminary approval with the Superior Court of Los Angeles County, which granted preliminary approval on December 19, 2007. On March 17, 2008, the court granted final approval of the proposed settlement, thereby giving the settlement class until May 16, 2008 to appeal the court’s order. Management estimates that its expected liability is $2.2 million and has accordingly recorded a charge to selling, general and administrative expenses during the year ended December 31, 2007.

We are party to various other legal and environmental proceedings incidental to our business. Certain claims, suits and complaints arising in the ordinary course of business have been filed or are pending against us. Based on facts now known, we believe all such matters are adequately provided for, covered by insurance, are without merit, and/or involve such amounts that would not materially adversely affect our consolidated results of operations, cash flows or financial position.

ITEM 4 - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter of 2007, no matters were submitted to a vote of security holders through the solicitation of proxies or otherwise.

EXECUTIVE OFFICERS OF THE REGISTRANT

Information regarding executive officers that are Directors is contained in our 2008 Annual Proxy Statement under the caption “Election of Directors”. Such information is incorporated herein by reference. All executive officers are appointed annually by the Board of Directors and serve one-year terms. Also see “Employment Agreements” in our 2008 Annual Proxy Statement, which is incorporated herein by reference.

Listed below are the name, age, position and business experience of each of our officers who are not directors:

| | | | | | | | | | Assumed | |

| Name | | | Age | | | Position | | | Position | |

| | | | | | | | | | | |

| Robert H. Bouskill | | | 62 | | | Senior Vice President, Manufacturing Technology | | | 2005 | |

| | | | | | | Vice President, Manufacturing Technology | | | 2000 | |

| | | | | | | | | | | |

| Robert D. Bracy | | | 60 | | | Senior Vice President, Facilities | | | 2005 | |

| | | | | | | Vice President, Facilities | | | 1997 | |

| | | | | | | | | | | |

| Robert A. Earnest | | | 46 | | | Vice President, General Counsel and Corporate Secretary | | | 2007 | |

| | | | | | | Director, Tax and Legal and Corporate Secretary | | | 2006 | |

| | | | | | | Director, Tax and Customs – Nissan North America | | | 2001 | |

| | | | | | | | | | | |

| Emil J. Fanelli | | | 65 | | | Vice President and Corporate Controller | | | 2008 | |

| | | | | | | Acting Chief Financial Officer | | | 2007 | |

| | | | | | | Vice President and Corporate Controller | | | 2001 | |

| | | | | | | | | | | |

| Stephen H. Gamble | | | 53 | | | Vice President, Treasurer | | | 2006 | |

| | | | | | | Director, Financial Planning and Analysis | | | 2001 | |

| | | | | | | | | | | |

| Parveen Kakar | | | 41 | | | Vice President, Program Development | | | 2003 | |

| | | | | | | Director, Engineering Services | | | 1989 | |

| | | | | | | | | | | |

| Michael J. O’Rourke | | | 47 | | | Executive Vice President, Sales and Administration | | | 2008 | |

| | | | | | | Senior Vice President, Sales and Administration | | | 2003 | |

| | | | | | | Vice President, OEM Program Administration | | | 1995 | |

| | | | | | | | | | | |

| Razmik Perian | | | 50 | | | Chief Information Officer | | | 2006 | |

| | | | | | | Director, Corporate Information Technology | | | 2000 | |

| | | | | | | | | | | |

| Name | | | Age | | | Position | | | Position | |

| | | | | | | | | | | |

| Eddie Rodriquez | | | 53 | | | Vice President, Human Resources | | | 2007 | |

| | | | | | | Director, Human Resources – The Coca-Cola Company | | | 2004 | |

| | | | | | | Vice President, Operations – First Data Corporation | | | 1999 | |

| | | | | | | | | | | |

| Gabriel Soto | | | 59 | | | Vice President, Mexico Operations | | | 2004 | |

| | | | | | | General Manager, Mexico Operations | | | 1994 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Kenneth A. Stakas | | | 56 | | | Senior Vice President, Manufacturing | | | 2006 | |

| | | | | | | Vice President of Operations - | | | | |

| | | | | | | Amcast Automotive, Components Group | | | 2000 | |

| | | | | | | | | | | |

| Cameron Toyne | | | 48 | | | Vice President, Supply Chain | | | 2008 | |

| | | | | | | Vice President, Purchasing | | | 2007 | |

| | | | | | | Director of Purchasing | | | 2004 | |

| | | | | | | Manager of Supply Chain – L-3 Communications | | | 2002 | |

| | | | | | | | | | | |

| Erika H. Turner | | | 53 | | | Chief Financial Officer | | | 2008 | |

| | | | | | | Chief Financial Officer/ Vice President, Finance – Monogram Systems | | | 2004 | |

| | | | | | | Chief Financial Officer – Quantum Corporation, Storage Solutions Group | | | 2003 | |

| | | | | | | | | | | |

ITEM 5 - MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

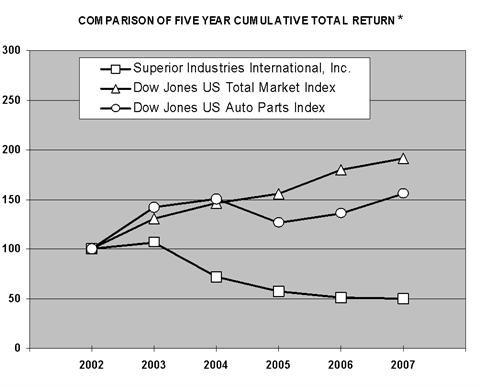

Our common stock is traded on the New York Stock Exchange (symbol: SUP). We had approximately 591 shareholders of record as of December 30, 2007 and 26.6 million shares issued and outstanding as of March 14, 2008. Information relating to equity securities authorized under our equity compensation plans and a five-year cumulative total return of our Common Stock as of December 31, 2007 is set forth below.

*Assumes the value of the investment in Superior Industries International common stock and each index was $100 on December 31, 2002 and that all dividends were reinvested.

| | | | | | | | | | |

| | | Superior Industries | | | Dow Jones US Total | | | Dow Jones US Auto | |

| | | International, Inc. | | | Market Index | | | Parts Index | |

| | | | | | | | | | |

| 2002 | | $ | 100.00 | | | $ | 100.00 | | | $ | 100.00 | |

| 2003 | | $ | 106.59 | | | $ | 130.75 | | | $ | 142.21 | |

| 2004 | | $ | 72.48 | | | $ | 146.45 | | | $ | 150.00 | |

| 2005 | | $ | 57.05 | | | $ | 155.72 | | | $ | 126.40 | |

| 2006 | | $ | 51.13 | | | $ | 179.96 | | | $ | 135.37 | |

| 2007 | | $ | 49.74 | | | $ | 190.77 | | | $ | 155.51 | |

Quarterly Common Stock Price Information

The following table sets forth the high and low closing sales price per share of our common stock during the periods indicated.

| | | 2007 | | | | 2006 | |

| | | High | | | Low | | | | High | | | | Low | |

| | | | | | | | | | | | | | | |

| First Quarter | $ | 23.19 | | $ | 19.07 | | | $ | 23.21 | | | $ | 19.06 | |

| Second Quarter | $ | 24.06 | | $ | 21.25 | | | $ | 19.63 | | | $ | 17.25 | |

| Third Quarter | $ | 23.05 | | $ | 18.33 | | | $ | 18.88 | | | $ | 16.38 | |

| Fourth Quarter | $ | 22.23 | | $ | 17.81 | | | $ | 20.23 | | | $ | 16.40 | |

Securities Authorized for Issuance Under Equity Compensation Plans

The table below contains information about securities authorized for issuance under equity compensation plans. The features of these plans are described further in Note 13 – Stock-based Compensation in Notes to the Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

| | | Number of securities | | | | | Number of securities |

| | | to be issued | | Weighted-average | | remaining available |

| | | upon exercise of | | exercise price of | | for future issuance |

| | | outstanding options, | | outstanding options, | | under equity |

| Plan Category | | warrants and rights | | warrants and rights | | compensation plans |

| | | | | | | | |

| Equity compensation plans approved by security holders | | 3,198,111 | | $ | 26.53 | | 746,902 |

| | | | | | | | |

| Equity compensation plans not approved by security holders | | - | | | - | | - |

| | | | | | | | |

| Total | | 3,198,111 | | $ | 26.53 | | 746,902 |

| | | | | | | | |

Dividend Policy

Cash dividends declared during 2007 and 2006 totaled $0.64 per share in each year and were paid on a quarterly basis. We anticipate continuing the policy of paying dividends quarterly, which is contingent upon various factors, including economic and market conditions, none of which can be accurately predicted.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On March 17, 2000, the Board of Directors authorized the repurchase of 4.0 million shares of our common stock as part of the 2000 Stock Repurchase Plan (Plan). During the fourth quarter of 2007, there were no repurchases of common stock. As of December 31, 2007, approximately 3.2 million shares remained available for repurchase under the Plan.

ITEM 6 - SELECTED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

Our fiscal year is the 52- or 53-week period ending on the last Sunday of the calendar year. The fiscal year 2007 comprised the 52-week period ended December 30, 2007. The fiscal year 2006 comprised the 53-week period ended December 31, 2006. The fiscal years 2005, 2004 and 2003 comprised the 52-week periods ended December 25, 2005, December 26, 2004 and December 28, 2003, respectively. For convenience of presentation, all fiscal years are referred to as beginning as of January 1 and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

The consolidated statements of operations data for the years ended December 31, 2007, 2006 and 2005, and the consolidated balance sheet data at December 31, 2007 and 2006, are derived from our audited consolidated financial statements appearing Item 8 – Financial Statements and Supplementary Data in this Annual Report on Form 10-K. The consolidated statements of operations data for the years ended December 31, 2004 and 2003 and the consolidated balance sheet data at December 31, 2005, 2004 and 2003 are derived from our unaudited financial statements that are not included in this Annual Report on Form 10-K. The financial statements as of and for the fiscal years 2006, 2005, 2004 and 2003 have been restated to correct errors in the accounting for certain deferred tax liabilities and our equity method investment in Suoftec, as further described in Note 2 – Restatement of Consolidated Financial Statements in Notes to Consolidated Financial Statements in Item 8 – Financial Statements and Supplementary Data in this Annual Report on Form 10-K. These historical results are not indicative of the results to be expected in any future period.

| Fiscal Year Ended December 31, | | 2007 | | | 2006 | | | 2005 (4) | | | 2004 (4) | | | 2003 (4) | |

| | | | | | As restated | | | As restated | | | As restated | | | As restated | |

| | | | | | | | | | | | | | | | |

| Statement of Operations (000's) | | | | | | | | | | | | | | | |

| Net Sales | | $ | 956,892 | | | $ | 789,862 | | | $ | 804,161 | | | $ | 872,258 | | | $ | 825,940 | |

| Net Income (Loss) from Continuing Operations | | $ | 9,292 | | | $ | (10,799 | ) | | $ | 19,375 | | | $ | 53,167 | | | $ | 80,550 | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet (000's) | | | | | | | | | | | | | | | | | | | | |

| Current Assets | | $ | 356,079 | | | $ | 346,593 | | | $ | 359,740 | | | $ | 368,976 | | | $ | 388,510 | |

| Current Liabilities | | | 95,596 | | | | 112,083 | | | | 110,634 | | | | 87,343 | | | | 83,621 | |

| Working Capital | | | 260,483 | | | | 234,510 | | | | 249,106 | | | | 281,633 | | | | 304,889 | |

| Total Assets | | | 729,922 | | | | 712,505 | | | | 719,895 | | | | 745,180 | | | | 703,205 | |

| Long-Term Debt | | | - | | | | - | | | | - | | | | - | | | | - | |

| Shareholders' Equity | | $ | 550,573 | | | $ | 563,114 | | | $ | 583,988 | | | $ | 609,731 | | | $ | 581,368 | |

| | | | | | | | | | | | | | | | | | | | | |

| Financial Ratios | | | | | | | | | | | | | | | | | | | | |

Current Ratio (1) | | 3.7:1 | | | 3.1:1 | | | 3.3:1 | | | 4.2:1 | | | 4.6:1 | |

Long-Term Debt/Total Capitalization (2) | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

Return on Average Shareholders' Equity (3) | | | 1.7 | % | | | -1.8 | % | | | -1.2 | % | | | 7.6 | % | | | 13.9 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Share Data | | | | | | | | | | | | | | | | | | | | |

| Net Income (Loss) from Continuing Operations | | | | | | | | | | | | | | | | | | | | |

| - Basic | | $ | 0.35 | | | $ | (0.41 | ) | | $ | 0.73 | | | $ | 2.00 | | | $ | 3.01 | |

| - Diluted | | $ | 0.35 | | | $ | (0.41 | ) | | $ | 0.73 | | | $ | 1.99 | | | $ | 2.97 | |

| | | | | | | | | | | | | | | | | | | | | |

| Shareholders' Equity at Year-End | | $ | 20.67 | | | $ | 21.16 | | | $ | 21.95 | | | $ | 22.90 | | | $ | 21.72 | |

| Dividends Declared | | $ | 0.6400 | | | $ | 0.6400 | | | $ | 0.6350 | | | $ | 0.6025 | | | $ | 0.5375 | |

| (1) The Current Ratio is current assets divided by current liabilities. | | | | | | | | | | | | |

| (2) Long-term Debt/Total Capitalization represents long-term debit divided by total shareholders' equity plus long-term debt. | |

| (3) Return on Average Shareholders' Equity is net income (loss) divided by average shareholders' equity. Average shareholders' equity |

| | is the beginning of the year shareholders' equity plus the end of year shareholders' equity divided by two. | | | | |

| (4) Restated consolidated statements of operations for the fiscal years 2004 and 2003 and consolidated balance sheets for the | |

| fiscal years ended December 31, 2005, 2004 and 2003 are unaudited. | | | | | | | | | | | |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(Thousands of dollars, except per share amounts)

(Unaudited)

| Fiscal Year 2004 | | As reported | | | Adjustments | | | As restated | |

| | | | | | | | | | |

| NET SALES | | $ | 872,258 | | | $ | - | | | $ | 872,258 | |

| Cost of sales | | | 779,752 | | | | - | | | | 779,752 | |

| | | | | | | | | | | | | |

| GROSS PROFIT | | | 92,506 | | | | - | | | | 92,506 | |

| | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 24,154 | | | | - | | | | 24,154 | |

| Impairments of long-lived assets | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | | | 68,352 | | | | - | | | | 68,352 | |

| | | | | | | | | | | | | |

| Interest income, net | | | 2,772 | | | | - | | | | 2,772 | |

| Other income (expense), net | | | (1,614 | ) | | | - | | | | (1,614 | ) |

| | | | | | | | | | | | | |

| INCOME (LOSS) FROM CONTINUING OPERATIONS | | | | | | | | | | | | |

| BEFORE INCOME TAXES AND EQUITY EARNINGS | | | 69,510 | | | | - | | | | 69,510 | |

| | | | | | | | | | | | | |

| Income tax (provision) benefit | | | (26,209 | ) | | | 592 | | | | (25,617 | ) |

| Equity in earnings of joint ventures | | | 8,611 | | | | 663 | | | | 9,274 | |

| | | | | | | | | | | | | |

| NET INCOME (LOSS) FROM CONTINUING OPERATIONS | | | 51,912 | | | | 1,255 | | | | 53,167 | |

| | | | | | | | | | | | | |

| Income (loss) from discontinued operations, net of taxes | | | (8,108 | ) | | | - | | | | (8,108 | ) |

| | | | | | | | | | | | | |

| NET INCOME (LOSS) BEFORE CUMULATIVE EFFECT | | | | | | | | | | | | |

| OF ACCOUNTING CHANGE | | | 43,804 | | | | 1,255 | | | | 45,059 | |

| | | | | | | | | | | | | |

| Cumulative effect of accounting change, net of taxes | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| NET INCOME (LOSS) | | $ | 43,804 | | | $ | 1,255 | | | $ | 45,059 | |

| | | | | | | | | | | | | |

| EARNINGS (LOSS) PER SHARE - BASIC: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) from continuing operations | | $ | 1.95 | | | $ | 0.05 | | | $ | 2.00 | |

| Income (loss) from discontinued operations, net of taxes | | | (0.30 | ) | | | - | | | | (0.30 | ) |

| Cumulative effect of accounting change, net of taxes | | | - | | | | - | | | | - | |

| Net income (loss) | | $ | 1.65 | | | $ | 0.05 | | | $ | 1.70 | |

| | | | | | | | | | | | | |

| EARNINGS (LOSS) PER SHARE - DILUTED: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) from continuing operations | | $ | 1.94 | | | $ | 0.05 | | | $ | 1.99 | |

| Income (loss) from discontinued operations, net of taxes | | | (0.30 | ) | | | - | | | | (0.30 | ) |

| Cumulative effect of accounting change, net of taxes | | | - | | | | - | | | | - | |

| Net income (loss) | | $ | 1.64 | | | $ | 0.05 | | | $ | 1.69 | |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(Thousands of dollars, except per share amounts)

(Unaudited)