- SUP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Superior Industries International (SUP) DEF 14ADefinitive proxy

Filed: 17 Mar 22, 5:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

A NOTE FROM MAJDI ABULABAN

|

March 17, 2022

Dear Superior Stockholder:

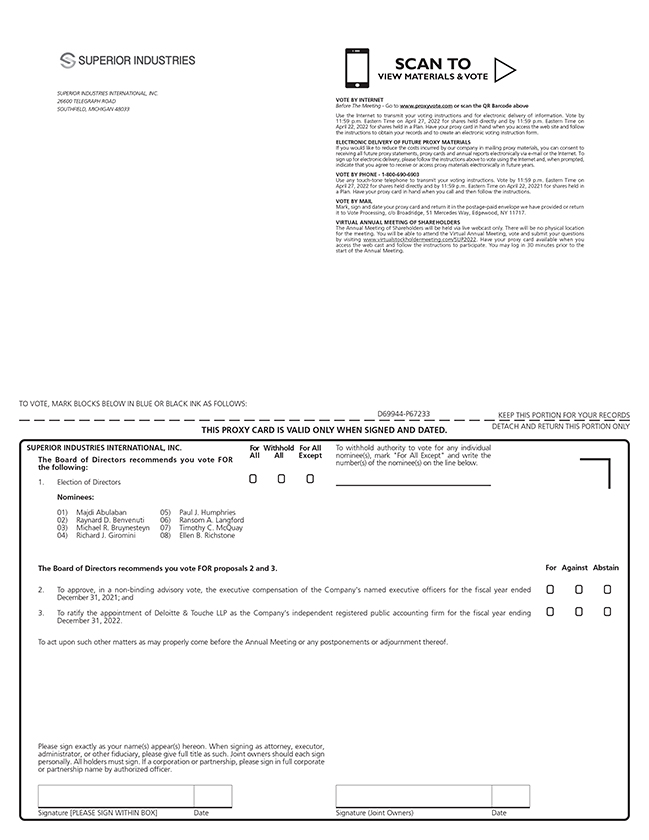

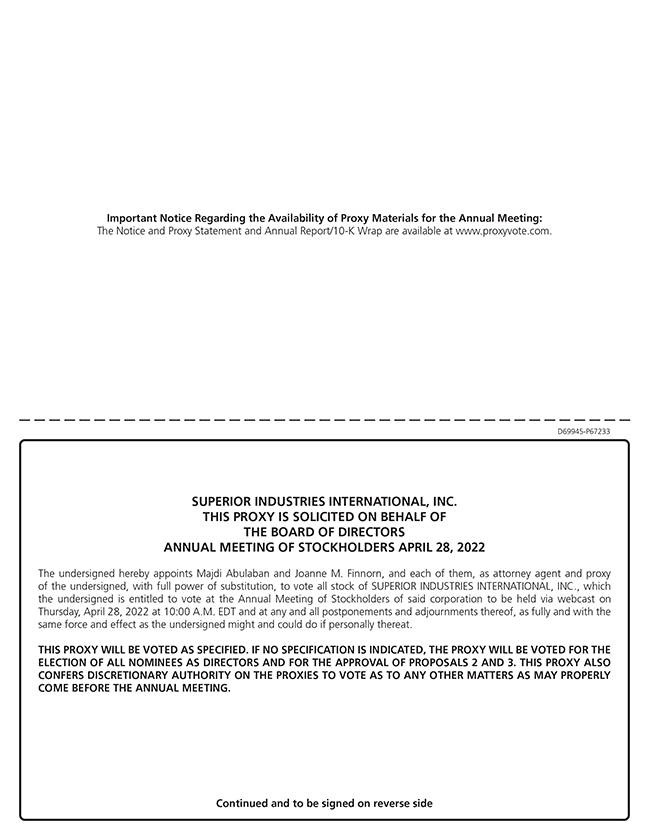

I cordially invite you to attend the annual meeting of stockholders of Superior Industries International, Inc. (the “Annual Meeting”). The meeting will be held on April 28, 2022, at 10:00 a.m. Eastern Daylight Time. Due to ongoing concerns related to COVID-19 and to support the health and well-being of our stockholders, employees, and partners, the Annual Meeting will be a completely “virtual meeting,” conducted via live audio webcast on the Internet. You will be able to attend the Annual Meeting as well as vote and submit your questions during the live audio webcast of the meeting by visiting www.virtualstockholdermeeting.com/SUP2022. Next, enter the 16-digit control number included in our notice of internet availability of the proxy materials, on your proxy card or in the instructions that accompanied your proxy materials.

Your Vote is Important. We invite you to attend the Annual Meeting via audio webcast. If you are not able to attend via the live audio webcast, we encourage you to vote by proxy. The proxy statement contains detailed information about the matters on which we are asking you to vote. Whether or not you plan to attend the Annual Meeting via the live audio webcast, your vote is important, and we encourage you to vote promptly. You can vote your shares over the telephone, via the Internet or by completing, dating, signing and returning the enclosed proxy card or voting instruction form provided by your broker, as described in the enclosed Proxy Statement.

Thank you for your ongoing support of Superior.

Majdi Abulaban

President and Chief Executive Officer

This Proxy Statement is dated March 17, 2022 and is first being made available to stockholders via the Internet on or about March 17, 2022.

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

|

Time and Date: | April 28, 2022, at 10:00 a.m. Eastern Daylight Time, via a live audio webcast that is available at www.virtualstockholdermeeting.com/SUP2022. There will be no physical meeting location and the meeting will only be conducted via the live audio webcast. To participate in the meeting, you must have your 16-digit control number that is shown on your Notice, proxy card or voting instruction form. | |

Record Date: | March 4, 2022

Each holder of Superior Industries International, Inc. (“Superior” or the “Company”) common stock and Series A Preferred Stock as of the Record Date will be entitled to one vote on each matter for each share of common stock held, or into which such holder’s Series A Preferred Stock is convertible, on the Record Date. | |

Items to Be Voted On: | 1. To elect eight nominees to the Board of Directors (the “Board”), each to serve until Superior’s 2023 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

2. To approve, in a non-binding advisory vote, the executive compensation of the Company’s named executive officers for the fiscal year ended December 31, 2021;

3. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and

4. To act upon such other matters as may properly come before the Annual Meeting or any postponements or adjournments thereof. | |

How to Vote: | YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING VIA THE LIVE AUDIO WEBCAST, PLEASE VOTE YOUR SHARES PROMPTLY BY COMPLETING, DATING, SIGNING, AND RETURNING THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM. INSTRUCTIONS FOR VOTING YOUR SHARES OVER THE TELEPHONE OR VIA THE INTERNET AS DESCRIBED IN THE PROXY STATEMENT ARE PROVIDED ON THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM. | |

Contact Information: | If you have any questions about the attached Proxy Statement or require assistance in voting your shares on the proxy card or voting instruction form, or need additional copies of Superior’s proxy materials, please contact Okapi Partners LLC, our proxy solicitor assisting us with the Annual Meeting, toll free at (855) 305-0856. | |

| BY ORDER OF THE BOARD OF DIRECTORS, |

| /s/ Joanne M. Finnorn |

| Joanne M. Finnorn |

| Senior Vice President, General Counsel and Corporate Secretary |

Southfield, Michigan

March 17, 2022

Notice of Electronic Availability of Proxy Statement and Annual Report

As permitted by rules adopted by the United States Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and our Annual Report available to stockholders electronically via the Internet. On or about March 17, 2022, we will mail to most of our stockholders a notice (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and to vote via the Internet or by telephone.

The Notice also contains instructions on how to request a printed copy of the proxy materials. In addition, you may elect to receive future proxy materials in printed form by mail or electronically by e-mail by following the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail, unless you elect otherwise.

Superior Industries International, Inc. • Table of Contents

2022 Proxy Statement | i

Superior Industries International, Inc. • Table of Contents

| FORM 10-K | 67 | |||

| OTHER MATTERS | 68 | |||

ii | Superior Industries International, Inc.

Proxy Summary • 2022 Annual Meeting of Stockholders

This summary highlights selected information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding our 2021 performance, please review our 2021 Annual

Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 3, 2022. The 2021 annual report to stockholders, including financial statements, is being made available to stockholders together with these proxy materials on or about March 17, 2022.

2022 Annual Meeting of Stockholders – Annual Meeting Information

Time and Date: |

April 28, 2022 at 10:00 a.m. Eastern Daylight Time, via a live audio webcast that is available at www.virtualstockholdermeeting.com/SUP2022. There will be no physical meeting location and the meeting will only be conducted via the live audio webcast. To participate in the meeting, you must have your 16-digit control number that is shown on your Notice, proxy card or voting instruction form. | |

Record Date: |

March 4, 2022 (the “Record Date”) | |

Voting: |

You are entitled to vote at the meeting if you were a stockholder of record of Superior’s common stock or Series A Preferred Stock at the close of business on the Record Date. Each holder of Superior common stock or Series A Preferred Stock as of the Record Date will be entitled to one vote on each matter for each share of common stock held, or into which such holder’s Series A Preferred Stock is convertible, on the Record Date. |

For more information regarding the Annual Meeting and voting, please see our “Information About the Annual Meeting and Voting” Section, found on page 57.

2022 Annual Meeting of Stockholders – Agenda and Voting Recommendations

Proposals: |

|

|

| Board Voting Recommendation: | Page Reference for More Detail: | |||||||

1. | Election of eight Directors |

|

|

| “FOR” all nominees | 6 | ||||||

2. | To approve, in a non-binding advisory vote, executive compensation of the Company’s named executive officers for the fiscal year ended December 31, 2021 |

|

|

| “FOR” | 29 | ||||||

3. | Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 |

|

|

| “FOR” | 31 | ||||||

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting via the live audio webcast, your vote is important, and we encourage you to vote promptly. You can vote your shares over the telephone, via the Internet or by completing, dating, signing and returning a proxy card or voting instruction form, as described in the Proxy Statement. Your prompt cooperation is greatly appreciated.

2022 Proxy Statement | 1

Proxy Summary • 2021 Performance & Business Highlights

2021 Performance & Business Highlights

The following chart highlights key metrics of our financial and operating performance in 2019, 2020 and 2021:

| Key Metric ($ in Millions except per wheel data, Units in Thousands) | 2021 | 2020 | 2019 | |||

Units Shipped | 16,123 | 15,194 | 19,246 | |||

Net Sales | $1,385 | $1,101 | $1,372 | |||

Value-Added Sales(1) | $754 | $648 | $755 | |||

Content per Wheel(1) | $45.83 | $42.06 | $39.25 | |||

Net Income (Loss)(2) | $4 | ($244) | ($97) | |||

Adjusted EBITDA(1) | $167 | $129 | $169 | |||

Adjusted EBITDA % of Value-Added Sales | 22.1% | 20.0% | 22.3% | |||

Cash Provided by Operating Activities | $45 | $150 | $163 | |||

Free Cash Flow(1) |

($28) |

$87 |

$79 | |||

| • | Effectively responded to the challenging operating environment: |

| • | Delivered $167 million Adjusted EBITDA 29% ($37 million) above 2020 based on only 6% increase of sold wheels, and expanded Adjusted EBITDA margin as a percentage of Value-Added Sales by 2.1% |

| • | Further enhanced competitive position, despite headwinds from COVID-19 and semiconductor shortages. Compared to 2019, wheels sold declined by 16% in an industry environment that worsened by 24%(5), and the Company managed to maintain an Adjusted EBITDA margin as a percentage of Value-Added Sales of 22% |

| • | Maintained strong available liquidity(4) position of $309M at year-end, despite elevated working capital requirements due to increased aluminum prices |

| • | Accelerated enterprise-wide continuous improvement programs, and applied cost and commercial discipline at all levels of the company, in-line with long-term value creation initiatives |

| • | Ensured a safe work environment: |

| • | Designed and implemented health and safety protocols in response to the continued COVID-19 pandemic to ensure our employees’ health |

and welfare and enable us to operate with no production disruptions |

| • | Further reduced number of recordable safety incidents; Total Recordable Incident Rate (as defined by OSHA) (“TRIR”) dropped 11% in 2021, resulting in an industry-leading TRIR of 0.68 |

| • | Executed on the continued shift to higher-content wheels: |

| • | Achieved another record level of product complexity in our facilities; average 2021 Content per Wheel grew 9% compared to 2020 |

| • | Grew Value-Added Sales excluding Foreign Exchange(1) over Market by 17%(3); achieving third consecutive year of growth |

| • | Increased large diameter wheels (19-inch and greater) to 43% of all wheels sold (including our European Aftermarket business), up from 29% in 2019, supported by our differentiated portfolio of innovative technologies |

| • | Passed durability testing with second major OEM for PVD, a finishing technology for which we were nominated a finalist for the 2021 Automotive News PACE Award |

| • | Awarded first OEM program for 24-inch wheels |

2 | Superior Industries International, Inc.

Proxy Summary • 2021 Performance & Business Highlights

| • | Advanced our Environmental, Social and Governance (“ESG”) objectives: |

| • | Published inaugural UN Global Compact Sustainability Report |

| • | Established goal to be carbon neutral by 2039 |

| • | Launched low carbon wheel for Ford’s all electric Mustang Mach-E |

| (1) | Value-Added Sales, Value-Added Sales excluding Foreign Exchange, Adjusted EBITDA, Content per Wheel, and Free Cash Flow are non-GAAP financial measures. We are including 2019, 2020 and 2021 results of these measures to show an aspect of performance. See Appendix A to this Proxy Statement for a reconciliation to the most comparable GAAP measures. |

| (2) | Full year 2019 results include goodwill and intangible impairment charges of $102.2 million, and $14.8 million in restructuring expense and machinery and equipment relocation costs related to the closure of our Fayetteville, Arkansas plant. Full year 2020 results include goodwill and intangible impairment charges of $193.6 million. Full year 2021 results include charges for the Werdohl (Germany) flood damages and plant restructuring of $6 million. |

| (3) | Based on Value-Added Sales excluding Foreign Exchange compared to North American and Western and Central European industry production as reported by IHS on February 14, 2022. |

| (4) | Includes cash and availability on committed revolving credit facilities. |

| (5) | Comprised of North American and Western and Central European industry production as reported by IHS. |

Executive Compensation Highlights

Highlights of our 2021 executive compensation program are summarized as follows:

| • | Individual Performance Component of Annual Incentive. Our Annual Incentive Performance Plan (the “AIPP”) plays an important role in our approach to total compensation. We believe it motivates participants to focus on improving our performance on key financial measures during the year because it requires that we achieve defined, objectively determinable goals before participants become eligible for an incentive payout. |

| • | 2021 AIPP Payouts. The Company achieved Adjusted EBITDA(A) of $167 million in 2021, which was 98.2% of the $170 million target, resulting in the funding of the 2021 AIPP bonus pool for our named executive officers (“NEOs”) at 96.1% of target. |

| • | Long Term Incentive Plan (“LTIP”) Performance Measures. In 2021, we granted performance based restricted stock units (“PRSUs”) that can be earned based on our achievement of the following two performance measures as calculated over a three-year period.(B) |

LTIP Net Debt

50% weighting

|

Relative Total Stockholder Return

(“Relative TSR”)

50% weighting

|

As discussed in the “2021 Executive Compensation Components – Long Term Equity Incentive Compensation” section of this Proxy Statement, these performance targets were developed after a rigorous bottom-up financial analysis of our business.

| (A) | Please see the “Annual Incentive Compensation and Bonuses” portion of the “Narrative Disclosure Regarding Compensation” section of this Proxy Statement for a discussion of how AIPP Adjusted EBITDA is calculated. |

| (B) | Please see the “Long Term Equity Incentive Compensation” portion of the “Narrative Disclosure Regarding Compensation” section of this Proxy Statement for a discussion of how each of these performance measures is calculated. |

2022 Proxy Statement | 3

Proxy Summary • Corporate Governance Highlights

Corporate Governance Highlights

Our Board is committed to having a sound governance structure that promotes the best interests of our stockholders. Highlights of our governance practices include:

| • | Requirement that at least a majority of the Board be independent |

| • | “Plurality-plus vote” policy in uncontested elections of directors with a director resignation policy |

| • | Availability of proxy access |

| • | Separation of the Board Chair and Chief Executive Officer roles |

| • | Annual election of all directors |

| • | Audit, Compensation and Benefits, and Nominating and Corporate Governance Committees are comprised entirely of independent directors |

| • | Annual Board and Committee self-evaluations |

| • | Limitation on the number of a director’s additional public board memberships to three for non-employee directors and one for executive directors |

| • | Independent directors meet regularly without the presence of management |

| • | Stock ownership and retention requirement for non-employee directors and executive officers |

| • | No waivers of code of conduct policy for any director or executive officer |

| • | Stockholders have the right to call special meetings |

| • | No poison pill in place |

| • | Clear and robust corporate governance guidelines |

4 | Superior Industries International, Inc.

Proxy Summary • Director Nominee Highlights

Name | Age* | Director Since | Principal Occupation | Independent | Board Committees/Roles | |||||

Majdi B. Abulaban | 58 | 2019 | President and Chief Executive Officer of the Company |

|

| |||||

Raynard D. Benvenuti | 66 | 2020 | Founder of Concord Investment Partners | X | • Compensation & Benefits Committee • Nominating & Corporate Governance Committee | |||||

Michael R. Bruynesteyn | 58 | 2015 | Chief Financial Officer of Raistone | X | • Audit Committee • Nominating & Corporate Governance Committee | |||||

Richard J. Giromini | 69 | 2018 | Retired Chief Executive Officer and Director of Wabash National Corporation (NYSE: WNC) | X | • Compensation & Benefits Committee • Nominating & Corporate Governance Committee (Chair) | |||||

Paul J. Humphries | 67 | 2014 | Retired President of High Reliability Solution (a business group of Flex LTD) | X | • Audit Committee • Compensation & Benefits Committee (Chair) | |||||

Ransom A. Langford | 50 | 2017 | Partner, TPG Growth | X |

| |||||

Timothy C. McQuay | 70 | 2011 | Retired Managing Director, Investment Banking, Noble Financial Markets | X | • Chairman of the Board | |||||

Ellen B. Richstone | 70 | 2016 | Retired Chief Financial Officer, Rohr Aerospace | X | • Audit Committee (Chair) • Nominating & Corporate Governance Committee | |||||

| * | Age as of April 28, 2022 |

2022 Proxy Statement | 5

Proposal No. 1 • General

Upon the recommendation of our Nominating and Corporate Governance Committee, the Board has nominated the eight individuals listed below to stand for election at the Annual Meeting for a one-year term ending at the annual meeting of stockholders in 2023 or until their successors, if any, are elected or appointed. All of our nominees have consented to be named in this Proxy Statement and to serve as directors, if elected by the Company’s stockholders. In the event that any of our nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies returned to us will be voted for the election of a substitute nominee(s)

designated by the Board upon the recommendation of its Nominating and Corporate Governance Committee. If any such substitute nominee(s) is designated, we will file an amended proxy statement that, as applicable, identifies the substitute nominee(s), discloses that such nominees have consented to being named in the amended proxy statement and to serve as directors if elected, and provide information about such nominees required by the rules of the SEC. As of the date of this Proxy Statement, the Board is not aware that any of its nominees is unable or will decline to serve as a director.

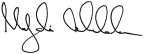

The Board, through the Nominating and Corporate Governance Committee, considers the following experience, qualifications, attributes and skills of both potential director nominees as well as existing members of the Board:

For more information regarding director nominations and qualifications, see the sections titled “Information about Director Nominees” (beginning on page 7) and “Director Selection” (beginning on page 18).

6 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

Information about Director Nominees

Set forth below is information about our nominees, including their names and ages, recent employment or principal occupation, their period of service as a Superior director, the names of other public companies for which they currently serve as a director or have served as a director within the last five years and a summary of their specific experience, qualifications, attributes or skills that led to the conclusion that they are qualified to serve as a

director. Mr. Langford was appointed and is being nominated to the Board pursuant to the Investor Rights Agreement, dated as of May 22, 2017, by and between the Company and TPG Growth III Sidewall, L.P.

Each of the nominees for director has consented to serve, if elected.

MAJDI ABULABAN

Superior Industries International, Inc. President and Chief Executive Officer

Age: 58

Director since: 2019

Board Committees: None

Education: Mr. Abulaban holds a Bachelor of Applied Science in Mechanical Engineering from the University of Pittsburgh and an M.B.A. from Weatherhead School of Management at Case Western Reserve University.

Current Public Directorships: SPX Flow (NYSE: FLOW)

Former Public Directorships: None

|

Qualifications: Mr. Abulaban has more than 30 years of leadership experience in global automotive supplier operations. Mr. Abulaban was appointed to the Board based on his experience and skills, including his significant experience in the automotive industry and strong operational background. He led three global product business units and over 120,000 employees to transform Delphi/Aptiv into a world-class provider of electrical architecture. He has a proven track record of implementing successful strategies, operating systems and organizational structures that drive performance. In addition, he was instrumental in establishing Delphi as an automotive leader in China.

Mr. Abulaban was appointed as the Company’s President and Chief Executive Officer effective May 15, 2019. He was Senior Vice President & Group President, Global Signal and Power Solutions at Aptiv PLC (formerly Delphi Automotive), a technology company that develops connected solutions from 2017 to 2019. He previously was Senior Vice President and Group President, Global Electrical and Electronic Architecture Segment and President of Aptiv Asia Pacific. He also held various business unit leadership positions with Delphi in China, Singapore and the United States, having joined the company in 1985. |

2022 Proxy Statement | 7

Proposal No. 1 • Information about Director Nominees

RAYNARD BENVENUTI

Founder & Managing Member, Concord Investment Partners

Independent

Age: 66

Director since: 2020

Board Committees: Compensation and Benefits Nominating and Corporate Governance

Education: Mr. Benvenuti earned a Bachelor of Engineering in Mechanical Engineering from Manhattan College a Master of Science in Mechanical and Aerospace Engineering from Princeton University, and an M.B.A from the Harvard Graduate School of Business Administration.

Current Public Directorships: NN, Inc. (Nasdaq NNBR)

Former Public Directorships: None

|

Qualifications: Mr. Benvenuti has extensive experience as a senior executive, director and advisor to various aerospace, automotive and manufacturing companies, including in turnaround and highly leveraged situations. He has valuable strategic, financial, operational and corporate governance expertise.

Mr. Benvenuti founded Concord Investment Partners, a boutique investment and advisory firm that invests in engineering-centric industries including aerospace, automotive and industrial manufacturing/distribution companies in 1996. From 2007 to 2015, he served as a Managing Partner, Managing Director and an operational practice leader for the aerospace and automotive/truck sectors at Greenbriar Equity Group, L.P. (“Greenbriar”), a private equity group focused on transportation-related enterprises. While at Greenbriar, Mr. Benvenuti served as a director on five boards, three as Chairman, including as Chairman and interim CEO of Align Aerospace, LLC, an aerospace hardware distribution company. From 2002 until its sale to GKN plc in 2006, Mr. Benvenuti served as the President and CEO of Stellex Aerostructures, Inc., a manufacturer of large structural components for commercial and military aircraft. Prior to 2002, he worked at Forstmann Little & Co., a private equity firm, and McKinsey & Company, a global management consulting firm, where he advised high technology and industrial sector clients in the areas of strategic planning and operational improvement. |

8 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

MICHAEL R. BRUYNESTEYN

Chief Financial Officer, Raistone

Independent

Age: 58

Director since: 2015

Board Committees: Audit Nominating and Corporate Governance

Education: Mr. Bruynesteyn holds a Bachelor of Applied Science in Mechanical Engineering from the University of British Columbia and an M.B.A. from the London Business School.

Current Public Directorships: None

Former Public Directorships: None |

Qualifications: Mr. Bruynesteyn has developed a deep understanding of capital markets from hands-on experience over the last 20 years. He cultivated a firm grasp of the investor’s perspective from the vantage points of directing investor relations for General Motors Company, leading the research team covering the automotive industry for Prudential Equity Group, and investing on the buy-side as part of a $6 billion hedge fund owned by Lehman Brothers. Mr. Bruynesteyn provided deal-making advice to automotive and energy storage companies with boutique investment bank Strauss Capital and remained active in the capital markets in his role as Treasurer of Turner Construction. Mr. Bruynesteyn continues his engagement in the automotive industry as a member of the Advisory Board of ClearMotion, Inc., a developer of breakthrough active suspension technology. Mr. Bruynesteyn is a National Association of Corporate Directors Governance Fellow.

Mr. Bruynesteyn is Chief Financial Officer of Raistone, a leader in providing working capital solutions. Previously, he was Treasurer and Vice President, Strategic Finance of Turner Construction Company, the largest non-residential commercial construction company in the United States, a position he held from 2013-2018. He also was a Managing Director at the investment banking firm Strauss Capital Partners from 2008 to 2012. Prior to that, Mr. Bruynesteyn was a Managing Director in the asset management division of investment banking firm Lehman Brothers, where he focused on transportation-related investments from 2006 to 2008. From 1999 to 2006, Mr. Bruynesteyn was the Senior Equity Research Analyst at Prudential Equity Group in the Automotive Group, where he acted as a sell-side analyst. Mr. Bruynesteyn also worked at General Motors, where he held various finance positions until he departed as Director of Investor Relations in 1998. |

2022 Proxy Statement | 9

Proposal No. 1 • Information about Director Nominees

RICHARD J. GIROMINI

Retired Chief Executive Officer and Director of Wabash National Corporation (NYSE: WNC)

Independent

Age: 69

Director since: 2018

Board Committee: Compensation and Benefits Nominating and Corporate Governance (Chair)

Education: Mr. Giromini holds a Master of Science degree in Industrial Management and a Bachelor of Science degree in Mechanical Engineering, both from Clarkson University. He is also a graduate of the Advanced Management Program at the Duke University Fuqua School of Management

Current Public Directorships: None

Former Public Directorships: Wabash National Corporation (NYSE: WNC), Robbins & Myers (formerly traded NYSE: RBN)

|

Qualifications: Mr. Giromini brings over 40 years of operational leadership experience within the automotive and heavy transportation industries, including more than eleven years as Chief Executive Officer of a transportation equipment public company, providing key strategic growth, sales, engineering, operational and turnaround expertise. This, combined with his extensive automotive industry experience working as a Tier 1 supplier, including five years in executive leadership positions within the automotive aluminum wheel industry, make Mr. Giromini a valued member of the Board.

Mr. Giromini served as President and Chief Executive Officer of Wabash National Corporation, North America’s largest trailer manufacturer, from January 2007 until October 2016, Chief Executive Officer until June 2018 and then as an Executive Advisor until his retirement in June 2019. Earlier service with WNC included President & Chief Operating Officer (December 2005 – December 2006), Executive Vice President & Chief Operating Officer (February 2005 – December 2005), and SVP & Chief Operating Officer (July 2002 – February 2005). Earlier experience includes 26 years in the automotive industry, having begun his career with General Motors Company (1976-1985), serving in a variety of positions of increasing responsibility, then continuing service in several senior management positions within the Tier 1 automotive sector, including Accuride Corporation, AKW LP, ITT Automotive, Hayes Wheels, and Doehler-Jarvis. |

10 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

PAUL J. HUMPHRIES

Retired President of High Reliability Solution (a business group of Flex LTD (NASDAQ: FLEX)

Independent

Director since: 2014

Age: 67

Board Committees: Audit Compensation and Benefits (Chair)

Education: Mr. Humphries has a B.A. in applied social studies from Lanchester Polytechnic (now Coventry University) and post-graduate certification in human resources management from West Glamorgan Institute of Higher Education.

Current Public Directorships: None

Former Public Directorships: None

|

Qualifications: Mr. Humphries has extensive experience in the automotive supplier industry and senior level management experience with multinational public companies, providing valuable expertise in strategy, growth, human resources and global operations. Further, Mr. Humphries has extensive experience in planning, implementing and integrating mergers and acquisitions.

Mr. Humphries served as President of High Reliability Solutions at Flex LTD (“Flex”), a global end-to-end supply chain solutions company that serves the medical, automotive and aerospace and defense markets, from 2011 until December 2020. From 2006 to 2011, Mr. Humphries served as Executive Vice President of Human Resources at Flex. In that capacity, he led Flex’s global human resources organization, programs and related functions including global loss prevention, environmental compliance and management systems. Mr. Humphries joined Flex with the acquisition of Chatham Technologies Incorporated in April 2000. While at Chatham Technologies, he served as Senior Vice President of Global Operations. Prior to that, Mr. Humphries held several senior management positions at Allied Signal, Inc. and its successor, Honeywell Inc., BorgWarner Inc. and Ford Motor Company. |

2022 Proxy Statement | 11

Proposal No. 1 • Information about Director Nominees

RANSOM A. LANGFORD

Partner, TPG Growth

Independent

Director since: 2017

Age: 50

Board Committees: None

Education: Mr. Langford earned a B.A. from University of North Carolina, Chapel Hill and an M.B.A. from the Wharton School at University of Pennsylvania.

Current Public Directorships: None

Former Public Directorships: None

|

Qualifications: Mr. Langford is a Partner of TPG Growth based in New York, where he leads the platform’s investments in industrial and business services. Mr. Langford has extensive experience as a board member, serving on boards of directors for several TPG portfolio companies, including The Private Suite Holdings, LLC, Seasoned Holdco, LLC, Artel, LLC, Denali Water Solutions, LLC, Halo Branded Solutions, Inc., Tenth Revolution Group, Keter Environmental Services, and People 2.0. Mr. Langford’s substantial board and investment experience make him a valuable contributor to the Board.

Prior to joining TPG in 2009, Mr. Langford was a Managing Director and Partner with J.H. Whitney & Co., a private equity firm, where he was a senior member of the investment team responsible for investing several private equity partnerships and was a member of the firm’s Investment Committee. Prior to his tenure at J.H. Whitney, Mr. Langford was an Associate at Brentwood Associates, representing a number of portfolio companies as a member of the investment team. Mr. Langford has also spent time as an analyst in the Mergers & Acquisitions group at New York-based investment bank Donaldson, Lufkin & Jenrette. |

12 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

TIMOTHY C. MCQUAY

Retired Managing Director, Investment Banking, Noble Financial Markets

Independent

Director since: 2011

Age: 70

Board Committees: None

Education: Mr. McQuay received an A.B. degree in economics from Princeton University and an M.B.A. in finance from the University of California at Los Angeles.

Current Public Directorships: None

Former Public Directorships: Keystone Automotive Industries, Inc. (Chair, Audit Committee) (formerly NASDAQ: KEYS); Meade Instruments Corp. (NASDAQ: MEAD) (Chairman); Perseon Corp. (fka BSD Medical Corp.) (NASDAQ: PRSN) (Chairman)

|

Qualifications: Mr. McQuay provides extensive business and financial experience as well as public company board experience, which includes service on compensation and audit committees. Mr. McQuay has a deep knowledge of Superior’s business as well as a deep understanding of the capital markets and significant investment banking experience. Mr. McQuay also brings to the Board valuable insight into corporate strategy and risk management that he has gained from nearly 40 years of experience in the investment banking and financial services industries. While Mr. McQuay served on the board of Keystone Automotive Industries, Inc., the company made eight strategic acquisitions representing more than $400 million in aggregate value. Mr. McQuay served on Keystone’s special committee in connection with the company’s sale to LKQ Corporation in 2007 for $800 million.

From November 2011 until his retirement in December 2015, Mr. McQuay served as Managing Director, Investment Banking with Noble Financial Capital Markets, an investment banking firm. Previously, he served as Managing Director, Investment Banking with B. Riley & Co., an investment banking firm, from September 2008 to November 2011. From August 1997 to December 2007, he served as Managing Director – Investment Banking at A.G. Edwards & Sons, Inc. From May 1995 to August 1997, Mr. McQuay was a Partner at Crowell, Weedon & Co., a stock brokerage firm, and from October 1994 to August 1997, he also served as Managing Director of Corporate Finance. From May 1993 to October 1994, Mr. McQuay served as Vice President, Corporate Development with Kerr Group, Inc., a plastics manufacturing company. From May 1990 to May 1993, Mr. McQuay served as Managing Director of Merchant Banking with Union Bank. |

2022 Proxy Statement | 13

Proposal No. 1 • Information about Director Nominees

ELLEN B. RICHSTONE

Retired Chief Financial Officer, Rohr Aerospace

Independent

Director since: 2016

Age: 70

Board Committees: Audit (Chair) Nominating and Corporate Governance

Education: Ms. Richstone received a B.A. from Scripps College in Claremont, California and a Master of Law and Diplomacy in International Business from the Fletcher School of Law and Diplomacy at Tufts University.

Current Public Directorships: Cognition Therapeutics (NASDAQ: CGTX); eMagin Corp. (NYSE: EMAN); Orion Energy Systems, Inc. (NASDAQ: OESX)

Former Public Directorships: American Power Conversion (formerly traded NASDAQ: APCC); BioAmber Inc. (NYSE: BIOA)

|

Qualifications: Ms. Richstone provides extensive business and financial experience as Chief Financial Officer of public and private companies ranging in size up to $4 billion in revenue over a 24-year period and her public company board experience, which includes being awarded the first annual Distinguished Director Award from the American College of Corporate Directors. Ms. Richstone’s public company board experience has been at companies ranging in size from microcap to Fortune 500. Ms. Richstone holds an Executive Master’s Certification in Director Governance from the American College of Corporate Directors – Platinum Level. In January 2018, Ms. Richstone was named as an NACD Board Leadership Fellow and in 2020 she was named a Top 100 Director, signifying that she has demonstrated her commitment to the highest level of leadership in the boardroom.

Ms. Richstone has served as the Chief Financial Officer of several public and private companies between 1989 and 2012, including Rohr Aerospace, a Fortune 500 aerospace company. From 2002 to 2004, Ms. Richstone was the President and Chief Executive Officer of the Entrepreneurial Resources Group, an executive management firm. From 2004 until its sale in 2007, Ms. Richstone served as the financial expert on the board of directors of American Power Conversion, an S&P 500 company. Ms. Richstone currently sits on the board of the National Association of Corporate Directors (NACD) in New England, as well as other non-profit organizations. |

14 | Superior Industries International, Inc.

Proposal No. 1 • Recommendation of the Board

Each director nominee must receive the affirmative vote of a plurality of the votes cast to be elected, meaning that the eight persons receiving the largest number of “yes” votes will be elected as directors. You may vote in favor of any or all of the nominees or you may withhold your vote as to any or all of the nominees. The nominees receiving the highest number of affirmative votes of the shares entitled to vote at the meeting will be elected as directors. Proxies may not be voted for more than the eight directors, and stockholders may not cumulate votes in

the election of directors. In an uncontested election, our Corporate Governance Guidelines provide that any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation following certification of the stockholder vote. The Nominating and Corporate Governance Committee and the Board must then decide whether to accept the tendered resignation, culminating with a public disclosure explaining the Board’s decision and decision-making process.

We believe each of our eight director nominees has the professional and leadership experience, industry knowledge, commitment, diversity of skills and ability to work in a collaborative manner necessary to execute our strategic plans. We believe the election of

the Company’s eight nominees named in Proposal 1 and on the proxy card best positions the Company to deliver value to and represent the interests of all Company stockholders.

The Board unanimously recommends a vote “FOR” its eight nominees for election as Director named in this Proxy Statement and on the proxy card. Proxies solicited by the Board will be voted “FOR” all of Superior’s eight nominees unless stockholders specify a contrary vote.

2022 Proxy Statement | 15

Board Structure and Committee Composition • Board Structure and Leadership

BOARD STRUCTURE AND COMMITTEE COMPOSITION

Board Structure and Leadership

The roles of Board Chair and Chief Executive Officer are separate, with Timothy C. McQuay serving as Chairman of the Board. The Board believes separating the roles of Board Chair and Chief Executive Officer allows our Chief Executive Officer to focus on developing and implementing the Company’s strategic business plans and managing the Company’s day-to-day business operations and allows our Board Chair to lead the Board in its oversight and advisory roles. As a result of the many responsibilities of the Board and the significant amount of time and effort required by each of the Board Chair and Chief Executive Officer to perform their respective duties, the Company believes that having separate persons in these roles enhances the

ability of each to discharge those duties effectively and enhances the Company’s prospects for success.

Superior’s Corporate Governance Guidelines provide the Board with flexibility to select the appropriate leadership structure depending on then-current circumstances. In making leadership structure determinations, the Board considers many factors, including the specific needs of the business and what is in the best interests of Superior’s stockholders. If the Board Chair is not an independent director, on an annual basis, one of the independent directors is designated by a majority of the independent directors to be the Lead Director.

On an annual basis, the Board, with the assistance of the Nominating and Corporate Governance Committee, makes a determination as to the independence of each director considering the current standards for “independence” established by the New York Stock Exchange (the “NYSE”), additional criteria set forth in Superior’s Corporate Governance Guidelines and consideration of any other material relationship a director may have with Superior as disclosed in annual director and officer questionnaires. Our Corporate Governance Guidelines provide that a majority of the Board and all members of the Audit, Compensation and Benefits and Nominating and Corporate Governance Committees of the Board will be independent.

The Board has determined that all of its current directors are independent under these standards, except for Majdi Abulaban, our Chief Executive Officer. In addition, upon the recommendation of the Nominating and Corporate Governance Committee, the Board has determined that the members of the Audit Committee and Compensation and Benefits Committee meet the additional independence criteria required for audit committee and compensation committee membership under the applicable NYSE listing standards.

16 | Superior Industries International, Inc.

Board Structure and Committee Composition • Board Composition

The following matrix provides information regarding our director nominees, including certain types of knowledge, skills, experiences and attributes

possessed by one or more of our directors which our Board believes are relevant to our business or industry.

|  |  |  |  |  |  |  | |||||||||

Functional Expertise | ||||||||||||||||

Automotive Industry | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||

Global /International | ● | ● | ● | ● | ● | ● | ● | |||||||||

Strategy Development/Execution/M&A | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||

Finance/Treasury (« Qualified Financial Expert) | « | « | « | « | ● | ● | « | « | ||||||||

Capital Markets | ● | ● | ● | ● | ● | |||||||||||

CEO or Division President | ● | ● | ● | ● | ● | |||||||||||

Public Company Experience | ● | ● | ● | ● | ● | ● | ● | |||||||||

Public Company CEO | ● | ● | ||||||||||||||

Supply Chain/Commodities Management | ● | ● | ● | ● | ||||||||||||

Diverse Manufacturing | ● | ● | ● | ● | ||||||||||||

Materials Science/Engineering | ● | ● | ● | ● | ||||||||||||

Personal/Demographics | ||||||||||||||||

Diversity | ● | ● | ||||||||||||||

Age as of April 28, 2022 | 58 | 66 | 58 | 69 | 67 | 50 | 70 | 70 | ||||||||

| INDEPENDENCE |

| TENURE | ||

The Board has determined that all director nominees, other than Mr. Abulaban (87.5%), meet the independence standards set by the NYSE. | The median tenure of the director nominees is approximately four years, which reflects a balance of experience and new perspectives. | |||

|

| |||

2022 Proxy Statement | 17

Board Structure and Committee Composition • Meetings and Attendance

During 2021, the Board held five meetings. During this period, all of the directors attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all Committees of the Board on which each such director served, during the period for which each such director served. All of Superior’s directors who were directors at the time of last year’s annual meeting of stockholders attended the annual meeting of stockholders. Superior’s directors are not required, but are encouraged, to attend the annual meeting of stockholders.

The Board and its Committees also consulted informally with management from time to time and acted at various times by written consent without a meeting during 2021. Additionally, the independent directors met in executive session regularly without the presence of management. Mr. McQuay, in his capacity as Chairman of the Board, presided over executive sessions of the independent directors in 2021.

Our Nominating and Corporate Governance Committee seeks to build and maintain an effective, well-rounded, financially literate and diverse Board that represents all of our stockholders.

Process for Identification and Review of Director Candidates to Join the Board

Identifying and recommending individuals for nomination, election or re-election to our Board is a principal responsibility of our Nominating and Corporate Governance Committee. This Committee carries out this function through an ongoing, year-round process, which includes the annual Board and Committee evaluation process. Each director and director candidate is evaluated by the Nominating and Corporate Governance Committee based on his or her individual merits, taking into account Superior’s needs and the composition of our Board.

To assist in its evaluation of directors and director candidates, the Nominating and Corporate Governance Committee has adopted strategy-based board composition criteria and looks for certain experiences, qualifications, attributes and skills that would be beneficial to have represented on the Board and on our committees at any particular point in time. Nominees for the Board should be committed to enhancing long-term stockholder value and must

possess relevant experience and skills, good business judgment and personal and professional integrity. The Nominating and Corporate Governance Committee considers experience in the automotive industry, finance, operational management, international business, capital markets, legal and regulatory compliance, sales and marketing, strategy development, strategy execution, mergers and acquisitions, supply chain/commodities management and diverse manufacturing as well as roles in senior executive management, public companies and public company boards. The Nominating and Corporate Governance Committee focuses on selecting new board members from a diverse candidate pool, seeking diversity of race, ethnicity, gender, age, education, cultural background, business experience, and viewpoints, and diversity of skills in finance, marketing, international business, financial reporting and other areas that are expected to contribute to an effective Board.

18 | Superior Industries International, Inc.

Board Structure and Committee Composition • Director Selection

In recommending candidates for election to the Board, the Nominating and Corporate Governance Committee considers nominees recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Stockholder recommendations of director nominees should be sent to the attention of our Corporate Secretary at the following address: Superior Industries International, Inc., Attention: Corporate Secretary, 26600 Telegraph Rd., Southfield, MI 48033. The Nominating and Corporate Governance Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board. The Nominating and Corporate Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Proxy Access Bylaw

Our Bylaws include a proxy access provision that allows a stockholder, or group of no more than 20 eligible stockholders, that has maintained continuous ownership of 3% or more of our common stock for at least three years to include in our proxy materials for an annual meeting of stockholders a number of director nominees for up to 20% of the directors then in office as of the last day on which a notice of proxy access nomination may be delivered to the Company

(if such an amount is not a whole number, then the closest whole number below 20%). An eligible stockholder must maintain the 3% ownership requirement at least until the annual meeting at which the proponent’s nominee will be considered. Proxy access nominees who withdraw, become ineligible or unavailable or who do not receive at least a 25% vote in favor of election will be ineligible as a nominee for the following two years.

The proponent is required to provide the information about itself and the proposed nominee(s) that is specified in the proxy access provision of our Bylaws. The required information must be in writing and provided to the Corporate Secretary of the Company not less than 90 days nor more than 120 days prior to the anniversary of the date that the Company first distributed its proxy statement to stockholders for the immediately preceding annual meeting of stockholders. We are not required to include any proxy access nominee in our proxy statement if the nomination does not comply with the proxy access requirements of our Bylaws. Any stockholder considering utilizing proxy access should refer to the specific requirements set forth in our Bylaws.

If any stockholder notifies us of its intent to nominate one or more director nominees under the advance notice provision in our Bylaws, we are not required to include any such nominee in our proxy statement for the annual meeting.

2022 Proxy Statement | 19

Board Structure and Committee Composition • Committees of the Board

Superior has three standing committees: the Audit Committee, the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee. Each of these Committees has a written charter approved by the Board. A copy of each charter can be found by clicking on “Corporate Governance” in the “Investor Relations”

section of our website at www.supind.com. This website address is included here and elsewhere in this Proxy Statement for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement.

AUDIT COMMITTEE |

Members: Ellen B. Richstone, Chair Michael R. Bruynesteyn Paul J. Humphries

Meetings in 2021: 9

|

Qualifications:

The Board has determined that each of Ms. Richstone and Mr. Bruynesteyn qualifies as an “audit committee financial expert” and that each member of the Audit Committee satisfies the “financial literacy” requirements of the NYSE listing standards. Ms. Richstone currently serves on the audit committee of three public companies in addition to our Audit Committee. Following discussion with Ms. Richstone, the Board determined that such simultaneous service does not impair Ms. Richstone’s ability to effectively serve as a member and Chair of our Audit Committee. The Board noted that Ms. Richstone’s experience serving on other public company audit committees has the potential to enhance her service on our Audit Committee.

Key Responsibilities:

The Audit Committee is responsible for:

| ● | Overseeing and monitoring the integrity of the financial statements and the other financial information that will be provided to stockholders and others |

| ● | Reviewing the system of internal controls which management and the Board have established, including oversight of the Internal Audit function |

| ● | Appointing, retaining and overseeing the performance of the independent registered public accounting firm |

| ● | Overseeing Superior’s accounting and financial reporting processes and the audits of Superior’s financial statements |

| ● | Pre-approving audit and permissible non-audit services provided by the independent registered public accounting firm |

| ● | Overseeing and monitoring treasury and tax matters |

| ● | Overseeing enterprise risk management (including evaluation of supply chain risks) |

| ● | Overseeing execution of the Company’s environmental, social, and governance (“ESG”) practices (including sustainability, privacy, and data security) |

| ● | Overseeing employee reports made through the ethics line and other reporting channels |

| ● | Overseeing compliance with legal, regulatory and public disclosure requirements |

| ● | Conducting an annual self-evaluation of its performance |

The report of the Audit Committee is on page 56 of this Proxy Statement.

20 | Superior Industries International, Inc.

Board Structure and Committee Composition • Committees of the Board

Compensation and Benefits Committee |

Members: Paul J. Humphries, Chair Raynard D. Benvenuti Richard J. Giromini

Meetings in 2021: 8

|

Key Responsibilities:

The Compensation and Benefits Committee is responsible for:

| ● | Reviewing the performance and development of Superior’s management in achieving corporate goals and objectives |

| ● | Assuring that Superior’s executive officers are compensated effectively in a manner consistent with Superior’s strategy, competitive practice, sound corporate governance principles and stockholder interests. |

| ● | Reviewing and recommending to the Board the compensation of the Chief Executive Officer |

| ● | Reporting annually to the Board on the Chief Executive Officer succession plan |

| ● | Reviewing and approving the Company’s compensation to other officers and key employees based upon compensation and benefit proposals presented to the Compensation and Benefits Committee by the Chief Executive Officer and our Human Resources Department annually reviewing and approving the Company’s compensation strategy to ensure that it promotes stockholder interests, supports the Company’s strategic and tactical objectives, and provides appropriate rewards and incentives for management and employees through administration of the Company’s 2018 Equity Plan (as hereinafter defined), compensation agreements, perquisites, and benefits |

| ● | Reviewing compensation-related risk management |

| ● | Reviewing and recommending to the Board the compensation of non-employee directors, chairs, lead directors and Board committee members |

| ● | Conducting an annual review of management development, retention programs, succession planning and diversity and inclusion efforts |

| ● | Overseeing the Company’s policies on clawbacks, hedging and pledging of Company stock, and director and officer stock ownership requirements |

| ● | Conducting an annual self-evaluation of its performance |

For 2021, the Compensation and Benefits Committee performed these oversight responsibilities and duties by, among other things, directing a review of our compensation practices and policies generally, including conducting an evaluation of the design of our executive compensation program in light of our risk management policies and programs. Additional information regarding the Compensation and Benefits Committee’s risk management review appears in the “Compensation Philosophy and Objectives” portion of the “Narrative Disclosure Regarding Compensation” section of this Proxy Statement.

In 2021, the Compensation and Benefits Committee engaged Willis Towers Watson to compile compensation surveys for review by the Compensation and Benefits Committee and to compare compensation paid to Superior’s directors with compensation paid to directors at companies included in the surveys.

For additional description of the Compensation and Benefits Committee’s processes and procedures for consideration and determination of executive officer compensation, see the “Narrative Disclosure Regarding Compensation” section of this Proxy Statement.

2022 Proxy Statement | 21

Board Structure and Committee Composition • Committees of the Board

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

Members: Richard Giromini, Chair Raynard D. Benvenuti Michael R. Bruynesteyn Ellen B. Richstone

Meetings in 2021: 6

|

Key Responsibilities:

The Nominating and Corporate Governance Committee is responsible for:

| ● | Establishing criteria for Board membership based on skills, experience, and diversity |

| ● | Assisting the Board in identifying qualified individuals to become directors |

| ● | Recommending to the Board increases or decreases in the size of the Board, qualified director nominees for election at the stockholders’ annual meeting, and membership on the Board committees |

| ● | Conducting an annual review of the Corporate Governance Guidelines and Code of Conduct and recommending any changes to the Board |

| ● | Overseeing new director orientation and director continuing education programs |

| ● | Maintaining an informed status and making recommendations to the Board, as appropriate, on best practices and regulatory developments in corporate governance |

| ● | Conducting an annual self-evaluation of the Committee’s performance |

| ● | Overseeing the annual self-evaluation by the Board |

22 | Superior Industries International, Inc.

Corporate Governance Principles and Board Matters • Corporate Governance Principles

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Superior is committed to implementing and maintaining sound corporate governance principles. Key information regarding Superior’s corporate governance initiatives can be found on our website, including Superior’s Corporate Governance

Guidelines, Superior’s Code of Conduct and the charter for each Committee of the Board. The corporate governance pages can be found by clicking on “Corporate Governance” in the “Investor Relations” section of our website at www.supind.com.

Corporate Governance Principles

Superior is committed to excellence in corporate governance and maintains clear policies and practices that promote good corporate governance, including:

| • | Requirement that at least a majority of the Board be independent. |

| • | “Plurality-plus vote” policy in uncontested elections of directors with a director resignation policy. |

| • | Availability of proxy access. |

| • | Separation of the Board Chair and Chief Executive Officer roles. |

| • | Annual election of directors. |

| • | All members of the Audit Committee, the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee are independent. |

| • | Limit on the number of additional public directorships to three for non-employee directors and one for executive directors. |

| • | The independent members of the Board meet regularly without the presence of management. |

| • | Stock ownership and retention requirements for its non-employee directors and executive officers. |

| • | Clear and robust corporate governance guidelines that are reviewed annually by the Board. |

| • | Code of Conduct reviewed annually by the Board, monitored by management and affirmed annually by all employees and directors. |

| • | Conflict of interest policy requires all employees to report annually on any conflicts of interest they have or certify that they do not have any conflicts of interest. |

| • | Ethics line available for all employees to submit reports of activity they believe to violate the Company’s Code of Conduct or policies. |

| • | Anti-hedging and anti-pledging policies in place for officers and directors. |

| • | Stockholders have the right to call special meetings. |

| • | No poison pill. |

Annual Board and Committee Self-Evaluations

Each year, the directors undertake a self-evaluation of the Board and each Committee on which they serve that elicits feedback on the performance and effectiveness of the Board and its Committees. As part of this self-evaluation, the directors are asked to consider the Board’s role, relations with management, composition and meetings. Each Committee is asked to consider its role and the responsibilities articulated

in the Committee charter, the composition of the Committee and the Committee meetings. Each Committee and the full Board reviews such self-evaluations and considers areas that can benefit from change. These opportunities, as well as proposed action plans, are shared with the full Board and, if supported, the plan is implemented and re-assessed at the time of the next annual self-evaluation.

2022 Proxy Statement | 23

Corporate Governance Principles and Board Matters • Succession Planning

Our Board, in coordination with the Compensation and Benefits Committee, oversees and is actively engaged in Chief Executive Officer and senior management succession planning, which is reviewed at least annually. As part of its succession planning process, the Board reviews the senior management team’s experience, skills, competence, and potential

to assess which executives have the ability to develop the attributes that the Board believes are necessary to lead and achieve the Company’s goals. Directors personally assess candidates by engaging with potential successors at Board and Committee meetings, as well as less formal settings.

The Role of the Board in Risk Oversight

Superior’s management is responsible for day-to-day risk management activities. The Board, acting directly and through its Committees, is responsible for the oversight of Superior’s risk management. Superior and the Board approach risk management by integrating and communicating strategic planning, operational decision-making and risk oversight. The Board commits extensive time and effort every year to discussing and agreeing upon Superior’s strategic plan, and it reconsiders key elements of the strategic plan as significant events and opportunities arise during the year. As part of the review of the strategic plan, as well as in evaluating events and opportunities that occur during the year, the Board and management focus on the primary success factors and risks for Superior. With such oversight of the Board, Superior has implemented practices and programs designed to help manage the risks to which Superior is exposed in its business and to align risk-taking appropriately with its efforts to increase stockholder value. Superior’s internal audit department provides both management and the Audit Committee, which oversees our financial and risk management policies, with ongoing assessments of Superior’s risk management processes and system of internal control and the specific risks facing Superior. While the Board has primary responsibility for oversight of the Company’s risk management, the Board’s standing Committees support the Board by regularly addressing various risks in their respective areas of oversight. Specifically, the Audit Committee

identifies and requires reporting on the Company’s environmental, social and governance activities and areas perceived as potential risks to Superior’s business (including supply chain risks, privacy and data security). As provided in its Committee charter, the Audit Committee reports regularly to the Board. As part of the overall risk oversight framework, other Committees of the Board also oversee certain categories of risk associated with their respective areas of responsibility. For example, the Compensation and Benefits Committee oversees compensation-related risk management, as discussed further under “Compensation and Benefits Committee” and in the “Compensation Philosophy and Objectives” portion of the “Narrative Disclosure Regarding Compensation” section of this proxy.

Each Committee reports regularly to the full Board on its activities. In addition, the Board participates in regular discussions among the Board and with Superior’s senior management of many core subjects, including strategy, finance, legal and public policy matters, in which risk oversight is an inherent element. The Board believes that the leadership structure described above under “Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, working through its Committees, including the independent Audit Committee, to participate actively in the oversight of management’s actions.

Stockholder Communications with the Board

Stockholders and third parties may communicate with Superior’s Board, or any individual member or members of the Board, through Superior’s Corporate Secretary at Superior Industries International, Inc., 26600 Telegraph Rd., Southfield, MI 48033, with a request to forward the communication to the intended

recipient or recipients. In general, any stockholder communication delivered to Superior for forwarding to the Board or specified director or directors will be forwarded in accordance with the stockholder’s instructions. However, the Company reserves the right not to forward to directors any abusive, threatening or otherwise inappropriate materials.

24 | Superior Industries International, Inc.

Corporate Governance Principles and Board Matters • Corporate Governance Guidelines

Corporate Governance Guidelines

The Board believes in sound corporate governance practices and has adopted formal Corporate Governance Guidelines to enhance its effectiveness. Our Board has adopted these Corporate Governance Guidelines to ensure that it has the necessary authority and practices in place to fulfill its role of management oversight and monitoring for the benefit of our stockholders. The Corporate Governance Guidelines set forth the practices our Board will follow

with respect to, among other areas, director qualification and independence, Board and Committee meetings, involvement of and access to management, and Chief Executive Officer performance evaluation and succession planning. The Corporate Governance Guidelines can be found by clicking on “Corporate Governance” in the “Investor Relations” section of our website at www.supind.com.

Superior’s Code of Conduct outlines the Company’s key policies and standards of expected business conduct, consistent with legal and ethical practices, including expectations on maintaining a diverse and harassment-free workplace, health and safety, employee data privacy, conflicts of interest, anti-corruption, anti-bribery, trade compliance, supporting our communities, protecting the environment, and not making political contributions or utilizing Company funds, assets, or facilities for political activities. All Superior employees, including the Chief Executive

Officer, the Chief Financial Officer, the Chief Accounting Officer and the Board are required to comply with the Code of Conduct. The Nominating and Corporate Governance Committee reviews the Code of Conduct annually and recommends changes, as appropriate, to the Board. The Audit Committee oversees compliance with the Code of Conduct. Our Code of Conduct is included on our website, www.supind.com, under “Corporate Governance” in the “Investor Relations” tab.

Superior is committed to environmental sustainability, social responsibility, and good governance practices. This commitment enables us to serve the needs of our customers, employees, and communities, while building long-term value in the Company and addressing the interests of our investors. Superior’s commitment is reflected in our Company values of Integrity, Teamwork, Customer Focus, Continuous Improvement, and Diversity and Inclusion. We are committed to safety in our workplaces, integrity in the conduct of our business, sustainability in our operations and products, and supporting our people in the global communities in which we live and work. We also expect our suppliers of goods and services to share our commitment to social responsibility and ethical conduct.

The Board of Directors establishes the Company’s philosophy on environmental, social and governance (“ESG”) activities and execution of the Company’s ESG strategy is overseen by the Audit Committee. In addition to the Audit Committee, the other Board Committees also oversee discrete sustainability

matters from a strategic and risk perspective. For example, the Compensation and Benefits Committee discusses people, diversity and inclusion and stewardship outreach to stockholders, and the Nominating and Corporate Governance Committee oversees the Company’s Code of Conduct, board governance and shareholder rights.

On a management level, ESG efforts are led by an Executive Steering Committee led by our CEO. These activities are carried out by resources in each of our plant facilities under the direction of our Global Director of Employee Health & Safety, Corporate Social Responsibility and Sustainability.

Superior is a signatory to the UN Global Compact, demonstrating our commitment to support human rights, labor standards, environmental protection and the fight against corruption. We published our first UN Global Compact Global Sustainability Report in 2021. In addition, Superior participates in CDP reporting for our global operations in the categories of climate change and water security.

2022 Proxy Statement | 25

Corporate Governance Principles and Board Matters • Sustainability

Based on our first ever Materiality Assessment, Superior has developed a 4-pillar strategy for sustainability: People, Product, Planet and Process:

People: Foster healthy, safe and inclusive work environments and communities

| Product: Design, develop and deliver sustainable products for a carbon neutral world | |

We believe the best way to deliver the highest quality products and services is to maintain a work environment that prioritizes safety and fosters collaboration, inclusion, tolerance and respect.

We are committed to employee engagement and development through our “Culture of Excellence”

● We have achieved an industry leading Total Recordable Incident Rate (TRIR), as defined by OSHA, of 0.68, an improvement of 11% over 2020, compared to the U.S. manufacturing sector 2020 average of 3.1.

● We implemented our first ever global culture and engagement survey, with a global participation rate of 89%.

● We are signatories to CEO Action for Diversity and Inclusion, the largest CEO-driven business community to advance diversity and inclusion in the workplace.

| From design through delivery, we are committed to exceeding customer expectations with high quality and sustainable products.

Our innovative products and technologies allow our OEM customers to offer lighter weight and lower carbon products for greater sustainability

● We launched the R4TM Wheel initiative, developing low carbon and carbon neutral products.

● We developed a light-weighting technology portfolio, including our patented AluliteTM technology to help make our customers’ cars more fuel efficient.

● We reduced the carbon footprint of our purchased aluminum by 17% from 2020-2021, and our carbon footprint for purchased aluminum is now less than half the global average. |

| Planet: Minimize environmental impact | Process: Anchor our actions and governance with integrity | |

We are committed to sustainable products and operations and delivering on our commitments to reduce natural gas, electricity, water consumption, solid waste and air emissions at all of our facilities globally.

We are reducing emissions, saving energy, and conserving natural resources in our operations

● We are targeting to achieve carbon neutrality by 2039.

● All Superior manufacturing plants have implemented Environmental Management Systems that are ISO14001 certified.

● We are targeting a 30% reduction in energy consumption by 2030. | Governance at Superior means doing the right thing in the right way. This means creating a culture of ethics and integrity in everything we do.

Ethics and compliance is always a top priority

● We require 100% of employees to complete annual Code of Conduct training and we conduct Code of Conduct training for all new salaried hires.

We partner with our suppliers to ensure sustainability awareness throughout our supply chain

● We seek opportunities to increase local sourcing of recyclable and sustainable materials.

● Approved suppliers must have a Code of Conduct that is consistent with Superior’s Code of Conduct.

We pursue a target of zero incidents of compromised security systems, loss of data or breaches of privacy. |

These four pillars guide how we will interact with our employees, our customers, our investors and our communities as we embark on the journey towards greater sustainability.

26 | Superior Industries International, Inc.

Compensation of Directors • General

Superior uses a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on the Board. Superior does not provide any perquisites to its non-employee Board members. In setting the compensation of non-employee directors, Superior considers the significant amount of time that the Board members expend in fulfilling their duties to Superior as well as the experience level required to serve on the Board. The Board, through its Compensation and Benefits Committee, annually reviews the compensation arrangements and compensation policies for non-employee directors, non-employee chair, lead directors and Board Committee members. The Compensation and Benefits Committee reviewed market data compiled by Willis Towers Watson to assist in assessing total non-employee director compensation. Our Compensation and Benefits Committee is guided by three goals: (i) compensation

should fairly pay directors for work required in a company of Superior’s size and scope; (ii) compensation should align directors’ interests with the long-term interests of Superior’s stockholders; and (iii) the structure of the compensation should be clearly disclosed to Superior’s stockholders.

Our directors (other than Mr. Langford, who does not receive compensation for his service on the Board) received the following annual compensation for service in 2021, which is paid in cash and time-based restricted stock units (“RSUs”) granted pursuant to the Superior Industries International, Inc. 2018 Equity Incentive Plan, as amended (the “2018 Equity Plan”). The Chairman of the Board receives an annual retainer of $150,000 and all other Directors receive an annual cash retainer of $60,000. In 2021, non-employee directors received the following additional annual compensation for service as Committee members and Committee Chairs:

Committee | Additional Director Annual Compensation | Additional Chair Annual Compensation* | ||||||

Audit | $ | 12,000 |

| $ | 15,000 |

| ||

Compensation and Benefits | $ | 8,000 |

| $ | 10,000 |

| ||

Nominating and Governance | $ | 6,000 |

| $ | 10,000 |

| ||

| * | Committee Chairs receive the Additional Chair Annual Compensation and do not receive the Additional Director Annual Compensation for the Committees they chair. |

An annual grant of RSU’s is typically made on or near the day of each annual meeting of stockholders of the Company, which vests one year following the grant date. On May 25, 2021, non-employee directors, other than Mr. Langford, were granted 15,577 RSUs, which had a grant date fair value of $100,000. Cash compensation is paid monthly. Non-employee directors do not receive additional forms of remuneration, including perquisites or benefits, but are reimbursed for their expenses in attending meetings. No cash fees are payable for attendance at Board or Committee meetings.

As of December 31, 2021, each director has 15,577 unvested RSUs, with the exception of Mr. Langford, who does not have any RSUs. The Board has adopted an amended and restated stock ownership policy (the “Stock Ownership Policy”) for members of the Board. The Stock Ownership Policy requires each non-employee director to own shares of Superior’s common stock having a value equal to at least three times the non-employee director’s annual cash retainer, with a three-year period to attain that ownership level. For 2021, all non-employee directors were in compliance with the Stock Ownership Policy. Mr. Langford, who does not receive compensation from Superior for his service on the Board, is not subject to the Stock Ownership Policy.

2022 Proxy Statement | 27

Compensation of Directors • 2021 Total Compensation

The table below shows the cash and equity compensation paid to each non-employee director in 2021:

Director Compensation Table

Name(1) | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | Total ($) | |||||||||

Raynard D. Benvenuti | 70,667 | 100,000 | 170,667 | |||||||||