QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

|

(Name of Registrant as Specified In Its Charter) |

Pathmark Stores, Inc. |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

PATHMARK STORES, INC.

200 Milik Street

Carteret, NJ 07008

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 11, 2004

To the Stockholders of the Company:

The Annual Meeting of Stockholders of PATHMARK STORES, INC. will be held at the corporate headquarters, 200 Milik Street, Carteret, New Jersey 07008, on Friday, June 11, 2004, at 2:00 p.m., local eastern time, for the following purposes:

- 1.

- to elect seven directors;

- 2.

- to ratify our selection of Deloitte & Touche LLP as our independent public accountants for 2004; and

- 3.

- to transact such other business as properly may be brought before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on April 19, 2004 are entitled to notice of and to vote at the annual meeting or any adjournments thereof.

Your attention is called to the Proxy Statement on the following pages. We hope that you will attend the meeting. Whether or not you plan to attend, please fill in, sign, date and mail the enclosed proxy in the enclosed envelope, which requires no postage if mailed in the United States.

May 5, 2004

PATHMARK STORES, INC.

200 Milik Street

Carteret, New Jersey 07008

PROXY STATEMENT

INTRODUCTION

This Proxy Statement is sent to you in connection with the solicitation of proxies by the Board of Directors of Pathmark Stores, Inc., a Delaware corporation, for use at the 2004 Annual Meeting of Stockholders. The meeting will be held at the Company's headquarters, 200 Milik Street, Carteret, New Jersey 07008, at 2:00 p.m. (local Eastern Time), on Friday, June 11, 2004, and at any adjournment or postponement thereof. Copies of this Proxy Statement and the accompanying proxy are being mailed to stockholders on or about May 7, 2004.

As used in this Proxy Statement, "Annual Meeting" refers to the meeting described above. "Company" or "Pathmark" refers to Pathmark Stores, Inc., "Common Stock" refers to the Company's common stock, par value $0.01, "Record Date" for the Annual Meeting refers to April 19, 2004, and "Fiscal 2003" refers to the Company's fiscal year ended January 31, 2004.

On July 12, 2000 (the "Petition Date"), Pathmark and its then three parent entities, PTK Holdings, Inc. ("PTK"), Supermarkets General Holdings Corporation ("Holdings") and SMG-II Holdings Corporation ("SMG-II"), filed a prepackaged plan of reorganization (the "Plan of Reorganization") in the U.S. Bankruptcy Court in Delaware (the "Court") pursuant to Chapter 11 of the United States Bankruptcy Code ("Chapter 11"). On September 7, 2000, the Court entered an order confirming the Plan of Reorganization, which became effective on September 19, 2000 (the "Plan Effective Date"), at which time the Company formally exited Chapter 11. As part of the Plan of Reorganization, all subordinated debt in the amount of approximately $1 billion was canceled and the holders of such subordinated debt received 100% of the Common Stock and warrants to purchase an additional 15% of the Common Stock (the "Warrants"). Additionally, as part of the Plan of Reorganization, (a) PTK merged with Pathmark, with Pathmark being the surviving entity; (b) immediately thereafter Holdings merged with Pathmark, with Pathmark being the surviving entity; and (c) immediately thereafter, SMG-II merged with Pathmark, with Pathmark being the surviving entity, on the Plan Effective Date.

1

VOTING INFORMATION

Stockholders Who May Vote

Only holders of record of the Common Stock at the close of business on the Record Date are entitled to vote at the Annual Meeting. On the Record Date, there were outstanding for voting purposes 30,071,192 shares of Common Stock. Each stockholder shall have one vote per share on all business of the Annual Meeting.

Quorum; Effect of Votes

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the Company's Common Stock will constitute a quorum at the Annual Meeting. Outstanding shares of Common Stock represented by stockholders who duly execute and return proxies on the accompanying proxy card will be treated as being present at the Annual Meeting for purposes of determining a quorum.

Directors are to be elected by a plurality of the votes cast at the meeting in person or by proxy by the holders of shares entitled to vote in the election. The affirmative vote of a majority of the shares present, or represented by proxy and entitled to vote at the Annual Meeting, is required to ratify the appointment of Deloitte & Touche LLP ("Deloitte") as the Company's independent public accountants, and to approve any other matters properly brought before the Annual Meeting. Shares represented by proxies which are marked "withhold authority" with respect to the election of any one or more nominees as directors, and proxies which are marked to abstain or vote against the ratification of the independent public accountants, or to deny discretionary authority on other matters, will be counted for the purpose of determining the number of shares represented by proxy at the Annual Meeting. Such proxies will thus have the same effect as if the shares represented thereby were voted against such nominee or nominees, against ratification of the independent public accountants, and against such other matters, respectively.

The Company knows of no other matters to be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the accompanying proxy intend to vote or act with respect to items in accordance with their best judgment. The affirmative vote of the holders of the majority of shares represented at the meeting and entitled to vote on the subject matter is required for approval of any such other matters which are properly brought before the meeting.

Householding of Annual Meeting Materials

The Securities and Exchange Commission (the "SEC") permits registrants to send a mailing containing a single annual report and proxy statement to any household at which two or more stockholders reside if the registrant believes they are members of the same family. The procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces the expense to the Company. The Company has not implemented this householding rule with respect to its record holders; however, a number of brokerage firms have instituted householding which may impact certain beneficial owners of Common Stock. If your family has multiple accounts by which you hold Common Stock, you may have previously received a householding information notification from your broker. Please contact your broker directly if you have any questions, require additional copies of the Proxy Statement or Annual Report, or wish to revoke your decision to household, and thereby receive multiple reports.

2

Proxy Solicitation

Proxies are being solicited by the Company on behalf of the Board of Directors for the 2004 Annual Meeting. All expenses of this solicitation, including the cost of preparing and mailing this Proxy Statement, will be borne by the Company. In addition to solicitation by use of the mails, proxies may be solicited by directors, officers and employees of the Company in person or by telephone, facsimile or other means of communication. Such directors, officers and employees will not be additionally compensated, but may be reimbursed by the Company for out-of-pocket expenses in connection with such solicitation. Arrangements will also be made with custodians, nominees and fiduciaries for forwarding of proxy solicitation materials to beneficial owners of Common Stock held of record by such custodians, nominees and fiduciaries, and the Company may reimburse such custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith.

Proxy Voting and Revocation of Proxy

The proxy solicited by this Proxy Statement, if properly signed and received by the Company in time for the Annual Meeting, will be voted in accordance with the instructions it contains. You may revoke the proxy at any time prior to its use at the Annual Meeting by filing written notice of such revocation with the Secretary of the Company at 200 Milik Street, Carteret, New Jersey 07008, by submitting a later dated and properly executed proxy, or by appearing at the Annual Meeting and giving the Secretary notice of your intention to vote in person. Representatives of Mellon Investor Services will tabulate the votes and act as inspectors of election.

YOU ARE REQUESTED TO COMPLETE AND SIGN THE ACCOMPANYING PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED FOR THAT PURPOSE. Unless you indicate otherwise in your proxy, the persons named as your proxies will vote FOR all of the nominees for director and FOR ratification of the appointment of Deloitte as the Company's independent public accountants. Although the Company does not presently know of any other business to be presented at the meeting, should any other business properly come before the meeting, the persons named as your proxies, to the extent permitted by law, will have discretion to vote and will vote in accordance with their best judgment.

3

PROPOSAL 1

ELECTION OF DIRECTORS

At this Annual Meeting, seven directors are to be elected to hold office until the next Annual Meeting of Stockholders and until their successors are elected and qualified. All director nominees are currently directors of the Company (except Mr. Bruce Hartman) and each has consented to serve as director until the expiration of his term. If any of them should decline or be unable to act as a director, the persons named in the proxy will vote for such substitute nominee or nominees, as may be designated by the Board, unless the Board reduces the number of directors accordingly. Mr. Steven L. Volla, the Non-Executive Chairman of the Board, has decided not to stand for re-election and the Board intends to elect a new Non-Executive Chairman from among the non-employee directors to serve following the expiration of Mr. Volla's term as a director.

Nominees for Board of Directors

The following are the nominees for directors of the Company, their principal occupation, background over the last five years, period of service as a director of the Company (if applicable), other directorships and age.

Nominees

Name

| | Age

| | Positions And Office

| | Director Of The

Company Since

|

|---|

| William J. Begley | | 61 | | Former Deputy Chairman at Wasserstein Perella Co., Inc., an investment bank, and former President of it's trading division. | | 2000 |

Daniel H. Fitzgerald |

|

51 |

|

Partner in Pinewood Capital Partners, a hedge fund, since January 2004. From 1996 to 2000, Mr. Fitzgerald was a Managing Director at Gleacher Natwest, an investment bank, where he was head of its High Yield Bond Department. |

|

2000 |

Eugene M. Freedman |

|

72 |

|

Limited Partner in Monitor Company Group Limited Partnership, an international business strategy and consulting firm which he joined in 1995 and which he served as a senior advisor until the end of 2003. Mr. Freedman also was a founder, Managing Director and President of Monitor Clipper Partners, a private equity firm, from its formation in 1997 until the end of 1999, and from 1999 until the end of 2002, he was a Senior Advisor of that firm. From 1991 to 1994, Mr. Freedman was the Chairman and CEO of Coopers & Lybrand LLP, U.S. and Chairman of Coopers & Lybrand, International. Mr. Freedman is currently a director of Limited Brands, Inc., e-Studio Live, Inc., e-Credit.com, Inc., Concord Coalition, JNet Enterprises, Inc. and Outcome Sciences, Inc., and he is a member of the Advisory Board of the Cross Country Group, Inc. |

|

2000 |

| | | | | | | |

4

Bruce Hartman |

|

50 |

|

Executive Vice President and Chief Financial Officer of Foot Locker, Inc., an athletic footwear and apparel retailing company, since April 2002. Senior Vice President and Chief Financial Officer of Foot Locker, Inc., prior thereto. |

|

— |

James L. Moody, Jr. |

|

72 |

|

Chairman of the Board of Hannaford Bros. Co., an operator of supermarkets, from 1984 until his retirement in 1997. Mr. Moody also served as Chief Executive Officer of Hannaford Bros. Co. from 1973 until 1992. Mr. Moody is also a director of Staples, Inc. and IDEXX Laboratories, Inc. |

|

2003 |

Eileen R. Scott(1) |

|

51 |

|

Chief Executive Officer of the Company since October 2002. Executive Vice President, Store Operations, from November 2001 until October 2002; Executive Vice President, Merchandising and Logistics, prior thereto. Ms. Scott is also a director of Dollar Tree Stores, Inc. |

|

2002 |

Frank G. Vitrano(1) |

|

48 |

|

President, Chief Financial Officer and Treasurer of the Company since October 2002; Executive Vice President, Chief Financial Officer and Treasurer from January 2000 to October 2002; Senior Vice President, Chief Financial Officer and Treasurer from September 1998 to January 2000, and Vice President and Treasurer prior thereto. |

|

2000 |

- (1)

- Ms. Scott served as the Company's Executive Vice President, Merchandising and Logistics, and Mr. Vitrano served as the Company's Executive Vice President and Chief Financial Officer on the Petition Date. The Plan of Reorganization was confirmed by the Court on September 7, 2000 and the Company emerged from Chapter 11 on the Plan Effective Date.

Board Recommendation

The Board unanimously recommends a vote FOR election of the above nominees as directors.

5

INFORMATION ABOUT OUR BOARD OF DIRECTORS

General

Our Board of Directors oversees our business and affairs and monitors the performance of management. Our directors are elected annually and hold office for a period of one year or until their successors are duly elected and qualified. Our Board of Directors has made a determination that each director and nominee for director, except for Ms. Scott and Mr. Vitrano, both of whom are executive officers of the Company, meets the definition of "independent director" as that term is defined in the Nasdaq Marketplace Rules (the "Nasdaq Rules").

There are no family relationships among any of our directors, nominees for director or executive officers. There are no material proceedings to which any of our directors, nominees or executive officers, or any of their associates, is a party adverse to the Company or any of its subsidiaries, or has a material interest adverse to the Company or any of its subsidiaries.

Board Committees and Meetings

During Fiscal 2003, our Board of Directors and the various committees held the following number of meetings: Board of Directors—10; Audit Committee—7; Compensation Committee—2; and the Governance Committee—1. Each incumbent director attended 75% or more of the aggregate Board and committee meetings of the Board (held during the period for which the director was in office) of which the director was a member, except for Mr. Volla, who attended 74% of all such meetings. The independent directors held one regularly scheduled meeting at which only independent directors were present in Fiscal 2003, and have resolved to hold such meetings at least twice each year going forward.

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Governance Committee.

Audit Committee

The Audit Committee (1) oversees financial and operational matters involving accounting, internal and independent auditing, internal controls and financial reporting; (2) reviews areas of potential significant financial risk to the Company; (3) is directly responsible for the appointment, termination, compensation and oversight of the work of the Company's independent accounting firm, and monitors and reviews the independence and performance of the Company's independent accounting firm; and (4) provides an avenue of communication among the Company's independent accountants, management, the internal auditing functions and the Board of Directors.

The members of the Audit Committee for Fiscal 2003 were Eugene M. Freedman, who served as Chairman, Daniel H. Fitzgerald and Steven L. Volla. Our Board of Directors has made a determination that each of Messrs. Freedman, Fitzgerald and Volla (i) are "independent directors" as that term is defined by the Nasdaq Rules, and (ii) satisfies the Nasdaq Rules relating to financial literacy and experience. In addition, the Board of Directors has determined, in its judgment, that each member of the Audit Committee is independent within the meaning of Section 10A of the Securities Exchange Act of 1934 (the "Exchange Act"). Our Board of Directors has also determined that Mr. Freedman is an "audit committee financial expert" within the meaning of the SEC's regulations. The Committee operates pursuant to a charter which is attached hereto as Appendix A.

Compensation Committee

The Compensation Committee approves the policies and oversees the practices of the Company with respect to the compensation made available to the Company's management so as to enable the Company to attract and retain high quality leadership in a manner consistent with the stated compensation strategy of the Company, internal equity considerations and competitive practice. The

6

Committee also administers the Company's 2000 Employee Equity Plan (the "EEP"). The Board of Directors has determined that each member of the Compensation Committee is an "independent director" as that term is defined under the Nasdaq Rules. The members of the Compensation Committee in Fiscal 2003 were William J. Begley, who served as Chairman, James L. Moody, Jr. and Steven L. Volla.

Compensation Committee Interlocks and Insider Participation

No member of the Company's Compensation Committee is a current or former officer or employee of the Company. In addition, there are no compensation committee interlocks between the Company and other entities involving the Company's executive officers and the Company's Board members who serve as executive officers of such other entities.

Governance Committee

The Governance Committee, established in 2003, makes recommendations to the Board of Directors concerning the selection, qualification and compensation of members of the Board and its committees, as well as the size and composition of the Board and its committees. The Committee also periodically reviews and reports to the Board on a periodic basis with regard to matters of corporate governance. The Board of Directors has determined that each member of the Governance Committee is an "independent director" as that term is defined under the Nasdaq Rules. The Committee operates pursuant to a Charter which is attached hereto as Appendix B. The members of the Governance Committee in Fiscal 2003 were Daniel H. Fitzgerald, who served as Chairman, Eugene M. Freedman and Steven L. Volla.

Selection of Nominees for Election to the Board

The Governance Committee considers potential nominees for Board membership suggested by its members and other Board members, as well as by members of management and stockholders. In addition, the Company, at the request of the Governance Committee, has retained an outside search firm to identify prospective Board nominees.

The Governance Committee will consider properly submitted stockholder recommendations for candidates for the Board. Stockholders may recommend an individual for consideration by submitting to the Committee the name of the individual, his or her background (including education and employment history), a statement of the particular skills and expertise that the candidate would bring to the Board, the name, address and number of shares of the Company owned by the stockholder submitting the recommendation, any relationship or interest between such stockholder and the proposed candidate, and any additional information that would be required under applicable SEC rules to be included in the Company's Proxy Statement if such proposed candidate were to be nominated as a director.

Such submissions should be addressed to the Company's Governance Committee, at the Company's headquarters address, in care of the Secretary. In order for a candidate to be considered for any annual meeting, the submission must be received by the Committee no later than the December 1st preceding such annual meeting.

The Committee will evaluate the biographical information and background material relating to each potential candidate and may seek additional information from the submitting stockholder, the potential candidate, and/or other sources. The Committee may hold interviews with selected candidates. Individuals recommended by stockholders will be considered under the same factors as individuals recommended by other sources.

7

The Governance Committee also considers other relevant factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, and the need for financial and accounting expertise. The Governance Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Governance Committee. With respect to the Company's newest directors and nominees, Mr. Moody was initially suggested as a candidate by an independent director, and Mr. Hartman was initially identified to the Governance Committee by a director search firm.

Board Compensation and Benefits

Retainer and Fees. Non-employee directors receive retainers based on an annualized rate of $50,000 a year. Non-employee directors also receive $2,500 for each Board meeting attended ($1,250 for a telephonic meeting) and $2,000 for each committee meeting attended ($1,000 for a telephonic meeting). In addition, non-employee directors also receive a retainer of $5,000 per year for serving as Chairman of either the Compensation or Governance Committee and $10,000 for serving as Chairman of the Audit Committee. The non-executive Chairman of the Board receives an additional retainer of $50,000 per year. Directors who are also employees of the Company, such as Ms. Scott and Mr. Vitrano, receive no additional compensation for service on the Board.

Options. Each member of the Board who has not been an employee of the Company or any of its subsidiaries for at least one year prior to the date of grant automatically receives a non-qualified option to purchase (i) 15,000 shares of Common Stock on the date that a non-employee director is initially elected or appointed to the Board, and (ii) 5,000 shares on the date of each Annual Meeting of Stockholders, pursuant to the 2000 Non-Employee Directors Equity Plan (the "Directors Plan"). The option price for each option granted is the fair market value of the Common Stock on the date of grant. Options are generally exercisable twelve months from the date of grant (subject to vesting and the individual serving as director for the duration of that period), vest in three equal annual installments beginning on the first anniversary of the grant date, and expire five years after the date of grant (subject to earlier termination if the director ceases to serve as a director).

Stockholders Communication With The Board of Directors

Any stockholder may send written correspondence to the Board, a committee of the Board, the non-management directors, or any individual director in his/her capacity as such.

The correspondence should be sent to the attention of the General Counsel and include the following information: the name, mailing address and telephone number of the stockholder sending the communication, the number of Company securities owned by the stockholder and, if the stockholder is not the record owner of the Company stock, the name of the record owner.

The General Counsel will forward correspondence which is not more suitably directed to management to the Board, committee or individual director(s), as appropriate. The General Counsel will log all correspondence not forwarded to the Board, committee or individuals, and will periodically provide such log to the Board.

Policy on Attendance at Annual Meeting of Stockholders

The Company does not have a stated policy, but encourages its directors to attend each annual meeting of stockholders. At last year's annual meeting of stockholders, held on June 13, 2003, all six directors were present and in attendance.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

By Directors and Executive Officers

The following table sets forth the amount of shares of Common Stock beneficially owned (as of April 19, 2004 unless otherwise indicated) by current directors of the Company and the named executive officers reported in the "Executive Compensation—Summary Compensation Table" below ("named executive officers"), and all directors and executive officers as a group. Percentage of ownership is calculated using the number of shares outstanding as of April 19, 2004, the Record Date, plus the number of shares the individual or group had the right to acquire within 60 days, as indicated in note (1) following the table.

Beneficial Owner

| | Shares of

Common Stock

Beneficially Owned(1)

| | Percentage

of Ownership

|

|---|

| Directors: | | | | |

| | Eileen R. Scott | | 389,000 | | 1.3 |

| | Frank G. Vitrano | | 397,520 | | 1.3 |

| | William J. Begley | | 20,000 | | * |

| | Daniel H. Fitzgerald | | 25,000 | | * |

| | Eugene M. Freedman | | 20,000 | | * |

| | Bruce Hartman | | — | | * |

| | James L. Moody, Jr. | | — | | * |

| | Steven L. Volla | | 20,000 | | * |

| Other Named Executive Officers: | | | | |

| | Robert J. Joyce | | 264,350 | | * |

| | Art Whitney | | 116,022 | | * |

| | Harvey M. Gutman | | 83,199 | | * |

| All Directors and Officers as group (14 persons) | | 1,541,717 | | 5.1 |

- *

- Less than 1% of outstanding shares.

- (1)

- Includes shares which directors and executive officers have, or will have, within 60 days, the current right to acquire upon exercise of options under the EEP or Directors Plan, as applicable: Ms. Scott and Mr. Vitrano, 387,500 shares each; Mr. Joyce, 263,750 shares; Mr. Whitney, 116,000 shares; Mr. Gutman, 80,215 shares; Messrs. Begley, Fitzgerald, Freedman and Volla, 20,000 shares each; and all directors and executive officers as a group, 1,516,765 shares. Also includes with respect to Mr. Vitrano, 202 shares of Common Stock which Mr. Vitrano has a right to acquire upon the exercise of 202 Warrants at an exercise price of $22.31 per share and 4,000 shares held by his wife.

By Others

Management of the Company knows of no person, except as set forth below, who is the beneficial owner of more than 5% of the Company's issued and outstanding Common Stock as of April 19, 2004, the Record Date:

Name of

Beneficial Owner

| | Shares of Common Stock

Beneficially Owned

| | Percentage of

Ownership

|

|---|

| FMR Corp. | | 6,662,559 | (1) | 21.4 |

| Citigroup, Inc. | | 3,453,729 | (2) | 11.5 |

| David J. Greene and Company, LLC | | 2,315,994 | (3) | 7.7 |

| Northeast Investors Trust | | 1,600,398 | (4) | 5.3 |

| Dimensional Fund Advisors, Inc. | | 1,557,204 | (5) | 5.2 |

- (1)

- Information regarding FMR Corp. and its affiliates ("FMR") is based on information disclosed in the amended Schedule 13G/A filed on February 17, 2004 by FMR Corp., Edward C. Johnson, III

9

and Abigail P. Johnson (the "FMR Schedule 13G"). The FMR Schedule 13G indicates that, at December 31, 2003, (i) Fidelity Management & Research Company, a wholly-owned subsidiary of FMR Corp., was the beneficial owner of 6,069,857 (including 747,828 Warrants) shares of Common Stock as a result of acting as investment advisor to various investment companies; (ii) Fidelity Management Trust Company, a bank that is wholly-owned by FMR Corp., was the beneficial owner of 588,766 (including 198,332 Warrants) shares of Common Stock as a result of its serving as investment managers of institutional account(s); (iii) Fidelity International Limited, the beneficial owner of 3,936 shares of Common Stock as a result of its providing investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors, and (iv) FMR Corp. and Edward C. Johnson, III each has sole dispositive power of over 6,662,559 shares of Common Stock and sole voting power over 527,262 shares of Common Stock. The address for FMR is 82 Devonshire Street, Boston, MA 02109.

- (2)

- Information regarding Citigroup and its affiliates is based on information disclosed in the Schedule 13G/A filed on February 11, 2004 by Citigroup, Inc., Smith Barney Fund Management LLC, Citigroup Financial Products and Citigroup Global Markets Holdings, Inc. (the "Citigroup Schedule 13G"). The Citigroup Schedule 13G indicates that, at December 31, 2003, Citigroup, Inc., in its capacity as parent holding company or control person, was the beneficial owner of the reported shares. Citigroup, Inc. has shared voting power and shared dispositive power with respect to all of the shares. The address for Citigroup, Inc. is 399 Park Avenue, New York, NY 10043.

- (3)

- Information regarding David J. Greene and Company, LLC is based on information disclosed in the Schedule 13G/A filed on February 4, 2004 by David J. Greene and Company, LLC (the "Greene Schedule 13G"). The Greene Schedule 13G indicates that at December 31, 2003, David J. Greene and Company, LLC was the beneficial owner of 2,315,994 shares of Common Stock and had shared voting power with respect to 1,422,600 shares of Common Stock and shared dispositive power with respect to all of the shares. The address for David J. Greene Company, LLC is 599 Lexington Avenue, New York, NY 10022.

- (4)

- Based on Schedule 13G/A filed with the SEC on February 10, 2003 by Northeast Investors Trust reporting sole dispositive power and sole voting power as to all shares shown. The address for Northeast Investors Trust is 50 Congress Street, Suite 1000, Boston, MA 02109.

- (5)

- Based on Schedule 13G filed with the SEC on February 16, 2004 by Dimensional Fund Advisors, Inc. reporting sole voting power and sole dispositive power as to all shares shown. The address of Dimensional Fund Advisors is 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the directors and executive officers of the Company to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock, and to furnish the Company with all such filings. Based solely on a review of these filings and other communications received from directors and executive officers, the Company believes all such filings were timely made.

Code of Ethics

The Company has adopted a Code of Business Conduct that applies to its employees, officers and directors, including the principal executive officer, the principal financial officer and the principal accounting officer. Our Code of Business Conduct is available, free of charge, upon written request to the Secretary, Pathmark Stores, Inc., 200 Milik Street, Carteret, New Jersey 07008 (telephone: (732) 499-3000)

10

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by the Company during the last three fiscal years to all individuals serving as the Company's Chief Executive Officer in Fiscal 2003 and to the four highest paid executive officers of the Company, other than the CEO, in Fiscal 2003:

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term Compensation Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)(1)

| | Securities

Underlying

Options/SARs(#)(2)

| | All Other

Compensation

($)(3)

|

|---|

Eileen R. Scott

Chief Executive Officer | | 2003

2002

2001 | | 550,000

372,115

295,000 | | 99,000

—

156,136 | | —

500,000

100,000 | | 5,683

6,981

6,112 |

Frank G. Vitrano

President and Chief Financial Officer |

|

2003

2002

2001 |

|

500,000

357,692

295,000 |

|

75,000

—

156,136 |

|

—

500,000

100,000 |

|

5,712

6,808

6,112 |

Robert J. Joyce

Executive Vice President-

Administration |

|

2003

2002

2001 |

|

266,825

260,000

255,000 |

|

24,014

—

134,965 |

|

—

80,000

100,000 |

|

5,876

6,100

6,031 |

Art Whitney

Executive Vice President-

Merchandising & Logistics |

|

2003

2002

2001 |

|

245,430

231,000

209,155 |

|

22,088

—

100,096 |

|

—

108,000

120,000 |

|

5,922

6,089

6,080 |

Harvey M. Gutman

Senior Vice President-

Retail Development |

|

2003

2002

2001 |

|

233,141

228,011

225,638 |

|

15,737

—

95,728 |

|

—

100,000

20,000 |

|

5,888

6,110

5,981 |

- (1)

- The amounts in this column represent payments made pursuant to the Company's Executive Incentive Plan (the "EIP").

- (2)

- No Stock Appreciation Rights (SARs) have been granted and none are outstanding. These are options for shares of Common Stock issued pursuant to the EEP.

- (3)

- Represents the Company's matching contributions under the Company's 401(k) Plan.

Fiscal Year Option Grants

No stock options (or stock appreciation rights) were granted to any named executive officers during Fiscal 2003.

11

Option Exercises and Year-End Option Values

The table below shows the number of exercisable and unexercisable options and the values of those that are in the money at fiscal year-end (January 31, 2004). No Stock Appreciation Rights (SARs) have been granted. No stock options were exercised by any named executive officer during Fiscal 2003. An option is in-the-money if the fair market value of the underlying securities exceeds the exercise price of the option.

FISCAL YEAR END OPTION/VALUES

| | Number of Securities Underlying Unexercised Options/SARs at FY-end(#)

| | Value of Unexercised

In-The-Money Options/SARs at FY-end($)(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| E. Scott | | 362,500 | | 487,500 | | 397,500 | | 1,192,500 |

| F. Vitrano | | 362,500 | | 487,500 | | 397,500 | | 1,192,500 |

| R. Joyce | | 238,750 | | 166,250 | | 65,600 | | 196,800 |

| A. Whitney | | 111,000 | | 149,000 | | 65,600 | | 196,800 |

| H. Gutman | | 75,215 | | 99,000 | | 65,600 | | 196,800 |

- (1)

- Values were calculated by subtracting the exercise price of the option from the closing market price of the Common Stock at January 31, 2004 ($7.93), and multiplying the result by the respective number of shares relating to in-the-money options.

Pension Plans

Pension benefits are provided to all nonunion employees (including executive officers) of the Company under the Pension Plan, a qualified defined benefit pension plan, and the Excess Benefit Plan (collectively, the "Pension Plans"). The Excess Benefit Plan provides benefits to eligible employees, including those named in the Summary Compensation Table, that cannot be paid under the qualified Pension Plan due to Internal Revenue Code limitations on the amount of compensation that may be recognized and the amount of benefits that may be paid. The table below illustrates the aggregate annual pension benefits payable under the Pension Plans.

PENSION PLAN TABLE

| | Years of Service

|

|---|

Final Average Pay

|

|---|

| | 10

| | 15

| | 20

| | 25

| | 30 or More

|

|---|

| $ | 300,000 | | $ | 40,000 | | $ | 60,000 | | $ | 80,000 | | $ | 100,000 | | $ | 120,000 |

| | 350,000 | | | 46,667 | | | 70,000 | | | 93,333 | | | 116,667 | | | 140,000 |

| | 400,000 | | | 53,333 | | | 80,000 | | | 106,667 | | | 133,333 | | | 160,000 |

| | 450,000 | | | 60,000 | | | 90,000 | | | 120,000 | | | 150,000 | | | 180,000 |

| | 500,000 | | | 66,667 | | | 100,000 | | | 133,333 | | | 166,667 | | | 200,000 |

| | 550,000 | | | 73,333 | | | 110,000 | | | 146,667 | | | 183,333 | | | 220,000 |

| | 600,000 | | | 80,000 | | | 120,000 | | | 160,000 | | | 200,000 | | | 240,000 |

| | 650,000 | | | 86,667 | | | 130,000 | | | 173,333 | | | 216,667 | | | 260,000 |

| | 700,000 | | | 93,333 | | | 140,000 | | | 186,667 | | | 233,333 | | | 280,000 |

| | 750,000 | | | 100,000 | | | 150,000 | | | 200,000 | | | 250,000 | | | 300,000 |

| | 800,000 | | | 106,667 | | | 160,000 | | | 213,334 | | | 266,668 | | | 320,000 |

| | 850,000 | | | 113,333 | | | 170,000 | | | 226,666 | | | 283,333 | | | 340,000 |

| | 900,000 | | | 120,000 | | | 180,000 | | | 240,000 | | | 300,000 | | | 360,000 |

| | 950,000 | | | 126,667 | | | 190,000 | | | 253,334 | | | 316,668 | | | 380,000 |

| | 1,000,000 | | | 133,334 | | | 200,000 | | | 266,668 | | | 333,335 | | | 400,000 |

| | 1,100,000 | | | 146,666 | | | 220,000 | | | 293,332 | | | 366,665 | | | 440,000 |

| | 1,200,000 | | | 160,000 | | | 240,000 | | | 320,000 | | | 400,000 | | | 480,000 |

| | 1,300,000 | | | 173,334 | | | 260,000 | | | 346,668 | | | 433,335 | | | 520,000 |

| | 1,400,000 | | | 186,666 | | | 280,000 | | | 373,332 | | | 466,665 | | | 560,000 |

12

The retirement benefit for individuals with 30 years of credited service is 40% of the individual's average compensation during his or her highest five compensation years in the last ten years before retirement, less one-half of the social security benefit received. The retirement benefit is reduced by 3.33% for every year of credited service less than 30. Covered compensation under the Pension Plans includes all cash compensation subject to withholding, plus amounts deferred under the Savings Plan pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended, and as to individuals identified in the Summary Compensation Table, would be the amount set forth in that table under the headings "Salary" and "Bonus". The above table shows the estimated annual benefits an individual would be entitled to receive if normal retirement at age 65 occurred in January 2004 after the indicated number of years of covered employment and if the average of the participant's covered compensation for the five years out of the last ten years of such employment yielding the highest such average equaled the amounts indicated. The estimated annual benefits are based on the assumption that the individual will receive retirement benefits in the form of a single life annuity (married participants may elect a joint survivorship option) and are before applicable deductions for social security benefits in effect as of January 2004. As of December 31, 2003, the following individuals had the number of years of credited service indicated after their names: Ms. Scott, 28.8; Mr. Vitrano, 26.2; Mr. Joyce, 30; Mr. Whitney, 28.1, and Mr. Gutman, 27.8. As described below in "Supplemental Retirement Agreements", each of the named executive officers is a party to a Supplemental Retirement Agreement with Pathmark.

Supplemental Retirement Agreements. The Company has entered into a supplemental retirement agreement with each of Ms. Scott and Messrs. Vitrano, Joyce, Whitney and Gutman (the "SRA"), which provides that said executive officer will be paid upon termination of employment after attainment of age 60 a supplemental pension benefit in such an amount as to assure him or her an annual amount of pension benefits payable under the SRA, the Pension Plans and certain other plans of the Company, including Savings Plan balances as of March 31, 1983 (A) with respect to Ms. Scott and Messrs. Vitrano, Joyce, Whitney and Gutman, equal to (i) 30% of his or her final average "Compensation" based on ten years of service with the Company and increasing 1% per year for each year of service thereafter, to a maximum of 40%, of his or her final average Compensation (as defined in the SRA) based on 20 years of service, or (ii) $250,000 (the "Cap")with respect to Ms. Scott and Messrs. Vitrano, Joyce and Whitney; and $150,000 with respect to Mr. Gutman, in each case whichever is less;provided, however, that with respect to Ms. Scott and Mr. Vitrano, the Cap will be increased to $480,000 and $440,000, respectively, on the earliest to occur of (a) January 1, 2007; (b) death of the executive; (c) Disability of the executive (as defined in the SRA), or (d) a Change in Control (as defined in the EEP). "Compensation" includes base salary and bonus payments, but excludes Company matching contributions under the Savings Plan. If the executive leaves the Company prior to completing 20 years of service (other than for disability), the supplemental benefit would be reduced proportionately. Should the executive die, the surviving spouse would be entitled to a benefit equal to two-thirds of the benefit to which the executive would have been entitled, provided the executive has attained at least ten years of service with the Company.

Employment Agreements

As of October 16, 2002, Pathmark entered into employment agreements with each of Ms. Scott, as Chief Executive Officer, and Mr. Vitrano, as President and CFO. Pathmark has also entered into employment agreements with each of Messrs. Whitney, Joyce and Gutman. Each employment agreement has a two-year term which renews automatically each year for an additional one year unless proper notice is provided by either party to the other of such party's desire to terminate the agreement. Each employment agreement provides for an annual base salary that will be reviewed at the discretion of the Compensation Committee, but may not be reduced.

Each of the employment agreements also provides that the executive shall be entitled to participate in the EIP and shall be provided the opportunity to participate in pension and welfare

13

plans, programs and arrangements that are generally made available to executives of Pathmark, or as may be deemed appropriate by the Compensation Committee.

In the event of the Involuntary Termination of any of the five above named executives, that executive is entitled to receive his or her base salary and continued coverage under health and insurance plans for a period of two years from the date of such termination or resignation.

The employment agreements contain agreements by the executives not to compete with Pathmark as long as they are receiving payments under the employment agreement.

As used in the employment agreements, "Involuntary Termination" means termination of the executive's employment by Pathmark other than for Cause or termination by the executive for Good Reason. "Cause" is defined generally as a felony conviction, perpetration by the executive of a material dishonest act or fraud against Pathmark, material breach or willful and repeated failure to perform material duties of employment. "Good Reason" is defined generally as demotion, reduction in compensation, unapproved relocation, material breach of the employment agreement by Pathmark, and failure to extend the term of the employment agreement.

14

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION(1)

- (1)

- This Report is not deemed filed with the SEC and shall not be determined to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, by any general incorporation language in any such filing, except to the extent that the Company specifically incorporates the Report by reference in any such filing.

Overview and Philosophy

The Compensation Committee is composed entirely of "independent directors" as that term is defined under the Nasdaq Marketplace Rules, and is responsible for developing and making recommendations to the Board with respect to the Company's executive compensation policies. The Compensation Committee determines on an annual basis the compensation to be paid to the executive officers of the Company, recommends to the Board of Directors the compensation to be paid to the Chief Executive Officer, and administers the Executive Incentive Plan (the "EIP") and the Amended and Restated 2000 Employee Equity Plan ("EEP"). The Compensation Committee is comprised solely of members who are "outside directors"under Section 162(m) of the Internal Revenue Code.

The objectives of the Company's executive compensation program are to:

- •

- Provide compensation that will attract and retain superior talent and reward individual performance.

- •

- Support the achievement of the Company's strategic business plan and short and long-term financial and operating goals which, in turn, will maximize stockholder value.

- •

- Align the executive officers' interest with the interests of the Company by placing a portion of pay at risk, with payout dependent upon corporate performance.

The executive compensation program is designed to provide an overall level of compensation opportunity that is above the median level of the market contingent on achieving superior levels of performance. Competitive pay levels are determined by reviewing compensation levels of food retail and supermarket industries, as well as with a broader group of retail companies of comparable size and complexity. The Compensation Committee uses survey data from several compensation consulting firms to determine these pay levels.

Executive Officer Compensation For Fiscal 2003

The Company's executive officer compensation program is comprised of base salary, annual cash incentive compensation, long-term incentive compensation in the form of stock options, and various benefits, including medical and pension plans generally available to non-union full-time associates of the Company.

Base Salary

Salary levels for executive officers are determined by:

- •

- evaluating each position's responsibilities and accountabilities, as compared to other positions within the Company, and

- •

- comparing to salaries at companies in the food retail and supermarket industries and at other comparable retail companies as previously described.

Each year, a formal performance review is conducted and salary increases are granted to reward performance under the Company's "Pay for Performance" program. Increases to salary are influenced by 1) individual performance against goals; 2) an executive's position within his/her established salary range, and 3) budgetary guidelines.

These salary increase guidelines are set each year, taking into account published salary planning information from compensation consultants, economic data available from the Bureau of Labor Statistics, surveys of selected food retail and supermarket chains, competitive position against the market, and expected Company financial performance.

Annual Incentive Compensation

The EIP is the Company's annual incentive program for executive officers. The purpose of the plan is to provide a direct financial incentive in the form of an annual cash award to executives who

15

achieve pre-established individual performance goals and/or the Company's financial goals. Goals for Company and business unit performance are set near the beginning of each fiscal year and, with respect to the fiscal year ended January 31, 2004 ("Fiscal 2003"), were measured based on Earnings Before Interest, Taxes, Depreciation, Amortization and LIFO charges, same-store sales targets, and personal and team goals.

Target incentive awards for executives in Fiscal 2003 ranged from 35% to 120% of base salary and were set at a competitive level as previously discussed and depend on the level of each position based on an evaluation of its responsibilities and accountabilities and its contribution to Company results. For Fiscal 2003, 80% of an eligible executive's maximum bonus opportunity was allocated to the Company's performance against predetermined financial goals, and 20% was allocated to the executive's achievement of predetermined personal and team goals. Performance against the goals was measured after the end of the year and the amount of the executive's bonus for that year was determined on the basis of such measured performance as a percentage of the maximum potential bonus. Based on performance for Fiscal 2003, the Compensation Committee approved bonus payments under the EIP to eligible executives totaling approximately 15% of the maximum bonus opportunity.

Stock Option Program

Long-term incentives are intended to closely align stockholder and executive interests through the achievement of the Company's strategic business plan. Currently, long-term incentives are granted in the form of stock options under the EEP. Under the plan, the Committee may award stock options, stock appreciation rights, stock awards, restricted stock units, and performance units which have terms not to exceed ten years and are granted at no less than the fair market value of Pathmark common stock on the date of the award grant. After reviewing the level of stock option grants in 2002 to executive officers, the Committee determined not to grant any stock options to the Chief Executive Officer and other executive officers in Fiscal 2003.

Chief Executive Officer Compensation

The fiscal compensation for Ms. Scott is set forth in her employment agreement, subject to review by the Board of Directors. The compensation elements under Ms. Scott's agreement include base salary and bonus. In October 2002, Ms. Scott became the Chief Executive Officer at a base salary of $550,000 per annum. During 2003, the Compensation Committee reviewed existing publicly available compensation data for both supermarket and non-supermarket companies and concluded, based on said data and Ms. Scott's recent promotion to CEO, not to adjust her base salary for Fiscal 2003. Ms. Scott's target incentive award in Fiscal 2003 was set at 120% of base salary and based upon performance against the predetermined goals, she received a bonus totaling approximately 15% of her maximum bonus opportunity.

Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code disallows a deduction for federal income tax purposes by public corporations for compensation paid in excess of $1,000,000 in any year to a "covered employee" except under certain circumstances, including the attainment of objective "performance-based" goals. "Covered employees" are defined as the CEO and the other four most highly compensated executive officers of a company. It is the Company's policy to qualify all compensation paid to its top executives, in a manner consistent with the Company's compensation policies, for deductibility under Section 162(m) in order to maximize the Company's income tax deductions. However, this policy does not rule out the possibility that compensation may be approved that may not qualify for the compensation deduction if, in light of all applicable circumstances, the Committee determines it would be in the best interests of the Company for such compensation to be paid.

THE COMPENSATION COMMITTEE

William J. Begley (Chairman)

James L. Moody, Jr.

Steven L. Volla

16

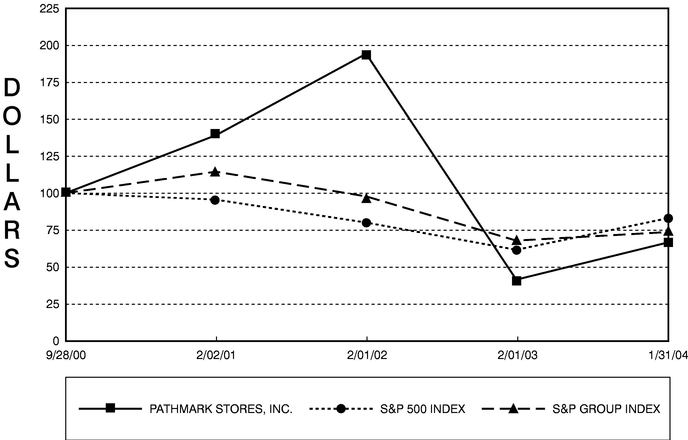

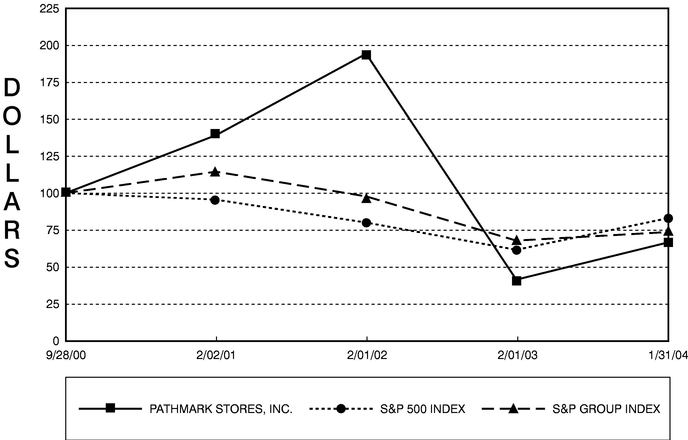

PERFORMANCE GRAPH(1)

COMPARE CUMULATIVE TOTAL RETURN

AMONG PATHMARK STORES, INC.,

S&P 500 INDEX AND S&P GROUP INDEX

ASSUMES $100 INVESTED ON SEPT. 28, 2000

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING JAN. 31, 2004

| | 9/28/00

| | 2/02/01

| | 2/01/02

| | 2/01/03

| | 1/31/04

|

|---|

| Pathmark | | 100.00 | | 139.26 | | 194.67 | | 41.38 | | 66.43 |

| S&P Group Index | | 100.00 | | 114.59 | | 97.77 | | 67.74 | | 73.64 |

| S&P 500 Index | | 100.00 | | 95.45 | | 80.04 | | 61.61 | | 82.91 |

The above graph compares the cumulative total stockholder return on Common Stock (based on its market price) since September 28, 2000, the date Pathmark's common shares began trading on the Nasdaq National Market, through January 30, 2004, with the Standard & Poor's 500 Stock Index ("S&P 500") and the Standard & Poor's Retail (Food Chains) Index for the same period. The graph assumes: 1) $100 invested on September 28, 2000, and 2) that all dividends have been reinvested.

Stock price performance shown on the graph is not necessarily indicative of future price performance and in no way reflects the Company's forecast of future financial performance.

- (1)

- This performance graph is not deemed filed with the SEC and shall not be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, by any general incorporation language in any such filing, except to the extent that the Company specifically incorporates the performance graph by reference in any such filing.

17

Equity Compensation Plans

The following table summarizes information, as of January 31, 2004, relating to equity compensation plans of the Company pursuant to which grants of options, restricted stock, restricted stock units or other rights to acquire shares may be granted from time to time.

EQUITY COMPENSATION PLAN INFORMATION

Plan Category

| | Number of Securities

to be Issued Upon Exercise

of Outstanding Options,

Warrants and Rights

(a)

| | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b)

| | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding Securities

Reflected in Column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders(1) | | 5,548,424 | | $ | 11.55 | | 1,226,959 |

| Equity compensation plans not approved by security holders | | N/A | | | N/A | | N/A |

- (1)

- These plans are the Company's 2000 Equity Plan for Non-Employee Directors and the 2000 Employee Equity Plan.

18

PROPOSAL 2:

RATIFICATION OF APPOINTMENT

OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors was responsible for selecting the Company's independent public accountants in prior fiscal years. As a result of recent legislation, the Audit Committee is now solely responsible for selecting the Company's independent public accountants.

The Audit Committee has selected Deloitte as the Company's independent public accountants for fiscal year 2004. This selection is being submitted to the stockholders for ratification at the Annual Meeting. If the stockholders do not ratify this appointment, such appointment will be reconsidered by the Audit Committee. The proxy will be voted as specified, and if no specification is made, the proxy will be cast "For" this proposal.

A representative of Deloitte will be present at the Annual Meeting and will be afforded an opportunity to make a statement and to respond to questions.

Board Recommendation

The Board of Directors unanimously recommends a voteFOR the approval of Deloitte as our independent public accountants for 2004.

Audit Firm Fee Summary

During Fiscal 2003 and the fiscal year ended February 1, 2003 ("Fiscal 2002"), the Company's independent public accountants, Deloitte, provided services to the Company in the following categories and amounts:

| | Fiscal 2003

| | Fiscal 2002

|

|---|

| Audit | | $ | 909,000 | | $ | 674,000 |

| Audit Related | | | 86,250 | | | 103,000 |

| Tax Fees | | | 206,900 | | | 139,000 |

| All Other Fees | | | 11,500 | | | 10,000 |

| | |

| |

|

| | | $ | 1,213,650 | | $ | 926,000 |

| | |

| |

|

Audit Fees. This category includes the aggregate fees billed for professional services rendered for the audits of the Company's consolidated financial statements for Fiscal 2003 and Fiscal 2002, for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q during Fiscal 2003 and Fiscal 2002, and for services that are normally provided by the independent public accountants in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees. This category includes the aggregate fees billed in each of the last two fiscal years for assurance and related services by the independent public accountants that are reasonably related to the performance of the audits or reviews of the financial statements, and are not reported above under "Audit Fees", and generally consist of fees for accounting consultation and audits of employee benefit plans.

Tax Fees. This category includes the aggregate fees billed in each of the last two fiscal years for professional services rendered by the independent public accountants for tax compliance, tax planning, tax advice and preparation of tax forms.

19

All Other Fees. This category includes the aggregate fees billed in each of the last two fiscal years for products and services provided by the independent public accountants that are not reported above under "Audit Fees","Audit-Related Fees", or "Tax Fees". In Fiscal 2003 and Fiscal 2002, these fees related to Deloitte's tax software annual service used by the Company in the preparation of its federal and state income tax returns and, in Fiscal 2003, to the Company's use of Deloitte's accounting research tool.

The Audit Committee has considered the compatibility of the non-audit services performed by and fees paid to Deloitte in fiscal 2003, and determined that such services and fees were compatible with the independence of the public accountants.

Policy for Approval of Audit and Non-Audit Services

All of the services performed by the independent auditor in 2003 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee in 2003, except as described above underAll Other Fees, which were approved pursuant to the SEC'sde minimis exception for permitted non-audit services. This policy describes the permitted audit, audit-related, tax and other services that the independent auditor may perform. The policy also requires that each year a description of the services expected to be performed by the independent auditor during the following fiscal year in each of the specified categories be presented to the Audit Committee for pre-approval. Any pre-approval is detailed as to the particular service or category of services and generally is subject to a budget.

Any requests for audit, audit-related, tax and other services not contemplated by those pre-approved services must be submitted to the Audit Committee for specific pre-approval. Normally, pre-approval is considered at regularly scheduled meetings. However, the authority to grant specific pre-approval between meetings, as necessary, has been delegated to the Chairman of the Audit Committee. The Chairman must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval. Any proposed services exceeding the pre-approval fee levels will require separate pre-approval by the Audit Committee.

20

AUDIT COMMITTEE REPORT(1)

The Audit Committee of the Board is responsible for providing independent, objective oversight of the Company's financial and operational matters involving accounting, internal and independent auditing, internal controls and financial reporting. The Audit Committee is composed of three directors, each of whom is independent as defined by the Nasdaq listing standards. The Audit Committee operates under a written charter approved by the Board of Directors, a copy of which is included in this Proxy Statement as Appendix A.

Management is responsible for the Company's internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of the Company's consolidated financial statements, in accordance with auditing standards generally accepted in the United States of America, and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee, in the fiscal year ended January 31, 2004, reviewed the overall audit scope, plans and results of the audit engagement, and met with management and the independent accountants to review and discuss the audited consolidated financial statements for the year ended January 31, 2004. Prior to the filing of each requisite quarterly report with the Securities and Exchange Commission ("SEC"), the Audit Committee reviewed any significant issues arising out of the independent accountants quarterly review. The Audit Committee also discussed with the Company's senior management and independent accountants the process used for certification by the Company's Chief Executive Officer and Chief Financial Officer, which is required by the SEC and the Sarbanes-Oxley Act of 2002 for certain of the Company's filings. The Audit Committee also discussed and reviewed with the independent accountants all communications required by generally accepted auditing standards, including the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee also received written disclosures from the independent accountants required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee discussed with the independent accountants any relationships that may impact their objectivity and independence, and satisfied itself as to the independent accountants' independence. The Audit Committee also discussed with management, as well as the independent accountants and internal auditors, the quality and adequacy of the Company's internal controls.

Based upon the Audit Committee's discussions with management and the independent accountants and the Audit Committee's review of the representations of management and the independent accountants, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended January 31, 2004 for filing with the SEC.

THE AUDIT COMMITTEE

Eugene M. Freedman (Chairman)

Daniel H. Fitzgerald

Steven L. Volla

- (1)

- This Report is not deemed filed with the SEC and shall not be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, by any general incorporation language in any such filing, except to the extent that the Company specifically incorporates the Report by reference in any such filing.

21

ANNUAL REPORT

A copy of the 2003 Annual Report to Stockholders on Form 10-K, which includes the financial statements (but excludes Form 10-K exhibits) is being mailed to each stockholder of record as of April 19, 2004, together with the proxy materials.

DEADLINE FOR STOCKHOLDER PROPOSALS

To be considered for inclusion in next year's Proxy Statement, any proposal of an eligible stockholder must be in writing and received by the Secretary of the Company at its principal executive offices located at 200 Milik Street, Carteret, New Jersey 07008 on or before January 10, 2005.

For any proposal that is not submitted for inclusion in next year's Proxy Statement, but is instead sought to be presented directly at the 2005 annual meeting, under our Bylaws, certain procedures are provided which a stockholder must follow to nominate persons for election as Directors or to introduce an item of business at an annual meeting of stockholders. These procedures provide that recommendations for Director nominees, and/or an item of business to be introduced at an annual meeting of stockholders, must be submitted in writing to the Secretary of the Company at 200 Milik Street, Carteret, New Jersey 07008. A notice of intention to propose an item of business must set forth as to each proposal (i) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting, (ii) the proposing stockholder's name and address, (iii) the class and number of shares of the Company's stock which are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in such business. A notice of recommendation to nominate a candidate for director must include certain information required by the Bylaws of the Company regarding the potential nominee and contain the potential nominee's consent to serve if elected. A notice of recommendation for nomination or proposed item of business at the Company's 2005 Annual Meeting must be received by the Company:

- •

- no earlier than 90 but no later than 60 days in advance of the one year anniversary of the date of this year's Annual Meeting, if the 2005 Annual Meeting is to be held within thirty days of the one year anniversary of the date of this year's Annual Meeting; or

- •

- by the tenth day following the date of public disclosure of the meeting in all other cases.

OTHER BUSINESS

As of the date of this Proxy Statement, neither the Board nor Management knows of any other matters to be brought before the stockholders at this Annual Meeting. If any other matters properly come before the meeting, action my be taken thereon pursuant to the proxies in the form enclosed, which confer discretionary authority on the persons named therein or their substitute with respect to such matters.

| | | By Order of the Board of Directors, |

| May 5, 2004 | | |

| | | Marc A. Strassler

Senior Vice President

Secretary and General Counsel |

22

APPENDIX A

PATHMARK STORES, INC.

AUDIT COMMITTEE CHARTER

POLICY

- •

- This Audit Committee Charter (the "Charter") has been adopted by the Board of Directors (the "Board") of Pathmark Stores, Inc. (the "Company"). The Audit Committee (the "Committee") shall review and reassess this Charter annually and recommend any proposed changes to the Board for approval.

- •

- The Committee assists the Board in fulfilling its responsibility for oversight of (1) the quality and integrity of the accounting, auditing, internal control and financial reporting practices of the Company, (2) the Company's compliance with legal and regulatory requirements, (3) the independent auditors' qualifications and independence, (4) the performance of the Company's internal audit function and independent auditors and (5) related-party transactions.

ORGANIZATION AND INDEPENDENCE

- •

- The membership of the Committee shall consist of as many members as the Board shall determine, but in no event fewer than three members. The members of the Committee shall be appointed annually by the Board, upon the recommendation of the Governance Committee. The members of the Committee may be removed or replaced, and any vacancies on the Committee shall be filled, by the Board upon the recommendation of the Governance Committee.

- •

- Each member of the Committee shall meet all applicable independence, financial literacy and other requirements of law and the Nasdaq Marketplace Rules. At least one member of the Committee must meet both the applicable Securities and Exchange Commission ("SEC") and Nasdaq definition of financial expert. The members should not have participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years.

- •

- The Company is responsible for providing the Committee with educational resources relating to accounting principles and procedures, current accounting topics pertinent to the Company and other materials as requested by the Committee. The Company shall assist the Committee in maintaining appropriate financial literacy.

OPERATIONS

- •

- One member of the Committee shall be appointed as chairman. The chairman shall be appointed by the Board, upon the recommendation of the Governance Committee. The chairman shall be responsible for leadership of the Committee, presiding over meetings and making regular reports to the Board, and shall submit to the Board the minutes of the Committee's meetings. The chairman will also maintain regular contact with the Company's Chief Executive Officer, Chief Financial Officer and Controller and the independent and internal auditors. The chairman shall also have the authority to act on behalf of the Committee between meetings.

- •

- The Committee shall maintain free and open communication with the independent auditors, the internal auditors and Company management. In discharging its oversight role, the Committee is empowered to investigate any matter relating to the Company's accounting, auditing, internal control or financial reporting practices brought to its attention, with full access to all Company books, records, facilities and personnel. The Committee may retain outside counsel, auditors or other advisors.

A-1

- •

- The chairman of the Committee, in consultation with the Committee members, shall determine the schedule and frequency of the Committee meetings; provided that the Committee shall meet at least four times per year. The Committee shall meet separately, periodically, with management, the general counsel, the internal auditors and the independent auditors. The Committee shall also meet separately with the independent auditors at every meeting of the Committee at which the independent auditors are present.

- •

- The chairman shall develop and set the Committee's agenda, in consultation with other members of the Committee, the Board and management. The agenda and information concerning the business to be conducted at each Committee meeting shall, to the extent practical, be communicated to the members of the Committee sufficiently in advance of each meeting to permit meaningful review.

RESPONSIBILITIES

- •

- The Committee shall be directly responsible for the appointment, retention, compensation and oversight of the work of the independent auditors engaged (including resolution of disagreements between management and the auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The independent auditors must report directly to the Committee.

- •

- The Committee shall have sole authority to pre-approve any audit and non-audit services to be provided by the independent auditors. The Committee shall review with the lead audit partner whether any of the audit team members receive any discretionary compensation from the audit firm with respect to non-audit services performed by the independent auditors.

- •

- The Committee shall obtain and review with the lead audit partner and a more senior representative of the independent auditors, annually or more frequently as the Committee considers appropriate, a report by the independent auditors describing: the independent auditors' internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the independent auditors, or by any inquiry, review or investigation by governmental, professional or other regulatory authorities, within the preceding five years, respecting independent audits carried out by the independent auditors, and any steps taken to deal with these issues. The Committee shall assure the regular rotation of the lead audit partner.

- •

- The Committee shall obtain annually from the independent auditors a formal written statement describing all relationships between the auditors and the Company, consistent with Independence Standards Board Standard No.1. The Committee shall actively engage in a dialogue with the independent auditors with respect to any relationships that may impact the objectivity and independence of the auditors and shall take, or recommend that the Board take appropriate actions to oversee and satisfy itself as to the auditors' independence.

- •

- The Committee shall review the experience, qualifications and performance of the senior members of the independent auditors' team.

- •

- The Committee shall review the annual audited financial statements and quarterly financial statements with management and the independent auditors, including the Company's disclosures under "Management's Discussion and Analysis of Financial Condition and Results of Operations," before the filing of the Company's Form 10-K and Form 10-Q.

- •

- The Committee shall review with management earnings press releases before they are issued. The Committee shall review generally with management the nature of the financial information and earnings guidance provided to analysts and rating agencies

A-2

- •

- The Committee shall review with the independent auditors: (a) all critical accounting policies and practices to be used by the Company in preparing its financial statements, (b) all alternative treatments of financial information within GAAP that have been discussed with management, ramifications of use of these alternative disclosures and treatments, and the treatment preferred by the independent auditors, and (c) other material written communications between the independent auditors and management, such as any management letter or schedule of unadjusted differences. In addition, the Committee shall review with the independent auditors any audit problems or difficulties, management's response and the resolution thereof.

- •

- The Committee shall issue annually a report to be included in the Company's proxy statement as required by the rules of the SEC, if applicable.

- •

- The Committee shall have sole authority to preapprove the hiring of any employee or former employee of the independent auditors who was a member of the Company's audit team during the preceding three fiscal years. In addition, the Committee shall have sole authority to preapprove the hiring of any employee or former employee of the independent auditor (within the preceding three fiscal years) for senior positions within the Company, regardless of whether that person was a member of the Company's audit team.

- •

- The Committee shall review and approve policies and procedures with respect to related-party transactions for potential conflict of interest situations on an ongoing basis. The Committee shall review and approve in advance all such related-party transactions.

- •

- The Committee shall oversee internal audit activities, including discussing with management and the internal auditors the internal audit function's organization, objectivity, responsibilities, plans, results, budget and staffing. In addition, management shall consult with the Committee on the appointment, replacement, reassignment or dismissal of the principal internal auditor.

- •