UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-01236

Deutsche Market Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 8/31 |

| Date of reporting period: | 2/28/2015 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

February 28, 2015

Semiannual Report

to Shareholders

Deutsche Strategic Equity Long/Short Fund

Contents

3 Letter to Shareholders 4 Performance Summary 7 Portfolio Management Team 8 Portfolio Summary 10 Investment Portfolio 26 Statement of Assets and Liabilities 28 Statement of Operations 30 Statement of Changes in Net Assets 31 Financial Highlights 35 Notes to Financial Statements 49 Information About Your Fund's Expenses 51 Advisory Agreement Board Considerations and Fee Evaluation 54 Account Management Resources 56 Privacy Statement |

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the fund's objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the fund. Please read the prospectus carefully before you invest.

Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Emerging markets tend to be more volatile than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Since the fund will typically hold both long and short positions, the fund’s results will suffer both when there is a general market advance and the fund holds significant short positions, or when there is a general market decline and the fund holds significant long positions. Investment strategies employed by the fund’s investment management teams are intended to be complementary, but may not be. The interplay of the various strategies may result in the fund holding a significant amount of certain types of securities and could increase the fund’s portfolio turnover rates which may result in higher transactional costs and/or capital gains or losses. Some money managers will have a greater degree of correlation with each other and with the market than others. The degree of correlation will vary as a result of market conditions and other factors. This fund is non-diversified and can take larger positions in fewer issues, increasing its potential risk. The fund may lend securities to approved institutions. Short sales — which involve selling borrowed securities in anticipation of a price decline, then returning an equal number of the securities at some point in the future — could magnify losses and increase volatility. Stocks may decline in value. See the prospectus for details.

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its subsidiaries, including the Advisor and DeAWM Distributors, Inc.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Dear Shareholder:

From an economic standpoint, the view seems brighter than it has been for several years. Multiple signs suggest sustainable growth, at least for the near term. Our economists at Deutsche Asset & Wealth Management expect the global economy to accelerate in 2015, led by the United States and China.

That is heartening news. Yet one cannot ignore the complexities of an increasingly interconnected global economy. Low oil prices, a stronger employment picture and consumer spending bode well for the domestic economy, at least in the short term. Yet sluggish growth abroad, falling commodity prices and the strong U.S dollar may be headwinds to global growth and American exports. And, as we have seen time and again, any number of factors can unexpectedly shift the markets and the overall outlook.

The take-away message amidst these mixed signals: Be prepared to stick to your long-term plan, with a portfolio that can help weather short-term fluctuations. When in doubt, or if your individual situation or objectives change, talk with a trusted financial professional before taking action.

For timely information about economic developments and your Deutsche fund investment, we hope you will visit us at deutschefunds.com. There you will find the views of our Chief Investment Officer and economists. It is a resource we are proud to offer to help keep you up-to-date and make informed decisions.

As always, we thank you for your continued investment and the opportunity to put our capabilities to work for you.

Best regards,

Brian Binder

President, Deutsche Funds

| Class A | 6-Month‡ | Life of Fund* |

Average Annual Total Returns as of 2/28/15 | ||

| Unadjusted for Sales Charge | –1.34% | –0.55% |

| Adjusted for the Maximum Sales Charge (max 5.75% load) | –7.02% | –6.27% |

HFRX Equity Hedge Index† | 1.66% | 3.29% |

Average Annual Total Returns as of 12/31/14 (most recent calendar quarter end) | ||

| Unadjusted for Sales Charge | –3.57% | |

| Adjusted for the Maximum Sales Charge (max 5.75% load) | –9.12% | |

HFRX Equity Hedge Index† | 1.67% | |

| Class C | 6-Month‡ | Life of Fund* |

Average Annual Total Returns as of 2/28/15 | ||

| Unadjusted for Sales Charge | –1.65% | –1.16% |

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) | –2.62% | –2.14% |

HFRX Equity Hedge Index† | 1.66% | 3.29% |

Average Annual Total Returns as of 12/31/14 (most recent calendar quarter end) | ||

| Unadjusted for Sales Charge | –4.07% | |

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) | –5.03% | |

HFRX Equity Hedge Index† | 1.67% | |

| Class S | 6-Month‡ | Life of Fund* |

Average Annual Total Returns as of 2/28/15 | ||

| No Sales Charge | –1.25% | –0.55% |

HFRX Equity Hedge Index† | 1.66% | 3.29% |

Average Annual Total Returns as of 12/31/14 (most recent calendar quarter end) | ||

| No Sales Charge | –3.67% | |

HFRX Equity Hedge Index† | 1.67% | |

| Institutional Class | 6-Month‡ | Life of Fund* |

Average Annual Total Returns as of 2/28/15 | ||

| No Sales Charge | –1.24% | –0.45% |

HFRX Equity Hedge Index† | 1.66% | 3.29% |

Average Annual Total Returns as of 12/31/14 (most recent calendar quarter end) | ||

| No Sales Charge | –3.47% | |

HFRX Equity Hedge Index† | 1.67% | |

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit deutschefunds.com for the Fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated December 1, 2014 are 3.26%, 4.02%, 3.16% and 2.97% for Class A, Class C, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

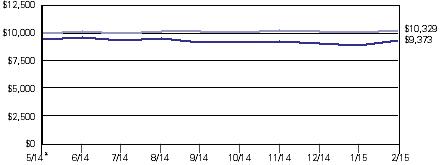

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge) |

|

|

The Fund's growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

* The Fund commenced operations on May 15, 2014. The performance shown for the index is for the time period of May 31, 2014 through February 28, 2015 (through December 31, 2014 for the most recent calendar quarter end returns), which is based on the performance period of the life of the Fund.

† The HFRX Equity Hedge Index tracks the performance of investing strategies that maintain both long and short positions primarily in equity and equity-derivative securities.

‡ Total returns shown for periods less than one year are not annualized.

| Class A | Class C | Class S | Institutional Class | |||||||||||||

| Net Asset Value | ||||||||||||||||

| 2/28/15 | $ | 9.88 | $ | 9.82 | $ | 9.88 | $ | 9.89 | ||||||||

| 8/31/14 | $ | 10.08 | $ | 10.05 | $ | 10.07 | $ | 10.08 | ||||||||

Distribution Information as of 2/28/15 | ||||||||||||||||

| Income Dividends, Six Months | $ | .04 | $ | .04 | $ | .04 | $ | .04 | ||||||||

| Capital Gain Distributions, Six Months | $ | .02 | $ | .02 | $ | .02 | $ | .02 | ||||||||

Deutsche Investment Management Americas Inc.

Mihir Meswani, Director, DIMA

Portfolio Manager of the fund. Began managing the fund in 2014.

— Joined Deutsche Asset & Wealth Management in 2014 with 21 years of industry experience in asset allocation and portfolio management of multi-asset class portfolios.

— Previously, he worked at Mount Yale Capital Group where he was a portfolio manager for the group’s alternative mutual funds. Prior to that, he was Chief Investment Strategist at Sandalwood Securities, where he was a member of the Investment Committee with direct responsibility for the portfolio management of Sandalwood’s fund of hedge funds and alternative mutual fund portfolio.

— Previously, he held a position as Director of Public Investments for the Robert Wood Johnson Foundation where he managed assets across equity and fixed income, hedge funds, credit and real assets. He also worked for Bank of America and JP Morgan in similar roles.

— BS in Finance and a BA in Economics, Rutgers University.

Chris Umscheid, Director, DIMA

Portfolio Manager of the fund. Began managing the fund in 2014.

— Global Head of Hedge Fund Research and Due Diligence and Member of the Global Hedge Fund Investment Committee: New York.

— Joined Deutsche Asset & Wealth Management in 2007 with 13 years of industry experience; previously, served as a Portfolio Manager for Fund of Hedge Funds at Wafra Investment Advisory Group, a Portfolio Manager and Director of Research at Yankee Advisers, LLC and a Senior Analyst at Phoenix Advisers Inc. Began career as a Financial Analyst at Goldman Sachs.

— AB in Economics, Dartmouth College.

Subadvisors

Atlantic Investment Management, Inc.

Alexander Roepers. President of Atlantic Investment Management, Inc.

Portfolio Manager of a sleeve of the fund. Began managing the fund in 2014.

— Founded Atlantic Investment Management, Inc. in 1988.

Chilton Investment Company, LLC

Richard L. Chilton, Jr. Founder, Chairman, Chief Executive Officer and Chief Investment Officer of Chilton Investment Company, LLC.

Portfolio Manager of a sleeve of the fund. Began managing the fund in 2014.

— Founded Chilton Investment Company, LLC in 1992.

Lazard Asset Management LLC

Jean-Daniel Malan. Director at Lazard Asset Management LLC.

Portfolio Manager of a sleeve of the fund. Began managing the fund in 2014.

— Joined Lazard Asset Management LLC in 1998 as an Equity Analyst and then worked as a Portfolio Manager for European Equity, and rejoined Lazard in 2008 after working as a Hedge Fund Manager for two years at BlueCrest Capital Management.

Omega Advisors, Inc.

Leon G. Cooperman. Chairman and Chief Executive Officer, Omega Advisors, Inc.

Portfolio Manager of a sleeve of the fund. Began managing the fund in 2014.

— Founded Omega Advisors, Inc. in 1992.

Ten Largest Long Common Stock Holdings at February 28, 2015 (15.3% of Net Assets) | |

1. Actavis PLC Manufactures specialty pharmaceuticals | 2.5% |

2. Owens-Illinois, Inc. Manufactures plastic and glass packing products | 2.0% |

3. W.R. Grace & Co. Supplier of specialty chemical and container products | 1.9% |

4. Triumph Group, Inc. Designs, engineers, manufactures, repairs, overhauls and distributes aircraft components | 1.7% |

5. Harman International Industries, Inc. Designs, manufactures and markets audio and electronic systems | 1.5% |

6. Becton, Dickinson & Co. Provider of medical supplies and devices | 1.2% |

7. Medtronic PLC Develops therapeutic and diagnostic medical products | 1.2% |

8. Union Pacific Corp. Operates as a rail transportation provider | 1.1% |

9. FedEx Corp. Provider of express transportation, package delivery and logistics solutions | 1.1% |

10. Atlas Energy LP Produces, transports and processes natural gas and oil | 1.1% |

Ten Largest Common Stock Sold Short Equity Holdings at February 28, 2015 (3.3% of Net Assets) | |

1. Getinge AB Develops, manufactures and sells equipment and systems for sterilization and disinfection | 0.4% |

2. L'Oreal SA Manufactures, markets and distributes health and beauty aids | 0.4% |

3. LVMH Moet Hennessy Louis Vuitton SA Diversified luxury goods group | 0.4% |

4. Kirin Holdings Co., Ltd. Produces beer, soft drinks, food products, whisky and pharmaceuticals | 0.3% |

5. Sprouts Farmers Market, Inc. Operates a chain of retail grocery stores | 0.3% |

6. International Flavors & Fragrances, Inc. Creates, manufactures and supplies flavors and fragrances | 0.3% |

7. Sanofi Manufactures prescription pharmaceuticals | 0.3% |

8. LIXIL Group Corp. Producer of aluminum | 0.3% |

9. NetScout Systems, Inc. Designs, develops, manufactures, markets and supports computer networks and business software applications | 0.3% |

10. Electrolux AB Manufactures home appliances and appliances for professional use | 0.3% |

Portfolio holdings and characteristics are subject to change. | |

| Shares | Value ($) | |||||||

| Long Positions 104.3% | ||||||||

| Common Stocks 97.2% | ||||||||

| Consumer Discretionary 24.5% | ||||||||

| Auto Components 4.3% | ||||||||

| American Axle & Manufacturing Holdings, Inc.* (a) | 34,598 | 862,182 | ||||||

| Cie Generale des Etablissements Michelin | 3,900 | 374,819 | ||||||

| Goodyear Tire & Rubber Co. (a) | 41,128 | 1,099,352 | ||||||

| Koito Manufacturing Co., Ltd. | 21,200 | 679,903 | ||||||

| Lear Corp. (a) | 7,240 | 788,581 | ||||||

| Magna International, Inc. | 7,826 | 852,721 | ||||||

| Plastic Omnium SA | 14,495 | 440,544 | ||||||

| 5,098,102 | ||||||||

| Automobiles 0.2% | ||||||||

| General Motors Co. | 7,200 | 268,632 | ||||||

| Hotels, Restaurants & Leisure 5.0% | ||||||||

| Bloomin' Brands, Inc.* | 25,366 | 653,428 | ||||||

| Buffalo Wild Wings, Inc.* | 3,707 | 708,482 | ||||||

| Caesars Acquisition Co. "A"* | 1,800 | 13,302 | ||||||

| Caesars Entertainment Corp.* | 31,000 | 328,600 | ||||||

| Domino's Pizza, Inc. | 10,124 | 1,027,890 | ||||||

| McDonald's Corp. (a) | 3,422 | 338,436 | ||||||

| Melco Crown Entertainment Ltd. (ADR) | 14,000 | 336,280 | ||||||

| Sonic Corp. | 27,850 | 885,351 | ||||||

| Wyndham Worldwide Corp. (a) | 11,354 | 1,038,664 | ||||||

| Wynn Macau Ltd. | 66,900 | 175,178 | ||||||

| Wynn Resorts Ltd. | 2,234 | 318,345 | ||||||

| 5,823,956 | ||||||||

| Household Durables 1.5% | ||||||||

| Century Communities, Inc.* | 998 | 18,513 | ||||||

| Harman International Industries, Inc. (a) | 13,024 | 1,797,182 | ||||||

| 1,815,695 | ||||||||

| Internet & Catalog Retail 0.3% | ||||||||

| Groupon, Inc.* | 45,200 | 369,736 | ||||||

| Media 8.1% | ||||||||

| CBS Corp. "B" (a) | 3,340 | 197,394 | ||||||

| Cineplex, Inc. | 8,800 | 351,127 | ||||||

| Comcast Corp. "A" | 6,900 | 406,720 | ||||||

| DISH Network Corp. "A"* | 8,000 | 600,320 | ||||||

| Liberty Global PLC "A"* | 15,698 | 848,634 | ||||||

| Loral Space & Communications, Inc.* | 5,400 | 384,102 | ||||||

| New Media Investment Group, Inc. | 9,900 | 244,530 | ||||||

| Pearson PLC | 28,486 | 622,969 | ||||||

| Publicis Groupe SA | 5,336 | 434,985 | ||||||

| Sirius XM Holdings, Inc.* | 221,900 | 863,191 | ||||||

| Societe Television Francaise 1 | 29,111 | 501,796 | ||||||

| Telenet Group Holding NV* | 14,700 | 843,262 | ||||||

| Time Warner Cable, Inc. | 1,000 | 154,050 | ||||||

| Time Warner, Inc. | 3,200 | 261,952 | ||||||

| Tribune Media Co. "A"* | 12,400 | 818,028 | ||||||

| Twenty-First Century Fox, Inc. "A" | 8,100 | 283,500 | ||||||

| UBM PLC | 33,756 | 282,614 | ||||||

| Viacom, Inc. "B" (a) | 4,290 | 300,042 | ||||||

| Walt Disney Co. (a) | 10,900 | 1,134,472 | ||||||

| 9,533,688 | ||||||||

| Multiline Retail 0.3% | ||||||||

| Myer Holdings Ltd. | 159,994 | 232,208 | ||||||

| Sears Holdings Corp.* | 3,400 | 127,840 | ||||||

| 360,048 | ||||||||

| Specialty Retail 3.5% | ||||||||

| AutoZone, Inc.* (a) | 1,682 | 1,080,988 | ||||||

| Best Buy Co., Inc. | 15,072 | 574,243 | ||||||

| Home Depot, Inc. | 8,952 | 1,027,242 | ||||||

| JB Hi-Fi Ltd. | 15,505 | 211,605 | ||||||

| Sanrio Co., Ltd. | 7,700 | 226,273 | ||||||

| Tiffany & Co. | 5,269 | 464,831 | ||||||

| United Arrows Ltd. | 16,400 | 505,932 | ||||||

| 4,091,114 | ||||||||

| Textiles, Apparel & Luxury Goods 1.3% | ||||||||

| Kering | 1,500 | 305,091 | ||||||

| NIKE, Inc. "B" | 9,457 | 918,464 | ||||||

| PVH Corp. | 2,500 | 266,325 | ||||||

| 1,489,880 | ||||||||

| Consumer Staples 5.1% | ||||||||

| Beverages 1.2% | ||||||||

| Ambev SA | 110,100 | 711,311 | ||||||

| Brown-Forman Corp. "B" | 7,506 | 688,225 | ||||||

| 1,399,536 | ||||||||

| Food & Staples Retailing 1.2% | ||||||||

| Costco Wholesale Corp. (a) | 6,583 | 967,438 | ||||||

| Metcash Ltd. | 243,846 | 298,653 | ||||||

| Sysco Corp. (a) | 3,635 | 141,728 | ||||||

| 1,407,819 | ||||||||

| Food Products 2.1% | ||||||||

| Associated British Foods PLC | 7,012 | 338,108 | ||||||

| Chocoladefabriken Lindt & Sprungli AG (Registered) | 18 | 1,172,540 | ||||||

| Kellogg Co. (a) | 4,624 | 298,156 | ||||||

| Oceana Group Ltd. | 16,983 | 160,131 | ||||||

| Suedzucker AG | 9,593 | 146,225 | ||||||

| The JM Smucker Co. (a) | 2,751 | 317,328 | ||||||

| 2,432,488 | ||||||||

| Personal Products 0.4% | ||||||||

| Asaleo Care Ltd. | 317,421 | 444,878 | ||||||

| Tobacco 0.2% | ||||||||

| British American Tobacco PLC | 5,111 | 298,100 | ||||||

| Energy 6.0% | ||||||||

| Energy Equipment & Services 2.3% | ||||||||

| Aker Solutions ASA | 30,427 | 170,147 | ||||||

| Amec Foster Wheeler PLC | 22,970 | 311,017 | ||||||

| Baker Hughes, Inc. | 6,200 | 387,562 | ||||||

| Dril-Quip, Inc.* (a) | 4,316 | 313,600 | ||||||

| Nordic American Offshore Ltd.* | 15,250 | 143,045 | ||||||

| Oceaneering International, Inc. (a) | 6,932 | 378,002 | ||||||

| Oil States International, Inc.* (a) | 20,639 | 897,384 | ||||||

| Transocean Partners LLC (Units) | 5,400 | 73,926 | ||||||

| 2,674,683 | ||||||||

| Oil, Gas & Consumable Fuels 3.7% | ||||||||

| Anadarko Petroleum Corp. | 3,700 | 311,651 | ||||||

| Atlas Energy LP* | 40,855 | 1,307,360 | ||||||

| Atlas Pipeline Partners LP | 22,900 | 609,827 | ||||||

| Atlas Resource Partners LP | 21,300 | 208,740 | ||||||

| Caltex Australia Ltd. | 7,994 | 229,743 | ||||||

| Concho Resources, Inc.* | 400 | 43,568 | ||||||

| Gulf Coast Ultra Deep Royalty Trust* | 71,049 | 71,049 | ||||||

| Kinder Morgan, Inc. | 12,800 | 524,928 | ||||||

| Newfield Exploration Co.* | 1,300 | 42,939 | ||||||

| QEP Resources, Inc. | 29,200 | 627,216 | ||||||

| SandRidge Energy, Inc.* | 171,900 | 304,263 | ||||||

| WPX Energy, Inc.* | 13,900 | 149,842 | ||||||

| 4,431,126 | ||||||||

| Financials 14.6% | ||||||||

| Banks 4.1% | ||||||||

| Bank of Ireland* | 800,447 | 303,854 | ||||||

| China Construction Bank Corp. "H" | 359,661 | 299,288 | ||||||

| Chongqing Rural Commercial Bank Co., Ltd. "H" | 584,000 | 364,033 | ||||||

| Citigroup, Inc. | 16,600 | 870,172 | ||||||

| ING Groep NV (CVA)* | 21,765 | 324,044 | ||||||

| JPMorgan Chase & Co. | 5,800 | 355,424 | ||||||

| Kasikornbank PCL (Foreign Registered) | 28,800 | 192,181 | ||||||

| Mizuho Financial Group, Inc. | 131,300 | 242,191 | ||||||

| Piraeus Bank SA* | 235,647 | 149,240 | ||||||

| Standard Chartered PLC | 9,896 | 151,209 | ||||||

| Sumitomo Mitsui Financial Group, Inc. | 6,400 | 254,959 | ||||||

| Turkiye Garanti Bankasi AS | 75,369 | 269,315 | ||||||

| Wells Fargo & Co. | 19,157 | 1,049,612 | ||||||

| 4,825,522 | ||||||||

| Capital Markets 2.6% | ||||||||

| Azimut Holding SpA | 26,598 | 696,317 | ||||||

| Capital Southwest Corp. (a) | 5,700 | 277,590 | ||||||

| Close Brothers Group PLC | 13,257 | 335,185 | ||||||

| E*TRADE Financial Corp.* | 30,100 | 783,653 | ||||||

| Ellington Financial LLC | 800 | 16,384 | ||||||

| Fifth Street Asset Management, Inc.* | 1,000 | 13,050 | ||||||

| KKR & Co. LP | 17,800 | 406,730 | ||||||

| Tetragon Financial Group Ltd. (b) | 6,300 | 62,998 | ||||||

| Tetragon Financial Group Ltd. (b) | 35,500 | 360,325 | ||||||

| THL Credit, Inc. | 13,111 | 158,512 | ||||||

| 3,110,744 | ||||||||

| Consumer Finance 0.6% | ||||||||

| Navient Corp. | 31,955 | 683,837 | ||||||

| Diversified Financial Services 1.2% | ||||||||

| Euronext NV, 144A (REG S)* | 9,564 | 358,208 | ||||||

| Moody's Corp. | 10,264 | 994,992 | ||||||

| On Deck Capital, Inc.* | 600 | 11,640 | ||||||

| 1,364,840 | ||||||||

| Insurance 3.0% | ||||||||

| American International Group, Inc. | 15,300 | 846,549 | ||||||

| BB Seguridade Participacoes SA | 25,900 | 295,609 | ||||||

| Insurance Australia Group Ltd. | 86,832 | 413,508 | ||||||

| MetLife, Inc. | 5,000 | 254,150 | ||||||

| Prudential PLC | 17,197 | 432,401 | ||||||

| Sampo Oyj "A" | 5,757 | 290,253 | ||||||

| Sanlam Ltd. | 22,572 | 146,136 | ||||||

| St James's Place PLC | 39,022 | 570,786 | ||||||

| W.R. Berkley Corp. | 3,703 | 184,817 | ||||||

| XL Group PLC | 1,100 | 39,820 | ||||||

| 3,474,029 | ||||||||

| Real Estate Investment Trusts 1.4% | ||||||||

| Chimera Investment Corp. (REIT) | 179,300 | 575,553 | ||||||

| Gaming and Leisure Properties, Inc. (REIT) | 7,800 | 264,030 | ||||||

| Klepierre (REIT) | 3,166 | 154,676 | ||||||

| New Residential Investment Corp. (REIT) | 13,900 | 210,029 | ||||||

| New Senior Investment Group, Inc. (REIT) | 9,516 | 160,250 | ||||||

| PennyMac Mortgage Investment Trust (REIT) | 14,400 | 308,736 | ||||||

| 1,673,274 | ||||||||

| Real Estate Management & Development 1.5% | ||||||||

| Altisource Portfolio Solutions SA* | 9,000 | 181,260 | ||||||

| Altus Group Ltd. | 12,900 | 227,022 | ||||||

| Daiwa House Industry Co., Ltd. | 13,100 | 257,965 | ||||||

| Mitsubishi Estate Co., Ltd. | 20,000 | 467,496 | ||||||

| Pruksa Real Estate PCL (Foreign Registered) | 168,000 | 166,285 | ||||||

| Pruksa Real Estate PCL | 54,700 | 54,098 | ||||||

| Realogy Holdings Corp.* | 10,200 | 469,200 | ||||||

| 1,823,326 | ||||||||

| Thrifts & Mortgage Finance 0.2% | ||||||||

| PennyMac Financial Services, Inc. "A"* | 12,200 | 213,012 | ||||||

| Health Care 10.6% | ||||||||

| Biotechnology 1.1% | ||||||||

| Actelion Ltd. (Registered) | 3,032 | 362,402 | ||||||

| Celldex Therapeutics, Inc.* | 600 | 15,324 | ||||||

| Curis, Inc.* | 1,400 | 4,312 | ||||||

| Gilead Sciences, Inc.* | 5,400 | 559,062 | ||||||

| Juno Therapeutics, Inc.* | 400 | 18,768 | ||||||

| United Therapeutics Corp.* (a) | 2,290 | 355,065 | ||||||

| 1,314,933 | ||||||||

| Health Care Equipment & Supplies 2.4% | ||||||||

| Becton, Dickinson & Co. (a) | 9,962 | 1,461,625 | ||||||

| Medtronic PLC (a) | 17,409 | 1,350,764 | ||||||

| 2,812,389 | ||||||||

| Health Care Providers & Services 1.8% | ||||||||

| Fresenius SE & Co. KGaA | 5,241 | 300,129 | ||||||

| Humana, Inc. | 2,400 | 394,512 | ||||||

| McKesson Corp. | 2,800 | 640,360 | ||||||

| Mediclinic International Ltd. | 28,158 | 297,502 | ||||||

| Odontoprev SA | 76,900 | 283,084 | ||||||

| Spire Healthcare Group PLC, 144A (REG S)* | 25,900 | 126,241 | ||||||

| 2,041,828 | ||||||||

| Health Care Technology 0.0% | ||||||||

| Inovalon Holdings, Inc. "A"* | 600 | 18,636 | ||||||

| Life Sciences Tools & Services 0.9% | ||||||||

| Thermo Fisher Scientific, Inc. | 7,933 | 1,031,290 | ||||||

| Pharmaceuticals 4.4% | ||||||||

| Actavis PLC* (a) | 9,898 | 2,883,881 | ||||||

| AstraZeneca PLC | 4,170 | 287,294 | ||||||

| Bayer AG (Registered) | 988 | 145,863 | ||||||

| Novartis AG (Registered) | 2,948 | 301,971 | ||||||

| Relypsa, Inc.* | 100 | 3,880 | ||||||

| Shire PLC (ADR) | 2,600 | 628,966 | ||||||

| Teva Pharmaceutical Industries Ltd. (ADR) (a) | 8,105 | 462,147 | ||||||

| Zoetis, Inc. (a) | 10,426 | 480,534 | ||||||

| 5,194,536 | ||||||||

| Industrials 17.1% | ||||||||

| Aerospace & Defense 2.8% | ||||||||

| MacDonald Dettwiler & Associates Ltd. | 5,556 | 437,733 | ||||||

| TransDigm Group, Inc. | 4,466 | 968,497 | ||||||

| Triumph Group, Inc. (a) | 32,729 | 1,956,867 | ||||||

| 3,363,097 | ||||||||

| Air Freight & Logistics 1.1% | ||||||||

| FedEx Corp. (a) | 7,396 | 1,308,944 | ||||||

| Airlines 1.4% | ||||||||

| Alaska Air Group, Inc. (a) | 14,445 | 919,424 | ||||||

| United Continental Holdings, Inc.* | 11,000 | 716,980 | ||||||

| 1,636,404 | ||||||||

| Building Products 1.1% | ||||||||

| Fortune Brands Home & Security, Inc. (a) | 27,458 | 1,271,855 | ||||||

| Commercial Services & Supplies 0.8% | ||||||||

| ADT Corp. | 4,400 | 172,568 | ||||||

| Elior Participations SCA, 144A (REG S) | 15,600 | 258,939 | ||||||

| KAR Auction Services, Inc. | 13,100 | 477,757 | ||||||

| 909,264 | ||||||||

| Electrical Equipment 2.2% | ||||||||

| Alstom SA* | 18,071 | 596,450 | ||||||

| General Cable Corp. (a) | 84,980 | 1,278,099 | ||||||

| OSRAM Licht AG | 8,675 | 397,333 | ||||||

| Rockwell Automation, Inc. (a) | 2,477 | 289,908 | ||||||

| 2,561,790 | ||||||||

| Industrial Conglomerates 0.5% | ||||||||

| Alliance Global Group, Inc. | 1,106,488 | 596,809 | ||||||

| Machinery 4.1% | ||||||||

| FANUC Corp. | 1,500 | 288,064 | ||||||

| Harsco Corp. (a) | 50,041 | 825,176 | ||||||

| Kurita Water Industries Ltd. | 24,900 | 616,904 | ||||||

| Pall Corp. | 9,846 | 992,575 | ||||||

| Sulzer AG (Registered) | 4,619 | 560,542 | ||||||

| Terex Corp. (a) | 37,980 | 1,041,032 | ||||||

| Timken Co. (a) | 10,984 | 466,600 | ||||||

| 4,790,893 | ||||||||

| Professional Services 0.2% | ||||||||

| Randstad Holding NV | 5,254 | 309,264 | ||||||

| Road & Rail 1.8% | ||||||||

| Kansas City Southern | 6,630 | 768,019 | ||||||

| Union Pacific Corp. (a) | 10,988 | 1,321,417 | ||||||

| 2,089,436 | ||||||||

| Trading Companies & Distributors 0.7% | ||||||||

| AerCap Holdings NV* | 17,400 | 774,300 | ||||||

| Neff Corp. "A"* | 800 | 8,360 | ||||||

| 782,660 | ||||||||

| Transportation Infrastructure 0.4% | ||||||||

| Aena SA, 144A (REG S)* | 2,700 | 250,961 | ||||||

| BBA Aviation PLC | 30,746 | 164,370 | ||||||

| Macquarie Infrastructure Co., LLC | 400 | 31,444 | ||||||

| 446,775 | ||||||||

| Information Technology 6.2% | ||||||||

| Communications Equipment 0.7% | ||||||||

| Arista Networks, Inc.* | 300 | 20,763 | ||||||

| Motorola Solutions, Inc. | 11,100 | 754,134 | ||||||

| 774,897 | ||||||||

| Electronic Equipment, Instruments & Components 0.2% | ||||||||

| Anixter International, Inc.* (a) | 2,910 | 229,570 | ||||||

| Internet Software & Services 0.8% | ||||||||

| eBay, Inc.* | 7,300 | 422,743 | ||||||

| Google, Inc. "A"* | 1,017 | 572,195 | ||||||

| 994,938 | ||||||||

| IT Services 2.5% | ||||||||

| Amadeus IT Holding SA "A" | 5,400 | 222,235 | ||||||

| AtoS | 6,824 | 485,035 | ||||||

| FleetCor Technologies, Inc.* | 4,372 | 670,796 | ||||||

| International Business Machines Corp. | 1,500 | 242,910 | ||||||

| Itochu Techno-Solutions Corp. | 15,200 | 597,660 | ||||||

| MasterCard, Inc. "A" | 7,987 | 719,868 | ||||||

| 2,938,504 | ||||||||

| Semiconductors & Semiconductor Equipment 1.1% | ||||||||

| Maxim Integrated Products, Inc. (a) | 13,800 | 474,651 | ||||||

| SunEdison, Inc.* | 35,700 | 790,398 | ||||||

| 1,265,049 | ||||||||

| Software 0.9% | ||||||||

| Intuit, Inc. | 6,140 | 599,448 | ||||||

| Monitise PLC* | 1,368,600 | 463,313 | ||||||

| 1,062,761 | ||||||||

| Materials 11.5% | ||||||||

| Chemicals 7.9% | ||||||||

| Arkema SA | 5,533 | 413,855 | ||||||

| Ashland, Inc. | 3,800 | 484,956 | ||||||

| Clariant AG (Registered) | 20,597 | 372,516 | ||||||

| Cytec Industries, Inc. (a) | 16,752 | 879,983 | ||||||

| Eastman Chemical Co. | 6,600 | 491,436 | ||||||

| Ecolab, Inc. | 8,941 | 1,033,043 | ||||||

| FMC Corp. (a) | 18,003 | 1,141,570 | ||||||

| Kuraray Co., Ltd. | 49,900 | 686,929 | ||||||

| LyondellBasell Industries NV "A" | 4,300 | 369,413 | ||||||

| Orion Engineered Carbons SA | 2,400 | 39,504 | ||||||

| The Sherwin-Williams Co. (a) | 4,140 | 1,180,728 | ||||||

| W.R. Grace & Co.* (a) | 22,416 | 2,222,547 | ||||||

| 9,316,480 | ||||||||

| Construction Materials 0.8% | ||||||||

| CRH PLC | 17,300 | 489,839 | ||||||

| Martin Marietta Materials, Inc. | 2,835 | 403,506 | ||||||

| 893,345 | ||||||||

| Containers & Packaging 2.8% | ||||||||

| Nampak Ltd. | 156,818 | 546,591 | ||||||

| Owens-Illinois, Inc.* (a) | 88,743 | 2,321,517 | ||||||

| Pact Group Holdings Ltd. | 123,087 | 419,666 | ||||||

| 3,287,774 | ||||||||

| Telecommunication Services 0.9% | ||||||||

| Diversified Telecommunication Services 0.3% | ||||||||

| Sunrise Communications Group AG, 144A (REG S)* | 3,899 | 306,121 | ||||||

| Wireless Telecommunication Services 0.6% | ||||||||

| SoftBank Corp. | 7,200 | 443,958 | ||||||

| Turkcell Iletisim Hizmetleri AS* | 51,203 | 269,125 | ||||||

| 713,083 | ||||||||

| Utilities 0.7% | ||||||||

| Independent Power & Renewable Eletricity Producers 0.5% | ||||||||

| Infinis Energy PLC | 118,194 | 364,361 | ||||||

| TerraForm Power, Inc. "A" | 4,100 | 142,393 | ||||||

| Vivint Solar, Inc.* | 1,900 | 15,333 | ||||||

| 522,087 | ||||||||

| Water Utilities 0.2% | ||||||||

| Cia de Saneamento Basico do Estado de Sao Paulo | 46,000 | 274,500 | ||||||

Total Common Stocks (Cost $108,989,031) | 114,167,977 | |||||||

| Preferred Stocks 0.1% | ||||||||

| Financials | ||||||||

| Federal Home Loan Mortgage Corp. "X"* | 1,000 | 4,150 | ||||||

| Federal Home Loan Mortgage Corp. "V"* | 2,500 | 9,250 | ||||||

| Federal National Mortgage Association "S"* | 15,400 | 69,300 | ||||||

| Federal National Mortgage Association "N"* | 3,500 | 27,125 | ||||||

| Federal National Mortgage Association "M"* | 1,700 | 13,515 | ||||||

Total Preferred Stocks (Cost $109,776) | 123,340 | |||||||

| Principal Amount ($) | Value ($) | |||||||

| Corporate Bonds 0.3% | ||||||||

| Consumer Discretionary 0.0% | ||||||||

| Caesars Entertainment Resort Properties LLC, 144A, 11.0%, 10/1/2021 | 60,000 | 53,100 | ||||||

| Financials 0.1% | ||||||||

| Harbinger Group, Inc., 144A, 7.75%, 1/15/2022 | 100,000 | 101,375 | ||||||

| Telecommunication Services 0.1% | ||||||||

| HC2 Holdings, Inc., 144A, 11.0%, 12/1/2019 | 70,000 | 71,575 | ||||||

Intelsat Luxembourg SA: 7.75%, 6/1/2021 | 30,000 | 27,788 | ||||||

| 8.125%, 6/1/2023 | 30,000 | 27,900 | ||||||

| 127,263 | ||||||||

| Utilities 0.1% | ||||||||

| Energy Future Intermediate Holding Co., LLC, 144A, 11.75%, 3/1/2022* | 90,000 | 107,775 | ||||||

Total Corporate Bonds (Cost $381,412) | 389,513 | |||||||

| Contracts | Value ($) | |||||||

| Put Options Purchased 0.0% | ||||||||

| Option on Exchange-Traded Futures Contracts | ||||||||

| DAX Index Futures, Expiration Date 3/20/2015, Strike Price $11,000.00 (Cost $34,784) | 46 | 34,315 | ||||||

| Shares | Value ($) | |||||||

| Cash Equivalents 6.7% | ||||||||

| Central Cash Management Fund, 0.06% (c) (Cost $7,827,645) | 7,827,645 | 7,827,645 | ||||||

| % of Net Assets | Value ($) | |||||||

Total Long Positions (Cost $117,342,648)† | 104.3 | 122,542,790 | ||||||

| Other Assets and Liabilities, Net | 30.3 | 35,555,574 | ||||||

| Securities Sold Short | (34.6 | ) | (40,608,592 | ) | ||||

| Net Assets | 100.0 | 117,489,772 | ||||||

† The cost for federal income tax purposes was $118,811,007. At February 28, 2015, net unrealized appreciation for all securities based on tax cost was $3,731,783. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $12,057,908 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $8,326,125.

| Shares | Value ($) | |||||||

| Common Stocks Sold Short 6.2% | ||||||||

| Consumer Discretionary 0.9% | ||||||||

| Household Durables 0.3% | ||||||||

| Electrolux AB "B" | 9,734 | 318,030 | ||||||

| Media 0.2% | ||||||||

| Mediaset Espana Comunicacion SA | 24,017 | 296,519 | ||||||

| Textiles, Apparel & Luxury Goods 0.4% | ||||||||

| LVMH Moet Hennessy Louis Vuitton SA | 2,400 | 439,131 | ||||||

| Consumer Staples 1.2% | ||||||||

| Beverages 0.3% | ||||||||

| Kirin Holdings Co., Ltd. | 30,800 | 403,192 | ||||||

| Food & Staples Retailing 0.3% | ||||||||

| Sprouts Farmers Market, Inc. | 9,500 | 349,695 | ||||||

| Household Products 0.2% | ||||||||

| Spectrum Brands Holdings, Inc. | 3,000 | 281,040 | ||||||

| Personal Products 0.4% | ||||||||

| L'Oreal SA | 2,438 | 442,174 | ||||||

| Energy 0.4% | ||||||||

| Oil, Gas & Consumable Fuels 0.4% | ||||||||

| Santos Ltd. | 36,018 | 222,450 | ||||||

| Statoil ASA | 11,759 | 221,288 | ||||||

| 443,738 | ||||||||

| Financials 0.7% | ||||||||

| Banks 0.4% | ||||||||

| Banco Santander SA | 27,494 | 200,713 | ||||||

| U.S. Bancorp. | 6,600 | 294,426 | ||||||

| 495,139 | ||||||||

| Capital Markets 0.3% | ||||||||

| Julius Baer Group Ltd. | 6,156 | 283,822 | ||||||

| Health Care 1.1% | ||||||||

| Biotechnology 0.4% | ||||||||

| Gilead Sciences, Inc. | 2,000 | 207,060 | ||||||

| Keryx Biopharmaceuticals, Inc. | 11,900 | 144,704 | ||||||

| Seattle Genetics, Inc. | 2,650 | 96,063 | ||||||

| 447,827 | ||||||||

| Health Care Equipment & Supplies 0.4% | ||||||||

| Getinge AB "B" | 18,006 | 497,950 | ||||||

| Pharmaceuticals 0.3% | ||||||||

| Sanofi | 3,353 | 328,900 | ||||||

| Industrials 1.0% | ||||||||

| Building Products 0.3% | ||||||||

| LIXIL Group Corp. | 13,600 | 324,362 | ||||||

| Machinery 0.4% | ||||||||

| Aalberts Industries NV | 6,258 | 193,521 | ||||||

| Deere & Co. | 3,450 | 312,570 | ||||||

| 506,091 | ||||||||

| Trading Companies & Distributors 0.3% | ||||||||

| MSC Industrial Direct Co., Inc. "A" | 1,948 | 142,184 | ||||||

| WW Grainger, Inc. | 725 | 171,760 | ||||||

| 313,944 | ||||||||

| Information Technology 0.4% | ||||||||

| IT Services 0.1% | ||||||||

| Western Union Co. | 8,300 | 162,016 | ||||||

| Software 0.3% | ||||||||

| NetScout Systems, Inc. | 8,000 | 322,560 | ||||||

| Materials 0.3% | ||||||||

| Chemicals 0.3% | ||||||||

| International Flavors & Fragrances, Inc. | 2,844 | 346,769 | ||||||

| Utilities 0.2% | ||||||||

| Electric Utilities 0.2% | ||||||||

| Fortum Oyj | 13,452 | 306,091 | ||||||

Total Common Stocks Sold Short (Proceeds $6,867,946) | 7,308,990 | |||||||

| Exchange-Traded Funds Sold Short 28.4% | ||||||||

| Energy Select Sector SPDR Fund | 27,738 | 2,191,857 | ||||||

| iShares Nasdaq Biotechnology Fund | 3,725 | 1,257,076 | ||||||

| Lyxor ETF STOXX Europe 600 Automobiles & Parts | 23,076 | 1,757,684 | ||||||

| Lyxor UCITS ETF Euro Stoxx 50 | 36,990 | 1,481,782 | ||||||

| Nikkei 225 Fund | 4,919 | 790,028 | ||||||

| SPDR S&P 500 ETF Trust | 101,528 | 21,387,888 | ||||||

| SPDR S&P MidCap 400 Trust | 11,778 | 3,229,528 | ||||||

| Vanguard FTSE Europe Fund | 21,538 | 1,203,759 | ||||||

Total Exchange-Traded Funds Sold Short (Proceeds $32,046,177) | 33,299,602 | |||||||

Total Positions Sold Short (Proceeds $38,914,123) | 40,608,592 | |||||||

* Non-income producing security.

The following table represents a bond that is in default:

| Security | Coupon | Maturity Date | Principal Amount | Cost ($) | Value ($) | ||||||||||||

| Energy Future Intermediate Holding Co., LLC* | 11.75 | % | 3/1/2022 | 90,000 | 105,588 | 107,775 | |||||||||||

(a) All or a portion of these securities are pledged as collateral for short sales.

(b) Securities with the same description are the same corporate entity but trade on different stock exchanges.

(c) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ADR: American Depositary Receipt

CVA: Certificaten Van Aandelen (Certificate of Stock)

FTSE: Financial Times and the London Stock Exchange

REIT: Real Estate Investment Trust

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933.

S&P: Standard & Poor's

SPDR: Standard & Poor's Depositary Receipt

At February 28, 2015, open futures contracts purchased were as follows:

| Futures | Currency | Expiration Date | Contracts | Notional Value ($) | Unrealized Appreciation ($) | |||||||||

| Nikkei 225 Index | JPY | 3/12/2015 | 5 | 786,625 | 26,059 | |||||||||

| Nikkei 400 Index | JPY | 3/12/2015 | 20 | 231,390 | 6,675 | |||||||||

| TOPIX Index | JPY | 3/12/2015 | 6 | 765,141 | 8,389 | |||||||||

| S&P 500 Index | USD | 3/19/2015 | 4 | 2,102,800 | 44,665 | |||||||||

| Total unrealized appreciation | 85,788 | |||||||||||||

At February 28, 2015, open futures contracts sold were as follows:

| Futures | Currency | Expiration Date | Contracts | Notional Value ($) | Unrealized Appreciation ($) | |||||||||

| Japanese Yen | USD | 3/16/2015 | 4 | 417,700 | 3,031 | |||||||||

As of February 28, 2015, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | In Exchange For | Settlement Date | Unrealized Appreciation ($) | Counterparty | |||||||||||

| EUR | 40,000 | USD | 51,935 | 4/22/2015 | 7,147 | State Street Bank and Trust | |||||||||

| DKK | 1,932,200 | USD | 293,701 | 5/20/2015 | 3,166 | State Street Bank and Trust | |||||||||

| EUR | 4,819,053 | USD | 5,494,488 | 5/20/2015 | 96,642 | State Street Bank and Trust | |||||||||

| EUR | 1,710,000 | USD | 2,049,395 | 6/25/2015 | 132,951 | State Street Bank and Trust | |||||||||

| CAD | 1,231,922 | USD | 987,161 | 5/20/2015 | 2,743 | State Street Bank and Trust | |||||||||

| EUR | 100,000 | USD | 125,782 | 4/24/2015 | 13,809 | State Street Bank and Trust | |||||||||

| EUR | 660,000 | USD | 827,285 | 6/24/2015 | 87,618 | State Street Bank and Trust | |||||||||

| GBP | 107,415 | USD | 168,779 | 3/18/2015 | 2,963 | State Street Bank and Trust | |||||||||

| BRL | 10,190,900 | USD | 3,818,261 | 3/3/2015 | 227,071 | State Street Bank and Trust | |||||||||

| EUR | 750,000 | USD | 850,910 | 8/19/2015 | 9,584 | State Street Bank and Trust | |||||||||

| CHF | 902,500 | USD | 965,499 | 5/20/2015 | 15,879 | State Street Bank and Trust | |||||||||

| NOK | 1,004,500 | USD | 133,458 | 5/20/2015 | 2,668 | State Street Bank and Trust | |||||||||

| EUR | 70,000 | USD | 82,965 | 4/27/2015 | 4,582 | State Street Bank and Trust | |||||||||

| JPY | 356,804,879 | USD | 3,008,678 | 5/20/2015 | 22,985 | State Street Bank and Trust | |||||||||

| EUR | 80,000 | USD | 103,871 | 4/23/2015 | 14,294 | State Street Bank and Trust | |||||||||

| EUR | 750,000 | USD | 937,299 | 6/23/2015 | 96,781 | State Street Bank and Trust | |||||||||

| USD | 697,485 | SEK | 5,861,200 | 5/20/2015 | 6,138 | State Street Bank and Trust | |||||||||

| USD | 506,774 | CHF | 515,572 | 3/18/2015 | 34,307 | State Street Bank and Trust | |||||||||

| USD | 60,160 | GBP | 39,898 | 3/18/2015 | 1,430 | State Street Bank and Trust | |||||||||

| USD | 2,191,730 | GBP | 1,424,800 | 5/20/2015 | 6,782 | State Street Bank and Trust | |||||||||

| USD | 92,397 | GBP | 60,000 | 8/19/2015 | 137 | State Street Bank and Trust | |||||||||

| USD | 1,377,999 | BRL | 3,934,877 | 3/3/2015 | 8,131 | State Street Bank and Trust | |||||||||

| Total unrealized appreciation | 797,808 | ||||||||||||||

| Contracts to Deliver | In Exchange For | Settlement Date | Unrealized Depreciation ($) | Counterparty | |||||||||||

| HKD | 5,186,018 | USD | 668,387 | 5/20/2015 | (259 | ) | State Street Bank and Trust | ||||||||

| CHF | 1,579,102 | USD | 1,649,925 | 3/18/2015 | (7,308 | ) | State Street Bank and Trust | ||||||||

| GBP | 4,495,411 | USD | 6,913,934 | 5/20/2015 | (22,625 | ) | State Street Bank and Trust | ||||||||

| USD | 443,092 | DKK | 2,880,540 | 5/20/2015 | (9,960 | ) | State Street Bank and Trust | ||||||||

| USD | 121,959 | EUR | 100,000 | 4/24/2015 | (9,987 | ) | State Street Bank and Trust | ||||||||

| USD | 573,410 | EUR | 490,000 | 6/23/2015 | (24,272 | ) | State Street Bank and Trust | ||||||||

| AUD | 2,361,129 | USD | 1,826,269 | 5/20/2015 | (10,665 | ) | State Street Bank and Trust | ||||||||

| ZAR | 14,078,419 | USD | 1,190,967 | 5/20/2015 | (846 | ) | State Street Bank and Trust | ||||||||

| USD | 94,781 | EUR | 80,000 | 4/23/2015 | (5,205 | ) | State Street Bank and Trust | ||||||||

| USD | 1,079,535 | EUR | 940,000 | 6/25/2015 | (26,052 | ) | State Street Bank and Trust | ||||||||

| USD | 295,202 | KRW | 322,014,000 | 3/3/2015 | (1,796 | ) | State Street Bank and Trust | ||||||||

| USD | 47,390 | EUR | 40,000 | 4/22/2015 | (2,603 | ) | State Street Bank and Trust | ||||||||

| USD | 780,411 | EUR | 660,000 | 6/24/2015 | (40,744 | ) | State Street Bank and Trust | ||||||||

| USD | 5,081,392 | EUR | 4,466,100 | 5/20/2015 | (78,890 | ) | State Street Bank and Trust | ||||||||

| USD | 2,385,288 | BRL | 6,256,023 | 3/3/2015 | (180,716 | ) | State Street Bank and Trust | ||||||||

| USD | 361,291 | NOK | 2,747,600 | 5/20/2015 | (3,544 | ) | State Street Bank and Trust | ||||||||

| USD | 1,124,465 | JPY | 133,349,200 | 5/20/2015 | (8,618 | ) | State Street Bank and Trust | ||||||||

| USD | 273,055 | CHF | 258,300 | 5/20/2015 | (1,269 | ) | State Street Bank and Trust | ||||||||

| BRL | 3,934,877 | USD | 1,340,993 | 6/2/2015 | (7,936 | ) | State Street Bank and Trust | ||||||||

| KRW | 322,014,000 | USD | 293,140 | 3/3/2015 | (266 | ) | State Street Bank and Trust | ||||||||

| GBP | 370,000 | USD | 564,968 | 8/19/2015 | (5,659 | ) | State Street Bank and Trust | ||||||||

| Total unrealized depreciation | (449,220 | ) | |||||||||||||

| Currency Abbreviations |

AUD Australian Dollar BRL Brazilian Dollar CAD Canadian Dollar CHF Swiss Franc DKK Danish Krone EUR Euro GBP Great British Pound HKD Hong Kong Dollar JPY Japanese Yen KRW South Korean Won NOK Norwegian Krone SEK Swedish Krona USD United States Dollar ZAR South African Rand |

For information on the Fund's policy and additional disclosures regarding options purchased, futures contracts and forward foreign currency exchange contracts, please refer to the Derivatives section of Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of February 28, 2015 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks (d) | $ | 85,862,388 | $ | 28,305,589 | $ | — | $ | 114,167,977 | ||||||||

| Preferred Stocks | 123,340 | — | — | 123,340 | ||||||||||||

| Corporate Bonds (d) | — | 389,513 | — | 389,513 | ||||||||||||

| Short-Term Investments | 7,827,645 | — | — | 7,827,645 | ||||||||||||

| Derivatives (e) | ||||||||||||||||

| Purchased Options | — | 34,315 | — | 34,315 | ||||||||||||

| Futures Contracts | 88,819 | — | — | 88,819 | ||||||||||||

| Forward Foreign Currency Exchange Contracts | — | 797,808 | — | 797,808 | ||||||||||||

| Total | $ | 93,902,192 | $ | 29,527,225 | $ | — | $ | 123,429,417 | ||||||||

| Liabilities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks Sold Short, at Value (d) | $ | (2,830,847 | ) | $ | (4,478,143 | ) | $ | — | $ | (7,308,990 | ) | |||||

| Exchange-Traded Funds Sold Short | (33,299,602 | ) | — | — | (33,299,602 | ) | ||||||||||

| Derivatives (e) | ||||||||||||||||

| Forward Foreign Currency Exchange Contracts | — | (449,220 | ) | — | (449,220 | ) | ||||||||||

| Total | $ | (36,130,449 | ) | $ | (4,927,363 | ) | $ | — | $ | (41,057,812 | ) | |||||

There have been no transfers between fair value measurement levels during the period ended February 28, 2015.

(d) See Investment Portfolio for additional detailed categorizations.

(e) Derivatives include value of options purchased; unrealized appreciation (depreciation) on futures contracts and forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

| as of February 28, 2015 (Unaudited) | ||||

| Assets | ||||

Investments: Investments in non-affiliated securities, at value (cost $109,515,003) | $ | 114,715,145 | ||

| Investment in Central Cash Management Fund (cost $7,827,645) | 7,827,645 | |||

| Total investments in securities, at value (cost $117,342,648) | 122,542,790 | |||

| Deposit with broker for futures contracts | 160,526 | |||

| Deposit with broker for securities sold short | 34,682,168 | |||

| Receivable for investments sold | 3,806,070 | |||

| Receivable for Fund shares sold | 712,538 | |||

| Dividends receivable | 103,409 | |||

| Interest receivable | 76,018 | |||

| Receivable for variation margin on futures contracts | 89,057 | |||

| Unrealized appreciation on forward foreign currency exchange contracts | 797,808 | |||

| Foreign taxes recoverable | 13,260 | |||

| Other assets | 23,818 | |||

| Total assets | 163,007,462 | |||

| Liabilities | ||||

| Cash overdraft | 143,143 | |||

| Foreign currency overdraft, at value (cost $199,940) | 198,220 | |||

| Payable for investments purchased | 3,495,791 | |||

| Payable for securities sold short, at value (proceeds of $38,914,123) | 40,608,592 | |||

| Payable for Fund shares redeemed | 324,426 | |||

| Unrealized depreciation on forward foreign currency exchange contracts | 449,220 | |||

| Dividends payable for securities sold short | 7,260 | |||

| Accrued management fee | 147,834 | |||

| Accrued Trustees' fee | 2,574 | |||

| Other accrued expenses and payables | 140,630 | |||

| Total liabilities | 45,517,690 | |||

| Net assets, at value | $ | 117,489,772 | ||

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities as of February 28, 2015 (Unaudited) (continued) | ||||

| Net Assets Consist of | ||||

| Accumulated net investment loss | (1,957,678 | ) | ||

Net unrealized appreciation (depreciation) on: Investments | 5,200,142 | |||

| Securities sold short | (1,694,469 | ) | ||

| Futures | 88,819 | |||

| Foreign currency | 346,043 | |||

| Accumulated net realized gain (loss) | (7,854,833 | ) | ||

| Paid-in capital | 123,361,748 | |||

| Net assets, at value | $ | 117,489,772 | ||

| Net Asset Value | ||||

Class A Net Asset Value and redemption price per share ($16,392,813 ÷ 1,659,052 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ | 9.88 | ||

Maximum offering price per share (100 ÷ 94.25 of $9.88) | $ | 10.48 | ||

Class C Net Asset Value, offering and redemption price (subject to contingent deferred sales charge) per share ($6,045,216 ÷ 615,856 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ | 9.82 | ||

Class S Net Asset Value, offering and redemption price per share ($16,399,449 ÷ 1,660,102 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ | 9.88 | ||

Institutional Class Net Asset Value, offering and redemption price per share ($78,652,294 ÷ 7,952,638 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | $ | 9.89 | ||

The accompanying notes are an integral part of the financial statements.

| for the six months ended February 28, 2015 (Unaudited) | ||||

| Investment Income | ||||

Income: Dividends (net of foreign taxes withheld of $31,707) | $ | 1,682,043 | ||

| Interest | 15,351 | |||

| Income distributions — Central Cash Management Fund | 4,115 | |||

| Total income | 1,701,509 | |||

Expenses: Management fee | 1,527,531 | |||

| Administration fee | 87,287 | |||

| Services to shareholders | 37,064 | |||

| Distribution and service fees | 45,539 | |||

| Custodian fee | 28,365 | |||

| Professional fees | 75,816 | |||

| Reports to shareholders | 9,352 | |||

| Registration fees | 1,731 | |||

| Trustees' fees and expenses | 4,946 | |||

| Dividend expense on securities sold short | 430,158 | |||

| Interest expense on securities sold short | 185,663 | |||

| Other | 21,162 | |||

| Total expenses | 2,454,614 | |||

| Net investment income (loss) | (753,105 | ) | ||

| Realized and Unrealized Gain (Loss) | ||||

Net realized gain (loss) from: Investments | (7,478,582 | ) | ||

| Securities sold short | (2,071,656 | ) | ||

| Futures | (27,933 | ) | ||

| Foreign currency | 3,211,158 | |||

| (6,367,013 | ) | |||

Change in net unrealized appreciation (depreciation) on: Investments | 727,081 | |||

| Securities sold short | 236,510 | |||

| Futures | 48,429 | |||

| Foreign currency | (87,474 | ) | ||

| 924,546 | ||||

| Net gain (loss) | (5,442,467 | ) | ||

| Net increase (decrease) in net assets resulting from operations | $ | (6,195,572 | ) | |

The accompanying notes are an integral part of the financial statements.

| Increase (Decrease) in Net Assets | Six Months Ended February 28, 2015 (Unaudited) | Period Ended August 31, 2014 (Unaudited)* | ||||||

Operations: Net investment income (loss) | $ | (753,105 | ) | $ | (1,018,476 | ) | ||

Operations: Net investment income (loss) | $ | (753,105 | ) | $ | (1,018,476 | ) | ||

| Net realized gain (loss) | (6,367,013 | ) | (448,010 | ) | ||||

| Change in net unrealized appreciation (depreciation) | 924,546 | 3,015,989 | ||||||

| Net increase (decrease) in net assets resulting from operations | (6,195,572 | ) | 1,549,503 | |||||

Distributions to shareholders from: Net investment income: Class A | (63,700 | ) | — | |||||

| Class C | (20,723 | ) | — | |||||

| Class S | (90,055 | ) | — | |||||

| Institutional Class | (575,753 | ) | — | |||||

Net realized gains: Class A | (40,816 | ) | — | |||||

| Class C | (13,279 | ) | — | |||||

| Class S | (57,703 | ) | — | |||||

| Institutional Class | (368,914 | ) | — | |||||

| Total distributions | (1,230,943 | ) | — | |||||

Fund share transactions: Proceeds from shares sold | 26,399,940 | 52,499,529 | ||||||

| Reinvestment of distributions | 1,224,962 | — | ||||||

| Cost of shares redeemed | (112,423,652 | ) | (44,337,995 | ) | ||||

| Net increase (decrease) in net assets from Fund share transactions | (84,798,750 | ) | 8,161,534 | |||||

| Increase (decrease) in net assets | (92,225,265 | ) | 9,711,037 | |||||

| Net assets at beginning of period | 209,715,037 | 200,004,000 | ||||||

| Net assets at end of period (including accumulated net investment loss of $1,957,678 and $454,342, respectively) | $ | 117,489,772 | $ | 209,715,037 | ||||

* For the period from May 15, 2014 (commencement of operations) to August 31, 2014.

The accompanying notes are an integral part of the financial statements.

| Class A | Six Months Ended 2/28/15 (Unaudited) | Period Ended 8/31/14a | ||||||

| Selected Per Share Data | ||||||||

| Net asset value, beginning of period | $ | 10.08 | $ | 10.00 | ||||

Income (loss) from investment operations: Net investment income (loss)b | (.06 | ) | (.06 | ) | ||||

| Net realized and unrealized gain (loss) | (.08 | ) | .14 | |||||

| Total from investment operations | (.14 | ) | .08 | |||||

Less distributions from: Net investment income | (.04 | ) | — | |||||

| Net realized gains on investment | (.02 | ) | — | |||||

| Total distributions | (.06 | ) | — | |||||

| Net asset value, end of period | $ | 9.88 | $ | 10.08 | ||||

Total Return (%)c | (1.34 | )** | .80 | ** | ||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||

| Net assets, end of period ($ millions) | 16 | 16 | ||||||

| Ratio of expenses (including interest expense and dividend expense for securities sold short) (%) | 3.04 | * | 3.25 | * | ||||

| Ratio of expenses (excluding interest expense and dividend expense for securities sold short) (%) | 2.33 | * | 2.40 | * | ||||

| Ratio of net investment income (loss) (%) | (1.16 | )* | (1.95 | )* | ||||

| Portfolio turnover rate (%) | 160 | ** | 119 | ** | ||||

a For the period from May 15, 2014 (commencement of operations) to August 31, 2014. b Based on average shares outstanding during the period. c Total return does not reflect the effect of any sales charges. * Annualized ** Not annualized | ||||||||

| Class C | Six Months Ended 2/28/15 (Unaudited) | Period Ended 8/31/14a | ||||||

| Selected Per Share Data | ||||||||

| Net asset value, beginning of period | $ | 10.05 | $ | 10.00 | ||||

Income (loss) from investment operations: Net investment income (loss)b | (.09 | ) | (.08 | ) | ||||

| Net realized and unrealized gain (loss) | (.08 | ) | .13 | |||||

| Total from investment operations | (.17 | ) | .05 | |||||

Less distributions from: Net investment income | (.04 | ) | — | |||||

| Net realized gains on investment | (.02 | ) | — | |||||

| Total distributions | (.06 | ) | — | |||||

| Net asset value, end of period | $ | 9.82 | $ | 10.05 | ||||

Total Return (%)c | (1.65 | )** | .50 | d** | ||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||

| Net assets, end of period ($ millions) | 6 | 4 | ||||||

| Ratio of expenses before expense reductions (including interest expense and dividend expense for securities sold short) (%) | 3.80 | * | 4.01 | * | ||||

| Ratio of expenses after expense reductions (including interest expense and dividend expense for securities sold short) (%) | 3.80 | * | 4.00 | * | ||||

| Ratio of expenses after expense reductions (excluding interest expense and dividend expense for securities sold short) (%) | 3.09 | * | 3.15 | * | ||||

| Ratio of net investment income (loss) (%) | (1.91 | )* | (2.74 | )* | ||||

| Portfolio turnover rate (%) | 160 | ** | 119 | ** | ||||

a For the period from May 15, 2014 (commencement of operations) to August 31, 2014. b Based on average shares outstanding during the period. c Total return does not reflect the effect of any sales charges. d Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized | ||||||||

| Class S | Six Months Ended 2/28/15 (Unaudited) | Period Ended 8/31/14a | ||||||

| Selected Per Share Data | ||||||||

| Net asset value, beginning of period | $ | 10.07 | $ | 10.00 | ||||

Income (loss) from investment operations: Net investment income (loss)b | (.05 | ) | (.05 | ) | ||||

| Net realized and unrealized gain (loss) | (.08 | ) | .12 | |||||

| Total from investment operations | (.13 | ) | .07 | |||||

Less distributions from: Net investment income | (.04 | ) | — | |||||

| Net realized gains on investment | (.02 | ) | — | |||||

| Total distributions | (.06 | ) | — | |||||

| Net asset value, end of period | $ | 9.88 | $ | 10.07 | ||||

| Total Return (%) | (1.25 | )** | .70 | c** | ||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||

| Net assets, end of period ($ millions) | 16 | 24 | ||||||

| Ratio of expenses before expense reductions (including interest expense and dividend expense for securities sold short) (%) | 2.93 | * | 3.15 | * | ||||

| Ratio of expenses after expense reductions (including interest expense and dividend expense for securities sold short) (%) | 2.93 | * | 3.10 | * | ||||

| Ratio of expenses after expense reductions (excluding interest expense and dividend expense for securities sold short) (%) | 2.22 | * | 2.25 | * | ||||

| Ratio of net investment income (loss) (%) | (1.04 | )* | (1.69 | )* | ||||

| Portfolio turnover rate (%) | 160 | ** | 119 | ** | ||||

a For the period from May 15, 2014 (commencement of operations) to August 31, 2014. b Based on average shares outstanding during the period. c Total return would have been lower had certain expenses not been reduced. * Annualized ** Not annualized | ||||||||

| Institutional Class | Six Months Ended 2/28/15 (Unaudited) | Period Ended 8/31/14a | ||||||

| Selected Per Share Data | ||||||||

| Net asset value, beginning of period | $ | 10.08 | $ | 10.00 | ||||

Income (loss) from investment operations: Net investment income (loss)b | (.04 | ) | (.05 | ) | ||||

| Net realized and unrealized gain (loss) | (.09 | ) | .13 | |||||

| Total from investment operations | (.13 | ) | .08 | |||||

Less distributions from: Net investment income | (.04 | ) | — | |||||

| Net realized gains on investment | (.02 | ) | — | |||||

| Total distributions | (.06 | ) | — | |||||

| Net asset value, end of period | $ | 9.89 | $ | 10.08 | ||||

| Total Return (%) | (1.24 | )** | .80 | ** | ||||

| Ratios to Average Net Assets and Supplemental Data | ||||||||

| Net assets, end of period ($ millions) | 79 | 166 | ||||||

| Ratio of expenses (including interest expense and dividend expense for securities sold short) (%) | 2.73 | * | 2.96 | * | ||||

| Ratio of expenses (excluding interest expense and dividend expense for securities sold short) (%) | 2.02 | * | 2.11 | * | ||||

| Ratio of net investment income (loss) (%) | (.76 | )* | (1.60 | )* | ||||

| Portfolio turnover rate (%) | 160 | ** | 119 | ** | ||||

a For the period from May 15, 2014 (commencement of operations) to August 31, 2014. b Based on average shares outstanding during the period. * Annualized ** Not annualized | ||||||||

A. Organization and Significant Accounting Policies

Deutsche Strategic Equity Long/Short Fund (the "Fund") is a diversified series of Deutsche Market Trust (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are offered to investors subject to an initial sales charge. Class C shares are offered to investors without an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class S shares are not subject to initial or contingent deferred sales charges and are only available to a limited group of investors. Institutional Class shares are generally available only to qualified institutions, are not subject to initial or contingent deferred sales charges and generally have lower ongoing expenses than other classes.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as services to shareholders, distribution and service fees and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities and exchange-traded funds ("ETFs") are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Long equity securities and ETFs for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Short equity securities and ETFs for which no sales are reported are valued at the calculated mean between the most recent bid and ask quotations on the relevant market or, if a mean cannot be determined, at the most recent ask quotation. Equity securities are generally categorized as Level 1 For certain international equity securities, in order to adjust for events which may occur between the close of the foreign exchanges and the close of the New York Stock Exchange, a fair valuation model may be used. This fair valuation model takes into account comparisons to the valuation of American Depository Receipts (ADRs), exchange-traded funds, futures contracts and certain indices, and these securities are categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are categorized as Level 1. Over-the-counter written or purchased options are valued at prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer with which the option was traded. Over-the-counter written or purchased options are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities; the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

Short Sales. When the Fund takes a short position, it sells at the current market price a security it does not own but has borrowed in anticipation that the market price of the security will decline. To complete, or close out, the short sale transaction, the Fund buys the same security in the market and returns it to the lender.

Upon entering into a short sale, the Fund is required to designate liquid assets it owns in the form of cash or securities as segregated assets at its custodian in an amount at least equal to its obligations to purchase the securities sold short. For financial statements purposes, segregated cash is reflected as an asset on the Statement of Assets and Liabilities, and the settlement amount for securities sold short is reflected as a corresponding liability. Securities segregated as collateral are identified in the Investment Portfolio. The amount of the liability is marked-to-market to reflect the current value of the short position.

The Fund may receive or pay the net of the borrowing fee on securities sold short and any income earned on the cash held as collateral for securities sold short. The net amounts of income or fees are included as interest income, or interest expense on securities sold short, in the Statement of Operations.

Short sales involve the risk that the Fund will incur a loss by subsequently buying a security at a higher price than the price at which the Fund previously sold the security short. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the Fund must pay to a lender of the security. In addition, because the Fund's loss on a short sale stems from increases in the value of the security sold short, the extent of such loss, like the price of the security sold short, is theoretically unlimited. By contrast, the Fund's loss on a long position arises from decreases in the value of the security held by the Fund and therefore is limited by the fact that a security's value cannot drop below zero.

Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

The Fund has reviewed the tax positions for the open tax year as of August 31, 2014, and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements.

Distribution of Income and Gains. Distributions from net investment income of the Fund, if any, are declared and distributed to shareholders annually. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to investment in foreign denominated investments, investments in futures, investments in passive foreign investment companies, investments in short sales, recognition of certain foreign currency gains (losses) as ordinary income (loss) and certain securities sold at a loss. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Expenses. Expenses of the Trust arising in connection with a specific fund are allocated to that fund. Other Trust expenses which cannot be directly attributed to a fund are apportioned among the funds in the Trust based upon the relative net assets or other appropriate measures.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Dividend income on short sale transactions is recorded on ex-date and disclosed as an expense in the Statement of Operations. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments.

B. Derivative Instruments

Futures Contracts. A futures contract is an agreement between a buyer or seller and an established futures exchange or its clearinghouse in which the buyer or seller agrees to take or make a delivery of a specific amount of a financial instrument at a specified price on a specific date (settlement date). For the six months ended February 28, 2015, the Fund entered into futures contracts as a substitute for direct investment in a particular market, to hedge exposure to changes in foreign currency exchange rates on foreign currency denominated portfolio holdings or to maintain full long and short exposure.

Upon entering into a futures contract, the Fund is required to deposit with a financial intermediary cash or securities ("initial margin") in an amount equal to a certain percentage of the face value indicated in the futures contract. Subsequent payments ("variation margin") are made or received by the Fund dependent upon the daily fluctuations in the value and are recorded for financial reporting purposes as unrealized gains or losses by the Fund. Gains or losses are realized when the contract expires or is closed. Since all futures contracts are exchange traded, counterparty risk is minimized as the exchange's clearinghouse acts as the counterparty, and guarantees the futures against default.

Certain risks may arise upon entering into futures contracts, including the risk that an illiquid market will limit the Fund's ability to close out a futures contract prior to the settlement date and the risk that the futures contract is not well correlated with the security, index or currency to which it relates. Risk of loss may exceed amounts disclosed in the Statement of Assets and Liabilities.

A summary of the open futures contracts as of February 28, 2015 is included in a table following the Fund's Investment Portfolio. For the six months ended February 28, 2015, the investment in futures contracts purchased had a total notional value generally indicative of a range from $0 to approximately $3,886,000, and the investment in futures contracts sold had a total notional value generally indicative of a range from $0 to approximately $418,000.