UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-01236

Deutsche DWS Market Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 10/31 |

| | |

| Date of reporting period: | 10/31/2022 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

| | (a) |

October 31, 2022

Annual Report

to Shareholders

DWS Global Income Builder Fund

This report must be preceded or accompanied by a prospectus. To obtain a summary prospectus, if available, or prospectus for any of our funds, refer to the Account Management Resources information provided in the back of this booklet. We advise you to consider the Fund’s objectives, risks, charges and expenses carefully before investing. The summary prospectus and prospectus contain this and other important information about the Fund. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE

NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| | DWS Global Income Builder Fund |

Although allocation among different asset categories generally limits risk, portfolio management may favor an asset category that underperforms other assets or markets as a whole. Stocks may decline in value. Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest-rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increased volatility. The Fund may lend securities to approved institutions. Please read the prospectus for details.

War, terrorism, sanctions, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and, in the future, may lead to significant disruptions in U.S. and world economies and markets, which may lead to increased market volatility and may have significant adverse effects on the Fund and its investments.

DWS Global Income Builder Fund | | |

Letter to Shareholders

Dear Shareholder:

Financial markets experienced several negative impacts which began in late February with the Russia-Ukraine war and have continued through the second quarter due to volatility in energy, a rise in inflation, pressure on supply chains, and slower corporate earnings growth. Global monetary authorities have moved aggressively to tame inflation which in turn has created a swift decline in equity and fixed income markets. The longer-term effects of these headwinds remain uncertain. De-globalization and a desire for energy independence across Europe and North America may continue to push prices upwards, and we expect inflation will remain higher than average over the next decade.

In periods such as this, real capital preservation becomes more challenging. Our portfolio managers continue to assess risks and form opinions on how these headwinds may impact investment portfolios over multiple time horizons. Yields for bonds can be impacted by economic risks, rising inflation, and slowing monetary support. We expect a moderate rise in government bond yields while short term spread widening may offer potential over the next year. For equities, we expect continued volatility in the short-term, however we do have a favorable view on companies with solid balance sheets and business models over a twelve-month horizon. We believe alternatives such as real estate, infrastructure and commodities may help in preserving capital given pricing power and correlation to inflation. Overall, we believe a diversified and balanced portfolio may help mitigate portfolio volatility during this uncertain economic and market cycle.

In our view, the current environment underscores the value add of active portfolio management. We also believe that the strong partnership between our portfolio managers and our CIO Office — which synthesizes the views of more than 900 DWS economists, analysts and investment professionals around the world — makes an important difference in making strategic and tactical decisions for the DWS Funds. Thank you for your trust. We welcome the opportunity to help you navigate these unusual times. For ongoing updates to our market and economic outlook, please visit the “Insights” section of dws.com.

Best regards,

Hepsen Uzcan

President, DWS Funds

Assumptions, estimates and opinions contained in this document constitute our judgment as of the date of the document and are subject to change without notice. Any projections are based on a number of assumptions as to market conditions and there can be no guarantee that any projected results will be achieved. Past performance is not a guarantee of future results.

| | DWS Global Income Builder Fund |

Portfolio Management Review(Unaudited)

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Returns shown are for Class A shares, unadjusted for sales charges. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the most recent month-end performance of all share classes. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had. Please refer to pages 11 through 14 for more complete performance information.

Investment Strategy

Portfolio management seeks to maximize risk adjusted returns by allocating the Fund’s assets among various asset categories. Portfolio management draws upon a broad investible universe to establish a strategic allocation based upon collective, long-term views on asset class selection, implementation, expected returns and other relevant factors. Portfolio management periodically reviews the Fund’s allocations and may adjust them based on current or anticipated market conditions or to manage risk consistent with the Fund’s overall investment strategy.

Within each asset category, portfolio management uses one or more investment strategies for selecting equity and debt securities. Each investment strategy is managed by a team that specializes in a particular asset category, and that may use a variety of quantitative and qualitative techniques. As a general matter, in buying and selling securities for the portfolio, the portfolio management teams utilize in-house research and resources to determine suitability of specific securities and use sector specialists to determine relative value within each relevant sector. The portfolio management teams may also utilize proprietary ratings in seeking to identify financially material Environmental, Social and Governance (ESG) risks and opportunities.

Examples of the Fund’s asset categories are U.S. and foreign equities of any size and style (including emerging-market equities), U.S. and foreign fixed income of any credit quality (including emerging market bonds and inflation-indexed bonds), and alternative assets. Some asset categories may be represented by exchange-traded funds.

DWS Global Income Builder Fund returned –17.80% during the 12-month period that ended on October 31, 2022. The Fund slightly underperformed the –17.99% return of its benchmark, the Blended Index 60/40. The index consists of a blend of 60% MSCI All Country World Index and 40% Bloomberg U.S. Universal Index. The two indexes returned –19.96% and

DWS Global Income Builder Fund | | |

–15.79%, respectively. The Fund outperformed its Morningstar peer group, World Allocation Funds, in the five- and 10-year intervals ended October 31, 2022.

Market Overview

The world financial markets performed poorly in the past 12 months. Inflation remained a persistent concern, fueled by ongoing stresses in global supply chains and rising energy prices. The price pressures led the U.S. Federal Reserve (Fed) to end its quantitative easing program and raise interest rates by a total of three percentage points, and other central banks enacted rate hikes of their own. What’s more, the Fed appeared set to continue raising rates until inflation showed signs of returning closer to its longer-term target of 2%. Rising rates, in turn, fostered concerns about slowing economic growth and a concurrent decline in corporate earnings.

Geopolitical factors played a role in the markets’ weak return, as well. Russia’s invasion of Ukraine, which was followed by sanctions from the West, was a significant headwind for sentiment. China was also a source of concern. The nation’s government continued to put regulatory pressure on its technology companies, and it maintained a zero-COVID policy that proved to be a large hinderance to growth.

“The Fund was adversely affected by an environment in which virtually all major asset categories, with the exception of cash, lost ground.”

In combination, these developments depressed corporate earnings estimates and led to a compression of valuations in the equity market. While nearly all market segments lost ground in the sell-off, Europe, the emerging markets, and mega-cap U.S. technology-related stocks were particularly weak. On the other hand, energy stocks and resource-heavy nations held up reasonably well in the downturn thanks to the robust rally in crude oil prices.

All major fixed-income categories finished in the red, with bonds experiencing one of their worst stretches of performance in history. The yield on the two-year note rose from 0.48% at the beginning of the period to 4.51% by the end of October 2022, while the 10-year yield climbed

| | DWS Global Income Builder Fund |

from 1.55% to 4.10%. Longer-term bonds, domestic investment-grade corporates, and emerging markets debt were especially poor performers.

Contributors and Detractors

The Fund was adversely affected by an environment in which virtually all major asset categories, with the exception of cash, lost ground. As would be expected, its 12-month return was in between those of the equity and fixed-income benchmarks.

The Fund’s equity portfolio posted a negative absolute return but outpaced the MSCI World Index. Sector allocation added value, particularly an overweight in energy and an underweight in consumer discretionary. Country allocation was also a plus, primarily due to a large underweight in China. An overweight in Canada was also positive, while overweights in Europe and Japan detracted. Stock selection was a further contributor, as our emphasis on income-producing, profitable companies proved helpful in the challenging environment. In terms of portfolio activity, we increased the Fund’s weightings in the consumer discretionary and industrials sectors, as well as in the United States. The largest decreases occurred in financials, information technology, and Japan.

The Fund’s bond portfolio lost ground in absolute terms and trailed the Bloomberg U.S. Universal Index. We maintained overweight positions in domestic high-yield and emerging-market bonds, both of which underperformed at a time of elevated investor risk aversion. On the other hand, an underweight to duration (interest-rate sensitivity) contributed positively. The portfolio’s yield curve positioning, which favored short-term debt over longer-term issues, was a further plus.

We maintained an allocation to convertible securities and preferred stocks in lieu of bonds, with the goal of providing an additional source of yield with a lower degree of interest rate sensitivity than bonds. Preferreds, which outperformed the fixed-income index thanks to their above-average yields, contributed to performance. However, convertibles — which have a high correlation to the growth style due to the large representation of smaller technology and healthcare companies in the category — lagged.

The Fund used derivatives during the past 12 months. On the equity side, we used futures on equity indexes to achieve our desired weightings in a more efficient manner than buying and selling individual securities. In the bond portfolio, we used credit default swaps and other derivatives to

DWS Global Income Builder Fund | | |

manage the currency exposure of certain positions in foreign bonds. We also used interest-rate futures and swaps to manage the Fund’s duration. In the aggregate, our use of derivatives was a net detractor. Derivatives are used to achieve the fund’s risk and return objectives and should be evaluated within the context of the entire portfolio rather than as a standalone strategy.

Outlook and Positioning

We maintained a very cautious outlook at the close of the period. An economic slowdown appears likely to materialize in the coming year, creating the potential for significant negative earnings revisions. On the other hand, the markets may begin to stabilize if inflation starts to cool given the extent to which the major asset classes have already declined in the past year.

It’s extremely challenging to predict the accurate outcome of these cross-cutting developments, particularly when the market’s consensus view seems to change on almost a day-to-day basis. We therefore believe the most prudent approach is to remain positioned for a broad range of scenarios and keep overall risk on the lower end of the spectrum until uncertainty begins to dissipate.

Portfolio Management Team

Dokyoung Lee, CFA, Regional Head of Multi Asset & Solutions

Portfolio Manager of the Fund. Began managing the Fund in 2018.

—Joined DWS in 2018 with 24 years of industry experience; previously, worked as Head of Research and Portfolio Manager in the Global Multi-Asset Group at Oppenheimer Funds, and in research and portfolio management roles at AllianceBernstein.

—Americas Multi-Asset Head: New York.

—BSE, Princeton University.

Di Kumble, CFA, Senior Portfolio Manager Equity

Portfolio Manager of the Fund. Began managing the Fund in 2017.

—Joined DWS in 2003 with seven years of industry experience. Prior to joining, she served as a Portfolio Manager at Graham Capital Management. Previously, she worked as a Quantitative Strategist at ITG Inc. and Morgan Stanley.

—Senior Portfolio Manager, Head of Tax Managed Equities: New York.

—BS, Beijing University; PhD in Chemistry, Princeton University.

Thomas M. Farina, CFA, Head of Investment Strategy Fixed Income

Portfolio Manager of the Fund. Began managing the Fund in 2019.

—Joined DWS in 2006 with 12 years of industry experience. Head of Investment Grade Corporate Credit since 2013. Prior to joining, he held roles at Merrill Lynch Investment

| | DWS Global Income Builder Fund |

Management, Greenwich NatWest and at DnB Asset Management. He began his career as a Ratings Analyst at Standard & Poor’s.

—Senior Portfolio Manager and Co-Head of US Credit: New York.

—BA and MA in Economics, State University of New York at Albany.

Darwei Kung, Head of Investment Strategy Liquid Real Assets

Portfolio Manager of the Fund. Began managing the Fund in 2015.

—Joined DWS in 2006; previously has worked as a Director, Engineering and Business Development at Calpoint LLC from 2001–2004.

—Portfolio Manager: New York.

—BS and MS, University of Washington, Seattle; MS and MBA, Carnegie Mellon University.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

Blended Index 60/40 consists of an equally weighted blend of 60% MSCI All Country World Index and 40% Bloomberg U.S. Universal Index.

MSCI All Country World Index is an unmanaged equity index which captures large and mid-capitalization representation across 23 developed markets and 24 emerging markets countries. It covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Universal Index measures the performance of U.S. dollar-denominated taxable bonds that are rated either investment grade or high yield. The index includes U.S. Treasury bonds, investment-grade and high yield U.S. corporate bonds, mortgage-backed securities, and Eurodollar bonds.

Morningstar World Allocation portfolios seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds, and cash. The average category returns for the one-, five- and 10-year periods ending October 31, 2022 were –15.24%, 1.91%, and 3.89%, respectively.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Contribution and detraction incorporate both an investment’s total return and its weighting in the Fund.

Overweight means that a fund holds a higher weighting in a given sector or security than its benchmark index. Underweight means that a fund holds a lower weighting.

Duration, which is expressed in years, measures the sensitivity of the price of a bond or bond fund to a change in interest rates.

Convertible securities are bonds that can be exchanged for equity at a pre-stated price. Convertibles generally offer higher income than is available from a common stock, but more appreciation potential than bonds.

Derivatives are contracts whose values can be based on a variety of instruments including indices, currencies or securities. They can be utilized for a variety of reasons including for hedging purposes; for risk management; for non-hedging purposes to

DWS Global Income Builder Fund | | |

seek to enhance potential gains; or as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility.

Futures contracts are contractual agreements to buy or sell a particular commodity or financial instrument at a pre-determined price in the future.

A swap is a derivative in which two counterparties exchange cash flows of one party’s financial instrument for those of the other party’s financial instrument for a set period of time. The prices of credit default swaps, which are designed to offset credit risk, typically move in the opposite direction of the index or security they track.

| | DWS Global Income Builder Fund |

Performance SummaryOctober 31, 2022 (Unaudited)

| | | |

Average Annual Total Returns as of 10/31/22 |

Unadjusted for Sales Charge | | | |

Adjusted for the Maximum Sales Charge

(max 5.75% load) | | | |

MSCI All Country World Index† | | | |

| | | |

Bloomberg U.S. Universal Index††† | | | |

| | | |

Average Annual Total Returns as of 10/31/22 |

Unadjusted for Sales Charge | | | |

Adjusted for the Maximum Sales Charge

(max 1.00% CDSC) | | | |

MSCI All Country World Index† | | | |

| | | |

Bloomberg U.S. Universal Index††† | | | |

| | | |

Average Annual Total Returns as of 10/31/22 |

| | | |

MSCI All Country World Index† | | | |

| | | |

Bloomberg U.S. Universal Index††† | | | |

| | | |

Average Annual Total Returns as of 10/31/22 |

| | | |

MSCI All Country World Index† | | | |

| | | |

Bloomberg U.S. Universal Index††† | | | |

DWS Global Income Builder Fund | | |

| | | |

Average Annual Total Returns as of 10/31/22 |

| | | |

MSCI All Country World Index† | | | |

| | | |

Bloomberg U.S. Universal Index††† | | | |

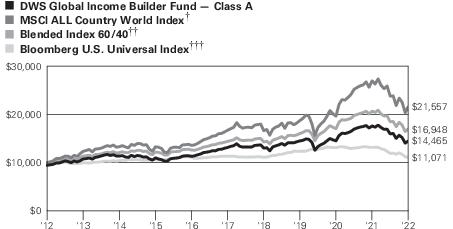

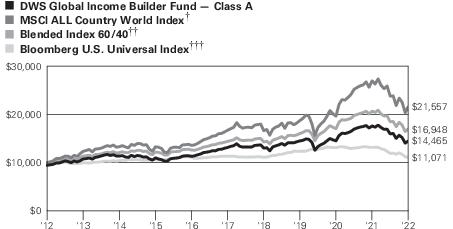

Performance in the Average Annual Total Returns table above and the Growth of an Assumed $10,000 Investment line graph that follows is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit dws.com for the Fund’s most recent month-end performance. Fund performance includes reinvestment of all distributions. Unadjusted returns do not reflect sales charges and would have been lower if they had.

The gross expense ratios of the Fund, as stated in the fee table of the prospectus dated March 1, 2022 are 0.89%, 1.71%, 0.56%, 0.70% and 0.66% for Class A, Class C, Class R6, Class S and Institutional Class shares, respectively, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Performance figures do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

| | DWS Global Income Builder Fund |

Growth of an Assumed $10,000 Investment

(Adjusted for Maximum Sales Charge)

Yearly periods ended October 31

Yearly periods ended October 31

The Fund’s growth of an assumed $10,000 investment is adjusted for the maximum sales charge of 5.75%. This results in a net initial investment of $9,425.

The growth of $10,000 is cumulative.

Performance of other share classes will vary based on the sales charges and the fee structure of those classes.

| Class R6 shares commenced operations on August 25, 2014. The performance shown for the Blended Index 60/40 is for the time period of August 31, 2014 through October 31, 2022, which is based on the performance period of the life of Class R6. |

| MSCI All Country World Index is an unmanaged equity index which captures large and mid-capitalization representation across 23 developed markets and 24 emerging markets countries. It covers approximately 85% of the global investable equity opportunity set. |

| The Blended Index 60/40 consists of an equally weighted blend of 60% MSCI All Country World Index and 40% Bloomberg U.S. Universal Index. |

| Bloomberg U.S. Universal Index measures the performance of U.S. dollar-denominated taxable bonds that are rated either investment grade or high yield. The index includes U.S. Treasury bonds, investment-grade and high yield U.S. corporate bonds, mortgage-backed securities, and Eurodollar bonds. The Advisor believes the additional Blended Index 60/40 and Bloomberg U.S. Universal Index, collectively, reflect the Fund’s asset allocations and generally represent the Fund’s overall investment process. |

DWS Global Income Builder Fund | | |

| | | | | |

|

| | | | | |

| | | | | |

Distribution Information as of 10/31/22 |

Income Dividends, Twelve Months | | | | | |

Capital Gain Distributions | | | | | |

| | DWS Global Income Builder Fund |

Portfolio Summary(Unaudited)

Asset Allocation (As a % of Investment Portfolio excluding Securities Lending Collateral) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Government & Agency Obligations | | |

| | |

Commercial Mortgage-Backed Securities | | |

Short-Term U.S. Treasury Obligations | | |

Collateralized Mortgage Obligations | | |

Loan Participations and Assignments | | |

Mortgage-Backed Securities Pass-Throughs | | |

| | |

| | |

| | |

Sector Diversification (As a % of Common Stocks, Preferred Stocks, Warrants, Corporate Bonds and Loan Participations and Assignments) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

DWS Global Income Builder Fund | | |

Geographical Diversification (As a % of Investment Portfolio excluding Exchange-Traded Funds, Securities Lending Collateral and Cash Equivalents) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Five Largest Equity Holdings at October 31, 2022

(7.3% of Net Assets) | |

| |

Designs, manufactures and markets personal computers and related computing and mobile-communication devices | |

| |

Develops, manufactures, licenses, sells and supports software products | |

| |

Holding company with subsidiaries that provide Web-based search, maps, hardware products and various software applications | |

| |

Explorer and producer of oil and gas | |

| |

Online retailer offering a wide range of products | |

Five Largest Fixed-Income Long-Term Securities

at October 31, 2022 (8.8% of Net Assets) | |

| |

| |

2Credit Suisse Commercial Mortgage Trust | |

| |

3Madison Park Funding XXVI Ltd. | |

| |

4Citigroup Commercial Mortgage Trust | |

| |

| |

| |

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 17. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Account Management Resources section on page 84 for contact information.

| | DWS Global Income Builder Fund |

Investment Portfolioas of October 31, 2022

| | |

| |

Communication Services 4.7% | |

Diversified Telecommunication Services 1.8% | |

| | | |

| | | |

Deutsche Telekom AG (Registered) | | | |

| | | |

| | | |

| | | |

Telefonica Deutschland Holding AG | | | |

| | | |

| | | |

| | | |

Verizon Communications, Inc. | | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

Interactive Media & Services 1.6% | |

| | | |

| | | |

| | | |

| | | |

| | | |

Meta Platforms, Inc. “A” * | | | |

ZoomInfo Technologies, Inc. “A” * | | | |

| | | |

| |

| | | |

Interpublic Group of Companies, Inc. | | | |

| | | |

| | | |

Wireless Telecommunication Services 0.8% | |

America Movil SAB de CV “L” (ADR) | | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

| | | |

| | | |

| | | |

Consumer Discretionary 4.3% | |

| |

| | | |

| | | |

| | | |

Hotels, Restaurants & Leisure 0.8% | |

| | | |

| | | |

| | | |

La Francaise des Jeux SAEM 144A | | | |

| | | |

Restaurant Brands International, Inc. | | | |

| | | |

| | | |

| | | |

| |

| | | |

Internet & Direct Marketing Retail 1.0% | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

Chow Tai Fook Jewellery Group Ltd. | | | |

H & M Hennes & Mauritz AB “B” | | | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

Textiles, Apparel & Luxury Goods 0.2% | |

| | | |

LVMH Moet Hennessy Louis Vuitton SE | | | |

| | | |

| | | |

| | | |

| |

| |

| | | |

| | | |

Coca-Cola Europacific Partners PLC | | | |

Coca-Cola Femsa SAB de CV (ADR) | | | |

| | | |

| | | |

Food & Staples Retailing 0.8% | |

| | | |

| | | |

| | | |

Walgreens Boots Alliance, Inc. | | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| |

| | | |

| |

British American Tobacco PLC | | | |

| | | |

| | | |

Philip Morris International, Inc. | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

| |

Oil, Gas & Consumable Fuels | |

| | | |

Canadian Natural Resources Ltd. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| |

Australia & New Zealand Banking Group Ltd. | | | |

Banco Bilbao Vizcaya Argentaria SA | | | |

| | | |

Banco Santander Chile (ADR) | | | |

| | | |

| | | |

| | | |

BOC Hong Kong Holdings Ltd. | | | |

Canadian Imperial Bank of Commerce | | | |

Citizens Financial Group, Inc. | | | |

Commonwealth Bank of Australia | | | |

| | | |

Huntington Bancshares, Inc. | | | |

| | | |

KB Financial Group, Inc. (ADR) | | | |

| | | |

Mizrahi Tefahot Bank Ltd. | | | |

| | | |

PNC Financial Services Group, Inc. | | | |

| | | |

| | | |

Shinhan Financial Group Co., Ltd. (ADR) | | | |

Skandinaviska Enskilda Banken AB “A” | | | |

| | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

Daiwa Securities Group, Inc. | | | |

| | | |

| | | |

Partners Group Holding AG | | | |

T. Rowe Price Group, Inc. | | | |

| | | |

Diversified Financial Services 0.3% | |

Apollo Global Management, Inc. | | | |

| | | |

| | | |

| |

| | | |

| | | |

Assicurazioni Generali SpA | | | |

| | | |

| | | |

Legal & General Group PLC | | | |

Ping An Insurance Group Co. of China Ltd. (ADR) | | | |

| | | |

Zurich Insurance Group AG | | | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Health Care Equipment & Supplies 0.7% | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

| | | |

| | | |

| | | |

Edwards Lifesciences Corp.* | | | |

Intuitive Surgical, Inc.* | | | |

| | | |

| | | |

| | | |

Health Care Providers & Services 0.9% | |

| | | |

| | | |

| | | |

| | | |

| | | |

Life Sciences Tools & Services 0.0% | |

| | | |

| |

| | | |

| | | |

Chugai Pharmaceutical Co., Ltd. | | | |

| | | |

| | | |

| | | |

Hikma Pharmaceuticals PLC | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Roche Holding AG (Genusschein) | | | |

| | | |

Takeda Pharmaceutical Co., Ltd. | | | |

| | | |

| |

| |

| | | |

Raytheon Technologies Corp. | | | |

| | | |

Air Freight & Logistics 0.5% | |

Deutsche Post AG (Registered) | | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

| | | |

United Parcel Service, Inc. “B” | | | |

| | | |

Commercial Services & Supplies 0.0% | |

| | | |

Construction & Engineering 0.0% | |

| | | |

Electrical Equipment 0.3% | |

| | | |

| | | |

| | | |

Industrial Conglomerates 0.7% | |

| | | |

Honeywell International, Inc. | | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

Illinois Tool Works, Inc. | | | |

| | | |

Techtronic Industries Co., Ltd. | | | |

| | | |

| |

Kuehne + Nagel International AG (Registered) | | | |

Professional Services 0.2% | |

Nihon M&A Center Holdings, Inc. | | | |

| | | |

| | | |

| | | |

| |

| | | |

Canadian National Railway Co. | | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

Trading Companies & Distributors 0.2% | |

| | | |

| | | |

| | | |

Information Technology 13.5% | |

Communications Equipment 0.7% | |

| | | |

| |

| | | |

Automatic Data Processing, Inc. | | | |

| | | |

| | | |

| | | |

| | | |

International Business Machines Corp. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Semiconductors & Semiconductor Equipment 3.6% | |

Advanced Micro Devices, Inc.* | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Monolithic Power Systems, Inc. | | | |

| | | |

| | | |

Taiwan Semiconductor Manufacturing Co., Ltd. (ADR) | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

| | | |

United Microelectronics Corp. (ADR)* | | | |

| | | |

| |

| | | |

| | | |

Cadence Design Systems, Inc.* | | | |

Crowdstrike Holdings, Inc. “A” * | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Technology Hardware, Storage & Peripherals 2.6% | |

| | | |

| | | |

Samsung Electronics Co. Ltd. (GDR) REG S | | | |

| | | |

| |

| |

Air Products & Chemicals, Inc. | | | |

| | | |

| | | |

LyondellBasell Industries NV “A” | | | |

Sociedad Quimica y Minera de Chile SA (ADR) | | | |

| | | |

| | | |

| | | |

Construction Materials 0.2% | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

Containers & Packaging 0.3% | |

| | | |

| | | |

Packaging Corp. of America | | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

POSCO Holdings, Inc. (ADR) | | | |

| | | |

Sumitomo Metal Mining Co., Ltd. | | | |

| | | |

| |

Equity Real Estate Investment Trusts (REITs) 1.6% | |

Ascendas Real Estate Investment Trust | | | |

| | | |

Gaming and Leisure Properties, Inc. | | | |

| | | |

Mapletree Pan Asia Commercial Trust | | | |

| | | |

Simon Property Group, Inc. | | | |

| | | |

| | | |

| | | |

Real Estate Management & Development 0.3% | |

Daito Trust Construction Co., Ltd. | | | |

Henderson Land Development Co., Ltd. | | | |

| | | |

| | | |

| | | |

| |

| |

American Electric Power Co., Inc. | | | |

HK Electric Investments & HK Electric Investments Ltd. | | | |

| | | |

Power Assets Holdings Ltd. | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

| | | |

| | | |

| | | |

| |

| | | |

| |

Algonquin Power & Utilities Corp. | | | |

| | | |

| | | |

| | | |

Total Common Stocks (Cost $306,579,609) | |

| |

Communication Services 0.4% | |

AT&T, Inc., 5.35% (Cost $2,528,800) | | | |

| |

AGNC Investment Corp., Series C, 9.19% | | | |

Charles Schwab Corp., Series D, 5.95% | | | |

Fifth Third Bancorp., Series I, 6.625% | | | |

Goldman Sachs Group, Inc., Series J, 5.5% | | | |

KeyCorp., Series E, 6.125% | | | |

Morgan Stanley, Series K, 5.85% | | | |

PNC Financial Services Group, Inc., Series P, 8.528% | | | |

Regions Financial Corp., Series B, 6.375% | | | |

Wells Fargo & Co., Series Y, 5.625% | | | |

| | | |

| |

Kimco Realty Corp., Series L, 5.125% | | | |

Prologis, Inc., Series Q, 8.54% | | | |

Simon Property Group, Inc., Series J, 8.375% | | | |

| | | |

Total Preferred Stocks (Cost $24,213,173) | |

| |

| |

Hercules Trust II, Expiration Date 3/31/2029* (a) (Cost $90,210) | | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

| |

Communication Services 1.4% | |

America Movil SAB de CV, 4.375%, 4/22/2049 | | | |

| | | |

| | | |

| | | |

Charter Communications Operating LLC: | | | |

| | | |

| | | |

Discovery Communications LLC, 4.0%, 9/15/2055 | | | |

Grupo Televisa SAB, 5.25%, 5/24/2049 | | | |

Meituan, 144A, 2.125%, 10/28/2025 | | | |

Netflix, Inc., 5.875%, 11/15/2028 | | | |

Rogers Communications, Inc., 144A, 3.8%, 3/15/2032 | | | |

Tencent Holdings Ltd., REG S, 2.39%, 6/3/2030 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Verizon Communications, Inc.: | | | |

| | | |

| | | |

| | | |

Consumer Discretionary 1.1% | |

Ford Motor Co., 3.25%, 2/12/2032 | | | |

Ford Motor Credit Co. LLC: | | | |

| | | |

| | | |

| | | |

| | | |

General Motors Co., 5.6%, 10/15/2032 | | | |

General Motors Financial Co., Inc.: | | | |

| | | |

| | | |

Newell Brands, Inc., 6.375%, 9/15/2027 | | | |

Nissan Motor Co., Ltd., 144A, 4.345%, 9/17/2027 | | | |

Warnermedia Holdings, Inc., 144A, 5.05%, 3/15/2042 | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

| |

Anheuser-Busch Companies LLC, 4.9%, 2/1/2046 | | | |

Anheuser-Busch InBev Worldwide, Inc.: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Cheniere Corpus Christi Holdings LLC, 5.875%, 3/31/2025 | | | |

Cheniere Energy Partners LP, 4.5%, 10/1/2029 | | | |

Ecopetrol SA, 6.875%, 4/29/2030 | | | |

Enterprise Products Operating LLC: | | | |

| | | |

| | | |

Petroleos Mexicanos, 6.7%, 2/16/2032 | | | |

Plains All American Pipeline LP, 3.8%, 9/15/2030 | | | |

SA Global Sukuk Ltd., 144A, 2.694%, 6/17/2031 | | | |

| | | |

| | | |

| | | |

Williams Companies, Inc., 4.65%, 8/15/2032 | | | |

| | | |

| |

AerCap Ireland Capital DAC, 1.75%, 1/30/2026 | | | |

Air Lease Corp., 4.125%, Perpetual (c) | | | |

Aircastle Ltd., 144A, 5.25%, Perpetual (c) | | | |

Ally Financial, Inc., 4.7%, Perpetual (c) | | | |

Ares Capital Corp., 2.875%, 6/15/2027 | | | |

Banco Nacional de Panama, 144A, 2.5%, 8/11/2030 | | | |

Banco Santander SA, 5.294%, 8/18/2027 | | | |

| | | |

| | | |

| | | |

Bank of New York Mellon Corp.: | | | |

| | | |

| | | |

Blackstone Secured Lending Fund: | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

| | | |

Capital One Financial Corp., 3.95%, Perpetual (c) | | | |

Citigroup, Inc., 3.057%, 1/25/2033 | | | |

Enstar Finance LLC, 5.5%, 1/15/2042 | | | |

HSBC Holdings PLC, 7.336%, 11/3/2026 (d) | | | |

JPMorgan Chase & Co., 3.328%, 4/22/2052 | | | |

KKR Group Finance Co., XII LLC, 144A, 4.85%, 5/17/2032 | | | |

Liberty Mutual Group, Inc., 144A, 5.5%, 6/15/2052 | | | |

Lloyds Banking Group PLC, 4.716%, 8/11/2026 | | | |

MDGH GMTN RSC Ltd., REG S, 3.7%, 11/7/2049 | | | |

Morgan Stanley, 2.484%, 9/16/2036 | | | |

Nippon Life Insurance Co., 144A, 2.75%, 1/21/2051 | | | |

PNC Financial Services Group, Inc., 3.4%, Perpetual (c) | | | |

| | | |

| | | |

| | | |

| | | |

144A, 5.375%, Perpetual (c) | | | |

| | | |

State Street Corp., 4.164%, 8/4/2033 | | | |

| | | |

| | | |

| | | |

The Charles Schwab Corp., Series I, 4.0%, Perpetual (c) | | | |

The Goldman Sachs Group, Inc., 3.8%, Perpetual (c) | | | |

Truist Financial Corp., Series N, 4.8%, Perpetual (c) | | | |

U.S. Bancorp, 5.85%, 10/21/2033 | | | |

UBS Group AG, 144A, 4.375%, Perpetual (c) | | | |

| | | |

| |

| | | |

| | | |

| | | |

Charles River Laboratories International, Inc., 144A, 3.75%, 3/15/2029 | | | |

| | | |

| | | |

| | | |

Elevance Health, Inc., 6.1%, 10/15/2052 (d) | | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

Teva Pharmaceutical Finance Netherlands III BV, 3.15%, 10/1/2026 | | | |

UnitedHealth Group, Inc., 5.875%, 2/15/2053 | | | |

| | | |

| |

Adani Ports & Special Economic Zone Ltd., 144A, 4.2%, 8/4/2027 | | | |

American Airlines, Inc., 144A, 5.5%, 4/20/2026 | | | |

Block, Inc., 2.75%, 6/1/2026 | | | |

Boeing Co., 2.196%, 2/4/2026 | | | |

Delta Air Lines, Inc., 3.75%, 10/28/2029 | | | |

Eaton Corp., 4.15%, 3/15/2033 | | | |

Empresa de los Ferrocarriles del Estado, 144A, 3.068%, 8/18/2050 | | | |

Mileage Plus Holdings LLC, 144A, 6.5%, 6/20/2027 | | | |

Prime Security Services Borrower LLC, 144A, 5.25%, 4/15/2024 | | | |

| | | |

Information Technology 1.1% | |

Broadcom, Inc., 144A, 2.6%, 2/15/2033 | | | |

Dell International LLC, 5.3%, 10/1/2029 | | | |

HP, Inc., 5.5%, 1/15/2033 | | | |

Micron Technology, Inc., 6.75%, 11/1/2029 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Open Text Corp., 144A, 3.875%, 2/15/2028 | | | |

| | | |

| | | |

| | | |

SK Hynix, Inc., 144A, 1.5%, 1/19/2026 | | | |

| | | |

| |

AngloGold Ashanti Holdings PLC, 3.75%, 10/1/2030 | | | |

Berry Global, Inc., 1.65%, 1/15/2027 | | | |

Celanese U.S. Holdings LLC: | | | |

| | | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

Corp. Nacional del Cobre de Chile, 144A, 3.15%, 1/15/2051 | | | |

MEGlobal Canada ULC, 144A, 5.0%, 5/18/2025 | | | |

Suzano Austria GmbH, 2.5%, 9/15/2028 | | | |

| | | |

| |

Boston Properties LP, (REIT), 2.55%, 4/1/2032 | | | |

MPT Operating Partnership LP, (REIT), 3.5%, 3/15/2031 | | | |

| | | |

| |

AES Panama Generation Holdings SRL, 144A, 4.375%, 5/31/2030 | | | |

CMS Energy Corp., 3.75%, 12/1/2050 | | | |

Duke Energy Corp., 3.25%, 1/15/2082 | | | |

Enel Finance International NV, 144A, 5.0%, 6/15/2032 | | | |

Eskom Holdings SOC Ltd., REG S, 6.35%, 8/10/2028 | | | |

NextEra Energy Operating Partners LP: | | | |

| | | |

| | | |

Pacific Gas and Electric Co.: | | | |

| | | |

| | | |

| | | |

| | | |

Perusahaan Listrik Negara PT, 144A, 2.875%, 10/25/2025 | | | |

Sempra Energy, 4.125%, 4/1/2052 | | | |

Southern Co., 3.75%, 9/15/2051 | | | |

| | | |

Total Corporate Bonds (Cost $129,549,768) | |

|

Automobile Receivables 0.1% | |

JPMorgan Chase Bank NA, “E” , Series 2021-1, 144A, 2.365%, 9/25/2028 | | | |

| |

CF Hippolyta Issuer LLC, “B1” , Series 2021-1A, 144A, 1.98%, 3/15/2061 | | | |

DB Master Finance LLC, “A23” , Series 2021-1A, 144A, 2.791%, 11/20/2051 | | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

Madison Park Funding XXVI Ltd., “AR” , Series 2007-4A, 144A, 3-month USD-LIBOR + 1.2%, 5.615% (e), 7/29/2030 | | | |

Octagon Investment Partners Ltd., “A1R” , Series 2019-4A, 144A, 3-month USD-LIBOR + 1.15%, 4.073% (e), 5/12/2031 | | | |

Venture 37 CLO Ltd., “A1R” , Series 2019-37A, 144A, 3-month USD-LIBOR + 1.15%, 5.229% (e), 7/15/2032 | | | |

Wendy’s Funding LLC, “A2II” , Series 2021-1A, 144A, 2.775%, 6/15/2051 | | | |

| | | |

Total Asset-Backed (Cost $28,370,009) | |

Mortgage-Backed Securities Pass-Throughs 0.0% | |

Government National Mortgage Association, 6.5%, 8/20/2034 (Cost $19,336) | | | |

Commercial Mortgage-Backed Securities 2.6% | |

Citigroup Commercial Mortgage Trust: | | | |

“C” , Series 2019-PRM, 144A, 3.896%, 5/10/2036 | | | |

“D” , Series 2019-PRM, 144A, 4.35%, 5/10/2036 | | | |

Credit Suisse Commercial Mortgage Trust: | | | |

“A” , Series 2020-TMIC, 144A, 1-month USD-LIBOR + 3.0%, 6.412% (e), 12/15/2035 | | | |

“B” , Series 2020-TMIC, 144A, 1-month USD-LIBOR + 5.0%, 8.412% (e), 12/15/2035 | | | |

Freddie Mac Multifamily Structured Credit Risk, “M2” , Series 2021-MN1, 144A, 30-day average SOFR + 3.75%, 6.747% (e), 1/25/2051 | | | |

Total Commercial Mortgage-Backed Securities (Cost $15,005,420) | |

Collateralized Mortgage Obligations 1.0% |

Connecticut Avenue Securities Trust: | | | |

“1M2” , Series 2020-R01, 144A, 1-month USD-LIBOR + 2.05%, 5.636% (e), 1/25/2040 | | | |

“1M2” , Series 2019-R03, 144A, 1-month USD-LIBOR + 2.15%, 5.736% (e), 9/25/2031 | | | |

“1M2” , Series 2019-R02, 144A, 1-month USD-LIBOR + 2.3%, 5.886% (e), 8/25/2031 | | | |

Fannie Mae Connecticut Avenue Securities, “1M2” , Series 2018-C06, 1-month USD-LIBOR + 2.0%, 5.586% (e), 3/25/2031 | | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | |

Federal National Mortgage Association, “I” , Series 2003-84, Interest Only, 6.0%, 9/25/2033 | | | |

Freddie Mac Structured Agency Credit Risk Debt Notes: | | | |

“M2” , Series 2020-DNA2, 144A, 1-month USD-LIBOR + 1.85%, 5.436% (e), 2/25/2050 | | | |

“M2” , Series 2019-DNA2, 144A, 1-month USD-LIBOR + 2.45%, 6.036% (e), 3/25/2049 | | | |

JPMorgan Mortgage Trust, “AM” , Series 2016-3, 144A, 3.24% (e), 10/25/2046 | | | |

Total Collateralized Mortgage Obligations (Cost $5,980,716) | |

Government & Agency Obligations 6.1% |

| |

Brazilian Government International Bond, 3.875%, 6/12/2030 | | | |

Indonesia Government International Bond: | | | |

| | | |

| | | |

Perusahaan Penerbit SBSN Indonesia III, 144A, 2.8%, 6/23/2030 | | | |

United Mexican States, 3.5%, 2/12/2034 | | | |

| | | |

U.S. Treasury Obligations 5.0% | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Total Government & Agency Obligations (Cost $38,526,280) | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | |

Loan Participations and Assignments 0.5% |

| |

Hilton Worldwide Finance LLC, Term Loan B2, 1-month-USD LIBOR + 1.75%, 5.336%, 6/22/2026 | | | |

TransDigm, Inc., Term Loan F, 3-month USD-LIBOR + 2.25%, 5.924%, 12/9/2025 | | | |

| | | |

Total Loan Participations and Assignments (Cost $2,620,629) | |

Short-Term U.S. Treasury Obligations 1.3% |

| | | |

| | | |

1.998% (f), 4/20/2023 (g) (h) | | | |

Total Short-Term U.S. Treasury Obligations (Cost $7,627,498) | |

| | |

Exchange-Traded Funds 3.0% |

SPDR Bloomberg Convertible Securities ETF (Cost $13,817,168) | | | |

|

DWS Central Cash Management Government Fund, 3.0% (i) (Cost $847,361) | | | |

| | | |

Total Investment Portfolio (Cost $573,247,177) | | | |

Other Assets and Liabilities, Net | | | |

| | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

A summary of the Fund’s transactions with affiliated investments during the year ended October 31, 2022 are as follows:

| | | Net

Realized

Gain/

(Loss) ($) | Net

Change in

Unrealized

Appreci-

ation

(Deprecia-

tion) ($) | | Capital

Gain

Distribu-

tions ($) | Number of

Shares at

10/31/2022 | |

Securities Lending Collateral 0.0% |

DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” , 2.93% (i) (j) |

| | | | | | | | |

|

DWS Central Cash Management Government Fund, 3.0% (i) |

| | | | | | | | |

| | | | | | | | |

| Non-income producing security. |

| Investment was valued using significant unobservable inputs. |

| Principal amount stated in U.S. dollars unless otherwise noted. |

| Perpetual, callable security with no stated maturity date. |

| |

| Variable or floating rate security. These securities are shown at their current rate as of October 31, 2022. For securities based on a published reference rate and spread, the reference rate and spread are indicated within the description above. Certain variable rate securities are not based on a published reference rate and spread but adjust periodically based on current market conditions, prepayment of underlying positions and/or other variables. Securities with a floor or ceiling feature are disclosed at the inherent rate, where applicable. |

| Annualized yield at time of purchase; not a coupon rate. |

| At October 31, 2022, this security has been pledged, in whole or in part, to cover initial margin requirements for open centrally cleared swap contracts. |

| At October 31, 2022, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts. |

| Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the year ended October 31, 2022. |

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

ADR: American Depositary Receipt |

CLO: Collateralized Loan Obligation |

GDR: Global Depositary Receipt |

Interest Only: Interest Only (IO) bonds represent the “interest only” portion of payments on a pool of underlying mortgages or mortgage-backed securities. IO securities are subject to prepayment risk of the pool of underlying mortgages. |

MSCI: Morgan Stanley Capital International |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

REG S: Securities sold under Regulation S may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. |

REIT: Real Estate Investment Trust |

|

SBSN: Surat Berharga Syariah Negara (Islamic Based Government Securities) |

|

SOFR: Secured Overnight Financing Rate |

SPDR: Standard & Poor’s Depositary Receipt |

LIBOR: London Interbank Offered Rate, the benchmark rate for certain floating rate securities, has been phased out as of the end of 2021 for most maturities and currencies, although certain widely used US Dollar LIBOR rates are expected to continue to be published through June 2023 to assist with the transition. The Fund or the instruments in which the Fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. Although the transition process away from LIBOR has become increasingly well defined, there remains uncertainty regarding the future use of LIBOR and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the Fund of the transition away from LIBOR.

Included in the portfolio are investments in mortgage or asset-backed securities which are interests in separate pools of mortgages or assets. Effective maturities of these investments may be shorter than stated maturities due to prepayments.

At October 31, 2022, open futures contracts purchased were as follows:

| | | | | | Unrealized

Depreciation ($) |

10 Year U.S. Treasury Note | | | | | | |

MSCI E-Mini Emerging Market Index | | | | | | |

Ultra Long U.S. Treasury Bond | | | | | | |

Total unrealized depreciation | |

At October 31, 2022, open futures contracts sold were as follows:

| | | | | | Unrealized

Appreciation/

(Depreciation) ($) |

| | | | | | |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

| | | | | | Unrealized Appreciation/ (Depreciation) ($) |

| | | | | | |

| | | | | | |

Total net unrealized appreciation | |

At October 31, 2022, open interest rate swap contracts were as follows:

|

Cash Flows

Paid by

the Fund/

Frequency | Cash Flows

Received by

the Fund/

Frequency | | | | | Upfront

Payments

Paid/

(Received)

($) | Unrealized

Appreciation

($) |

Fixed — 0.25% Semi-Annually | Floating — 3-Month LIBOR Quarterly β | | | | | | |

Fixed — 0.45% Semi-Annually | Floating — 3-Month LIBOR Quarterly β | | | | | | |

Fixed — 1.3% Semi-Annually | Floating — 3-Month LIBOR Quarterly β | | | | | | |

Fixed — 1.63% Semi-Annually | Floating — 3-Month LIBOR Quarterly β | | | | | | |

Total unrealized appreciation | |

| 3-month LIBOR rate as of October 31, 2022 is 4.460%. |

At October 31, 2022, the Fund had the following open forward foreign currency contracts:

| | | Unrealized

Appreciation ($) | |

| | | | | | |

| | | Unrealized

Depreciation ($) | |

| | | | | | |

| | | | | | |

Total unrealized depreciation | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

For information on the Fund’s policy and additional disclosures regarding futures contracts, interest rate swap contracts and forward foreign currency contracts, please refer to the Derivatives section of Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2022 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments,

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Mortgage-Backed Securities Pass-Throughs | | | | |

Commercial Mortgage-Backed Securities | | | | |

Collateralized Mortgage Obligations | | | | |

Government & Agency Obligations (a) | | | | |

Loan Participations and Assignments | | | | |

Short-Term U.S. Treasury Obligations | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Interest Rate Swap Contracts | | | | |

Forward Foreign Currency Contracts | | | | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

| | | | |

| | | | |

| | | | |

Forward Foreign Currency Contracts | | | | |

| | | | |

| See Investment Portfolio for additional detailed categorizations. |

| Derivatives include unrealized appreciation (depreciation) on open futures contracts, interest rate swap contracts and forward foreign currency contracts. |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

Statement of Assets and Liabilities

as of October 31, 2022

| |

Investments in non-affiliated securities, at value (cost $572,399,816) | |

Investment in DWS Central Cash Management Government Fund (cost $847,361) | |

| |

Foreign currency, at value (cost $347,590) | |

Receivable for Fund shares sold | |

| |

| |

Receivable for variation margin on centrally cleared swaps | |

Unrealized appreciation on forward foreign currency contracts | |

Foreign taxes recoverable | |

| |

| |

| |

Payable for investments purchased — when-issued securities | |

Payable for Fund shares redeemed | |

Payable for variation margin on futures contracts | |

Unrealized depreciation on forward foreign currency contracts | |

| |

| |

Other accrued expenses and payables | |

| |

| |

| |

Distributable earnings (loss) | |

| |

| |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

Statement of Assets and Liabilities as of October 31, 2022 (continued)

| |

| |

Net Asset Value and redemption price per share

($403,683,884 ÷ 49,383,169 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized) | |

Maximum offering price per share (100 ÷ 94.25 of $8.17) | |

| |

Net Asset Value, offering and redemption price

(subject to contingent deferred sales charge) per share

($4,099,048 ÷ 501,516 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | |

| |

Net Asset Value, offering and redemption price per share

($8,964,786 ÷ 1,098,708 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | |

| |

Net Asset Value, offering and redemption price per share

($130,155,168 ÷ 15,924,249 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | |

| |

Net Asset Value, offering and redemption price per share

($19,300,511 ÷ 2,364,367 outstanding shares of beneficial interest, no par value, unlimited number of shares authorized) | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

Statement of Operations

for the year ended October 31, 2022

| |

| |

Dividends (net of foreign taxes withheld of $803,882) | |

| |

Income distributions — DWS Central Cash Management Government Fund | |

Securities lending income, net of borrower rebates | |

| |

| |

| |

| |

| |

Distribution and service fees | |

| |

| |

| |

| |

Trustees' fees and expenses | |

| |

| |

| |

Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) from: | |

| |

| |

| |

Forward foreign currency contracts | |

| |

| |

Change in net unrealized appreciation (depreciation) on: | |

| |

| |

| |

Forward foreign currency contracts | |

| |

| |

| |

Net increase (decrease) in net assets resulting from operations | |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

Statements of Changes in Net Assets

| |

Increase (Decrease) in Net Assets | | |

| | |

| | |

| | |

Change in net unrealized appreciation

(depreciation) | | |

Net increase (decrease) in net assets resulting from operations | | |

Distributions to shareholders: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Proceeds from shares sold | | |

Reinvestment of distributions | | |

Payments for shares redeemed | | |

Net increase (decrease) in net assets from Fund share transactions | | |

Increase (decrease) in net assets | | |

Net assets at beginning of period | | |

Net assets at end of period | | |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

Financial Highlights

DWS Global Income Builder Fund — Class A |

| |

| | | | | |

|

Net asset value, beginning of period | | | | | |

Income (loss) from investment operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

Total from investment operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of period | | | | | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data |

Net assets, end of period ($ millions) | | | | | |

| | | | | |

Ratio of net investment income (%) | | | | | |

Portfolio turnover rate (%) | | | | | |

| Based on average shares outstanding during the period. |

| Total return does not reflect the effect of any sales charges. |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

DWS Global Income Builder Fund — Class C |

| |

| | | | | |

|

Net asset value, beginning of period | | | | | |

Income (loss) from investment operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

Total from investment operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of period | | | | | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data |

Net assets, end of period ($ millions) | | | | | |

| | | | | |

Ratio of net investment income (%) | | | | | |

Portfolio turnover rate (%) | | | | | |

| Based on average shares outstanding during the period. |

| Total return does not reflect the effect of any sales charges. |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

DWS Global Income Builder Fund — Class R6 |

| |

| | | | | |

| | | | | |

Net asset value, beginning of period | | | | | |

Income (loss) from investment operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

Total from investment operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of period | | | | | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data |

Net assets, end of period ($ millions) | | | | | |

| | | | | |

Ratio of net investment income (%) | | | | | |

Portfolio turnover rate (%) | | | | | |

| Based on average shares outstanding during the period. |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

DWS Global Income Builder Fund — Class S |

| |

| | | | | |

|

Net asset value, beginning of period | | | | | |

Income (loss) from investment operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

Total from investment operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of period | | | | | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data |

Net assets, end of period ($ millions) | | | | | |

| | | | | |

Ratio of net investment income (%) | | | | | |

Portfolio turnover rate (%) | | | | | |

| Based on average shares outstanding during the period. |

| Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

DWS Global Income Builder Fund | | |

DWS Global Income Builder Fund — Institutional Class |

| |

| | | | | |

|

Net asset value, beginning of period | | | | | |

Income (loss) from investment operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

Total from investment operations | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net asset value, end of period | | | | | |

| | | | | |

Ratios to Average Net Assets and Supplemental Data |

Net assets, end of period ($ millions) | | | | | |

| | | | | |

Ratio of net investment income (%) | | | | | |

Portfolio turnover rate (%) | | | | | |

| Based on average shares outstanding during the period. |

| Amount is less than $.005. |

The accompanying notes are an integral part of the financial statements.

| | DWS Global Income Builder Fund |

Notes to Financial Statements

A.

Organization and Significant Accounting Policies

DWS Global Income Builder Fund (the “Fund” ) is a diversified series of Deutsche DWS Market Trust (the “Trust” ), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act” ), as an open-end management investment company organized as a Massachusetts business trust.

The Fund offers multiple classes of shares which provide investors with different purchase options. Class A shares are subject to an initial sales charge. Class C shares are not subject to an initial sales charge but are subject to higher ongoing expenses than Class A shares and a contingent deferred sales charge payable upon certain redemptions within one year of purchase. Class C shares automatically convert to Class A shares in the same fund after 8 years, provided that the Fund or the financial intermediary through which the shareholder purchased the Class C shares has records verifying that the Class C shares have been held for at least 8 years. Class R6 shares are not subject to initial or contingent deferred sales charges and are generally available only to certain qualifying plans and programs. Class S shares are not subject to initial or contingent deferred sales charges and are available through certain intermediary relationships with financial services firms, or can be purchased by establishing an account directly with the Fund’s transfer agent. Institutional Class shares are not subject to initial or contingent deferred sales charges and are generally available only to qualified institutions.

Investment income, realized and unrealized gains and losses, and certain fund-level expenses and expense reductions, if any, are borne pro rata on the basis of relative net assets by the holders of all classes of shares, except that each class bears certain expenses unique to that class such as distribution and service fees, services to shareholders and certain other class-specific expenses. Differences in class-level expenses may result in payment of different per share dividends by class. All shares of the Fund have equal rights with respect to voting subject to class-specific arrangements.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP” ) which require the use of management estimates. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting Standards Codification of U.S. GAAP. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

DWS Global Income Builder Fund | | |

The Fund’s Board has designated DWS Investment Management Americas, Inc. (the “Advisor” ) as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Advisor’s Pricing Committee (the “Pricing Committee” ) typically values securities using readily available market quotations or prices supplied by independent pricing services (which are considered fair values under Rule 2a-5). The Advisor has adopted fair valuation procedures that provide methodologies for fair valuing securities.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Equity securities and exchange-traded funds (“ETFs” ) are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Equity securities or ETFs for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities and ETFs are generally categorized as Level 1. For certain international equity securities, in order to adjust for events which may occur between the close of the foreign exchanges and the close of the New York Stock Exchange, a fair valuation model may be used. This fair valuation model takes into account comparisons to the valuation of American Depository Receipts (ADRs), exchange-traded funds, futures contracts and certain indices and these securities are categorized as Level 2.

Debt securities are valued at prices supplied by independent pricing services approved by the Pricing Committee. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers. These securities are generally categorized as Level 2.

Senior loans are valued by independent pricing services approved by the Pricing Committee, whose valuations are intended to reflect the average of broker supplied quotes representing mean between the bid and asked prices. If the pricing services are unable to provide valuations, the

| | DWS Global Income Builder Fund |

securities are valued at the mean of the most recent bid and asked quotations or evaluated price, as applicable, obtained from one or more broker-dealers. Certain securities may be valued on the basis of a price provided by a single source or broker-dealer. No active trading market may exist for some senior loans, and they may be subject to restrictions on resale. The inability to dispose of senior loans in a timely fashion could result in losses. Senior loans are generally categorized as Level 2.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Futures contracts are generally valued at the settlement prices established each day on the exchange on which they are traded and are categorized as Level 1.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Swap contracts are valued daily based upon prices supplied by a pricing vendor approved by the Pricing Committee, if available, and otherwise are valued at the price provided by the broker-dealer with which the swap was traded. Swap contracts are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Pricing Committee and are generally categorized as Level 3. In accordance with the Fund’s valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company’s or issuer’s financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund’s Investment Portfolio.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars

DWS Global Income Builder Fund | | |

at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.