- JEF Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Jefferies Financial (JEF) DEF 14ADefinitive proxy

Filed: 17 Feb 23, 4:32pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| þ | Filed by the Registrant | |||

| ☐ | Filed by a Party other than the Registrant |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

Jefferies Financial Group Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2023 Annual Meeting of Shareholders

Proxy Statement

MARCH 29, 2023

February 17, 2023

Dear Fellow Shareholders,

We present this year’s Proxy Statement and invite you to participate in our 2023 Annual Meeting of Shareholders on Wednesday, March 29, 2023 at 10:00 a.m. New York City time. We will be conducting our meeting virtually to provide a consistent experience to all our shareholders regardless of where they are located and to make it easier for our shareholders to attend (see page 3 for details). The agenda will include a vote for the election of directors, an advisory vote to approve our 2022 executive-compensation program, an advisory vote on the frequency of the executive-compensation program vote, and an advisory vote on the selection of our independent auditors. Our CEO, Rich Handler, and our President, Brian Friedman, will discuss our strategy and operating performance and answer your questions.

Our Year

Although our net revenues and net earnings did not match the record-breaking levels they reached in 2021, 2022 again demonstrated the core strength and immense progress of the Jefferies platform in terms of execution of our long-term strategy, gains in market share and industry rankings, and operational resilience.

And those accomplishments were no mean feats in the face of Russia’s invasion of Ukraine, sharp increases in inflation followed by global central bank tightening (that effectively froze the markets for IPOs and leveraged finance), economic slowdowns and fears of recession, continued political upheaval, the significant declines across most asset classes and – in the face of all that – the as-to-be expected market volatility across the equities, fixed-income and commodities markets.

Through it all, though, the strength of the Jefferies global platform and its accomplishments stood out:

| • | Management further underscored the transition to a pure financial-services firm by merging Jefferies Group LLC (“Jefferies Group”) into Jefferies Financial Group Inc. (“Jefferies”), streamlining our operations and rationalizing the presentation of our financial statements. |

| • | More substantively, management continued to shrink our Merchant Banking portfolio through the highly profitable sale of Idaho Timber and paving the way for the spin-off of our holdings in Vitesse Energy and Vitesse Oil, which came to fruition on January 13, 2023. Between those divestitures, the Merchant Banking portfolio declined $0.6 billion in book value from November 30, 2021 to today. In fact, reflecting our pure financial-services firm strategy and the reality of those divestitures, we have ceased reporting a separate Merchant Banking segment. |

| • | As our CEO and President outlined in their annual letter to you which, as usual, we strongly recommend for your review, we are consistently gaining in rankings and market share against our competitors: |

| º | Jefferies ranked #6 in M&A and ECM globally, | |

| º | Jefferies ranked #7 globally in M&A, ECM and Leveraged Finance, and | |

| º | Our Equities and Fixed Income franchises continue to grow market share and expand their opportunities. |

2022 HIGHLIGHTS

93rd percentile 2022 TSR relative to peer firms – ranked |

97th percentile 3-year TSR relative to peer firms – ranked |

#6 both M&A and ECM globally |

#7 globally in combined M&A, ECM and Leveraged Finance |

#6 in U.S. and #7 in Europe for equity research |

#3 in Asia for combined equity |

2023 Proxy Statement 1

| • | It also bears noting that, to support the growth of Jefferies’ global, full-service investment banking and capital markets business, since 2019 management increased the number of employee-partners from 3,600 to approximately 5,000, and has done so not only seamlessly and with no material operational risk incidents, but also with a robust increase in Human Capital resources available to those new hires, instilling in them the Jefferies culture and providing them with tools and training to support their success and Jefferies’ success. |

| • | And, we are pleased to report, management’s efforts resulted in total shareholder return that put Jefferies in the number two spot among our peer firms, ranking it in the 93rd percentile on a one-year measurement period and 97th percentile on a three-year measurement period. |

The very good news is that the executive management team that successfully led us through 2020 and 2021, as well as a much more financially challenging 2022, are likely to be with us for years to come. We strongly support Rich and Brian and are pleased that our showing of support for them via our Leadership Continuity Grant should have the direct result of all of Jefferies benefitting from their leadership for the long term.

OUR CONTINUED GRATITUDE

We again want to express our deepest and most sincere gratitude to our employee-partners who, in the face of incredible headwinds and market upheaval, delivered as they always do for our shareholders and all other stakeholders the best Jefferies has to offer. We remain proud of them and pleased to have them on our team. Well done one and all!

YOUR VOTE MATTERS

Thank you very much for your investment and partnership with us. We genuinely hope you will participate in our annual shareholders meeting. If you are not able to participate, we ask you to vote by proxy in support of our recommendations. The proxy materials contain necessary information about the matters on which we are asking you to vote. The Jefferies team is open to addressing any questions you may have. Thank you again for your support.

Sincerely,

The Jefferies Board of Directors

Who We Are

Jefferies is a leading global, full-service investment banking and capital markets firm that provides advisory, sales and trading, research and wealth and asset management services. With more than 40 offices around the world, we offer insights and expertise to investors, companies and governments.

2 Jefferies Financial Group

Notice of Annual Meeting of Shareholders

This Proxy Statement is being furnished to our shareholders in connection with the solicitation of proxies by our Board of Directors for use at our 2023 Annual Meeting of Shareholders.

LOGISTICS

| Date and Time March 29, 2023 |  | Jefferies virtual Annual Meeting of Shareholders may be accessed using the following link: |

Purpose of Meeting

| Proposal | Vote Required to Elect or Approve | Board Recommendation | Page Reference | ||||||

| 1 | ELECTION OF DIRECTORS | Majority of the votes cast |

each nominee |  | 9 | ||||

| 2 | ADVISORY VOTE ON 2022 EXECUTIVE-COMPENSATION PROGRAM | Majority of the votes cast |  For For |  | 38 | ||||

| 3 | ADVISORY VOTE ON FREQUENCY OF EXECUTIVE-COMPENSATION PROGRAM VOTE | Majority of the votes cast |  1 year 1 year |  | 63 | ||||

| 4 | RATIFICATION OF INDEPENDENT AUDITORS | Majority of the votes cast |  For For |  | 64 | ||||

Consider other matters that properly come before the meeting.

Other Important Information

Shareholders should read Important Information for Our Shareholders beginning on page 71 for additional information, including ways for you to vote prior to the meeting.

Whether you hold shares directly as a shareholder of record or beneficially in street name, you may vote your shares without attending the Annual Meeting. Voting instructions are outlined in the Notice of Internet Availability of Proxy Materials and on your proxy card.

| By Internet (24 hours a day): |  | By Mail: If you are a shareholder of record: Return a properly executed and dated proxy card in the provided pre-paid envelope | |

| By Telephone (24 hours a day): | If you hold your shares in street name: Return a properly executed and dated voting instruction form by mail, depending upon the method(s) your bank, brokerage firm, broker-dealer or other similar organization makes available |

2023 Proxy Statement 3

Notice of Annual Meeting of Shareholders

Generally, the deadline for voting by telephone or using the internet is 11:59 p.m. EDT on Tuesday, March 28, 2023. Please read Important Information for Our Shareholders on page 71 for other voting deadlines.At the virtual Annual Meeting, shareholders will be able to listen to the meeting live and vote. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/JEF2023, you must enter the 16-digit control number available on your proxy card if you are a shareholder of record or included in your voting instruction card and voting instructions you received from your broker, bank or other institution. Although you may vote online during the virtual Annual Meeting, we encourage you to vote via the Internet, by telephone or by mail as outlined in the Notice of Internet Availability of Proxy Materials or on your proxy card to ensure that your shares are represented and voted.

A technical support line will be available on the meeting website for any questions on how to participate in the Annual Meeting or if you encounter any difficulties accessing the virtual meeting.

The meeting webcast will begin promptly at 10:00 a.m., New York City time, on Wednesday, March 29, 2023, and we encourage you to access the meeting prior to the start time.

Shareholders will be able to ask questions through the virtual meeting website during the meeting. Questions may be submitted during the virtual Annual Meeting through www.virtualshareholdermeeting.com/JEF2023. The Company will answer appropriate questions during the virtual Annual Meeting.

4 Jefferies Financial Group

Proxy Summary

Proposal 1 | |||||||

| Election of Directors | |||||||

| THE BOARD RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES |  | See page 9 | ||||

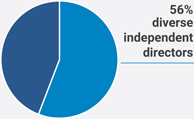

• Our directors are elected at each annual meeting of shareholders and hold office for a one-year term. • The Nominating and Corporate Governance Committee considers and chooses nominees for our Board with a primary goal of presenting a diverse slate of candidates who will serve the Board, its Committees, Jefferies and our shareholders. • 42% of our Board (and 56% of our independent directors) are diverse. | |||||||

Our Director Nominees

| Name and Age | Tenure | Other Public Directorships (Non-Portfolio) | Jefferies Committees | ||||||

| A | C | ESG/DEI | NCG | RLO | |||||

| Linda L. Adamany, 70 Lead Independent Director | 2014 | Coeur Mining Inc. BlackRock Institutional Trust Company Vitesse Energy, Inc. |  |  |  | ||||

| Barry J. Alperin, 82 Independent | 2018 | None |  |  |  |  | |||

| Robert D. Beyer, 63 Independent | 2013 | LiveVox Holdings, Inc. |  |  | |||||

| Matrice Ellis Kirk, 61 Independent | 2021 | None |  |  |  | ||||

| Brian P. Friedman, 67 President | 2013 | Vitesse Energy, Inc. | |||||||

| MaryAnne Gilmartin, 58 Independent | 2018 | None |  |  |  |  | |||

| Richard B. Handler, 61 Chief Executive Officer | 2013 | Landcadia Holdings IV, Inc. | |||||||

| Thomas W. Jones, 73 Independent | 2022 | Assured Guaranty, Ltd. |  |  |  |  | |||

| Jacob M. Katz, 70 Independent | 2018 | None |  |  |  | ||||

| Michael T. O’Kane, 77 Independent | 2013 | None |  |  | |||||

| Joseph S. Steinberg, 79 Chairman of the Board | 1978 | Crimson Wine Group Ltd., Vitesse Energy, Inc. | |||||||

| Melissa V. Weiler, 58 Independent | 2021 | Owl Rock Capital Corporation |  |  |  | ||||

| A | Audit | ESG/DEI | ESG, Diversity, Equity & Inclusion | NCG | Nominating and Corporate Governance |  Member Member |

| C | Compensation | RLO | Risk and Liquidity Oversight |  Chair Chair |

Our Board made several changes to refresh our committee membership after fiscal 2022 year end, as described on page 27.

2023 Proxy Statement 5

Proxy Summary

Board of Directors Skills and Experience

| Audit & Financial Expertise |  | Corporate Strategy & Business Development |  | Corporate Governance | |||

| Ethics/Social Responsibility Oversight |  | Financial Services |  | International Business & Operations | |||

| Executive Leadership & Management |  | Mergers & Acquisitions |  | Private Equity | |||

| Risk Oversight |  | Expertise in Portfolio Company Related Industry | |||||

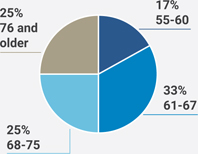

DIRECTORS BY TENURE 6 of 12 | DIRECTOR DIVERSITY 5 of 12 | DIRECTORS BY AGE ~68.3 years | ||||||

| Directors added in last five years AVERAGE TENURE | DIRECTOR NOMINEES ARE GENDER OR ETHNICALLY DIVERSE (5 OF 9, OR 56%, OF INDEPENDENT DIRECTORS ARE DIVERSE) | AVERAGE AGE | ||||||

|  |  | ||||||

Corporate Governance Ongoing Practices

Independent Lead Director Majority Voting Board Refreshment Clawback Policy Prohibition on Hedging Independent Compensation Consultant | Board Committee Dedicated to ESG and DEI Shareholder Proxy Access Individual Director and Board Assessments Robust CEO and President Stock Ownership Guidelines | Minimum Holding Periods of Vested Equity CEO and President Evaluations Corporate Social Responsibility Principles Shareholder Engagement Robust Director Stock Ownership Guidelines |

6 Jefferies Financial Group

Proxy Summary

Proposal 2 | |||||||

Advisory Vote on 2022 Executive-Compensation Program | |||||||

| THE BOARD RECOMMENDS A VOTE FOR THE 2022 EXECUTIVE-COMPENSATION PROGRAM |  | See page 38 | ||||

We are requesting that shareholders indicate their approval of our executive-compensation program, as described in the compensation tables, narrative discussion, and the Compensation Discussion and Analysis beginning on page 39 of this Proxy Statement. While the vote is non-binding and advisory in nature, it will be given careful consideration by us, the Compensation Committee, and our Board of Directors. | |||||||

Proposal 3 | |||||||

Advisory Vote on Frequency of Executive-Compensation Program Vote | |||||||

| THE BOARD RECOMMENDS A VOTE FOR “EVERY YEAR,” ON AN ADVISORY BASIS, ON THE FREQUENCY VOTE TO APPROVE OUR EXECUTIVE-COMPENSATION PROGRAM |  | See page 63 | ||||

With respect to the advisory proposal on the frequency of holding future advisory votes on the compensation of our named executive officers, you may vote for “1 Year,” “2 Years” or “3 Years” or mark your proxy “Abstain.” We will consider shareholders to have expressed a non-binding preference for the frequency that receives the highest number of favorable votes. While our Board of Directors intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature. | |||||||

Proposal 4 | |||||||

Ratification of Independent Auditors | |||||||

| THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT AUDITORS |  | See page 64 | ||||

The Audit Committee selected Deloitte & Touche LLP as our independent auditors for 2023. This proposal is being submitted to shareholders because we believe that this action follows sound corporate practice and is in the best interests of our shareholders. While our Audit Committee intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature. | |||||||

2023 Proxy Statement 7

8 Jefferies Financial Group

Proposal 1 | |||||

| THE BOARD RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES | ||||

Our directors are elected at each annual meeting of shareholders and hold office for a one-year term. Our Nominating and Corporate Governance Committee considers and chooses nominees for our Board with a primary goal of presenting a diverse slate of candidates who will serve the Board, its Committees, Jefferies and our shareholders, taking into account the attributes of each candidate’s professional skillset and credentials, as well as gender, age, ethnicity and personal background. In evaluating nominees, the Nominating and Corporate Governance Committee reviews each candidate’s background and assesses each candidate’s independence, skills, experience and expertise based upon myriad factors, including the candidate’s individual director assessment. Directors should have the highest professional and personal ethics, integrity and character that conform to our standards. Directors should also have experience at the governance and policy-making level in their respective fields. The Nominating and Corporate Governance Committee will consider whether a candidate for director has a proven professional background that displays the ability to make important judgments as Board members. The Committee also determines whether a candidate’s skills and experience complement existing Board members’ skills and experience.

As illustrated by their biographies and highlighted in the chart on the next page, each of our directors was chosen because his or her background provides each director with the experience and skillset geared toward helping us succeed. Our directors bring to us myriad expertise and backgrounds: strong executive operating experience; expertise in the financial services sector; accounting expertise; broad experience in such diverse sectors as oil and gas, mining, investment management, retail food, real estate, private equity, communications, media, government and international banking, among others; and a meaningful commitment to community and public service. That wealth of knowledge and experience is ideally suited to our diverse financial services platforms.

Unless otherwise directed, proxies will be voted for our 12 nominees and, if a nominee becomes unavailable for election, for the substitute nominee as proposed by our Board of Directors.

2023 Proxy Statement 9

Corporate Governance Matters

Board of Directors Skills and Experience

We believe these skills and experience, which we describe below, allow our directors to provide sound and prudent guidance and effective oversight of the Company.

|  |  | ||

| 100% | 83% | 83% | ||

Executive Leadership & Management Executive management experience that provides insight into and practical understanding of driving and managing change and growth within a large and complex organization.

| Audit & Financial Expertise Experience in finance and financial reporting that enables a high level of sophistication in evaluating our performance based on our key financial metrics and financial reporting.

| Private Equity Knowledge or experience that provides insight into the Board’s analyses of financing considerations. Investment oversight and potential business opportunities in private equity.

| ||

|  |  | ||

| 100% | 83% | 92% | ||

Risk Oversight Experience in identifying, managing and/or mitigating risk, including one or more of our major risk exposures, including cybersecurity, climate-related, investment, capital or reputational risk. | Expertise in Portfolio Company Related Industry First-hand business knowledge and understanding of portfolio company management and investment strategies | Corporate Strategy & Business Development Strategic planning/execution and business development experience that provides insight into developing and implementing strategies for enhancing our business and navigating challenges. | ||

|  |  | ||

| 75% | 100% | 92% | ||

Mergers & Acquisitions Experience in analyzing proposed M&A transactions and valuations, their alignment with corporate strategies and integration planning. | Financial Services Experience in the financial services industry or asset management that provides perspective on issues specific to our business, operations and strategy. | Ethics/Social Responsibility Oversight Knowledge or experience that contributes to the Board’s understanding of one or more ESG or DEI matters, such as climate, community and human capital issues. | ||

|  | |||

| 100% | 67% | |||

Corporate Governance Experience on public company boards that provides knowledge of corporate governance practices and policies, and an appreciation of how they can impact the Company. | International Business & Operations Global business or international experience that provides perspective on our cross-border operations and enables the oversight of our global strategic initiatives. | |||

10 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications Ms. Adamany’s financial and operating executive experience in multiple industries, as well as her diverse experience serving on various boards, provides us with wise counsel and the perspective of an experienced leader. Ms. Adamany has served as a director of Jefferies since 2014, and has been a director of Jefferies International Limited (our U.K. business) since March 2021. Ms. Adamany is our Independent Lead Director, Chairs the Nominating and Corporate Governance Committee, and serves as a member of the Audit, and ESG/DEI Committees. She also serves as a director and member of the Audit, Nominations, and Risk Committees, and as Chair of the Remuneration Committee of Jefferies International Limited. Ms. Adamany’s additional experience serving on the boards of directors and committees of other public companies, including an ethics committee and audit committee as chair, as well as previous compensation and corporate governance committees experience, qualifies her for service on our Board. PROFESSIONAL HIGHLIGHTS Ms. Adamany served in several capacities at BP plc from 1980 until her retirement in August 2007, including from April 2005 until August 2007 as a member of the five-person Refining & Marketing Executive Committee responsible for overseeing the day-to-day operations and human resources management of BP plc’s Refining and Marketing business segment. She also served as Executive Assistant to the Group Chief Executive from October 2002 until March 2005 and as Chief Executive of BP Shipping from October 1999 until September 2002. Other Engagements Ms. Adamany has served as a director of Coeur Mining Inc. since March 2013 and is a member of the Environmental, Health, Safety and Social Responsibility Committee and Chair of the Audit Committee. Coeur Mining Inc. is the largest U.S.-based primary silver and gold producer and is listed on the NYSE. Ms. Adamany also has served as a director of BlackRock Institutional Trust Company, N.A. since March 2018, where she serves as a member of their Audit and Risk Committees. Ms. Adamany serves as a director of Vitesse Energy, Inc. which was spun off to our shareholders in January 2023. Ms. Adamany serves on Vitesse’s Audit, Compensation (Chair) and Nominating, Governance and Environmental and Social Responsibility Committees. From October 2017 through April 2019, Ms. Adamany also served as a director and member of both the Audit Committee and the Safety, Assurance and Business Ethics Committee of Wood plc, a global leader in the delivery of project, engineering and technical services to energy and industrial markets, listed on the London Stock Exchange, following its acquisition of AMEC Foster Wheeler plc. Prior to that time, from October 2012 until October 2017, Ms. Adamany served as a member of the board of directors of AMEC Foster Wheeler plc, and chaired the Health, Safety, Environmental and Reputation Committee and served as a member of the Audit, Nominations & Governance, and Compensation Committees. Ms. Adamany served as a member of the board of directors of National Grid plc from October 2006 until October 2012. Education Ms. Adamany is a C.P.A. and holds a B.S. in Business Administration with a major in Accounting, magna cum laude, from John Carroll University. | ||||

Linda L. Adamany Independent Lead Director Director since 2014 Committees • Audit • ESG/DEI • Nominating and Corporate Governance (Chair) | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 11

Corporate Governance Matters

|

| |||

Key Qualifications Mr. Alperin’s tenure as a director of Jefferies since 2018, and as a director of Jefferies Group from December 2013 until its merger with Jefferies in November 2022, provides us with continued and solid experience in the oversight of our financial services businesses. His broad experience in financial transactions, including corporate mergers and acquisitions, provides additional board oversight to our Investment Banking and Merchant Banking platforms. His experience serving on the boards of directors and committees of both public and private companies qualifies him for service on our Board. Professional Highlights Mr. Alperin served as Vice Chairman of Hasbro, Inc. from 1990 through 1995, as Co-Chief Operating Officer of Hasbro from 1989 through 1990 and as Senior Vice President or Executive Vice President of Hasbro from 1985 through 1989. He was a director of Hasbro from 1985 through 1996. Prior to joining Hasbro, Mr. Alperin practiced law in New York City for 20 years, advising on corporate, public and private financial transactions, corporate mergers and acquisitions, compensation issues and securities law matters. Other Engagements Mr. Alperin served as a director of Henry Schein, Inc. from 1996 until May 2022. During his tenure at Henry Schein, he served on its Audit Committee, the Nominating and Governance Committee, and as Chair of the Compensation Committee. Mr. Alperin also served as a director of a privately held marine construction corporation, Weeks Marine, Inc. until its sale in January 2023. Mr. Alperin was also a director of Fiesta Restaurant Group from July 2012 through April 2019. Mr. Alperin serves as a trustee and member of the Executive Committee of The Caramoor Center for Music and the Arts, President Emeritus and a Life Trustee of The Jewish Museum in New York City and is a past President of the New York Chapter of the American Jewish Committee, where he also served as Chairman of the Audit Committee of the national organization. Mr. Alperin also formerly served as Chairman of the Board of Advisors of the Tucker Foundation at Dartmouth College, was President of the Board of the Stanley Isaacs Neighborhood Center in New York City, was a trustee of the Hasbro Children’s Foundation, was President of the Toy Industry Association and was a member of the Columbia University Medical School Health Sciences Advisory Council. Education Mr. Alperin received a B.A. in Economics, magna cum laude, from Dartmouth College, an M.B.A., with high distinction, from the Amos Tuck School of Business and a J.D., cum laude, from Harvard Law School | ||||

Barry J. Alperin Independent Director Director since 2018 Committees • Audit • Compensation • ESG/DEI (Chair) • Nominating and Corporate Governance | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

12 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications Mr. Beyer’s leadership experience, particularly in risk oversight of financial services businesses, is valuable to our financial services focus and, in particular, Jefferies’ Investment Banking platform. His additional experience as a director of Jefferies Group since November 2018 until its merger with Jefferies in November 2022, as well as serving on the boards of directors and committees of other public and private companies, including Audit, Compensation and Corporate Governance Committees, qualifies him for service on our Board. Professional Highlights Mr. Beyer is Chairman of Chaparal Investments LLC, a private investment firm and holding company. He was Executive Chairman of Crescent Acquisition Corp, a special-purpose acquisition company, until its merger with LiveVox Holdings, Inc. in 2021. From 2005 to 2009, Mr. Beyer served as Chief Executive Officer of The TCW Group, Inc., a global investment management firm. Mr. Beyer previously served as President and Chief Investment Officer from 2000 until 2005 of Trust Company of the West, the principal operating subsidiary of TCW. Other Engagements Mr. Beyer is a director of LiveVox Holdings, Inc., a NASDAQ listed company, and serves on the Audit and Nominating and Corporate Governance Committees. He also serves on the boards of the University of Southern California, the Harvard- Westlake School and the Milwaukee Brewers Baseball Club. Mr. Beyer formerly served as a director of The Kroger Co. from 1999 to 2019 and of The Allstate Corporation from 2006 to 2016, each NYSE listed companies. Mr. Beyer was also formerly a director of Société Générale Asset Management, S.A. and its subsidiary, The TCW Group, Inc. Education Mr. Beyer received an M.B.A. from the UCLA Anderson School of Management and a B.S. from the University of Southern California. | ||||

Robert D. Beyer Independent Director Director since 2013 Committees • Compensation (Chair) • Risk and Liquidity Oversight | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 13

Corporate Governance Matters

|

| |||

Key Qualifications Ms. Ellis Kirk has extensive experience in the executive search and human capital industry and has a proven commitment to governance and successful team-building. Her experience serving on the boards of directors of a diverse set of companies and community organizations qualifies her for service on our Board. Professional Highlights Ms. Ellis Kirk is the CEO of Ellis Kirk Group, a full service executive search firm, focusing on governance, succession and building leadership teams. Ms. Ellis Kirk was a Managing Director and a member of the Executive Committee at RSR Partners executive search firm from 2014 to 2021. Previously she was with the international executive search firm, Heidrick & Struggles, from 1999 to 2014. From 1996 to 1999, Ms. Ellis Kirk was a director of Spencer Stuart, an executive search firm. Prior to her career in search, Ms. Ellis Kirk was a Vice President of Apex Securities, an investment banking firm, from 1992 to 1996. From 1986 to 1992, she was Director of the Office of Management and Budget for Dallas Area Rapid Transit, a regional transit agency, and prior to that, from 1982 to 1986, she held several positions with MBank Dallas, the predecessor of the Dallas office of JPMorgan Chase Bank. Other Engagements Ms. Ellis Kirk is the Chair Emeritus of the AT&T Performing Arts Center. She served as the Dallas City Council appointed board Chair of the DFW Airport Authority until March 2022 and resigned from the board in January 2023. Ms. Ellis Kirk served as a director of ACE Cash Express from December 2005 until October 2006 when ACE Cash Express was acquired by JLL Partners. Ms. Ellis Kirk also served as a director of Chancellor Media, which later became AMFM, Inc., from 1996 until October 1999 when it was acquired by Clear Channel. Education Ms. Ellis Kirk graduated from the University of Pennsylvania with a degree in Economics. | ||||

Matrice Ellis Kirk Independent Director Director since 2021 Committees • ESG/DEI • Nominating and Corporate Governance • Risk and Liquidity Oversight | ||||

Relevant Skills • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • Executive Leadership & Management • Risk Oversight |

14 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications As our President for ten years and a long-standing executive officer of Jefferies Group, Mr. Friedman brings managerial, strategic, transactional and investing experience in a broad range of businesses and, most significantly, in financial services. His additional extensive experience serving on the boards of directors of both public and private companies qualifies him for service on our Board. Professional Highlights Mr. Friedman has served as a director and our President since March 2013 and served as a director and executive officer of Jefferies Group since July 2005 until its merger with Jefferies in November 2022. Since 1997, Mr. Friedman has also served as President of Jefferies Capital Partners (formerly, FS Private Investments), a private equity fund management company controlled by Mr. Friedman in which we have an ownership interest, and that is in the process of completing the wind down of its last legacy fund. Mr. Friedman was previously employed by Furman Selz LLC and its successors, including serving as Head of Investment Banking and a member of its Management and Operating Committees. Prior to his seventeen years with Furman Selz and its successors, Mr. Friedman was an attorney with Wachtell, Lipton, Rosen & Katz. Stock Ownership Since becoming an executive officer of Jefferies Group and as President of Jefferies Financial Group, approximately 74% of Mr. Friedman’s compensation has consisted of non-cash, equity related securities vesting over three to five years. Pro forma for all earned and unearned deferred shares and options, and assuming that performance goals relating to performance-based awards are achieved at target levels, Mr. Friedman would own 10,256,478 shares, representing approximately 4.3% of our outstanding shares. Other Engagements Mr. Friedman serves as a director of Vitesse Energy, Inc. which was spun off to our shareholders in January 2023. As a result of his historic management of various private equity funds and the significant equity positions those funds held in their portfolio companies, Mr. Friedman served on a large number of boards of directors of such private and public portfolio companies. Mr. Friedman also served as our representative on the board of Fiesta Restaurant Group from 2012 through April 2021 and served as a board member of HomeFed Corporation from 2014 to July 2019. Mr. Friedman is also engaged in a range of philanthropic efforts personally and through his family foundation, and serves as the Co-Chairman of the Board of Strive International, a workforce training effort, and a Board Member of the HC Leukemia Foundation. Mr. Friedman also serves as the Co-Chair of the Global Diversity Council at Jefferies. Education Mr. Friedman received a J.D. from Columbia Law School and a B.S. in Economics, summa cum laude, and M.S. in Accounting from The Wharton School, University of Pennsylvania. | ||||

Brian P. Friedman President Director since 2013 Committees • None | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • International Business & Operations • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 15

Corporate Governance Matters

|

| |||

Key Qualifications Ms. Gilmartin’s tenure as a director since 2018, and as a director of Jefferies Group from March 2015 until its merger with Jefferies in November 2022, provides us with continued oversight of our financial services businesses. Her broad executive management experience, consulting roles and entrepreneurial spirit complement our Board and provides additional oversight to our Merchant Banking efforts. Professional Highlights Ms. Gilmartin is the Founder and Chief Executive Officer of MAG Partners LP, a New York-based real estate development company she founded in 2020. Prior to founding MAG Partners, Ms. Gilmartin was Co-Founder and Chief Executive Officer of L&L MAG, a New York-based real estate development firm. After a successful two-year partnership with L&L MAG, Ms. Gilmartin spun out of L&L MAG to launch MAG Partners. The company is currently developing a 480-unit residential building in Chelsea, designed by acclaimed architecture firm COOKFOX. Most recently, Ms. Gilmartin also served as interim Chief Executive Officer and Chair of the Board of Directors of Mack-Cali Realty Corporation. She was on the board of directors for the company from June 2019 to June 2021. Previously, Ms. Gilmartin was the Chief Executive Officer and President of Forest City Ratner Companies, LLC, a subsidiary of Forest City Realty Trust, Inc. (formerly, Forest City Enterprises, Inc.) from April 17, 2013 until January 2018. Ms. Gilmartin served as an Executive Vice President of Commercial Development and Leasing of Forest City Ratner Companies, LLC until April 17, 2013 and co-managed the Commercial Development division. During her tenure, Ms. Gilmartin led the efforts to build Barclays Center, the state-of-the-art sports and entertainment venue and the centerpiece of the $4.9 billion, 22-acre mixed-use Pacific Park Brooklyn development. Ms. Gilmartin oversaw the development of The New York Times Building; New York by Gehry; and the Tata Innovation Center at Cornell Tech. Additionally, Ms. Gilmartin directed the leasing of Forest City Ratner’s five million square foot commercial portfolio at MetroTech Center in Brooklyn, New York. Other Engagements Ms. Gilmartin serves as Chair Emeritus of the Downtown Brooklyn Partnership, member of the Executive Committee of The Brooklyn Academy of Music, member of the New York Public Radio Board of Trustees, member of the Executive Committee and Board of Governors of The Real Estate Board of New York, and part of the Industry Advisory Board of the MS Real Estate Development Program at Columbia University. Education Ms. Gilmartin graduated with a B.A. in Political Science, summa cum laude, and a Master of Public Administration, both from Fordham University | ||||

MaryAnne Gilmartin Independent Director Director since 2018 Committees • Compensation • ESG/DEI • Nominating and Corporate Governance • Risk and Liquidity Oversight | ||||

Relevant Skills • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • Executive Leadership & Management • Risk Oversight • Expertise in Portfolio Company Related Industry |

16 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications Having served as Jefferies Group’s CEO for over 21 years and Jefferies’ CEO for the past ten years, Mr. Handler has the managerial and investing experience vital to leading all our businesses. His extensive experience leading our and Jefferies Group’s Boards and his years of managerial leadership qualify him for service on our Board. Professional Highlights Mr. Handler was with Jefferies Group since 1990 and served as its Chief Executive Officer since 2001 and Chairman since 2002, making him the longest serving CEO on Wall Street. Mr. Handler has served as a director and as Chief Executive Officer of Jefferies since 2013. Prior to Jefferies, Mr. Handler worked at Drexel Burnham Lambert in the High Yield Bond Department. Stock Ownership Since becoming CEO of Jefferies Group and as CEO of Jefferies, approximately 70% of Mr. Handler’s compensation has consisted of non-cash, equity-related securities vesting over three to five years. Aside from charitable donations and tax-related sales, Mr. Handler has never sold any of his Jefferies shares. Including all earned and unearned deferred shares and options, and assuming that performance goals relating to performance-based awards are achieved at target levels, Mr. Handler currently owns 20,466,109 shares, representing approximately 8.4% of our outstanding shares. Other Engagements Mr. Handler is a Director, Co-Chairman and President of Landcadia Holdings IV, Inc., a publicly listed special purpose acquisition company sponsored by us and Fertitta Entertainment, Inc., and he previously served as a Director, Co-Chairman and President of Landcadia Holdings, Inc., from 2016 to 2018, Director, Co-Chairman and President of Landcadia Holdings II, Inc., from 2019 to 2020, and a Director, Co-Chairman and President of Landcadia Holdings III, Inc. from 2020 to 2021. Mr. Handler is Chairman and CEO of the Handler Family Foundation, a non-profit organization that focuses on many philanthropic areas, including providing four-year all-inclusive fully-paid college educations each year to 15 of the most talented and deserving students coming from challenging backgrounds and circumstances. The Foundation also works to protect the environment by protecting endangered species, primarily endangered wolves. Mr. Handler also serves as Co-Chair of the Global Diversity Council at Jefferies. Education Mr. Handler received an M.B.A. from Stanford University in 1987 and a B.A. in Economics (magna cum laude, High Distinction) from the University of Rochester in 1983 where he now serves as Chairman of the Board of Trustees. | ||||

Richard B. Handler CHIEF EXECUTIVE OFFICER Director since 2013 Committees • None | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 17

Corporate Governance Matters

|

| |||

Key Qualifications Mr. Jones has a proven track record as a business leader with significant background in the financial services industry. His experience in senior leadership positions along with serving on the boards of directors of private and public companies, as well as educational institutions, qualifies him for service on our Board. Professional Highlights Mr. Jones is Founder and Senior Partner of TWJ Capital, an investment firm. Mr. Jones is former Chairman and Chief Executive Officer of Global Investment Management at Citigroup, and former Chairman and Chief Executive Officer of Citigroup Asset Management with approximately $500 billion assets under management. Mr. Jones was appointed asset management CEO in August 1997, and sector CEO in August 1999, and continued in that capacity until October 2004. This business sector included Citigroup Asset Management, Citigroup Alternative Investments, Citigroup Private Bank, and Traveler’s Life & Annuity. Prior to joining Citigroup, Mr. Jones was Vice Chairman and Director of TIAA-CREF since 1995, President and Chief Operating Officer from 1993 to 1997, and Executive Vice President and Chief Financial Officer from 1989 to 1993. Mr. Jones was Senior Vice President and Treasurer and other positions with John Hancock Mutual Life Insurance Company from 1982 to 1989, and spent the previous eleven years in public accounting and management consulting primarily with “Big 8” public accounting firm Arthur Young & Company (predecessor firm to Ernst & Young). Mr. Jones is a Certified Public Accountant. Other Engagements Mr. Jones is a Director of Assured Guaranty Ltd. and serves on their Audit, Compensation (Chair), and Nominating and Corporate Governance Committees. Mr. Jones is Trustee Emeritus of Cornell University. Past board positions include Vice Chairman of Federal Reserve Bank of New York, and director of Altria Group, Freddie Mac, Fox Entertainment Group, Travelers Group, Pepsi Bottling Group, TIAA-CREF, Eastern Enterprises, Thomas & Betts Corporation, Howard University, Investment Company Institute, and Economic Club of New York. Education Mr. Jones holds a Bachelor of Arts and Masters of Science degrees from Cornell University, and a Masters of Business Administration degree from Boston University. Mr. Jones has been awarded honorary doctoral degrees by Howard University, Pepperdine University, and College of New Rochelle. | ||||

Thomas W. Jones Independent Director Director since 2022 Committees • Audit • ESG/DEI • Nominating and Corporate Governance • Risk and Liquidity Oversight (Chair) | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight |

18 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications Mr. Katz, a director of Jefferies since 2018, and Jefferies Group from September 2016 until its merger with Jefferies in November 2022, and a director of Jefferies International Limited (our U.K. business) since November 2017, brings broad and extensive oversight to our financial services business as a result of his executive management and leadership skills gained as the national managing partner and global leader of a financial accounting firm as well as his extensive financial knowledge and experience. His additional experience serving on the boards of directors and committees of both public and private companies, including audit committees and a finance committee qualifies him for service on our Board. Professional Highlights Mr. Katz was the national managing partner and global leader of financial services at Grant Thornton LLP, a member firm of one of the world’s leading organizations of independent audit, tax and advisory firms, from 2013 until his retirement in July 2016. Mr. Katz was employed by Grant Thornton for nearly 40 years, during which time he led Grant Thornton’s financial services practice for approximately 20 years. He held various other leadership roles at Grant Thornton, including as the Northeast region managing partner from 2010 to 2013, as the New York office managing partner from 2003 to 2013 and as a member of the firm’s partnership board from 1999 to 2012, holding the title of chairman of the board for much of that time. Other Engagements Mr. Katz Chairs the Risk Committee and also serves as a member of the Audit, Nominations and Remuneration Committees of Jefferies International Limited. He served on the board of Herc Holdings Inc., a NYSE listed equipment rental supplier for five years, and was the Audit Committee Chair at the company for part of his term. Mr. Katz is an advisor to private companies, including a Board Advisor of a data solutions and protection company, and has served on the boards of various not for profit organizations. Mr. Katz is a member of The National Association of Corporate Directors. Mr. Katz also served for a number of years on the Global Public Policy Committee (GPPC) Bank Working Group, the global forum of representatives from the six largest international accounting networks. Education Mr. Katz is a C.P.A. and received an M.B.A. in taxation from the City University of New York and a B.A. in accounting from Brooklyn College. | ||||

Jacob M. Katz Independent Director Director since 2018 Committees • Audit (Chair) • ESG/DEI • Risk and Liquidity Oversight | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 19

Corporate Governance Matters

|

| |||

Key Qualifications Mr. O’Kane’s years as a director of Jefferies Group from January 2006 through April 2014, and again from 2018 until its merger with Jefferies in November 2022, and as a director of Jefferies since 2013, as well as his managerial and investing experience in the financial sector, particularly in the area of asset management, brings oversight to our merchant banking and financial services businesses. His additional experience serving on the boards of directors and committees of both public and private companies qualifies him for service on our Board. Professional Highlights From 1986 to 2004, Mr. O’Kane served in various capacities for TIAA, first as a Managing Director – Private Placements from 1986 to 1990, then as Managing Director – Structured Finance from 1990 to 1996 and finally as Senior Managing Director – Securities Division from 1996 to 2004, when he was responsible for approximately $120 billion of fixed income and $3.5 billion of private equity assets under management. Other Engagements Mr. O’Kane served on the Board of Directors of Assured Guaranty, until he retired in May 2022. During his tenure at Assured Guaranty, he served on its Audit Committee, as Chair of its Finance Committee and as a member of its Risk Oversight Committee. In addition, Mr. O’Kane served on the Board of Trustees of Scholarship America, a non-profit company engaged in providing scholarships for young students to attend college, from 2001 to 2006. Mr. O’Kane was also the Chief Financial Officer of Motor Coils Manufacturing Company during 1984 and 1985. Education Mr. O’Kane received an M.B.A. in Finance from Rutgers Graduate School of Business and an A.B. in Economics from Lafayette College. | ||||

Michael T. O’Kane Independent Director Director since 2013 Committees • Compensation • Nominating and Corporate Governance | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Governance • Financial Services • Executive Leadership & Management • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

20 Jefferies Financial Group

Corporate Governance Matters

|

| |||

Key Qualifications As our Chairman and with over 40 years of executive leadership experience with us, Mr. Steinberg has the requisite managerial and investing experience necessary to continue as one of our senior executives. Mr. Steinberg served as a director of Jefferies Group from April 2008 until its merger with Jefferies in November 2022 and his extensive experience with our other portfolio companies and investments and experience on the boards of directors and committees of both public and private companies qualify him for service on our Board. Professional Highlights Mr. Steinberg has served as a director since December 1978, our Chairman since March 2013, and was our President from January 1979 until March 2013. Other Engagements Mr. Steinberg serves on the Board of Directors of Crimson Wine Group, Ltd., which was spun off to our shareholders in February 2013. Mr. Steinberg serves as a director of Vitesse Energy, Inc., which was spun off to our shareholders in January 2023. Mr. Steinberg served on the Board of Directors of Pershing Square Tontine Holdings, Ltd, a special-purpose acquisition company, from July 2020 until 2022. Previously, he served as our representative as a board member overseeing our investments in HRG Group from 2014 to 2018, HomeFed Corporation and Spectrum Brands Holdings, Inc. through 2019 and as a director of Fidelity & Guaranty Life from 2015 to 2017. Education Mr. Steinberg received an M.B.A. from Harvard Business School and an A.B. in Government from New York University. | ||||

Joseph S. Steinberg Chairman Director since 1978 Committees • None | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • International Business & Operations • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

2023 Proxy Statement 21

Corporate Governance Matters

|

| |||

Key Qualifications Ms. Weiler has over 30 years of experience in the credit markets and is a strategic thinker and business leader. Ms. Weiler’s business background in senior management positions and experience serving on the boards of directors and committees of other public and private companies, including nominating and governance, compensation, and audit committees, qualifies her for service on our Board. Professional Highlights Ms. Weiler was formerly a Managing Director and a member of the Management Committee of Crescent Capital Group, a Los Angeles-based asset management firm (Crescent), where she served from January 2011 until she retired in December 2020. During that time, Ms. Weiler was responsible for the oversight of Crescent’s CLO management business from July 2017 through December 2020 and managed several multi-strategy credit funds from January 2011 through June 2017. During her tenure at Crescent, she also served on the Risk Management and Diversity & Inclusion committees. From October 1995 to December 2010, Ms. Weiler was a Managing Director at Trust Company of the West, a Los Angeles-based asset management firm (TCW). At TCW, she managed several multi-strategy credit funds from July 2006 to December 2010 and served as lead portfolio manager for TCW’s high-yield bond strategy from October 1995 to June 2006. Other Engagements Ms. Weiler serves as a director of the Board of Owl Rock Capital Corporation, an NYSE listed specialty finance company focused on providing direct lending solutions to middle market companies. Ms. Weiler is concurrently serving on the Boards of Owl Rock Capital Corporation II, Owl Rock Capital Corporation III, Owl Rock Technology Finance Corp. I and II, Owl Rock Technology Income Corp., and Owl Rock Core Income Corp. Ms. Weiler is also a member of the Nominating and Corporate Governance and Audit Committees for all seven Owl Rock boards as well as a member of the Compensation Committee for Owl Rock Capital Corporation. Ms. Weiler is a member of the Cedars-Sinai Board of Governors and is actively involved in the global industry association 100 Women in Finance. Education Ms. Weiler holds a B.S. in Economics from the Wharton School at the University of Pennsylvania. | ||||

Melissa V. Weiler Independent Director Director since 2021 Committees • Audit • Compensation • Risk and Liquidity Oversight | ||||

Relevant Skills • Audit & Financial Expertise • Corporate Strategy & Business Development • Corporate Governance • Ethics/Social Responsibility Oversight • Financial Services • Executive Leadership & Management • Mergers & Acquisitions • Private Equity • Risk Oversight • Expertise in Portfolio Company Related Industry |

22 Jefferies Financial Group

Corporate Governance Matters

Board Skills & Experience and Demographic Matrix

|

|

|

|

|

|

|

|

|

|

|

| |

Skills & Experience | ||||||||||||

Audit & Financial Expertise | l | l | l | l | l | l | l | l | l | l | ||

Corporate Strategy & Business Development | l | l | l | l | l | l | l | l | l | l | l | |

Corporate Governance | l | l | l | l | l | l | l | l | l | l | l | l |

Ethics/Social Responsibility | l | l | l | l | l | l | l | l | l | l | l | |

Financial Services (Incl. Asset Management & Investment Banking) | l | l | l | l | l | l | l | l | l | l | l | l |

International Business & Operations | l | l | l | l | l | l | l | l | ||||

Executive Leadership & Management | l | l | l | l | l | l | l | l | l | l | l | l |

Mergers & Acquisitions | l | l | l | l | l | l | l | l | l | |||

Private Equity | l | l | l | l | l | l | l | l | l | l | ||

Risk Oversight | l | l | l | l | l | l | l | l | l | l | l | l |

Expertise in Portfolio Company | l | l | l | l | l | l | l | l | l | l | ||

Demographic Background | ||||||||||||

Years on Board | 9 | 4 | 10 | 2 | 10 | 4 | 10 | 1 | 4 | 10 | 44 | 2 |

Gender | ||||||||||||

Male | l | l | l | l | l | l | l | l | ||||

Female | l | l | l | l | ||||||||

Age | ||||||||||||

At February 5, 2023 | 70 | 82 | 63 | 61 | 67 | 58 | 61 | 73 | 70 | 77 | 79 | 58 |

Race/Ethnicity | ||||||||||||

African American/Black | l | l | ||||||||||

Asian, Hawaiian, or Pacific Islander | ||||||||||||

White/Caucasian | l | l | l | l | l | l | l | l | l | l | ||

Hispanic/Latino | ||||||||||||

Native American | ||||||||||||

Other | ||||||||||||

Number of Non-Portfolio Company | 3 | 0 | 1 | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 2 | 1 |

2023 Proxy Statement 23

Corporate Governance Matters

We remain committed to ensuring women and minority candidates are among every pool of individuals from which new Board nominees are chosen, as well as considering diverse candidates from nontraditional venues. Our three most recent director appointments to the Board all embody diverse backgrounds.

Linda Adamany, as our Independent Lead Director and Chair of the Nominating and Corporate Governance Committee, has made clear her ongoing commitment to diversity. The Nominating and Corporate Governance Committee considers nominee candidates through:

1 | 2 | 3 |

Suggestions from our Board and senior management | Hiring third-party search firms as needed | Reviewing candidates proposed by shareholders in the same manner we evaluate candidates proposed by our Board or senior management |

“To fulfill its purpose, the Committee shall… add women and minority candidates to each pool of individuals from which new Board nominees are chosen and consider diverse candidates from nontraditional venues.”

Jefferies Nominating and Corporate Governance Committee charter

We plan to continue the progress made to date by continuing to implement our policy of recruiting diverse nominee candidates.

The Nominating and Corporate Governance Committee is committed to a policy of inclusiveness and seeks members with diverse backgrounds, an understanding of our business and a reputation for integrity. Our director refreshment over the last several years has resulted in a group of independent directors with gender and ethnic diversity, low average tenure, and significant experience. We intend to maintain and leverage those attributes as we move forward.

| DIRECTOR DIVERSITY OF OUR BOARD(1) | DIVERSITY OF INDEPENDENT DIRECTORS(1) |

|  |

| (1) | Four female directors (including one African American) and one African American male director. |

24 Jefferies Financial Group

Corporate Governance Matters

Our Board of Directors is responsible for the general oversight of all matters that | ||

To increase the scope of the Board’s risk oversight responsibilities, Jack Katz, the Chair of our Audit Committee, and | ||

AUDIT COMMITTEE The Audit Committee has responsibility for risk oversight in connection with its review of our financial reports filed with the SEC. The Audit Committee receives reports from our CFO, our internal audit department and our independent auditors in connection with the review of our quarterly and annual financial statements regarding significant financial transactions, accounting and reporting matters, internal control over financial reporting, critical accounting estimates, and management’s exercise of judgment in accounting matters. When reporting on such matters, our independent auditors also provide their assessment of management’s report and conclusions. The Audit Committee also reviews the audit plan, including the risk based approach to its development. Our Audit Committee receives reports from our Chief Compliance Officer in accordance with our Whistle Blower Policy. Our Audit Committee also oversees our Related Person Transaction Policy. Additionally, prior to its merger with us in November 2022, Jefferies Group’s risk management team continuously monitored its various business groups, the level of risk they were taking and the efficacy of potential risk mitigation strategies and presented such information to Jefferies Group’s senior management and our Board. RISK AND LIQUIDITY OVERSIGHT COMMITTEE Our Board’s Risk and Liquidity Oversight Committee oversees our enterprise risk management. The Committee approves the risk management framework; approves the risk identification and materiality assessment framework; reviews our major risk exposures, including among others, IT, privacy, and cybersecurity risk, and the steps management has taken to monitor and control such exposures; reviews our capital, liquidity and funding against established risk methodologies; and oversees the Chief Risk Officer. ESG/DEI COMMITTEE Our Board’s ESG, Diversity, Equity and Inclusion (ESG/DEI) Committee provides oversight and input to | ||

2023 Proxy Statement 25

Corporate Governance Matters

Lead Director Position and Duties

Ms. Adamany was selected by the Board as our Independent Lead Director of the Board beginning on March 28, 2022.

OUR CORPORATE GOVERNANCE GUIDELINES PROVIDES THAT OUR LEAD DIRECTOR | |||||

Presides at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board, and has the authority to call meetings of the independent members of the Board Presides at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board, and has the authority to call meetings of the independent members of the Board Serves as liaison between the Chairman of the Board and the independent members of the Board, and provides the Chairman of the Board, the Chief Executive Officer, and the President with feedback from executive sessions of the independent members of the Board Serves as liaison between the Chairman of the Board and the independent members of the Board, and provides the Chairman of the Board, the Chief Executive Officer, and the President with feedback from executive sessions of the independent members of the Board Reviews and approves the information to be provided to the Board Reviews and approves the information to be provided to the Board Reviews and approves meeting agendas and coordinates with management to develop such agendas Reviews and approves meeting agendas and coordinates with management to develop such agendas Approves meeting schedules to assure there is sufficient time for discussion of all agenda items Approves meeting schedules to assure there is sufficient time for discussion of all agenda items |  If requested by major shareholders, ensures that he or she is available for consultation and direct communication If requested by major shareholders, ensures that he or she is available for consultation and direct communication Interviews, along with the chair of the Nominating and Corporate Governance Committee, all Board candidates and makes recommendations to the Nominating and Corporate Governance Committee and the Board Interviews, along with the chair of the Nominating and Corporate Governance Committee, all Board candidates and makes recommendations to the Nominating and Corporate Governance Committee and the Board Provides input relating to the membership of various Committees of the Board and the selection of the Chairs of such Committees Provides input relating to the membership of various Committees of the Board and the selection of the Chairs of such Committees Consults with the Chairs of each Board Committee and solicits their participation in performing the duties described above Consults with the Chairs of each Board Committee and solicits their participation in performing the duties described above Performs such other functions and responsibilities as requested by the Board from time to time Performs such other functions and responsibilities as requested by the Board from time to time | ||||

Director Independence

In accordance with our Corporate Governance Guidelines, available on our website, Jefferies.com, our Board of Directors undertook its annual review of director independence. During this review, our Board considered all transactions and relationships between us and each nominee for director or any member of such person’s immediate family. The purpose of this review is to determine whether any relationship or transaction is considered a “material relationship” that would be inconsistent with a determination that a director is independent.

Our Board affirmatively determined that each of our non-employee director nominees is independent with respect to board service and service on each of the committees on which they sit. In making this determination, our Board reviewed the corporate governance rules of the NYSE, the principal exchange on which our shares are traded, and considered commercial, charitable, family and other relationships that directors or members of their immediate family have or have had with us. In addition, for our Audit Committee members, our Board also considered the requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our Board also considered that certain Board members share directorships on unaffiliated third-party boards, and has determined that these relationships are not material relationships and, therefore, do not affect our Board’s determination of director independence.

26 Jefferies Financial Group

Corporate Governance Matters

Executive Sessions

Our independent directors meet regularly in executive session outside the presence of management. No formal Board action may be taken at any executive session. Our independent Lead Director presides over each executive session and has the authority to call such meetings.

Directors and Board Committees

Our Board has standing Audit, Compensation, ESG/DEI, Nominating and Corporate Governance, and Risk and Liquidity Oversight Committees, each of which has adopted a written charter that is available on our website at Jefferies.com.

The Board approved several changes to refresh our committee memberships after our fiscal 2022 year end. On December 1, 2022, Mr. Jones joined and now Chairs the Risk and Liquidity Oversight Committee. On January 10, 2023, Ms. Gilmartin joined the Compensation Committee, Ms. Ellis Kirk joined the Nominating and Corporate Governance Committee, Ms. Weiler joined the Risk and Liquidity Oversight Committee, and Ms. Adamany rotated off the Risk and Liquidity Oversight Committee.

| Board of Directors | |||||

TWELVE MEETINGS IN FISCAL 2022 BOARD OF DIRECTORS CHAIR Joseph S. Steinberg 2022 INDEPENDENT LEAD DIRECTOR Linda L. Adamany | All of our directors attended at least 75% of the meetings of our Board of Directors and Committees on which they served during fiscal 2022. All of our Board members attended our 2022 shareholder meeting, although we do not have a policy requiring director attendance. KEY RESPONSIBILITIES • Evaluate our performance, plans and prospects | ||||

MEMBERS Linda L. Adamany Barry J. Alperin Robert D. Beyer Matrice Ellis Kirk Brian P. Friedman MaryAnne Gilmartin |

Richard B. Handler Thomas W. Jones Jacob M. Katz Michael T. O’Kane Joseph S. Steinberg Melissa V. Weiler | • Supervise and direct the management of the Company in the interest and for the benefit of our shareholders • Manage succession planning of our executives • Designate Board committee members • Oversee additional risks related to human capital management | |||

2023 Proxy Statement 27

Corporate Governance Matters

Audit Committee | ||||

EIGHT MEETINGS IN FISCAL 2022 CHAIR Jacob M. Katz MEMBERS Adamany, Alperin, Jones, Katz, Weiler Our Board determined that each member of the Audit Committee, including Mr. Katz, the Chairman, is qualified as an audit committee financial expert within the meaning of regulations of the SEC, thereby satisfying the financial literacy and accounting or related financial management expertise requirements of the listing standards of the NYSE. | Our Board’s Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent external audit firm retained to audit our financial statements. The Audit Committee has appointed Deloitte & Touche LLP (Deloitte) as our independent external auditor for fiscal 2023. This will be Deloitte’s seventh consecutive year auditing us. The Audit Committee is responsible for the audit fee negotiations associated with our retention of Deloitte. To assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent external audit firm. In conjunction with the mandated rotation of our audit firm’s lead engagement partner, the Audit Committee and its Chair are directly involved in the selection of our audit firm’s new lead engagement partner. The members of the Audit Committee and our Board believe that the retention of Deloitte to serve as our independent external auditor is in the best interests of Jefferies and our shareholders. KEY RESPONSIBILITIES •Oversee our financial statements, internal audit function and internal control over financial reporting •Oversee our independent auditors and our audit, approve all services to be provided by our independent auditors and determine whether to retain or terminate our independent auditors •Assist our Board and management with oversight of legal and regulatory compliance •Oversee compliance with our Code of Business Practice •Prepare the Audit Committee Report required under SEC rules •Establish procedures for managing complaints about accounting, internal accounting controls or auditing matters •Review and approve related person transactions |

28 Jefferies Financial Group

Corporate Governance Matters

| Compensation | ||||

Committee TWO MEETINGS IN FISCAL 2022 CHAIR Robert D. Beyer MEMBERS Alperin, Beyer, Gilmartin, O’Kane, Weiler | Among other responsibilities, our Compensation Committee considers whether our compensation policies and practices properly reward employees for prudent risk taking. Our Compensation Committee has determined that our compensation policies and practices, and before the merger, those of Jefferies Group, are reasonably designed for the benefit of our shareholders and bondholders. Our Compensation Committee members were never employed by us nor served as an officer for us. During fiscal 2022, none of our executive officers served on any compensation committee or other board committee performing equivalent functions of another entity, one of whose executive officers was a member of our Board of Directors or a member of our Compensation Committee.

As noted later in our CD&A, after our 2022 vote results, our executive compensation plan and our response to our shareholders were the topic not only at our Committee and full Board meeting on the day of our 2022 Annual Meeting, but also at every Board meeting but one throughout the year as we decided the best path forward to address our fellow shareholders’ concerns.

KEY RESPONSIBILITIES •Set the compensation of our executive officers •Review and approve corporate goals and objectives relevant to the compensation of our executive officers, evaluate their performance and approve their compensation payout •Oversee senior management in establishing our general compensation philosophy, and oversee the development and implementation of executive compensation programs, including our incentive compensation plans and equity-based plans •Oversee regulatory and legal compliance with respect to executive compensation matters •Retain, evaluate and review the advice of the Compensation Committee’s independent compensation consultant •Prepare the Compensation Committee Report and approve the “Compensation Discussion and Analysis” on pages 39 – 61. |

2023 Proxy Statement 29

Corporate Governance Matters

ESG/DEI Committee | ||||

THREE MEETINGS IN FISCAL 2022 CHAIR Barry Alperin MEMBERS Adamany, Alperin, | The ESG/DEI Committee oversees the environmental, social and governance matters arising from our business, as well as how Jefferies broadens its diversity in the workforce and helps to address social issues in the communities in which we operate. The Committee reviews how management takes all such matters into account as they lead our operations. KEY RESPONSIBILITIES •Provide oversight and input to our management on risks, policies and strategies related to sustainability, climate change, corporate social responsibility and diversity, equity and inclusion •Consider and provide input to management on social, political and environmental trends in public policy, regulation and legislation and consider additional corporate social responsibility actions in response to such issues •Monitor our performance and progress against goals that are established from time to time with respect to these matters •Monitor our progress against our Corporate Social Responsibility Principles •Oversee strategies and practices to further our corporate culture •Provide input to the Nominating and Corporate Governance Committee regarding Board diversity initiatives •Oversee and evaluate management’s efforts to mitigate our impact on environmental and social issues •Oversee and evaluate management’s efforts to increase the diversity of the Jefferies workforce and promote an environment of inclusion, and work with outside consultants on such topics •Oversee and evaluate management’s efforts to react and respond to social issues affecting Jefferies and the communities in which we operate •Act as a resource to Jefferies’ management and employees regarding diversity, equity and inclusion matters |

30 Jefferies Financial Group

Corporate Governance Matters

Nominating and Corporate Governance Committee TWO MEETINGS IN FISCAL 2022 CHAIR Linda L. Adamany MEMBERS Adamany, Alperin, Ellis Kirk, | ||||

A key function of our Nominating and Corporate Governance Committee is to assist our Board by identifying qualified Board candidates and recommending candidates to our Board who will be instrumental to our growth and success. As noted earlier, the Committee takes into consideration such factors as it deems appropriate, which may include: •Judgment, skill, diversity, experience with businesses and other organizations of comparable size •The interplay of the candidate’s experience with the experience of other Board members •Extent to which the candidate would be a desirable addition to our Board and its Committees •To identify and recruit qualified candidates for the Board, the Governance and Nominating Committee has previously utilized the services of professional search firms and/or sought referrals from other members of the Board, management, stockholders and other sources. After conducting an initial evaluation of a candidate, one or more members of the Nominating and Corporate Governance Committee will interview that candidate if the committee believes the candidate might be suitable to be a director and may ask the candidate to meet with other directors and management. If the Nominating and Corporate Governance Committee believes a candidate would be a valuable addition to the Board, it will recommend to the full Board of Directors that candidate’s election. •Our Nominating and Corporate Governance Committee will review all candidates for director (including nominees for director pursuant to our proxy access bylaw) in the same manner, regardless of the source of the recommendation. Candidates recommended by our shareholders will be considered in accordance with the requirements for such recommendations. See “Important Information for our Shareholders—Shareholder Proposals and Director Nominations for 2024” for additional details. KEY RESPONSIBILITIES •Recommend individuals to our Board for nomination, election or appointment as members of our Board •Oversee the evaluation and refreshment of Board •Oversee the evaluation and succession planning of management •Establish and oversee our corporate governance and compliance with our corporate governance guidelines •Review and recommend to our Board any changes in director compensation | ||||

2023 Proxy Statement 31

Corporate Governance Matters

| Risk and Liquidity Oversight Committee FOUR MEETINGS IN FISCAL 2022 CHAIR Thomas W. Jones MEMBERS Beyer, Ellis Kirk, Gilmartin, Jones, Katz, Weiler | ||||

|

|

| The Risk and Liquidity Oversight Committee oversees our enterprise risk management. KEY RESPONSIBILITIES •Oversee our enterprise risk management •Approve risk management framework, risk appetite statement, and risk identification and materiality assessment framework •Review our major risk exposures, including among others, cybersecurity risk, and the steps management has taken to monitor and control such exposures •Review our capital, liquidity and funding against established risk methodologies •Receive reports from our Chief Risk Officer and assist the Chief Executive Officer and President in overseeing this position | |

32 Jefferies Financial Group

Corporate Governance Matters

Board Practices, Processes and Policies

Corporate Governance Best Practices

We continuously monitor corporate governance best practices, and over the years have made enhancements to strengthen our Board’s independence, ensure robust risk oversight and bolster alignment, communication and transparency with our shareholders.