- JEF Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Jefferies Financial (JEF) FWPFree writing prospectus

Filed: 3 Jun 24, 1:41pm

Market Linked Securities— Contingent Fixed Return and Contingent Downside Principal at Risk Securities Linked to the Lowest Performing of the Common Stock of NVIDIA Corporation and the Common Stock of Advanced Micro Devices, Inc. due June 27, 2025 Term Sheet to Preliminary Pricing Supplement dated June 3, 2024 |

| Issuer: | Jefferies Financial Group Inc. | ||

| Market Measures: | The common stock of NVIDIA Corporation (Bloomberg ticker: NVDA) and the common stock of Advanced Micro Devices, Inc. (Bloomberg ticker: AMD) (each referred to as an “Underlying Stock,” and collectively as the “Underlying Stocks”) | ||

| Pricing Date*: | June 17, 2024 | ||

| Issue Date*: | June 21, 2024 | ||

| Calculation Day*: | June 24, 2025 | ||

| Stated Maturity Date*: | June 27, 2025 | ||

Face Amount and Original Offering Price: | $1,000 per security | ||

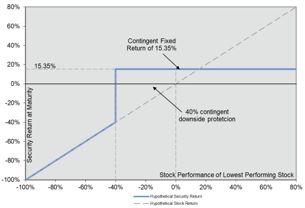

Maturity Payment Amount (per security): | • if the ending price of the lowest performing Underlying Stock is greater than or equal to its threshold price: $1,000 plus the contingent fixed return; or • if the ending price of the lowest performing Underlying Stock is less than its threshold price: $1,000 + ($1,000 × stock return of the lowest performing Underlying Stock) | ||

Lowest Performing Underlying Stock: | The Underlying Stock with the lowest stock return | ||

| Starting Price: | For each Underlying Stock, its stock closing price on the pricing date | ||

| Ending Price: | For each Underlying Stock, its stock closing price on the calculation day | ||

Contingent Fixed Return: | At least 15.35% of the face amount (at least $153.50 per security) (to be determined on the pricing date) | ||

| Stock Return: | For each Underlying Stock, (ending price – starting price) / starting price | ||

| Threshold Price: | For each Underlying Stock, 60% of its starting price | ||

| Calculation Agent: | Jefferies Financial Services Inc. (“JFSI”), a wholly owned subsidiary of Jefferies Financial Group Inc. | ||

| Denominations: | $1,000 and any integral multiple of $1,000 | ||

| Agents Discount**: | Up to 2.325%; dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of up to 1.75% and WFS may pay 0.075% of the agent’s discount to WFA as a distribution expense fee | ||

| CUSIP: | 47233WFE4 | ||

Material Tax Consequences: | See the preliminary pricing supplement. |

| The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet and the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement. |

| • | If the Ending Price of the Lowest Performing Underlying Stock Is Less Than Its Threshold Price, You Will Lose More Than 40%, and Possibly All, of the Face Amount of Your Securities at Maturity. |

| • | The Potential Return on the Securities Is Limited to the Contingent Fixed Return and May Be Lower Than the Return on a Direct Investment in Either Underlying Stock. |

| • | Your Ability to Receive the Contingent Fixed Return May Terminate on the Calculation Day |

| • | The Securities Are Subject To The Full Risks Of Each Underlying Stock And Will Be Negatively Affected If Any Underlying Stock Performs Poorly, Even If The Other Underlying Stock Performs Favorably. |

| • | Your Return On The Securities Will Depend Solely On The Performance Of The Underlying Stock That Is The Lowest Performing Underlying Stock On The Calculation Day, And You Will Not Benefit In Any Way From The Performance Of The Better Performing Underlying Stock. |

| • | You Will Be Subject To Risks Resulting From The Relationship Among The Underlying Stocks. |

| • | You May Be Fully Exposed To The Decline In The Lowest Performing Underlying Stock On The Calculation Day From Its Starting Price, But Will Not Participate In Any Positive Performance Of Any Underlying Stock. |

| • | The Stated Maturity Date May Be Postponed If A Calculation Day Is Postponed. |

| • | The Tax Consequences Of An Investment In Your Securities Are Uncertain. |

| • | The Securities Are Subject To Our Credit Risk. |

| • | The Estimated Value Of The Securities On The Pricing Date, Based On Jefferies LLC Proprietary Pricing Models At That Time And Our Internal Funding Rate, Will Be Less Than The Original Offering Price. |

| • | The Estimated Value Of The Securities Was Determined For Us By Our Subsidiary Using Proprietary Pricing Models. |

| • | The Estimated Value Of The Securities Would Be Lower If It Were Calculated Based On Our Secondary Market Rate. |

| • | The Estimated Value Of The Securities Is Not An Indication Of The Price, If Any, At Which WFS, Jefferies LLC Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market. |

| • | The Value Of The Securities Prior To Stated Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways. |

| • | The Securities Will Not Be Listed On Any Securities Exchange And The Issuer Does Not Expect A Trading Market For The Securities To Develop. |

| • | Any Payments On The Securities And Whether The Securities Are Automatically Called Will Depend Upon The Performance Of Each Underlying Stock And Therefore The Securities Are Subject To The Risks Associated With The Underlying Stocks, As Discussed In The Accompanying Pricing Supplement and Product Supplement. |

| • | Our Economic Interests And Those Of Any Dealer Participating In The Offering Are Potentially Adverse To Your Interests. |