Exhibit 99

Leucadia National Corporation 2014 Inves0tor Meeting September 3, 2014

Note on Forward Looking Statements This document contains “forward looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements include statements about our future and statements that are not historical facts. These forward looking statements are usually preceded by the words “should,” “expect,” “intend,” “may,” “will,” or similar expressions. Forward looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans, and objectives. Forward looking statements also include statements pertaining to our strategies for future development of our business and products. Forward looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors, including our Risk Factors, that could cause actual results to differ, perhaps materially, from those in our forward looking statements is contained in reports we file with the SEC. You should read and interpret any forward looking statement together with reports we file with the SEC.

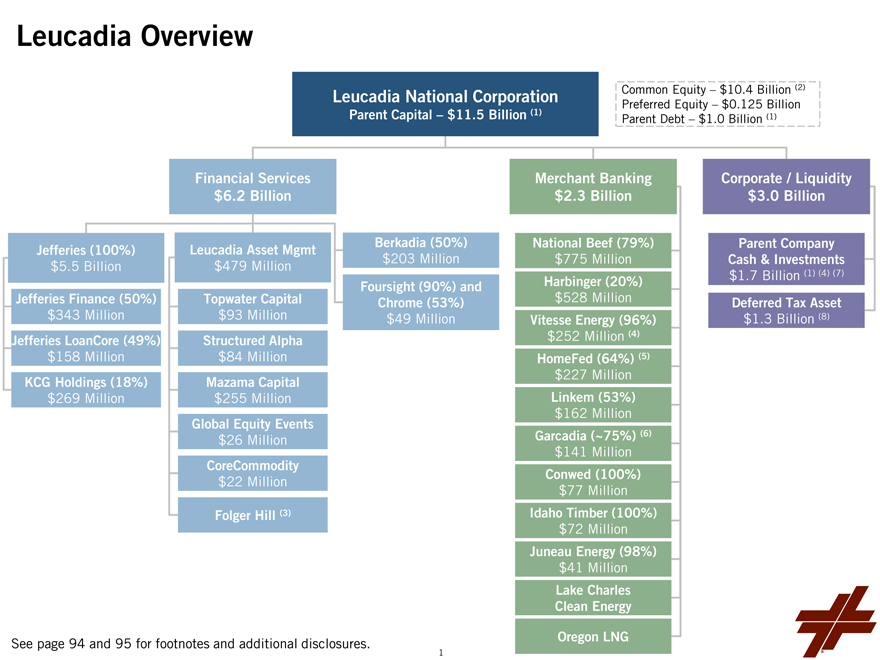

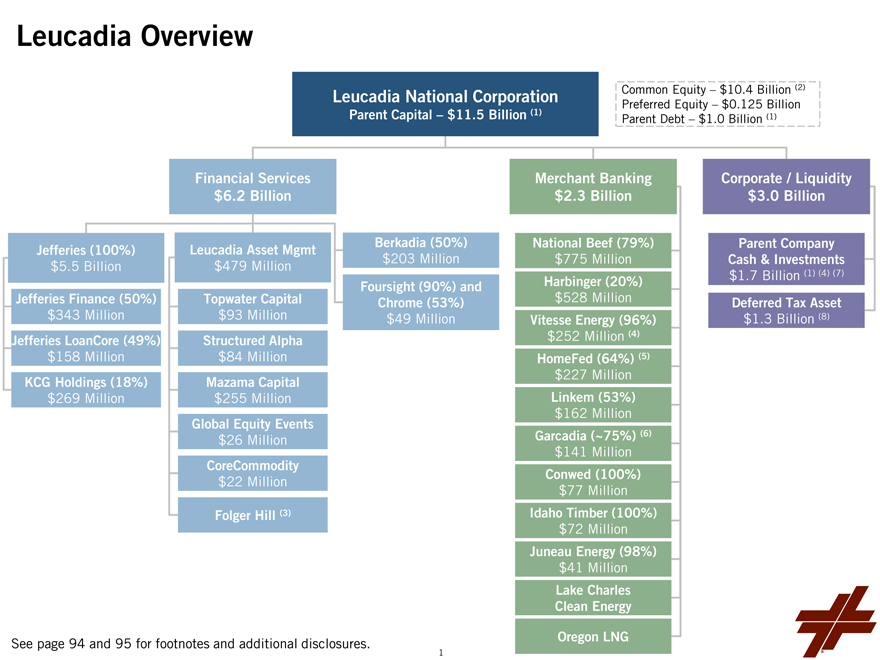

Leucadia Overview

Leucadia National Corporation

Parent Capital – $11.5 Billion (1)

Common Equity – $10.4 Billion (2)

Preferred Equity – $0.125 Billion

Parent Debt – $1.0 Billion (1)

Financial Services

$6.2 Billion

Merchant Banking

$2.3 Billion

Corporate / Liquidity

$3.0 Billion

Jefferies (100%)

$5.5 Billion

Jefferies Finance (50%)

$343 Million

Jefferies LoanCore (49%)

$158 Million

KCG Holdings (18%)

$269 Million

Leucadia Asset Mgmt

$479 Million

Topwater Capital

$93 Million

Structured Alpha

$84 Million

Mazama Capital

$255 Million

Global Equity Events

$26 Million

CoreCommodity

$22 Million

Folger Hill (3)

Berkadia (50%)

$203 Million

Foursight (90%) and

Chrome (53%)

$49 Million

National Beef (79%)

$775 Million

Harbinger (20%)

$528 Million

Vitesse Energy (96%)

$252 Million (4)

HomeFed (64%) (5)

$227 Million

Linkem (53%)

$162 Million

Garcadia (~75%) (6)

$141 Million

Conwed (100%)

$77 Million

Idaho Timber (100%)

$72 Million

Juneau Energy (98%)

$41 Million

Lake Charles

Clean Energy

Oregon LNG

Parent Company

Cash & Investments

$1.7 Billion (1) (4) (7)

Deferred Tax Asset

$1.3 Billion (8)

See page 94 and 95 for footnotes and additional disclosures.

1

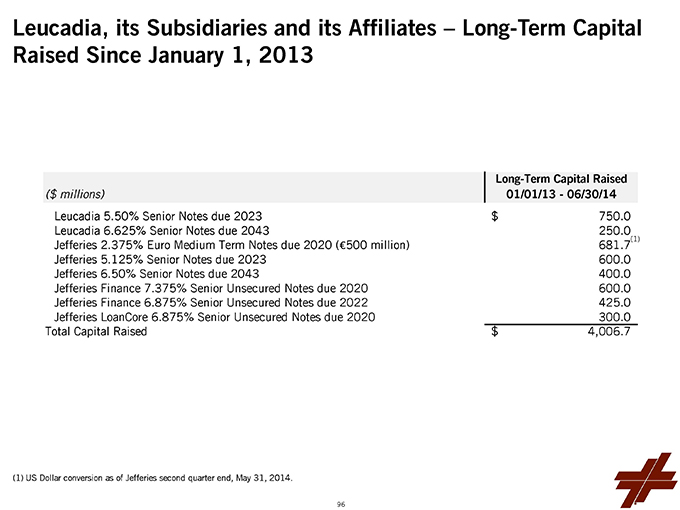

Momentum Since March 1, 2013n Divestitures: $1.0 billion in cash realized ? Inmet – $732 million ? Premier Entertainment – $250 million ? Global Caribbean Fiber – $33 million (pending close upon regulatory approval) Investments: $1.4 billion of capital invested (1); active pipelinen ? LAM Platform ? Vitesse Energy ? Harbinger ? Juneau Energy ? Linkem (Follow-on) ? Foursight Capital (Follow-on) ? Garcadia (Follow-on) ? Chrome Capitaln Other Actions ? Contributed real estate assets to HomeFed in exchange for common stock, increasing Leucadia’s economic ownership to 64% ? Since January 2013, Leucadia, Jefferies and associated joint ventures have raised over $4 billion of long-term capital (2) (1) Includes pending acquisition of EnerVest by Vitesse. (2) See page 96 for detail of all long-term capital raised since January 1, 2013. 2

A Unique Financial Services and Merchant Banking Platformn Financial Services – Our historic sector; post-crisis opportunity ? Jefferiesn Continue to prudently build a leading, independent global investment banking firmn Drive market share, margin expansion and earnings growth ? Jefferies Finance and Jefferies LoanCoren Continue to prudently build corporate and commercial real estate lending platforms ? Asset Managementn Leverage Leucadia’s brand, relationships and capital to own significant general partnership stakes in differentiated, alternative asset management strategies (minimize goodwill and acquisition costs) ? Berkadian Become the best full-service mortgage banking firm in the industryn Build out geographic coverage, products and capabilities to meet client’s needs and expectationsn Merchant Banking ? Opportunistic value investments in businesses we understandn Smart entry pointsn Ability to drive value creation 3

JEFFERIES

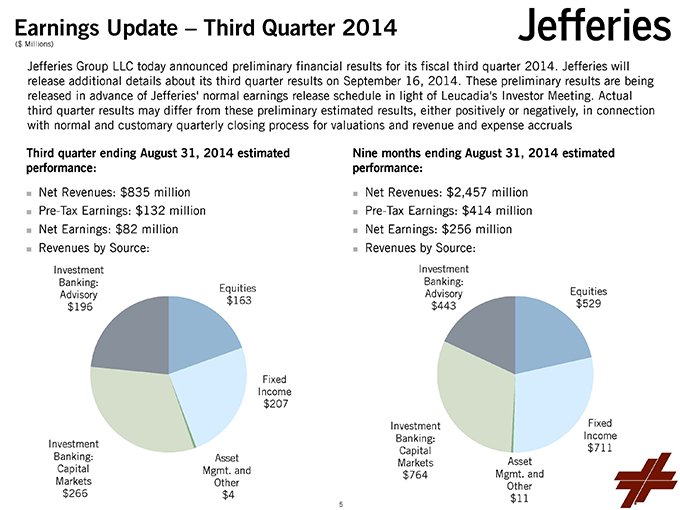

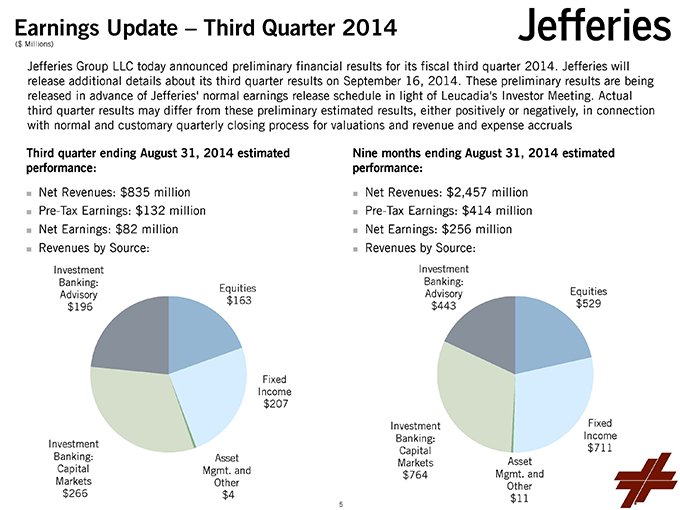

Earnings Update – Third Quarter 2014 Nine months ending August 31, 2014 estimated performance:nNet Revenues: $2,457 millionnPre-Tax Earnings: $414 millionnNet Earnings: $256 millionnRevenues by Source: Equities $163 Fixed Income $207 Asset Mgmt. and Other $4 Investment Banking: Capital Markets $266 Investment Banking: Advisory $196 Equities $529 Fixed Income $711 Asset Mgmt. and Other $11 Investment Banking: Capital Markets $764 Investment Banking: Advisory $443 ($ Millions) Third quarter ending August 31, 2014 estimated performance:nNet Revenues: $835 millionnPre-Tax Earnings: $132 millionnNet Earnings: $82 millionnRevenues by Source: Jefferies Group LLC today announced preliminary financial results for its fiscal third quarter 2014. Jefferies will release additional details about its third quarter results on September 16, 2014. These preliminary results are being released in advance of Jefferies’ normal earnings release schedule in light of Leucadia’s Investor Meeting. Actual third quarter results may differ from these preliminary estimated results, either positively or negatively, in connection with normal and customary quarterly closing process for valuations and revenue and expense accruals 5

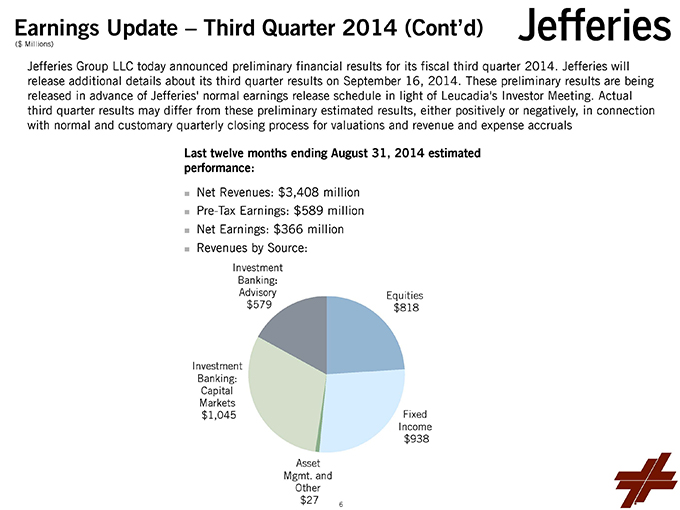

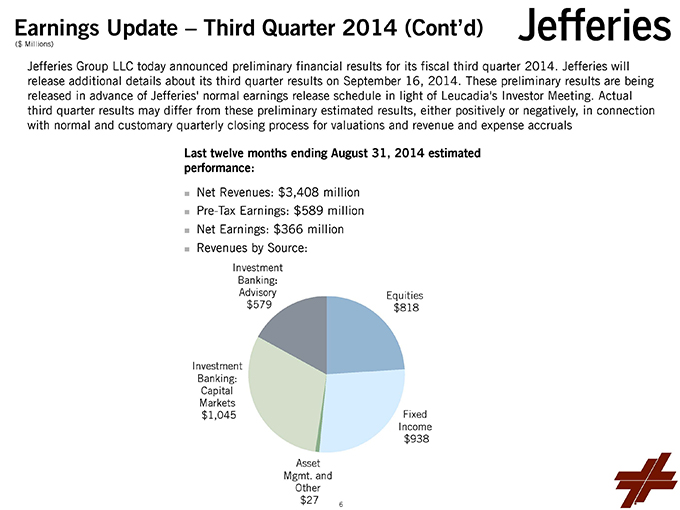

Earnings Update – Third Quarter 2014 (Cont’d) Equities $818 Fixed Income $938 Asset Mgmt. and Other $27 Investment Banking: Capital Markets $1,045 Investment Banking: Advisory $579 ($ Millions) Last twelve months ending August 31, 2014 estimated performance:nNet Revenues: $3,408 millionnPre-Tax Earnings: $589 millionnNet Earnings: $366 millionnRevenues by Source: Jefferies Group LLC today announced preliminary financial results for its fiscal third quarter 2014. Jefferies will release additional details about its third quarter results on September 16, 2014. These preliminary results are being released in advance of Jefferies’ normal earnings release schedule in light of Leucadia’s Investor Meeting. Actual third quarter results may differ from these preliminary estimated results, either positively or negatively, in connection with normal and customary quarterly closing process for valuations and revenue and expense accruals 6

Jefferies’ Momentum and Ongoing OpportunitynRecord revenues and earnings for the first nine months of the fiscal year demonstrate the strength of Jefferies’ operating model: ?Significant growth across Investment Banking reflects the quality and increasing momentum of Jefferies’ full service global platform ?Ongoing growth and expansion of Jefferies Finance corporate lending platform ?Solid growth in Equities’ revenues and market share ?Durable Fixed Income, Commodities and Currencies effort, despite less volatile marketsnJefferies’ position as the only non-bank holding company, independent global investment banking firm headquartered in the U.S. creates a unique ongoing growth opportunitynContinued emphasis on margin expansion and earnings growth through investment banking hiring, cross-product client penetration and increased employee productivitynJefferies continues to prudently manage risk, maintaining a disciplined approach to leverage, funding and asset-quality 7

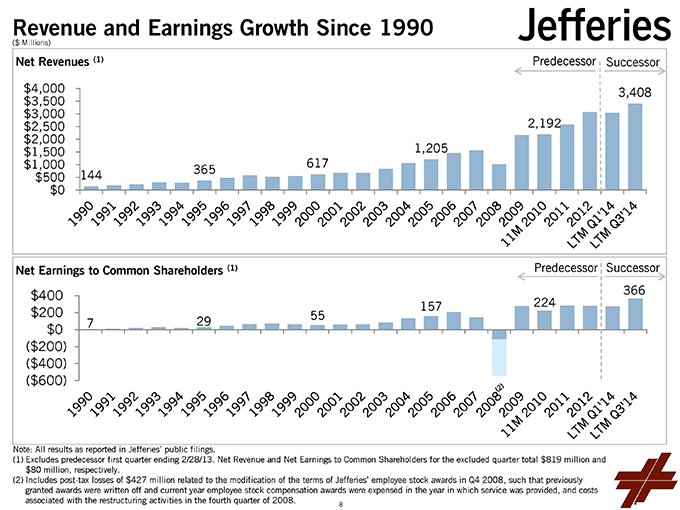

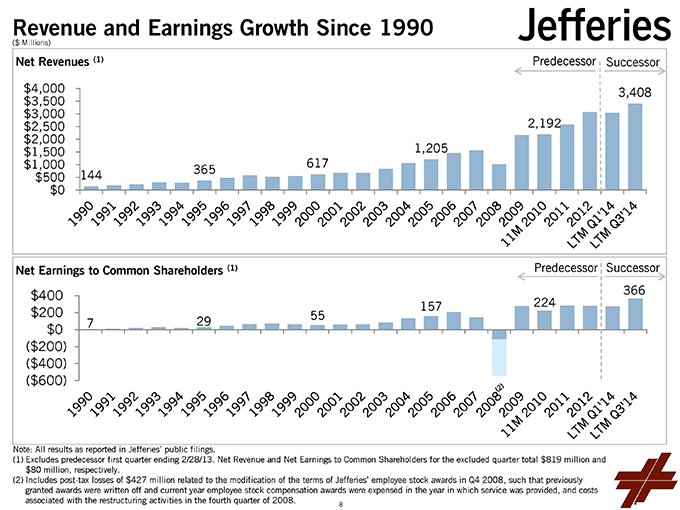

Revenue and Earnings Growth Since 1990 Net Revenues (1) 144 365 617 1,205 2,192 3,408 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 Net Earnings to Commo n S h areholders (1) 7 29 55 157 224 366 ($600) ($400) ($200) $0 $200 $400Note: All r esults as reported in Jefferies’ public filings. (1)Excludes predecessor first quarter ending 2/28/13. Net Revenue and Net Earnings to Common Shareholders for the excluded quarter total $819 million and $80 million, respectively. (2)Includes post-tax losses of $427 million related to the modification of the terms of Jefferies’ employee stock awards in Q4 2008, such that previously granted awards were written off and current year employee stock compensation awards were expensed in the year in which service was provided, and costs associated with the restructuring activities in the fourth quarter of 2008. Predecessor Successor Predecessor ($ Millions) Successor 8

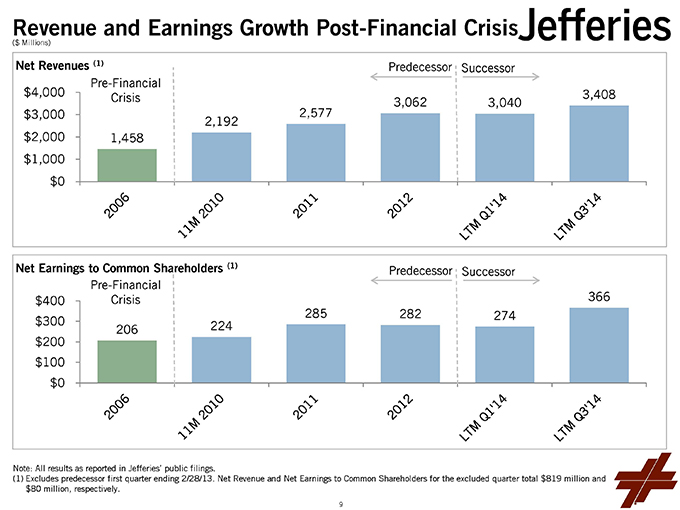

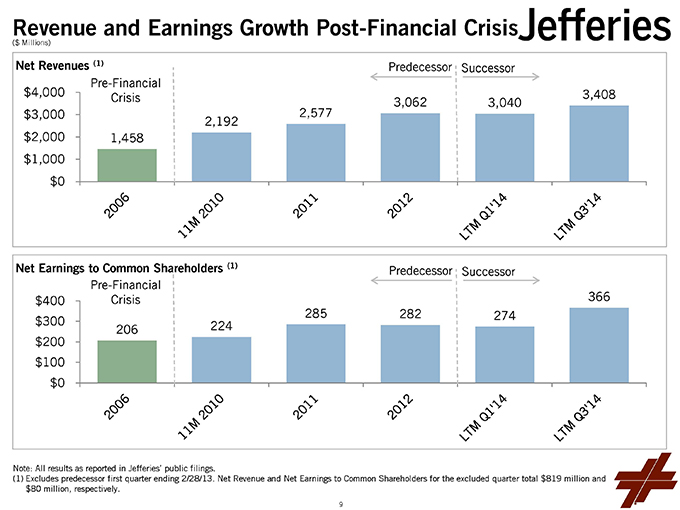

Revenue and Earnings Growth Post-Financial Crisis Net Revenues (1) 1,458 2,192 2,577 3,062 3,040 3,408 $0 $1,000 $2,000 $3,000 $4,000 Ne t E a rnings to Common Shareholders (1) Note: All results as reported in Jefferies’ public filings. (1)Excludes predecessor first quarter ending 2/28/13. Net Revenue and Net Earnings to Common Shareholders for the excluded quarter total $819 million and $80 million, respectively. Predecessor Successor ($ Millions) 206 224 285 282 274 366 $0 $100 $200 $300 $400Pr edecessor Successor Pre-Financial Crisis Pre-Financial Crisis 9

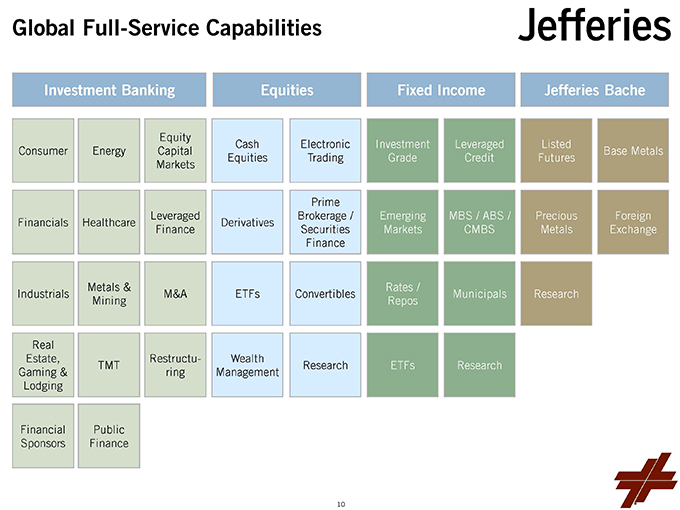

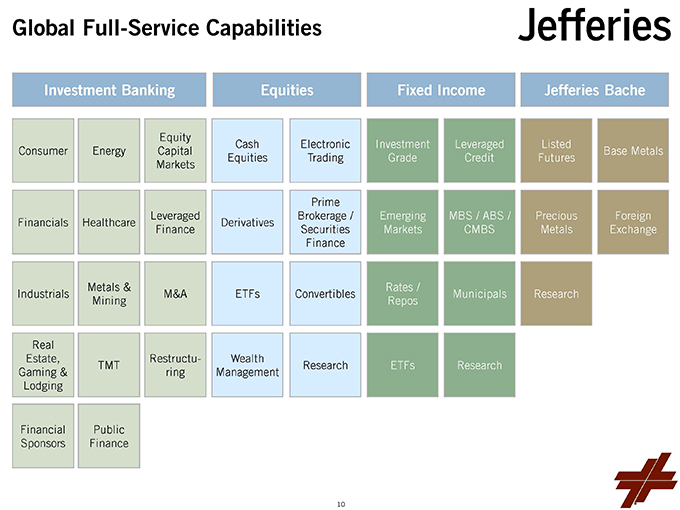

Global Full-Service Capabilities Derivatives Cash Equities Electronic Trading Prime Brokerage / Securities Finance ETFs Convertibles Wealth Management MBS / ABS / CMBS Emerging Markets Investment Grade Rates / Repos Leveraged Credit Municipals Base Metals Listed Futures Precious Metals Forei gn Exchange Metals & Mining Industrials Healthcare Financials TMT Real Estate, Gaming & Lodging Energy Consumer Equity Capital Markets Leveraged Finance M&A Financial Sponsors Equities Fixed Income Jefferies Bache Investment Banking Public Finance Restructu-ring Research ETFs Research Research 10

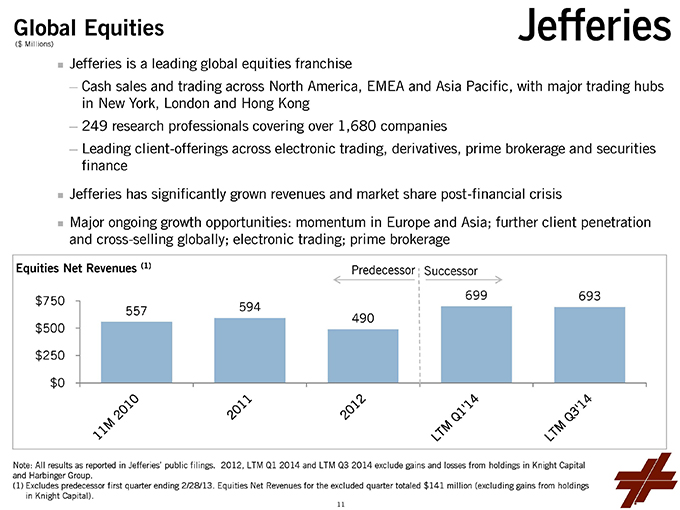

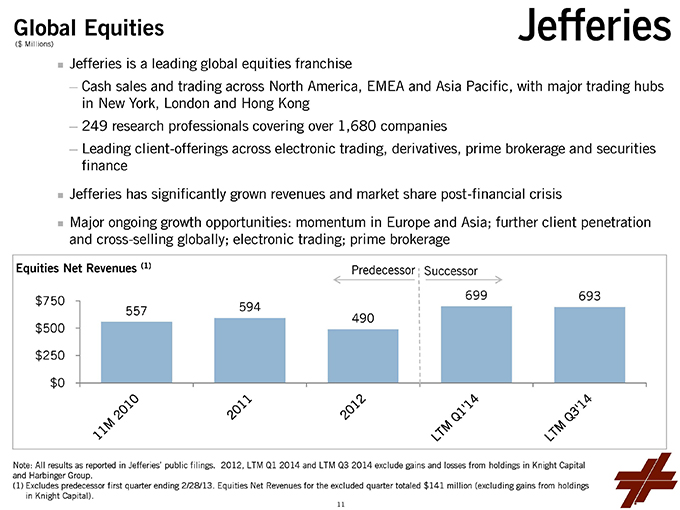

Global EquitiesnJefferies is a leading global equities franchise ?Cash sales and trading across North America, EMEA and Asia Pacific, with major trading hubs in New York, London and Hong Kong ?249 research professionals covering over 1,680 companies ?Leading client-offerings across electronic trading, derivatives, prime brokerage and securities financenJefferies has significantly grown revenues and market share post-financial crisisnMajor ongoing growth opportunities: momentum in Europe and Asia; further client penetration and cross-selling globally; electronic trading; prime brokerage Note: All results as reported in Jefferies’ public filings. 2012, LTM Q1 2014 and LTM Q3 2014 exclude gains and losses from holdings in Knight Capital and Harbinger Group. (1)Excludes predecessor first quarter ending 2/28/13. Equities Net Revenues for the excluded quarter totaled $141 million (excluding gains from holdings in Knight Capital). Equities Net Revenues (1) 557 594 490 699 693 $0 $250 $500 $750 P red e cessor Successor ($ Millions) 11

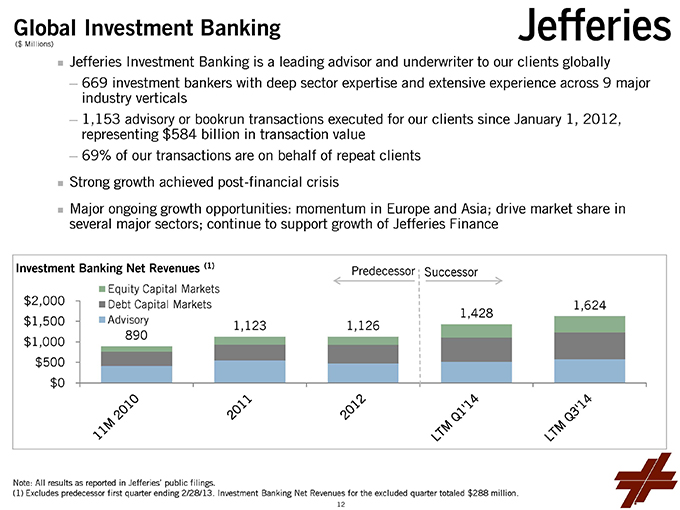

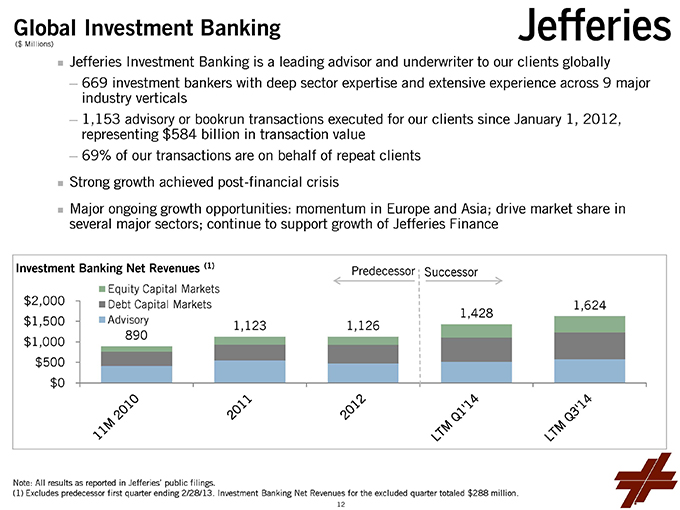

Global Investment Banking Note: All results as reported in Jefferies’ public filings. (1)Excludes predecessor first quarter ending 2/28/13. Investment Banking Net Revenues for the excluded quarter totaled $288 million. Investment Banking Net Revenues (1) 890 1,123 1,126 1,428 1,624 $0 $500 $1,000 $1,500 $2,000 E qui t y Capital Markets Debt Capital Markets Advisory Predecessor SuccessornJefferies Investment Banking is a leading advisor and underwriter to our clients globally ?669 investment bankers with deep sector expertise and extensive experience across 9 major industry verticals ?1,153 advisory or bookrun transactions executed for our clients since January 1, 2012, representing $584 billion in transaction value ?69% of our transactions are on behalf of repeat clientsnStrong growth achieved post-financial crisisnMajor ongoing growth opportunities: momentum in Europe and Asia; drive market share in several major sectors; continue to support growth of Jefferies Finance ($ Millions) 12

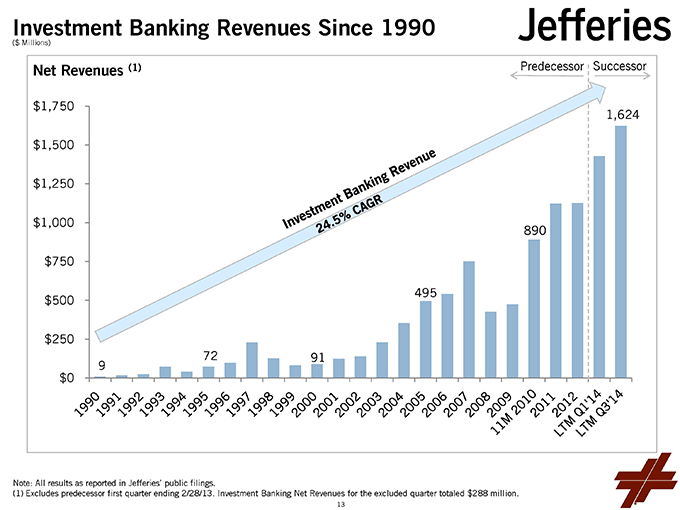

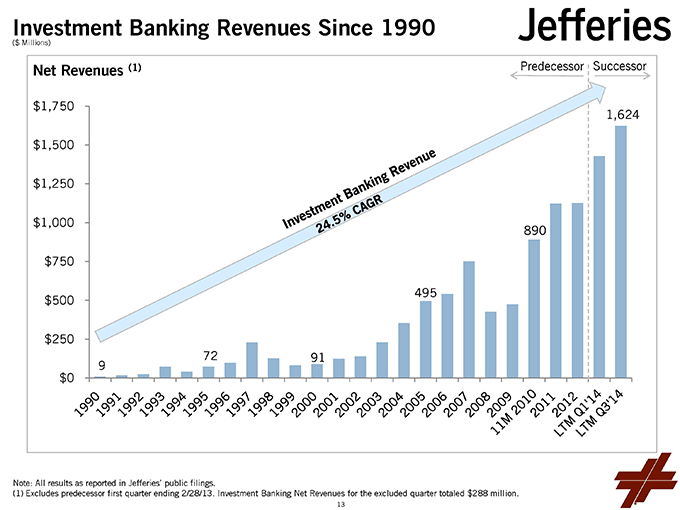

Net Revenues (1) Investment Banking Revenues Since 1990 9 72 91 495 890 1,624 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 ($ Millions) Predeces sor S uccessor Note: All results as reported in Jefferies’ public filings. (1)Excludes predecessor first quarter ending 2/28/13. Investment Banking Net Revenues for the excluded quarter totaled $288 million. 13

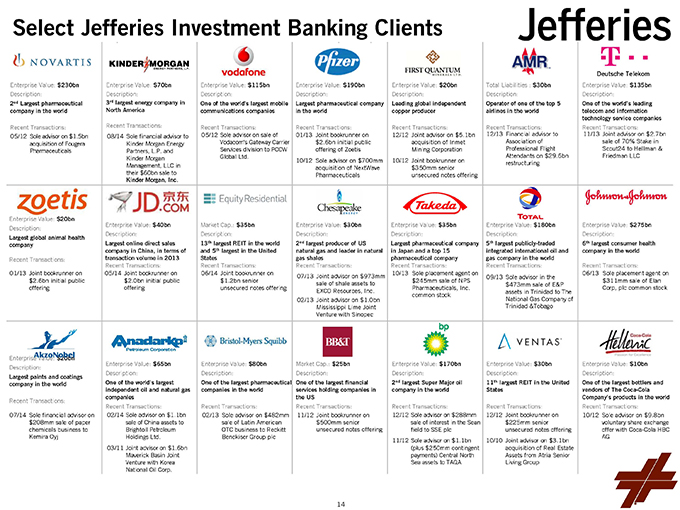

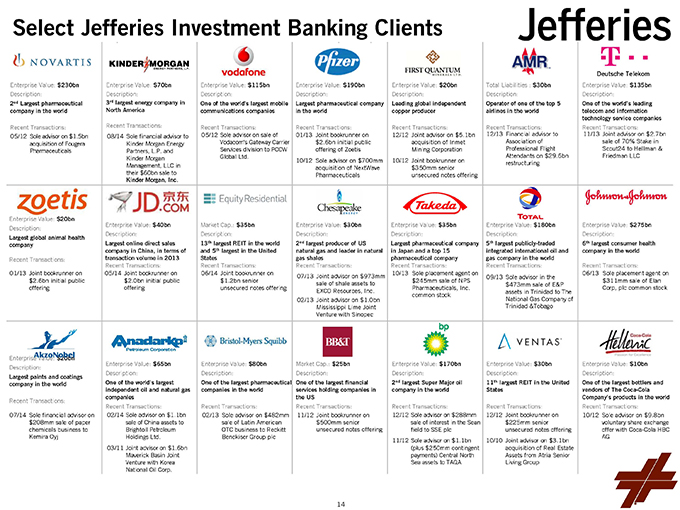

Select Jefferies Investment Banking Clients 02/14 Sole advisor on $1.1bn sale of China assets to Brightoil Petroleum Holdings Ltd. 03/11 Joint advisor on $1.6bn Maverick Basin Joint Venture with Korea National Oil Corp. Enterprise Value: $65bn Description: One of the world’s largest independent oil and natural gas companies Recent Transactions: Enterprise Value: $170bn Description: 2nd largest Super Major oil company in the world Recent Transactions: Enterprise Value: $190bn Description: Largest pharmaceutical company in the world Recent Transactions: 01/13 Joint bookrunner on $2.6bn initial public offering of Zoetis 10/12 Sole advisor on $700mm acquisition of NextWave Pharmaceuticals Enterprise Value: $20bn Description: Leading global independent copper producer Recent Transactions: 12/12 Joint advisor on $5.1bn acquisition of Inmet Mining Corporation 10/12 Joint bookrunner on $350mm senior unsecured notes offering Enterprise Value: $70bn Description: 3rd largest energy company in North America Recent Transactions: 08/14 Sole financial advisor to Kinder Morgan Energy Partners, L.P. and Kinder Morgan Management, LLC in their $60bn sale to Kinder Morgan, Inc. Enterprise Value: $230bn Description: 2nd Largest pharmaceutical company in the world Recent Transactions: 05/12 Sole advisor on $1.5bn acquisition of Fougera Pharmaceuticals Total Liabilities : $30bn Description: Operator of one of the top 5 airlines in the world Recent Transactions: 12/13 Financial advisor to Association of Professional Flight Attendants on $29.6bn restructuring Enterprise Value: $115bn Description: One of the world’s largest mobile communications companies Recent Transactions: 05/12 Sole advisor on sale of Vodacom’s Gateway Carrier Services division to PCCW Global Ltd. 07/13 Joint advisor on $973mm sale of shale assets to EXCO Resources, Inc. 02/13 Joint advisor on $1.0bn Mississippi Lime Joint Venture with Sinopec 12/12 Sole advisor on $288mm sale of interest in the Sean field to SSE plc 11/12 Sole advisor on $1.1bn (plus $250mm contingent payments) Central North Sea assets to TAQA Enterprise Value: $135bn Description: One of the world’s leading telecom and information technology service companies Recent Transactions: 11/13 Joint advisor on $2.7bn sale of 70% Stake in Scout24 to Hellman & Friedman LLC Enterprise Value: $30bn Description: 11th largest REIT in the United States Recent Transactions: 12/12 Joint bookrunner on $225mm senior unsecured notes offering 10/10 Joint advisor on $3.1bn acquisition of Real Estate Assets from Atria Senior Living Group Market Cap.: $25bn Description: One of the largest financial services holding companies in the US Recent Transactions: 11/12 Joint bookrunner on $500mm senior unsecured notes offering 10/12 Sole advisor on $9.8bn voluntary share exchange offer with Coca-Cola HBC AG Enterprise Value: $10bn Description: One of the largest bottlers and vendors of The Coca-Cola Company’s products in the world Recent Transactions: Enterprise Value: $80bn Description: One of the largest pharmaceutical companies in the world Recent Transactions: 02/13 Sole advisor on $482mm sale of Latin American OTC business to Reckitt Benckiser Group plc 09/13 Sole advisor in the $473mm sale of E&P assets in Trinidad to The National Gas Company of Trinidad &Tobago Deutsche Telekom Enterprise Value: $30bn Description: 2nd largest producer of US natural gas and leader in natural gas shales Recent Transactions: Enterprise Value: $20bn Description: Largest global animal health company Recent Transactions: 01/13 Joint bookrunner on $2.6bn initial public offering Enterprise Value: $275bn Description: 6th largest consumer health company in the world Recent Transactions: 06/13 Sole placement agent on $311mm sale of Elan Corp, plc common stock Enterprise Value: $180bn Description: 5th largest publicly-traded integrated international oil and gas company in the world Recent Transactions: Enterprise Value: $35bn Description: Largest pharmaceutical company in Japan and a top 15 pharmaceutical company Recent Transactions: 10/13 Sole placement agent on $245mm sale of NPS Pharmaceuticals, Inc. common stock 05/14 Joint bookrunner on $2.0bn initial public offering Enterprise Value: $40bn Description: Largest online direct sales company in China, in terms of transaction volume in 2013 Recent Transactions: Market Cap.: $35bn Description: 13th largest REIT in the world and 5th largest in the United States Recent Transactions: 06/14 Joint bookrunner on $1.2bn senior unsecured notes offering Enterprise Value: $20bn Description: Largest paints and coatings company in the world Recent Transactions: 07/14 Sole financial advisor on $208mm sale of paper chemicals business to Kemira Oyj 14

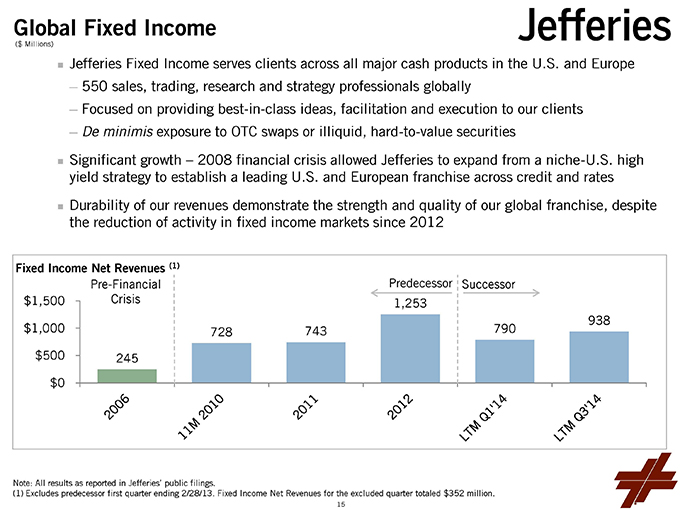

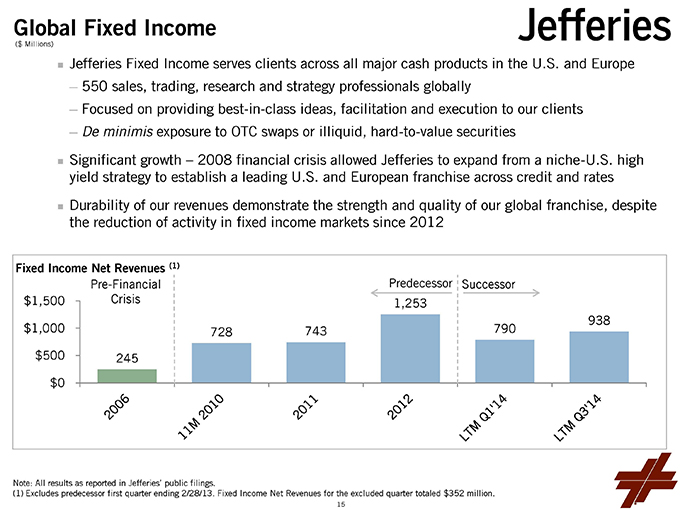

Global Fixed Income Fixed Income Net Revenues (1) 245 728 743 1,253 790 938 $0 $500 $1,000 $1,500 Pr ede c essor SuccessornJefferies Fixed Income serves clients across all major cash products in the U.S. and Europe ?550 sales, trading, research and strategy professionals globally ?Focused on providing best-in-class ideas, facilitation and execution to our clients ?De minimis exposure to OTC swaps or illiquid, hard-to-value securitiesnSignificant growth – 2008 financial crisis allowed Jefferies to expand from a niche-U.S. high yield strategy to establish a leading U.S. and European franchise across credit and ratesnDurability of our revenues demonstrate the strength and quality of our global franchise, despite the reduction of activity in fixed income markets since 2012 Pre-Financial Crisis Note: All results as reported in Jefferies’ public filings. (1)Excludes predecessor first quarter ending 2/28/13. Fixed Income Net Revenues for the excluded quarter totaled $352 million. ($ Millions) 15

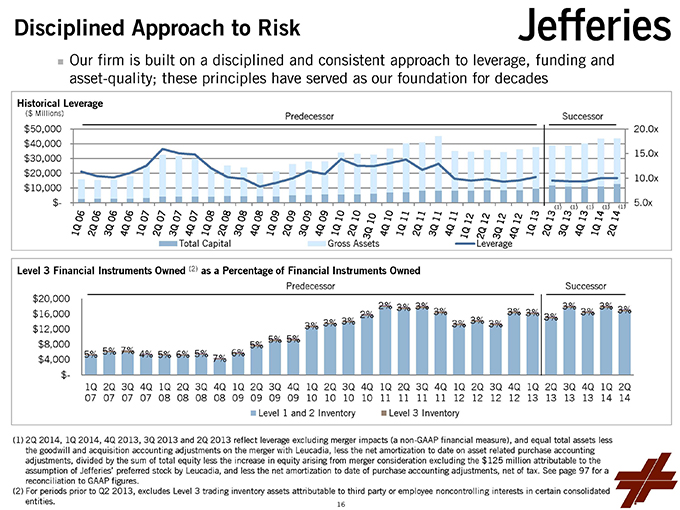

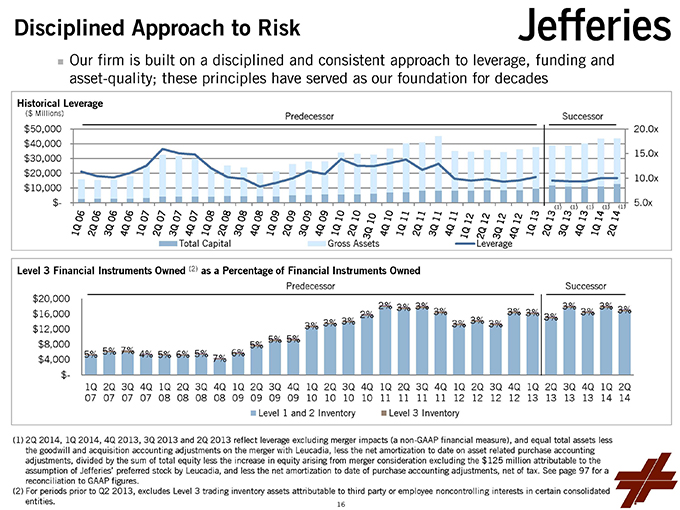

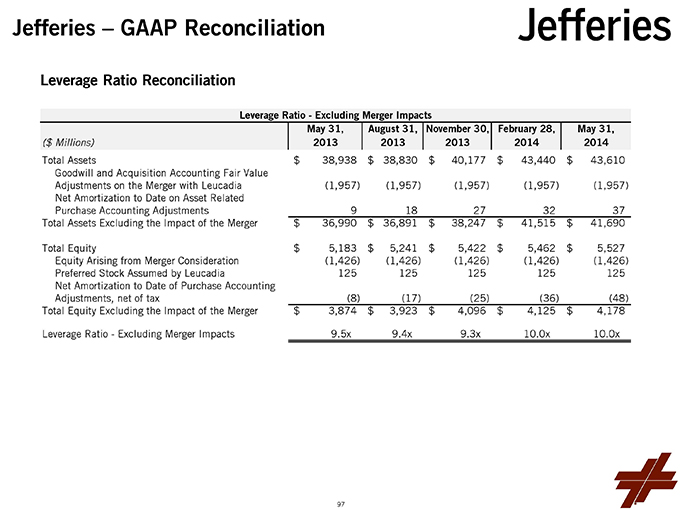

Level 3 Financial Instruments Owned (2) as a Percentage of Financial Instruments Owned Historical Leverage 5.0x 10.0x 15.0x 20.0x $- $10,000 $20,000 $30,000 $40,000 $50,000 T o t a l C a p i t a l G r o s s A s s e t s L e v e r a g e D isciplined Approach to RisknOur firm is built on a disciplined and consistent approach to leverage, funding and asset-quality; these principles have served as our foundation for decades (1)2Q 2014, 1Q 2014, 4Q 2013, 3Q 2013 and 2Q 2013 reflect leverage excluding merger impacts (a non-GAAP financial measure), and equal total assets less the goodwill and acquisition accounting adjustments on the merger with Leucadia, less the net amortization to date on asset related purchase accounting adjustments, divided by the sum of total equity less the increase in equity arising from merger consideration excluding the $125 million attributable to the assumption of Jefferies’ preferred stock by Leucadia, and less the net amortization to date of purchase accounting adjustments, net of tax. See page 97 for a reconciliation to GAAP figures. (2)For periods prior to Q2 2013, excludes Level 3 trading inventory assets attributable to third party or employee noncontrolling interests in certain consolidated entities. Predecessor Successor ($ Millions) (1)(1) (1) (1) (1) 5% 5% 7% 4% 5% 6% 5% 7% 6% 5% 5% 5% 3% 3% 3% 2% 2% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% $- $4,000 $8,000 $12,000 $16,000 $20,000 1Q 07 2Q 07 3Q 07 4Q 07 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 2Q 09 3Q 09 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14 Level 1 and 2 Inventory Level 3 InventoryPredecessor Successor 16

Upcoming Investor CalendarnJefferies Investor Day – Thursday, October 9, 2014 ?Presentations to include:nFirm ManagementnFinance and TreasurynEquitiesnFixed IncomenInvestment Banking 17

Leucadia Asset Management 18

OverviewnDiversified alternative asset management platform – seeding and developing focused funds managed by distinct management teamsn$479 million – substantially all invested in liquid strategies ?Topwater Capital (First-Loss Hedge Fund Investments) ?Structured Alpha (Quantitative Strategies) ?Global Equity Events Opportunity Fund (Event Driven Strategies) ?Mazama Capital Management (Long-Only Growth Equity) ?CoreCommodity Management (Commodity Strategies)nFolger Hill Asset Management ?Multi-manager hedge fund platform ?Led by Sol Kumin, former COO of SAC, serving as CEO ?Board of Directors: Rich Handler, Brian Friedman and Sol Kumin ?Leucadia investment commitment of $400 million contingent on Folger Hill raising at least $400 million of outside capital Leucadia Asset Management 19

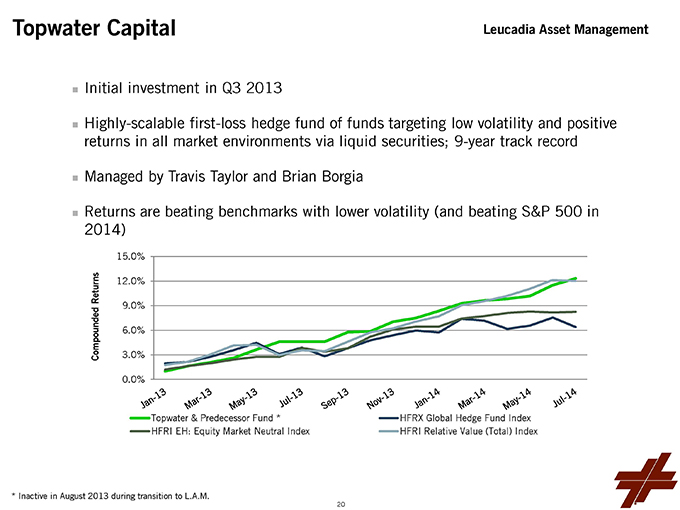

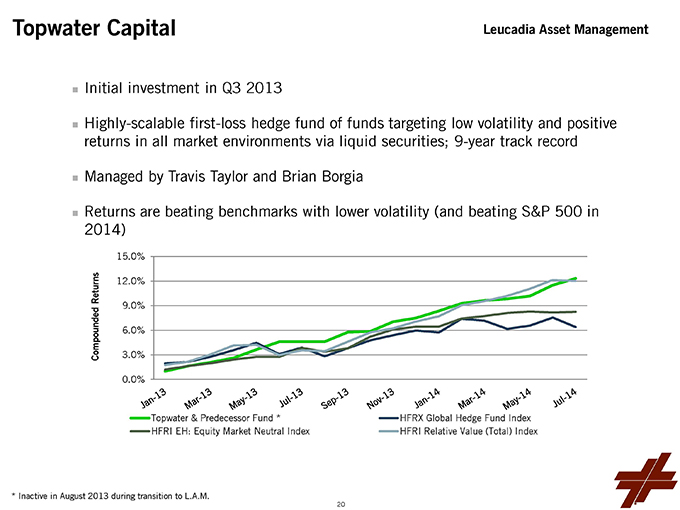

Topwater Capital Leucadia Asset ManagementnInitial investment in Q3 2013nHighly-scalable first-loss hedge fund of funds targeting low volatility and positive returns in all market environments via liquid securities; 9-year track recordnManaged by Travis Taylor and Brian BorgianReturns are beating benchmarks with lower volatility (and beating S&P 500 in 2014) * Inactive in August 2013 during transition to L.A.M. 0.0% 3.0% 6.0% 9.0% 12.0% 15.0% CompoundedReturns Topwater & Predecessor Fund * HFRX Global Hedge Fund Index HFRI EH: Equity Market Neutral Index HFRI Relative Value (Total) Index 20

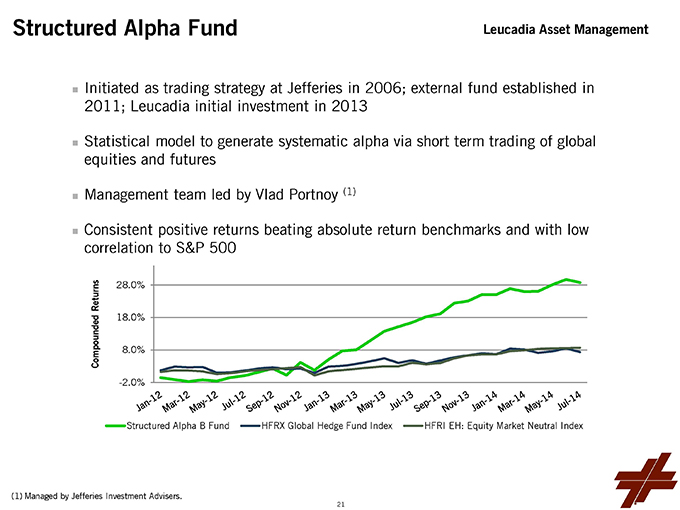

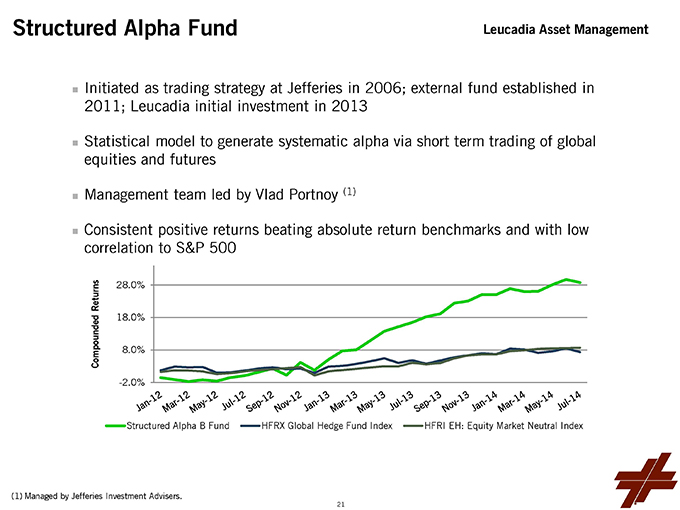

Structured Alpha Fund Leucadia Asset ManagementnInitiated as trading strategy at Jefferies in 2006; external fund established in 2011; Leucadia initial investment in 2013nStatistical model to generate systematic alpha via short term trading of global equities and futuresnManagement team led by Vlad Portnoy (1) nConsistent positive returns beating absolute return benchmarks and with low correlation to S&P 500 -2.0% 8.0% 18.0% 28.0% Compounded Returns Structured Alpha B Fund HFRX Global Hedge Fund Index HFRI EH: Equity Market Neutral Index (1)Managed by Jefferies Investment Advisers. 21

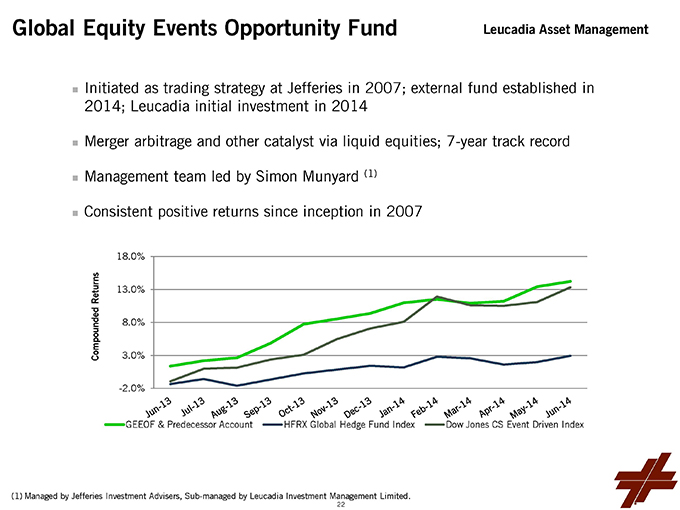

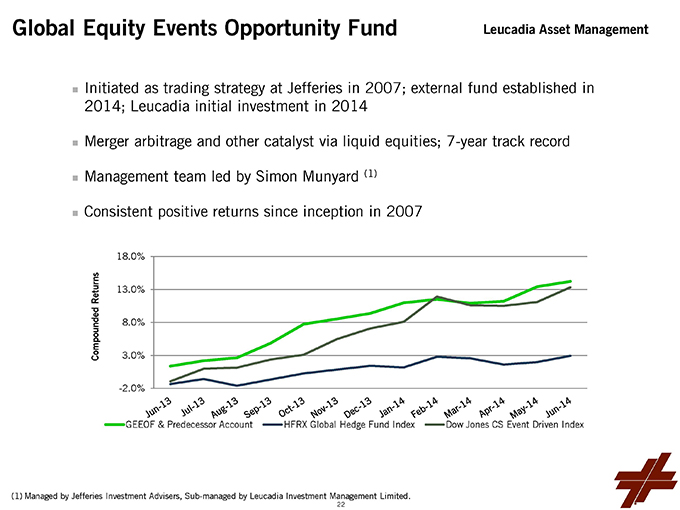

Global Equity Events Opportunity FundnInitiated as trading strategy at Jefferies in 2007; external fund established in 2014; Leucadia initial investment in 2014nMerger arbitrage and other catalyst via liquid equities; 7-year track recordnManagement team led by Simon Munyard (1) nConsistent positive returns since inception in 2007 Leucadia Asset Management -2.0% 3.0% 8.0% 13.0% 18.0% Compounded Returns GEEOF & Predecessor Account HFRX Global Hedge Fund Index Dow Jones CS Event Driven Index (1)Managed by Jefferies Investment Advisers, Sub-managed by Leucadia Investment Management Limited. 22

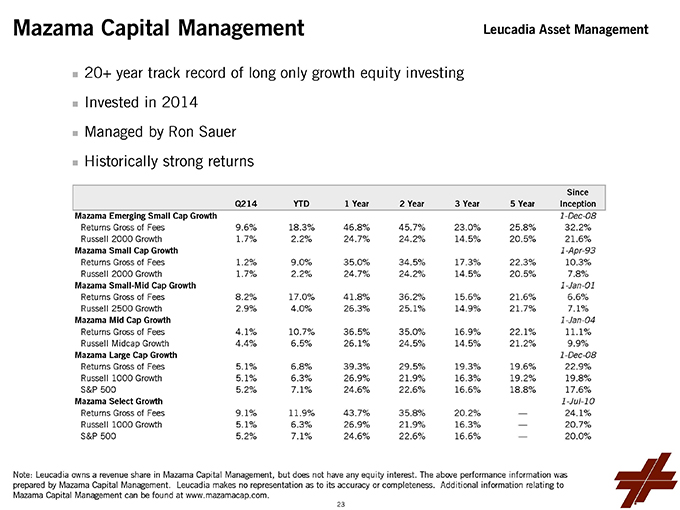

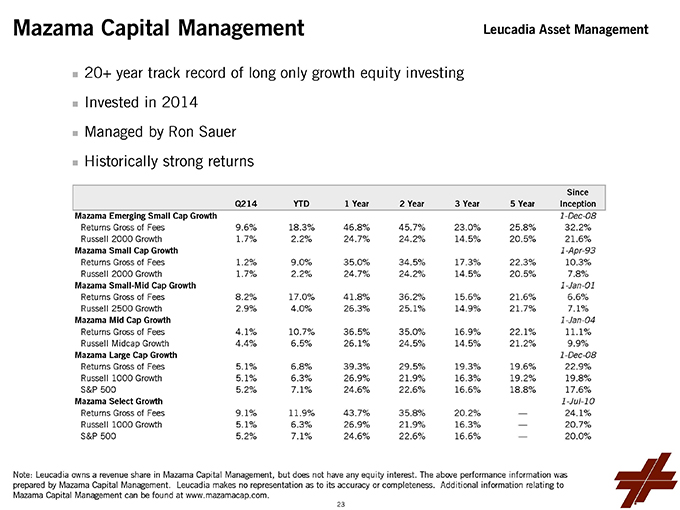

Mazama Capital Managementn20+ year track record of long only growth equity investingnInvested in 2014nManaged by Ron SauernHistorically strong returns Leucadia Asset Management Q214YTD1 Year2 Year3 Year5 YearSince InceptionMazama Emerging Small Cap Growth1-Dec-08Returns Gross of Fees9.6%18.3%46.8%45.7%23.0%25.8%32.2%Russell 2000 Growth1.7%2.2%24.7%24.2%14.5%20.5%21.6%Mazama Small Cap Growth1-Apr-93Returns Gross of Fees1.2%9.0%35.0%34.5%17.3%22.3%10.3%Russell 2000 Growth1.7%2.2%24.7%24.2%14.5%20.5%7.8%Mazama Small-Mid Cap Growth1-Jan-01Returns Gross of Fees8.2%17.0%41.8%36.2%15.6%21.6%6.6%Russell 2500 Growth2.9%4.0%26.3%25.1%14.9%21.7%7.1%Mazama Mid Cap Growth1-Jan-04Returns Gross of Fees4.1%10.7%36.5%35.0%16.9%22.1%11.1%Russell Midcap Growth4.4%6.5%26.1%24.5%14.5%21.2%9.9%Mazama Large Cap Growth1-Dec-08Returns Gross of Fees5.1%6.8%39.3%29.5%19.3%19.6%22.9%Russell 1000 Growth5.1%6.3%26.9%21.9%16.3%19.2%19.8%S&P 5005.2%7.1%24.6%22.6%16.6%18.8%17.6%Mazama Select Growth1-Jul-10Returns Gross of Fees9.1%11.9%43.7%35.8%20.2%—24.1%Russell 1000 Growth5.1%6.3%26.9%21.9%16.3%—20.7%S&P 5005.2%7.1%24.6%22.6%16.6%—20.0%Note: Leucadia owns a revenue share in Mazama Capital Management, but does not have any equity interest. The above performance information was prepared by Mazama Capital Management. Leucadia makes no representation as to its accuracy or completeness. Additional information relating to Mazama Capital Management can be found at www.mazamacap.com. 23

Berkadia the industry of one 24

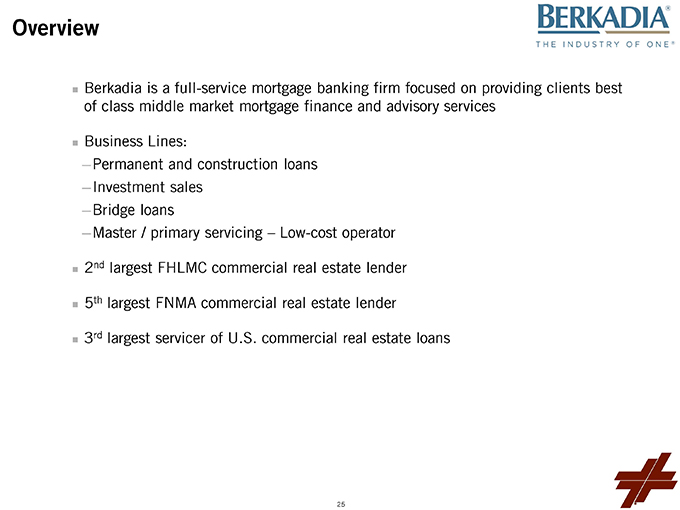

OverviewnBerkadia is a full-service mortgage banking firm focused on providing clients best of class middle market mortgage finance and advisory servicesnBusiness Lines: ?Permanent and construction loans ?Investment sales ?Bridge loans ?Master / primary servicing – Low-cost operatorn2nd largest FHLMC commercial real estate lendern5th largest FNMA commercial real estate lendern3rd largest servicer of U.S. commercial real estate loans 25

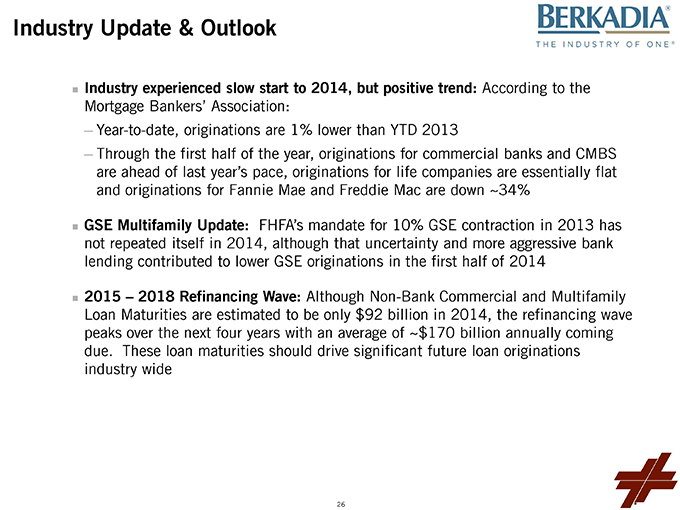

Industry Update & OutlooknIndustry experienced slow start to 2014, but positive trend: According to the Mortgage Bankers’ Association: ?Year-to-date, originations are 1% lower than YTD 2013 ?Through the first half of the year, originations for commercial banks and CMBS are ahead of last year’s pace, originations for life companies are essentially flat and originations for Fannie Mae and Freddie Mac are down ~34%nGSE Multifamily Update: FHFA’s mandate for 10% GSE contraction in 2013 has not repeated itself in 2014, although that uncertainty and more aggressive bank lending contributed to lower GSE originations in the first half of 2014n2015 – 2018 Refinancing Wave: Although Non-Bank Commercial and Multifamily Loan Maturities are estimated to be only $92 billion in 2014, the refinancing wave peaks over the next four years with an average of ~$170 billion annually coming due. These loan maturities should drive significant future loan originations industry wide 26

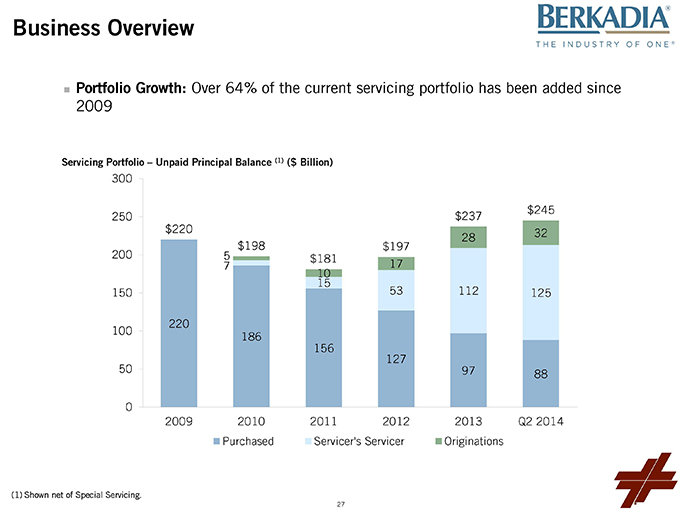

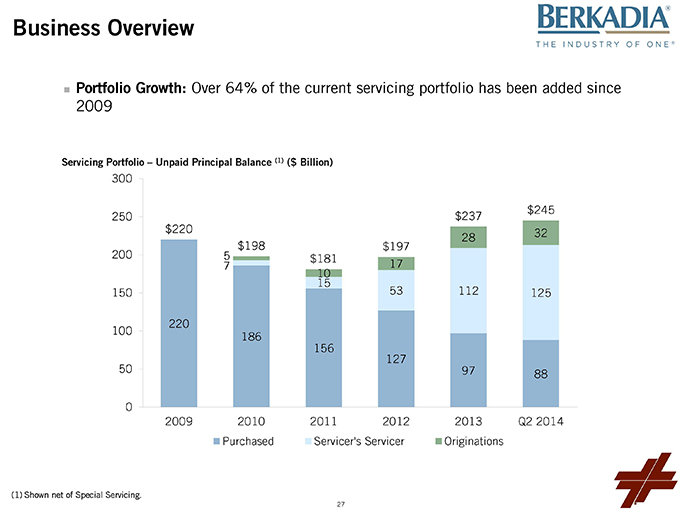

Servicing Portfolio – Unpaid Principal Balance (1) ($ Billion) Business OverviewnPortfolio Growth: Over 64% of the current servicing portfolio has been added since 2009 (1)Shown net of Special Servicing. 220 186 156 127 97 88 7 15 53 112 125 5 10 17 28 32 $220 $198 $181 $197 $237 $245 0 50 100 150 200 250 300 2009 2010 2011 2012 2013 Q2 2014 Purchased Servicer’s Servicer Originations 27

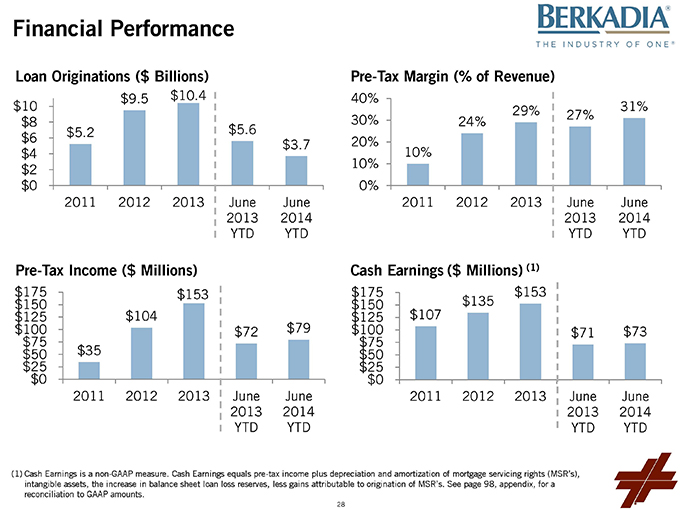

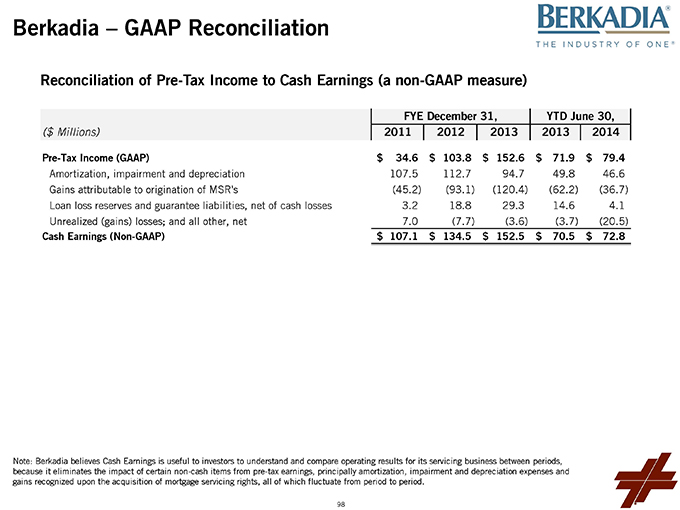

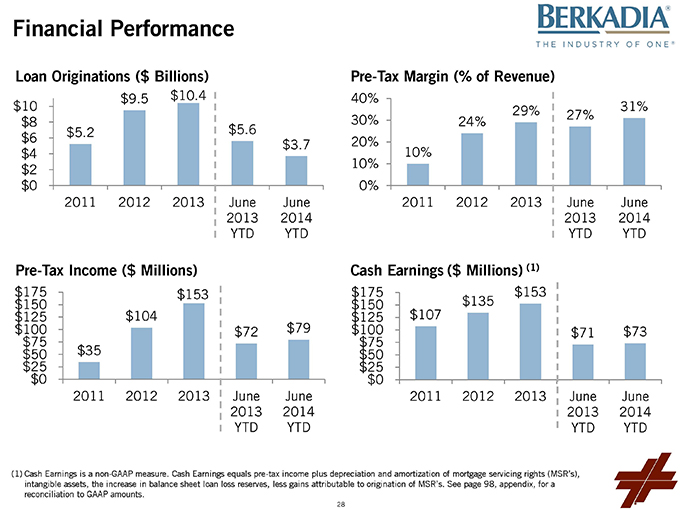

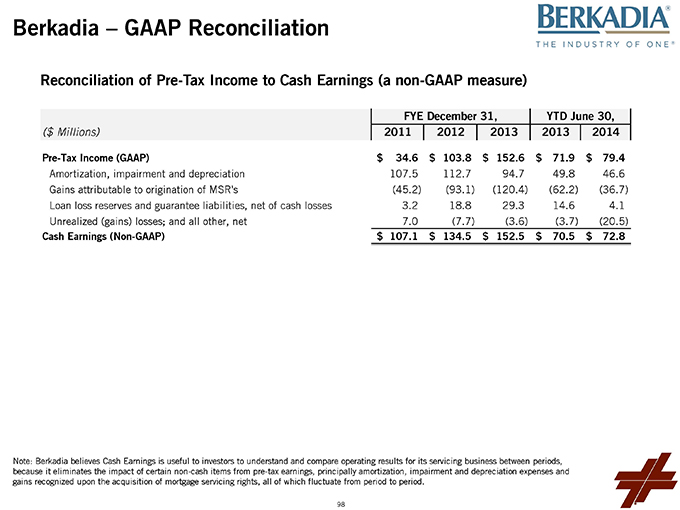

Financial Performance Cash Earnings ($ Millions) (1) $107 $135 $153 $71 $73 $0 $25 $50 $75 $100 $125 $150 $175 2011 2012 2013 June 2013 YTD June 2014 YTDLoan Originations ($ Billions) Pre-Tax Margin (% of Revenue) Pre-Tax Income ($ Millions) $5.2 $9.5 $10.4 $5.6 $3.7 $0 $2 $4 $6 $8 $10 2011 2012 2013 June 2013 YTD June 2014 YTD10% 24% 29% 27% 31% 0% 10% 20% 30% 40% 2011 2012 2013 June 2013 YTD June 2014 YTD $35 $104 $153 $72 $79 $0 $25 $50 $75 $100 $125 $150 $175 2011 2012 2013 June 2013 YTD June 2014 YTD (1)Cash Earnings is a non-GAAP measure. Cash Earnings equals pre-tax income plus depreciation and amortization of mortgage servicing rights (MSR’s), intangible assets, the increase in balance sheet loan loss reserves, less gains attributable to origination of MSR’s. See page 98, appendix, for a reconciliation to GAAP amounts. 28

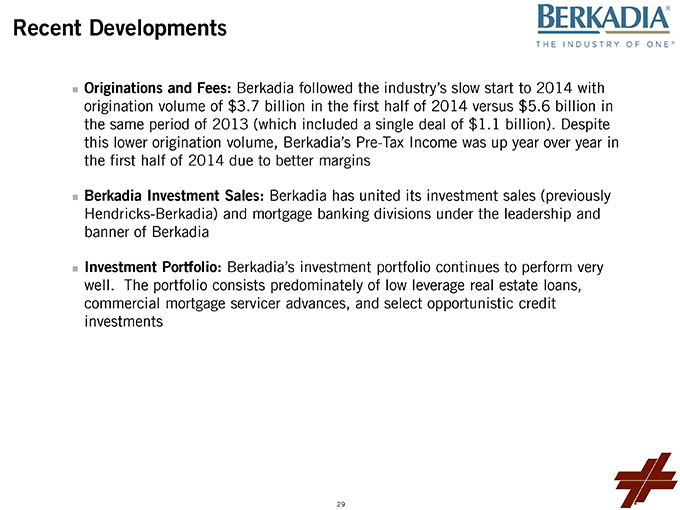

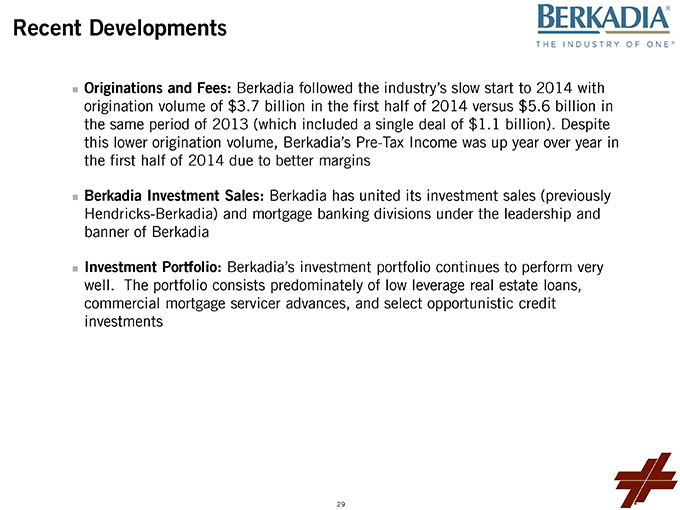

Recent Developments Originations and Fees: Berkadia followed the industry’s slow start to 2014 with origination volume of $3.7 billion in the first half of 2014 versus $5.6 billion in the same period of 2013 (which included a single deal of $1.1 billion). Despite this lower origination volume, Berkadia’s Pre-Tax Income was up year over year in the first half of 2014 due to better margins Berkadia Investment Sales: Berkadia has united its investment sales (previously Hendricks-Berkadia) and mortgage banking divisions under the leadership and banner of Berkadia Investment Portfolio: Berkadia’s investment portfolio continues to perform very well. The portfolio consists predominately of low leverage real estate loans, commercial mortgage servicer advances, and select opportunistic credit investments 29

Strategic PrioritiesnIncrease production ?Add additional mortgage bankers and investment sales professionals ?Grow market share through the maturity waven“Servicer’s Servicer” ?Berkadia Commercial Real Estate Services has the capabilities and expertise to substantially improve the profitability of the Mortgage Servicing Rights held by others, and is actively pursuing additional servicing engagements with 3rd partiesnGrow commercial real estate customer base ?Continue to build product suite and capabilities 30

31

Business OverviewnNational Beef processes ~3 million fed cattle per year representing ~12.5% market share ?2 processing plants strategically located in Liberal and Dodge City, KS ?Primary competitors: Tyson, Cargill, JBS ?Export beef and beef by-products to more than 20 countriesnBeef processing is a spread margin business, so National Beef is intensely focused on value-added production to drive superior performance versus its commodity-focused competitors ?National Beef operates 3 further processing plants converting beef and pork into fresh, consumer-ready products ?Strategically located in PA, GA and KSnNational Beef’s tannery is among the largest in the world ?Convert raw cattle hides to wet blue leather for use in finished leather production for automotive, shoes, fashion, etc.nwww.kansascitysteaks.com ?Premium direct-to-consumer beef and other center-of-the-plate entrees 32

nHeifer and beef cow slaughter have been declining recently. While this has put pressure on industry margins in the short run, in the longer run we believe this may lead to an increase in the number of fed cattle available for slaughternThe U.S. has historically been a net importer of beef. Due to increasing international demand for U.S. beef and a decline of lean beef imports, the U.S. is now a net exporter of beef. We anticipate this should have a positive impact on industry margins Industry Trends 30% 35% 40% 45%Heifer Slaughter as a % of Steer/Heifer Slaughter US Net Beef Trade – Imports minus Exports (millions lbs.) Source: USDA. Source: USDA. 33

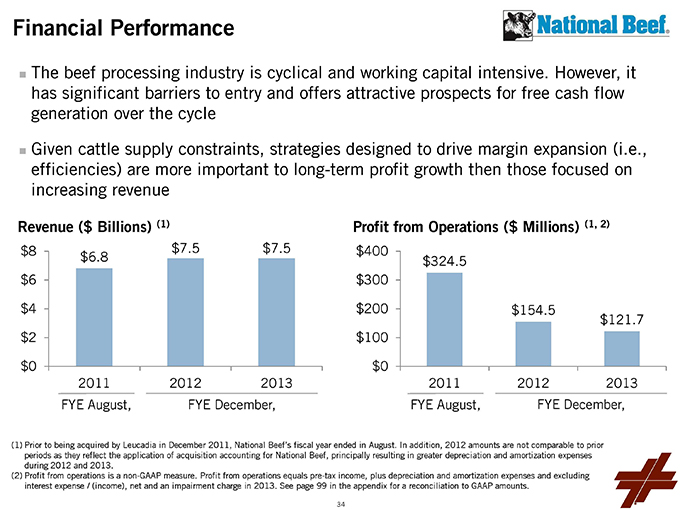

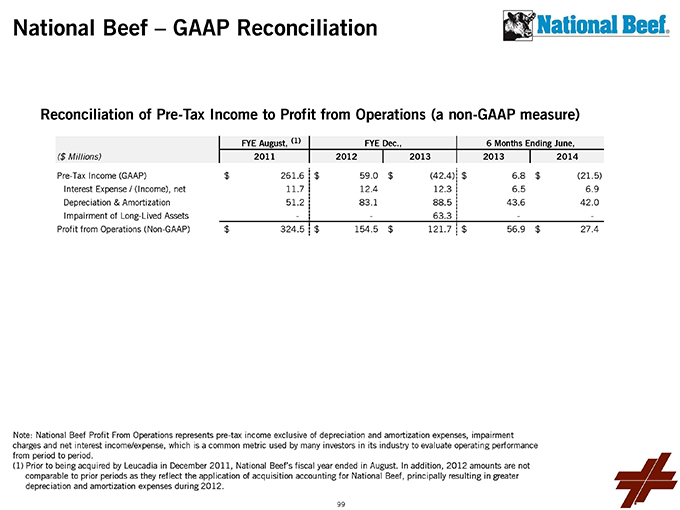

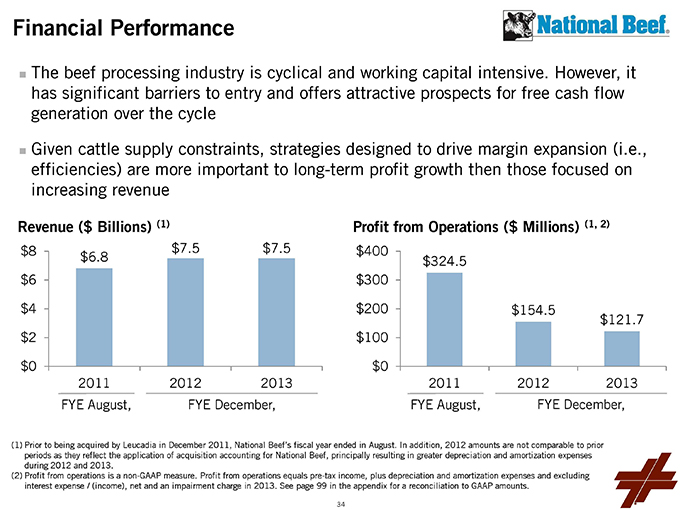

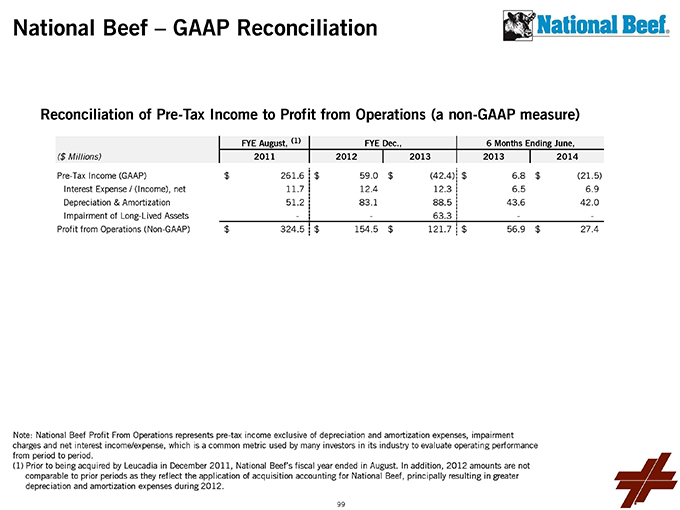

Profit from Operations ($ Millions) (1, 2) Revenue ($ Billions) (1) Financial PerformancenThe beef processing industry is cyclical and working capital intensive. However, it has significant barriers to entry and offers attractive prospects for free cash flow generation over the cyclenGiven cattle supply constraints, strategies designed to drive margin expansion (i.e., efficiencies) are more important to long-term profit growth then those focused on increasing revenue (1)Prior to being acquired by Leucadia in December 2011, National Beef’s fiscal year ended in August. In addition, 2012 amounts are not comparable to prior periods as they reflect the application of acquisition accounting for National Beef, principally resulting in greater depreciation and amortization expenses during 2012 and 2013. (2)Profit from operations is a non-GAAP measure. Profit from operations equals pre-tax income, plus depreciation and amortization expenses and excluding interest expense / (income), net and an impairment charge in 2013. See page 99 in the appendix for a reconciliation to GAAP amounts. $6.8 $7.5 $7.5 $0 $2 $4 $6 $8 2011 2012 2013$324.5 $154.5 $121.7 $0 $100 $200 $300 $400 2011 2012 2013FYE August, FYE December, FYE August, FYE December, 34

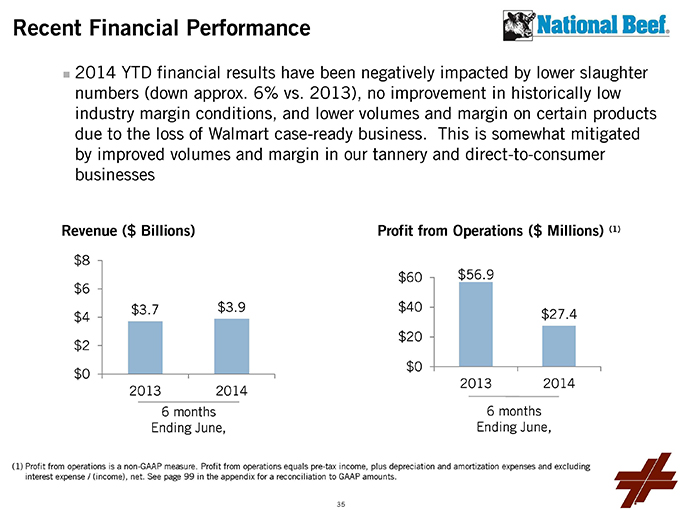

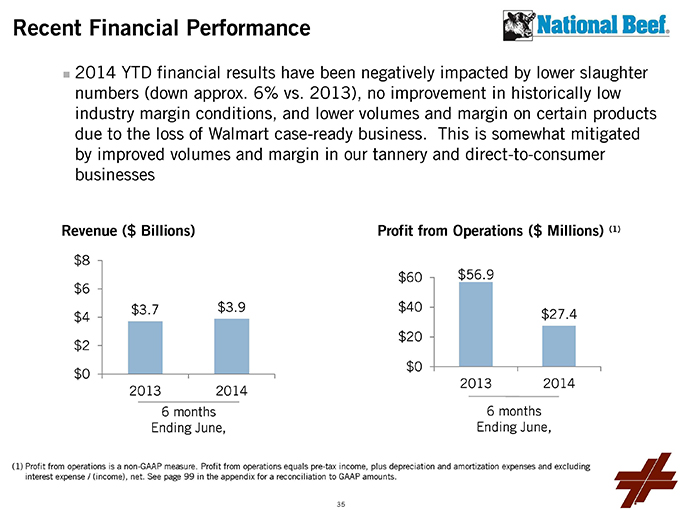

Profit from Operations ($ Millions) (1) Revenue ($ Billions) Recent Financial Performancen2014 YTD financial results have been negatively impacted by lower slaughter numbers (down approx. 6% vs. 2013), no improvement in historically low industry margin conditions, and lower volumes and margin on certain products due to the loss of Walmart case-ready business. This is somewhat mitigated by improved volumes and margin in our tannery and direct-to-consumer businesses (1)Profit from operations is a non-GAAP measure. Profit from operations equals pre-tax income, plus depreciation and amortization expenses and excluding interest expense / (income), net. See page 99 in the appendix for a reconciliation to GAAP amounts. $3.7 $3.9 $0 $2 $4 $6 $8 2013 20146 months Ending June, $56.9 $27.4 $0 $20 $40 $60 2013 2014 6 months Ending June, 35

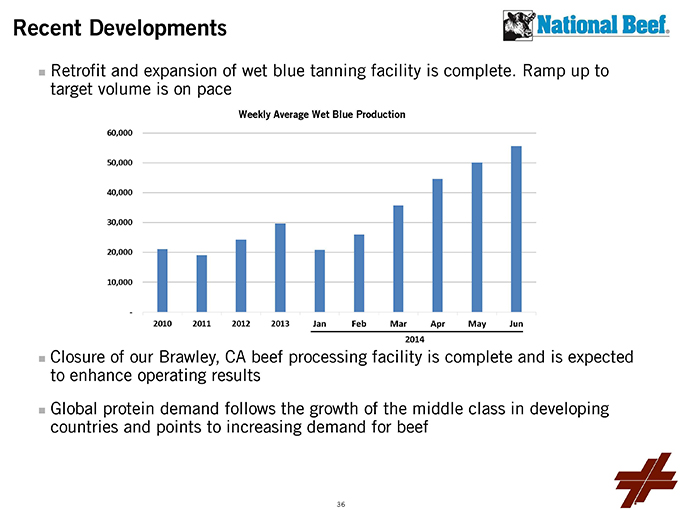

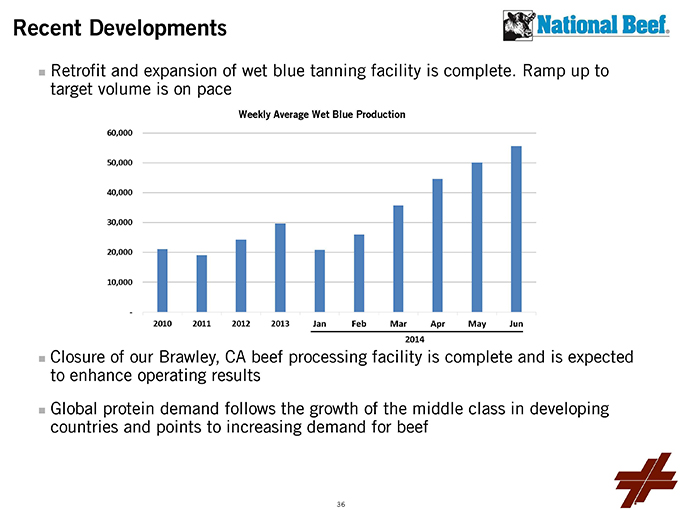

Recent DevelopmentsnRetrofit and expansion of wet blue tanning facility is complete. Ramp up to target volume is on pacenClosure of our Brawley, CA beef processing facility is complete and is expected to enhance operating resultsnGlobal protein demand follows the growth of the middle class in developing countries and points to increasing demand for beef JanMarFebAprMayJun 2014 Weekly Average Wet Blue Production 36

Strategic PrioritiesnFocus on additional value-added production ?Our 3 further processing plants have significant capacity available for growth ?Ongoing dialogue with retailer and food service providers regarding consumer-ready, portion-controlled and ready-to-cook product linesnDrive volume and margin through our expanded and modernized tannery ?Provide the highest quality lime-fleshed, wet blue hides from one of the largest and most technologically advanced facilities in the worldnMaintain market share and enhance profitability ?Capture value of efficiencies and operational improvements ?Position company for long-term rebound in domestic herd size ?Focus on export opportunities as markets developnExecute on strategic plan to drive significant growth of Kansas City Steak Company 37

38

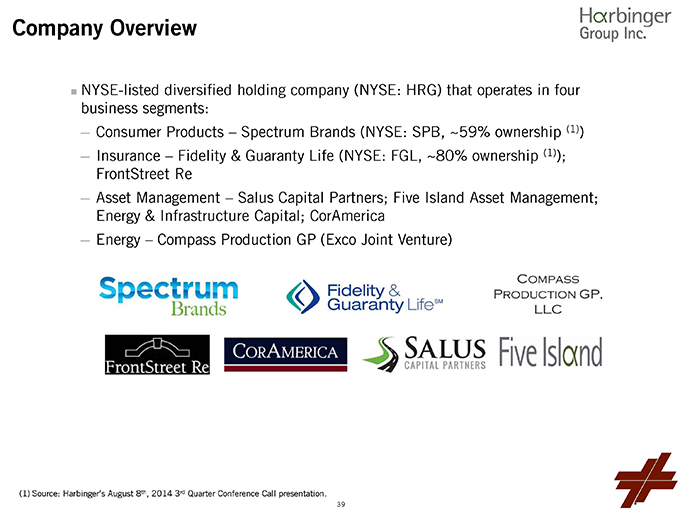

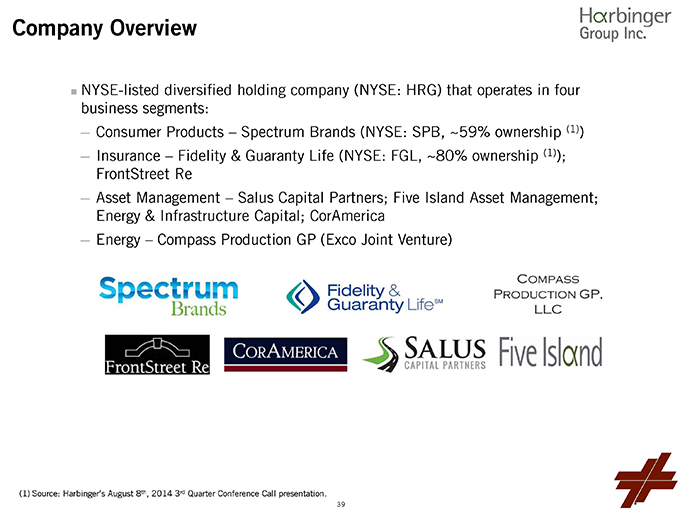

Company Overview (1)Source: Harbinger’s August 8th, 2014 3rd Quarter Conference Call presentation.nNYSE-listed diversified holding company (NYSE: HRG) that operates in four business segments: ?Consumer Products – Spectrum Brands (NYSE: SPB, ~59% ownership (1)) ?Insurance – Fidelity & Guaranty Life (NYSE: FGL, ~80% ownership (1)); FrontStreet Re ?Asset Management – Salus Capital Partners; Five Island Asset Management; Energy & Infrastructure Capital; CorAmerica ?Energy – Compass Production GP (Exco Joint Venture) 39

Key Ownership DetailsnDate of Initial Investment: September 2013nCost: $411 millionnBook Value at 06/30/14: $528.3 millionnOwnership: 20.1%nJoseph Steinberg and Andrew Whittaker serve on Harbinger’s Board of Directors 40

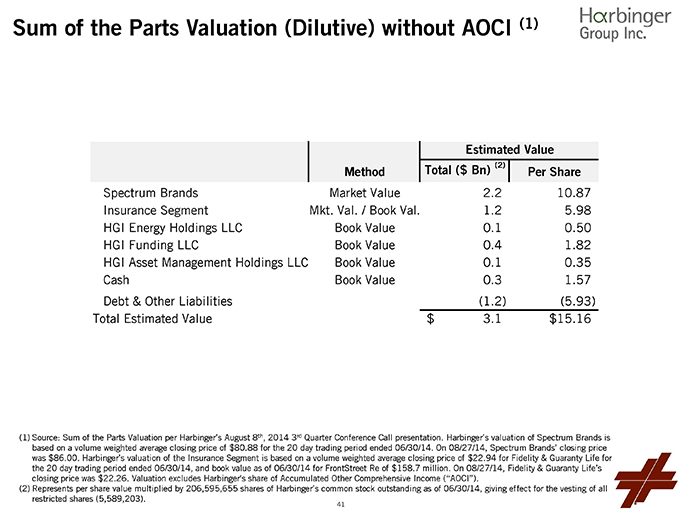

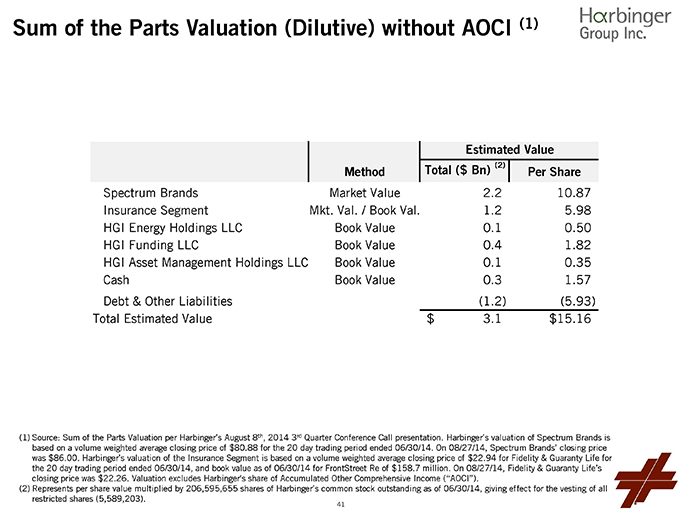

Sum of the Parts Valuation (Dilutive) without AOCI (1) (1)Source: Sum of the Parts Valuation per Harbinger’s August 8th, 2014 3rd Quarter Conference Call presentation. Harbinger’s valuation of Spectrum Brands is based on a volume weighted average closing price of $80.88 for the 20 day trading period ended 06/30/14. On 08/27/14, Spectrum Brands’ closing price was $86.00. Harbinger’s valuation of the Insurance Segment is based on a volume weighted average closing price of $22.94 for Fidelity & Guaranty Life for the 20 day trading period ended 06/30/14, and book value as of 06/30/14 for FrontStreet Re of $158.7 million. On 08/27/14, Fidelity & Guaranty Life’s closing price was $22.26. Valuation excludes Harbinger’s share of Accumulated Other Comprehensive Income (“AOCI”). (2)Represents per share value multiplied by 206,595,655 shares of Harbinger’s common stock outstanding as of 06/30/14, giving effect for the vesting of all restricted shares (5,589,203). Estimated ValueMethodTotal ($ Bn) (2)Per ShareSpectrum BrandsMarket Value2.2 10.87Insurance SegmentMkt. Val. / Book Val.1.2 5.98HGI Energy Holdings LLCBook Value0.1 0.50HGI Funding LLCBook Value0.4 1.82HGI Asset Management Holdings LLCBook Value0.1 0.35CashBook Value0.3 1.57Debt & Other Liabilities(1.2) (5.93)Total Estimated Value3.1$ $15.16 41

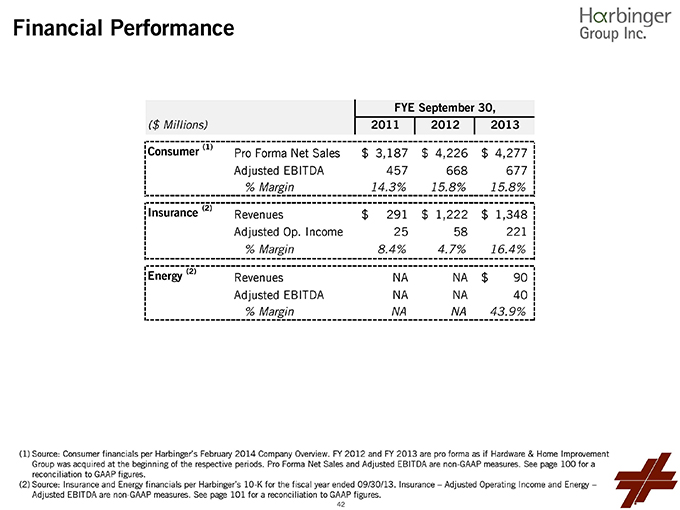

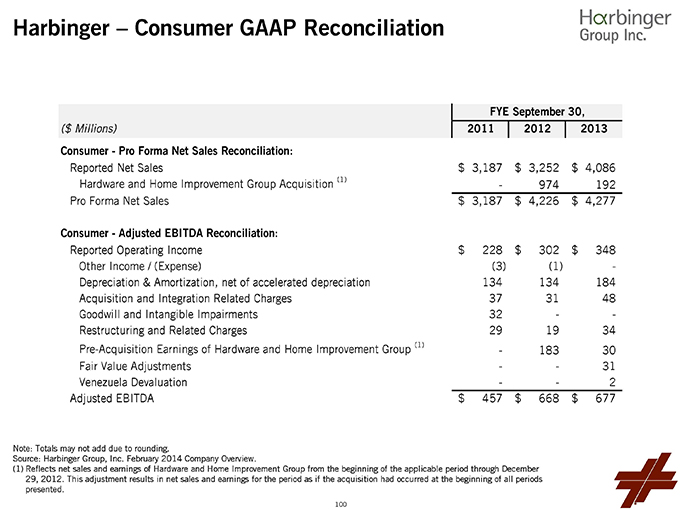

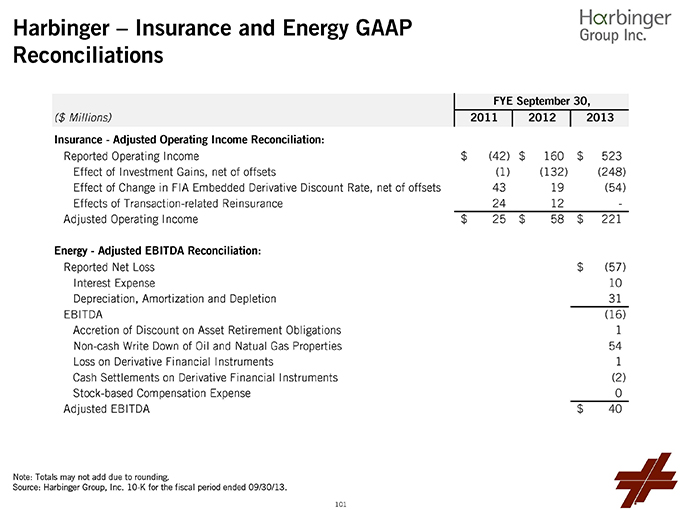

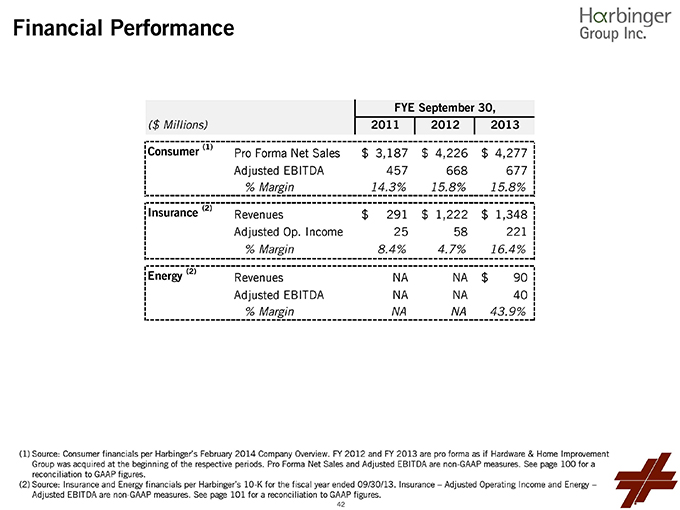

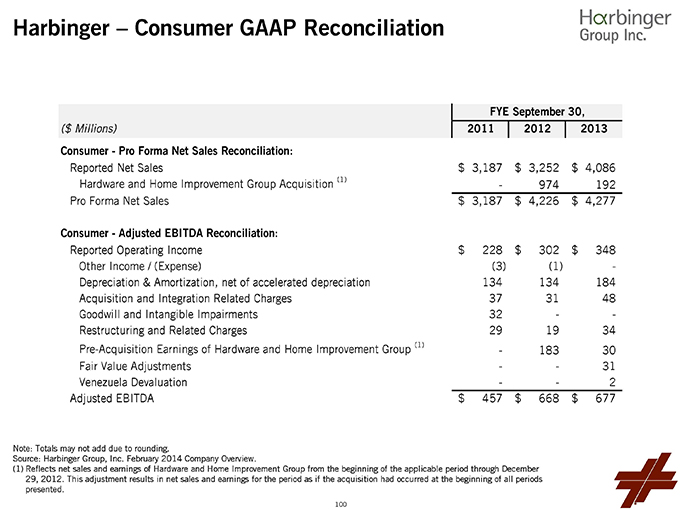

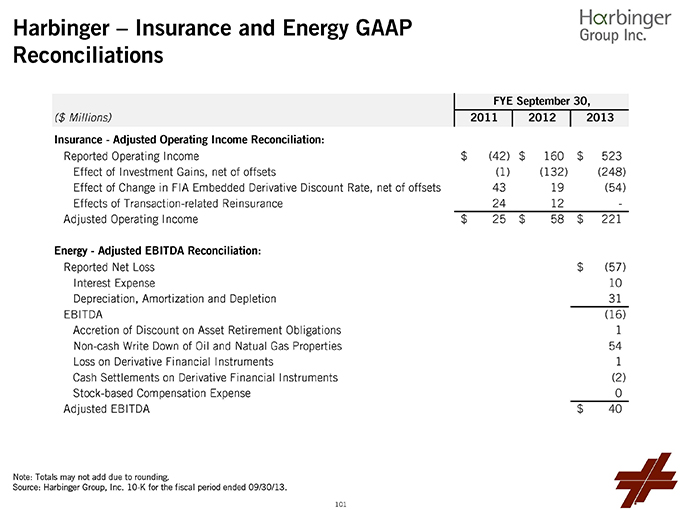

Financial Performance (1)Source: Consumer financials per Harbinger’s February 2014 Company Overview. FY 2012 and FY 2013 are pro forma as if Hardware & Home Improvement Group was acquired at the beginning of the respective periods. Pro Forma Net Sales and Adjusted EBITDA are non-GAAP measures. See page 100 for a reconciliation to GAAP figures. (2)Source: Insurance and Energy financials per Harbinger’s 10-K for the fiscal year ended 09/30/13. Insurance – Adjusted Operating Income and Energy – Adjusted EBITDA are non-GAAP measures. See page 101 for a reconciliation to GAAP figures. FYE September 30,($ Millions)201120122013Consumer (1)Pro Forma Net Sales3,187$ 4,226$ 4,277$ Adjusted EBITDA457 668 677 % Margin14.3%15.8%15.8%Insurance (2)Revenues291$ 1,222$ 1,348$ Adjusted Op. Income25 58 221 % Margin8.4%4.7%16.4%Energy (2)RevenuesNANA90$ Adjusted EBITDANANA40 % MarginNA NA 43.9% 42

43

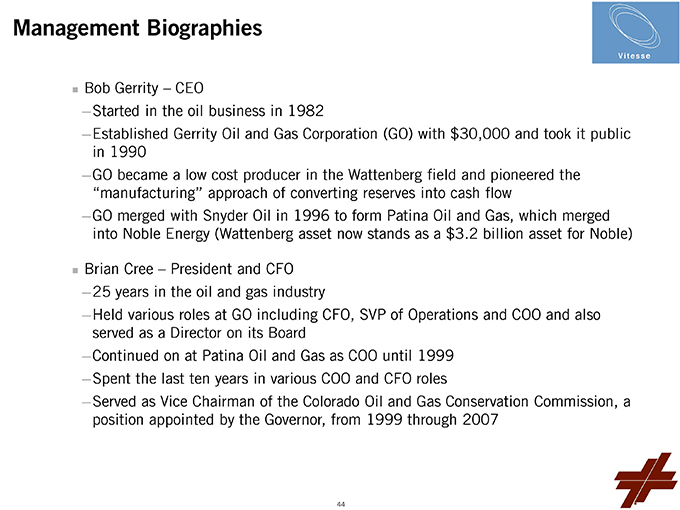

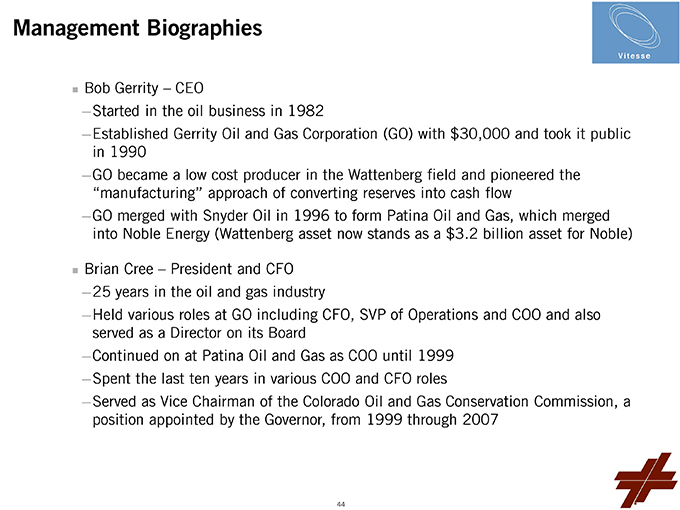

Management BiographiesnBob Gerrity – CEO ?Started in the oil business in 1982 ?Established Gerrity Oil and Gas Corporation (GO) with $30,000 and took it public in 1990 ?GO became a low cost producer in the Wattenberg field and pioneered the “manufacturing” approach of converting reserves into cash flow ?GO merged with Snyder Oil in 1996 to form Patina Oil and Gas, which merged into Noble Energy (Wattenberg asset now stands as a $3.2 billion asset for Noble)nBrian Cree – President and CFO ?25 years in the oil and gas industry ?Held various roles at GO including CFO, SVP of Operations and COO and also served as a Director on its Board ?Continued on at Patina Oil and Gas as COO until 1999 ?Spent the last ten years in various COO and CFO roles ?Served as Vice Chairman of the Colorado Oil and Gas Conservation Commission, a position appointed by the Governor, from 1999 through 2007 44

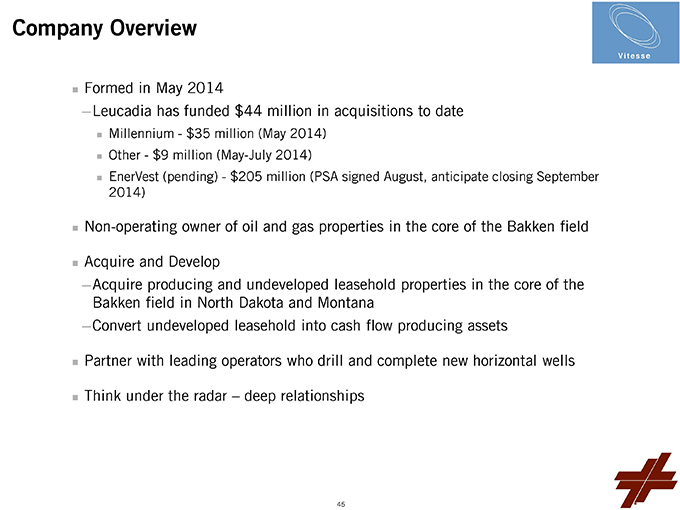

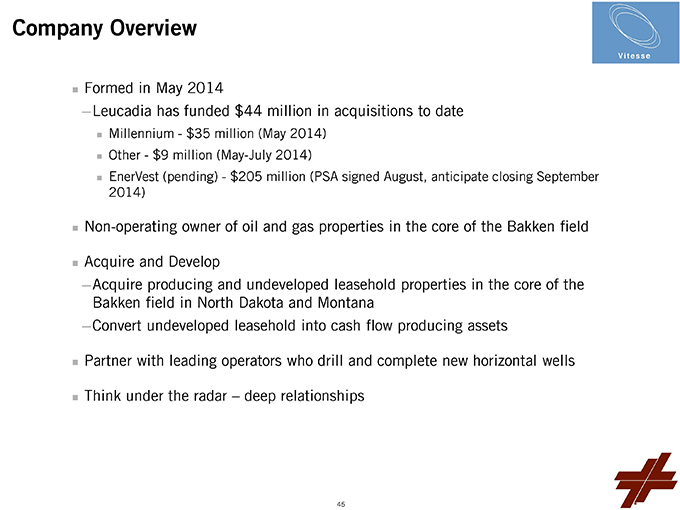

Company OverviewnFormed in May 2014 ?Leucadia has funded $44 million in acquisitions to datenMillennium—$35 million (May 2014)nOther—$9 million (May-July 2014)nEnerVest (pending)—$205 million (PSA signed August, anticipate closing September 2014)nNon-operating owner of oil and gas properties in the core of the Bakken fieldnAcquire and Develop ?Acquire producing and undeveloped leasehold properties in the core of the Bakken field in North Dakota and Montana ?Convert undeveloped leasehold into cash flow producing assetsnPartner with leading operators who drill and complete new horizontal wellsnThink under the radar – deep relationships 45

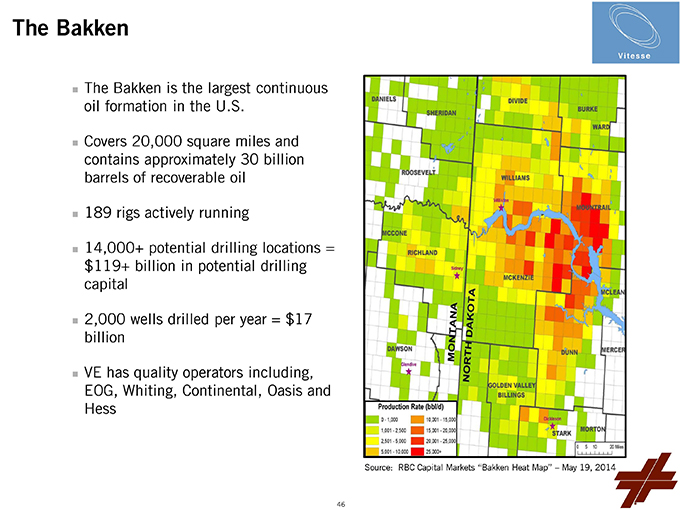

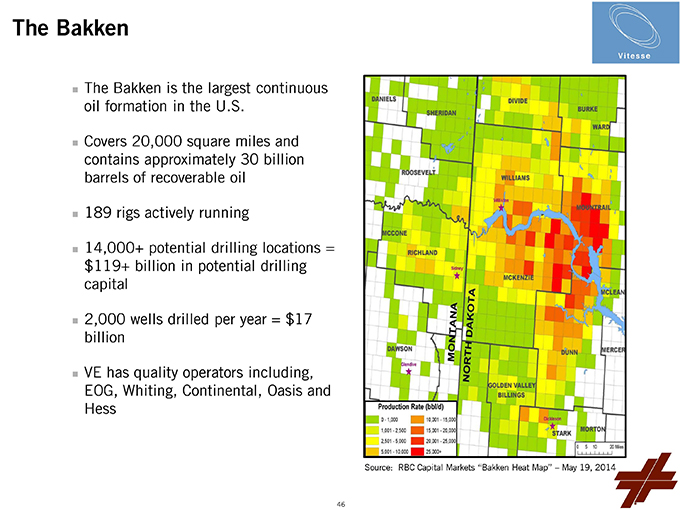

The BakkennThe Bakken is the largest continuous oil formation in the U.S.nCovers 20,000 square miles and contains approximately 30 billion barrels of recoverable oiln189 rigs actively runningn14,000+ potential drilling locations = $119+ billion in potential drilling capitaln2,000 wells drilled per year = $17 billionnVE has quality operators including, EOG, Whiting, Continental, Oasis and Hess Source: RBC Capital Markets “Bakken Heat Map” – May 19, 2014 46

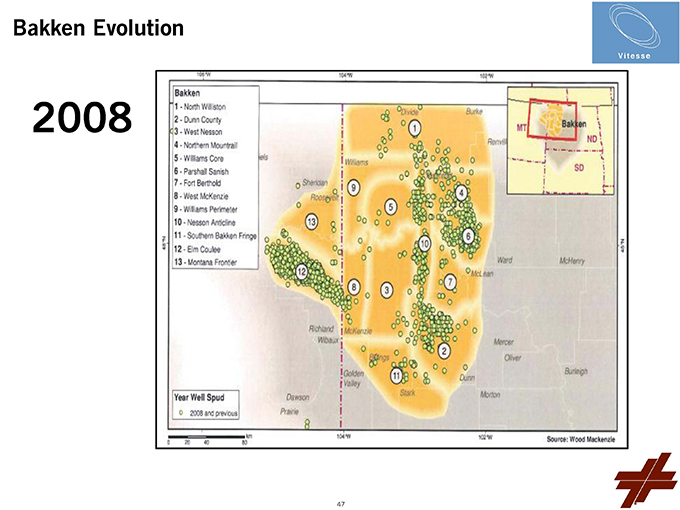

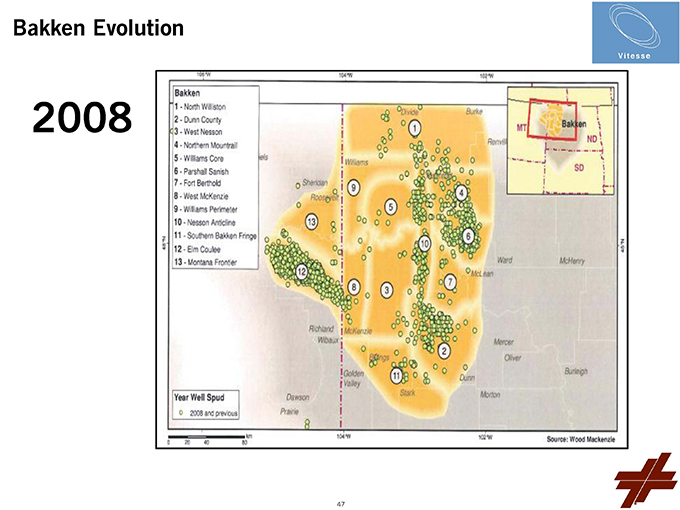

47

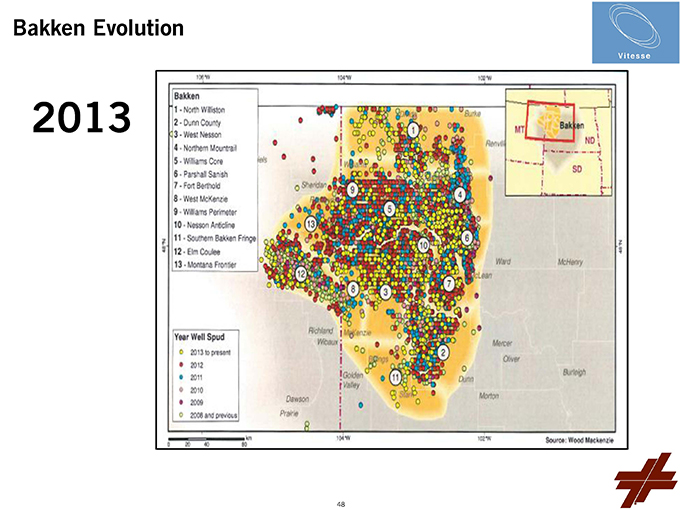

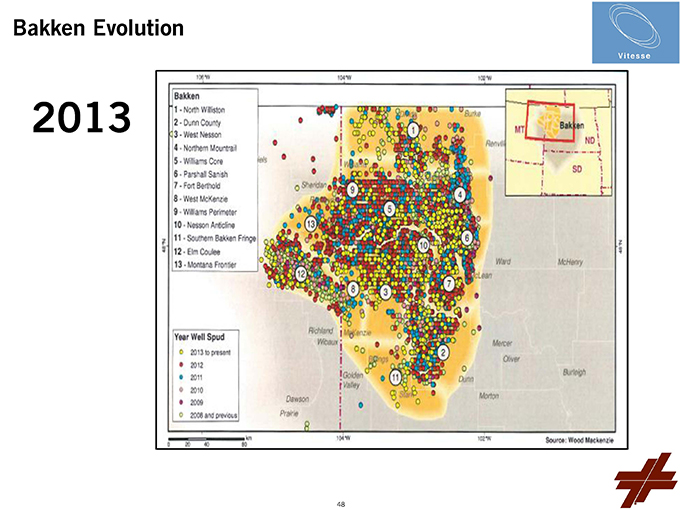

48

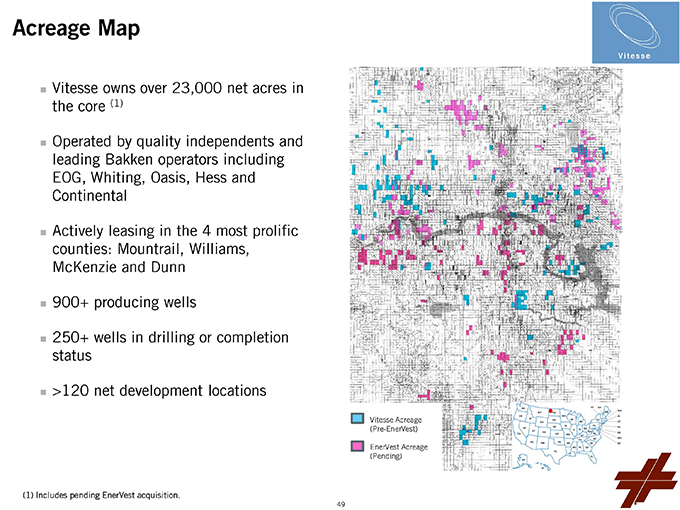

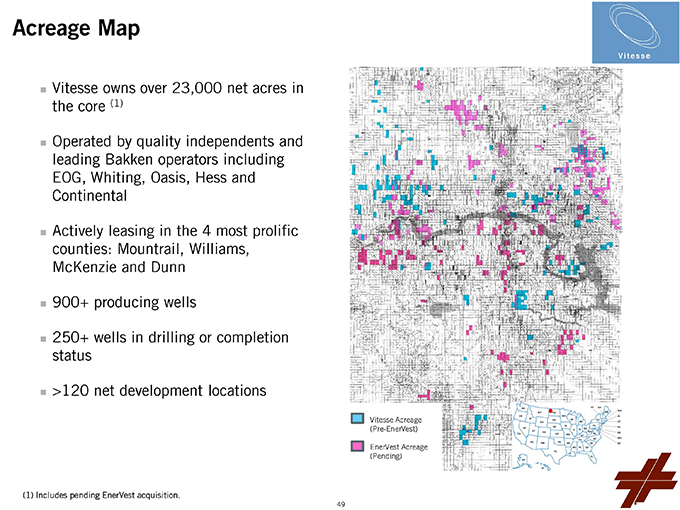

Acreage MapnVitesse owns over 23,000 net acres in the core (1) nOperated by quality independents and leading Bakken operators including EOG, Whiting, Oasis, Hess and ContinentalnActively leasing in the 4 most prolific counties: Mountrail, Williams, McKenzie and Dunnn900+ producing wellsn250+ wells in drilling or completion statusn>120 net development locations (1)Includes pending EnerVest acquisition. Vitesse Acreage (Pre-EnerVest) EnerVest Acreage (Pending) 49

StrategynAggregate assets in the core of the BakkennOptimize portfolio of assets. Add to desired core acreage and divest fringenIncreasing cash flow from new well development over next 10 yearsnHedge flowing production when appropriatenSelectively sell assets when appropriate 50

Vitesse TodaynOver 23,000 net acres predominantly in the core Bakken counties of Williams, McKenzie, Mountrail and Dunn, North DakotanDiversified exposure to high quality operators including EOG, Whiting, Oasis, Hess and ContinentalnStrong cash flow from over 1,800 Boe/d of net production (1) nSignificant development potential with over 120 net undeveloped locations (2) nWell-capitalized to pursue further growth opportunities (1)July 2014 estimate including the pending EnerVest acquisition. (2)Based on management estimate and generally assumes 6-10 locations per DSU, including the pending EnerVest acquisition. 51

52

Company OverviewnHomeFed is a public company (stock ticker: “HOFD”) that develops and owns residential and mixed-use real estate projects in California, Maine, New York, Virginia, South Carolina and Florida. HomeFed is 64% owned by Leucadia National CorporationnActivities include: ?Acquisition of raw, partially entitled or entitled land ?Land planning and design engineering ?Entitlement and permitting of project with local, state and federal agencies ?Grading and construction of public infrastructure and other facilities ?Master planned community formation, governance and sales to national and local builders ?Oversight and management of operating assets 53

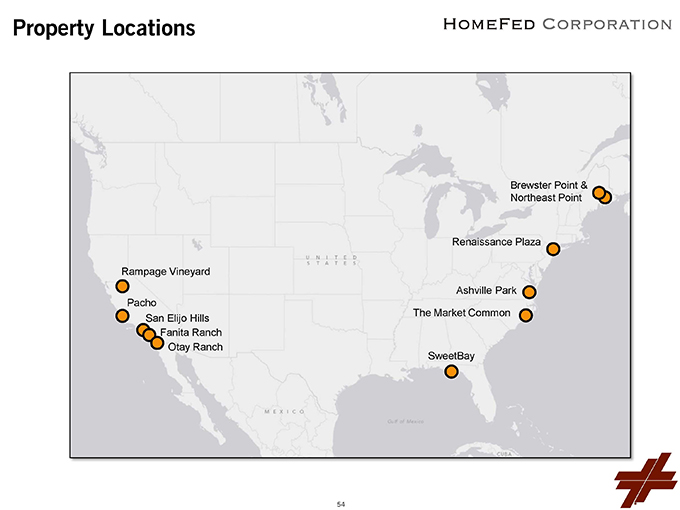

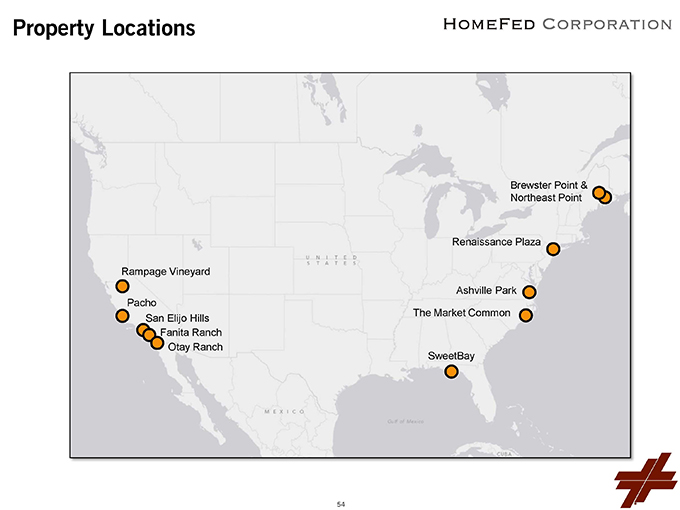

Rampage Vineyard Pacho San Elijo Hills SweetBay Ashville Park Renaissance Plaza Brewster Point & Northeast Point The Market Common Fanita Ranch Otay Ranch Property Locations 54

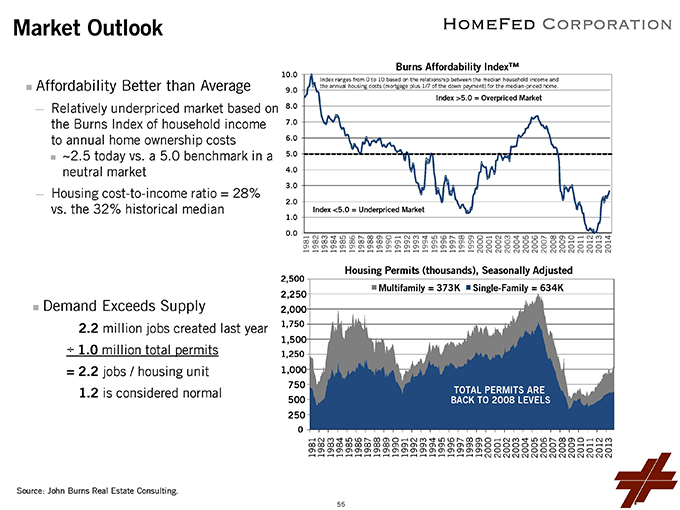

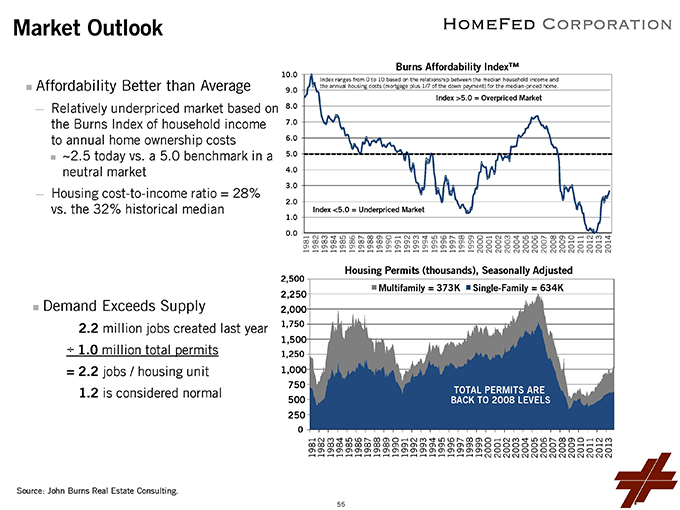

Market Outlook Affordability Better than Average Relatively underpriced market based on the Burns Index of household income to annual home ownership costs ~2.5 today vs. a 5.0 benchmark in a neutral market Housing cost-to-income ratio = 28% vs. the 32% historical median Demand Exceeds Supply 2.2 million jobs created last year ÷ 1.0 million total permits = 2.2 jobs / housing unit 1.2 is considered normal Source: John Burns Real Estate Consulting.

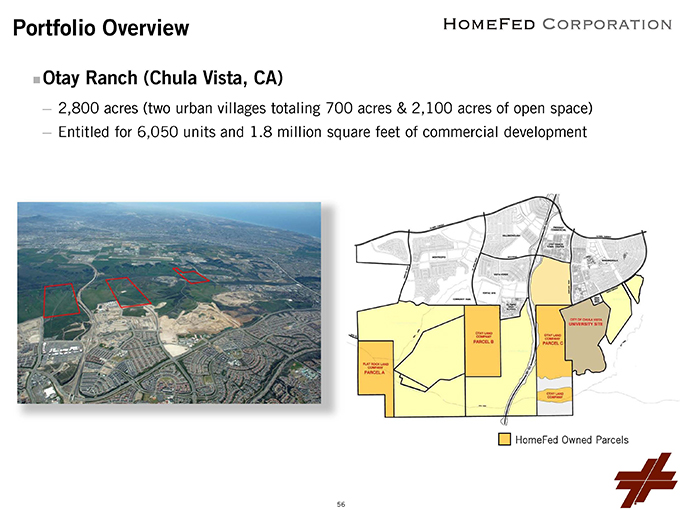

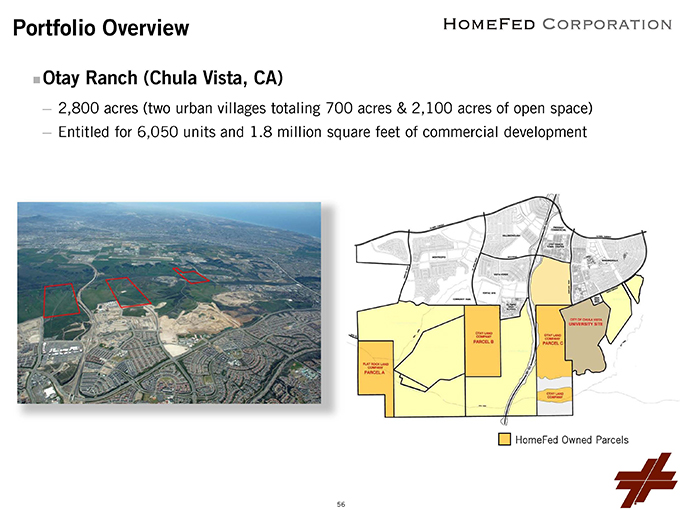

nOtay Ranch (Chula Vista, CA) ?2,800 acres (two urban villages totaling 700 acres & 2,100 acres of open space) ?Entitled for 6,050 units and 1.8 million square feet of commercial development HomeFed Owned Parcels Portfolio Overview 56

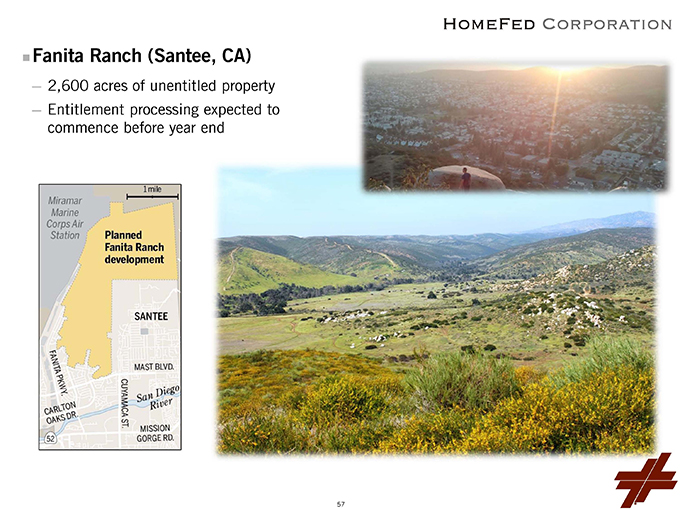

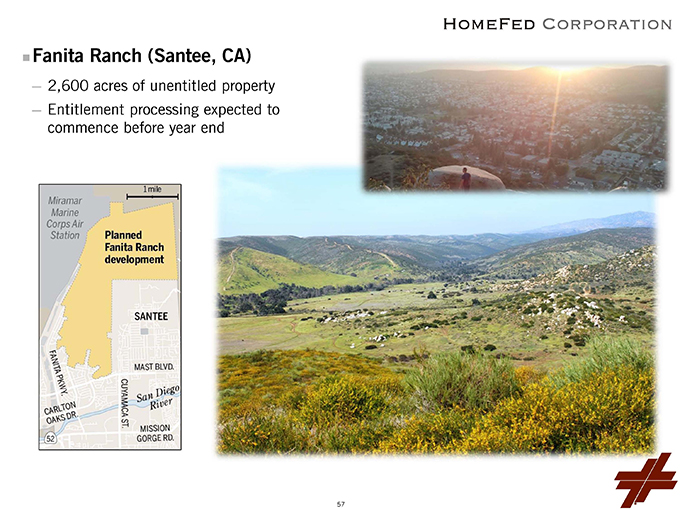

nFanita Ranch (Santee, CA) ?2,600 acres of unentitled property ?Entitlement processing expected to commence before year end 57

nAshville Park (Virginia Beach, VA) ?450 acres—499 dwelling units ?270 unsold dwelling units 58

nSweetBay (Panama City, FL) ?700 acres entitled for 3,200 dwelling units, 700,000 square feet of commercial development and a 117 slip marina ?Established charter school opened new campus for the fall of 2014 59

nThe Market Common (Myrtle Beach, SC) ?Existing 390,000 square feet of office and retail with 195 short and long-term apartments ?Residential land entitled for up to 572 additional dwelling units 7 60

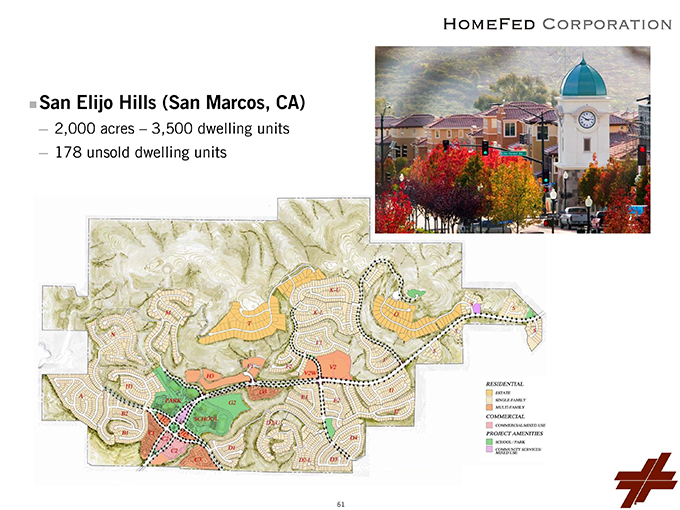

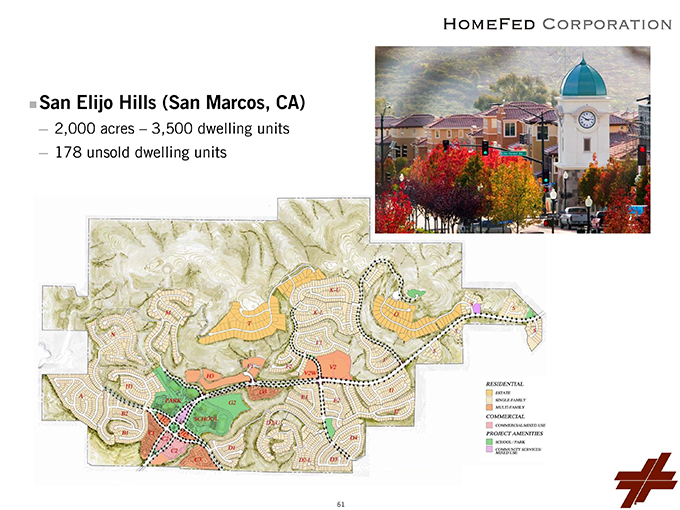

nSan Elijo Hills (San Marcos, CA) ?2,000 acres – 3,500 dwelling units ?178 unsold dwelling units 61

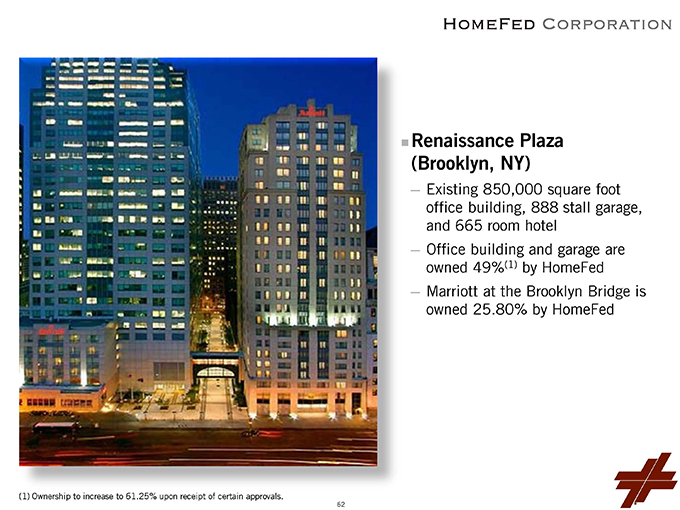

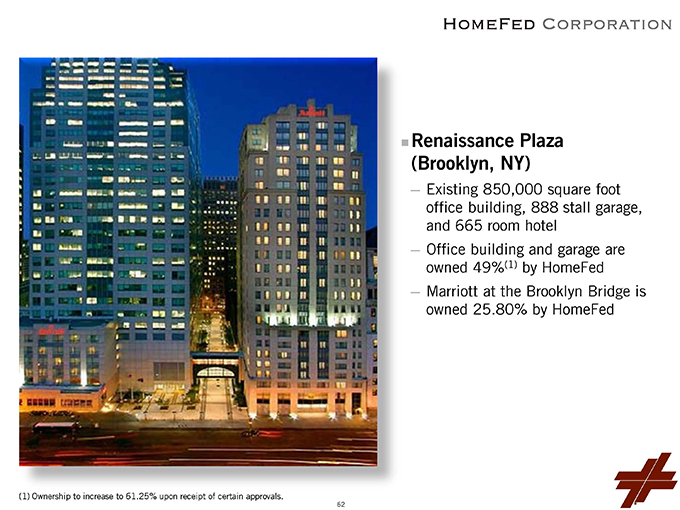

nRenaissance Plaza (Brooklyn, NY) ?Existing 850,000 square foot office building, 888 stall garage, and 665 room hotel ?Office building and garage are owned 49%(1) by HomeFed ?Marriott at the Brooklyn Bridge is owned 25.80% by HomeFed (1)Ownership to increase to 61.25% upon receipt of certain approvals. 62

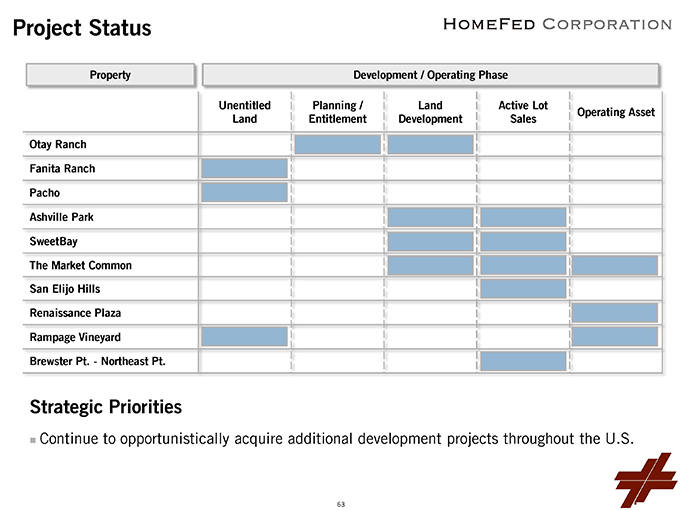

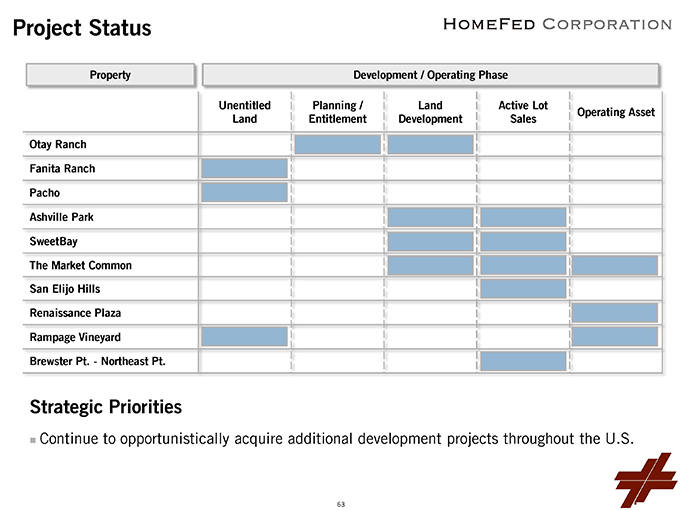

Strategic PrioritiesnContinue to opportunistically acquire additional development projects throughout the U.S. Project Status Unentitled Land Planning / Entitlement Land Development Active Lot Sales Operating Asset Otay Ranch Fanita Ranch Pacho Ashville Park SweetBay The Market Common San Elijo Hills Renaissance Plaza Rampage Vineyard Brewster Pt.—Northeast Pt. Development / Operating Phase Property 63

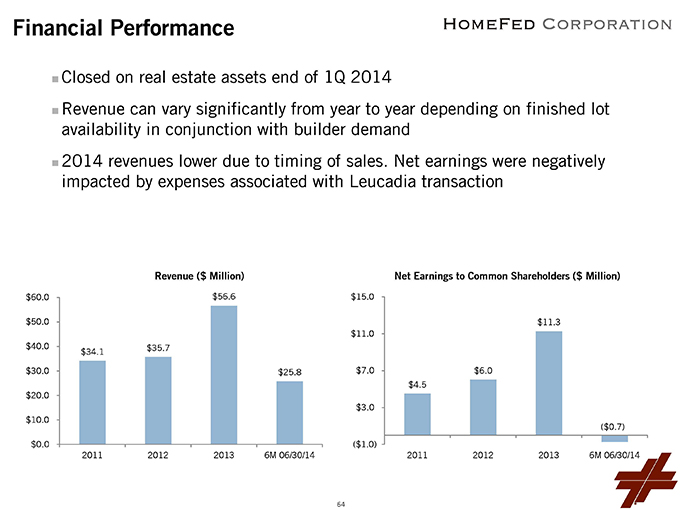

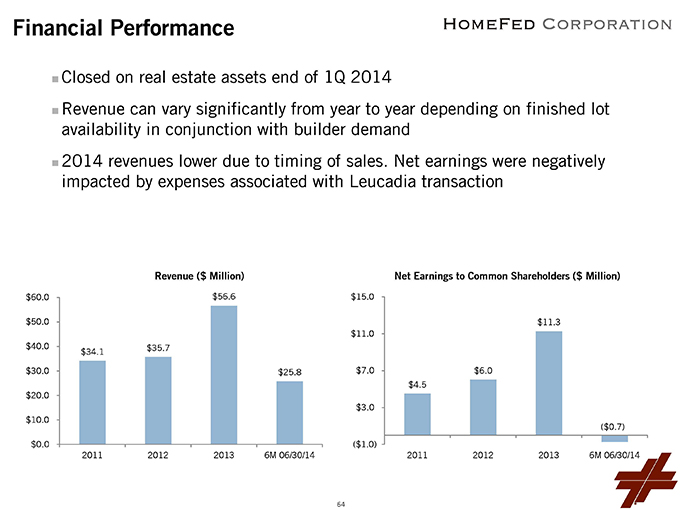

nClosed on real estate assets end of 1Q 2014nRevenue can vary significantly from year to year depending on finished lot availability in conjunction with builder demandn2014 revenues lower due to timing of sales. Net earnings were negatively impacted by expenses associated with Leucadia transaction Financial Performance $34.1 $35.7 $56.6 $25.8 $0.0$10.0$20.0$30.0$40.0$50.0$60.02011201220136M 06/30/14$4.5 $6.0 $11.3 ($0.7) ($1.0)$3.0$7.0$11.0$15.02011201220136M 06/30/14Revenue ($ Million) Net Earnings to Common Shareholders ($ Million) 64

65

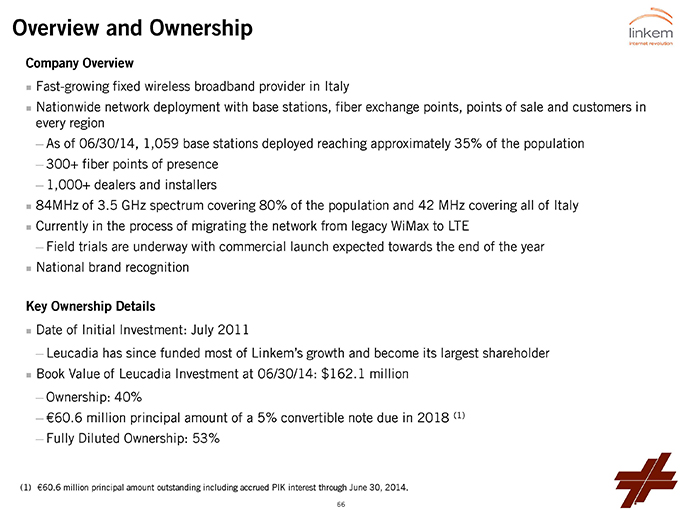

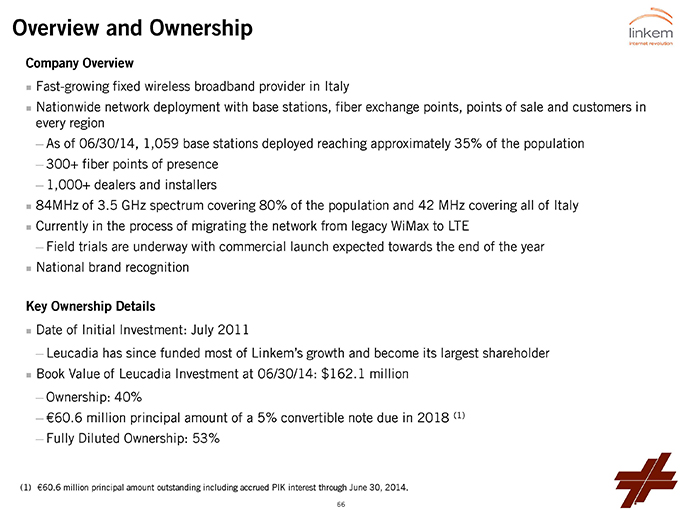

Overview and Ownership Company OverviewnFast-growing fixed wireless broadband provider in ItalynNationwide network deployment with base stations, fiber exchange points, points of sale and customers in every region ?As of 06/30/14, 1,059 base stations deployed reaching approximately 35% of the population ?300+ fiber points of presence ?1,000+ dealers and installersn84MHz of 3.5 GHz spectrum covering 80% of the population and 42 MHz covering all of ItalynCurrently in the process of migrating the network from legacy WiMax to LTE ?Field trials are underway with commercial launch expected towards the end of the yearnNational brand recognition Key Ownership DetailsnDate of Initial Investment: July 2011 ?Leucadia has since funded most of Linkem’s growth and become its largest shareholdernBook Value of Leucadia Investment at 06/30/14: $162.1 million ?Ownership: 40% ?€60.6 million principal amount of a 5% convertible note due in 2018 (1) ?Fully Diluted Ownership: 53% (1)€60.6 million principal amount outstanding including accrued PIK interest through June 30, 2014. 66

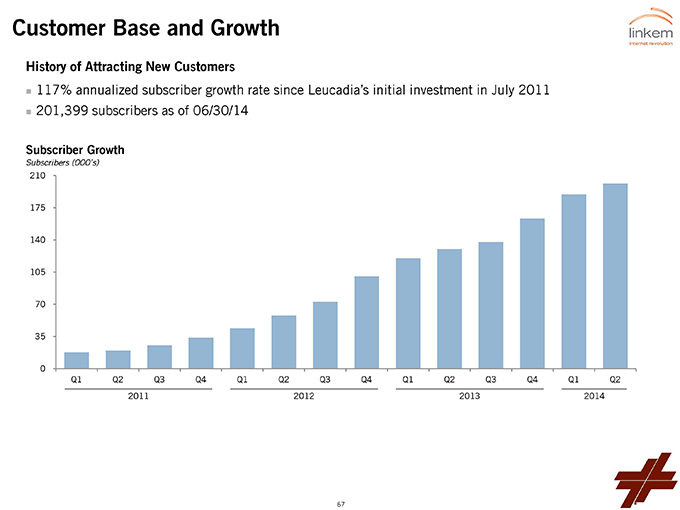

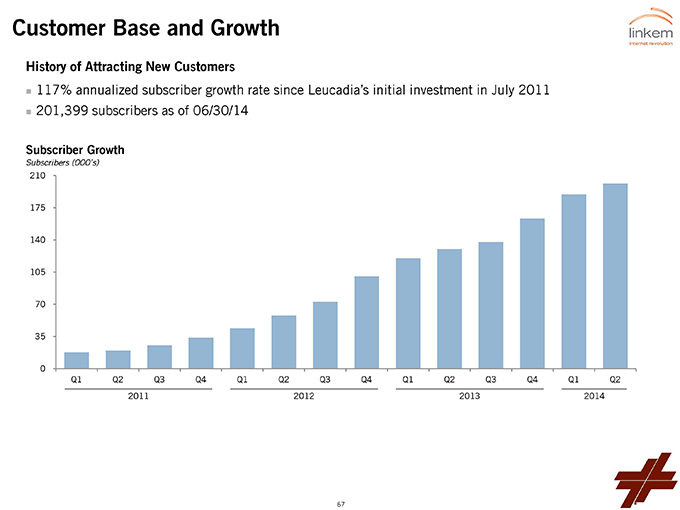

Subscriber Growth Customer Base and Growth 03570105140175210Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4Q1Q22011 2014 Subscribers (000’s) 2012 2013 History of Attracting New Customersn117% annualized subscriber growth rate since Leucadia’s initial investment in July 2011n201,399 subscribers as of 06/30/14 67

Market Overview & Key Market TrendsnLinkem provides a residential wireless broadband service with a compelling combination of speed and pricenItalians have poor broadband alternatives ?Few cable television systems ?Expensive and substandard DSL networks ?Limited and slow fiber deploymentnAttractive demographics and market dynamics ?31% of Italian households are mobile only ?8% of Italian households are in the “digital divide” without access to broadband servicesnLinkem added more new subscribers in 2013 than all the Italian DSL providers combined 68

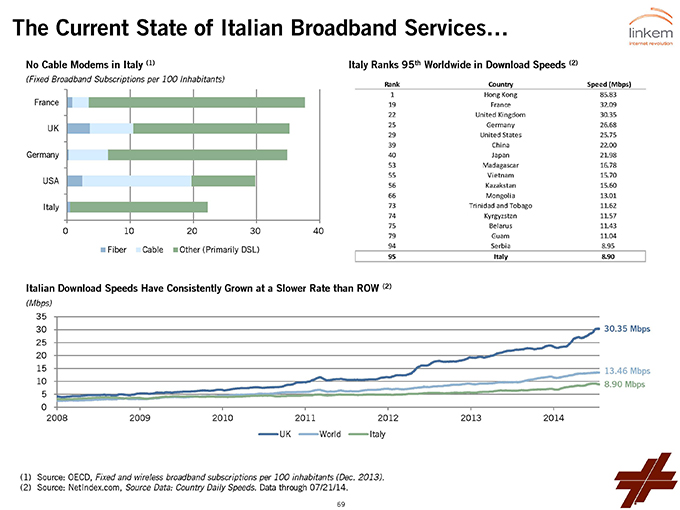

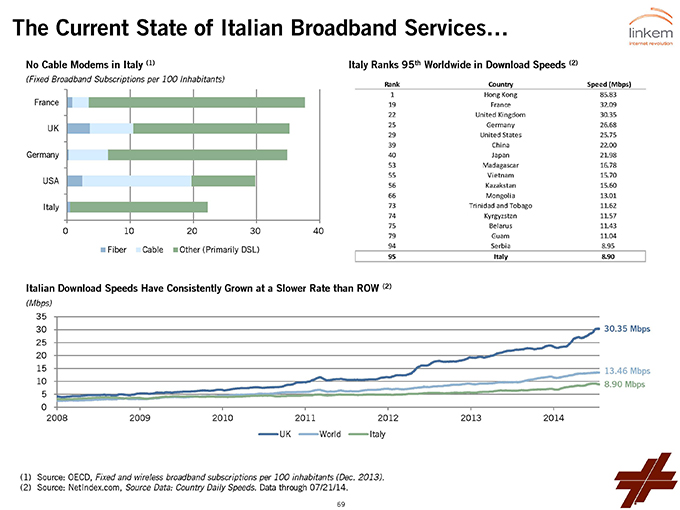

Italian Download Speeds Have Consistently Grown at a Slower Rate than ROW (2) The Current State of Italian Broadband Services… No Cable Modems in Italy (1) 010203040ItalyUSAGermanyUKFranceFiberCableOther (Primarily DSL)Italy Ranks 95th Worldwide in Download Speeds (2) (1)Source: OECD, Fixed and wireless broadband subscriptions per 100 inhabitants (Dec. 2013). (2)Source: NetIndex.com, Source Data: Country Daily Speeds. Data through 07/21/14. 051015202530352008200920102011201220132014UKWorldItaly30.35 Mbps 13.46 Mbps 8.90 Mbps RankCountrySpeed (Mbps)1Hong Kong85.8319France32.0922United Kingdom30.3525Germany26.6829United States25.7539China22.0040Japan21.9853Madagascar16.7855Vietnam15.7056Kazakstan15.6066Mongolia13.0173Trinidad and Tobago11.6274Kyrgyzstan11.5775Belarus11.4379Guam11.0494Serbia8.9595Italy8.90(Mbps) (Fixed Broadband Subscriptions per 100 Inhabitants) 69

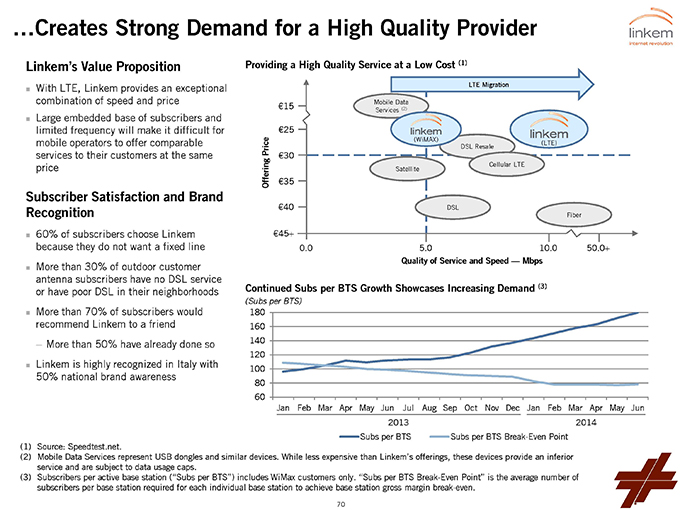

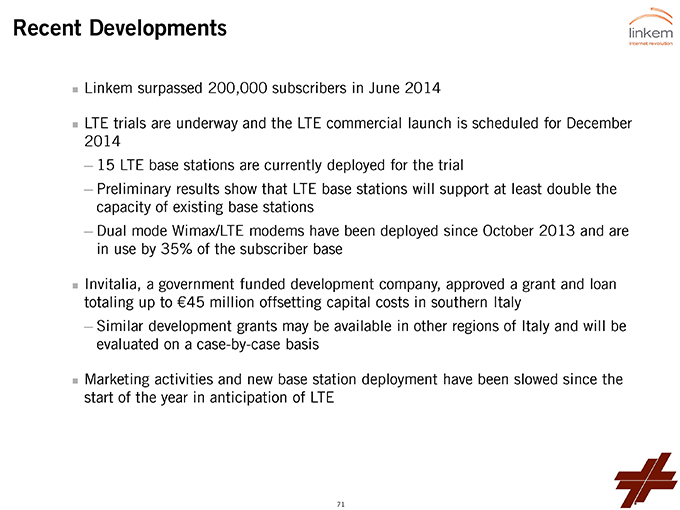

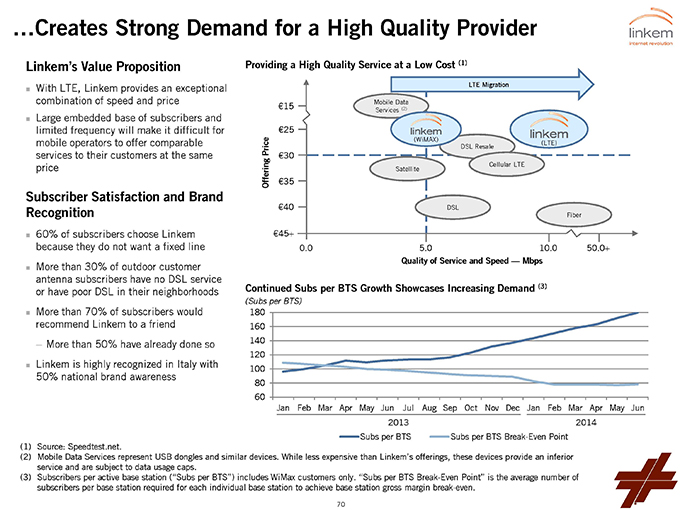

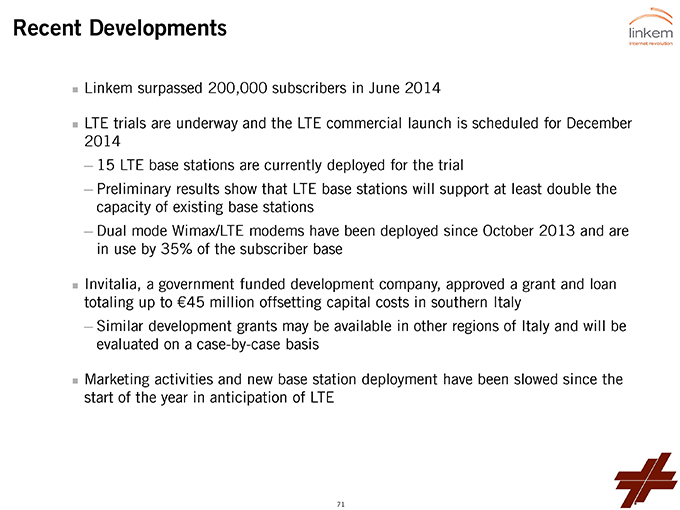

Providing a High Quality Service at a Low Cost (1) …Creates Strong Demand for a High Quality Provider Linkem’s Value PropositionnWith LTE, Linkem provides an exceptional combination of speed and pricenLarge embedded base of subscribers and limited frequency will make it difficult for mobile operators to offer comparable services to their customers at the same price Subscriber Satisfaction and Brand Recognitionn60% of subscribers choose Linkem because they do not want a fixed linenMore than 30% of outdoor customer antenna subscribers have no DSL service or have poor DSL in their neighborhoodsnMore than 70% of subscribers would recommend Linkem to a friend ?More than 50% have already done sonLinkem is highly recognized in Italy with 50% national brand awareness (1)Source: Speedtest.net. (2)Mobile Data Services represent USB dongles and similar devices. While less expensive than Linkem’s offerings, these devices provide an inferior service and are subject to data usage caps. (3)Subscribers per active base station (“Subs per BTS”) includes WiMax customers only. “Subs per BTS Break-Even Point” is the average number of subscribers per base station required for each individual base station to achieve base station gross margin break-even. Continued Subs per BTS Growth Showcases Increasing Demand (3) 6080100120140160180JanFebMarAprMayJunJulAugSepOctNovDecJanFebMarAprMayJunSubs per BTSSubs per BTS Break-Even Point(Subs per BTS) €30 €45+ Quality of Service and Speed — Mbps 0.0 50.0+ 5.0 10.0 Offering Price Fiber Satellite DSL DSL Resale Cellular LTE €35 €25 LTE Migration 2013 2014 Mobile Data Services (2) (WiMAX) €15 €40 (LTE) 70 Recent DevelopmentsnLinkem surpassed 200,000 subscribers in June 2014nLTE trials are underway and the LTE commercial launch is scheduled for December 2014 ?15 LTE base stations are currently deployed for the trial ?Preliminary results show that LTE base stations will support at least double the capacity of existing base stations ?Dual mode Wimax/LTE modems have been deployed since October 2013 and are in use by 35% of the subscriber basenInvitalia, a government funded development company, approved a grant and loan totaling up to €45 million offsetting capital costs in southern Italy ?Similar development grants may be available in other regions of Italy and will be evaluated on a case-by-case basisnMarketing activities and new base station deployment have been slowed since the start of the year in anticipation of LTE 71

Strategic PrioritiesnMaintain subscriber growth on the existing base station footprintnComplete the LTE trial and prepare for the LTE commercial launch at the end of the yearnPursue strategic and partnership opportunities in the rapidly shifting Italian telecom marketplacenReady the company to accelerate growth at the opportune time 72

73

OverviewnA top 15 U.S. dealership group ?3 clusters, 22 dealerships—11 domestic brands, 11 foreignnIowa – 5 dealershipsnTexas – 8 dealershipsnCalifornia – 9 dealerships ?~2,000 employeesnEmphasis on changing customer experience to be “UNCAR-LIKE” ?Leverage digital channels to grow sales volume ?Provide real time reporting to optimize profit per transaction ?Balance expense structure ?Retool employee culture 74

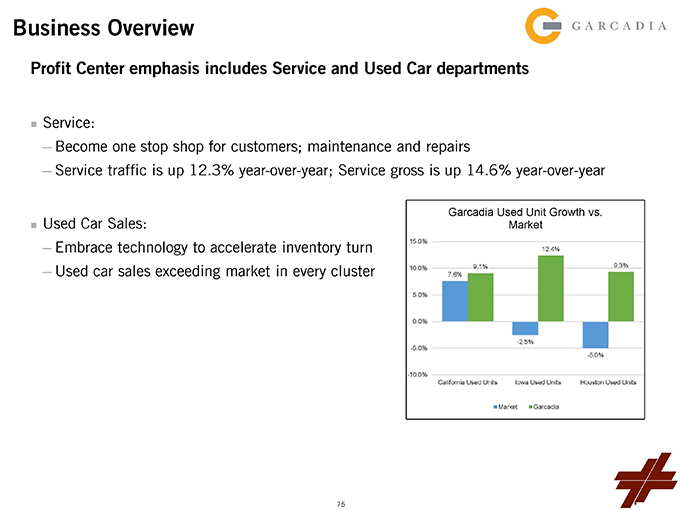

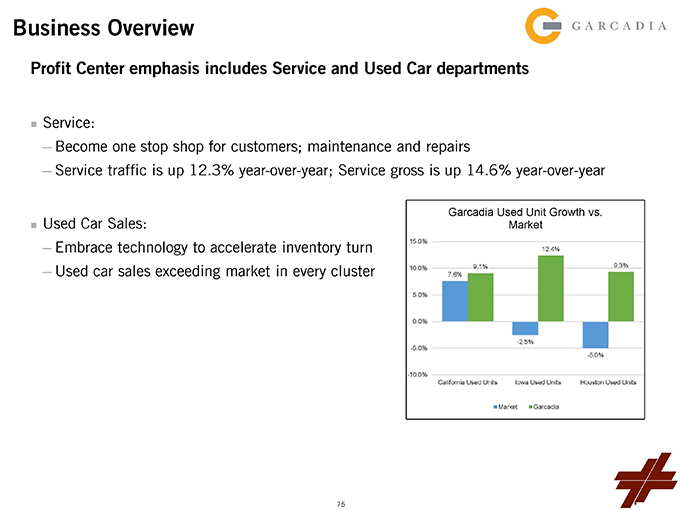

Business Overview Profit Center emphasis includes Service and Used Car departmentsnService: ?Become one stop shop for customers; maintenance and repairs ?Service traffic is up 12.3% year-over-year; Service gross is up 14.6% year-over-yearnUsed Car Sales: ?Embrace technology to accelerate inventory turn ?Used car sales exceeding market in every cluster 7.6%-2.5%-5.0%9.1%12.4%9.3%-10.0%-5.0%0.0%5.0%10.0%15.0%California Used UnitsIowa Used UnitsHouston Used UnitsGarcadia Used Unit Growth vs. MarketMarketGarcadia 75

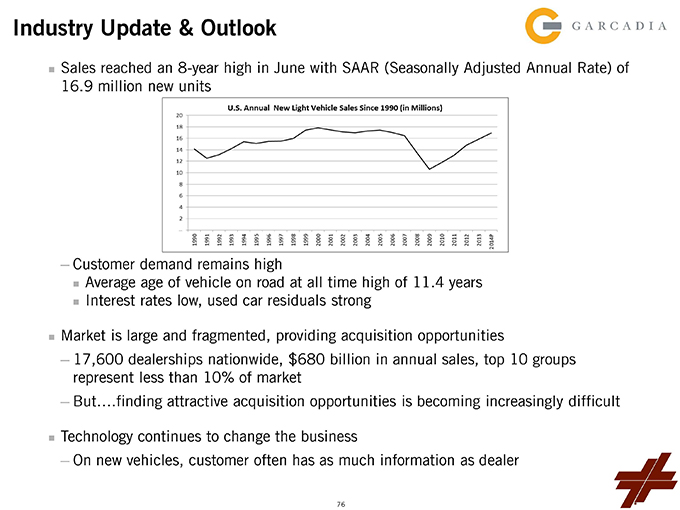

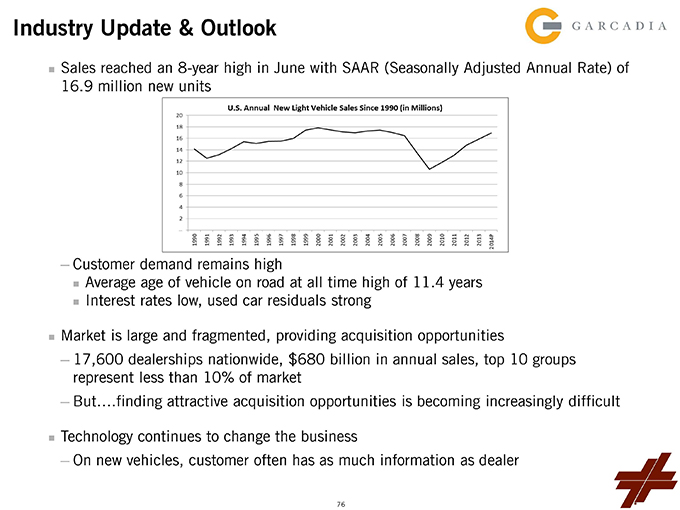

Industry Update & OutlooknSales reached an 8-year high in June with SAAR (Seasonally Adjusted Annual Rate) of 16.9 million new units ?Customer demand remains highnAverage age of vehicle on road at all time high of 11.4 yearsnInterest rates low, used car residuals strongnMarket is large and fragmented, providing acquisition opportunities ?17,600 dealerships nationwide, $680 billion in annual sales, top 10 groups represent less than 10% of market ?But….finding attractive acquisition opportunities is becoming increasingly difficultnTechnology continues to change the business ?On new vehicles, customer often has as much information as dealer 76

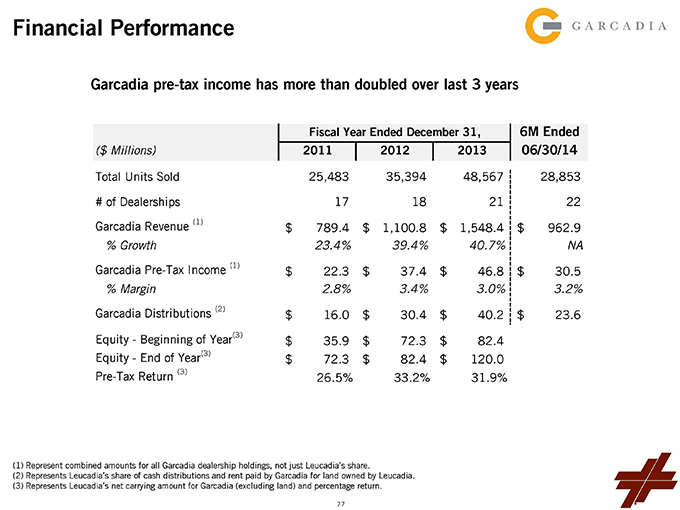

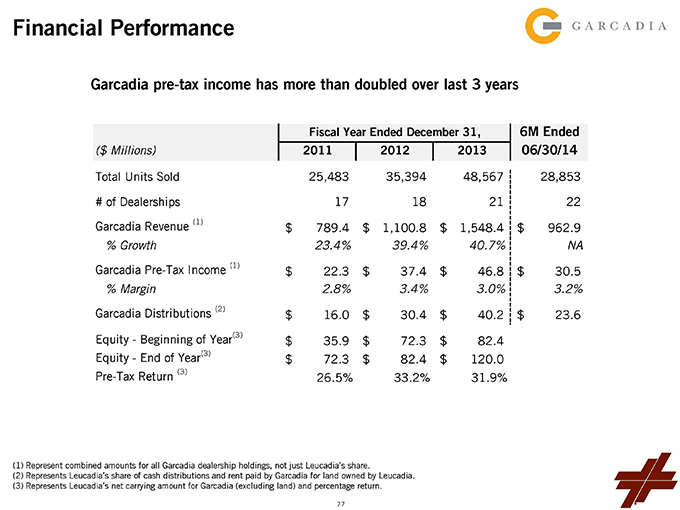

Financial Performance (1)Represent combined amounts for all Garcadia dealership holdings, not just Leucadia’s share. (2)Represents Leucadia’s share of cash distributions and rent paid by Garcadia for land owned by Leucadia. (3)Represents Leucadia’s net carrying amount for Garcadia (excluding land) and percentage return. Garcadia pre-tax income has more than doubled over last 3 years Fiscal Year Ended December 31,6M Ended($ Millions)20112012201306/30/14Total Units Sold25,483 35,394 48,567 28,853 # of Dealerships17 18 21 22 Garcadia Revenue (1)789.4$ 1,100.8$ 1,548.4$ 962.9$ % Growth23.4%39.4%40.7%NAGarcadia Pre-Tax Income (1)22.3$ 37.4$ 46.8$ 30.5$ % Margin2.8%3.4%3.0%3.2%Garcadia Distributions (2)16.0$ 30.4$ 40.2$ 23.6$ Equity—Beginning of Year(3)35.9$ 72.3$ 82.4$ Equity—End of Year(3)72.3$ 82.4$ 120.0$ Pre-Tax Return (3)26.5%33.2%31.9% 77

Strategic PrioritiesnBe different – Create lifetime customers ?Deliver an unsurpassed customer experience ?Empower employees via in store ‘Champions’ to lead the creation of a better car ownership experience ?Drive down turnovernBe first to embrace new technology – Improve operating efficiency ?Exceed market growth in new car sales ?Increase used car volume ?Grow service and parts businessnBe a smart buyer – Acquire profitable but underperforming dealerships ?Keep looking, be patient 78

79

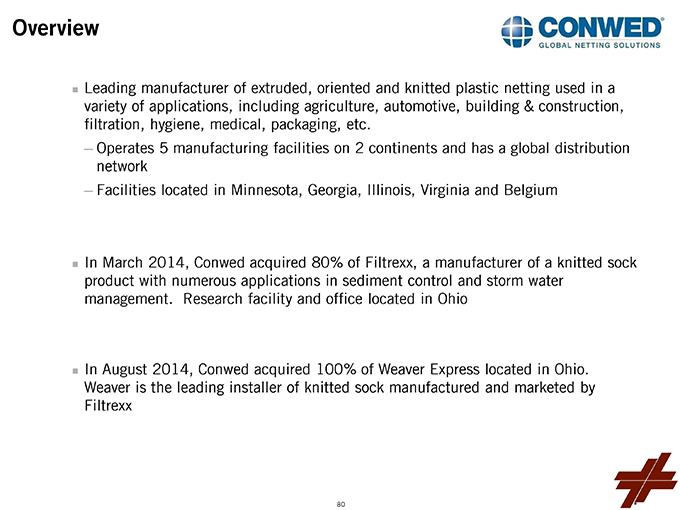

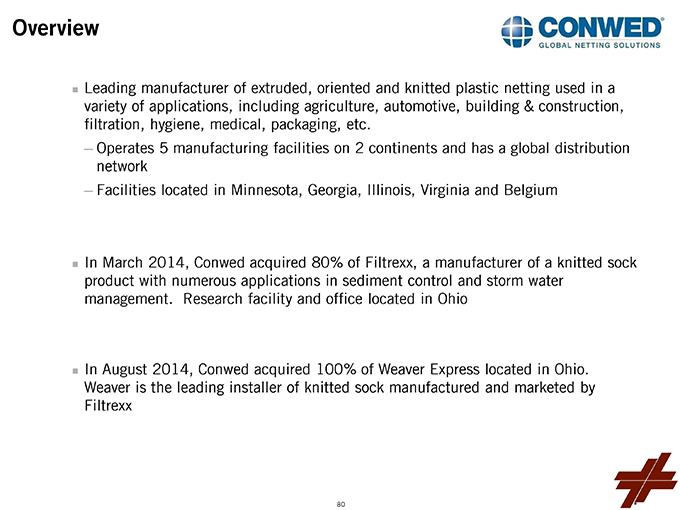

nLeading manufacturer of extruded, oriented and knitted plastic netting used in a variety of applications, including agriculture, automotive, building & construction, filtration, hygiene, medical, packaging, etc. ?Operates 5 manufacturing facilities on 2 continents and has a global distribution network ?Facilities located in Minnesota, Georgia, Illinois, Virginia and BelgiumnIn March 2014, Conwed acquired 80% of Filtrexx, a manufacturer of a knitted sock product with numerous applications in sediment control and storm water management. Research facility and office located in OhionIn August 2014, Conwed acquired 100% of Weaver Express located in Ohio. Weaver is the leading installer of knitted sock manufactured and marketed by Filtrexx Overview 80

Netting Capabilities CONTAINMENT GRIP LAMINATION PACKAGING PROTECTION REINFORCEMENT SEPARATION STRETCH VALUE ADDED 81

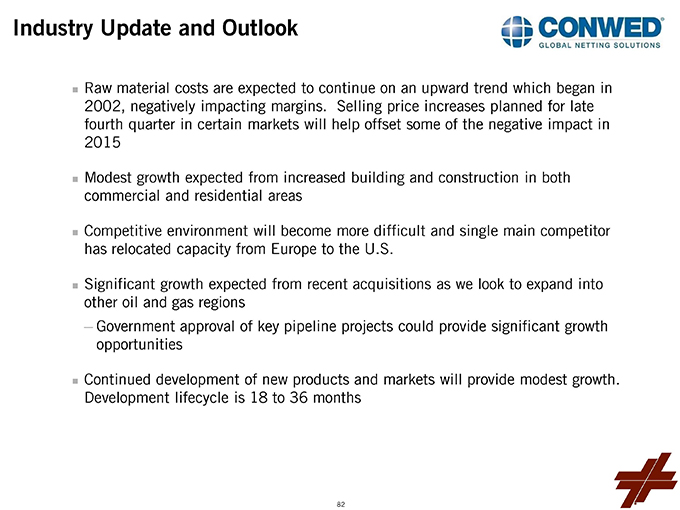

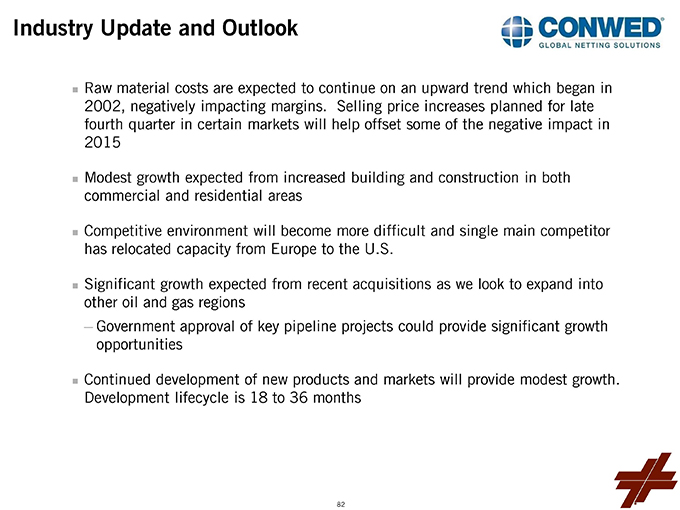

nRaw material costs are expected to continue on an upward trend which began in 2002, negatively impacting margins. Selling price increases planned for late fourth quarter in certain markets will help offset some of the negative impact in 2015nModest growth expected from increased building and construction in both commercial and residential areasnCompetitive environment will become more difficult and single main competitor has relocated capacity from Europe to the U.S.nSignificant growth expected from recent acquisitions as we look to expand into other oil and gas regions ?Government approval of key pipeline projects could provide significant growth opportunitiesnContinued development of new products and markets will provide modest growth. Development lifecycle is 18 to 36 months Industry Update and Outlook 82

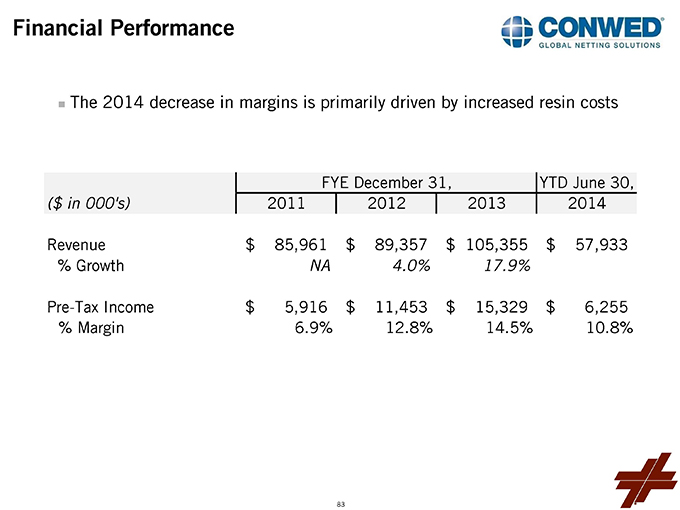

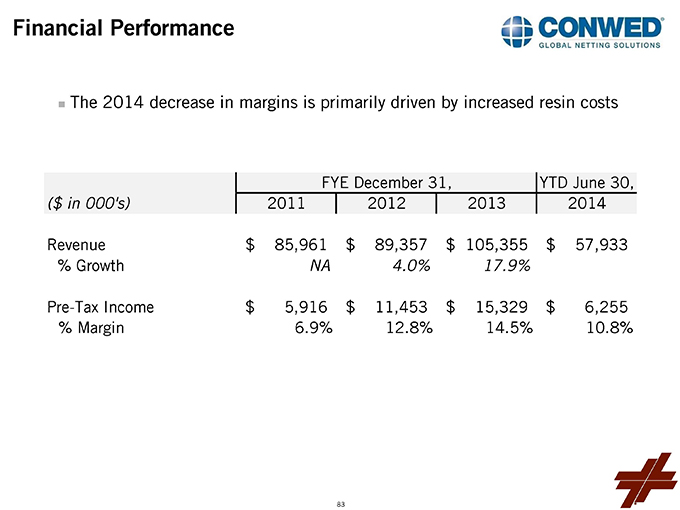

Financial PerformancenThe 2014 decrease in margins is primarily driven by increased resin costs FYE December 31,YTD June 30,($ in 000’s)2011201220132014Revenue85,961$ 89,357$ 105,355$ 57,933$ % GrowthNA4.0%17.9%Pre-Tax Income5,916$ 11,453$ 15,329$ 6,255$ % Margin6.9%12.8%14.5%10.8% 83

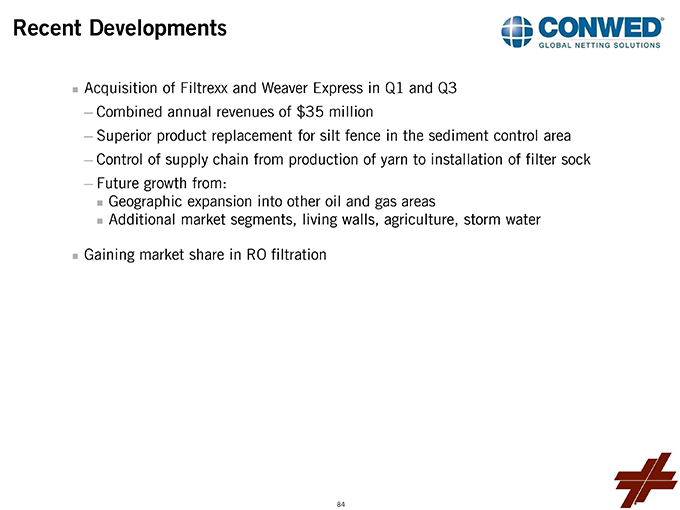

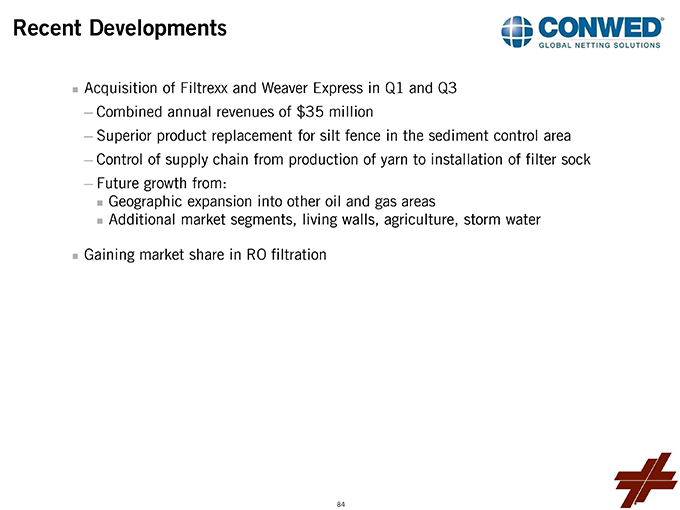

nAcquisition of Filtrexx and Weaver Express in Q1 and Q3 ?Combined annual revenues of $35 million ?Superior product replacement for silt fence in the sediment control area ?Control of supply chain from production of yarn to installation of filter sock ?Future growth from:nGeographic expansion into other oil and gas areasnAdditional market segments, living walls, agriculture, storm waternGaining market share in RO filtration Recent Developments 84

nDrive organic growth ?Continued co-development with customers ?New products, markets and applications for Conwed’s core technology ?Geographic market expansionnMinimize lost businessnRelentlessly improve customer service levelsnDevelop Filtrexx/Weaver business Strategic Priorities 85

86

OverviewnManufacturer and distributer of wood products including: ?Remanufacturing dimension lumber ?Remanufacturing, bundling and bar coding of home center boards and related products ?Primary manufacturing of pine dimension lumber, pine decking and cedar productsn7 plants and 3 sawmills located in Arkansas, Florida, Idaho, Louisiana, New Mexico, North Carolina and Texas ?922,000 square feet of manufacturing and office space, covering ~214 acresnIn March 2013, Idaho Timber purchased an idled primary mill in Coushatta, Louisiana, capable of producing both dimensional lumber and radius edge decking 87

Business OverviewnRemanufacturing Segment ?Purchase lower-value dimension lumber and remanufacture to add value and develop tallies that allow us to provide just-in-time deliveries of specified products to our customers ?Customer base consists primarily of pro dealers and lumber yardsnHome Center Board Segment ?Proprietarily grade, bundle and bar code board products for delivery to Home Center stores ?Additional service provided through vendor managed inventory programsnSawmill Segment ?Primary sawmills located in Arkansas and Louisiana manufacture southern yellow pine products and sell primarily to lumber treating companies ?Much of the product we sell ends up as treated decking for sale in Home Center stores ?Split-rail cedar mill in Idaho manufactures cedar fencing and related products 88

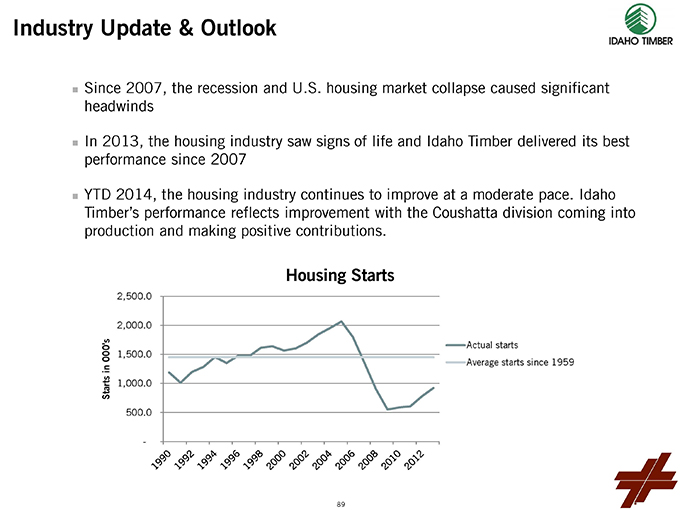

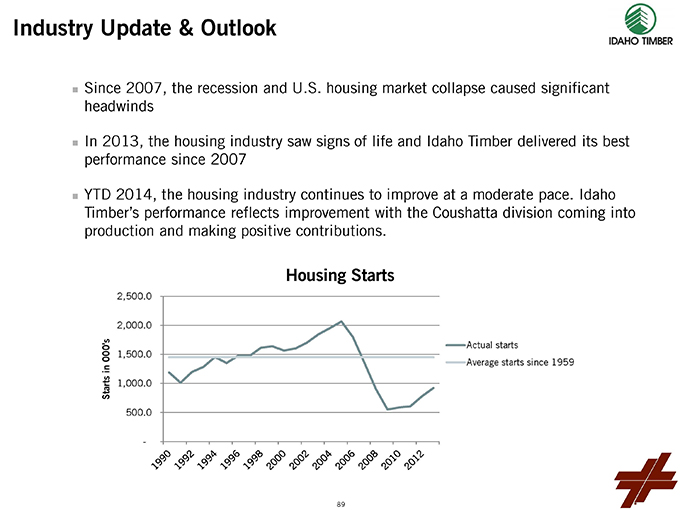

Industry Update & Outlook?Since 2007, the recession and U.S. housing market collapse caused significant headwinds?In 2013, the housing industry saw signs of life and Idaho Timber delivered its best performance since 2007?YTD 2014, the housing industry continues to improve at a moderate pace. Idaho Timber’s performance reflects improvement with the Coushatta division coming into production and making positive contributions.-500.01,000.01,500.02,000.02,500.0199019921994199619982000200220042006200820102012Starts in 000’sHousing StartsActual startsAverage starts since 195989

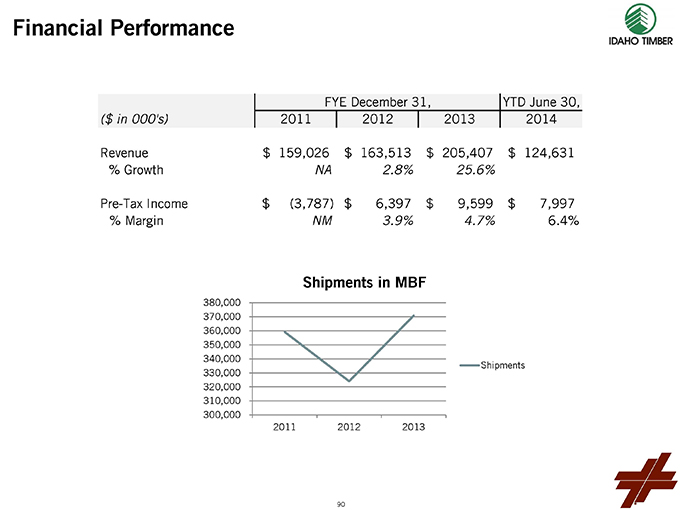

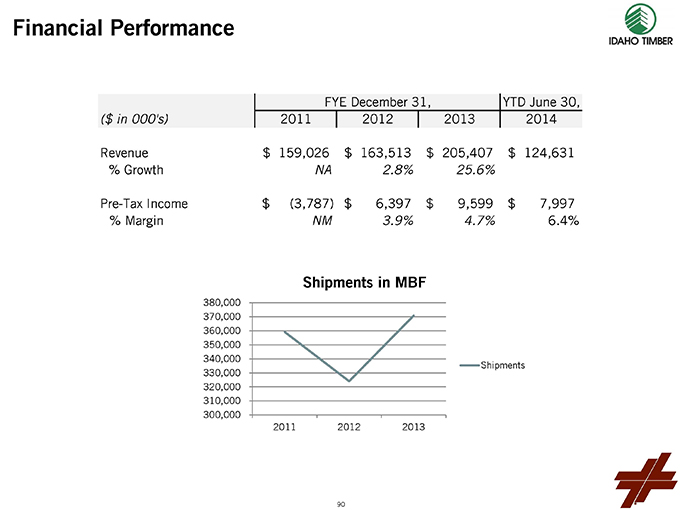

Financial Performance 300,000 310,000 320,000 330,000 340,000 350,000 360,000 370,000 380,000201120122013Shipments in MBF ShipmentsFYE December 31,YTD June 30,($ in 000’s)2011201220132014Revenue159,026$ 163,513$ 205,407$ 124,631$ % GrowthNA2.8%25.6%Pre-Tax Income(3,787)$ 6,397$ 9,599$ 7,997$ % MarginNM3.9%4.7%6.4% 90

Recent DevelopmentsnThe remanufacturing segment is experiencing additional supply opportunities due to industry wide production increases and moderating demand by the Chinese for certain lumber itemsnWe expect continued market volatility which should create strategic purchasing opportunities to improve the remanufacturing segment spreadnWe were able to increase our prices and volumes to our largest customer for the Home Center board segment, thereby improving the outlook for the Home Center board segmentnThe sawmill in Coushatta is operating on a one-shift basis and showing steady improvement in production efficiency as our work force gains experience 91

Strategic PrioritiesnPrimary Mill: ?Develop production capabilities and market to achieve consistent production results on a full one-shift capacity basisnBoards: Return to consistent profitability by 2015nRemanufacturing: Drive production efficiencies by increasing shipments over 2013nBusiness Development: Explore opportunities to identify the next expansion by acquisition 92

Appendix 93

Note: Dollar amounts are Leucadia’s net carrying amount for each investment, for consolidated subsidiaries equal to their assets less liabilities.1)Adjusted for assumed redemption of 2015 8.125% Sr. Notes using Parent Company Cash.2)Includes $2.8 billion of goodwill and intangibles.3)Investment commitment of $400 million contingent on Folger Hill raising at least $400 million of outside capital.4)Adjusted for the pending $205 million EnerVest acquisition, which is expected to close in September 2014.5)Carrying amount is net of deferred gain on real estate sale.6)Represents Leucadia’s approximate weighted average ownership; ownership varies by dealership between 65% and 90%.7)Adjusted to include proceeds from the sale of Premier Entertainment to Twin River Management Group, Inc., closed July 2014.8)Excludes Jefferies Net Deferred Tax Asset of $445 million.Notes and Disclosures to Leucadia Overview94

Note: Dollar amounts are Leucadia’s net carrying amount for each investment, for consolidated subsidiaries equal to their assets less liabilities. 1)Adjusted for assumed redemption of 2015 8.125% Sr. Notes using Parent Company Cash. 2)Includes $2.8 billion of goodwill and intangibles. 3)Investment commitment of $400 million contingent on Folger Hill raising at least $400 million of outside capital. 4)Adjusted for the pending $205 million EnerVest acquisition, which is expected to close in September 2014. 5)Carrying amount is net of deferred gain on real estate sale. 6)Represents Leucadia’s approximate weighted average ownership; ownership varies by dealership between 65% and 90%. 7)Adjusted to include proceeds from the sale of Premier Entertainment to Twin River Management Group, Inc., closed July 2014. 8)Excludes Jefferies Net Deferred Tax Asset of $445 million. Notes and Disclosures to Leucadia Overview 94

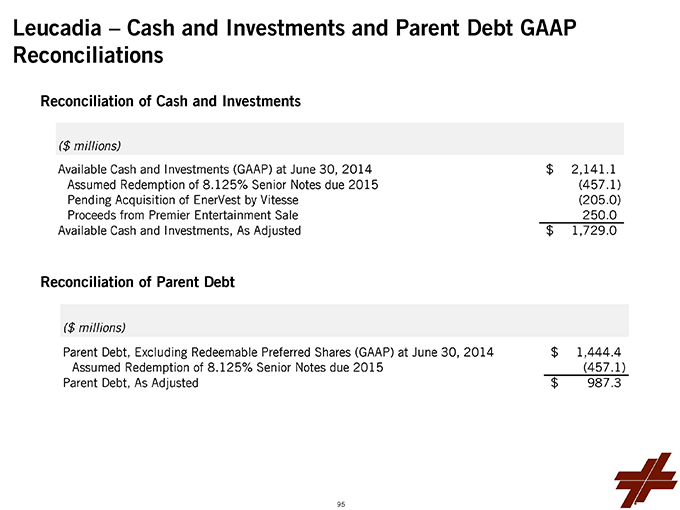

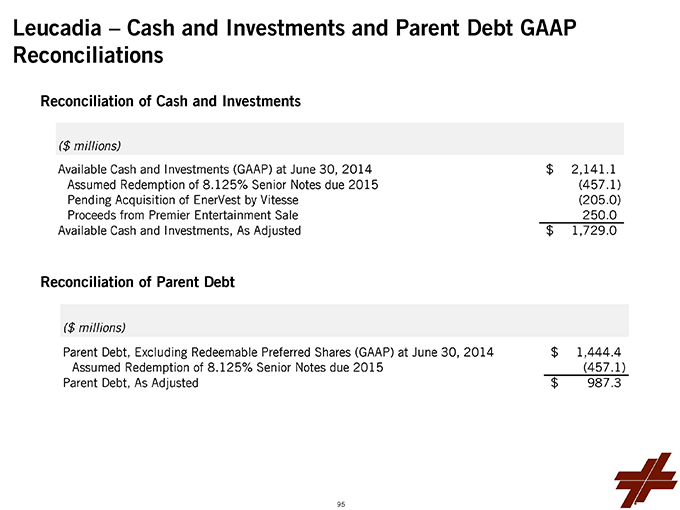

Leucadia – Cash and Investments and Parent Debt GAAP Reconciliations Reconciliation of Cash and Investments Reconciliation of Parent Debt ($ millions)Available Cash and Investments (GAAP) at June 30, 20142,141.1$ Assumed Redemption of 8.125% Senior Notes due 2015(457.1) Pending Acquisition of EnerVest by Vitesse(205.0) Proceeds from Premier Entertainment Sale250.0 Available Cash and Investments, As Adjusted1,729.0$ ($ millions)Parent Debt, Excluding Redeemable Preferred Shares (GAAP) at June 30, 20141,444.4$ Assumed Redemption of 8.125% Senior Notes due 2015(457.1) Parent Debt, As Adjusted987.3$ 95

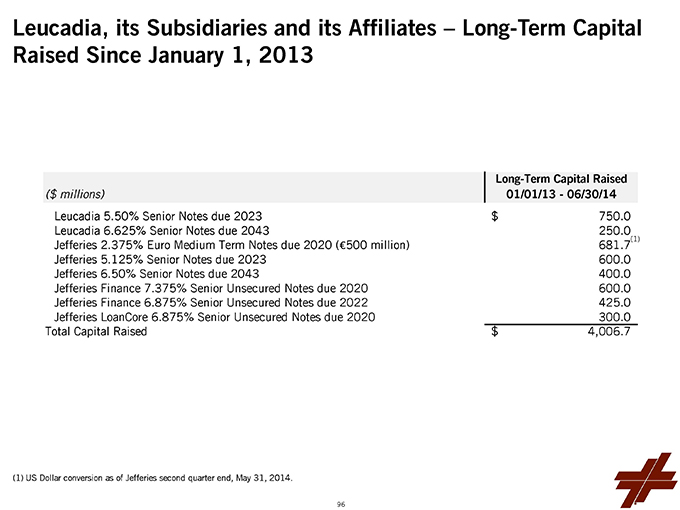

Leucadia, its Subsidiaries and its Affiliates – Long-Term Capital Raised Since January 1, 2013 (1) (1)US Dollar conversion as of Jefferies second quarter end, May 31, 2014. Long-Term Capital Raised($ millions)01/01/13—06/30/14Leucadia 5.50% Senior Notes due 2023750.0$ Leucadia 6.625% Senior Notes due 2043250.0 Jefferies 2.375% Euro Medium Term Notes due 2020 (€500 million)681.7 Jefferies 5.125% Senior Notes due 2023600.0 Jefferies 6.50% Senior Notes due 2043400.0 Jefferies Finance 7.375% Senior Unsecured Notes due 2020600.0 Jefferies Finance 6.875% Senior Unsecured Notes due 2022425.0 Jefferies LoanCore 6.875% Senior Unsecured Notes due 2020300.0 Total Capital Raised4,006.7$ 96

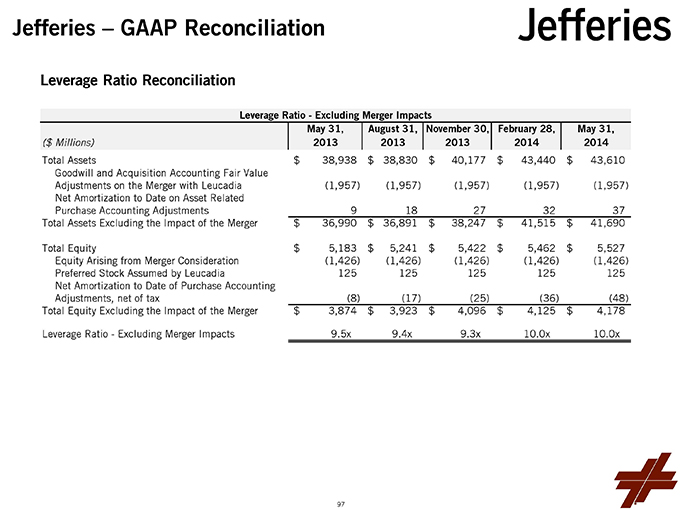

Jefferies – GAAP Reconciliation Leverage Ratio Reconciliation May 31,August 31,November 30,February 28,May 31,($ Millions)20132013201320142014Total Assets38,938$ 38,830$ 40,177$ 43,440$ 43,610$ Goodwill and Acquisition Accounting Fair ValueAdjustments on the Merger with Leucadia(1,957) (1,957) (1,957) (1,957) (1,957) Net Amortization to Date on Asset RelatedPurchase Accounting Adjustments9 18 27 32 37 Total Assets Excluding the Impact of the Merger36,990$ 36,891$ 38,247$ 41,515$ 41,690$ Total Equity5,183$ 5,241$ 5,422$ 5,462$ 5,527$ Equity Arising from Merger Consideration(1,426) (1,426) (1,426) (1,426) (1,426) Preferred Stock Assumed by Leucadia125 125 125 125 125 Net Amortization to Date of Purchase AccountingAdjustments, net of tax(8) (17) (25) (36) (48) Total Equity Excluding the Impact of the Merger3,874$ 3,923$ 4,096$ 4,125$ 4,178$ Leverage Ratio—Excluding Merger Impacts9.5x9.4x9.3x10.0x10.0xLeverage Ratio—Excluding Merger Impacts 97

Berkadia – GAAP Reconciliation Note: Berkadia believes Cash Earnings is useful to investors to understand and compare operating results for its servicing business between periods, because it eliminates the impact of certain non-cash items from pre-tax earnings, principally amortization, impairment and depreciation expenses and gains recognized upon the acquisition of mortgage servicing rights, all of which fluctuate from period to period. Reconciliation of Pre-Tax Income to Cash Earnings (a non-GAAP measure) FYE December 31,YTD June 30,($ Millions)20112012201320132014Pre-Tax Income (GAAP)34.6$ 103.8$ 152.6$ 71.9$ 79.4$ Amortization, impairment and depreciation107.5 112.7 94.7 49.8 46.6 Gains attributable to origination of MSR’s(45.2) (93.1) (120.4) (62.2) (36.7) Loan loss reserves and guarantee liabilities, net of cash losses3.2 18.8 29.3 14.6 4.1 Unrealized (gains) losses; and all other, net7.0 (7.7) (3.6) (3.7) (20.5) Cash Earnings (Non-GAAP)107.1$ 134.5$ 152.5$ 70.5$ 72.8$ 98

FYE August,($ Millions)20112012201320132014Pre-Tax Income (GAAP)261.6$ 59.0$ (42.4)$ 6.8$ (21.5)$ Interest Expense / (Income), net11.7 12.4 12.3 6.5 6.9 Depreciation & Amortization51.2 83.1 88.5 43.6 42.0 Impairment of Long-Lived Assets— 63.3 — Profit from Operations (Non-GAAP)324.5$ 154.5$ 121.7$ 56.9$ 27.4$ FYE Dec.,6 Months Ending June,National Beef – GAAP Reconciliation Note: National Beef Profit From Operations represents pre-tax income exclusive of depreciation and amortization expenses, impairment charges and net interest income/expense, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. (1)Prior to being acquired by Leucadia in December 2011, National Beef’s fiscal year ended in August. In addition, 2012 amounts are not comparable to prior periods as they reflect the application of acquisition accounting for National Beef, principally resulting in greater depreciation and amortization expenses during 2012. (1) Reconciliation of Pre-Tax Income to Profit from Operations (a non-GAAP measure) 99

Harbinger – Consumer GAAP Reconciliation Note: Totals may not add due to rounding. Source: Harbinger Group, Inc. February 2014 Company Overview. (1)Reflects net sales and earnings of Hardware and Home Improvement Group from the beginning of the applicable period through December 29, 2012. This adjustment results in net sales and earnings for the period as if the acquisition had occurred at the beginning of all periods presented. FYE September 30,($ Millions)201120122013Consumer—Pro Forma Net Sales Reconciliation:Reported Net Sales3,187$ 3,252$ 4,086$ Hardware and Home Improvement Group Acquisition (1)- 974 192 Pro Forma Net Sales3,187$ 4,226$ 4,277$ Consumer—Adjusted EBITDA Reconciliation:Reported Operating Income228$ 302$ 348$ Other Income / (Expense)(3) (1)—Depreciation & Amortization, net of accelerated depreciation134 134 184 Acquisition and Integration Related Charges37 31 48 Goodwill and Intangible Impairments32 — Restructuring and Related Charges29 19 34 Pre-Acquisition Earnings of Hardware and Home Improvement Group (1)- 183 30 Fair Value Adjustments— 31 Venezuela Devaluation— 2 Adjusted EBITDA457$ 668$ 677$ 100

Harbinger – Insurance and Energy GAAP Reconciliations Note: Totals may not add due to rounding. Source: Harbinger Group, Inc. 10-K for the fiscal period ended 09/30/13. FYE September 30,($ Millions)201120122013Insurance—Adjusted Operating Income Reconciliation:Reported Operating Income(42)$ 160$ 523$ Effect of Investment Gains, net of offsets(1) (132) (248) Effect of Change in FIA Embedded Derivative Discount Rate, net of offsets43 19 (54) Effects of Transaction-related Reinsurance24 12—Adjusted Operating Income25$ 58$ 221$ Energy—Adjusted EBITDA Reconciliation:Reported Net Loss(57)$ Interest Expense10 Depreciation, Amortization and Depletion31 EBITDA(16) Accretion of Discount on Asset Retirement Obligations1 Non-cash Write Down of Oil and Natual Gas Properties54 Loss on Derivative Financial Instruments1 Cash Settlements on Derivative Financial Instruments(2) Stock-based Compensation Expense0 Adjusted EBITDA40$ 101

Leucadia National Corporation 2014 Investor Meeting September 3, 2014