Exhibit 99

Leucadia National Corporation

2015 Investor Day

October 8, 2015

Note on Forward Looking Statements

This document contains “forward looking statements” within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements include statements about our future and statements that are not historical facts. These forward looking statements are usually preceded by the words “should,” “expect,” “intend,” “may,” “will,” or similar expressions. Forward looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans, and objectives. Forward looking statements also include statements pertaining to our strategies for future development of our business and products. Forward looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors, including our Risk Factors, that could cause actual results to differ, perhaps materially, from those in our forward looking statements is contained in reports we file with the SEC. You should read and interpret any forward looking statement together with reports we file with the SEC.

i

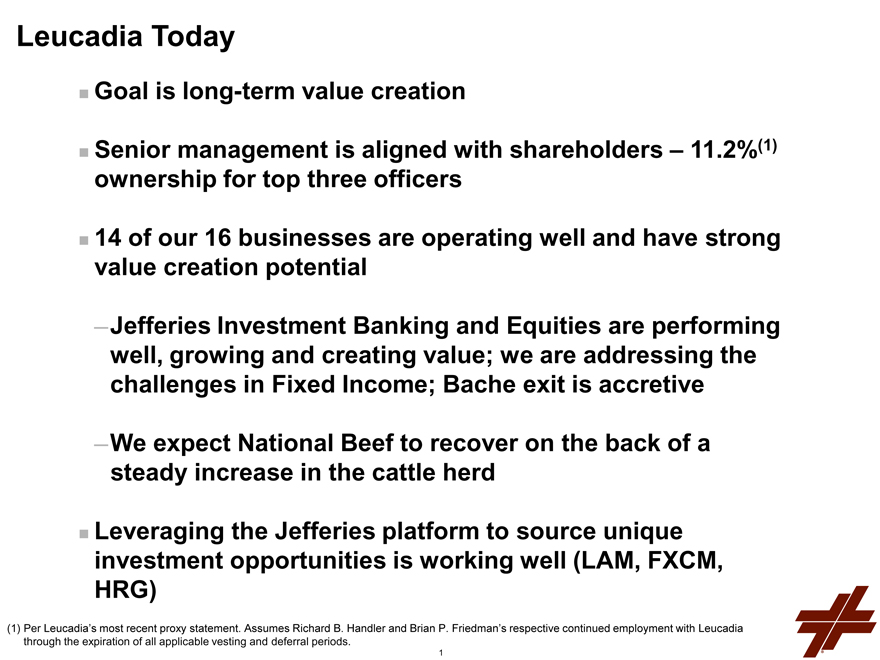

Leucadia Today

Goal is long-term value creation

Senior management is aligned with shareholders – 11.2%(1) ownership for top three officers

14 of our 16 businesses are operating well and have strong value creation potential

Jefferies Investment Banking and Equities are performing well, growing and creating value; we are addressing the challenges in Fixed Income; Bache exit is accretive

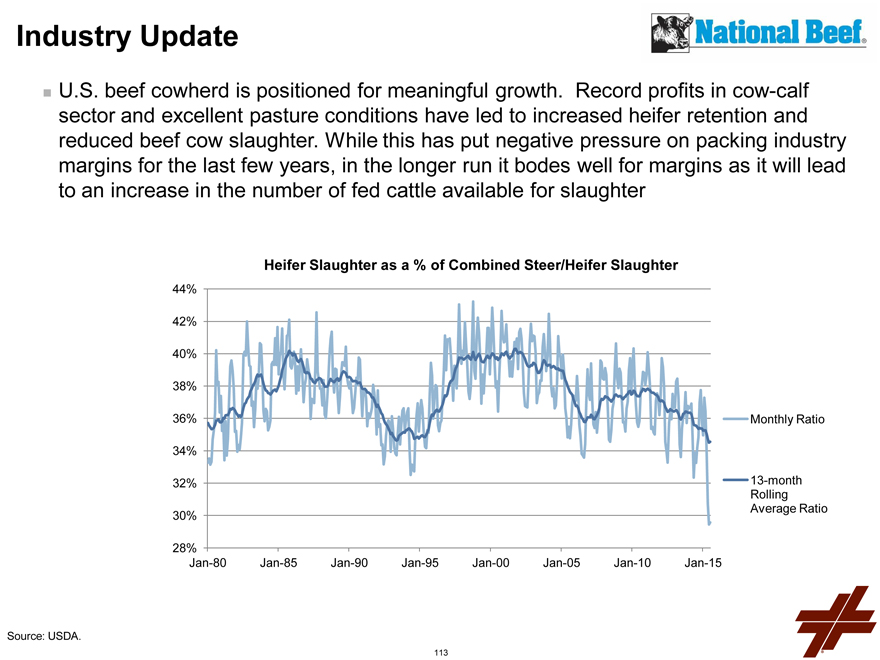

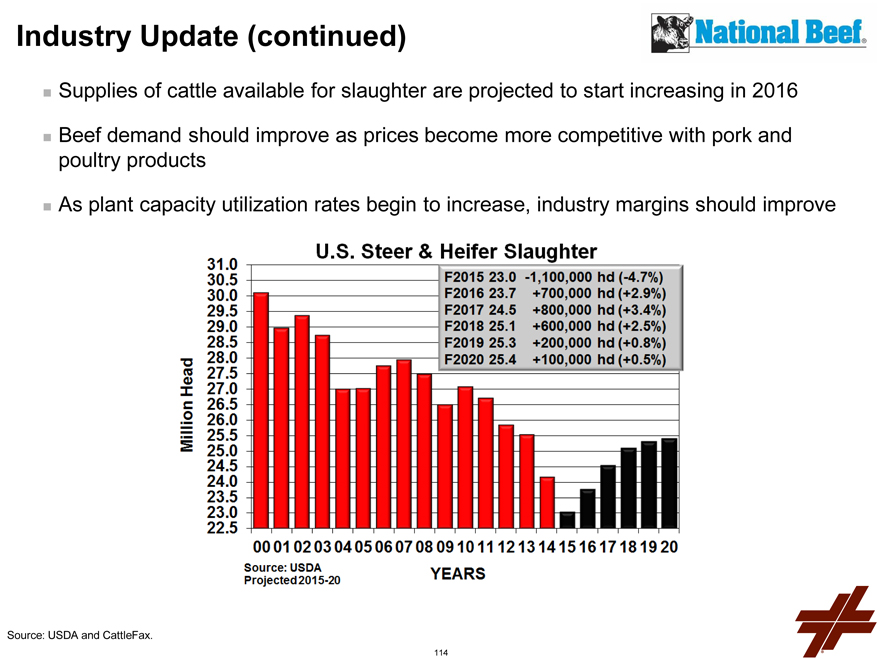

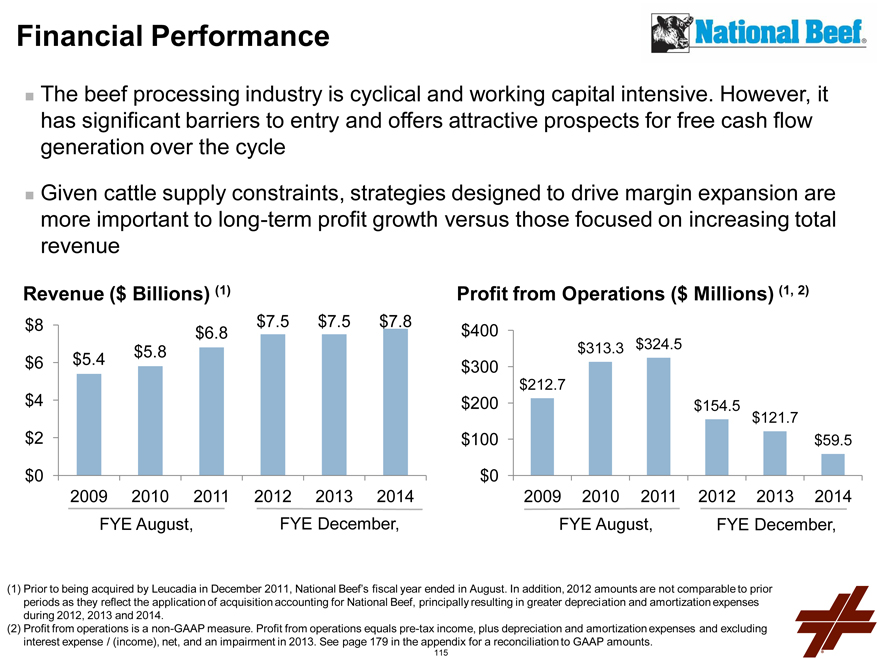

We expect National Beef to recover on the back of a steady increase in the cattle herd

Leveraging the Jefferies platform to source unique investment opportunities is working well (LAM, FXCM, HRG)

(1) Per Leucadia’s most recent proxy statement. Assumes Richard B. Handler and Brian P. Friedman’s respective continued employment with Leucadia through the expiration of all applicable vesting and deferral periods.

1

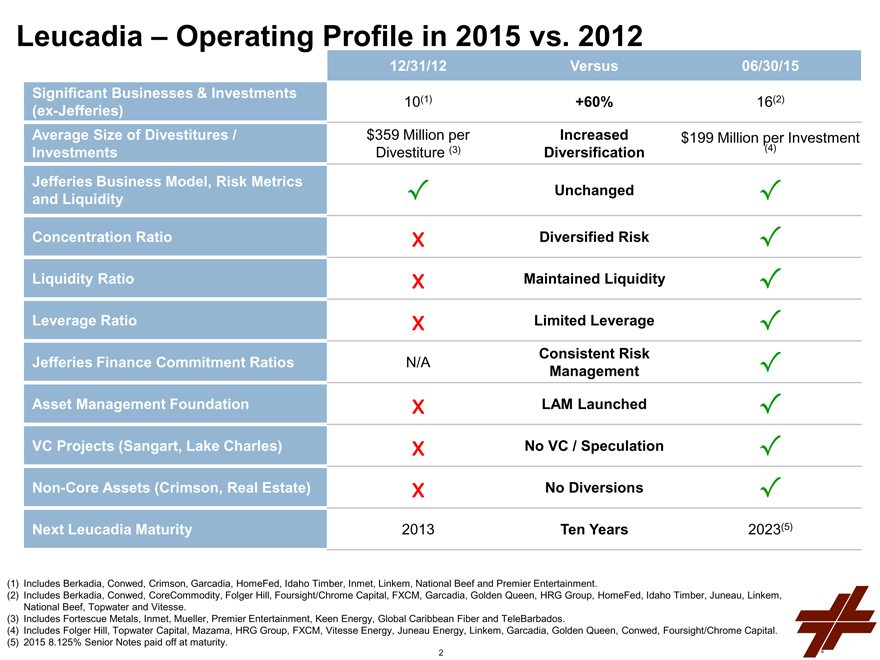

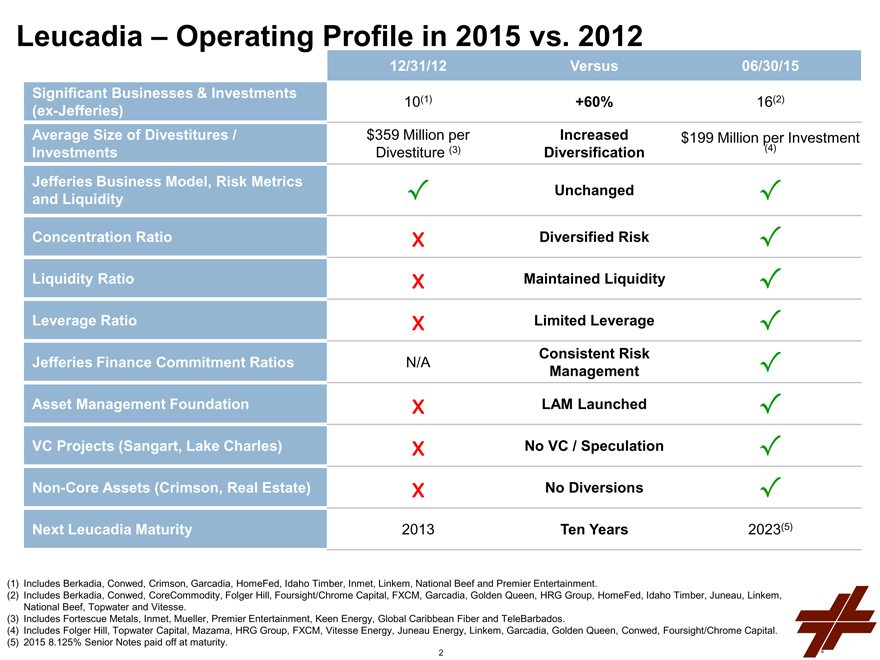

Leucadia – Operating Profile in 2015 vs. 2012

12/31/12 Versus 06/30/15

Significant Businesses & Investments 10(1) +60% 16(2)

(ex-Jefferies)

Average Size of Divestitures /Investments $359 Million per Divestiture (3) Increased Diversification $199 Million per Investment (4)

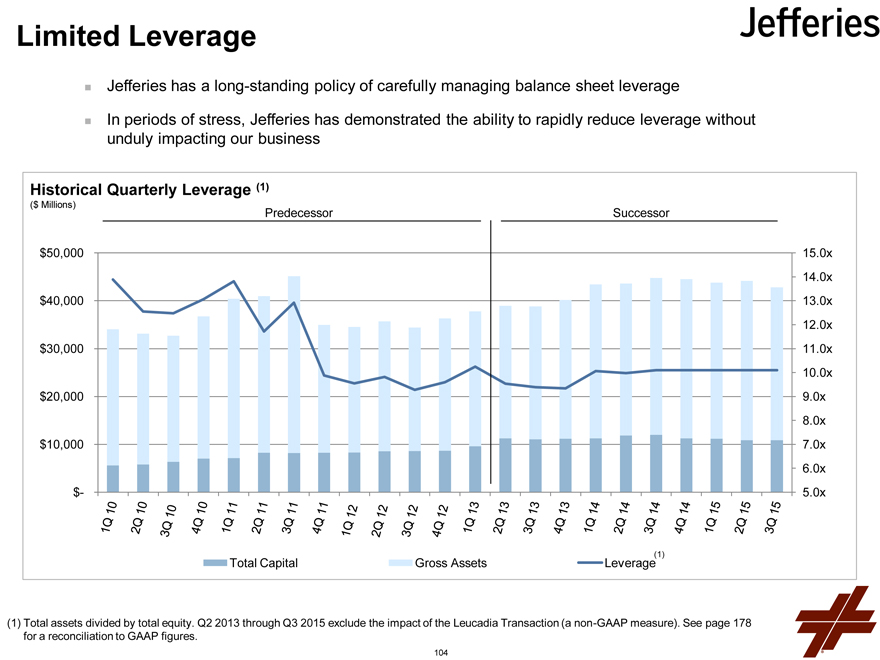

Jefferies Business Model, Risk Metrics and Liquidity Unchanged

Concentration Ratio x Diversified Risk

Liquidity Ratio x Maintained Liquidity

Leverage Ratio x Limited Leverage

Jefferies Finance Commitment Ratios N/A Consistent Risk Management

Asset Management Foundation x LAM Launched

VC Projects (Sangart, Lake Charles) x No VC / Speculation

Non-Core Assets (Crimson, Real Estate) x No Diversions

Next Leucadia Maturity 2013 Ten Years 2023(5)

(1) Includes Berkadia, Conwed, Crimson, Garcadia, HomeFed, Idaho Timber, Inmet, Linkem, National Beef and Premier Entertainment.

(2) Includes Berkadia, Conwed, CoreCommodity, Folger Hill, Foursight/Chrome Capital, FXCM, Garcadia, Golden Queen, HRG Group, HomeFed, Idaho Timber, Juneau, Linkem, National Beef, Topwater and Vitesse.

(3) Includes Fortescue Metals, Inmet, Mueller, Premier Entertainment, Keen Energy, Global Caribbean Fiber and TeleBarbados.

(4) Includes Folger Hill, Topwater Capital, Mazama, HRG Group, FXCM, Vitesse Energy, Juneau Energy, Linkem, Garcadia, Golden Queen, Conwed, Foursight/Chrome Capital.

(5) 2015 8.125% Senior Notes paid off at maturity.

2

Leucadia Overview

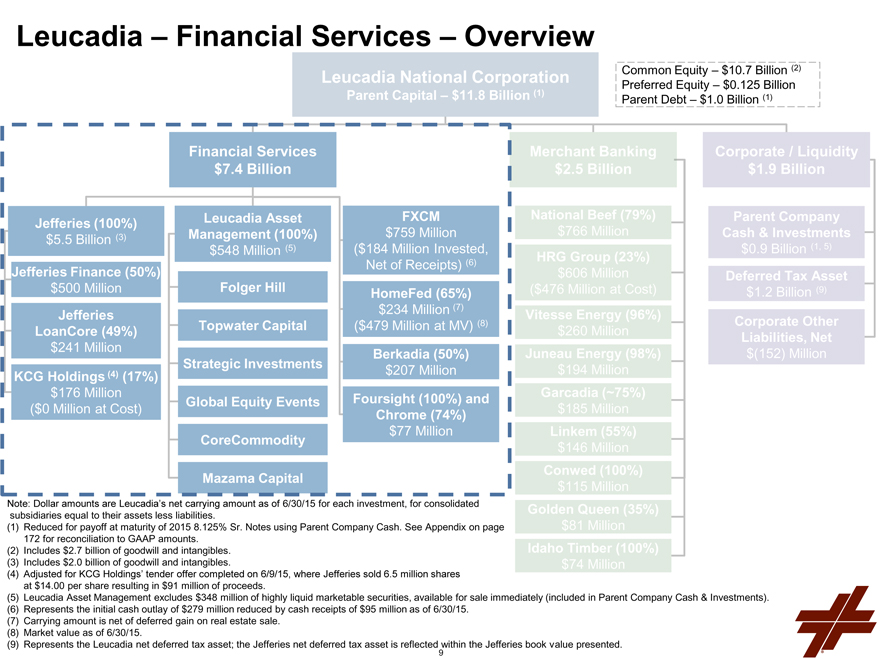

Leucadia National Corporation Parent Capital – $11.8 Billion (1)

Common Equity – $10.7 Billion (2) Preferred Equity – $0.125 Billion Parent Debt – $1.0 Billion (1)

Financial Services $7.4 Billion Merchant Banking $2.5 Billion Corporate / Liquidity $1.9 Billion

Jefferies (100%) $5.5 Billion (3)

Jefferies Finance (50%) $500 Million

Jefferies LoanCore (49%) $241 Million

KCG Holdings (4) (17%) $176 Million ($0 Million at Cost)

Leucadia Asset Management (100%) $548 Million (5)

Folger Hill

Topwater Capital

Strategic Investments

Global Equity Events

CoreCommodity

Mazama Capital

FXCM $759 Million ($184 Million Invested, Net of Receipts) (6)

HomeFed (65%) $234 Million (7) ($479 Million at MV) (8)

Berkadia (50%) $207 Million

Foursight (100%) and Chrome (74%) $77 Million

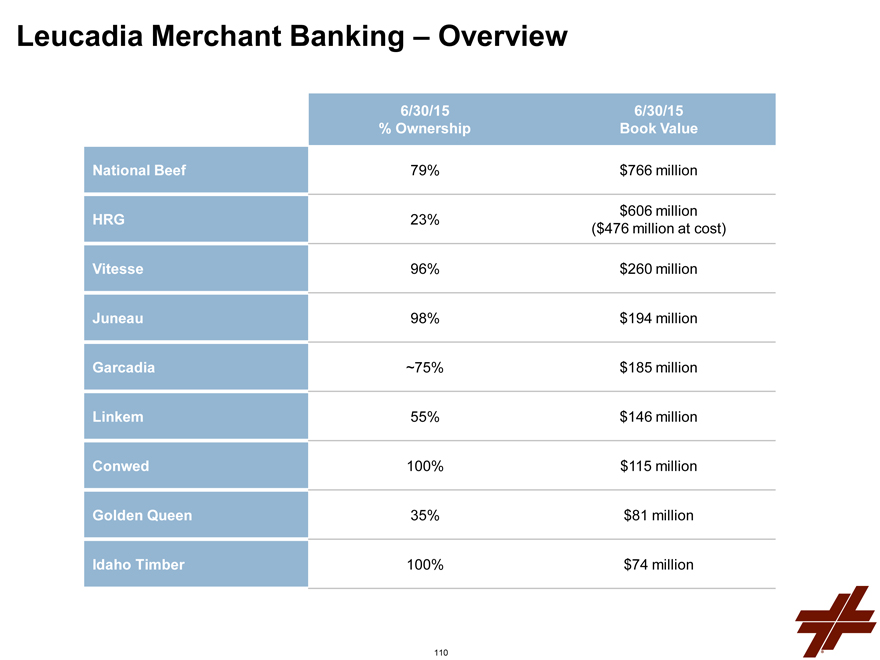

National Beef (79%) $766 Million

HRG Group (23%) $606 Million ($476 Million at Cost)

Vitesse Energy (96%) $260 Million

Juneau Energy (98%) $194 Million

Garcadia (~75%) $185 Million

Linkem (55%) $146 Million

Conwed (100%) $115 Million

Golden Queen (35%) $81 Million

Idaho Timber (100%) $74 Million

Parent Company Cash & Investments $0.9 Billion (1, 5)

Deferred Tax Asset $1.2 Billion (9)

Corporate Other Liabilities, Net $(152) Million

Note: Dollar amounts are Leucadia’s net carrying amount as of 6/30/15 for each investment, for consolidated Golden Queen (35%) subsidiaries equal to their assets less liabilities. $81 Million

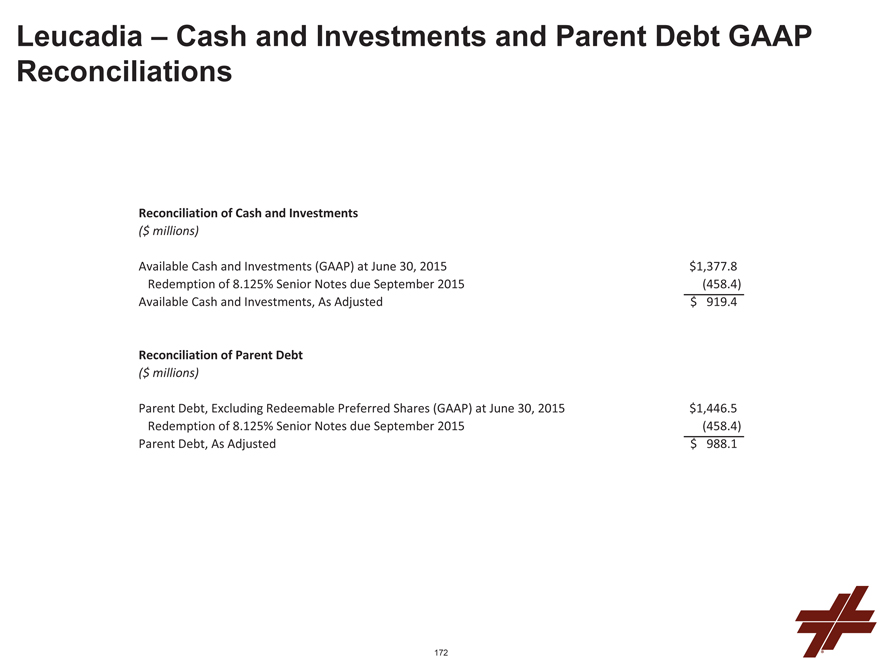

(1) Reduced for payoff at maturity of 2015 8.125% Sr. Notes using Parent Company Cash. See Appendix on page 172 for reconciliation to GAAP amounts. Idaho Timber (100%)

(2) Includes $2.7 billion of goodwill and intangibles. $74 Million

(3) Includes $2.0 billion of goodwill and intangibles.

(4) Adjusted for KCG Holdings’ tender offer completed on 6/9/15, where Jefferies sold 6.5 million shares at $14.00 per share resulting in $91 million of proceeds.

(5) Leucadia Asset Management excludes $348 million of highly liquid marketable securities, available for sale immediately (included in Parent Company Cash & Investments).

(6) Represents the initial cash outlay of $279 million reduced by cash receipts of $95 million as of 6/30/15.

(7) Carrying amount is net of deferred gain on real estate sale.

(8) Market value as of 6/30/15.

(9) Represents the Leucadia net deferred tax asset; the Jefferies net deferred tax asset is reflected within the Jefferies book value presented.

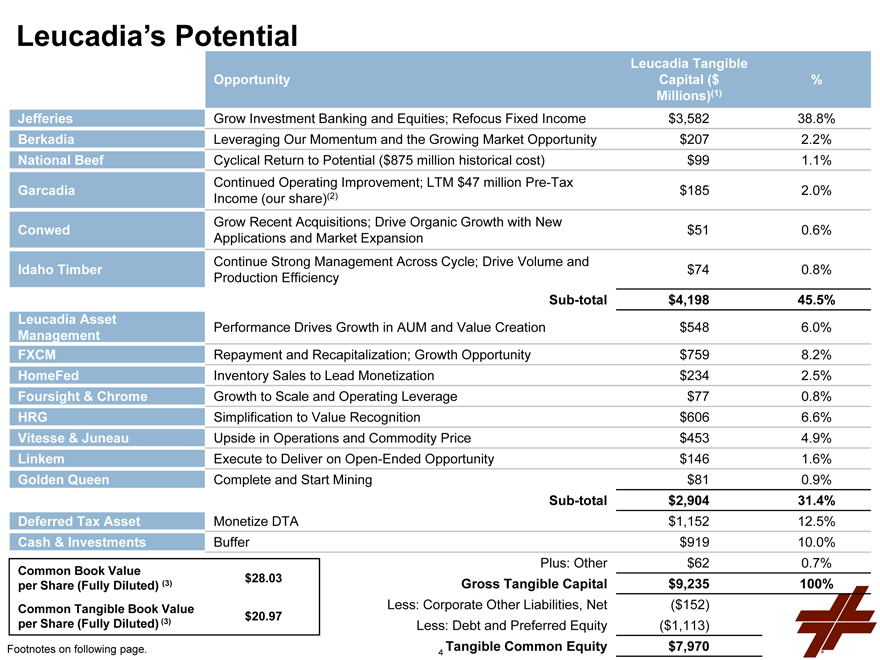

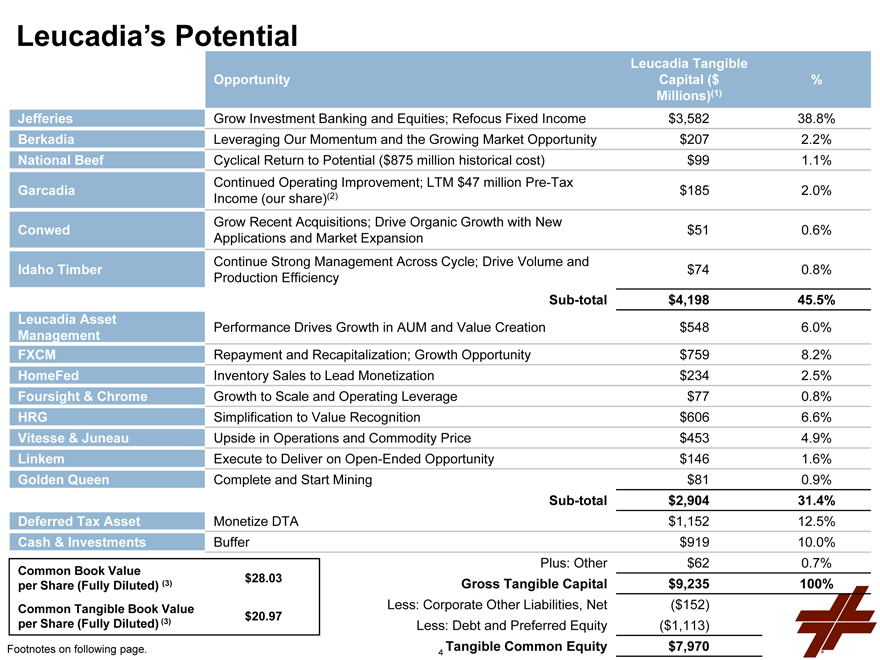

Leucadia’s Potential

Opportunity

Leucadia Tangible Capital ($ Millions)(1)

%

Jefferies Grow Investment Banking and Equities; Refocus Fixed Income $3,582 38.8%

Berkadia Leveraging Our Momentum and the Growing Market Opportunity $207 2.2%

National Beef Cyclical Return to Potential ($875 million historical cost) $99 1.1%

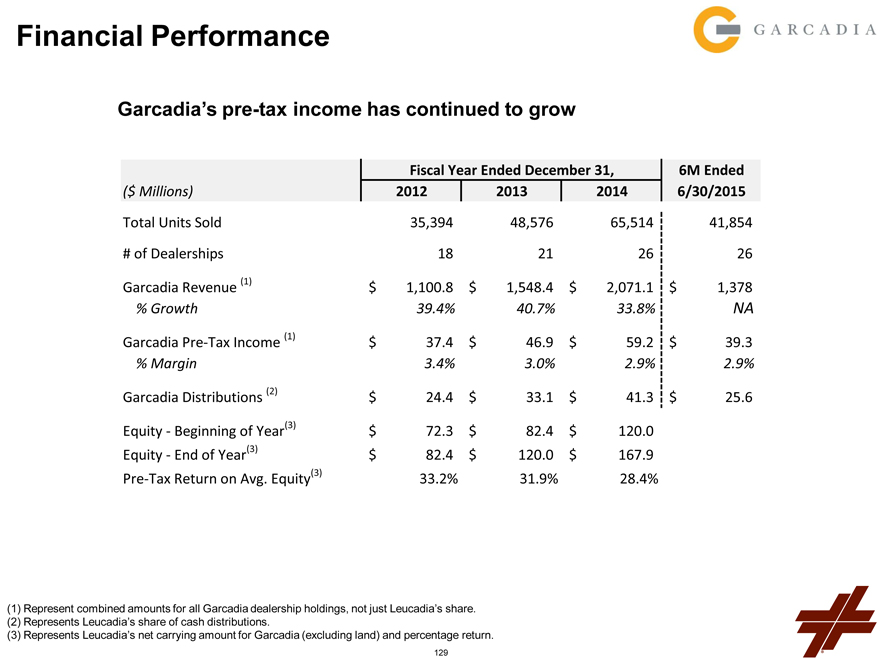

Garcadia Continued Operating Improvement; LTM $47 million Pre-Tax Income (our share)(2) $185 2.0%

Conwed Grow Recent Acquisitions; Drive Organic Growth with New Applications and Market Expansion $51 0.6%

Idaho Timber Continue Strong Management Across Cycle; Drive Volume and Production Efficiency $74 0.8%

Sub-total $4,198 45.5%

Leucadia Asset Management Performance Drives Growth in AUM and Value Creation $548 6.0%

FXCM Repayment and Recapitalization; Growth Opportunity $759 8.2%

HomeFed Inventory Sales to Lead Monetization $234 2.5%

Foursight & Chrome Growth to Scale and Operating Leverage $77 0.8%

HRG Simplification to Value Recognition $606 6.6%

Vitesse & Juneau Upside in Operations and Commodity Price $453 4.9%

Linkem Execute to Deliver on Open-Ended Opportunity $146 1.6%

Golden Queen Complete and Start Mining $81 0.9%

Sub-total $2,904 31.4%

Deferred Tax Asset Monetize DTA $1,152 12.5%

Cash & Investments Buffer $919 10.0%

Plus: Other $62 0.7%

Gross Tangible Capital $9,235 100%

Less: Corporate Other Liabilities, Net($152)

Less: Debt and Preferred Equity($1,113)

Tangible Common Equity $7,970

Common Book Value $ 28.03

per Share (Fully Diluted) (3)

Common Tangible Book

Value per Share (Fully $ 20.97

Diluted) (3)

Footnotes on following page.

4

Footnotes: Leucadia’s Potential

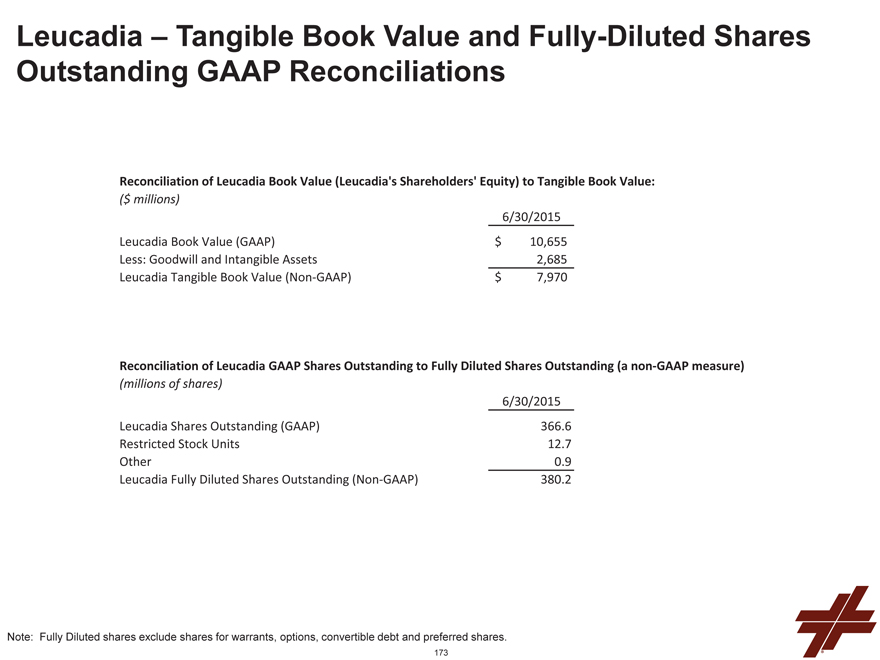

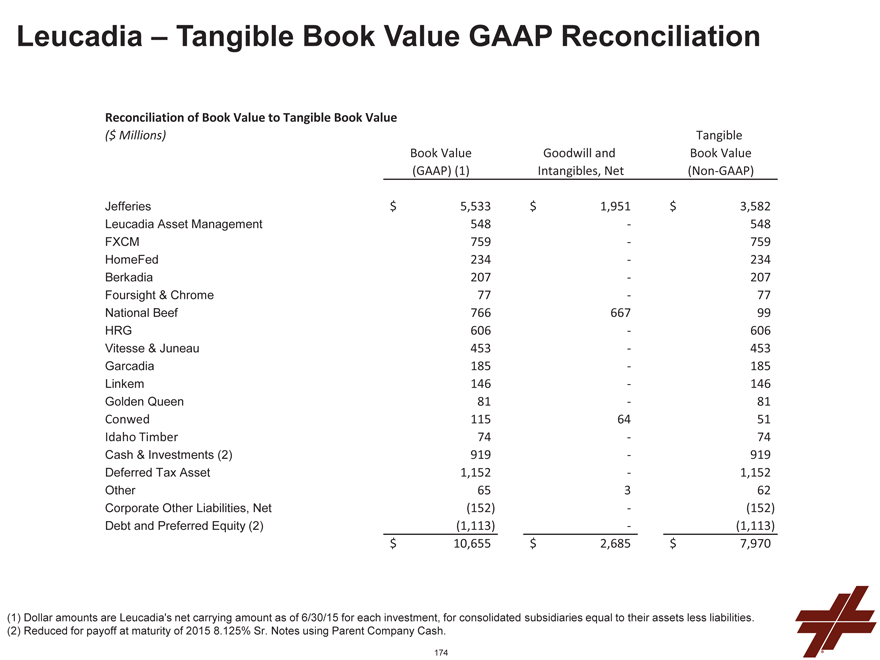

1. Leucadia Tangible Capital is a non-GAAP financial measure excluding goodwill and intangibles from Book Value. See appendix on pages 174 for reconciliation to GAAP measures.

2. Our share of Garcadia pre-tax income, excluding our interest in Garcadia land, is a non-GAAP measure, however, there are no income taxes at the Garcadia level; therefore our share of their net income equals our share of their pre-tax income.

3. Common Book Value per Share (fully-diluted) and Common Tangible Book Value per Share (fully-diluted) are non-GAAP financial measures widely used by investors in assessing investment and financial services firms. See Appendix on page 173 for a reconciliation to GAAP measure.

A Unique Financial Services and Merchant Banking Platform

Financial Services – Our historic sector; post-crisis opportunity

Jefferies

Drive market share, margin expansion and earnings growth by growing Investment Banking and Equities and refocusing in Fixed Income

Jefferies Finance and Jefferies LoanCore – Execute on the opportunity and momentum of our corporate and commercial real estate lending platforms

KCG Holdings – Significant interest in a leading global electronic market maker (>100% of cost recovered)(1)

Berkadia

Become the best full-service mortgage banking firm in the industry

Build out geographic coverage, products and capabilities to drive profitability and cash flow

Leucadia Asset Management

Leverage Leucadia’s brand, Jefferies’ relationships and Leucadia capital to own significant general partnership stakes in differentiated alternative asset management strategies (business model inherently avoids goodwill and acquisition costs)

FXCM

Opportunistic and well-structured investment, with significant near and long-term value creation potential

Counter-cyclical performance relative to Jefferies’ core business

Leucadia’s results may continue to be volatile for several more quarters as we fair value the FXCM investment quarterly

HomeFed

Following recent $150 million Otay Ranch acquisition, begin to harvest ripening projects and assets

Foursight and Chrome

Drive market share and originations, while maintaining a disciplined approach to credit quality

(1) Adjusted for KCG Holdings’ tender offer completed on 6/9/15, where Jefferies sold 6.5 million shares at $14.00 per share resulting in $91 million of proceeds.

6

A Unique Financial Services and Merchant Banking Platform

Merchant Banking – Opportunistic value investments in businesses we understand

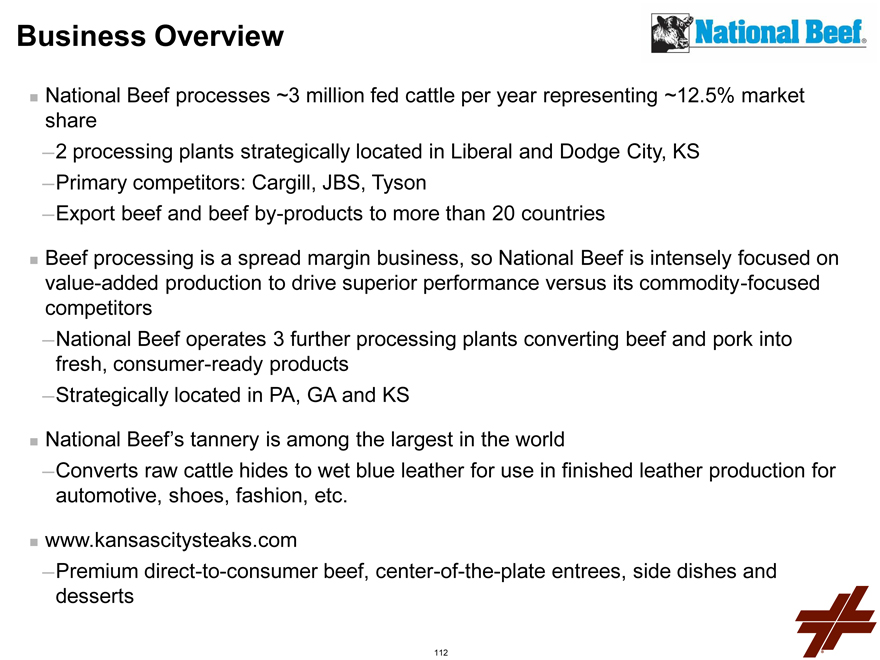

National Beef

Manage business through the cattle cycle

Maintain core market share and enhance profitability through efficiency and growth of value-added segments (tannery, consumer ready, Kansas City Steaks)

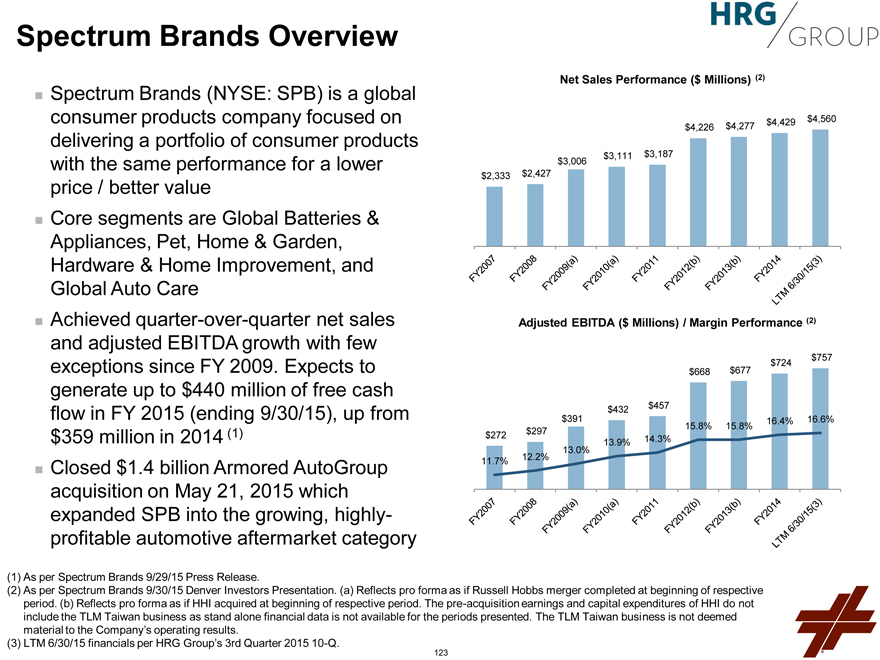

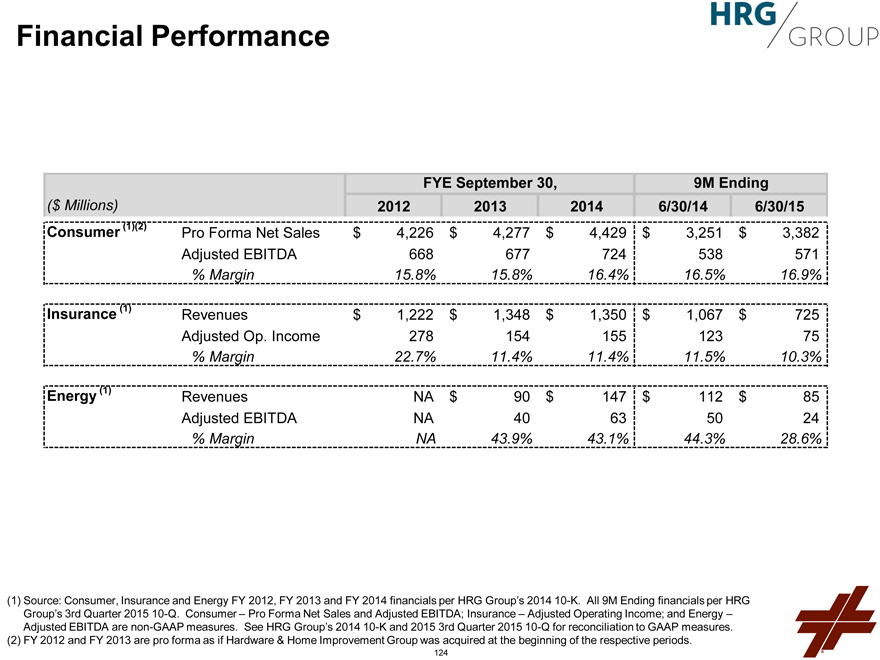

HRG

Drive value through simplification and strategic focus, as well as growth of Spectrum Brands

Vitesse and Juneau

Drive cash flow on existing investments

Opportunities for new investments following oil price collapse

Garcadia

Enhance performance in existing dealerships

Selectively expand dealership network in a robust market environment

Linkem

Increase coverage through LTE network deployment

Prepare for launch in major Italian cities

Conwed

Drive organic growth with new applications and market expansion

Idaho Timber

Drive volume and production efficiency

Golden Queen

Deliver working mine on time and on budget

Three Q & A’s –

IRQuestions@Leucadia.com

Leucadia Financial Services

8

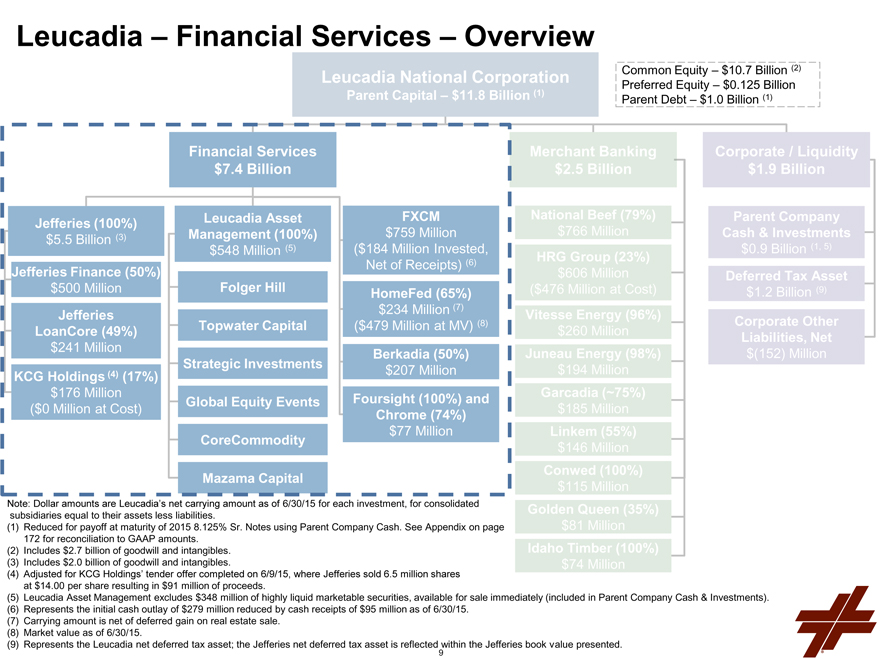

Leucadia – Financial Services – Overview

Leucadia National Corporation

Parent Capital – $11.8 Billion (1)

Common Equity – $10.7 Billion (2) Preferred Equity – $0.125 Billion Parent Debt – $1.0 Billion (1)

Jefferies (100%) $5.5 Billion (3)

Jefferies Finance (50%) $500 Million

Jefferies LoanCore (49%) $241 Million

KCG Holdings (4) (17%) $176 Million

($0 Million at Cost)

Financial Services $7.4 Billion

Leucadia Asset Management (100%) $548 Million (5)

Folger Hill Topwater Capital Strategic Investments Global Equity Events CoreCommodity Mazama Capital

FXCM $759 Million

($184 Million Invested, Net of Receipts) (6)

HomeFed (65%) $234 Million (7)

($479 Million at MV) (8)

Berkadia (50%) $207 Million

Foursight (100%) and Chrome (74%)

$77 Million

Merchant Banking $2.5 Billion

National Beef (79%) $766 Million

HRG Group (23%) $606 Million

($476 Million at Cost)

Vitesse Energy (96%) $260 Million

Juneau Energy (98%) $194 Million

Garcadia (~75%) $185 Million

Linkem (55%) $146 Million

Conwed (100%) $115 Million

Golden Queen (35%)

$81 Million

Idaho Timber (100%)

$74 Million

Corporate / Liquidity $1.9 Billion

Parent Company Cash & Investments $0.9 Billion (1, 5)

Deferred Tax Asset $1.2 Billion (9)

Corporate Other Liabilities, Net $(152) Million

Note: Dollar amounts are Leucadia’s net carrying amount as of 6/30/15 for each investment, for consolidated subsidiaries equal to their assets less liabilities.

(1) Reduced for payoff at maturity of 2015 8.125% Sr. Notes using Parent Company Cash. See Appendix on page 172 for reconciliation to GAAP amounts.

(2) Includes $2.7 billion of goodwill and intangibles. (3) Includes $2.0 billion of goodwill and intangibles.

(4) Adjusted for KCG Holdings’ tender offer completed on 6/9/15, where Jefferies sold 6.5 million shares at $14.00 per share resulting in $91 million of proceeds.

(5) Leucadia Asset Management excludes $348 million of highly liquid marketable securities, available for sale immediately (included in Parent Company Cash & Investments). (6) Represents the initial cash outlay of $279 million reduced by cash receipts of $95 million as of 6/30/15.

(7) Carrying amount is net of deferred gain on real estate sale. (8) Market value as of 6/30/15.

(9) Represents the Leucadia net deferred tax asset; the Jefferies net deferred tax asset is reflected within the Jefferies book value presented.

9

BERKADIA

10

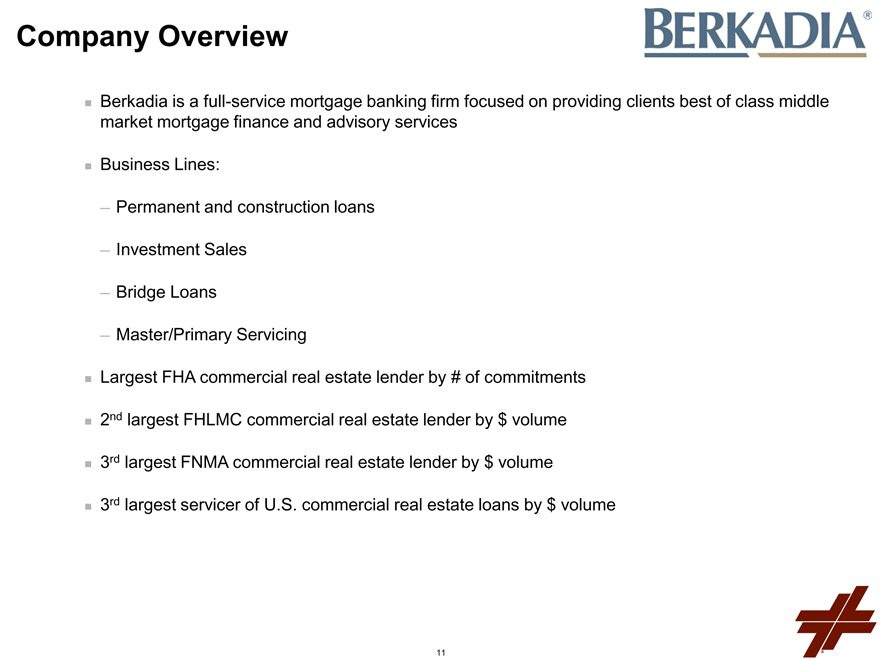

Company Overview

Berkadia is a full-service mortgage banking firm focused on providing clients best of class middle market mortgage finance and advisory services

Business Lines:

Permanent and construction loans

Investment Sales

Bridge Loans

Master/Primary Servicing

Largest FHA commercial real estate lender by # of commitments 2nd largest FHLMC commercial real estate lender by $ volume 3rd largest FNMA commercial real estate lender by $ volume 3rd largest servicer of U.S. commercial real estate loans by $ volume

11

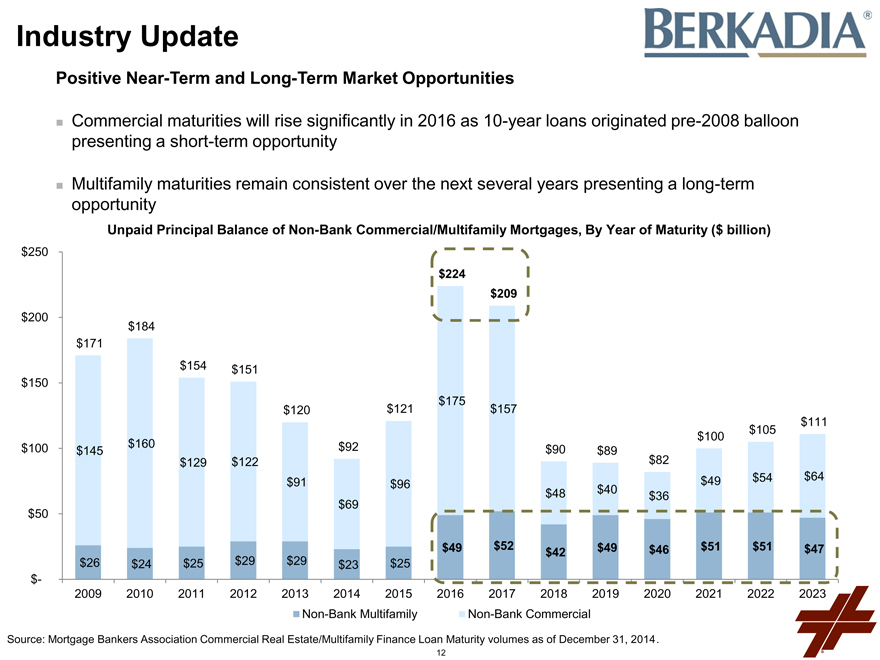

Industry Update

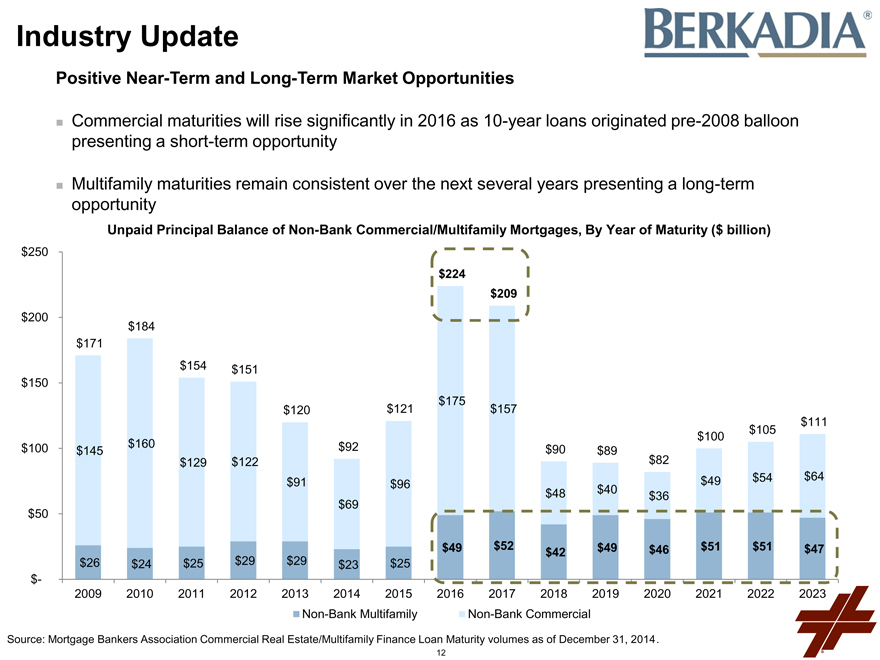

Positive Near-Term and Long-Term Market Opportunities

Commercial maturities will rise significantly in 2016 as 10-year loans originated pre-2008 balloon presenting a short-term opportunity

Multifamily maturities remain consistent over the next several years presenting a long-term opportunity

Unpaid Principal Balance of Non-Bank Commercial/Multifamily Mortgages, By Year of Maturity ($ billion)

$250 $224 $209 $200 $184 $171 $154 $151 $150 $175 $120 $121 $157 $111 $105 $100 $100 $160 $92 $145 $90 $89 $82 $129 $122

$49 $54 $64

$91 $96

$48 $40 $36 $69 $50

$49 $52 $49 $46 $51 $51 $47 $42

$26 $24 $25 $29 $29 $23 $25 $-

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Non-Bank Multifamily Non-Bank Commercial

Source: Mortgage Bankers Association Commercial Real Estate/Multifamily Finance Loan Maturity volumes as of December 31, 2014.

12

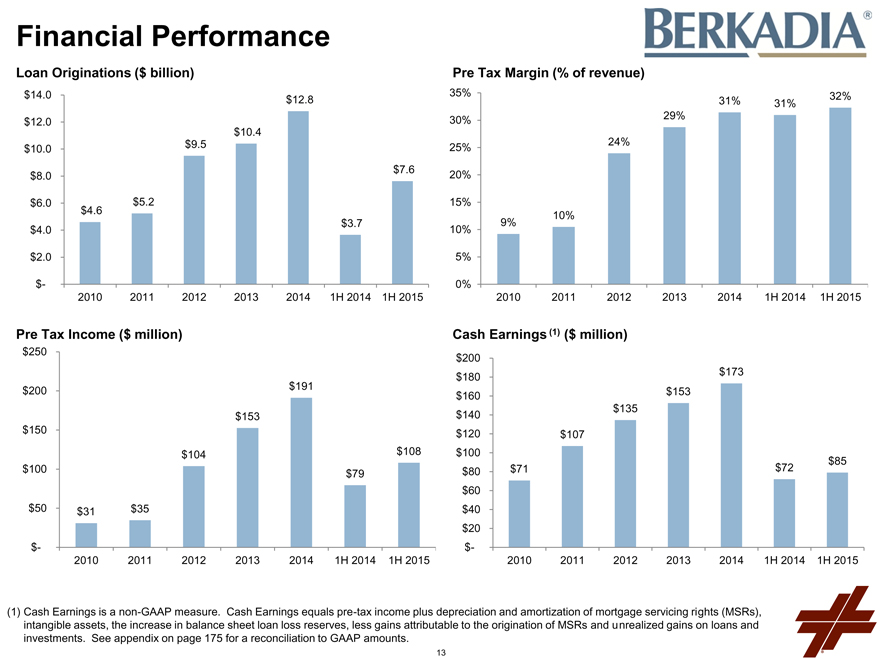

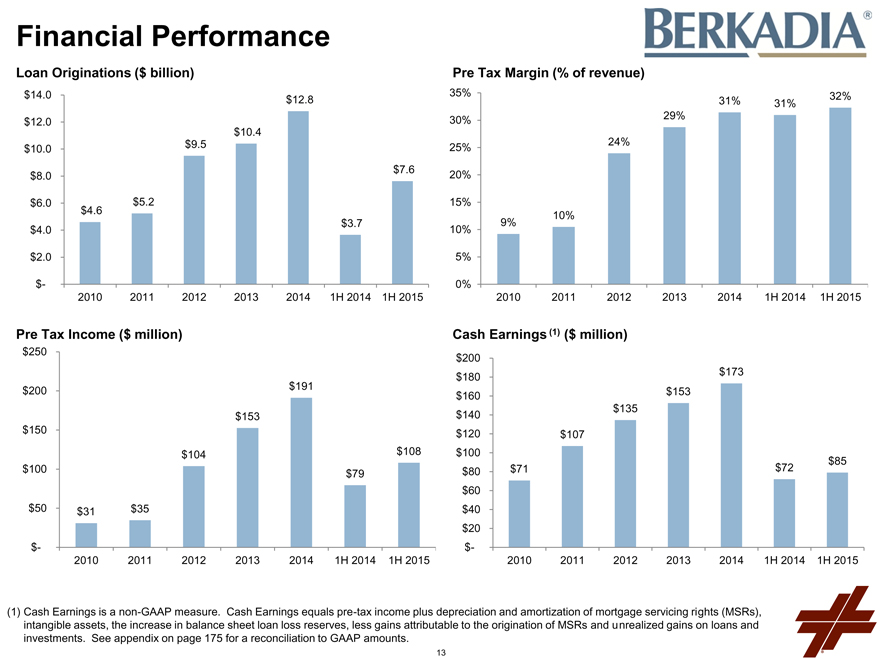

Financial Performance

Loan Originations ($ billion)

Pre Tax Margin (% of revenue)

$14.0 $12.8

$12.0 $10.4 $10.0 $9.5

$7.6

$8.0

$6.0 $5.2

$4.6

$3.7

$4.0

$2.0

$-

2010 2011 2012 2013 2014 1H 2014 1H 2015

35% 32% 31% 31% 30% 29% 24% 25%

20%

15%

10% 9% 10%

5%

0%

2010 2011 2012 2013 2014 1H 2014 1H 2015

Pre Tax Income ($ million)

$250

$200 $191 $153 $150 $104 $108 $100 $79

$50 $31 $35

$-

2010 2011 2012 2013 2014 1H 2014 1H 2015

Cash Earnings (1) ($ million)

$200 $173 $180 $160 $153 $135 $140 $120 $107 $100 $85

$80 $71 $72 $60 $40 $20 $-

2010 2011 2012 2013 2014 1H 2014 1H 2015

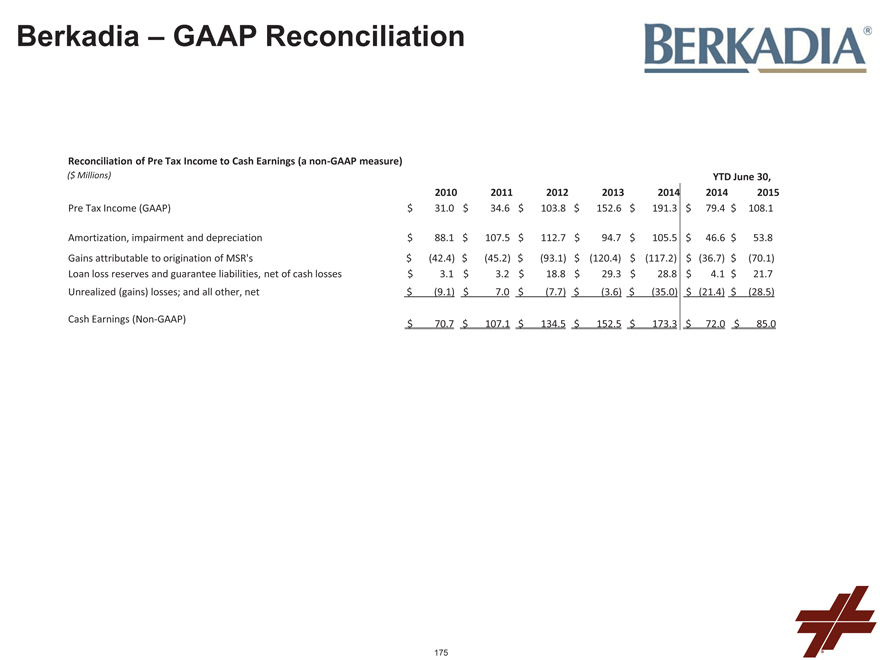

(1) Cash Earnings is a non-GAAP measure. Cash Earnings equals pre-tax income plus depreciation and amortization of mortgage servicing rights (MSRs), intangible assets, the increase in balance sheet loan loss reserves, less gains attributable to the origination of MSRs and unrealized gains on loans and investments. See appendix on page 175 for a reconciliation to GAAP amounts.

13

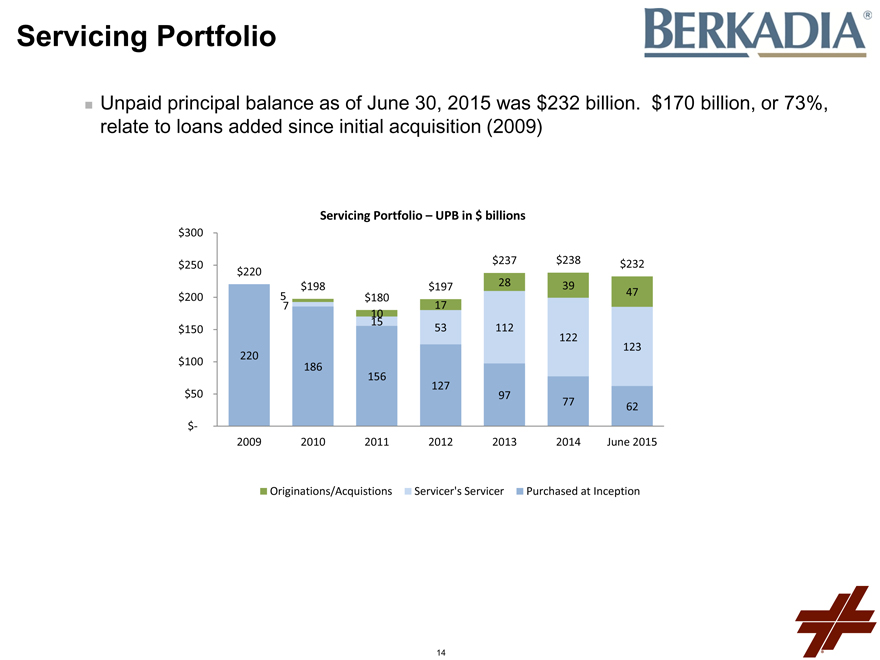

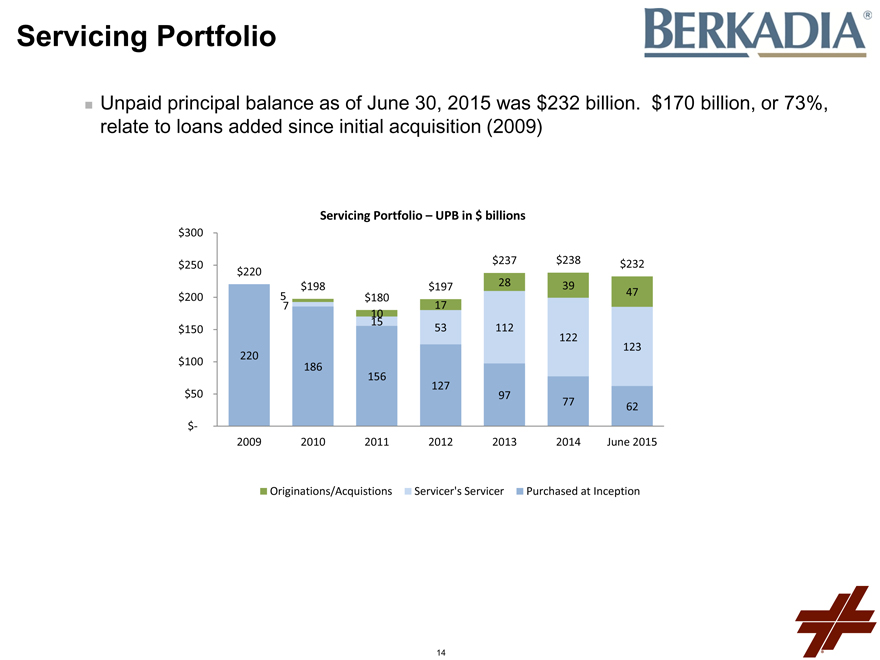

Servicing Portfolio

Unpaid principal balance as of June 30, 2015 was $232 billion. $170 billion, or 73%, relate to loans added since initial acquisition (2009)

Servicing Portfolio – UPB in $ billions

$300

$237 $238 $232 $250 $220 $198 $197 28 39 47 $200 5 7 $180 17 10 15 $150 53 112 122 123 220 $100 186 156 127

$50 97

77

62 $-2009 2010 2011 2012 2013 2014 June 2015

Originations/Acquistions Servicer’s Servicer Purchased at Inception

14

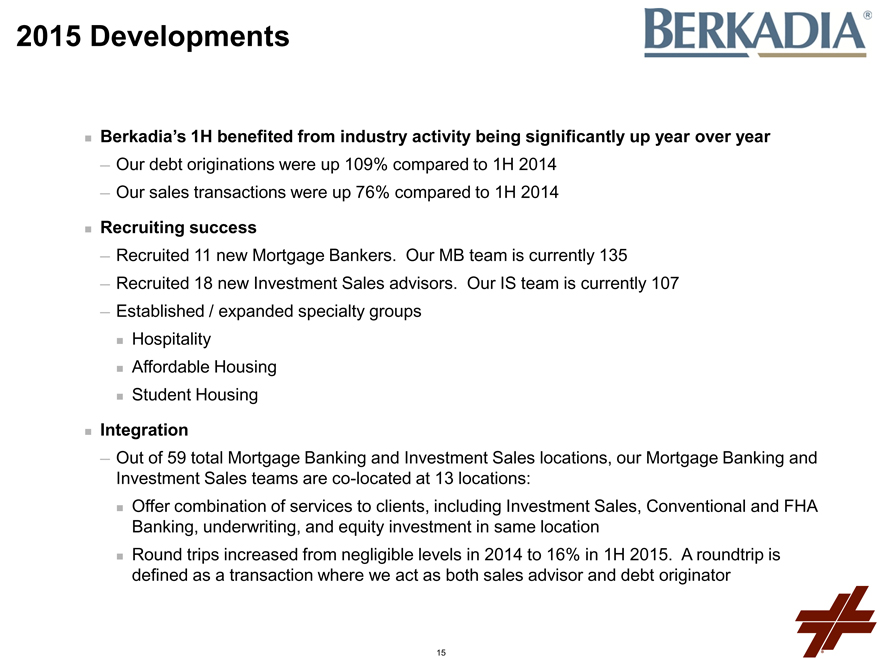

2015 Developments

Berkadia’s 1H benefited from industry activity being significantly up year over year

Our debt originations were up 109% compared to 1H 2014

Our sales transactions were up 76% compared to 1H 2014

Recruiting success

Recruited 11 new Mortgage Bankers. Our MB team is currently 135

Recruited 18 new Investment Sales advisors. Our IS team is currently 107

Established / expanded specialty groups Hospitality Affordable Housing Student Housing

Integration

Out of 59 total Mortgage Banking and Investment Sales locations, our Mortgage Banking and Investment Sales teams are co-located at 13 locations:

Offer combination of services to clients, including Investment Sales, Conventional and FHA

Banking, underwriting, and equity investment in same location

Round trips increased from negligible levels in 2014 to 16% in 1H 2015. A roundtrip is defined as a transaction where we act as both sales advisor and debt originator

15

2015-2016 Strategic Priorities

Increase Business with Existing Clients

Unique Ideas, Proprietary Databases and Solutions

Speed

Expand Client Reach

Rifle-Shot Recruiting

Continued Integration of Offices / Team Approach

Drive Profitability and Cash Flow

Market Share and Revenue Growth

Process and Technology Improvements

Relentlessly.

16

FXCM LISTED NYSE

FXCM

17

Note on Forward Looking Statements

Certain statements contained herein may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and/or the Private Securities Litigation Reform Act of 1995, which reflect FXCM’s current views with respect to, among other things, its operations and financial performance in the future, and the potential impact to FXCM of the cybersecurity incident described in this press release. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about FXCM’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with the events that took place in the currency markets on January 15, 2015 and their impact on FXCM’s capital structure, risks associated with FXCM’s ability to recover all or a portion of any capital losses, risks relating to the ability of FXCM to satisfy the terms and conditions of or make payments pursuant to the terms of the credit agreement with Leucadia, risks related to FXCM’s dependence on FX market makers, market conditions, risks associated with the outcome of any potential litigation or regulatory inquiries to which FXCM may become subject as a result of this cybersecurity incident, risks associated with potential reputational damage to FXCM resulting from this cybersecurity incident, the outcome of FXCM’s ongoing investigation (including FXCM’s potential discovery of additional information relating to this cybersecurity incident) and the extent of remediation costs and other additional expenses that may be incurred by FXCM as a result of this security incident, and those other risks described under “Risk Factors” in FXCM Inc.‘s Annual Report on Form 10-K and other reports or documents FXCM files with, or furnishes to, the SEC from time to time, which are accessible on the SEC website at sec.gov. This information should also be read in conjunction with FXCM’s Consolidated Financial Statements and the Notes thereto contained in FXCM’s Annual Report on Form 10-K, and in other reports or documents the FXCM files with, or furnishes to, the SEC from time to time, which are accessible on the SEC website at sec.gov.

18

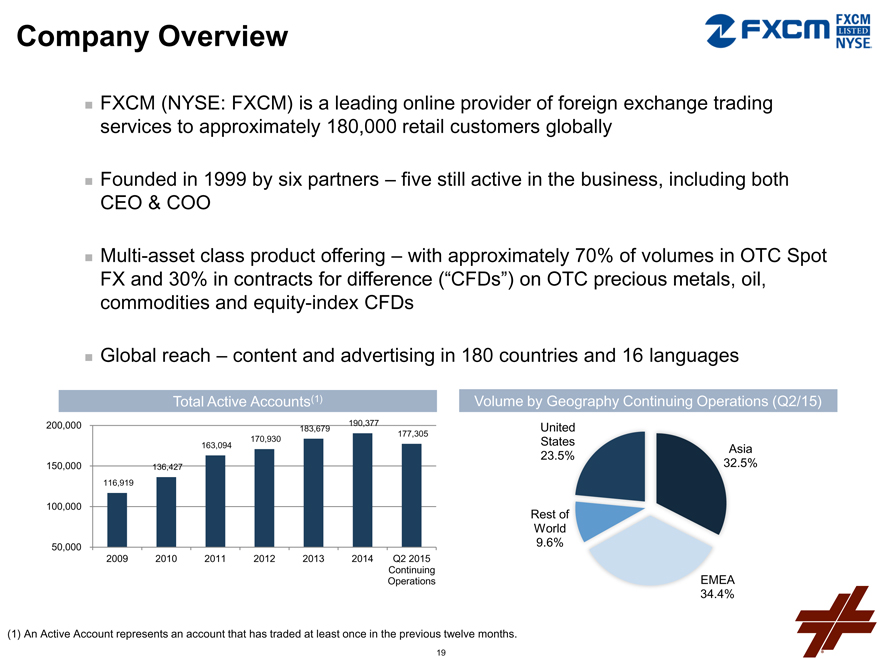

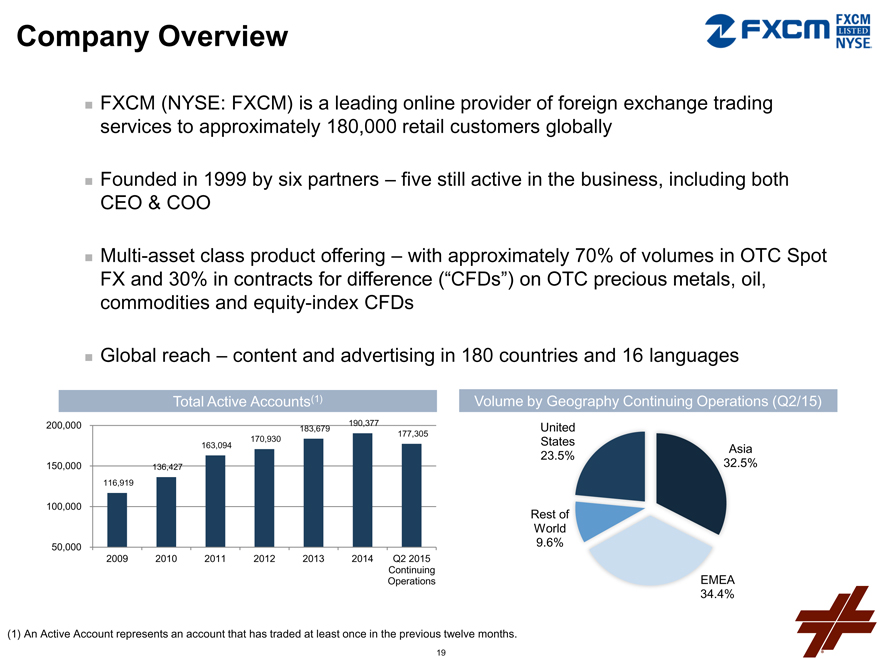

Company Overview

FXCM (NYSE: FXCM) is a leading online provider of foreign exchange trading services to approximately 180,000 retail customers globally

Founded in 1999 by six partners – five still active in the business, including both CEO & COO

Multi-asset class product offering – with approximately 70% of volumes in OTC Spot

FX and 30% in contracts for difference (“CFDs”) on OTC precious metals, oil, commodities and equity-index CFDs

Global reach – content and advertising in 180 countries and 16 languages

Total Active Accounts(1)

200,000 190,377 183,679

177,305 170,930 163,094

150,000 136,427 116,919

100,000

50,000

2009 2010 2011 2012 2013 2014 Q2 2015 Continuing Operations

Volume by Geography Continuing Operations (Q2/15)

United States

Asia 23.5% 32.5%

Rest of World

9.6%

EMEA 34.4%

(1) An Active Account represents an account that has traded at least once in the previous twelve months.

19

Transaction Summary

2014 adjusted revenues of $453 million and adjusted EBITDA of $107 million; market capitalization of $1.2 billion prior to Swiss National Bank (“SNB”) currency adjustment

Leucadia provided a two-year $300 million secured financing in January 2015 to support the capital shortfall that resulted from extraordinary volatility in the Swiss Franc as a result of the action taken by the SNB on January 15, 2015

$203 million remains outstanding today, which is expected to be repaid in the next 6 months, and Leucadia has realized $148 million from principal repayments, interest and fees through September 30, 2015

Leucadia is entitled to a percentage of the proceeds received in connection with certain transactions, including sale proceeds, dividends and distributions

20

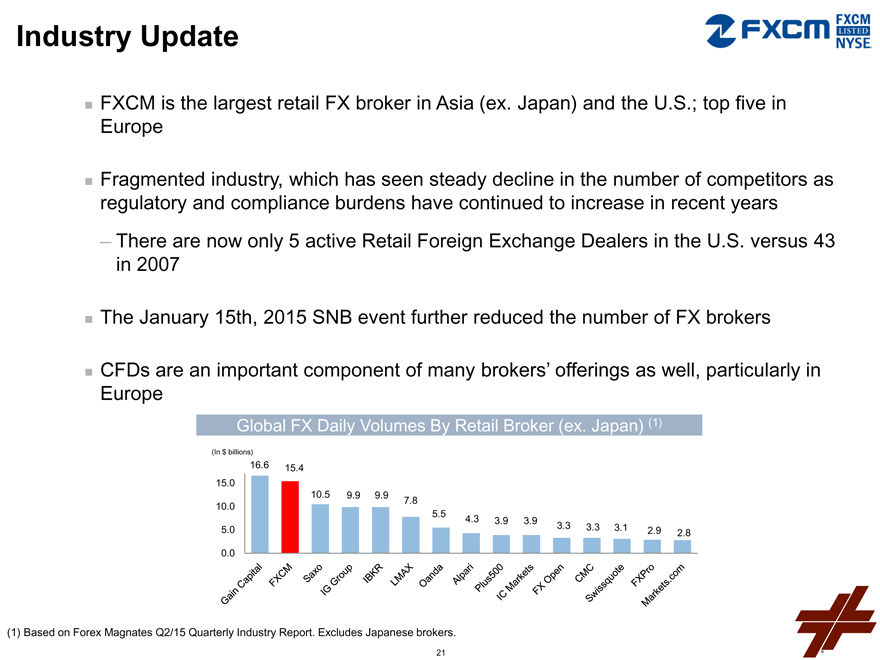

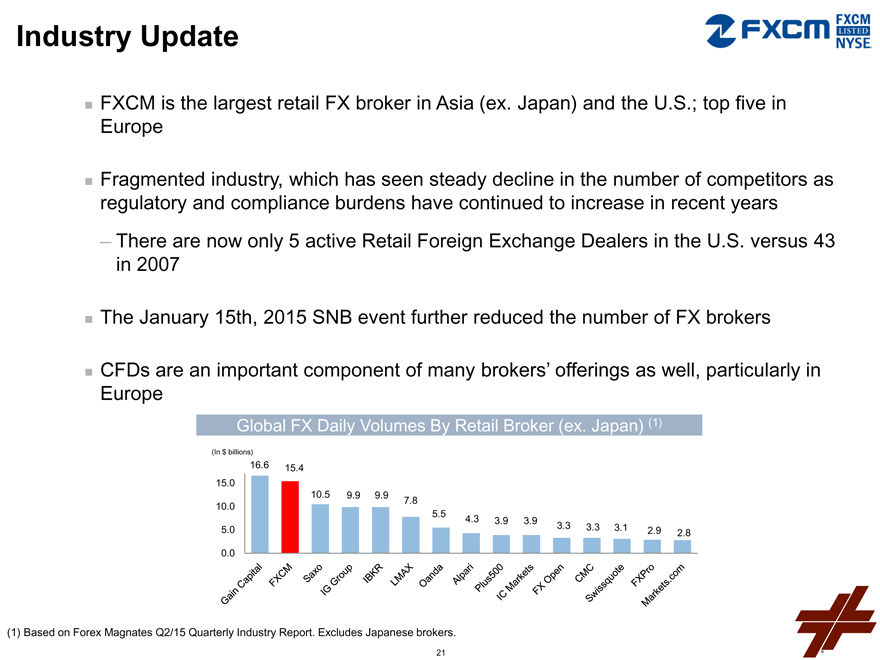

Industry Update

FXCM is the largest retail FX broker in Asia (ex. Japan) and the U.S.; top five in Europe

Fragmented industry, which has seen steady decline in the number of competitors as regulatory and compliance burdens have continued to increase in recent years

There are now only 5 active Retail Foreign Exchange Dealers in the U.S. versus 43 in 2007

The January 15th, 2015 SNB event further reduced the number of FX brokers

CFDs are an important component of many brokers’ offerings as well, particularly in Europe

Global FX Daily Volumes By Retail Broker (ex. Japan) (1)

(In $ billions)

16.6 15.4

15.0

10.5 9.9 9.9

7.8 10.0

5.5 4.3

3.9 3.9 3.3

5.0 3.3 3.1 2.9

2.8

0.0

Gain Capital FXCM Saxo IG Group IBKR LMAX ONDA Alpari Plus500 IC MARKETS FXOpen CMC Swissquote FXPro Markets.com

(1) Based on Forex Magnates Q2/15 Quarterly Industry Report. Excludes Japanese brokers.

21

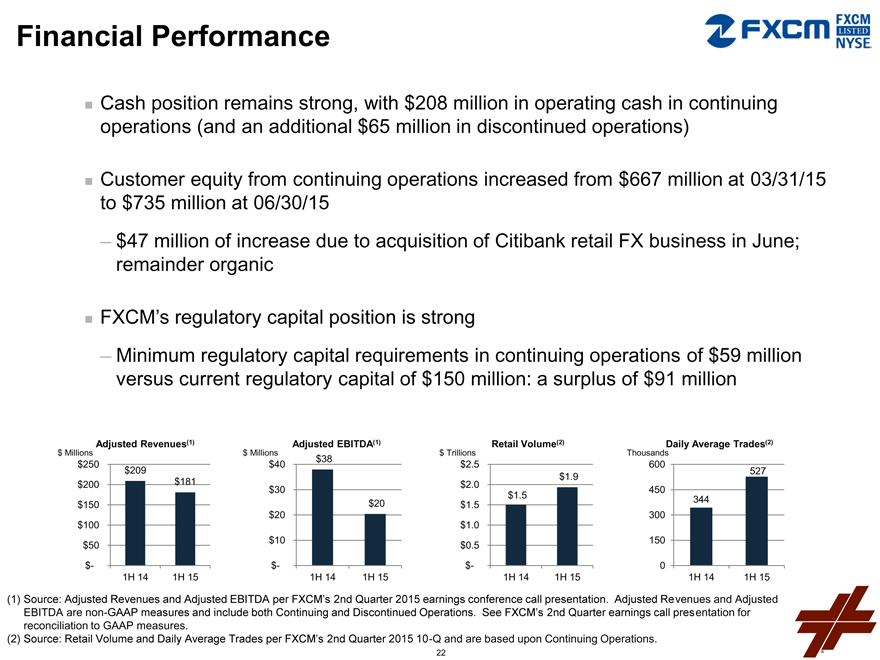

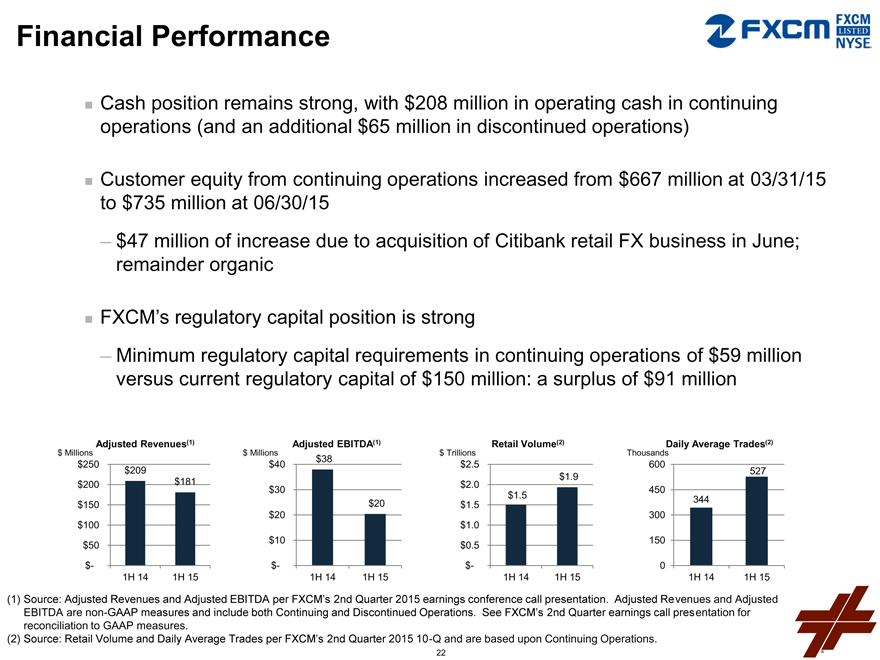

Financial Performance

Cash position remains strong, with $208 million in operating cash in continuing

operations (and an additional $65 million in discontinued operations)

Customer equity from continuing operations increased from $667 million at 03/31/15

to $735 million at 06/30/15

$47 million of increase due to acquisition of Citibank retail FX business in June;

remainder organic

FXCM’s regulatory capital position is strong

Minimum regulatory capital requirements in continuing operations of $59 million

versus current regulatory capital of $150 million: a surplus of $91 million

Adjusted Revenues(1) $ Millions $250 $209 $200 $181 $150

$100

$50

$-

1H 14 1H 15

Adjusted EBITDA(1) $ Millions $38 $40

$30 $20 $20

$10

$-

1H 14 1H 15

Retail Volume(2) $ Trillions

$2.5

$1.9

$2.0

$1.5

$1.5

$1.0

$0.5

$-

1H 14 1H 15

Daily Average Trades(2)

Thousands

600

527 450 344 300

150

0

1H 14 1H 15

(1) Source: Adjusted Revenues and Adjusted EBITDA per FXCM’s 2nd Quarter 2015 earnings conference call presentation. Adjusted Revenues and Adjusted EBITDA are non-GAAP measures and include both Continuing and Discontinued Operations. See FXCM’s 2nd Quarter earnings call presentation for reconciliation to GAAP measures.

(2) Source: Retail Volume and Daily Average Trades per FXCM’s 2nd Quarter 2015 10-Q and are based upon Continuing Operations.

22

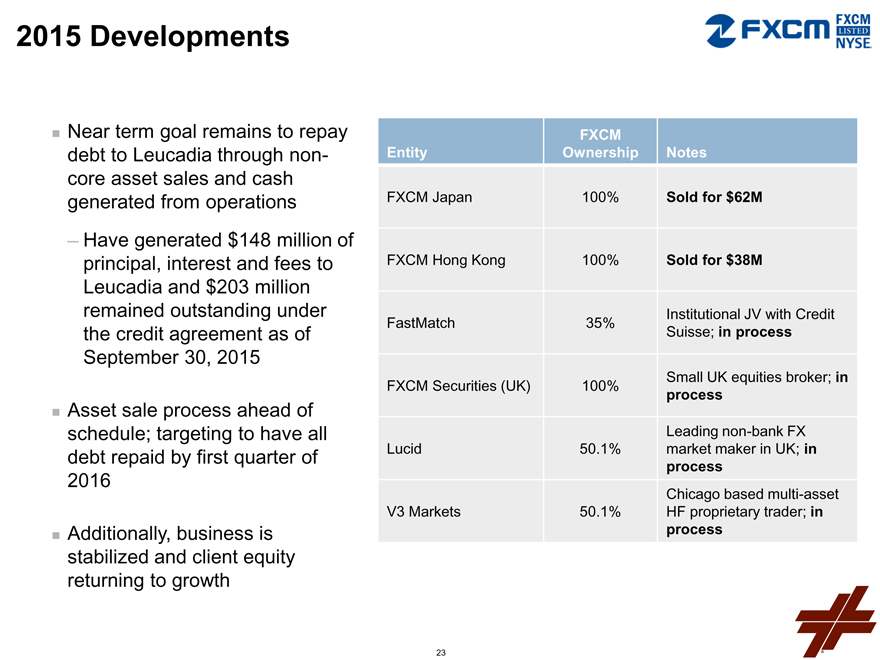

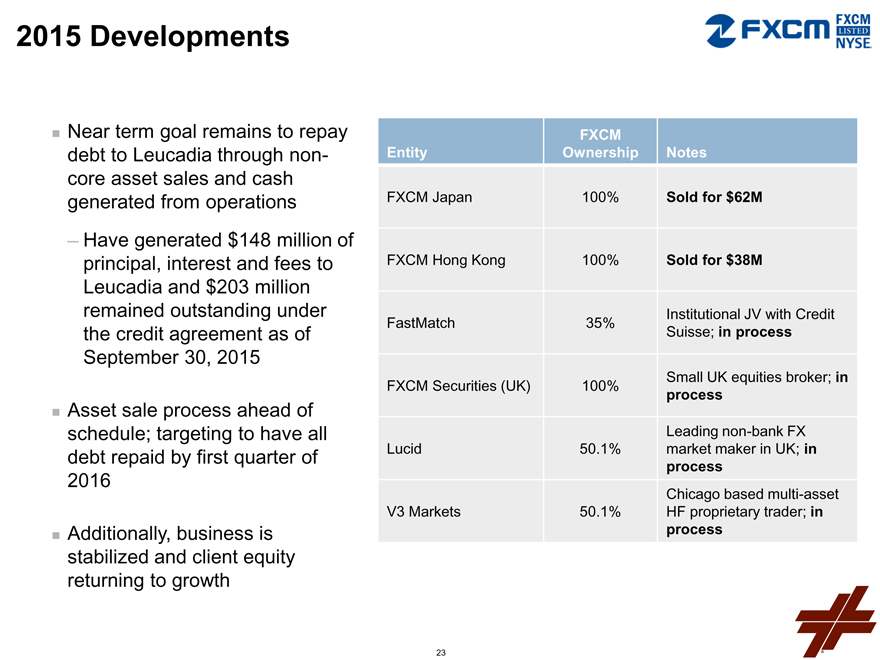

2015 Developments

Near term goal remains to repay debt to Leucadia through non-core asset sales and cash generated from operations

Have generated $148 million of principal, interest and fees to Leucadia and $203 million remained outstanding under the credit agreement as of September 30, 2015

Asset sale process ahead of schedule; targeting to have all debt repaid by first quarter of 2016

Additionally, business is stabilized and client equity returning to growth

FXCM

Entity Ownership Notes

FXCM Japan 100% Sold for $ 62M

FXCM Hong Kong 100% Sold for $ 38M

FastMatch 35% Institutional JV with Credit

Suisse; in process

FXCM Securities (UK) 100% Small UK equities broker; in

process

Leading non-bank FX

Lucid 50.1% market maker in UK; in

process

Chicago based multi-asset

V3 Markets 50.1% HF proprietary trader; in

process

23

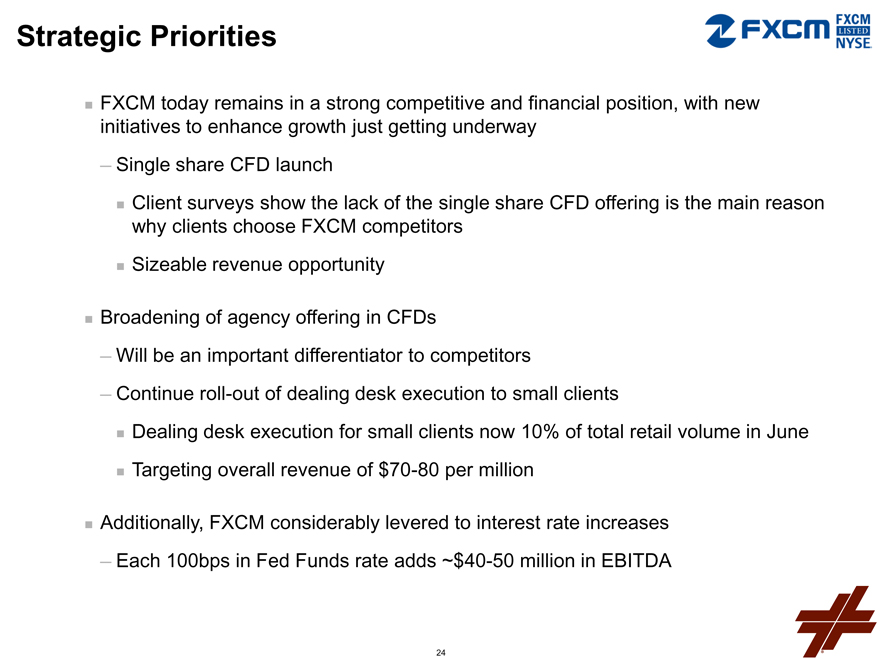

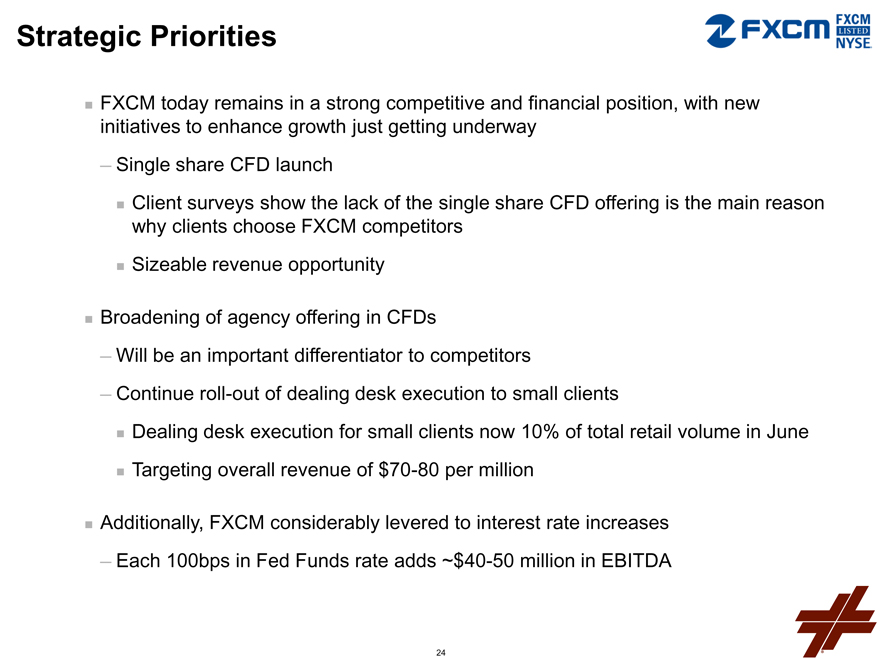

Strategic Priorities

FXCM today remains in a strong competitive and financial position, with new initiatives to enhance growth just getting underway

Single share CFD launch

Client surveys show the lack of the single share CFD offering is the main reason why clients choose FXCM competitors Sizeable revenue opportunity

Broadening of agency offering in CFDs

Will be an important differentiator to competitors

Continue roll-out of dealing desk execution to small clients

Dealing desk execution for small clients now 10% of total retail volume in June

Targeting overall revenue of $70-80 per million

Additionally, FXCM considerably levered to interest rate increases

Each 100bps in Fed Funds rate adds ~$40-50 million in EBITDA

24

HOMEFED CORPORATION

25

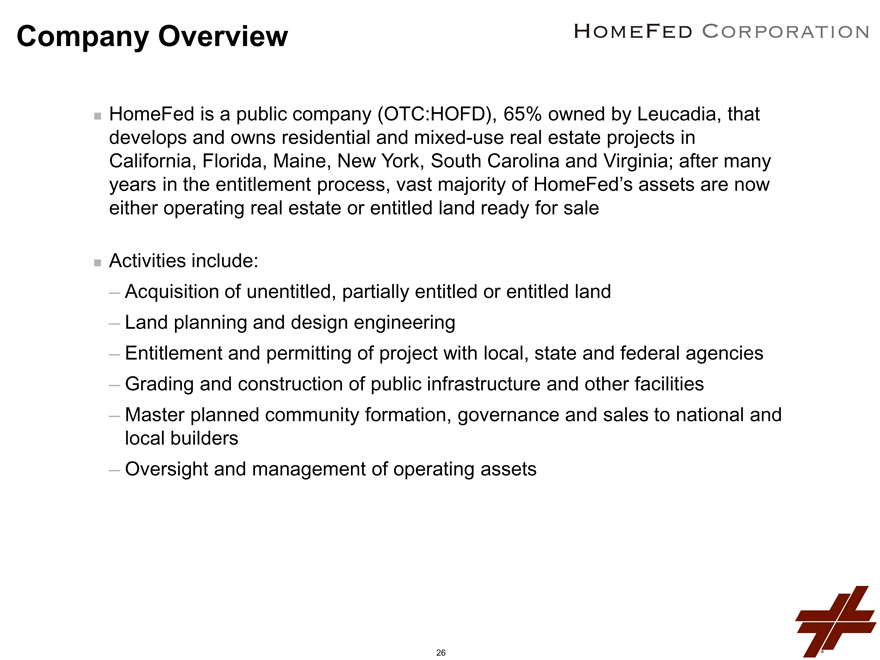

Company Overview

HomeFed is a public company (OTC:HOFD), 65% owned by Leucadia, that develops and owns residential and mixed-use real estate projects in California, Florida, Maine, New York, South Carolina and Virginia; after many years in the entitlement process, vast majority of HomeFed’s assets are now either operating real estate or entitled land ready for sale

Activities include:

Acquisition of unentitled, partially entitled or entitled land

Land planning and design engineering

Entitlement and permitting of project with local, state and federal agencies

Grading and construction of public infrastructure and other facilities

Master planned community formation, governance and sales to national and local builders

Oversight and management of operating assets

HOMEFED CORPORATION

26

Property Locations

Rampage Vineyard

Pacho

San Elijo Hills

Fanita Ranch

Otay Ranch

Northeast Point

Renaissance Plaza

Ashville Park

The Market Common

SweetBay

Mexico

United States

Gulf of Mexico

27

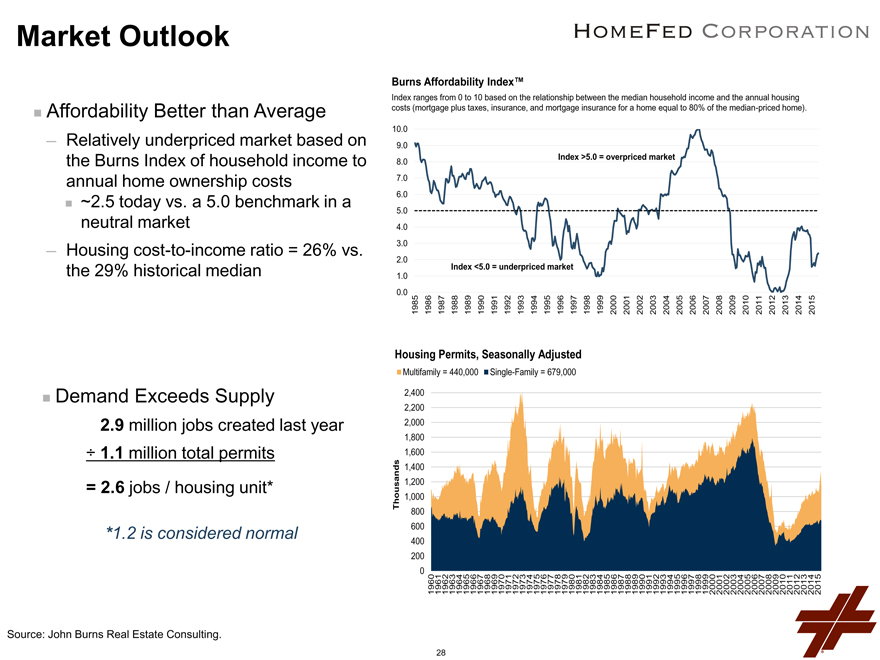

Market Outlook

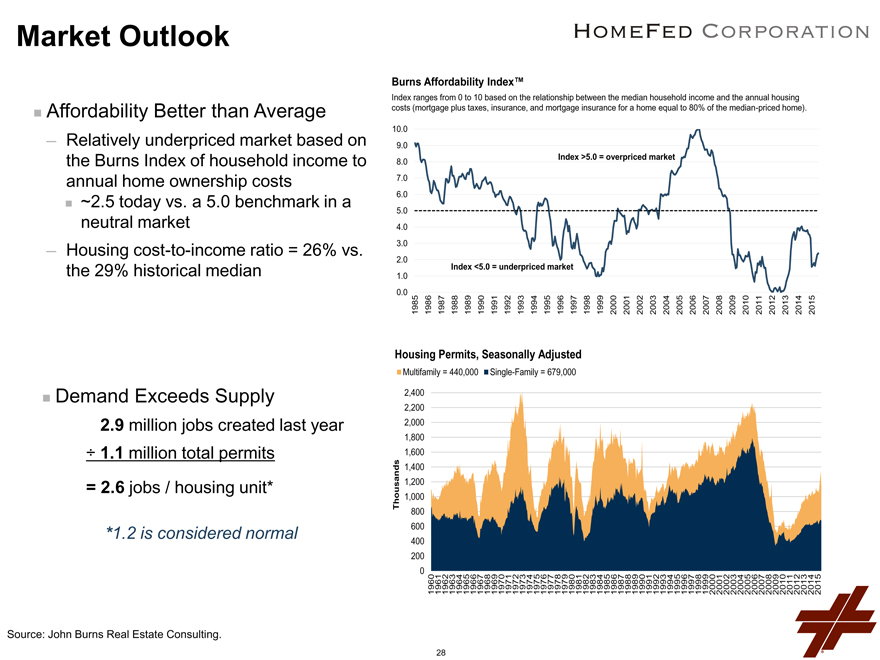

Affordability Better than Average

Relatively underpriced market based on the Burns Index of household income to annual home ownership costs

~2.5 today vs. a 5.0 benchmark in a neutral market

Housing cost-to-income ratio = 26% vs. the 29% historical median

Demand Exceeds Supply

2.9 million jobs created last year

÷ 1.1 million total permits

= 2.6 jobs / housing unit*

*1.2 is considered normal

Burns Affordability Index™

Index ranges from 0 to 10 based on the relationship between the median household income and the annual housing costs (mortgage plus taxes, insurance, and mortgage insurance for a home equal to 80% of the median-priced home).

10.0

9.0

Index >5.0 = overpriced market

8.0

7.0

6.0

5.0

4.0

3.0

2.0

Index <5.0 = underpriced market

1.0

0.0 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Source: John Burns Real Estate Consulting, LLC BHVI (Data: Jul-15, 2.4 Current; Pub: Aug-15)

Housing Permits, Seasonally Adjusted

Multifamily = 440,000 Single-Family = 679,000

Source: Thousands

Census 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400

1960

1961

Bureau 1962

1963

(Data: 1964

1965

Jul 1966

-

15, 1967

Pub: 1969 1968

Aug 1971 1970

-

15) 1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

28

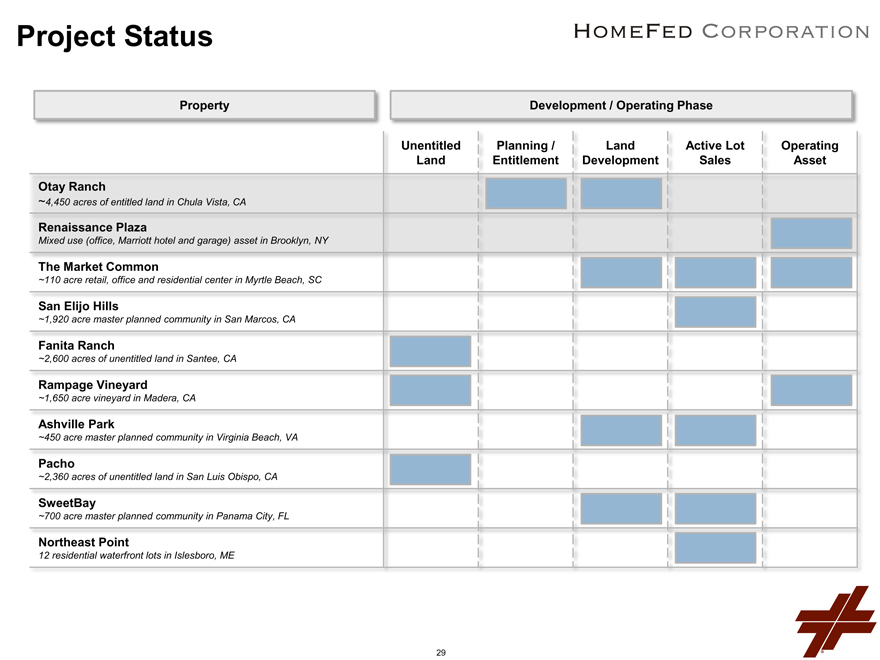

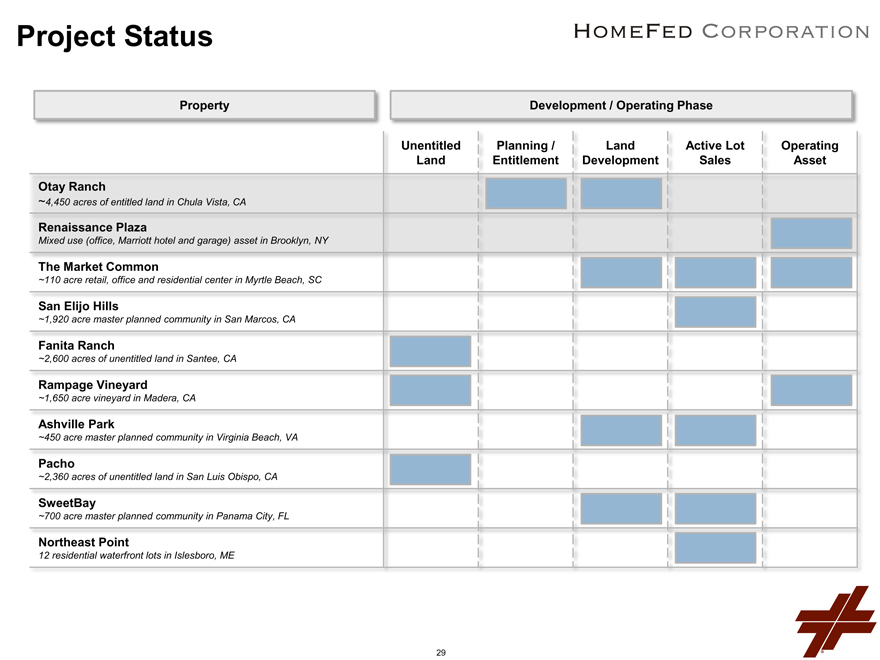

Project Status

Property

Development / Operating Phase

Unentitled

Land Planning /

Entitlement Land

Development Active Lot

Sales Operating

Asset

Otay Ranch

~4,450 acres of entitled land in Chula Vista, CA

Renaissance Plaza

Mixed use (office, Marriott hotel and garage) asset in Brooklyn, NY

The Market Common

~110 acre retail, office and residential center in Myrtle Beach, SC

San Elijo Hills

~1,920 acre master planned community in San Marcos, CA

Fanita Ranch

~2,600 acres of unentitled land in Santee, CA

Rampage Vineyard

~1,650 acre vineyard in Madera, CA

Ashville Park

~450 acre master planned community in Virginia Beach, VA

Pacho

~2,360 acres of unentitled land in San Luis Obispo, CA

SweetBay

~700 acre master planned community in Panama City, FL

Northeast Point

12 residential waterfront lots in Islesboro, ME

29

2015 Developments

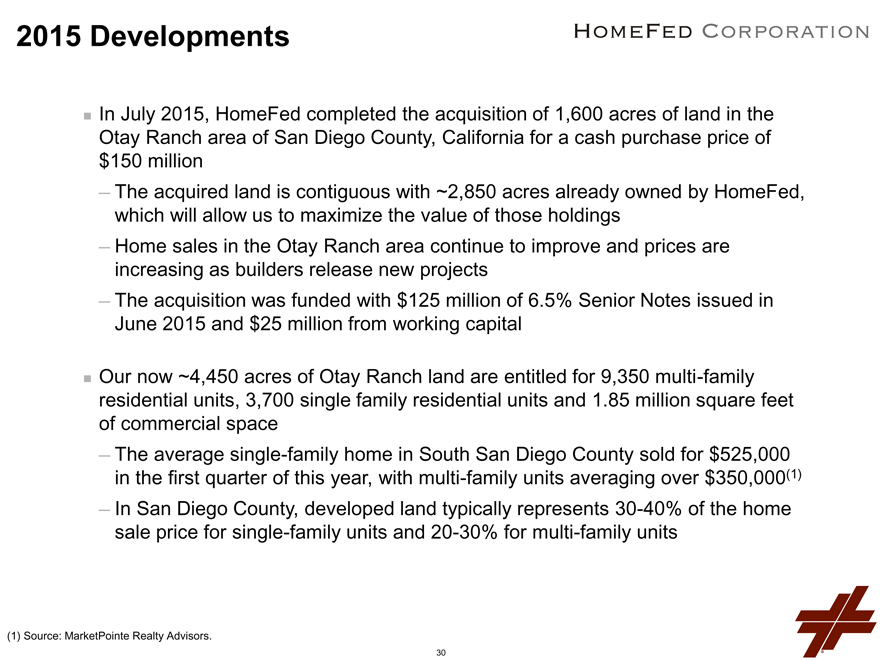

In July 2015, HomeFed completed the acquisition of 1,600 acres of land in the Otay Ranch area of San Diego County, California for a cash purchase price of $150 million

The acquired land is contiguous with ~2,850 acres already owned by HomeFed, which will allow us to maximize the value of those holdings

Home sales in the Otay Ranch area continue to improve and prices are increasing as builders release new projects

The acquisition was funded with $125 million of 6.5% Senior Notes issued in June 2015 and $25 million from working capital

Our now ~4,450 acres of Otay Ranch land are entitled for 9,350 multi-family residential units, 3,700 single family residential units and 1.85 million square feet of commercial space

The average single-family home in South San Diego County sold for $525,000 in the first quarter of this year, with multi-family units averaging over $350,000(1)

In San Diego County, developed land typically represents 30-40% of the home sale price for single-family units and 20-30% for multi-family units

(1) Source: MarketPointe Realty Advisors.

30

Strategic Priorities

Turn our land into cash

Optimize Otay Ranch assets – focus on expediting development programs and maximizing revenue over the coming years Increase lot and home sales throughout our other active projects, including:

Ashville Park in Virginia

The Market Common in South Carolina

San Elijo Hills in California

SweetBay in Florida

Develop land strategically and continue entitlement processes where ongoing

31

Foursight Capital

32

Company Overview

Auto loan originator and servicer

Successor to Franklin Capital’s auto finance business

Franklin was liquidated in early 2012 after pulling back during the credit crisis

Funded and serviced $5.2 billion of cumulative auto receivables and serviced a peak $1.2 billion portfolio

Leucadia partnered with management to restart the business, initially leveraging originations from Garcadia, but most of the growth has come from 3rd party dealerships

80% of Q2 ’15 originations from 3rd party dealerships, up from 70% in Q4 ’14

33

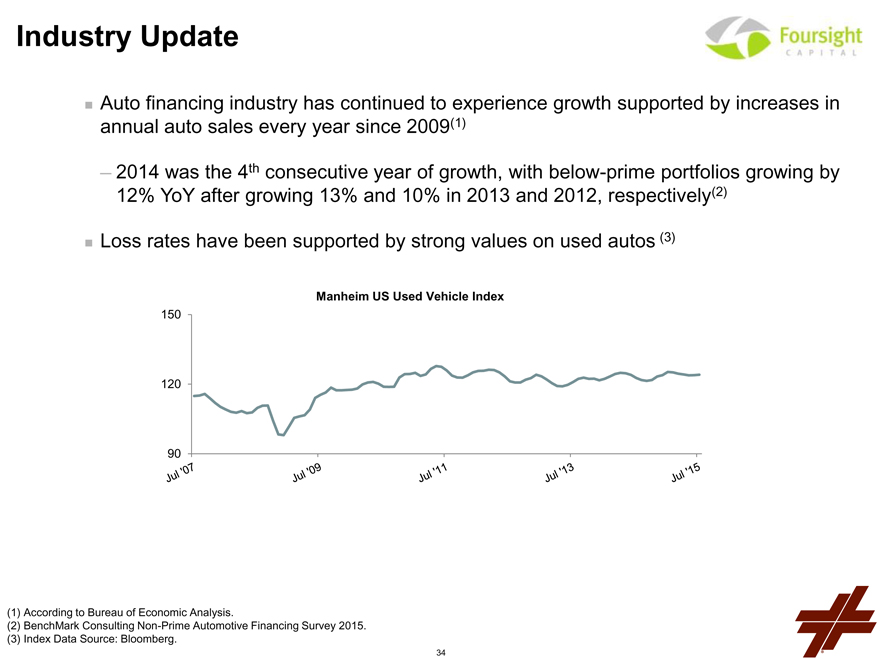

Industry Update

Auto financing industry has continued to experience growth supported by increases in annual auto sales every year since 2009(1)

2014 was the 4th consecutive year of growth, with below-prime portfolios growing by 12% YoY after growing 13% and 10% in 2013 and 2012, respectively(2)

Loss rates have been supported by strong values on used autos (3)

Manheim US Used Vehicle Index

150 120 90

Jul’07 jul’09 jul’11 JUL’13 JUL’15

(1) According to Bureau of Economic Analysis.

(2) BenchMark Consulting Non-Prime Automotive Financing Survey 2015. (3) Index Data Source: Bloomberg.

34

2015 Developments & Portfolio Growth

Surpassed $250 million in assets and currently pacing $20+ million of originations per month

Medium term goal is to grow annual originations to $500 million (supported by an estimated $90 million in capital), with a pre-tax return on equity of ~20%

$60 Portfolio Overview ($ Millions) $250

$30 $125

$0 $0

Quarterly Originations (Left) Outstanding Portfolio (Right)

Added 7 additional marketing and origination reps, bringing total to 17

Closed second term ABS in May for $106 million (FCART 2015-1)

Rated by DBRS

Brought Chrome Capital in as first sub-servicing client

35

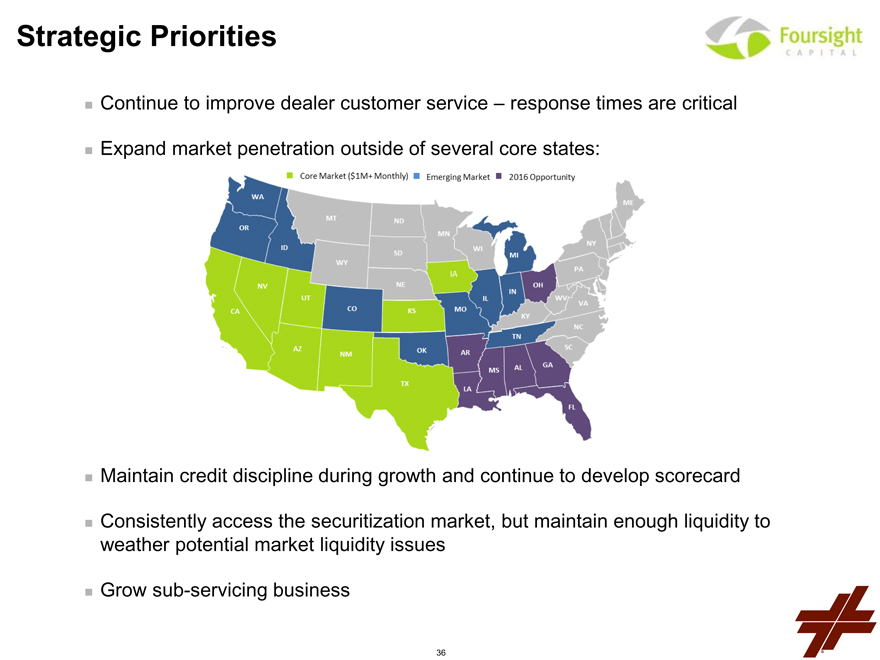

Strategic Priorities

Continue to improve dealer customer service – response times are critical

Expand market penetration outside of several core states:

Maintain credit discipline during growth and continue to develop scorecard

Consistently access the securitization market, but maintain enough liquidity to weather potential market liquidity issues

Grow sub-servicing business

36

Leucadia Asset Management

37

General Disclaimer

Past performance is not indicative of future results.

This presentation does not constitute an offer of any commodities, securities or investment advisory services and should not be used to form the basis of any investment decision in any of the investment strategies or funds described herein. Information contained herein does not purport to be complete and is subject to change. Actual characteristics and performance may differ from the assumptions used in preparing these materials. Changes in assumptions may have a material impact on the information set forth in these materials. Neither Leucadia nor its affiliates makes any representation or warranty as to the appropriateness or accuracy of such assumptions or the actual yield that an account adviser or investor may receive.

38

Business Overview

Diversified alternative asset management platform – seeding and developing focused funds managed by distinct management teams

Fee-generating assets, long-term stable cash flows, able to recycle capital

Goal of growing third party AUM, while earning a reasonable return on our capital

Compelling edge – leverage Jefferies to source, and Leucadia to capitalize and syndicate

$548 million Leucadia book value in LAM products as of June 30, 2015, excluding $348 million of investments in marketable securities available for sale immediately; this does not reflect any potential value of the management companies executing these strategies (1)

Recently initiated LAM-level marketing & IR function

Continue to seek new platforms / partners

(1) The $548 million of LAM book value is across Folger Hill, Topwater Capital and CoreCommodity. The $348 million includes investments across Mazama Capital, Strategic Investments, Global Equity Events and others, which are highly liquid marketable securities available for sale immediately.

39

Platforms and Strategies

Strategic Investments Division (Quantitative Strategies)

Proprietary Jefferies strategy since 2006; flagship external fund established in 2011; $1.1 billion AUM equivalent

Systematic Macro Investment Division (Quantitative Strategies)

Division to be launched Q4 2015 to create fund that will pursue macro quantitative strategies

Folger Hill Asset Management (Multi-Manager)

Launched in 2015 with $400 million Leucadia seed investment; $1.1 billion AUM

Topwater Capital (Multi-Manager / First-loss)

Launched in 2013 with Leucadia $100 million seed investment; 22 consecutive positive months through August 2015; $843 million regulatory AUM

CoreCommodity Management (Commodity Strategies)

Proprietary Jefferies strategy since 2003; spun off in 2013; $5.7 billion AUM

Global Equity Events Opportunity Fund (Event-Driven Strategies)

Proprietary Jefferies strategy since 2007; external fund established in 2014; $134 million AUM equivalent

Mazama Capital Management (1) (Long-Only Growth Equity)

20+ year track record of long only growth equity investing; $503 million AUM

54 Madison (Real Estate)

Recently launched real estate / hospitality special situations; initial investments approved in September; maximum Leucadia commitment of $225 million

(1) Leucadia owns a revenue share in Mazama Capital Management but does not have any equity interest.

40

FOLGER HILL

41

Overview

Founded in mid-2014; Launched fund in March 2015 with Leucadia seed investment of $400 million; $1.1 billion AUM as of June 30, 2015

Multi-manager discretionary long/short equity hedge fund platform aiming to deliver strong positive results with lower volatility and market correlation than typical equity long/short hedge funds

Absolute return investment strategy, with broad industry and geographic diversification

Portfolio manager expense pass-through plus incentive fee model Robust risk systems and focus on liquidity 58 full time employees as of September 30, 2015 Board of Directors: Rich Handler, Brian Friedman and Sol Kumin

42

Key Differentiators

High-pedigree portfolio managers and analytical support

PMs average 15 years of investment experience

Sourced from best-in-class fundamental equity investment firms

Large allocations: average PM buying power of $337 million as of June 30, 2015 (1)

Top caliber compliance and finance teams centrally monitoring portfolios and limits

CRO: Todd Rapp – Highfields, Karsch, Goldman Sachs

CCO: Lisa Baroni – U.S. Attorney’s Office, Southern District of N.Y., Securities and

Commodities Fraud Unit

CFO: John Larre – Karsch, Morgan Stanley

General Counsel: Jason Ketchen – Fidelity, Geode, Bingham McCutchen

Business Development: Kevin McDonald & Jared Brecher

Head Trader: Tucker Jones – MFS Investment Management

(1) Buying Power is equivalent to available Gross Market Value.

43

Talent Selection

What We Look For

Long/short equity PMs, primarily with a sector-specific focus

Investment processes that utilize fundamental idea generation to identify a path that will drive prices over a specified time horizon

Repeatable and scalable investment process

Proven alpha generation capability

Individuals we believe can successfully operate within our risk parameters and culture

How We Find It

Talent acquisition is a dedicated, full-time and ongoing function

Leverage management team and Leucadia contacts with investment professionals to identify candidates

Engage in multi-step vetting process whereby potential PMs will meet with Business Development professionals, Senior Management and existing PMs

Conduct independent and robust due diligence and background checks

44

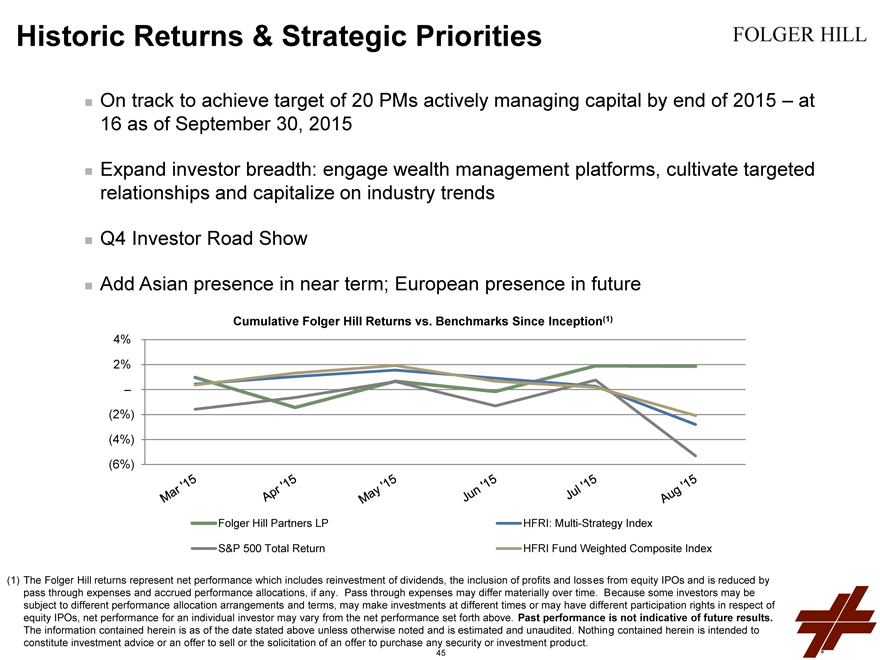

Historic Returns & Strategic Priorities

On track to achieve target of 20 PMs actively managing capital by end of 2015 – at 16 as of September 30, 2015

Expand investor breadth: engage wealth management platforms, cultivate targeted relationships and capitalize on industry trends

Q4 Investor Road Show

Add Asian presence in near term; European presence in future

Cumulative Folger Hill Returns vs. Benchmarks Since Inception(1)

4%

2%

–

(2%)

(4%)

(6%)

Folger Hill Partners LP HFRI: Multi-Strategy Index

S&P 500 Total Return HFRI Fund Weighted Composite Index

(1) The Folger Hill returns represent net performance which includes reinvestment of dividends, the inclusion of profits and losses from equity IPOs and is reduced by pass through expenses and accrued performance allocations, if any. Pass through expenses may differ materially over time. Because some investors may be subject to different performance allocation arrangements and terms, may make investments at different times or may have different participation rights in respect of equity IPOs, net performance for an individual investor may vary from the net performance set forth above. Past performance is not indicative of future results.

The information contained herein is as of the date stated above unless otherwise noted and is estimated and unaudited. Nothing contained herein is intended to constitute investment advice or an offer to sell or the solicitation of an offer to purchase any security or investment product.

45

Topwater Capital

46

Topwater Capital – Overview

Highly-scalable multi-manager and multi-strategy liquid securities fund targeting low volatility and positive returns in all market environments

Continuous track record dating back to 2004

Initial Leucadia investment in Q3 2013

Soft launch in late 2013 and first full year of operation in 2014

Pioneered the first-loss model of investing

Portfolio managers required to contribute capital that sits in a first loss position

Creates strong layer of principal protection

Portfolio managers compensated by above-market incentives Returns are beating benchmarks, with lower volatility

$ 843 million regulatory AUM as of June 30, 2015

47

Topwater Capital – Key Differentiators

Proven track record of delivering consistent positive uncorrelated performance, with 100% positive annual performance dating back to 2004, including a 10% annual return in 2008 and positive returns in August and September 2015

Added well over 200 managers to platform since 2004

Experienced, dedicated risk team, fully devoted to monitoring underlying aggregated risks

Fund Portfolio Metrics:

2014 Rate of Return: 7.7%, net; YTD August 31, 2015: 5.8%, net

Annualized Standard Deviation: 1.63%

Annualized Sharpe Ratio: 3.88

% Positive Months: 92.0%

Correlation to S&P 500: 0.15

48

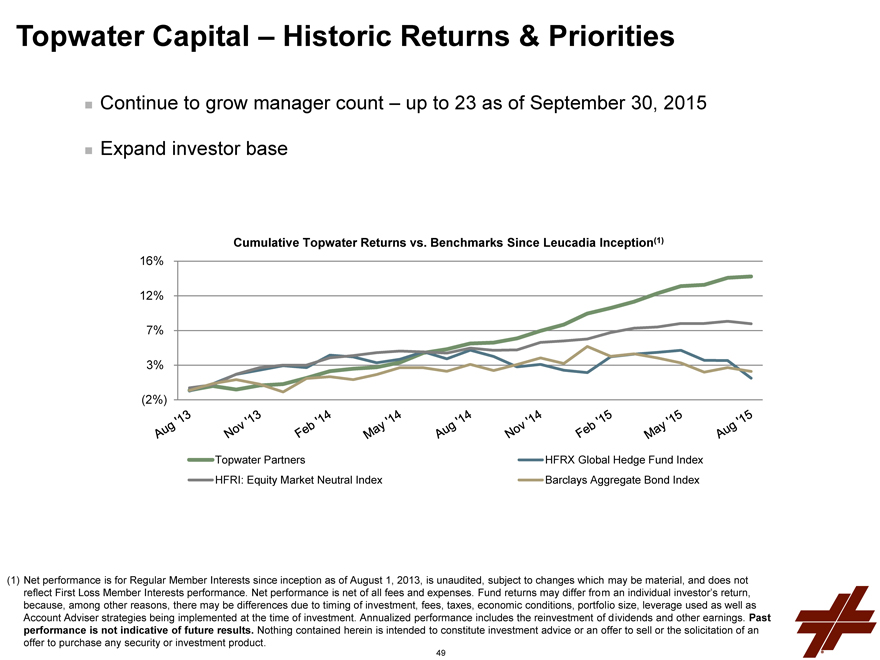

Topwater Capital – Historic Returns & Priorities

Continue to grow manager count – up to 23 as of September 30, 2015

Expand investor base

Cumulative Topwater Returns vs. Benchmarks Since Leucadia Inception(1)

16%

12%

7%

3%

(2%)

Topwater Partners HFRX Global Hedge Fund Index

HFRI: Equity Market Neutral Index Barclays Aggregate Bond Index

Net performance is for Regular Member Interests since inception as of August 1, 2013, is unaudited, subject to changes which may be material, and does not reflect First Loss Member Interests performance. Net performance is net of all fees and expenses. Fund returns may differ from an individual investor’s return, because, among other reasons, there may be differences due to timing of investment, fees, taxes, economic conditions, portfolio size, leverage used as well as Account Adviser strategies being implemented at the time of investment. Annualized performance includes the reinvestment of dividends and other earnings. Past performance is not indicative of future results. Nothing contained herein is intended to constitute investment advice or an offer to sell or the solicitation of an offer to purchase any security or investment product.

49

Strategic Investments Division

50

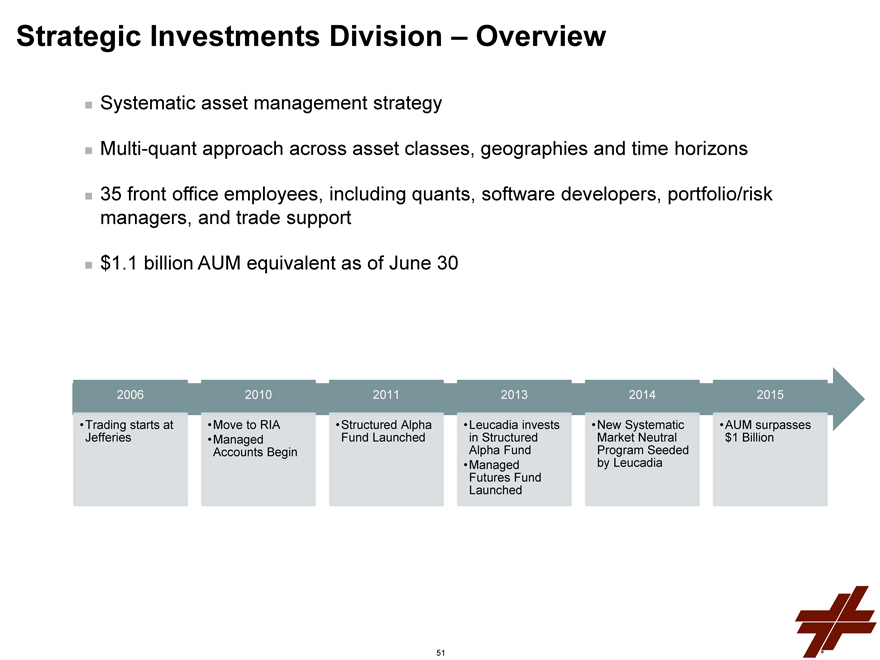

Strategic Investments Division – Overview

Systematic asset management strategy

Multi-quant approach across asset classes, geographies and time horizons

35 front office employees, including quants, software developers, portfolio/risk managers, and trade support

$1.1 billion AUM equivalent as of June 30

2006 2010 2011 2013 2014 2015

Trading starts at Move to RIA Structured Alpha Leucadia invests New Systematic AUM surpasses

Jefferies • Managed Fund Launched in Structured Market Neutral $1 Billion

Accounts Begin Alpha Fund Program Seeded

• Managed by Leucadia

Futures Fund

Launched

51

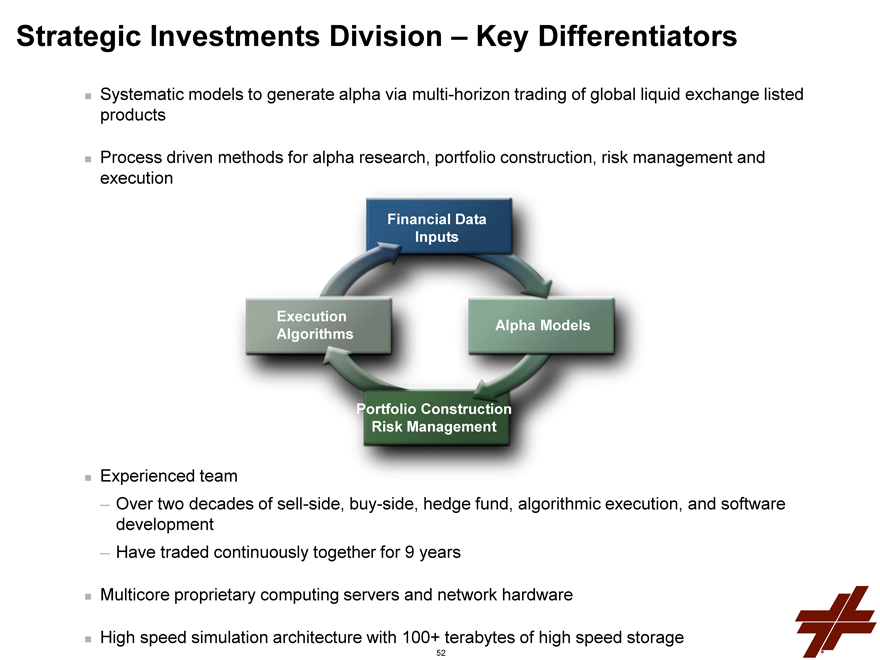

Strategic Investments Division – Key Differentiators

Systematic models to generate alpha via multi-horizon trading of global liquid exchange listed

products

Process driven methods for alpha research, portfolio construction, risk management and

execution

Financial Data

Inputs

Execution

Algorithms

Alpha Models

Portfolio Construction

Risk Management

Experienced team

Over two decades of sell-side, buy-side, hedge fund, algorithmic execution, and software

development

Have traded continuously together for 9 years

Multicore proprietary computing servers and network hardware

High speed simulation architecture with 100+ terabytes of high speed storage

52

Strategic Investments Division – Product Overview

Structured Alpha Program

11.8% annualized net returns since the program’s inception at Jefferies in 2006

Sharpe ratio above 2; typical turnover 5—10 days;

Low correlation to major asset classes, risk factors and peers

Managed Futures Program

Short term systematic diversified strategy set applied to global futures

Low correlation to CTA / Trend followers by design

10x the annualized rate of return of Newedge Short-Term Trading index since the program’s inception at Jefferies in 2007

Systematic Equity Market Neutral Program

Leucadia seeded October 2014, results to date meeting expectations

Targets mid-teens net return with 10% annualized volatility

Anticipate Founders Share Class launch early 2016

53

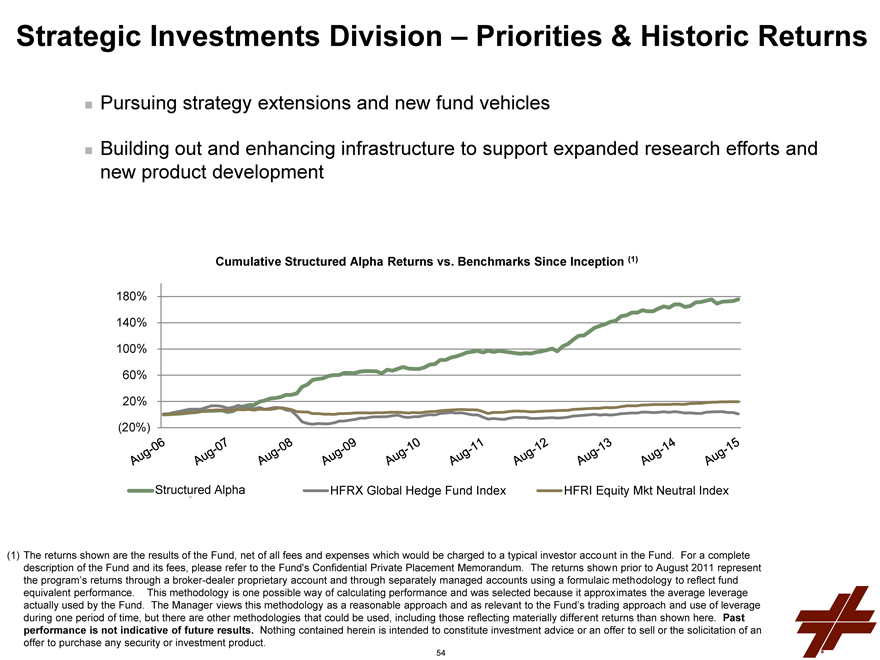

Strategic Investments Division – Priorities & Historic Returns Pursuing strategy extensions and new fund vehicles Building out and enhancing infrastructure to support expanded research efforts and new product development

Cumulative Structured Alpha Returns vs. Benchmarks Since Inception (1)

180%

140%

100%

60%

20%

(20%)

Structured Alpha HFRX Global Hedge Fund Index HFRI Equity Mkt Neutral Index

(1) The returns shown are the results of the Fund, net of all fees and expenses which would be charged to a typical investor account in the Fund. For a complete description of the Fund and its fees, please refer to the Fund’s Confidential Private Placement Memorandum. The returns shown prior to August 2011 represent the program’s returns through a broker-dealer proprietary account and through separately managed accounts using a formulaic methodology to reflect fund equivalent performance. This methodology is one possible way of calculating performance and was selected because it approximates the average leverage

actually used by the Fund. The Manager views this methodology as a reasonable approach and as relevant to the Fund’s trading approach and use of leverage during one period of time, but there are other methodologies that could be used, including those reflecting materially different returns than shown here. Past

performance is not indicative of future results. Nothing contained herein is intended to constitute investment advice or an offer to sell or the solicitation of an offer to purchase any security or investment product.

54

Q & A IRQuestions@Leucadia.com

Jefferies

55

Note on Adjusted Financials

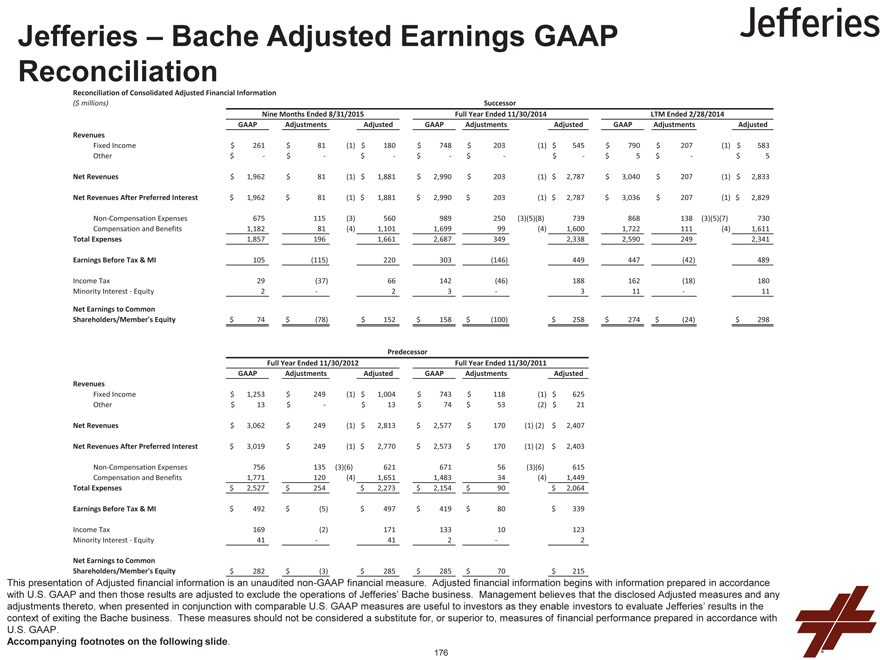

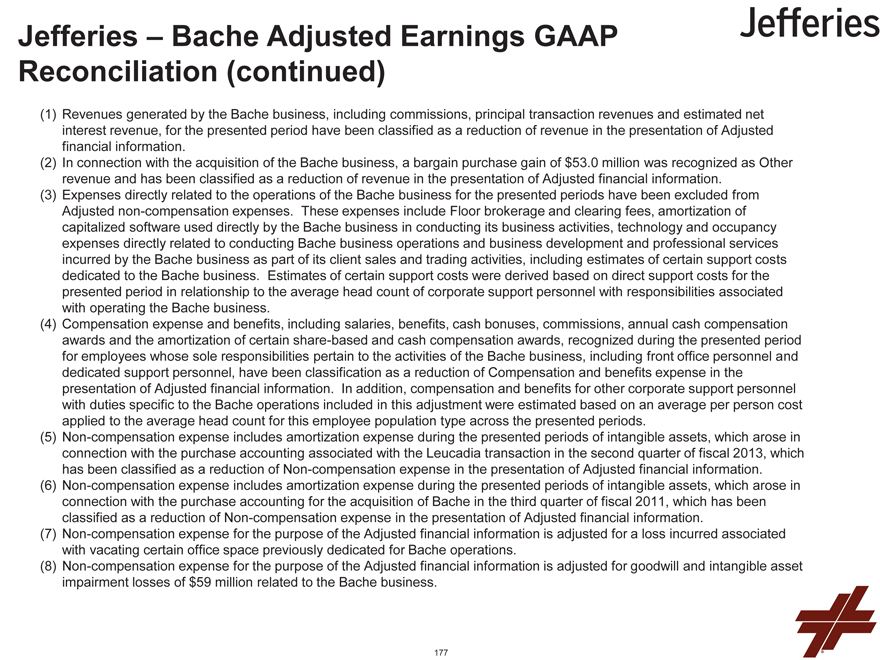

Note on the Use of Non-GAAP Financial Measures to Show Results Exclusive of the Bache Futures Business:

Jefferies announced during its fourth quarter 2014 that it would pursue strategic alternatives for its Bache futures business. Since that time, Jefferies has taken steps to exit the Bache futures business and has supplemented certain of its financial disclosures to show results that exclude the Bache futures business. These supplemental financial measures begin with information prepared in accordance with U.S. GAAP and are adjusted to exclude the operations of the Bache futures business. These adjusted financial measures are non-GAAP financial measures. Management believes such measures, when presented in conjunction with comparable U.S. GAAP measures, provide meaningful information as it enables investors to evaluate results in the context of the announced exit of the Bache futures business. These measures should not be considered a substitute for, or superior to, financial information prepared in accordance with U.S. GAAP.

Reconciliations of these non-GAAP financial measures to U.S. GAAP financial measures are contained throughout this presentation and on pages 176—177 of the appendix.

56

Jefferies Overview

57

Jefferies Strategic Update

We are building the leading, client-focused global investment banking firm, with our focus to provide clients with the best ideas, expertise and execution in global capital markets

Investment Banking and Equities have delivered solid, multi-year growth, and have continued momentum and meaningful upside

Fixed Income has proven more challenging due to periods of price volatility and low market activity in cash credit markets, which are Jefferies’ primary focus

Priorities are margin expansion and earnings growth

Fixed Income will be refocused to match opportunity ahead, reducing risk, balance sheet and capital utilization, and to deliver reasonable margins and returns

Bache exit is accretive to Jefferies’ earnings

58

Jefferies Operating Results

59

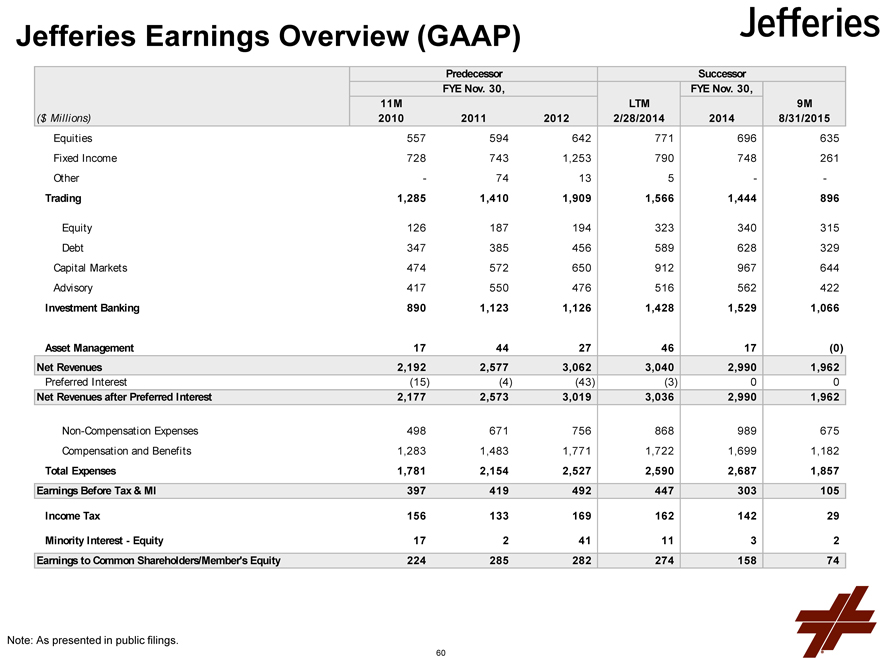

Jefferies Earnings Overview (GAAP)

Predecessor Successor

FYE Nov. 30, FYE Nov. 30,

11M LTM 9M

($ Millions) 2010 2011 2012 2/28/2014 2014 8/31/2015

Equities 557 594 642 771 696 635

Fixed Income 728 743 1,253 790 748 261

Other—74 13 5 —

Trading 1,285 1,410 1,909 1,566 1,444 896

Equity 126 187 194 323 340 315

Debt 347 385 456 589 628 329

Capital Markets 474 572 650 912 967 644

Advisory 417 550 476 516 562 422

Investment Banking 890 1,123 1,126 1,428 1,529 1,066

Asset Management 17 44 27 46 17(0)

Net Revenues 2,192 2,577 3,062 3,040 2,990 1,962

Preferred Interest(15)(4)(43)(3) 0 0

Net Revenues after Preferred Interest 2,177 2,573 3,019 3,036 2,990 1,962

Non-Compensation Expenses 498 671 756 868 989 675

Compensation and Benefits 1,283 1,483 1,771 1,722 1,699 1,182

Total Expenses 1,781 2,154 2,527 2,590 2,687 1,857

Earnings Before Tax & MI 397 419 492 447 303 105

Income Tax 156 133 169 162 142 29

Minority Interest—Equity 17 2 41 11 3 2

Earnings to Common Shareholders/Member’s Equity 224 285 282 274 158 74

Note: As presented in public filings.

60

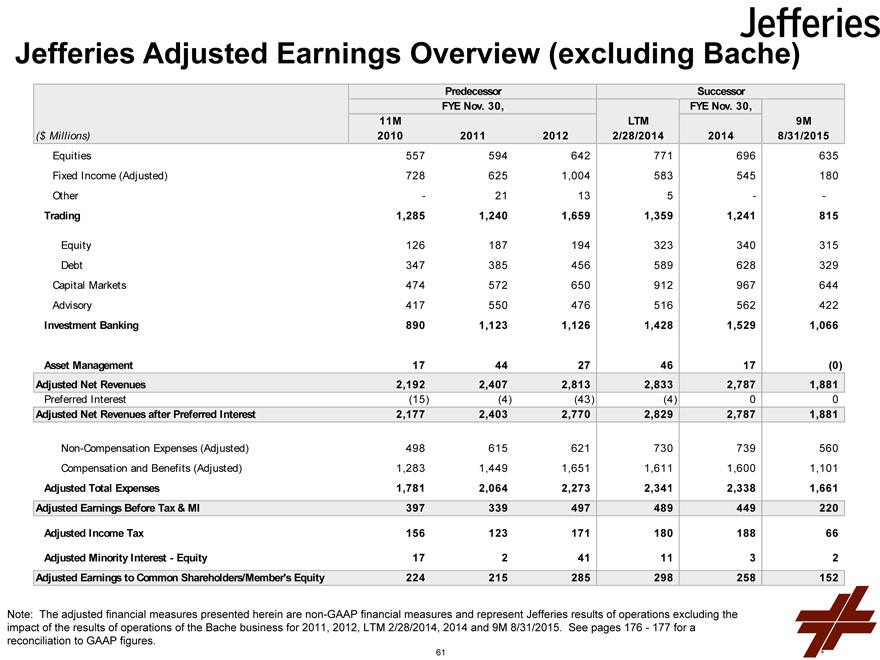

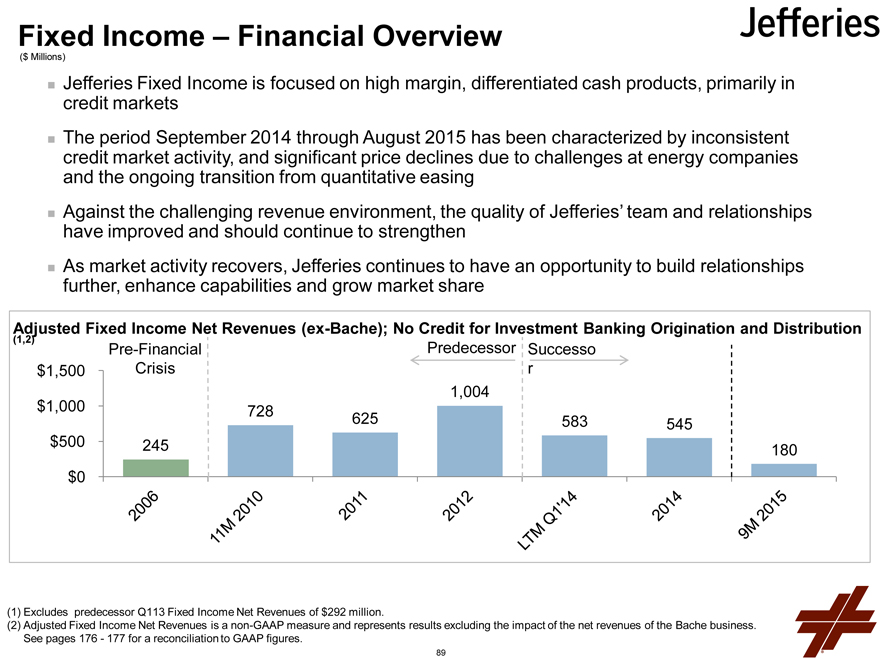

Jefferies Adjusted Earnings Overview (excluding Bache)

Predecessor Successor

FYE Nov. 30, FYE Nov. 30,

11M LTM 9M

($ Millions) 2010 2011 2012 2/28/2014 2014 8/31/2015

Equities 557 594 642 771 696 635

Fixed Income (Adjusted) 728 625 1,004 583 545 180

Other—21 13 5 —

Trading 1,285 1,240 1,659 1,359 1,241 815

Equity 126 187 194 323 340 315

Debt 347 385 456 589 628 329

Capital Markets 474 572 650 912 967 644

Advisory 417 550 476 516 562 422

Investment Banking 890 1,123 1,126 1,428 1,529 1,066

Asset Management 17 44 27 46 17(0)

Adjusted Net Revenues 2,192 2,407 2,813 2,833 2,787 1,881

Preferred Interest(15)(4)(43)(4) 0 0

Adjusted Net Revenues after Preferred Interest 2,177 2,403 2,770 2,829 2,787 1,881

Non-Compensation Expenses (Adjusted) 498 615 621 730 739 560

Compensation and Benefits (Adjusted) 1,283 1,449 1,651 1,611 1,600 1,101

Adjusted Total Expenses 1,781 2,064 2,273 2,341 2,338 1,661

Adjusted Earnings Before Tax & MI 397 339 497 489 449 220

Adjusted Income Tax 156 123 171 180 188 66

Adjusted Minority Interest—Equity 17 2 41 11 3 2

Adjusted Earnings to Common Shareholders/Member’s Equity 224 215 285 298 258 152

Note: The adjusted financial measures presented herein are non-GAAP financial measures and represent Jefferies results of operations excluding the impact of the results of operations of the Bache business for 2011, 2012, LTM 2/28/2014, 2014 and 9M 8/31/2015. See pages 176—177 for a reconciliation to GAAP figures.

61

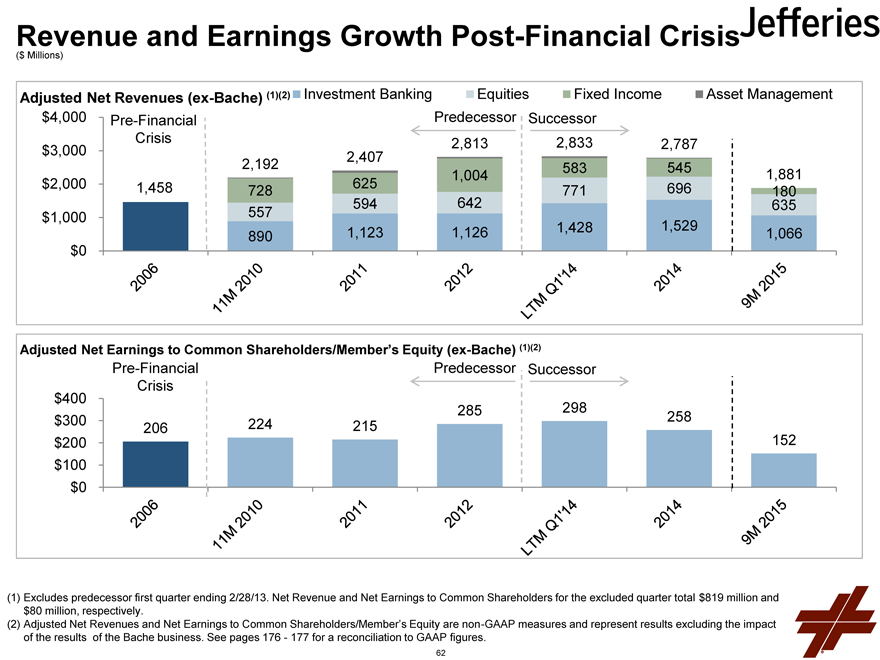

Revenue and Earnings Growth Post-Financial Crisis

($ Millions)

Adjusted Net Revenues (ex-Bache) (1)(2) Investment Banking Equities Fixed Income Asset Management

$4,000 Pre-Financial Predecessor Successor

Crisis 2,813 2,833 2,787

$3,000 2,407

2,192 583 545

625 1,004 1,881

$2,000 1,458 728 771 696 180

594 642 635

$1,000 557 1,428 1,529

890 1,123 1,126 1,066

$0

Adjusted Net Earnings to Common Shareholders/Member’s Equity (ex-Bache) (1)(2)

Pre-Financial Predecessor Successor

Crisis

$400

285 298

$300 206 224 215 258

$200 152

$100

$0

Excludes predecessor first quarter ending 2/28/13. Net Revenue and Net Earnings to Common Shareholders for the excluded quarter total $819 million and $80 million, respectively.

Adjusted Net Revenues and Net Earnings to Common Shareholders/Member’s Equity are non-GAAP measures and represent results excluding the impact of the results of the Bache business. See pages 176—177 for a reconciliation to GAAP figures.

62

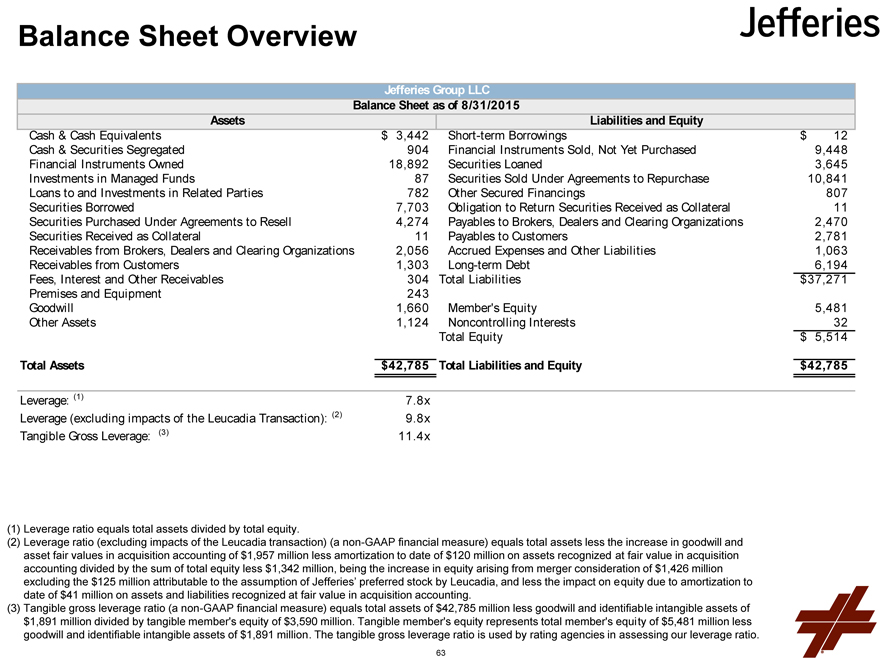

Balance Sheet Overview

Jefferies Group LLC

Balance Sheet as of 8/31/2015

Assets Liabilities and Equity

Cash & Cash Equivalents $ 3,442 Short-term Borrowings $ 12

Cash & Securities Segregated 904 Financial Instruments Sold, Not Yet Purchased 9,448

Financial Instruments Owned 18,892 Securities Loaned 3,645

Investments in Managed Funds 87 Securities Sold Under Agreements to Repurchase 10,841

Loans to and Investments in Related Parties 782 Other Secured Financings 807

Securities Borrowed 7,703 Obligation to Return Securities Received as Collateral 11

Securities Purchased Under Agreements to Resell 4,274 Payables to Brokers, Dealers and Clearing Organizations 2,470

Securities Received as Collateral 11 Payables to Customers 2,781

Receivables from Brokers, Dealers and Clearing Organizations 2,056 Accrued Expenses and Other Liabilities 1,063

Receivables from Customers 1,303 Long-term Debt 6,194

Fees, Interest and Other Receivables 304 Total Liabilities $37,271

Premises and Equipment 243

Goodwill 1,660 Member’s Equity 5,481

Other Assets 1,124 Noncontrolling Interests 32

Total Equity $ 5,514

Total Assets $42,785 Total Liabilities and Equity $42,785

Leverage: (1) 7.8x

Leverage (excluding impacts of the Leucadia Transaction): (2) 9.8x

Tangible Gross Leverage: (3) 11.4x

Leverage ratio equals total assets divided by total equity.

Leverage ratio (excluding impacts of the Leucadia transaction) (a non-GAAP financial measure) equals total assets less the increase in goodwill and asset fair values in acquisition accounting of $1,957 million less amortization to date of $120 million on assets recognized at fair value in acquisition accounting divided by the sum of total equity less $1,342 million, being the increase in equity arising from merger consideration of $1,426 million excluding the $125 million attributable to the assumption of Jefferies’ preferred stock by Leucadia, and less the impact on e quity due to amortization to date of $41 million on assets and liabilities recognized at fair value in acquisition accounting.

Tangible gross leverage ratio (a non-GAAP financial measure) equals total assets of $42,785 million less goodwill and identifiable intangible assets of $1,891 million divided by tangible member’s equity of $3,590 million. Tangible member’s equity represents total member’s equity of $5,481 million less goodwill and identifiable intangible assets of $1,891 million. The tangible gross leverage ratio is used by rating agencies in assessing our leverage ratio.

63

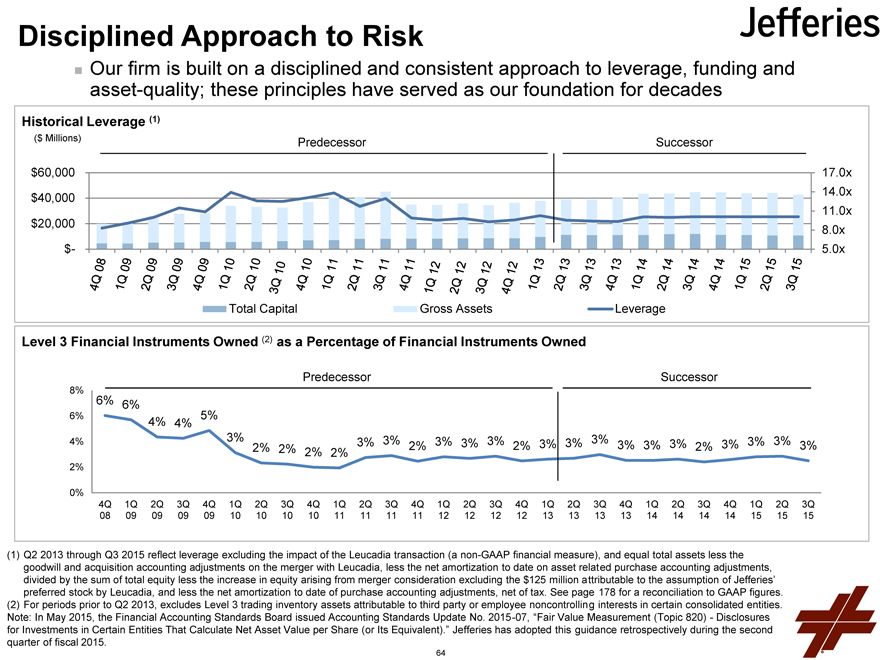

Disciplined Approach to Risk

Our firm is built on a disciplined and consistent approach to leverage, funding and asset-quality; these principles have served as our foundation for decades

Historical Leverage (1)

($ Millions) Predecessor Successor

$60,000 17.0x

$40,000 14.0x

11.0x

$20,000 8.0x

$- 5.0x

Total Capital Gross Assets Leverage

Level 3 Financial Instruments Owned (2) as a Percentage of Financial Instruments Owned

Predecessor Successor

8%

6% 6%

6% 5%

4% 4%

4% 3% 2% 2% 2% 2% 3% 3% 2% 3% 3% 3% 2% 3% 3% 3% 3% 3% 3% 2% 3% 3% 3% 3%

2%

0%

4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

08 09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15

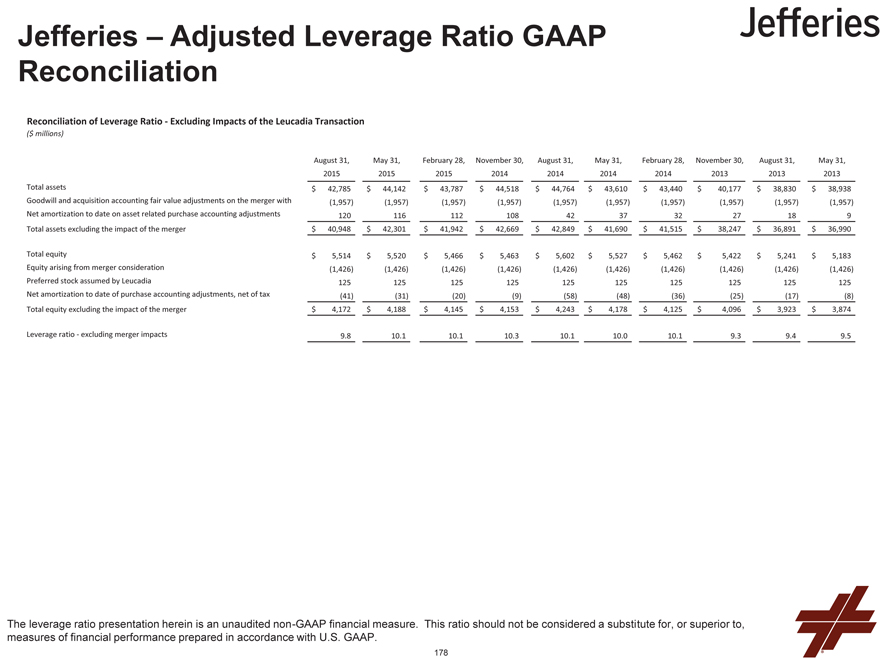

(1) Q2 2013 through Q3 2015 reflect leverage excluding the impact of the Leucadia transaction (a non-GAAP financial measure), and equal total assets less the goodwill and acquisition accounting adjustments on the merger with Leucadia, less the net amortization to date on asset related purchase accounting adjustments, divided by the sum of total equity less the increase in equity arising from merger consideration excluding the $125 million attributable to the assumption of Jefferies’ preferred stock by Leucadia, and less the net amortization to date of purchase accounting adjustments, net of tax. See page 178 for a reconciliation to GAAP figures. (2) For periods prior to Q2 2013, excludes Level 3 trading inventory assets attributable to third party or employee noncontrolling interests in certain consolidated entities. Note: In May 2015, the Financial Accounting Standards Board issued Accounting Standards Update No. 2015-07, “Fair Value Measurement (Topic 820)—Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent).” Jefferies has adopted this guidance retrospectively during the second quarter of fiscal 2015.

64

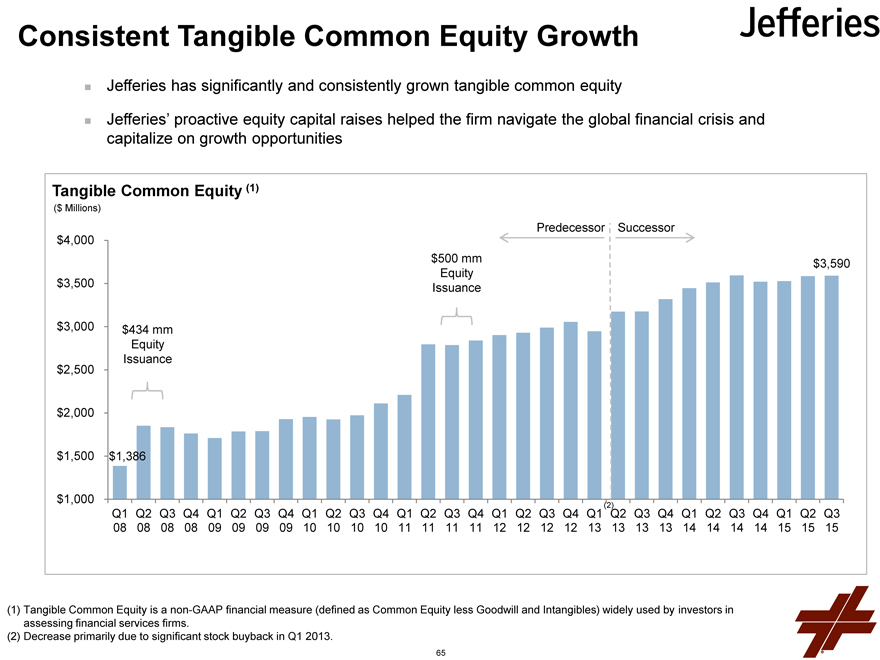

Consistent Tangible Common Equity Growth

Jefferies has significantly and consistently grown tangible common equity

Jefferies’ proactive equity capital raises helped the firm navigate the global financial crisis and capitalize on growth opportunities

Tangible Common Equity (1)

($ Millions)

Predecessor Successor

$4,000

$500 mm $3,590

Equity

$3,500 Issuance

$3,000 $434 mm

Equity

Issuance

$2,500

$2,000

$1,500 $1,386

$1,000(2)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

08 08 08 08 09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14 15 15 15

Tangible Common Equity is a non-GAAP financial measure (defined as Common Equity less Goodwill and Intangibles) widely used by investors in assessing financial services firms.

Decrease primarily due to significant stock buyback in Q1 2013.

65

Jefferies Business Review

66

Investment Banking

67

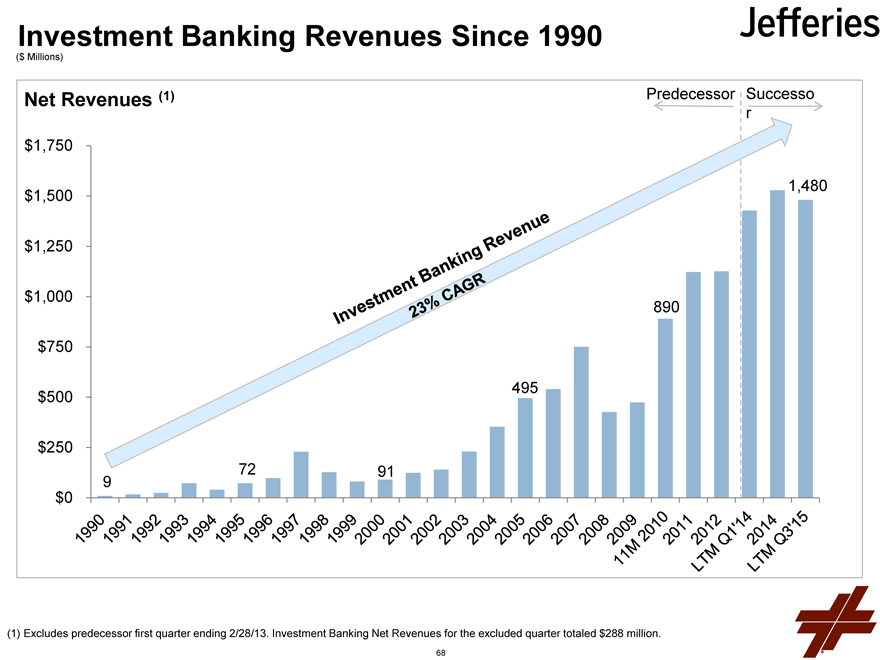

Investment Banking Revenues Since 1990

($ Millions)

Net Revenues(1) Predecessor Successo

r

$1,750

$1,500 1,480

$1,250

$1,000

890

$750

$500 495

$250

9 72 91

$0

(1) Excludes predecessor first quarter ending 2/28/13. Investment Banking Net Revenues for the excluded quarter totaled $288 million.

68

Investment Banking – Overview

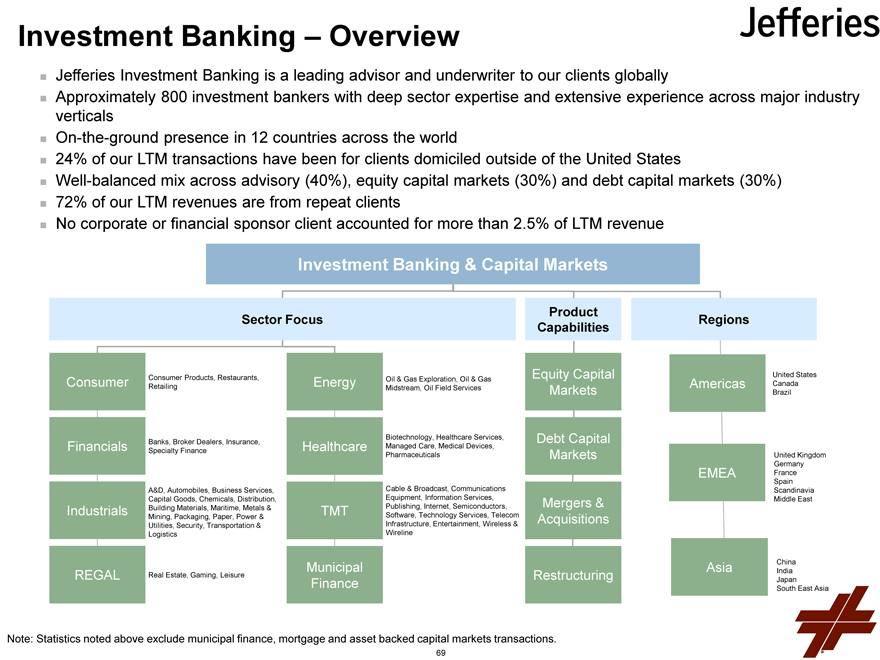

Jefferies Investment Banking is a leading advisor and underwriter to our clients globally

Approximately 800 investment bankers with deep sector expertise and extensive experience across major industry verticals

On-the-ground presence in 12 countries across the world

24% of our LTM transactions have been for clients domiciled outside of the United States

Well-balanced mix across advisory (40%), equity capital markets (30%) and debt capital markets (30%)

72% of our LTM revenues are from repeat clients

No corporate or financial sponsor client accounted for more than 2.5% of LTM revenue

Investment Banking & Capital Markets

Product

Sector Focus Regions

Capabilities

Consumer Products, Restaurants, Oil & Gas Exploration, Oil & Gas Equity Capital United States

Consumer Retailing Energy Midstream, Oil Field Services Americas Canada

Markets Brazil

Banks, Broker Dealers, Insurance, Biotechnology, Healthcare Services, Debt Capital

Financials Specialty Finance Healthcare Managed Care, Medical Devices,

Pharmaceuticals Markets United Kingdom

Germany

EMEA France

Spain

A&D, Automobiles, Business Services, Cable & Broadcast, Communications Scandinavia

Capital Goods, Chemicals, Distribution, Equipment, Information Services, Mergers & Middle East

Industrials Building Materials, Maritime, Metals & TMT Publishing, Internet, Semiconductors,

Mining, Packaging, Paper, Power & Software, Technology Services, Telecom Acquisitions

Utilities, Security, Transportation & Infrastructure, Entertainment, Wireless &

Logistics Wireline

Municipal Asia China

REGAL Real Estate, Gaming, Leisure Restructuring India

Finance South Japan East Asia

Note: Statistics noted above exclude municipal finance, mortgage and asset backed capital markets transactions.

69

Investment Banking – Market Update

M&A: Large Transactions Were Active, But Deals Under $5 Billion Accounted For 76% Of The Global M&A Fee Pool(1)

In this $5 billion segment, Jefferies increased its market share globally

We advised on 25% more $1+ billion M&A transactions in 9M 2015 vs. 9M 2014 The size of our median M&A transaction increased 16% in 9M 2015 vs. 9M 2014

Grew 12% In 9M 2015 vs 9M 2014 ECM: Jefferies ECM Revenue

The global ECM fee declined 7%(1) in the same time frame pool Fiscal Q3 2015 was our best quarter ever in ECM revenue

Leveraged Finance: Global Finance Fee Pool Declined 27%(2) In 9M 2015 vs 9M 2014 Leveraged

Jefferies Leveraged Finance business, while impacted by this market trend, increased its market share in 2015 We also made significant progress penetrating the top tier of financial sponsors

We executed “first time” lead left debt financings for 5 of the 10 largest and 8 of the 20 largest global financial sponsors

Per Dealogic.

Global High Yield Bond and Institutional Leverage Loan Issuance per S&P Capital IQ’s LCD Comps.

70

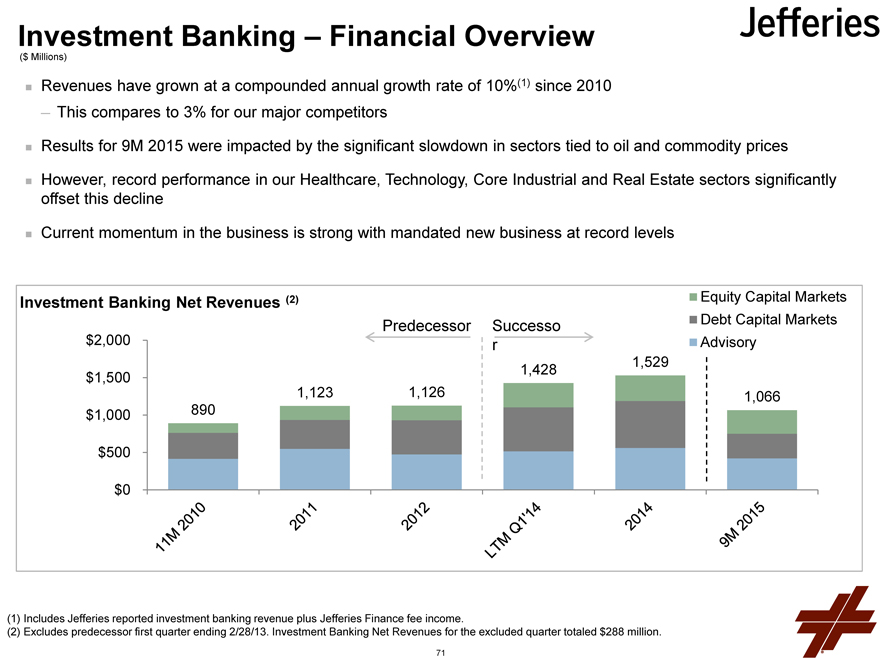

Investment Banking – Financial Overview

($ Millions)

Revenues have grown at a compounded annual growth rate of 10%(1) since 2010 ? This compares to 3% for our major competitors

Results for 9M 2015 were impacted by the significant slowdown in sectors tied to oil and commodity prices

However, record performance in our Healthcare, Technology, Core Industrial and Real Estate sectors significantly offset this decline

Current momentum in the business is strong with mandated new business at record levels

Investment Banking Net Revenues (2) Equity Capital Markets

Predecessor Successo Debt Capital Markets

$2,000 r Advisory

1,428 1,529

$1,500

1,123 1,126 1,066

$1,000 890

$500

$0

Includes Jefferies reported investment banking revenue plus Jefferies Finance fee income.

Excludes predecessor first quarter ending 2/28/13. Investment Banking Net Revenues for the excluded quarter totaled $288 million.

71

Investment Banking – Strategic Priorities

Continue to Increase Managing Director Productivity

Our revenue per sector MD has increased 5% per year since 2010

Further increases in revenue per MD are expected as senior hires over the last several years reach targeted revenue levels and recent MD hires begin to gain traction

Capitalize on Revenue Opportunities in Recently Entered Sectors

In the last 12 months, we have entered 12 new sub-sectors across US, Europe and Asia, giving us access to approximately $2.5 billion of new addressable fee pool

Capitalize on Revenue Opportunities in Recently Entered Countries/Regions

In the last 12 months, we have established on the ground presence in 5 new countries / regions, giving us access to over $3 billion of new addressable fee pool

72

Jefferies Finance LLC

73

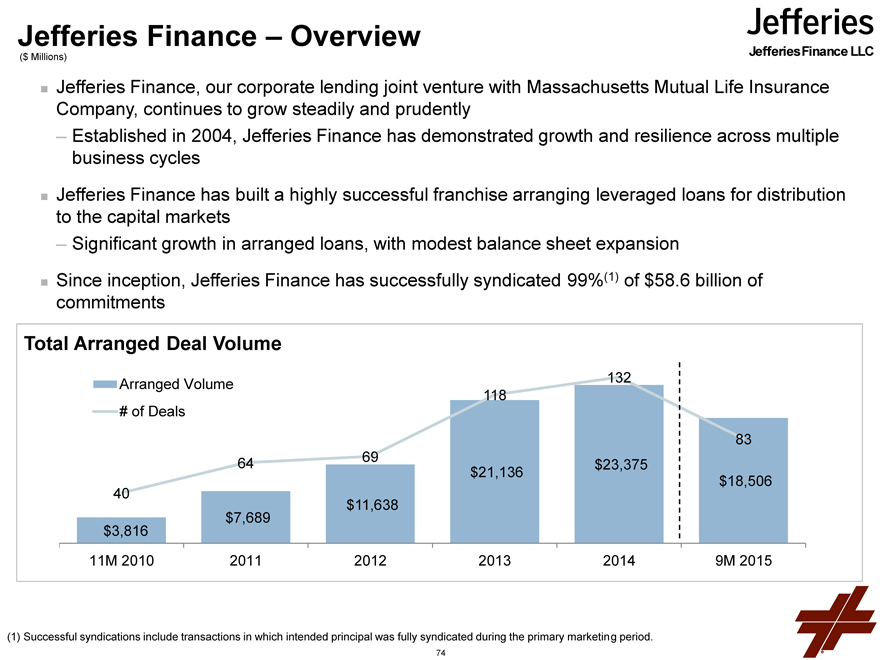

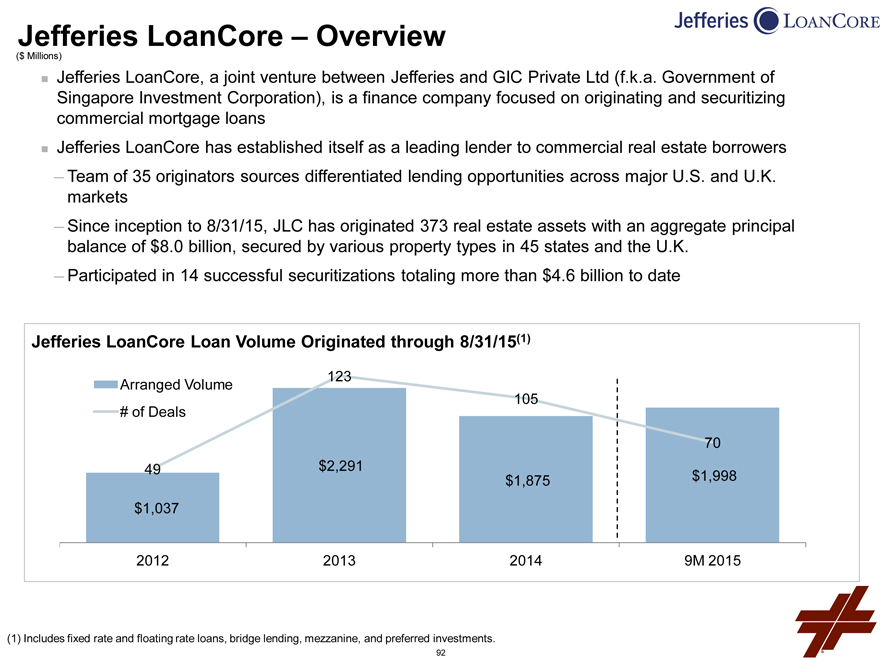

Jefferies Finance – Overview

Jefferies Finance LLC

($ Millions)

Jefferies Finance, our corporate lending joint venture with Massachusetts Mutual Life Insurance Company, continues to grow steadily and prudently

Established in 2004, Jefferies Finance has demonstrated growth and resilience across multiple business cycles

Jefferies Finance has built a highly successful franchise arranging leveraged loans for distribution to the capital markets

Significant growth in arranged loans, with modest balance sheet expansion

Since inception, Jefferies has successfully syndicated 99%(1) of $58.6 billion of ? Finance commitments

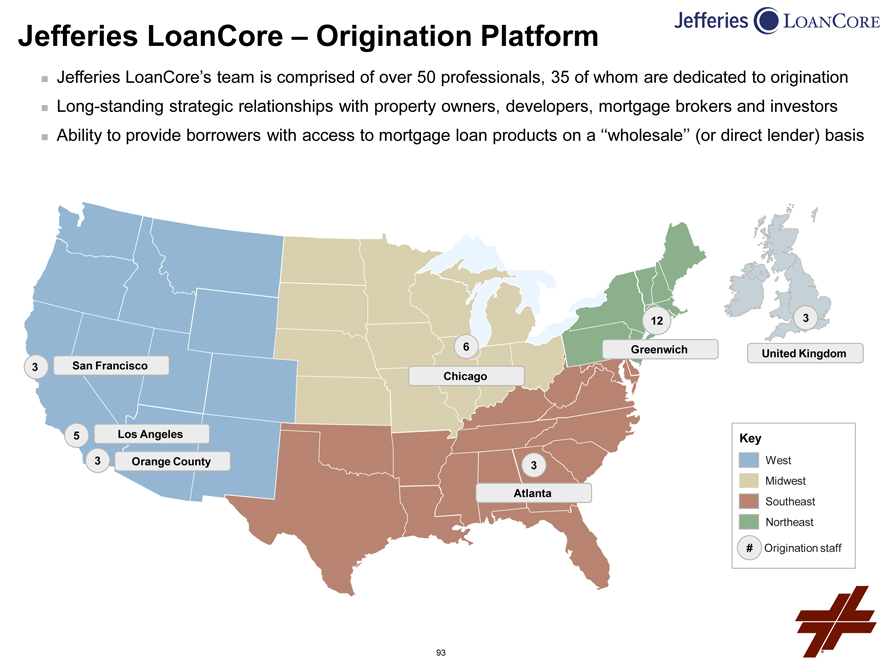

Total Arranged Deal Volume

140

Arranged Volume 132

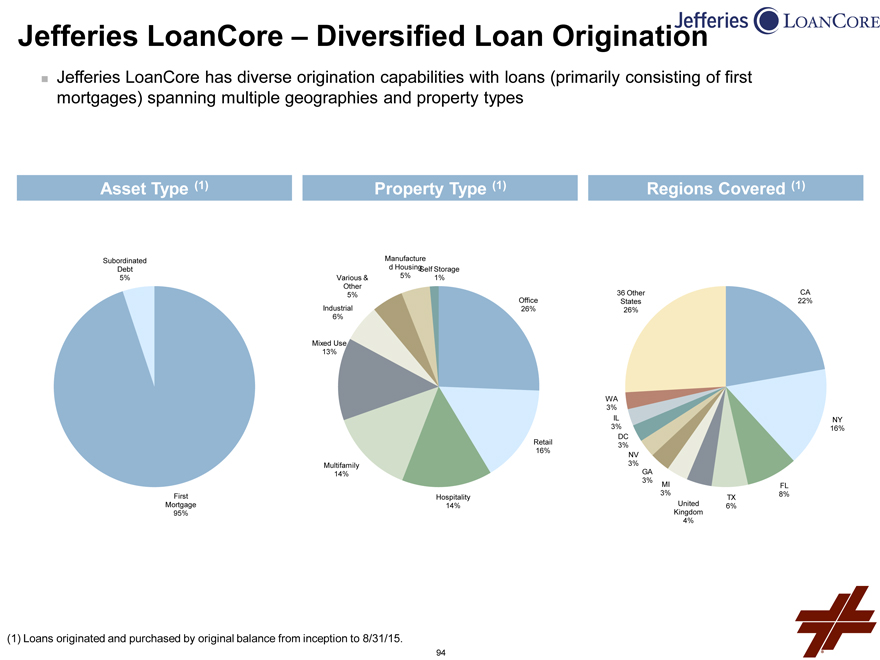

118 120

# of Deals 100

83 80

64 69 $23,375 60

$21,136 $18,506

40 40

$11,638

$7,689 20

$3,816

0

11M 2010 2011 2012 2013 2014 9M 2015

(1) Successful syndications include transactions in which intended principal was fully syndicated during the primary marketing period.

74

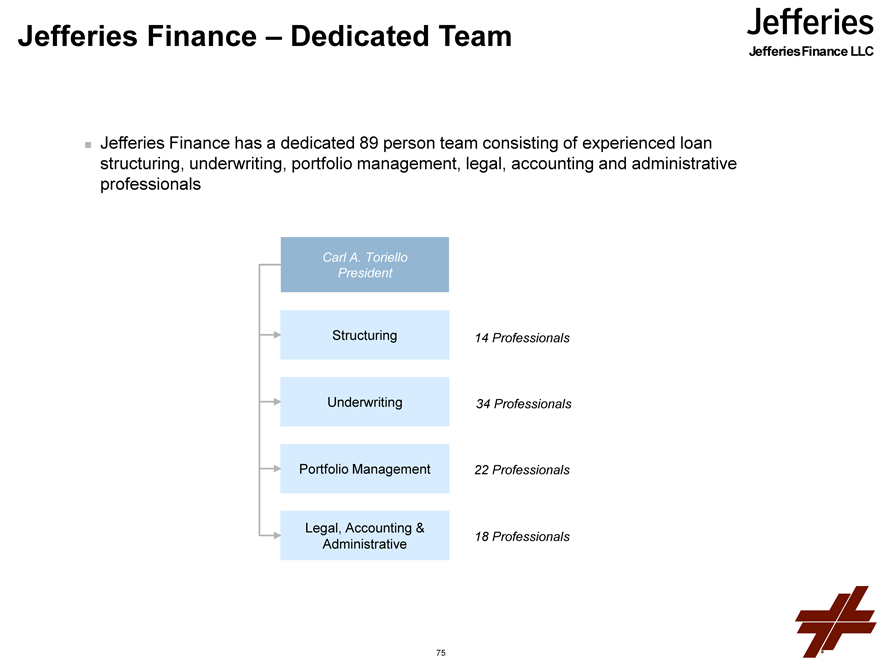

Jefferies Finance – Dedicated Team

Jefferies Finance LLC

Jefferies Finance has a dedicated 89 person team consisting of experienced loan structuring, underwriting, portfolio management, legal, accounting and administrative professionals

Carl A. Toriello

President

Structuring 14 Professionals

Underwriting 34 Professionals

Portfolio Management 22 Professionals

Legal, Accounting &

Administrative 18 Professionals

75

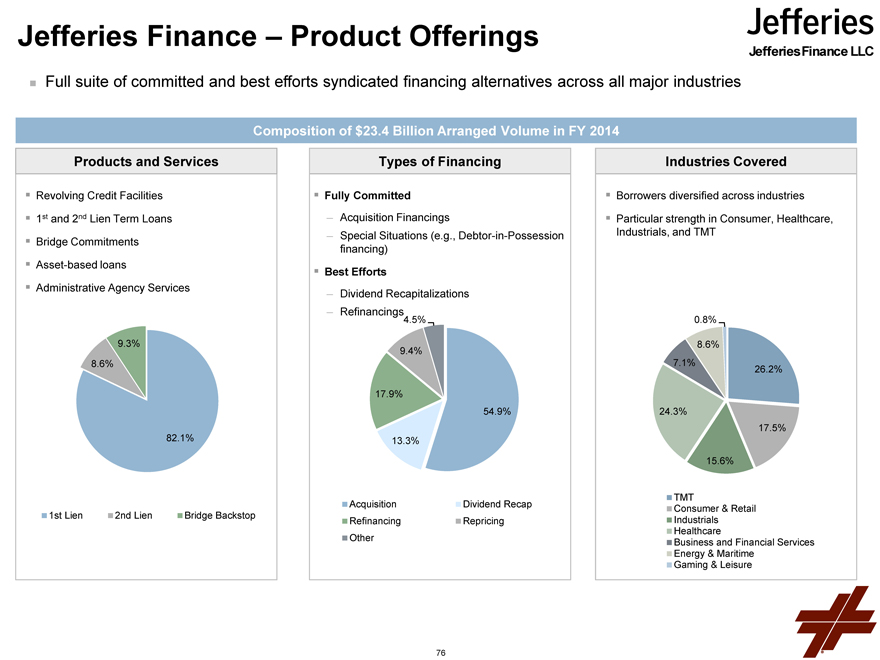

Jefferies Finance – Product Offerings

Jefferies Finance LLC

Full suite of committed and best efforts syndicated financing alternatives across all major industries

Composition of $23.4 Billion Arranged Volume in FY 2014

Products and Services Types of Financing Industries Covered

Revolving Credit Facilities Fully Committed Borrowers diversified across industries

1st and 2nd Lien Term Loans ? Acquisition Financings Particular strength in Consumer, Healthcare,

? Special Situations (e.g., Debtor-in-Possession Industrials, and TMT

Bridge Commitments financing)

Asset-based loans Best Efforts

Administrative Agency Services ? Dividend Recapitalizations

Refinancings

4.5% 0.8%

9.3% 8.6%

9.4%

8.6% 7.1% 26.2%

17.9%

54.9% 24.3%

17.5%

82.1% 13.3%

15.6%

TMT

Acquisition Dividend Recap Consumer & Retail

1st Lien 2nd Lien Bridge Backstop Refinancing Repricing Industrials

Healthcare

Other Business and Financial Services

Energy & Maritime

Gaming & Leisure

76

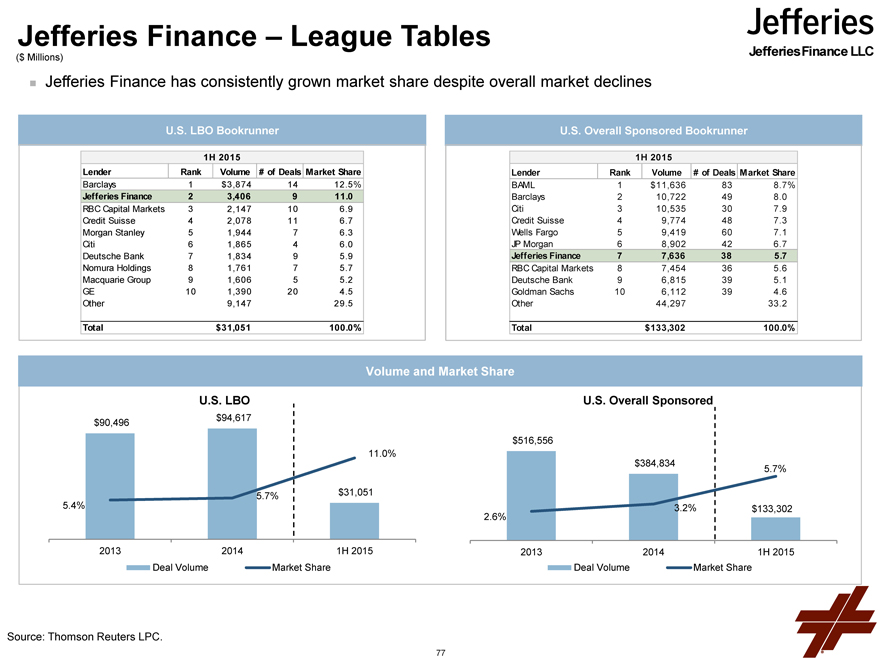

Jefferies Finance – League Tables

Jefferies Finance LLC

($ Millions)

Jefferies Finance has consistently grown market share despite overall market declines

U.S. LBO Bookrunner U.S. Overall Sponsored Bookrunner

1H 2015 1H 2015

Lender Rank Volume # of Deals Market Share Lender Rank Volume # of Deals Market Share

Barclays 1 $3,874 14 12.5% BAML 1 $11,636 83 8.7%

Jefferies Finance 2 3,406 9 11.0 Barclays 2 10,722 49 8.0

RBC Capital Markets 3 2,147 10 6.9 Citi 3 10,535 30 7.9

Credit Suisse 4 2,078 11 6.7 Credit Suisse 4 9,774 48 7.3

Morgan Stanley 5 1,944 7 6.3 Wells Fargo 5 9,419 60 7.1

Citi 6 1,865 4 6.0 JP Morgan 6 8,902 42 6.7

Deutsche Bank 7 1,834 9 5.9 Jefferies Finance 7 7,636 38 5.7

Nomura Holdings 8 1,761 7 5.7 RBC Capital Markets 8 7,454 36 5.6

Macquarie Group 9 1,606 5 5.2 Deutsche Bank 9 6,815 39 5.1

GE 10 1,390 20 4.5 Goldman Sachs 10 6,112 39 4.6

Other 9,147 29.5 Other 44,297 33.2

Total $31,051 100.0% Total $133,302 100.0%

Volume and Market Share

U.S. LBO U.S. Overall Sponsored

$90,496 $94,617

$516,556

11.0%

$384,834 5.7%

5.7% $31,051

5.4% 3.2% $133,302

2.6%

2013 2014 1H 2015 2013 2014 1H 2015

Deal Volume Market Share Deal Volume Market Share

Source: Thomson Reuters LPC.

77

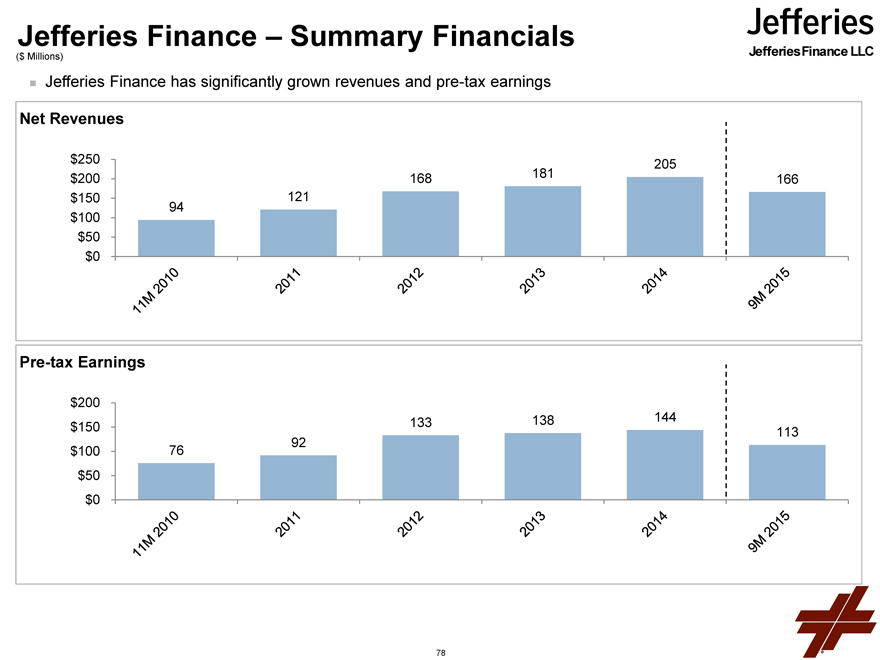

Jefferies Finance – Summary Financials

($ Millions) Jefferies Finance LLC

Jefferies Finance has significantly grown revenues and pre-tax earnings

Net Revenues

$250 205

$200 168 181 166

$150 121

94

$100

$50

$0

Pre-tax Earnings

$200

$150 133 138 144

113

$100 76 92

$50

$0

78

Jefferies Finance – Strategic Priorities

Jefferies Finance LLC

Continue to drive market share in our core U.S. Sponsor Finance business, leveraging the strength and momentum of Jefferies Investment Banking

Expand in complementary areas: middle market, asset-based lending and asset management

Grow European franchise, leveraging Jefferies’ European Investment Banking platform

79

Equities

80

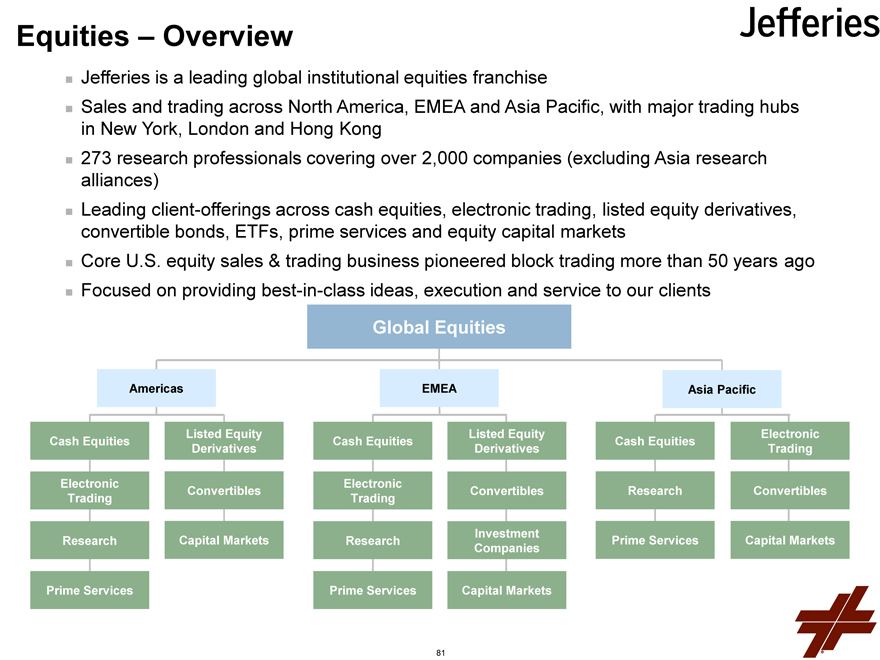

Equities – Overview

Jefferies is a leading global institutional equities franchise

Sales and trading across North America, EMEA and Asia Pacific, with major trading hubs in New York, London and Hong Kong 273 research professionals covering over 2,000 companies (excluding Asia research alliances) Leading client-offerings across cash equities, electronic trading, listed equity derivatives, convertible bonds, ETFs, prime services and equity capital markets

Core U.S. equity sales & trading business pioneered block trading more than 50 years ago Focused on providing best-in-class ideas, execution and service to our clients

Global Equities

Americas EMEA Asia Pacific

Listed Equity Listed Equity Electronic

Cash Equities Cash Equities Cash Equities

Derivatives Derivatives Trading

Electronic Electronic

Convertibles Convertibles Research Convertibles

Trading Trading

Investment

Research Capital Markets Research Prime Services Capital Markets

Companies

Prime Services Prime Services Capital Markets

81

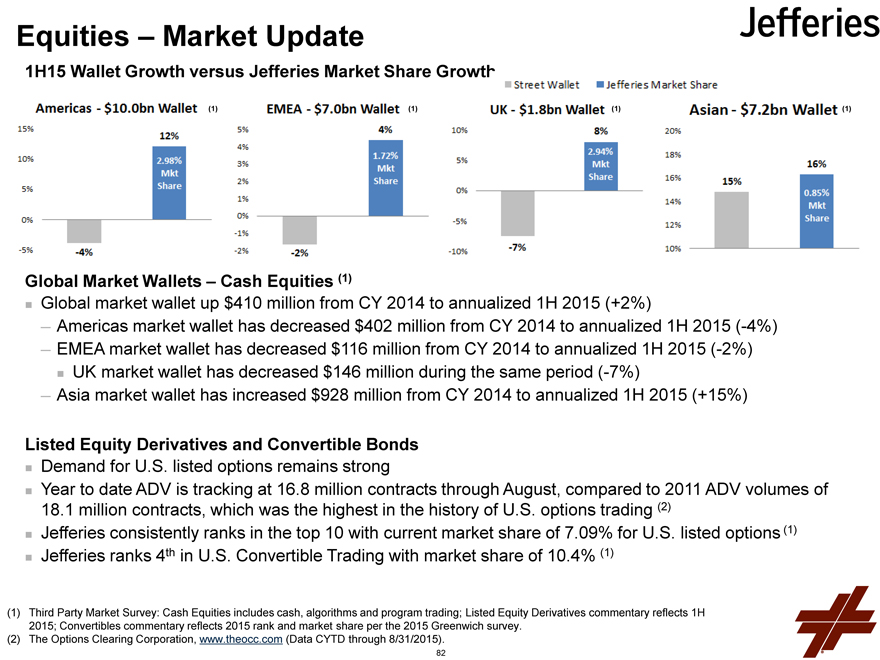

Equities – Market Update

1H15 Wallet Growth versus Jefferies Market Share Growth

(1)(1)(1)(1)

Global Market Wallets – Cash Equities (1)

Global market wallet up $410 million from CY 2014 to annualized 1H 2015 (+2%)

Americas market wallet has decreased $402 million from CY 2014 to annualized 1H 2015 (-4%)

EMEA market wallet has decreased $116 million from CY 2014 to annualized 1H 2015 (-2%)

UK market wallet has decreased $146 million during the same period (-7%)

Asia market wallet has increased $928 million from CY 2014 to annualized 1H 2015 (+15%)

Listed Equity Derivatives and Convertible Bonds

Demand for U.S. listed options remains strong

Year to date ADV is tracking at 16.8 million contracts through August, compared to 2011 ADV volumes of

18.1 million contracts, which was the highest in the history of U.S. options trading (2)

Jefferies consistently ranks in the top 10 with current market share of 7.09% for U.S. listed options (1)

Jefferies ranks 4th in U.S. Convertible Trading with market share of 10.4% (1)

Third Party Market Survey: Cash Equities includes cash, algorithms and program trading; Listed Equity Derivatives commentary reflects 1H 2015; Convertibles commentary reflects 2015 rank and market share per the 2015 Greenwich survey.

The Options Clearing Corporation, www.theocc.com (Data CYTD through 8/31/2015).

82

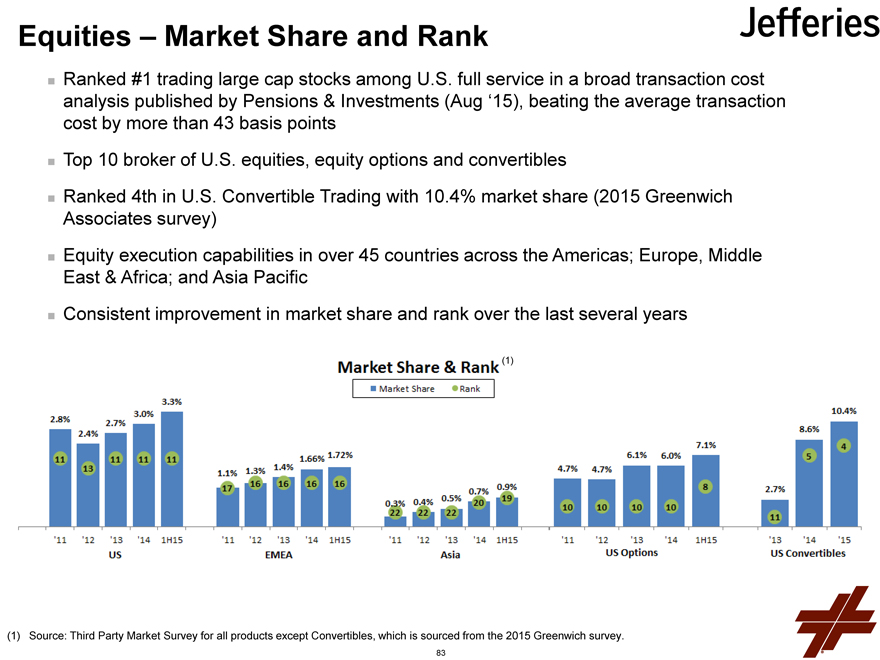

Equities – Market Share and Rank

Ranked #1 trading large cap stocks among U.S. full service in a broad transaction cost analysis published by Pensions & Investments (Aug ‘15), beating the average transaction cost by more than 43 basis points

Top 10 broker of U.S. equities, equity options and convertibles

Ranked 4th in U.S. Convertible Trading with 10.4% market share (2015 Greenwich

Associates survey)

Equity execution capabilities in over 45 countries across the Americas; Europe, Middle East & Africa; and Asia Pacific

Consistent improvement in market share and rank over the last several years

(1)

Source: Third Party Market Survey for all products except Convertibles, which is sourced from the 2015 Greenwich survey.

83

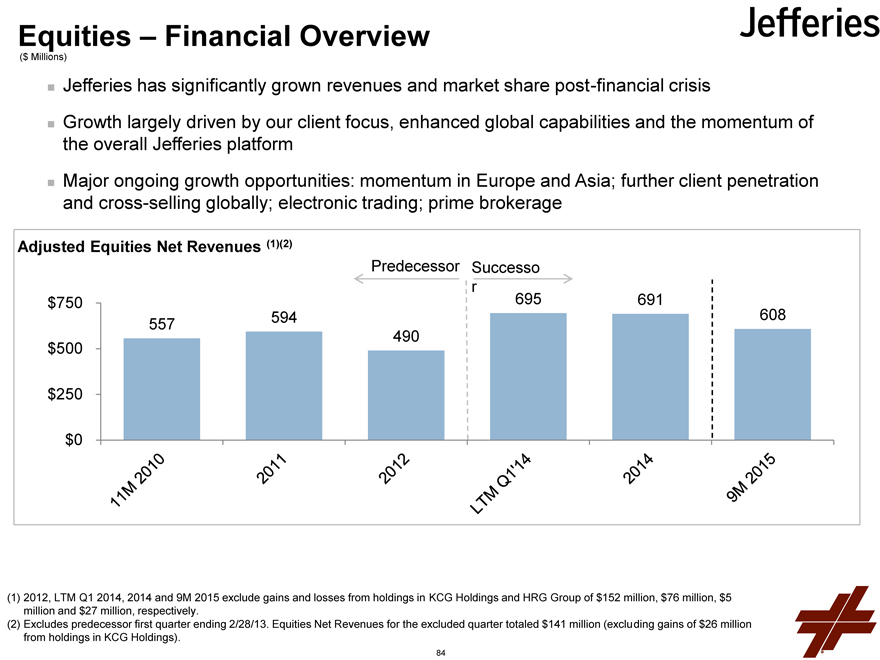

Equities – Financial Overview

($ Millions)

Jefferies has significantly grown revenues and market share post-financial crisis

Growth largely driven by our client focus, enhanced global capabilities and the momentum of the overall Jefferies platform

Major ongoing growth opportunities: momentum in Europe and Asia; further client penetration and cross-selling globally; electronic trading; prime brokerage

2012, LTM Q1 2014, 2014 and 9M 2015 exclude gains and losses from holdings in KCG Holdings and HRG Group of $152 million, $76 million, $5 million and $27 million, respectively.

Excludes predecessor first quarter ending 2/28/13. Equities Net Revenues for the excluded quarter totaled $141 million (excluding gains of $26 million from holdings in KCG Holdings).

84

Equities – Global Strategic Priorities

Global Electronic Trading Distribution

Increase the breadth of clients, as well as expanding penetration with existing clients

Grow the EMEA and Asia Electronic distribution platform and continue to cross-sell capabilities across regions

Prime Brokerage

Capitalize on U.S. opportunities to serve mid-sized prime brokerage clients that are increasingly underserved by the large bank holding companies

Continued focus on the efficient use of balance sheet and higher ROA clients

Leverage the Strength and Depth of our European Capabilities

Grow European research coverage into new sectors and broaden existing sector coverage

Further enhance distribution capabilities in Continental Europe

85

Fixed Income

86

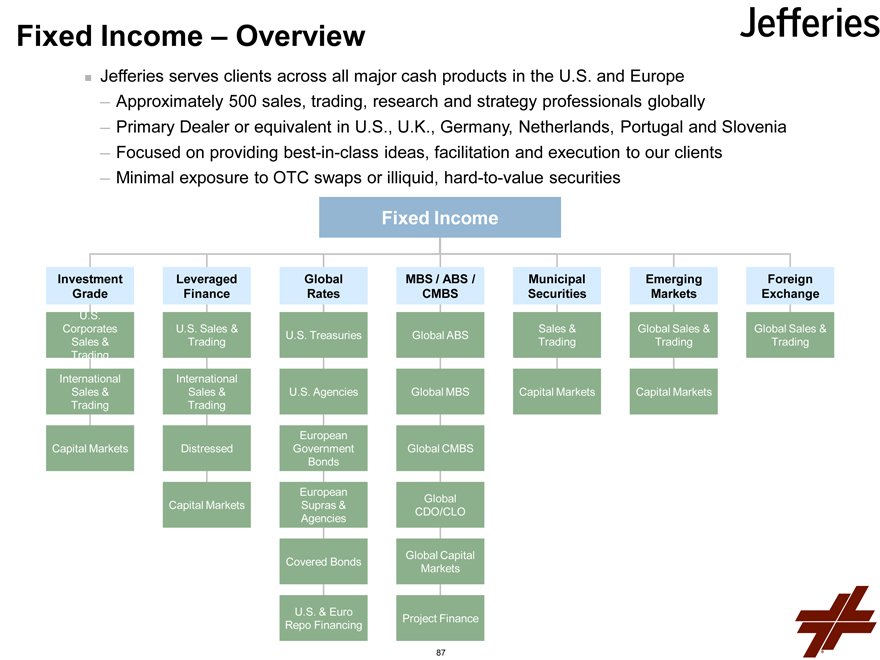

Fixed Income – Overview

.Jefferies serves clients across all major cash products in the U.S. and Europe

-Approximately 500 sales, trading, research and strategy professionals globally

-Primary Dealer or equivalent in U.S., U.K., Germany, Netherlands, Portugal and Slovenia

-Focused on providing best-in-class ideas, facilitation and execution to our clients

-Minimal exposure to OTC swaps or illiquid, hard-to-value securities

Fixed Income

Emerging

Markets

Capital Markets

Global Sales &

Trading

Municipal

Securities

Sales &

Trading

Capital Markets

Investment

Grade

Capital Markets

U.S.

Corporates

Sales &

Trading

International

Sales &

Trading

Leveraged

Finance

U.S. Sales &

Trading

International

Sales &

Trading

Distressed

Global

Rates

U.S. Treasuries

U.S. Agencies

European

Government

Bonds

U.S. & Euro

Repo Financing

European

Supras &

Agencies

Covered Bonds

MBS / ABS /

CMBS

Global

CDO/CLO

Global ABS

Global MBS

Global CMBS

Project Finance

Global Capital

Markets

Foreign

Exchange

Global Sales &

Trading

Capital Markets

87

Fixed Income – Market Update

.Markets are currently being influenced by central bank intervention and global balance

sheet deleveraging

.Over the last twelve months, uncertainty surrounding the global economy has increased,

driven by China, Emerging Markets, Greece and commodities

-This caused a further slowdown in secondary market volumes as spreads widened, new

issue activity in leveraged products slowed, and trading liquidity in certain market

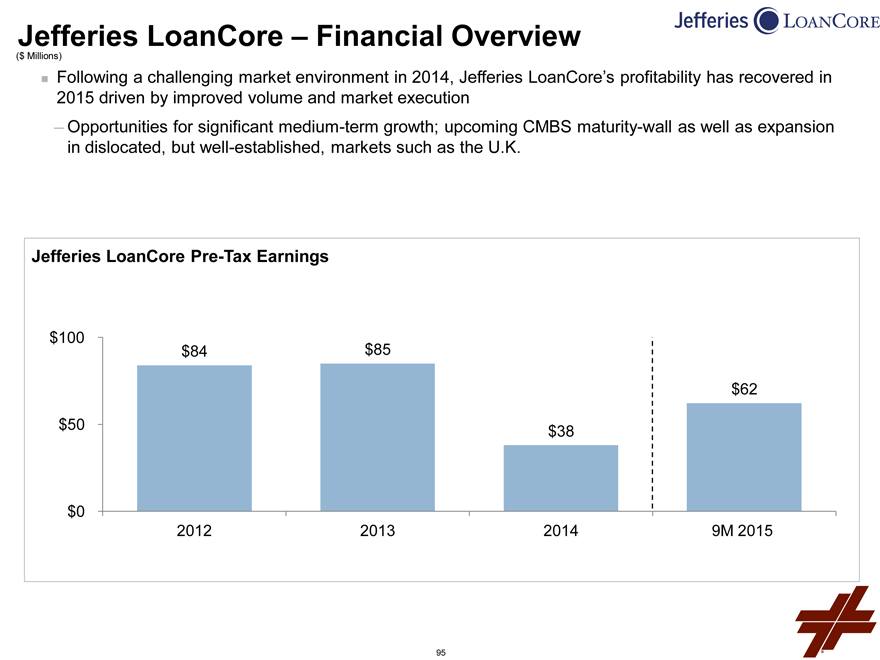

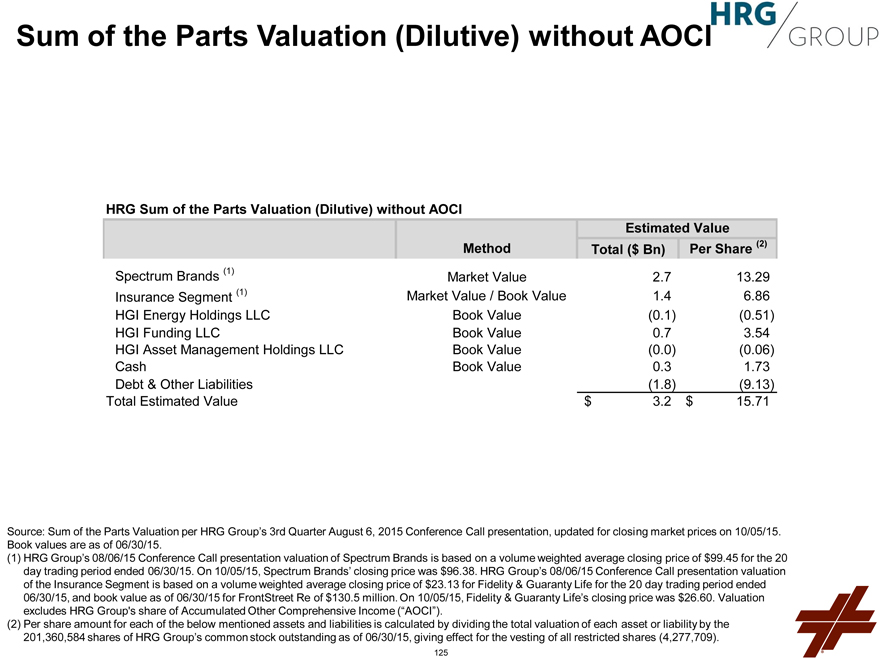

segments declined