Jefferies Financial Group Inc. 2018 Investor Meeting October 4, 2018 Exhibit 99

Note on Forward Looking Statements Certain statements contained herein may constitute "forward-looking statements," within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and/or the Private Securities Litigation Reform Act of 1995, regarding Jefferies Financial Group Inc., Jefferies Group LLC, Spectrum Brands Holdings, Inc., Global Brokerage, Inc. and HomeFed Corporation, and their respective subsidiaries. These forward-looking statements reflect the respective issuer’s current views relating to, among other things, future revenues, earnings, operations, and other financial results, and may include statements of future performance, plans, and objectives. Forward-looking statements may also include statements pertaining to an issuer’s strategies for the future development of its business and products. These forward-looking statements are not historical facts and are based on the respective issuer’s management expectations, estimates, projections, beliefs and certain other assumptions, many of which, by their nature, are inherently uncertain and beyond management’s control. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, the cautionary statements and risks set forth in the respective issuer’s Annual and Quarterly Reports and other reports or documents filed with, or furnished to, the SEC from time to time, which are accessible on the SEC website at sec.gov. This information should also be read in conjunction with each respective issuer’s Consolidated Financial Statements and the Notes thereto contained in the Annual, Quarterly and Periodic Reports filed by such issuer that are also accessible on the SEC website at sec.gov. Any forward-looking statements made by an issuer herein are unique to that issuer and are not to be attributed as statements made or endorsed by any other issuer. i

2018 Investor Meeting Agenda 1

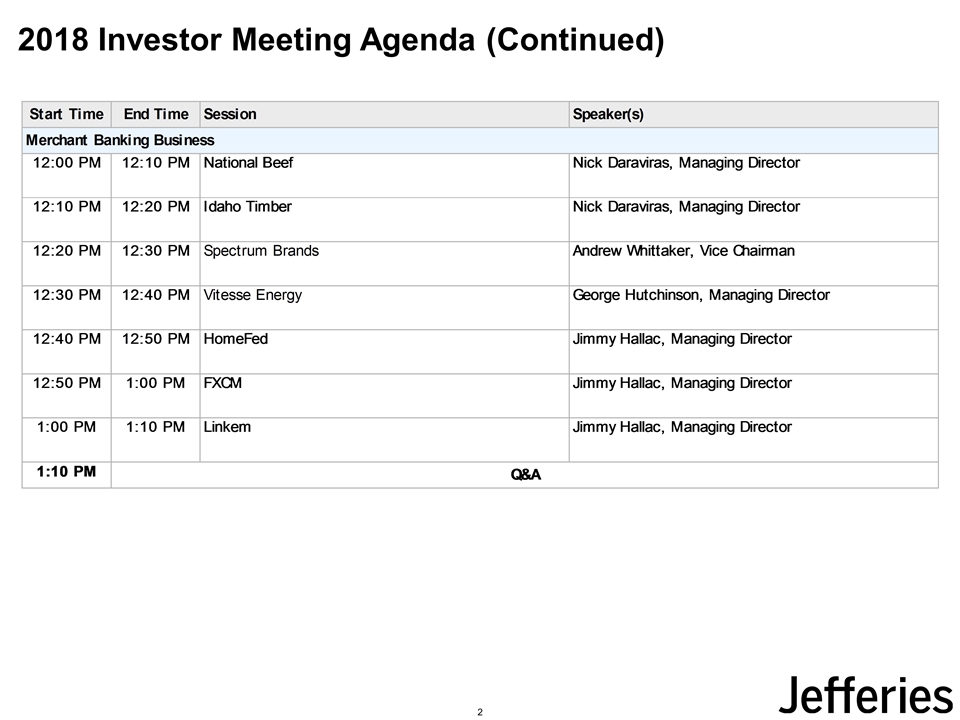

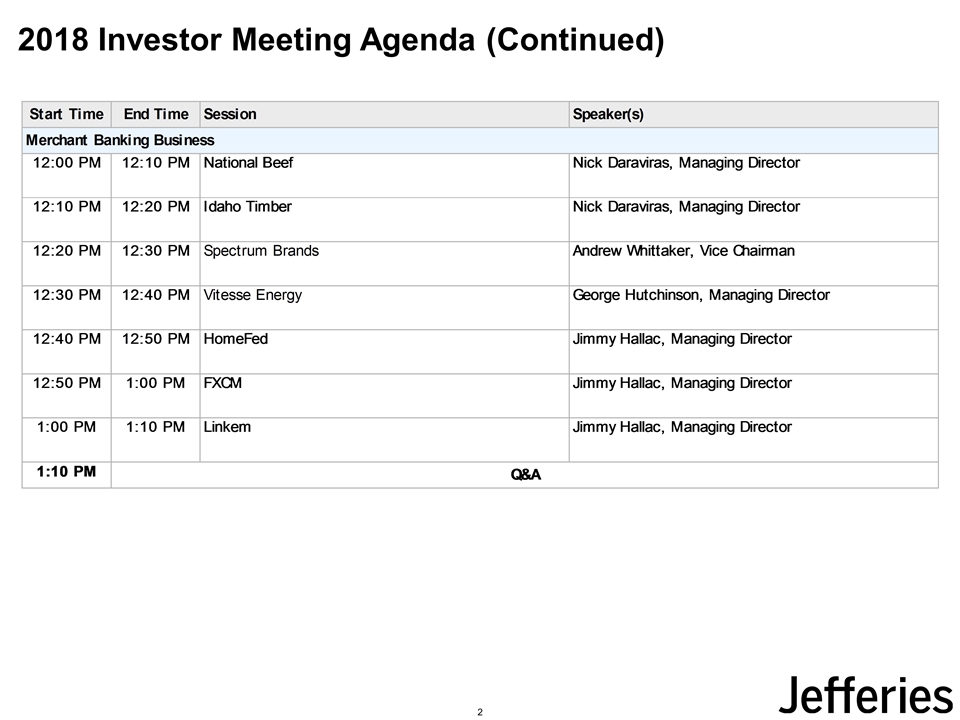

2018 Investor Meeting Agenda (Continued) 2

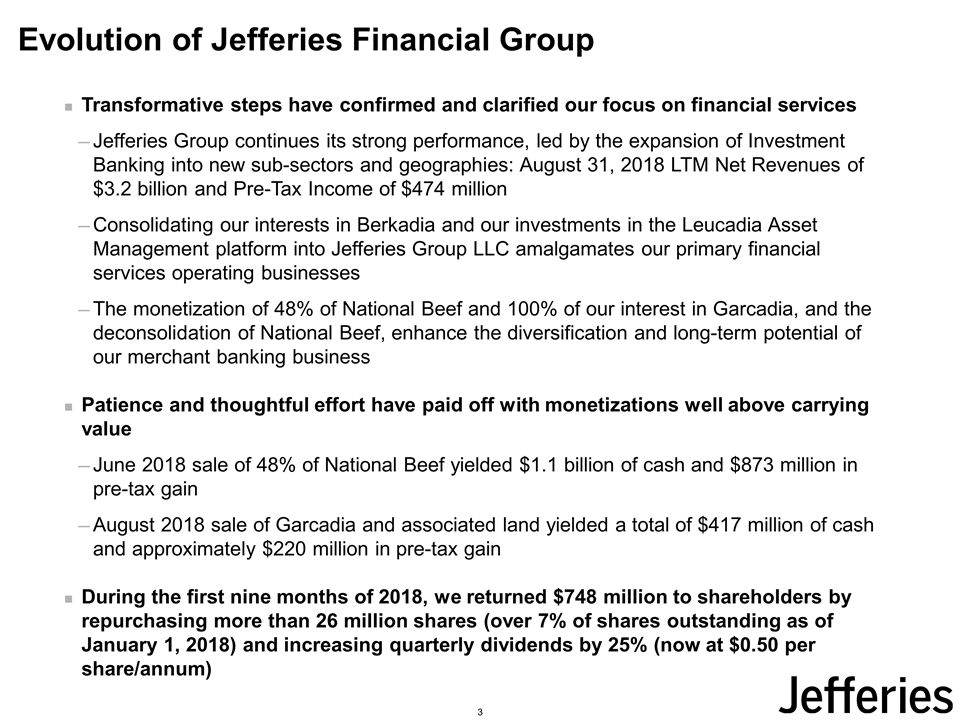

Evolution of Jefferies Financial Group Transformative steps have confirmed and clarified our focus on financial services Jefferies Group continues its strong performance, led by the expansion of Investment Banking into new sub-sectors and geographies: August 31, 2018 LTM Net Revenues of $3.2 billion and Pre-Tax Income of $474 million Consolidating our interests in Berkadia and our investments in the Leucadia Asset Management platform into Jefferies Group LLC amalgamates our primary financial services operating businesses The monetization of 48% of National Beef and 100% of our interest in Garcadia, and the deconsolidation of National Beef, enhance the diversification and long-term potential of our merchant banking business Patience and thoughtful effort have paid off with monetizations well above carrying value June 2018 sale of 48% of National Beef yielded $1.1 billion of cash and $873 million in pre-tax gain August 2018 sale of Garcadia and associated land yielded a total of $417 million of cash and approximately $220 million in pre-tax gain During the first nine months of 2018, we returned $748 million to shareholders by repurchasing more than 26 million shares (over 7% of shares outstanding as of January 1, 2018) and increasing quarterly dividends by 25% (now at $0.50 per share/annum) 3

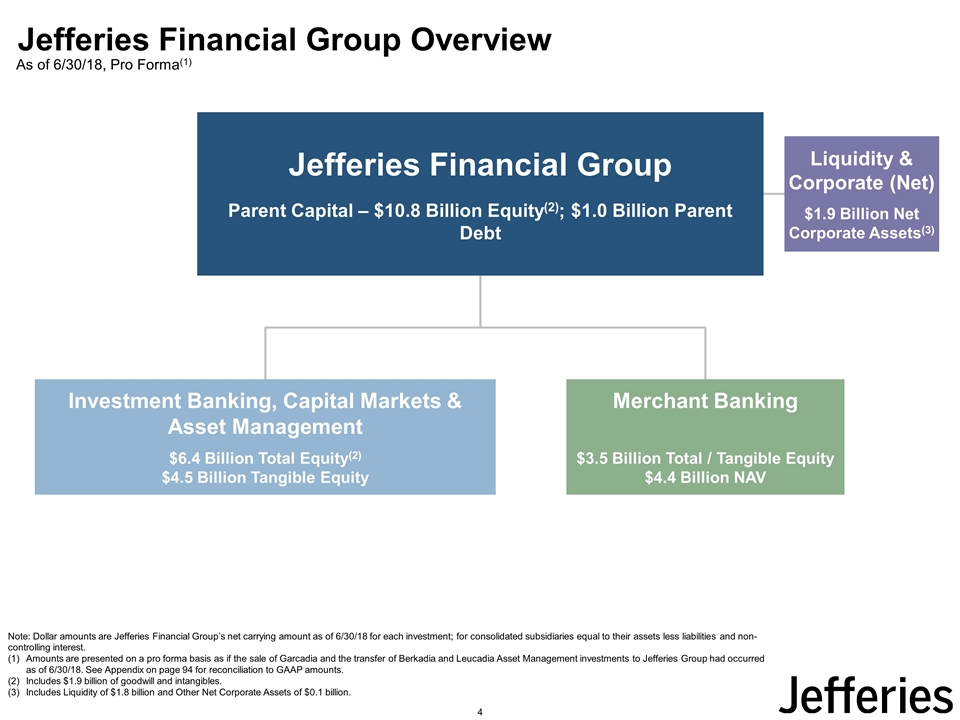

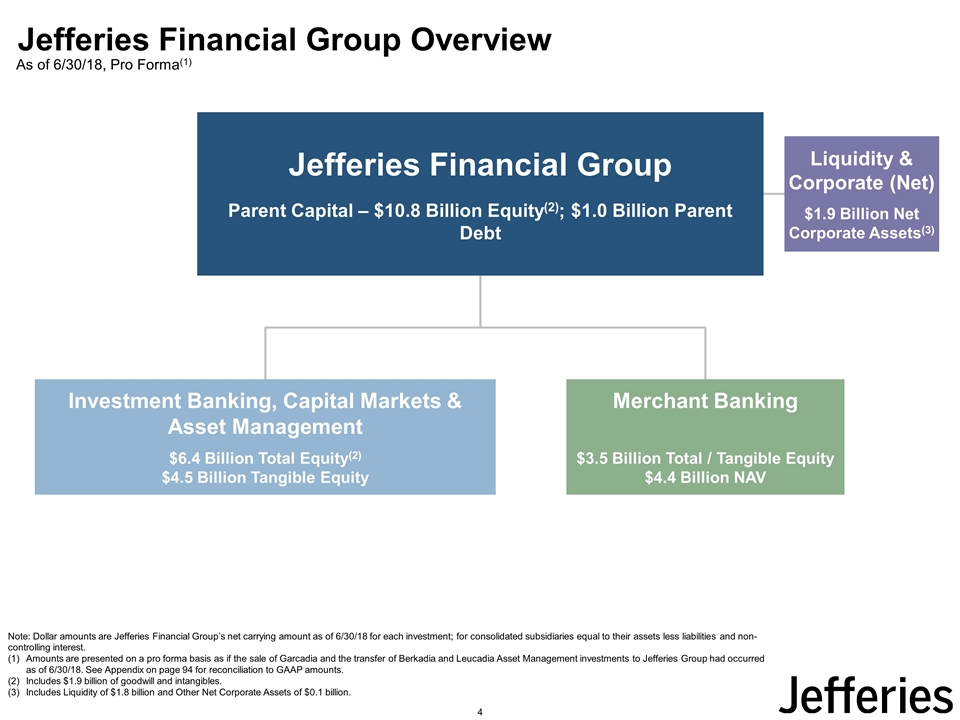

Jefferies Financial Group Overview Note: Dollar amounts are Jefferies Financial Group’s net carrying amount as of 6/30/18 for each investment; for consolidated subsidiaries equal to their assets less liabilities and non-controlling interest. Amounts are presented on a pro forma basis as if the sale of Garcadia and the transfer of Berkadia and Leucadia Asset Management investments to Jefferies Group had occurred as of 6/30/18. See Appendix on page 94 for reconciliation to GAAP amounts. Includes $1.9 billion of goodwill and intangibles. Includes Liquidity of $1.8 billion and Other Net Corporate Assets of $0.1 billion. As of 6/30/18, Pro Forma(1) Jefferies Financial Group Parent Capital – $10.8 Billion Equity(2); $1.0 Billion Parent Debt Liquidity & Corporate (Net) $1.9 Billion Net Corporate Assets(3) Merchant Banking $3.5 Billion Total / Tangible Equity $4.4 Billion NAV Investment Banking, Capital Markets & Asset Management $6.4 Billion Total Equity(2) $4.5 Billion Tangible Equity 4

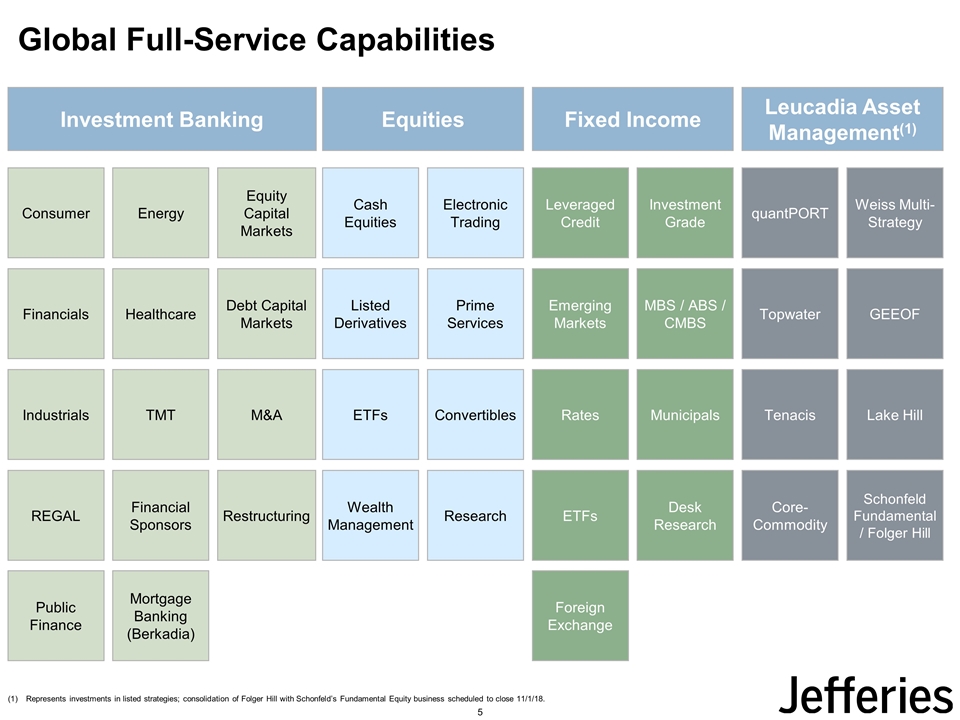

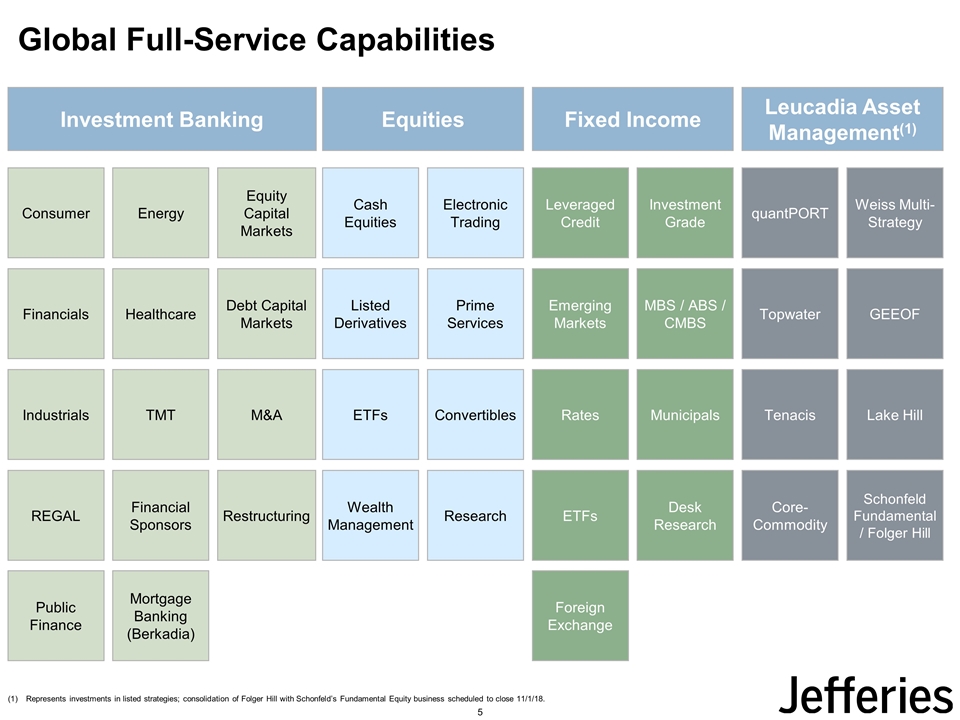

Global Full-Service Capabilities Listed Derivatives Cash Equities Electronic Trading Prime Services ETFs Convertibles Wealth Management MBS / ABS / CMBS Emerging Markets Investment Grade Rates Municipals TMT Industrials Healthcare Financials Financial Sponsors REGAL Equity Capital Markets Energy Consumer Debt Capital Markets M&A Public Finance Equities Fixed Income Investment Banking Restructuring Research ETFs Desk Research Leveraged Credit Foreign Exchange Leucadia Asset Management(1) Weiss Multi-Strategy quantPORT Topwater GEEOF Tenacis Lake Hill Core-Commodity Mortgage Banking (Berkadia) Schonfeld Fundamental / Folger Hill Represents investments in listed strategies; consolidation of Folger Hill with Schonfeld’s Fundamental Equity business scheduled to close 11/1/18. 5

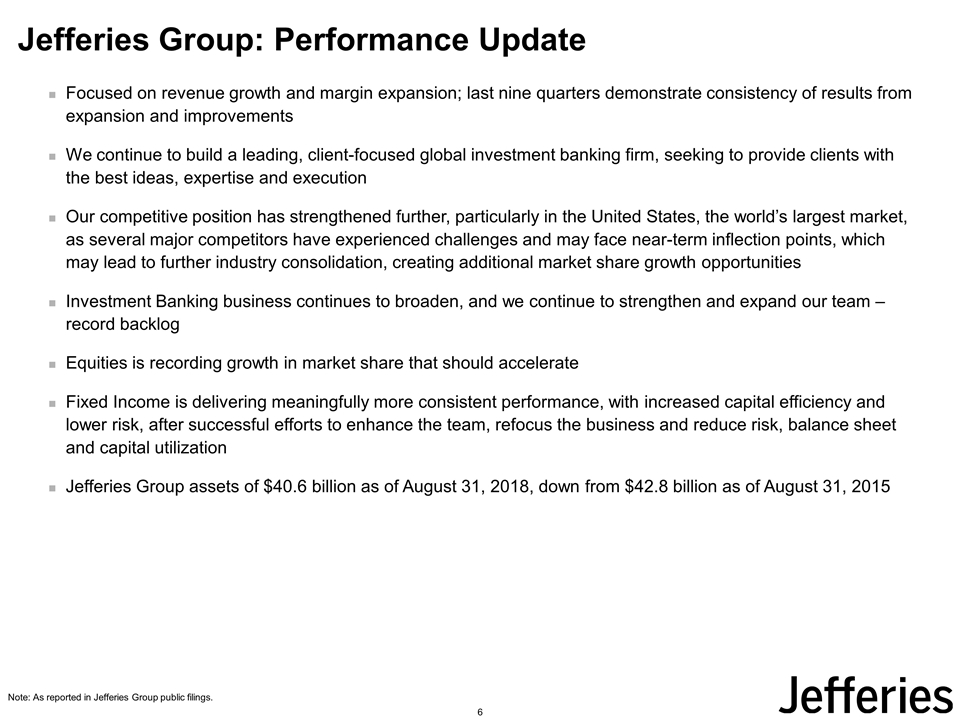

Jefferies Group: Performance Update Focused on revenue growth and margin expansion; last nine quarters demonstrate consistency of results from expansion and improvements We continue to build a leading, client-focused global investment banking firm, seeking to provide clients with the best ideas, expertise and execution Our competitive position has strengthened further, particularly in the United States, the world’s largest market, as several major competitors have experienced challenges and may face near-term inflection points, which may lead to further industry consolidation, creating additional market share growth opportunities Investment Banking business continues to broaden, and we continue to strengthen and expand our team – record backlog Equities is recording growth in market share that should accelerate Fixed Income is delivering meaningfully more consistent performance, with increased capital efficiency and lower risk, after successful efforts to enhance the team, refocus the business and reduce risk, balance sheet and capital utilization Jefferies Group assets of $40.6 billion as of August 31, 2018, down from $42.8 billion as of August 31, 2015 Note: As reported in Jefferies Group public filings. 6

Jefferies Group: Priorities Our priorities are revenue growth and margin expansion, while maintaining our discipline around liquidity and risk management Highest priority is revenue growth led by Investment Banking maturation and continuing new hires Equities and Fixed Income are pursuing market share gains, as capabilities strengthen and competitors reshuffle Margin expansion will be achieved over time with active outsourcing efforts, further automation and net revenue growth reducing operating expenses as a percent of net revenue, and net revenue growth will allow compensation ratio to be reduced Digitalization effort focused on leveraging technology and innovation to help increase productivity 7

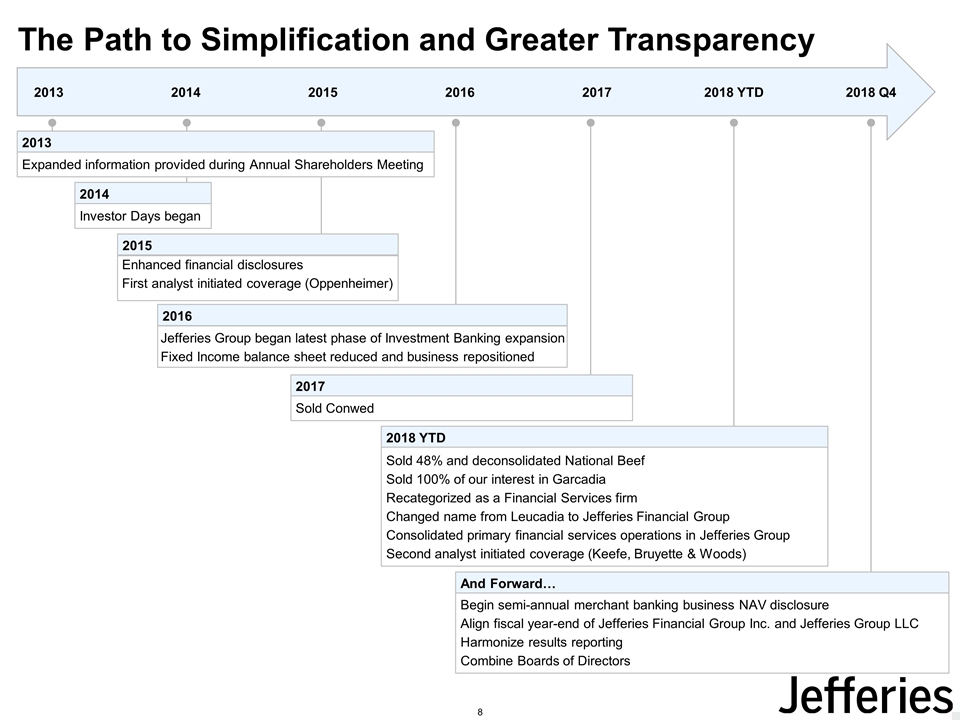

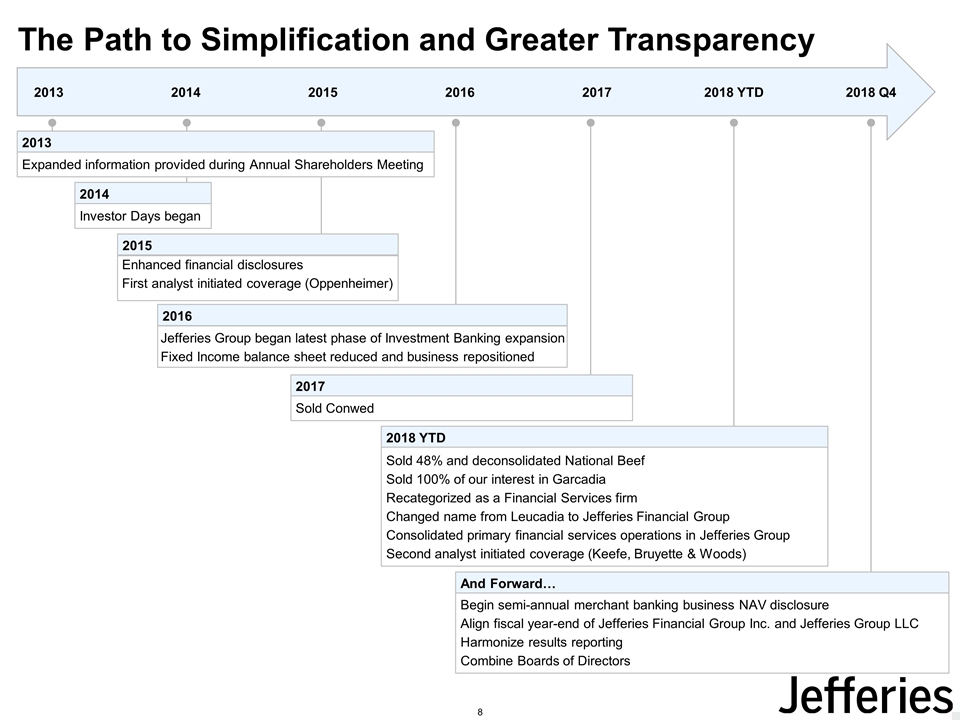

2016 The Path to Simplification and Greater Transparency 2013 2015 2016 2017 2018 YTD 2018 Q4 2017 Sold Conwed 2017 2018 YTD Sold 48% and deconsolidated National Beef Sold 100% of our interest in Garcadia Recategorized as a Financial Services firm Changed name from Leucadia to Jefferies Financial Group Consolidated primary financial services operations in Jefferies Group Second analyst initiated coverage (Keefe, Bruyette & Woods) 2018 YTD And Forward… Begin semi-annual merchant banking business NAV disclosure Align fiscal year-end of Jefferies Financial Group Inc. and Jefferies Group LLC Harmonize results reporting Combine Boards of Directors And Forward… 2014 2013 Expanded information provided during Annual Shareholders Meeting 2013 2014 Investor Days began 2014 8 2015 Jefferies Group began latest phase of Investment Banking expansion Fixed Income balance sheet reduced and business repositioned Enhanced financial disclosures First analyst initiated coverage (Oppenheimer)

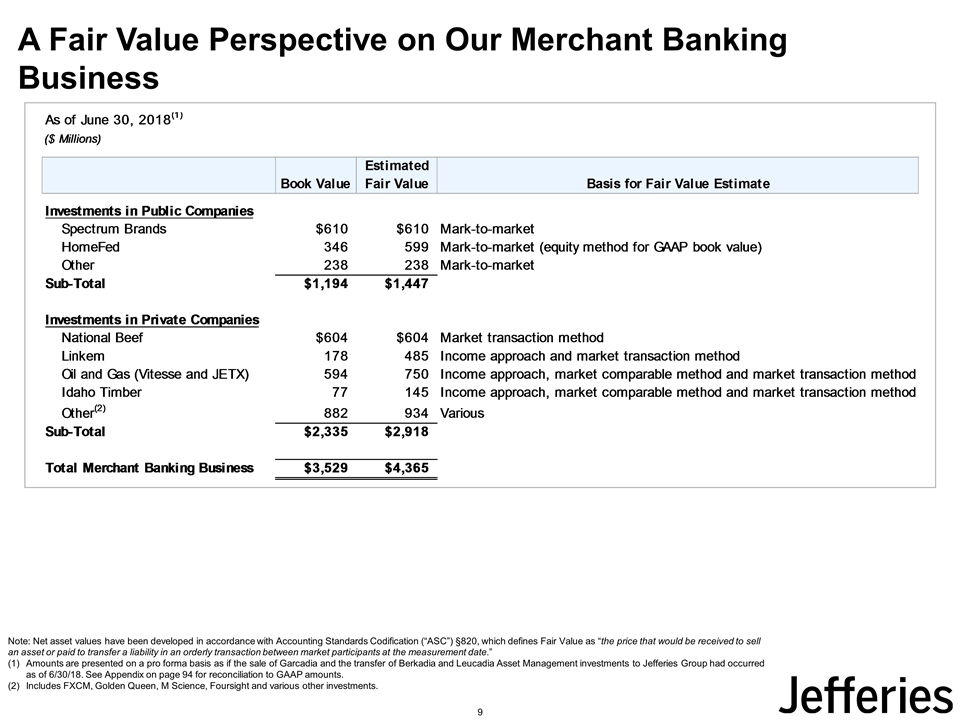

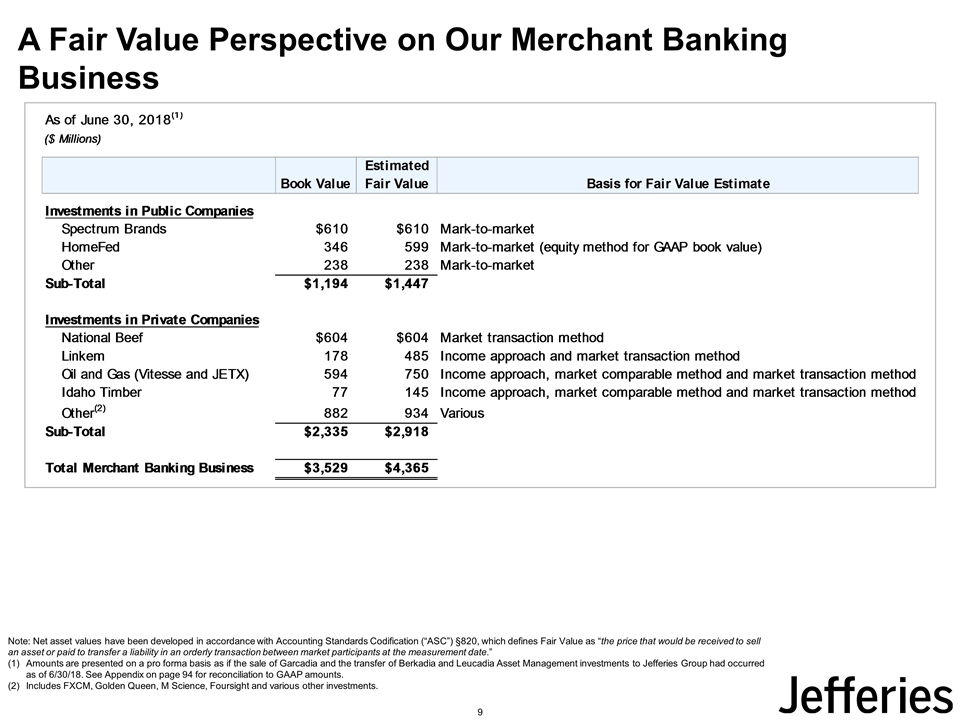

A Fair Value Perspective on Our Merchant Banking Business Note: Net asset values have been developed in accordance with Accounting Standards Codification (“ASC”) §820, which defines Fair Value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Amounts are presented on a pro forma basis as if the sale of Garcadia and the transfer of Berkadia and Leucadia Asset Management investments to Jefferies Group had occurred as of 6/30/18. See Appendix on page 94 for reconciliation to GAAP amounts. Includes FXCM, Golden Queen, M Science, Foursight and various other investments. 9

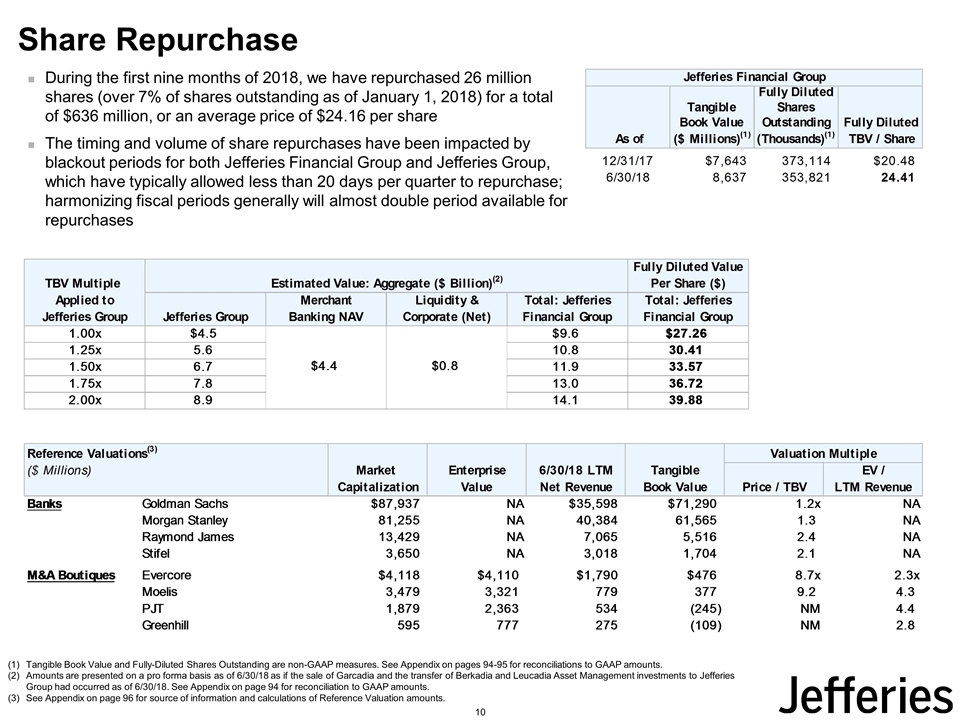

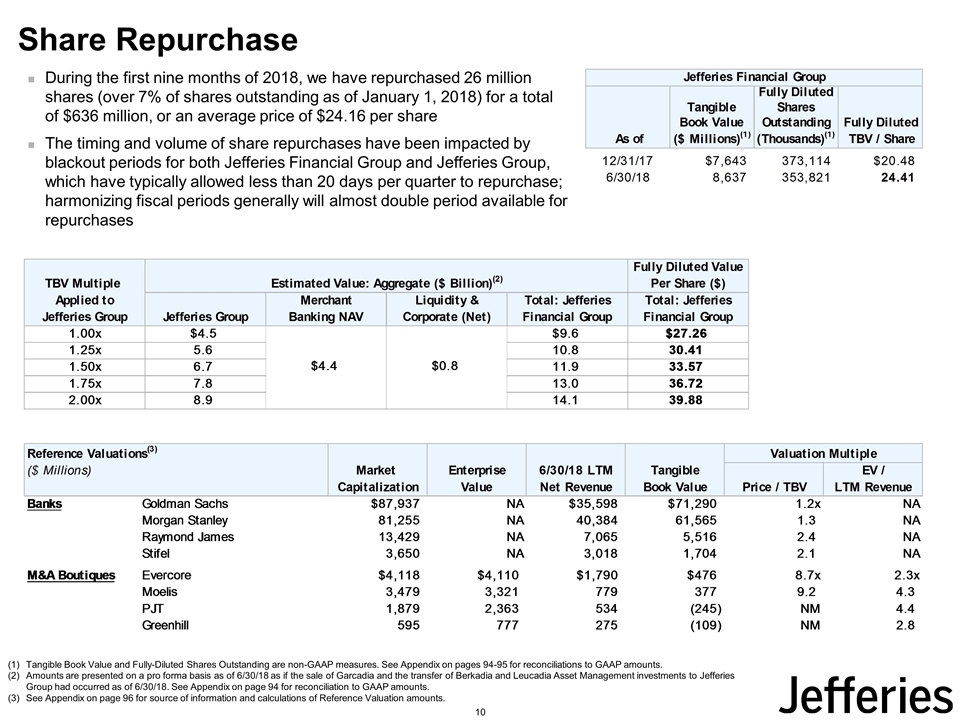

Share Repurchase Tangible Book Value and Fully-Diluted Shares Outstanding are non-GAAP measures. See Appendix on pages 94-95 for reconciliations to GAAP amounts. Amounts are presented on a pro forma basis as of 6/30/18 as if the sale of Garcadia and the transfer of Berkadia and Leucadia Asset Management investments to Jefferies Group had occurred as of 6/30/18. See Appendix on page 94 for reconciliation to GAAP amounts. See Appendix on page 96 for source of information and calculations of Reference Valuation amounts. During the first nine months of 2018, we have repurchased 26 million shares (over 7% of shares outstanding as of January 1, 2018) for a total of $636 million, or an average price of $24.16 per share The timing and volume of share repurchases have been impacted by blackout periods for both Jefferies Financial Group and Jefferies Group, which have typically allowed less than 20 days per quarter to repurchase; harmonizing fiscal periods generally will almost double period available for repurchases 10

Jefferies Group LLC 11

Financial Overview 12

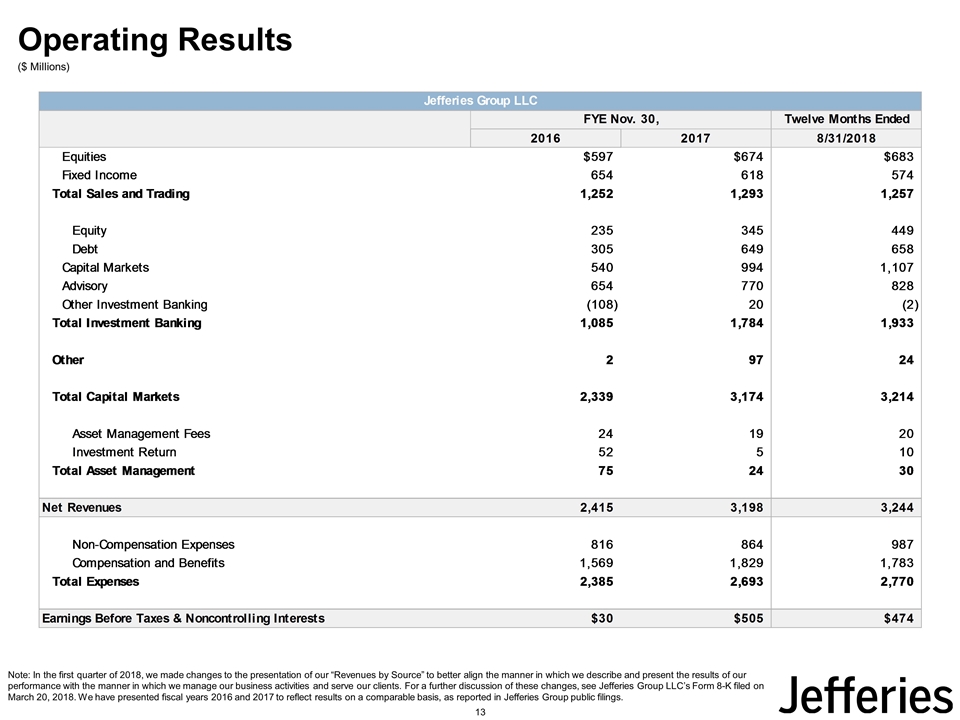

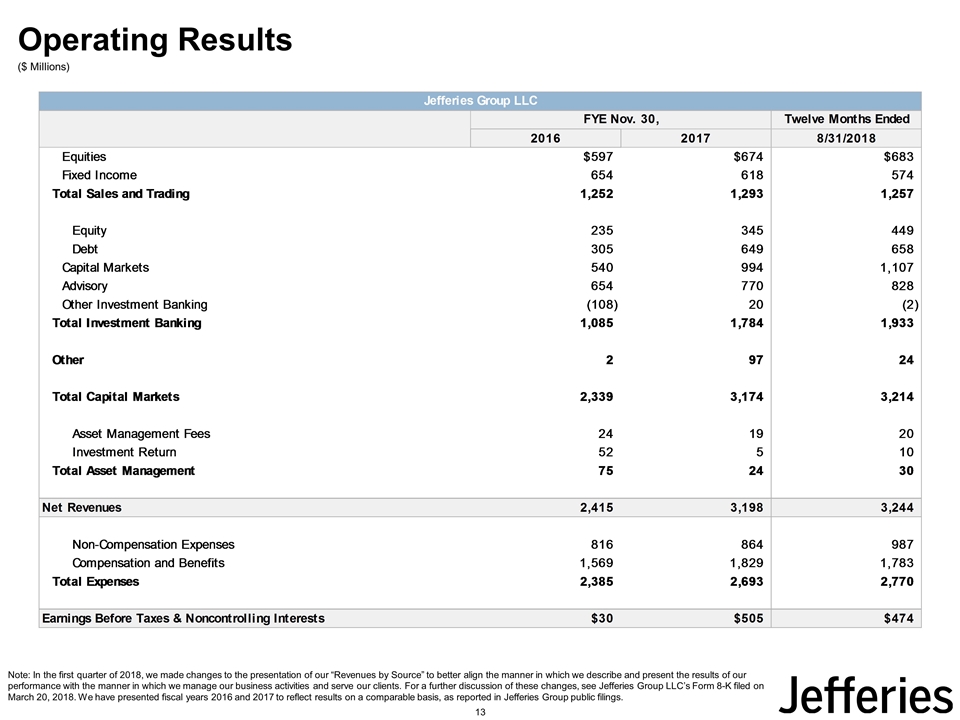

Operating Results Note: In the first quarter of 2018, we made changes to the presentation of our “Revenues by Source” to better align the manner in which we describe and present the results of our performance with the manner in which we manage our business activities and serve our clients. For a further discussion of these changes, see Jefferies Group LLC’s Form 8-K filed on March 20, 2018. We have presented fiscal years 2016 and 2017 to reflect results on a comparable basis, as reported in Jefferies Group public filings. ($ Millions) 13

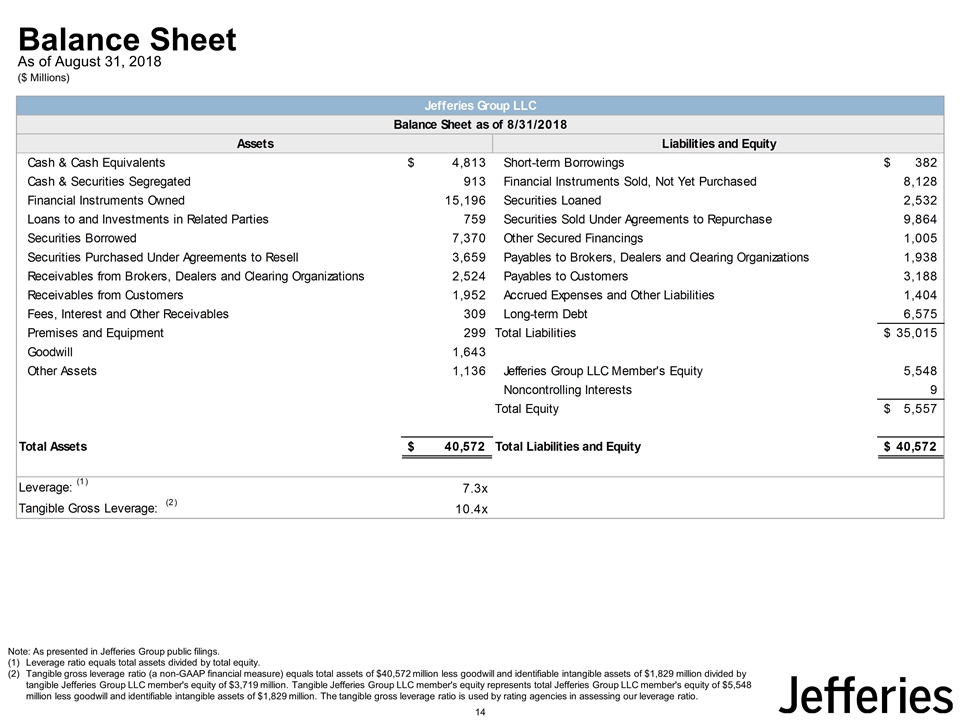

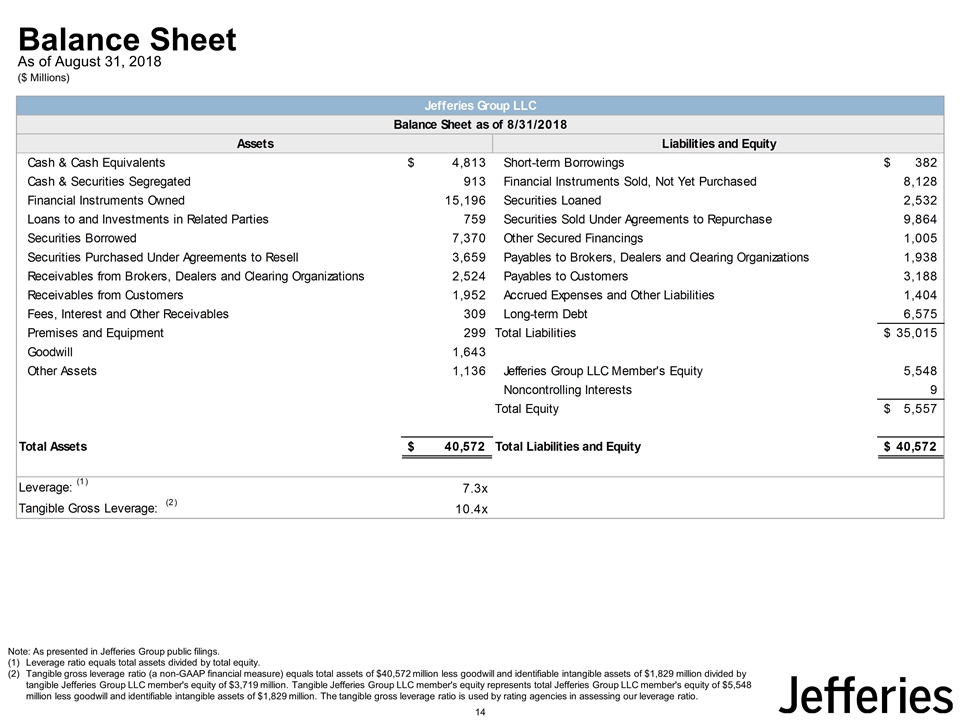

Balance Sheet As of August 31, 2018 ($ Millions) Note: As presented in Jefferies Group public filings. Leverage ratio equals total assets divided by total equity. Tangible gross leverage ratio (a non-GAAP financial measure) equals total assets of $40,572 million less goodwill and identifiable intangible assets of $1,829 million divided by tangible Jefferies Group LLC member's equity of $3,719 million. Tangible Jefferies Group LLC member's equity represents total Jefferies Group LLC member's equity of $5,548 million less goodwill and identifiable intangible assets of $1,829 million. The tangible gross leverage ratio is used by rating agencies in assessing our leverage ratio. 14

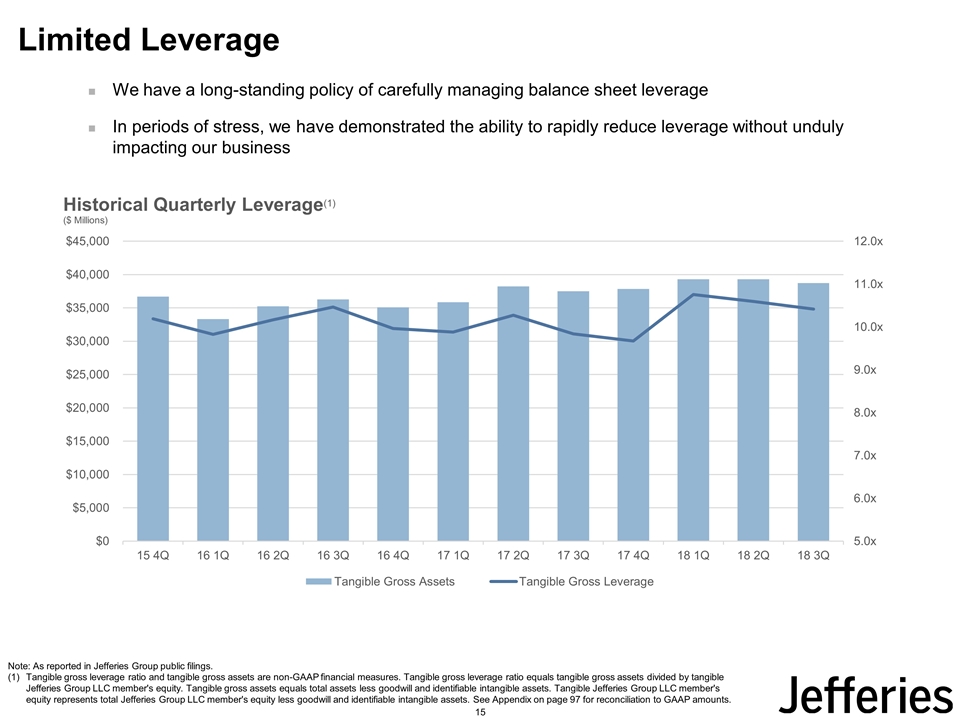

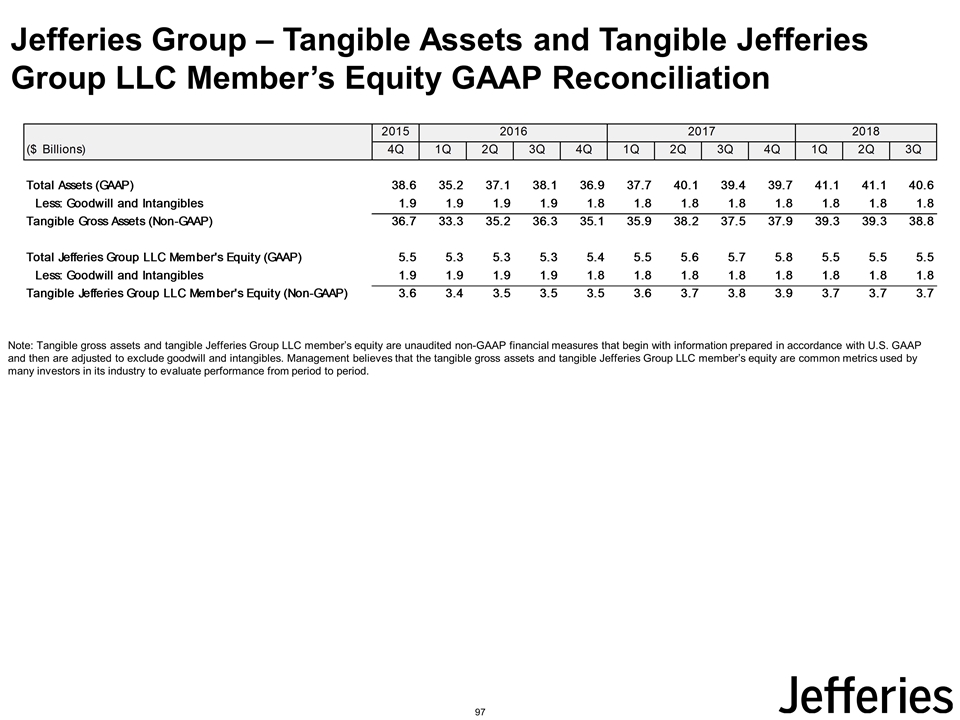

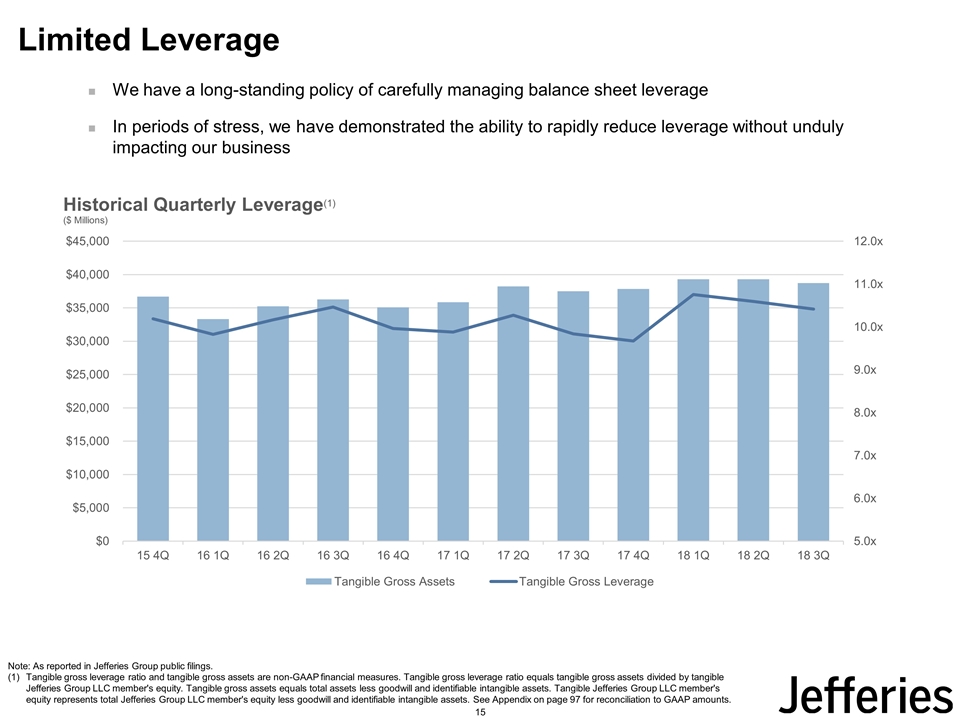

Limited Leverage Note: As reported in Jefferies Group public filings. Tangible gross leverage ratio and tangible gross assets are non-GAAP financial measures. Tangible gross leverage ratio equals tangible gross assets divided by tangible Jefferies Group LLC member's equity. Tangible gross assets equals total assets less goodwill and identifiable intangible assets. Tangible Jefferies Group LLC member's equity represents total Jefferies Group LLC member's equity less goodwill and identifiable intangible assets. See Appendix on page 97 for reconciliation to GAAP amounts. We have a long-standing policy of carefully managing balance sheet leverage In periods of stress, we have demonstrated the ability to rapidly reduce leverage without unduly impacting our business 15

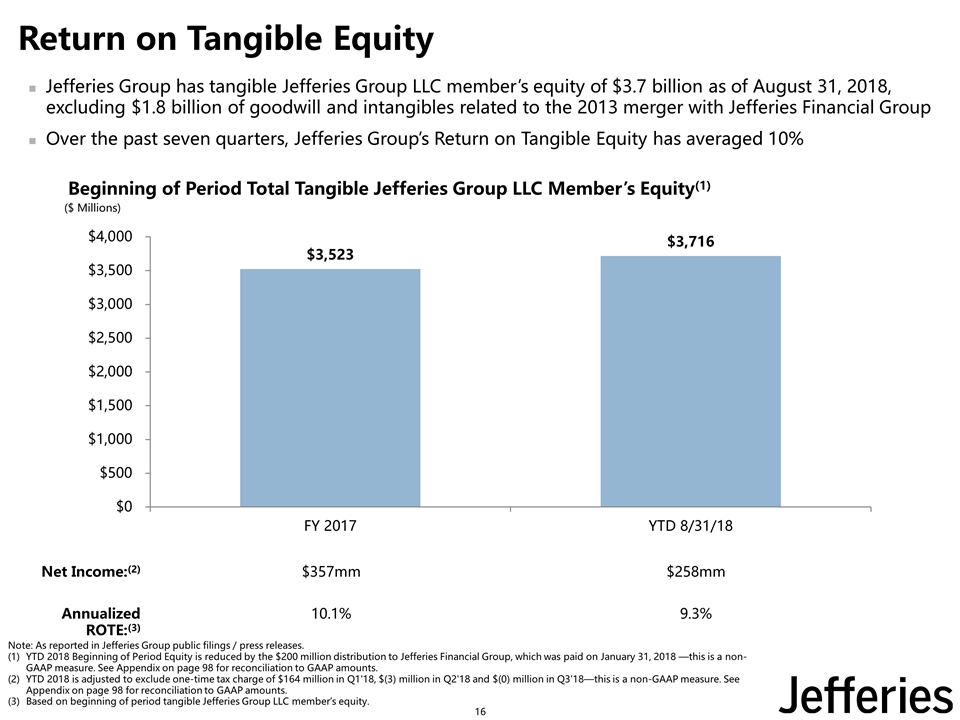

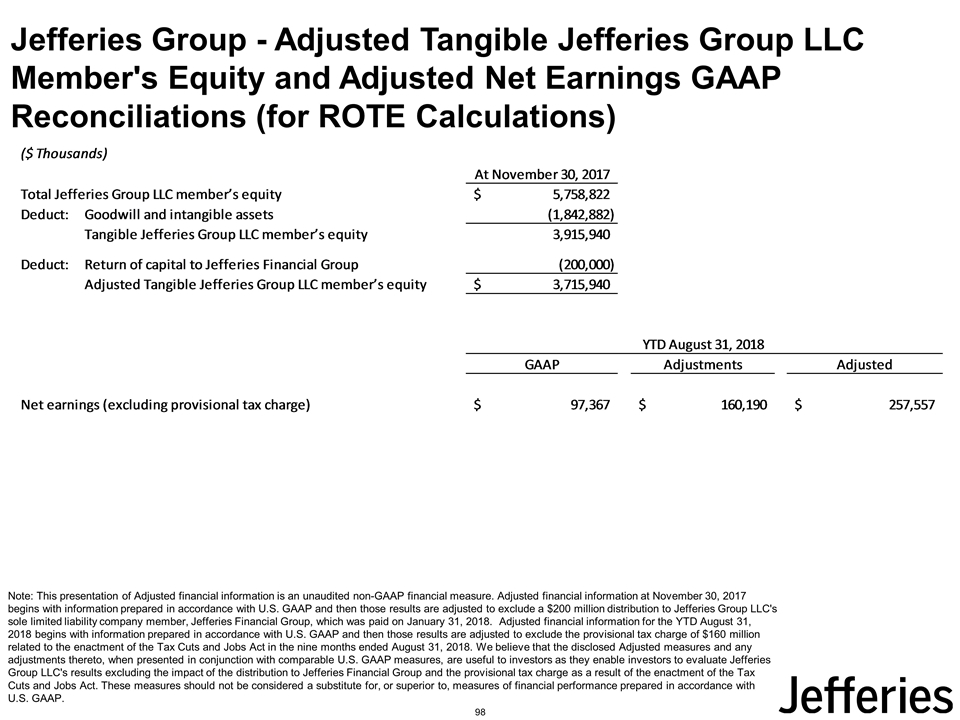

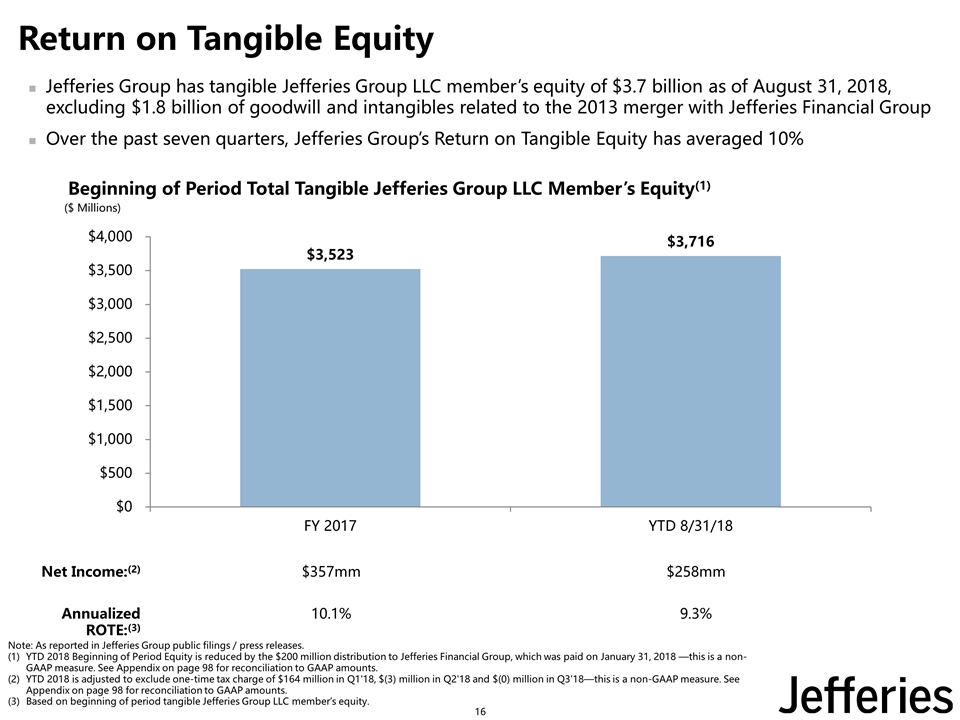

Beginning of Period Total Tangible Jefferies Group LLC Member’s Equity(1) Return on Tangible Equity Jefferies Group has tangible Jefferies Group LLC member’s equity of $3.7 billion as of August 31, 2018, excluding $1.8 billion of goodwill and intangibles related to the 2013 merger with Jefferies Financial Group Over the past seven quarters, Jefferies Group’s Return on Tangible Equity has averaged 10% ($ Millions) Note: As reported in Jefferies Group public filings / press releases. YTD 2018 Beginning of Period Equity is reduced by the $200 million distribution to Jefferies Financial Group, which was paid on January 31, 2018 —this is a non-GAAP measure. See Appendix on page 98 for reconciliation to GAAP amounts. YTD 2018 is adjusted to exclude one-time tax charge of $164 million in Q1'18, $(3) million in Q2'18 and $(0) million in Q3'18—this is a non-GAAP measure. See Appendix on page 98 for reconciliation to GAAP amounts. Based on beginning of period tangible Jefferies Group LLC member’s equity. Net Income:(2) Annualized ROTE:(3) $357mm 10.1% $258mm 9.3% 16

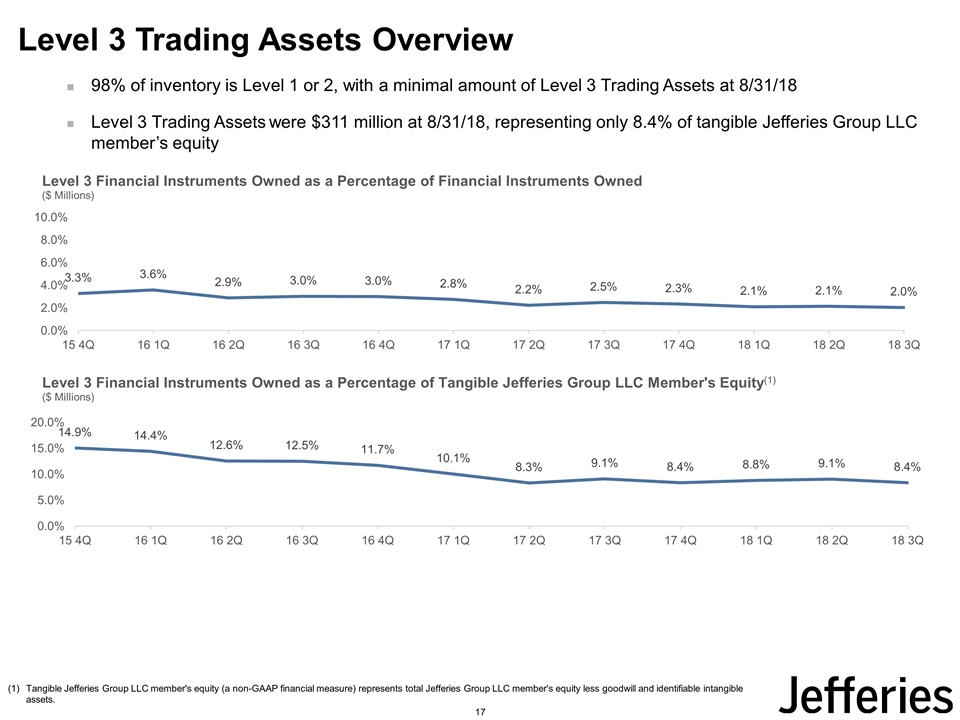

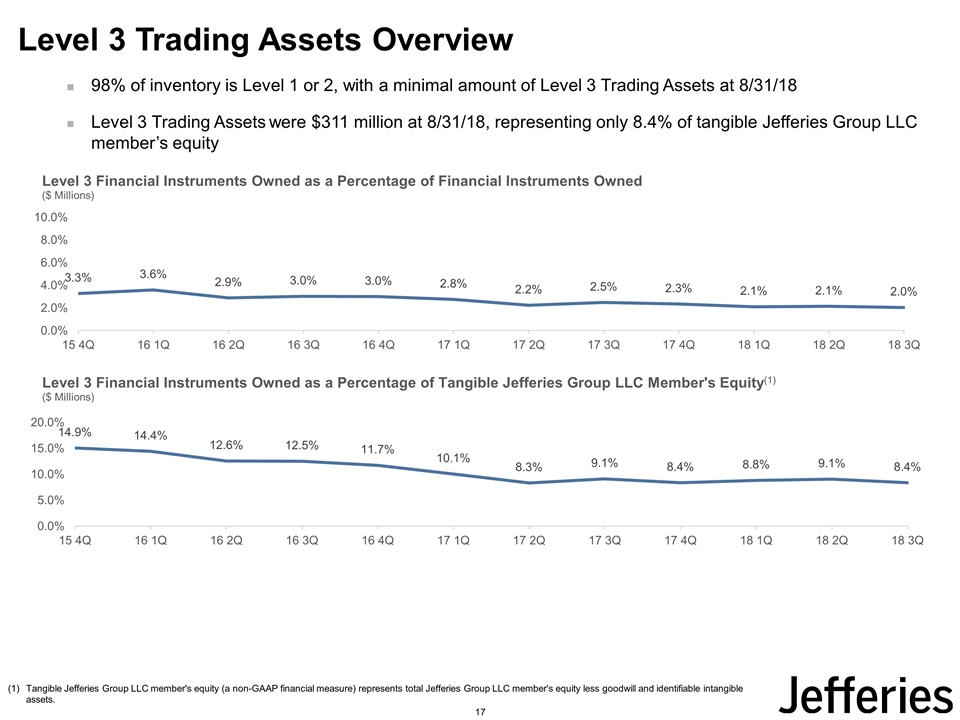

Level 3 Trading Assets Overview 98% of inventory is Level 1 or 2, with a minimal amount of Level 3 Trading Assets at 8/31/18 Level 3 Trading Assets were $311 million at 8/31/18, representing only 8.4% of tangible Jefferies Group LLC member’s equity Tangible Jefferies Group LLC member's equity (a non-GAAP financial measure) represents total Jefferies Group LLC member's equity less goodwill and identifiable intangible assets. 17

Investment Banking 18

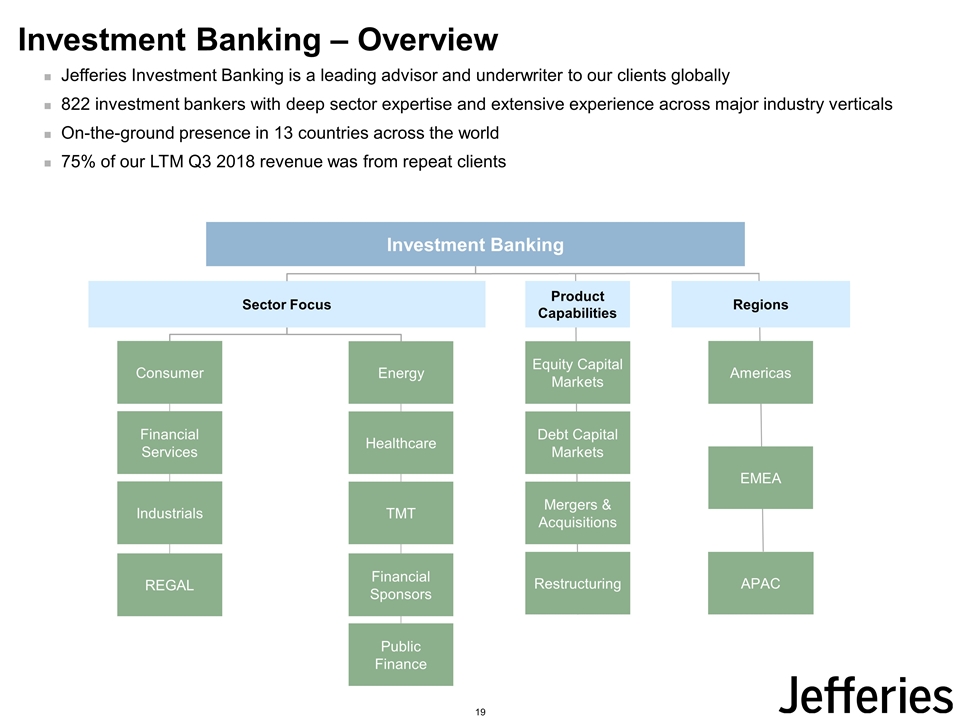

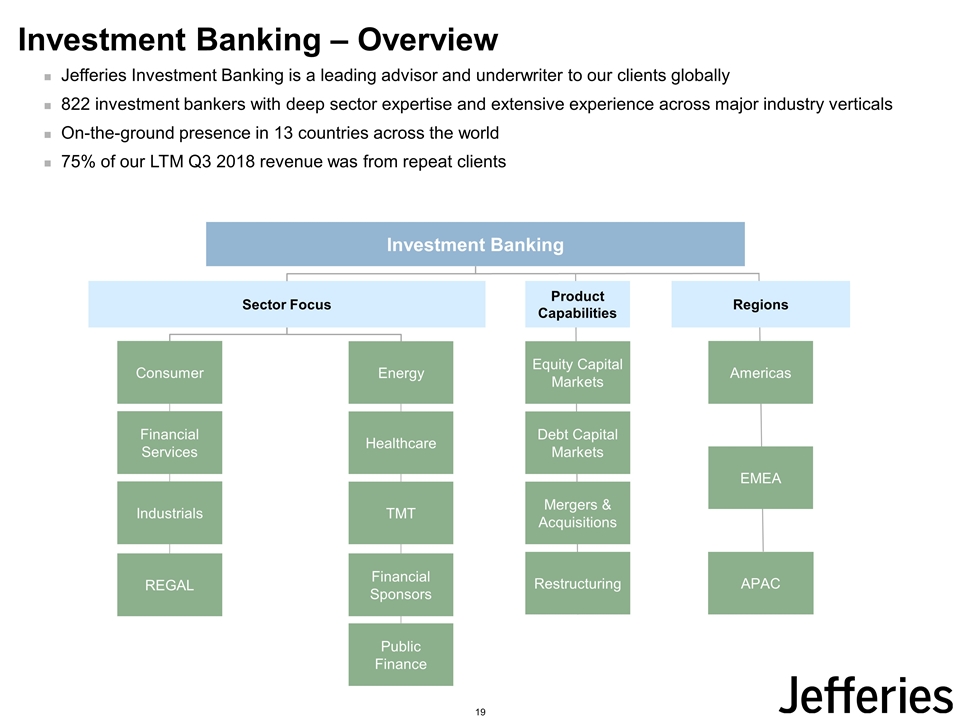

Investment Banking – Overview Jefferies Investment Banking is a leading advisor and underwriter to our clients globally 822 investment bankers with deep sector expertise and extensive experience across major industry verticals On-the-ground presence in 13 countries across the world 75% of our LTM Q3 2018 revenue was from repeat clients Sector Focus Consumer Investment Banking Energy REGAL Public Finance Regions Americas Product Capabilities Restructuring Healthcare TMT Financial Services Industrials Debt Capital Markets Equity Capital Markets Mergers & Acquisitions EMEA APAC Financial Sponsors 19

Investment Banking – Sector, Product, and Regional Expansion Since the beginning of fiscal 2017, we have expanded our Managing Director footprint across sectors, products and geographies Expanded our sector footprint in Industrials, Consumer, Technology, Financial Services and Municipal Finance Expanded our M&A specialist footprint in Industrials, Consumer, REGAL and Technology sectors Established an Activist and Takeover Defense business Expanded our ECM platform into 144a Offerings, SPACs, At-The-Market Offerings and Technology Private Placements Expanded our coverage of Mid-Cap Financial Sponsors Established investment banking businesses in Benelux and Australia and further expanded our footprint in the U.K. Industrials Building Products Business Services Capital Goods Aerospace, Defense and Government Services Metals and Mining Consumer and Retail Beauty and Personal Care Lifestyle and Outdoor Areas of Managing Director Expansion Since Beginning of 2017 TMT Cloud Infrastructure Technology-Enabled Services Financial Services Commercial Banks Insurance Services Healthcare Healthcare IT Financial Sponsors Middle Market Sponsors Municipal Finance Sector Regions Products Equity Capital Markets 144a Offerings SPACs At-The-Market Offerings Technology Private Placements Mergers & Acquisitions Activist and Takeover Defense Middle Market M&A Australia Benelux U.K. 20

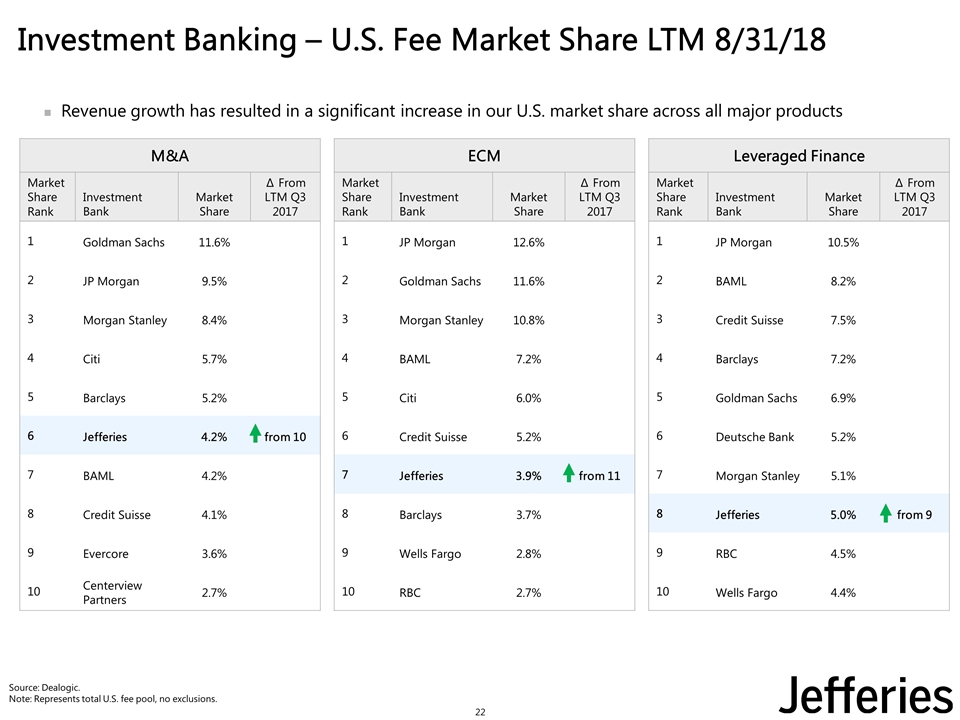

Our investment banking revenues for the nine months ended fiscal 2018 increased 12% compared to the nine months ended fiscal 2017 and for the LTM Q3 2018 increased 16% compared to the same period in 2017 Our performance was driven by significant revenue increases in ECM and M&A This resulted in our market share increasing across both the U.S. and Europe Investment Banking Net Revenues(1) Investment Banking – Performance Update Note: As reported in Jefferies Group public filings. In the first quarter of 2018, we made changes to the presentation of our “Revenues by Source” to better align the manner in which we describe and present the results of our performance with the manner in which we manage our business activities and serve our clients. For a further discussion of these changes, see Jefferies Group LLC’s Form 8-K filed on March 20, 2018. We have presented fiscal years 2016 and 2017 to reflect results on a comparable basis, as reported in Jefferies Group public filings. Periods prior to fiscal 2016 do not reflect these “Revenues by Source” changes to the presentation. (1) Excludes Other Investment Banking revenue. ($ Billions) 21

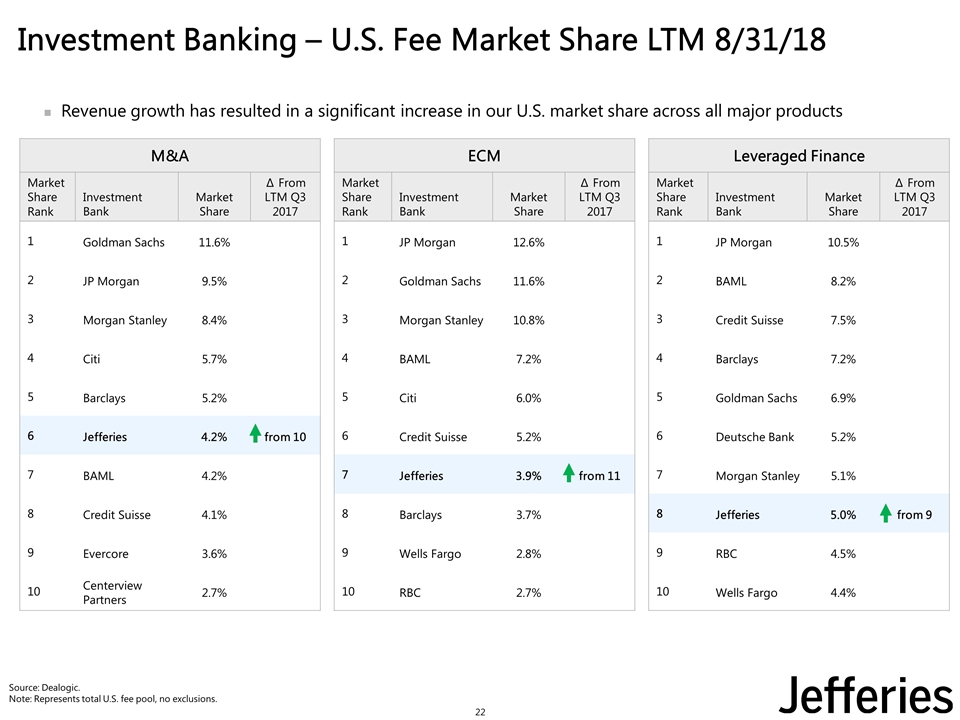

Investment Banking – U.S. Fee Market Share LTM 8/31/18 M&A Market Share Rank Investment Bank Market Share ∆ From LTM Q3 2017 1 Goldman Sachs 11.6% 2 JP Morgan 9.5% 3 Morgan Stanley 8.4% 4 Citi 5.7% 5 Barclays 5.2% 6 Jefferies 4.2% from 10 7 BAML 4.2% 8 Credit Suisse 4.1% 9 Evercore 3.6% 10 Centerview Partners 2.7% Revenue growth has resulted in a significant increase in our U.S. market share across all major products ECM Market Share Rank Investment Bank Market Share ∆ From LTM Q3 2017 1 JP Morgan 12.6% 2 Goldman Sachs 11.6% 3 Morgan Stanley 10.8% 4 BAML 7.2% 5 Citi 6.0% 6 Credit Suisse 5.2% 7 Jefferies 3.9% from 11 8 Barclays 3.7% 9 Wells Fargo 2.8% 10 RBC 2.7% Leveraged Finance Market Share Rank Investment Bank Market Share ∆ From LTM Q3 2017 1 JP Morgan 10.5% 2 BAML 8.2% 3 Credit Suisse 7.5% 4 Barclays 7.2% 5 Goldman Sachs 6.9% 6 Deutsche Bank 5.2% 7 Morgan Stanley 5.1% 8 Jefferies 5.0% from 9 9 RBC 4.5% 10 Wells Fargo 4.4% Source: Dealogic. Note: Represents total U.S. fee pool, no exclusions. 22

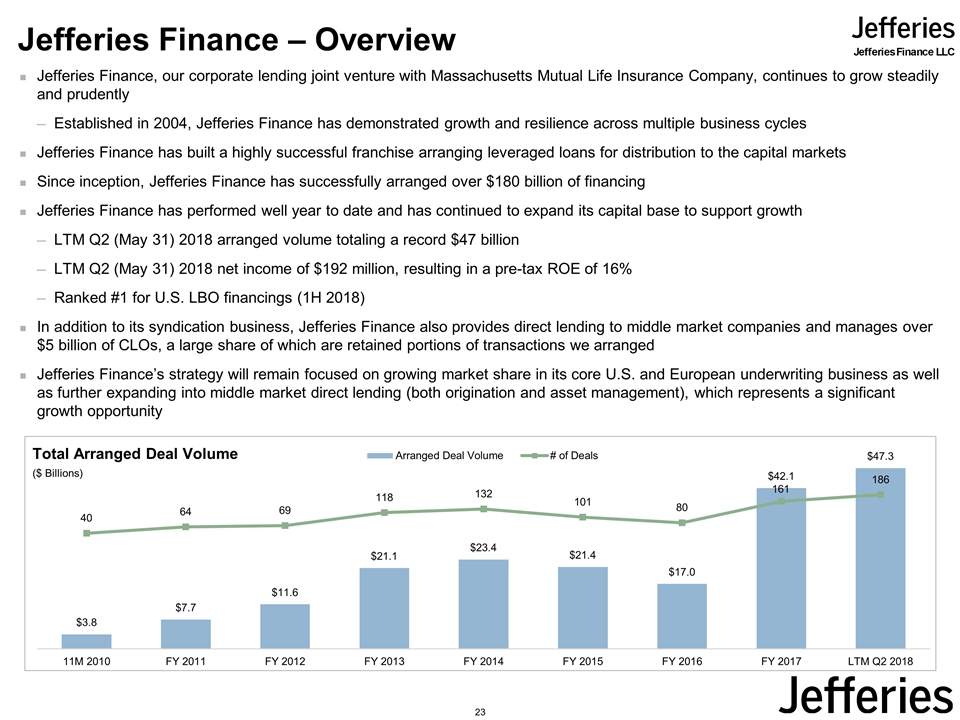

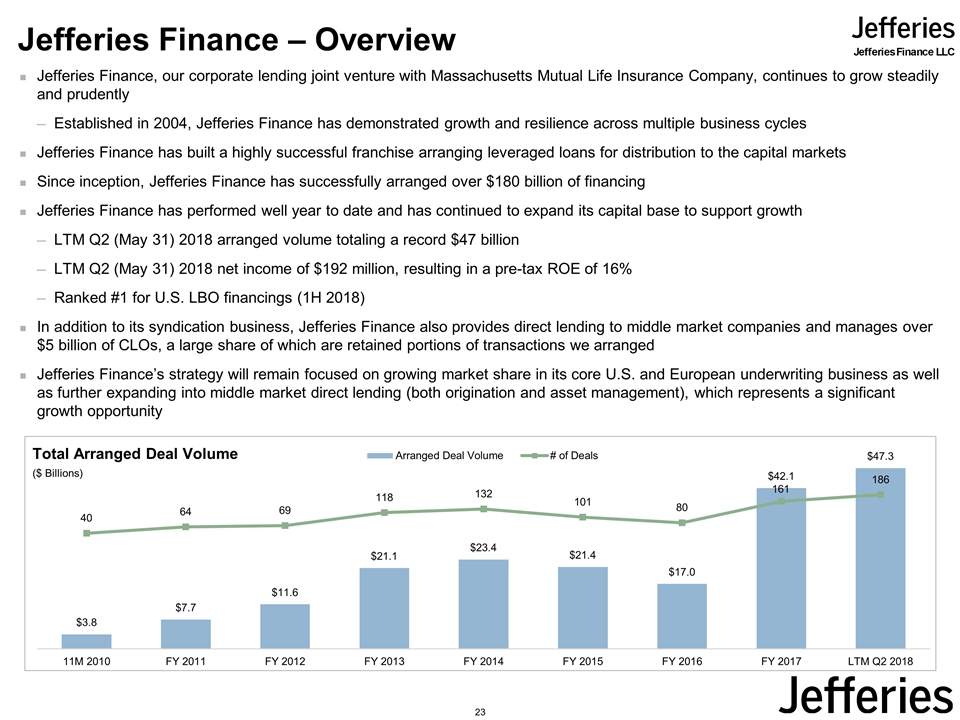

Jefferies Finance – Overview Jefferies Finance, our corporate lending joint venture with Massachusetts Mutual Life Insurance Company, continues to grow steadily and prudently Established in 2004, Jefferies Finance has demonstrated growth and resilience across multiple business cycles Jefferies Finance has built a highly successful franchise arranging leveraged loans for distribution to the capital markets Since inception, Jefferies Finance has successfully arranged over $180 billion of financing Jefferies Finance has performed well year to date and has continued to expand its capital base to support growth LTM Q2 (May 31) 2018 arranged volume totaling a record $47 billion LTM Q2 (May 31) 2018 net income of $192 million, resulting in a pre-tax ROE of 16% Ranked #1 for U.S. LBO financings (1H 2018) In addition to its syndication business, Jefferies Finance also provides direct lending to middle market companies and manages over $5 billion of CLOs, a large share of which are retained portions of transactions we arranged Jefferies Finance’s strategy will remain focused on growing market share in its core U.S. and European underwriting business as well as further expanding into middle market direct lending (both origination and asset management), which represents a significant growth opportunity Total Arranged Deal Volume ($ Billions) 23

Continue to increase the productivity of our sector MDs Capitalize on the significant revenue opportunities in recently entered sectors, products and regions Drive further market share gains in M&A by leveraging our increased coverage footprint and continuing to increase the average size and fees of our M&A transactions Monetize the large number of M&A and ECM opportunities embedded in our incumbent positions as the leading underwriter of acquisitions by financial sponsors Significantly penetrate the middle market sponsor universe by combining our expanded sponsor footprint, together with our deep sector expertise, sell-side M&A franchise and direct lending capabilities Capitalize on the ECM revenue opportunities arising from our expansion into SPACs, 144a Offerings, At-The-Market Offerings and Technology Private Placements Selectively enter new industry sub-sectors in Industrials, Consumer and Financial Services across both U.S. and Europe Investment Banking – Strategic Priorities 24

Equities 25

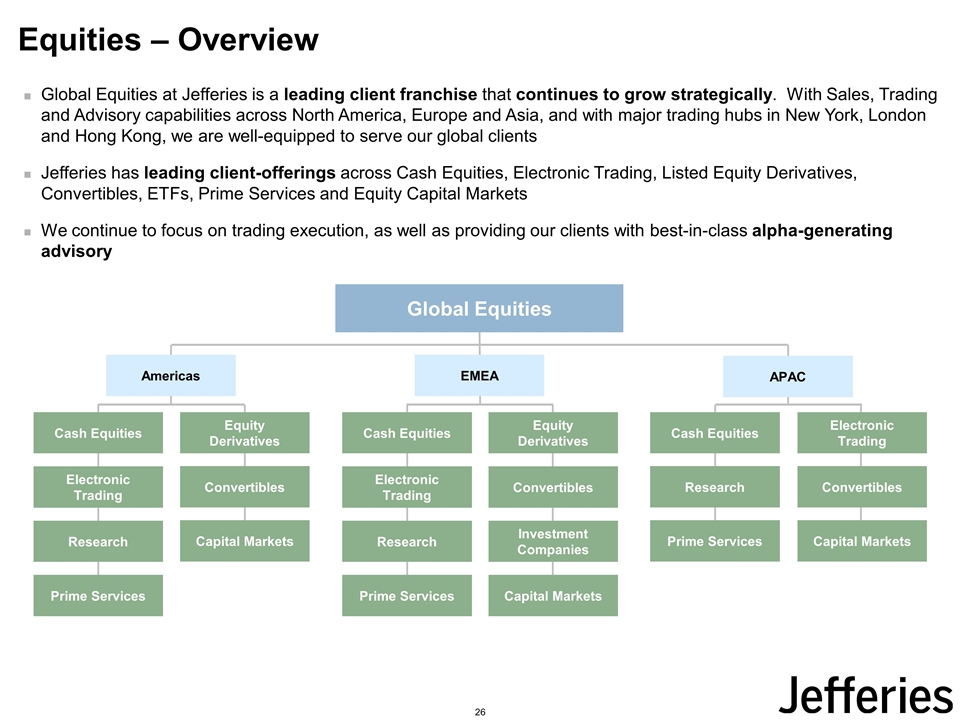

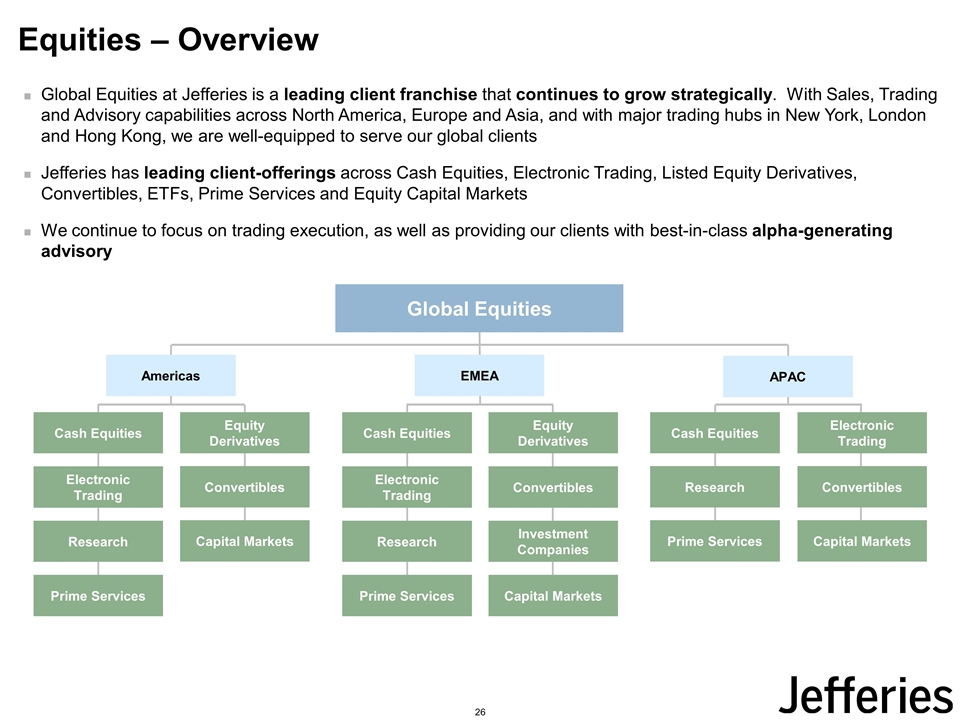

Equities – Overview Global Equities at Jefferies is a leading client franchise that continues to grow strategically. With Sales, Trading and Advisory capabilities across North America, Europe and Asia, and with major trading hubs in New York, London and Hong Kong, we are well-equipped to serve our global clients Jefferies has leading client-offerings across Cash Equities, Electronic Trading, Listed Equity Derivatives, Convertibles, ETFs, Prime Services and Equity Capital Markets We continue to focus on trading execution, as well as providing our clients with best-in-class alpha-generating advisory APAC Cash Equities Americas Equity Derivatives EMEA Global Equities Electronic Trading Capital Markets Equity Derivatives Electronic Trading Capital Markets Electronic Trading Convertibles Research Research Research Convertibles Convertibles Prime Services Prime Services Prime Services Investment Companies Capital Markets Cash Equities Cash Equities 26

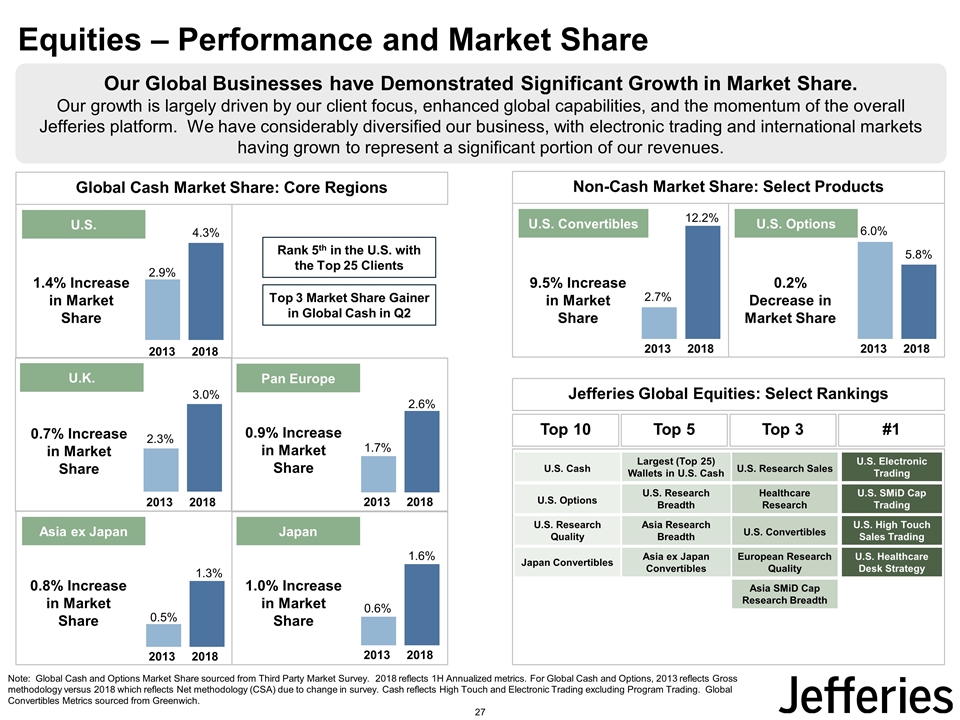

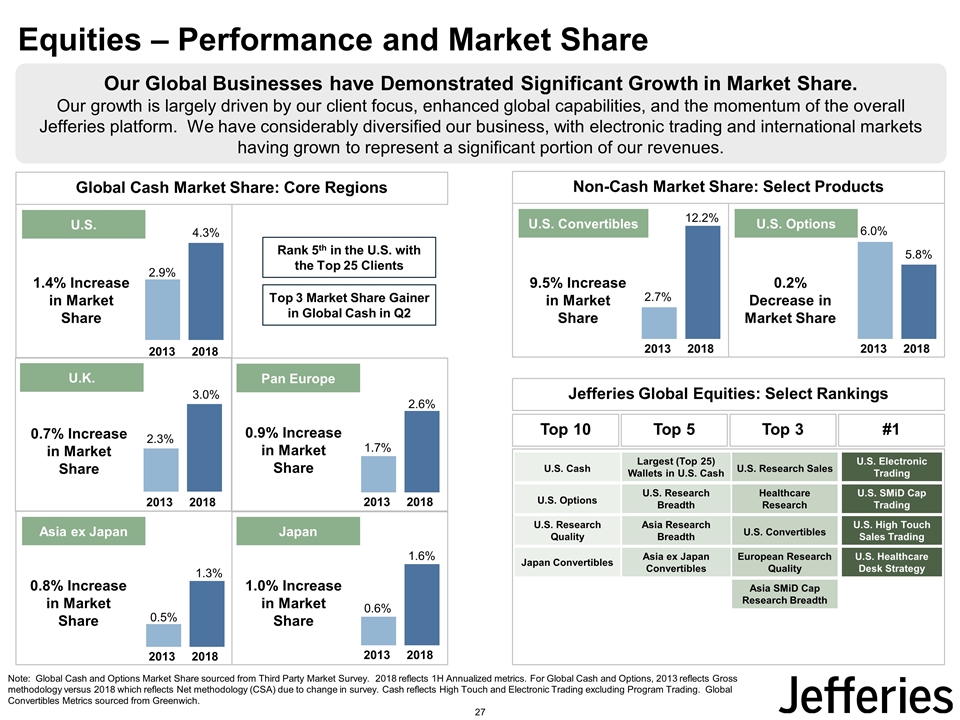

Our Global Businesses have Demonstrated Significant Growth in Market Share. Our growth is largely driven by our client focus, enhanced global capabilities, and the momentum of the overall Jefferies platform. We have considerably diversified our business, with electronic trading and international markets having grown to represent a significant portion of our revenues. Global Cash Market Share: Core Regions Non-Cash Market Share: Select Products Top 10 2013 2018 U.S. U.K. Asia ex Japan Japan 2013 2018 2013 2018 2013 2018 2013 2018 U.S. Options 2.9% 2.3% 0.5% 0.6% 1.4% Increase in Market Share 0.8% Increase in Market Share 0.7% Increase in Market Share 1.0% Increase in Market Share 0.2% Decrease in Market Share 6.0% Pan Europe 2013 2018 1.7% 0.9% Increase in Market Share Top 5 Top 3 #1 U.S. Cash U.S. Options Asia Research Breadth U.S. Research Breadth European Research Quality U.S. Research Sales Healthcare Research U.S. Convertibles Asia ex Japan Convertibles Japan Convertibles U.S. Electronic Trading U.S. SMiD Cap Trading U.S. High Touch Sales Trading U.S. Healthcare Desk Strategy Asia SMiD Cap Research Breadth Jefferies Global Equities: Select Rankings 4.3% 3.0% 2.6% 1.3% 1.6% 5.8% Largest (Top 25) Wallets in U.S. Cash Note: Global Cash and Options Market Share sourced from Third Party Market Survey. 2018 reflects 1H Annualized metrics. For Global Cash and Options, 2013 reflects Gross methodology versus 2018 which reflects Net methodology (CSA) due to change in survey. Cash reflects High Touch and Electronic Trading excluding Program Trading. Global Convertibles Metrics sourced from Greenwich. U.S. Research Quality Equities – Performance and Market Share Rank 5th in the U.S. with the Top 25 Clients Top 3 Market Share Gainer in Global Cash in Q2 2013 2018 U.S. Convertibles 9.5% Increase in Market Share 2.7% 12.2% 27

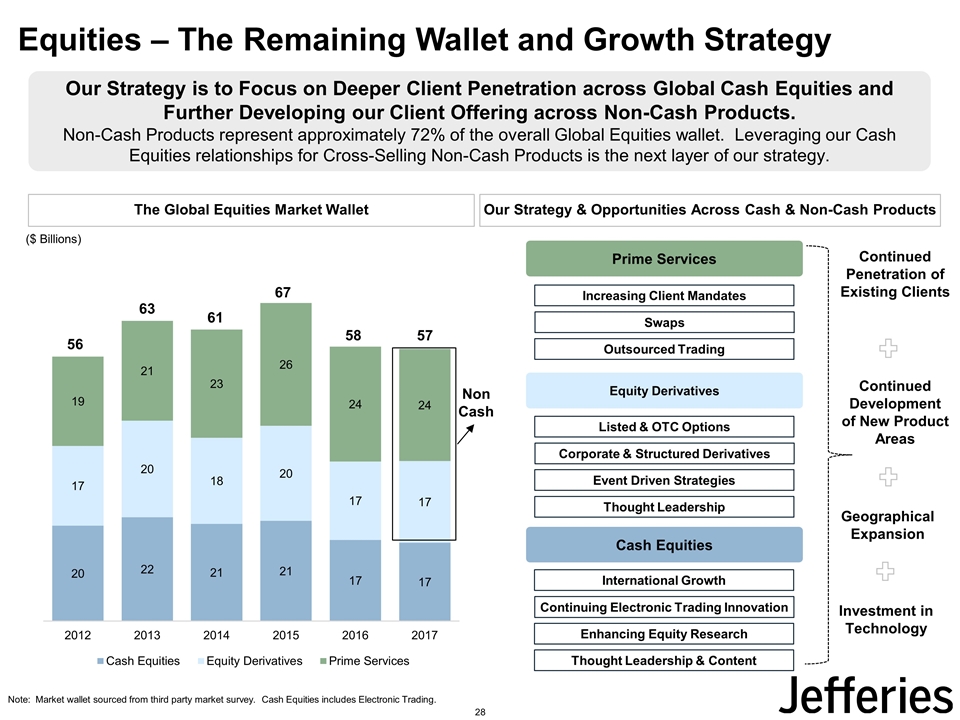

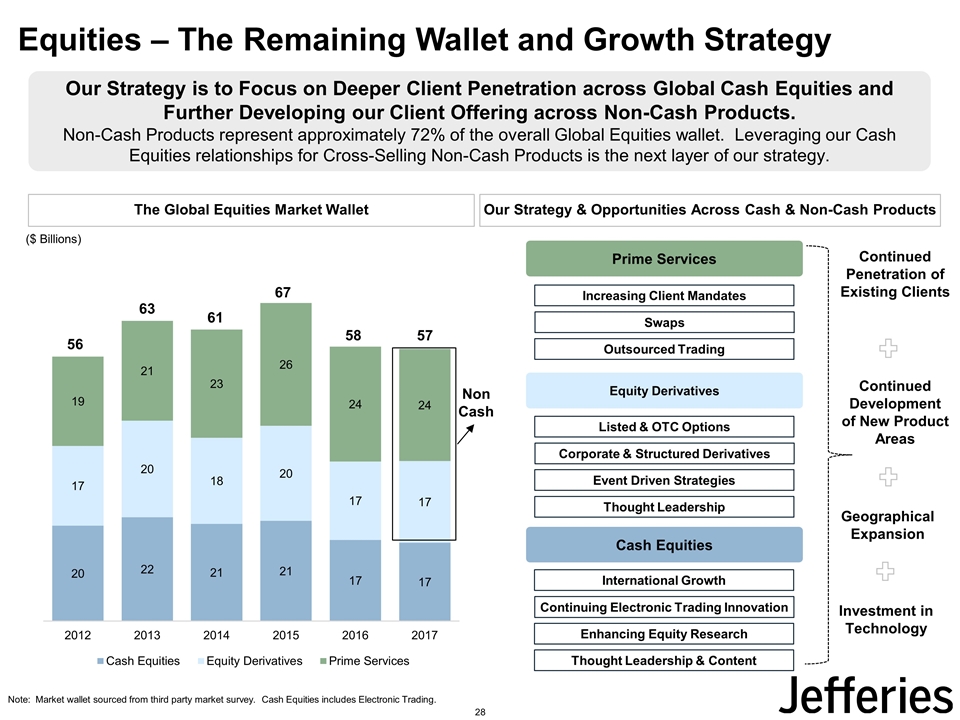

Equities – The Remaining Wallet and Growth Strategy Our Strategy is to Focus on Deeper Client Penetration across Global Cash Equities and Further Developing our Client Offering across Non-Cash Products. Non-Cash Products represent approximately 72% of the overall Global Equities wallet. Leveraging our Cash Equities relationships for Cross-Selling Non-Cash Products is the next layer of our strategy. The Global Equities Market Wallet Our Strategy & Opportunities Across Cash & Non-Cash Products ($ Billions) 57 58 67 61 63 56 Non Cash Note: Market wallet sourced from third party market survey. Cash Equities includes Electronic Trading. Continued Penetration of Existing Clients Geographical Expansion Continued Development of New Product Areas Investment in Technology Prime Services Increasing Client Mandates Swaps Outsourced Trading Equity Derivatives Listed & OTC Options Corporate & Structured Derivatives Event Driven Strategies Thought Leadership Cash Equities International Growth Continuing Electronic Trading Innovation Enhancing Equity Research Thought Leadership & Content 28

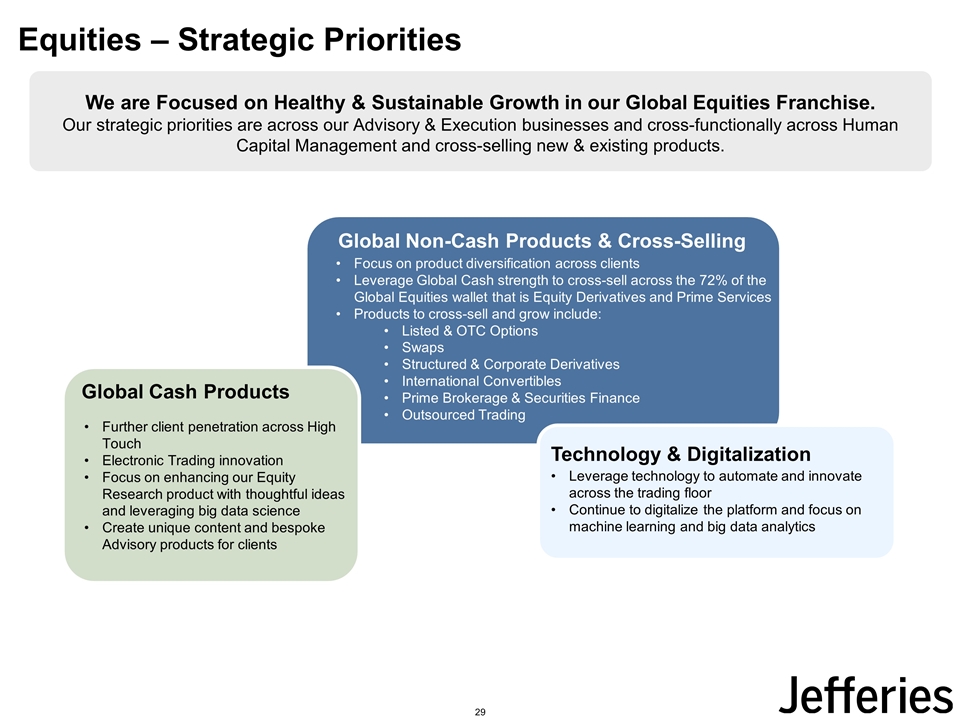

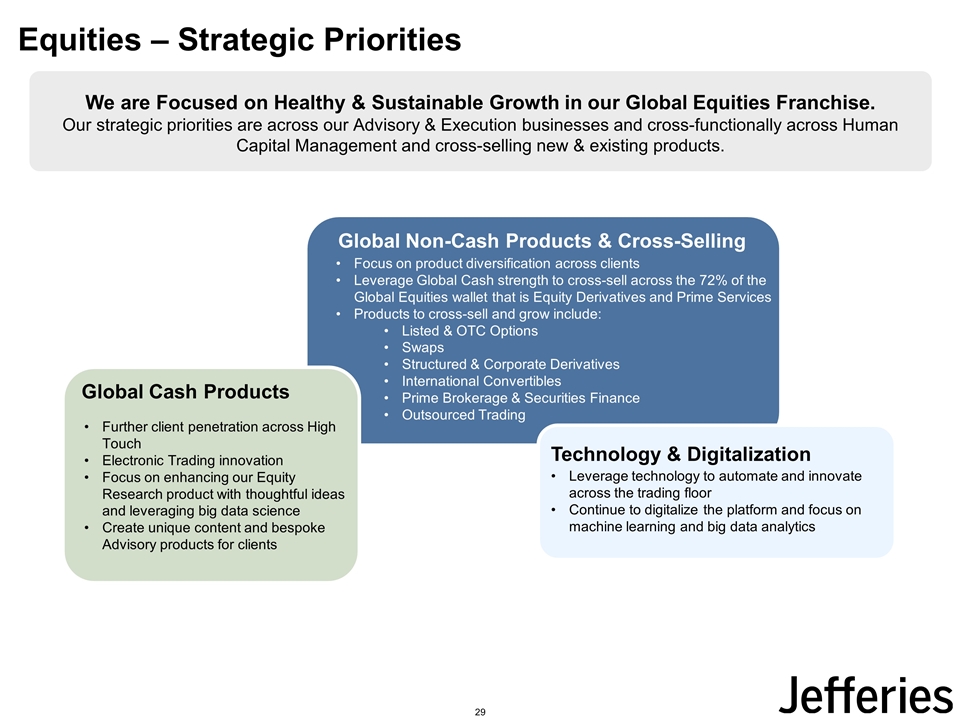

Equities – Strategic Priorities We are Focused on Healthy & Sustainable Growth in our Global Equities Franchise. Our strategic priorities are across our Advisory & Execution businesses and cross-functionally across Human Capital Management and cross-selling new & existing products. Business Area Global Non-Cash Products & Cross-Selling Focus on product diversification across clients Leverage Global Cash strength to cross-sell across the 72% of the Global Equities wallet that is Equity Derivatives and Prime Services Products to cross-sell and grow include: Listed & OTC Options Swaps Structured & Corporate Derivatives International Convertibles Prime Brokerage & Securities Finance Outsourced Trading Technology & Digitalization Leverage technology to automate and innovate across the trading floor Continue to digitalize the platform and focus on machine learning and big data analytics Business Area Global Cash Products Further client penetration across High Touch Electronic Trading innovation Focus on enhancing our Equity Research product with thoughtful ideas and leveraging big data science Create unique content and bespoke Advisory products for clients 29

Fixed Income 30

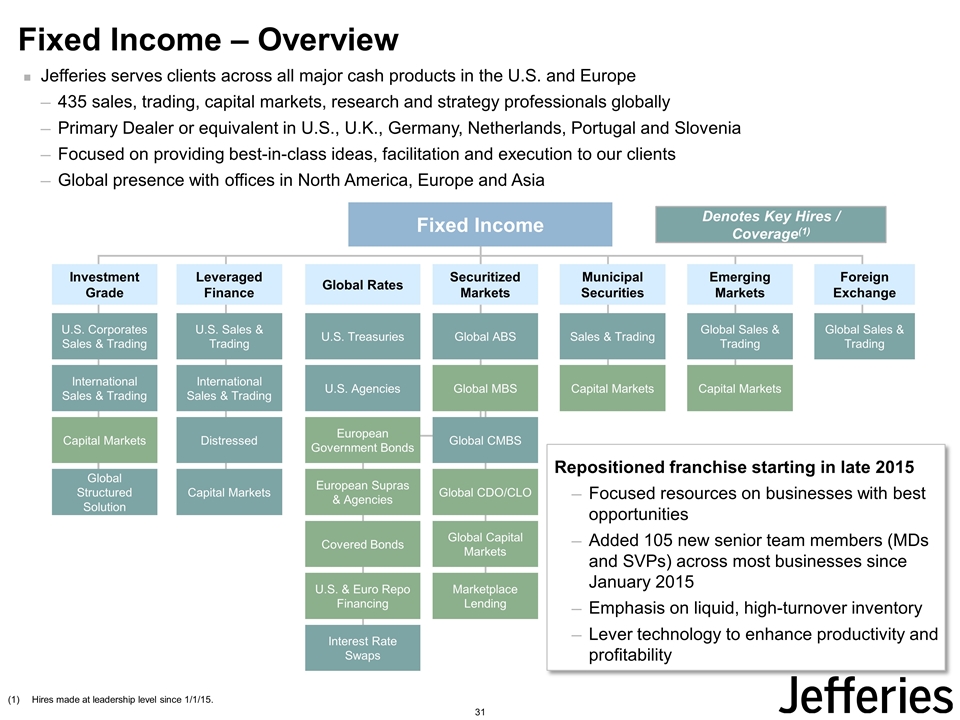

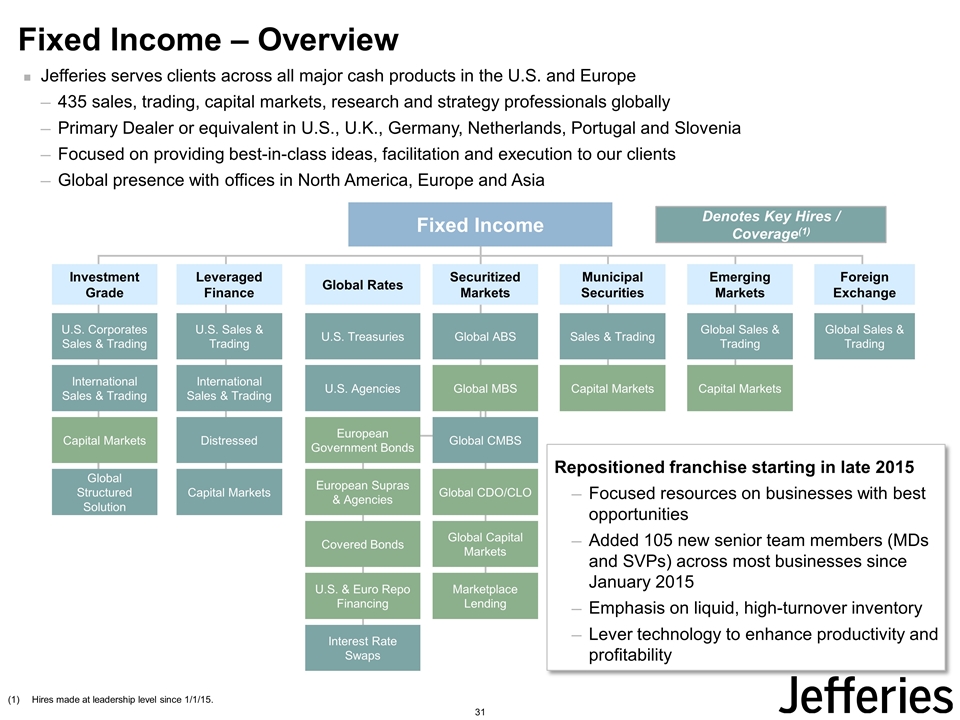

Jefferies serves clients across all major cash products in the U.S. and Europe 435 sales, trading, capital markets, research and strategy professionals globally Primary Dealer or equivalent in U.S., U.K., Germany, Netherlands, Portugal and Slovenia Focused on providing best-in-class ideas, facilitation and execution to our clients Global presence with offices in North America, Europe and Asia Fixed Income – Overview Hires made at leadership level since 1/1/15. Denotes Key Hires / Coverage(1) Fixed Income Emerging Markets Capital Markets Global Sales & Trading Municipal Securities Sales & Trading Capital Markets Investment Grade Capital Markets U.S. Corporates Sales & Trading International Sales & Trading Leveraged Finance U.S. Sales & Trading International Sales & Trading Distressed Global Rates U.S. Treasuries U.S. Agencies European Government Bonds U.S. & Euro Repo Financing European Supras & Agencies Covered Bonds Securitized Markets Global CDO/CLO Global ABS Global MBS Global CMBS Marketplace Lending Global Capital Markets Foreign Exchange Global Sales & Trading Capital Markets Global Structured Solution Repositioned franchise starting in late 2015 Focused resources on businesses with best opportunities Added 105 new senior team members (MDs and SVPs) across most businesses since January 2015 Emphasis on liquid, high-turnover inventory Lever technology to enhance productivity and profitability Interest Rate Swaps 31

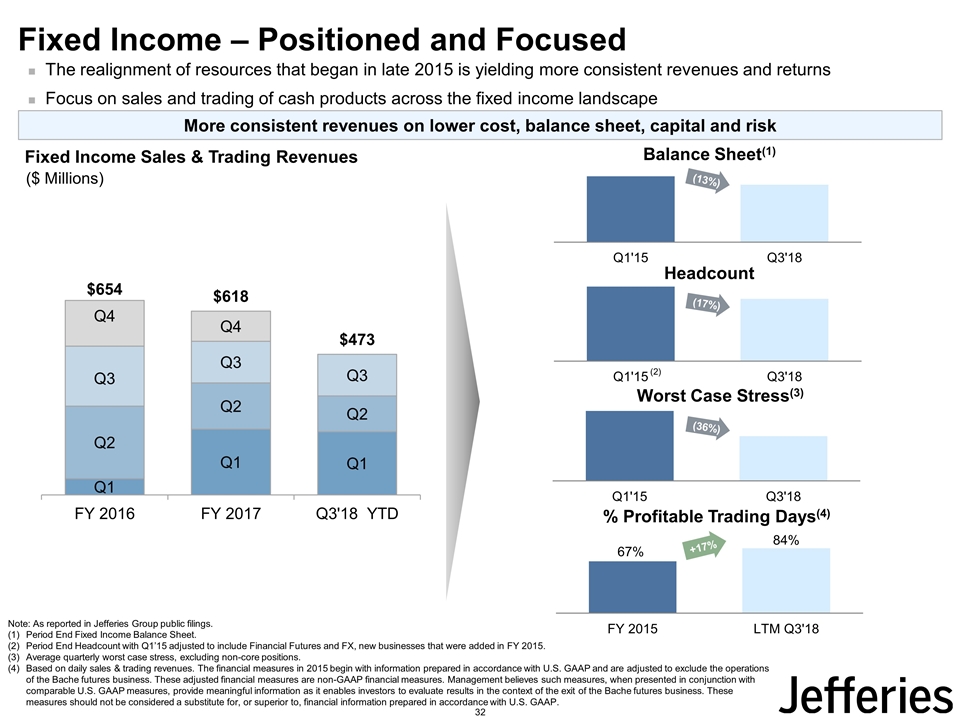

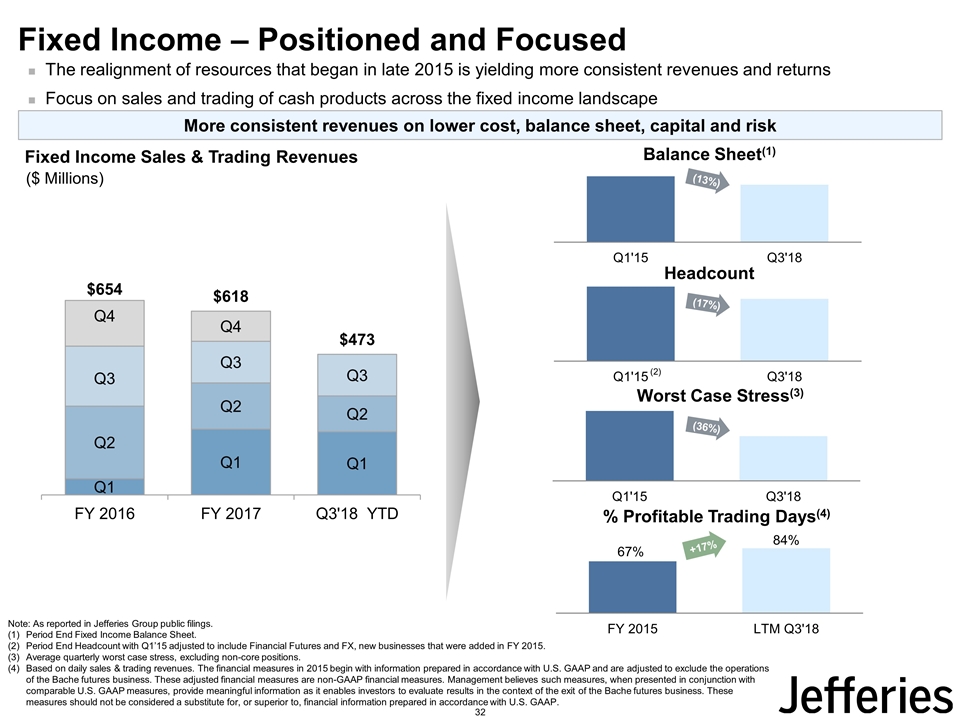

More consistent revenues on lower cost, balance sheet, capital and risk Fixed Income – Positioned and Focused Note: As reported in Jefferies Group public filings. Period End Fixed Income Balance Sheet. Period End Headcount with Q1’15 adjusted to include Financial Futures and FX, new businesses that were added in FY 2015. Average quarterly worst case stress, excluding non-core positions. Based on daily sales & trading revenues. The financial measures in 2015 begin with information prepared in accordance with U.S. GAAP and are adjusted to exclude the operations of the Bache futures business. These adjusted financial measures are non-GAAP financial measures. Management believes such measures, when presented in conjunction with comparable U.S. GAAP measures, provide meaningful information as it enables investors to evaluate results in the context of the exit of the Bache futures business. These measures should not be considered a substitute for, or superior to, financial information prepared in accordance with U.S. GAAP. Fixed Income Sales & Trading Revenues The realignment of resources that began in late 2015 is yielding more consistent revenues and returns Focus on sales and trading of cash products across the fixed income landscape (13%) (17%) (36%) +17% ($ Millions) (2) 32

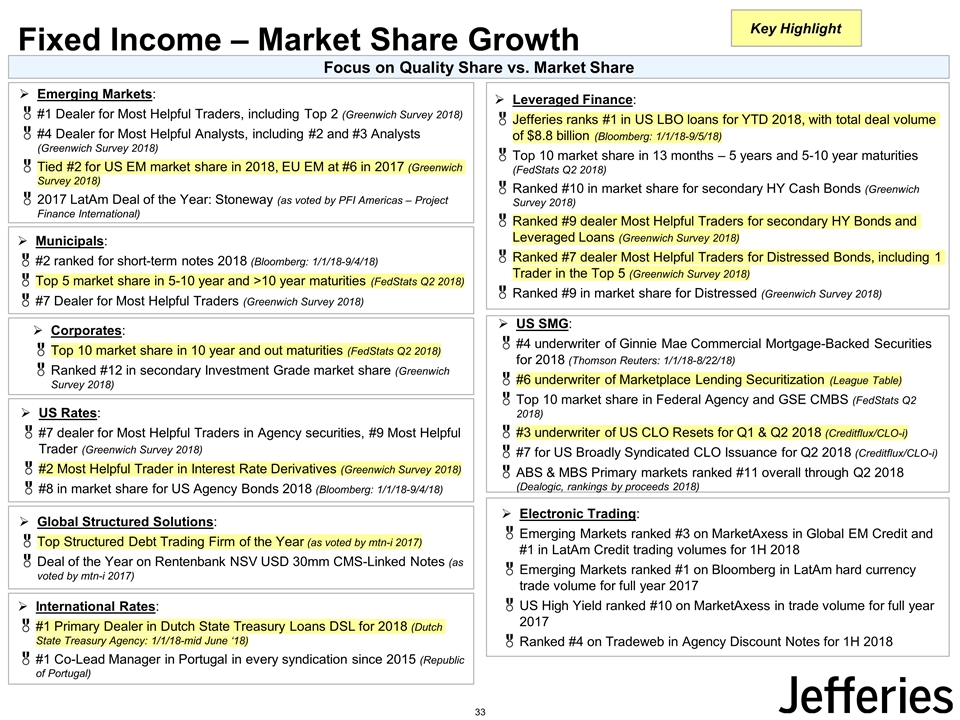

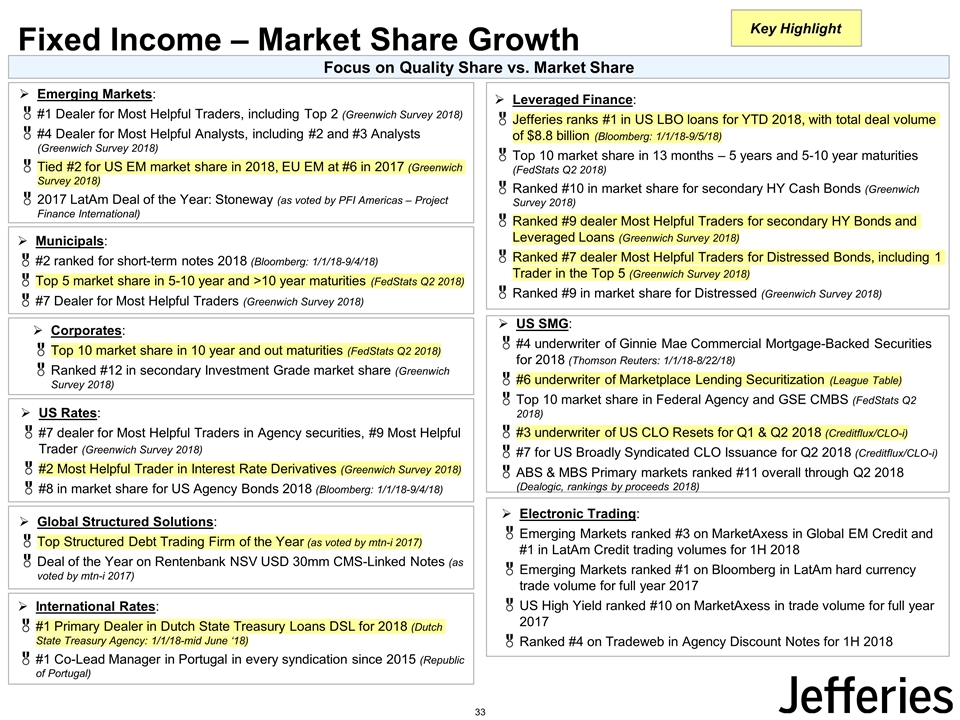

Fixed Income – Market Share Growth Emerging Markets: #1 Dealer for Most Helpful Traders, including Top 2 (Greenwich Survey 2018) #4 Dealer for Most Helpful Analysts, including #2 and #3 Analysts (Greenwich Survey 2018) Tied #2 for US EM market share in 2018, EU EM at #6 in 2017 (Greenwich Survey 2018) 2017 LatAm Deal of the Year: Stoneway (as voted by PFI Americas – Project Finance International) Corporates: Top 10 market share in 10 year and out maturities (FedStats Q2 2018) Ranked #12 in secondary Investment Grade market share (Greenwich Survey 2018) Leveraged Finance: Jefferies ranks #1 in US LBO loans for YTD 2018, with total deal volume of $8.8 billion (Bloomberg: 1/1/18-9/5/18) Top 10 market share in 13 months – 5 years and 5-10 year maturities (FedStats Q2 2018) Ranked #10 in market share for secondary HY Cash Bonds (Greenwich Survey 2018) Ranked #9 dealer Most Helpful Traders for secondary HY Bonds and Leveraged Loans (Greenwich Survey 2018) Ranked #7 dealer Most Helpful Traders for Distressed Bonds, including 1 Trader in the Top 5 (Greenwich Survey 2018) Ranked #9 in market share for Distressed (Greenwich Survey 2018) US Rates: #7 dealer for Most Helpful Traders in Agency securities, #9 Most Helpful Trader (Greenwich Survey 2018) #2 Most Helpful Trader in Interest Rate Derivatives (Greenwich Survey 2018) #8 in market share for US Agency Bonds 2018 (Bloomberg: 1/1/18-9/4/18) US SMG: #4 underwriter of Ginnie Mae Commercial Mortgage-Backed Securities for 2018 (Thomson Reuters: 1/1/18-8/22/18) #6 underwriter of Marketplace Lending Securitization (League Table) Top 10 market share in Federal Agency and GSE CMBS (FedStats Q2 2018) #3 underwriter of US CLO Resets for Q1 & Q2 2018 (Creditflux/CLO-i) #7 for US Broadly Syndicated CLO Issuance for Q2 2018 (Creditflux/CLO-i) ABS & MBS Primary markets ranked #11 overall through Q2 2018 (Dealogic, rankings by proceeds 2018) Global Structured Solutions: Top Structured Debt Trading Firm of the Year (as voted by mtn-i 2017) Deal of the Year on Rentenbank NSV USD 30mm CMS-Linked Notes (as voted by mtn-i 2017) International Rates: #1 Primary Dealer in Dutch State Treasury Loans DSL for 2018 (Dutch State Treasury Agency: 1/1/18-mid June ‘18) #1 Co-Lead Manager in Portugal in every syndication since 2015 (Republic of Portugal) Electronic Trading: Emerging Markets ranked #3 on MarketAxess in Global EM Credit and #1 in LatAm Credit trading volumes for 1H 2018 Emerging Markets ranked #1 on Bloomberg in LatAm hard currency trade volume for full year 2017 US High Yield ranked #10 on MarketAxess in trade volume for full year 2017 Ranked #4 on Tradeweb in Agency Discount Notes for 1H 2018 Municipals: #2 ranked for short-term notes 2018 (Bloomberg: 1/1/18-9/4/18) Top 5 market share in 5-10 year and >10 year maturities (FedStats Q2 2018) #7 Dealer for Most Helpful Traders (Greenwich Survey 2018) Focus on Quality Share vs. Market Share 33 Key Highlight

Fixed Income – Strategic Priorities Drive consistent results by continuing to emphasize our long-standing client centric strategy Quality Share vs. Market Share Building deeper partnerships with targeted clients Highly productive balance sheet with emphasis on high turnover inventory Invest in technology that drives productivity, enhances client connectivity and is integrated throughout the firm Relentlessly focus on capital efficiency and cost containment 34

35

Company Overview Berkadia is a full-service mortgage banking firm that provides clients best of class services and products in middle market mortgage finance, advisory and servicing Business Lines: Permanent and construction commercial real estate loans Investment Sales broker for multifamily, hospitality and healthcare properties Bridge Loans Master/Primary Servicing Largest FHA commercial real estate lender by $ of commitments from HUD in 2017 2nd largest FHLMC commercial real estate lender by $ volume in 2017 2nd largest FNMA commercial real estate lender by $ volume in 2017 4th largest servicer of U.S. commercial real estate loans by $ volume as of YE2017 36

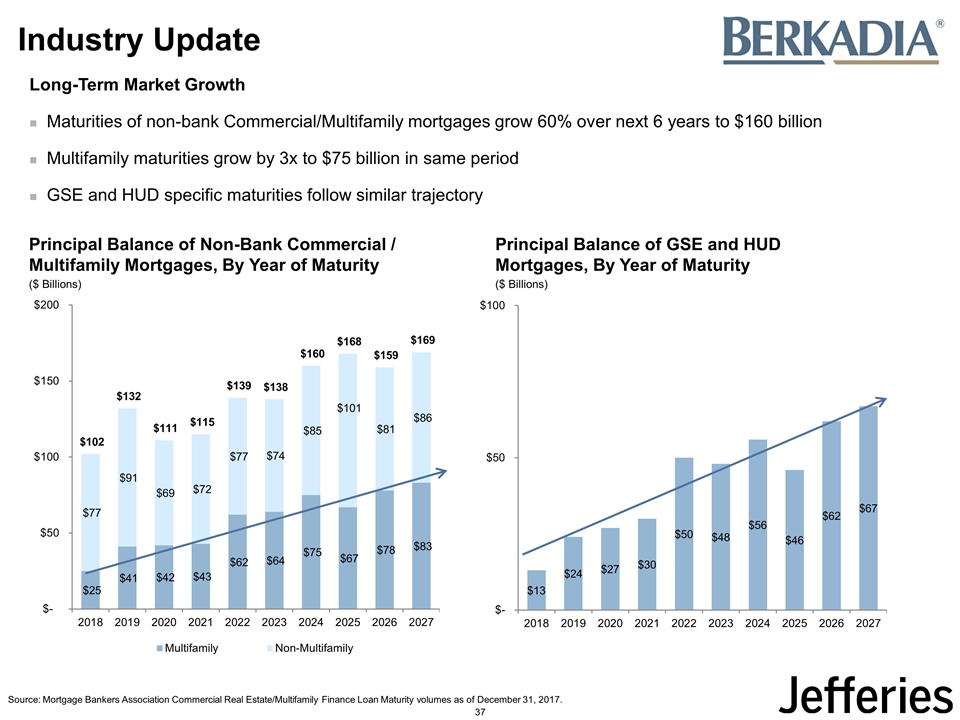

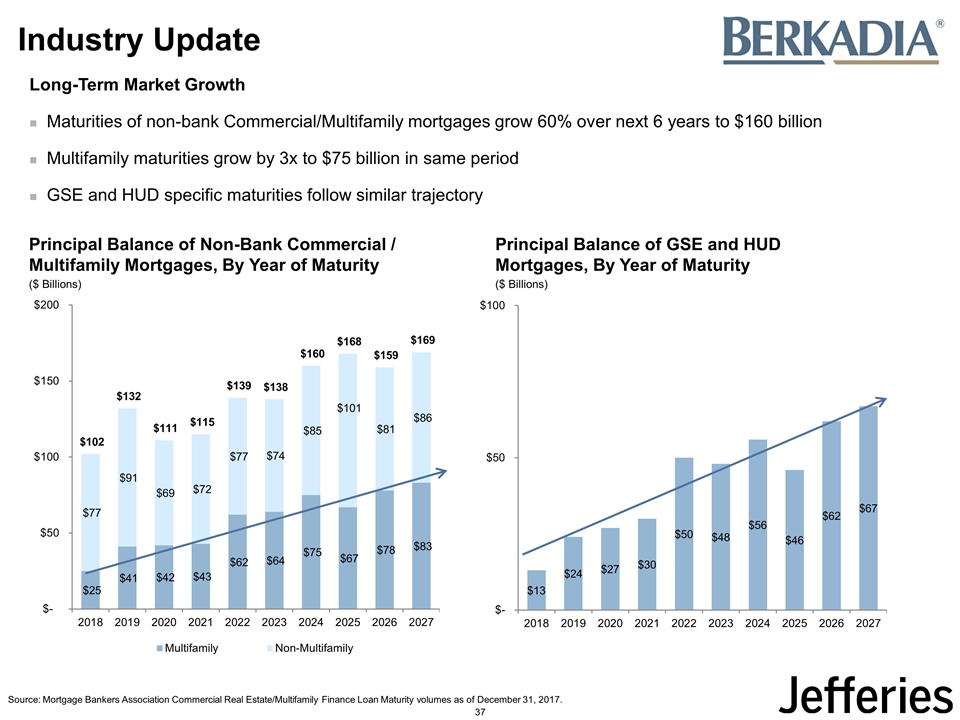

Industry Update Telecom – Linkem Real Estate Development – HomeFed Industrial Conwed Idaho Timber Metals & Mining – Golden Queen Consumer, Healthcare and Media Long-Term Market Growth Maturities of non-bank Commercial/Multifamily mortgages grow 60% over next 6 years to $160 billion Multifamily maturities grow by 3x to $75 billion in same period GSE and HUD specific maturities follow similar trajectory Source: Mortgage Bankers Association Commercial Real Estate/Multifamily Finance Loan Maturity volumes as of December 31, 2017. Principal Balance of Non-Bank Commercial / Multifamily Mortgages, By Year of Maturity ($ Billions) Principal Balance of GSE and HUD Mortgages, By Year of Maturity ($ Billions) 37

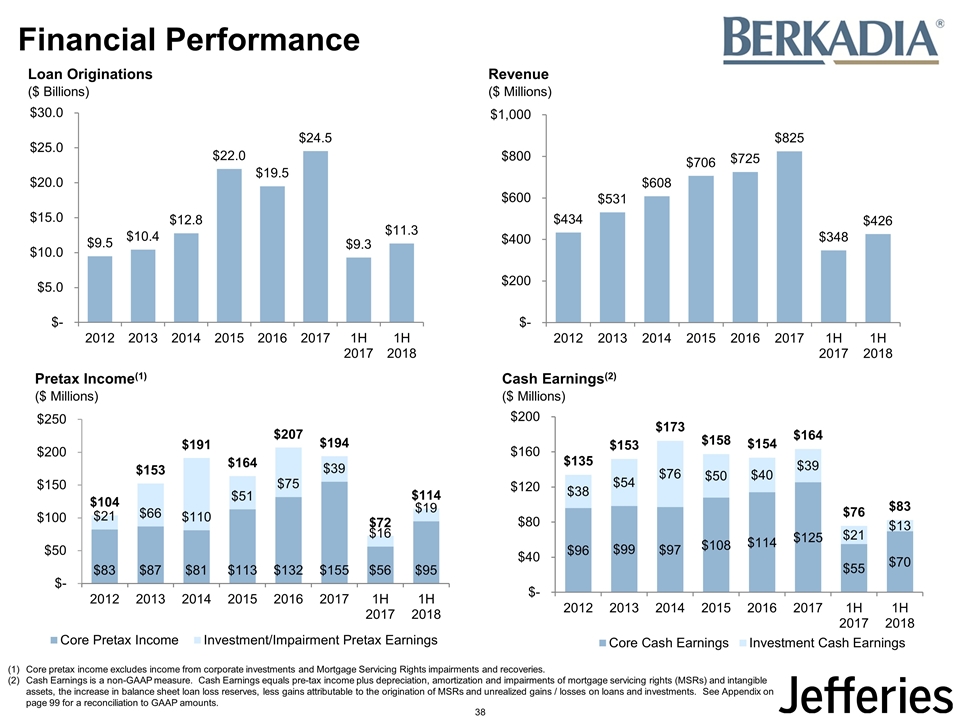

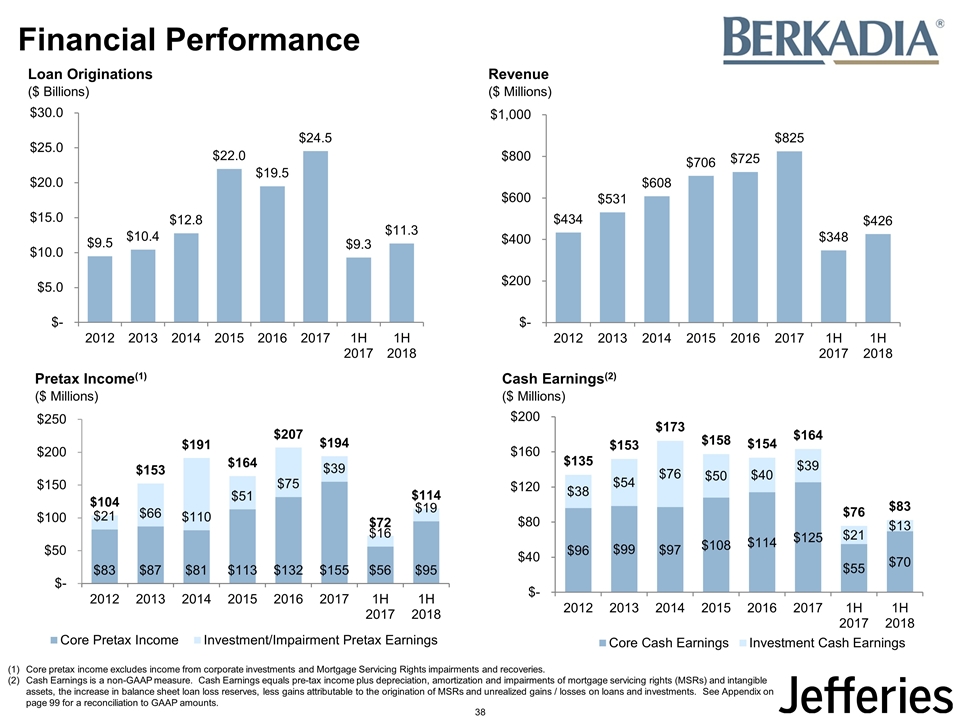

Financial Performance Core pretax income excludes income from corporate investments and Mortgage Servicing Rights impairments and recoveries. Cash Earnings is a non-GAAP measure. Cash Earnings equals pre-tax income plus depreciation, amortization and impairments of mortgage servicing rights (MSRs) and intangible assets, the increase in balance sheet loan loss reserves, less gains attributable to the origination of MSRs and unrealized gains / losses on loans and investments. See Appendix on page 99 for a reconciliation to GAAP amounts. Loan Originations ($ Billions) Revenue ($ Millions) Cash Earnings(2) ($ Millions) Pretax Income(1) ($ Millions) 38

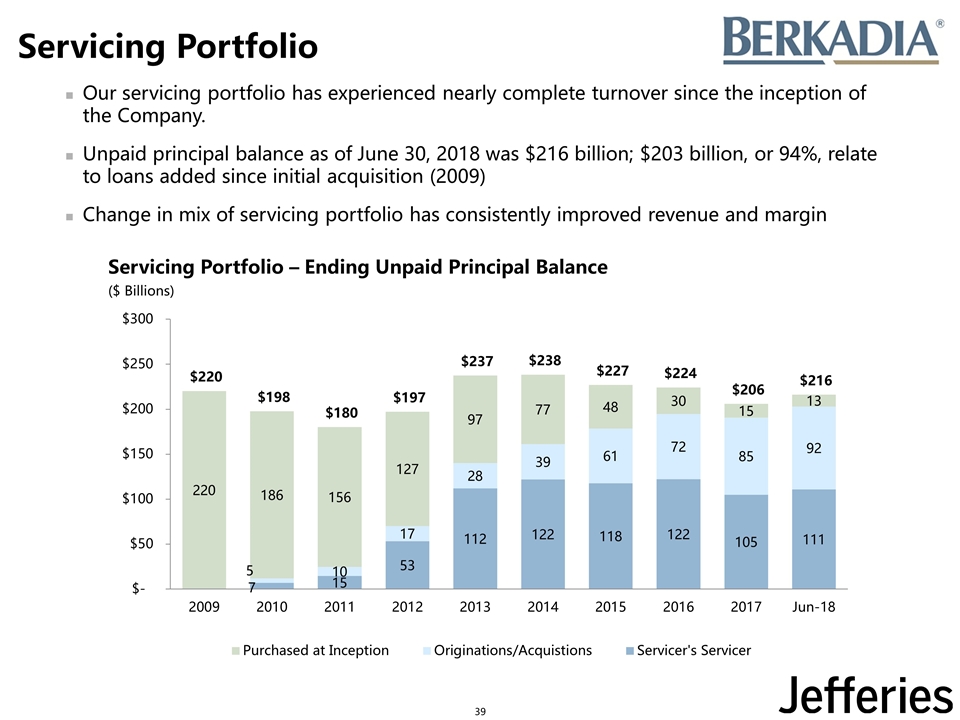

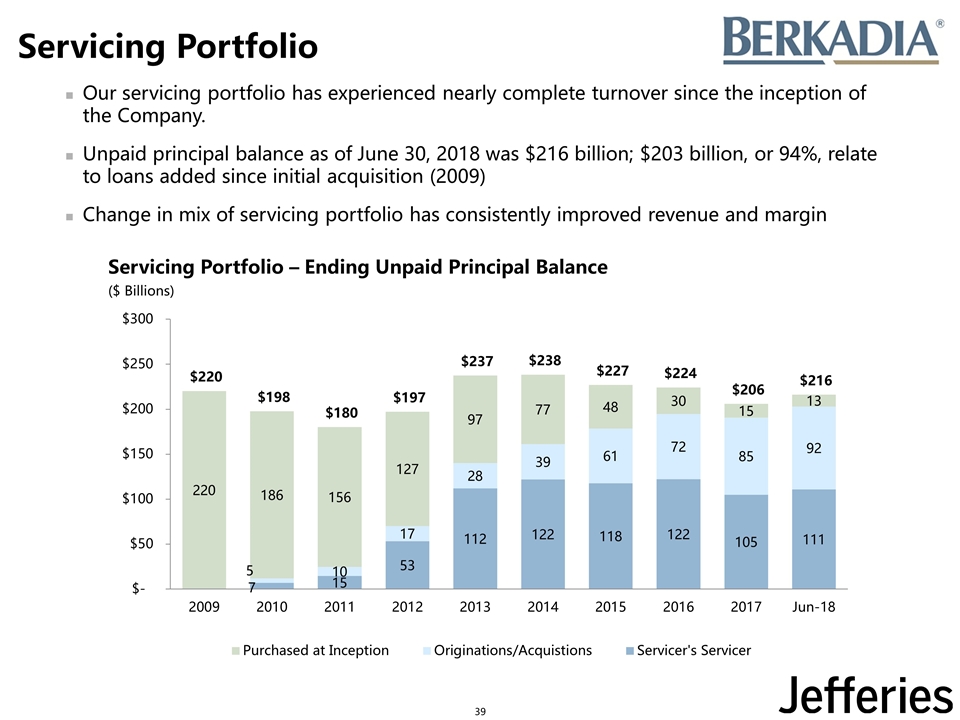

Servicing Portfolio Our servicing portfolio has experienced nearly complete turnover since the inception of the Company. Unpaid principal balance as of June 30, 2018 was $216 billion; $203 billion, or 94%, relate to loans added since initial acquisition (2009) Change in mix of servicing portfolio has consistently improved revenue and margin Servicing Portfolio – Ending Unpaid Principal Balance ($ Billions) 39

2018 Update 1H 2018 Core cash earnings growth of 27% to $70 million. This was driven by a shift in servicing portfolio mix toward loans with higher weighted average service fees, as well as a 23% increase in origination cash fees YoY Improved productivity of Bankers / Sales Advisors. Annualized volume per MB increased to $140 million in 1H 2018 from $132 million in 1H 2017, a 6% increase. Annualized volume per Sales Advisor increased to $79 million in 1H 2018 from $60 million in 1H 2017, a 32% increase. Investment Sales volume overall was up 25% Round trips, where we act as both sales advisor and debt originator have increased steadily with each passing year. 2017 cross-selling was our best year to date with 33% of investment sales volume financed. This rate has increased to 36% through 1H 2018 Added top-tier Bankers / Sales Advisors including expansion of our HUD team’s footprint in Denver, Columbus, and DC Metro, our Senior’s Housing team in Dallas, and our GSE team in Arizona Bolstered our Affordable Housing presence via a joint venture with The Michaels Organization in Riverside Capital, a Low Income Housing Tax Credit (LIHTC) syndicator. Added affordable housing expertise in Columbus and New York 40

Goals and Priorities Our Long-Term Goals Be the No. 1 Fannie Mae, Freddie Mac, and HUD lender by combined volume (3rd in 2017) Transform the commercial real estate finance industry through innovation, technology and data Drive process excellence throughout the firm Our Priorities Help our clients beat their competition by: Providing actionable insights to inform decision-making Increasing speed and accuracy of response and delivery Enabling our team members to bring the resources of the entire firm to bear Further increase our mortgage banking and investment sales volumes via productivity improvements and recruiting Leverage our best in class platform to gain additional servicing opportunities 41

Leucadia Asset Management 42

Leucadia Asset Management – Overview Diversified alternative asset management platform – supporting and developing focused funds and managed accounts managed by distinct management teams Includes all asset management activities within the firm, including investments and strategic relationships where we participate in all or a portion of the revenue or income of the underlying manager Over $17 billion of NAV-equivalent assets under management across platform Leverage Jefferies Group to source and Leucadia’s brand to market Build scalable in-house LAM-level marketing & IR functions Objectives: Grow fee-generating 3rd party assets; prospect of long-term stable cash flows Continue to add new platforms Earn reasonable risk-adjusted return on seed capital; recycle capital to continue to form new platforms Minimize cost and mitigate risk Leverage Jefferies Group back office to minimize launch costs and operating expenses Strict controls to manage and limit risk Cut losses when necessary at pre-determined levels 43

Leucadia Asset Management – Recent Developments January 2018: Launch of Tenacis comingled fund April 2018: quantPORT re-branding and growth initiative Re-branded quantPORT from Strategic Investment Division Focus on further scaling the successful quantitative investment platform April 2018: Folger Hill and Schonfeld Fundamental Equity Combination Announced a transaction to combine Folger Hill with Schonfeld’s Fundamental Equity business – transaction expected to close November 1, 2018 The combination creates a global multi-manager platform with strong prospects for growth Upside through revenue share in the management company and continued investment May 2018: Weiss Multi-Strategy Advisors Investment Invested $250 million in Weiss' strategy and will receive a profit share in the first year, and a revenue share thereafter June 2018: Launch of Lake Hill Dynamic Beta Launched a dynamic beta equity product in June and a dynamic beta fixed income product in September September 2018: Began premarketing of extension of GEEOF, Sikra Capital, a catalyst driven fundamental long/short equity strategy; seeded Kathmandu Capital, an energy focused long/short equity strategy December 2018: Topwater Capital Levered Strategy Exploring launch of a new levered first-loss investment product 44

Leucadia Asset Management – Select Platforms and Strategies Asset Class NAV(1) Founded Description Multi-PM Multi $0.5 2002 First-loss, scalable multi-manager and multi-strategy liquid securities fund Multi $1.7 1978 Multi-strategy asset manager with 40 year track-record Equities $0.5(3) 1988/ 2014 Pending combination of Folger Hill with Schonfeld’s Fundamental Equity business Discretionary long/short equity hedge fund platform Systematic Multi $1.8 2006 Systematic strategy with a multi-quant approach across asset classes, geographies and time horizons Structured Alpha B, Managed Futures, Grouper (equity market neutral) Options/ Futures $0.8 2005/ 2015 Electronic trading of listed options and futures across asset classes Multi $0.3 2015 Systematic macro fund encompassing equities, credit, FX, rates and volatility Fundamental Equities $0.5 2007 Event driven strategy investing in merger arbitrage, relative value and stock loan arbitrage Commodity- Related $3.9 2003 Active strategies designed to provide enhanced commodity exposure Credit $7.5 2004 CLO Manager, leveraged finance and middle-market credit investing platform Global Equity Events Opportunities ($ Billions) Represents Net Asset Value or Net Asset Value Equivalent. Represents revenue share agreement with Weiss. Represents Folger Hill’s NAV. Not pro forma for Schonfeld Fundamental Equity NAV. (2) 45

Risk Management 46

Risk Management Framework Jefferies' comprehensive risk management framework has been a foundation for our success across market cycles Our Risk Management Principles Robust risk culture Hands on approach to risk management Independent and integrated Asset quality Risk Governance and Risk Strategy Extensive formal committee approval and review structure (on next page) Comprehensive suite of risk management policies Federated approach to risk management Detailed limits and metrics to ensure that we operate within Risk Appetite Contingency planning Jefferies Risk Appetite Modest leverage, consistent with investment grade ratings Diversified business mix, no outsize concentrations Robust capital plan to sustain operating model through stressed conditions Stable and efficient access to funding and liquidity Asset quality – limited appetite for illiquid assets and derivatives Protect Jefferies reputation and franchise always 47

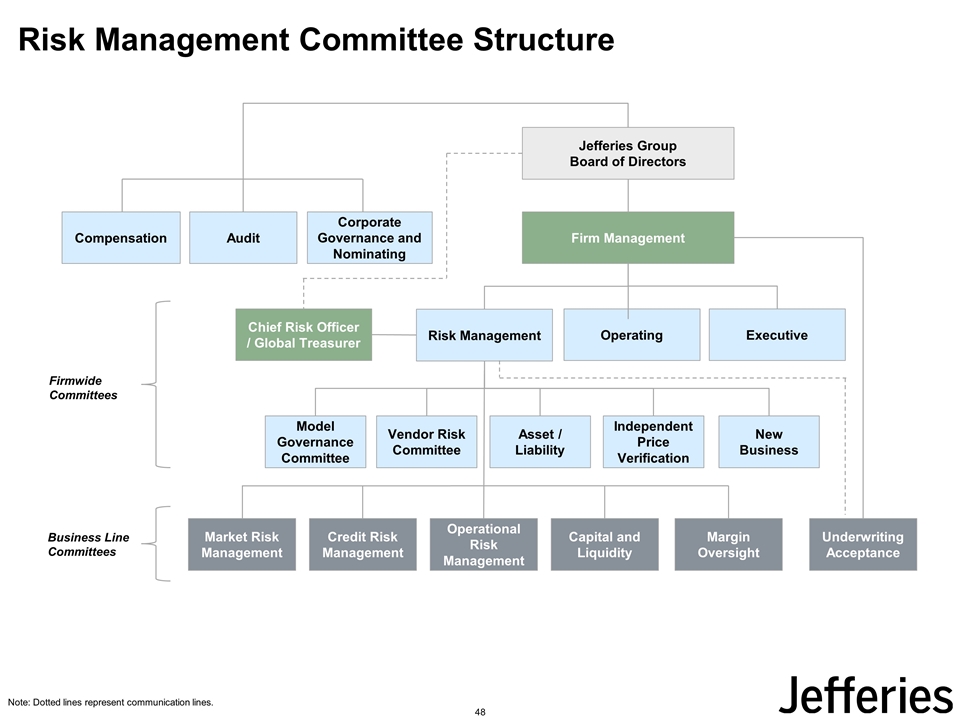

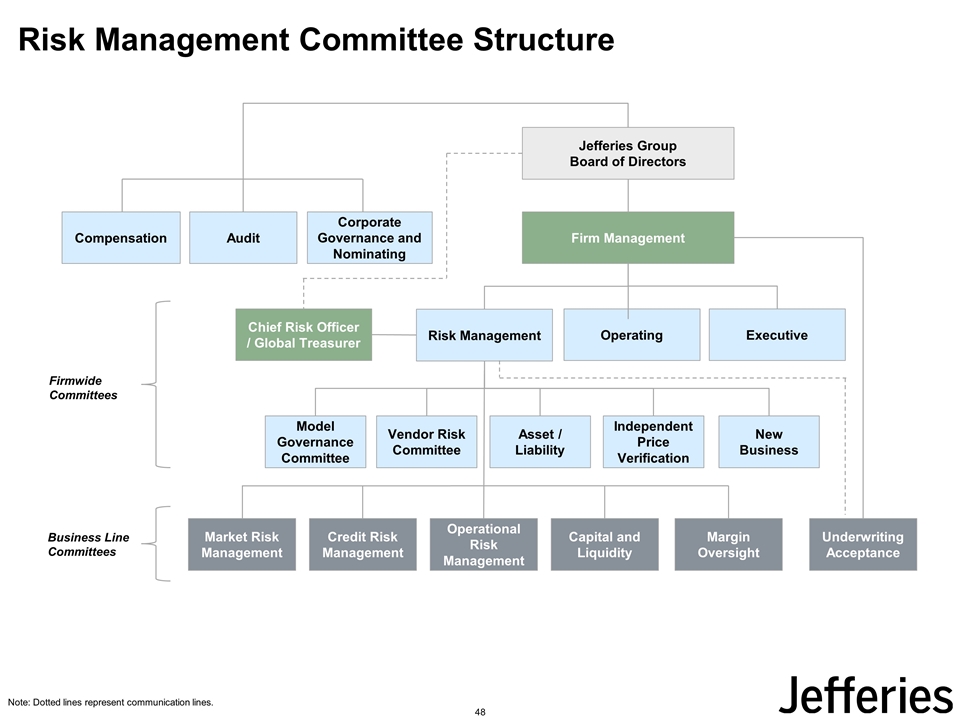

Note: Dotted lines represent communication lines. Risk Management Committee Structure Jefferies Group Board of Directors Firm Management Chief Risk Officer / Global Treasurer Risk Management Market Risk Management Compensation Audit Corporate Governance and Nominating Operating Executive Asset / Liability Independent Price Verification New Business Model Governance Committee Vendor Risk Committee Credit Risk Management Operational Risk Management Capital and Liquidity Margin Oversight Underwriting Acceptance Firmwide Committees Business Line Committees 48

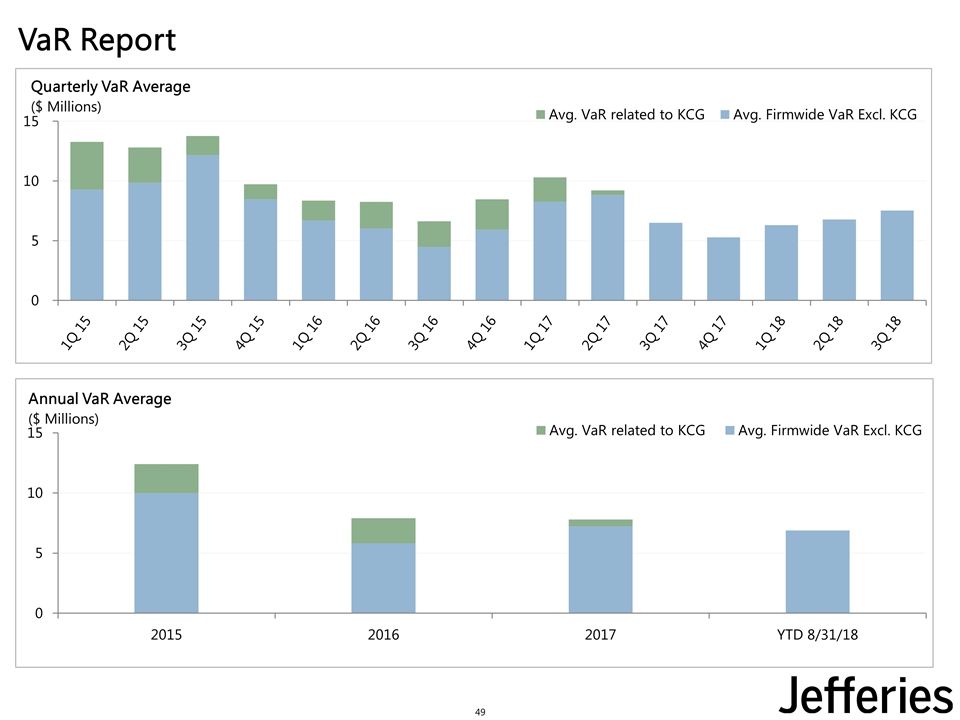

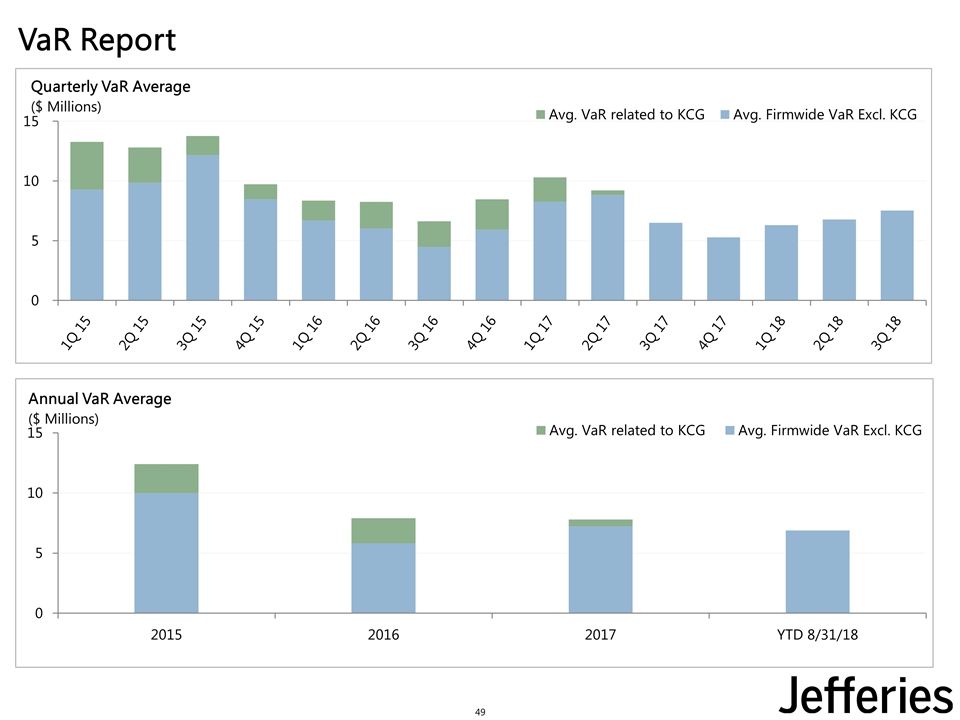

VaR Report 49

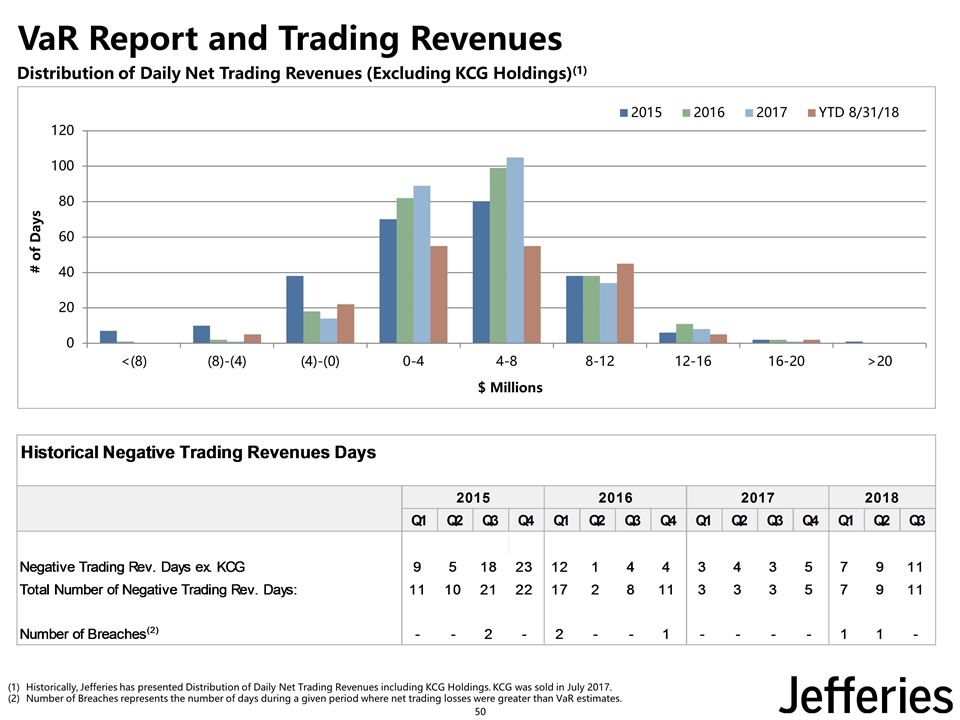

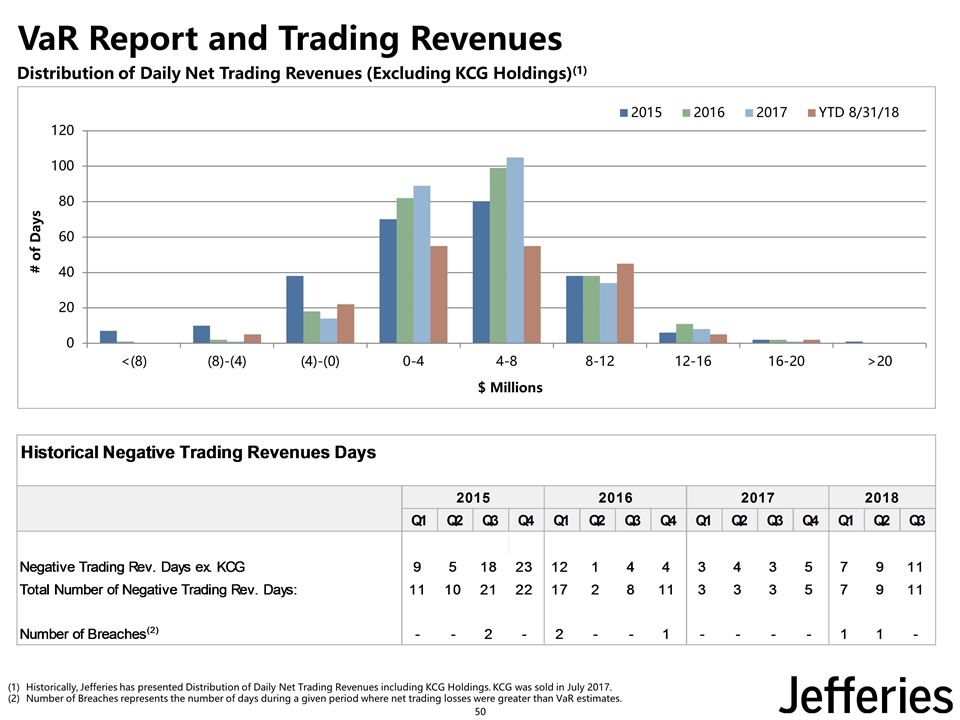

VaR Report and Trading Revenues Historically, Jefferies has presented Distribution of Daily Net Trading Revenues including KCG Holdings. KCG was sold in July 2017. Number of Breaches represents the number of days during a given period where net trading losses were greater than VaR estimates. Distribution of Daily Net Trading Revenues (Excluding KCG Holdings)(1) 50

Capital and Liquidity Management 51

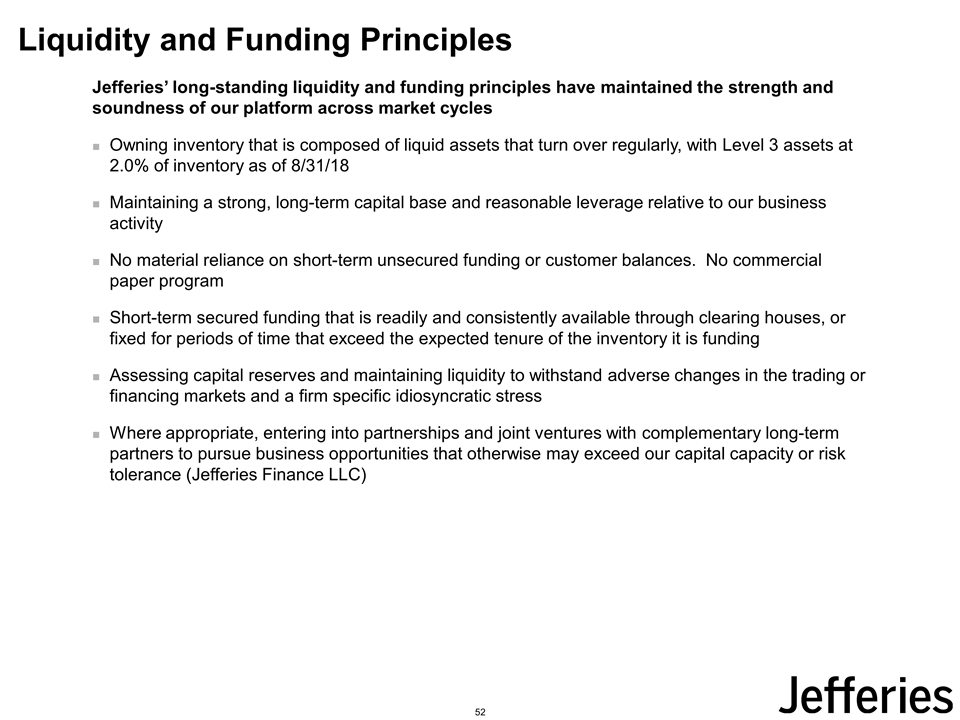

Liquidity and Funding Principles Jefferies’ long-standing liquidity and funding principles have maintained the strength and soundness of our platform across market cycles Owning inventory that is composed of liquid assets that turn over regularly, with Level 3 assets at 2.0% of inventory as of 8/31/18 Maintaining a strong, long-term capital base and reasonable leverage relative to our business activity No material reliance on short-term unsecured funding or customer balances. No commercial paper program Short-term secured funding that is readily and consistently available through clearing houses, or fixed for periods of time that exceed the expected tenure of the inventory it is funding Assessing capital reserves and maintaining liquidity to withstand adverse changes in the trading or financing markets and a firm specific idiosyncratic stress Where appropriate, entering into partnerships and joint ventures with complementary long-term partners to pursue business opportunities that otherwise may exceed our capital capacity or risk tolerance (Jefferies Finance LLC) 52

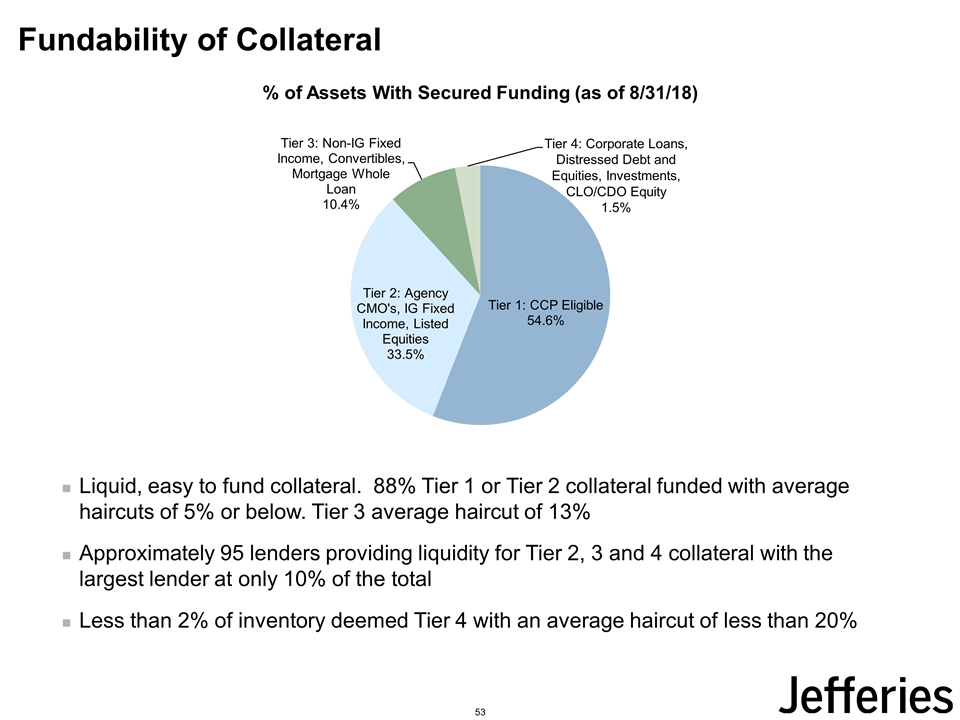

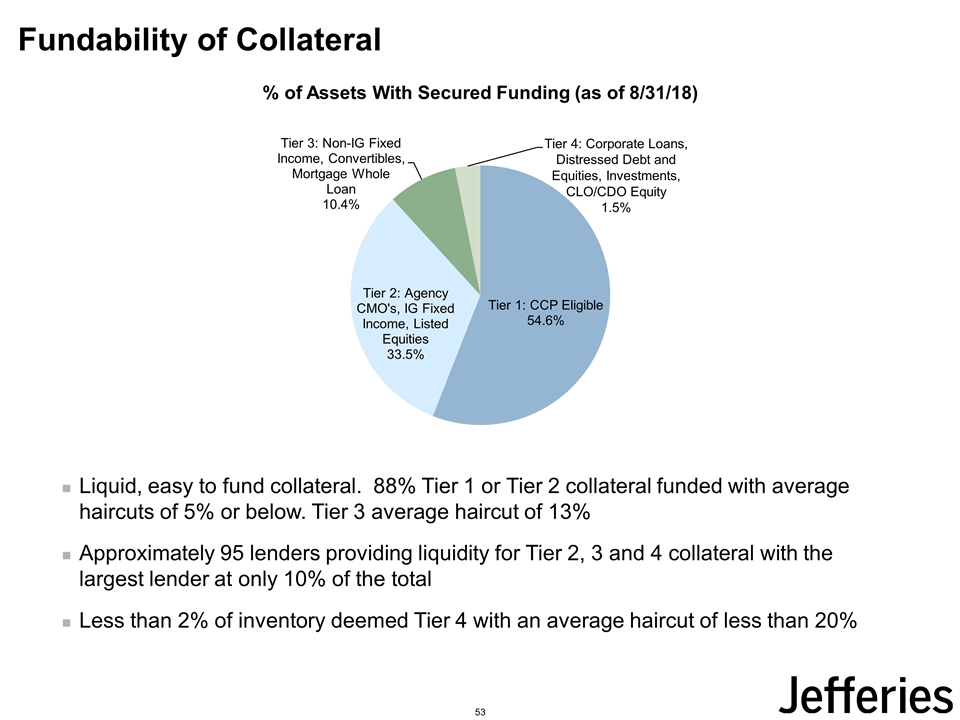

Fundability of Collateral Liquid, easy to fund collateral. 88% Tier 1 or Tier 2 collateral funded with average haircuts of 5% or below. Tier 3 average haircut of 13% Approximately 95 lenders providing liquidity for Tier 2, 3 and 4 collateral with the largest lender at only 10% of the total Less than 2% of inventory deemed Tier 4 with an average haircut of less than 20% % of Assets With Secured Funding (as of 8/31/18) 53 1.5%

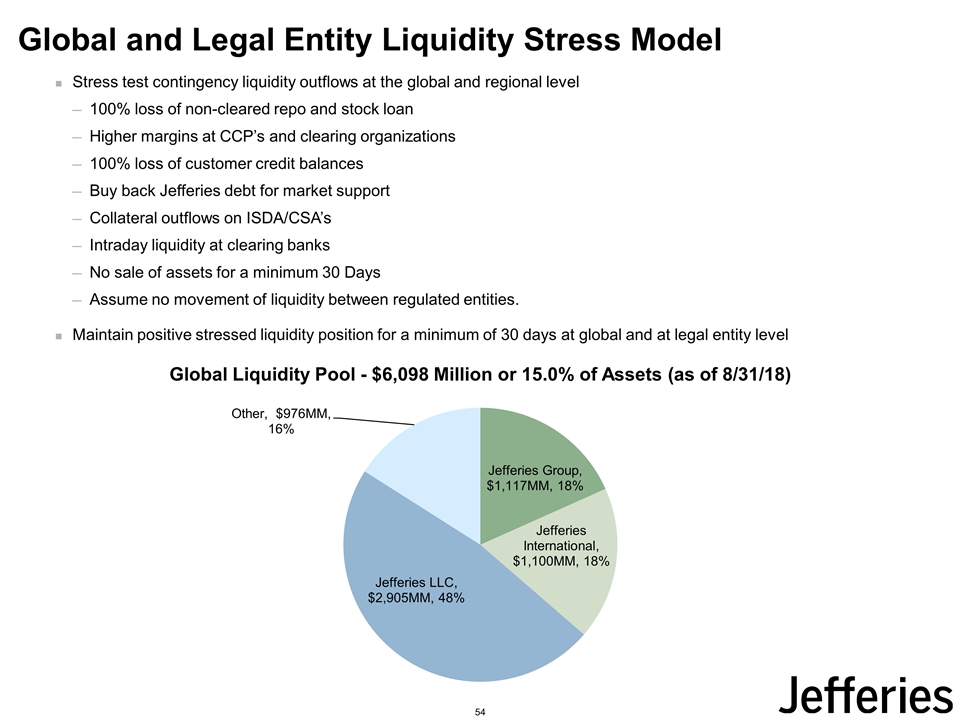

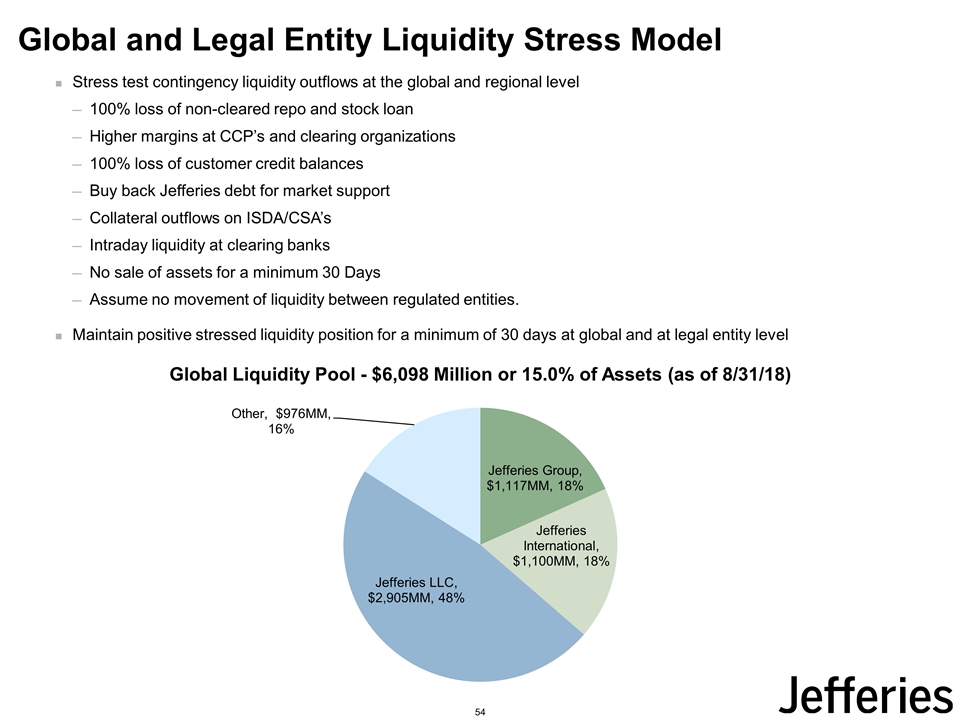

Global and Legal Entity Liquidity Stress Model Stress test contingency liquidity outflows at the global and regional level 100% loss of non-cleared repo and stock loan Higher margins at CCP’s and clearing organizations 100% loss of customer credit balances Buy back Jefferies debt for market support Collateral outflows on ISDA/CSA’s Intraday liquidity at clearing banks No sale of assets for a minimum 30 Days Assume no movement of liquidity between regulated entities. Maintain positive stressed liquidity position for a minimum of 30 days at global and at legal entity level Global Liquidity Pool - $6,098 Million or 15.0% of Assets (as of 8/31/18) 54

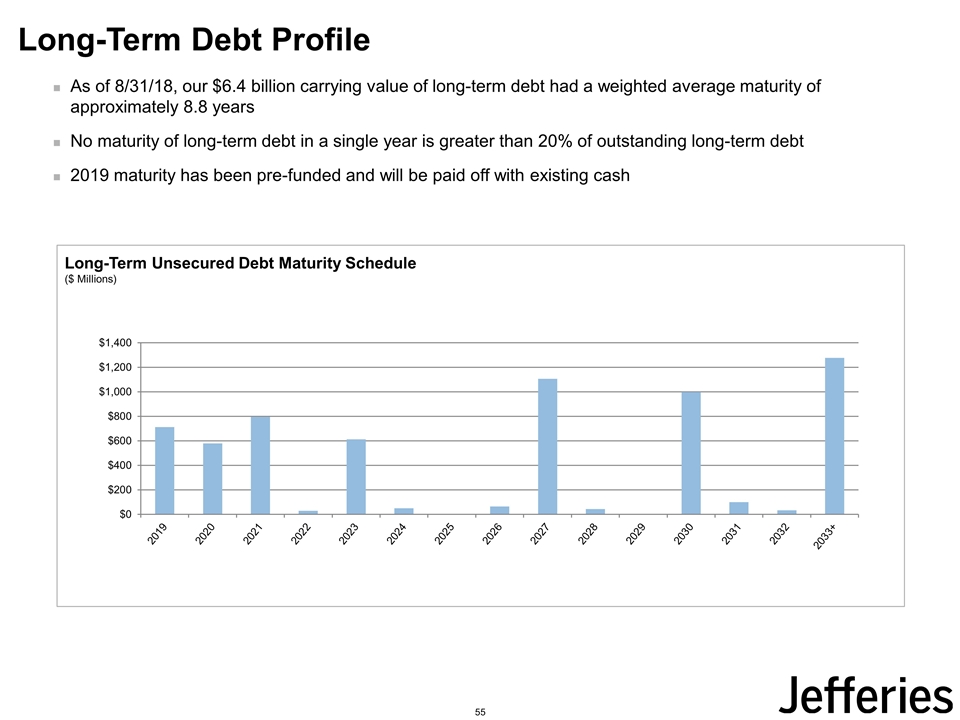

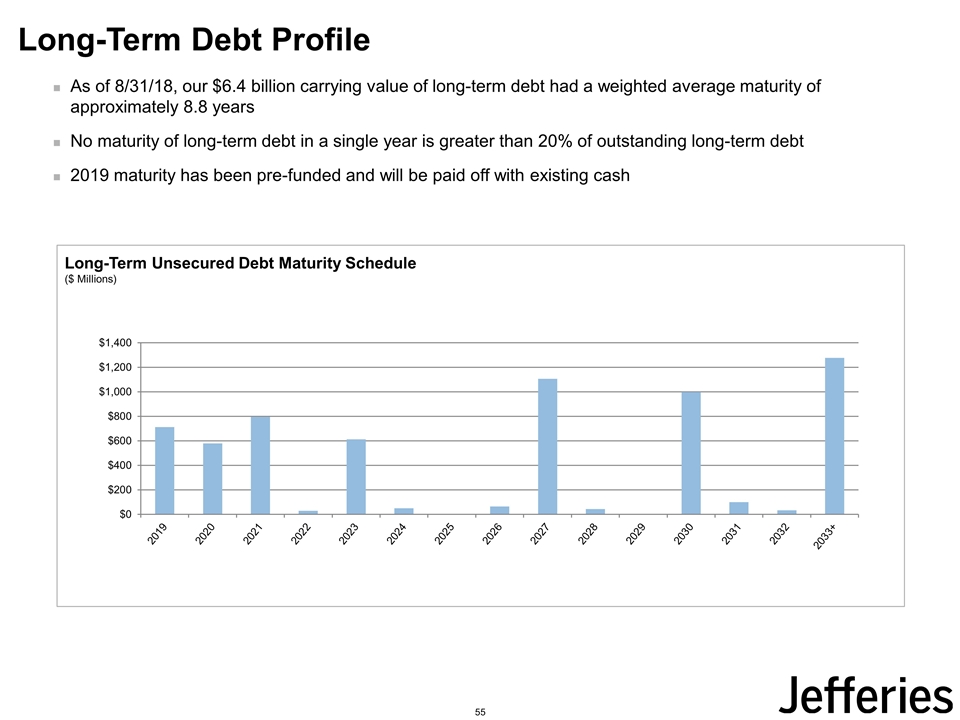

Long-Term Unsecured Debt Maturity Schedule ($ Millions) Long-Term Debt Profile As of 8/31/18, our $6.4 billion carrying value of long-term debt had a weighted average maturity of approximately 8.8 years No maturity of long-term debt in a single year is greater than 20% of outstanding long-term debt 2019 maturity has been pre-funded and will be paid off with existing cash 55

Q & A’s – IRQuestions@Jefferies.com

Merchant Banking 56

57

Company Overview 4th Largest U.S. Beef Company LTM 6/30/18 Sales – $7.7 Billion Market Share – ~12.5% Employees – ~8,100 #1 U.S. Exporter of Chilled Beef Market Share – 26% 2nd Largest U.S. Hide Tanner Market Share – 33% Intensely Focused on Value-Added Production LTM 06/30/18 EBITDA(1) and Pre-Tax Income of $640 million and $529 million, respectively Non-GAAP measure. See Appendix on page 99 for reconciliation to GAAP amounts. 58

2018 Transaction Highlights In June, we closed the sale of 48% of National Beef to Marfrig, a Brazilian beef packer, for $908 million in cash, reducing our ownership to 31% and allowing us to deconsolidate National Beef We received an additional $229 million in pre-closing distributions, reflecting a true up to the agreed debt level used in the $2.3 billion purchase price Enterprise Value and distributions for the pre-closing period We recorded a $873 million pre-tax gain on the sale in the second quarter of 2018 Marfrig also acquired a further 3% of National Beef from other shareholders and owns 51% of National Beef We continue to have two board seats and a series of other rights in respect of our continuing equity interest, with a lockup period of five years and thereafter fair market value liquidity rights The transaction delivers a number of compelling benefits to Jefferies’ shareholders Our decision to support the business through the trough of the cycle in 2012-2015 was rewarded, as we were able to realize fair value in a strong market Deconsolidating National Beef simplifies our income statement and balance sheet, and affords better diversification to our merchant banking business We continue to retain a meaningful equity interest in a business that is expected to generate significant cashflow through the cycle National Beef and Marfrig management have a positive, constructive and long-standing relationship; both companies understand the beef packing business globally, and the partnership could create new business opportunities 59

2018 Operating Update In LTM 6/30/18, National Beef’s EBITDA margin improved to 8.4% vs. 6.9% in the prior year period (LTM 6/30/17), while total volume was up 4.3% based on equivalent weeks The domestic supply of fed cattle continued to increase in 2018, supporting greater capacity utilization and higher margins As reported by the USDA, domestic weekly F.I. steer and heifer slaughter averaged 493,406 head/week in LTM 6/30/18, a 3.3% increase over 477,507 head/week in LTM 6/30/17 Packer margins continued to improve during the year, with the cutout ratio averaging 1.77 in LTM 6/30/18 compared to 1.69 in the prior year period Robust demand for U.S. beef has been driven by the strengthening domestic economy and increasing export sales, led by Japan The average price of boxed beef increased 3.3% in LTM 6/30/18 despite a 3.3% increase in beef production during the same period The export market into China is still in its infancy and represents a significant source of untapped demand Our consumer-ready products business is positioned to generate growth from new and existing customer’s expansion plans as well as a the retail industry's shift away from in-house cutting operations In our tannery business, product quality, customer relationships and operational efficiencies have improved significantly over the past year; production volumes and gross margins are approaching target levels and the business generated positive EBITDA in the first half of 2018 60

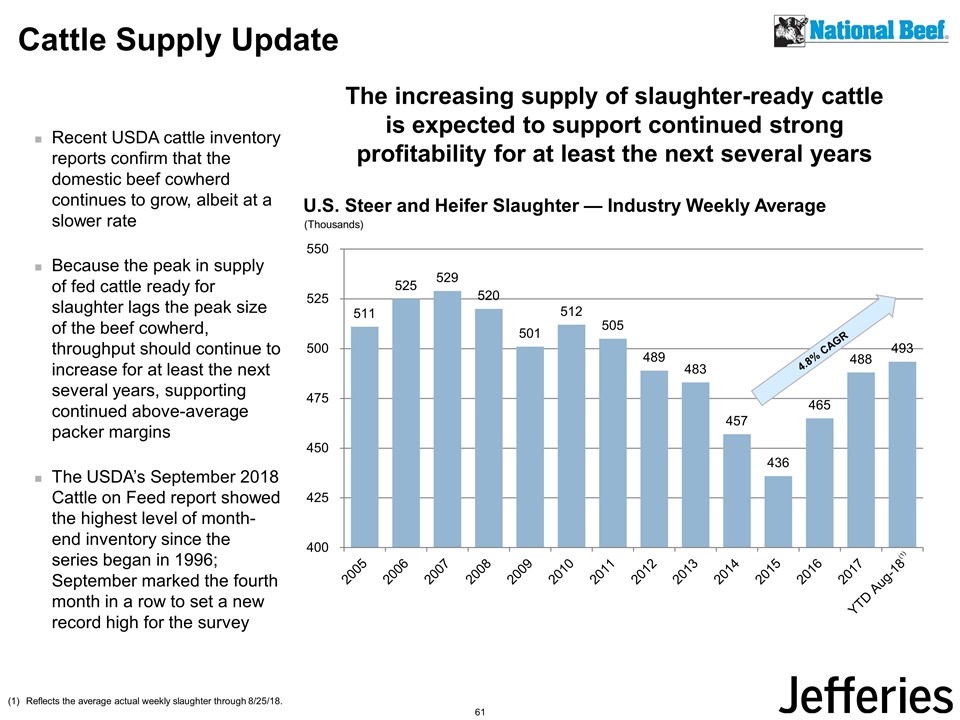

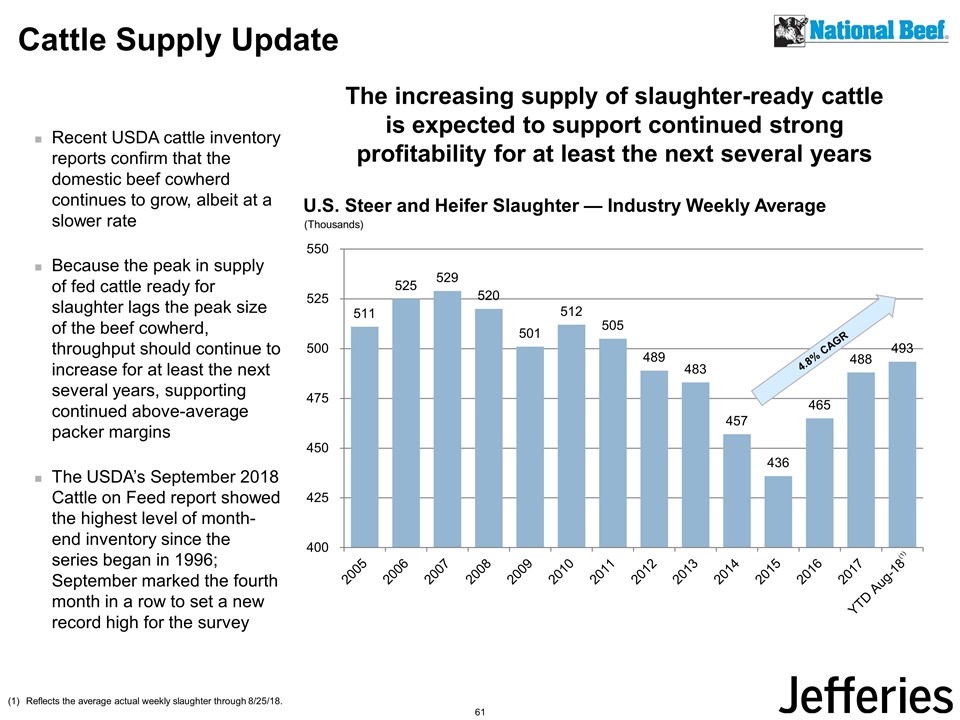

Cattle Supply Update Recent USDA cattle inventory reports confirm that the domestic beef cowherd continues to grow, albeit at a slower rate Because the peak in supply of fed cattle ready for slaughter lags the peak size of the beef cowherd, throughput should continue to increase for at least the next several years, supporting continued above-average packer margins The USDA’s September 2018 Cattle on Feed report showed the highest level of month-end inventory since the series began in 1996; September marked the fourth month in a row to set a new record high for the survey 4.8% CAGR Reflects the average actual weekly slaughter through 8/25/18. (1) The increasing supply of slaughter-ready cattle is expected to support continued strong profitability for at least the next several years U.S. Steer and Heifer Slaughter — Industry Weekly Average (Thousands) 61

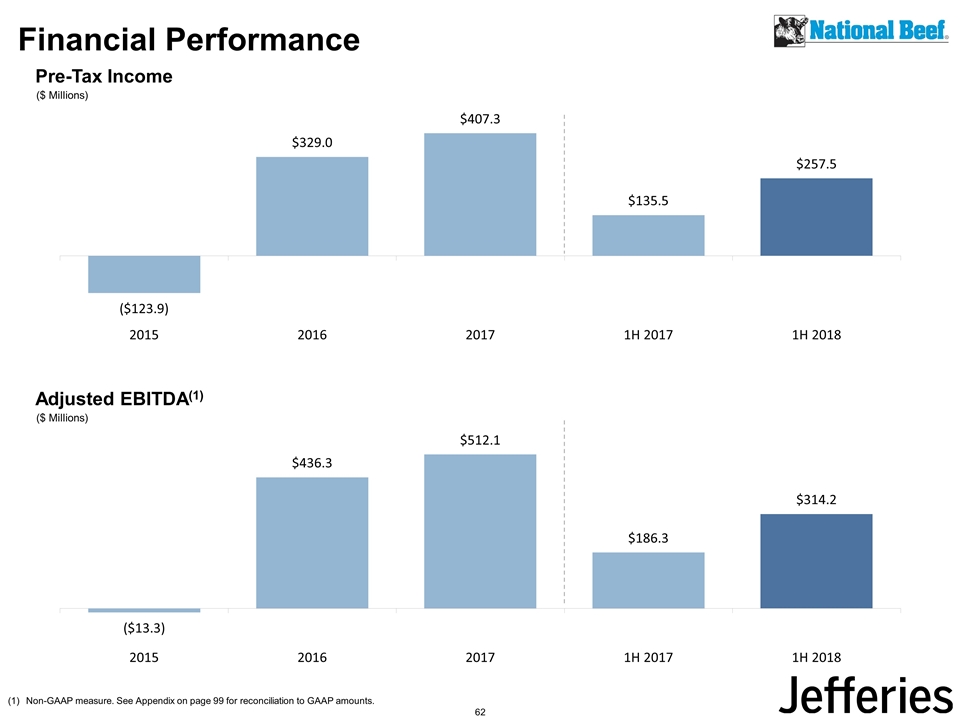

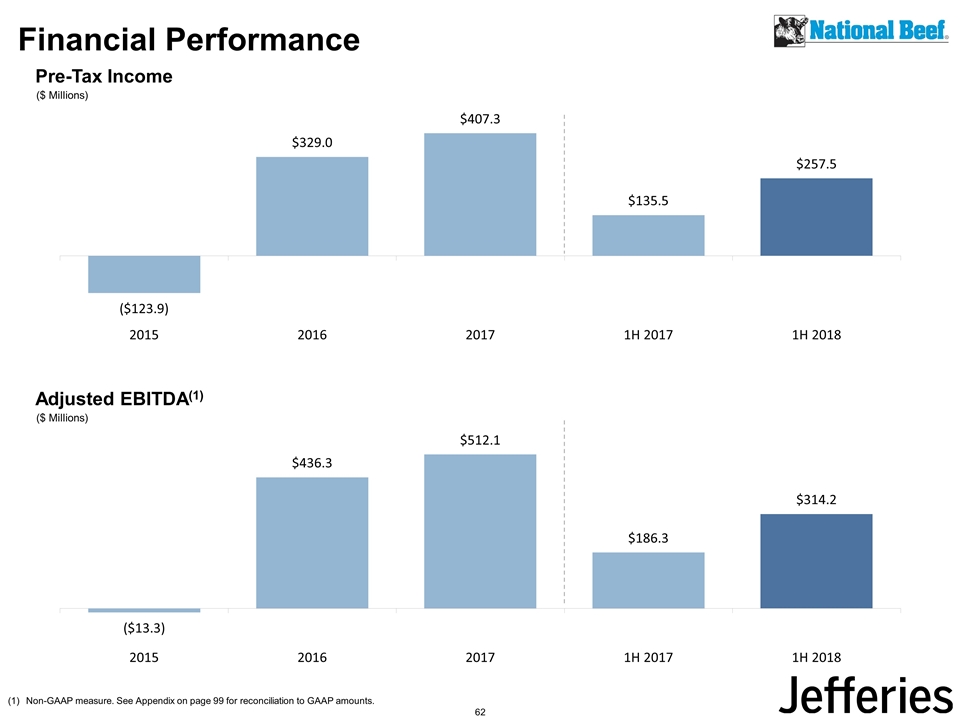

Financial Performance Non-GAAP measure. See Appendix on page 99 for reconciliation to GAAP amounts. Pre-Tax Income ($ Millions) Adjusted EBITDA(1) ($ Millions) 62

Strategic Priorities Explore the benefits of partnership with Marfrig Focus on additional value-added production Ongoing marketing to retailers and food service providers of consumer-ready, portion-controlled and other value-added product lines As capacity utilization increases, seek margin enhancement opportunities Manage for growth and enhanced profitability Capture benefits of the ongoing growth in fed cattle supply Continue to drive efficiencies and operational improvements Focus on export opportunities to capitalize on long-term secular growth in global protein consumption Realize the full potential of our tannery Achieve volume and margin targets by providing the highest quality wet blue hides from one of the largest and most technologically advanced facilities in the world 63

64

Overview Manufacturer and distributor of wood products Complementary Remanufacturing and Sawmill segments 7 plants and 3 sawmills located in 7 states ~1.0 billion board feet of capacity Remanufacturing segment Purchase low value dimension lumber and remanufacture to add value for pro dealers and lumber yards Sawmill segment Sawmills in Arkansas, Louisiana and Idaho producing southern yellow pine and cedar products primarily for sale to lumber treating companies and pro dealers End market predominantly treated decking for sale in home centers Grade, bundle and bar code proprietary board products for major home center stores Ownership Details Initial Investment: $134 million (2005) Book Value at 6/30/18: $77 million Ownership: 100% 65

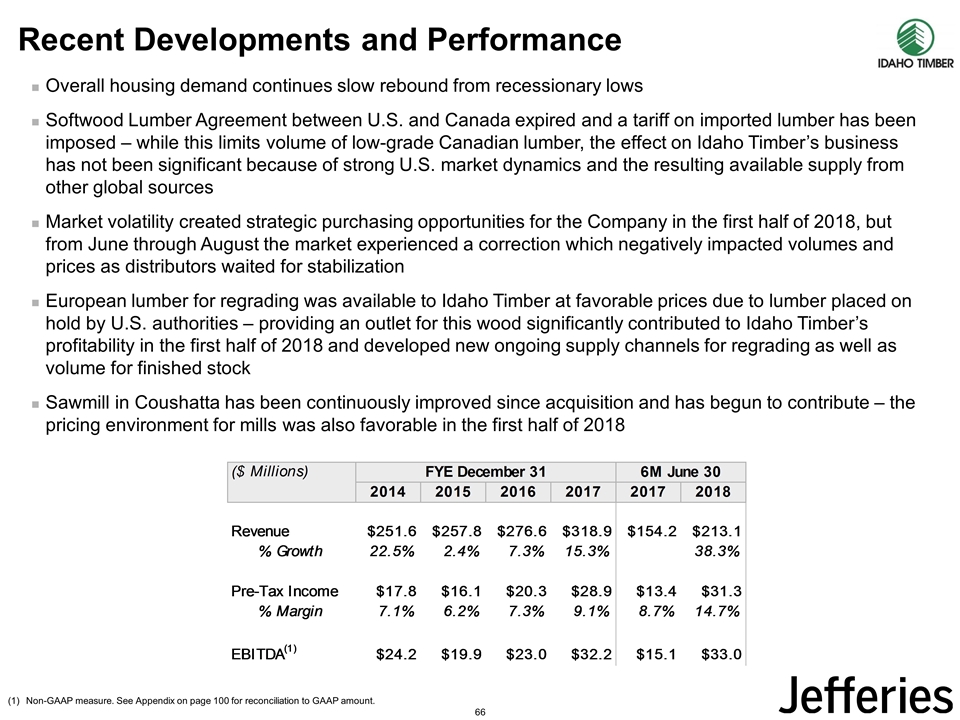

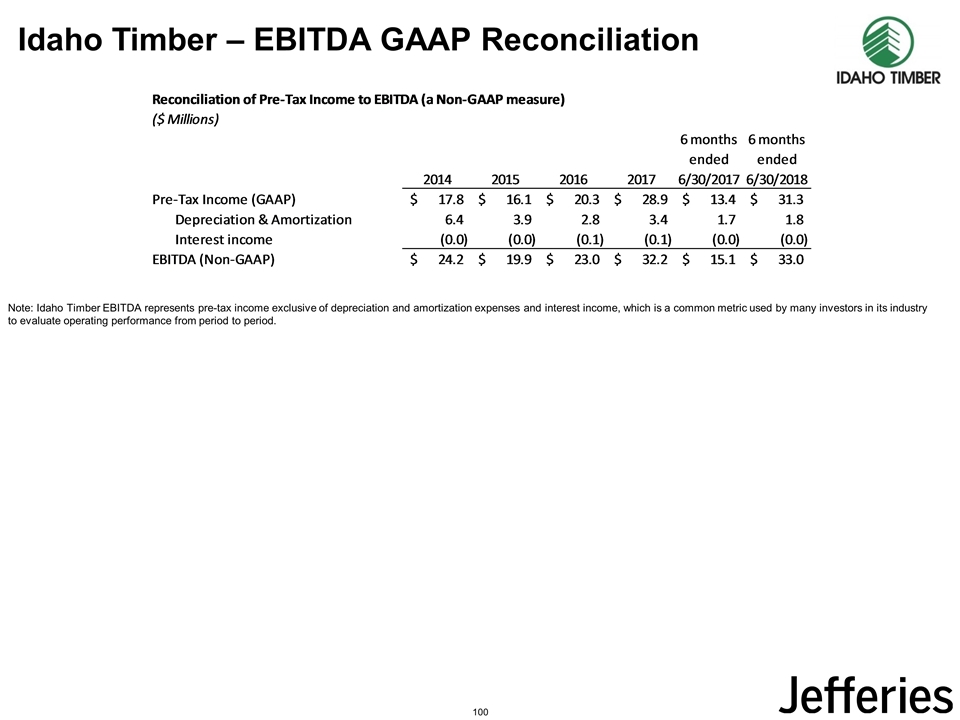

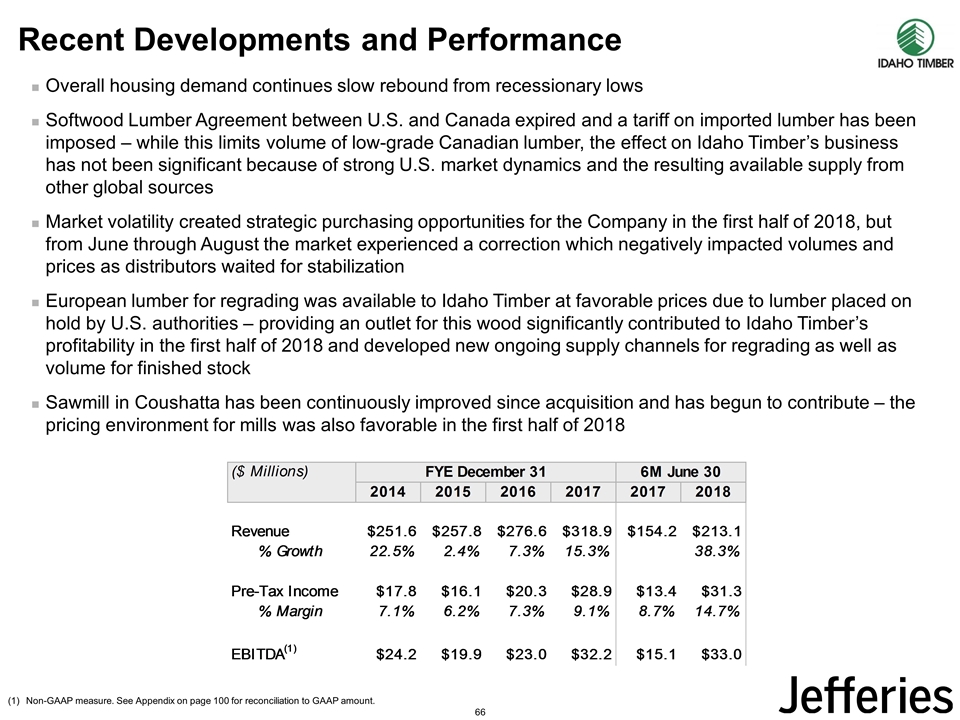

Recent Developments and Performance Overall housing demand continues slow rebound from recessionary lows Softwood Lumber Agreement between U.S. and Canada expired and a tariff on imported lumber has been imposed – while this limits volume of low-grade Canadian lumber, the effect on Idaho Timber’s business has not been significant because of strong U.S. market dynamics and the resulting available supply from other global sources Market volatility created strategic purchasing opportunities for the Company in the first half of 2018, but from June through August the market experienced a correction which negatively impacted volumes and prices as distributors waited for stabilization European lumber for regrading was available to Idaho Timber at favorable prices due to lumber placed on hold by U.S. authorities – providing an outlet for this wood significantly contributed to Idaho Timber’s profitability in the first half of 2018 and developed new ongoing supply channels for regrading as well as volume for finished stock Sawmill in Coushatta has been continuously improved since acquisition and has begun to contribute – the pricing environment for mills was also favorable in the first half of 2018 Non-GAAP measure. See Appendix on page 100 for reconciliation to GAAP amount. 66

Strategic Priorities Opportunistically invest in new capacity Focus on timely purchasing opportunities to enhance revenue and margins Continue to improve efficiency at primary sawmills Continue to reposition operations to increase spread and volumes in remanufacturing segment Continue to work with home center clients to develop unique programs, product line expansion and margin improvement 67

68

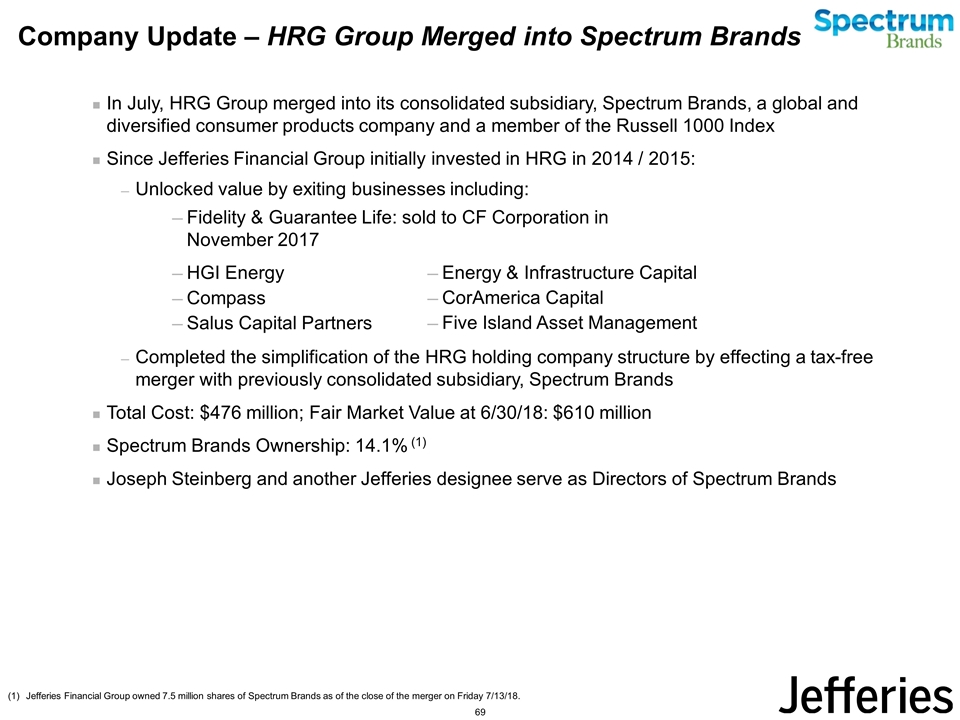

Company Update – HRG Group Merged into Spectrum Brands In July, HRG Group merged into its consolidated subsidiary, Spectrum Brands, a global and diversified consumer products company and a member of the Russell 1000 Index Since Jefferies Financial Group initially invested in HRG in 2014 / 2015: Unlocked value by exiting businesses including: Completed the simplification of the HRG holding company structure by effecting a tax-free merger with previously consolidated subsidiary, Spectrum Brands Total Cost: $476 million; Fair Market Value at 6/30/18: $610 million Spectrum Brands Ownership: 14.1% (1) Joseph Steinberg and another Jefferies designee serve as Directors of Spectrum Brands Jefferies Financial Group owned 7.5 million shares of Spectrum Brands as of the close of the merger on Friday 7/13/18. Fidelity & Guarantee Life: sold to CF Corporation in November 2017 HGI Energy Compass Salus Capital Partners Energy & Infrastructure Capital CorAmerica Capital Five Island Asset Management 69

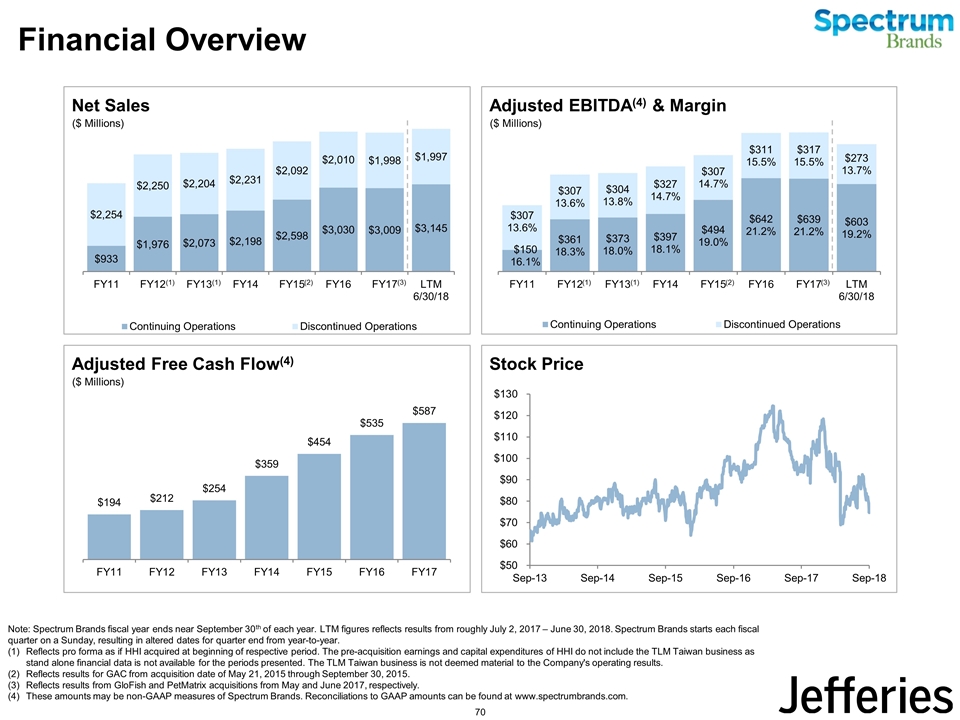

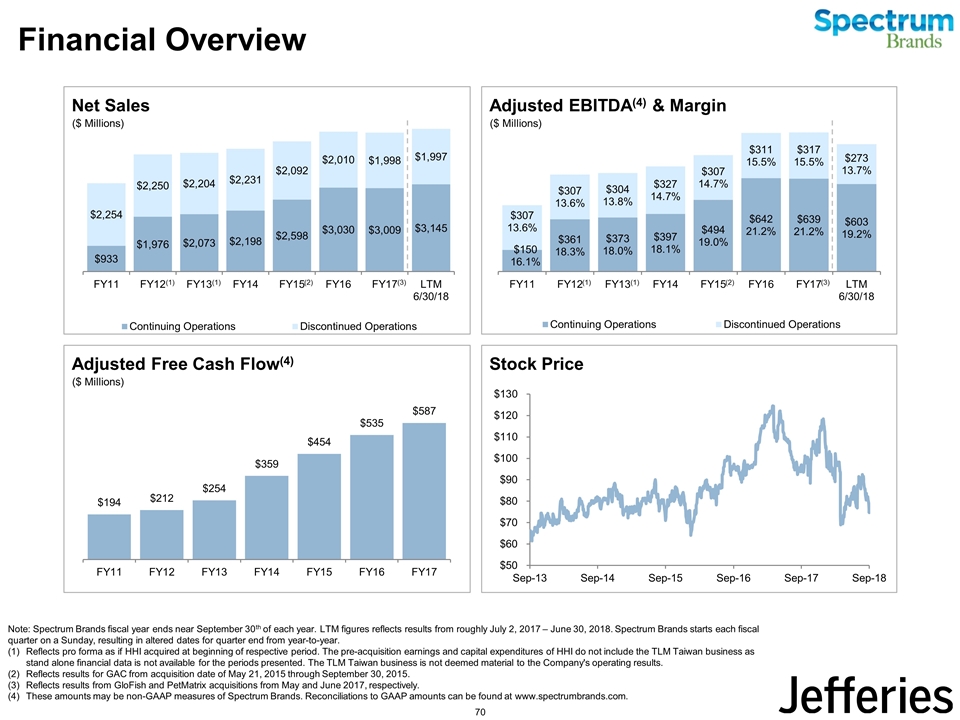

Stock Price Adjusted EBITDA(4) & Margin Financial Overview Note: Spectrum Brands fiscal year ends near September 30th of each year. LTM figures reflects results from roughly July 2, 2017 – June 30, 2018. Spectrum Brands starts each fiscal quarter on a Sunday, resulting in altered dates for quarter end from year-to-year. Reflects pro forma as if HHI acquired at beginning of respective period. The pre-acquisition earnings and capital expenditures of HHI do not include the TLM Taiwan business as stand alone financial data is not available for the periods presented. The TLM Taiwan business is not deemed material to the Company's operating results. Reflects results for GAC from acquisition date of May 21, 2015 through September 30, 2015. Reflects results from GloFish and PetMatrix acquisitions from May and June 2017, respectively. These amounts may be non-GAAP measures of Spectrum Brands. Reconciliations to GAAP amounts can be found at www.spectrumbrands.com. Source Company Presentation: 2018_08_15_SPB_Oppenheimer_FINAL Saved here: N:\Shared\Investments\Sublett\_Active\06. HRG Group\2018\04. JEF IR Day Slides Net Sales Adjusted Free Cash Flow(4) (1) (1) (2) (3) ($ Millions) ($ Millions) ($ Millions) (1) (1) (2) (3) 70

71

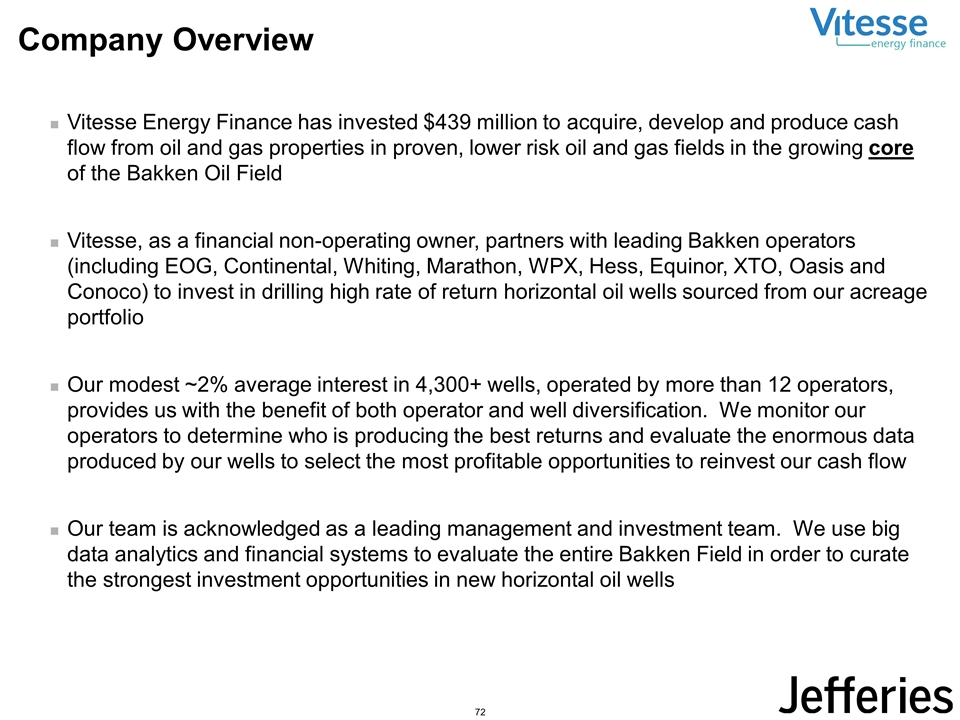

Company Overview Vitesse Energy Finance has invested $439 million to acquire, develop and produce cash flow from oil and gas properties in proven, lower risk oil and gas fields in the growing core of the Bakken Oil Field Vitesse, as a financial non-operating owner, partners with leading Bakken operators (including EOG, Continental, Whiting, Marathon, WPX, Hess, Equinor, XTO, Oasis and Conoco) to invest in drilling high rate of return horizontal oil wells sourced from our acreage portfolio Our modest ~2% average interest in 4,300+ wells, operated by more than 12 operators, provides us with the benefit of both operator and well diversification. We monitor our operators to determine who is producing the best returns and evaluate the enormous data produced by our wells to select the most profitable opportunities to reinvest our cash flow Our team is acknowledged as a leading management and investment team. We use big data analytics and financial systems to evaluate the entire Bakken Field in order to curate the strongest investment opportunities in new horizontal oil wells 72

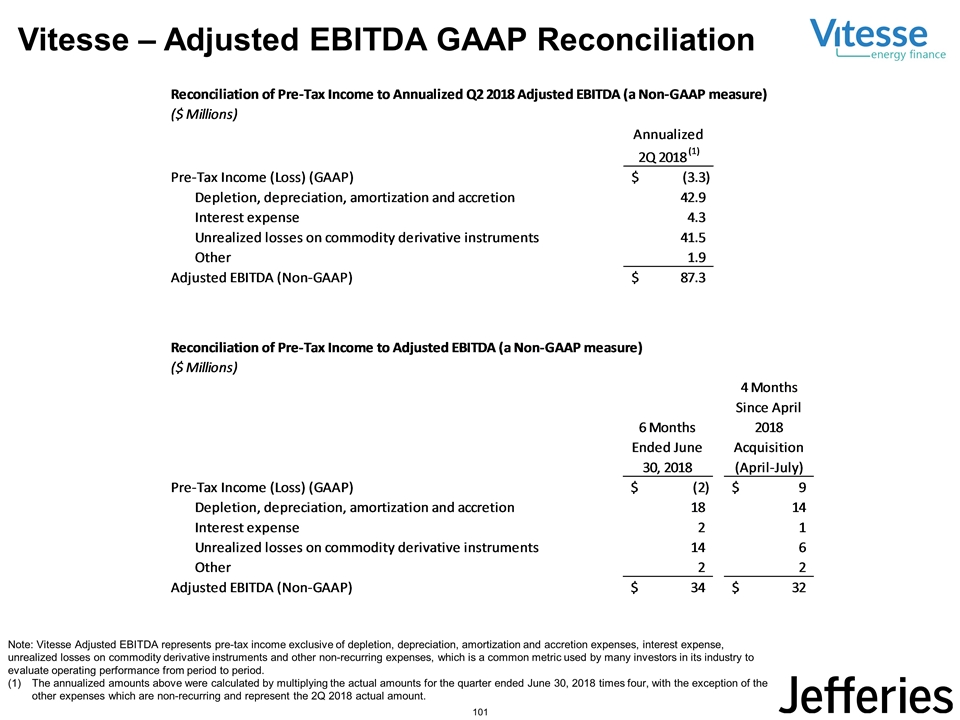

Company Overview (Continued) Vitesse has hedged substantially all current and the majority of its anticipated new production in the second half of 2018 and all of 2019 with price floors on average of $58.60/Bbl and $53.35/Bbl, respectively $87.3 million of annualized Q2 2018 Adjusted EBITDA(1) reflecting Vitesse’s catalytic $190mm acquisition in early April 2018 Vitesse’s production, EBITDA and pre-tax income should continue to grow as we re-invest free cash flow into the drilling of high returning wells. Over 90% of Vitesse’s oil and gas reserves are undeveloped and remain in the ground to be developed. Our capex is expected to be funded from free cash flow from operations This is a Non-GAAP measure. See Appendix on page 101 for reconciliation to GAAP amount. 73

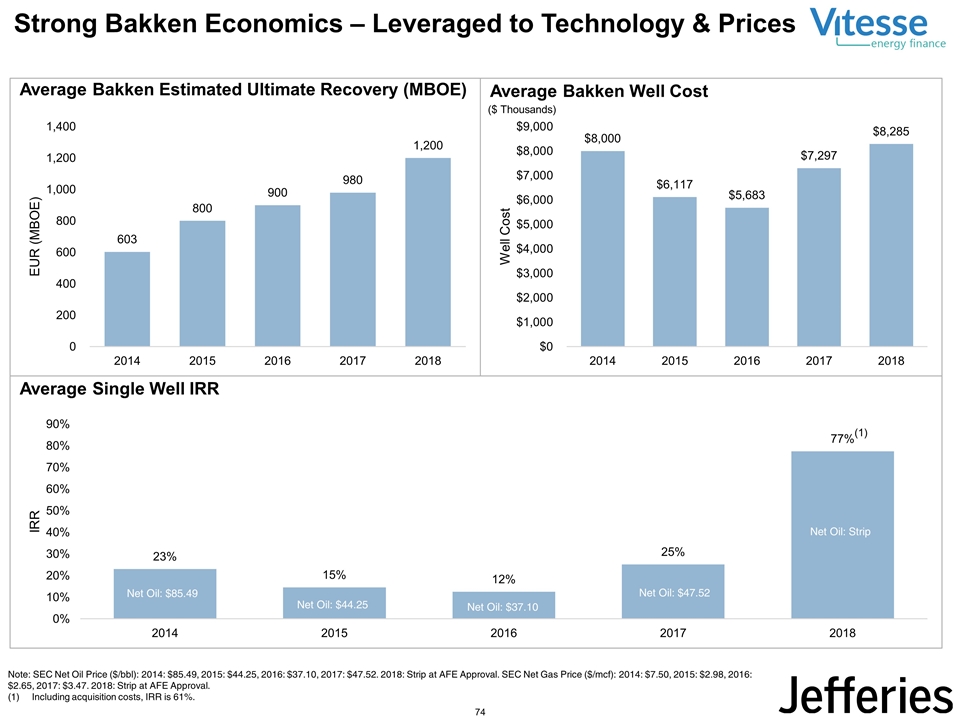

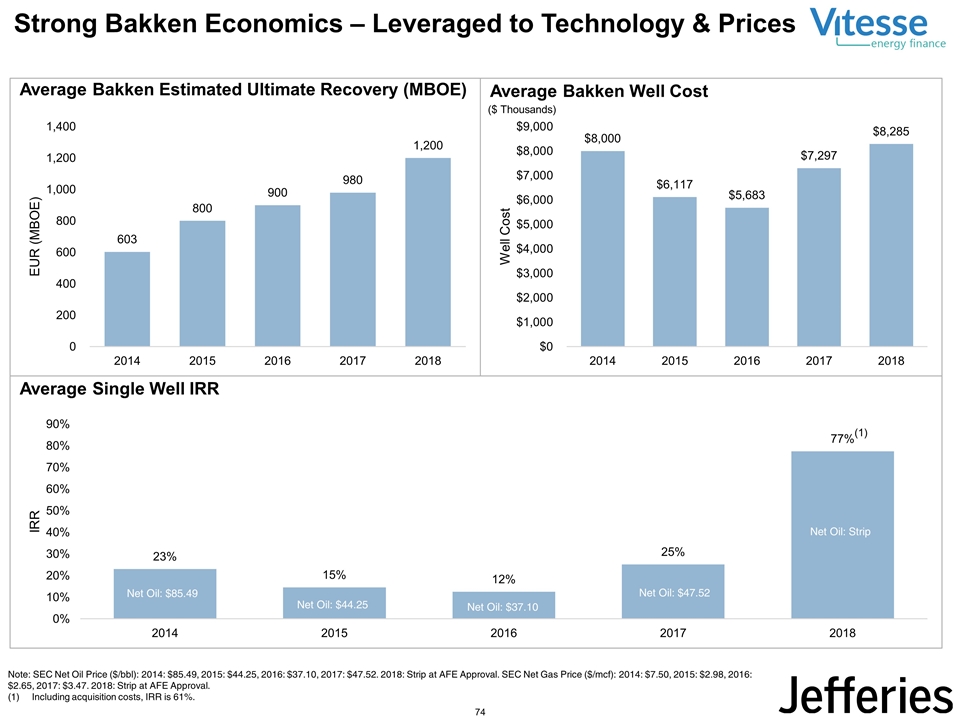

Strong Bakken Economics – Leveraged to Technology & Prices Note: SEC Net Oil Price ($/bbl): 2014: $85.49, 2015: $44.25, 2016: $37.10, 2017: $47.52. 2018: Strip at AFE Approval. SEC Net Gas Price ($/mcf): 2014: $7.50, 2015: $2.98, 2016: $2.65, 2017: $3.47. 2018: Strip at AFE Approval. Including acquisition costs, IRR is 61%. (1) Average Bakken Estimated Ultimate Recovery (MBOE) ($ Thousands) Average Bakken Well Cost Average Single Well IRR 74

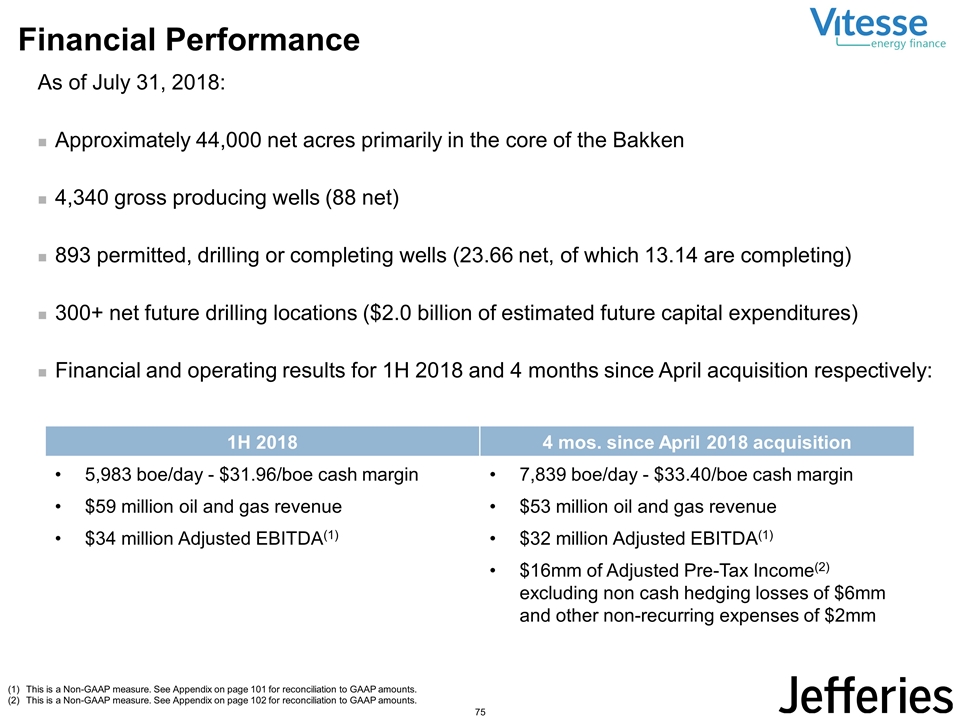

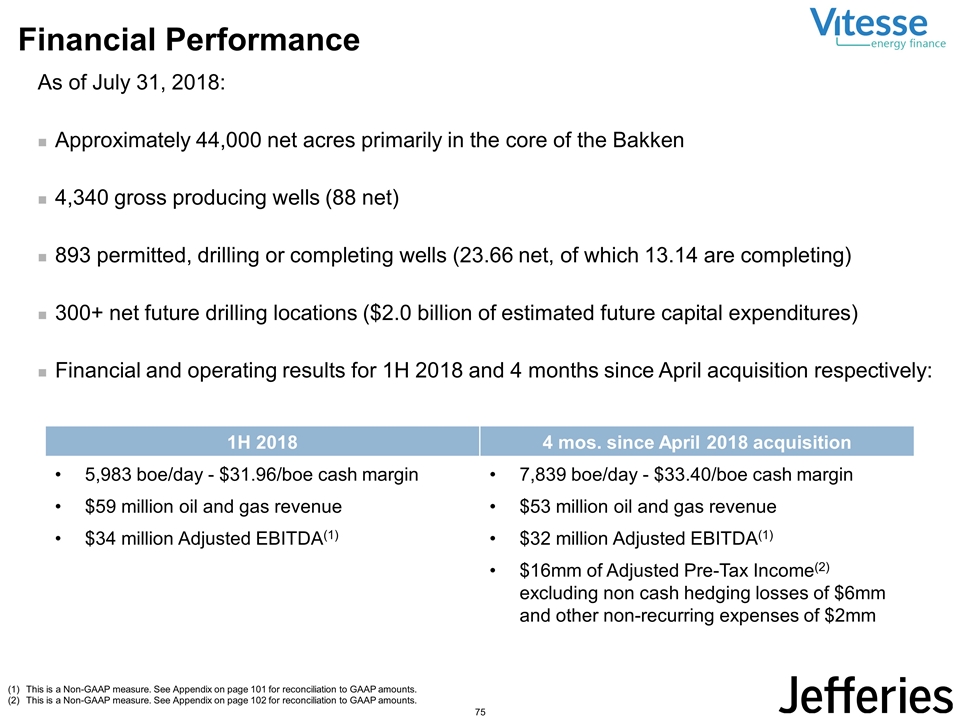

Financial Performance As of July 31, 2018: Approximately 44,000 net acres primarily in the core of the Bakken 4,340 gross producing wells (88 net) 893 permitted, drilling or completing wells (23.66 net, of which 13.14 are completing) 300+ net future drilling locations ($2.0 billion of estimated future capital expenditures) Financial and operating results for 1H 2018 and 4 months since April acquisition respectively: 1H 2018 4 mos. since April 2018 acquisition 5,983 boe/day - $31.96/boe cash margin 7,839 boe/day - $33.40/boe cash margin $59 million oil and gas revenue $53 million oil and gas revenue $34 million Adjusted EBITDA(1) $32 million Adjusted EBITDA(1) $16mm of Adjusted Pre-Tax Income(2) excluding non cash hedging losses of $6mm and other non-recurring expenses of $2mm This is a Non-GAAP measure. See Appendix on page 101 for reconciliation to GAAP amounts. This is a Non-GAAP measure. See Appendix on page 102 for reconciliation to GAAP amounts. 75

Strategic Priorities Profitably grow production, EBITDA and pre-tax income Reinvest and compound our cash flow in the Bakken Invest in high return development wells with best operators at compelling valuations Leverage our data base / knowledge to acquire acreage inexpensively, where technology has recently improved returns and development in the acreage will ramp up 76

77

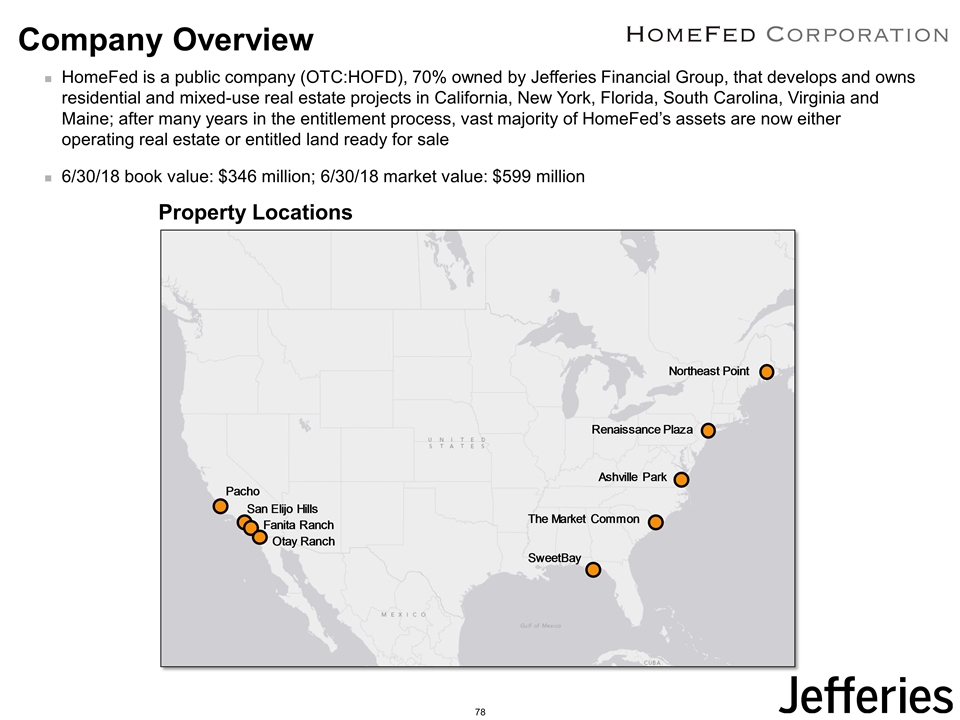

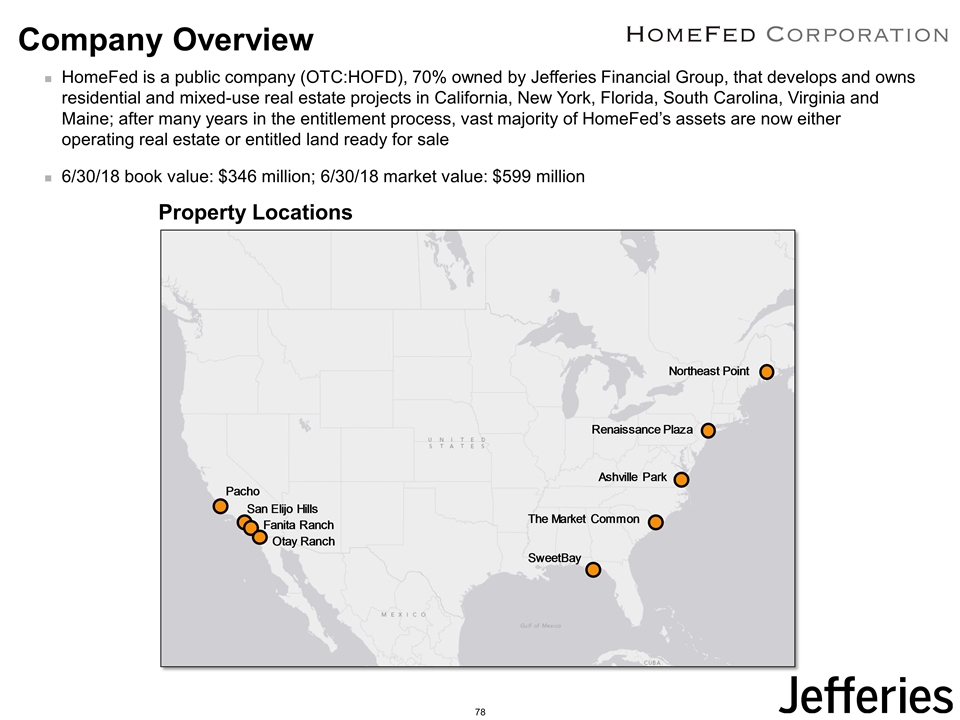

Company Overview HomeFed is a public company (OTC:HOFD), 70% owned by Jefferies Financial Group, that develops and owns residential and mixed-use real estate projects in California, New York, Florida, South Carolina, Virginia and Maine; after many years in the entitlement process, vast majority of HomeFed’s assets are now either operating real estate or entitled land ready for sale 6/30/18 book value: $346 million; 6/30/18 market value: $599 million Property Locations 78

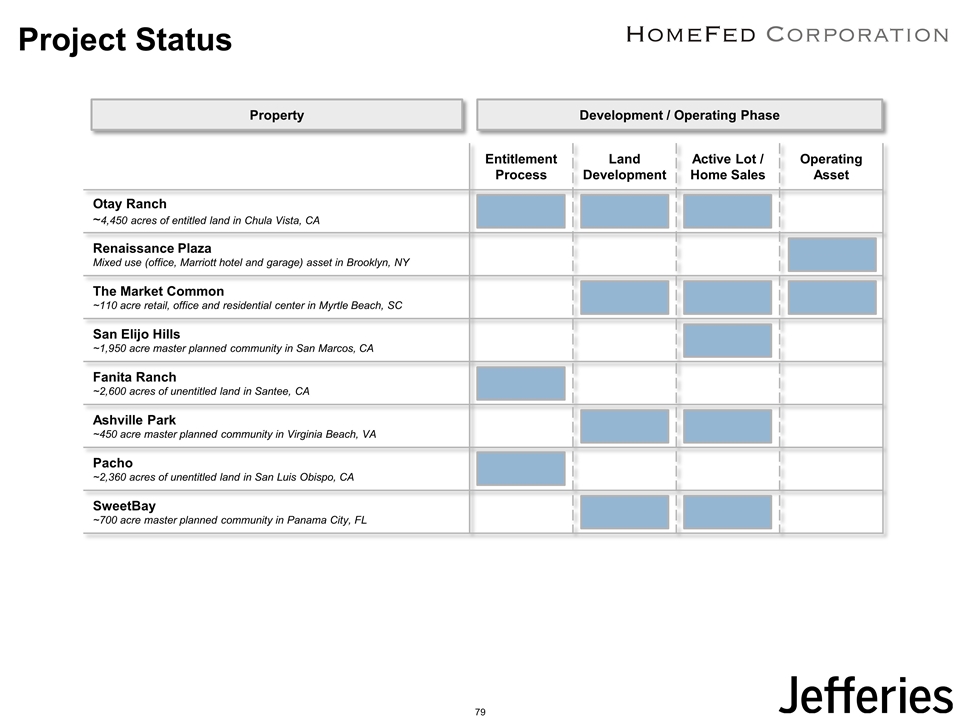

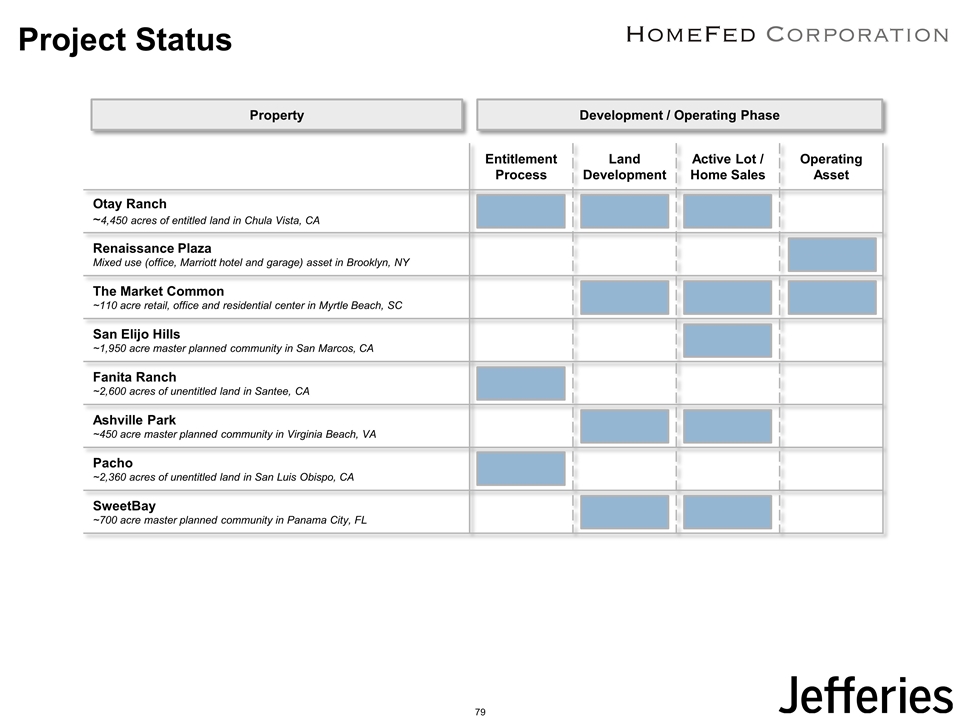

Project Status Entitlement Process Land Development Active Lot / Home Sales Operating Asset Otay Ranch ~4,450 acres of entitled land in Chula Vista, CA Renaissance Plaza Mixed use (office, Marriott hotel and garage) asset in Brooklyn, NY The Market Common ~110 acre retail, office and residential center in Myrtle Beach, SC San Elijo Hills ~1,950 acre master planned community in San Marcos, CA Fanita Ranch ~2,600 acres of unentitled land in Santee, CA Ashville Park ~450 acre master planned community in Virginia Beach, VA Pacho ~2,360 acres of unentitled land in San Luis Obispo, CA SweetBay ~700 acre master planned community in Panama City, FL Development / Operating Phase Property 79

Otay Ranch HomeFed acquired 4,800 acres in Otay Ranch in 1998 and began entitling for development. In 2015, HomeFed acquired another 1,600 contiguous acres from State Street Bank In total, HomeFed holdings in Otay Ranch include approximately 6,200 acres, planned and entitled for approximately 13,050 homes and up to 1.85 million square feet of commercial (retail, office and mixed-use) development. More than 75 acres have been set aside for schools and approximately 300 acres for parks HomeFed’s holdings in the Otay Ranch are being developed in distinct villages In April 2016, HomeFed entered into joint ventures with Brookfield, Lennar, and Shea Homes to build and sell a total of 948 homes in Village 3, now known as The Village of Escaya. HomeFed received initial payments totaling $50 million from the builders with the balance of HomeFed’s proceeds coming from home closings The Village of Escaya had its grand opening in June 2017; home sales and closings have been strong with 191 homes closed through June 2018 HomeFed arranged financing and started construction on The Residences and Shops at Village of Escaya, a mixed-use project comprised of 272 apartments, approximately 20,000 of retail space, and a 10,000 square foot community facility building Bullet 5 Source: Q2’18 10Q, p. 33 Bullet 4 Source: Q2’18 10Q, p. 9 Bullet 1 & 2Source: HomeFed website http://www.homefedcorporation.com/portfolio/otay-ranch/ 80

Other Developments HomeFed closed a $198 million refinancing of an office condominium in Brooklyn Renaissance Plaza that provided net proceeds of $88 million to HomeFed in February 2018 Further streamlined operations when it ceased farming operations with the sale of the Rampage property for $26 million in January 2018 The San Elijo project is nearing completion and sales remain brisk amidst a strong housing market and rising housing prices in San Diego Through 6/30/18, HomeFed has sold 3,411 of the 3,463 total single family lots and multi-family units and has agreements in place to sell the remaining lots and units Home sales are underway at Sweetbay, HomeFed’s 700 acre, 3,200 unit master planned community in Panama City HomeFed is seeking to raise up to $125 million in EB-5 funds to finance its Village of Escaya project, of which $92 million has been drawn from escrow Bullet 4 Source: Q2’18 10Q, p. 27 8-K 2018 Annual Shareholder Meeting (JS – housing prices) Bullet 3 Source: Q2’18 10Q, p. 33 8-K 2018 Annual Shareholder Meeting (JS – sales, closings, families) Bullet 2 Source: Q2’18 10Q, p. 32 Bullet 1 Source: Q2’18 10Q, p. 20 81

Strategic Priorities Monetize land assets Optimize Otay Ranch assets – focus on expediting development programs and maximizing revenue over the coming years Continue to monetize Village of Escaya home sales and future village developments through sales and partnerships with top tier builders Progress mixed-use developments as opportunities present themselves Continue to optimize the capital structure of Renaissance Plaza Increase lot and home sales throughout our other active projects, including: Ashville Park in Virginia The Market Common in South Carolina San Elijo Hills in California SweetBay in Florida Northeast Point in Maine Develop existing land holdings strategically and seek new opportunities that provide strong risk adjusted returns 82

83

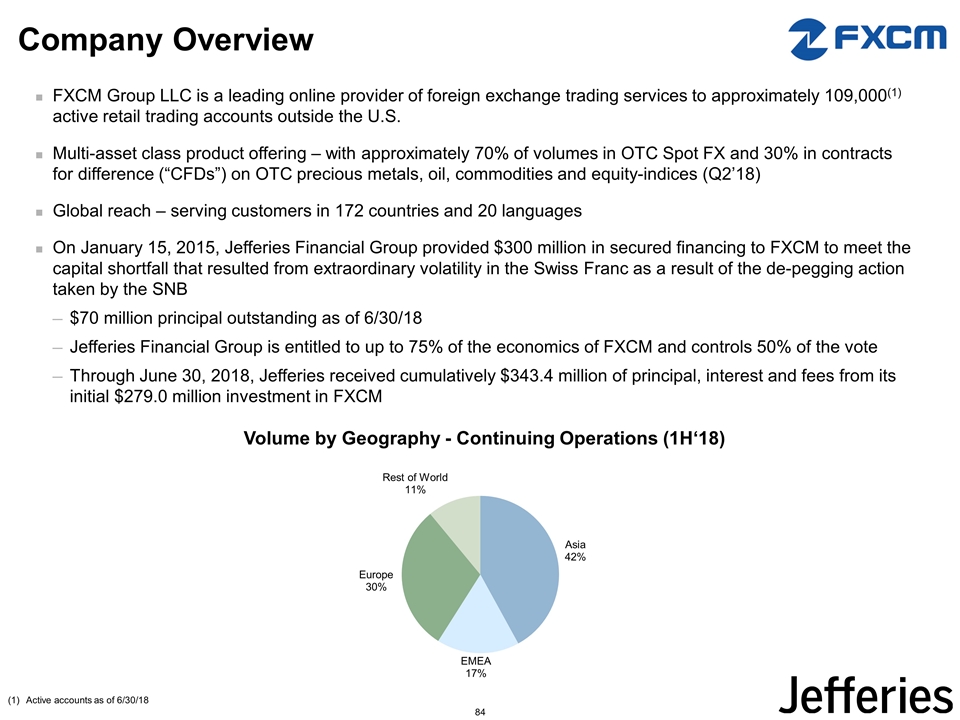

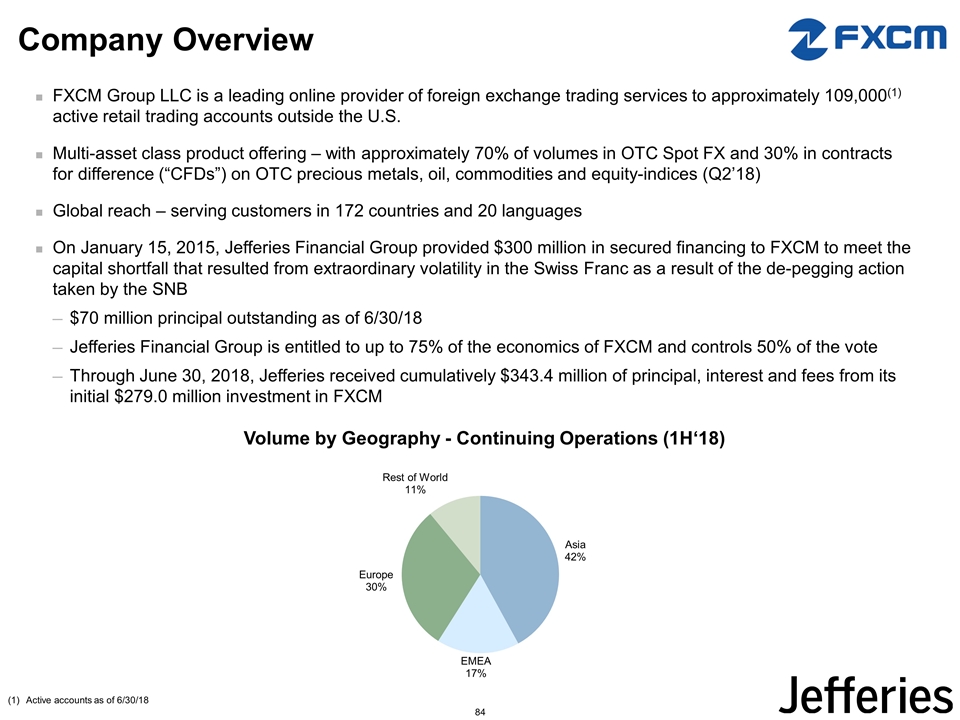

Company Overview FXCM Group LLC is a leading online provider of foreign exchange trading services to approximately 109,000(1) active retail trading accounts outside the U.S. Multi-asset class product offering – with approximately 70% of volumes in OTC Spot FX and 30% in contracts for difference (“CFDs”) on OTC precious metals, oil, commodities and equity-indices (Q2’18) Global reach – serving customers in 172 countries and 20 languages On January 15, 2015, Jefferies Financial Group provided $300 million in secured financing to FXCM to meet the capital shortfall that resulted from extraordinary volatility in the Swiss Franc as a result of the de-pegging action taken by the SNB $70 million principal outstanding as of 6/30/18 Jefferies Financial Group is entitled to up to 75% of the economics of FXCM and controls 50% of the vote Through June 30, 2018, Jefferies received cumulatively $343.4 million of principal, interest and fees from its initial $279.0 million investment in FXCM Active accounts as of 6/30/18 Volume by Geography - Continuing Operations (1H‘18) 84

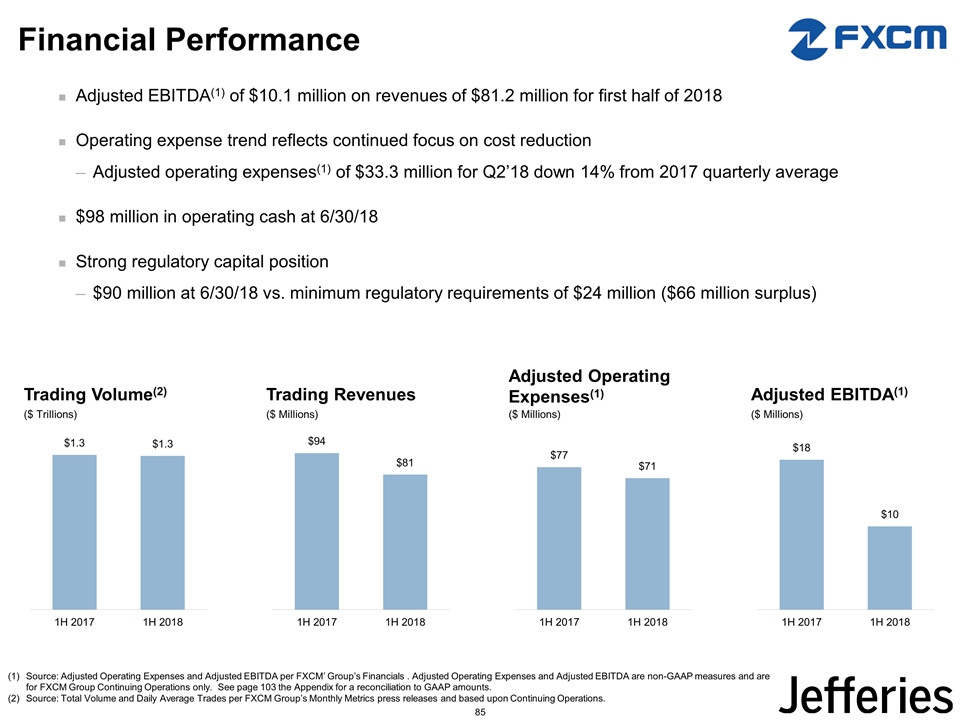

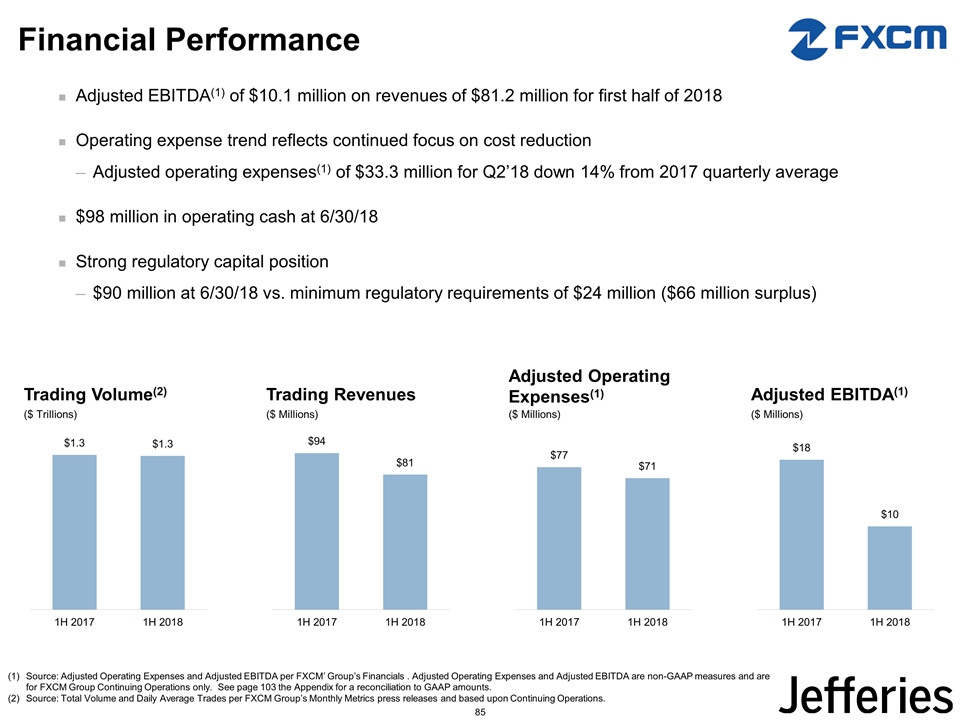

Financial Performance Adjusted EBITDA(1) of $10.1 million on revenues of $81.2 million for first half of 2018 Operating expense trend reflects continued focus on cost reduction Adjusted operating expenses(1) of $33.3 million for Q2’18 down 14% from 2017 quarterly average $98 million in operating cash at 6/30/18 Strong regulatory capital position $90 million at 6/30/18 vs. minimum regulatory requirements of $24 million ($66 million surplus) Source: Adjusted Operating Expenses and Adjusted EBITDA per FXCM’ Group’s Financials . Adjusted Operating Expenses and Adjusted EBITDA are non-GAAP measures and are for FXCM Group Continuing Operations only. See page 103 the Appendix for a reconciliation to GAAP amounts. Source: Total Volume and Daily Average Trades per FXCM Group’s Monthly Metrics press releases and based upon Continuing Operations. Trading Volume(2) ($ Trillions) Adjusted EBITDA(1) ($ Millions) Trading Revenues ($ Millions) Adjusted Operating Expenses(1) ($ Millions) 85

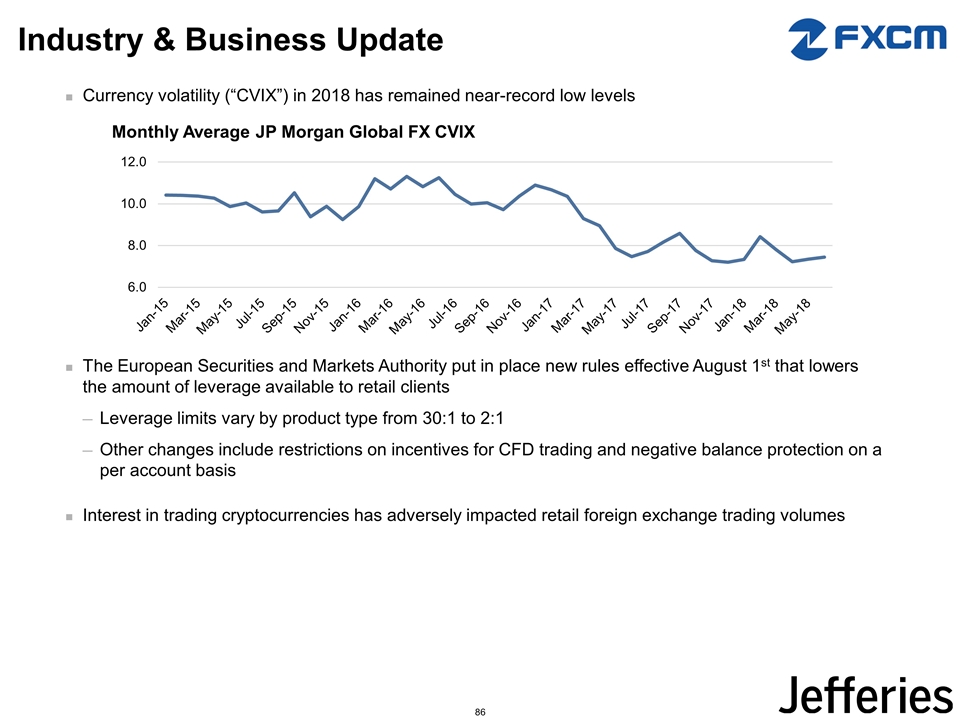

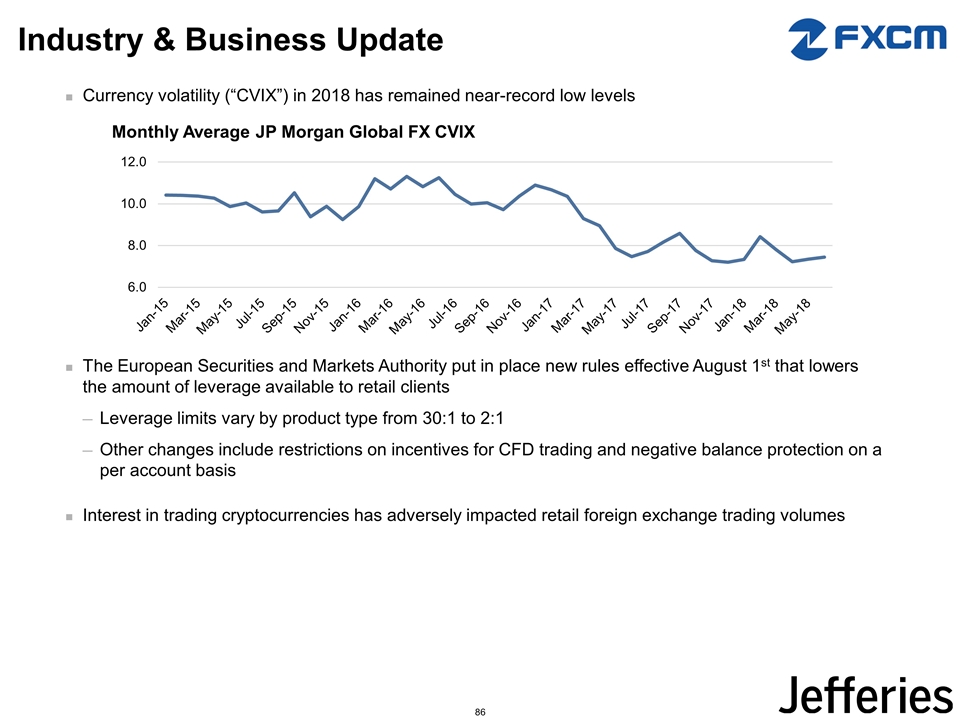

Currency volatility (“CVIX”) in 2018 has remained near-record low levels The European Securities and Markets Authority put in place new rules effective August 1st that lowers the amount of leverage available to retail clients Leverage limits vary by product type from 30:1 to 2:1 Other changes include restrictions on incentives for CFD trading and negative balance protection on a per account basis Interest in trading cryptocurrencies has adversely impacted retail foreign exchange trading volumes Industry & Business Update Monthly Average JP Morgan Global FX CVIX 86

Strategic Priorities Continue focus on costs / well positioned to capitalize when volatility improves Advance new enhanced algorithmic and API offerings Promotion of new HTML5 web-based platform Improve CFD pricing Expand on Crypto CFD offering (Bitcoin launched in July 2018) Enhance client onboarding technology to increase account conversion 87

88

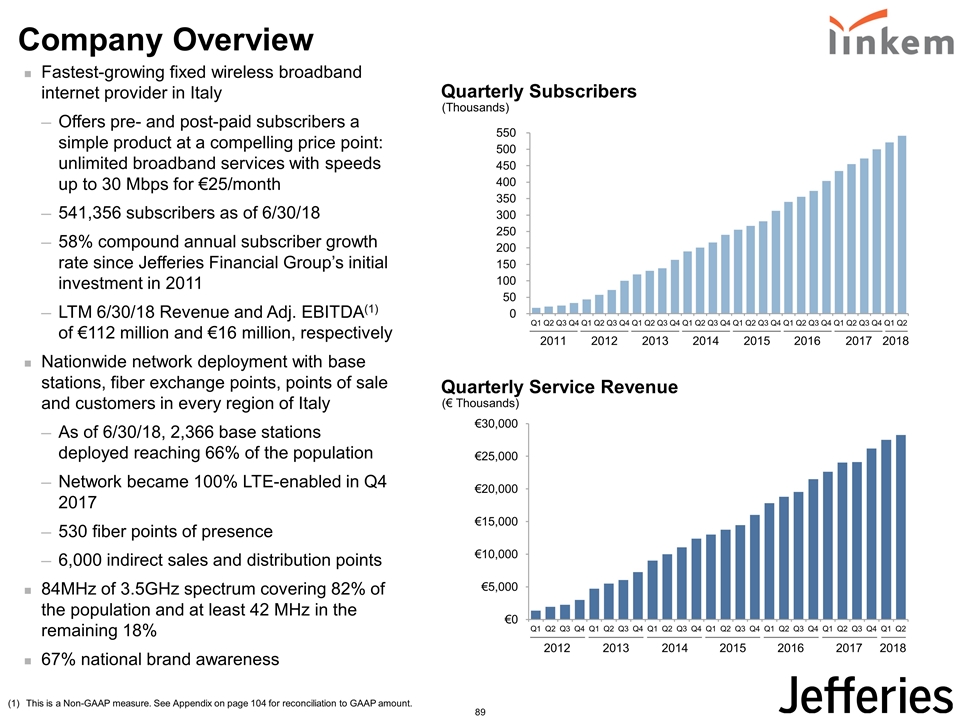

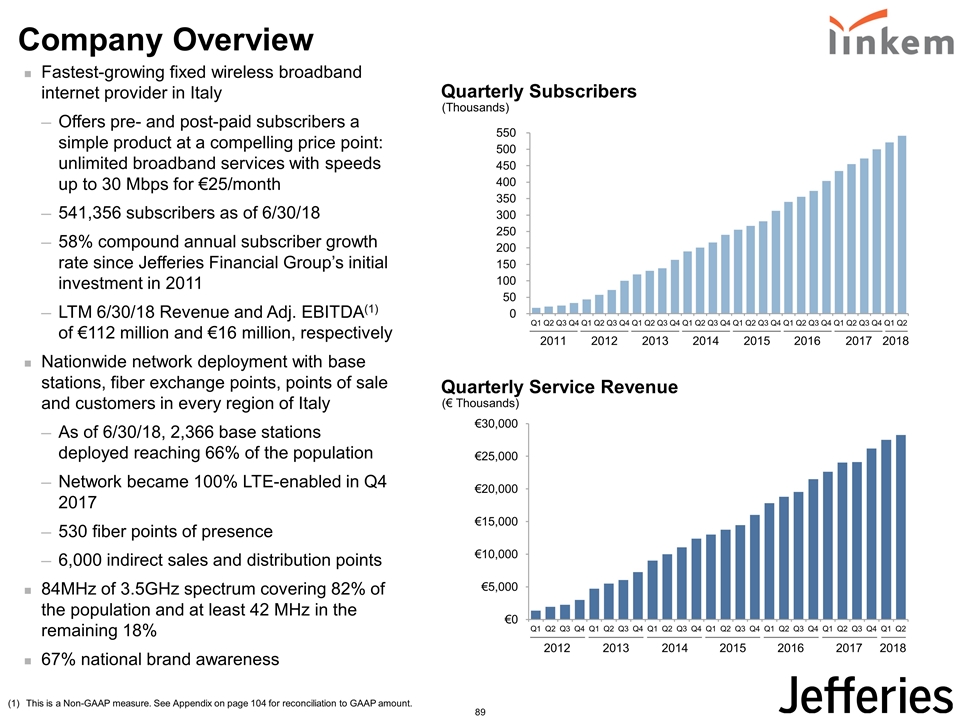

Company Overview Quarterly Subscribers 2011 2012 2013 2014 2015 2016 2017 2018 This is a Non-GAAP measure. See Appendix on page 104 for reconciliation to GAAP amount. Sources – Bullets 541,356k Subscribers, 2,366 BTS – from File 02 66% of Italian Households, 530 fiber points, 6,000 indirect sales points, 67% brand awareness– from File 01, p. 5 LTM Financials from File 06. Calculations (which are sourced from all 4 Maroon Book files) 84 MHz of 3.5 GHz frequency covering 82% of the country and either 63 MHz or 42 MHz in the remaining 18% – from File 01, p. 5 58% CAGR from data in chart on slide in this deck titled ‘Subscriber and Network Growth’ (which is sourced from File 05 / Maroon Books) (Thousands) 2012 2013 2014 2015 2016 2017 2018 Quarterly Service Revenue (€ Thousands) Fastest-growing fixed wireless broadband internet provider in Italy Offers pre- and post-paid subscribers a simple product at a compelling price point: unlimited broadband services with speeds up to 30 Mbps for €25/month 541,356 subscribers as of 6/30/18 58% compound annual subscriber growth rate since Jefferies Financial Group’s initial investment in 2011 LTM 6/30/18 Revenue and Adj. EBITDA(1) of €112 million and €16 million, respectively Nationwide network deployment with base stations, fiber exchange points, points of sale and customers in every region of Italy As of 6/30/18, 2,366 base stations deployed reaching 66% of the population Network became 100% LTE-enabled in Q4 2017 530 fiber points of presence 6,000 indirect sales and distribution points 84MHz of 3.5GHz spectrum covering 82% of the population and at least 42 MHz in the remaining 18% 67% national brand awareness Sources – Graphs Quarterly Subs – Updated an old Graph used in LUK 2017 IR day (see File 00.) using File 06. Calculations (which are sourced from all 4 Maroon Book files) Quarterly Serv. Rev. – File 08 89

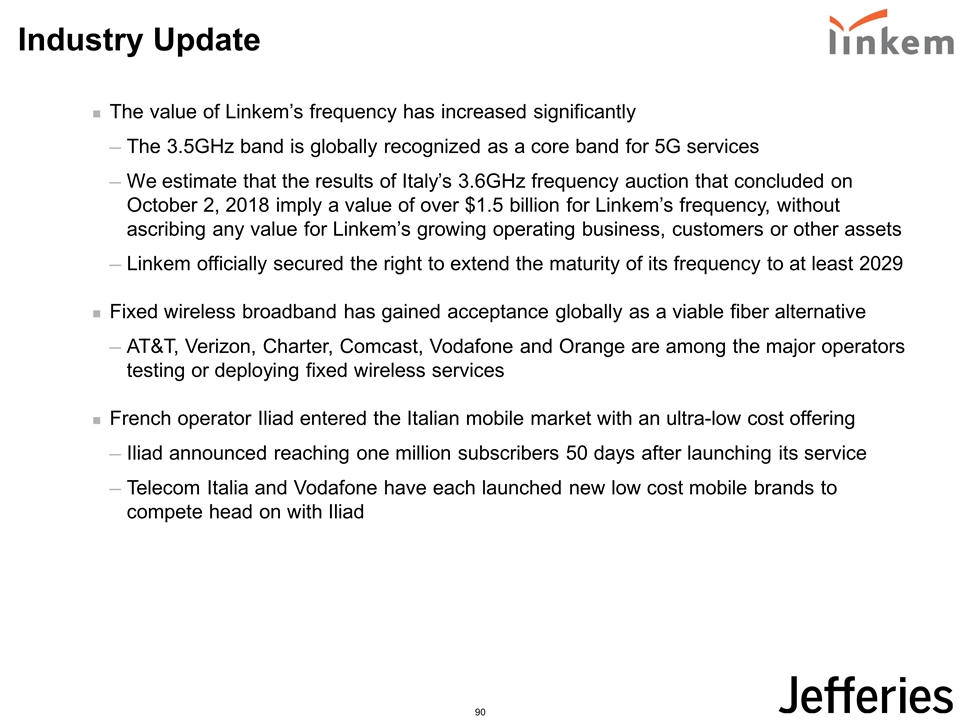

Industry Update The value of Linkem’s frequency has increased significantly The 3.5GHz band is globally recognized as a core band for 5G services We estimate that the results of Italy’s 3.6GHz frequency auction that concluded on October 2, 2018 imply a value of over $1.5 billion for Linkem’s frequency, without ascribing any value for Linkem’s growing operating business, customers or other assets Linkem officially secured the right to extend the maturity of its frequency to at least 2029 Fixed wireless broadband has gained acceptance globally as a viable fiber alternative AT&T, Verizon, Charter, Comcast, Vodafone and Orange are among the major operators testing or deploying fixed wireless services French operator Iliad entered the Italian mobile market with an ultra-low cost offering Iliad announced reaching one million subscribers 50 days after launching its service Telecom Italia and Vodafone have each launched new low cost mobile brands to compete head on with Iliad 90

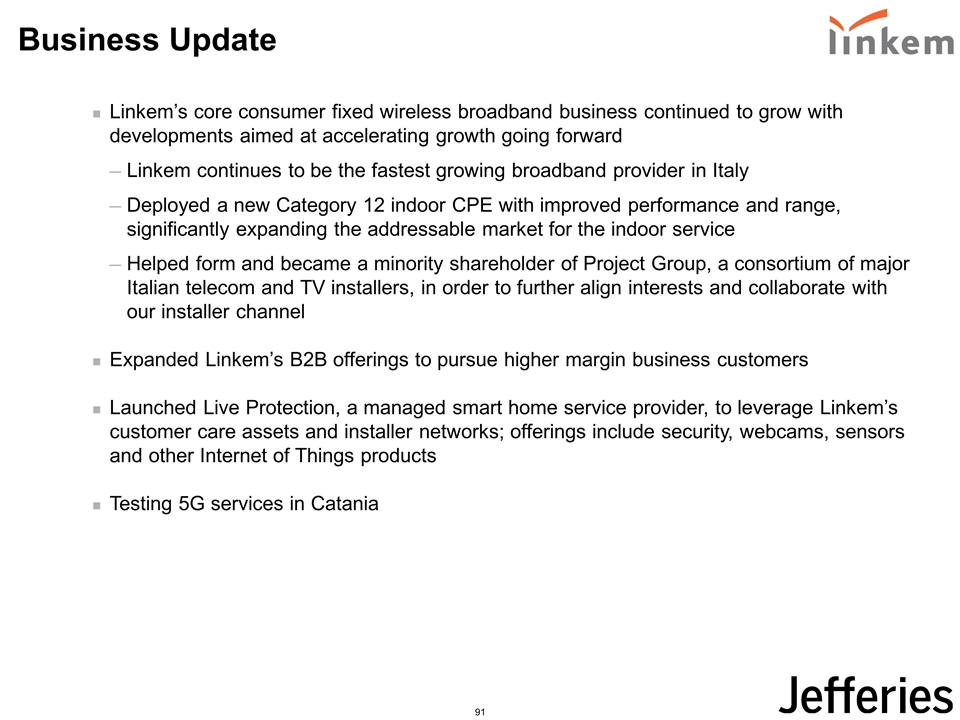

Business Update Linkem’s core consumer fixed wireless broadband business continued to grow with developments aimed at accelerating growth going forward Linkem continues to be the fastest growing broadband provider in Italy Deployed a new Category 12 indoor CPE with improved performance and range, significantly expanding the addressable market for the indoor service Helped form and became a minority shareholder of Project Group, a consortium of major Italian telecom and TV installers, in order to further align interests and collaborate with our installer channel Expanded Linkem’s B2B offerings to pursue higher margin business customers Launched Live Protection, a managed smart home service provider, to leverage Linkem’s customer care assets and installer networks; offerings include security, webcams, sensors and other Internet of Things products Testing 5G services in Catania Sources Jimmy Hallac 91

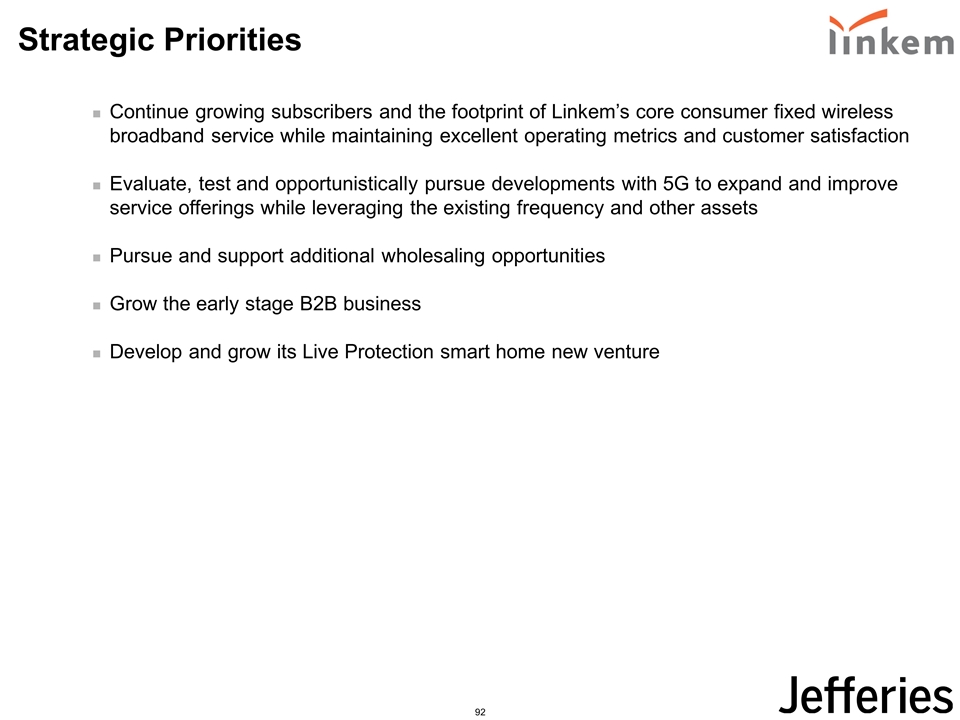

Strategic Priorities Continue growing subscribers and the footprint of Linkem’s core consumer fixed wireless broadband service while maintaining excellent operating metrics and customer satisfaction Evaluate, test and opportunistically pursue developments with 5G to expand and improve service offerings while leveraging the existing frequency and other assets Pursue and support additional wholesaling opportunities Grow the early stage B2B business Develop and grow its Live Protection smart home new venture Sources Jimmy Hallac 92

Q & A’s – IRQuestions@Jefferies.com

Appendix 93

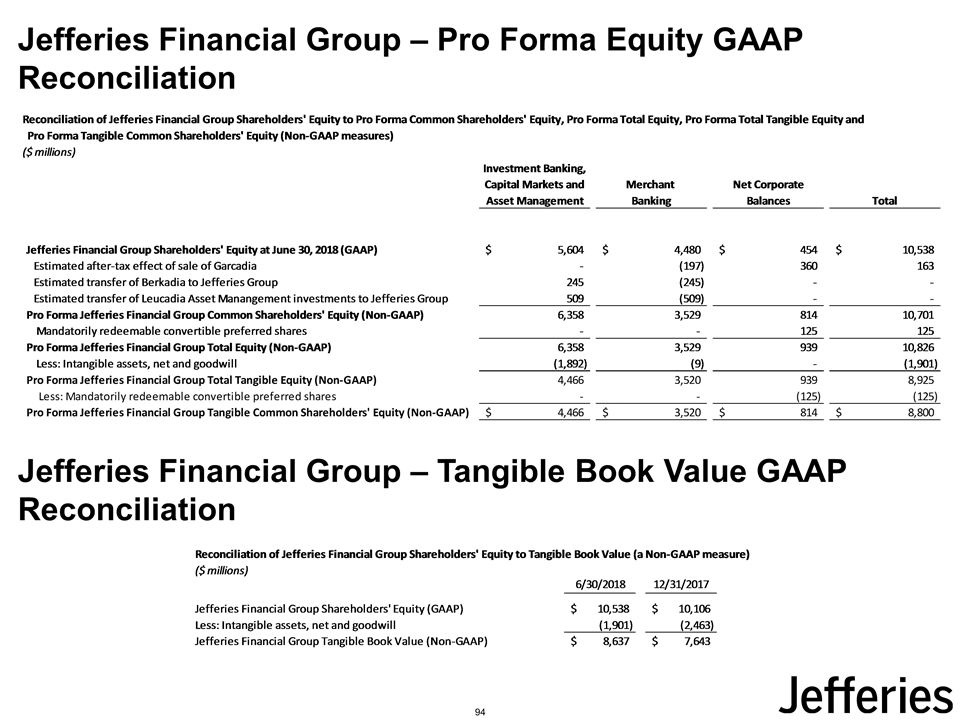

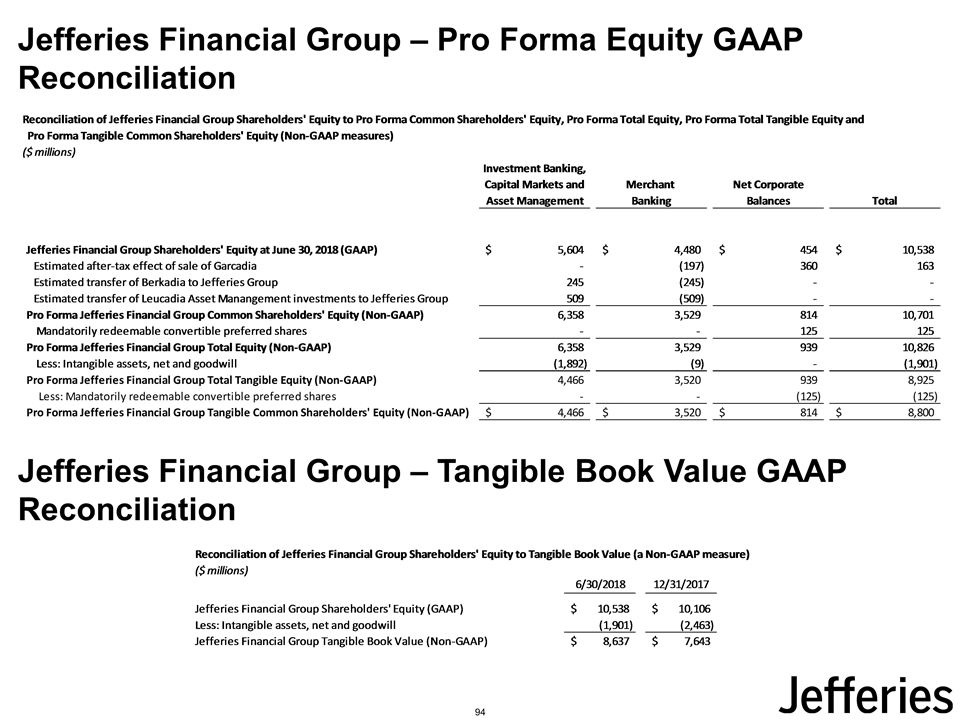

Jefferies Financial Group – Pro Forma Equity GAAP Reconciliation Jefferies Financial Group – Tangible Book Value GAAP Reconciliation 94

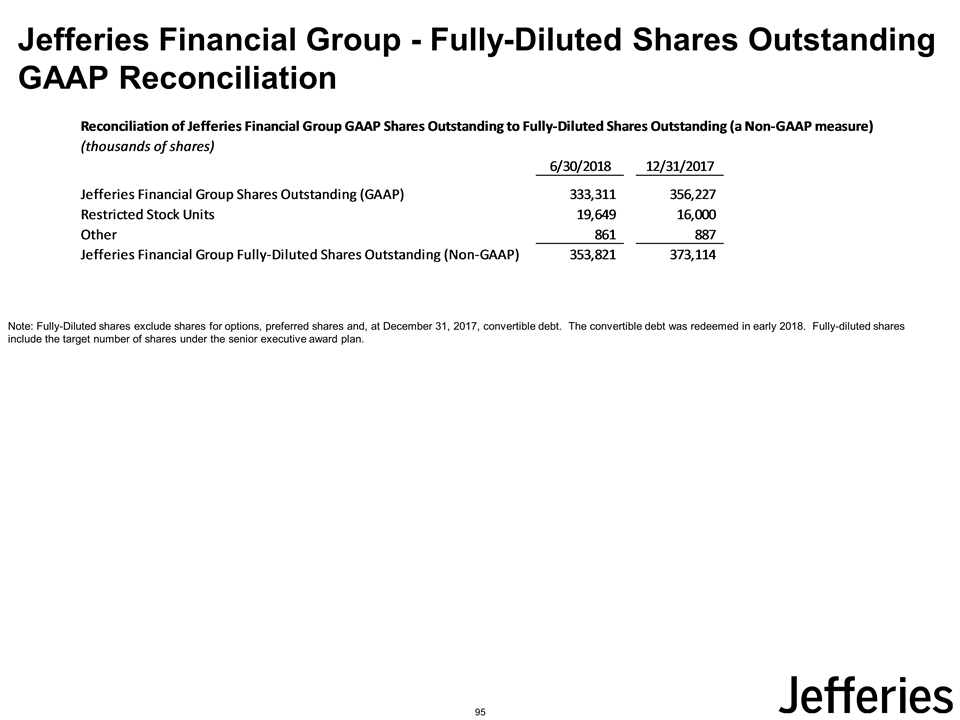

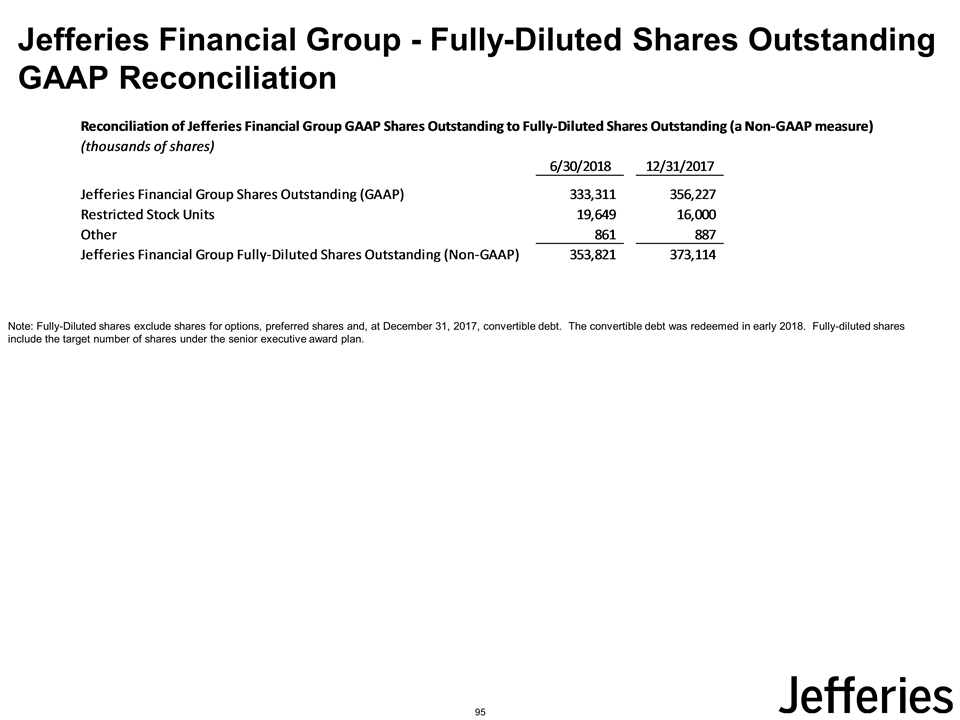

Jefferies Financial Group - Fully-Diluted Shares Outstanding GAAP Reconciliation Note: Fully-Diluted shares exclude shares for options, preferred shares and, at December 31, 2017, convertible debt. The convertible debt was redeemed in early 2018. Fully-diluted shares include the target number of shares under the senior executive award plan. 95

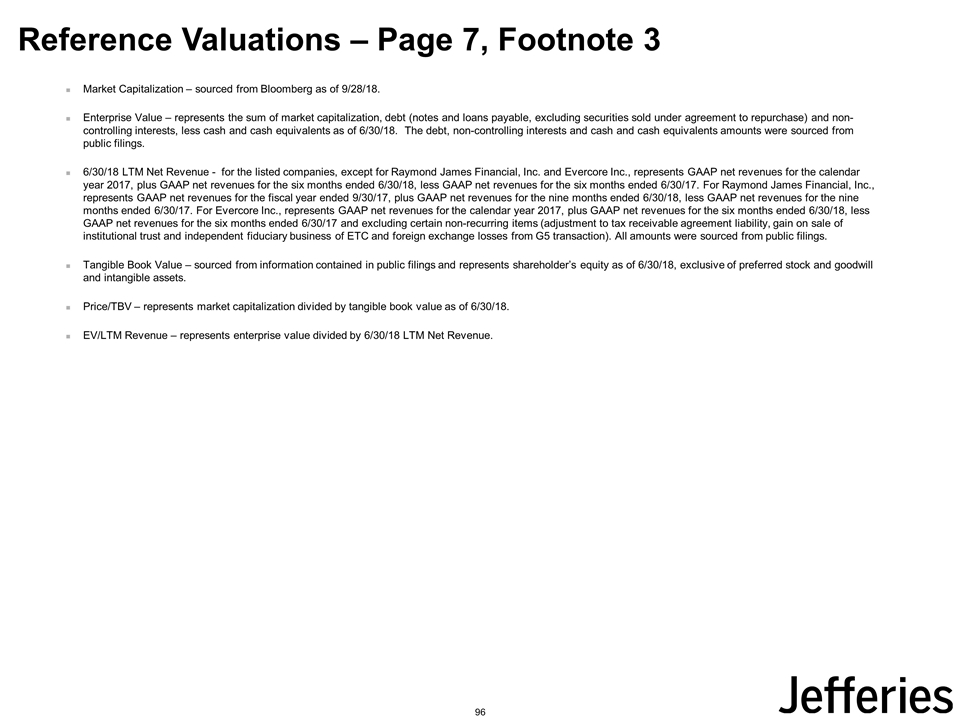

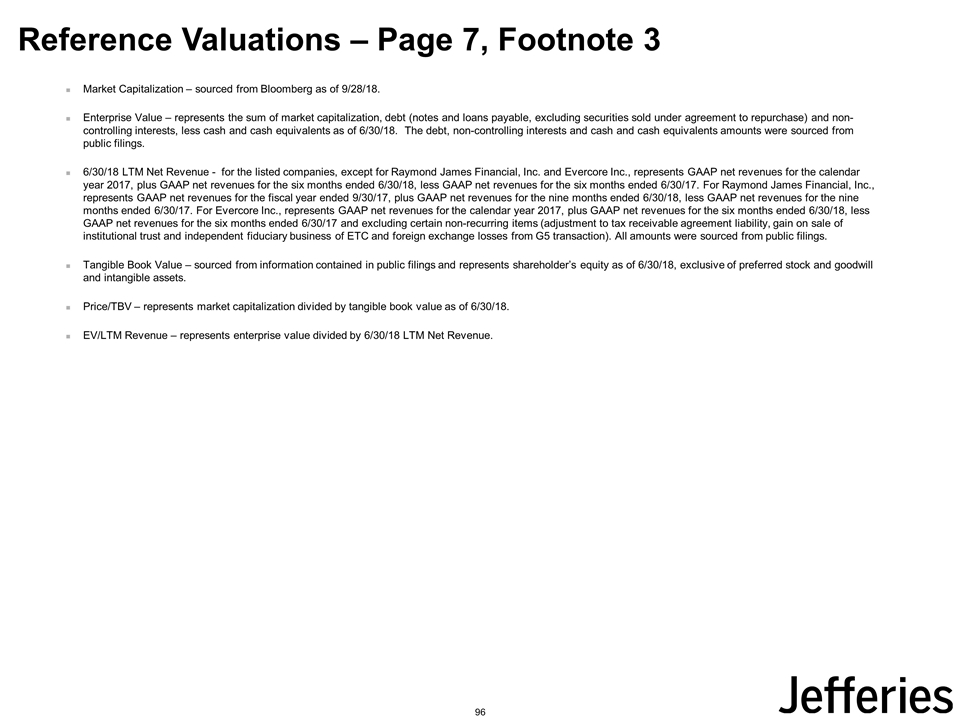

Reference Valuations – Page 7, Footnote 3 Market Capitalization – sourced from Bloomberg as of 9/28/18. Enterprise Value – represents the sum of market capitalization, debt (notes and loans payable, excluding securities sold under agreement to repurchase) and non-controlling interests, less cash and cash equivalents as of 6/30/18. The debt, non-controlling interests and cash and cash equivalents amounts were sourced from public filings. 6/30/18 LTM Net Revenue - for the listed companies, except for Raymond James Financial, Inc. and Evercore Inc., represents GAAP net revenues for the calendar year 2017, plus GAAP net revenues for the six months ended 6/30/18, less GAAP net revenues for the six months ended 6/30/17. For Raymond James Financial, Inc., represents GAAP net revenues for the fiscal year ended 9/30/17, plus GAAP net revenues for the nine months ended 6/30/18, less GAAP net revenues for the nine months ended 6/30/17. For Evercore Inc., represents GAAP net revenues for the calendar year 2017, plus GAAP net revenues for the six months ended 6/30/18, less GAAP net revenues for the six months ended 6/30/17 and excluding certain non-recurring items (adjustment to tax receivable agreement liability, gain on sale of institutional trust and independent fiduciary business of ETC and foreign exchange losses from G5 transaction). All amounts were sourced from public filings. Tangible Book Value – sourced from information contained in public filings and represents shareholder’s equity as of 6/30/18, exclusive of preferred stock and goodwill and intangible assets. Price/TBV – represents market capitalization divided by tangible book value as of 6/30/18. EV/LTM Revenue – represents enterprise value divided by 6/30/18 LTM Net Revenue. 96

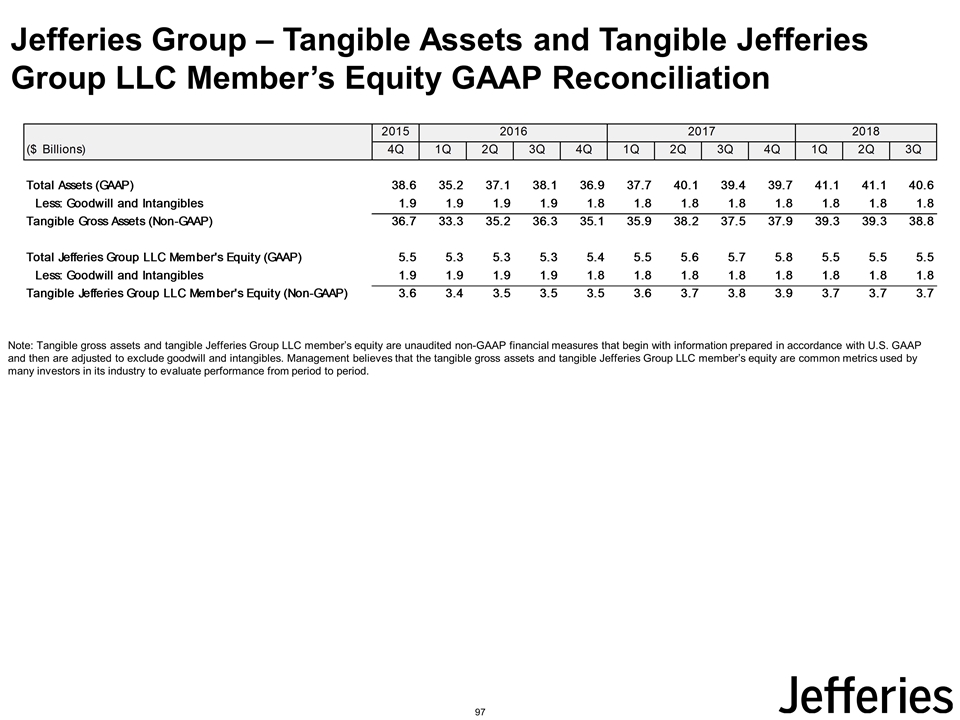

Jefferies Group – Tangible Assets and Tangible Jefferies Group LLC Member’s Equity GAAP Reconciliation Note: Tangible gross assets and tangible Jefferies Group LLC member’s equity are unaudited non-GAAP financial measures that begin with information prepared in accordance with U.S. GAAP and then are adjusted to exclude goodwill and intangibles. Management believes that the tangible gross assets and tangible Jefferies Group LLC member’s equity are common metrics used by many investors in its industry to evaluate performance from period to period. 97

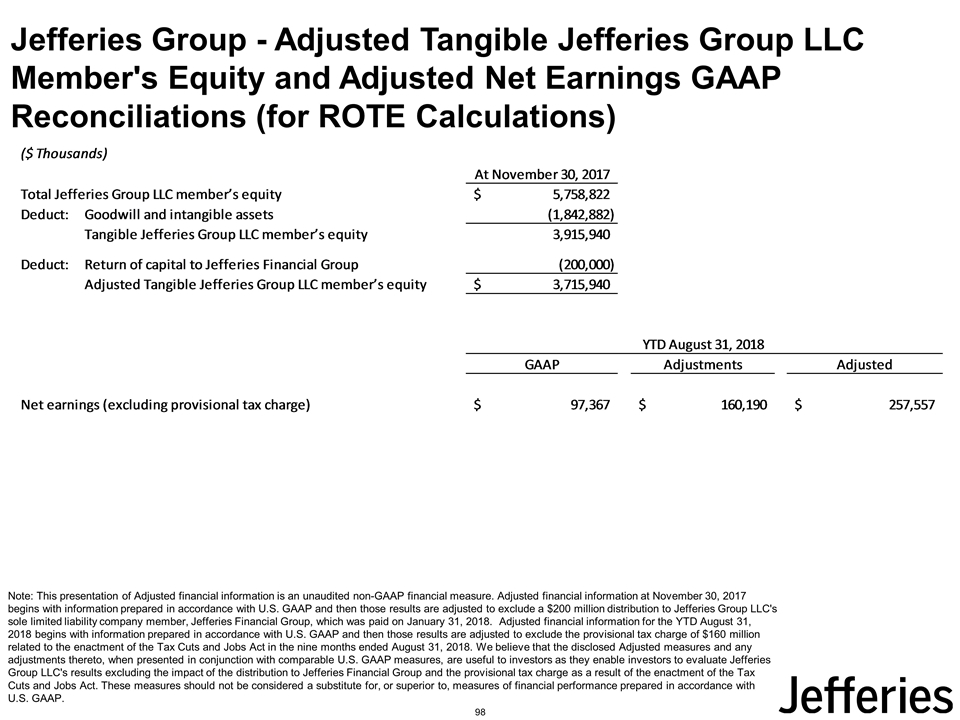

Jefferies Group - Adjusted Tangible Jefferies Group LLC Member's Equity and Adjusted Net Earnings GAAP Reconciliations (for ROTE Calculations) Note: This presentation of Adjusted financial information is an unaudited non-GAAP financial measure. Adjusted financial information at November 30, 2017 begins with information prepared in accordance with U.S. GAAP and then those results are adjusted to exclude a $200 million distribution to Jefferies Group LLC's sole limited liability company member, Jefferies Financial Group, which was paid on January 31, 2018. Adjusted financial information for the YTD August 31, 2018 begins with information prepared in accordance with U.S. GAAP and then those results are adjusted to exclude the provisional tax charge of $160 million related to the enactment of the Tax Cuts and Jobs Act in the nine months ended August 31, 2018. We believe that the disclosed Adjusted measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP measures, are useful to investors as they enable investors to evaluate Jefferies Group LLC's results excluding the impact of the distribution to Jefferies Financial Group and the provisional tax charge as a result of the enactment of the Tax Cuts and Jobs Act. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. 98

Berkadia – Cash Earnings GAAP Reconciliation National Beef – Adjusted EBITDA GAAP Reconciliation Note: National Beef Adjusted EBITDA represents pre-tax income exclusive of depreciation and amortization expenses, impairment charges and net interest income/expense, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. Note: Berkadia is not consolidated by Jefferies Financial Group and is accounted for under the equity method. The above reconciliation is provided for convenience only. Berkadia cash earnings represents pre-tax income plus depreciation, amortization and impairments of mortgage servicing rights (MSRs) and intangible assets, the increase in balance sheet loan loss reserves, less gains attributable to the origination of MSRs and unrealized gains on loans and investments, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. 99

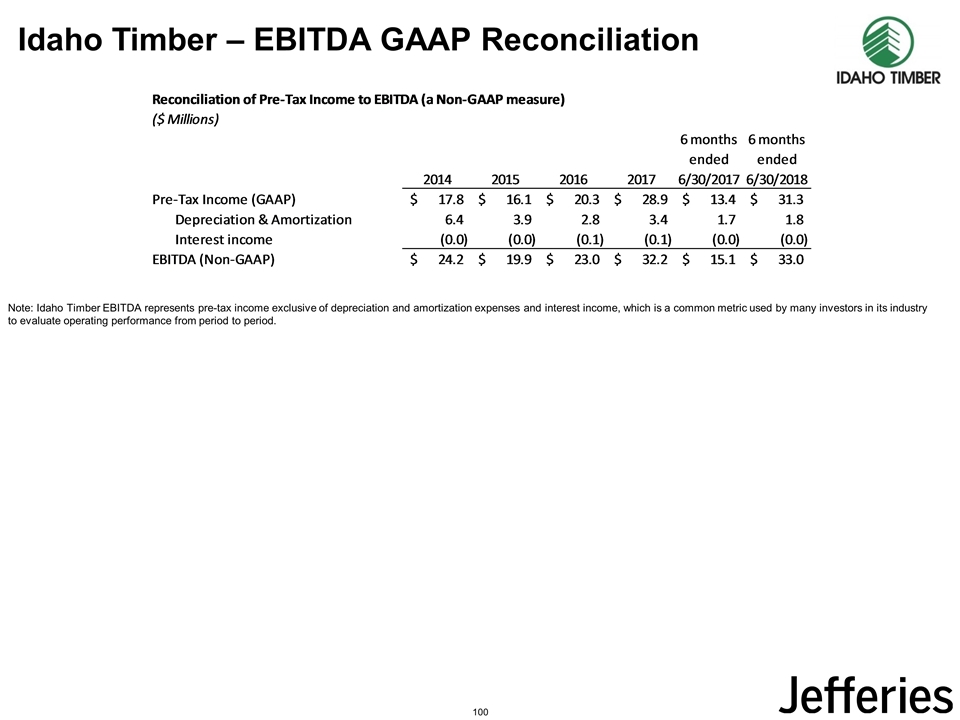

Idaho Timber – EBITDA GAAP Reconciliation Note: Idaho Timber EBITDA represents pre-tax income exclusive of depreciation and amortization expenses and interest income, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. 100

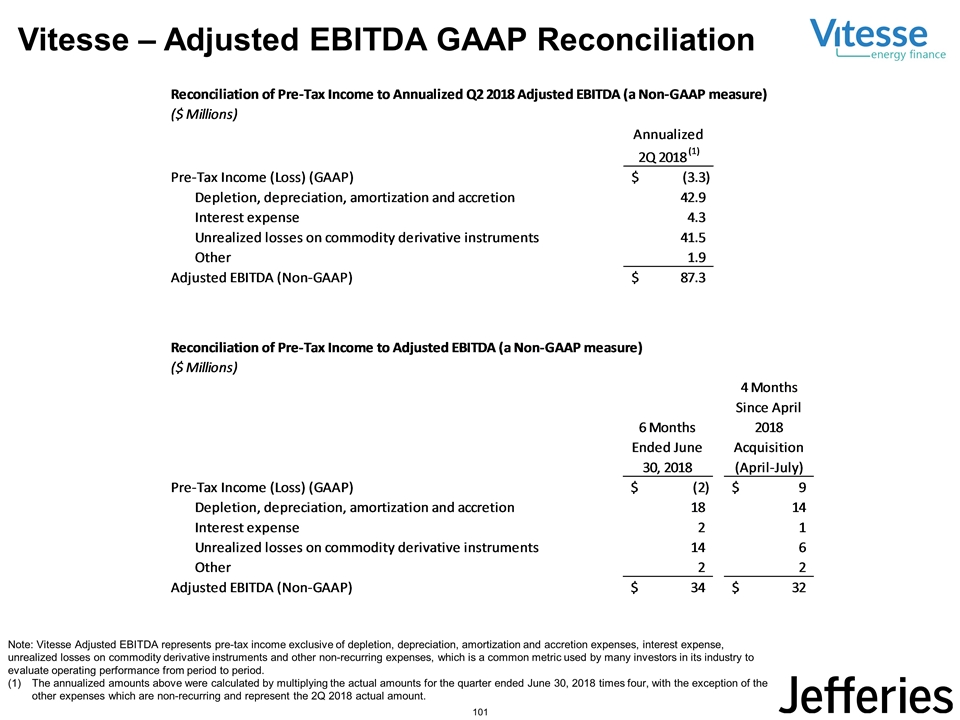

Vitesse – Adjusted EBITDA GAAP Reconciliation Note: Vitesse Adjusted EBITDA represents pre-tax income exclusive of depletion, depreciation, amortization and accretion expenses, interest expense, unrealized losses on commodity derivative instruments and other non-recurring expenses, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. The annualized amounts above were calculated by multiplying the actual amounts for the quarter ended June 30, 2018 times four, with the exception of the other expenses which are non-recurring and represent the 2Q 2018 actual amount. 101

Vitesse – Adjusted Pre-Tax Income GAAP Reconciliation Note: Vitesse Adjusted Pre-Tax Income represents pre-tax income exclusive of unrealized losses on commodity derivative instruments and other non-recurring expenses, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. 102

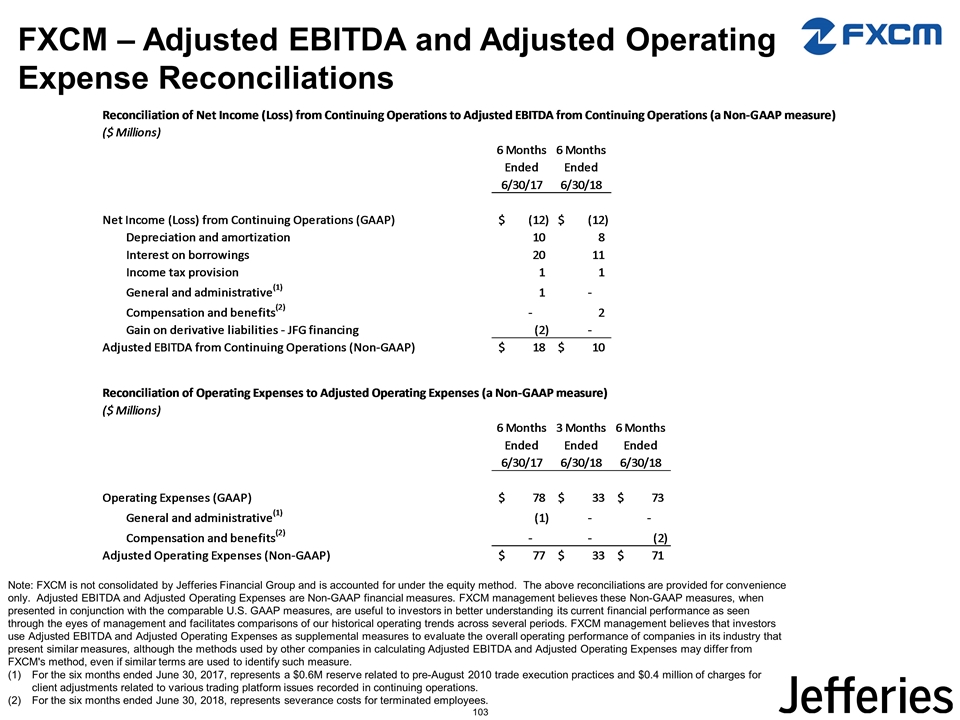

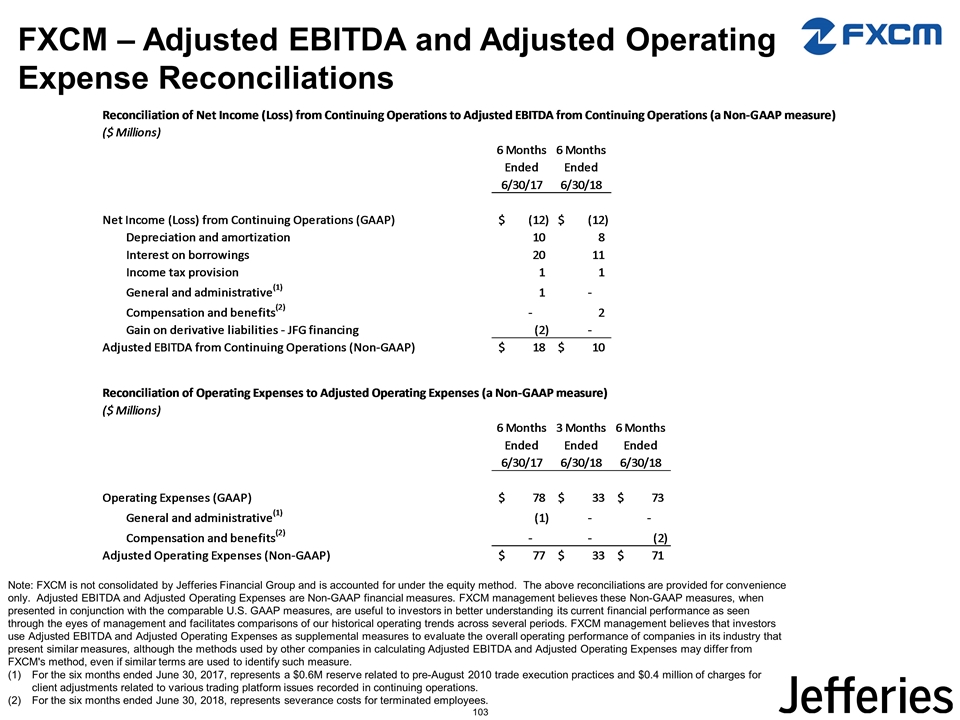

FXCM – Adjusted EBITDA and Adjusted Operating Expense Reconciliations Note: FXCM is not consolidated by Jefferies Financial Group and is accounted for under the equity method. The above reconciliations are provided for convenience only. Adjusted EBITDA and Adjusted Operating Expenses are Non-GAAP financial measures. FXCM management believes these Non-GAAP measures, when presented in conjunction with the comparable U.S. GAAP measures, are useful to investors in better understanding its current financial performance as seen through the eyes of management and facilitates comparisons of our historical operating trends across several periods. FXCM management believes that investors use Adjusted EBITDA and Adjusted Operating Expenses as supplemental measures to evaluate the overall operating performance of companies in its industry that present similar measures, although the methods used by other companies in calculating Adjusted EBITDA and Adjusted Operating Expenses may differ from FXCM's method, even if similar terms are used to identify such measure. For the six months ended June 30, 2017, represents a $0.6M reserve related to pre-August 2010 trade execution practices and $0.4 million of charges for client adjustments related to various trading platform issues recorded in continuing operations. For the six months ended June 30, 2018, represents severance costs for terminated employees. 103

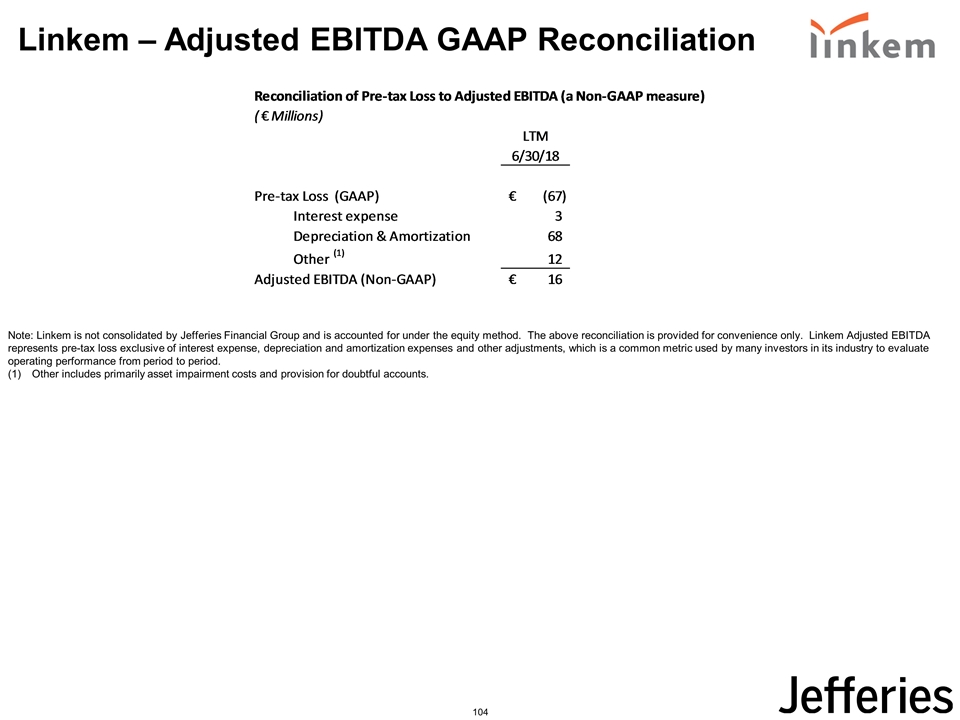

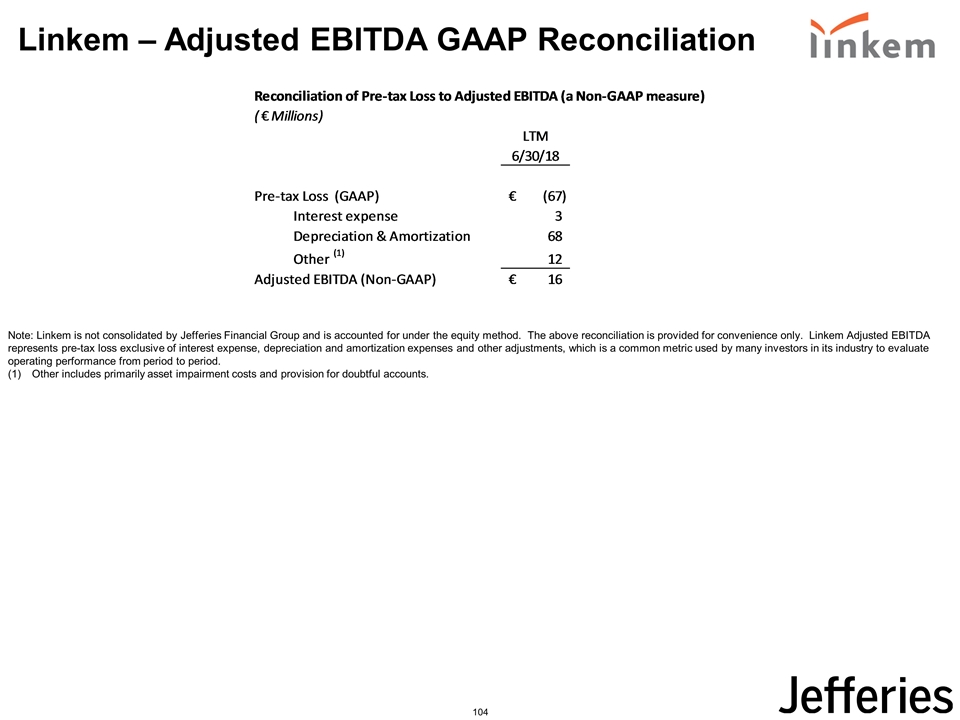

Linkem – Adjusted EBITDA GAAP Reconciliation Note: Linkem is not consolidated by Jefferies Financial Group and is accounted for under the equity method. The above reconciliation is provided for convenience only. Linkem Adjusted EBITDA represents pre-tax loss exclusive of interest expense, depreciation and amortization expenses and other adjustments, which is a common metric used by many investors in its industry to evaluate operating performance from period to period. Other includes primarily asset impairment costs and provision for doubtful accounts. 104