With our typical contrarian bent, in 2019, we continued to invest in both Europe and Asia, and we appear to be well-positioned in both regions for 2020 and beyond. Jefferies has 899 employees based across Europe, and 404 in Asia and Australia, an increase of 15% during the past year. In the face of an opening we saw in the competitive environment, we made a series of hires across Asia to strengthen our platforms in Hong Kong/China, Japan, India and Singapore. In less than two years, our entry into Australia has grown to 55 employees primarily across Investment Banking and Equities.

We have noted for several years that a number of our major competitors are experiencing challenges or changes in their business priorities that create further opportunity for us. This remains the case and we believe will continue to work to our advantage. Finally, our culture, capabilities and brand have never been stronger and, while market forces can prove challenging, we strongly believe Jefferies is in the best position possible as we start 2020 to deliver on our potential.

Long-Term Perspective

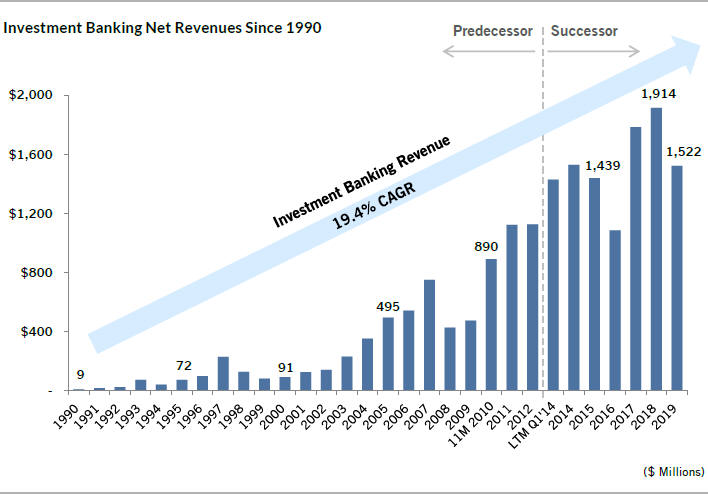

We have previously noted that Investment Banking is the fundamental driver of our core businesses. We decided several years ago, and still believe strongly, that our Investment Banking effort is readily scalable, the most differentiated of all our businesses and the most likely to deliver consistent long-term results and meaningful growth. Approximately 70% of our Investment Banking net revenues in 2019 came from repeat clients. We have refocused our Fixed Income business to reduce risk and capital utilization, and to prioritize partnership with Investment Banking. Our Equities business continues to develop well and in a capital-efficient manner, and is also closely aligned with our Investment Banking focus.

Building a world class investment banking platform is not easy to do and requires relentless effort, patience and perseverance over a long period of time and through multiple economic and market cycles. Thirty years ago, just after one of us arrived at our firm, Jefferies was a pure boutique with one real business, cash equities, which drove net earnings of $4 million on total galactic-wide revenues of $131 million. Twenty years ago, as the other of us was heading toward our firm, Jefferies was still headquartered in Los Angeles and had grown mightily to 885 employees. We were no longer a boutique, but a serious niche player that was diversifying to better serve our clients. Our net revenues were $544 million, with Equities representing 56%, or $302 million. We had $397 million in shareholders’ equity and an equity market capitalization of what we thought then to be an incredible $528 million. Ten years ago, Jefferies emerged from the Financial Crisis without requiring or receiving taxpayer support and with net revenues surpassing $2 billion. In 2010, Investment Banking represented almost half of our revenues and the balance was split roughly evenly between Equities and Fixed Income.

Jefferies today is an incredibly stronger global full-service investment banking firm, and hugely differentiated from boutiques which typically are dependent on one product and operate without direct knowledge of the broader Investment Banking and Capital Markets landscape, and from bank holding companies that generally lead with balance sheet, rather than insight, creativity or entrepreneurial agility.

Decades show true evolution, while shorter periods of time provide only an erratic glimpse. Looking back at individual years that make up each of the past three decades, one would get a limited picture of our momentum and opportunity. Some years we click on all cylinders, sometimes most of them and occasionally just a couple, but we find a way to always persevere, advance our platform and ultimately thrive.

Jefferies Financial Group Inc. Annual Report 2019 3