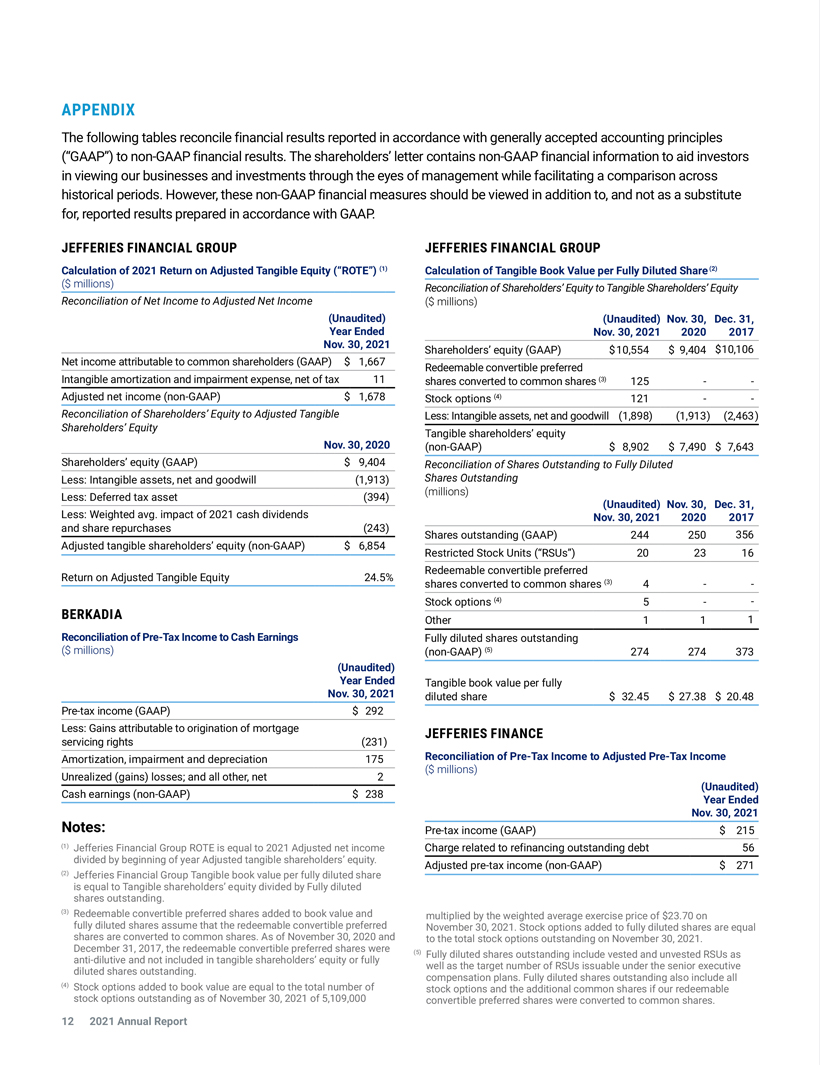

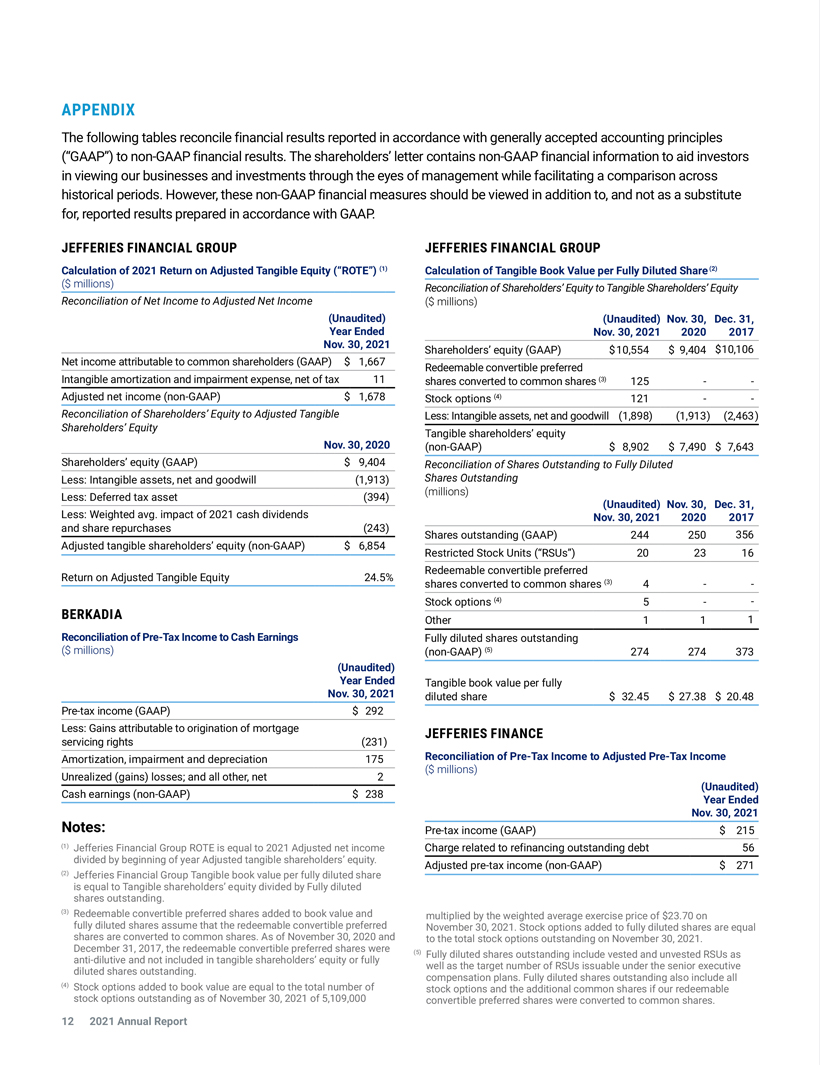

APPENDIX

The following tables reconcile financial results reported in accordance with generally accepted accounting principles (“GAAP”) to non-GAAP financial results. The shareholders’ letter contains non-GAAP financial information to aid investors in viewing our businesses and investments through the eyes of management while facilitating a comparison across historical periods. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, reported results prepared in accordance with GAAP.

JEFFERIES FINANCIAL GROUP

Calculation of 2021 Return on Adjusted Tangible Equity (“ROTE”) (1)

($ millions)

Reconciliation of Net Income to Adjusted Net Income

(Unaudited) Year Ended Nov. 30, 2021

Net income attributable to common shareholders (GAAP) $ 1,667 Intangible amortization and impairment expense, net of tax 11 Adjusted net income (non-GAAP) $ 1,678

Reconciliation of Shareholders’ Equity to Adjusted Tangible Shareholders’ Equity

Nov. 30, 2020

Shareholders’ equity (GAAP) $ 9,404 Less: Intangible assets, net and goodwill (1,913) Less: Deferred tax asset (394) Less: Weighted avg. impact of 2021 cash dividends and share repurchases (243) Adjusted tangible shareholders’ equity (non-GAAP) $ 6,854

Return on Adjusted Tangible Equity 24.5%

BERKADIA

Reconciliation of Pre-Tax Income to Cash Earnings

($ millions)

(Unaudited) Year Ended Nov. 30, 2021

Pre-tax income (GAAP) $ 292 Less: Gains attributable to origination of mortgage servicing rights (231) Amortization, impairment and depreciation 175 Unrealized (gains) losses; and all other, net 2 Cash earnings (non-GAAP) $ 238

Notes:

(1) Jefferies Financial Group ROTE is equal to 2021 Adjusted net income divided by beginning of year Adjusted tangible shareholders’ equity. (2) Jefferies Financial Group Tangible book value per fully diluted share is equal to Tangible shareholders’ equity divided by Fully diluted shares outstanding.

(3) Redeemable convertible preferred shares added to book value and fully diluted shares assume that the redeemable convertible preferred shares are converted to common shares. As of November 30, 2020 and December 31, 2017, the redeemable convertible preferred shares were anti-dilutive and not included in tangible shareholders’ equity or fully diluted shares outstanding.

(4) Stock options added to book value are equal to the total number of stock options outstanding as of November 30, 2021 of 5,109,000

JEFFERIES FINANCIAL GROUP

Calculation of Tangible Book Value per Fully Diluted Share (2)

Reconciliation of Shareholders’ Equity to Tangible Shareholders’ Equity

($ millions)

(Unaudited) Nov. 30, Dec. 31, Nov. 30, 2021 2020 2017

Shareholders’ equity (GAAP) $10,554 $ 9,404 $10,106 Redeemable convertible preferred shares converted to common shares (3) 125 —Stock options (4) 121 —Less: Intangible assets, net and goodwill (1,898) (1,913) (2,463) Tangible shareholders’ equity (non-GAAP) $ 8,902 $ 7,490 $ 7,643

Reconciliation of Shares Outstanding to Fully Diluted Shares Outstanding

(millions)

(Unaudited) Nov. 30, Dec. 31, Nov. 30, 2021 2020 2017

Shares outstanding (GAAP) 244 250 356 Restricted Stock Units (“RSUs”) 20 23 16 Redeemable convertible preferred shares converted to common shares (3) 4 —Stock options (4) 5 —Other 1 1 1 Fully diluted shares outstanding (non-GAAP) (5) 274 274 373

Tangible book value per fully diluted share $ 32.45 $ 27.38 $ 20.48

JEFFERIES FINANCE

Reconciliation of Pre-Tax Income to Adjusted Pre-Tax Income

($ millions)

(Unaudited) Year Ended Nov. 30, 2021

Pre-tax income (GAAP) $ 215 Charge related to refinancing outstanding debt 56 Adjusted pre-tax income (non-GAAP) $ 271

multiplied by the weighted average exercise price of $23.70 on

November 30, 2021. Stock options added to fully diluted shares are equal to the total stock options outstanding on November 30, 2021.

(5) Fully diluted shares outstanding include vested and unvested RSUs as well as the target number of RSUs issuable under the senior executive compensation plans. Fully diluted shares outstanding also include all stock options and the additional common shares if our redeemable convertible preferred shares were converted to common shares.

12 2021 Annual Report