UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

RadioShack Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(l), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

RadioShack Corporation

100 Throckmorton Street, Suite 1800

Fort Worth, Texas 76102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Thursday, May 15, 2003

10:00 a.m.

RadioShack Corporation

Answers University, Suite 128

300 West Third Street

Fort Worth, Texas 76102

AGENDA

| | (1) | | To elect 13 members of the board of directors to serve until the next annual meeting of stockholders or until their successors are elected and qualified; and |

| | (2) | | To transact any other business properly brought before the meeting or any adjournment of the meeting. |

Stockholders of record at the close of business on March 18, 2003, will be entitled to notice of the meeting and the right to vote at the meeting.

By Order of the Board of Directors

Mark C. Hill

Senior Vice President, Corporate

Secretary and General Counsel

April 7, 2003

Regardless of whether you plan to attend the annual meeting, pleaseVOTE OVER THE TELEPHONE OR THE INTERNET AS INSTRUCTED ON THE ENCLOSED PROXY CARD OR YOU MAY COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED. In the event you decide to attend the meeting, you may, if desired, revoke the proxy and vote your shares in person.

Table of Contents

PROXY STATEMENT

RADIOSHACK CORPORATION

100 Throckmorton Street, Suite 1800

Fort Worth, Texas 76102

ANNUAL MEETING OF STOCKHOLDERS OF RADIOSHACK CORPORATION

TO BE HELD ON THURSDAY, MAY 15, 2003

This Proxy Statement is being furnished to stockholders of RadioShack Corporation, a Delaware corporation, in connection with the solicitation of proxies by the Board of Directors of the Company. The Board of Directors is soliciting proxies from holders of record of the Company’s common stock as of the close of business on March 18, 2003, for use at the Annual Meeting of Stockholders of the Company and at any resumption of the meeting after adjournment or postponement of the meeting.

The Annual Meeting will be held on Thursday, May 15, 2003, at 10:00 a.m. (Central Daylight Savings Time) at RadioShack Corporation, Answers University, Suite 128, 300 West Third Street, Fort Worth, Texas 76102.

This Proxy Statement is first being mailed to the holders of the Company’s common stock on or about April 7, 2003.

PURPOSES OF THE ANNUAL MEETING

Holders of the Company’s common stock entitled to vote at the Annual Meeting will be asked to consider and to vote upon the following matters:

| | 1. | | the election of 13 members of the board of directors of the Company to serve until the next annual meeting of stockholders or until their successors are elected and qualified, and |

| | 2. | | any other business that may properly come before the meeting. |

As of the date of this Proxy Statement, the Board knows of no other business that will come before the Annual Meeting.

ITEM 1

ELECTION OF DIRECTORS

The Board of Directors Recommends a Vote “FOR” All Nominees.

Proxies submitted to the Company will be so voted

unless stockholders specify otherwise in their proxies.

Thirteen members of the board of directors of the Company are to be elected at the Annual Meeting to hold office until the next annual meeting of stockholders or until their successors have been duly elected and qualified. It is the intention of the persons named in the accompanying form of proxy card to vote for the election of all 13 nominees listed below as directors of the Company unless authority to so vote is withheld. All nominees have indicated their willingness to serve for the ensuing term.

The nominees for directors of the Company are listed below, along with information about each nominee.

|

Name | | (1) Principal Occupation

(2) Public Company Directorships | | Age | | Director

Since |

|

Frank J. Belatti | | (1) Chairman and Chief Executive Officer of AFC Enterprises,Inc. (the parent company of Popeyes Chicken& Biscuits, Church’s Chicken, Seattle CoffeeCompany and Cinnabon International). (2) AFC Enterprises, Inc. and Galyan’s Trading Company,Inc. | | 55 | | 1998 |

|

Ronald E. Elmquist | | (1) President and Chief Executive Officer of SubmitOrder,Inc. (a provider of comprehensive informationtechnology, distribution, and customerresponse services) since May 2001. Consultantfrom February 2001 to May 2001. Chairman,President and Chief Executive Officerof Keystone Automotive, Inc. (a specialty automotiveparts marketer) from June 1998 to February2001. Previously President of Global FoodService-Campbell Soup Company and CorporateVice President of Campbell Soup Company(a global manufacturer and marketer ofsoup and other food products) from January 1994to April 1998. | | 56 | | 1997 |

|

Robert S. Falcone | | (1) Executive Vice President and Chief Financial Officerof BearingPoint, Inc. (a consulting, systemsintegration and managed service firm) sinceApril 2003. Previously financial consultantto early stage enterprises from March2002 to March 2003. Senior Vice Presidentand Chief Financial Officer, 800.com (aninternet retailer of consumer electronics) fromJanuary 2000 to March 2002. A private investorfrom January 1998 to January 2000. SeniorVice President and Chief Financial Officer,Nike, Inc. (an international sports and fitnessfootwear and apparel company) from April1992 to January 1998. (2) International Microcomputer Software, Inc. and NautilusGroup, Inc. | | 56 | | 2003 |

|

2

|

Name | | (1) Principal Occupation

(2) Public Company Directorships | | Age | | Director

Since |

|

Daniel R. Feehan | | (1) Chief Executive Officer and President, Cash AmericaInternational, Inc. (a provider of specialtyfinancial services to individuals) sinceFebruary 2000. Previously President andChief Operating Officer, Cash America International,Inc. from January 1990 to February2000. (2) Cash America International, Inc., AZZ Incorporatedand Calloway’s Nursery, Inc. | | 52 | | 2003 |

|

Richard J. Hernandez | | (1) President, McKesson Corporate Solutions, McKessonCorporation (a provider of supply, informationand care management products andservices for the healthcare industry) sinceJanuary 2000. Previously Vice Presidentand General Manager of Consultingand Services Group of Johnson & Johnson(a manufacturer of healthcare products)from 1996 to 1999. | | 59 | | 2001 |

|

Lawrence V. Jackson | | (1) Senior Vice President of Supply Operations of Safeway,Inc. (a food and drug retailer) since October1997. Previously Senior Vice Presidentand Chief Operating Officer of WorldwideOperations of PepsiCo Food Systems,Inc. (a distributor of restaurant equipmentand supplies) from December 1994to October 1997. (2) Allied Waste Industries, Inc. | | 49 | | 2000 |

|

Robert J. Kamerschen | | (1) Retired Chairman and Chief Executive Officerof ADVO, Inc. (a targeted direct mail marketingservices company) since June 1999and January 1999, respectively. Consultantand private investor since February2002. Chairman and Chief ExecutiveOfficer of DIMAC Holdings, Inc. (a providerof direct response marketing solutions)from October 1999 to February 2002.Previously Chairman of ADVO, Inc. fromJanuary 1999 to June 1999 and Chief ExecutiveOfficer of ADVO, Inc. from November1988 to January 1999. DIMAC Holdings,Inc. filed for bankruptcy protection onApril 6, 2000 and emerged from bankruptcyprotection on February 27, 2001. (2) IMS Health, Inc.; Linens ‘n Things, Inc.; MemberworksIncorporated; R. H. Donnelley Corp.and Synavant Inc. | | 67 | | 1999 |

|

3

|

Name | | (1) Principal Occupation

(2) Public Company Directorships | | Age | | Director

Since |

|

H. Eugene Lockhart | | (1) Venture Partner - Oak Investment Partners (aventure capital firm) from February 2003. PreviouslyChairman of the Board of NewPowerHoldings (a nationwide provider of energyto residential and small commercial customers)from January 2000 to January 2003.President, Consumer Services, of AT&TCorp. (a voice, video and data communicationscompany) from 1999 to 2000,and President, Global Retail Bank, of Bankof America Corporation (a banking company)from 1997 to 1998. NewPower Holdings(and subsidiaries) filed for bankruptcyprotection on June 11, 2002. (2) IMS Health Inc. and Synavant Inc. | | 53 | | 2003 |

|

Jack L. Messman | | (1) President, Chief Executive Officer and Chairmanof the Board of Novell, Inc. (a providerof information solutions through varioussoftware platforms) since July 2001. Presidentand Chief Executive Officer of CambridgeTechnology Partners, Inc. (now a subsidiaryof Novell, Inc.) since July 1999. PreviouslyChairman and Chief Executive Officer,Union Pacific Resources Group Inc. (anoil and gas exploration and development company)from October 1996 until July 1999,and President and Chief Executive Officerof Union Pacific Resources, Inc. from May1991 until July 1999. (2) Novell, Inc.; Mettallurg, Inc.; Safeguard Scientifics,Inc. and US Data Corporation. | | 63 | | 1993 |

|

William G. Morton, Jr. | | (1) Retired as Chairman Emeritus, Boston Stock Exchange,Inc. (a regional stock exchange) sinceOctober 2002. Previously Chairman Emeritus,Boston Stock Exchange from March2001 to October 2002, and Chairman andChief Executive Officer, Boston Stock Exchange,Inc. until March 2001. (2) Morgan Stanley Institutional Funds, Inc. | | 66 | | 1987 |

|

4

|

Name | | (1) Principal Occupation

(2) Public Company Directorships | | Age | | Director

Since |

|

Thomas G. Plaskett | | (1) Managing Director, Fox Run Capital Associates(a private merchant banking and consultingfirm), corporate director and businessconsultant. Previously Chairman of ProbexCorporation (a company engaged in thecommercialization of patented technology toprocess lubricating oil) from November 1999to December 2000 and President and ChiefExecutive Officer of Probex Corporation fromNovember 1999 to August 2000. Vice Chairman,Legend Airlines, Inc. (a commercial airlinecompany) from June 1997 to February 2001and Executive Vice President from September1999 to February 2001. Previously Chairmanof Greyhound Lines, Inc. (a providerof intercity bus transportation) from March1995 to March 1999. Legend Airlines, Inc.filed for bankruptcy protection on December3, 2000. (2) Novell, Inc. and Smart & Final, Inc. | | 59 | | 1986 |

|

Leonard H. Roberts | | (1) Chairman of the Board of Directors, RadioShackCorporation since May 1999; ChiefExecutive Officer of RadioShack Corporationsince January 1999. Previously President,RadioShack Corporation from December1995 to December 2000. (2) J.C. Penney Company, Inc. | | 54 | | 1997 |

|

Edwina D. Woodbury | | (1) President and Chief Executive Officer, The ChapelHill Press, Inc. (a personal publishing company)since July 1999. A Consultant from January1999 through June 1999. Previously ExecutiveVice President-Business Process Redesign,Avon Products, Inc. (a direct seller ofbeauty and related products) from February 1998through December 1998; and Senior VicePresident, Chief Financial and AdministrativeOfficer, Avon Products, Inc. fromNovember 1993 to February 1998. (2) Click Commerce, Inc. | | 51 | | 1998 |

|

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

OF COMPANY VOTING SECURITIES

Unless otherwise indicated, the following table sets forth, as of February 28, 2003, certain information with respect to the beneficial ownership of the Company’s voting securities held by (i) each current director (and director nominee) of the Company, (ii) the Chairman and Chief Executive Officer and the four most highly compensated current executive officers of the Company (“Named Executive Officers”) for the year ended December 31, 2002, (iii) the Company’s current directors and executive officers as a group, and (iv) persons known to the Company to own beneficially more than 5% of any class of the Company’s voting securities, except for the RadioShack 401(k) Plan Trustee, which holds the Company’s common stock for the benefit of RadioShack 401(k) Plan participants.

| |

| | |

| | | Amount and Nature of Common Stock Beneficially Owned (1)(2) | | | |

| |

| | |

| | | Number of Shares Held of Record | | Right to Acquire (3) | | Total Number of Shares Beneficially Owned | | Percent of Class | | | Common Stock Units (4) |

| | |

Directors and Other Named Executive Officers | | | | | | | | | | | |

| | | | | | | | | | |

Frank J. Belatti, Director | | 500 | | 67,999 | | 68,499 | | * | | | -0- |

Ronald E. Elmquist, Director | | 268 | | 67,999 | | 68,267 | | * | | | 7,631 |

Robert S. Falcone, Director | | -0- | | -0- | | -0- | | * | | | -0- |

Daniel R. Feehan, Director | | -0- | | -0- | | -0- | | * | | | -0- |

Richard J. Hernandez, Director | | 888 | | 11,999 | | 12,887 | | * | | | 1,098 |

Lawrence V. Jackson, Director | | 900 | | 18,666 | | 19,566 | | * | | | 3,067 |

Robert J. Kamerschen, Director | | 9,899 | | 51,999 | | 61,898 | | * | | | 3,694 |

Lewis F. Kornfeld, Jr., Director (5) (6) | | 28,000 | | 47,999 | | 75,999 | | * | | | -0- |

H. Eugene Lockhart, Director | | -0- | | -0- | | -0- | | * | | | -0- |

Jack L. Messman, Director | | 2,524 | | 63,999 | | 66,523 | | * | | | 14,726 |

William G. Morton, Jr., Director | | 7,000 | | 47,999 | | 54,999 | | * | | | 9,910 |

Thomas G. Plaskett, Director | | 16,034 | | 53,999 | | 70,033 | | * | | | 3,492 |

Leonard H. Roberts, Chairman and

Chief Executive Officer | | 121,909 | | 2,027,569 | | 2,149,478 | | 1.3 | % | | 334,230 |

Alfred J. Stein, Director (5) | | 16,748 | | 139,999 | | 156,747 | | * | | | 5,794 |

William E. Tucker, Director (5) | | 35,746 | | 115,999 | | 151,745 | | * | | | -0- |

Edwina D. Woodbury, Director | | 1,000 | | 67,999 | | 68,999 | | * | | | 4,970 |

David J. Edmondson, President and

Chief Operating Officer | | 26,987 | | 625,804 | | 652,791 | | * | | | 20,664 |

Evelyn V. Follit, Senior Vice President – Organizational Enabling Services and

Chief Information Officer | | 1,642 | | 190,150 | | 191,792 | | * | | | 14,439 |

Mark C. Hill, Senior Vice President, Corporate Secretary and General Counsel | | 14,265 | | 339,408 | | 353,673 | | * | | | 47,266 |

Michael D. Newman, Senior Vice President

and Chief Financial Officer | | -0- | | 71,666 | | 71,666 | | * | | | 9,319 |

Directors and executive officers as a group (23 people) | | 304,791 | | 4,435,733 | | 4,740,524 | | 2.8 | % | | 508,891 |

| | | | | | | | | | |

Stockholders | | | | | | | | | | | |

| | | | | | | | | | |

Barclays Global Investors, NA and affiliates (7) Murray House

1 Royal Mint Court

London, EC3N 4HH | | 14,891,362 | | -0- | | 14,891,362 | | 8.8 | % | | -0- |

Davis Selected Advisers, L.P. (8)

2849 East Elvira Road, Suite 101

Tucson, Arizona 85706 | | 10,041,202 | | -0- | | 10,041,202 | | 5.9 | % | | -0- |

AIM Funds Management, Inc. (9)

5140 Yonge Street Suite 900

Toronto, Ontario M2N 6X7 | | 13,384,900 | | -0- | | 13,384,900 | | 7.9 | % | | -0- |

6

| (1) | | The address of each director and Named Executive Officer is c/o RadioShack Corporation, 100 Throckmorton Street, Suite 1800, Fort Worth, Texas 76102. |

| (2) | | Unless otherwise noted, each person has sole dispositive and voting power with respect to the shares indicated. |

| (3) | | Shares acquirable by exercising stock options within 60 days after February 28, 2003. |

| (4) | | Common stock units are not shares of common stock and have no voting power. This information is set forth as of December 31, 2002. The units for directors represent director fee deferrals and partial Company matches under the Directors’ Unfunded Deferred Compensation Plan. The units for executive officers represent in some cases restricted stock deferrals and also salary and bonus deferrals and Company percentage matches under either or both the Company’s Executive Deferred Compensation Plan and the Executive Deferred Stock Plan. |

| (5) | | The terms of Messrs. Kornfeld, Stein, and Tucker expire on May 15, 2003, and they are not standing for reelection. |

| (6) | | Includes 10,000 shares of the Company’s common stock owned by a trust of which Mr. Kornfeld is the sole beneficiary. |

| (7) | | According to Schedule 13G filed with the SEC on February 10, 2003, the following entities, which are affiliates of one another, have sole voting and dispositive power with respect to an aggregate of 14,891,362 shares (or approximately 8.8%) of the Company’s common stock, in the amounts indicated: Barclays Global Investors, NA, 12,343,903 shares (or approximately 7.3%); Barclays Global Fund Advisors, 735,443 shares (or approximately 0.4%); Barclays Global Investors, Ltd, 1,676,822 shares (or approximately 1.0%); Barclays Trust and Banking Company (Japan) Limited, 122,072 shares (or approximately 0.1%); Barclays Life Assurance Company Limited, 8,759 shares (or approximately 0.0%); and Barclays Capital Securities Limited, 4,363 shares (or approximately 0.0%). The Schedule 13G states that the reported shares are held by the companies in trust accounts for the economic benefit of the beneficiaries of those accounts. |

| (8) | | According to Schedule 13G filed with the SEC on February 21, 2002, Davis Selected Advisers, L.P. has sole voting and dispositive power with respect to an aggregate of 10,041,202 shares (or approximately 5.9%). |

| (9) | | According to Schedule 13G filed with the SEC on February 21, 2002, AIM Funds Management, Inc. has sole voting and dispositive power with respect to an aggregate of 13,384,900 shares (or approximately 7.9%). |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the securities laws of the United States, the Company’s directors, executive officers and all persons holding 10% or more of the Company’s common stock are required to report their ownership of the Company’s securities and any changes in that ownership to the Securities and Exchange Commission and the New York Stock Exchange. Specific due dates for these reports have been established, and the Company is required to report in this Proxy Statement any failure to file by these dates during the year ended December 31, 2002. To the Company’s knowledge, these filing requirements were satisfied by the Company’s present directors and executive officers, except as provided below. Mr. Morton, a director of the Company, inadvertently failed to timely file a Form 4 reporting a sale by him in December 2002 of the Company’s common stock. The required report to reflect this sale has now been filed. In addition, the Company inadvertently failed to timely file a Form 5 on behalf of each of Mr. Jensen, Ms. Moore and Ms. Spinelli, executive officers of the Company, due February 14, 2003, reporting a grant of stock options by the Company to each of such persons in 2002. The required reports to reflect these grants were filed on March 7, 2003.

DIRECTOR ATTENDANCE

The Board held 5 meetings during 2002. Other than Mr. Hernandez, each director, after being elected or appointed to office in 2002, attended at least 75% of the total number of meetings of the Board and committees on which he or she served.

7

DIRECTOR COMPENSATION

The following table represents components of non-employee director compensation:

Components | | Note | | | Compensation |

|

|

Annual Board Retainer | | (1 | ) | | $30,000 |

|

Annual Option Grant | | (2 | ) | | One option grant to purchase 16,000 shares of common stock. |

|

Annual Retainer for Committee Chair | | | | | $5,000 |

|

Board Attendance Fee (each in person meeting) | | | | | $1,500 |

|

Board Attendance Fee (each conference call meeting) | | | | | $1,000 |

|

Committee Attendance Fee (each in person meeting) | | | | | $1,250 |

|

Committee Attendance Fee (each conference call meeting) | | | | | $1,250 |

|

Expenses of Attendance | | | | | Reimbursement of actual expenses incurred. |

|

New Director Option Grant | | (3 | ) | | One-time option grant to purchase 20,000 shares of common stock. |

|

| (1) | | Each non-employee director may elect before May 1 of each year to have 50% or 100% of this annual retainer fee paid in shares of the Company’s common stock. |

| (2) | | Each non-employee director, who has served one year or more as of September 1 of any year, is automatically granted a non-qualified stock option to purchase 16,000 shares of the Company’s common stock on the first business day in September of each year that he or she serves as a director. The option exercise price of all options granted to non-employee directors is set at the fair market value (average of the high and low sales prices) of a share of the Company’s common stock on the first business day in September of the year of grant. The options vest in three equal increments on the first, second and third anniversaries of the date of grant. |

| (3) | | Each new non-employee director receives a one-time grant of an option to purchase 20,000 shares of the Company’s common stock on the date he or she attends his or her first Board meeting. The option exercise price is set at the fair market value (average of the high and low sales prices) of a share of the Company’s common stock on the date of grant. These options vest in three equal increments on the first, second and third anniversaries of the date of grant. |

Unfunded Deferred Compensation Plan for Directors

Under the Company’s Unfunded Deferred Compensation Plan for Directors, non-employee directors may elect to defer payment of all or a specified part of their annual retainer fees and meeting fees payable for services rendered to the Company. Interest is credited for fees deferred in cash at the rate of 1% below the prime rate. If a director elects to defer payment of fees payable in the Company’s common stock in excess of three years, the Company will make an additional contribution of 25% of the amount deferred in the Company’s common stock. Upon a change in control of the Company, a director will receive any deferred fees and the additional Company contribution in a lump sum cash payment.

8

COMMITTEES OF THE BOARD OF DIRECTORS

The Board has four standing committees: the Audit and Compliance Committee, the Corporate Governance Committee, the Executive Committee, and the Management Development and Compensation Committee. Actions taken by any of these committees are reported to the Board, and the Board receives a copy of the minutes of all committee meetings. Membership in each of the committees is as follows:

Audit and Compliance Committee | | Executive Committee |

|

Ms. Woodbury (Chair) Mr. Belatti Mr. Elmquist Mr. Hernandez Mr. Jackson Mr. Plaskett | | Mr. Roberts (Chair) Mr. Kamerschen Mr. Messman Mr. Plaskett Ms. Woodbury |

|

Corporate Governance Committee | | Management Development and Compensation Committee |

|

Mr. Plaskett (Chair) Mr. Kornfeld* Mr. Morton Mr. Stein* Mr. Tucker* | | Mr. Kamerschen (Chair) Mr. Belatti Mr. Elmquist Mr. Jackson Mr. Messman Mr. Tucker* |

| * | | The terms of Messrs. Kornfeld, Stein, and Tucker expire on May 15, 2003, and they are not standing for reelection. |

Audit and Compliance Committee | | 10 meetings in calendar year 2002 |

| 1. | | Reviews the Company’s internal control systems, audit functions, financial reporting processes and methods of monitoring compliance with regulatory matters; |

| 2. | | Selects and evaluates the independent auditor; |

| 3. | | Reviews the scope, timing and results of the audit of the independent auditor; |

| 4. | | Approves non-audit services provided to the Company by its independent auditor; |

| 5. | | Discusses with the independent auditor the independence of the auditor’s firm; |

| 6. | | Reviews the adequacy of internal controls that could significantly affect the Company’s financial statements; |

| 7. | | Reviews significant accounting and reporting issues; |

| 8. | | Reviews the organization and scope of the Company’s internal system of audit, financial and disclosure controls; |

| 9. | | Appraises the Company’s financial reporting activities, including the Company’s annual report and the accounting standards and principles followed; |

9

| 10. | | Reviews and discusses the Company’s financial statements and related disclosures with management and the Company’s independent auditor; and |

| 11. | | Reviews the activities, effectiveness and qualifications of the internal audit function and reviews the results of the audits performed by the internal audit group. |

Executive Committee | | 1 meeting in calendar year 2002 |

Exercises all powers of the Board when it is impractical to assemble the full Board, unless the actions otherwise are prohibited by law or involve amending the charter of any Board Committee.

Management Development and Compensation Committee | | 4 meetings in calendar year 2002 |

| 1. | | Assists the Board in developing and evaluating potential candidates for executive positions and oversees the development of executive succession plans; |

| 2. | | Reviews and approves the compensation structure for the Company’s executive officers and provides oversight of management’s decisions concerning the performance and compensation of other Company officers; |

| 3. | | Reviews management’s appointments and promotions to officer positions; |

| 4. | | Reviews corporate goals and objectives with respect to the Chief Executive Officer’s compensation, evaluates the Chief Executive Officer’s performance in light of these goals and objectives, and sets the Chief Executive Officer’s annual compensation; and |

| 5. | | Reviews the Company’s incentive-based and equity-based compensation plans and makes recommendations to the Board concerning these plans. |

Corporate Governance Committee | | 5 meetings in calendar year 2002 |

| 1. | | Reviews, and nominates to the Board, candidates to be directors of the Company and reviews compensation of Board members; |

| 2. | | Approves or denies requests by Company officers to serve on the boards of outside companies; |

| 3. | | Recommends to the Board the members and chair persons of all standing committees; |

| 4. | | Recommends the duties to be included in the charter of new standing committees; |

| 5. | | Develops and oversees an evaluation of the full Board, individual Board members and executive management; |

| 6. | | Reviews director compliance with stock ownership guidelines; |

| 7. | | Reviews director independence; |

| 8. | | Reviews major litigation and risk management policies and procedures, including insurance coverages; and |

10

| 9. | | Reviews the Company’s policies and procedures with respect to laws and the Company’s code of ethics. |

STATEMENT ON CORPORATE GOVERNANCE

The Board has for many years followed specific policies regarding corporate governance. The Board has incorporated these policies and procedures into its Statement on Corporate Governance. To obtain a complete copy of the Statement on Corporate Governance, please contact Ms. Carolyn Hoopes, Vice President – Corporate Governance and Compliance, 100 Throckmorton Street, Suite 1724, Fort Worth, Texas 76102-2816, Telephone (817) 415-2758, or visit our website atwww.radioshackcorporation.com. The following is a summary of certain material items in the Statement on Corporate Governance.

Board Responsibilities

The principal responsibilities of the Board are as follows:

| · | | To promote and act in the best interests of all stockholders of the Company through careful selection and oversight of executive management, including the further development of compensation plans based on performance. |

| · | | To consider and monitor the potential impact of Board and executive management decisions on the Company’s stockholders, employees, customers, suppliers, lenders and the communities in which it operates. |

Board Oversight of Management

| 1. | | Evaluate the performance of the executive management with the Chief Executive Officer annually. |

| 2. | | Review and approve the broad strategic and financial objectives of the Company through a collaborative process with executive management. |

| 3. | | Review and approve compensation plans of any officer of the Company who is paid $125,000 or more per year. The Board believes that compensation plans should be tied directly to the Company’s performance. |

| 4. | | Review the succession plans for executive management so that continuity in the operation of the Company can be maintained in the event of untimely displacement of key management members. |

Board Composition

| 1. | | The Company’s By-Laws provide that the Board of Directors must have at least three members, with a maximum number to be set by the Board from time to time. |

| 2. | | Four standing committees have been established by the Board: the Audit and Compliance Committee; the Corporate Governance Committee; the Executive Committee; and the Management Development and Compensation Committee. |

| 3. | | New committees may be established by the Board at any time. |

11

Board Independence

| 1. | | It is the Board’s goal that at least 75% of the members of the Board be independent. |

| 2. | | Each of the independent directors, in the opinion of the Board, is independent of management and free from any relationship that would interfere with the director’s exercise of independent judgment. |

| 3. | | Only independent directors are eligible to serve as members of the Audit and Compliance Committee, the Management Development and Compensation Committee, and the Corporate Governance Committee under the applicable rules and regulations of the Securities and Exchange Commission, the New York Stock Exchange and the Internal Revenue Service. Each independent director is eligible to serve on each of these Committees. |

Directors

| 1. | | Under the Company’s By-Laws, directors stand for re-election every year. |

| 2. | | The Corporate Governance Committee has responsibility for nominating members to the Board. |

| 3. | | Within three years of their election to the Board, directors are required to own shares of the Company’s common stock that are at least equal in value to 200% of the Board’s annual retainer fee then in effect. |

| 4. | | Directors cannot stand for re-election after age 70. |

AUDIT AND COMPLIANCE COMMITTEE MATTERS

Audit and Compliance Committee Report

The Audit and Compliance Committee presents the following report concerning its activities regarding oversight of the Company’s financial reporting and auditing process. As discussed in its charter, the Committee assists the Board of Directors in fulfilling its oversight responsibilities by reviewing the Company’s internal control systems, audit functions, and financial reporting processes. PricewaterhouseCoopers LLP, the Company’s independent auditing firm, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted accounting principles.

The function of the Audit and Compliance Committee is to provide oversight at the board level, along with advice, counsel, and direction to management and the auditors on the basis of information it receives, discussions with management and the auditors, and the experience of the Committee’s members in business, financial, and accounting matters. The Committee’s role is not intended to duplicate or to certify the activities of management and the independent auditor.

The Committee reports the following with respect to the Company’s 2002 audited financial statements:

| · | | The Committee reviewed and discussed the Company’s 2002 audited consolidated financial statements with the Company’s management and PricewaterhouseCoopers LLP. |

12

| · | | The Committee discussed with the Company’s independent auditors, PricewaterhouseCoopers LLP, the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, and Statement on Auditing Standards No. 90,Audit Committee Communications, which include, among other items, matters related to the conduct of the audit of the Company’s consolidated financial statements. |

| · | | The Committee received written disclosures and the letter, dated July 8, 2002, from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, relating to the auditor’s independence from the Company and its related entities, and has discussed with the auditors the auditors’ independence from the Company. |

| · | | Based on a review and discussions of the Company’s 2002 audited consolidated financial statements with management and discussions with the independent auditors, the Audit and Compliance Committee recommended to the Board of Directors that the Company’s 2002 audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K. |

Audit and Compliance Committee

Edwina D. Woodbury (Chair) | | Richard J. Hernandez |

Frank J. Belatti | | Lawrence V. Jackson |

Ronald E. Elmquist | | Thomas G. Plaskett |

Audit and Compliance Committee Charter

On December 12, 2002, the Board of Directors amended its written charter for the Audit and Compliance Committee. A copy of the amended charter is attached to this Proxy Statement as Exhibit A. The Board of Directors reviews the Audit and Compliance Committee charter annually and approves any changes as needed based on this review.

Independence of Audit and Compliance Committee Members

Ms. Woodbury and Messrs. Belatti, Elmquist, Hernandez, Jackson and Plaskett, all of whom are members of the Audit and Compliance Committee, are independent as defined by the applicable New York Stock Exchange listing standards.

Mr. Jackson is Senior Vice President of Supply Operations of Safeway, Inc. The Company rents space for one of its RadioShack retail stores from The Vons Companies, Inc., a subsidiary of Safeway, Inc. The Board has determined this relationship is not material to the Company, Vons or Safeway and that the relationship does not interfere with Mr. Jackson’s exercise of independent judgment.

Mr. Plaskett is on the Board of Directors of Novell, Inc. The Company has entered into a consulting services agreement with Celerant Consulting, Incorporated, a subsidiary of Novell, Inc. The Board has determined this relationship is not material to the Company, Celerant or Novell and that the relationship does not interfere with Mr. Plaskett’s exercise of independent judgment.

13

INDEPENDENCE OF COMPANY’S AUDITORS

In accordance with standing policy and applicable law, PricewaterhouseCoopers LLP periodically changes the personnel who work on the Company’s audit.

Audit Fees and Out-of-Pocket Expenses

PricewaterhouseCoopers LLP performed the audit of the Company’s consolidated financial statements as of and for the year ended December 31, 2002. The audit fees and expenses billed for 2002 are set forth below:

Audit in connection with the Annual Report on Form 10-K and limited review of the Company’s Quarterly Reports on Form 10-Q | | $697,000 |

All Other Fees and Out-of-Pocket Expenses

In addition to its audit services, PricewaterhouseCoopers LLP provided various other services to the Company during 2002, and the fees and expenses for these other services are set forth below:

All other fees and expenses | | $1,023,000 |

“All other fees and expenses” include the following items and amounts:

Tax Services | | $120,000 |

Statutory audits —

Puerto Rico and Hong Kong | | 99,000 |

Employee benefit plan audit | | 32,000 |

Review of registration statements | | 130,000 |

Accounting principles analysis —

new Company headquarters | | 476,000 |

Survey of Finance and Accounting Group | | 161,000 |

Other | | 5,000 |

| | |

|

Total | | $1,023,000 |

Financial Information Systems Design and Implementation Fees

PricewaterhouseCoopers LLP did not provide any services related to financial information systems design and implementation during 2002.

Determination of Independence

The Audit and Compliance Committee periodically reviews summaries of the services provided by PricewaterhouseCoopers LLP and the related fees and has considered whether the provision of non-audit services is compatible with maintaining the independence of PricewaterhouseCoopers LLP.

The Audit and Compliance Committee has determined the provision of these non-audit services is compatible with maintaining PricewaterhouseCoopers LLP’s independence.

14

MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The members of the Management Development and Compensation Committee are appointed by the Board of Directors, and the Committee is composed entirely of independent directors.

Compensation Philosophy and Overall Objectives

The Company’s executive compensation program is designed to encourage and reward enhancement of stockholder value by linking the financial interest of the Company’s key executives closely to the financial interests of the Company’s stockholders, specifically, stockholder value appreciation. The program focuses on the following key objectives:

| · | | To attract, retain, motivate and reward key executives through competitive salary and incentive plans. |

| · | | To encourage executive performance that benefits the overall organizational results. |

| · | | To reward effective ongoing management of Company operations through annual performance incentives tied to increased levels of Company and business unit performance. |

| · | | To motivate executives towards long-term management of the Company through prudent use of stock programs and/or other performance driven incentives that focus management attention on increasing stockholder value. |

2002 Annual Incentive Bonus

The 2002 incentive bonuses for the Named Executive Officers and Chief Executive Officer had two performance measures:

| · | | 100% of the bonus base was calculated upon an increase in earnings per share over that of 2001; and |

| · | | An additional 15% of the above bonus base amount was calculated upon the positive stock price performance of the Company in relation to a similar group of other retail companies. |

No bonuses were paid in 2002 to any Named Executive Officer or the Chief Executive Officer.

2003 Annual Incentive Bonus

To achieve the Company’s strategy to dominate cost-effective solutions to meet everyone’s routine electronics needs and families’ distinct electronics wants, the 2003 incentive bonuses for the Named Executive Officers and Chief Executive Officer will be based on various performance measures, depending on each of the officer’s duties:

| · | | Each of the Named Executive Officers and Chief Executive Officer will have a performance measure based on the increase in operating income over the previous year. |

| · | | Each of the Named Executive Officers and Chief Executive Officer will have a performance measure based on the increase in earnings per share over the previous year. |

15

| · | | The other performance measure for the Chairman of the Board and the Chief Executive Officer and the President and the Chief Operating Officer will be growth in sales over the previous year. |

| · | | Three Named Executive Officers’ performance measures will be based on reductions in selling, general and administrative expenses from the prior year. |

Policy Regarding Incentive Bonus Measures

The Committee continuously monitors the effectiveness of the incentive bonus performance measures utilized and will change the performance measures at any time should the Committee determine that the enhancement of stockholder value warrants it.

Base Salary

The Company’s executive compensation program includes a competitive base salary based on a review of pay practices of similar companies, the executive officer’s past performance, and an assessment of his or her ability to contribute to the Company’s progress.

Long-term Incentives

The Company’s executive compensation program also includes long-term incentives, such as stock options and other types of stock-based awards, including a deferred compensation plan, a stock purchase plan and a salary continuation plan.

During 2002, the Committee granted a total of 1,299,200 stock options to over 500 employees under the Company’s 1993 Incentive Stock Plan (“1993 Plan”), 1997 Incentive Stock Plan (“1997 Plan”), 1999 Incentive Stock Plan (“1999 Plan”) and 2001 Incentive Stock Plan (“2001 Plan”). The Named Executive Officers were granted stock options in 2002. The quantity of options granted to officers was determined by the Committee based on its evaluation of the individual’s performance following consultation with the Chief Executive Officer. The grant of options to the Chief Executive Officer was determined solely by the Committee. No broad-based employee option grants were made in 2002.

The 1993 Plan terminated in March 2003 and no further grants and awards may be made under this Plan. Under the 1997 Plan, the Company may also grant restricted stock to eligible participants in amounts to be determined by the Committee, subject to the restrictions set forth in the plan. The 1999 Plan provides only for grants of non-qualified stock options and stock appreciation rights. The 2001 Plan provides only for grants of incentive stock options and non-qualified stock options to eligible participants. Under the present incentive stock plans of the Company, all options and awards are awarded at their fair market value (the average of the high and low sales prices) on the date of grant and will not be repriced.

The Committee continues to believe that stock options are very important in motivating and rewarding the creation of long-term stockholder value. The Committee has awarded in the past, and plans to award in the future, stock options to a broad spectrum of employees based on continuing progress of the Company and improvements in individual performance.

Compensation of the Chief Executive Officer and Executive Officers

For the year ended December 31, 2002, the compensation of the Chief Executive Officer and executive officers was determined under the compensation plan approved by the stockholders on May 20, 1999 and an amendment to this compensation plan approved by

16

stockholders on May 18, 2000. The bonus factors utilized for 2002 in the compensation plan, as amended, were increases in the Company’s earnings per share over the previous year and the Company’s stock price performance in relation to a similar group of other retail companies. Based on these factors, in 2002 Mr. Roberts received a base salary of $1,100,000 and a grant of options to purchase 575,000 shares of the Company’s common stock. Additionally, using the bonus factors described above, Mr. Roberts did not receive a bonus for 2002. For fiscal year 2001, Mr. Roberts received a base salary of $1,100,000 and no bonus.

Policy Regarding Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code generally limits corporate deductions to $1 million for compensation, except for qualified performance-based compensation paid to a person who on the last day of a fiscal year is either the Chief Executive Officer or among the four most highly compensated officers other than the Chief Executive Officer.

The Committee does not believe compensation decisions should be constrained by how much compensation is deductible for federal income tax purposes and accordingly has not and will not make compensation decisions based solely on the deductibility of compensation for federal income tax purposes.

Management Development and Compensation Committee

Robert J. Kamerschen (Chair) | | Lawrence V. Jackson |

Frank J. Belatti | | Jack L. Messman |

Ronald E. Elmquist | | William E. Tucker |

17

EXECUTIVE COMPENSATION

The following table reflects the cash and non-cash compensation attributable to the Chief Executive Officer of the Company and the four other most highly compensated executive officers of the Company (“Named Executive Officers”) for the year ended December 31, 2002.

| | | Summary Compensation Table

| |

| | | Annual Compensation (1)

| | Long-Term Compensation

| |

Name and

Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Restricted Stock Awards ($)(2) | | Securities Underlying Options/SARs (#)(3) | | All Other Compensation ($)(4) | |

|

Leonard H. Roberts Chairman and Chief Executive Officer | | 2002 2001 2000 | | 1,100,000 1,100,000 1,000,000 | | 0 0 1,705,547 | | 0 0 1,178,125 | | 575,000 500,000 350,000 | | 202,124 459,194 313,387 | (5) (5) |

|

David J. Edmondson President and Chief Operating Officer | | 2002 2001 2000 | | 600,000 600,000 420,000 | | 0 0 547,782 | | 0 0 84,825 | | 345,000 300,000 160,000 | | 59,472 87,705 68,581 | |

|

Evelyn V. Follit Senior Vice President – Organizational Enabling Services and Chief Information Officer | | 2002 2001 2000 | | 280,000 280,000 260,000 | | 0 148,049 343,272 | | 0 0 85,625 | | 75,000 60,000 60,000 | | 24,394 53,465 38,982 | |

|

Mark C. Hill Senior Vice President, Corporate Secretary and General Counsel | | 2002 2001 2000 | | 320,000 320,000 302,000 | | 0 0 309,057 | | 0 0 160,225 | | 92,000 80,000 100,000 | | 18,958 55,672 106,044 | |

|

Michael D. Newman Senior Vice President and Chief Financial Officer (6) | | 2002 2001 | | 450,000 261,058 | | 0 204,350 | | 0 0 | | 115,000 100,000 | | 91,524 60,193 | |

(1) Other than restricted stock awards (see (2) below) for the years shown, the Named Executive Officers did not receive any annual compensation other than salary and bonus, except for certain perquisites and other personal benefits. In accordance with SEC regulations, the amounts for perquisites and other personal benefits for the Named Executive Officers are not shown because the aggregate amount of such compensation, if any, for each of the Named Executive Officers during the fiscal year shown does not exceed $50,000.

(2) On May 10, 2000, Messrs. Roberts, Edmondson, Hill, and Ms. Follit were granted 25,000, 1,800, 3,400 and 2,000 shares of restricted stock, respectively. These shares were to vest in equal one-third increments annually on the anniversary date of grant over a three year period only if certain bonus targets were met and the Named Executive Officer is still employed by the Company. The first one-third of the shares vested in March 2001, and the remainder of the shares did not vest.

(3) Includes all options granted during the year under the 1993 Plan and the 1997 Plan, regardless of whether the options are incentive stock options or non-qualified stock options.

(4) Includes the Company’s contributions allocated to the accounts of the Named Executive Officers participating in the following employee benefit plans: the Stock Plan (a stock purchase plan), RadioShack 401(k) Plan, the Employees’ Supplemental Stock Plan (an excess benefit plan) (“SUP”), Executive Deferred Compensation Plan, Executive Deferred Stock Plan, several deferred compensation agreements and insurance premiums for disability, medical and life insurance. The applicable amounts allocated in 2002 to the Named Executive Officers in the Stock Plan, RadioShack 401(k) Plan, SUP, the deferral plans, and insurance premiums, respectively, are: $4,920, $1,203, $1,514, $183,150 and $10,984 for Mr. Roberts; $4,400, $7,130, $13,200, $22,200 and $12,542 for Mr. Edmondson; $1,775, $2,151, $3,635, $10,908 and $5,925 for Ms. Follit; $1,980, $1,473, $812, $0 and $14,693 for Mr. Hill; and $0, $0, $0, $82,088 and $9,436 for Mr. Newman. Amounts do not include amounts payable in the event of a change in control of the Company. See “Change in Control Protections.”

(5) Includes $354 and $30 for Mr. Roberts for amounts imputed as income in 2002 and 2001, respectively, in connection with the Company’s December 21, 2001 loan of $2,180,000 to the Leonard and Laurie Roberts Heritage Trust for the Trust to pay a premium on a life insurance policy on the lives of Mr. Roberts and his spouse in exchange for the relinquishment and waiver by Mr. Roberts of the right to receive under the Company’s Executive Deferred Compensation Plan the sum of $2,180,000, which Mr. Roberts had previously deferred. The cost of the

18

loan to the Company will not exceed the cost the Company would have incurred with respect to the amounts waived by Mr. Roberts under the Company’s Executive Deferred Compensation Plan. Upon the last to die of Mr. Roberts and his spouse, the Company will be repaid under the Trust’s December 21, 2001 Promissory Note to the Company the principal amount of its loan to the Trust plus accrued interest at the rate of 4.99% per annum. In connection with this transaction, the Company, Mr. Roberts and his spouse entered into a Death Benefit Agreement, which is described below under Executive Deferred Compensation Plans and Other Agreements.

(6) Mr. Newman was appointed Senior Vice President and Chief Financial Officer of the Company on May 17, 2001. Prior to that date, Mr. Newman was not employed by the Company.

OPTION GRANTS IN THE LAST FISCAL YEAR

Options were granted in 2002 under the 1993 Plan to two Named Executive Officers and under the 1997 Plan to three of the Named Executive Officers. The potential value of these options at the specified rates of appreciation is shown in the table below. The 1993 Plan and the 1997 Plan also provided for the grant of restricted stock awards; however, no restricted stock awards were granted in 2002 to the Named Executive Officers.

Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2)

|

Name and Type of Option (1) | | Number of Securities Underlying Options/SARs Granted | | % of Total Options/SARs Granted To Employees in Fiscal Year | | | Exercise or Base Price ($/Share) | | Expiration Date | | 5% ($) | | 10% ($) |

|

Leonard H. Roberts | | 575,000 | | 44.3 | % | | $ | 30.03 | | 1/2/09 | | $ | 7,028,334 | | $ | 16,379,008 |

|

David J. Edmondson | | 345,000 | | 26.6 | % | | $ | 30.03 | | 1/2/09 | | $ | 4,217,001 | | $ | 9,827,405 |

|

Evelyn V. Follit | | 75,000 | | 5.8 | % | | $ | 30.03 | | 1/2/09 | | $ | 916,739 | | $ | 2,136,392 |

|

Mark C. Hill | | 92,000 | | 7.1 | % | | $ | 30.03 | | 1/2/09 | | $ | 1,124,533 | | $ | 2,620,641 |

|

Michael D. Newman | | 115,000 | | 8.9 | % | | $ | 30.03 | | 1/2/09 | | $ | 1,405,667 | | $ | 3,275,802 |

(1) Mr. Roberts’ and Mr. Hill’s options were granted under the 1993 Plan, and all other options shown were granted under the 1997 Plan. These options vest in annual increments of one-third beginning on January 2, 2003. For persons who continue to serve as employees of the Company, options expire seven years from the date of grant.

(2) The dollar gains under these columns result from calculations assuming 5% and 10% growth rates as set by the Securities and Exchange Commission and are not intended to forecast future price appreciation of the Company’s common stock. The gains reflect a future value based upon growth, compounded annually during the 10-year option period, at these prescribed rates. The Company did not use an alternative formula for a grant date valuation that would state gains at present, and therefore lower, value. The Company is not aware of any formula that will determine with reasonable accuracy a present value based on future unknown or volatility factors. Consequently, the potential realizable value has not been discounted to present value.

19

OPTION EXERCISES IN THE LAST YEAR AND YEAR-END OPTION VALUES

There were no options exercised by the Named Executive Officers in the year ended December 31, 2002. The following table summarizes the number of unexercised options at December 31, 2002 and the year-end value of the unexercised options of the Named Executive Officers.

| | | Shares Acquired on Exercise (#) | | Value Realized ($) | | Number of Unexercised Options at Year-End (#) | | Value of Unexercised In-The-Money Options/SARs at Year-End ($)(1) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

|

Leonard H. Roberts | | -0- | | -0- | | 1,835,903 | | 1,145,001 | | 3,397,629 | | -0- |

David J. Edmondson | | -0- | | -0- | | 510,804 | | 598,334 | | 84,311 | | -0- |

Evelyn V. Follit | | -0- | | -0- | | 165,150 | | 135,000 | | 22,409 | | -0- |

Mark C. Hill | | -0- | | -0- | | 308,742 | | 178,668 | | 128,494 | | -0- |

Michael D. Newman | | -0- | | -0- | | 33,333 | | 181,667 | | -0- | | -0- |

(1) For purposes of calculating whether an option was “in-the-money,” this chart uses the December 31, 2002, average of the high and low trading prices on the New York Stock Exchange for the Company’s common stock of $18.78.

RETIREMENT AND DEFERRED COMPENSATION

The Plans

Under the Company’s Salary Continuation Plan for Executive Employees and its Officers Deferred Compensation Plan, the Management Development and Compensation Committee may select full-time executive employees for participation in these plans. The plans generally provide for the payment of reduced benefits following a participant’s early retirement between the ages of 55 and 65, full benefits in case of retirement between the ages of 65 and 70, reduced benefits in case of retirement between the ages of 70 and 75, and for payment of a death benefit to the participant’s designated beneficiary in the event of death prior to age 75 during employment. Benefits are payable in 120 equal monthly installments.

Under the plans, the Committee determines an amount designated as the “Retirement Compensation Amount” for each participant. The amount established by the Committee does not necessarily bear any relationship to the participant’s present compensation, final compensation or years of service.

The annual Retirement Compensation Amount when retiring at age 65 for the Named Executive Officers at December 31, 2002 would have been as follows:

| | | Salary Continuation Plan | | Deferred Compensation Plan | | Total |

| |

|

Leonard H. Roberts | | $ | -0- | | $ | 1,375,000 | | $ | 1,375,000 |

David J. Edmondson | | $ | 162,500 | | $ | 437,500 | | $ | 600,000 |

Evelyn V. Follit | | $ | -0- | | $ | 250,000 | | $ | 250,000 |

Mark C. Hill | | $ | -0- | | $ | 275,000 | | $ | 275,000 |

Michael D. Newman | | $ | -0- | | $ | -0- | | $ | -0- |

Special Provisions of the Salary Continuation Plan

The Salary Continuation Plan provides for payments to be made to certain executive employees in the event of their voluntary or involuntary termination of employment following a Change in Control, as defined in a 1984 letter of amendment to the plan. In the event of a

20

Change in Control, each executive employee who is subject to such letter amendment becomes immediately vested at the age 65 benefit level for a period of three years. If his or her employment with the Company ceases, whether voluntarily or involuntarily, during this three year period, he or she will receive payments equal to the annual retirement benefit at age 65. Payment is made in 120 equal monthly installments to the participant or to his or her beneficiary.

Special Provisions of the Deferred Compensation Plan

The Deferred Compensation Plan provides that, for one year following the occurrence of a Change in Control (as defined in the plan), the plan will not be terminated or amended in any way, nor will the manner in which the plan is administered be changed in any way that adversely affects the rights of its participants or beneficiaries. In the event of a Change in Control, each participant in this plan becomes immediately vested at the age 65 benefit level. Additionally, if the participant’s employment is terminated for any reason following a Change in Control, the Company must make a lump-sum payment equal to the present value of the age 65 benefit level. Upon a Change in Control, the provisions of the Deferred Compensation Plan provide that any benefit due under it shall be (1) offset by any outstanding loan to the participant and (2) forfeited if the participant engages in any activity that is in competition with the Company.

EXECUTIVE DEFERRED COMPENSATION PLANS AND OTHER AGREEMENTS

The Company’s Executive Deferred Compensation Plan and Executive Deferred Stock Plan permit executive employees of the Company to defer, on a pre-tax basis, up to 100% of their base salary and/or bonuses. These plans are distinct from the Salary Continuation and Deferred Compensation Plans described above. The major features of these plans are:

| | · | | Deferral of the receipt of up to 100% of certain executive employees’ base salaries or bonuses, |

| | · | | Deferral of any restricted stock that would otherwise vest and any gain realized upon exercise of any non-qualified stock option, |

| | · | | Investment of cash deferrals in either the Company’s common stock or mutual funds, |

| | · | | Company matching payments on salary and bonus as follows: 12% match on salary and bonus deferrals in the form of the Company’s common stock and an additional 25% match on salary or bonus deferrals in the form of the Company’s common stock if salary and/or bonus deferrals are deferred for more than five years and are invested in the Company’s common stock, |

| | · | | Selection of a future distribution date to receive the deferrals and matches in either a lump sum or annual installment payments not exceeding 20 years, and |

| | · | | In the event the Company experiences a Change in Control (as defined in these plans), these plans provide that, within two weeks of this event, each executive employee participant will be paid the full value of his or her accounts in the plans in the form of cash or the Company’s common stock, as the case may be. |

Agreement with Mr. Roberts

Upon Mr. Roberts’ appointment as Chief Executive Officer of the Company, the Board determined that it is in the best interests of the Company and its stockholders to provide for

21

an orderly transition should Mr. Roberts leave the employ of the Company. If Mr. Roberts involuntarily leaves the Company under defined circumstances, the Agreement provides for salary and bonus payments and acceleration of certain stock awards. In the event Mr. Roberts voluntarily leaves the Company or leaves under other defined circumstances, Mr. Roberts receives no payments or accelerations under this Agreement. In no event would Mr. Roberts receive benefits under both this Agreement and the Termination Protection Agreement described below under “Change in Control Protections.”

Death Benefit Agreement with Mr. Roberts and His Spouse

In connection with the December 21, 2001 loan by the Company to the Leonard and Laurie Roberts Heritage Trust described above in note 5 under Executive Compensation, the Company has agreed to pay beneficiaries, as designated by Mr. Roberts and his spouse, a death benefit amount. This death benefit amount will only be paid by the Company in the event, after the second to die of Mr. Roberts and his spouse, that the Leonard and Laurie Roberts Heritage Trust fully repays to the Company the $2,180,000 loan made to the Trust plus accrued interest. The death benefit amount is a calculated amount to make the arrangement cost neutral to the Company on a present value basis.

CHANGE IN CONTROL PROTECTIONS

In addition to the change in control protections contained in the Salary Continuation Plan, the Deferred Compensation Plan, the Executive Deferred Compensation Plan and the Executive Deferred Stock Plan described above, the Company has also implemented the following change in control protections:

Benefit Protections

The Board also has included change in control protections in the RadioShack 401(k) Plan, the Employees Supplemental Stock Program, Stock Plan, Post Retirement Death Benefit Plan, 1993 Plan, 1997 Plan, 1999 Plan, 2001 Plan and several other plans. The RadioShack 401(k) Plan provides that for a period of one year following a Change in Control, the plan may not be terminated or amended in any way that would adversely affect the amount or entitlement of benefits. The Supplemental Stock Program and the Stock Plan contain similar protections and provide that the Company may not reduce the level of its contributions to these plans. The Stock Plan additionally provides that in the event of a Change in Control or a tender offer, the Company will distribute to participants the Company’s common stock credited to each participant’s account. The change in control provisions of the 1993 Plan, 1997 Plan, 1999 Plan and 2001 Plan provide that all outstanding options become immediately vested and exercisable in the event of a Change in Control.

Termination Protection Agreements

As of December 31, 2002, the Company entered into Termination Protection Agreements with certain of the currently serving Named Executive Officers. The Agreements remain in effect unless terminated by either party. If the employment of any executive covered by these Agreements is terminated (with certain exceptions) within 24 months following a Change in Control, each Executive will be entitled to receive cash payments (amounts equal to two times current annual salary and the amount of the bonus guarantee under a Bonus Guarantee Letter Agreement (the highest bonus paid in the last three years) and an amount equal to the contributions that the Company would have made to the Stock Plan, RadioShack 401(k) Plan and SUP over a 24-month period, assuming the foregoing salary and

22

bonus guarantee were used to calculate the Company’s contributions), as well as the continuation of fringe benefits (including life insurance, disability, medical, dental and hospitalization benefits) for a period of up to 24 months. Additionally, all outstanding incentive awards and stock options will become fully vested, and the Company will be required to purchase for cash, on demand, any shares of unrestricted stock and shares purchased upon the exercise of options at the then per-share fair market value.

The Termination Protection Agreements also provide that the Company will make an additional “Gross-Up Payment” to the executives covered by these Agreements to offset fully the effect of any excise tax imposed under the Internal Revenue Code. In addition, the Company will pay all legal fees and related expenses incurred by any of those executives arising out of the employment of any of them or termination of employment under certain circumstances.

Payments upon a Change in Control

Assuming a Change in Control occurred on the date of this Proxy Statement and all of the currently serving Named Executive Officers’ employment terminated on that date, the approximate cash payment made by virtue of all Change in Control protections implemented by the Company (not including the Gross-Up Payments) to Messrs. Roberts, Edmondson, Hill, Newman and Ms. Follit would be approximately $6,309,617; $2,596,224; $1,434,280; $1,490,936; and $1,421,321, respectively. The amount of the Gross-Up Payment, if any, to be paid may be substantial and will depend upon numerous factors.

Rabbi Trust

In connection with the benefits described above, and several other plans and agreements, the Company is authorized to enter into a Rabbi Trust, which is intended to be a grantor trust under the Internal Revenue Code. The Rabbi Trust may be funded by the Company at any time, but is required to be funded upon a “Threatened Change in Control” or upon a Change in Control in an amount sufficient to provide for the payment of all benefits described above and several other plans and agreements. The trust assets of the Rabbi Trust will be subject to the claims of the Company’s creditors in the event of the Company’s bankruptcy or insolvency. To date, no Rabbi Trust has been established.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None.

23

PERFORMANCE GRAPH

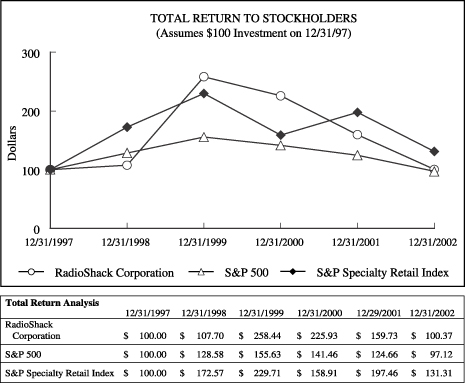

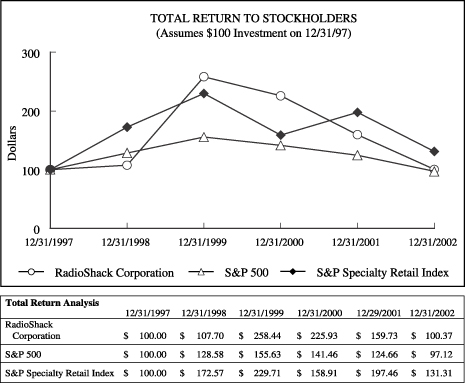

The following graph compares the cumulative total stockholder return on the Company’s common stock against the cumulative total return on the S&P Corporate 500 Stock Index and the S&P Specialty Retail Index (assuming $100 was invested on December 31, 1997 in the Company’s common stock and in the stocks comprising the S&P Corporate 500 Stock Index and the S&P Specialty Retail Index and also assuming the reinvestment of all dividends). The S&P Specialty Retail Index, as well as the S&P Corporate 500 Stock Index, includes the Company.

The historical stock price performance of the Company’s common stock shown on the graph below is not necessarily indicative of future price performance.

Any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, will not be deemed to incorporate by reference this graph, and this graph will not otherwise be deemed filed under these Acts. The Company may, however, specifically incorporate this graph by reference in filings under these Acts.

CERTAIN TRANSACTIONS WITH MANAGEMENT AND OTHERS

None.

24

APPOINTMENT OF INDEPENDENT AUDITORS

The Audit and Compliance Committee has selected PricewaterhouseCoopers LLP, which has previously audited the Company’s books annually, as independent auditors for 2003. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement and to respond to appropriate questions.

VOTING RIGHTS AND PROXY INFORMATION

Voting Rights and Number of Outstanding Shares

Only holders of record of shares of the Company’s common stock as of March 18, 2003, the record date, will be entitled to notice of, and to vote at, the Annual Meeting and at any resumption of the Annual Meeting after adjournment or postponement of the Annual Meeting. The holders of shares of the Company’s common stock are entitled to one vote per share on any matter that may properly come before the Annual Meeting.

As of the record date, there were 169,563,463 shares of the Company’s common stock outstanding, which includes 10,670,265 shares of the Company’s common stock held by participants of the Company’s Stock Plan, SUP and RadioShack 401(k) Plan.

As of the record date, a total of 9,691,649 shares of the Company’s common stock was held in the RadioShack 401(k) Plan. Each participant in the RadioShack 401(k) Plan is entitled to direct the RadioShack 401(k) Plan Trustee with respect to the voting of the Company’s common stock allocated to his or her account. If a participant does not direct the Trustee with respect to the voting of his or her shares, the Trustee will vote such securities in the same proportion as other participants who have directed the Trustee with respect to allocated shares. The Trustee will also vote all unallocated shares of the Company’s common stock held by the RadioShack 401(k) Plan in this proportion.

Quorum, Broker Non-Votes and Approval of Matters

The presence, either in person or by properly executed proxy, of the holders of a majority of the Company’s common stock as of the record date is necessary to constitute a quorum at the Annual Meeting. Shares held by holders who are either present in person or represented by proxy who abstain will be treated as present for quorum purposes on all matters. For purposes of determining whether a proposal has received a majority vote, abstentions will be included in the vote total, with the result that an abstention will have the same effect as a negative vote. For purposes of determining whether a proposal has received a majority vote, in instances where brokers are prohibited from exercising discretionary authority for beneficial holders of the Company’s common stock who have not returned a proxy (the “broker non-votes”), those shares will not be included in the vote totals and, therefore, will have no effect on the outcome of the vote.

The affirmative vote by the holders of a plurality of the Company’s common stock entitled to vote and represented in person or by properly executed proxy at the Annual Meeting is required to approve the election of each of the Company’s nominees for election as a director. With respect to the election of directors, shares that abstain will be included in the vote total as withholds (i.e., treated as votes against the Company’s nominees for election).

25

The affirmative vote by the holders of a majority of the Company’s common stock entitled to vote and represented in person or by properly executed proxy at the Annual Meeting is required to approve all matters other than the election of directors.

Revocation of Proxies

Any proxy given under this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by: (i) filing with the Company, at or before the Annual Meeting, a written notice of revocation bearing a later date than the proxy; (ii) duly executing a subsequent proxy relating to the same voting securities and delivering it to the Company at or before the Annual Meeting; (iii) submitting another subsequent timely proxy by telephone or the Internet; or (iv) attending the Annual Meeting, filing a written revocation of proxy and voting in person (attendance at the Annual Meeting and voting will not in and of itself constitute a revocation of a proxy). Any written notice revoking a proxy or subsequent proxies should be received by mail or other method of delivery or hand delivered to RadioShack Corporation, Attention: Ms. Carolyn Hoopes, Vice President – Corporate Governance and Compliance, 100 Throckmorton Street, Suite 1724, Fort Worth, Texas 76102-2818.

Voting Procedures; Telephone and Internet Voting

Registered stockholders and holders of the Company’s common stock in the RadioShack 401(k) Plan, the Stock Plan and the SUP can also deliver proxies by calling a toll-free telephone number or by using the Internet. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly. A proxy vote by telephone or over the Internet is a properly executed proxy. Instructions for voting by telephone or over the Internet are on the enclosed proxy card.

All voting securities that are represented at the Annual Meeting by properly executed proxies (including a proxy by telephone or over the Internet) received by the Corporate Secretary prior to or at the Annual Meeting and not revoked will be voted at the Annual Meeting in accordance with the instructions indicated in such proxies. If no instructions are indicated, such proxies will be voted FOR the election of the Board’s nominees for election as directors of the Company.

Electronic Delivery of Proxy Materials

Registered stockholders with access to the Internet and an e-mail account can elect to receive the Company’s annual report and proxy statement over the Internet instead of receiving printed materials by mail. Choosing electronic delivery will give stockholders faster and more convenient access to the proxy materials and will reduce the Company’s printing and postage costs. Please note that although there is no charge for this service, there may be costs associated with electronic access, such as usage charges for Internet service providers and telephone companies, which will be the stockholders’ responsibility.

Registered stockholders can read additional information about electronic delivery and enroll in the service by going towww.econsent.com/rsh, on the Internet. Stockholders will be asked to enter their account numbers, which can be found on their Forms 1099-DIV. Registered stockholders needing assistance in obtaining their account numbers should call the Company’s transfer agent, toll free, at (888) 218-4374.

26

Stockholders who own their shares in “street” name should contact their broker to determine their account numbers and to choose electronic delivery.

Registered stockholders can also request the service while voting via the Internet by simply clicking the box consenting to electronic delivery.

After a stockholder elects to receive electronic delivery of materials, that stockholder will no longer receive printed copies of the Company’s shareholder communications. When the Company’s materials are available, the Company will send an e-mail with instructions on how to access the materials electronically. A stockholder can always request paper copies of the materials by calling Shareholder Services at (817) 415-3022 or by visiting the Company’s Web site atwww.radioshackcorporation.com/ir.

If a stockholder already receives his or her proxy materials via the Internet, he or she will continue to receive them electronically until the stockholder’s account becomes inactive or the stockholder cancels his or her enrollment. Stockholders can review and modify account information, and also cancel enrollment, by going towww.econsent.com/rsh on the Internet.

Costs of Solicitation

The Company will bear the cost of the proxy solicitation. In addition to solicitation by mail, the Company will request banks, brokers and other custodian nominees and fiduciaries to supply proxy material to the beneficial owners of the Company’s common stock and will reimburse them for their expenses in so doing. In addition, the Company may engage D.F. King & Co., Inc. to provide proxy services for a fee anticipated not to exceed $10,000 plus out-of-pocket expenses. Certain directors, officers and other employees of the Company may solicit proxies, without additional remuneration therefor, by personal interview, mail, telephone, facsimile or other electronic means.

STOCKHOLDER PROPOSALS AND NOMINATIONS

FOR DIRECTORS FOR THE 2004 ANNUAL MEETING

For proposals of stockholders to be considered for inclusion in the proxy statement for the 2004 Annual Meeting of Stockholders of the Company, which is now scheduled to be held on May 20, 2004, such proposals must be received by the Corporate Secretary of the Company by December 9, 2003. With respect to stockholder proposals for the 2004 Annual Meeting that arenot to be included in the Proxy Statement, these proposals must also be received by the Corporate Secretary by December 9, 2003.

Stockholders who wish to nominate persons for election as directors at the 2004 Annual Meeting, which is now scheduled to be held on May 20, 2004, must give notice of their intention to make a nomination in writing to the Corporate Secretary of the Company on or before December 9, 2003. Each notice must set forth: (a) the name and address, as they appear on the Corporation’s records, of the stockholder making the nomination and the name and address of the beneficial owner, if any, on whose behalf the nomination is made; (b) the number of shares of common stock owned beneficially and of record by such stockholder of record and by the beneficial owner, if any, on whose behalf the nomination is made; (c) any material interest or relationship that the stockholder of record and/or the beneficial owner, if any, on whose behalf the proposal or nomination is made may respectively have with the nominee; (d) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed

27

pursuant to the proxy rules of the Securities and Exchange Commission as then in effect; and (e) the consent of each nominee to serve as director of the Company, if so elected. The Corporate Governance Committee will consider director nominees made by stockholders pursuant to procedures set forth in the Corporate Governance Committee Charter.

ANNUAL REPORT