The information in this Preliminary Pricing Supplement is not complete and may be changed. We may not sell these Securities until the Pricing Supplement is delivered in final form. We are not selling these Securities, nor are we soliciting offers to buy these Securities, in any State where such offer or sale is not permitted.

| PRELIMINARY PRICING SUPPLEMENT | Filed Pursuant to Rule 424(b)(2) |

| Subject to Completion | Registration No. 333-228614 |

| Dated November 2, 2020 |

Pricing Supplement dated November ●, 2020 to the

Prospectus dated December 26, 2018,

Prospectus Supplement dated December 26, 2018 and Product Prospectus Supplement (Equity Linked Index Notes, Series A) dated December 26, 2018

The Bank of Nova Scotia

$

Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities

Linked to the Russell 2000® Index Due December 3, 2024

The Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities, Linked to the Russell 2000® Index Due December 3, 2024 (the "Securities") offered hereunder are senior unsecured debt obligations of The Bank of Nova Scotia (the "Bank") and are subject to investment risks including possible loss of the Principal Amount invested due to the negative performance of the Reference Asset and the credit risk of the Bank. As used in this pricing supplement, the "Bank," "we," "us" or "our" refers to The Bank of Nova Scotia.

The Securities will not be listed on any securities exchange or automated quotation system.

The Securities will not bear interest. If the Closing Level of the Russell 2000® Index (which we refer to as the “Reference Asset”) on any Call Date (including the Final Calculation Day) is greater than or equal to the Starting Level, we will automatically call the Securities for the Principal Amount plus the Call Premium applicable to that Call Date. If the Securities are not automatically called on any Call Date, the amount that you will be paid on your Securities at maturity will be based on the performance of the Reference Asset as measured from the Pricing Date to and including the Final Calculation Day. If the Securities are not automatically called and the Percentage Change of the Reference Asset is below -10.00% (the Ending Level is less than the Starting Level by more than 10.00%), you will lose a portion of your investment in the Securities and may lose up to 90.00% of your investment depending on the performance of the Reference Asset. Additionally, any positive return on the Securities will be limited to the applicable Call Premium, even if the Closing Level of the Reference Asset on the applicable Call Date significantly exceeds the Starting Level. You will not participate in any appreciation of the Reference Asset beyond the applicable fixed Call Premium. In addition, any payment on your Securities is subject to the creditworthiness of The Bank of Nova Scotia.

The Call Dates and the Call Premium applicable to each Call Date are set forth in the table below:

| Call Date | Call Premium* |

| December 2, 2021 | [5.00 – 6.00]% of the Principal Amount |

| December 2, 2022 | [10.00 - 12.00]% of the Principal Amount |

| December 4, 2023 | [15.00 - 18.00]% of the Principal Amount |

| November 25, 2024 (which is also the Final Calculation Day) | [20.00 - 24.00]% of the Principal Amount |

| *The actual Call Premium applicable to each Call Date will be determined on the Pricing Date. | |

If the Securities are not automatically called on any Call Date (including the Final Calculation Day), to determine your payment at maturity, we will first calculate the percentage decrease in the Ending Level (determined on the Final Calculation Day, subject to adjustment) from the Starting Level (which will be the Closing Level of the Reference Asset on the Pricing Date), which we refer to as the Percentage Change. If the Securities are not automatically called, the percentage change will reflect a negative return based on the decrease in the level of the Reference Asset over the term of the Securities. If the Securities are not automatically called, at maturity, for each $1,000 Principal Amount of your Securities:

| ● | if the Ending Level is less than the Starting Level but not by more than 10.00% (the Percentage Change is negative but not below -10.00%), you will receive an amount in cash equal to $1,000; or |

| ● | if the Ending Level is less than the Starting Level by more than 10.00% (the Percentage Change is negative and below -10.00%), you will receive less than $1,000 and have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00%. In this case, you will receive an amount in cash equal to the sum of: (1) $1,000 plus (2) the product of (i) $1,000 times (ii) the sum of the Percentage Change plus 10.00%. |

You could lose up to 90.00% of your investment in the Securities. A percentage decrease of more than 10.00% between the Starting Level and the Ending Level will reduce the payment you will receive at maturity below the Principal Amount of your Securities.

The difference between the estimated value of your Securities and the Original Offering Price reflects costs that the Bank expects to incur and profits that the Bank expects to realize in connection with hedging activities related to the Securities. These costs and profits will likely reduce the secondary market price, if any, at which the Underwriters are willing to purchase the Securities. The Underwriters may, but are not obligated to, purchase any Securities. As a result, you may experience an immediate and substantial decline in the market value of your Securities on the Trade Date and you may lose a substantial portion of your initial investment. The Bank's profit in relation to the Securities will vary based on the difference between (i) the amounts received by the Bank in connection with the issuance and the reinvestment return received by the Bank in connection with such amounts and (ii) the costs incurred by the Bank in connection with the issuance of the Securities and the hedging transactions it effects. The Bank's affiliates or the Underwriters’ affiliates may also realize a profit from a hedging transaction with our affiliate and/or an affiliate of Wells Fargo Securities, LLC ("WFS") in connection with your Securities as described under “The Bank’s Estimated Value of the Securities”.

The return on your Securities will relate to the price return of the Reference Asset and will not include a total return or dividend component. The Securities are derivative products based on the performance of the Reference Asset. The Securities do not constitute a direct investment in any of the shares, units or other securities represented by the Reference Asset. By acquiring Securities, you will not have any direct economic or other interest in, claim or entitlement to, or any legal or beneficial ownership of any such share, unit or security and will not have any rights as a shareholder, unitholder or other security holder of any of the issuers including, without limitation, any voting rights or rights to receive dividends or other distributions.

Neither the United States Securities and Exchange Commission ("SEC"), nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or the adequacy of this document, the accompanying prospectus, prospectus supplement or product prospectus supplement. Any representation to the contrary is a criminal offense.

The Securities are not insured by the Canada Deposit Insurance Corporation pursuant to the Canada Deposit Insurance Corporation Act (the “CDIC Act”) or the U.S. Federal Deposit Insurance Corporation or any other governmental agency of Canada, the United States or any other jurisdiction.

Scotia Capital (USA) Inc., our affiliate, will purchase the Securities from us for distribution to other registered broker dealers including WFS or will offer the Securities directly to investors. Scotia Capital (USA) Inc. or any of its affiliates or agents may use this pricing supplement in market-making transactions in Securities after their initial sale. If you are buying Securities from Scotia Capital (USA) Inc. or another of its affiliates or agents, the final pricing supplement to which this pricing supplement relates may be used in a market-making transaction. See "Supplemental Plan of Distribution (Conflicts of Interest)" in this pricing supplement and on page PS-32 of the accompanying product prospectus supplement.

| Per Security | Total | |

Price to public1 | 100.00% | $● |

Underwriting commissions2 | 3.15% | $● |

Proceeds to The Bank of Nova Scotia3 | 96.85% | $● |

The Securities have complex features and investment in the Securities involves certain risks. You should refer to "Additional Risks" beginning on page P-15 in this pricing supplement and "Additional Risk Factors Specific to the Notes" beginning on page PS-5 of the accompanying product prospectus supplement and "Risk Factors" beginning on page S-2 of the accompanying prospectus supplement and on page 6 of the accompanying prospectus.

We will deliver the Securities in book-entry form through the facilities of The Depository Trust Company ("DTC") on the Original Issue Date against payment in immediately available funds.

| Scotia Capital (USA) Inc. | Wells Fargo Securities, LLC. |

1 If the Securities priced today, the estimated value of the Securities as determined by the Bank would be between $902.91 (90.291%) and $938.46 (93.846%) per $1,000 Principal Amount of the Securities. See "The Bank's Estimated Value of the Securities" in this pricing supplement for additional information.

2 Scotia Capital (USA) Inc. or one of our affiliates will purchase the aggregate Principal Amount of the Securities and as part of the distribution, will sell the Securities to WFS at a discount of up to $31.50 (3.15%) per $1,000 Principal Amount of the Securities. WFS will provide selected dealers, which may include Wells Fargo Advisors ("WFA", the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), with a selling concession of up to $17.50 (1.75%) per $1,000 Principal Amount of the Securities, and WFA will receive a distribution expense fee of $0.75 (0.075%) per $1,000 Principal Amount of the Securities for Securities sold by WFA. In respect of certain Securities sold in this offering, we may pay a fee of up to $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. See "Supplemental Plan of Distribution (Conflicts of Interest)" in this pricing supplement for additional information.

3 Excludes any profits from hedging. For additional considerations relating to hedging activities see "Additional Risks—The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices" in this pricing supplement.

Summary

The information in this "Summary" section is qualified by the more detailed information set forth in this pricing supplement, and the accompanying prospectus, prospectus supplement, and product prospectus supplement. See "Additional Terms of the Securities" in this pricing supplement.| Issuer: | The Bank of Nova Scotia (the "Bank") |

| Issue: | Senior Note Program, Series A |

| CUSIP/ISIN: | 064159YH3 / US064159YH32 |

| Type of Securities: | Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities |

| Reference Asset: | The Russell 2000® Index (Bloomberg Ticker: RTY) |

| Sponsor: | FTSE Russell |

Minimum Investment and Denominations: | $1,000 and integral multiples of $1,000 in excess thereof |

| Principal Amount: | $1,000 per Security |

| Original Offering Price: | 100.00% of the Principal Amount of each Security |

| Currency: | U.S. Dollars |

| Pricing Date: | Expected to be November 24, 2020 |

| Trade Date: | Expected to be November 24, 2020 |

| Original Issue Date: | Expected to be December 2, 2020 (to be determined on the Trade Date and expected to be the 5th scheduled Business Day after the Trade Date). We expect that delivery of the Securities will be made against payment therefor on or about the 5th Business Day following the Trade Date (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally are required to settle in 2 Business Days (T+2), unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities on the Trade Date will be required, by virtue of the fact that each Security initially will settle in 5 Business Days (T+5), to specify alternative settlement arrangements to prevent a failed settlement. |

| Maturity Date: | December 3, 2024 or, if such day is not a Business Day, the next succeeding Business Day. If the scheduled Final Calculation Day is not a Trading Day or if a market disruption event occurs or is continuing on the day that would otherwise be the Final Calculation Day so that the Final Calculation Day as postponed falls less than two Business Days prior to the scheduled Maturity Date, the Maturity Date will be postponed to the second Business Day following the Final Calculation Day as postponed. |

| Final Calculation Day: | November 25, 2024 or, if such day is not a Trading Day, the next succeeding Trading Day. The Final Calculation Day is also subject to postponement due to the occurrence of a market disruption event. See “—Postponement of a Calculation Day” below. |

P-2

| Trading Day: | For purposes of the Securities, a “Trading Day” means a day, as determined by the Calculation Agent, on which (i) the relevant exchanges with respect to each security underlying the Reference Asset (the “Reference Asset Constituent Stocks”) are scheduled to be open for trading for their respective regular trading sessions and (ii) each related exchange is scheduled to be open for trading for its regular trading session. |

| Principal at Risk: | You may lose a substantial portion of your initial investment at maturity if the Securities are not automatically called and there is a percentage decrease from the Starting Level to the Ending Level of more than 10.00%. |

Automatic Call Feature: | If the Closing Level of the Reference Asset on any Call Date (including the Final Calculation Day) is greater than or equal to the Starting Level, the Securities will be automatically called, and on the related Call Settlement Date you will be entitled to receive a cash payment per Security in U.S. dollars equal to the Principal Amount per Security plus the Call Premium applicable to the relevant Call Date. The last Call Date is the Final Calculation Day, and payment upon an automatic call on the Final Calculation Day, if applicable, will be made on the Maturity Date. |

| Any positive return on the Securities will be limited to the applicable Call Premium, even if the Closing Level of the Reference Asset on the applicable Call Date significantly exceeds the Starting Level. You will not participate in any appreciation of the Reference Asset beyond the applicable fixed Call Premium. | |

| If the Securities are automatically called, they will cease to be outstanding on the related Call Settlement Date and you will have no further rights under the Securities after such Call Settlement Date. You will not receive any notice from us if the Securities are automatically called. |

Call Dates and Call Premiums: | Call Date | Call Premium | Payment per Security upon an Automatic Call |

| December 2, 2021 | [5.00 – 6.00]% of the Principal Amount | [$1,050.00 – $1,060.00] | |

| December 2, 2022 | [10.00 - 12.00]% of the Principal Amount | [$1,100.00 – $1,120.00] | |

| December 4, 2023 | [15.00 - 18.00]% of the Principal Amount | [$1,150.00 – $1,180.00] | |

| November 25, 2024* | [20.00 - 24.00]% of the Principal Amount | [$1,200.00 – $1,240.00] |

The actual Call Premium and payment per Security upon an automatic call that is applicable to each Call Date will be determined on the Pricing Date and will be within the ranges specified in the foregoing table. *November 25, 2024 is also the Final Calculation Day. | |

| The Call Dates are subject to postponement for non-Trading Days and the occurrence of a market disruption event. See “—Postponement of a Calculation Day” below. | |

| Call Settlement Date: | Five business days after the applicable Call Date (as each such Call Date may be postponed pursuant to “—Postponement of a Calculation Day” below, if applicable); provided that the Call Settlement Date for the last Call Date is the Maturity Date. |

P-3

| Fees and Expenses: | Scotia Capital (USA) Inc. or one of our affiliates will purchase the aggregate Principal Amount of the Securities and as part of the distribution, will sell the Securities to WFS at a discount of up to $31.50 (3.15%) per $1,000 Principal Amount of the Securities. WFS will provide selected dealers, which may include Wells Fargo Advisors (“WFA”), with a selling concession of up to $17.50 (1.75%) per $1,000 Principal Amount of the Securities, and WFA will receive a distribution expense fee of $0.75 (0.075%) per $1,000 Principal Amount of the Securities for Securities sold by WFA. |

| In addition, in respect of certain Securities sold in this offering, we may pay a fee of up to $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. | |

| The price at which you purchase the Securities includes costs that the Bank, the Underwriters or their respective affiliates expect to incur and profits that the Bank, the Underwriters or their respective affiliates expect to realize in connection with hedging activities related to the Securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any secondary market develops, for the Securities. As a result, you may experience an immediate and substantial decline in the market value of your Securities on the Pricing Date. See "Additional Risks—The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices" in this pricing supplement. | |

| Redemption Amount at Maturity: | If the Securities are not automatically called on any Call Date (including the Final Calculation Day), the Redemption Amount at Maturity will be based on the performance of the Reference Asset and will be calculated as follows: |

• If the Ending Level is less than the Starting Level and greater than or equal to the Threshold Level, the Redemption Amount at Maturity will equal: $1,000; or • If the Ending Level is less than the Threshold Level, the Redemption Amount at Maturity will equal: | |

| Principal Amount + [Principal Amount × (Percentage Change + Threshold Percentage)] | |

| In this case you will have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00%. Accordingly, you could lose up to 90.00% of your initial investment. | |

| Starting Level: | The Closing Level of the Reference Asset on the Pricing Date. |

| Ending Level: | The Closing Level of the Reference Asset on the Final Calculation Day. |

| Closing Level: | For any date of determination, the closing level of the Reference Asset published on the Bloomberg Professional® service (“Bloomberg”) page “RTY<Index>” or any successor page on Bloomberg or any successor service, as applicable. In certain special circumstances, the Closing Level will be determined by the Calculation Agent. See “—Market Disruption Events”, “—Postponement of a Calculation Day” and “General Terms of the Notes—Unavailability of the Level of the Reference Asset on a Valuation Date” herein. |

| Percentage Change: | The Percentage Change, expressed as a percentage, with respect to the Redemption Amount at Maturity, is calculated as follows: Ending Level – Starting Level Starting Level |

P-4

| For the avoidance of doubt, because the Percentage Change will be calculated only if the Closing Level of the Reference Asset is less than the Starting Level on each Call Date, including the Final Calculation Day, the Percentage Change will be a negative value. | |

| Threshold Level: | To be determined on the Pricing Date (equal to the Starting Level multiplied by the difference of 100.00% minus the Threshold Percentage). |

| Threshold Percentage: | 10.00% |

| Market Disruption Event: | For purposes of the Securities, the definition of “market disruption event” set forth in the accompanying product prospectus supplement is superseded. For purposes of the Securities, a “market disruption event” means any of the following events as determined by the Calculation Agent in its sole discretion: (A) The occurrence or existence of a material suspension of or limitation imposed on trading by the relevant exchange(s) or otherwise relating to securities which then comprise 20% or more of the level of the Reference Asset or any successor equity index at any time during the one-hour period that ends at the close of trading on that day, whether by reason of movements in price exceeding limits permitted by those relevant exchanges or otherwise. (B) The occurrence or existence of a material suspension of or limitation imposed on trading by any related exchange or otherwise in futures or options contracts relating to the Reference Asset or any successor equity index on any related exchange at any time during the one-hour period that ends at the close of trading on that day, whether by reason of movements in price exceeding limits permitted by the related exchange or otherwise. (C) The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, securities that then comprise 20% or more of the level of the Reference Asset or any successor equity index on their relevant exchanges at any time during the one-hour period that ends at the close of trading on that day. (D) The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to the Reference Asset or any successor equity index on any related exchange at any time during the one-hour period that ends at the close of trading on that day. (E) The closure on any exchange business day of the relevant exchanges on which securities that then comprise 20% or more of the level of the Reference Asset or any successor equity index are traded or any related exchange prior to its scheduled closing time unless the earlier closing time is announced by the relevant exchange or related exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such relevant exchange or related exchange, as applicable, and (2) the submission deadline for orders to be entered into the relevant exchange or related exchange, as applicable, system for execution at such actual closing time on that day. (F) The relevant exchange for any Reference Asset Constituent or any security underlying a successor equity index or any related exchange fails to open for trading during its regular trading session. For purposes of determining whether a market disruption event has occurred: |

(1) the relevant percentage contribution of a security to the level of the Reference Asset or any successor equity index will be based on a comparison of (x) the portion of the level of such index attributable to that security and (y) the overall |

P-5

level of the Reference Asset or successor equity index, in each case immediately before the occurrence of the market disruption event; | |

| (2) the “close of trading” on any Trading Day for the Reference Asset or any successor equity index means the scheduled closing time of the relevant exchanges with respect to the Reference Asset Constituents or the securities underlying a successor equity index on such Trading Day; provided that, if the actual closing time of the regular trading session of any such relevant exchange is earlier than its scheduled closing time on such Trading Day, then (x) for purposes of clauses (A) and (C) of the definition of “market disruption event” above, with respect to any security underlying the Reference Asset or successor equity index for which such relevant exchange is its relevant exchange, the “close of trading” means such actual closing time and (y) for purposes of clauses (B) and (D) of the definition of “market disruption event” above, with respect to any futures or options contract relating to the Reference Asset or successor equity index, the “close of trading” means the latest actual closing time of the regular trading session of any of the relevant exchanges, but in no event later than the scheduled closing time of the relevant exchanges; | |

| (3) the “scheduled closing time” of any relevant exchange or related exchange on any Trading Day for the Reference Asset or any successor equity index means the scheduled weekday closing time of such relevant exchange or related exchange on such Trading Day, without regard to after hours or any other trading outside the regular trading session hours; and | |

| (4) an “exchange business day” means any Trading Day for the Reference Asset or any successor equity index on which each relevant exchange for the Reference Asset Constituents or the securities underlying a successor equity index and each related exchange are open for trading during their respective regular trading sessions, notwithstanding any such relevant exchange or related exchange closing prior to its scheduled closing time | |

| Relevant Exchange: | The “relevant exchange” for any security then underlying the Reference Asset means the primary exchange or quotation system on which such security is traded, as determined by the Calculation Agent. |

| Related Exchange: | The “related exchange” means an exchange or quotation system where trading has a material effect (as determined by the Calculation Agent) on the overall market for futures or options contracts relating to the Reference Asset. |

Postponement of a Calculation Day: | The Call Dates (including the Final Calculation Day) are each referred to as a “calculation day” for purposes of postponement. If any calculation day is not a Trading Day, such calculation day will be postponed to the next succeeding Trading Day. |

| If a market disruption event occurs or is continuing on any calculation day, then such calculation day will be postponed to the first succeeding Trading Day on which a market disruption event has not occurred and is not continuing. If a market disruption event occurs or is continuing on each Trading Day to and including the eighth Trading Day following the originally scheduled calculation day, then that eighth Trading Day will be deemed to be the applicable calculation day. If a calculation day has been postponed eight Trading Days after the originally scheduled calculation day, then the Closing Level of the Reference Asset on such eighth Trading Day will be determined (or, if not determinable, estimated by the Calculation Agent in a manner which is considered commercially reasonable under the circumstances) by the Calculation Agent on that eighth Trading Day, regardless of the occurrence or continuance of the market disruption event on that day. In such an event, the Calculation Agent will make a good faith estimate in its sole discretion of the Closing Level that would have prevailed on such date in the absence of the market disruption event. |

P-6

| Notwithstanding anything to the contrary in the accompanying product prospectus supplement, the Call Dates (including the Final Calculation Day) (each referred to in this section as a “calculation day”) will be postponed as set forth herein. | |

| Form of Securities: | Book-entry |

| Calculation Agent: | Scotia Capital Inc., an affiliate of the Bank |

| Underwriters: | Scotia Capital (USA) Inc. and Wells Fargo Securities, LLC. |

| Status: | The Securities will constitute direct, senior, unsubordinated and unsecured obligations of the Bank ranking pari passu with all other direct, senior, unsecured and unsubordinated indebtedness of the Bank from time to time outstanding (except as otherwise prescribed by law). Holders will not have the benefit of any insurance under the provisions of the CDIC Act, the U.S. Federal Deposit Insurance Act or under any other deposit insurance regime. |

| Tax Redemption: | The Bank (or its successor) may redeem the Securities, in whole but not in part, at a redemption price determined by the Calculation Agent in a manner reasonably calculated to preserve your and our relative economic position, if it is determined that changes in tax laws of Canada (or the jurisdiction of organization of the successor to the Bank) or of any political subdivision or taxing authority thereof or therein affecting taxation or their interpretation will result in the Bank (or its successor) becoming obligated to pay additional amounts with respect to the Securities. See “Tax Redemption” in the accompanying product prospectus supplement. |

| Listing: | The Securities will not be listed on any securities exchange or automated quotation system. |

| Use of Proceeds: | General corporate purposes |

| Clearance and Settlement: | The Depository Trust Company |

| Business Day: | New York and Toronto |

| Canadian Bail-in: | The Securities are not bail-inable debt securities under the CDIC Act. |

Investing in the Securities involves significant risks. You may lose up to 90.00% of your principal amount. The downside market exposure to the Reference Asset is buffered only at maturity. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of the Bank. If the Bank were to default on its payment obligations you may not receive any amounts owed to you under the Securities and you could lose your entire investment.

P-7

ADDITIONAL TERMS OF THE SECURITIES

You should read this pricing supplement together with the accompanying prospectus dated December 26, 2018, as supplemented by the accompanying prospectus supplement dated December 26, 2018 and the product prospectus supplement (Equity Linked Index Notes, Series A) dated December 26, 2018, relating to our Senior Note Program, Series A, of which these Securities are a part. Certain terms used but not defined in this pricing supplement will have the meanings given to them in the accompanying product prospectus supplement. In the event of any conflict, this pricing supplement will control. The Securities may vary from the terms described in the accompanying prospectus, prospectus supplement, and product prospectus supplement in several important ways. You should read this pricing supplement, including the documents incorporated herein, carefully.This pricing supplement, together with the documents listed below, contains the terms of the Securities and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in "Additional Risk Factors Specific to the Notes" in the accompanying product prospectus supplement, as the Securities involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Securities. You may access these documents on the SEC website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website at http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000009631):

Prospectus dated December 26, 2018:

Prospectus Supplement dated December 26, 2018:

Product Prospectus Supplement (Equity Linked Index Notes, Series A), dated December 26, 2018:

P-8

INVESTOR SUITABILITY

The Securities may be suitable for you if:| • | You fully understand and accept the risks inherent in an investment in the Securities, including the risk of losing most of your initial investment. |

| • | You can tolerate a loss of up to 90.00% of your initial investment. |

| • | You believe that the Closing Level of the Reference Asset will be greater than or equal to the Starting Level on one of the four Call Dates. |

| • | You seek the potential for a fixed return if the Reference Asset has appreciated at all as of any of the four Call Dates in lieu of full participation in any potential appreciation of the Reference Asset. |

| • | You understand that if the Closing Level of the Reference Asset is less than the Starting Level on each of the four Call Dates (including the Final Calculation Day), you will not receive any positive return on your investment in the Securities, and that if the Closing Level of the Reference Asset on the Final Calculation Day (i.e., the Ending Level) is less than the Starting Level by more than 10.00%, you will receive less, and up to 90.00% less, than the Principal Amount at maturity. |

| • | You can tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the Reference Asset. |

| • | You do not seek current income from your investment and are willing to forgo dividends paid on the Reference Asset Constituent Stocks. |

| • | You understand that the term of the Securities may be as short as approximately 12 months and that you will not receive a higher Call Premium payable with respect to a later Call Date if the Securities are called on an earlier Call Date. |

| • | You are willing to accept the risk of exposure to the small capitalization segment of the U.S. equity market. |

| • | You are willing to hold the Securities to maturity, a term of approximately 48 months, and accept that there may be little or no secondary market for the Securities. |

| • | You are willing to assume the credit risk of the Bank for all payments under the Securities, and understand that if the Bank defaults on its obligations you may not receive any amounts due to you, including any repayment of principal. |

The Securities may not be suitable for you if:

| • | You do not fully understand or are unwilling to accept the risks inherent in an investment in the Securities, including the risk of losing most of your initial investment. |

| • | You seek a security with a fixed term. |

| • | You require an investment designed to guarantee a full return of principal at maturity. |

| • | You cannot tolerate a loss of up to 90.00% of your initial investment. |

| • | You are unwilling to accept the risk that, if the Closing Level of the Reference Asset is less than the Starting Level on each of the four Call Dates (including the Final Calculation Day), you will not receive any positive return on your investment in the Securities. |

| • | You are unwilling to purchase Securities with an estimated value as of the Pricing Date that is lower than the Principal Amount and that may be as low as the lower estimated value set forth on the cover page. |

| • | You seek exposure to the upside performance of the Reference Asset beyond the applicable Call Premium. |

| • | You cannot tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the Reference Asset. |

| • | You seek current income from your investment or prefer to receive dividends paid on the Reference Asset Constituent Stocks. |

| • | You are not willing to accept the risk of exposure to the small capitalization segment of the U.S. equity market. |

| • | You are unwilling to hold the Securities to maturity, a term of approximately 48 months, or you seek an investment for which there will be an active secondary market. |

P-9

| • | You are not willing to assume the credit risk of the Bank for all payments under the Securities. |

| • | You prefer the lower risk of fixed income investments with comparable maturities issued by companies with comparable credit ratings. |

The investor suitability considerations identified above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should also review “Additional Risks” of this preliminary pricing supplement and the “Additional Risk Factors Specific to the Notes” of the accompanying product prospectus supplement for risks related to an investment in the Securities.

P-10

P-11

HYPOTHETICAL RETURNS

Hypothetical Returns if the Securities are Called

If the Securities are automatically called:

Assuming that the Securities are automatically called, the following table illustrates, for each hypothetical Call Date on which the Securities are automatically called:

| • | the hypothetical payment per Security on the related Call Settlement Date, assuming that the Call Premiums are equal to the midpoints of their specified ranges; and |

| • | the hypothetical pre-tax total rate of return. |

Hypothetical Call Date on which Securities are automatically called | Hypothetical payment per Security on related Call Settlement Date | Hypothetical pre-tax total rate of return |

| 1st Call Date | $1,055.00 | 5.50% |

| 2nd Call Date | $1,110.00 | 11.00% |

| 3rd Call Date | $1,165.00 | 16.50% |

| 4th Call Date | $1,220.00 | 22.00% |

If the Securities are not automatically called:

Assuming that the Securities are not automatically called, the following table illustrates, for a range of hypothetical Ending Levels of the Reference Asset:

| • | the hypothetical percentage change from the hypothetical Starting Level to the hypothetical Ending Level, assuming a hypothetical Starting Level of 1,600.00; |

| • | the hypothetical Redemption Amount at Maturity per Security; and |

| • | the hypothetical pre-tax total rate of return. |

Hypothetical Ending Level | Hypothetical percentage change from the hypothetical Starting Level to the hypothetical Ending Level | Hypothetical Redemption Amount at Maturity per Security | Hypothetical pre-tax total rate of return |

| 1,520.000 | -5.00% | $1,000.00 | 0.00% |

| 1,440.000 | -10.00% | $1,000.00 | 0.00% |

| 1,424.000 | -11.00% | $990.00 | -1.00% |

| 1,280.000 | -20.00% | $900.00 | -10.00% |

| 1,200.000 | -25.00% | $850.00 | -15.00% |

| 800.000 | -50.00% | $600.00 | -40.00% |

| 400.000 | -75.00% | $350.00 | -65.00% |

| 0.000 | -100.00% | $100.00 | -90.00% |

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. The actual amount you will receive upon an automatic call or at maturity and the resulting pre-tax rate of return will depend on (i) whether the Securities are automatically called; (ii) if the Securities are automatically called, the actual Call Premium and the actual Call Date on which the Securities are called; (iii) if the Securities are not automatically called, the actual Ending Level of the Reference Asset; and (iv) whether you hold your Securities to maturity or earlier automatic call.

P-12

HYPOTHETICAL PAYMENTS AT MATURITY ON THE SECURITIES

If the Closing Level of the Reference Asset is less than the Starting Level on each of the first three Call Dates, the Securities will not be automatically called prior to the Final Calculation Day, and you will receive a Redemption Amount at Maturity that will be greater than, equal to or less than the Principal Amount per Security, depending on the Ending Level (i.e., the Closing Level of the Reference Asset on the Final Calculation Day). The examples set out below are included for illustration purposes only and are used to illustrate the calculation of the Redemption Amount at Maturity (rounded to two decimal places). These examples are not estimates or forecasts of the Starting Level, the Ending Level or the Closing Level of the Reference Asset on any Call Date, on the Final Calculation Day or on any Trading Day prior to the Maturity Date. All examples assume that a holder purchased Securities with a Principal Amount of $1,000.00, a Threshold Percentage of 10.00% (the Threshold Level is 90.00% of the Starting Level), a hypothetical Call Premium applicable to the Final Calculation Day of 22.00% (the midpoint of the specified range for the Call Premium applicable to the Final Calculation Day), the Securities have not been automatically called on any of the first three Call Dates and that no market disruption event occurs on the Final Calculation Day. Amounts below may have been rounded for ease of analysis.Example 1. Ending Level is greater than the Starting Level, the Securities are automatically called on the Final Calculation Day and the Redemption Amount at Maturity is equal to the Principal Amount plus the applicable Call Premium:

Hypothetical Starting Level: 1,600.000

Hypothetical Ending Level: 2,400.000

Because the hypothetical Ending Level is greater than the hypothetical Starting Level, the Securities are automatically called on the Final Calculation Day and you will receive the Principal Amount of your Securities plus a Call Premium of 22.00% of the Principal Amount per Security. Even though the Reference Asset appreciated by 50.00% from its Starting Level to its Ending Level in this example, your return is limited to the Call Premium of 22.00% that is applicable to the Final Calculation Day.

On the Maturity Date, you would receive $1,220.00 per Security.

Example 2. Ending Level is less than the Starting Level but equal to or greater than the Threshold Level and the Redemption Amount at Maturity is equal to the Principal Amount:

Hypothetical Starting Level: 1,600.000

Hypothetical Ending Level: 1,520.000

Hypothetical Threshold Level: 1,440.000, which is 90.00% of the hypothetical Starting Level

Because the hypothetical Ending Level is less than the hypothetical Starting Level, but not by more than 10.00%, you would not lose any of the Principal Amount of your Securities.

On the Maturity Date, you would receive $1,000.00 per Security.

Example 3. Ending Level is less than the Threshold Level and the Redemption Amount at Maturity is less than the Principal Amount:

Hypothetical Starting Level: 1,600.000

Hypothetical Ending Level: 800.000

Hypothetical Threshold Level: 1,440.000, which is 90.00% of the hypothetical Starting Level

Because the hypothetical Ending Level is less than the hypothetical Starting Level by more than 10.00%, you would lose a portion of the Principal Amount of your Securities and receive a Redemption Amount at Maturity equal to:

$1,000 + [$1,000 × (-50.00% + 10.00%)] = $600.00

On the Maturity Date, you would receive $600.00 per Security, resulting in a loss of 40.00%.

To the extent that the Starting Level, Threshold Level and Ending Level differ from the values assumed above, the results indicated above would be different.

P-13

Accordingly, if the Securities are not automatically called on any Call Date and the Percentage Change is negative by more than -10.00%, meaning the percentage decline from the Starting Level to the Ending Level is greater than 10.00%, the Bank will pay you less than the full Principal Amount, resulting in a loss on your investment that is equal to the Percentage Change in excess of the Threshold Percentage. You may lose up to 90.00% of your initial investment.

Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of the Bank. If the Bank were to default on its payment obligations, you may not receive any amounts owed to you under the Securities and you could lose your entire investment.

P-14

ADDITIONAL RISKS

An investment in the Securities involves significant risks. In addition to the following risks included in this pricing supplement, we urge you to read "Additional Risk Factors Specific to the Notes" in the accompanying product prospectus supplement and "Risk Factors" in the accompanying prospectus supplement and the accompanying prospectus.You should understand the risks of investing in the Securities and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the Securities in light of your particular financial circumstances and the information set forth in this pricing supplement and the accompanying prospectus, prospectus supplement and product prospectus supplement.

Risks Relating to Return Characteristics

Risk of Loss at Maturity

Any payment on the Securities at maturity depends on the Percentage Change of the Reference Asset. If the Securities are not automatically called, the Bank will only repay you the full Principal Amount of your Securities if the Percentage Change does not reflect a decrease in the Reference Asset of more than 10.00%. If the Percentage Change is negative by more than 10.00%, meaning the Ending Level is less than the Threshold Level, you will lose a significant portion of your initial investment in an amount equal to the Percentage Change in excess of the Threshold Percentage. Accordingly, if the Securities are not automatically called, you may lose up to 90.00% of your investment in the Securities if the percentage decline from the Starting Level to the Ending Level is greater than 10.00%.

The Downside Market Exposure to the Reference Asset is Buffered Only at Maturity

You should be willing to hold your Securities to maturity. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the level of the Reference Asset at such time is greater than or equal to the Threshold Level.

The Potential Return On The Securities Is Limited To The Call Premium

The potential return on the Securities is limited to the applicable Call Premium, regardless of the performance of the Reference Asset. The Reference Asset may appreciate by significantly more than the percentage represented by the applicable Call Premium from the Pricing Date through the applicable Call Date, in which case an investment in the Securities will underperform a hypothetical alternative investment providing a 1-to-1 return based on the performance of the Reference Asset. In addition, you will not receive the value of dividends or other distributions paid with respect to the Reference Asset. Furthermore, if the Securities are called on an earlier Call Date, you will receive a lower Call Premium than if the Securities were called on a later Call Date, and accordingly, if the Securities are called on one of the three earlier Call Dates, you will not receive the highest potential Call Premium.

You Will Be Subject To Reinvestment Risk

If your Securities are automatically called prior to the Final Calculation Day, the term of the Securities may be reduced to as short as approximately 12 months. There is no guarantee that you would be able to reinvest the proceeds from an investment in the Securities at a comparable return for a similar level of risk in the event the Securities are automatically called prior to maturity.

No Interest.

The Securities will not bear interest and, accordingly, you will not receive any interest payments on the Securities.

The Securities Differ from Conventional Debt Instruments

The Securities are not conventional notes or debt instruments. The Securities do not provide you with interest payments prior to maturity as a conventional fixed-rate or floating-rate debt security with the same maturity would. The return that you will receive on the Securities, which could be negative, may be less than the return you could earn on other investments. If the Securities are not automatically called, your return on the securities will be zero or negative, and therefore will be less than the return you would earn if you bought a conventional senior interest bearing debt security of the Bank.

Holding the Securities is Not the Same as Holding the Reference Asset Constituent Stocks

Holding the Securities is not the same as holding the Reference Asset Constituent Stocks. As a holder of the Securities, you will not be entitled to the voting rights or rights to receive dividends or other distributions or other rights that holders of the Reference Asset Constituent Stocks would enjoy.

P-15

No Assurance that the Investment View Implicit in the Securities Will Be Successful

It is impossible to predict with certainty whether and the extent to which the level of the Reference Asset will rise or fall. There can be no assurance that the level of the Reference Asset will rise above the Starting Level as of any Call Date or that the percentage decline from the Starting Level to the Ending Level will not be greater than the Threshold Percentage. The Closing Levels of the Reference Asset and the Ending Level may be influenced by complex and interrelated political, economic, financial and other factors that affect the Reference Asset Constituent Stocks. You should be willing to accept the risks of the price performance of equity securities in general and the Reference Asset Constituent Stocks in particular, and the risk of losing some or most of your initial investment.

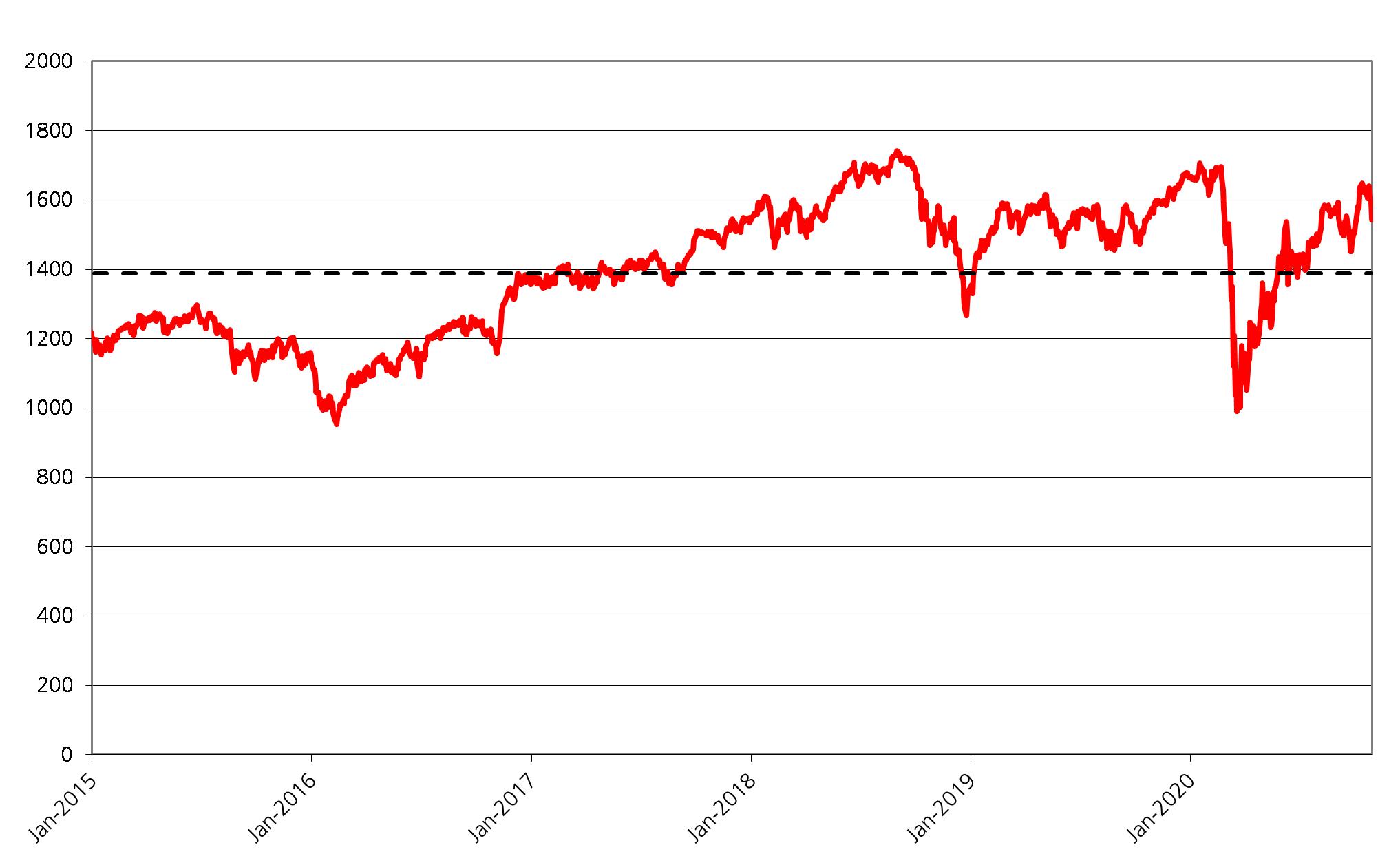

Furthermore, we cannot give you any assurance that the future performance of the Reference Asset or the Reference Asset Constituent Stocks will result in your receiving an amount greater than or equal to the Principal Amount of your Securities. Certain periods of historical performance of the Reference Asset or the Reference Asset Constituent Stocks would have resulted in you receiving less than the Principal Amount of your Securities if you had owned Securities with terms similar to these Securities in the past. See "Information Regarding The Reference Asset" in this pricing supplement for further information regarding the historical performance of the Reference Asset.

Risks Relating to Characteristics of the Reference Asset

The Securities are Subject to Market Risk

The return on the Securities is directly linked to the performance of the Reference Asset and indirectly linked to the value of the Reference Asset Constituent Stocks. The return on the Securities will depend on whether the Closing Level of the Reference Asset on any Call Date is greater than or equal to the Starting Level which will result in an automatic call of the Securities and a return equal to the applicable Call Premium, and if not automatically called, the extent to which the Percentage Change is negative. The level of the Reference Asset can rise or fall sharply due to factors specific to the Reference Asset Constituent Stocks, as well as general market factors, such as general market volatility and levels, interest rates and economic and political conditions. Recently, the coronavirus infection has caused volatility in the global financial markets and a slowdown in the global economy. Coronavirus or any other communicable disease or infection may adversely affect the Reference Asset Constituent Stocks and, therefore, the Reference Asset.

The Securities are Subject to Small-Capitalization Stock Risks

The Securities are subject to risks associated with small-capitalization companies because the Reference Asset Constituent Stocks are considered small-capitalization companies. These companies often have greater stock price volatility, lower trading volume and less liquidity than large-capitalization companies and therefore the reference asset may be more volatile than an index in which a greater percentage of the reference asset constituents are issued by large-capitalization companies. Stock prices of small-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business and economic developments, and the stocks of small-capitalization companies may be thinly traded. In addition, small-capitalization companies are typically less stable financially than large-capitalization companies and may depend on a small number of key personnel, making them more vulnerable to loss of personnel. Small-capitalization companies are often given less analyst coverage and may be in early, and less predictable, periods of their corporate existences. Such companies tend to have smaller revenues, less diverse product lines, smaller shares of their product or service markets, fewer financial resources and less competitive strengths than large-capitalization companies and are more susceptible to adverse developments related to their products.

The Reference Asset Reflects Price Return Only and Not Total Return

The return on your Securities is based on the performance of the Reference Asset, which reflects the changes in the market prices of the Reference Asset Constituent Stocks. It is not, however, linked to a “total return” index or strategy, which, in addition to reflecting those price returns, would also reflect dividends paid on the Reference Asset Constituent Stocks. The return on your Securities will not include such a total return feature or dividend component.

Past Performance is Not Indicative of Future Performance

The actual performance of the Reference Asset over the life of the Securities, as well as the amount payable at maturity, may bear little relation to the historical performance of the Reference Asset or to the hypothetical return examples set forth elsewhere in this pricing supplement. We cannot predict the future performance of the Reference Asset.

P-16

Changes Affecting the Reference Asset Could Have an Adverse Effect on the Value of, and the Amount Payable on, the Securities

The policies of the Sponsor concerning additions, deletions and substitutions of the Reference Asset Constituent Stocks and the manner in which the Sponsor takes account of certain changes affecting those Reference Asset Constituent Stocks may adversely affect the level of the Reference Asset. The policies of the Sponsor with respect to the calculation of the Reference Asset could also adversely affect the level of the Reference Asset. The Sponsor may discontinue or suspend calculation or dissemination of the Reference Asset. Any such actions could have a material adverse effect on the value of, and the amount payable on, the Securities.

The Bank Cannot Control Actions by the Sponsor and the Sponsor Has No Obligation to Consider Your Interests

The Bank and its affiliates are not affiliated with the Sponsor and have no ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the Reference Asset. The Sponsor is not involved in the Securities offering in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions that might negatively affect the market value of, and the amount payable on, your Securities.

Risks Relating to Hedging Activities and Conflicts of Interest

Hedging Activities by the Bank and/or the Underwriters May Negatively Impact Investors in the Securities and Cause Our Respective Interests and Those of Our Clients and Counterparties to Be Contrary to Those of Investors in the Securities

The Bank or one or more of our respective affiliates and/or the Underwriters has hedged or expects to hedge the obligations under the Securities by purchasing futures and/or other instruments linked to the Reference Asset. The Bank or one or more of our respective affiliates and/or the Underwriters also expects to adjust the hedge by, among other things, purchasing or selling any of the foregoing, and perhaps other instruments linked to the Reference Asset or one or more of the Reference Asset Constituent Stocks, at any time and from time to time, and to unwind the hedge by selling any of the foregoing on or before a Call Date (including the Final Calculation Day).

The Bank or one or more of our respective affiliates and/or the Underwriters may also enter into, adjust and unwind hedging transactions relating to other basket- or index-linked securities whose returns are linked to changes in the level or price of the Reference Asset or the Reference Asset Constituent Stocks. Any of these hedging activities may adversely affect the level of the Reference Asset—directly or indirectly by affecting the price of the Reference Asset Constituent Stocks—and therefore the market value of the Securities and the amount you will receive, if any, on the Securities. In addition, you should expect that these transactions will cause the Bank, our respective affiliates and/or the Underwriters, or our respective clients or counterparties, to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the Securities. The Bank, our respective affiliates and/or the Underwriters will have no obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the Securities, and may receive substantial returns with respect to these hedging activities while the value of the Securities may decline.

Market Activities by the Bank or the Underwriters for Their Own Respective Accounts or for Their Respective Clients Could Negatively Impact Investors in the Securities

The Bank, the Underwriters and their respective affiliates provide a wide range of financial services to a substantial and diversified client base. As such, each of the Bank, the Underwriters and their respective affiliates may act as an investor, investment banker, research provider, investment manager, investment advisor, market maker, trader, prime broker or lender. In those and other capacities, we and/or our affiliates and the Underwriters and/or their respective affiliates purchase, sell or hold a broad array of investments, actively trade securities (including the Securities or other securities that we have issued), the Reference Asset Constituent Stocks, derivatives, loans, credit default swaps, indices, baskets and other financial instruments and products for our own accounts or for the accounts of our customers, and we and the Underwriters will have other direct or indirect interests in those securities and in other markets that may not be consistent with your interests and may adversely affect the level of the Reference Asset and/or the value of the Securities. Any of these financial market activities may, individually or in the aggregate, have an adverse effect on the level of the Reference Asset and the market for your Securities, and you should expect that our interests and those of our affiliates and those of the Underwriters and/or of their respective affiliates, or our or their clients or counterparties, will at times be adverse to those of investors in the Securities.

P-17

The Bank, the Underwriters and their respective affiliates regularly offer a wide array of securities, financial instruments and other products into the marketplace, including existing or new products that are similar to the Securities or other securities that we may issue, the Reference Asset Constituent Stocks or other securities or instruments similar to or linked to the foregoing. Investors in the Securities should expect that the Bank, the Underwriters and their respective affiliates will offer securities, financial instruments, and other products that may compete with the Securities for liquidity or otherwise.

In addition, our and their affiliates or any dealer participating in the offering of the Securities or its affiliates may, at present or in the future, publish research reports on the Reference Asset or the Reference Asset Constituent Stocks. This research is modified from time to time without notice and may, at present or in the future, express opinions or provide recommendations that are inconsistent with purchasing or holding the Securities. Any research reports on the Reference Asset or the Reference Asset Constituent Stocks could adversely affect the level of the Reference Asset and, therefore, adversely affect the value of and your return on the Securities. You are encouraged to derive information concerning the Reference Asset from multiple sources and should not rely on the views expressed by us, the Underwriters or our or their affiliates or any participating dealer or its affiliates.

The Bank, the Underwriters and Their Respective Affiliates Regularly Provide Services to, or Otherwise Have Business Relationships with, a Broad Client Base, Which Has Included and May Include the Reference Asset Constituent Stock Issuers

The Bank, the Underwriters and their respective affiliates regularly provide financial advisory, investment advisory and transactional services to a substantial and diversified client base. You should assume that the Bank or the Underwriters will, at present or in the future, provide such services or otherwise engage in transactions with, among others, the Reference Asset Constituent Stock Issuers or transact in securities or instruments or with parties that are directly or indirectly related to these entities. These services could include making loans to or equity investments in those companies, providing financial advisory or other investment banking services, or issuing research reports. You should expect that the Bank, the Underwriters and their respective affiliates, in providing these services, engaging in such transactions, or acting for their own accounts, may take actions that have direct or indirect effects on the Securities or other securities that the Bank may issue, the Reference Asset Constituent Stocks or other securities or instruments similar to or linked to the foregoing, and that such actions could be adverse to the interests of investors in the Securities. In addition, in connection with these activities, certain personnel within the Bank or the Underwriters and their respective affiliates may have access to confidential material non-public information about these parties that would not be disclosed to investors in the Securities.

Other Investors in the Securities May Not Have the Same Interests as You

The interests of other investors may, in some circumstances, be adverse to your interests. Other investors may make requests or recommendations to us regarding the establishment of transactions on terms that are adverse to your interests, and investors in the Securities are not required to take into account the interests of any other investor in exercising remedies, voting or other rights in their capacity as noteholders. Further, other investors may enter into market transactions with respect to the Securities, assets that are the same or similar to the Securities, assets referenced by the Securities (such as stocks or stock indices) or other similar assets or securities which may adversely impact the market for or value of your Securities. For example, an investor could take a short position (directly or indirectly through derivative transactions) in respect of securities similar to your Securities or in respect of the Reference Asset.

The Calculation Agent Can Postpone any Call Date (including the Final Calculation Day) for the Securities if a Market Disruption Event with Respect to the Reference Asset Occurs

If the Calculation Agent determines, in its sole discretion, that, on a day that would otherwise be a Call Date, a market disruption event with respect to the Reference Asset has occurred or is continuing for the Reference Asset, such Call Date will be postponed until the first following Trading Day on which no market disruption event occurs or is continuing, although such Call Date will not be postponed by more than eight scheduled Trading Days. Moreover, if such Call Date is postponed to the last possible day, but a market disruption event occurs or is continuing on that day, that day will nevertheless be the Call Date or the Final Calculation Day, as applicable, and the Calculation Agent will determine the applicable Closing Level or Ending Level that must be used to determine whether the Securities are subject to an automatic call or the Redemption Amount at Maturity, as applicable. See “Summary—Market Disruption Events” and “—Postponement of a Calculation Day” in this pricing supplement as well as “General Terms of the Notes—Unavailability of the Level of the Reference Asset on a Valuation Date” in the accompanying product prospectus supplement.

P-18

There Is No Affiliation Between Any Reference Asset Constituent Stock Issuers or the Sponsor and Us and We Are Not Responsible for Any Disclosure by Any of the Other Reference Asset Constituent Stock Issuers or the Sponsor

The Bank, the Underwriters and their respective affiliates may currently, or from time to time in the future, engage in business with the Reference Asset Constituent Stock Issuers. The Bank, the Underwriters and their respective affiliates are not affiliated with any of the companies included in the Reference Asset. None of us, the Underwriters or our or their affiliates assumes any responsibility for the accuracy or the completeness of any information about the Reference Asset or any of the Reference Asset Constituent Stocks. Before investing in the Securities you should make your own investigation into the Reference Asset and the Reference Asset Constituent Stock Issuers. See the section below entitled "Information Regarding the Reference Asset" in this pricing supplement for additional information about the Reference Asset.

A Participating Dealer or its Affiliates May Realize Hedging Profits Projected by its Proprietary Pricing Models in Addition to any Selling Concession and/or any Distribution Expense Fee, Creating a Further Incentive for the Participating Dealer to Sell the Securities to You

If any dealer participating in the distribution of the Securities (referred to as a "participating dealer") or any of its affiliates conducts hedging activities for us in connection with the Securities, that participating dealer or its affiliate will expect to realize a projected profit from such hedging activities. If a participating dealer receives a concession and/or any distribution expense fee for the sale of the Securities to you, this projected profit will be in addition to the concession and/or distribution expense fee, creating a further incentive for the participating dealer to sell the Securities to you.

Risks Relating to Estimated Value and Liquidity

The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices

Assuming no change in market conditions or any other relevant factors, the price, if any, at which Scotia Capital (USA) Inc. or any other party is willing to purchase the Securities at any time in secondary market transactions will likely be significantly lower than the Original Offering Price, since secondary market prices are likely to exclude discounts and underwriting commissions paid with respect to the Securities and the cost of hedging our obligations under the Securities that are included in the Original Offering Price. The cost of hedging includes the projected profit that we or our hedge provider may realize in consideration for assuming the risks inherent in managing the hedging transactions. These secondary market prices are also likely to be reduced by the costs of unwinding the related hedging transactions. The profits also include an estimate of the difference between the amounts we or our hedge provider pay and receive in a hedging transaction with our affiliate and/or an affiliate of WFS in connection with your Securities. In addition, any secondary market prices may differ from values determined by pricing models used by Scotia Capital (USA) Inc. or WFS as a result of dealer discounts, mark-ups or other transaction costs.

WFS has advised us that if it or any of its affiliates makes a secondary market in the Securities at any time up to the Original Issue Date or during the 5-month period following the Original Issue Date, the secondary market price offered by WFS or any of its affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring and hedging the Securities that are included in the Original Offering Price. Because this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it or any of its affiliates offers during this period will be higher than it otherwise would be outside of this period, as any secondary market price offered outside of this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase in the secondary market price will decline steadily to zero over this 5-month period. If you hold the Securities through an account at WFS or any of its affiliates, WFS has advised us that it expects that this increase will also be reflected in the value indicated for the Securities on your brokerage account statement.

The Bank's Estimated Value of the Securities Will Be Lower Than the Original Offering Price of the Securities

The Bank's estimated value is only an estimate using several factors. The Original Offering Price of the Securities will exceed the Bank's estimated value because costs associated with selling and structuring the Securities, as well as hedging the Securities, are included in the Original Offering Price of the Securities. These costs include the selling commissions and the estimated cost of using a third party hedge provider to hedge our obligations under the Securities. See "The Bank's Estimated Value of the Securities" in this pricing supplement.

P-19

The Bank's Estimated Value Does Not Represent Future Values of the Securities and may Differ from Others' Estimates

The Bank's estimated value of the Securities is determined by reference to the Bank's internal pricing models when the terms of the Securities are set. This estimated value is based on market conditions and other relevant factors existing at that time and the Bank's assumptions about market parameters, which can include volatility, dividend rates, interest rates and other factors as well as an estimate of the difference between the amounts we or our hedge provider pay and receive in a hedging transaction with our affiliate and/or an affiliate of WFS in connection with your Securities. Different pricing models and assumptions could provide valuations for Securities that are greater than or less than the Bank's estimated value. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to be incorrect. On future dates, the value of the Securities could change significantly based on, among other things, changes in market conditions, our creditworthiness, interest rate movements and other relevant factors, which may impact the price, if any, at which the Bank would be willing to buy Securities from you in secondary market transactions. See "The Bank's Estimated Value of the Securities" in this pricing supplement.

The Bank's Estimated Value is not Determined by Reference to Credit Spreads for our Conventional Fixed-Rate Debt

The internal funding rate used in the determination of the Bank's estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. If the Bank were to use the interest rate implied by our conventional fixed-rate credit spreads, we would expect the economic terms of the Securities to be more favorable to you. Consequently, our use of an internal funding rate would have an adverse effect on the terms of the Securities and any secondary market prices of the Securities. See "The Bank's Estimated Value of the Securities" in this pricing supplement.

If the Levels of the Reference Asset or the Reference Asset Constituent Stocks Change, the Market Value of Your Securities May Not Change in the Same Manner

Your Securities may trade quite differently from the performance of the Reference Asset or the Reference Asset Constituent Stocks. Changes in the levels of the Reference Asset or the Reference Asset Constituent Stocks may not result in a comparable change in the market value of your Securities. We discuss some of the reasons for this disparity under "—The Price at Which the Securities May Be Sold Prior to Maturity will Depend on a Number of Factors and May Be Substantially Less Than the Amount for Which They Were Originally Purchased" below.

We May Sell an Additional Aggregate Principal Amount of the Securities at a Different Issue Price

We may decide to sell an additional aggregate Principal Amount of the Securities subsequent to the date of the final pricing supplement. The issue price of the Securities in the subsequent sale may differ substantially (higher or lower) from the Original Offering Price as provided on the cover of this pricing supplement.

The Price at Which the Securities May Be Sold Prior to Maturity will Depend on a Number of Factors and May Be Substantially Less Than the Amount for Which They Were Originally Purchased

The price at which the Securities may be sold prior to maturity will depend on a number of factors. Some of these factors include, but are not limited to: (i) actual or anticipated changes in the level of the Reference Asset over the full term of the Security, (ii) volatility of the level of the Reference Asset and the market's perception of future volatility of the level of the Reference Asset, (iii) changes in interest rates generally, (iv) any actual or anticipated changes in our credit ratings or credit spreads, (v) dividend yields on the securities included in the Reference Asset and (vi) time remaining to maturity. In particular, because the provisions of the Security relating to the Redemption Amount at Maturity and the Call Premium behave like options, the value of the Security will vary in ways which are non-linear and may not be intuitive.

Depending on the actual or anticipated level of the Reference Asset and other relevant factors, the market value of the Securities may decrease and you may receive substantially less than 100.00% of the Original Offering Price if you sell your Securities prior to maturity. We anticipate that the value of the Securities will always be at a discount to the Principal Amount plus the relevant Call Premium.

The Securities Lack Liquidity

The Securities will not be listed on any securities exchange or automated quotation system. Therefore, there may be little or no secondary market for the Securities. Scotia Capital (USA) Inc. may, but is not obligated to, make a market in the Securities. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Securities easily. Because we do not expect that other broker-dealers will participate significantly in the secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which Scotia Capital (USA) Inc. is willing to purchase the Securities from you. If at any time Scotia Capital (USA) Inc. was not to make a

P-20

market in the Securities, it is likely that there would be no secondary market for the Securities. Accordingly, you should be willing to hold your Securities to maturity.

Risks Relating to General Credit Characteristics

Your Investment is Subject to the Credit Risk of the Bank

The Securities are senior unsecured debt obligations of the Bank, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus, prospectus supplement and product prospectus supplement, the Securities will rank on a parity with all of the other unsecured and unsubordinated debt obligations of the Bank, except such obligations as may be preferred by operation of law. Any payment to be made on the Securities, including the Redemption Amount at Maturity, depends on the ability of the Bank to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of the Bank may affect the market value of the Securities and, in the event the Bank were to default on its obligations, you may not receive the amounts owed to you under the terms of the Securities. If you sell the Securities prior to maturity, you may receive substantially less than the Principal Amount of your Securities.

The COVID-19 Virus May Have an Adverse Impact on the Bank