- BNS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

424B2 Filing

The Bank of Nova Scotia (BNS) 424B2Prospectus for primary offering

Filed: 3 Nov 20, 12:00pm

The information in this preliminary pricing supplement is not complete and may be changed. We may not sell these Securities until the pricing supplement, the accompanying product prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus (collectively, the “Offering Documents”) are delivered in final form. The Offering Documents are not an offer to sell these Securities and we are not soliciting offers to buy these Securities in any state where the offer or sale is not permitted.

| Subject to Completion PRELIMINARY PRICING SUPPLEMENT Dated November 3, 2020 Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-228614 (To Prospectus dated December 26, 2018, Prospectus Supplement dated December 26, 2018 and Product Prospectus Supplement dated December 26, 2018) |

The Bank of Nova Scotia $n Trigger GEARS

Linked to the Russell 1000® Value Index due on or about November 18, 2025

Investment Description

The Bank of Nova Scotia Trigger GEARS (the “Securities”) are unsubordinated, unsecured debt securities issued by The Bank of Nova Scotia (“BNS” or the “issuer”) linked to the performance of the Russell 1000® Value Index (the “underlying”). The amount you receive at maturity will be based on the direction and percentage change in the level of the underlying from the trade date to the final valuation date (the “underlying return”) and whether the closing level of the underlying on the final valuation date (the “final level”) is less than the downside threshold. If the underlying return is positive, at maturity, BNS will pay you a cash payment per Security equal to the principal amount plus a percentage return equal to the underlying return multiplied by the upside gearing. If the underlying return is zero or negative and the final level is equal to or greater than the downside threshold, at maturity BNS will pay you a cash payment per Security equal to the principal amount. If, however, the final level is less than the downside threshold, BNS will pay you a cash payment per Security that is less than the principal amount, if anything, resulting in a percentage loss on your initial investment equal to the underlying return and, in extreme situations, you could lose all of your initial investment. Investing in the Securities involves significant risks. The Securities do not pay interest. You may lose a significant portion or all of your initial investment. The contingent repayment of principal applies only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of BNS. If BNS were to default on its payment obligations you may not receive any amounts owed to you under the Securities and you could lose all of your initial investment.

Features

| □ | Enhanced Exposure to Positive Underlying Return: At maturity, the Securities provide exposure to any positive underlying return multiplied by the upside gearing. |

| □ | Contingent Repayment of Principal at Maturity with Potential for Full Downside Market Exposure: If the underlying return is zero or negative and the final level is equal to or greater than the downside threshold, at maturity BNS will pay you a cash payment per Security equal to the principal amount. If, however, the underlying return is negative and the final level is less than the downside threshold, BNS will pay you a cash payment per Security that is less than the principal amount, if anything, resulting in a percentage loss on your initial investment equal to the underlying return and, in extreme situations, you could lose all of your initial investment. The contingent repayment of principal applies only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of BNS. |

Key Dates*

| Trade Date** | November 13, 2020 | |

| Settlement Date** | November 18, 2020 | |

| Final Valuation Date | November 13, 2025 | |

| Maturity Date | November 18, 2025 |

| * | Expected. See page 2 for additional details. |

| ** | We expect to deliver the Securities against payment on or about the third business day following the trade date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days (T+2), unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities in the secondary market on any date prior to two business days before delivery of the Securities will be required, by virtue of the fact that each Security initially will settle in three business days (T+3), to specify alternative settlement arrangements to prevent a failed settlement of the secondary market trade. |

Notice to investors: the Securities are significantly riskier than conventional debt instruments. The issuer is not necessarily obligated to repay the principal amount of the Securities at maturity, and the Securities may have the same downside market risk as the underlying. This market risk is in addition to the credit risk inherent in purchasing a debt obligation of BNS. You should not purchase the Securities if you do not understand or are not comfortable with the significant risks involved in investing in the Securities.

You should carefully consider the risks described under “Key Risks” beginning on page P-3 and under “Additional Risk Factors Specific to the Notes” beginning on page PS-6 of the accompanying product prospectus supplement and “Risk Factors” beginning on page S-2 of the accompanying prospectus supplement and on page 5 of the accompanying prospectus. Events relating to any of those risks, or other risks and uncertainties, could adversely affect the market value of, and the return on your Securities. You may lose a significant portion or all of your initial investment in the Securities. The Securities will not be listed or displayed on any securities exchange or any electronic communications network.

Security Offering

These preliminary terms relate to the Securities. The final terms for the Securities will be set on the trade date. The Securities are offered at a minimum investment of $1,000, or 100 Securities at $10 per Security, and integral multiples of $10 in excess thereof.

| Underlying | Bloomberg Ticker | Upside Gearing | Initial Level | Downside Threshold | CUSIP | ISIN |

| Russell 1000® Value Index | RLV | 1.25 - 1.35 | • | 75.00% of the Initial Level | 06417Q338 | US06417Q3386 |

The initial estimated value of your Securities at the time the terms of your Securities are set on the trade date is expected to be between $9.430 and $9.892 per principal amount, which will be less than the issue price to public listed below. See “Additional Information Regarding Estimated Value of the Securities” herein and “Key Risks” beginning on page P-3 of this document for additional information. The actual value of your Securities at any time will reflect many factors and cannot be predicted with accuracy.

See “Additional Information about BNS and the Securities” on page ii. The Securities will have the terms set forth in the accompanying product prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus, each dated December 26, 2018 and this document.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this document, the accompanying product prospectus supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The Securities are not insured by the Canada Deposit Insurance Corporation (the “CDIC”) pursuant to the Canada Deposit Insurance Corporation Act (the “CDIC Act”) or the U.S. Federal Deposit Insurance Corporation or any other government agency of Canada, the U.S. or any other jurisdiction. The Securities are not bail-inable debt securities under the CDIC Act.

| Offering of Securities | Issue Price to Public | Underwriting Discount(1)(2) | Proceeds to The Bank of Nova Scotia(1)(2) | |||

| Total | Per Security | Total | Per Security | Total | Per Security | |

| Securities linked to the Russell 1000® Value Index | $• | $10.00 | $• | $0.00 | $• | $10.00 |

| (1) | Scotia Capital (USA) Inc. (“SCUSA”), our affiliate, will purchase the Securities at the principal amount and, as part of the distribution of the Securities, will sell the Securities to UBS Financial Services Inc. (“UBS”) at the principal amount. UBS proposes to offer the Securities at the issue price to certain fee-based advisory accounts for which UBS is an investment advisor. See “Supplemental Plan of Distribution (Conflicts of Interest); Secondary Markets (if any)” herein for additional information. |

| (2) | This amount excludes any profits to BNS, SCUSA or any of our other affiliates from hedging. See “Key Risks” and “Supplemental Plan of Distribution (Conflicts of Interest); Secondary Markets (if any)” herein for additional considerations relating to hedging activities. |

| Scotia Capital (USA) Inc. | UBS Financial Services Inc. |

Additional Information about BNS and the Securities

You should read this pricing supplement together with the prospectus dated December 26, 2018, as supplemented by the prospectus supplement dated December 26, 2018 and the product prospectus supplement (Equity Linked Index Notes, Series A) dated December 26, 2018, relating to our Senior Note Program, Series A, of which these Securities are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to them in the product prospectus supplement.

The Securities may vary from the terms described in the accompanying prospectus, accompanying prospectus supplement and accompanying product prospectus supplement in several important ways. You should read this pricing supplement carefully, including the documents incorporated by reference herein. In the event of any conflict between this pricing supplement and any of the foregoing, the following hierarchy will govern: first, this pricing supplement; second, the accompanying product prospectus supplement; third, the accompanying prospectus supplement; and last, the accompanying prospectus. You may access these documents on the SEC website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website).

This pricing supplement, together with the documents listed below, contains the terms of the Securities and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Key Risks” herein, in “Additional Risk Factors Specific to the Securities” of the accompanying product prospectus supplement and in “Risk Factors” of the accompanying prospectus supplement and of the accompanying prospectus, as the Securities involve risks not associated with conventional debt securities.

We urge you to consult your investment, legal, tax, accounting and other advisors concerning an investment in the Securities in light of your particular circumstances.

You may access these documents on the SEC website at www.sec.gov as follows:

| ¨ | Product Prospectus Supplement (Equity Linked Index Notes, Series A) dated December 26, 2018: http://www.sec.gov/Archives/edgar/data/9631/000091412118002483/bn50682441-424b2.htm |

| ¨ | Prospectus Supplement dated December 26, 2018: |

http://www.sec.gov/Archives/edgar/data/9631/000091412118002473/bn50676984-424b3.htm

| ¨ | Prospectus dated December 26, 2018: http://www.sec.gov/Archives/edgar/data/9631/000119312518357537/d677731d424b3.htm |

References to "BNS", "we", "our" and "us" refer only to The Bank of Nova Scotia and not to its consolidated subsidiaries and references to the "Trigger GEARS" or the "Securities" refer to the Securities that are offered hereby. Also, references to the “accompanying product prospectus supplement” mean the BNS product prospectus supplement, dated December 26, 2018, references to the “accompanying prospectus supplement” mean the BNS prospectus supplement, dated December 26, 2018 and references to the “accompanying prospectus” mean the BNS prospectus, dated December 26, 2018.

BNS reserves the right to change the terms of, or reject any offer to purchase, the Securities prior to their issuance. In the event of any changes to the terms of the Securities, BNS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case BNS may reject your offer to purchase.

| P-ii |

Investor Suitability

The Securities may be suitable for you if:

| ¨ | You fully understand and are willing to accept the risks inherent in an investment in the Securities, including the risk of loss of all of your initial investment. |

| ¨ | You can tolerate a loss of a significant portion or all of your initial investment and are willing to make an investment that may have the same downside market risk as the underlying or the stocks comprising the underlying (the “underlying constituents”). |

| ¨ | You believe that the level of the underlying will appreciate over the term of the Securities. |

| ¨ | You are willing to invest in the Securities based on the downside threshold indicated on the cover hereof and if the upside gearing was set equal to the bottom of the range indicated on the cover hereof (the actual upside gearing will be set on the trade date). |

| ¨ | You can tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the underlying. |

| ¨ | You do not seek current income from your investment and are willing to forgo any dividends paid on the underlying constituents. |

| ¨ | You understand and are willing to accept the risks associated with the underlying. |

| ¨ | You are willing to hold the Securities to maturity and accept that there may be little or no secondary market for the Securities. |

| ¨ | You are willing to assume the credit risk of BNS for all payments under the Securities, and understand that if BNS defaults on its obligations you may not receive any amounts due to you including any repayment of principal. |

The Securities may not be suitable for you if:

| ¨ | You do not fully understand or are not willing to accept the risks inherent in an investment in the Securities, including the risk of loss of all of your initial investment. |

| ¨ | You require an investment designed to provide a full return of principal at maturity. |

| ¨ | You cannot tolerate a loss of a significant portion or all of your initial investment or are unwilling to make an investment that may have the same downside market risk as the underlying or the underlying constituents. |

| ¨ | You believe that the level of the underlying will decline during the term of the Securities and is likely to be less than the downside threshold on the final valuation date. |

| ¨ | You are unwilling to invest in the Securities based on the downside threshold indicated on the cover hereof or if the upside gearing was set equal to the bottom of the range indicated on the cover hereof (the actual upside gearing will be set on the trade date). |

| ¨ | You cannot tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the level of the underlying. |

| ¨ | You do not understand or are not willing to accept the risks associated with the underlying. |

| ¨ | You seek current income from your investment or prefer to receive any dividends paid on the underlying constituents. |

| ¨ | You are unable or unwilling to hold the Securities to maturity or you seek an investment for which there will be an active secondary market. |

| ¨ | You are not willing to assume the credit risk of BNS for all payments under the Securities, including any repayment of principal. |

The investor suitability considerations identified above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should review “Information About the Underlying” herein for more information on the underlying. You should also review “Key Risks” herein and the more detailed “Risk Factors” in the accompanying product prospectus supplement for risks related to an investment in the Securities.

| P-1 |

Preliminary Terms

| Issuer | The Bank of Nova Scotia |

| Issue | Senior Note Program, Series A |

| Agents | Scotia Capital (USA) Inc. (“SCUSA”) and UBS Financial Services Inc. (“UBS”) |

| Principal Amount | $10 per Security (subject to a minimum investment of 100 Securities) |

| Term | Approximately 5 years. In the event that we make any change to the expected trade date and settlement date, the calculation agent may adjust the final valuation date and maturity date to ensure that the stated term of the Securities remains the same. |

| Underlying | Russell 1000® Value Index |

| Upside Gearing | Between 1.25 and 1.35. The actual upside gearing will be determined on the trade date. |

| Payment at Maturity (per Security) | If the underlying return is positive, BNS will pay you an amount in cash equal to: |

| $10 × (1 + Underlying Return × Upside Gearing) | |

If the underlying return is zero or negative and the final level is equal to or greater than the downside threshold, BNS will pay you an amount in cash equal to: Principal Amount of $10 | |

| If the underlying return is negative and the final level is less than the downside threshold, BNS will pay you an amount in cash that is less than your principal amount, if anything, equal to: | |

$10 × (1 + Underlying Return) In this scenario, you will suffer a percentage loss on your initial investment equal to the underlying return and, in extreme situations, you could lose all of your initial investment. | |

| Underlying Return | The quotient, expressed as a percentage, of the following formula: Final Level − Initial Level |

| Initial Level(1) | The closing level of the underlying on the trade date. |

| Final Level(1) | The closing level of the underlying on the final valuation date. |

| Downside Threshold(1) | A specified level of the underlying that is less than the initial level, equal to a percentage of the initial level, as indicated on the cover hereof. |

| (1) As determined by the calculation agent and as may be adjusted as described under “General Terms of the Notes — Unavailability of the Level of the Reference Asset on a Valuation Date”, as described in the accompanying product prospectus supplement. | |

| Tax Redemption | Notwithstanding anything to the contrary in the accompanying product prospectus supplement, the provision set forth under “General Terms of the Notes—Payment of Additional Amounts” and “General Terms of the Notes—Tax Redemption” shall not apply to the Securities. |

| Canadian Bail-in | The Securities are not bail-inable debt securities under the CDIC Act. |

| Terms Incorporated | All of the terms appearing above the item under the caption “General Terms of the Notes” beginning on page PS-15 in the accompanying product prospectus supplement, as modified by this pricing supplement, and for purposes of the foregoing, references herein to “underlying”, “underlying constituents”, “underlying return” and “downside threshold” mean “reference asset”, “reference asset constituents”, “percentage change” and “barrier level”, respectively, each as defined in the accompanying product prospectus supplement. In addition to those terms, the following two sentences are also so incorporated into the master note: BNS confirms that it fully understands and is able to calculate the effective annual rate of interest applicable to the Securities based on the methodology for calculating per annum rates provided for in the Securities. BNS irrevocably agrees not to plead or assert Section 4 of the Interest Act (Canada), whether by way of defense or otherwise, in any proceeding relating to the Securities. |

Investment Timeline

| Trade Date | The initial level is observed and the final terms of the Securities are set. | |

| ||

| Maturity Date | The final level is observed on the final valuation date and the underlying return is calculated. If the underlying return is positive, BNS will pay you an amount in cash per Security equal to: $10 × (1 + Underlying Return × Upside Gearing) If the underlying return is zero or negative and the final level is equal to or greater than the downside threshold, BNS will pay you an amount in cash per Security equal to: Principal Amount of $10 If the underlying return is negative and the final level is less than the downside threshold, BNS will pay you an amount in cash per Security that is less than your principal amount, if anything, equal to: $10 × (1 + Underlying Return) In this scenario, you will suffer a percentage loss on your initial investment equal to the underlying return and, in extreme situations, you could lose all of your initial investment. |

Investing in the Securities involves significant risks. You may lose a significant portion or all of your initial investment. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of BNS. If BNS were to default on its payment obligations, you may not receive any amounts owed to you under the Securities and you could lose all of your initial investment.

| P-2 |

Key Risks

An investment in the Securities involves significant risks. Some of the key risks that apply to the Securities are summarized below, but we urge you to read the more detailed explanation of risks relating to the Securities in under “Additional Risk Factors Specific to the Notes” of the accompanying product prospectus supplement and “Risk Factors” of the accompanying prospectus supplement and of the accompanying prospectus. We also urge you to consult your investment, legal, tax, accounting and other advisors concerning an investment in the Securities in light of your particular circumstances.

Risks Relating to Return Characteristics

| ¨ | Risk of loss at maturity — The Securities differ from ordinary debt securities in that BNS will not necessarily repay the principal amount of the Securities. BNS will pay you the principal amount of your Securities in cash at maturity only if the final level is equal to or greater than the downside threshold. If the underlying return is negative and the final level is less than the downside threshold, you will lose a percentage of your principal amount equal to the underlying return and, in extreme situations, you could lose all of your initial investment. |

| ¨ | The contingent repayment of principal applies only at maturity — You should be willing to hold your Securities to maturity. The stated payout by the issuer is available only if you hold your Securities to maturity. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the then-current level of the underlying is equal to or greater than the downside threshold. |

| ¨ | The upside gearing applies only at maturity — You should be willing to hold your Securities to maturity. If you are able to sell your Securities prior to maturity in the secondary market, the price you receive will likely not reflect the full economic value of the upside gearing, and the percentage return you realize may be less than the then-current underlying return multiplied by the upside gearing, even if such return is positive. You can receive the full benefit of the upside gearing only if you hold your Securities to maturity. |

| ¨ | No interest payments — BNS will not pay any interest with respect to the Securities. |

| ¨ | Greater expected volatility generally indicates an increased risk of loss at maturity — “Volatility" refers to the frequency and magnitude of changes in the level of the underlying. The greater the expected volatility of the underlying as of the trade date, the greater the expectation is as of the that date that the final level of the underlying could be less than the downside threshold and, as a consequence, indicates an increased risk of loss. However, the underlying's volatility can change significantly over the term of the Securities, and a relatively lower downside threshold may not necessarily indicate that the Securities have a greater likelihood of a return of principal at maturity. You should be willing to accept the downside market risk of the underlying and the potential to lose a significant portion or all of your initial investment. |

| ¨ | Owning the Securities is not the same as owning the underlying constituents — The return on your Securities may not reflect the return you would realize if you actually owned the underlying constituents. For instance, you will not receive or be entitled to receive any dividend payments or other distributions during the term of the Securities, and any such dividends or distributions will not be factored into the calculation of the payment at maturity on your Securities. In addition, as an owner of the Securities, you will not have voting rights or any other rights that a holder of the underlying constituents may have. |

Risks Relating to Characteristics of the Underlying

| ¨ | Market risk — The return on the Securities, which may be negative, is directly linked to the performance of the underlying and indirectly linked to the performance of the underlying constituents, and will depend on whether, and the extent to which, the underlying return is positive or negative. The level of the underlying can rise or fall sharply due to factors specific to the underlying and its underlying constituents and their issuers (each, an “underlying constituent issuer”), such as stock price volatility, earnings and financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock market or commodity market volatility and levels, interest rates and economic and political conditions. Recently, the coronavirus infection has caused volatility in the global financial markets and a slowdown in the global economy. Coronavirus or any other communicable disease or infection may adversely affect the underlying constituent issuers and, therefore, the underlying. You, as an investor in the Securities, should conduct your own investigation into the underlying and underlying constituents. |

| ¨ | There can be no assurance that the investment view implicit in the Securities will be successful — It is impossible to predict whether and the extent to which the level of the underlying will rise or fall and there can be no assurance that the final level of the underlying will be equal to or greater than the initial level or downside threshold. The final level of the underlying will be influenced by complex and interrelated political, economic, financial and other factors that affect the underlying constituents. You should be willing to accept the risks of owning equities in general and the underlying constituents in particular, and the risk of losing a significant portion or all of your initial investment. |

| ¨ | The underlying reflects price return, not total return — The return on your Securities is based on the performance of the underlying, which reflects the changes in the market prices of the underlying constituents. Your Securities are not, however, linked to a “total return” index or strategy, which, in addition to reflecting those price returns, would also reflect any dividends paid on the underlying constituents. The return on your Securities will not include such a total return feature or any dividend component. |

| ¨ | Changes affecting the underlying could have an adverse effect on the market value of, and any amount payable on, the Securities — The policies of the sponsor of the underlying as specified under “Information About the Underlying” (the “index sponsor”), concerning additions, deletions and substitutions of the underlying constituents and the manner in which the index sponsor takes account of certain changes affecting those underlying constituents may adversely affect the level of the underlying. The policies of the index sponsor with respect to the calculation of the underlying could also adversely affect the level of the underlying. The index |

| P-3 |

| sponsor may discontinue or suspend calculation or dissemination of the underlying. Any such actions could have an adverse effect on the market value of, and any amount payable on, the Securities. |

| ¨ | BNS cannot control actions by the index sponsor and the index sponsor has no obligation to consider your interests — None of BNS, UBS or our or their respective affiliates are affiliated with the index sponsor or have any ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the calculation of the underlying. The index sponsor is not involved in the Securities offering in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions that might affect the market value of, and any amount payable on, the Securities. |

Estimated Value Considerations

| ¨ | BNS’ initial estimated value of the Securities at the time of pricing (when the terms of your Securities are set on the trade date) will be lower than the issue price of the Securities — BNS’ initial estimated value of the Securities is only an estimate. The issue price of the Securities will exceed BNS’ initial estimated value. The difference between the issue price of the Securities and BNS’ initial estimated value reflects costs associated with selling and structuring the Securities, as well as hedging its obligations under the Securities with SCUSA or another affiliate. Therefore, the economic terms of the Securities are less favorable to you than they would have been if these expenses not been paid or had been lower. |

| ¨ | Neither BNS’ nor SCUSA’s estimated value of the Securities at any time is determined by reference to credit spreads or the borrowing rate BNS would pay for its conventional fixed-rate debt securities — BNS’ initial estimated value of the Securities and SCUSA’s estimated value of the Securities at any time are determined by reference to BNS’ internal funding rate. The internal funding rate used in the determination of the estimated value of the Securities generally represents a discount from the credit spreads for BNS’ conventional fixed-rate debt securities and the borrowing rate BNS would pay for its conventional fixed-rate debt securities. This discount is based on, among other things, BNS’ view of the funding value of the Securities as well as the higher issuance, operational and ongoing liability management costs of the Securities in comparison to those costs for BNS’ conventional fixed-rate debt. If the interest rate implied by the credit spreads for BNS’ conventional fixed-rate debt securities, or the borrowing rate BNS would pay for its conventional fixed-rate debt securities were to be used, BNS would expect the economic terms of the Securities to be more favorable to you. Consequently, the use of an internal funding rate for the Securities increases the estimated value of the Securities at any time and has an adverse effect on the economic terms of the Securities. |

| ¨ | BNS’ initial estimated value of the Securities does not represent future values of the Securities and may differ from others’ (including SCUSA’s) estimates — BNS’ initial estimated value of the Securities is determined by reference to its internal pricing models when the terms of the Securities are set. These pricing models consider certain factors, such as BNS’ internal funding rate on the trade date, the expected term of the Securities, market conditions and other relevant factors existing at that time, and BNS’ assumptions about market parameters, which can include volatility, dividend rates, interest rates and other factors. Different pricing models and assumptions (including the pricing models and assumptions used by SCUSA) could provide valuations for the Securities that are different, and perhaps materially lower, from BNS’ initial estimated value. Therefore, the price at which SCUSA would buy or sell your Securities (if SCUSA makes a market, which it is not obligated to do) may be materially lower than BNS’ initial estimated value. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to be incorrect. |

Risks Relating to Liquidity and Secondary Market Price Considerations

| ¨ | The Securities have limited liquidity — The Securities will not be listed on any securities exchange or automated quotation system. Therefore, there may be little or no secondary market for the Securities. SCUSA and any other affiliates of BNS intend, but are not required to, make a market in the Securities. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Securities easily. Because we do not expect that other broker-dealers will participate in the secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which SCUSA is willing to purchase the Securities from you. If at any time SCUSA does not make a market in the Securities, it is likely that there would be no secondary market for the Securities. Accordingly, you should be willing to hold your Securities to maturity. |

| ¨ | The price at which SCUSA would buy or sell the Securities (if SCUSA makes a market, which it is not obligated to do) will be based on SCUSA’s estimated value of the Securities and, depending on your broker, may be less than the valuation provided on your customer account statement — SCUSA’s estimated value of the Securities is determined by reference to its pricing models and takes into account BNS’ internal funding rate. If SCUSA buys or sells the Securities it will do so at prices that reflect the estimated value determined by reference to SCUSA’s pricing models at that time. The price at which SCUSA will buy or sell the Securities at any time also will reflect its then current bid and ask spread for similar sized trades of structured notes. The value provided by SCUSA on its customer account statements is based on these pricing models. As a result, depending on your broker, SCUSA or its affiliates may offer to buy or sell the Securities in the secondary market at a price that is less than the valuation provided on your broker’s customer account statements. Investors should inquire as to the valuation provided on their customer account statement provided by unaffiliated dealers, including UBS. As described above, SCUSA and its affiliates intend, but are not required, to make a market for the Securities and may stop making a market at any time. |

| SCUSA’s pricing models consider certain variables, including principally BNS’ internal funding rate, interest rates (forecasted, current and historical rates), volatility of the underlying, price-sensitivity analysis and the time to maturity of the Securities. These pricing models are proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, the actual value you would receive if you sold your Securities in the secondary market, if any, to others may differ, perhaps materially, from the estimated value of the Securities determined by reference to SCUSA’s models, taking into account BNS’ internal funding rate, due to, among other things, any differences in pricing models or assumptions used by others. If SCUSA calculated its estimated value of the Securities by reference to BNS’ credit spreads or the borrowing rate BNS would pay for its conventional fixed-rate debt securities (as |

| P-4 |

| opposed to BNS’ internal funding rate), the price at which SCUSA would buy or sell the Securities (if SCUSA makes a market, which it is not obligated to do) could be significantly lower. |

| In addition to the factors discussed above, the value and quoted price of the Securities at any time will reflect many factors and cannot be predicted. If SCUSA makes a market in the Securities, the price quoted by SCUSA would reflect any changes in market conditions and other relevant factors, including any deterioration in BNS’ creditworthiness or perceived creditworthiness. These changes may adversely affect the value of the Securities, including the price you may receive for the Securities in any market making transaction. To the extent that SCUSA makes a market in the Securities, the quoted price will reflect the estimated value determined by reference to SCUSA’s pricing models at that time, plus or minus SCUSA’s then current bid and ask spread for similar sized trades of structured notes. Furthermore, if you sell your Securities, you will likely be charged a commission for secondary market transactions, or the price will likely reflect a dealer discount. This commission or discount will further reduce the proceeds you would receive for your Securities in a secondary market sale. |

| ¨ | The price of the Securities prior to maturity will depend on a number of factors and may be substantially less than the principal amount — Because structured notes, including the Securities, can be thought of as having a debt component and a derivative component, factors that influence the values of debt instruments and options and other derivatives will also affect the terms and features of the Securities at issuance and the market price of the Securities prior to maturity. Some of these factors include, but are not limited to: (i) actual or anticipated changes in the level of the underlying over the full term of the Securities, (ii) volatility of the level of the underlying and the prices of the underlying constituents and the market's perception of future volatility of the foregoing, (iii) changes in interest rates generally, (iv) any actual or anticipated changes in our credit ratings or credit spreads, (v) dividend yields on the underlying constituents and (vi) time remaining to maturity. In particular, because the provisions of the Securities relating to the payment at maturity behave like options, the value of the Securities will vary in ways which are non-linear and may not be intuitive. |

| Depending on the actual or anticipated level of the underlying and other relevant factors, the market value of the Securities may decrease and you may receive substantially less than the principal amount if you sell your Securities prior to maturity regardless of the level of the underlying at such time. |

Risks Relating to Hedging Activities and Conflicts of Interest

| ¨ | Hedging activities by BNS and SCUSA may negatively impact investors in the Securities and cause our respective interests and those of our clients and counterparties to be contrary to those of investors in the Securities — We, SCUSA or one or more of our other affiliates has hedged or expects to hedge our obligations under the Securities. Such hedging transactions may include entering into swap or similar agreements, purchasing shares of the underlying constituents and/or purchasing futures, options and/or other instruments linked to the underlying and/or one or more of the underlying constituents. We, SCUSA or one or more of our or their respective affiliates also expects to adjust the hedge by, among other things, purchasing or selling any of the foregoing, and perhaps other instruments linked to the underlying and/or one or more of the underlying constituents, at any time and from time to time, and to unwind the hedge by selling any of the foregoing on or before the final valuation date. We, SCUSA or one or more of our or their respective affiliates may also enter into, adjust and unwind hedging transactions relating to other basket- or index-linked Securities whose returns are linked to changes in the level of the underlying and/or one or more of the underlying constituents. Any of these hedging activities may adversely affect the level of the underlying — directly or indirectly by affecting the price of the underlying constituents — and therefore the market value of the Securities and the amount you will receive, if any, on the Securities. |

| You should expect that these transactions will cause BNS, SCUSA or our other affiliates, or our or their respective clients or counterparties, to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the Securities. None of BNS, SCUSA or any of our other affiliates will have any obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the Securities, and any of the foregoing may receive substantial returns with respect to these hedging activities while the value of, and return on, the Securities declines. |

| ¨ | We, the Agents and our or their respective affiliates regularly provide services to, or otherwise have business relationships with, a broad client base, which has included and may include us and the issuers of the underlying constituents and the market activities by us, the Agents or our or their respective affiliates for our or their own respective accounts or for our or their respective clients could negatively impact investors in the Securities — We, the Agents and our or their respective affiliates regularly provide a wide range of financial services, including financial advisory, investment advisory and transactional services to a substantial and diversified client base. As such, we each may act as an investor, investment banker, research provider, investment manager, investment advisor, market maker, trader, prime broker or lender. In those and other capacities, we, the Agents and/or our or their respective affiliates purchase, sell or hold a broad array of investments, actively trade securities (including the Securities or other securities that we have issued), the underlying constituents, derivatives, loans, credit default swaps, indices, baskets and other financial instruments and products for our or their own respective accounts or for the accounts of our or their respective customers, and we will have other direct or indirect interests, in those securities and in other markets that may not be consistent with your interests and may adversely affect the level of the underlying and/or the value of the Securities. You should assume that we or they will, at present or in the future, provide such services or otherwise engage in transactions with, among others, us and the underlying constituent issuers, or transact in securities or instruments or with parties that are directly or indirectly related to these entities. These services could include making loans to or equity investments in those companies, providing financial advisory or other investment banking services, or issuing research reports. Any of these financial market activities may, individually or in the aggregate, have an adverse effect on the level of the underlying and the market for your Securities, and you should expect that our interests and those of the Agents and/or our or their respective affiliates, clients or counterparties, will at times be adverse to those of investors in the Securities. |

| You should expect that we, the Agents, and our or their respective affiliates, in providing these services, engaging in such transactions, or acting for our or their own respective accounts, may take actions that have direct or indirect effects on the Securities or other |

| P-5 |

| securities that we may issue, the underlying constituents other securities or instruments similar to or linked to the foregoing, and that such actions could be adverse to the interests of investors in the Securities. In addition, in connection with these activities, certain personnel within us, the Agents or our or their respective affiliates may have access to confidential material non-public information about these parties that would not be disclosed to investors in the Securities. |

| We, the Agents and our or their respective affiliates regularly offer a wide array of securities, financial instruments and other products into the marketplace, including existing or new products that are similar to the Securities or other securities that we may issue, the underlying constituents or other securities or instruments similar to or linked to the foregoing. Investors in the Securities should expect that we, the Agents and our or their respective affiliates offer securities, financial instruments, and other products that may compete with the Securities for liquidity or otherwise. |

| ¨ | Potential BNS impact on price — Trading or transactions by BNS, the Agents or our or their respective affiliates in the underlying constituents, listed and/or over-the-counter options, futures or other instruments with returns linked to the performance of the underlying or any underlying constituents may adversely affect the performance of the underlying or applicable underlying constituent and, therefore, the market value of, and any amount payable on, the Securities. |

| ¨ | The calculation agent will have significant discretion with respect to the Securities, which may be exercised in a manner that is adverse to your interests — The calculation agent will be an affiliate of BNS. The calculation agent can postpone the determination of the final level on the final valuation date if a market disruption event occurs and is continuing on that day. |

| ¨ | Potentially inconsistent research, opinions or recommendations by BNS — BNS, the Agents and our or their respective affiliates may publish research from time to time on financial markets and other matters that may influence the value of the Securities, or express opinions or provide recommendations that are inconsistent with purchasing or holding the Securities. Any research, opinions or recommendations expressed by BNS, the Agents or our or their respective affiliates may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the Securities and the underlying to which the Securities are linked. |

Risks Relating to General Credit Characteristics

| ¨ | Credit risk of BNS — The Securities are unsubordinated, unsecured debt obligations of BNS and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Securities, including any repayment of principal at maturity, depends on the ability of BNS to satisfy its obligations as they come due. As a result, BNS’ actual and perceived creditworthiness may affect the market value of the Securities. If BNS were to default on its obligations, you may not receive any amounts owed to you under the terms of the Securities and you could lose all of your initial investment. |

| ¨ | The COVID-19 virus may have an adverse impact on BNS — On March 11, 2020, the World Health Organization declared the outbreak of a strain of novel coronavirus disease, COVID-19, a global pandemic. Governments in affected areas have imposed a number of measures designed to contain the outbreak, including business closures, travel restrictions, quarantines and cancellations of gatherings and events. The spread of COVID-19 has had disruptive effects in countries in which BNS operates and the global economy more widely, as well as causing increased volatility and declines in financial markets. COVID-19 has materially impacted and continues to materially impact the markets in which BNS operates. If the pandemic is prolonged, or further diseases emerge that give rise to similar effects, the adverse impact on the global economy could deepen and result in further declines in financial markets. A substantial amount of BNS’ business involves making loans or otherwise committing resources to specific companies, industries or countries. The COVID-19 pandemic’s impact on such borrowers, industries and countries could have a material adverse effect on BNS’ financial results, businesses, financial condition or liquidity. The COVID-19 pandemic may also result in disruption to BNS’ key suppliers of goods and services and result in increased unavailability of staff adversely impacting the quality and continuity of service to customers and the reputation of BNS. As a result, the business, results of operations, corporate reputation and financial condition of BNS could be adversely impacted for a substantial period of time. |

| ¨ | BNS is subject to the resolution authority under the CDIC Act — Although the Securities are not bail-inable debt securities under the CDIC Act, as described elsewhere in this pricing supplement, BNS remains subject generally to Canadian bank resolution powers under the CDIC Act. Under such powers, the Canada Deposit Insurance Corporation may in certain circumstances take actions that could negatively impact holders of the Securities and result in a loss on your investment. See “Risk Factors — Risks Related to the Bank’s Debt Securities” in the accompanying prospectus for more information. |

Risks Relating to Canadian and U.S. Federal Income Taxation

| ¨ | Uncertain tax treatment — Significant aspects of the tax treatment of the Securities are uncertain. You should consult your tax advisor about your tax situation. See “Material Canadian Income Tax Consequences” and “What Are the Tax Consequences of the Securities?” in this pricing supplement. |

| P-6 |

Hypothetical Examples and Return Table of the Securities at Maturity

The below examples and table are based on hypothetical terms. The actual terms will be set on the trade date and will be indicated on the cover of the applicable pricing supplement.

The examples and table below illustrate the Payment at Maturity for a $10 Security on a hypothetical offering of the Securities, with the following assumptions (amounts may have been rounded for ease of analysis):

| Term: | Approximately 5 years |

| Initial Level: | 1,200 |

| Downside Threshold: | 900 (75% of the Initial Level) |

| Upside Gearing: | 1.25 |

| Range of Underlying Return: | -100% to 40% |

Example 1: The Underlying Return is 20%.

Because the underlying return is positive, the payment at maturity will be calculated as follows:

$10 × (1 + 20% × 1.25)

= $10 x (1 + 25.00%)

= $12.50 per Security (a 25.00% total return).

Example 2: The Underlying Return is -20% and the Final Level is equal to or greater than the Downside Threshold.

Because the underlying return is negative and the final level is equal to or greater than the downside threshold, the payment at maturity per Security will be equal to the principal amount of $10 (a 0% total return).

Example 3: The Underlying Return is -60% and the Final Level is less than the Downside Threshold.

Because the underlying return is negative and the final level is less than the downside threshold, the payment at maturity per Security will be less than the principal amount, if anything, calculated as follows:

$10 × (1 + -60.00%)

= $10 × 0.4

= $4 per Security (a 60.00% loss).

In this scenario, you will suffer a percentage loss on your initial investment in an amount that is equal to the underlying return and, in extreme situations, you could lose all of your initial investment.

| P-7 |

| Underlying | Payment and Return at Maturity | |||

| Final Level | Underlying Return | Payment at Maturity | Security Total Return at Maturity | |

| 1,680.00 | 40.00% | $15.00 | 50.00% | |

| 1,560.00 | 30.00% | $13.75 | 37.50% | |

| 1,440.00 | 20.00% | $12.50 | 25.00% | |

| 1,320.00 | 10.00% | $11.25 | 12.50% | |

| 1,260.00 | 5.00% | $10.63 | 6.25% | |

| 1,200.00 | 0.00% | $10.00 | 0.00% | |

| 1,080.00 | -10.00% | $10.00 | 0.00% | |

| 1,020.00 | -15.00% | $10.00 | 0.00% | |

| 960.00 | -20.00% | $10.00 | 0.00% | |

| 900.00 | -25.00% | $10.00 | 0.00% | |

| 840.00 | -30.00% | $7.00 | -30.00% | |

| 720.00 | -40.00% | $6.00 | -40.00% | |

| 600.00 | -50.00% | $5.00 | -50.00% | |

| 480.00 | -60.00% | $4.00 | -60.00% | |

| 360.00 | -70.00% | $3.00 | -70.00% | |

| 240.00 | -80.00% | $2.00 | -80.00% | |

| 120.00 | -90.00% | $1.00 | -90.00% | |

| 0.00 | -100.00% | $0.00 | -100.00% | |

| P-8 |

Information About the Underlying

All disclosures contained in this document regarding the underlying are derived from publicly available information. BNS has not conducted any independent review or due diligence of any publicly available information with respect to the underlying. You should make your own investigation into the underlying.

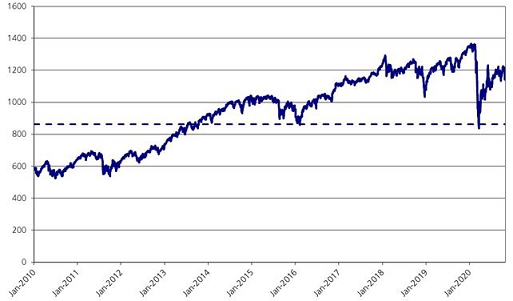

Included on the following pages is a brief description of the underlying. This information has been obtained from publicly available sources. Set forth below is a graph that illustrates the past performance for the underlying. The information below is for the period indicated. We obtained the past performance information set forth below from Bloomberg Professional® service (“Bloomberg”) without independent verification. You should not take the historical levels of the underlying as an indication of future performance.

Russell 1000® Value Index

General

The Russell 1000® Value Index measures the capitalization-weighted price performance of the stocks included in the Russell 1000® Index that are determined by FTSE Russell to be value oriented, with lower price-to-book ratios and lower forecasted and historical growth. The Russell 1000® Index tracks 1,000 U.S. large-capitalization stocks listed on eligible U.S. exchanges (the “Russell 1000 Stocks”).

Selection of Constituent Stocks of the Russell 1000® Value Index

The Russell 1000® Value Index is a sub-index of the Russell 3000® Index. To be eligible for inclusion in the Russell 3000® Index, and, consequently, the Russell 1000® Value Index, a company’s stocks must be listed on the last trading day of May of a given year and FTSE Russell must have access to documentation verifying the company’s eligibility for inclusion. Eligible initial public offerings are added to Russell U.S. Indices at the end of each calendar quarter, based on total market capitalization rankings within the market-adjusted capitalization breaks established during the most recent reconstitution. To be added to any Russell U.S. index during a quarter outside of reconstitution, initial public offerings must meet additional eligibility criteria.

A company is included in the U.S. equity markets and is eligible for inclusion in the Russell 3000® Index, and consequently, the Russell 1000® Value Index, if that company incorporates in, has its headquarters in and also trades with the highest liquidity (as defined by a two-year average daily dollar trading volume from all exchanges) in the United States or its territories. If a company satisfies any one of these criteria and the primary location of that company’s assets or its revenue, based on an average of two years of assets or revenues data, is also in the United States, that company will also be considered part of the U.S. equity market. In addition, if there is insufficient information to assign a company to the U.S. equity markets based on its assets or revenue, the company may nonetheless be assigned to the U.S. equity markets if the headquarters of the company is located in certain “benefit-driven incorporation countries,” or “BDIs,” and that company’s most liquid stock exchange is also in the United States. The BDI countries are Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, Belize, Bermuda, Bonaire, British Virgin Islands, Cayman Islands, Channel Islands, Cook Islands, Curacao, Gibraltar, Guernsey, Isle of Man, Jersey, Liberia, Marshall Islands, Panama, Saba, Sint Eustatius, Sint Maarten and Turks and Caicos Islands. ADRs and ADSs are not eligible for inclusion in the Russell 1000® Value Index.

Exclusions from the Russell 1000® Value Index

FTSE Russell specifically excludes the following companies and securities from the Russell 1000® Value Index: (i) preferred and convertible preferred stock, redeemable shares, participating preferred stock, warrants, rights, depositary receipts, installment receipts and trust receipts; (ii) royalty trusts, U.S. limited liability companies, closed-end investment companies (companies that are required to report Acquired Fund Fees and Expenses, as defined by the SEC, including business development companies), blank check companies, special purpose acquisition companies and limited partnerships; (iii) companies with a total market capitalization less than $30 million; (iv) companies with only a small portion of their shares available in the marketplace (companies with 5% or less float); (v) bulletin board, pink sheets or over-the-counter traded securities; (vi) companies that generate, or have historically generated, unrelated business taxable income and have not taken steps to block their unrelated business taxable income to equity holders; and (vii) exchange traded funds and mutual funds.

Initial List of Eligible Securities

The primary criterion FTSE Russell uses to determine the initial list of securities eligible for the Russell 3000® Index and consequently, the Russell 1000® Value Index, is total market capitalization, which is calculated by multiplying the total outstanding shares for a company times the market price as of the “rank day” (typically the last trading day in May but a confirmed timetable is announced each spring) in May. All common stock share classes are combined in determining market capitalization. If multiple share classes have been combined, the pricing vehicle will be designated as the share class with the highest two-year trading volume as of the rank day in May. In cases where the common stock share classes act independently of each other (e.g., tracking stocks), each class is considered for inclusion separately. Stocks must have a closing price at or above $1.00 on their primary exchange on the last trading day of May of each year to be eligible for inclusion in the Russell 1000® Value Index. In order to reduce unnecessary turnover, if an existing member’s closing price is less than $1.00 on the last trading day of May, it will be considered eligible if the average of the daily closing prices from their primary exchange during the month of May is equal to or greater than $1.00.

Annual Reconstitution

The Russell 1000® Value Index is reconstituted annually by FTSE Russell to reflect changes in the marketplace. The list of companies is ranked based on total market capitalization on the rank day in May, with the actual reconstitution effective on the first trading day following the final Friday of June each year, unless the final Friday in June is the 29th or 30th, in which case reconstitution will be effective on the preceding Friday. Changes in the constituents are preannounced and subject to change if any corporate activity occurs or if any new information is received prior to release.

| P-9 |

Russell 1000® Value Index Calculation and Capitalization Adjustments

As a capitalization-weighted index, the Russell 1000® Value Index reflects changes in the capitalization, or market value, of the underlier stocks relative to the capitalization on a base date. This discussion describes the “price return” calculation of the Russell 1000® Value Index. The current Russell 1000® Value Index value is the compounded result of the cumulative daily (or monthly) return percentages, where the starting value of the Russell 1000® Value Index is equal to the base value (100) and base date (December 31, 1978). Returns between any two dates can then be derived by dividing the ending period index value (IV1) by the beginning period (IV0) index value, so that the return equals [(IV1 / IV0) – 1] * 100. The ending period index value, for purposes of calculating the Index value, on any date is determined by adding the market values of the underlier stocks, which are derived by multiplying the primary closing price of each stock by the number of available shares, to arrive at the total market capitalization of the 2,000 stocks.

Constituent stocks of the Russell 1000® Value Index are weighted in the Russell 1000® Value Index by their free-float market capitalization, which is calculated by multiplying the primary closing price by the number of free-float shares. Free-float shares are shares that are available to the public for purchase as determined by FTSE Russell. FTSE Russell determines shares available to the public for purchase based on information recorded in corporate filings with the SEC and other reliable sources in the event of missing or questionable data. FTSE Russell removes the following types of shares from total market capitalization to arrive at free-float market capitalization:

Officers and directors’ holdings — shares held by officers and directors.

Large private holdings — shares held by an individual, a group of individuals acting together or a corporation (that is included in the Russell 1000® Value Index) if such holdings constitute 10% or more of the shares outstanding.

Institutional holdings — shares held by investment companies, partnerships, insurance companies, mutual funds or banks are excluded if the holding is greater than 30%. If a firm has a direct relationship to the company, such as board representation, they are considered strategic holdings and excluded regardless of the size of holding per the officers and directors’ exclusion rule.

Publicly listed companies — shares held by publicly listed companies. Holdings considered as Institutional will be considered as available unless the 30% threshold is surpassed, regardless of listing.

ESOP or LESOP shares — shares held by employee stock ownership plans and leveraged employee stock ownership plans.

Initial public offering lock-ups — shares locked-up during an initial public offering are not available to the public and will be excluded from the market value at the time the initial public offering enters the Russell 1000® Value Index.

Government holdings — shareholdings listed as “government of.” Shares held by government investment boards and/or investment arms are treated like shares held by large private shareholdings and are excluded if the number of shares is greater than 10% of outstanding shares. Shares held by a government pension plan are considered institutional holdings and will not be excluded unless the holding is greater than 30%.

Corporate Actions Affecting the Russell 1000® Value Index

FTSE Russell adjusts the Russell 1000® Value Index on a daily basis in response to certain corporate actions and events. Therefore, a company’s membership in the Russell 1000® Value Index and its weight in the Russell 1000® Value Index can be impacted by these corporate actions. The adjustment is applied based on sources of public information, including press releases and SEC filings. Prior to the completion of a corporate action or event, FTSE Russell estimates the effective date. FTSE Russell will then adjust the anticipated effective date based on public information until the date is considered final. Depending on the time on a given day that an action is determined to be final, FTSE Russell will generally either (1) apply the action before the open on the ex-date or (2) apply the action after providing appropriate notice to its clients regarding the impact of the action and the effective date. FTSE Russell applies the following methodology guidelines when adjusting the Russell 1000® Value Index in response to corporate actions and events:

“No Replacement” Rule — Securities that are deleted from the Russell 1000® Value Index between reconstitution dates, for any reason (e.g., mergers, acquisitions or other similar corporate activity) are not replaced. Thus, the number of securities in the Russell 1000® Value Index over the past year will fluctuate according to corporate activity.

Mergers and Acquisitions — Between constituents: When mergers and acquisitions take place between companies that are both constituents of a Russell index, the target company is deleted and its market capitalization simultaneously moves to the acquiring company’s stock. In the absence of an active market for the target company at the time of index implementation, the target company will be deleted from the Russell 1000® Value Index using a synthetic price based on the offer terms. Given sufficient market hours after confirmation, FTSE Russell effects this action after the close on the last day of trade of the target company, or at an appropriate time once the transaction has been deemed to be final (implementation may occur prior to the last day of trade to avoid potential delays with the associated synthetic pricing).

Between a constituent and a non-constituent: If the target company is a member of the Russell 1000® Value Index, it is deleted from the Russell 1000® Value Index after FTSE Russell determines that the action or event is final. If the acquiring company is a member of the Russell 1000® Value Index, its shares are adjusted by adding the target company’s market capitalization (if the increase in shares is greater than 5%). If the target company is not a member of a Russell index shares of the acquiring company will remain unchanged. If a non-index member acquires an index member, the acquired member will be deleted from the Russell 1000® Value Index once the action is final.

Reincorporation — Members of the Russell 1000® Value Index that reincorporate to another country and continue to trade in the United States and companies that reincorporate to the United States during the year are analyzed for assignment by FTSE Russell during annual reconstitution. Members that reincorporate in another country and no longer trade in the United States are immediately deleted from the Russell U.S. indices.

| P-10 |

Reclassification of shares (pricing vehicles) — Pricing vehicles will not be assessed or changed outside of a reconstitution period unless the existing class ceases to exist. In the event of extenuating circumstances signaling a necessary pricing vehicle change, proper notification will be made.

Rights Offerings — Rights offered to shareholders are reflected in the Russell 1000® Value Index only if the subscription price of the rights is at a discount to the market price. Provided that FTSE Russell has been alerted to the rights offer prior to the ex-date, it will adjust the price of the stock for the value of the rights and increased shares according to the terms of the offering before the open on the ex-date. Where the Rights Issue / Entitlement offer subscription price remains unconfirmed on the ex-date, an estimated price will be used. FTSE Russell will estimate the subscription price using the value being raised and the offer terms. This treatment applies for both transferable and non-transferable rights. Rights issued as part of a poison pill arrangement or entitlements that give shareholders the right to purchase ineligible securities such as convertible debt are excluded from this treatment.

Changes to Shares Outstanding — Changes to shares outstanding due to buybacks (including Dutch auctions), secondary offerings, and other potential changes are generally updated on the last Friday of June (unless the last Friday occurs on the 29th or 30th, when reconstitution will occur on the Friday prior). FTSE Russell only applies month-end changes to available shares outstanding if the cumulative change in the number of shares outstanding is greater than 5%. Share changes that are confirmed by their vendors and verified by FTSE Russell by use of an SEC filing at least six days prior to month end are implemented and communicated to clients who subscribe at the Premier level five trading days prior to month end. The float factor last determined (either at reconstitution or due to a corporate action implementation) is applied to the new shares. No such changes are made in June due to the most recent annual reconstitution.

Spin-offs — Spin-offs will be valued using an estimate prior to ex-date. When a spin-off results in an eligible security type being listed on an eligible exchange, the spin-off company will remain in the Russell 1000® Value Index until the next index review, regardless of size. When an index constituent spins off an ineligible security type or the spin-off company is listed on an ineligible exchange only, the security will be added to the Russell 1000® Value Index on the ex-date and subsequently removed with notice at market price once “regular way” trade has commenced.

Tender Offers — A company acquired as a result of a cash tender offer is removed if (i) Where offer acceptances are below 90%, there is reason to believe that the remaining free float is under 5% based on information available at the time; or (ii) Following completion of the offer the acquirer has stated intent to finalize the acquisition via a short-form merger, squeeze-out, top-up option or any other compulsory mechanism; or (iii) Offer acceptances reach 90% (initial, extension or subsequent); and (iv) Shareholders have validly tendered and the shares have been irrevocably accepted for payment; and all pertinent offer conditions have been reasonably met and the acquirer has not explicitly stated that it does not intend to acquire the remaining shares.

Voluntary Exchange Offers — A publicly traded company may offer to exchange or split-off some or all of its ownership in a separate publicly traded company. Once the offer expires, FTSE Russell will decrease the available shares in the offering company, and increase the available shares of ‘split-off’ company, based on the results of the offering. FTSE Russell will effect this change based on, but not limited to, preliminary results, company filings, and exchange notices.

Bankruptcy and Voluntary Liquidations — Companies that file for a Chapter 7 liquidation bankruptcy or have filed a liquidation plan will be removed from the Russell 1000® Value Index at the time of the bankruptcy filing; whereas companies filing for a Chapter 11 reorganization bankruptcy will remain a member of the Russell 1000® Value Index, unless the company is de-listed from the primary exchange, in which case normal de-listing rules apply. If a company files for bankruptcy, is delisted and it can be confirmed that it will not trade OTC, FTSE Russell may remove the stock at a nominal price of $0.0001.

Stock Distributions — A price adjustment for stock distributions is applied on the ex-date of the distribution. When the number of shares for the distribution is fixed, FTSE Russell increases the number of shares on the ex-date. When the number of shares is an undetermined amount based on future earnings and profits, FTSE Russell increases the number of shares on the pay-date.

Dividends — FTSE Russell includes gross dividends in the daily total return calculation of the Russell 1000® Value Index on the basis of their ex-dates. If a dividend is payable in stock and cash and the number of shares to be issued cannot be determined by the ex-date, the dividend is treated as all cash. Regular cash dividends are reinvested across the Russell 1000® Value Index at the close on the dividend ex-date, while special cash dividends are subtracted from the price of the stock before the open on the ex-date.

Halted Securities — Halted securities are not removed from the Russell 1000® Value Index until the time they are actually delisted from the exchange. If a security is halted and declared bankrupt without any indication of compensation to shareholders, the last traded price will be adjusted down to zero value and it will subsequently be removed from the Russell 1000® Value Index with T+2 notice. In all other cases, the security will continue to be included in the Russell 1000® Value Index for a period of up to 20 business days at its last traded price. If the security continues to be suspended at the end of a period of up to 20 business days, FTSE Russell will review it to decide whether to remove it at zero value, repeating such review as applicable at successive 20 business day intervals until trading recommences or specified time limits expire and the security is removed.

License Agreement

FTSE Russell has entered into a non-exclusive license agreement with us, granting us, and certain of our affiliates, in exchange for a fee, permission to use the Index in connection with the offer and sale of the Securities. We are not affiliated with FTSE Russell; the only relationship between FTSE Russell and us is the licensing of the use of the Russell 1000® Value Index (a trademark of FTSE Russell) and trademarks relating to the Index. We do not accept any responsibility for the calculation, maintenance or publication of the Index or any successor index.

The Securities are not sponsored, endorsed, sold or promoted by FTSE Russell. FTSE Russell makes no representation or warranty, express or implied, to the owners of the Securities or any member of the public regarding the advisability of investing in securities generally or in the Securities particularly or the ability of the Index to track general stock market performance or a segment of the same.

| P-11 |

FTSE Russell’s publication of the Index in no way suggests or implies an opinion by FTSE Russell as to the advisability of investment in any or all of the securities upon which the Index is based. FTSE Russell’s only relationship to us is the licensing of certain trademarks and trade names of FTSE Russell and of the Index which is determined, composed and calculated by FTSE Russell without regard to us or the Securities. FTSE Russell is not responsible for and has not reviewed the Securities nor any associated literature or publications and FTSE Russell makes no representation or warranty express or implied as to their accuracy or completeness, or otherwise. FTSE Russell reserves the right, at any time and without notice, to alter, amend, terminate or in any way change the Index. FTSE Russell has no obligation or liability in connection with the administration, marketing or trading of the Securities.

FTSE RUSSELL DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE RUSSELL 1000® VALUE INDEX OR ANY DATA INCLUDED THEREIN AND FTSE RUSSELL SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. FTSE RUSSELL MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY US, INVESTORS, HOLDERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR ANY DATA INCLUDED THEREIN. FTSE RUSSELL MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL FTSE RUSSELL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

| P-12 |

Historical Information

The graph below illustrates the performance of the underlying for the period from January 1, 2010 through October 30, 2020, based on the daily closing levels as reported by Bloomberg, without independent verification. BNS has not conducted any independent review or due diligence of any publicly available information obtained from Bloomberg. The closing level of the underlying on October 30, 2020 was 1,150.455 (the “hypothetical initial level”). The dotted line represents the hypothetical downside threshold of 862.841, which is equal to 75% of the hypothetical initial level. The actual initial level and downside threshold will be determined on the trade date. Past performance of the underlying is not indicative of the future performance of the underlying during the term of the Securities.

| P-13 |

What Are the Tax Consequences of the Securities?

The U.S. federal income tax consequences of your investment in the Securities are uncertain. There are no statutory provisions, regulations, published rulings or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as the Securities. Some of these tax consequences are summarized below, but we urge you to read the more detailed discussion in “Material U.S. Federal Income Tax Consequences”, in the accompanying product prospectus supplement and to discuss the tax consequences of your particular situation with your tax advisor. This discussion is based upon the Internal Revenue Code of 1986, as amended (the “Code”), final, temporary and proposed U.S. Treasury Department (the “Treasury”) regulations, rulings and decisions, in each case, as available and in effect as of the date hereof, all of which are subject to change, possibly with retroactive effect. Tax consequences under state, local and non-U.S. laws are not addressed herein. No ruling from the U.S. Internal Revenue Service (the “IRS”) has been sought as to the U.S. federal income tax consequences of your investment in the Securities, and the following discussion is not binding on the IRS.