| Filed Pursuant to Rule 424(b)(2) | |

| Registration No. 333-228614 | |

Pricing Supplement dated December 30, 2020 to the

Prospectus dated December 26, 2018,

Prospectus Supplement dated November 19, 2020 and Product Prospectus Supplement (Equity Securities Linked Notes and Exchange Traded Fund Linked Notes, Series A) dated November 19, 2020

The Bank of Nova Scotia

$ 866,000

Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities

Linked to The Technology Select Sector SPDR® Fund Due January 7, 2025

The Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities, Linked to The Technology Select Sector SPDR® Fund Due January 7, 2025 (the “Securities”) offered hereunder are senior unsecured obligations of the Bank and are subject to investment risks including possible loss of the Principal Amount invested due to the negative performance of the Reference Asset and the credit risk of the Bank. As used in this pricing supplement, the “Bank,” “we,” “us” or “our” refers to The Bank of Nova Scotia.

The Securities will not be listed on any securities exchange or automated quotation system.

The Securities do not bear interest. If the Fund Closing Price of The Technology Select Sector SPDR® Fund (which we refer to as the “Reference Asset”) on any Call Date (including the Final Calculation Day) is greater than or equal to the Starting Price, we will automatically call the Securities for the Principal Amount plus the Call Premium applicable to that Call Date. If the Securities are not automatically called on any Call Date, the amount that you will be paid on your Securities at maturity will be based on the performance of the Reference Asset as measured from the Pricing Date to and including the Final Calculation Day. If the Securities are not automatically called and the Percentage Change of the Reference Asset is below -10.00% (the Ending Price is less than the Starting Price by more than 10.00%), you will lose a portion of your investment in the Securities and may lose up to 90.00% of your investment depending on the performance of the Reference Asset. Additionally, any positive return on the Securities will be limited to the applicable Call Premium, even if the Fund Closing Price of the Reference Asset on the applicable Call Date significantly exceeds the Starting Price. You will not participate in any appreciation of the Reference Asset beyond the applicable fixed Call Premium. In addition, any payment on your Securities is subject to the creditworthiness of The Bank of Nova Scotia.

The Call Dates and the Call Premium applicable to each Call Date are set forth in the table below:

Call Date | Call Premium |

| January 5, 2022 | 6.10% of the Principal Amount |

| January 5, 2023 | 12.20% of the Principal Amount |

| January 5, 2024 | 18.30% of the Principal Amount |

| December 30, 2024 (which is also the Final Calculation Day) | 24.40% of the Principal Amount |

If the Securities are not automatically called on any Call Date (including the Final Calculation Day), to determine your payment at maturity, we will first calculate the percentage decrease in the Ending Price (determined on the Final Calculation Day, subject to adjustment) from the Starting Price (which is the Fund Closing Price of the Reference Asset on the Pricing Date), which we refer to as the Percentage Change. If the Securities are not automatically called, the percentage change will reflect a negative return based on the decrease in the price of the Reference Asset over the term of the Securities. If the Securities are not automatically called, at maturity, for each $1,000 Principal Amount of your Securities:

| ● | if the Ending Price is less than the Starting Price but not by more than 10.00% (the Percentage Change is negative but not below -10.00%), you will receive an amount in cash equal to $1,000; or |

| ● | if the Ending Price is less than the Starting Price by more than 10.00% (the Percentage Change is negative and below -10.00%), you will receive less than $1,000 and have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00%. In this case, you will receive an amount in cash equal to the sum of: (1) $1,000 plus (2) the product of (i) $1,000 times (ii) the sum of the Percentage Change plus 10.00%. |

You could lose up to 90.00% of your investment in the Securities. A percentage decrease of more than 10.00% between the Starting Price and the Ending Price will reduce the payment you will receive at maturity below the Principal Amount of your Securities.

The difference between the estimated value of your Securities and the Original Offering Price reflects costs that the Bank expects to incur and profits that the Bank expects to realize in connection with hedging activities related to the Securities. These costs and profits will likely reduce the secondary market price, if any, at which the Underwriters are willing to purchase the Securities. The Underwriters may, but are not obligated to, purchase any Securities. As a result, you may experience an immediate and substantial decline in the market value of your Securities on the Trade Date and you may lose a substantial portion of your initial investment. The Bank's profit in relation to the Securities will vary based on the difference between (i) the amounts received by the Bank in connection with the issuance and the reinvestment return received by the Bank in connection with such amounts and (ii) the costs incurred by the Bank in connection with the issuance of the Securities and the hedging transactions it effects. The Bank's affiliates or the Underwriters’ affiliates may also realize a profit from a hedging transaction with our affiliate and/or an affiliate of Wells Fargo Securities, LLC (“WFS”) in connection with your Securities as described under “The Bank’s Estimated Value of the Securities”.

The return on your Securities will relate to the price return of the Reference Asset and will not include any dividends or other distributions paid on the Reference Asset. The Securities are derivative products based on the performance of the Reference Asset. The Securities do not constitute a direct investment in the Reference Asset or any of the shares, units or other securities represented by the Reference Asset. By acquiring Securities, you will not have any direct economic or other interest in, claim or entitlement to, or any legal or beneficial ownership of the Reference Asset or any such share, unit or security and will not have any rights as a shareholder, unitholder or other security holder of any of the issuer of the Reference Asset or any other such issuers including, without limitation, any voting rights or rights to receive dividends or other distributions.

Neither the United States Securities and Exchange Commission (“SEC”), nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or the adequacy of this document, the accompanying prospectus, prospectus supplement or product prospectus supplement. Any representation to the contrary is a criminal offense.

The Securities are not insured by the Canada Deposit Insurance Corporation pursuant to the Canada Deposit Insurance Corporation Act (the “CDIC Act”) or the U.S. Federal Deposit Insurance Corporation or any other governmental agency of Canada, the United States or any other jurisdiction.

Scotia Capital (USA) Inc., our affiliate, has agreed to purchase the Securities from us for distribution to other registered broker dealers including WFS. Scotia Capital (USA) Inc. or any of its affiliates or agents may use this pricing supplement in market-making transactions in Securities after their initial sale. If you are buying Securities from Scotia Capital (USA) Inc. or another of its affiliates or agents, this pricing supplement may be used in a market-making transaction. See “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement and on page PS-31 of the accompanying product prospectus supplement.

| Per Security | Total | |

Price to public1 | 100.00% | $866,000.00 |

Underwriting commissions2 | 2.825% | $24,464.50 |

Proceeds to The Bank of Nova Scotia3 | 97.175% | $841,535.50 |

The Securities have complex features and investment in the Securities involves certain risks. You should refer to “Additional Risks” beginning on page P-17 in this pricing supplement and “Additional Risk Factors Specific to the Notes” beginning on page PS-5 of the accompanying product prospectus supplement and “Risk Factors” beginning on page S-2 of the accompanying prospectus supplement and on page 6 of the accompanying prospectus.

We will deliver the Securities in book-entry form through the facilities of The Depository Trust Company (“DTC”) on the Original Issue Date against payment in immediately available funds.

Scotia Capital (USA) Inc. | Wells Fargo Securities, LLC |

1 The estimated value of the Securities as determined by the Bank as of the pricing date is $947.89 (94.789%) per $1,000 Principal Amount of the Securities. See “The Bank's Estimated Value of the Securities” in this pricing supplement for additional information.

2 Scotia Capital (USA) Inc. or one of our affiliates has agreed to purchase the aggregate Principal Amount of the Securities and as part of the distribution, has agreed to sell the Securities to WFS at a discount of $28.25 (2.825%) per $1,000 Principal Amount of the Securities. WFS will provide selected dealers, which may include Wells Fargo Advisors (“WFA”, the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), with a selling concession of $17.50 (1.75%) per $1,000 Principal Amount of the Securities, and WFA will receive a distribution expense fee of $0.75 (0.075%) per $1,000 Principal Amount of the Securities for Securities sold by WFA. In addition, in respect of certain Securities sold in this offering, we will also pay a fee of $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. See “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement.

3 Excludes any profits from hedging. For additional considerations relating to hedging activities see “Additional Risks — Risks Relating to Estimated Value and Liquidity — The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices” in this pricing supplement.

Summary

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, and the accompanying prospectus, prospectus supplement, and product prospectus supplement. See “Additional Terms of the Securities” in this pricing supplement

| Issuer: | The Bank of Nova Scotia (the “Bank”) | |

| Issue: | Senior Note Program, Series A | |

| CUSIP/ISIN: | 064159F27 / US064159F276 | |

| Type of Securities: | Market Linked Securities – Auto-Callable with Fixed Percentage Buffered Downside, Principal at Risk Securities | |

| Reference Asset: | The Technology Select Sector SPDR® Fund (Bloomberg Ticker: XLK) | |

Minimum Investment and Denominations: | $1,000 and integral multiples of $1,000 in excess thereof | |

| Principal Amount: | $1,000 per Security | |

| Original Offering Price: | 100.00% of the Principal Amount of each Security | |

| Currency: | U.S. Dollars | |

| Pricing Date: | December 30, 2020 | |

| Trade Date: | December 30, 2020 | |

| Original Issue Date: | January 5, 2021 Delivery of the Securities will be made against payment therefor on the 3rd Business Day following the Trade Date (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), trades in the secondary market generally are required to settle in 2 Business Days (T+2), unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Securities on the Trade Date will be required, by virtue of the fact that each Security initially will settle in 3 Business Days (T+3), to specify alternative settlement arrangements to prevent a failed settlement. | |

| Maturity Date: | January 7, 2025 or, if such day is not a Business Day, the next succeeding Business Day. If the scheduled Final Calculation Day is not a Trading Day or if a market disruption event occurs or is continuing on the day that would otherwise be the Final Calculation Day so that the Final Calculation Day as postponed falls less than two Business Days prior to the scheduled Maturity Date, the Maturity Date will be postponed to the second Business Day following the Final Calculation Day as postponed. | |

| Final Calculation Day: | December 30, 2024 or, if such day is not a Trading Day, the next succeeding Trading Day. The Final Calculation Day is also subject to postponement due to the occurrence of a market disruption event. See “—Postponement of a Calculation Day” herein. | |

| Trading Day: | A “Trading Day” with respect to the Reference Asset means a day, as determined by the Calculation Agent, on which the relevant exchange and each related futures or options exchange with respect to the Reference Asset or any successor thereto, if applicable, are scheduled to be open for trading for their respective regular trading sessions. | |

P-2

| Principal at Risk: | You may lose a substantial portion of your initial investment at maturity if the Securities are not automatically called and there is a percentage decrease from the Starting Price to the Ending Price of more than 10.00%. |

Automatic Call Feature: | If the Fund Closing Price of the Reference Asset on any Call Date (including the Final Calculation Day) is greater than or equal to the Starting Price, the Securities will be automatically called, and on the related Call Settlement Date you will be entitled to receive a cash payment per Security in U.S. dollars equal to the Principal Amount per Security plus the Call Premium applicable to the relevant Call Date. The last Call Date is the Final Calculation Day, and payment upon an automatic call on the Final Calculation Day, if applicable, will be made on the Maturity Date. |

| Any positive return on the Securities will be limited to the applicable Call Premium, even if the Fund Closing Price of the Reference Asset on the applicable Call Date significantly exceeds the Starting Price. You will not participate in any appreciation of the Reference Asset beyond the applicable fixed Call Premium. | |

| If the Securities are automatically called, they will cease to be outstanding on the related Call Settlement Date and you will have no further rights under the Securities after such Call Settlement Date. You will not receive any notice from us if the Securities are automatically called. |

Call Dates and Call Premiums: | Call Date | Call Premium | Payment per Security upon an Automatic Call |

January 5, 2022 | 6.10% of the Principal Amount | $1,061.00 | |

January 5, 2023 | 12.20% of the Principal Amount | $1,122.00 | |

January 5, 2024 | 18.30% of the Principal Amount | $1,183.00 | |

December 30, 2024* | 24.40% of the Principal Amount | $1,244.00 |

* December 30, 2024 is also the Final Calculation Day. | |

The Call Dates are subject to postponement for non-Trading Days and the occurrence of a market disruption event. See “—Postponement of a Calculation Day” herein. | |

| Call Settlement Date: | Five business days after the applicable Call Date (as each such Call Date may be postponed pursuant to “—Postponement of a Calculation Day” herein, if applicable); provided that the Call Settlement Date for the last Call Date is the Maturity Date |

| Fees and Expenses: | Scotia Capital (USA) Inc. or one of our affiliates has agreed to purchase the aggregate Principal Amount of the Securities and as part of the distribution, has agreed to sell the Securities to WFS at a discount of $28.25 (2.825%) per $1,000 Principal Amount of the Securities. WFS will provide selected dealers, which may include Wells Fargo Advisors (“WFA”), with a selling concession of $17.50 (1.75%) per $1,000 Principal Amount of the Securities, and WFA will receive a distribution expense fee of $0.75 (0.075%) per $1,000 Principal Amount of the Securities for Securities sold by WFA. In addition, in respect of certain Securities sold in this offering, we will pay a fee of $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. |

| The price at which you purchase the Securities includes costs that the Bank, the Underwriters or their respective affiliates expect to incur and profits that the Bank, the Underwriters or their respective affiliates expect to realize in connection with hedging activities related to the Securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any secondary market develops, for the Securities. As a result, you may experience an immediate and substantial decline in the market value of your Securities on the Pricing Date. See “Additional Risks — Risks Relating to Estimated Value and Liquidity — The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices” in this |

P-3

| pricing supplement. | |

| Redemption Amount at Maturity: | If the Securities are not automatically called on any Call Date (including the Final Calculation Day), the Redemption Amount at Maturity will be based on the performance of the Reference Asset and will be calculated as follows: |

● If the Ending Price is less than the Starting Price and greater than or equal to the Threshold Price, the Redemption Amount at Maturity will equal: $1,000; or ● If the Ending Price is less than the Threshold Price, the Redemption Amount at Maturity will equal: | |

| Principal Amount + [Principal Amount × (Percentage Change + Threshold Percentage)] | |

| In this case you will have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00%. Accordingly, you could lose up to 90.00% of your initial investment. | |

| Starting Price: | $129.83 |

| Ending Price: | The Fund Closing Price of the Reference Asset on the Final Calculation Day |

| Fund Closing Price: | The Fund Closing Price with respect to the Reference Asset on any Trading Day means the product of (i) the Closing Price of one share of the Reference Asset (or one unit of any other security for which a Fund Closing Price must be determined) on such Trading Day and (ii) the Adjustment Factor applicable to the Reference Asset on such Trading Day. |

| Closing Price: | The Closing Price for one share of the Reference Asset (or one unit of any other security for which a closing price must be determined) on any trading day means the official closing price on such day published by the principal United States securities exchange registered under the Exchange Act on which the Reference Asset (or any such other security) is listed or admitted to trading. In certain special circumstances, the Closing Price will be determined by the Calculation Agent. See “—Market Disruption Events” and “—Postponement of a Calculation Day” herein. |

| Adjustment Factor: | The Adjustment Factor means, with respect to a share of the Reference Asset (or one unit of any other security for which a Fund Closing Price must be determined), 1.0, subject to adjustment in the event of certain events affecting the shares of the Reference Asset. See “—Anti-dilution Adjustments Relating to the Reference Asset” herein. |

| Percentage Change: | The Percentage Change, expressed as a percentage, with respect to the Redemption Amount at Maturity, is calculated as follows: |

Ending Price – Starting Price Starting Price | |

| For the avoidance of doubt, because the Percentage Change will be calculated only if the Fund Closing Price of the Reference Asset is less than the Starting Price on each Call Date, including the Final Calculation Day, the Percentage Change will be a negative value. | |

| Threshold Price: | $116.847, which is equal to the Starting Price multiplied by the difference of 100.00% minus the Threshold Percentage. |

| Threshold Percentage: | 10.00% |

| Market Disruption Event: | For purposes of the Securities, the definition of “market disruption event” set forth in the product prospectus supplement is superseded. For purposes of the Securities, a “market |

P-4

| disruption event” means any of the following events as determined by the Calculation Agent in its sole discretion: | |

| | (A) The occurrence or existence of a material suspension of or limitation imposed on trading by the relevant exchange or otherwise relating to the shares (or other applicable securities) of the Reference Asset or any successor fund on the relevant exchange at any time during the one-hour period that ends at the close of trading on such day, whether by reason of movements in price exceeding limits permitted by such relevant exchange or otherwise. (B) The occurrence or existence of a material suspension of or limitation imposed on trading by any related futures or options exchange or otherwise in futures or options contracts relating to the shares (or other applicable securities) of the Reference Asset or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day, whether by reason of movements in price exceeding limits permitted by the related futures or options exchange or otherwise. (C) The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, shares (or other applicable securities) of the Reference Asset or any successor fund on the relevant exchange at any time during the one-hour period that ends at the close of trading on that day. (D) The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to shares (or other applicable securities) of the Reference Asset or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day. (E) The closure of the relevant exchange or any related futures or options exchange with respect to the Reference Asset or any successor fund prior to its scheduled closing time unless the earlier closing time is announced by the relevant exchange or related futures or options exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such relevant exchange or related futures or options exchange, as applicable, and (2) the submission deadline for orders to be entered into the relevant exchange or related futures or options exchange, as applicable, system for execution at the close of trading on that day. (F) The relevant exchange or any related futures or options exchange with respect to the Reference Asset or any successor fund fails to open for trading during its regular trading session. |

For purposes of determining whether a market disruption event has occurred: | |

(1) “close of trading” means the scheduled closing time of the relevant exchange with respect to the Reference Asset or any successor fund; and (2) the “scheduled closing time” of the relevant exchange or any related futures or options exchange on any trading day for the Reference Asset or any successor fund means the scheduled weekday closing time of such relevant exchange or related futures or options exchange on such trading day, without regard to after hours or any other trading outside the regular trading session hours. |

P-5

Anti-dilution Adjustments Relating to the Reference Asset: | The Calculation Agent will adjust the adjustment factor as specified below if any of the events specified below occurs with respect to the Reference Asset and the effective date or ex-dividend date, as applicable, for such event is after the pricing date and on or prior to the final calculation day. |

| The adjustments specified below do not cover all events that could affect the Reference Asset, and there may be other events that could affect the Reference Asset for which the Calculation Agent will not make any such adjustments, including, without limitation, an ordinary cash dividend. Nevertheless, the Calculation Agent may, in its sole discretion, make additional adjustments to any terms of the securities upon the occurrence of other events that affect or could potentially affect the market price of, or shareholder rights in, the Reference Asset, with a view to offsetting, to the extent practical, any such change, and preserving the relative investment risks of the securities. In addition, the Calculation Agent may, in its sole discretion, make adjustments or a series of adjustments that differ from those described herein if the Calculation Agent determines that such adjustments do not properly reflect the economic consequences of the events specified in this pricing supplement or would not preserve the relative investment risks of the securities. All determinations made by the Calculation Agent in making any adjustments to the terms of the securities, including adjustments that are in addition to, or that differ from, those described in this pricing supplement, will be made in good faith and a commercially reasonable manner, with the aim of ensuring an equitable result. In determining whether to make any adjustment to the terms of the securities, the Calculation Agent may consider any adjustment made by the Options Clearing Corporation or any other equity derivatives clearing organization on options contracts on the Reference Asset. | |

| For any event described below, the Calculation Agent will not be required to adjust the adjustment factor unless the adjustment would result in a change to the adjustment factor then in effect of at least 0.10%. The adjustment factor resulting from any adjustment will be rounded up or down, as appropriate, to the nearest one-hundred thousandth. | |

(A) Stock Splits and Reverse Stock Splits If a stock split or reverse stock split has occurred, then once such split has become effective, the adjustment factor will be adjusted to equal the product of the prior adjustment factor and the number of securities which a holder of one share (or other applicable security) of the Reference Asset before the effective date of such stock split or reverse stock split would have owned or been entitled to receive immediately following the applicable effective date. (B) Stock Dividends If a dividend or distribution of shares (or other applicable securities) to which the securities are linked has been made by the Reference Asset ratably to all holders of record of such shares (or other applicable security), then the adjustment factor will be adjusted on the ex-dividend date to equal the prior adjustment factor plus the product of the prior adjustment factor and the number of shares (or other applicable security) of the Reference Asset which a holder of one share (or other applicable security) of the Reference Asset before the ex-dividend date would have owned or been entitled to receive immediately following that date; provided, however, that no adjustment will be made for a distribution for which the number of securities of the Reference Asset paid or distributed is based on a fixed cash equivalent value. |

P-6

(C) Extraordinary Dividends If an extraordinary dividend (as defined below) has occurred, then the adjustment factor will be adjusted on the ex-dividend date to equal the product of the prior adjustment factor and a fraction, the numerator of which is the closing price per share (or other applicable security) of the Reference Asset on the trading day preceding the ex-dividend date, and the denominator of which is the amount by which the closing price per share (or other applicable security) of the Reference Asset on the trading day preceding the ex-dividend date exceeds the extraordinary dividend amount (as defined below). For purposes of determining whether an extraordinary dividend has occurred: (1) “extraordinary dividend” means any cash dividend or distribution (or portion thereof) that the Calculation Agent determines, in its sole discretion, is extraordinary or special; and (2) “extraordinary dividend amount” with respect to an extraordinary dividend for the securities of the Reference Asset will equal the amount per share (or other applicable security) of the Reference Asset of the applicable cash dividend or distribution that is attributable to the extraordinary dividend, as determined by the Calculation Agent in its sole discretion. A distribution on the securities of the Reference Asset described below under the section entitled “—Reorganization Events” herein that also constitutes an extraordinary dividend will only cause an adjustment pursuant to that “—Reorganization Events” section. (D) Other Distributions If the Reference Asset declares or makes a distribution to all holders of the shares (or other applicable security) of the Reference Asset of any non-cash assets, excluding dividends or distributions described under the section entitled “—Stock Dividends” herein, then the Calculation Agent may, in its sole discretion, make such adjustment (if any) to the adjustment factor as it deems appropriate in the circumstances. If the Calculation Agent determines to make an adjustment pursuant to this paragraph, it will do so with a view to offsetting, to the extent practical, any change in the economic position of a holder of the securities that results solely from the applicable event. (E) Reorganization Events If the Reference Asset, or any successor fund, is subject to a merger, combination, consolidation or statutory exchange of securities with another exchange traded fund, and the Reference Asset is not the surviving entity (a “reorganization event”), then, on or after the date of such event, the Calculation Agent shall, in its sole discretion, make an adjustment to the adjustment factor or the method of determining the payment at maturity, whether the securities are automatically called on any of the call dates or any other terms of the securities as the Calculation Agent determines appropriate to account for the economic effect on the securities of such event, and determine the effective date of that adjustment. If the Calculation Agent determines that no adjustment that it could make will produce a commercially reasonable result, then the Calculation Agent may deem such event a liquidation event (as defined below). |

P-7

| Liquidation Events: | If the Reference Asset is de-listed, liquidated or otherwise terminated (a “liquidation event”), and a successor or substitute exchange traded fund exists that the Calculation Agent determines, in its sole discretion, to be comparable to the Reference Asset, then, upon the Calculation Agent’s notification of that determination to the trustee and Wells Fargo, any subsequent Fund Closing Price for the Reference Asset will be determined by reference to the Fund Closing Price of such successor or substitute exchange traded fund (such exchange traded fund being referred to herein as a “successor fund”), with such adjustments as the Calculation Agent determines are appropriate to account for the economic effect of such substitution on holders of the securities. |

| If the Reference Asset undergoes a liquidation event prior to, and such liquidation event is continuing on, the date that any Fund Closing Price of the Reference Asset is to be determined and the Calculation Agent determines that no successor fund is available at such time, then the Calculation Agent will, in its discretion, calculate the Fund Closing Price for the Reference Asset on such date by a computation methodology that the Calculation Agent determines will as closely as reasonably possible replicate the Reference Asset, provided that if the Calculation Agent determines in its discretion that it is not practicable to replicate the Reference Asset (including but not limited to the instance in which the underlying index sponsor discontinues publication of the underlying index), then the Calculation Agent will calculate the Fund Closing Price for the Reference Asset in accordance with the formula last used to calculate such Fund Closing Price before such liquidation event, but using only those securities that were held by the Reference Asset immediately prior to such liquidation event without any rebalancing or substitution of such securities following such liquidation event. | |

| If a successor fund is selected or the Calculation Agent calculates the Fund Closing Price as a substitute for the Reference Asset, such successor fund or Fund Closing Price will be used as a substitute for the Reference Asset for all purposes, including for purposes of determining whether a market disruption event exists. Notwithstanding these alternative arrangements, a liquidation event with respect to the Reference Asset may adversely affect the value of the securities. | |

| If any event is both a reorganization event and a liquidation event, such event will be treated as a reorganization event for purposes of the securities unless the Calculation Agent makes the determination referenced in the last sentence of the section entitled “—Anti-dilution Adjustments—Reorganization Events” herein. | |

| Alternate Calculation: | If at any time the method of calculating the Reference Asset or a successor fund, or the underlying index, is changed in a material respect, or if the Reference Asset or a successor fund is in any other way modified so that the Reference Asset does not, in the opinion of the Calculation Agent, fairly represent the price of the securities of the Reference Asset or such successor fund had such changes or modifications not been made, then the Calculation Agent may, at the close of business in New York City on the date that any Fund Closing Price is to be determined, make such calculations and adjustments as, in the good faith judgment of the Calculation Agent, may be necessary in order to arrive at a closing price of the Reference Asset comparable to the Reference Asset or such successor fund, as the case may be, as if such changes or modifications had not been made, and calculate the Fund Closing Price and the payment at maturity and determine whether the securities are automatically called on any call date with reference to such adjusted closing price of the Reference Asset or such successor fund, as applicable. |

| Relevant Exchange: | The “relevant exchange” for the Reference Asset means the primary exchange or quotation system on which shares (or other applicable securities) of the Reference Asset are traded, as determined by the Calculation Agent. |

P-8

| Related Futures or Options Exchange: | The “related futures or options exchange” for the Reference Asset means each exchange or quotation system where trading has a material effect (as determined by the Calculation Agent) on the overall market for futures or options contracts relating to the Reference Asset. |

| Postponement of a Calculation Day: | The Call Dates (including the Final Calculation Day) are each referred to as a “calculation day” for purposes of postponement. If any calculation day is not a Trading Day, such calculation day will be postponed to the next succeeding Trading Day. |

| If a market disruption event occurs or is continuing on any calculation day, then such calculation day will be postponed to the first succeeding Trading Day on which a market disruption event has not occurred and is not continuing. If a market disruption event occurs or is continuing on each Trading Day to and including the eighth Trading Day following the originally scheduled calculation day, then that eighth Trading Day will be deemed to be the applicable calculation day. If a calculation day has been postponed eight Trading Days after the originally scheduled calculation day, then the Calculation Agent will determine the closing price of the Fund on such eighth trading day based on its good faith estimate of the value of the shares (or other applicable securities) of the Fund as of the close of trading on such eighth trading day. | |

Notwithstanding anything to the contrary in the accompanying product prospectus supplement, the Call Dates (including the Final Calculation Day) (each referred to in this section as a “calculation day”) will be postponed as set forth herein. | |

| Form of Securities: | Book-entry |

| Calculation Agent: | Scotia Capital Inc., an affiliate of the Bank |

| Underwriters: | Scotia Capital (USA) Inc. and Wells Fargo Securities, LLC |

| Status: | The Securities will constitute direct, senior, unsubordinated and unsecured obligations of the Bank ranking pari passu with all other direct, senior, unsecured and unsubordinated indebtedness of the Bank from time to time outstanding (except as otherwise prescribed by law). Holders will not have the benefit of any insurance under the provisions of the CDIC Act, the U.S. Federal Deposit Insurance Act or under any other deposit insurance regime. |

| Tax Redemption: | The Bank (or its successor) may redeem the Securities, in whole but not in part, at a redemption price determined by the Calculation Agent in a manner reasonably calculated to preserve your and our relative economic position, if it is determined that changes in tax laws or their interpretation will result in the Bank (or its successor) becoming obligated to pay additional amounts with respect to the Securities. See “Tax Redemption” in the accompanying product prospectus supplement. |

| Listing: | The Securities will not be listed on any securities exchange or automated quotation system |

| Use of Proceeds: | General corporate purposes |

| Clearance and Settlement: | The Depository Trust Company |

| Business Day: | New York and Toronto |

| Canadian Bail-in: | The Securities are not bail-inable debt securities under the CDIC Act |

Investing in the Securities involves significant risks. You may lose up to 90.00% of your principal amount. The downside market exposure to the Reference Asset is buffered only at maturity. Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of the Bank. If the Bank were to default on its payment obligations you may not receive any amounts owed to you under the Securities and you could lose your entire investment.

P-9

ADDITIONAL TERMS OF THE SECURITIES

You should read this pricing supplement together with the accompanying prospectus dated December 26, 2018, as supplemented by the accompanying prospectus supplement dated November 19, 2020 and the product prospectus supplement (Equity Securities Linked Notes and Exchange Traded Fund Linked Notes, Series A) dated November 19, 2020, relating to our Senior Note Program, Series A, of which these Securities are a part. Certain terms used but not defined in this pricing supplement will have the meanings given to them in the accompanying product prospectus supplement. In the event of any conflict, this pricing supplement will control. The Securities may vary from the terms described in the accompanying prospectus, prospectus supplement, and product prospectus supplement in several important ways. You should read this pricing supplement, including the documents incorporated herein, carefully.This pricing supplement, together with the documents listed below, contains the terms of the Securities and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Additional Risk Factors Specific to the Notes” in the accompanying product prospectus supplement, as the Securities involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Securities. You may access these documents on the SEC website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website at http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000009631):

Prospectus dated December 26, 2018:

Prospectus Supplement dated November 19, 2020:

Product Prospectus Supplement (Equity Securities Linked Notes and Exchange Traded Fund Linked Notes, Series A), dated November 19, 2020:

P-10

INVESTOR SUITABILITY

The Securities may be suitable for you if:| ● | You fully understand and accept the risks inherent in an investment in the Securities, including the risk of losing most of your initial investment |

| ● | You can tolerate a loss of up to 90.00% of your initial investment |

| ● | You believe that the Fund Closing Price of the Reference Asset will be greater than or equal to the Starting Price on one of the four Call Dates (including the Final Calculation Day) |

| ● | You seek the potential for a fixed return if the Reference Asset has appreciated at all as of any of the four Call Dates in lieu of full participation in any potential appreciation of the Reference Asset |

| ● | You understand that if the Fund Closing Price of the Reference Asset is less than the Starting Price on each of the four Call Dates (including the Final Calculation Day), you will not receive any positive return on your investment in the Securities, and that if the Fund Closing Price of the Reference Asset on the Final Calculation Day (i.e., the Ending Price) is less than the Starting Price by more than 10.00%, you will receive less, and possibly up to 90.00% less, than the Principal Amount at maturity |

| ● | You can tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the price of the Reference Asset |

| ● | You do not seek current income from your investment and are willing to forgo dividends paid on the shares of the Reference Asset |

| ● | You understand that the term of the Securities may be as short as approximately 12 months and that you will not receive a higher Call Premium payable with respect to a later Call Date if the Securities are called on an earlier Call Date |

| ● | You are willing to hold the Securities to maturity, a term of approximately 48 months, and accept that there may be little or no secondary market for the Securities |

| ● | You are willing to accept the risk of exposure to companies involved in the information technology sector in the U.S. equity markets |

| ● | You are willing to assume the credit risk of the Bank for all payments under the Securities, and understand that if the Bank defaults on its obligations you may not receive any amounts due to you, including any repayment of principal |

The Securities may not be suitable for you if:

| ● | You do not fully understand or are unwilling to accept the risks inherent in an investment in the Securities, including the risk of losing most of your initial investment |

| ● | You seek a security with a fixed term |

| ● | You require an investment designed to guarantee a full return of principal at maturity |

| ● | You cannot tolerate a loss of up to 90.00% of your initial investment |

| ● | You are unwilling to accept the risk that, if the Fund Closing Price of the Reference Asset is less than the Starting Price on each of the four Call Dates (including the Final Calculation Day), you will not receive any positive return on your investment in the Securities |

| ● | You are unwilling to purchase Securities with an estimated value as of the Pricing Date that is lower than the Principal Amount |

| ● | You seek exposure to the upside performance of the Reference Asset beyond the applicable Call Premiums |

| ● | You cannot tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the price of the Reference Asset |

| ● | You seek current income from your investment or prefer to receive dividends paid on the shares of the Reference Asset |

P-11

| ● | You are not willing to accept the risk of exposure to companies involved in the information technology sector in the U.S. equity markets |

| ● | You are unwilling to hold the Securities to maturity, a term of approximately 48 months, or you seek an investment for which there will be an active secondary market |

| ● | You are not willing to assume the credit risk of the Bank for all payments under the Securities |

| ● | You prefer the lower risk of fixed income investments with comparable maturities issued by companies with comparable credit ratings |

The investor suitability considerations identified above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should also review “Additional Risks” of this pricing supplement and the “Additional Risk Factors Specific to the Notes” of the accompanying product prospectus supplement for risks related to an investment in the Securities.

P-12

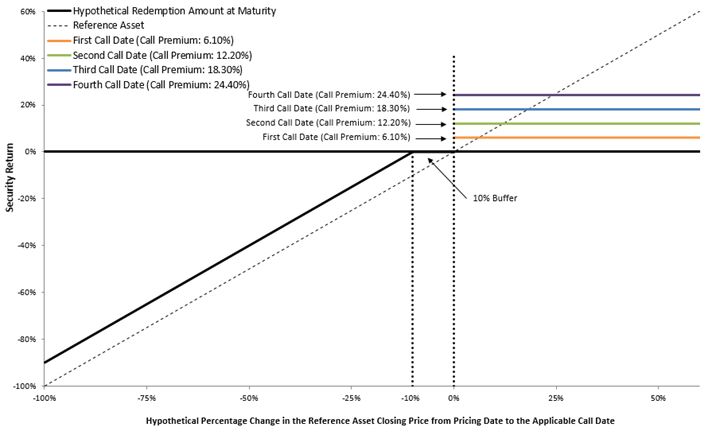

HYPOTHETICAL PAYOUT PROFILE

The following graph illustrates the potential payment on the Securities for a range of hypothetical percentage changes in the Fund Closing Price of the Reference Asset from the Pricing Date to the applicable Call Date (including the Final Calculation Day). The profile is based on the Call Premium of 6.10% for the first Call Date, 12.20% for the second Call Date, 18.30% for the third Call Date and 24.40% for the final Call Date and the Threshold Price, which is equal to 90.00% of the Starting Price. This profile has been prepared for purposes of illustration only. Your actual return will depend on (i) whether the Securities are automatically called; (ii) if the Securities are automatically called and the actual Call Date on which the Securities are called; (iii) if the Securities are not automatically called, the actual Ending Price of the Reference Asset; and (iv) whether you hold your Securities to maturity or earlier automatic call.

P-13

HYPOTHETICAL RETURNS

Hypothetical Returns if the Securities are CalledIf the Securities are automatically called:

Assuming that the Securities are automatically called, the following table illustrates, for each hypothetical Call Date on which the Securities are automatically called:

| ● | the payment per Security on the related Call Settlement Date; and |

| ● | the pre-tax total rate of return. |

Hypothetical Call Date on which Securities are automatically called | Payment per Security on related Call Settlement Date | Pre-tax total rate of return |

| 1st Call Date | $1,061.00 | 6.10% |

| 2nd Call Date | $1,122.00 | 12.20% |

| 3rd Call Date | $1,183.00 | 18.30% |

| 4th Call Date | $1,244.00 | 24.40% |

If the Securities are not automatically called:

Assuming that the Securities are not automatically called, the following table illustrates, for a range of hypothetical Ending Prices of the Reference Asset:

| ● | the hypothetical percentage change from the hypothetical Starting Price to the hypothetical Ending Price, assuming a hypothetical Starting Price of $100.00; |

| ● | the hypothetical Redemption Amount at Maturity per Security; and |

| ● | the hypothetical pre-tax total rate of return. |

Hypothetical Ending Price | Hypothetical percentage change from the hypothetical Starting Price to the hypothetical Ending Price | Hypothetical Redemption Amount at Maturity per Security | Hypothetical pre-tax total rate of return |

| $95.00 | -5.00% | $1,000.00 | 0.00% |

| $90.00 | -10.00% | $1,000.00 | 0.00% |

| $85.00 | -15.00% | $950.00 | -5.00% |

| $75.00 | -25.00% | $850.00 | -15.00% |

| $50.00 | -50.00% | $600.00 | -40.00% |

| $25.00 | -75.00% | $350.00 | -65.00% |

| $0.00 | -100.00% | $100.00 | -90.00% |

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. The actual amount you will receive upon an automatic call or at maturity and the resulting pre-tax rate of return will depend on (i) whether the Securities are automatically called; (ii) if the Securities are automatically called, the actual Call Date on which the Securities are called; (iii) if the Securities are not automatically called, the actual Ending Price of the Reference Asset; and (iv) whether you hold your Securities to maturity or earlier automatic call.

P-14

HYPOTHETICAL PAYMENTS AT MATURITY ON THE SECURITIES

If the Fund Closing Price of the Reference Asset is less than the Starting Price on each of the first three Call Dates, the Securities will not be automatically called prior to the Final Calculation Day, and you will receive a Redemption Amount at Maturity that will be greater than, equal to or less than the Principal Amount per Security, depending on the Ending Price (i.e., the Fund Closing Price of the Reference Asset on the Final Calculation Day). The examples set out below are included for illustration purposes only and are used to illustrate the calculation of the Redemption Amount at Maturity (rounded to two decimal places). These examples are not estimates or forecasts of the Starting Price, the Ending Price or the Fund Closing Price of the Reference Asset on any Call Date, on the Final Calculation Day or on any Trading Day prior to the Maturity Date. All examples assume that a holder purchased Securities with a Principal Amount of $1,000.00, a Threshold Percentage of 10.00% (the Threshold Price is 90.00% of the Starting Price), the Call Premium applicable to the Final Calculation Day of 24.40%, the Securities have not been automatically called on any of the first three Call Dates and that no market disruption event occurs on the Final Calculation Day. Amounts below may have been rounded for ease of analysis.Example 1. Ending Price is greater than the Starting Price, the Securities are automatically called on the Final Calculation Day and the Redemption Amount at Maturity is equal to the Principal Amount plus the applicable Call Premium:

Hypothetical Starting Price: $100.00

Hypothetical Ending Price: $150.00

Because the hypothetical Ending Price is greater than the hypothetical Starting Price, the Securities are automatically called on the Final Calculation Day and you will receive the Principal Amount of your Securities plus the Call Premium of 24.40% of the Principal Amount per Security. Even though the Reference Asset appreciated by 50.00% from its Starting Price to its Ending Price in this example, your return is limited to the Call Premium of 24.40% that is applicable to the Final Calculation Day.

On the Maturity Date, you would receive $1,244.00 per Security.

Example 2. Ending Price is less than the Starting Price but equal to or greater than the Threshold Price and the Redemption Amount at Maturity is equal to the Principal Amount:

Hypothetical Starting Price: $100.00

Hypothetical Ending Price: $90.00

Hypothetical Threshold Price: $90.00, which is 90.00% of the hypothetical Starting Price

Because the hypothetical Ending Price is less than the hypothetical Starting Price, but not by more than 10.00%, you would not lose any of the Principal Amount of your Securities.

On the Maturity Date, you would receive $1,000.00 per Security.

Example 3. Ending Price is less than the Threshold Price and the Redemption Amount at Maturity is less than the Principal Amount:

Hypothetical Starting Price: $100.00

Hypothetical Ending Price: $50.00

Hypothetical Threshold Price: $90.00, which is 90.00% of the hypothetical Starting Price

Because the hypothetical Ending Price is less than the hypothetical Starting Price by more than 10.00%, you would lose a portion of the Principal Amount of your Securities and receive a Redemption Amount at Maturity equal to:

$1,000 + [$1,000 × (-50.00% + 10.00%)] = $600.00

On the Maturity Date, you would receive $600.00 per Security, resulting in a loss of 40.00%.

Because the actual Starting Price and Threshold Price differ, and the Ending Price may differ, from the values assumed above, the results indicated above would be different; the actual Starting Price and Threshold Price are specified herein.

P-15

Accordingly, if the Securities are not automatically called on any Call Date and the Percentage Change is negative by more than -10.00%, meaning the percentage decline from the Starting Price to the Ending Price is greater than 10.00%, the Bank will pay you less than the full Principal Amount, resulting in a loss on your investment that is equal to the Percentage Change in excess of the Threshold Percentage. You may lose up to 90.00% of your initial investment.

Any payment on the Securities, including any repayment of principal, is subject to the creditworthiness of the Bank. If the Bank were to default on its payment obligations, you may not receive any amounts owed to you under the Securities and you could lose your entire investment.

P-16

ADDITIONAL RISKS

An investment in the Securities involves significant risks. In addition to the following risks included in this pricing supplement, we urge you to read “Additional Risk Factors Specific to the Notes” in the accompanying product prospectus supplement and “Risk Factors” in the accompanying prospectus supplement and the accompanying prospectus.You should understand the risks of investing in the Securities and should reach an investment decision only after careful consideration, with your advisors, of the suitability of the Securities in light of your particular financial circumstances and the information set forth in this pricing supplement and the accompanying prospectus, prospectus supplement and product prospectus supplement.

Risks Relating to Return Characteristics

Risk of Loss at Maturity

Any payment on the Securities at maturity depends on the Percentage Change of the Reference Asset. If the Securities are not automatically called, the Bank will only repay you the full Principal Amount of your Securities if the Percentage Change does not reflect a decrease in the Reference Asset of more than 10.00%. If the Percentage Change is negative by more than 10.00%, meaning the Ending Price is less than the Threshold Price, you will lose a significant portion of your initial investment in an amount equal to the Percentage Change in excess of the Threshold Percentage. Accordingly, if the Securities are not automatically called, you may lose up to 90.00% of your investment in the Securities if the percentage decline from the Starting Price to the Ending Price is greater than 10.00%.

The Downside Market Exposure to the Reference Asset is Buffered Only at Maturity

You should be willing to hold your Securities to maturity. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the price of the Reference Asset at such time is greater than or equal to the Threshold Price.

The Potential Return On The Securities Is Limited To The Call Premium

The potential return on the Securities is limited to the applicable Call Premium, regardless of the performance of the Reference Asset. The Reference Asset may appreciate by significantly more than the percentage represented by the applicable Call Premium from the Pricing Date through the applicable Call Date, in which case an investment in the Securities will underperform a hypothetical alternative investment providing a 1-to-1 return based on the performance of the Reference Asset. In addition, you will not receive the value of dividends or other distributions paid with respect to the Reference Asset. Furthermore, if the Securities are called on an earlier Call Date, you will receive a lower Call Premium than if the Securities were called on a later Call Date and, accordingly, you will not receive the highest potential Call Premium if the Securities are called on any of the first three Call Dates.

You Will Be Subject To Reinvestment Risk

If your Securities are automatically called prior to the Final Calculation Day, the term of the Securities may be reduced to as short as approximately 12 months. There is no guarantee that you would be able to reinvest the proceeds from an investment in the Securities at a comparable return for a similar level of risk in the event the Securities are automatically called prior to maturity.

No Interest.

The Securities do not bear interest and, accordingly, you will not receive any interest payments on the Securities.

The Securities Differ from Conventional Debt Instruments

The Securities are not conventional notes or debt instruments. The Securities do not provide you with interest payments prior to maturity as a conventional fixed-rate or floating-rate debt security with the same maturity would. The return that you will receive on the Securities, which could be negative, may be less than the return you could earn on other investments. If the Securities are not automatically called, your return on the securities will be zero or negative, and therefore will be less than the return you would earn if you bought a conventional senior interest bearing debt security of the Bank.

P-17

Holding the Securities is Not the Same as Holding the Reference Asset or the Reference Asset Constituent Stocks

Holding the Securities is not the same as holding the Reference Asset or the Reference Asset Constituent Stocks. As a holder of the Securities, you will not be entitled to the voting rights or rights to receive dividends or other distributions or other rights that holders of the Reference Asset or the Reference Asset Constituent Stocks would enjoy.

No Assurance that the Investment View Implicit in the Securities Will Be Successful

It is impossible to predict with certainty whether and the extent to which the price of the Reference Asset will rise or fall. There can be no assurance that the price of the Reference Asset will rise above the Starting Price as of any Call Date or that the percentage decline from the Starting Price to the Ending Price will not be greater than the Threshold Percentage. The Fund Closing Price of the Reference Asset and the Ending Price may be influenced by complex and interrelated political, economic, financial and other factors that affect the Reference Asset and the Reference Asset Constituent Stocks. You should be willing to accept the risks of the price performance of equity securities in general and the Reference Asset in particular, and the risk of losing some or most of your initial investment.

Furthermore, we cannot give you any assurance that the future performance of the Reference Asset will result in your receiving an amount greater than or equal to the Principal Amount of your Securities. Certain periods of historical performance of the Reference Asset or the Reference Asset Constituent Stocks would have resulted in you receiving less than the Principal Amount of your Securities if you had owned Securities with terms similar to these Securities in the past. See “Information Regarding The Reference Asset” in this pricing supplement for further information regarding the historical performance of the Reference Asset.

Risks Relating to Characteristics of the Reference Asset

The Securities are Subject to Market Risk

The return on the Securities is directly linked to the performance of the Reference Asset and indirectly linked to the value of the stocks (the “Reference Asset Constituent Stocks”) and other assets comprising the Reference Asset (collectively, the “Reference Asset Constituents”). The return on the Securities will depend on whether the Fund Closing Price of the Reference Asset on any Call Date is greater than or equal to the Starting Price which will result in an automatic call of the Securities and a return equal to the applicable Call Premium, and if not automatically called, the extent to which the Percentage Change is negative. The price of the Reference Asset can rise or fall sharply due to factors specific to the Reference Asset Constituents, as well as general market factors, such as general market volatility and levels, interest rates and economic and political conditions. Recently, the coronavirus infection has caused volatility in the global financial markets and a slowdown in the global economy. Coronavirus or any other communicable disease or infection may adversely affect the Reference Asset Constituents and, therefore, the Reference Asset.

The Securities are Subject to Risks Associated with Investments in the Information Technology Sector and Do Not Provide Diversified Exposure

The Reference Asset seeks to track the performance of the Technology Select Sector Index (the “Target Index”), which is comprised of the stocks of companies representing the information technology sector of the S&P 500® Index. All or substantially all of the Reference Asset Constituent Stocks are issued by companies whose primary line of business is directly associated with the information technology sector. Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a major effect on the value of the Reference Asset's investments. The value of stocks of information technology companies and companies that rely heavily on information technology is particularly vulnerable to rapid changes in information technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from non-U.S. competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on information technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability. Additionally, companies in the information technology sector may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. Because the Reference Asset Constituent Stocks are concentrated in the information technology sector, the Securities may be subject to greater volatility and be more adversely affected by a single economic, environmental, political or regulatory occurrence affecting these industries than an investment linked to a more broadly diversified group of securities.

P-18

Furthermore, the Reference Asset does not represent a direct investment in the information technology sector. As a result, the price of the Reference Asset may not perfectly correlate with the performance of the information technology sector and the price of the Reference Asset could decrease even if the performance of the information technology sector as a whole increases.

The Price of the Reference Asset May be Affected by the Performance of a Small Number of Companies

As of September 30, 2020 (as described below under “Information Regarding the Reference Asset”), approximately 43.96% of the Reference Asset’s portfolio consisted of the stocks of only two companies – Apple Inc. and Microsoft Corporation. The performance of the Reference Asset’s portfolio will be more significantly affected by the performance of these companies than would a more diversified pool of assets. Negative developments with respect to a small number of companies that account for a significant portion of the Reference Asset’s portfolio may have a significant adverse effect on the value of the Reference Asset and, accordingly, on the value of, and return on, your Securities.

Past Performance is Not Indicative of Future Performance

The actual performance of the Reference Asset over the term of the Securities, as well as the amount payable at maturity, may bear little relation to the historical performance of the Reference Asset or to the hypothetical return examples set forth elsewhere in this pricing supplement. We cannot predict the future performance of the Reference Asset.

Changes Affecting the Reference Asset Could Have an Adverse Effect on the Value of, and the Amount Payable on, the Securities

The policies of the Investment Advisor concerning additions, deletions and substitutions of the Reference Asset Constituent Stocks and the manner in which the Investment Advisor takes account of certain changes affecting those Reference Asset Constituent Stocks or the Target Index may adversely affect the price of the Reference Asset. The policies of the Investment Advisor with respect to the composition or calculation of the Reference Asset could also adversely affect the price of the Reference Asset. The Investment Advisor may discontinue or suspend calculation or dissemination of the Reference Asset. Any such actions could have a material adverse effect on the market value of, and the amount payable on, the Securities.

The Bank Cannot Control Actions by the Investment Advisor of the Reference Asset that May Adjust the Reference Asset in a Way that Could Adversely Affect the Payments on the Securities and Their Market Value, and the Investment Advisor Has No Obligation to Consider Your Interests

The investment advisor of the Reference Asset (as specified herein under “Information Regarding the Reference Asset”, the “Investment Advisor”), may from time to time be called upon to make certain policy decisions or judgments with respect to the implementation of policies of the Investment Advisor concerning the calculation of the net asset value (“NAV”) of the Reference Asset, additions, deletions or substitutions of securities in the Target Index for the Reference Asset and the manner in which changes affecting the Target Index are reflected in the Reference Asset that could affect the market price of the shares of the Reference Asset, and therefore, the amount payable on your Securities. The Bank and its affiliates are not affiliated with the Investment Advisor and have no ability to control or predict its actions, including any errors in or discontinuation of public disclosure regarding methods or policies relating to the composition or calculation of the Reference Asset. The Investment Advisor is not involved in the Securities offering in any way and has no obligation to consider your interest as an owner of the Securities in taking any actions. The amount payable on your Securities and their market value could also be affected if the Investment Advisor changes these policies, for example, by changing the manner in which it calculates the NAV of the Reference Asset, or if the Investment Advisor discontinues or suspends calculation or publication of the NAV of the Reference Asset. If events such as these occur, the Calculation Agent may be required to make discretionary judgments that affect the return you receive on the Securities. For example, as described herein, if the Reference Asset undergoes a liquidation event, selecting a successor fund or, if no successor fund is available, determining the Fund Closing Price of the Reference Asset on the applicable calculation day; and determining whether to adjust the Fund Closing Price of the Reference Asset on a calculation day in the event of certain changes in or modifications to the Fund or the Target Index.

P-19

There Are Risks Associated with a Reference Asset that is an Exchange-Traded Fund

Although the Reference Asset's shares are listed for trading on NYSE Arca, Inc. (the “NYSE Arca”) and a number of similar products have been traded on the NYSE Arca or other securities exchanges for varying periods of time, there is no assurance that an active trading market will continue for the shares of the Reference Asset or that there will be liquidity in the trading market. In addition:

Management Risk:

The Reference Asset is subject to management risk, which is the risk that the Investment Advisor’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. For example, the Investment Advisor may elect to invest certain of the Reference Asset's assets in shares of equity securities that are not included in the Target Index. The Reference Asset is also not actively managed and may be affected by a general decline in market segments relating to the Target Index. The Investment Advisor invests in securities included in, or representative of, the Target Index regardless of their investment merits. The Investment Advisor does not attempt to take defensive positions in declining markets. Accordingly, the performance of the Reference Asset could be lower than other types of funds that may actively shift portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline.

Custody and Liquidity Risk

In addition, the Reference Asset is subject to custody risk, which refers to the risks in the process of clearing and settling trades and to the holding of securities by local banks, agents and depositories. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation. The less developed a country’s securities market is, the greater the likelihood of custody problems. Difficulty in executing and settling trades in securities held by the Reference Asset may make it difficult to accurately calculate the NAV per share of the Reference Asset and the liquidity of the Reference Asset may be adversely affected. Market participants may face difficulty in creating and redeeming shares of the Reference Asset, which may have an adverse effect on the price per share of the Reference Asset and the value of the Securities.

Tracking and Underperformance Risk

The Reference Asset uses a replication strategy (more fully described under “Information Regarding the Reference Asset”) to attempt to track the performance of the Target Index. Accordingly, the Reference Asset will generally invest in substantially all of the securities in the Target Index in approximately the same proportions as the Target Index but may under certain limited circumstances invest in assets not included in the Target Index. Therefore, while the performance of the Reference Asset is generally linked to the performance of the Target Index, the performance of the Reference Asset may also linked in part to shares of equity securities not included in the Target Index and to the performance of other assets, such as futures contracts, options and swaps, as well as cash and cash equivalents, including shares of money market funds affiliated with the Investment Advisor.

In addition, the performance of the Reference Asset will reflect additional transaction costs and fees that are not included in the calculation of the Target Index. Also, corporate actions with respect to the sample of equity securities (such as mergers and spin-offs) may impact the performance differential between the Reference Asset and the Target Index.

For all of the foregoing reasons, the performance of the Reference Asset may not correlate with the performance of the Target Index. Consequently, the return on the Securities will not be the same as investing directly in the Reference Asset or in the Target Index or in the Reference Asset Constituents, and will not be the same as investing in a debt security with payments linked to the performance of the Target Index. This variation in performance is called “tracking error” and, at times, the tracking error may be significant.

P-20

The Value of the Reference Asset May Fluctuate Relative to its NAV

The NAV of the Reference Asset may fluctuate with changes in the market value of the Reference Asset Constituents. The market prices of the Reference Asset may fluctuate in accordance with changes in NAV and supply and demand on the applicable stock exchanges. In addition, the market price of the Reference Asset may differ from its NAV per share; the Reference Asset may trade at, above or below its NAV per share.

Risks Relating to Estimated Value and Liquidity

The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices

Assuming no change in market conditions or any other relevant factors, the price, if any, at which Scotia Capital (USA) Inc. or any other party is willing to purchase the Securities at any time in secondary market transactions will likely be significantly lower than the Original Offering Price, since secondary market prices are likely to exclude discounts and underwriting commissions paid with respect to the Securities and the cost of hedging our obligations under the Securities that are included in the Original Offering Price. The cost of hedging includes the projected profit that we or our hedge provider may realize in consideration for assuming the risks inherent in managing the hedging transactions. These secondary market prices are also likely to be reduced by the costs of unwinding the related hedging transactions. The profits also include an estimate of the difference between the amounts we or our hedge provider pay and receive in a hedging transaction with our affiliate and/or an affiliate of WFS in connection with your Securities. In addition, any secondary market prices may differ from values determined by pricing models used by Scotia Capital (USA) Inc. or WFS as a result of dealer discounts, mark-ups or other transaction costs.

WFS has advised us that if it or any of its affiliates makes a secondary market in the Securities at any time up to the Original Issue Date or during the 4-month period following the Original Issue Date, the secondary market price offered by WFS or any of its affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring and hedging the Securities that are included in the Original Offering Price. Because this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it or any of its affiliates offers during this period will be higher than it otherwise would be outside of this period, as any secondary market price offered outside of this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase in the secondary market price will decline steadily to zero over this 4-month period. If you hold the Securities through an account at WFS or any of its affiliates, WFS has advised us that it expects that this increase will also be reflected in the value indicated for the Securities on your brokerage account statement.

The Bank's Estimated Value of the Securities is Lower Than the Original Offering Price of the Securities

The Bank's estimated value is only an estimate using several factors. The Original Offering Price of the Securities exceeds the Bank's estimated value because costs associated with selling and structuring the Securities, as well as hedging the Securities, are included in the Original Offering Price of the Securities. These costs include the selling commissions and the estimated cost of using a third party hedge provider to hedge our obligations under the Securities. See “The Bank's Estimated Value of the Securities” in this pricing supplement.

The Bank's Estimated Value Does Not Represent Future Values of the Securities and may Differ from Others' Estimates

The Bank's estimated value of the Securities was determined by reference to the Bank's internal pricing models when the terms of the Securities were set. This estimated value is based on market conditions and other relevant factors existing at that time and the Bank's assumptions about market parameters, which can include volatility, dividend rates, interest rates and other factors as well as an estimate of the difference between the amounts we or our hedge provider pay and receive in a hedging transaction with our affiliate and/or an affiliate of WFS in connection with your Securities. Different pricing models and assumptions could provide valuations for Securities that are greater than or less than the Bank's estimated value. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to be incorrect. On future dates, the value of the Securities could change significantly based on, among other things, changes in market conditions, our creditworthiness, interest rate movements and other relevant factors, which may impact the price, if any, at which the Bank would be willing to buy Securities from you in secondary market transactions. See “The Bank's Estimated Value of the Securities” in this pricing supplement.

P-21

The Bank's Estimated Value is not Determined by Reference to Credit Spreads for our Conventional Fixed-Rate Debt