- BNS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

The Bank of Nova Scotia (BNS) FWPFree writing prospectus

Filed: 4 Jan 21, 11:19am

Filed Pursuant to Rule 433 Dated January 4, 2021 | |

| Registration No. 333-228614 |

|

Market Linked Securities – Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside, Principal at Risk Securities Linked to the shares of Invesco QQQ TrustSM, Series 1 due February 3, 2023 Term Sheet to the Preliminary Pricing Supplement dated January 4, 2021 |

Issuer | The Bank of Nova Scotia (the “Bank”) |

Term | Approximately 24 months |

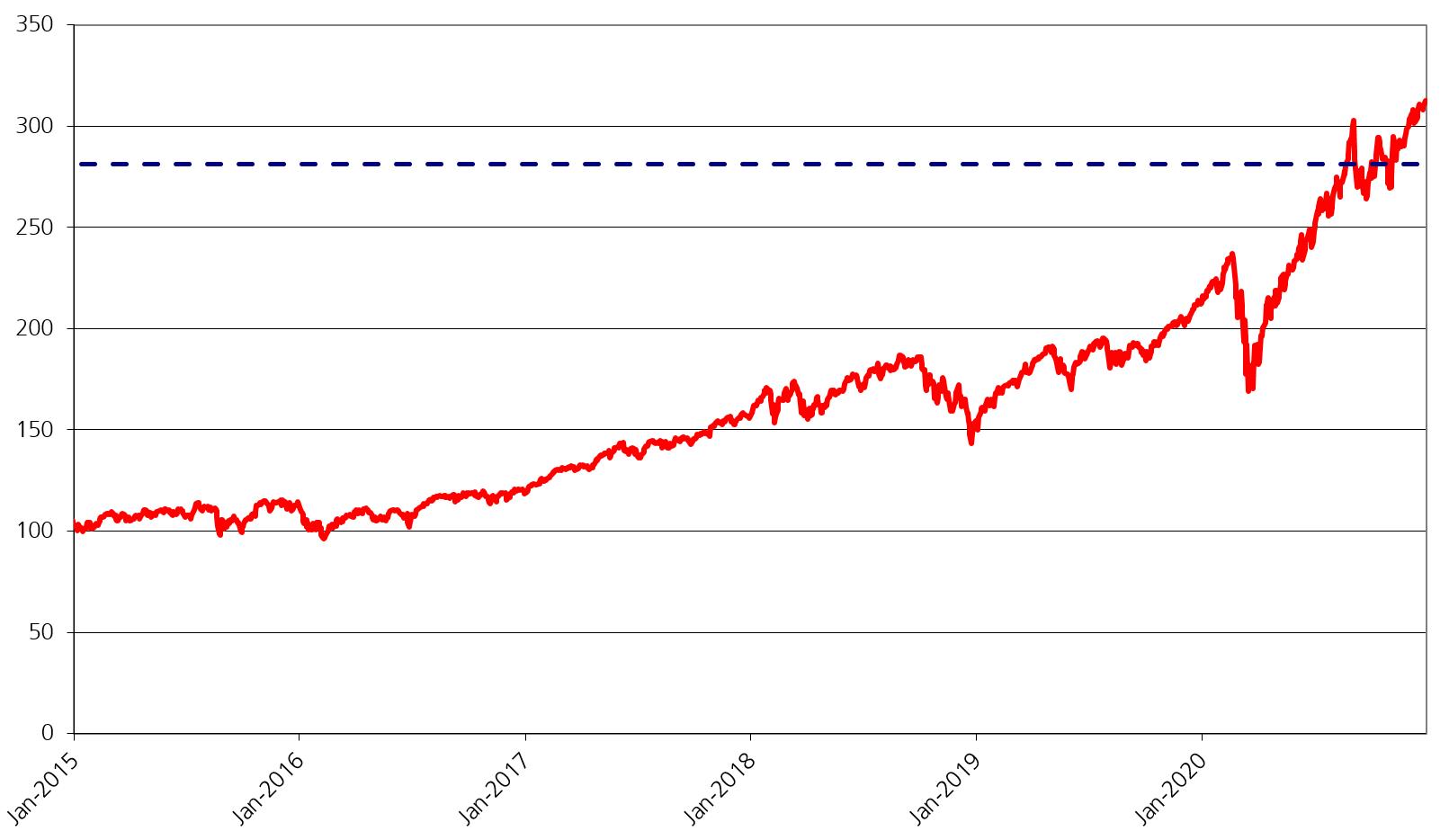

Market Measure | Shares of Invesco QQQ TrustSM, Series 1 (the “Reference Asset”) (Bloomberg Ticker: QQQ) |

Pricing Date | Expected to be January 29, 2021* |

Trade Date | Expected to be January 29, 2021* |

Issue Date | Expected to be February 3, 2021* |

Principal Amount | $1,000 per Security |

Original Offering Price | 100.00% of the Principal Amount of each Security |

Redemption Amount at Maturity | See “How the Redemption Amount at Maturity is Calculated” on page 3 |

Maturity Date | Expected to be February 3, 2023 |

Starting Price | The Fund Closing Price of the Reference Asset on the Pricing Date |

Ending Price | The Fund Closing Price of the Reference Asset on the Calculation Day |

Threshold Price | To be determined on the Pricing Date (equal to the Starting Price multiplied by the difference of 100.00% minus the Threshold Percentage). |

Threshold Percentage | 10.00% |

Capped Value | $[1,120.00-1,160.00] per $1,000 Principal Amount of the Securities (the actual amount to be determined on the Pricing Date) |

Participation Rate | 200.00% |

Percentage Change | The percentage increase or decrease in the Ending Price from the Starting Price. The Percentage Change may reflect a positive return (based on any increase in the price of the Reference Asset from the Starting Price to the Ending Price), no return, or a negative return (based on any decrease in the price of the Reference Asset from the Starting Price to the Ending Price) |

Calculation Day | Expected to be January 27, 2023 |

Calculation Agent | Scotia Capital Inc., an affiliate of the Bank |

Denominations | $1,000 and any integral multiple of $1,000 |

Agent Discount | Up to 3.15% of which dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of up to 1.75%, and WFA will receive a distribution expense fee of 0.075%. In respect of certain Securities sold in this offering, we may pay a fee of up to $1.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers. |

CUSIP/ISIN | 064159P59 / US064159P598 |

Underwriters | Scotia Capital (USA) Inc.; Wells Fargo Securities, LLC |

• | Linked to the shares of Invesco QQQ TrustSM, Series 1 |

• | Unlike ordinary debt securities, the Securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the Securities provide for a payment at maturity that may be greater than, equal to or less than the Principal Amount of the Securities, depending on the performance of the Reference Asset from its Starting Price to its Ending Price. |

| o | If the value of the Reference Asset increases: |

| o | If the value of the Reference Asset decreases but the decrease is not more than 10.00%: |

| o | If the value of the Reference Asset decreases by more than 10.00%: |

• | Investors may lose up to 90.00% of the Principal Amount. |

• | All payments on the Securities are subject to the credit risk of the Bank, and you will have no right to the shares of the Reference Asset or any securities held by the Reference Asset; if The Bank of Nova Scotia defaults on its obligations, you could lose your entire investment. |

• | No periodic interest payments or dividends. |

• | No exchange listing; designed to be held to maturity. |

If the Securities priced today, the estimated value of the Securities would be between $920.00 (92.000%) and $964.09 (96.409%) per $1,000 Principal Amount. See “The Bank’s Estimated Value of the Securities” in the preliminary pricing supplement. The Securities have complex features and investing in the Securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet, “Additional Risks” in the preliminary pricing supplement, “Additional Risk Factors Specific to the Notes” in the product prospectus supplement and “Risk Factors” in the prospectus supplement and prospectus. |

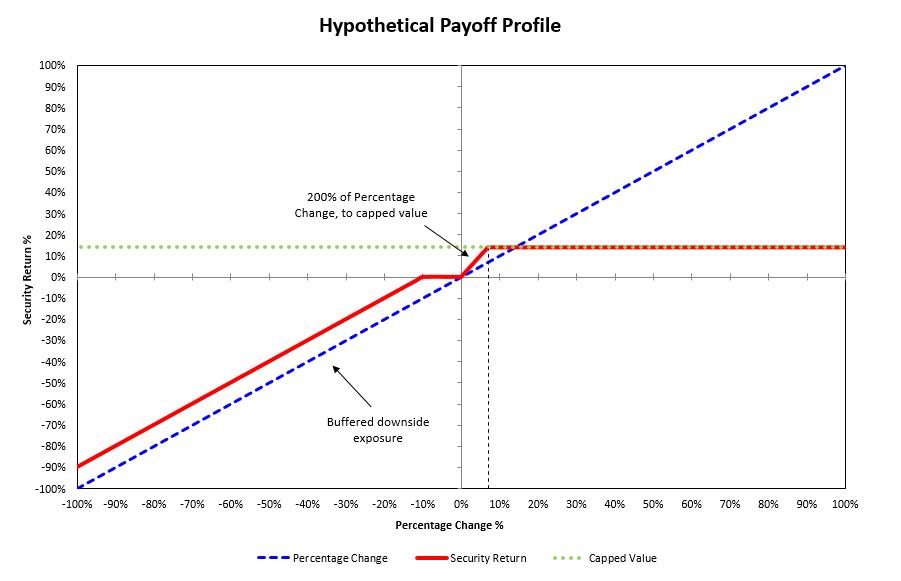

Hypothetical Payout Profile The profile to the right is based on a Capped Value of $1,140.00 (the midpoint of the range indicated herein) per $1,000 Principal Amount of the Securities, the Participation Rate of 200.00% and a Threshold Percentage of 10.00% (the Threshold Price equal to 90.00% of the Starting Price). This graph has been prepared for purposes of illustration only. Your actual return will depend on the actual Capped Value and Ending Price and whether you hold your Securities to maturity. |  |

| Hypothetical Ending Price | Hypothetical Percentage Change from the hypothetical Starting Price to the hypothetical Ending Price | Hypothetical Redemption Amount at Maturity per Security | Hypothetical pre-tax total rate of return |

| $150.00 | 50.00% | $1,140.00 | 14.00% |

| $140.00 | 40.00% | $1,140.00 | 14.00% |

| $130.00 | 30.00% | $1,140.00 | 14.00% |

| $120.00 | 20.00% | $1,140.00 | 14.00% |

| $110.00 | 10.00% | $1,140.00 | 14.00% |

| $107.00 | 7.00% | $1,140.00 | 14.00% |

| $106.00 | 6.00% | $1,120.00 | 12.00% |

| $104.00 | 4.00% | $1,080.00 | 8.00% |

| $102.00 | 2.00% | $1,040.00 | 4.00% |

| $100.00 | 0.00% | $1,000.00 | 0.00% |

| $98.00 | -2.00% | $1,000.00 | 0.00% |

| $95.00 | -5.00% | $1,000.00 | 0.00% |

| $90.00 | -10.00% | $1,000.00 | 0.00% |

| $80.00 | -20.00% | $900.00 | -10.00% |

| $70.00 | -30.00% | $800.00 | -20.00% |

| $50.00 | -50.00% | $600.00 | -40.00% |

| $25.00 | -75.00% | $350.00 | -65.00% |

| $0.00 | -100.00% | $100.00 | -90.00% |

• If the Ending Price is greater than the Starting Price, then the Redemption Amount at Maturity will equal: the lesser of (a) the Principal Amount + (Principal Amount x Participation Rate × Percentage Change) and (b) the Capped Value |

• If the Ending Price is less than or equal to the Starting Price, but greater than or equal to the Threshold Price, then the Redemption Amount at Maturity will equal: the Principal Amount |

• If the Ending Price is less than the Threshold Price, then the Redemption Amount at Maturity will equal: Principal Amount + [Principal Amount × (Percentage Change + Threshold Percentage)] If the Ending Price is less than the Threshold Price, you will have 1-to-1 downside exposure to the portion of such decrease in the Reference Asset that exceeds 10.00% and you will lose some and possibly up to 90.00% of your investment in the Securities. |

• | Risk of loss at maturity: Any payment on the Securities at maturity depends on the Percentage Change of the Reference Asset. The Bank will repay you the full Principal Amount of your Securities only if the Percentage Change does not reflect a decrease in the Reference Asset of more than 10.00%. If the Percentage Change is negative by more than 10.00%, meaning the Ending Price is less than the Threshold Price, you will lose a significant portion of your initial investment in an amount equal to the Percentage Change in excess of the Threshold Percentage. You may lose up to 90.00% of your investment in the Securities. |

• | The Participation Rate and the Buffered Downside Market Exposure to the Reference Asset Applies Only at Maturity |

• | Your Potential Redemption Amount at Maturity Is Limited by the Capped Value |

• | The Securities Differ from Conventional Debt Instruments |

• | No Interest: The Securities do not bear interest and, accordingly, you will not receive any interest payments on the Securities. |

• | The Redemption Amount at Maturity Is Not Linked to the Price of the Reference Asset at Any Time Other Than the Calculation Day |

• | Holding the Securities is Not the Same as Holding the Reference Asset or the Reference Asset Constituent Stocks |

• | No Assurance that the Investment View Implicit in the Securities Will Be Successful |

• | The Securities are Subject to Market Risk |

• | Past Performance is Not Indicative of Future Performance |

• | The Securities are Subject to Risks Associated with Non-U.S. Companies |

• | There Are Risks Associated with a Reference Asset that is an Exchange-Traded Fund |

• | The Value of the Reference Asset May Fluctuate Relative to its NAV |

• | Changes Affecting the Reference Asset Could Have an Adverse Effect on the Value of, and any Amount Payable on, the Securities |

• | The Bank Cannot Control Actions by the Investment Advisor of the Reference Asset that May Adjust the Reference Asset in a Way that Could Adversely Affect the Payments on the Securities and Their Market Value, and the Investment Advisor Has No Obligation to Consider Your Interests |

• | The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices |

• | The Bank’s Estimated Value of the Securities Will be Lower than the Original Offering Price of the Securities |

• | The Bank’s Estimated Value Does Not Represent Future Values of the Securities and may Differ from Others’ Estimates |

• | The Bank’s Estimated Value is not Determined by Reference to Credit Spreads for our Conventional Fixed-Rate Debt |

• | We May Sell an Additional Aggregate Principal Amount of the Securities at a Different Issue Price |

• | The Price at Which the Securities May Be Sold Prior to Maturity will Depend on a Number of Factors and May Be Substantially Less Than the Amount for Which They Were Originally Purchased |

• | The Securities Lack Liquidity |

• | If the Prices of the Reference Asset or the Reference Asset Constituent Stocks Change, the Market Value of Your Securities May Not Change in the Same Manner |

• | Hedging Activities by the Bank and/or the Underwriters May Negatively Impact Investors in the Securities and Cause Our Respective Interests and Those of Our Clients and Counterparties to Be Contrary to Those of Investors in the Securities |

• | Market Activities by the Bank or the Underwriters for Their Own Respective Accounts or for Their Respective Clients Could Negatively Impact Investors in the Securities |

• | The Bank, the Underwriters and Their Respective Affiliates Regularly Provide Services to, or Otherwise Have Business Relationships with, a Broad Client Base, Which Has Included and May Include the Investment Advisor and/or Reference Asset Constituent Stock Issuers |

• | Other Investors in the Securities May Not Have the Same Interests as You |

• | The Calculation Agent Can Postpone the Calculation Day for the Securities if a Market Disruption Event with Respect to the Reference Asset Occurs |

• | Anti-dilution Adjustments Relating To The Shares Of The Reference Asset Do Not Address Every Event That Could Affect Such Shares |

• | There Is No Affiliation Between Any Reference Asset Constituent Stock Issuers or the Investment Advisor and Us and We Are Not Responsible for Any Disclosure by Any of the Other Reference Asset Constituent Stock Issuers or the Investment Advisor |

• | A Participating Dealer or its Affiliates May Realize Hedging Profits Projected by its Proprietary Pricing Models in Addition to any Selling Concession, Creating a Further Incentive for the Participating Dealer to Sell the Securities to You |

• | Your Investment is Subject to the Credit Risk of the Bank |

• | The COVID-19 Virus May Have an Adverse Impact on the Bank |

| • | Uncertain Tax Treatment: Significant aspects of the tax treatment of the Securities are uncertain. You should consult your tax advisor about your tax situation. See “Canadian Income Tax Consequences” and “U.S. Federal Income Tax Consequences” in the pricing supplement. |