Hypothetical Returns

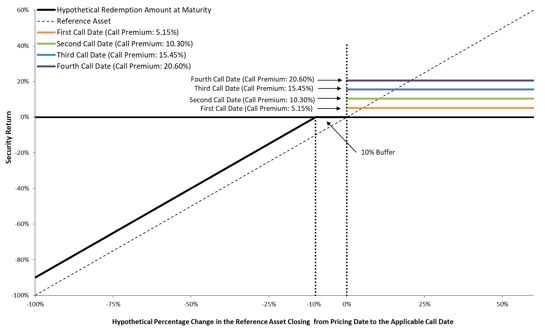

If the Securities are automatically called:

| Hypothetical Call Date on which Securities are automatically called | Payment per Security on related Call Settlement Date | Pre-tax total rate of return |

| 1st Call Date | $1,051.50 | 5.15% |

| 2nd Call Date | $1,103.00 | 10.30% |

| 3rd Call Date | $1,154.50 | 15.45% |

| 4th Call Date | $1,206.00 | 20.60% |

Each Security has a Principal Amount of $1,000.

If the Securities are not automatically called:

| Hypothetical Ending Level | Hypothetical Percentage Change | Hypothetical Redemption Amount at Maturity per Security | Hypothetical pre-tax total rate of return |

| 1,520.000 | -5.00% | $1,000.00 | 0.00% |

| 1,440.000 | -10.00% | $1,000.00 | 0.00% |

| 1,424.000 | -11.00% | $990.00 | -1.00% |

| 1,280.000 | -20.00% | $900.00 | -10.00% |

| 1,200.000 | -25.00% | $850.00 | -15.00% |

| 800.000 | -50.00% | $600.00 | -40.00% |

| 400.000 | -75.00% | $350.00 | -65.00% |

| 0.000 | -100.00% | $100.00 | -90.00% |

Assumes a hypothetical Starting Level of 1,600.000. The actual Starting Level is 2,123.201. Each Security has a Principal Amount of $1,000.

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. The actual amount you receive upon automatic call or at maturity and the resulting pre-tax rate of return will depend on (i) whether the Securities are automatically called; (ii) if the Securities are automatically called, the actual Call Date on which the Securities are called; (iii) if the Securities are not automatically called, the actual Ending Level of the Reference Asset; and (iv) whether you hold your Securities to maturity or earlier automatic call.

Call Dates and Call Premiums

Call Date | Call Premium | Payment per Security upon an Automatic Call |

| January 21, 2022 | 5.15% of the Principal Amount | $1,051.50 |

| January 23, 2023 | 10.30% of the Principal Amount | $1,103.00 |

| January 22, 2024 | 15.45% of the Principal Amount | $1,154.50 |

| January 15, 2025* | 20.60% of the Principal Amount | $1,206.00 |

The last Call Date is the Final Calculation Day, and payment upon an automatic call on the Final Calculation Day, if applicable, will be made on the Maturity Date.

* This is also the Final Calculation Day.

How the Redemption Amount at Maturity is Calculated

If the Closing Level of the Reference Asset is less than the Starting Level on each of the four Call Dates, the Securities will not be automatically called, and on the Maturity Date you will receive a Redemption Amount at Maturity per Security determined as follows:

| • | If the Ending Level is less than the Starting Level and greater than or equal to the Threshold Level, the Redemption Amount at Maturity will equal: $1,000; or |

| • | If the Ending Level is less than the Threshold Level, the Redemption Amount at Maturity will equal: |

Principal Amount + [Principal Amount x (Percentage Change + Threshold Percentage)]

In this case, you will receive less than the Principal Amount and will have 1-to-1 downside exposure to the decrease in the level of the Reference Asset in excess of 10.00%.

Any positive return on the Securities will be limited to the applicable Call Premium, even if the Closing Level of the Reference Asset significantly exceeds the Starting Level on the applicable Call Date. You will not participate in any appreciation of the Reference Asset beyond the applicable Call Premium. If the Securities are not automatically called on any Call Date and the Ending Level is less than the Threshold Level, you will receive less, and possibly 90.00% less, than the Principal Amount of your Securities at maturity.

Russell 2000® Index Daily Closing Levels*

*The graph above illustrates the performance of the Reference Asset from January 1, 2015 through January 15, 2021. The dotted line represents the Threshold Level of 1,910.8809, which is equal to 90.00% of 2,123.201, which was the Closing Level of the Reference Asset on January 15, 2021. Past performance of the Reference Asset is not indicative of the future performance of the Reference Asset.

Information from outside sources is not incorporated by reference in, and should not be considered part of, this term sheet, the pricing supplement, the prospectus, the prospectus supplement, or product prospectus supplement.

Selected Risk Considerations

The risks set forth below are discussed in detail in “Additional Risks” in the pricing supplement, “Additional Risk Factors Specific to the Notes” in the product prospectus supplement and “Risk Factors” in the prospectus supplement and prospectus. Please review those risk disclosures carefully.

| • | Risk of Loss at Maturity: Any payment on the Securities at maturity depends on the Percentage Change of the Reference Asset. If the Securities are not automatically called, the Bank will only repay you the full Principal Amount of your Securities if the Percentage Change does not reflect a decrease in the Reference Asset of more than 10.00%. If the Percentage Change is negative by more than 10.00%, meaning the Ending Level is less than the Threshold Level, you will lose a significant portion of your initial investment in an amount equal to the Percentage Change in excess of the Threshold Percentage. Accordingly, if the Securities are not automatically called, you may lose up to 90.00% of your investment in the Securities if the percentage decline from the Starting Level to the Ending Level is greater than 10.00%. |

| • | The Downside Market Exposure to the Reference Asset is Buffered Only at Maturity. |

| • | The Potential Return On The Securities Is Limited To The Call Premium. |

| • | You Will Be Subject To Reinvestment Risk. |

| • | No Interest: The Securities Do Not Bear Interest and, Accordingly, You Will Not Receive Any Interest Payments on the Securities. |

| • | The Securities Differ from Conventional Debt Instruments. |

| • | Holding the Securities is Not the Same as Holding the Reference Asset Constituent Stocks. |

| • | No Assurance that the Investment View Implicit in the Securities Will Be Successful. |

| • | The Securities are Subject to Market Risk. |

| • | The Securities are Subject to Small-Capitalization Stock Risks. |

| • | The Reference Asset Reflects Price Return Only and Not Total Return. |

| • | Past Performance is Not Indicative of Future Performance. |

| • | Changes Affecting the Reference Asset Could Have an Adverse Effect on the Value of, and the Amount Payable on, the Securities. |

| • | The Bank Cannot Control Actions by the Sponsor and the Sponsor Has No Obligation to Consider Your Interests. |

| • | Hedging Activities by the Bank and/or the Underwriters may Negatively Impact Investors in the Securities and Cause our Respective Interests and Those of our Clients and Counterparties to be Contrary to Those of Investors in the Securities. |

| • | Market Activities by the Bank or the Underwriters for Their own Respective Accounts or for Their Respective Clients Could Negatively Impact Investors in the Securities. |

| • | The Bank, the Underwriters and Their Respective Affiliates Regularly Provide Services to, or Otherwise Have Business Relationships with, a Broad Client Base, Which Has Included and May Include the Reference Asset Constituent Stock Issuers. |

| • | Other Investors in the Securities May Not Have the Same Interests as You. |

| • | The Calculation Agent Can Postpone any Call Date (including the Final Calculation Day) for the Securities if a Market Disruption Event with Respect to the Reference Asset Occurs. |

| • | There is no Affiliation Between any Reference Asset Constituent Stock Issuers or the Sponsor and us, and Neither we nor any of the Underwriters is Responsible for any Disclosure by any of the Reference Asset Constituent Stock Issuers or the Sponsor. |

| • | A Participating Dealer or its Affiliates May Realize Hedging Profits Projected by its Proprietary Pricing Models in Addition to any Selling Concession and/or any Distribution Expense Fee, Creating a Further Incentive for the Participating Dealer to Sell the Securities to You. |

| • | The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices. |

| • | The Bank's Estimated Value of the Securities is Lower Than the Original Offering Price of the Securities. |

| • | The Bank's Estimated Value Does Not Represent Future Values of the Securities and may Differ from Others' Estimates. |