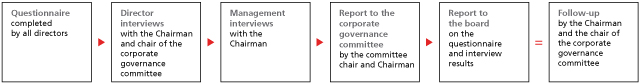

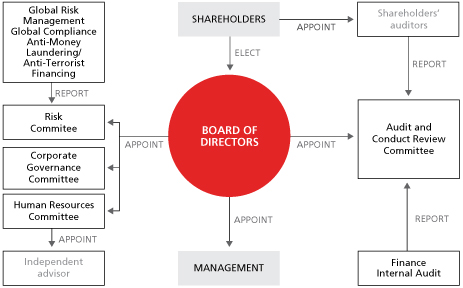

The corporate governance committee serves as our nominating committee, oversees our board assessment process, advises the board on our approach to shareholder engagement, oversees our CSR strategy and reviews how we may enhance our governance standards, policies and practices, consistent with changing regulations and emerging best practices. 2018 key responsibilities and highlights: Board composition and succession – • reviewed board composition, diversity (gender, age, ethnicity and geographic background), tenure, independence, skills, experience and other board service, and assessed potential board candidates • reviewed the key skills and experience in the director skills matrix that the board desires to have as a whole, so that the board is well-equipped to oversee the bank • reviewed potential director candidates and recommended Ms. Benita Warmbold as a new director. Ms. Warmbold was appointed to the board in October 2018. • in continuing the work done in fiscal 2017, dedicated significant time to Chairman succession planning with a view to an orderly leadership transition with the planned retirement of the Chairman. Recommended Mr. Regent as Chairman, subject to his re-election at the 2019 annual meeting. • reviewed the composition of each committee for balance and opportunities to enhance skills and gain new perspectives and see that there is appropriate representation of financial and risk management skills at each committee. Recommended to the board for approval changes to board committee composition with a view to committee and committee chair succession planning. Recommended Mr. Thomson as human resources committee chair, subject to hisre-election at the 2019 annual meeting. Governance standards and practices – • reviewed and approved meeting schedules for board approval, including the location of futureoff-site meetings with subsidiary boards in local markets • oversaw a comprehensive director orientation and education program, including hearing from leading thinkers in cyber-security, environment, social and governance topics and artificial intelligence • reviewed director compensation and equity holding requirements including benchmarking to direct Canadian peers and international banks and concluded that compensation levels and equity requirements continue to be appropriate • reviewed the bank’s director independence definition against stringent legislative requirements, for board approval • bolstered the core leadership responsibilities contained in ournon-executive Chairman mandate, available on our website • reviewed local and international regulatory developments, consumer protection initiatives and the new OSFI corporate governance guideline, and recommended changes to our corporate governance policies, committee charters and other mandates • reviewed the Chief Auditor’s annual report on the bank’s governance framework, which was also reviewed by the audit and conduct review committee Corporate social responsibility – • reviewed the bank’s CSR strategy, priorities and reporting and international trends in this area • monitored the bank’s CSR priorities throughout the year including youth, community initiatives and environmental matters Stakeholder engagement – • revised its charter to include explicit responsibilities for the bank’s approach to shareholder engagement as well as the bank’s approach to global emerging areas of focus for the bank’s stakeholders, including environmental and social issues • reviewed reports on the bank’s stakeholder engagement and areas of global focus, including climate change, human rights and gender pay gap reporting • with the entire board, met with OSFI to discuss various topics including corporate governance matters • reviewed shareholder proposals and the bank’s responses Board, Committee and Director Assessment – • oversaw the board, committee and director assessment process. Following a detailed questionnaire, the Chairman and committee chair conducted individual interviews with directors and senior management. No material issues were raised as part of the assessment. The Chairman and the committee chair developed an action plan to address areas for improvement Subsidiary governance– • reviewed the subsidiary governance report with the bank’s Chief Corporate Governance Officer and discussed oversight and priorities for the coming year • discussed reports on subsidiary governance developments throughout the year |

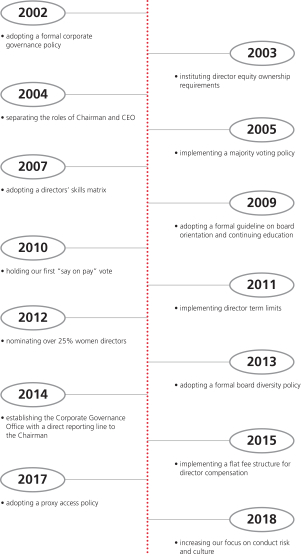

WHAT WE DO

WHAT WE DO