MANAGEMENT’S DISCUSSION & ANALYSIS

Financial performance summary

The Bank’s reported net income this quarter was $993 million, compared to $2,199 million in the same period last year and $1,689 million last quarter. The decrease in net income this quarter was due mainly to higher

non-interest

expenses which included an impairment loss of $1,362 million related to the announced sale of the banking operations in Colombia, Costa Rica and Panama. In addition, there were higher provision for credit losses and income taxes, partly offset by higher revenues.

Diluted earnings per share were $0.66 compared to $1.68 in the same period last year and $1.22 last quarter. Return on equity was 5.5%, compared to 11.8% in the same period last year and 8.3% last quarter.

Adjusted net income was $2,362 million compared to $2,212 million last year, an increase of 7%. The increase was driven mainly by higher revenues, partly offset by higher provision for credit losses,

non-interest

expenses and provision for income taxes. Compared to last quarter, adjusted net income increased 11% from $2,119 million. The increase was driven mainly by higher revenues, partly offset by higher provision for credit losses,

non-interest

expenses and provision for income taxes.

Adjusted diluted earnings per share were $1.76 compared to $1.69 last year and $1.57 last quarter. Adjusted return on equity was 11.8% compared to 11.9% a year ago and 10.6% last quarter.

Refer to

Non-GAAP

Measures starting on page 5 for details of adjustments.

On August 12, 2024, the Bank announced an agreement to acquire an approximate 14.9%

pro-forma

ownership interest in KeyCorp for approximately U.S. $2.8 billion through an

all-cash

purchase of newly issued voting common shares, at a fixed price of U.S.$17.17 per share.

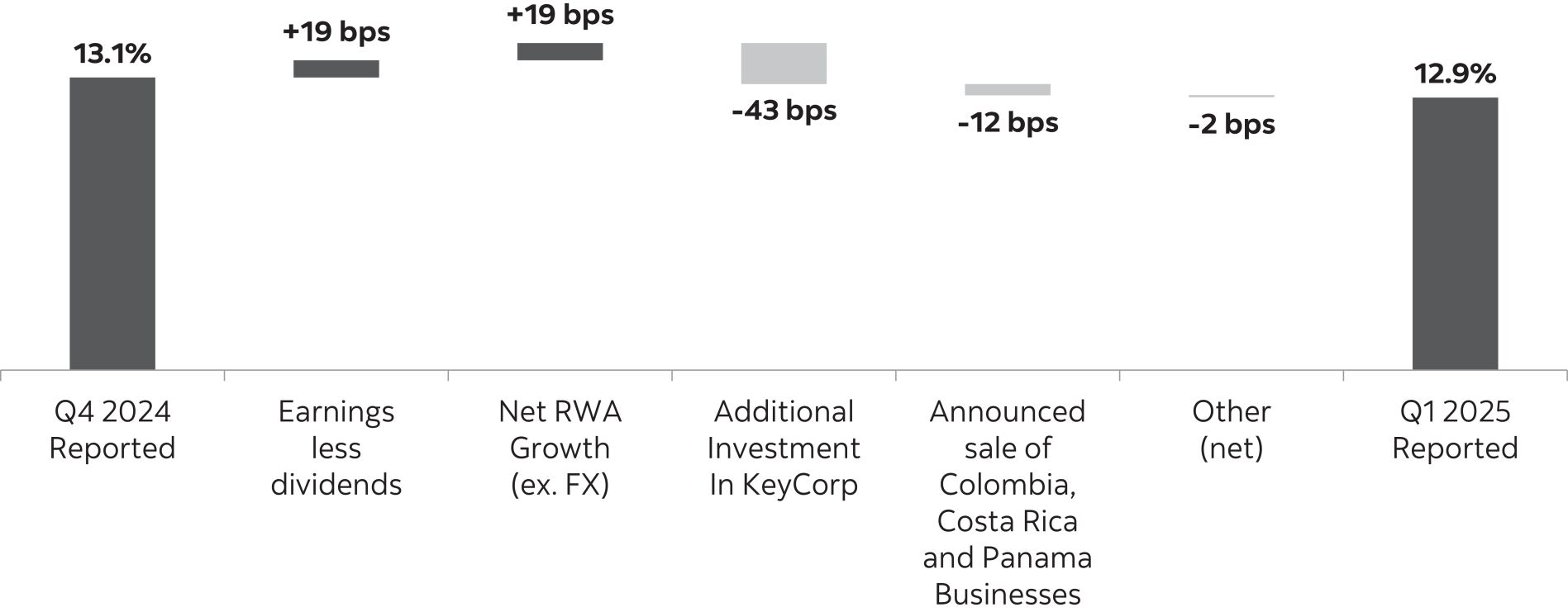

The acquisition was completed in two stages – an initial investment of 4.9% (Initial Investment) on August 30, 2024, and an additional investment of approximately 10% (Additional Investment) this quarter. The Bank completed the Additional Investment of approximately 115 million shares in KeyCorp for cash consideration of approximately U.S. $2.0 billion on December 27, 2024. This increased the Bank’s ownership interest from 4.9% to 14.92%, with total common share ownership of approximately 163 million shares. Following completion of the Additional Investment, the Bank designated two individuals to serve on KeyCorp’s Board of Directors.

Effective December 27, 2024, the combined 14.92% investment is accounted for as an investment in associate as the Bank has significant influence over KeyCorp as defined under IFRS, given its board representation and ownership interest. The Initial Investment of 4.9% previously accounted for at fair value through other comprehensive income was derecognized and included in the cost base of the investment in associate. The difference between the fixed transaction price and the quoted share price of KeyCorp at the date of Additional Investment (U.S.$17.20) was recognized as a gain in non-interest income – other this quarter, with a corresponding increase in the carrying value of the investment in associate. The carrying amount of the investment in associate upon closing was U.S. $2.8 billion (CAD $4.1 billion). For the three months ended January 31, 2025, the contribution to the Bank’s profit and loss from KeyCorp, net of funding costs, was $28 million after-tax, and $40 million ($35 million after-tax) was recorded in net income from investments in associated corporations representing the Bank’s approximate one-month share of KeyCorp’s financial results under IFRS.

Upon completion of the Additional Investment, the total impact to the Bank’s CET1 ratio from both stages of the transaction was a decrease of approximately 51 basis points.

Sale of banking operations in Colombia, Costa Rica and Panama

On January 6, 2025, the Bank entered into an agreement with Davivienda to sell Scotiabank’s banking operations in Colombia, Costa Rica and Panama in exchange for an approximately 20% ownership stake in the newly combined entity of Davivienda. The Bank’s ownership will consist of 14.99% voting common shares and the remainder in

non-voting

preferred shares. At the closing date, the Bank will have the right to designate individuals to serve on the Board of Directors of Davivienda’s combined operations commensurate with its ownership stake.

The transaction is expected to be completed in approximately 12 months from the signing date, subject to regulatory approvals in all jurisdictions and customary closing conditions.

The Bank’s operations that are part of this transaction have met the criteria for classification as held for sale in accordance with IFRS 5 and as at January 31, 2025, include total assets of $23 billion, consisting primarily of loans ($17 billion), investment securities ($2.4 billion) and cash and deposits ($2.1 billion) and total liabilities of $22 billion consisting primarily of deposits ($17.6 billion) and other liabilities ($3.3 billion).

The Bank recorded an impairment loss on the announcement date of $1,362 million, representing the write-down of goodwill ($589 million), intangibles ($151 million), property and equipment ($290 million) and the remaining in other assets. The impairment loss was recorded in

non-interest

expenses – other in the consolidated statement of income and in the Other operating segment. The impact to the Bank’s CET1 capital ratio was a decrease of approximately 12 basis points this quarter.

At each future reporting period, any changes in carrying value of the net assets being sold and the fair value of the shares to be received, will be recognized in profit and loss. In addition, upon closing, the net cumulative foreign currency translation reserve at that date, related to these operations will be recorded in the consolidated statement of income. As at January 31, 2025, the net cumulative foreign currency translation losses were $132 million.

Upon closing, the Bank’s investment in Davivienda will be accounted for as an investment in associate, as the Bank will have significant influence over Davivienda in accordance with IFRS, given its board representation and ownership interest.

Economic summary and outlook

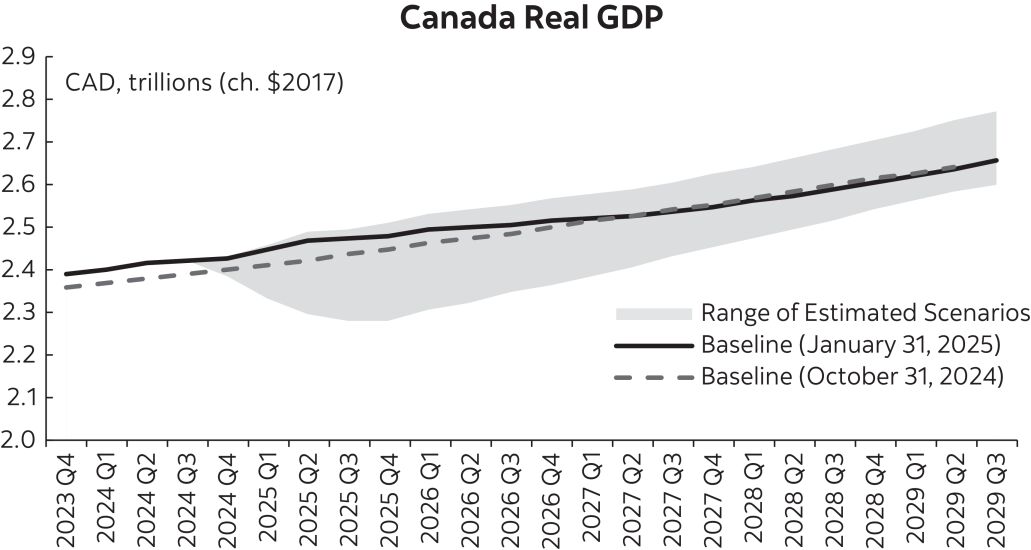

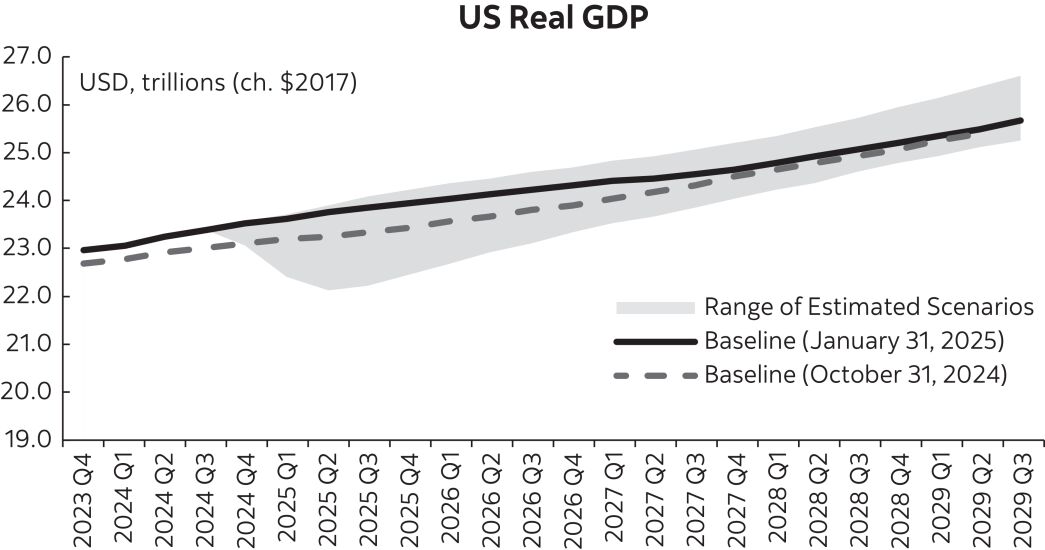

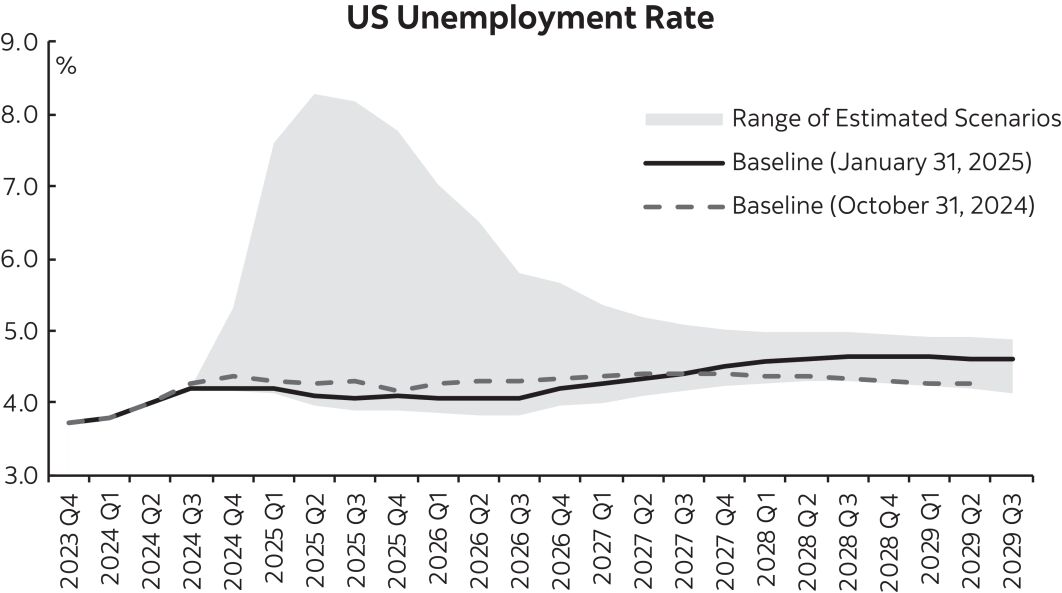

The global economic landscape remains in flux due to the change in administration in the United States and ensuing uncertainty surrounding future policy, particularly as it relates to trade. The global easing cycle has supported a recovery in economic activity. However, uncertainty surrounding the U.S. approach towards trade clouds the outlook significantly and tempers growth prospects in the short run.

The U.S. central bank rate is expected to hold through the first half of this year and maintain a significantly tighter stance relative to other central banks, as the U.S. economy continues to outperform and inflation remains elevated. This resilience provides the U.S. central bank with the flexibility to prioritize its inflation goal and assess the potential impacts of policy changes as they unfold, given the inflationary effect of tariffs should they be implemented. Restrictive monetary policy and extreme uncertainty surrounding tariffs are expected to contribute to a more moderate growth in 2025, even as planned corporate tax cuts support growth in the short run. The economy is expected to slow to 1.9% in 2025 from a roughly 2.8% pace in 2024. Certain tariffs have already been imposed, and while other policy changes advertised may never materialize, assuming only a fraction of such policies is expected to lower the economy’s potential growth, further slowing GDP growth in 2026 to 1.7%.

On the other hand, Canada’s central bank is expected to cut interest rates once more this year and hold at the mid-point of its neutral range thereafter. This wider differential with the U.S. monetary stance is supported by near-target inflation and reflects concerns about the damaging economic impact of trade uncertainty to Canada’s economy that is particularly vulnerable to tariffs. A surprising underlying momentum in the economy that seems to be largely a result of lower policy rates is creating a more positive backdrop in the face of tariffs threats and associated uncertainty. This underpins the expected acceleration in GDP growth from 1.3% in 2024 to 1.8% in 2025, before moderating to 1.6% in 2026. However, trade policy uncertainties from the U.S. pose significant risks, with the potential for a recession if large and broad-based tariffs are implemented.

| | |

| | Scotiabank First Quarter Report 2025 |