| Ira L. Kotel | ira.kotel@dentons.com | Salans FMC SNR Denton |

| Partner | D +1 (212) 398-5787 | dentons.com |

| | | |

| | Dentons US LLP | |

| | 1221 Avenue of the Americas | |

| | New York, NY 10020-1089 USA | |

| | | |

| | T +1 212 768 6700 | |

| | F +1 212 768 6800 | |

| December 20, 2013 | |

| |

| Mr. Kevin L. Vaughn | |

| Accounting Branch Chief | |

| U.S. Securities and Exchange Commission | |

| Division of Corporation Finance | |

| 100 F. Street, N.E. | |

| Washington, D.C. 20549 | |

| Re: | Pulse Electronics Corporation |

| | Form 10-K for the fiscal year ended December 28, 2012 |

| | Filed March 13, 2013 |

| | Form 10-Q for the quarter ended September 27, 2013 |

| | Filed November 5, 2013 |

| | File No. 001-5375 |

Dear Mr. Vaughn:

On behalf of Pulse Electronics Corporation (the “Company”), we are hereby submitting its response to the comments in the letter dated November 25, 2013 (the "Comment Letter") from the staff ("Staff") of the Securities and Exchange Commission ("Commission").

In order to facilitate your review, we have responded, on behalf of the Company, to each of the comments set forth in the Comment Letter on a point-by-point basis. The numbered paragraphs set forth below respond to the Staff’s comments in the Comment Letter. Bold face type indicates the Staff’s comments set forth in the Comment Letter.

Form 10-K for the fiscal year ended December 28, 2012

Note 1 – Summary of significant accounting policies, page 45

Revision of prior period financial statements, page 45

| 1. | We note your disclosure that in the third quarter of 2012, you identified an error in your deferred tax valuation allowance. We note the effect of the error correction on your income tax expense and net loss for the year ended December 30, 2011 was 19.3% and 10.3% respectively. Please address the following: |

| · | Tell us how you discovered the error. |

| · | Describe to us in greater detail the nature of the error in your deferred tax valuation allowance. |

| | · | Please provide us with your analysis of the materiality of the error. Discuss why you concluded the error was not material to prior periods and that an amendment to the December 30, 2011 Form 10-K was not necessary. |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 2 | |

RESPONSE:

During the preparation and review of the income tax provision for the quarter ended September 28, 2012, the Company determined that $5.5 million of excess deferred tax asset ("DTA") valuation allowances had been recorded in the quarter ended December 30, 2011. The Company identified the error while considering the release of liabilities for unrecognized tax benefits recorded in accordance with FASB ASC 740, Income Taxes, in connection with the expiration of certain statutes of limitations during the quarter ended September 28, 2012.

In the quarter ended December 30, 2011, the Company recorded valuation allowances against all of the U.S. and certain foreign DTAs of $38.0 million following a determination that it was not ‘more likely than not’ that such DTAs would be utilized. However, in calculating the $38.0 million of DTA valuation allowances, the Company had not considered that $5.5 million of DTAs could be offset by existing liabilities for unrecognized tax benefits. The Company assumed that these liabilities for unrecognized tax benefits would result in additional taxable income and actual cash payments of taxes if the tax positions driving the reserves were sustained by the applicable taxing authority. In the quarter ended September 28, 2012, the Company determined that, in fact, certain tax attributes of the existing DTAs could be available to offset such additional taxable income in those years. Accordingly, these tax attributes should have been applied by the Company as a reduction in the net DTA when calculating the necessary valuation allowances in 2011.

In order to assess whether the error was material to previously issued financial statements, the Company considered both quantitative and qualitative factors in accordance with Staff Accounting Bulletin ("SAB") No. 99. Below is the Company's detailed analysis.

Quantitative Measures Evaluated

The Company calculated the impact of the adjustment on several metrics. The following table summarizes this analysis ($ in thousands):

| Year Ended December 30, 2011 |

| As reported | Adjustment | Revised | % impact |

| Deferred tax assets | 79,783 | - | 79,783 | 0.0% |

| Valuation allowance | (73,104) | 5,548 | (67,556) | 7.6% |

| Total assets | 173,437 | 5,548 | 178,985 | 3.2% |

| (Deficit) equity | (37,820) | 5,548 | (32,272) | 14.7% |

| Revenue | 369,284 | - | 369,284 | 0.0% |

| Non-GAAP net operating loss | (1,257) | - | (1,257) | 0.0% |

| Adjusted EBITDA | 10,258 | - | 10,258 | 0.0% |

| Pre-tax loss from continuing operations | (24,655) | - | (24,655) | 0.0% |

| Income tax expense | 28,791 | (5,548) | 23,243 | 19.3% |

| Net loss | (53,474) | 5,548 | (47,926) | 10.4% |

| Effective tax rate | (116.8%) | | (94.3%) | 19.3% |

| Net loss per share | (1.30) | | (1.16) | 10.8% |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 3 | |

| Quarter Ended December 30, 2011 |

| As reported | Adjustment | Revised | % impact |

| Revenue | 90,473 | - | 90,473 | 0.0% |

| Non-GAAP net operating loss | (1,561) | - | (1,561) | 0.0% |

| Adjusted EBITDA | 1,179 | - | 1,179 | 0.0% |

| Pre-tax loss from continuing operations | (5,705) | - | (5,705) | 0.0% |

| Income tax expense | 37,303 | (5,548) | 31,755 | 14.9% |

| Net loss | (43,378) | 5,548 | (37,830) | 10.4% |

| Effective tax rate | (653.9%) | | (556.6%) | 14.9% |

| Net loss per share | (1.05) | . | (0.91) | 13.3% |

Impact on segments

The Company considered whether the $5.5 million adjustment to the income tax provision would have had any impact on reported segment financial information. The Company reports revenues and net operating profit by segment. Segment net operating profit is calculated as U.S. GAAP operating profit less severance, impairment, and other associated costs, and costs related to an unsolicited takeover attempt. Since revenues and net operating profit do not include the income tax provision, the $5.5 million adjustment had no impact on the segment disclosures in the financial statements for the year ended December 30, 2011.

Impact on unrecorded differences

The Company considered the impact that inclusion of the $5.5 million adjustment would have on the Company's aggregate assessment including previously unrecorded differences as of December 30, 2011. The following table summarizes this analysis ($ in thousands):

2011 Reported Net Loss | 2011 Unrecorded Differences | Impact of Tax Adjustment | 2011 Aggregate Unrecorded Differences | 2011 Net Income as Adjusted | % Impact |

| (53,474) | (1,598) | 5,548 | 3,950 | (49,524) | 7.4% |

Qualitative Measures Evaluated

The Company believes the primary metrics utilized by its investors and creditors are:

| · | Non-GAAP net operating profit |

| · | Non-GAAP Adjusted EBITDA |

| · | Secured debt to Adjusted EBITDA ratio |

| · | Total net debt to Adjusted EBITDA ratio |

| · | EBITDA to cash interest ratio |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 4 | |

As of December 2011, the metric used to analyze debt covenants under the Company's senior credit facility was Adjusted EBITDA. Following an amendment to the Company's credit facility in March 2012, the Company was not subject to any financial covenants other than restrictions on capital spending and payments of dividends. In November 2012, the Company entered into agreements with Oaktree Capital Management, L.P. ("Oaktree") to restructure and recapitalize the Company. As a result of the agreements, Oaktree held $102.5 million of the Company's debt, with $22.3 million of convertible debt held by others. Oaktree also held 79.9 million shares or 49.0% of the Company's outstanding common stock. The debt held by Oaktree is subject to financial covenants including a secured leverage ratio and a total net debt leverage ratio, both of which are a function of Adjusted EBITDA. Other financial covenants include maintenance of a minimum liquidity amount and restrictions on capital spending and payments of dividends.

Prior to 2013, the Company was followed by two analysts, CL King & Associates ("CL King") and Needham & Company LLC ("Needham"). The Company reviewed several CL King reports dated August 2012, March 2012, and November 2011 and Needham reports dated August 2012, March 2012, and November 2011. These analyst reports were primarily focused on the Company's revenue growth, gross margin, cost reduction actions, and financing alternatives.

The CL King reports also included projected non-GAAP earnings per share ("non-GAAP EPS"), which is calculated as net income per share excluding severance, impairment, and other associated costs, non-cash stock based compensation, and other adjustments. The Needham reports also highlighted total debt as a percentage of capital, ratio of stock price to revenue, tangible book value per share, and net cash per share and included projected non-GAAP EPS. While projected non-GAAP EPS includes income tax, the income tax provision was not specifically discussed in these analyst reports.

The Company also considered that due to the $38.0 million valuation allowance recorded in the quarter ended December 30, 2011, the 2011 income tax provision was highly unusual. The Company does not believe that its investors or creditors were considering or relying on the 2011 tax provision and therefore does not believe that an adjustment to reduce the tax expense would have had any material impact on their perspective concerning the Company.

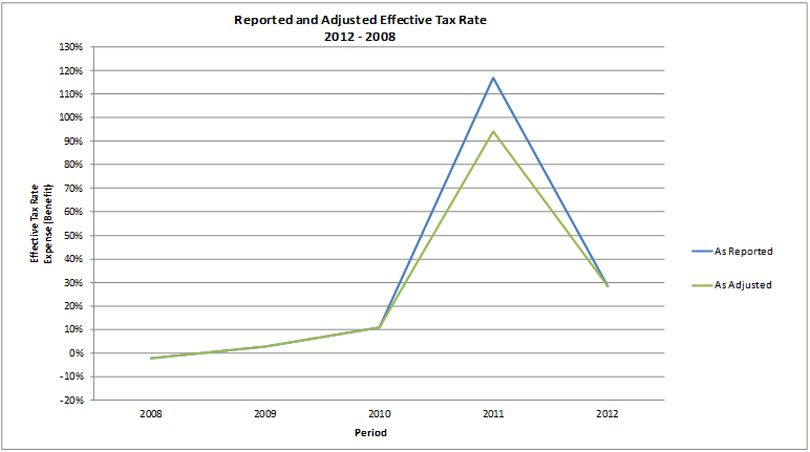

Further, the effective income tax rate has been volatile over the past several years due to significant unusual charges in each of the past five years, which have included the adjustment to the valuation allowance in 2011 discussed above and non-deductible goodwill and intangible asset impairments in 2010, 2009 and 2008. The following provides a comparison by the Company of the effective income tax rate for years 2012 through 2008 and for quarterly periods in 2012 and 2011:

| YTD |

| 2012 | 2011* | 2010 | 2009 | 2008 |

| Effective income tax rate | (28%) | (117%) | (11%) | (3%) | 2% |

| | QTD |

| | Q4 2012 | Q3 2012 | Q2 2012 | Q1 2012 |

| Effcetive income tax rate | (59%) | (4%) | (30%) | (18%) |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 5 | |

| QTD |

| Q4 2011* | Q3 2011 | Q2 2011 | Q1 2011 |

| Effcetive income tax rate | (654%) | 73% | 15% | 50% |

* Effective income tax rate prior to the $5.5 million adjustment.

With respect to fiscal year 2011, excluding the increase to the valuation allowance recorded in the income tax provision of $38.0 million, the income tax provision would have been a benefit of $9.2 million and the effective income tax rate would have been (37.35%). Thus, while the error was directly related to the single component causing the Company to have an extremely high effective tax rate, even if the entry to record the DTA valuation allowance was reduced by $5.5 million, the effective rate for 2011 would still have been almost 100% (94.3%).

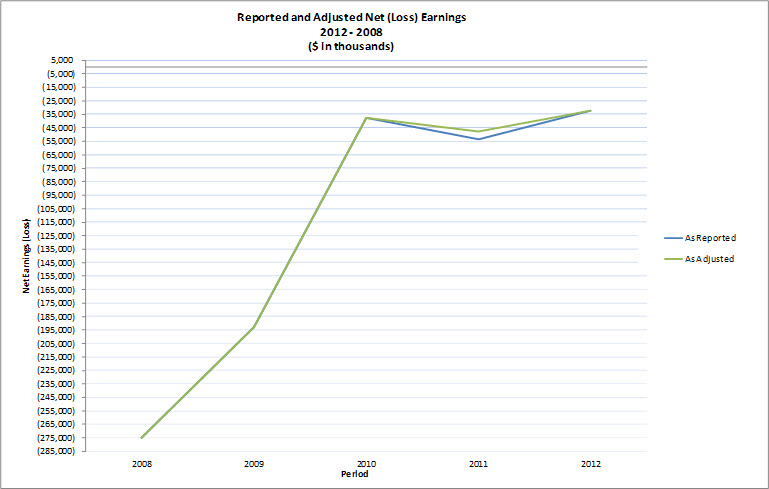

The Company also considered the impact of the $5.5 million error on the trend in net (loss) earnings. The following provides a comparison by the Company of the net (loss) earnings for years 2012 through 2008 ($ in thousands):

| YTD |

| Net (loss) earnings | 2012 | 2011 | 2010 | 2009 | 2008 |

| As Reported | (32,095) | (53,474) | (37,416) | (192,837) | (275,020) |

| As Adjusted | (32,095) | (47,926) | (37,416) | (192,837) | (275,020) |

The Company's net (losses)/earnings have been volatile over the past several years and in more recent years have been trending to a lower net loss as compared to the net losses in 2009 and 2008. While the Company acknowledges that the error had a 10.38% impact on its 2011 reported net loss, the error did not have any impact on the direction of the trend in the net loss since 2008. The net loss in 2011 was higher than the net loss in 2010 and higher than the net loss in 2012 on an "as reported" and on an "as adjusted" basis.

Please refer to the graphs in Appendix A for a comparison of the trends in net income and the effective tax rate on an "as reported" and on an "as adjusted" basis.

In addition, the Company considered that the adjustment results in a lower income tax expense and net loss in fiscal year 2011. While quantitatively the direction of the adjustment is less relevant, the Company believes that qualitatively the fact that this adjustment resulted in an overstatement of income tax expense and net loss would be less concerning for an investor than if the Company had understated tax expense.

The Company considered other qualitative factors listed in SAB 99, including whether the error had any impact on the Company's debt covenant compliance, management's compensation, or compliance with other regulatory requirements, and whether the error involved fraud or concealment of any unlawful transaction or masked a change in earnings or other trends. The Company noted that the error had no impact on the Company's debt covenant compliance, management's compensation, or compliance with any other regulatory requirements. Based on the analysis performed, the Company determined that the error was not intentional, did not involve fraud or concealment of any unlawful transaction, and was not made to mask a change in earnings or other trends.

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 6 | |

The Company considered that the impact of the error on fiscal year 2011 income tax expense was 19.3%. However, the Company believes that the impact to net loss of 10.38%, and consideration of the qualitative factors outlined above, including the fact that the metrics utilized by the Company's investors and creditors do not place emphasis on income tax expense, that the effective income tax rate has been volatile over the past several years and not a focus of the Company's investors and creditors, that the error did not impact the trend in the 2011 net loss, and that the impact of the adjustment was to reduce income tax expense and increase net income for fiscal year 2011, enable the Company to conclude that the $5.5 million adjustment would not have had a material impact on the fiscal year 2011 financial statements.

It should be noted that, as disclosed in the Company's Form 10-K for the year ended December 28, 2012, the Company determined that while the error was not material individually or in the aggregate to fiscal year 2011 and therefore amendments of previously filed reports were not required, if the prior period amount had been recorded in the third quarter of 2012, the impact could have been material to the financial results for the year ended December 28, 2012. As such, the Company revised the fiscal year 2011 financial information included in the Company's Form 10-Q for the quarter ended September 28, 2012 and in the Form 10-K for the year ended December 28, 2012.

Note 12 – Stock-based compensation, page 63

| 2. | We note that you use the Black-Scholes option-pricing model in determining the fair value of your option grants. Please revise future filings to disclose your methodologies for determining the significant assumptions in your Black-Scholes model or tell us why no revision to future filings is necessary. Refer to FASB ASC 718-10-50-2(f)(2). |

RESPONSE:

While the Company believes the prior disclosures concerning its methods used to estimate the expected term and volatility of share based options and similar instruments were appropriate, in future filings the disclosure will be changed as follows:

The fair value of options granted is estimated on the date of grant using the Black-Scholes model, which involves management assumptions about the expected term of the option, the risk free interest rate, the estimated volatility and expected dividend yield. The expected term is calculated using the “simplified” method. Under this method, the expected life is presumed to be the mid-point between the vesting date and the end of the contractual term. We will continue to use the “simplified” method until it has sufficient historical exercise data to estimate the expected life of the options. The risk-free interest rate is based on the U.S. Treasury rates at the date of grant with maturity dates approximately equal to the expected term at the grant date. The historical volatility of our stock is used as the basis for the volatility assumption since we believe the historical volatility is representative of the expected volatility over the expected term. The expected dividend yield was calculated as the average of the dividend yields for each period we paid a dividend.

Form 10-Q for the quarter ended September 27, 2013

Note 10 – Preferred Stock, page 12

| 3. | We note that in connection with the letter agreement you increased the preferred stock conversion rate from 64.38% to 67.9%. Additionally we note that you recorded a $5.8 million deferred loan cost as a result of this modification. Please explain to us why you recorded these costs as deferred loan costs, citing any authoritative literature upon which you are relying. |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 7 | |

RESPONSE:

On March 11, 2013, the Company entered into a Forbearance and Commitment letter (the "Letter Agreement") with Oaktree. The Letter Agreement provided the Company with the following: (a) forbearance with respect to certain covenants and (b) a $23.0 million loan commitment that the Company can draw upon under a specific circumstance. In consideration for the forbearance and the loan commitment included in the Letter Agreement, Oaktree received an increase in its preferred stock conversion rate from 64.38% to 67.9% of the Company's outstanding common stock, which represented a fair value of approximately $5.8 million.

The Company utilized the accounting framework under FASB ASC 470, Debt, to determine the accounting for the Letter Agreement and related costs. The Company first analyzed whether the modifications as a result of the Letter Agreement had resulted in a troubled debt restructuring, and concluded that the criteria for a troubled debt restructuring had not been met. Then, the Company considered whether the Letter Agreement should be accounted for as an extinguishment or a modification of the Oaktree debt.

In order to determine whether the Letter Agreement should be accounted for as an extinguishment or a modification, the Company evaluated whether there had been a substantial change to the present value of the cash flows in accordance with ASC 470-50-40-12, using the terms of the Oaktree debt in November 2012 and the modified terms of the Oaktree debt as a result of the Letter Agreement in March 2013. The Company determined the change in the present value of cash flows under two scenarios: 1) assuming no additional cash flows related to the $23.0 million commitment, inclusive of the fees/equity paid by the Company, and 2) as if the $23.0 million commitment had been borrowed by the Company, inclusive of the fees/equity paid by the Company. Under both scenarios, the change in the present value of cash flows of the Oaktree debt as a result of the Letter Agreement was less than 10%. Therefore, the Company concluded that the modification to the Oaktree debt did not result in a substantial change to the cash flows and should be accounted for as a modification.

As a result of the non-substantial debt modification conclusion reached in relation to the Letter Agreement, the Company concluded that the estimated fair value of the increase in the conversion rate of $5.8 million should be treated as a lender fee, which has been deferred and is being amortized as an adjustment to interest expense over the remaining term of the Oaktree debt using the effective interest method.

While not authoritative, the Company also considered guidance in the PwC Guide to Accounting for Financing Transactions (section 6.2.5.1), which indicates a payment (of cash or other instruments) made to a lender to effect a waiver of a covenant violation is considered a modification of the terms of the debt instrument and such payment should be analyzed using the debt modifications and extinguishments guidance in ASC 470. Also, PwC Dataline 2010-43 (paragraph .62) indicates that when companies enter into debt covenant waiver or forbearance agreements, related fees should generally be capitalized and amortized over the remaining life of the loan. This guidance is consistent with the Company's application of ASC 470 in accounting for the Letter Agreement.

| 4. | As a related matter, we note that the preferred stock will convert into common stock at such time that the $22.3 million of senior convertible notes has been discharged or conversion of the preferred stock would not otherwise constitute a change in control under the terms of the senior convertible notes. Additionally, the preferred stock will automatically convert into such number of shares of your common stock that will result in Oaktree having received 67.9% of your total common stock. Please explain to us why you are accounting for the preferred stock as permanent equity, citing any authoritative literature upon which you are relying. |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 8 | |

RESPONSE:

The Company evaluated the classification of the Series A preferred stock under ASC 480, Distinguishing Liabilities from Equity, and ASC 815, Derivatives and Hedging, to determine whether the Series A preferred stock should be classified as a liability or equity instrument. The analysis also considered whether or not the Series A preferred stock should be classified as permanent or temporary equity.

Based on the analysis detailed below, the Company determined that the Series A preferred stock did not meet the liability requirements under ASC 480, nor did the securities meet the mezzanine equity requirements under ASC 480-10-S99. Accordingly, the Company presented the preferred shares as permanent equity upon issuance in the quarter ended March 29, 2013.

Liability Classification under ASC 480

Under ASC 480-10-25, three types of obligations may require liability treatment:

| | (1) | Mandatorily redeemable financial instruments; |

| | (2) | Obligations to repurchase the issuer’s equity shares by transferring assets; and |

| | (3) | Obligations to issue a variable number of shares. |

| | (1) | Mandatorily redeemable financial instruments |

Under the guidance, mandatorily redeemable financial instruments shall be classified as a liability unless the redemption is required to occur only upon the liquidation or termination of the reporting entity. In addition, a financial instrument that embodies a conditional obligation to redeem the instrument by transferring assets upon an event not certain to occur becomes mandatorily redeemable if that event occurs, the condition is resolved, or the event becomes certain to occur.

The Company notes that the only instance in which it is required to redeem the Series A preferred stock is upon the occurrence of a liquidation, dissolution or winding up of the Company, whether voluntary or involuntary. Upon the event of liquidation, the holders of Series A preferred stock then outstanding shall be entitled to be paid out of the assets of the Company available for distribution to its shareholders, before any payment shall be made to the holders of any other shares of capital stock of the Company, in an amount per share equal to ten cents. The Company believes that this liquidation preference is immaterial to the holders of common stock because the liquidation preference is $0.10 per share, and only 1,000 shares of Series A preferred stock are authorized for issuance under the Restated Articles.

| | (2) | Obligations to repurchase the issuer’s equity shares by transferring assets |

Certain financial instruments, other than shares, that embody a conditional or unconditional obligation to repurchase the issuer’s equity shares (or is indexed to such an obligation) or require or may require the issuer to settle the obligation by transferring assets are accounted for as liabilities under ASC 480-10-25.

The Company notes that this criteria does not apply to the Series A preferred stock since it specifically excludes financial instruments that are shares. The Series A preferred stock cannot be classified as liabilities under this criteria because they do not contain any conditional or unconditional obligations of the Company to repurchase its equity shares (and are not indexed to such an obligation), and do not require the Company to settle the obligation by transferring assets.

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 9 | |

| | (3) | Certain Obligations to Issue a Variable Number of Shares |

According to ASC 480-10-25, a financial instrument that embodies an unconditional obligation, or a financial instrument other than an outstanding share that embodies a conditional obligation, that the issuer must or may settle by issuing a variable number of its equity shares shall be classified as a liability if, at inception, the monetary value of the obligation is based solely or predominantly on any one of the following: (a) a fixed monetary amount known at inception (b) variations in something other than the fair value of the issuer’s equity shares or (c) variations inversely related to changes in the fair value of the issuer’s equity shares).

The FASB has concluded that exposure to changes in the fair value of the issuer’s equity shares is a characteristic of an ownership relationship. Therefore, for the purposes of classifying an obligation that requires settlement by the issuance of the issuer’s equity shares, the distinction between obligations that are liabilities and obligations that are equity is based on the relationship between (a) the value that the holder of the instrument that embodies the obligation is entitled to receive upon settlement of the obligation and (b) the value of the underlying equity shares.

The underlying theory behind these criteria is that to be classified as equity and not as a liability, an obligation should expose the holder of the instrument that embodies the obligation to certain risks and benefits that are similar to those to which an owner (that is, a holder of an outstanding share of the entity’s equity) is exposed.

Upon discharge or the conversion of the Company’s outstanding senior convertible notes, the preferred stock will automatically convert into such number of shares of common stock that would result in the holders having received 67.9% of the Company's total outstanding common stock (on a pro forma fully diluted basis). While the number of the Company’s common shares that will be issued upon conversion will be variable, in order to reach the fixed ownership percentage, the monetary amount for this settlement will also be variable at the time of conversion. Since the monetary value of these shares will be based on the fair value of the common shares at the time of conversion, the holders of the preferred shares are exposed to similar risks and benefits to that of the common shareholders. Accordingly, the Company believes that the preferred stock does not require liability classification under these criteria.

Since the Series A preferred stock (1) are not mandatorily redeemable, (2) do not contain any conditional or unconditional obligations for the Company to repurchase its equity shares (and are not indexed to such an obligation) or require or may require the Company to settle the obligation by transferring assets and (3) do not embody any conditional or unconditional obligations that the Company must or may settle by issuing a variable number of its equity shares, the Company concluded that the Series A preferred stock do not fall within the scope of ASC 480 and should therefore be classified as equity instruments.

Mezzanine Equity Classification under ASC 480-10-S-99

The Company considered whether mezzanine equity classification was required under ASC 480-10-S99. ASC 480-10-S99 requires preferred securities that are redeemable for cash or other assets to be classified outside of permanent equity if they are contractually redeemable (1) at a fixed or determinable price on a fixed or determinable date or dates, (2) at the option of the holder, or (3) upon the occurrence of an event that is not solely within the control of the issuer.

In addition, ASC 480-10-S99-3A, paragraph 5, states the following:

“Determining whether an equity instrument is redeemable at the option of the holder or upon the occurrence of an event that is solely within the control of the issuer can be complex. The SEC staff believes that all of the individual facts and circumstances surrounding events that could trigger redemption should be evaluated separately and that the possibility that any triggering event that is not solely within the control of the issuer could occur – without regard to probability – would require the instrument to be classified in temporary equity.”

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 10 | |

The Company notes that the Series A preferred stock does not have any redemption rights. Further, the preferred stock is not redeemable at a “fixed or determinable date”, the preferred stock redemption rights are not at the option of the holders, and the preferred stock conditional redemption rights are all within the control of the Company.

The following summarizes certain key contractual provisions the Company considered that if applicable to the conversion terms of the Series A preferred stock would imply an obligation to redeem, and would require temporary equity classification:

| | a) | In the event of a conversion default that results from a situation in which the company cannot deliver the conversion shares because it does not have sufficient authorized and unissued shares available to settle the contract after considering all other commitments that may require the issuance of stock. The Company obtained shareholder approval on January 21, 2013 to increase the number of shares of common stock the Company was authorized to issue in order to have the sufficient number of shares available to effect the conversion of all outstanding Series A preferred stock. As of January 22, 2013 (transaction date) and as of March 29, 2013, the Company had a sufficient number of authorized shares to settle the conversion of the preferred stock within the range of common shares to be issued depending on the outcome of a potential exchange offer with convertible bondholders, as well as other commitments and financial instruments that may require issuance of common shares. Prior to shareholder approval, the obligation to issue Series A preferred stock was liability-classified at December 30, 2012 since the Company did not have sufficient authorized shares available to settle the contract. |

| | b) | In the event the company fails to get an IPO or other registration statement declared effective by a stated date. There are no contractual provisions requiring redemption in the event the Company fails to obtain a registration statement by a stated date. |

| | c) | In the event the company is delisted from trading on NASDAQ or any stock exchange on which it is listed. There are no contractual provisions that would require redemption upon the event the Company is delisted. |

| | d) | In the event the company fails to make timely filings with the SEC. There are no contractual provisions that would require redemption if the Company does not make timely SEC filings. |

| | e) | In the event of a change in control of the company, due to merger, consolidation or otherwise, sometimes described as a "deemed” liquidation event. There are no contractual provisions that would require redemption of the Series A preferred stock in the event of any “deemed” liquidation events. |

| | f) | Where the company sells preferred stock that is not mandatorily redeemable but is convertible at the holder’s option into common stock and the common stock is mandatorily redeemable at the holder’s option or upon a future event that is outside the company’s control. The Series A preferred stock is automatically converted (e.g. no option for the holder) into common stock upon discharge or conversion of the senior convertible notes. There are no provisions in the agreement in which the underlying common stock is redeemable upon a future event. |

The Company also evaluated whether there were any non-contractual redemption provisions which may require mezzanine equity classification under ASC 480-10-S99-1. The Company considered whether the preferred shareholders control the Board (or could control the Board in the future) and the Series A preferred stock terms contain a call option that would allow the Company to exercise a call right and redeem the preferred stock. The Company notes that there is no such call option contained in the Series A preferred stock terms that would allow the Company to exercise the right and redeem the Series A preferred stock. Additionally, as noted in a) above, the Company believes there is no risk of an inability to demonstrate settlement upon conversion of the Series A preferred stock.

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 11 | |

Based upon its evaluation of the above items, the Company concluded that the Series A preferred stock did not meet the requirements for mezzanine equity and therefore was classified as permanent equity within shareholders’ equity.

Embedded Derivative under ASC 815

Although not specifically requested by the Staff, the Company also evaluated the Series A preferred stock in accordance with ASC 815, Derivatives and Hedging, to determine whether the host instrument is more akin to debt or equity and whether the conversion option should be separated from the host instrument and accounted for at fair value.

The Company determined that the Series A preferred stock (host instrument) was more akin to equity since the Series A preferred stock has no redemption provisions (aside from normal liquidation), is not entitled to a stated dividend and participates equally with common stock in earnings and dividends, has no collateral requirements, and has no creditor rights. Since the Series A preferred stock will automatically convert into shares of common stock, the equity conversion option and the equity host are considered “clearly and closely related” as defined under ASC 815, therefore no further separation was required.

Item 2. Liquidity and Capital Resources, page 21

| 5. | We note that your outstanding borrowings with Oaktree are subject to maximum leverage ratios. We further note that as of September 27, 2013 you were in compliance with the amended leverage ratios. For any covenants where your actual leverage ratios are not substantially below the maximum allowable leverage ratio, please revise future filings to provide expanded disclosure. In this regard, disclose your actual leverage ratios, and a description of any significant factors and assumptions that could reasonably affect your compliance in future periods. |

RESPONSE:

For each quarter in 2013, the Company is required to comply with a maximum secured leverage ratio of 13.00 to 1.00 and a maximum net debt leverage ratio of 14.00 to 1.00. For the quarter ended September 27, 2013, the Company's secured leverage ratio was 6.69 to 1.00 and the Company's net debt leverage ratio was 7.24 to 1.00. Since the Company believes that the actual ratios are substantially below the maximum leverage ratios, the expanded disclosure was not deemed necessary. However, in future periods, the Company will include such expanded disclosures as necessary.

| 6. | Additionally, we note that as of September 27, 2013, approximately $23.5 million of subsidiary retained earnings are restricted under PRC law. Please explain to us how you considered the requirements of Rule 12-04 of Regulation S-X in preparing your annual financial statements. |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 12 | |

RESPONSE:

Pursuant to PRC laws and regulations, the Company's PRC subsidiaries are permitted to make payments of dividends only from their accumulated after-tax profits, if any, as determined in accordance with PRC accounting standards and regulations. The Company's PRC subsidiaries are required under PRC laws and regulations to allocate 10% of their after-tax profits to a statutory general reserve fund until the amount in the fund reaches 50% of the subsidiary's registered capital. As a result of these PRC laws and regulations, the PRC subsidiaries are restricted in their ability to transfer the amounts in the statutory reserves in the form of dividends, loans or advances.

In accordance with S-X Rule 4-08(e), the Company disclosed the $23.5 million of restricted retained earnings in its PRC subsidiaries as of September 27, 2013, which represents the amount of historical after-tax profits that have been designated as restricted. The Company also disclosed the $25.7 million of restricted retained earnings as of December 28, 2012 in its Form 10-K.

The Company has considered whether condensed parent company financial information in accordance with S-X Rule 12-04 was required as of December 28, 2012. S-X Rule 5-04(c) requires condensed parent company financial information when the proportionate share of the restricted net assets of consolidated subsidiaries exceeds 25% of a company's consolidated net assets. The Company had a consolidated total shareholders’ deficit of ($49.5) million as of December 28, 2012. Since the guidance in S-X Rule 5-04(c) does not specifically state how to calculate the 25% of consolidated net assets when a company’s consolidated net assets are negative, the Company referred to the Division of Corporation Finance’s Financial Reporting Manual, section 2810.4, which states the following:

“A registrant with a consolidated shareholders’ deficit is considered to have a net asset base of zero for the purpose of computing its proportionate share of the restricted net assets of consolidated subsidiaries. As a result, any restrictions placed on the net assets of subsidiaries with positive equity would result in the 25% threshold being met and a corresponding requirement to provide parent company financial information. This is viewed by the staff as consistent with the guidance in SAB Topic 6K2.b (Question 3), which states that a subsidiary with an excess of liabilities over assets has no restricted assets.”

Under S-X Rule 5-04(c), restricted net assets of consolidated subsidiaries is defined as "that amount of the registrant's proportionate share of net assets of consolidated subsidiaries (after intercompany eliminations) which as of the end of the most recent fiscal year may not be transferred to the parent company by subsidiaries in the form of loans, advances or cash dividends without the consent of a third party (i.e., lender, regulatory agency, foreign government, etc.). Where restrictions on the amount of funds which may be loaned or advanced differ from the amount restricted as to transfer in the form of cash dividends, the amount least restrictive to the subsidiary shall be used".

The Company applied the guidance in S-X Rule 5-04(c) and calculated the amount of restricted net assets as of December 28, 2012 to be $7.7 million as follows ($ in thousands):

| Subsidiary | Restricted Amount | Net Assets | Intercompany (receivables) payables | Adjusted Net Assets | Restricted Net Assets |

| Subsidiary A | 13,943 | 43,491 | (44,894) | (1,403) | - |

| Subsidiary B | 7,149 | (1,171) | 12,288 | 11,117 | 7,149 |

| Subsidiary C | 1,841 | (2,120) | 1,174 | (946) | - |

| Subsidiary D | 1,259 | 25,389 | (29,972) | (4,583) | - |

| Subsidiary E | 819 | 1,234 | (1,233) | 1 | 1 |

| Subsidiary F | 412 | 595 | (319) | 276 | 276 |

| Subsidiary G | 186 | 1,810 | (1,078) | 723 | 186 |

| Subsidiary H | 60 | 1,214 | 4,802 | 6,016 | 60 |

| Totals | 25,669 | | | | 7,672 |

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 13 | |

Since consolidated net assets as of December 28, 2012 is a negative amount, the Company acknowledges that any amount of restricted net assets triggers the requirement for condensed parent company financial information. However, the Company believes that the condensed parent company financial information is not meaningful to investors.

The Company understands that the intent of the disclosures required under S-X Rule 4-08 is to elicit information which will be predictive of future cash flows. A parent company that is a holding company may rely on cash from operating subsidiaries to service its indebtedness and continue its cash dividend policy.

The parent company, Pulse Electronics Corporation, is primarily funded by the operations of the Company's U.S. operating entity, Pulse Electronics, Inc. The Company's PRC subsidiaries manufacture on behalf of the Company's subsidiaries in the U.S. and Singapore, where the vast majority of the Company's third-party revenues are generated. The PRC entities have insignificant direct third-party sales and, by their nature, these entities are not cash generating subsidiaries of the Company. The Company’s Singapore subsidiary generates the majority of the Company’s third-party sales and is the parent company of its PRC subsidiaries. Funds generated by the Company's subsidiaries in Singapore, the U.S., and other entities outside of China are not subject to any legal restrictions on the transfer of funds in the form of dividends, loans and advances. These subsidiaries would be the source of funds, if needed, to satisfy the Company's indebtedness and other obligations, including the indebtedness and obligations of the Company's parent company.

As of December 28, 2012, the parent company had net assets of ($36.5 million) (excluding intercompany balances), which included $22.3 million of convertible debt, $5.0 million of U.S. pension liabilities and a $12.2 million warrant liability (cancelled in January 2013). These liabilities are the subject of separate disclosures in the Form 10-K for the year ended December 28, 2012. Therefore, the Company does not believe that inclusion of separate parent company financial information would be meaningful to its investors for purposes of assessing the Company's ability to repay its indebtedness.

For the Staff's reference, the financial statements for Pulse Electronics Corporation, the parent company, as of December 28, 2012 are attached in Appendix B.

In addition, as disclosed in Item 5 to the Form 10-K for the year ended December 28, 2012, the Company does not anticipate making any dividend payments to holders of its common stock in future periods. Further, under the terms of the Oaktree debt agreement, the Company is prohibited from making dividend payments to holders of its stock. Therefore, the parent company would not require any funds to be transferred from the PRC subsidiaries, or any other subsidiaries, for the purpose of making cash dividend payments to holders of its stock. Thus, the Company does not believe that the parent company financial information would be meaningful to its investors for purposes of assessing the Company's ability to make dividend payments to shareholders.

The Company also respectfully notes that for the year ended December 27, 2013, the Company is qualified as a smaller reporting company and therefore believes that the requirements of Rule12-04(a) of Regulation S-X will not be applicable.

| Kevin L. Vaughn December 20, 2013 | Salans FMC SNR Denton dentons.com |

| Page 14 | |

The Company hereby acknowledges that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff Comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Thank you for reviewing our responses. Should you have any questions, please do not hesitate to contact the undersigned at (212) 398-5787.

| Sincerely, |

| | |

| /s/ Ira L. Kotel |

| | Ira L. Kotel, Esq. |

| [Enclosures] |

| cc: | Ralph E. Faison |

| | Michael C. Bond |

| | |

| | Pulse Electronics Corporation |

| | |

| Victor H. Boyajian, Esq. |

| Brian Lee, Esq. |

| |

| | Dentons US LLP |

Appendix A

Appendix B

Pulse Electronics Corporation

Condensed Parent Company Balance Sheet

As of December 28, 2012

| | 2012 | |

Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | | $ | 14 | |

| Accounts receivable, net | | | 2,031 | |

| Amounts due from subsidiaries | | | 971 | |

| Inventory, net | | | 784 | |

| Prepaid expenses and other current assets | | | 639 | |

| Total current assets | | | 4,439 | |

| Long-term assets: | | | | |

| Net property, plant and equipment | | | 7 | |

| Investment in subsidiaries | | | 98,669 | |

| Other assets | | | 214 | |

| | $ | 103,329 | |

Liabilities and Shareholders’ Deficit | | | | |

| Current liabilities: | | | | |

| Accrued expenses and other current liabilities | | | 697 | |

| Amounts due to subsidiaries | | | 110,852 | |

| Warrant liability | | | 12,175 | |

| Total current liabilities | | | 123,724 | |

| Long-term liabilities: | | | | |

| Convertible senior notes | | | 22,315 | |

| Other long-term liabilities | | | 5,040 | |

| | | | |

| Shareholders’ deficit | | | | |

| Common stock and additional paid in capital | | | 236,157 | |

| Accumulated deficit | | | (279,711 | ) |

| Accumulated other comprehensive income | | | (4,196 | ) |

| Total deficit | | | (47,750 | ) |

| Total liabilities and shareholders' deficit | | $ | 103,329 | |

Pulse Electronics Corporation

Condensed Parent Company Statement of Operations and Comprehensive Loss

For the Year Ended December 28, 2012

| | 2012 | |

| | | |

| Net sales | | $ | 12,239 | |

| Cost of sales | | | 6,475 | |

| Gross profit | | | 5,764 | |

| | | | |

| Selling, general and administrative expenses | | | 4,039 | |

| Severance, impairment and other associated costs | | | (174 | ) |

| Cost related to unsolicited takeover attempt | | | (545 | ) |

| Operating income (loss) | | | 2,444 | |

| | | | |

| Other (expense) income: | | | | |

| Interest expense, net | | | (4,292 | ) |

| Other income (expense), net | | | 4,024 | |

| Total other expense | | | (268 | ) |

| | | | |

| Equity in net income of subsidiaries | | | (34,162 | ) |

| | | | |

| Loss before income taxes | | | (31,986 | ) |

| | | | |

| Income tax expense | | | - | |

| | | | |

| Net loss | | | (31,986 | ) |

| | | | |

| Other comprehensive loss: | | | | |

| Pension adjustments, net of tax | | | (853 | ) |

| | | | |

| Total comprehensive loss | | | (32,839 | ) |

Pulse Electronics Corporation

Condensed Parent Company Statement of Cash Flows

For the Year Ended December 28, 2012

| | 2012 | |

| Cash flows from operating activities: | | | |

| Net loss | | $ | (31,986 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Loss from subsidiaries | | | 34,162 | |

| Amortization/write-off of loan fees | | | 1,002 | |

| Unrealized gain on Oaktree warrants | | | (4,206 | ) |

| Amortization of stock incentive plan expense | | | 1,801 | |

| Severance and asset impairment expense, net of cash payments | | | (1,633 | ) |

| Other | | | 77 | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | | (398 | ) |

| Amounts due from subsidiaries | | | 1,454 | |

| Inventory | | | 244 | |

| Prepaid expenses and other current assets | | | 255 | |

| Accrued expenses and other current liabilities | | | (932 | ) |

| Net cash used in provided by operating activities | | | (160 | ) |

| | | | |

| Net cash used in by investing activities | | | - | |

| | | | |

| Net cash provided used in financing activities | | | - | |

| | | | |

| Net decrease in cash and cash equivalents | | | (160 | ) |

| Cash and cash equivalents at beginning of year | | | 174 | |

| Cash and cash equivalents at end of year | | $ | 14 | |