©2014 Tecumseh Products Company FY2013 Shareholder Update March 5, 2014 These slides should be reviewed in connection with the FY2013 audio presentation

Agenda Operational Overview FY2013 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 2 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

Disclaimer 3 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to the safe harbor provisions created by that Act. In addition, forward-looking statements may be made orally in the future by or on behalf of us. Forward-looking statements can be identified by the use of terms such as “expects,” “should,” “may,” “believes,” “anticipates,” “will,” and other future tense and forward-looking terminology. Our forward-looking statements generally relate to our future performance, including our anticipated operating results and liquidity sources and requirements, our business strategies and goals, and the effect of laws, rules, regulations, new accounting pronouncements and outstanding litigation, on our business, operating results, and financial condition. Readers and listeners are cautioned that actual results may differ materially from those projected as a result of certain risks and uncertainties, including, but not limited to, i) our history of losses and our ability to maintain adequate liquidity in total and within each foreign operation; ii) our ability to develop successful new products in a timely manner; iii) the success of our ongoing effort to improve productivity and restructure to reduce costs and bring them in line with projected production levels and product mix; iv) the extent of any business disruption that may result from the restructuring and realignment of our manufacturing operations and personnel or system implementations, the ultimate cost of those initiatives and the amount of savings actually realized; v) loss of, or substantial decline in, sales to any of our key customers; vi) current and future global or regional political and economic conditions, including housing starts, and the condition of credit markets, which may magnify other risk factors; vii) increased or unexpected warranty claims; viii) actions of competitors in markets with intense competition; ix) financial market changes, including fluctuations in foreign currency exchange rates and interest rates; x) the ultimate cost of defending and resolving legal and environmental matters, including any liabilities resulting from the regulatory antitrust investigations commenced by the United States Department of Justice Antitrust Division and the Secretariat of Economic Law of the Ministry of Justice of Brazil, both of which could preclude commercialization of products or adversely affect profitability and/or civil litigation related to such investigations; xi) local governmental, environmental, trade and energy regulations; xii) availability and volatility in the cost of materials, particularly commodities, including steel, copper and aluminum, whose cost can be subject to significant variation; xiii) significant supply interruptions or cost increases; xiv) loss of key employees; xv) the extent of any business disruption caused by work stoppages initiated by organized labor unions; xvi) risks relating to our information technology systems; xvii) impact of future changes in accounting rules and requirements on our financial statements; xviii) default on covenants of financing arrangements and the availability and terms of future financing arrangements; xix) reduction or elimination of credit insurance; xx) potential political and economic adversities that could adversely affect anticipated sales and production; xxi) in India, potential military conflict with neighboring countries that could adversely affect anticipated sales and production; xxii) weather conditions affecting demand for replacement products; and xxiii) the effect of terrorist activity and armed conflict. These forward-looking statements are made only as of the date of this presentation, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Agenda Operational Overview FY2013 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 4 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

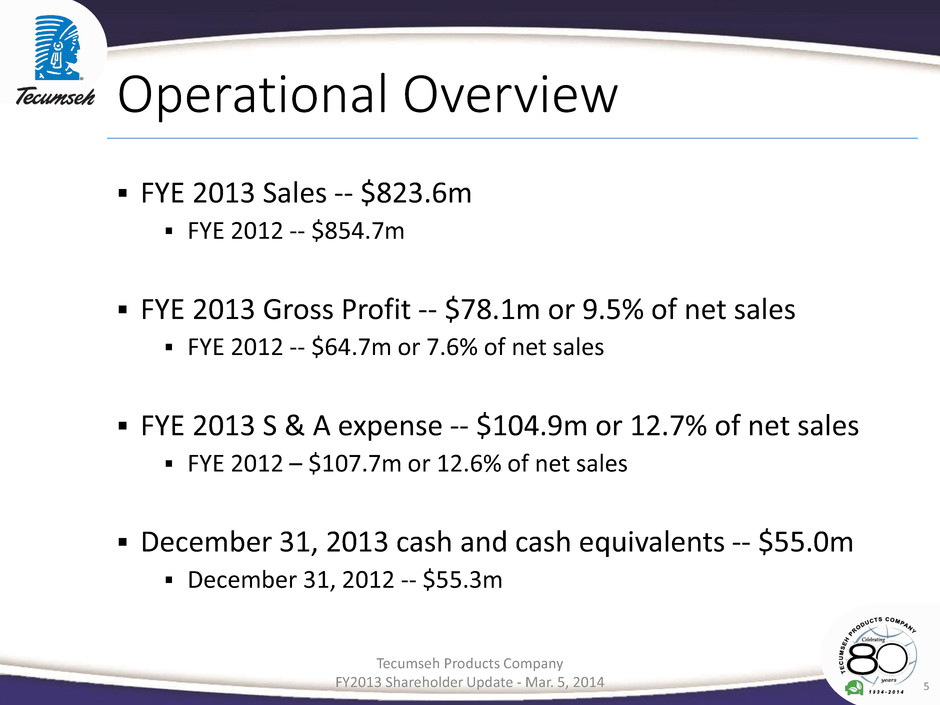

Operational Overview FYE 2013 Sales -- $823.6m FYE 2012 -- $854.7m FYE 2013 Gross Profit -- $78.1m or 9.5% of net sales FYE 2012 -- $64.7m or 7.6% of net sales FYE 2013 S & A expense -- $104.9m or 12.7% of net sales FYE 2012 – $107.7m or 12.6% of net sales December 31, 2013 cash and cash equivalents -- $55.0m December 31, 2012 -- $55.3m 5 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

Operational Overview - Key Objectives Focused product portfolio (value add) Focused market approach Rationalize manufacturing capacity Fixed cost containment efforts Advanced technology Improved profitability Enhanced liquidity 6 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Celseon ® Low Profile AJ AE2 Compressor “Midi” TA Compressor “Mini” Masterflux 48V Variable Speed Compressor

Operational Overview 7 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 AE2 Celseon Evaporative Condensate AE2 Celseon Low Profile AK Celseon Condensing Unit

Operational Overview 8 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

Operational Overview 9 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

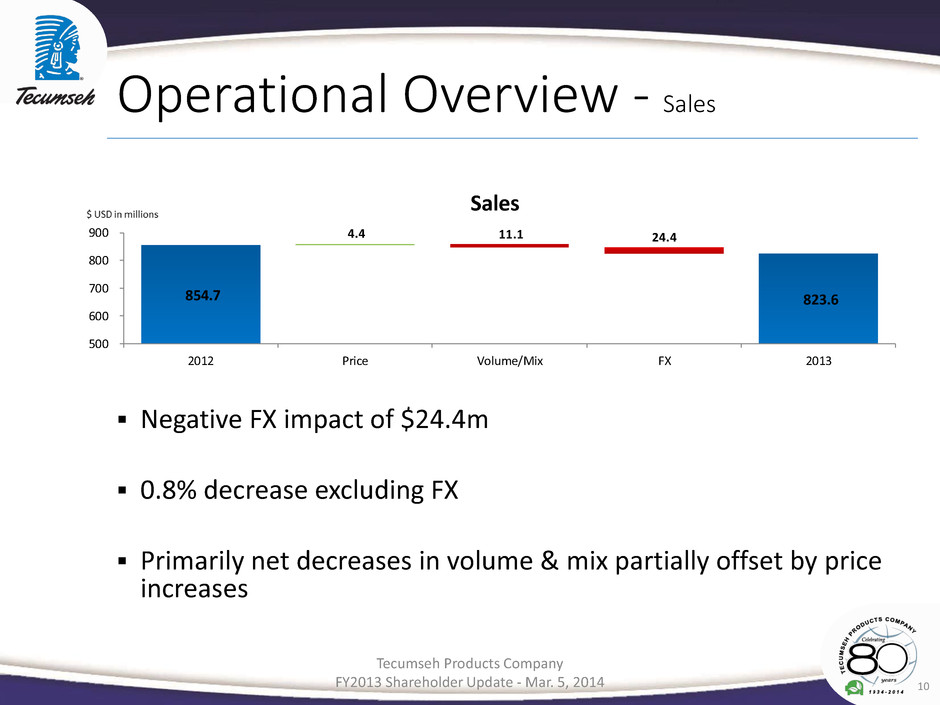

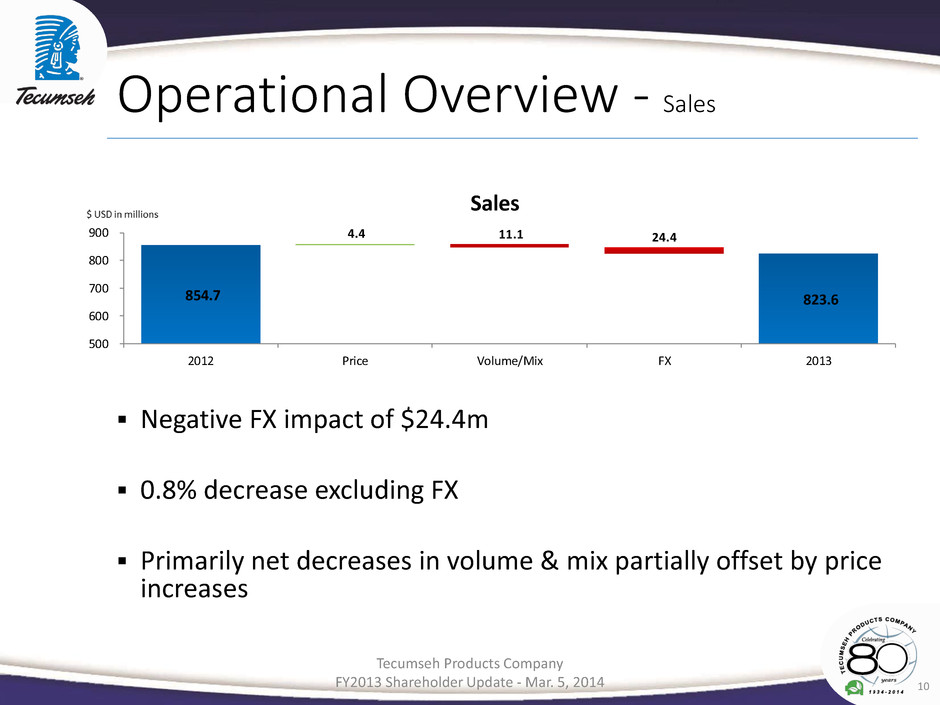

Negative FX impact of $24.4m 0.8% decrease excluding FX Primarily net decreases in volume & mix partially offset by price increases 10 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Operational Overview - Sales 823.6 11.1 24.44.4 854.7 500 600 700 800 900 2012 Price Volume/Mix FX 2013 Sales

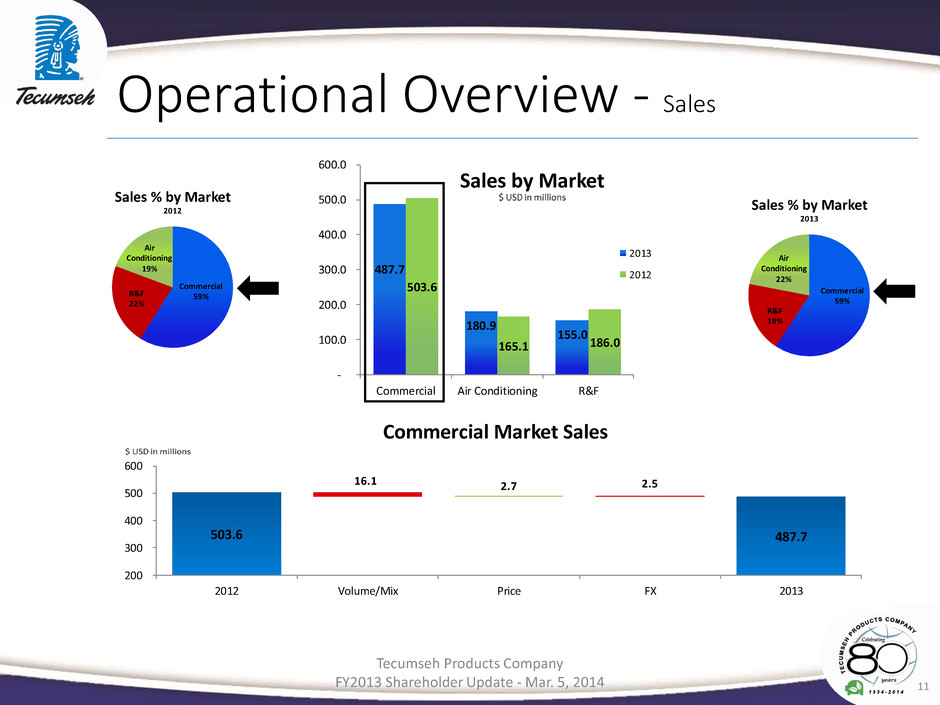

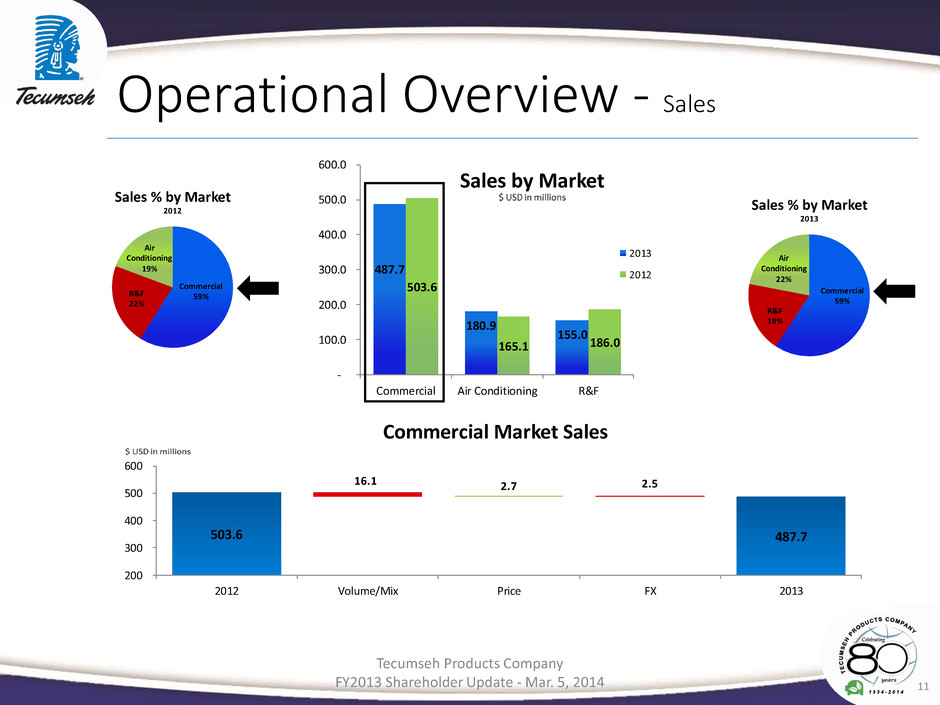

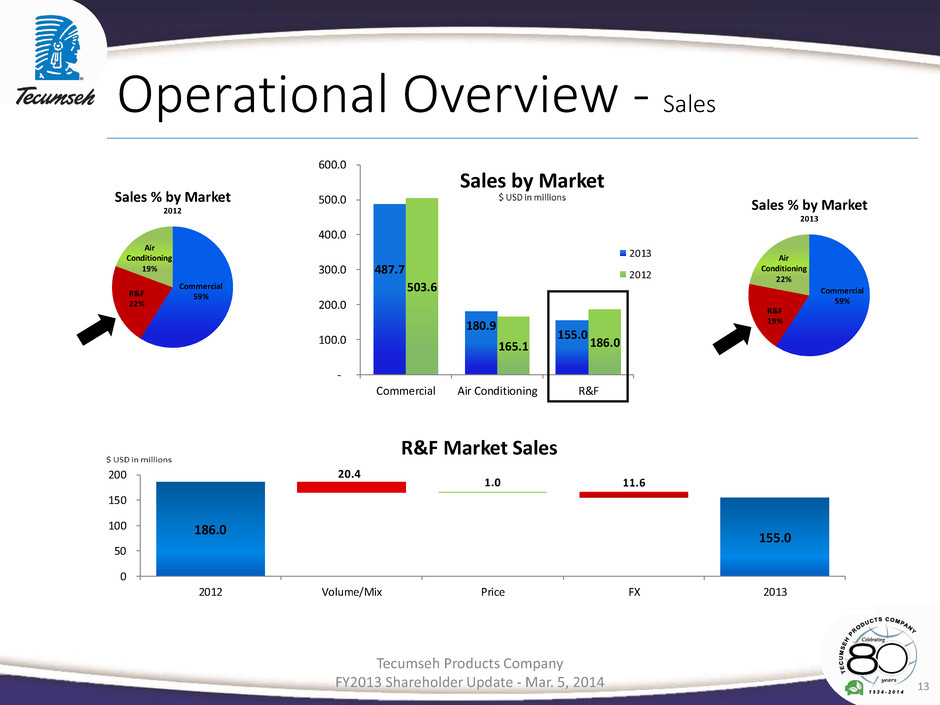

11 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Operational Overview - Sales Commercial 59%R&F 22% Air Conditioning 19% Sales % by Market 2012 Commercial 59% R&F 19% Air Conditioning 22% Sales % by Market 2013 487.7 180.9 155.0 503.6 165.1 186.0 - 100.0 200.0 300.0 400.0 500.0 600.0 Commercial Air Conditioning R&F Sales by Market 2013 2012 487.7 16.1 2.5 2.7 503.6 200 300 400 500 600 2012 Volume/Mix Price FX 2013 Commercial Market Sales

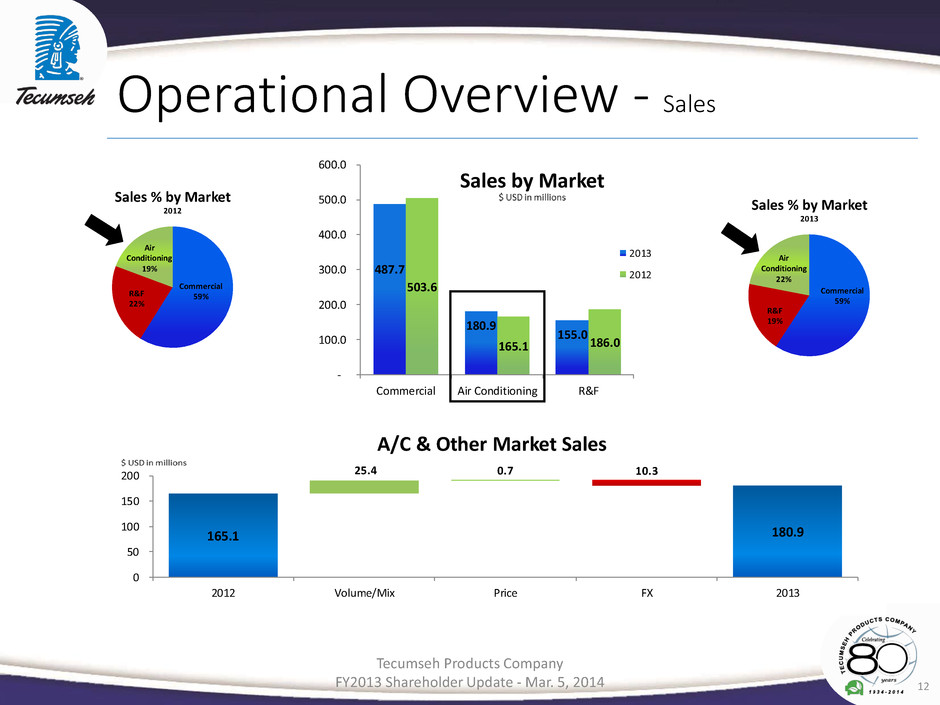

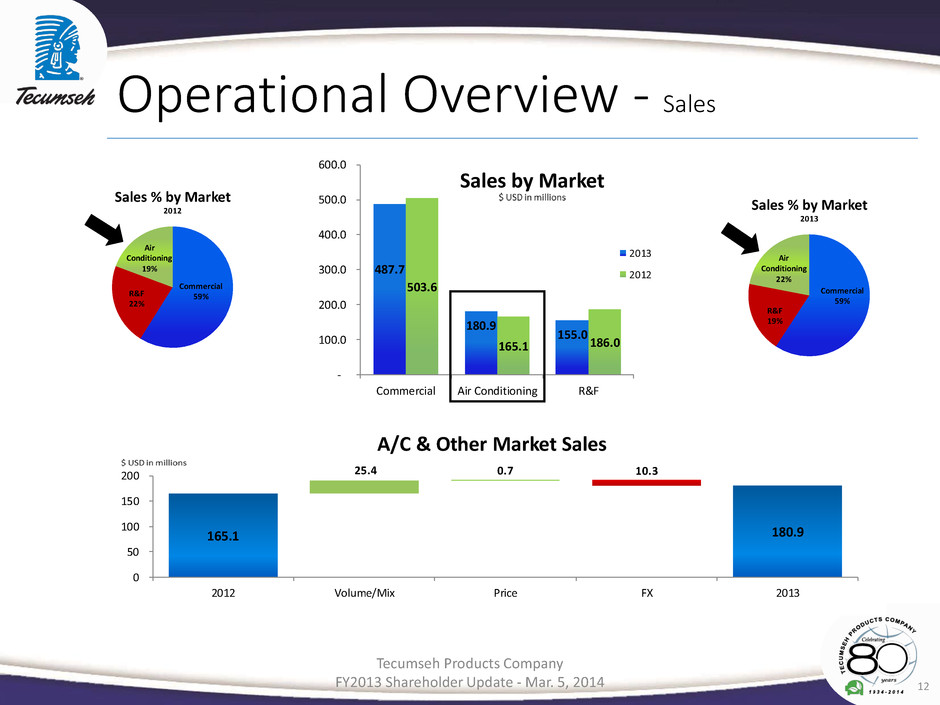

12 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Operational Overview - Sales Commercial 59%R&F 22% Air Conditioning 19% Sales % by Market 2012 Commercial 59% R&F 19% Air Conditioning 22% Sales % by Market 2013 487.7 180.9 155.0 503.6 165.1 186.0 - 100.0 200.0 300.0 400.0 500.0 600.0 Commercial Air Conditioning R&F Sales by Market 2013 2012 180.9 10.3 25.4 0.7 165.1 0 50 100 150 200 2012 Volume/Mix Price FX 2013 A/C & Other Market Sales

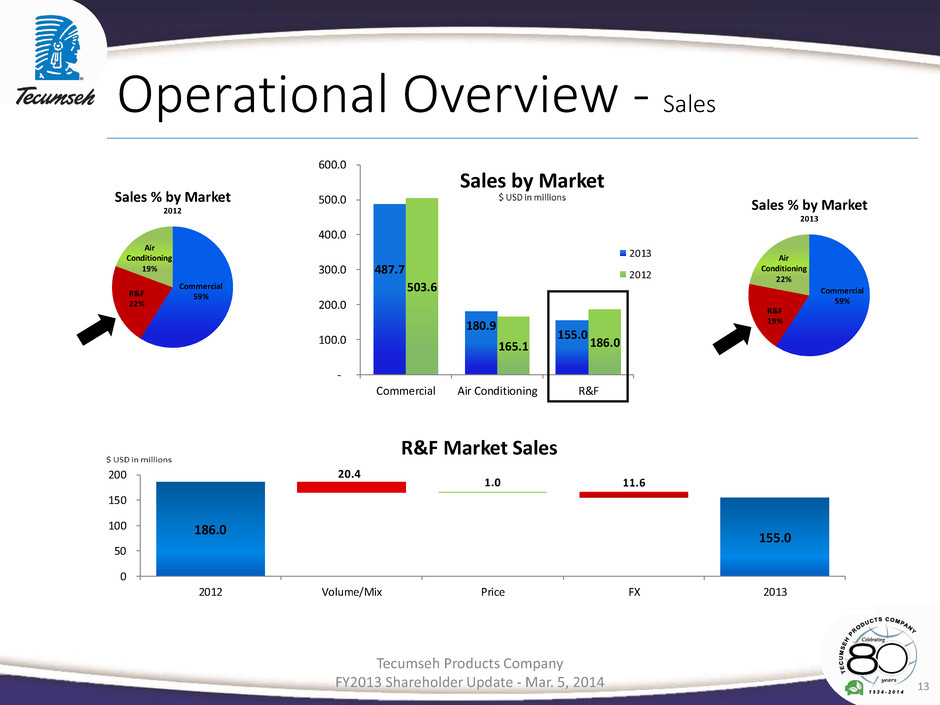

13 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Operational Overview - Sales Commercial 59%R&F 22% Air Conditioning 19% Sales % by Market 2012 Commercial 59% R&F 19% Air Conditioning 22% Sales % by Market 2013 487.7 180.9 155.0 503.6 165.1 186.0 - 100.0 200.0 300.0 400.0 500.0 600.0 Commercial Air Conditioning R&F Sales by Market 2013 2012 155.0 20.4 11.6 1.0 186.0 0 50 100 150 200 2012 Volume/Mix Price FX 2013 R&F Market Sales

Agenda Operational Overview FY2013 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 14 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

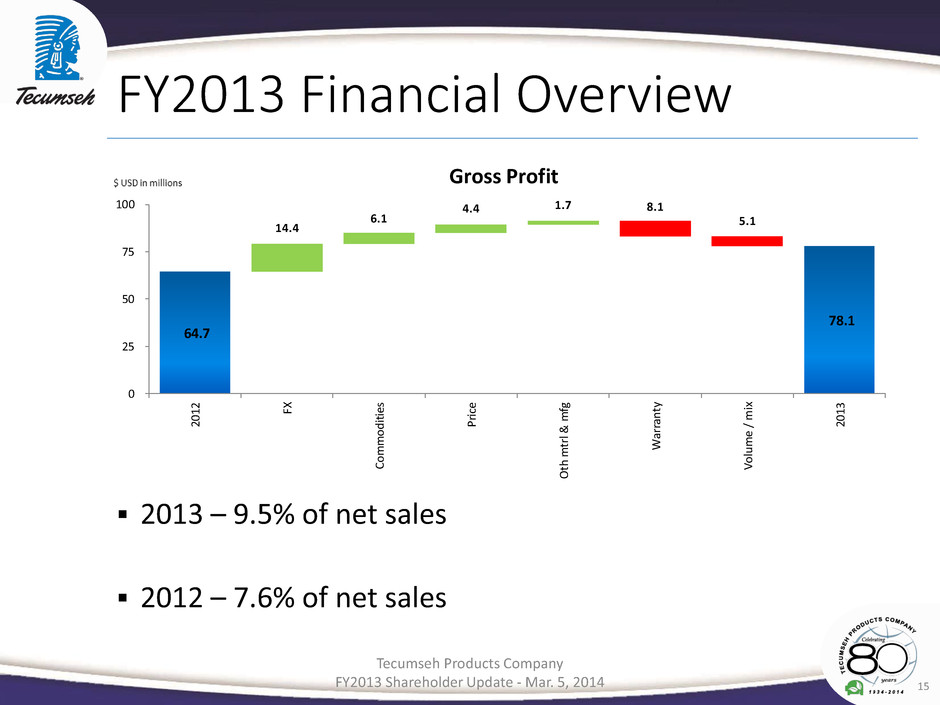

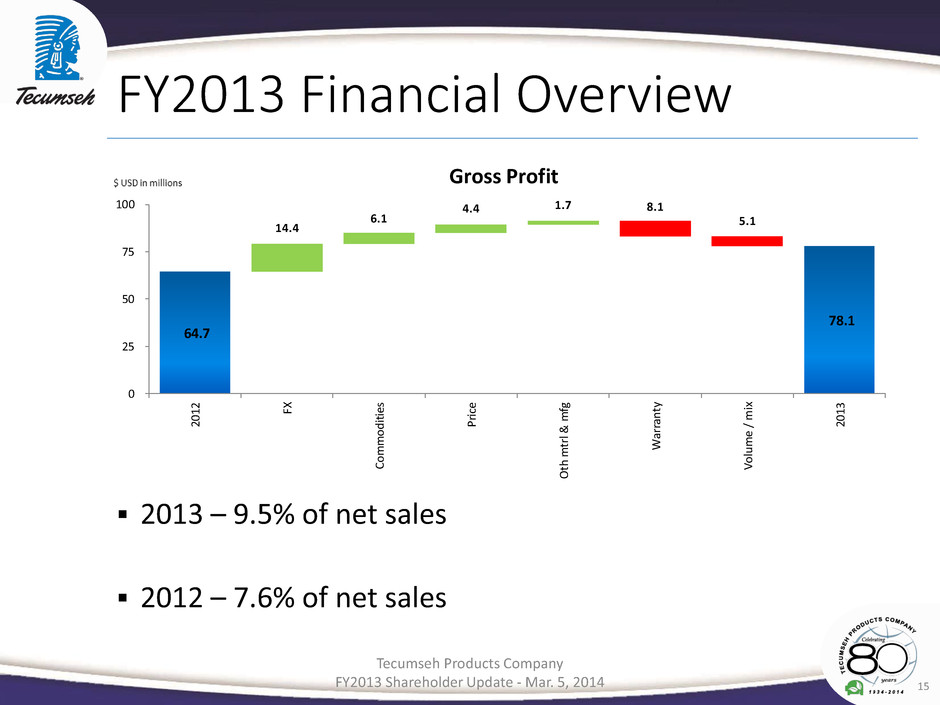

15 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 FY2013 Financial Overview 2013 – 9.5% of net sales 2012 – 7.6% of net sales 78.1 8.1 5.1 14.4 6.1 4.4 1.7 64.7 0 25 50 75 100 201 2 FX Com mo diti es Pric e Oth mt rl & mf g Wa rran ty Vol um e / mix 201 3 Gross Profit

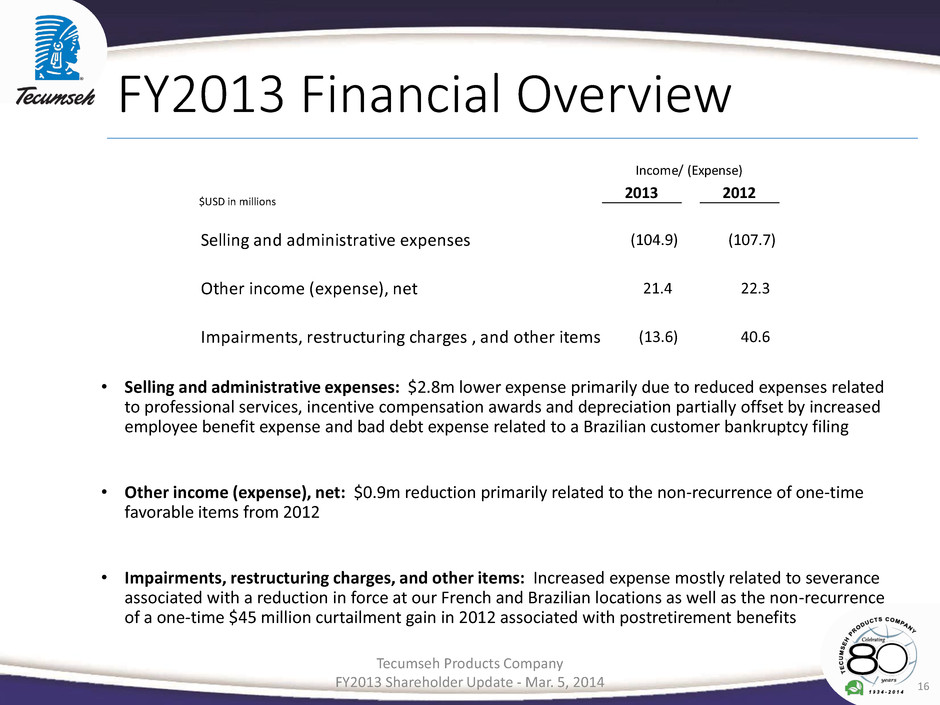

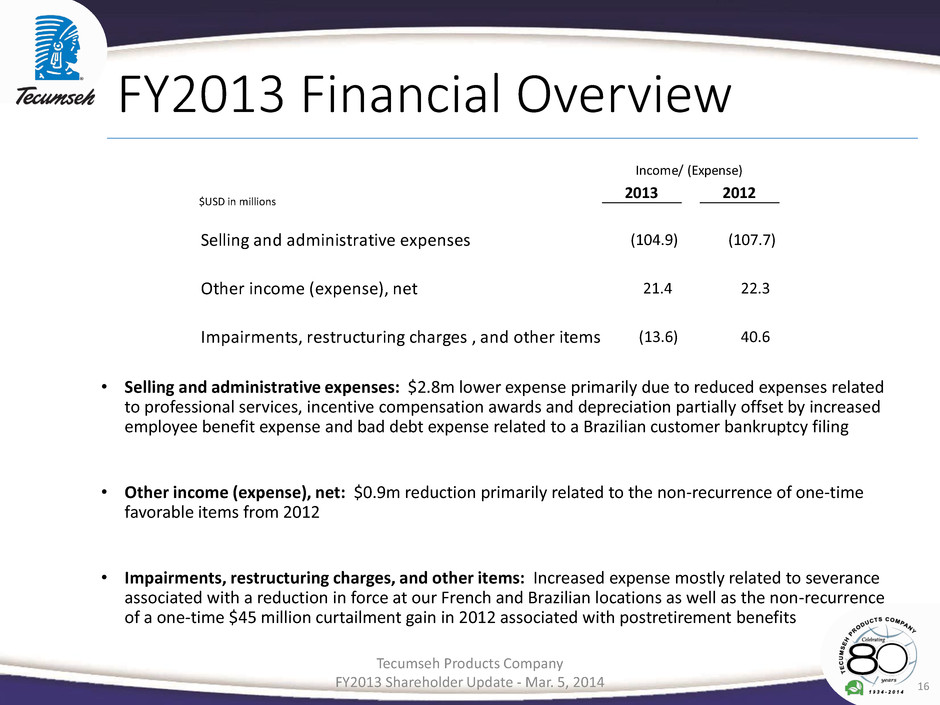

16 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 FY2013 Financial Overview • Selling and administrative expenses: $2.8m lower expense primarily due to reduced expenses related to professional services, incentive compensation awards and depreciation partially offset by increased employee benefit expense and bad debt expense related to a Brazilian customer bankruptcy filing • Other income (expense), net: $0.9m reduction primarily related to the non-recurrence of one-time favorable items from 2012 • Impairments, restructuring charges, and other items: Increased expense mostly related to severance associated with a reduction in force at our French and Brazilian locations as well as the non-recurrence of a one-time $45 million curtailment gain in 2012 associated with postretirement benefits 2013 2012 Selling and administrative expenses (104.9) (107.7) Other income (expense), net 21.4 22.3 Impairments, restructuring charges , and other items (13.6) 40.6 Income/ (Expense) $USD in millions

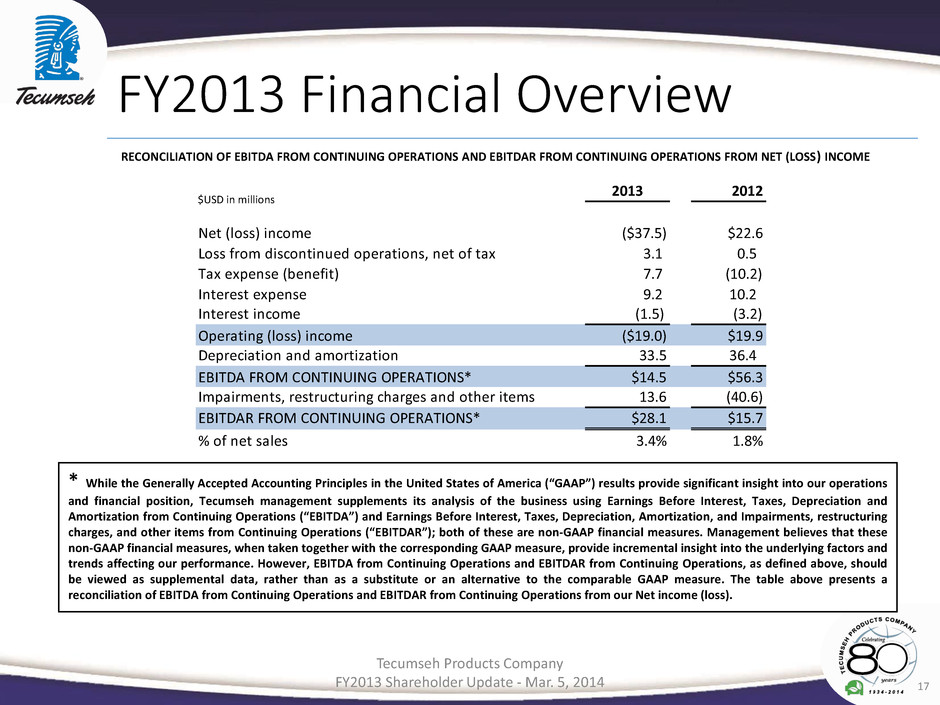

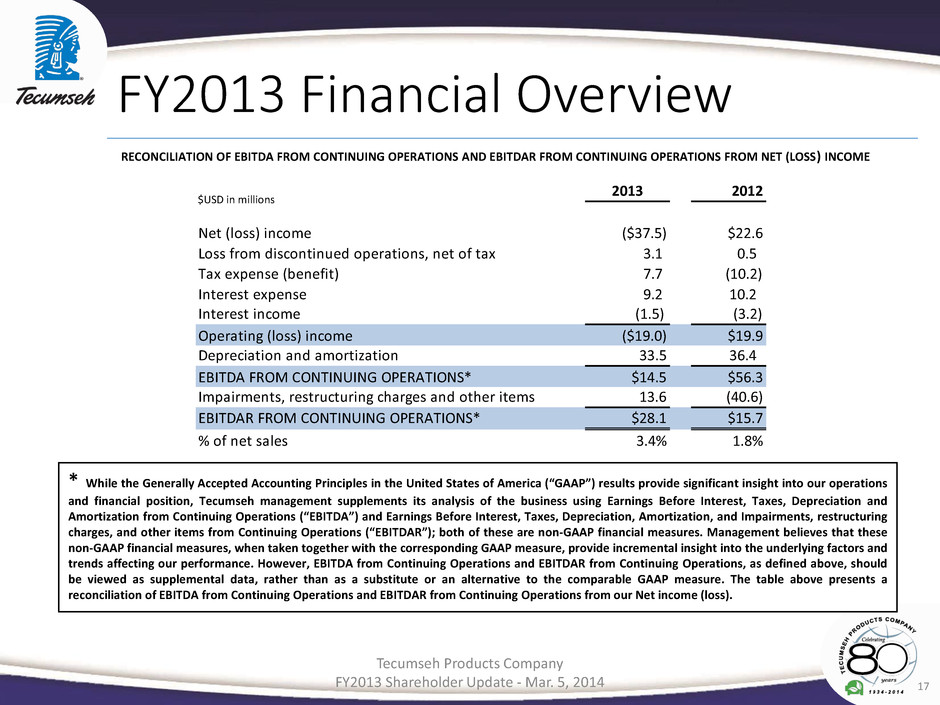

17 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 FY2013 Financial Overview * While the Generally Accepted Accounting Principles in the United States of America (“GAAP”) results provide significant insight into our operations and financial position, Tecumseh management supplements its analysis of the business using Earnings Before Interest, Taxes, Depreciation and Amortization from Continuing Operations (“EBITDA”) and Earnings Before Interest, Taxes, Depreciation, Amortization, and Impairments, restructuring charges, and other items from Continuing Operations (“EBITDAR”); both of these are non-GAAP financial measures. Management believes that these non-GAAP financial measures, when taken together with the corresponding GAAP measure, provide incremental insight into the underlying factors and trends affecting our performance. However, EBITDA from Continuing Operations and EBITDAR from Continuing Operations, as defined above, should be viewed as supplemental data, rather than as a substitute or an alternative to the comparable GAAP measure. The table above presents a reconciliation of EBITDA from Continuing Operations and EBITDAR from Continuing Operations from our Net income (loss). RECONCILIATION OF EBITDA FROM CONTINUING OPERATIONS AND EBITDAR FROM CONTINUING OPERATIONS FROM NET (LOSS) INCOME 2013 2012 Net (loss) income ($37.5) $22.6 Loss from discontinued operations, net of tax 3.1 0.5 Tax expense (benefit) 7.7 (10.2) Interest expense 9.2 10.2 Interest income (1.5) (3.2) Operating (loss) income ($19.0) $19.9 Depreciation and amortization 33.5 36.4 EBITDA FROM CONTINUING OPERATIONS* $14.5 $56.3 Impairments, restructuring charges and other items 13.6 (40.6) EBITDAR FROM CONTINUING OPERATIONS* $28.1 $15.7 % of net sales 3.4% 1.8% $USD in millions

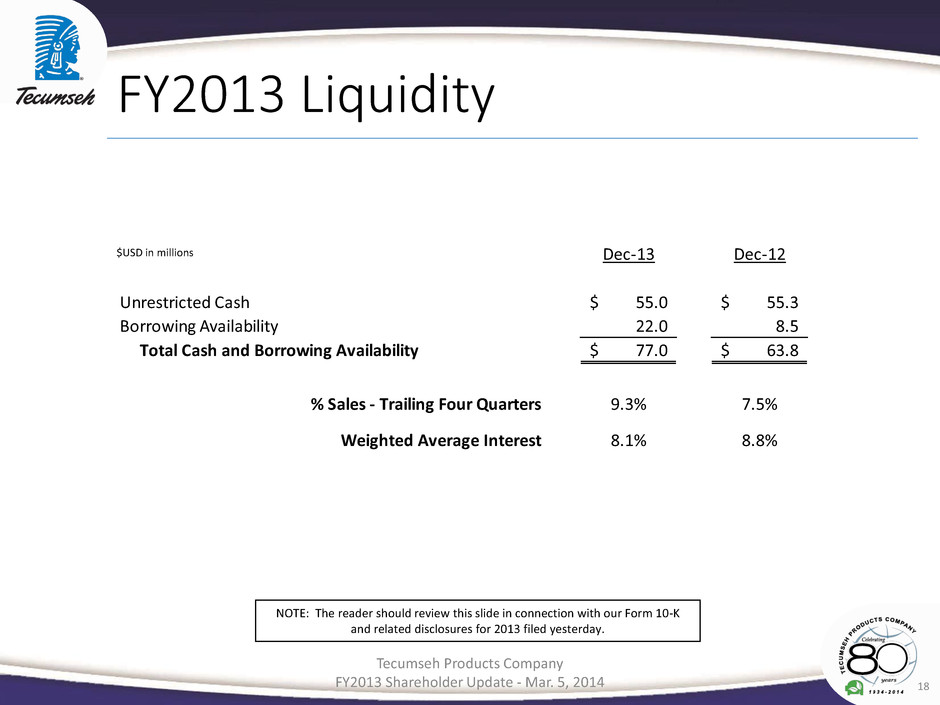

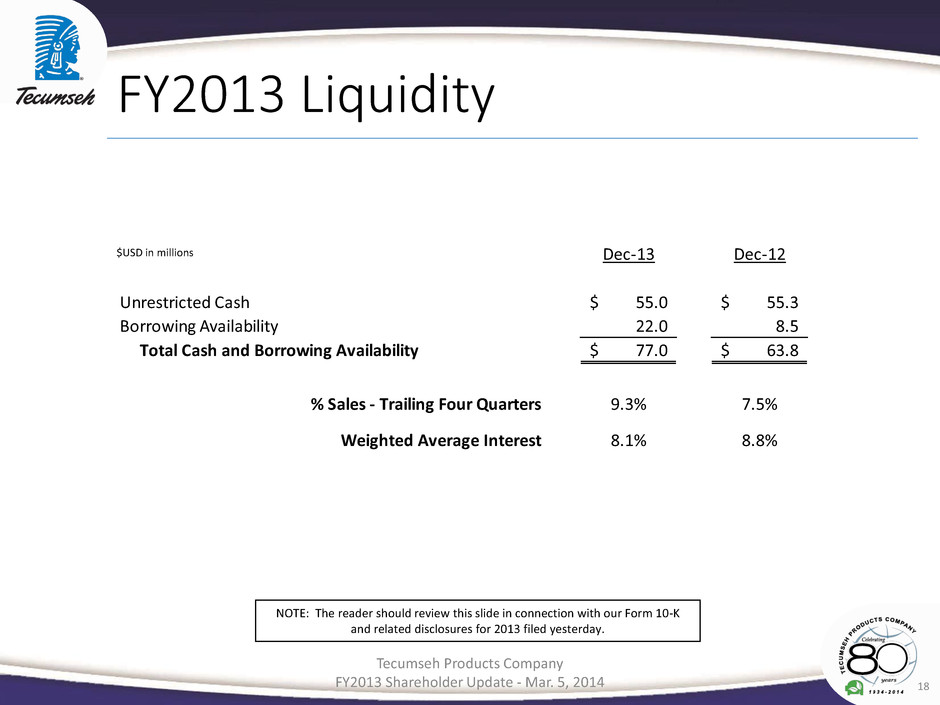

18 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 FY2013 Liquidity NOTE: The reader should review this slide in connection with our Form 10-K and related disclosures for 2013 filed yesterday. Dec-13 Dec-12 Unrestricted Cash 55.0$ 55.3$ Borrowing Availability 22.0 8.5 Total Cash and Borrowing Availability 77.0$ 63.8$ % Sales - Trailing Four Quarters 9.3% 7.5% Weighted Average Interest 8.1% 8.8% $USD in millions

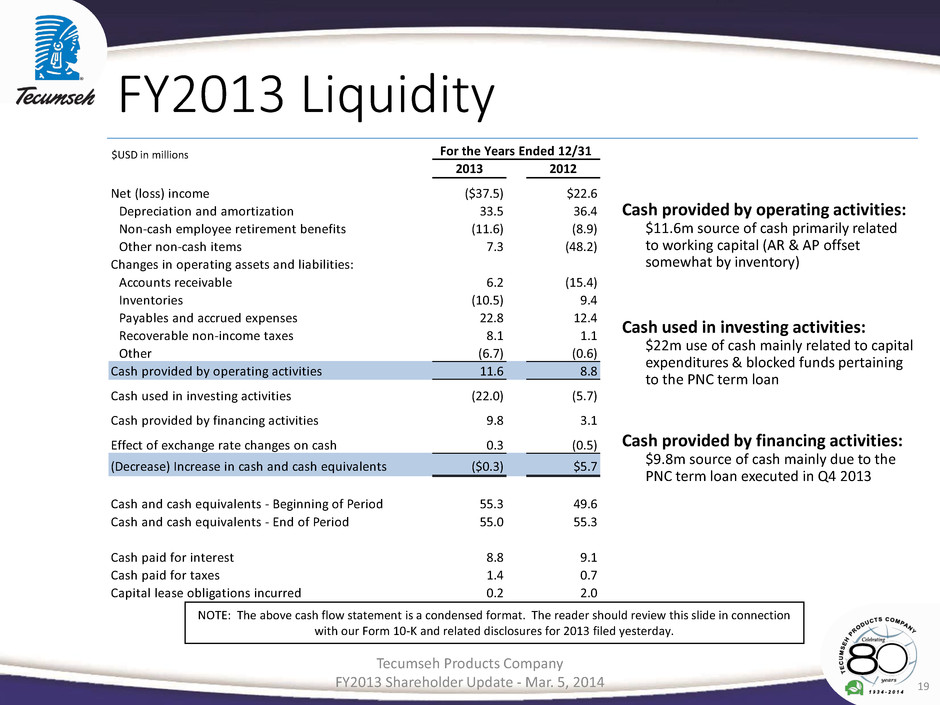

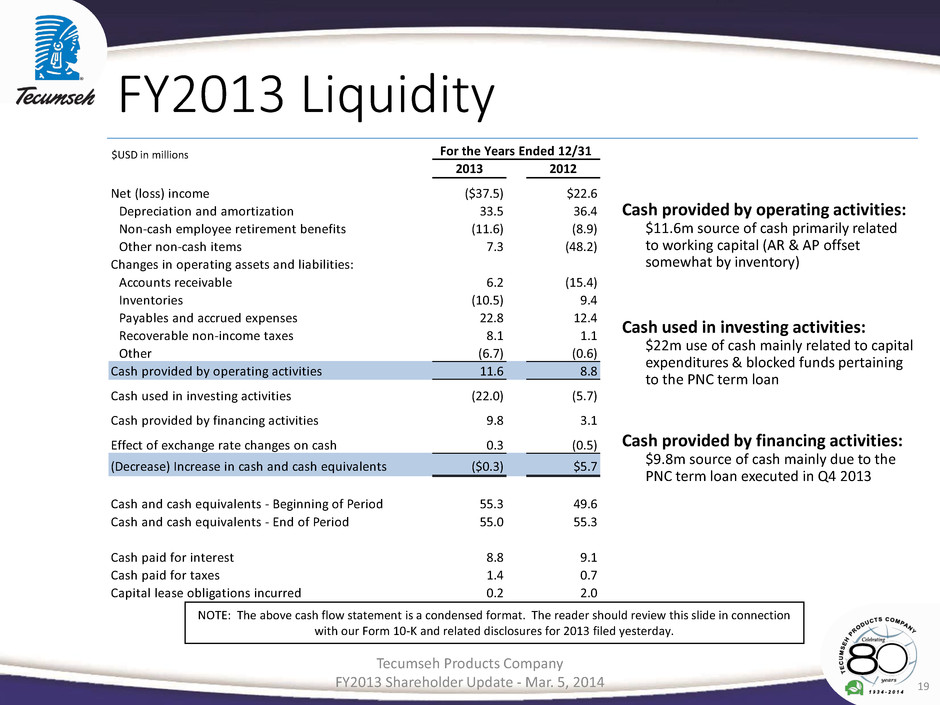

19 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 FY2013 Liquidity NOTE: The above cash flow statement is a condensed format. The reader should review this slide in connection with our Form 10-K and related disclosures for 2013 filed yesterday. Cash provided by operating activities: $11.6m source of cash primarily related to working capital (AR & AP offset somewhat by inventory) Cash used in investing activities: $22m use of cash mainly related to capital expenditures & blocked funds pertaining to the PNC term loan Cash provided by financing activities: $9.8m source of cash mainly due to the PNC term loan executed in Q4 2013 2013 2012 Net (loss) income ($37.5) $22.6 Depreciation and amortization 33.5 36.4 Non-cash employee retirement benefits (11.6) (8.9) Other non-cash items 7.3 (48.2) Changes in operating assets and liabilities: Accounts receivable 6.2 (15.4) Inventories (10.5) 9.4 Payables and accrued expenses 22.8 12.4 Recoverable non-income taxes 8.1 1.1 Other (6.7) (0.6) Cash provided by operating activities 11.6 8.8 Cash used in investing activities (22.0) (5.7) Cash provided by financing activities 9.8 3.1 Effect of exchange rate changes on cash 0.3 (0.5) (Decrease) Increase in cash and cash equivalents ($0.3) $5.7 Cash and cash equivalents - Beginning of Period 55.3 49.6 Cash and cash equivalents - End of Period 55.0 55.3 Cash paid for in erest 8.8 9.1 Cash paid for taxes 1.4 0.7 Capital lease obligations incurred 0.2 2.0 For the Years Ended 12/31 $USD in millions

Agenda Operational Overview FY2013 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 20 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

21 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Business Update • French social plan negotiations concluded in 2013 • Share recapitalization project on track for vote at 2014 Annual Shareholder Meeting – preliminary S-4 filed Jan. 29, 2014 • Continued focus on lean manufacturing initiatives, quality improvements, and manufacturing process improvements • Two new management team members & one new Board member

Agenda Operational Overview FY2013 Financial Overview & Liquidity Business Update Closing Remarks / Q&A 22 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014

23 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Closing Remarks / Q & A • Commence the turnaround process • Revamp our strategic planning • Thank you for attending Tecumseh Products Company 2013 Annual Shareholder Update Meeting • We will now take any questions you might have

24 Tecumseh Products Company FY2013 Shareholder Update - Mar. 5, 2014 Contact Information – Today’s Speakers Ms. Janice Stipp Executive Vice President, CFO & Treasurer Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 Mr. Jim Connor President & Chief Executive Officer Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 E-Mail: investor.relations@tecumseh.com Phone: 1 (734) 585 9507